Chapter 12

Identifying Trade Opportunities

In This Chapter

![]() Organizing market analysis to spot trade setups

Organizing market analysis to spot trade setups

![]() Locating pivotal support and resistance levels

Locating pivotal support and resistance levels

![]() Using momentum to spot trades and fine-tune entry and exits

Using momentum to spot trades and fine-tune entry and exits

![]() Trading on candlestick patterns

Trading on candlestick patterns

![]() Constructing a real-time trade strategy

Constructing a real-time trade strategy

Spotting trade opportunities and applying a trading plan are what it all boils down to. Traders and speculators spend the time and energy to follow the market and know what’s going on. They analyze and strategize, persistently scanning the market for trade opportunities, or setups, and waiting for the right time to step in and commit their money. And when they step in, they have a well-defined trade plan to guide them through whatever the market throws at them.

There’s certainly no shortage of opinions and ideas being voiced by market analysts and commentators, but in the end the trades you make are your decision. In this chapter, we go through the key steps to spotting trade opportunities and putting together a risk-aware trading plan to exploit the setup. In this chapter, we draw on many of the technical analysis concepts we outline in Chapter 11.

Developing a Routine for Market Analysis

Give some long, hard thought to how much time you can realistically afford to devote to market analysis before committing yourself to a specific routine. You may find you’re able to devote only a relatively short amount of time each day, so focus your energies on only one or two currency pairs. If you have the time, you can more effectively follow and analyze multiple currency pairs.

At the minimum, you should be prepared to devote at least an hour every day to looking at the market and keeping tabs on upcoming data and events. We like to follow a routine that focuses on:

- Multiple-time-frame technical analysis to identify support and resistance levels and to track overall price developments

- Candlestick and Ichimoku analysis after each daily and weekly close

- Reading economic data reports that have come out overnight to update our fundamental model (see Chapter 7)

- Assessing the likely market impact of upcoming data reports and events

- Reviewing market commentaries to stay on top of major themes and overall market sentiment

This may seem like a lot to squeeze into a single hour, but with time and practice, you’ll get your charting and market information sources all lined up so you can streamline the entire routine.

Performing Multiple-Time-Frame Technical Analysis

Look closely at the charts in Figures 12-1, 12-2, and 12-3. Notice anything similar about them? Don’t be surprised if you don’t — they all look extremely different. But that’s the point. They’re all charts of the same currency pair, but viewed in three different time frames. As you can see, viewing the forest through the trees takes on a whole new meaning when it comes to chart analysis.

Multiple-time-frame technical analysis is nothing more complicated than looking at charts using different time frames of data. The basic idea is to look at the big picture first to identify the key longer-term features and then drill down into shorter data time frames to pinpoint short-term price levels and trends. Our own preference is to focus on daily, four-hour, and hourly time frames, but you can use whichever time frames you think best match your trading style. Short-term traders, for instance, may want to focus on 2-hour, 30-minute, and 5-minute charts to better reflect the narrower time frames of their trading.

Source: eSignal (www.esignal.com)

Figure 12-1: EUR/USD on a daily candlestick chart.

Source: eSignal (www.esignal.com)

Figure 12-2: EUR/USD on a four-hour candlestick chart.

Source: eSignal (www.esignal.com)

Figure 12-3: EUR/USD on a one-hour candlestick chart.

The good thing about daily and weekly charts is that the technical levels don’t change quite as frequently as shorter time frames, so you can probably make do with updating the daily and weekly charts much less often.

In Figures 12-4, 12-5, and 12-6, we reproduce the same charts as the ones shown in Figures 12-1, 12-2, and 12-3, but this time we include our trend lines. We start by looking at the daily chart to identify the big levels and draw in longer-term trend lines. Then we drill down to the four-hour chart, where we take a fresh look based on what we’re seeing in that time frame and draw in more trend lines to encapsulate any price patterns or trends. To finish, we go down one more level to the hourly charts for a close-up view of the market’s most recent price action.

On subsequent updates, keep the trend lines that still appear to be valid (meaning, price action has not broken through them), and erase trend lines that are no longer active or have been broken. But don’t be in too great a rush to erase broken trend lines, because they’ll often continue to act as support or resistance, but in the opposite direction.

Source: eSignal (www.esignal.com)

Figure 12-4: Start out by drawing trend lines on longer-term charts, like weekly and daily (shown here), to identify major technical levels.

Source: eSignal (www.esignal.com)

Figure 12-5: Drill down from a longer-term view to a medium-term time frame, such as four hours (shown here) or two hours, to identify key medium-term support and resistance levels.

Source: eSignal (www.esignal.com)

Figure 12-6: Focus in on shorter time frames using 1-hour (shown here), 30-minute, 15-minute, and shorter time frames to identify short-term support and resistance.

Over time, you’ll get an idea of how good you are at spotting meaningful trend lines by the frequency with which you have to discard old trend lines. The longer the trend line contains price action or the longer prices react substantially when a trend line is broken, the more significant the trend line was. In Figures 12-4, 12-5, and 12-6, we keep in some of our older trend lines to give you an idea of how to draw them, as well as to show that some broken trend lines can still be valid.

Identifying Support and Resistance Levels

Multiple-time-frame technical analysis is your early-warning radar system. It alerts you to key support and resistance levels that, if broken, are likely to lead to larger directional breakouts and potential trading signals. Of course, the flip side is that if the support or resistance levels hold, price direction is likely to reverse course.

Now that you’ve gone through and analyzed a currency pair with trend lines in multiple time frames, you’re well on the way to identifying key technical support and resistance levels. But while trend lines are one of the simpler yet more powerful technical tools, there are still plenty of other sources of support and resistance to take note of. In Figure 12-7, we provide a chart showing support and resistance derived from the methods we outline in the following sections.

Source: eSignal (www.esignal.com)

Figure 12-7: Identifying short-term support and resistance levels on an hourly chart using trend lines, key price points (highs, lows, breakouts), congestion zones, and retracements.

Trend lines

You didn’t think you were done with trend lines yet, did you? Believe us when we say that trend lines are the gifts that keep on giving, as long as you keep drawing and redrawing them.

To determine support and resistance levels that correspond to the trend lines you’ve drawn, you simply need to place the cursor of your charting system on the trend line at the current time period. Your charting system should display the price value of the cursor placement on the right side of the chart; if not, you may have to use the crosshairs tool of the charting system to see the value. Keep in mind that trend-line price values will shift over time based on the slope of the trend line. If you’ve identified a trend line that’s sloping steeply higher, for instance, its price value will be higher in later periods. You can run the cursor up the trend line and note the price level and time interval to gauge how much it will change over time.

Highs and lows

After trend lines, markets tend to place the greatest amount of emphasis on period highs and lows as points of support and resistance, frequently referred to as horizontal support/resistance. You can pinpoint support or resistance levels from highs and lows by simply noting the price high or low, but give yourself a few pips of latitude (5 to 10 pips), because different charting systems have different data feeds, which may have slightly different high/low readings.

When you’re looking at a daily chart, you can pretty easily identify the relevant high or low. But when you’re looking at charts in shorter time frames, it’s not always clear which high/low you should use. A general rule is to look for significant price reactions from recent prior highs and lows.

Congestion zones

Congestion zones are price bands in which prior price action gives way to consolidation, or a period of sideways price action (see Figure 12-7 for some examples). Most congestion zones are roughly 30 to 50 pips wide, but they may be larger in more volatile pairs, like GBP/USD, or the JPY crosses. Unfortunately, there’s no easy recipe when it comes to deciding whether the top or bottom of a congestion zone will act as support or resistance, so you need to factor in the whole zone as a potential source of support/resistance. Prices moving higher, for instance, may stall at the base of a congestion zone, or they may make it all the way to the top. If the zone is cleared, however, prices are likely to move on to the next resistance level.

Fibonacci retracements

Fibonacci retracements should be drawn after significant directional price moves when it’s clear (or as clear as it can be) that the directional movement has stopped and reversed direction. (For more on Fibonacci levels, see Chapter 11.) You can draw the retracements by using the Fibonacci retracement drawing tool that’s standard in most charting systems. Figure 12-7 contains a Fibonacci retracement based on the most recent decline, and with prices currently above them they serve as potential support levels in any pullbacks.

Ichimoku levels

Ichimoku, or cloud charts, are an important source of support and resistance levels you won’t find anywhere else. We discuss the basics of Ichimoku charts in Chapter 11. The key to spotting trade opportunities with Ichimoku charts are daily closes above/below the various Ichimoku lines (Tenkan, Kijun, and the leading spans that make up the top and bottom of the cloud). On an intraday basis, those levels may be exceeded, but it’s only on a daily close basis that trading signals should be taken. After a move higher, for instance, a daily close below the Tenkan line should be taken as a cue to exit the prior trend, or potentially to go short.

Looking for Symmetry with Channels

If you’re new to chart analysis, you may be thinking that the array of bars or candles on a price chart looks like the ultimate in randomness. Sometimes that’s true, but more often than not, you’d be surprised how frequently symmetrical formations appear. By symmetrical formations, we mostly mean price channels, but also other chart patterns that we illustrate and cover in detail in Chapter 11.

Drawing price channels

A price channel is nothing more complicated than a series of parallel trend lines that encapsulate price action over a discernible period. Channels will form in all time frames, with long-term channels on a daily chart highlighting multiday or multiweek trading ranges, and short-term channels on an hourly chart revealing steady buying or selling during a trading session. Price channels can also form in any direction, from horizontal to steeply sloping up or down and anything in between.

The way to identify price channels is through visual inspection, using your eyes and imagination, as well as a fair amount of trial and error. Drawing channels is made much easier by the Copy a Line and Parallel Line functions, which are standard in most charting systems. To begin looking for and drawing potential channels, you need only one trend line to start with — the primary trend line. (In Figure 12-7, the lower trend line in the primary upchannel is the primary trend line.)

If the primary trend line is below the price bars or candles (support), look up at the tops of the price action to see if there is any parallel symmetry to the primary support trend line. If you’re not sure, simply copy the support trend line and drag it to the tops of the price bars to see if it captures the highest highs. If the copied trend line fits neatly onto the tops of the price action, you’ve found yourself a price channel.

That said, the parallel side (the upper channel line based on upward-sloping primary trend lines, and the lower channel line for downward-sloping primary trend lines) never behaves quite as neatly as the primary side. For example, during an uptrend most people are looking to buy; that’s why the price action often goes exactly to the primary channel support and then bounces higher. However, on rallies during an uptrend, there usually aren’t as many traders looking to sell and price action frequently exceeds the upper channel line. The same happens with the base of channels during declines, where fewer buyers are involved.

When you’re looking for channels, especially if prices have just changed direction and a new move is just beginning, keep in mind that you may have only one or two price points opposite the primary trend line to connect the parallel channel line. When that happens, go ahead and draw the parallel channel line — it’ll extend into empty space for the time being — but consider it only a tentative channel top or bottom until more price action confirms its validity.

Listening to Momentum

In Chapter 11, we look at various momentum indicators, like Relative Strength Index (RSI) and stochastics, and what they mean. As part of your routine of multiple-time-frame technical analysis, we strongly suggest that you incorporate two technical studies into your regimen of analysis.

Factoring momentum analysis into your routine

The first study to include in your analysis is a momentum oscillator like RSI or stochastics. We also recommend Moving Average Convergence/Divergence (MACD) — it’s not technically a momentum indicator, but it certainly acts like one. In fact, we prefer MACD over the more traditional momentum studies because MACD tends to change direction and generate crossovers more slowly than the other momentum studies. The result is fewer false signals, but the trade-off is that the signal may be delayed, giving you a less advantageous price entry level. In reality, though, the generally slower MACD signals are well suited to the forex market’s tendency to push a directional move as far as it will go for as long as possible.

The second study we recommend that you include in your analysis routine is the Directional Movement Indicator (DMI) system (which we also look at in greater detail in Chapter 11). The DMI serves as a double check on the momentum study. The Average Directional Index (ADX) component of the DMI is a trend identification signal that tells you whether the market is trending, regardless of direction. Relying solely on a momentum study can lead to serious problems when the market sets off on an extended trending movement.

The key is to double-check momentum readings with the ADX level to see if trending conditions are in place. If the ADX is above 25, you should discount what the momentum studies are indicating. Don’t completely ignore what the momentum study is showing — just defer to the ADX reading while it’s above 25. When the ADX tops out and turns down, you have a second indicator signaling that the directional move is likely coming to an end. If the ADX is below 25, defer to what the momentum indicators are signaling.

Looking at momentum in multiple time frames

Just as you were presented with starkly differing images by looking at the same price chart in different time frames, so will you be confronted with vastly different momentum readings across time frames. At any given moment, daily momentum readings may be negative and moving lower; four-hour momentum may be nearing overbought territory; and hourly momentum may have topped and turned lower.

Which one should you listen to? Simply put, all of them. The trick, however, is to keep each reading in perspective according to its time frame. Daily momentum readings develop over many days and weeks. Shorter-term readings play out in correspondingly shorter time frames.

The key is to view each period’s momentum indication in line with the time frame of the study. An hourly reading that has bottomed out and turned higher suggests that prices may stop declining for a few hours and possibly begin to move higher — but it’s no sure thing. Look next to the longer time frames to put the shorter-term readings into perspective. For example, if the hourly has bottomed out and started to move higher, and the four-hour reading is bottoming out in oversold territory, you may just have the makings of a larger turnaround to the upside. But if the four-hour reading is still in neutral territory and pointed lower, the hourly reading may suggest just a short-term bounce in a continuing move lower.

Trading on divergences between price and momentum

In Chapter 11, we introduce the idea of bullish/bearish divergences between price and momentum. In a nutshell, a bullish divergence occurs when prices make new lows, but momentum is not making similar new lows; a bearish divergence occurs when prices make new highs, but momentum is not making similar new highs.

Figure 12-8 shows an example of a bullish divergence between price and MACD. Because momentum is an underlying gauge of the speed of a directional move and, therefore, an indication of the level of market interest behind the move, a divergence between price and momentum typically signals that the latest price movement is false or unlikely to be sustained and will eventually reverse course in the direction of the momentum. So a bullish divergence tends to signal a price rebound after fresh selling makes new lows, and a bearish divergence typically signals a price decline after last-ditch buying makes a new high.

Source: eSignal (www.esignal.com)

Figure 12-8: A bullish divergence is created when new price lows are not matched by new lows in momentum, suggesting that the latest price decline may not be sustained.

- Has new information (data, comments, and so on) come into the market? If it’s new news, it may generate a fresh wave of directional buying or selling and overwhelm the divergence. If it’s old news, like reiterated comments or as-expected data that’s already been discounted, it could make for an ideal divergence setup.

- Are prices making significant new highs or lows? If prices have broken below a key daily low or trend-line support, for example, fresh selling interest may be coming into the market that creates a new wave lower. But if prices are pushing only below recent hourly lows, and longer-term support is still some distance off, the divergence will tend to correctly reflect that the price move down is invalid.

Using momentum for timing entry and exit

You can also use momentum studies to refine the timing of your trade entry and exit. If your analysis has led you to conclude that a long position is the way to go, for instance, and you’ve identified key trend-line support on which to buy, you can look at various time frames of momentum to determine the likelihood of prices actually reaching that support. If hourly momentum has turned up from oversold levels, and four-hour momentum is showing signs of bottoming out, but prices are still 50 pips away from your trend-line entry level, you may consider stepping in ahead of the trend-line support and buying sooner.

Alternatively, if daily and four-hour studies are both solidly negative, and hourly momentum has just gone through a short-term bounce higher but is now turning negative again, you can likely afford to wait for prices to reach your desired price level. (You may even rethink the overall strategy in light of such bearish momentum readings.) You can use momentum studies in the same way to gauge the likelihood of reaching your take-profit targets.

Trading on Candlestick Patterns

Candlestick formations are among our favorite trade identification tools; we highlight some of the most common reversal patterns to look for in Chapter 11. There are lots more patterns where those came from, with others signaling trend continuation or consolidation. Obviously, we like to home in on the reversal patterns because we think they give us the most price bang for our analysis buck.

Most trading books say that you can analyze candles in any time frame, but we like to focus exclusively on daily and weekly candles. Our thinking is that a full day’s or week’s price action carries more weight than a few hours or other intraday periods. Besides, a candlestick pattern that presents itself on a daily or weekly chart typically portends a larger price movement (hundreds of pips) over the next few days or weeks rather than smaller price moves signaled by intraday candle analysis.

Alternatively, or in tandem with the above strategy on an either/or basis, you can identify a key support/resistance level in the direction suggested by the candlestick pattern and place a stop-loss order to enter on the other side, in case the market moves directly as the pattern suggests. We outline a similar strategy in more detail in the following section.

Building a Trade Strategy from Start to Finish

If you’ve read any other trading books, you’ve undoubtedly seen numerous chart illustrations where the authors can point to a chart pattern and say, “See, the pattern indicates a price top,” and sure as shootin’, the rest of the chart shows that prices move lower. Don’t you just hate that? Well, hindsight is 20/20. Don’t get us wrong; we’re guilty of the same thing in this book. It’s largely unavoidable to get the point across.

In the real market, you’re never going to have the benefit of hindsight in advance. On every chart you look at, the future is going to be blank. And that’s the eternal struggle — basing decisions in the here and now on events that have yet to happen, all the while putting your money at risk.

To make amends, we do something a bit strange here and depict a trade opportunity in real time, or as real as we can make it in a book. Who knows? The trade may blow up in our faces, and we’ll have a bad trade recommendation preserved in book form for posterity. The point of this exercise, however, is not to show you how good or bad we are at spotting trades. It’s to give you an insight into how you may analyze the market and construct a trade strategy on a regular basis, using many of the approaches we outline in this chapter.

Follow along with Figures 12-9 and 12-10, which show some of the key daily and hourly price points we use to define our trade strategy for EUR/USD from March 21, 2011. In Chapter 11, we indicate our preference to use fundamental elements to determine the overall direction a currency pair should move, and then apply technical analysis to refine entry and exit levels.

So, how do the fundamentals for EUR/USD stack up? At the moment, pretty good in our view. European leaders have reached agreement on a long-term debt relief mechanism, and the market seems to find it credible, reducing fears of financial instability. The ECB has strongly indicated it plans to raise rates at its next meeting in a few weeks’ time, while the Fed has signaled rates will stay low for the foreseeable future, giving EUR an advantage over the USD on the monetary policy outlook. Also, one week ago the G7 intervened for the first time in more than a decade to support Japanese efforts to restrain JPY strength in the aftermath of the earthquake/tsunami/nuclear disaster earlier in March. That action saw the ECB buy EUR/JPY, giving EUR/USD, and risk assets in general, a boost in the process. And the USD is generally quite weak.

As such, our expectation is to see EUR/USD strengthen further (currently 1.4230) to the 1.4450 to 1.4500 area initially, with potential to around 1.4680 based on the measured move objective of the broken bull flag last month. A look at daily Ichimoku charts shows price well above the cloud and above the Tenkan and Kijun, signs of a solid trend higher.

But we’re also wary that EUR/USD has already gained ground on the fundamental factors we cite earlier, so we’re reluctant to buy at current levels. We also note the highs from November 2010 at about 1.4250/1.4280 as a potentially significant resistance point. We definitely don’t want to get long 50 points below a major daily high.

Instead, we’ll look to get long at better levels. Looking at the daily chart in Figure 12-9, the break above the 1.4000/50 level stands out as the most recent acceleration in the trend higher. Maybe we’ll get a chance to buy a retest of the break?

Source: eSignal (www.esignal.com)

Figure 12-9: Daily EUR/USD analysis suggests potential price targets based on the broken bull flag, but key daily highs loom just above current prices.

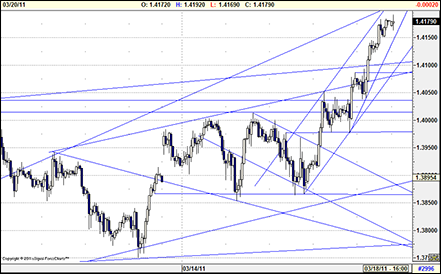

The hourly chart in Figure 12-10 shows prices potentially set to drift out of the primary channel, another cautionary sign. The hourly MACD is showing a bearish divergence on the newest highs, but it could also be basing out above the zero line, potentially signaling another move higher. Cross-checking with the ADX, it based out above the 25 trending level, and is currently above, but only barely. All in all, we think we have a reasonable basis to expect a pullback lower while the 1.4280 highs hold. If they don’t, we’ll have a strategy for that scenario.

Our strategy then is to buy a pullback at 1.4070 for a single lot of 100,000 EUR/USD, placing our if-done/then-OCO limit buying order just above the key 1.4000/50 break level in case it’s not reached. We’ll place our stop below that zone, allowing for a 20-pip margin of error, at 1.3980, for a total risk of about 90 pips, or $900. Our take-profit order will be to sell at 1.4420, just below what we think will be key round number resistance in the 1.4450/4500 area, possibly on some option-related selling interest, too, for a potential gain of around 350 pips, or $3,500. We’ll raise the stop loss to 1.4200 if the 1.4280/85 highs are tested, to lock in some profit in case of a failure.

In case prices move directly higher, we’re prepared to step up and buy on a stop-loss basis at 1.4310, which would represent a clear break of both the 1.4280 highs and the 1.4300 level. But if it’s triggered, we won’t hang on for too long in case the break ultimately fails. We’ll leave our stop at 1.4240 for a risk of around 70 pips, or $700. The take profit will be the same at 1.4420 for a potential gain of around 110 pips. Depending on the strength of any follow-through buying above 1.4280, we may opt for a trailing stop loss of 70 pips and see how the 1.4450/4500 area reacts.

Source: eSignal (www.esignal.com)

Figure 12-10: Hourly EUR/USD shows some signs of a potential stall in recent gains as seen in a bearish divergence in MACD.

So how’d the trade turn out? Surprise, surprise, it went well, but we changed what was a medium-term strategy into a short-term trade based on market developments. First, EUR/USD tried higher one more time on Tuesday, but stopped short of 1.4250 with a high at 1.4249, before turning lower. A combination of weaker Eurozone data, better U.S. data, and escalating concerns over Portuguese debt (the government collapsed on Wednesday night) saw EUR/USD drop to as low as 1.4054 (which is where the Ichimoku Tenkan line was on that day), triggering our limit entry order at 1.4070 on Thursday morning in European trading. A disappointing U.S. durable goods report later in the New York morning saw EUR/USD rebound quickly above 1.4120, eventually triggering stop-loss orders at 1.4150/70 and jumping as high as 1.4220.

With the quick bounce from the key 1.4000/50 support area identified earlier, we felt quite confident in the overall strategy. But we were also mindful of the key resistance up at 1.4250/80, which now appeared to be drawing sellers in below it. We decided to protect our profits, so we narrowed our order to a stop loss at 1.4145 (locking in 75 pips profit), just below the break-up level at 1.4150 earlier in the morning and lowering our take profit to 1.4230. The rest of Thursday traded between those levels, and we finished out the day still long one lot from 1.4070. Looking ahead, we considered headlines coming from the EU debt summit could send EUR/USD lower in a flash, and also that the German IFO survey due out on Friday morning was forecast to decline, also potentially sending EUR/USD back down. Shortly after the New York close, we decided to exit the trade and sold at 1.4175, for a gain of 105 pips, or $1,050.

What did we do right and what did we do wrong in the trade? First, we took time to analyze key price levels and identify an opportunistic entry level, placing our order just above key support, in case it wasn’t reached. Second, we aggressively protected our profits, adjusting our stop-loss order based on unfolding price movements. Third, we stayed flexible regarding exiting the trade, taking into account technical levels and developing fundamental events. Last and most important, we took profit. EUR/USD could’ve gone to the moon on Friday (it didn’t, but that’s another story) and we might’ve missed out as our ultimate view of a higher EUR was realized. But the bottom line is that we developed a trade strategy, stuck to it, and have something to show for it. You can’t go broke taking profit.

What did we do wrong? In hindsight, we could have been more aggressive and sold short above 1.4200, keeping a tight stop over 1.4250 or 1.4280, for a well-defined and relatively minimal risk. But that would have been contrary to our fundamental expectations, and we would have regretted it if it failed. We also may have then become gun-shy and reluctant to get long at even higher levels. So maybe it wasn’t such a bad thing after all.

We hope this example gives you a practical idea of how to put it all together, drawing on fundamentals, chart formations, and technical analysis to identify a trade setup and construct the trading plan to exploit it. In Chapters 13, 14, and 15, we look at considerations and strategies for entering positions, managing positions, and exiting trades in much greater detail. See the appendix for a comprehensive list of actionable trading strategies.

The first step is to commit to making time for market analysis. The more regular your analysis, the greater the feel you’ll develop for where the market has been and where it’s likely to go. Also, the more regularly you update yourself on the market, the less time it’ll take to stay up to speed. It’s a lot easier updating yourself every day than it is trying to catch up on several days’ worth of market news, data, and price developments.

The first step is to commit to making time for market analysis. The more regular your analysis, the greater the feel you’ll develop for where the market has been and where it’s likely to go. Also, the more regularly you update yourself on the market, the less time it’ll take to stay up to speed. It’s a lot easier updating yourself every day than it is trying to catch up on several days’ worth of market news, data, and price developments. Whichever time frames you end up working with, we strongly recommend that you include longer time frames, like daily and weekly, so you can get a sense of where the most significant price levels are. The strength and significance of support and resistance levels are a function of the time frame in which they’re evident, with longer-term technical levels holding greater meaning than shorter ones. You don’t want your focus to become so narrow that you lose sight of the big picture and go with a break of short-term resistance, for instance, when major daily or weekly resistance is just beyond.

Whichever time frames you end up working with, we strongly recommend that you include longer time frames, like daily and weekly, so you can get a sense of where the most significant price levels are. The strength and significance of support and resistance levels are a function of the time frame in which they’re evident, with longer-term technical levels holding greater meaning than shorter ones. You don’t want your focus to become so narrow that you lose sight of the big picture and go with a break of short-term resistance, for instance, when major daily or weekly resistance is just beyond. Breaks of sloping trend lines always have an immediate hurdle to climb, namely the prior high of a move up in the case of a break of downward sloping trend lines, or the prior low in the case of upward sloping trend lines. Some technical traders disregard sloping trend lines altogether and focus only on breaks of recent highs or lows, which we discuss next. (By the way, you can probably tell we’re not among them. We’ll leave it to you to judge the importance of sloping trend lines based on the charts in this book.)

Breaks of sloping trend lines always have an immediate hurdle to climb, namely the prior high of a move up in the case of a break of downward sloping trend lines, or the prior low in the case of upward sloping trend lines. Some technical traders disregard sloping trend lines altogether and focus only on breaks of recent highs or lows, which we discuss next. (By the way, you can probably tell we’re not among them. We’ll leave it to you to judge the importance of sloping trend lines based on the charts in this book.)