Chapter 10

My Trading Room and How It Works

I would like to start by reminding you that if I enter at a certain price level with a certain amount of shares, that doesn't mean you should be entering at that level or with that many shares. At this point I don't have to tell you why, but for the sake of risk management I'm telling you just the same, because being a nag about your not going broke is three-fifths of who I am.

As a beginner in this system, you haven't mastered it yet, and you may have less capital than I do. So you shouldn't be trading a first-tier swing level and you should only be trading in 100-share blocks. In most other online trading rooms that offer you instruction, that's not how it is. What you'll find there is counterintuitive and risky to the point of insane. Most are bogus, or they don't provide correct information. The operator/trader is offering only what works for him, with no clue what works for you. Many online trading rooms make their calls after the fact, meaning they reverse-engineer what happened in-market that day, and then they don't post their trading results until after the closing bell. Of course, this makes them look really profitable. Does the word illegal come to mind here? Many online trading rooms are thinly disguised scams. At the very least they offer their trade setups not caring that their entry/exit levels may not be the right ones for you.

With that said, are you ready for some good news? My online trading room bridges that quagmire and makes this ride relatively safe for you. I say relatively because with all trading activity there are inherent risks—the biggest risk being that you are your own worst enemy.

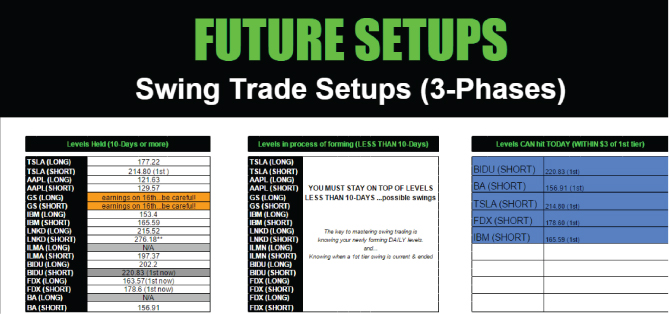

Contrary to what most other trainers have been doing, when I first designed my trading room, I aimed for transparency. From its beginnings and right to the present, my system has reflected exactly what the trading room does. The best way to do this is to show my swing levels prior to the day they will hit—in many cases I know the level weeks ahead of it hitting. This way there is no denying that my system works. For instance, in this chapter you'll see images of my “Future Setups” portion of the swing room. Here is where I show all the stocks I'm trading and the next swing level to hit on each stock. Once those swing levels hit, I document each trade setup.

When the price levels have dates and exact support /resistance levels to trade, prior to the price hitting, there's no way this system can be altered. This eliminates your confusion or suspicion of something bogus. I'm there to make consistent profits and show you how to do it. I have absolutely no incentive to hype up a worthless system.

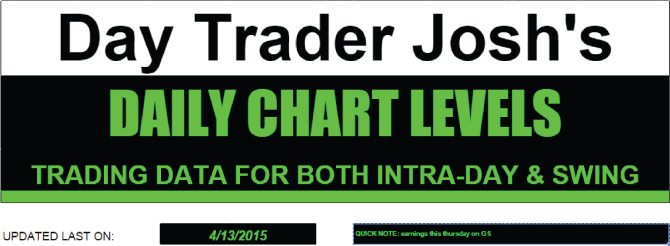

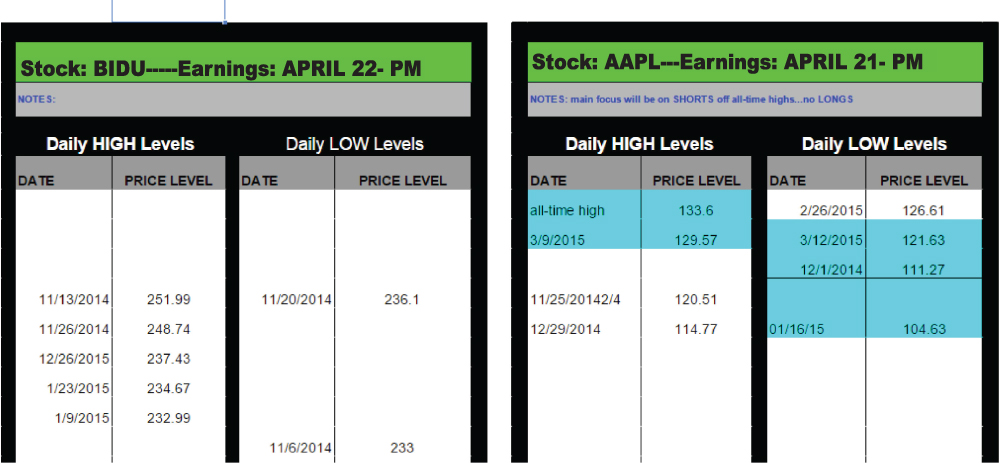

My online trading room is the key to my training program. Why? Because I found the price levels with my methodology. Therefore my trading room is your training wheels while you're working on mastery. In this chapter I include several screenshots of it. You will notice that there are two parts. I have my daily chart room (Figures 10.1 and 10.2) and the swing trading room (Figures 10.3–10.6).

Figure 10.1 Day Trader Josh's Daily Chart Levels

Figure 10.2 Daily Chart Room

Figure 10.3 Day Trader Josh's Swing Trading Room

The daily chart room is only specific to the daily levels for each stock (Figure 10.2). As you know by now, this room is the key to the entire system. Recall how important the daily levels are and how critical it is to constantly update them. My daily levels room does exactly that for each and every stock I trade.

The swing-trading room is more involved. It includes:

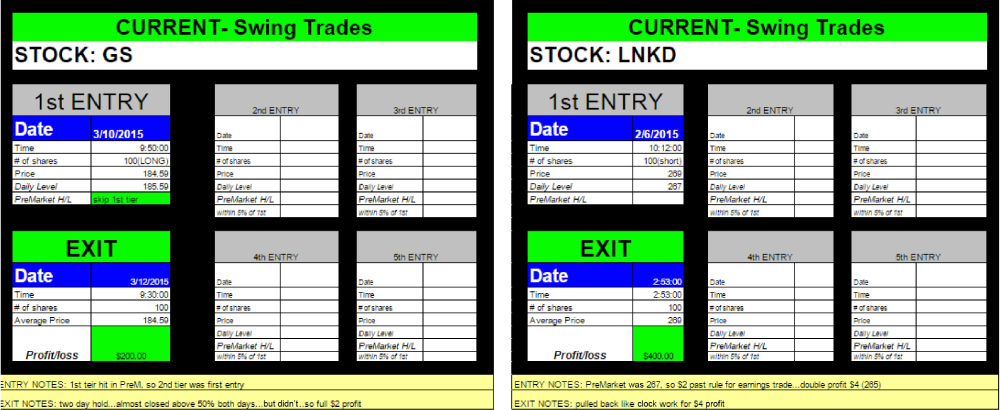

- Most recent trades that have been completed (Figure 10.4)

- The future trade setups and stocks most likely to hit levels today (Figure 10.5)

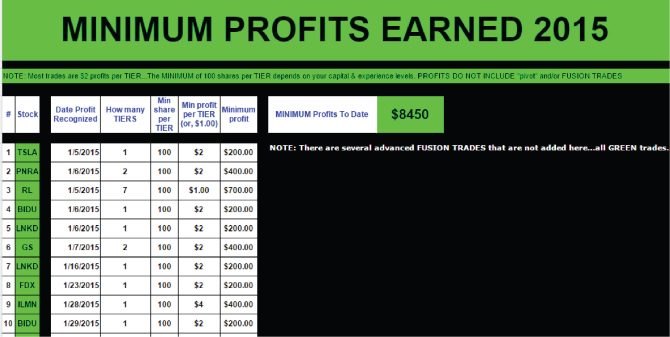

- The minimum profits to date (Figure 10.6)

Figure 10.4 Swing Trading Room—Most Recent Trades

Figure 10.5 Future Trade Setups

Figure 10.6 Minimum Profits to Date

Figure 10.6 shows the minimum profits that could have been earned with my system—minimum because when you examine the chart, you'll notice that each tier is 100 shares. This means that if you're trading with more than 100 shares, then more profits can be made. Also, the chart doesn't include all the intra-day fusion trades that were made during the wait for a swing to hit.

Fusion trades, for a master trader, can constitute as much profits as the normal swing trades produce. I just don't list them because there are far too many, and I simply do not have the time to document every single intra-day trade (fusion trades). If you choose to enter my training program, then this trading room will be your focus, and this will be in sync with my one-on-one coaching conference calls. You'll have access to it for a full year.