Chapter 8

Getting to Know the Major Currency Pairs

In This Chapter

![]() Looking at the trading fundamentals of the major currency pairs

Looking at the trading fundamentals of the major currency pairs

![]() Calculating the costs of trading

Calculating the costs of trading

![]() Understanding price movements

Understanding price movements

![]() Modifying trading strategies to fit the currency pair

Modifying trading strategies to fit the currency pair

The vast majority of trading volume takes place in the major currency pairs: EUR/USD, USD/JPY, GBP/USD, and USD/CHF. These currency pairs account for about two-thirds of daily trading volume in the market and are the most watched barometers of the overall forex market. When you hear about the dollar rising or falling, it’s usually referring to the dollar against these other currencies.

Even though these four pairs are routinely grouped together as the major currency pairs, each currency pair represents an individual economic and political relationship. In this chapter, we look at the fundamental drivers of each currency pair to see what moves them. We also look at the market’s quoting conventions and what they mean for margin-based trading.

Although it’s important to understand why a currency rate moves, we think it’s also essential to have an understanding of how different pairs’ rates move. Most currency trading is very short-term in nature, typically from a few minutes to a few days. This makes understanding a currency pair’s price action (how a currency pair’s price moves in the very short term) a key component of any trading strategy.

When you’re reading this chapter, keep in mind that our observations are not hard and fast rules. As far as we know, there are no hard and fast rules in any market, anywhere, any time. Think of them as rules of thumb that apply more often than not. When it comes to applying our insights into real-life trading, you’ll have to evaluate the overall circumstances each time to see if our insights make sense. The idea is that with a baseline of currency pair behavior, you’ll be in a better position to anticipate, interpret, and react to market developments.

The flip side of this coin is that there is information content when our insights don’t hold water. If the market usually reacts to certain events in a regular fashion, but it’s not doing so this time, it’s a clue that something else is at work (usually bigger). And that can be even more valuable trading information.

The Big Dollar: EUR/USD

EUR/USD is by far the most actively traded currency pair in the global forex market. Everyone and his brother, sister, and cousin trades EUR/USD. This will come as no surprise to anyone who has traded in the forex market, because if you have, more likely than not you traded EUR/USD at some point.

The same goes for the big banks. Every major trading desk has at least one, and probably several, EUR/USD traders to deal with the volume in this currency pair. This is in contrast to less liquid currency pairs such as USD/CAD or AUD/USD, for which trading desks may not have a dedicated trader. All those EUR/USD traders add up to vast amounts of market interest, which increases overall trading liquidity.

Trading fundamentals of EUR/USD

EUR/USD is the currency pair that pits the U.S. dollar against the single currency of the Eurozone, the euro. The Eurozone refers to a grouping of countries in the European Union (EU) that in 1999 retired their own national currencies and adopted a unified single currency. In one fell swoop, at midnight on January 1, 1999, the Deutsche mark, Italian lira, French franc, and nine other European currencies disappeared and the euro came into being.

The move to a single currency was the culmination of financial unification efforts by the founding members of the European Union. In adopting the single currency, the nations agreed to abide by fiscal policy constraints that limited the ratio of national budget deficits to gross domestic product (GDP), among other requirements. (Some people would say that the 2010 sovereign debt crisis made a mockery of these rules.) The nations also delegated monetary policy (setting interest rates) to the newly founded European Central Bank (ECB).

As of this printing, the countries that use the euro are: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain.

In 2010, the Eurozone underwent its first major challenge, known as the sovereign debt crisis. Some states had built up unsustainable debt loads and ended up needing bailouts. Greece was the first member state to topple, with Ireland, Portugal, and Cyprus also requiring financial bailouts in recent years. At the time of writing, the situation had stabilized, although the road to recovery for some of the countries involved is a long one. The sovereign debt crisis has been the defining event of the Eurozone this decade.

On a brighter note, even with the sovereign debt crisis, the Eurozone has continued to expand in recent years, boosting the size of the monetary union’s population to more than 300 million. Although its economy has taken a knock due to the sovereign debt crisis, its total GDP is still about equal to the GDP of the United States.

Trading EUR/USD by the numbers

Standard market convention is to quote EUR/USD in terms of the number of USD per EUR. For example, a EUR/USD rate of 1.3000 means that it takes $1.30 to buy €1.00.

EUR/USD has the euro as the base currency and the U.S. dollar as the secondary or counter currency. That means

- EUR/USD is traded in amounts denominated in euros. In online currency trading platforms, standard lot sizes are €100,000, mini lot sizes are €10,000, and micro lots are €1,000.

- The pip value, or minimum price fluctuation, is denominated in USD.

- Profit and loss accrue in USD. For one standard lot position size, each pip is worth $10; for one mini lot position size, each pip is worth $1. For each micro lot, each pip is worth $0.10.

- Margin calculations in online trading platforms are typically based in USD. At a EUR/USD rate of 1.3000, to trade a one-lot position worth €100,000, it’ll take $1,300 in available margin (based on 100:1 leverage). That calculation will change over time, of course, based on the level of the EUR/USD exchange rate. A higher EUR/USD rate will require more USD in available margin collateral, and a lower EUR/USD rate will need less USD in margin.

Swimming in deep liquidity

Liquidity in EUR/USD is unmatched by other major currency pairs. This is why you tend to get narrower trading spreads in EUR/USD. Normal market spreads for EUR/USD are typically less than 1 pip, although this can vary. Over the years, spreads have narrowed sharply, and you can typically trade most of the major currency pairs for a 1 pip spread, or even less.

In terms of concrete numbers, EUR/USD accounted for 33 percent of global daily trading volume, according to the 2013 Bank for International Settlements (BIS) survey of the foreign exchange markets. This has fallen in recent years because the legacy of the sovereign debt crisis has caused some investors to diversify away from the single currency. One of the beneficiaries has been the yen. In 2013, trading USD/JPY rose some 4 percent to 23 percent.

Liquidity in EUR/USD is based on a variety of fundamental sources, such as

- Global trade and asset allocation: The Eurozone constitutes the second largest economic bloc after the United States. Not only does this create tremendous commercial trade flows, but it also makes Eurozone financial markets, and the euro, the destination for massive amounts of international investment flows. In April 2007, overall European stock-market valuations surpassed the value of U.S. equity markets for the first time ever.

- Central bank credibility: The ECB has established itself in the eyes of global investors as an effective institution in fighting inflation and maintaining currency stability. It has also been given credit for stabilizing the currency bloc during the sovereign debt crisis, which has enhanced its reputation in recent years.

- Enhanced status as a reserve currency: Central banks around the world hold foreign currency reserves to support their own currencies and improve market stability. The euro is increasing in importance as an alternative global reserve currency to the U.S. dollar, although this has stalled in recent years due to the onset of the sovereign debt crisis.

The euro also serves as the primary foil to the U.S. dollar when it comes to speculating on the overall direction of the U.S. dollar in response to U.S. news or economic data. If weak U.S. economic data is reported, traders are typically going to sell the dollar, which begs the question, “Against what?” The euro is the first choice for many, simply because it’s there. It also helps that it’s the most liquid alternative, allowing for easy entry and exit.

Drivers of the EUR/USD can be cyclical. On any given day, traders will respond to European news and data and adjust prices accordingly for several hours until U.S. data is released.

Watching the data reports

Country-specific economic reports, such as Dutch retail sales or Italian industrial production, are increasingly disregarded by the forex market in favor of Eurozone aggregate economic data. However, German and French national economic reports can still register with markets as they represent the two largest Eurozone economies. Here’s a list of the major European data reports and events to keep an eye on:

- European Central Bank (ECB) interest rate decisions and press conferences after ECB Central Council meetings. This is when the ECB president explains the ECB’s thinking and offers guidance on the future course of interest rates. It includes a press conference by the ECB president.

- Speeches by ECB officials and individual European finance ministers.

- EU-harmonized Consumer Price Index (CPI), as well as national CPI and Producer Price Index (PPI) reports.

- EU Commission economic sector confidence indicators.

- Consumer and investor sentiment surveys separately issued by three private economic research firms known by their acronyms: Ifo, ZEW and GfK. The Markit sentiment surveys are also closely watched because they give a timely view of confidence across all sectors of the economy.

- Industrial production.

- Retail sales.

- Unemployment rate.

- Sovereign debt sales. These are now closely watched, especially in Europe’s smaller, financially fragile states, such as Greece. Although the sovereign debt crisis has calmed down in recent years, a failed bond auction could trigger more sovereign fears and weigh on the EUR.

Trading behavior of EUR/USD

The deep liquidity and tight trading spreads in EUR/USD make the pair ideal for both shorter-term and longer-term traders. The price action behavior in EUR/USD regularly exhibits a number of traits that traders should be aware of.

Trading tick by tick

In normal market conditions, EUR/USD tends to trade tick by tick, as opposed to other currency pairs, which routinely display sharper short-term price movements of several pips. In trading terms, if EUR/USD is trading at 1.2910/13, there are going to be traders looking to sell at 13, 14, and 15 and higher, while buyers are waiting to buy at 9, 8, 7, and lower.

In contrast, other less-liquid currency pairs, like AUD/USD and USD/CAD, typically fluctuate in a far jumpier fashion, which is reflected by the wider price spread in those pairs.

Fewer price jumps and smaller price gaps

The depth of liquidity in EUR/USD also reduces the number of price jumps or price gaps in short-term trading. A price jump refers to a quick movement in prices over a relatively small time frame (roughly 50 pips or more) in the course of normal trading. A price gap means prices have instantaneously adjusted over a larger price distance, typically in response to a news event or data release.

This is in contrast to other major currency pairs where short-term price gaps can develop from a one-off market flow, such as a portfolio manager selling a large amount of AUD/USD or a USD/CAD stop-loss order being triggered. When price gaps do occur in EUR/USD, they tend to be smaller relative to gaps in other pairs.

Backing and filling

When prices move rapidly in one direction, they tend to reach a short-term stopping point when opposite interest enters the market. For instance, let’s say EUR/USD just traded higher from 1.2910/13 to 1.2922/25 in relatively orderly fashion, tick by tick over two minutes, meaning no price gaps. When the price move higher pauses, short-term traders who were long for the quick 12-pip move higher will look to exit and sell.

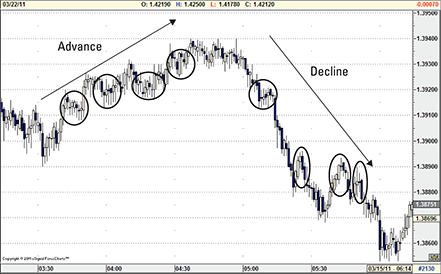

As selling interest begins to enter the market and prices stop rising, other not-so-fast longs will also start hitting bids (selling), pushing prices lower. From the other side, traders who missed the quick run up, or who were not as long as they wanted to be, will enter their buying interest in the market. Other buyers, sensing selling interest, may wait and place their buying interest at slightly lower levels. This back-and-forth consolidation after a short-term price movement is referred to as backing and filling. The price backs up and fills the short-term movement, though it can happen in both up and down price movements.

Source: eSignal (www.esignal.com)

Figure 8-1: A one-minute EUR/USD chart showing periods of backing and filling price action after short-term directional moves. Backing and filling occurs in price declines, too.

Prolonged tests of technical levels

When it comes to trading around technical support and resistance levels, EUR/USD can try the patience of even the most disciplined traders. We say this because EUR/USD can spend hours (an eternity in forex markets) or even several days undergoing tests of technical levels. (See Chapter 10 for a primer on technical analysis.)

This goes back to the tremendous amount of interest and liquidity that defines the EUR/USD market. All those viewpoints come together in the form of market interest (bids and offers) when technical levels come into play. The result is a tremendous amount of market interest that has to be absorbed at technical levels, which can take time.

Looking at GBP/USD and USD/CHF as leading indicators

If GBP/USD and USD/CHF are aggressively testing (trading at or through the technical level with very little pullback) similar technical levels to EUR/USD (for example, daily highs or equivalent trend-line resistance), then EUR/USD is likely to test that same level. If GBP/USD and USD/CHF break through their technical levels, the chances of EUR/USD following suit increases. By the same token, if GBP/USD and USD/CHF are not aggressively testing the key technical level, EUR/USD is likely to see its similar technical level hold.

GBP/USD and USD/CHF lead times can be anywhere from a few seconds or minutes to several hours and even days. Just make sure you’re looking at the equivalent technical levels in each pair.

Tactical trading considerations in EUR/USD

We’ve looked at the major trading attributes of EUR/USD and now its time to look at how those elements translate into real-life trading tactics. After all, that’s where the real money is made and lost.

Deciding whether it’s a U.S. dollar move or a euro move

Earlier in this chapter, we note that EUR/USD routinely acts as the primary vehicle for forex markets to express their view on the USD. At the same time, we also indicated that EUR/USD will also react to euro-centric news and data. So for traders approaching EUR/USD on any given day, it helps to understand whether the driving force at work is dollar-based or euro-based. Are they bearish on the USD, or are they bullish on the EUR? Or is it some combination of the two?

Having a sense of which currency is driving EUR/USD at any given moment is important so you can better adapt to incoming data and news. If it’s a EUR-based move higher, for instance, and surprisingly positive USD news or data is released later in the day, guess what? We’ve got countertrend information hitting the market, which could spark a reversal lower in EUR/USD (in favor of the dollar). By the same token, if that U.S. data comes out weaker than expected, it’s likely to spur further EUR/USD gains, because EUR-buying interest is now combined with USD-selling interest.

Being patient in EUR/USD

Earlier in this chapter, we explore why EUR/USD can spend hours trading in relatively narrow ranges or testing technical levels. The key in such markets is to remain patient based on your directional view and your technical analysis. You should be able to identify short-term support that keeps an upside test alive or resistance that keeps a down-move going. If those levels fail, the move is stalling at the minimum and may even be reversing.

Taking advantage of backing and filling

Because EUR/USD tends to retrace more of its short-term movements, you can usually enter a position in your desired direction by leaving an order to buy or sell at slightly better rates than current market prices may allow. If the post–08:30 ET U.S. data price action sees EUR/USD move lower, and you think getting short is the way to go, you can leave an offer slightly (roughly 5 to 10 pips) above the current market level and use it to get short, instead of reaching out and hitting the bid on a downtick.

If your order is executed, you’ve got your desired position at a better rate than if you went to market, and you’re probably in a better position rhythm-wise with the market (having sold on an uptick). Alternatively, you can take advantage of routine backing and filling by dealing at the market by selling on upticks and buying on downticks.

Allowing for a margin of error on technical levels

East Meets West: USD/JPY

USD/JPY is one of the more challenging currency pairs among the majors and trading in it requires a higher degree of discipline and patience. Where other currency pairs typically display routine market fluctuations and relatively steady, active trading interest, USD/JPY seems to have an on/off switch. It can spend hours and even days in relatively narrow ranges and then march off on a mission to a new price level.

USD/JPY can offer some of the clearest trade setups among the major pairs. When you’re right in USD/JPY, the returns can be astonishingly quick. When you’re wrong in USD/JPY, you’ll also know it pretty quickly. The key to developing a successful trading game plan in USD/JPY is to understand what drives the pair and the how price action behaves.

Trading fundamentals of USD/JPY

The Japanese yen is the third major international currency after the U.S. dollar and the European single currency, the euro. USD/JPY accounts for more than 20 percent of global trading volume, according to the 2013 BIS survey of foreign exchange markets. Japan stands as the third largest national economy after the United States and China in terms of GDP, and the JPY represents the third major currency group after the USD and the EUR groupings.

Trading USD/JPY by the numbers

Standard market convention is to quote USD/JPY in terms of the number of JPY per USD. For example, a USD/JPY rate of 115.35 means that it takes ¥115.35 to buy $1.

USD/JPY trades in the same direction as the overall value of the USD, and inversely to the value of the JPY. If the USD is strengthening and the JPY is weakening, the USD/JPY rate will move higher. If the USD is weakening and the JPY is strengthening, the USD/JPY rate will move lower.

USD/JPY has the U.S. dollar as the base currency and the JPY as the secondary or counter currency. This means

- USD/JPY is traded in amounts denominated in USD. In online currency trading platforms, standard lot sizes are $100,000, mini lot sizes are $10,000, and micro lot sizes are $1,000.

- The pip value, or minimum price fluctuation, is denominated in JPY.

- Profit and loss accrue in JPY. For one standard lot position size, each pip is worth ¥1000; for one mini lot position size, each pip is worth ¥100; and for each micro lot, each pip is worth ¥10. To convert those amounts to USD, divide the JPY amount by the USD/JPY rate. Using 115.00 as the rate, ¥1,000 = $8.70 and ¥100 = $0.87.

- Margin calculations are typically calculated in USD. So it’s a straightforward calculation using the leverage rate to see how much margin is required to hold a position in USD/JPY. At 100:1 leverage, $1,000 of available margin is needed to open a standard-size position of 100,000 USD/JPY.

USD/JPY is heavily influenced by U.S. interest rates

If we had to identify the main driver of USD/JPY, it would easily be the movements in U.S. interest rates. The main reason for this is the massive amount of U.S. government debt held by the Japanese government and Japanese investors. The Bank of Japan (BOJ) alone holds nearly $900 billion worth of U.S. Treasury debt. If U.S. interest rates begin to fall, the prices of U.S. government bonds rise, increasing the USD-value of Japan’s U.S. debt holdings. To offset, or hedge, their larger USD-long currency exposure, Japanese reserve managers need to sell more USD. This causes USD/JPY to closely track U.S. Treasury yields, as seen in Figure 8-2, which shows the USD/JPY rate and the yield on two-year U.S. Treasury notes on a monthly basis over ten years.

Source: Bloomberg, FOREX.com

Figure 8-2: USD/JPY exchange rate and yields on two-year U.S. Treasury notes over ten years on a monthly basis. USD/JPY closely follows the track of U.S. Treasury yields due to asset manager hedging operations.

It’s politically sensitive to trade

USD/JPY is the most politically sensitive currency pair among the majors. Japan remains a heavily export-oriented economy, accounting for more than 40 percent of overall economic activity. This means the JPY is a critical policy lever for Japanese officials to stimulate and manage the Japanese economy — and they aren’t afraid to get involved in the market to keep the JPY from strengthening beyond desired levels.

In the past, this has led to accusations of currency manipulation by trade partners and efforts to force the JPY to strengthen. But with China’s incredible growth in this decade, lil’ ol’ Japan and the yen seem to have dropped from the radar screen as the primary target of free-market advocates. But this is more a function of China’s vast current and future potential rather than any change to how the Japanese effectively manage the JPY.

The Ministry of Finance is routinely involved in the forex market

Currency intervention is usually a last resort for most major national governments. Instead, the Japanese Ministry of Finance (MOF) engages in routine verbal intervention in not-so-subtle attempts to influence the level of the JPY. The chief spokesman on currencies is, of course, the Minister of Finance, but the Vice Finance Minister for International Affairs is the more frequent commentator on forex market developments. Also watch comments from the Bank of Japan (see Chapter 5).

Beyond such jawboning, known as verbal intervention, the MOF has been known to utilize covert intervention through the use of sizeable market orders by the pension fund of the Japanese Postal Savings Bank, known as Kampo. After the 2011 tsunami, the yen surged in value, as its safe-haven status kicked in. To limit the damage to the Japanese economy, a multilateral effort was made by major global central banks to sell the yen and bring down its value.

In 2012, the new prime minister, Shinzo Abe, announced a radical economic program to try to boost the economy. One side effect of this was a weaker yen, which was supported by an extremely loose monetary policy from the Bank of Japan. As you can see, there are many ways that politics can get in the way of the yen.

Japanese asset managers tend to move together

If Americans are the ultimate consumers, then the Japanese are the consummate savers. The Japanese savings rate (the percentage of disposable income that’s not spent) is around 15 percent. (Compare that with the U.S. savings rate at around 5 percent!) As a result, Japanese financial institutions control trillions of dollars in assets, many of which find their way to investments outside of Japan. The bulk of assets are invested in fixed income securities and this means Japanese asset managers are on a continual hunt for the best yielding returns.

This theme has taken on added prominence in recent years due to extremely low domestic yields in Japan At the time of writing, the Bank of Japan had yields of close to 0 percent, and a massive QE program to keep interest rates low for the long term. These low yields tend to weigh on the yen’s value, so Japanese investors and asset managers tend to sell the yen and buy higher-yielding currencies that are stronger than the yen. This makes domestic interest-rate yields in Japan a key long-term determinant of the JPY’s value.

Japanese financial institutions also tend to pursue a highly collegial approach to investment strategies. The result for forex markets is that Japanese asset managers tend to pursue similar investment strategies at the same time, resulting in tremendous asset flows hitting the market over a relatively short period of time. This situation has important implications for USD/JPY price action (see the next section).

Important Japanese data reports

Keep in mind that politics and government officials’ (MOF) comments are quite frequent and can shift market sentiment and direction as much as, or more than, the fundamental data. The key data reports to focus on coming out of Japan are

- Bank of Japan (BOJ) policy decisions, monthly economic assessments, and Monetary Policy Committee (MPC) member speeches

- Tankan Report (a quarterly sentiment survey of Japanese firms by the BOJ — the key is often planned capital expenditures)

- Industrial production

- Machine orders

- Trade balance and current account

- Retail trade

- Bank lending

- Domestic Corporate Goods Price Index (CGPI)

- National CPI and Tokyo-area CPI

- All-Industry Activity Index and Tertiary Industry (service sector) Activity Index

The CPI data is extremely important these days, because the Bank of Japan has pledged to keep monetary policy low until inflation moves to a 2 percent target. Given that Japan has traditionally been mired in deflation, this is no small feat.

Price action behavior of USD/JPY

Earlier in this chapter, we note that USD/JPY seems to have an on/off switch when compared to the other major currency pairs. Add to that the fact that USD/JPY liquidity can be similarly fickle. Sometimes, hundreds of millions of USD/JPY can be bought or sold without moving the market noticeably; other times, liquidity can be extremely scarce.

This phenomenon is particularly acute in USD/JPY owing to the large presence of Japanese asset managers. As we mention earlier, the Japanese investment community tends to move en masse into and out of positions. Of course, they’re not the only ones involved in USD/JPY, but they do tend to play the fox while the rest of the market is busy playing the hounds.

Prone to short-term trends, followed by sideways consolidations

The result of this concentration of Japanese corporate interest is a strong tendency for USD/JPY to display short-term trends (several hours to several days) in price movements, as investors pile in on the prevailing directional move. This tendency is amplified by the use of standing market orders from Japanese asset managers.

For example, if a Japanese pension fund manager is looking to establish a long position in USD/JPY, he’s likely to leave orders at several fixed levels below the current market to try to buy dollars on dips. If the current market is at 102.00, he may buy a piece of the total position there, but then leave orders to buy the remaining amounts at staggered levels below, such as 101.75, 101.50, 101.25, and 101.00. If other investors are of the same view, then they’ll be bidding below the market as well.

If the market begins to move higher, the asset managers may become nervous that they won’t be able to buy on weakness and raise their orders to higher levels, or buy at the market. Either way, buying interest is moving up with the price action, creating a potentially accelerating price movement. Any countertrend move is met by solid buying interest and quickly reversed.

Such price shifts tend to reach their conclusion when everyone is onboard — most of the buyers who wanted to buy are now long. At this point, no more fresh buying is coming into the market, and the directional move begins to stall and move sideways. The early buyers may be capping the market with profit-taking orders to sell above, while laggard buyers are still buying on dips. This leads to the development of a consolidation range, which can be as wide as ¥1 or ¥2, or as narrow as 40 to 50 pips.

Technical levels are critical in USD/JPY

Perhaps no other currency pair is as beholden to technical support and resistance as USD/JPY. In large part, this has to do with the prevalence of substantial orders, where the order level is based on technical analysis. USD/JPY displays a number of other important trading characteristics when it comes to technical trading levels:

- USD/JPY tends to respect technical levels with far fewer false breaks. This situation is typically due to the presence of substantial order interest at the technical level. If trend-line analysis or daily price lows indicate major support at 101.20, for example, sizeable buying orders are likely to be located there. The bank traders watching the order may buy in front of it, preventing the level from ever being touched, or tested. If the selling interest is not sufficient to fill the buying order, the level will hold. On the other hand, if the technical level is breached, it’s a clear indication the selling interest is far greater and is likely to continue.

- USD/JPY’s price action is usually highly directional (one-way traffic) on breaks of technical support and resistance. When technical support or resistance is overcome, price movements tend to be sharp and one-sided, with minimal pullbacks or backing and filling (prices coming back to test the breakout level). This situation is the result of strong market interest overcoming any standing orders, as well as likely stop-loss orders beyond the technical level. For example, after USD/JPY broke above 80.00 back in September 2012, USD/JPY went on to rally (the yen lost value) more than 30 percent over the next nine months.

- Spike reversals (sharp — 20- to 50-pip — price movements in the opposite direction of the prior move) from technical levels are relatively common. Spike reversals are evidence of a significant amount of market interest in the opposite direction and frequently define significant highs and lows. They’re also evidence that the directional move that was reversed was probably false, which suggests greater potential in the direction of the reversal.

- Orders frequently define intraday highs and lows and reversal points. Japanese institutional orders also tend to be left at round-number prices, such as 84.00, 84.25, 84.50, and so on. When you look at charts involving JPY, always note tops/bottoms close to round-number price levels because there could be significant orders there.

Tactical trading considerations in USD/JPY

Earlier, we note USD/JPY’s tendency to either be active directionally or consolidating — the on/off switch. As such, we like to approach USD/JPY on a more strategic, hit-and-run basis — getting in when we think a directional move is happening and standing aside when we don’t. We look for breaks of trend lines, spike reversals, and candlestick patterns, as our primary clues for spotting a pending directional move (see Chapter 11).

On the tactical level, USD/JPY is generally a cleaner trading market than most of the other majors, so we like to approach it with generally tighter trading rules. The idea is that if we’re right, we’ll be along for the ride. But if we’re wrong, we jump off the bus at the next stop.

Actively trading trend-line and price-level breakouts

One of our trigger points for jumping into USD/JPY is breaks of trend lines and key price levels, such as daily or weekly highs/lows. We note earlier that it usually takes a significant amount of market interest to break key technical levels. We look at the actual breaks as concrete evidence of sizeable interest, rather than normal back-and-forth price action.

Jumping on spike reversals

Monitoring EUR/JPY and other JPY crosses

EUR/JPY is the most actively traded JPY cross and its movements routinely drive USD/JPY on an intraday basis. Be alert for when significant technical levels in the two pairs coincide, such as when both USD/JPY and EUR/JPY are testing a series of recent daily highs or lows. A break by either can easily spill into the other and provoke follow-through buying/selling in both.

Source: eSignal (www.esignal.com)

Figure 8-3: Hourly USD/JPY chart highlighting spike reversals (circled areas). Quick 20 to 30 point reversals can be an important signal that a directional move has ended and may be reversing.

The Other Majors: Sterling and Aussie

The other two major currency pairs are GBP/USD (otherwise known as sterling or cable) and AUD/USD. The pound is counted as a major currency pair, but its trading volume and liquidity are significantly less than EUR/USD or USD/JPY. In recent years, there has been a big shift in the most actively traded currencies, with the Aussie and Kiwi dollars overtaking the likes of the Swissy (Swiss franc) and the CAD. The Aussie in particular has seen its star rise, which is why we’re including it in this section.

The British pound: GBP/USD

Trading in cable presents its own set of challenges, because the pair is prone to sharp price movements and seemingly chaotic price action. But it’s exactly this type of price behavior that keeps the speculators coming back — when you’re right, you’ll know very quickly, and the short-term results can be significant.

Trading fundamentals of GBP/USD

The U.K. economy is the third largest national economy in Europe, after Germany and France, according to the 2013 GDP data, and the pound is heavily influenced by cross-border trade and mergers and acquisitions (M&A) activity between the United Kingdom and continental Europe. Upwards of two-thirds of U.K. foreign trade is conducted with EU member states, making the EUR/GBP cross one of the most important trade-driven cross rates.

The 2013 BIS survey of foreign exchange turnover showed that GBP/USD accounted for 8 percent of global daily trading volume, making cable the third most active pairing in the majors. But you may not believe that when you start trading cable, where liquidity seems always to be at a premium. These days, you can trade GBP/USD fairly cheaply and most brokers offer a spread of 1 pip or below.

Trading sterling by the numbers

GBP/USD is quoted in terms of the number of dollars it takes to buy a pound, so a rate of 1.6015 means it costs $1.6015 to buy £1. The GBP is the primary currency in the pair and the USD is the secondary currency. That means

- GBP/USD is traded in amounts denominated in GBP. In online currency trading platforms, standard lot sizes are £100,000, mini lot sizes are £10,000, and micro lots are GBP 1,000.

- The pip value, or minimum price fluctuation, is denominated in USD.

- Profit and loss accrue in USD. For one standard lot position size, each pip is worth $10; for one mini lot position size, each pip is worth $1; and for a micro lot, it is $0.10.

- Margin calculations are typically calculated in USD in online trading platforms. Because of its high relative value to the USD, trading in GBP pairs requires the greatest amount of margin on a per-lot basis. At a GBP/USD rate of 1.9000, to trade a one-lot position worth £100,000, it’ll take $1,900 in available margin (based on 100:1 leverage). That calculation will change over time, of course, based on the level of the GBP/USD exchange rate. A higher GBP/USD rate will require more USD in available margin collateral, and a lower GBP/USD rate will need less USD in margin.

Trading alongside EUR/USD, but with a lot more zip!

Cable is similar to the EUR/USD in that it trades inversely to the overall USD. But while EUR/USD frequently gets bogged down in tremendous two-way liquidity, cable exhibits much more abrupt volatility and more extreme overall price movements. If U.S. economic news disappoints, for instance, both sterling and EUR/USD will move higher. But if EUR/USD sees a 60-point rally on the day, cable may see a 100+ point rally.

This goes back to liquidity and a generally lower level of market interest in cable. In terms of daily global trading sessions, cable volume is at its peak during the U.K./European trading day, but that level of liquidity shrinks considerably in the New York afternoon and Asian trading sessions. During those off-peak times, cable can see significant short-term price moves simply on the basis of position-adjustments (for example, shorts getting squeezed out).

Important U.K. data reports

Key U.K. data reports to watch for are

- BOE Monetary Policy Committed (MPC) rate decisions, as well as speeches by MPC members and the BOE governor and BOE Inflation Reports, which are released four times a year

- BOE MPC minutes (released two weeks after each MPC meeting)

- Inflation gauges, such as CPI, PPI, and the British Retailers Consortium (BRC) shop price index

- Retail sales and the BRC retail sales monitor

- Royal Institution of Chartered Surveyors (RICS) house price balance

- Industrial and manufacturing production

- Trade balance

- GfK (a private market research firm) U.K. consumer confidence survey

The new kid in town: Trading the Aussie

The Aussie dollar has overtaken some of the other major currencies in recent years to become the fourth most commonly traded USD pair, according to the 2013 BIS Triennial survey on foreign exchange turnover. This was triggered by a few developments:

- The Australian economy weathered the 2008 financial crisis extremely well, and was the only one of the major economies not to fall into recession.

- The Aussie is often traded as a proxy for China. It has extremely close trade links to China, so its currency often reflects Chinese economic fundamentals.

Trading fundamentals of AUD/USD

The Aussie is the fourth most widely traded currency in the world, according to the 2013 BIS survey. It can be traded as a proxy for China, so its fortunes are closely linked to the performance of the Chinese economy. So, when you trade the Aussie, you need to be aware of Chinese data releases.

Australia is also one of the world’s major commodity producers, which influence it in two ways:

- It can be sensitive to changes in commodity prices. When commodity prices fall, this can be bad news for the Aussie because it reduces the value of Australian exports and can impact the economy. The reverse is also true.

- Big exports tend to favor a weaker currency to boost the attractiveness of their exports. This means that the Aussie can be at risk from verbal intervention from its central bank, the Reserve Bank of Australia (RBA), although the RBA rarely intervenes physically in the market, unlike the Bank of Japan or the Swiss National Bank.

Trading Aussie by the numbers

AUD/USD is quoted in terms of the number of dollars it takes to buy an Aussie dollar, so a rate of 0.9550 means it costs $0.9550 to buy AU$1. The AUD is the primary currency in the pair and the USD is the secondary currency. That means

- AUD/USD is traded in amounts denominated in AUD. In online currency trading platforms, standard lot sizes are AU$100,000, mini lot sizes are AU$10,000, and micro lots are AU$1,000.

- The pip value, or minimum price fluctuation, is denominated in USD.

- Profit and loss accrue in USD. For one standard lot position size, each pip is worth $10; for one mini lot position size, each pip is worth $1; and for a micro lot, it is $0.10.

- Margin calculations are typically calculated in USD in online trading platforms. At a AUD/USD rate of 0.9000, to trade a one-lot position worth £100,000, it’ll take $900 in available margin (based on 100:1 leverage). That calculation will change over time, of course, based on the level of the AUD/USD exchange rate. A higher AUD/USD rate will require more USD in available margin collateral, and a lower AUD/USD rate will need less USD in margin.

Important Australian data reports

Key Australian data reports to watch for are

- RBA rate decisions, as well as speeches by RBA members and in particular the RBA governor

- RBA MPC minutes (released two weeks after each RBA meeting)

- Inflation gauges, such as CPI and PPI

- Retail sales

- House prices

- Industrial and manufacturing production

- Trade balance

- Employment data

- Chinese data, including manufacturing PMI survey data, trade data, and interest rate changes

Understanding Forex Positioning Data

Forex is not traded on an exchange, so how can you know which currencies people are buying and which ones people are selling? Never fear — there are many sources of forex positioning data. Because the forex market is so big, the best you can hope for is a snapshot of trading activity, based on a certain segment of the market. For example, the Commodities Futures Trading Commission (CFTC) releases data each week (at 3:30 p.m. Eastern time on Friday) that measures the net noncommercial (speculative) futures positions for the major currencies versus the U.S. dollar. This gives you a good idea of whether the market is long (buying a currency) or short (selling a currency) on a weekly basis.

This data is useful because it can be interpreted as an indicator of current trading activity in the forex market.

How to interpret the data

The data shows you the number of open positions in dollar pairs. They can be positive (people are buying the dollar pair) or negative (people are selling the dollar pair). Often, if a currency is trending higher against the USD, you see CFTC positioning data also moving higher. This data can be used to confirm the strength of a trend. For example, if a large segment of the forex community — the futures community — is buying the pound, then GBP/USD is likely to be in an uptrend. However, it can also be used as a contrarian indicator: If the market has been buying sterling for a while, some traders may use that as a sell signal. Because, by definition, trends don’t go on forever, the contrarian trader may look at CFTC data to see if the market is too stretched to the upside in one currency pair (say, GBP/USD), and if he thinks that it is, he may choose to go short on GBP/USD.

Positioning data can be a useful resource, although we don’t recommend that you trade only using CFTC positioning data, because it can be a lagging indicator and doesn’t reflect news events or economic data that could impact a currency pair on a more frequent basis.

The FX fix

When you read about foreign exchange in the business press or if you go into a forex dealing room, you’re likely to hear the term the FX fix. So, what is it? The FX fix is essentially a 60-second window at which major exchange rates are set. The forex market isn’t controlled by any central exchange, so the fix is used to form benchmark forex rates.

The most popular fix times take place at 4 p.m. and 8 p.m. London time. The 4 p.m. London FX fix is a particularly popular benchmark, primarily because it was the first one introduced by the WM Company (it’s now a joint venture with Thomson Reuters). These prices are mostly used by the investment community, which uses these FX rates to compare their portfolios against benchmarks and other portfolios, without concern for changes in exchange rates.

Trading at a fixing time is an example of point-in-time (PIT) trading. This involves buying or selling currencies at particular times each day. But retail traders should be wary of trading any of the major FX pairs during fixing times because it can trigger a spike in volatility. This trading strategy involves trading at times when the currency markets are transitioning from one global region to another. During this time, liquidity can start to fade, which can increase volatility.

At the time of writing, the FX fix is also under scrutiny from global market regulators over fears that it could be manipulated. The investigation is ongoing, so there could be changes to the fix in the future, like increasing the 60-second window, but so far nothing has been confirmed.

Forex and regulation

Despite being the largest market in the world, the forex market has largely escaped official regulation. This means that traders can set prices on their own, without getting an official body involved in the process.

Because there are no formal rules or regulation in the forex market, trust is of the utmost importance. The forex market works because both sides of a transaction trust each other. However, in the aftermath of the 2008 financial crisis, there has been a push for more formal regulation. As we mention earlier, changes are afoot to make the FX fix less susceptible to manipulation.

In the coming years, we expect big changes in the forex regulatory space. There is a push to impose more electronic trading and new codes of conduct. Although retail traders nearly always trade on an electronic platform, codes of conduct could impact how you trade.

Here at FOREX.com, we believe that any push toward greater transparency is good for the market and good for the retail trader.

EUR/USD trades inversely to the overall value of the USD, which means when EUR/USD goes up, the euro is getting stronger and the dollar weaker. When EUR/USD goes down, the euro is getting weaker and the dollar stronger. If you believed the U.S. dollar was going to move higher, you’d be looking to sell EUR/USD. If you thought the dollar was going to weaken, you’d be looking to buy EUR/USD.

EUR/USD trades inversely to the overall value of the USD, which means when EUR/USD goes up, the euro is getting stronger and the dollar weaker. When EUR/USD goes down, the euro is getting weaker and the dollar stronger. If you believed the U.S. dollar was going to move higher, you’d be looking to sell EUR/USD. If you thought the dollar was going to weaken, you’d be looking to buy EUR/USD. Don’t get us wrong, price jumps/gaps do occur in EUR/USD, as anyone who has traded around data reports or other news events can attest. But price jumps/gaps in EUR/USD tend to be generated primarily by news/data releases and breaks of significant technical levels, events which can usually be identified in advance. As a caveat, there were large price gaps during the sovereign debt crisis, as uncertainty about the future of the Eurozone hung in the balance. At the time of writing, trading conditions had mostly returned to normal.

Don’t get us wrong, price jumps/gaps do occur in EUR/USD, as anyone who has traded around data reports or other news events can attest. But price jumps/gaps in EUR/USD tend to be generated primarily by news/data releases and breaks of significant technical levels, events which can usually be identified in advance. As a caveat, there were large price gaps during the sovereign debt crisis, as uncertainty about the future of the Eurozone hung in the balance. At the time of writing, trading conditions had mostly returned to normal. When it comes to EUR/USD price action, backing and filling is quite common and tends to be more substantial than in most currency pairs, meaning a greater amount of the directional move is retraced. Look at Figure

When it comes to EUR/USD price action, backing and filling is quite common and tends to be more substantial than in most currency pairs, meaning a greater amount of the directional move is retraced. Look at Figure