Chapter 1

Frequently Asked Questions

Short Answer

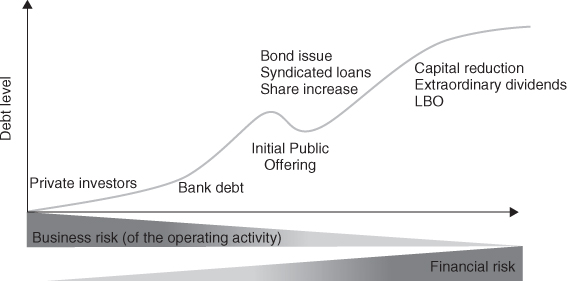

Corporate finance describes the financial decisions of corporations. Its main objective is to maximize corporate value while reducing financial risk. The financial manager has responsibility for corporate finance decisions.

Long Answer

In order to understand what corporate finance is, we need to understand who the financial manager is and what his or her responsibilities are.

The financial manager is responsible for financing the firm and acts as an intermediary between the financial system's institutions and markets, on the one hand, and the enterprise, on the other. He or she has two main roles:

1. To ensure the company has enough funds to finance its expansion and meet its obligations. In order to do this, the company issues securities (equity and debt) which the financial manager sells to financial investors at the highest possible price. In today's capital market economy, the role of the financial manager is less a buyer of funds, with an objective to minimize cost, but more a seller of financial securities. By emphasizing the financial security, we focus on its value, which combines the notions of return and risk. We thereby reduce the importance of minimizing the cost of financial resources, because this approach ignores the risk factor. Casting the financial manager in the role of salesman also underlines the marketing aspect of the job. Financial managers have customers (investors) whom they must persuade to buy the securities of their company. The better financial managers understand their needs, the more successful they will be.

2. To ensure that, over the long term, the company uses the resources provided by investors to generate a rate of return at least equal to the rate of return the investors require. If it does, the company creates value. If it does not, it destroys value. If it continues to destroy value, investors will turn their backs on the company and the value of its securities will decline.

The company's real assets are transformed into financial assets in the financial manager's first role. The financial manager must maximize the value of these financial assets, while selling them to the various categories of investors. The second role is a thankless one. The financial manager must be a ‘party-pooper’, a ‘Mr. No’ who examines every proposed investment project under the microscope of expected returns and advises on whether to reject those that fall below the cost of funds available to the company.

References and Further Reading

Quiry, P., Dallocchio, M., Le Fur, Y. and Salvi, A., Corporate Finance, 3rd ed. John Wiley & Sons, 2011.

Short Answer

Cash flows refer to the excess of cash revenues over cash outlays. They are usually measured during a specified period of time.

Example

Let's take the example of a greengrocer, who is ‘cashing up’ one evening. What does she find? First, she sees how much she spent in cash at the wholesale market in the morning and then the cash proceeds from fruit and vegetable sales during the day. If we assume that the greengrocer sold all the products she bought in the morning at a mark-up, the balance of receipts and payments for the day will be a cash surplus. If the greengrocer decides to add frozen food to her business, the operating cycle will no longer be the same. The greengrocer may, for instance, begin receiving deliveries only once a week and will therefore have to run much larger inventories. The impact of the longer operating cycle due to much larger inventories may be offset by larger credit from her suppliers. However, most importantly, before she can start up this new activity, our greengrocer needs to invest in a freezer chest. All these activities produce cash flows.

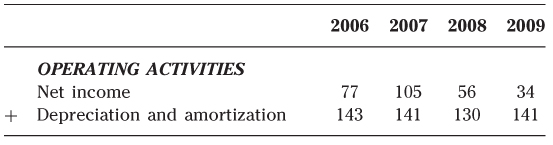

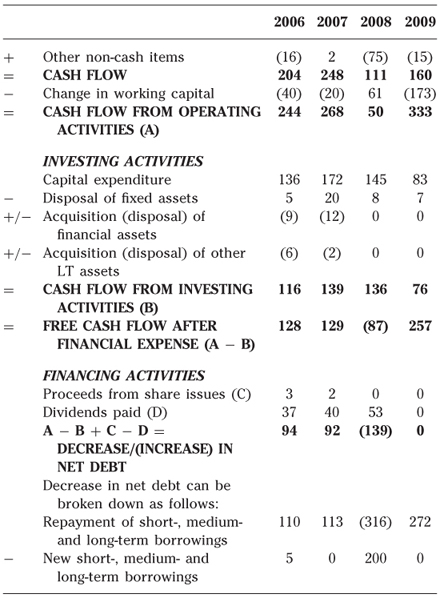

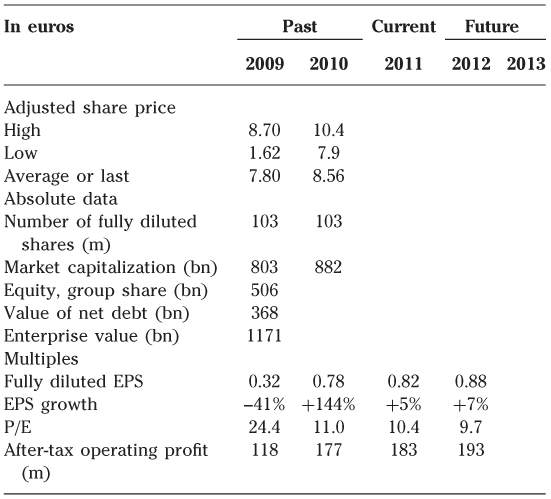

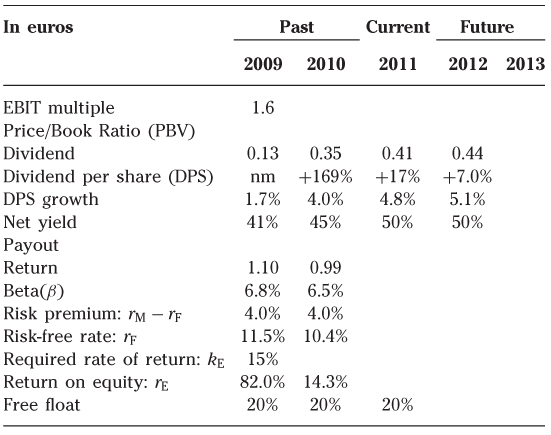

Example—Let's also take an example of a real company (Table 1.1), Indesit

Table 1.1: Cash flow statement for Indesit (€m)

Long Answer

The cash flows of a company can be divided into four categories: operating and investment flows, which are generated as part of its business activities, and debt and equity flows, which finance these activities.

The operating cycle is characterized by a time lag between the positive and negative cash flows deriving from the length of the production process (which varies from business to business) and the commercial policy (customer and supplier credit). Operating cash flow (the balance of funds generated by the various operating cycles in progress) comprises the cash flows generated by a company's operations during a given period. It represents the (usually positive) difference between operating receipts and payments. Operating cash flow is independent of any accounting policies, which makes sense since it relates only to cash flows. More specifically:

- the company's depreciation and provisioning policy

- its inventory valuation method

- the techniques used to defer costs over several periods

have no impact on the figure.

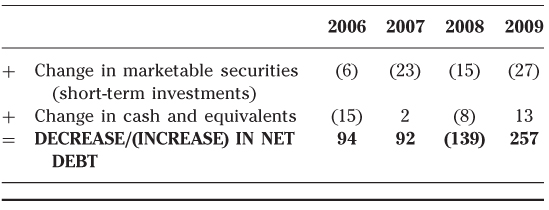

From a cash flow standpoint, capital expenditures must alter the operating cycle in such a way as to generate higher operating inflows going forward than would otherwise have been the case. Capital expenditures are intended to enhance the operating cycle by enabling it to achieve a higher level of profitability in the long term. This profitability can be measured only over several operating cycles, unlike operating payments which belong to a single cycle. As a result, investors forgo immediate use of their funds in return for higher cash flows over several operating cycles (see Table 1.2 for a cash flow statement).

Table 1.2: A simplified cash flow statement

Free cash flow can be defined as operating cash flow less capital expenditure (investment outlays).

When a company's free cash flow is negative, it must cover its funding shortfall by raising equity and debt capital.

Where a business rounds out its financing with debt capital, it undertakes to make capital repayments and interest payments (financial expense) to its lenders regardless of the success of the venture. Accordingly, debt represents an advance on the operating receipts generated by the investment that is guaranteed by the company's shareholders' equity.

Short-term financial investment, the rationale for which differs from investment, and cash should be considered in conjunction with debt. We prefer reasoning in terms of net debt (i.e. net of cash and of marketable securities, which are short-term financial investments) and net financial expense (i.e. net of financial income).

3. What Alternative Formats of the Balance Sheet May Companies Use?

Short Answer

A balance sheet can be analyzed either from a capital-employed perspective or from a solvency-and-liquidity perspective.

Example

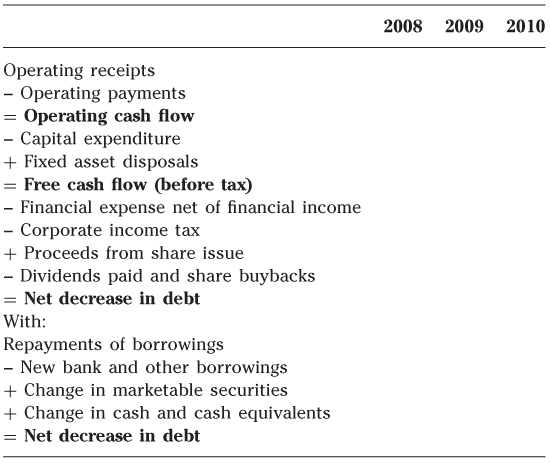

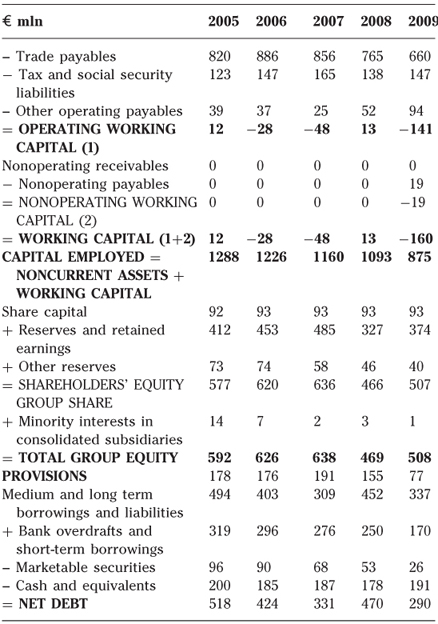

Table 1.3: Capital-employed balance sheet for Indesit*

Long Answer

A capital-employed analysis of the balance sheet shows all the uses of funds by a company as part of the operating cycle and analyzes the origin of the sources of a company's funds at a given point in time.

On the asset side, the capital-employed balance sheet has the following main headings:

- fixed assets, i.e. investments made by the company;

- operating working capital (inventories and trade receivables under deduction of trade payables). The size of the operating working capital depends on the operating cycle and the accounting methods used to determine earnings;

- non-operating working capital, a catch-all category for the rest.

The sum of fixed assets and working capital is called capital employed.

Capital employed is financed by the capital invested, i.e. shareholders' equity and net debt.

From a capital-employed standpoint, a company balance sheet can be analyzed as follows:

A solvency-and-liquidity analysis lists everything the company owns (on the asset side) and everything that it owes (on the liabilities side), the balance being the book value of shareholders' equity or net asset value. It can be analyzed from either a solvency or liquidity perspective.

Liquidity measures a firm's ability to meet its commitments up to a certain date by monetizing assets in the ordinary course of business.

A classification of the balance sheet items needs to be carried out prior to the liquidity analysis.

Liabilities are classified in the order in which they fall due for repayment. Since balance sheets are published annually, a distinction between the short term and long term depends on whether a liability is due in less than or more than one year. Accordingly, liabilities are classified into those due in the short term (less than one year), in the medium and long term (i.e. in more than one year) and those that are not due for repayment.

Likewise, what the company owns can also be classified by duration as follows:

- Assets that will have disappeared from the balance sheet by the following year, which comprise current assets in the vast majority of cases;

- Assets that will still appear on the balance sheet the following year, which comprise fixed assets in the vast majority of cases.

Consequently, from a liquidity perspective, we classify liabilities by their due date, investments by their maturity date and assets as follows:

- Assets are regarded as liquid where, as part of the normal operating cycle, they will be monetized in the same year. Thus they comprise (unless the operating cycle is unusually long) inventories and trade receivables.

- Assets that, regardless of their nature (head office, plant, etc.), are not intended for sale during the normal course of business are regarded as fixed (noncurrent) and not liquid.

Solvency measures the company's ability to honor its commitments in the event of liquidation; a company may be regarded as insolvent once its shareholders' equity turns negative. This means that it owes more than it owns.

References and Further Reading

Friedlob, G. and Welton, R., Keys to Reading an Annual Report, Barrons Educational Series, 2008.

Stolowy, H., Lebas, M. and Ding, Y., Financial Accounting and Reporting: A Global Perspective, 3rd ed., Thomson, 2010.

4. What is the Working Capital and How do Companies Manage It?

Short Answer

The working capital is the net balance of operating uses and sources of funds.

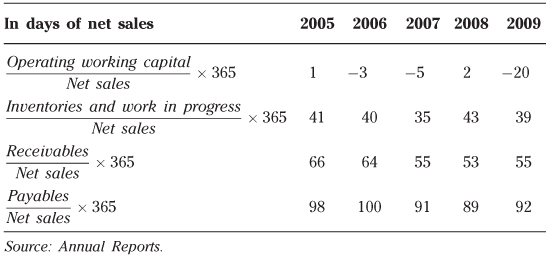

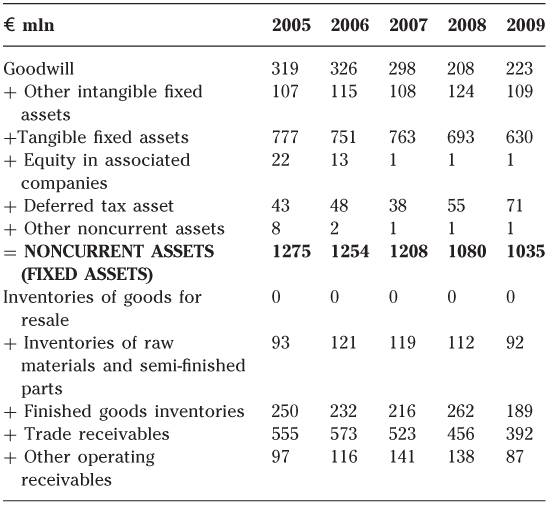

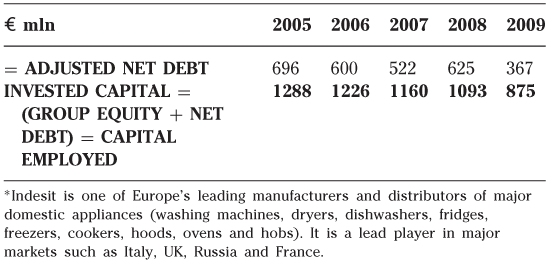

If uses of funds exceed sources of funds, the balance is positive and working capital needs to be financed, if negative, it represents a source of funds generated by the operating cycle (see Table 1.4).

Long Answer

Working capital can be divided between operating working capital and non-operating working capital.

Operating working capital includes the following accounting entries in Table 1.5:

Table 1.5: Operating working capital

| Inventories | Raw materials, goods for resale, products and work in progress, finished products. | |

| + | Trade receivables | Amounts owed by customers, prepayments to suppliers and other trade receivables. |

| − | Trade payables | Amounts owed to trade suppliers, social security and tax payables, prepayments by customers and other trade payables. |

| = | Operating working capital |

The working capital calculated at the year-end is not necessarily representative of the company's permanent requirement. Therefore, you must look at how it has evolved over time.

All of the components of working capital at a given point in time disappear shortly thereafter. Inventories are consumed, suppliers are paid and receivables are collected. But even if these components are being consumed, paid and collected, they are being replaced by others. Working capital is therefore both liquid and permanent.

Working capital turnover ratios measure the average proportion of funds tied up in the operating cycle. The principal ratios are:

- Days of Sales Outstanding (DSO)

accounts receivable/sales (incl. VAT) × 365.

- Days of Payables Outstanding (DPO)

accounts payable/purchases (incl. VAT) × 365.

- Days of Inventories Outstanding (DIO)

inventories and work in progress/sales (excl. VAT) × 365.

- Working capital turnover

working capital/sales (excl. VAT) × 365.

When a company grows, its working capital has a tendency to grow, because inventories and accounts receivable (via payment terms) increase faster than sales. Paradoxically, working capital continues to grow during periods of recession because restrictive measures do not immediately deliver their desired effect. It is only at the end of the recession that working capital subsides and cash flow problems ease.

The operating cycles of companies with negative working capital are such that, thanks to a favorable timing mismatch, they collect funds prior to disbursing certain payments. There are two basic scenarios:

- supplier credit is much greater than inventory turnover, while at the same time, customers pay quickly, in some cases in cash;

- customers pay in advance.

A low or negative working capital is a boon to companies looking to expand.

The level of working capital is an indication of the strength of the company's strategic position, because it reflects the balance of power between the company and its customers and suppliers.

Working capital is totally independent of the methods used to value fixed assets, depreciation, amortization and impairment losses on fixed assets. However, it is influenced by:

- inventory valuation methods;

- deferred income and cost (over one or more years);

- the company's provisioning policy for current assets and operating liabilities and costs.

Non-operating working capital is a catch-all category for items that cannot be classified anywhere else. It includes amounts due on fixed assets, dividends to be paid, extraordinary items, etc.

References and Further Reading

Biais, B. and Grolier, C., Trade credit and credit rationing, The Review of Financial Studies 10, 903–937, 1997.

Cunat, V., Inter-firm credit and industrial links, Mimeo, London School of Economics, 2000.

Deloof, M., Does working capital management affect profitability of Belgian firms, Journal of Business Finance & Accounting, 585, 2003.

Long, M., Malitz, I. and Ravid, A., Trade credit, quality guarantees, and product marketability, Financial Management 22, 117–127, 1993.

Maxwell, C., Gitman, L. and Smith, S., Working capital management and financial-service consumption preferences of US and foreign firms: A comparison of 1979 & 1996 preferences, Financial Management Association, 46–52, Autumn–Winter 1998.

Mian, S. and Smith, C., Accounts receivable management policy: Theory and evidence, Journal of Finance 47, 169–200, 1992.

Ng, J. and Smith, R., Evidence on the determinants of credit terms used in interfirm trade, Journal of Finance 54, 1109–1129, June 1999.

Shin, H. and Soenen, L., Efficiency of working capital management and corporate profitability, Financial Management Association, 37–45, Autumn–Winter 1998.

5. What are the Alternative Formats of an Income Statement?

Short Answer

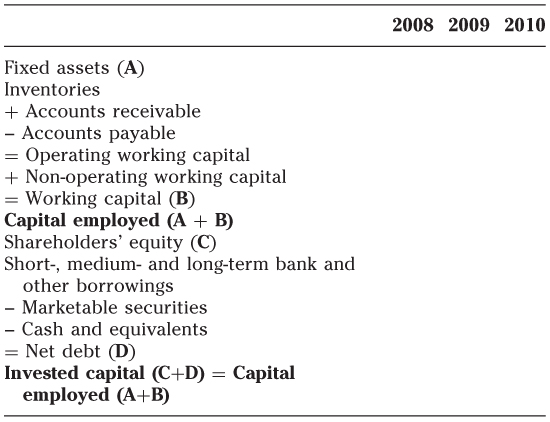

Two main formats of income statement are frequently used, which differ in the way they present revenues and expenses related to the operating and investment cycles. They may be presented either by function or by nature (see Figure 1.1).

Figure 1.1: Two main formats of income statement by nature or by function

Long Answer

The two main alternative formats for an income statement are:

- By function, i.e. according to the way revenues and charges are used in the operating and investing cycle. This format shows the cost of goods sold (COGS), selling and marketing costs (S&M), research and development costs (R&D) and general and administrative costs (G&A).

- By nature, i.e. by type of expenditure or revenue which shows the change in inventories of finished goods and in work in progress (closing less opening inventory), purchases of and changes in inventories (closing less opening inventory) of goods for resale and raw materials, other external charges, personnel expenses, taxes and other duties, depreciation and amortization.

The by-function income statement format is based on a management accounting approach, in which costs are allocated to the main corporate functions (Table 1.6).

Table 1.6: By-function income statement

| Function | Corresponding cost |

| Production | Cost of Sales (or Cost of Goods Sold - COGS) |

| Commercial | Selling and marketing costs |

| Research and development | Research and Development costs (R&D) |

| Administration | General and Administrative costs (G&A) |

As a result, personnel expense is allocated to each of these four categories (or three where selling, general and administrative costs are pooled into a single category) depending on whether an individual employee works in production, sales, research or administration. Likewise, depreciation expense for a tangible fixed asset is allocated to production if it relates to production machinery, to selling and marketing costs if it concerns a car used by the sales team, to research and development costs if it relates to laboratory equipment, or to general and administrative costs in the case of the accounting department's computers, for example.

The underlying principle is very simple indeed. This format clearly shows that operating profit is the difference between sales and the cost of sales irrespective of their nature (i.e. production, sales, research and development, administration).

On the other hand, it does not differentiate between the operating and investment processes since depreciation and amortization are not shown directly on the income statement (they are split up between the four main corporate functions), obliging analysts to track down the information in the cash flow statement or in the notes to the accounts.

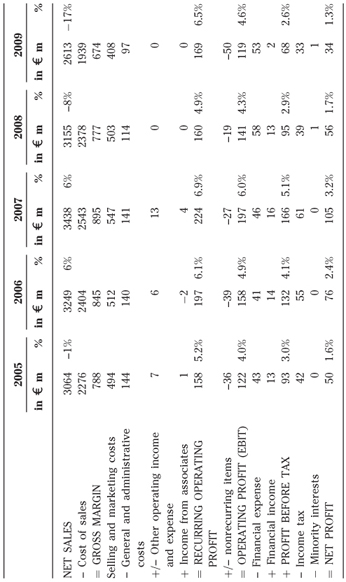

Table 1.7 shows the Indesit by-function income statement:

Table 1.7: Indesit by-function income statement

The by-nature format is simple to apply, even for small companies, because no allocation of expenses is required. It offers a more detailed breakdown of costs.

Naturally, as in the previous approach, operating profit is still the difference between sales and the cost of sales.

In this format, charges are recognized as they are incurred rather than when the corresponding items are used. Showing on the income statement all purchases made and all invoices sent to customers during the same period would not be comparing like with like.

A business may transfer to the inventory some of the purchases made during a given year. The transfer of these purchases to the inventory does not destroy any wealth. Instead, it represents the formation of an asset, albeit probably a temporary one, but one that has real value at a given point in time. Secondly, some of the end products produced by the company may not be sold during the year and yet the corresponding charges appear on the income statement.

To compare like with like, it is necessary to:

- eliminate changes in inventories of raw materials and goods for resale from purchases to get raw materials and goods for resale used rather than simply purchased;

- add changes in the inventory of finished products and work in progress back to sales. As a result, the income statement shows production rather than just sales.

The by-nature format shows the amount spent on production for the period and not the total expenses under the accruals convention. It has the logical disadvantage that it seems to imply that changes in inventory are revenues or expenses in their own right, which they are not. They are only an adjustment to purchases to obtain relevant costs.

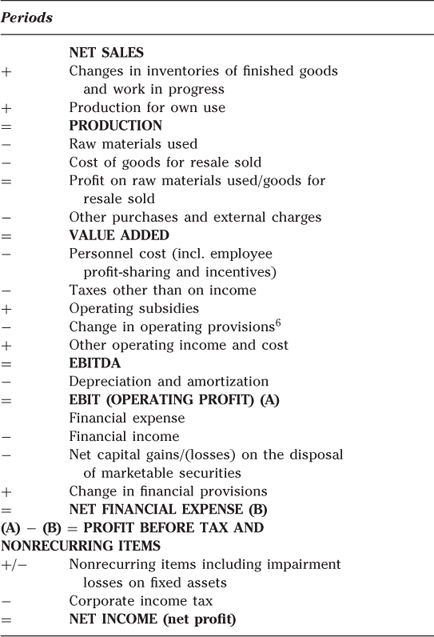

Below in Table 1.8 is the model of a by-nature income statement.

Table 1.8: Model of a by-nature income statement

References and Further Reading

Baker, C.R., Ding, Y. and Stolowy, H., The statement of intermediate balance: a tool for international financial statement analysis based on income statement ‘by nature’, an application to airline industry, Advances in International Accounting, 18, 2005.

Stolowy, H. and Lebas, M., Financial Accounting and Reporting: A Global Perspective, 2nd ed., Thomson, 2006.

6. How can We Perform the Financial Analysis of a Company?

Short Answer

The aim of financial analysis is to explain how a company can create value in the medium term (shareholders' viewpoint) or to determine whether it is solvent (lenders' standpoint).

Either way, the techniques applied in financial analysis are the same.

Long Answer

First of all, financial analysis involves a detailed examination of the company's economics.

This study entails straightforward reasoning and a good deal of common sense. We can emphasize different aspects.

- Company's market, in other terms the niche or space in which the business has some industrial, commercial or service-oriented expertise, and understanding the company's position within its market. In particular:

1. market growth;

2. market risk;

3. market share;

4. competition;

5. how the competition works (price-driven or product-driven).

- Production model, with specific focus on three aspects:

1. value chain—when studying a value chain, analysts need to identify weaknesses where a particular category of player has no or very little room for maneuver (scope for developing new activities, for selling operating assets with value independent of their current use, etc.);

2. production model—trying to detect any inconsistency between the product and the industrial organization adopted to produce it.

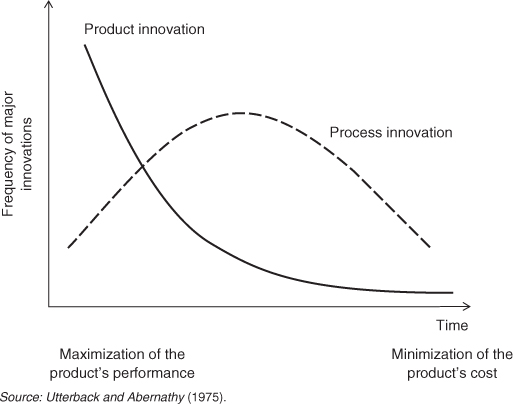

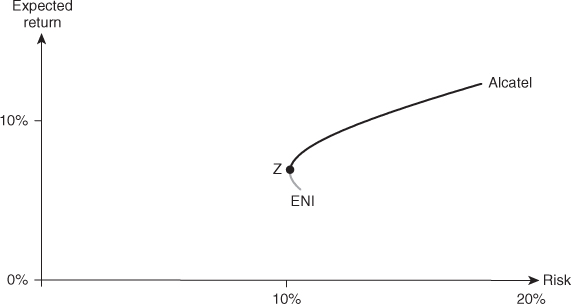

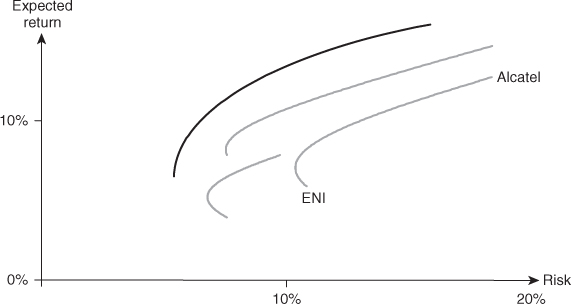

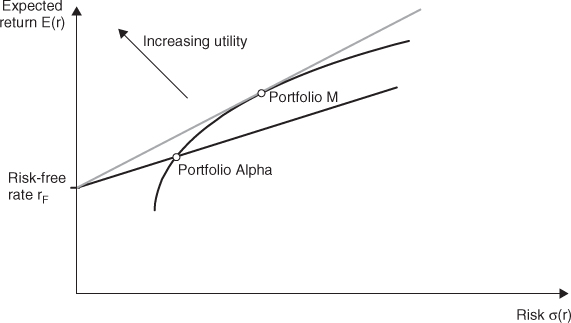

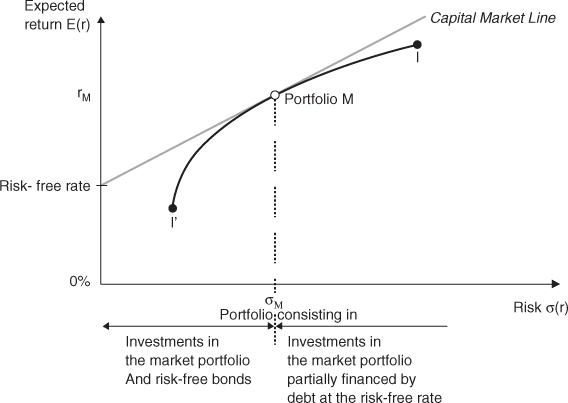

3. capital expenditure (CAPEX)—analysts should consider the relation between: time, product innovation and process innovation; as shown in the graph in Figure 1.2.

Figure 1.2: The relation between time, product innovation and process innovation

- Distribution networks. A distribution system usually plays three roles:

1. logistics—displaying, delivering and storing products;

2. advice and services—providing details about and promoting the product, providing after-sales service and circulating information between the producer and consumers, and vice versa;

3. financing— making firm purchases of the product, i.e. assuming the risk of poor sales.

The risk of a distribution network is that it does not perform its role properly and that it restricts the flow of information between the producer and consumers, and vice versa.

- Motivations of the company's key people, shareholders and managers, and the corporate culture.

Next, it entails a detailed analysis of the company's accounting principles to ensure that they reflect rather than distort the company's economic reality. Otherwise, there is no need to study the accounts, since they are not worth bothering with, and the company should be avoided like the plague, as far as shareholders, lenders and employees are concerned.

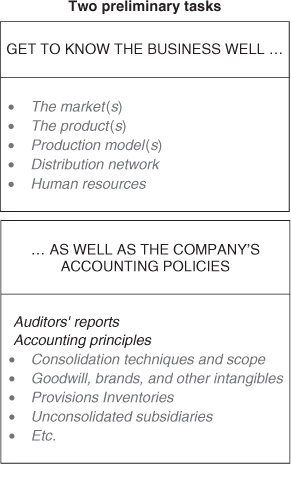

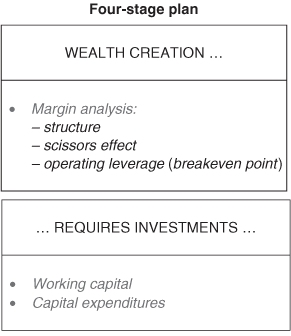

A standard financial analysis can be broken down into two preliminary tasks and four different stages:

Only then can the analyst come to a conclusion about the solvency of the company and its ability to create value.

Analysts may use:

- trend analysis, which uses past trends to assess the present and predict the future;

- comparative analysis, which uses comparisons with similar companies operating in the same sector as a point of reference;

- normative analysis, which is based on financial rules of thumb.

References and Further Reading

AIMR, Closing the Gap between Financial Reporting and Reality, Association for Investment Management and Research, 2003.

Chopra, S. and Meindl, P., Supply Chain Management, Prentice Hall, 4th ed., 2009.

Kotler, P. and Keller, P., Marketing Management, Prentice Hall, 13th ed., 2008.

Moingeon, B. and Soenen, G., Corporate and Organizational Identities, Routledge, London, 2003.

Mulford, C. and Comiskey, K., The Financial Number Game: Detecting Creative Accounting Practices, John Wiley & Sons, 2002.

O'Glove, T., Quality of Earnings, Free Press, 1998.

Stevenson, W., Operations Management, McGraw-Hill/Irwin, 2004.

Utterback, J. and Abernathy, W., A dynamic model of process and product innovations, Omega 3, 6, 1975.

7. What is the Operating Profit?

Short Answer

Operating profit or EBIT (earnings before interest and taxes) represents the earnings generated by investment and operating cycles for a given period.

Long Answer

Operating profit, which reflects the profits generated by the operating cycle, is a key figure in income statement analysis.

First of all, we look at how the figure is formed considering different factors.

- Sales trends are an essential factor in all financial analysis and company assessments. A company whose business activities are expanding rapidly, stagnating, growing slowly, turning lower or depressed will encounter different problems. An examination of sales trends sets the scene for an entire financial analysis. Sales growth forms the cornerstone for all financial analysis. Sales growth needs to be analyzed in terms of volume (quantities sold) and price trends, organic and acquisition-led growth.

Key points and indicators:

1. The rate of growth in sales is the key indicator that needs to be analyzed.

2. It should be broken down into volume and price trends, as well as into product and regional trends.

3. These different rates of growth should then be compared with those for the market at large and (general and sectoral) price indices. Currency effects should be taken into account.

4. The impact of changes in the scope of consolidation on sales needs to be studied.

- Production represents what the company has produced during the year. It leads to an examination of the level of unsold products and the accounting method used to value inventories, with overproduction possibly heralding a serious crisis.

Key points and indicators:

1. The growth rate in production and the production/sales ratio are the two key indicators.

2. They naturally require an analysis of production volumes and inventory valuation methods.

- Raw materials used and other external charges, which need to be broken down into their main components (i.e. raw materials, transportation, distribution costs, advertising, etc.) and analyzed in terms of their quantities and costs.

Key questions:

1. What are the main components of this item (raw materials, transportation costs, energy, advertising, etc.) and to what extent have they changed and are they forecast to change?

2. Have there been any major changes in the price of each of these components?

- Value added is of interest only insofar as it provides valuable insight regarding the degree of a company's integration within its sector.

- Personnel cost, which can be used to assess the workforce's productivity: sales/average headcount and value-added/average headcount and the company's grip on costs: personnel cost/average headcount.

- Depreciation and amortization, which reflect the company's investment policy.

Further down the income statement, operating profit is allocated as follows:

- Net financial expense, which reflects the company's financial policy. Heavy financial expense is not sufficient to account for a company's problems, it merely indicates that its profitability is not sufficient to cover the risks it has taken.

- Nonrecurring items (extraordinary items, exceptional items and results from discontinuing operations) and the items specific to consolidated accounts (income or losses from associates, minority interests, impairment losses on fixed assets).

- Corporate income tax.

8. What is the Scissors Effect?

Short Answer

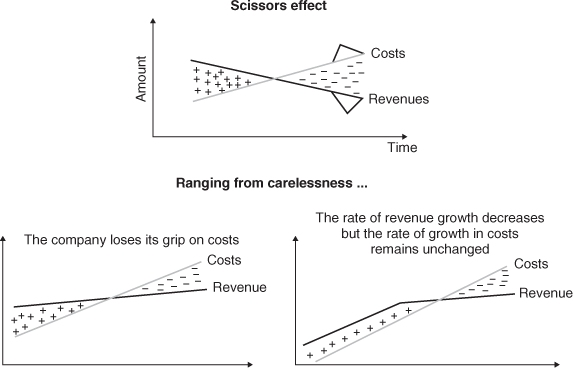

The scissors effect is what takes place when revenues and costs move in diverging directions. It accounts for trends in profits and margins.

Long Answer

The scissors effect is first and foremost the product of a simple phenomenon. If revenues are growing by 5% p.a. and certain costs are growing at a faster rate, earnings naturally decrease. If this trend continues, earnings will decline further each year and ultimately the company will sink into the red. This is what is known as the scissors effect.

Whether or not a scissors effect is identified matters little. What really counts is establishing the causes of the phenomenon. A scissors effect may occur for all kinds of reasons (regulatory developments, intense competition, mismanagement in a sector, etc.) that reflect the higher or lower quality of the company's strategic position in its market. If it has a strong position, it will be able to pass on any increase in its costs to its customers by raising its selling prices and thus gradually widening its margins.

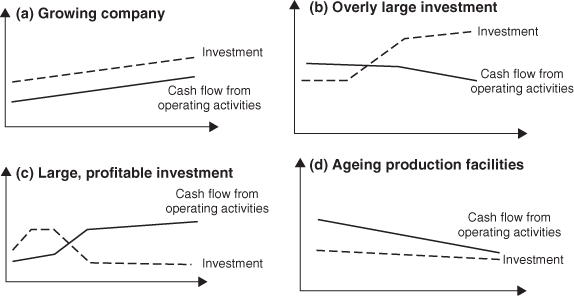

A scissors effect may arise in different situations, some examples of which are given above. When it reduces profits, the effect may be attributable to:

- A statutory freeze on selling prices, making it impossible to pass on the rising cost of production factors.

- Psychological reluctance to put up prices. During the 1970s, the impact of higher interest rates was very slow to be reflected in selling prices in certain debt-laden sectors.

- Poor cost control, e.g. where a company does not have a tight grip on its cost base and may not be able to pass rising costs on in full to its selling prices. As a result, the company no longer grows, but its cost base continues to expand.

The impact of trends in the cost of production factors is especially important because these factors represent a key component of the cost price of products.

In such cases, analysts have to try to estimate the likely impact of a delayed adjustment in prices. This depends primarily on how the company and its rivals behave and on their relative strength within the marketplace.

But the scissors effect may also work to the company's benefit, as shown by the last two charts in the diagram above.

9. How does Operating Leverage Work?

Short Answer

Operating leverage links variation in activity (measured by sales) with variations in result (either operating profit or net income). Operating leverage depends on the level and nature of the breakeven point.

Example

The higher a company's fixed costs, the greater the volatility of its earnings as illustrated in Table 1.9.

Table 1.9: Fixed costs and volatility of earnings

| Sales | Operating income | |

| Tesco | £ 54.3bn | £ 3.3bn |

| (+9.3%) | (+10%) | |

| SEB | € 3,176mn | € 248mn |

| (−2%) | (−11%) | |

| Lufthansa | € 22.3bn | € 96mn |

| (−10%) | (−89%) |

Tesco, the UK food retailer, has the lowest fixed costs of the three and the airline, Lufthansa, the highest. A 10% decrease in Lufthansa's turnover drives its earnings down by 89%, whereas a 9% increase in sales leads to a similar increase in Tesco's operating income (10%). The situation of SEB (small appliances) stands in between the two extremes of retail (very limited fixed costs) and airlines (almost all costs are fixed).

The purpose of the breakeven point analysis is to avoid extrapolating into the future the rate of earnings growth recorded in the past. Just because profits grew by 30% p.a. for two years as a result of a number of factors, does not mean they will necessarily keep growing at the same pace going forward.

Earnings and sales may not grow at the same pace owing to the following factors:

- structural changes in production;

- the scissors effect (see Question 8);

- simply a cyclical effect accentuated by the company's cost structure. This is what can be examined using the breakeven point and the degree of operating leverage.

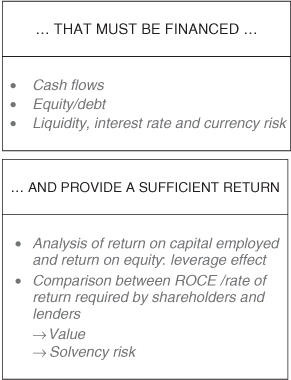

The breakeven point is the level of business activity, measured in terms of production, sales or the quantity of goods sold, at which total revenues cover total charges. At this level of sales, a company makes zero profit.

The breakeven point can be presented graphically as shown in Figure 1.4.

Figure 1.4: Breakeven point

The breakeven point is not an absolute measure—it depends on the length of period being considered because the distinction between fixed and variable costs can be justified only by a set of assumptions, and, sooner or later, any fixed cost can be made variable.

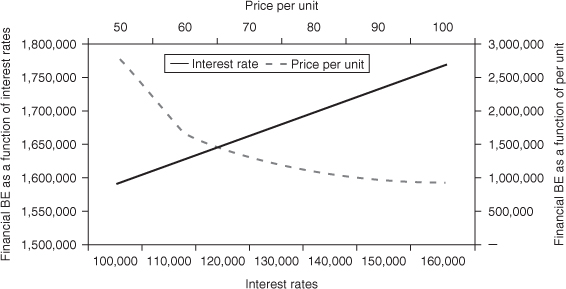

Three different breakeven points may be calculated:

- Operating breakeven, which is a function of the company's fixed and variable production costs. It determines the stability of operating activities, but may lead to financing costs being overlooked.

- Financial breakeven, which takes into account the interest expense incurred by the company, but not its cost of equity.

- Total breakeven, which takes into account both interest expense and the net profit required by shareholders. As a result, it takes into account all the returns required by all of the company's providers of funds.

Operating breakeven is calculated by dividing a company's fixed costs by its contribution margin ((sales—variable costs)/sales). Financial breakeven is calculated by adding interest expense to the fixed costs in the previous formula. Total breakeven is computed by adding the net income required to cover the cost of equity to fixed operating costs and interest costs.

The calculation and a static analysis of a company's breakeven point can be used to assess:

1. the stability of its earnings;

2. its normal earnings power;

3. the actual importance of the differences between budgeted and actual performance.

The further away a company lies from its breakeven point, the more stable its earnings and the more significant its earnings trends are.

The higher its fixed costs, as a share of total costs, the higher the breakeven point and the greater the operating leverage and the volatility of its earnings are.

The degree of operating leverage provides a useful measure of the link between the expected increase of sales and the increase of operating profit. This ‘multiple’ tells us how many times the operating profit will increase (or decrease) compared to the increase (or decrease) of sales:

References and Further Reading

Harvard Business School Press, Breakeven Analysis and Operating Leverage, 2008.

Marn, M., Roegner, E. and Zawada, C., The power of pricing, McKinsey Quarterly 1, 27–36, 2003.

Short Answer

CAPEX stands for ‘Capital Expenditure’ and represents the amount of money spent for investments carried out from a long-term perspective.

Long Answer

Through the production process, fixed assets are used up. The annual depreciation charge is supposed to reflect this wearing out. By comparing capital expenditure with depreciation charges, you can determine whether the company is:

- Expanding its industrial base by increasing production capacity. In this case, capital expenditure is higher than depreciation as the company invests more than simply to compensate for the annual wearing out of fixed assets.

- Maintaining its industrial base, replacing production capacity as necessary. In this case, capital expenditure approximately equals depreciation as the company invests just to compensate for the annual wearing out of fixed assets.

- Under investing or divesting (capital expenditure below depreciation). This situation can only be temporary or the company's future will be in danger, unless the objective is to liquidate the company.

Comparing capital expenditure with net fixed assets at the beginning of the period gives you an idea of the size of the investment program with respect to the company's existing production facilities. A company that invests an amount equal to 50% of its existing net fixed assets is building new facilities worth half what it has at the beginning of the year. This strategy carries certain risks:

- that economic conditions will take a turn for the worse;

- that production costs will be difficult to control (productivity deteriorates);

- technology risks, etc.

The theoretical relationship between capital expenditures and the cash flow from operating activities is not simple. New fixed assets are combined with those already on the balance sheet, and together they generate the cash flow of the period. Consequently, there is no direct link between operating cash flow and the capital expenditure of the period.

Thus, comparing cash flow from operating activities with capital expenditure makes sense only in the context of overall profitability and the dynamic equilibrium between sources and uses of funds.

The only reason to invest in fixed assets is to generate profits, i.e. positive cash flows. Any other objective turns finance on its head. You must therefore be very careful when comparing the trends in capital expenditure, cash flow, and cash flow from operating activities. This analysis can be done by examining the cash flow statement.

Any investment strategy must sooner or later result in an increase in cash flow from operating activities.

If it doesn't, then the investments are not profitable enough.

Be on the lookout for companies that grossly overinvest, despite their cash flow from operating activities not growing at the same rate as their investments. Management has lost sight of the all-important criterion that is profitability.

All the above does not mean that capital expenditure should be financed by internal sources only. Our point is simply that a good investment policy grows cash flow at the same rate as capital expenditure. This leads to a virtuous circle of growth, a necessary condition for the company's financial equilibrium, as shown in graph (a) of Figure 1.5 below. Graphs (b), (c) and (d) of Figure 1.5 illustrate other corporate situations. In (d), investment is far below the company's cash flow from operations.

Figure 1.5: Virtuous circle of growth

You must compare investment with depreciation charges in order to answer the following questions:

- Is the company living off the assets it has already acquired (profit generated by existing fixed assets)?

- Is the company's production equipment ageing?

- Are the company's current capital expenditures appropriate, given the rate of technological innovation in the sector?

Naturally, the risk in this situation is that the company is ‘resting on its laurels’, and that its technology is falling behind that of its competitors. This will eat into the company's profitability and, as a result, into its cash flow from operating activities at the very moment it will mostly need cash in order to make the investments necessary to close the gap vis-à-vis its rivals.

The most important piece of information to be gleaned from a cash flow statement is the relationship between capital expenditure and cash flow from operating activities and their respective growth rates.

Lastly, ask yourself the following questions about the company's divestments. Do they represent recurrent transactions, such as the gradual replacement of a rental car company's fleet of vehicles, or are they one-off disposals? In the latter case, is the company's insufficient cash flow forcing the company to divest? Or is the company selling old, outdated assets in order to turn itself into a dynamic, strategically-rejuvenated company?

References and Further Reading

Quiry, P., Dallocchio, M., Le Fur, Y. and Salvi, A., Corporate Finance. Theory and Practice, 3rd ed., John Wiley & Sons, 2011.

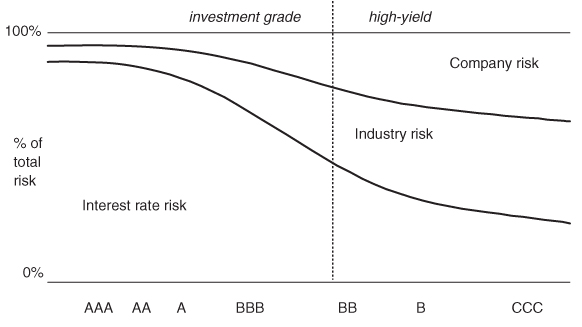

11. How can the Credit Risk of a Company be Assessed?

Short Answer

Analyzing the credit risk of a company means analyzing how the company is financed. This can be performed either by looking at several fiscal years, or on the basis of the latest available balance sheet.

Example

Looking at the cash flow statement of Indesit (see Question 2), we see that the cash flow from operating activity remains healthy from 2005 to 2007 (remaining over €200 million each year, even in 2005 when the activity slowed down slightly). Cash flows from operating activity are therefore sufficient to cover capital expenditure. In 2008 due to a sales decrease, the cash flow from operating activity is not enough to cover capital expenditure. However, in 2009, thanks to a deep reorganization, the cash flow from operating activity achieves an historical record at €333mn, while the operating profit is at its historical lowest.

In 2005 the free cash flows after financial expense are just enough to cover dividend payment; the net debt of the group therefore remains constant. In 2006 and 2007, Indesit generates large enough free cash flows to distribute dividends and to reduce its net debt level significantly. In 2008, the debt increases significantly before a considerable reduction in 2009 (€−257mn) thanks to the operating cash flow, a strong reduction of investments and the removal of dividends.

The combination of a reduction in net debt and an increasing EBITDA leads to a sharp decrease in net debt level measured by the ratio net debt/EBITDA (from 2.0x in 2005 to 1.1x in 2009).

Analyzing the balance sheet, the liquidity of the group in 2007 could be questioned as short-term debt (€276 million) is higher than the available cash and cash equivalent (€187 million). Digging a little further we find that c. 100 million euros of short term debt are against receivables. In addition, in 2006 the group secured for five years a syndicated loan of €350 million which is undrawn. We can therefore conclude that Indesit has no liquidity issue.

Long Answer

There are two approaches to assessing the credit risk of a company.

In the dynamic approach, your main analytical tool will be the cash flow statement. Cash flow from operating activities is the key metric: it must cover capital expenditure, loan repayment and dividends. Otherwise, the company will have to borrow more to pay for its past use of funds.

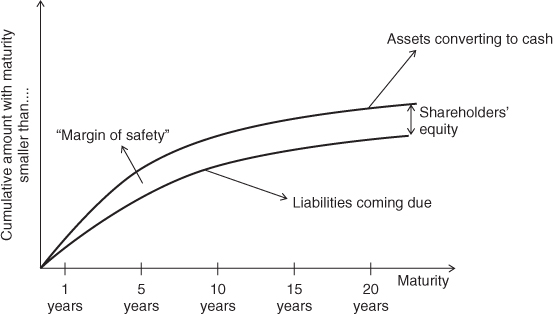

In the static approach, analysts try to answer two questions:

- Can the company repay its debts as scheduled? To answer this question, projected cash flow statements must be built, based on assumed rates of growth in sales, margins, working capital and capital expenditure. To perform a simplified analysis, the net debt/EBITDA (earnings before interest, taxes, depreciation, and amortization) ratio is calculated. If the company is to have an acceptable capacity to meet its repayment commitments as scheduled, the ratio should not be in excess of 4.

- Is the company running the risk of being illiquid? To answer this question, the dates at which the company's liabilities will come due and the dates at which its assets will be liquidated must be compared. Assets should mature before liabilities. If they do, the company will remain liquid (Figure 1.6).

To measure liquidity, then, we must compare the maturity of the company's assets to that of its liabilities.

Figure 1.6: Liquidity

This rule gives rise to the following ratios, commonly used in loan covenants. They enable banks to monitor the risk of their borrowers.

1. Current ratio:

![]()

This ratio measures whether the assets to be converted into cash in less than one year exceed the debts to be paid in less than one year.

2. Quick ratio: is another measure of the company's liquidity. It is the same as the current ratio, except that inventories are excluded from the calculation. Using the quick ratio is a way of recognizing that a portion of inventories corresponds to the minimum the company requires for its ongoing activity. As such, they are tantamount to fixed assets. It also recognizes that the company may not be able to liquidate the inventories it has on hand quickly enough in the event of an urgent cash need. Certain inventory items have value only to the extent they are used in the production process. The quick ratio (also called the acid test ratio) is calculated as follows:

![]()

3. Cash ratio:

![]()

The cash ratio is generally very low. Its fluctuations often do not lend themselves to easy interpretation.

References and Further Reading

Almeida, H. and Campello, R., Financial Constraints, Asset Tangibility, and Corporate Investment, Review of Financial Studies 20, 1429–1460, 2007.

Hackethal, A. and Schmidt, R., Financing Patterns: Measurement Concepts and Empirical Results, University of Frankfurt—Department of Finance, Working Paper n°125, 2004.

Morellec, A., Asset Liquidity, Capital Structure and Secured Debt, Journal of Financial Economics 61, 173–206, 2001.

12. How do We Measure the Profitability of a Company?

Short Answer

We can measure profitability only by studying returns in relation to the invested capital. If no capital is invested, there is no profitability to speak of.

Long Answer

Book profitability is the ratio of the wealth created (i.e. earnings) to the capital invested. Profitability should not be confused with margins. Margins represent the ratio of earnings to business volumes (i.e. sales or production), while profitability is the ratio of profits to the capital that had to be invested to generate the profits.

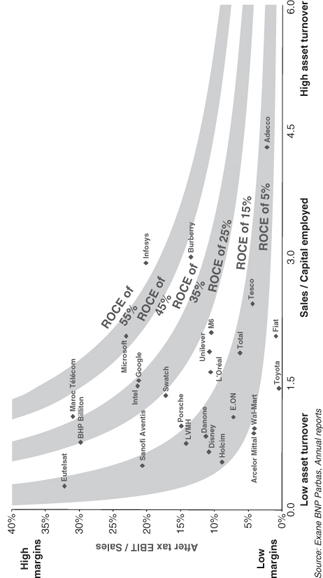

Above all, analysts should focus on the profitability of capital employed by studying the ratio of operating profit to capital employed, which is called the Return On Capital Employed (ROCE).

![]()

Return on capital employed can also be considered as the return on equity if the net debt is zero.

Much ink has been spilled over the issue of whether opening or closing capital employed or an average of the two figures should be used. We will leave it up to readers to decide for themselves. This said, care should be taken not to change the method decided upon as time goes on so that comparisons over longer periods are not skewed.

Return on capital employed can be calculated by combining a margin and turnover rate as follows:

The first ratio—operating profit after tax/sales—corresponds to the operating margin generated by the company, while the second—sales/capital employed—reflects asset turnover or capital turn (the inverse of capital intensity), which indicates the amount of capital (capital employed) required to generate a given level of sales. Consequently, a ‘normal’ return on capital employed may result from weak margins, but high asset turnover (and thus weak capital intensity), e.g. in mass retailing. It may also stem from high margins, but low asset turnover (i.e. high capital intensity), e.g. whisky producers.

Analysts will have to decide for themselves whether, as we suggest here, they work on an after-tax basis. If so, they will have to calculate operating profit after theoretical tax (calculated based on the company's normalized tax rate), which is called NOPAT (net operating profit after tax).

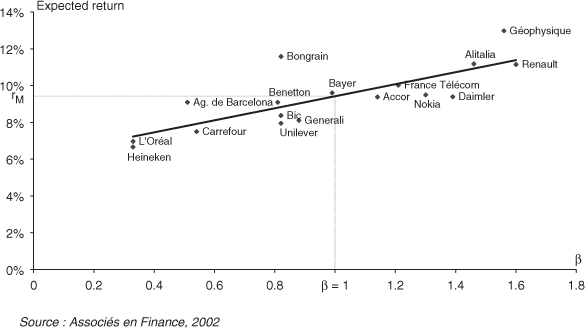

Example

The following graph (Figure 1.7) shows the ROCE and its components achieved by some leading European groups during 2010.

Figure 1.7: Return on capital employed (ROCE)

Secondly, we can calculate the return on equity (ROE), which is the ratio of net income to shareholders' equity.

![]()

In practice, most financial analysts take goodwill impairment losses and nonrecurring items out of net income before calculating return on equity.

Example

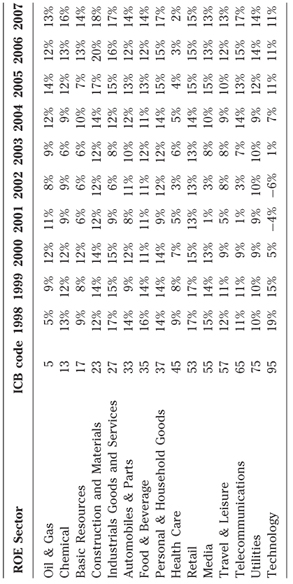

Table 1.10 reports the ROE of some European industries from 1998 to 2007.

Table 1.10: ROE of European industries 1998–2007

References and Further Reading

Andersson, T., Haslam, C. and Lee, E., Financialized account: Restructuring and return on capital employed in the S&P 500, Accounting Forum, 30, 21–41, June 2006.

13. What is the Financial Leverage Effect and How does It Work?

Short Answer

The leverage effect is the difference between return on equity and return on capital employed. Although it can lift a company's return on equity above return on capital employed, it can also depress it, turning the dream into a nightmare.

Example

Let's consider a company with capital employed of 100, generating a return of 10% after tax, which is financed entirely by equity. Its return on capital employed and return on equity both stand at 10%.

If the same company finances 30 of its capital employed with debt at an interest rate of 4% after tax and the remainder with equity, its return on equity is:

| Operating profit after tax: | 10% × 100 = 10 |

| Interest expense after tax: | 4% × 30 = 1.2 |

| = Net income after tax: | = 8.8 |

When divided by shareholders' equity of 70 (100 − 30), this yields a return on equity after tax of 12.6% (8.8/70), while the after-tax return on capital employed stands at 10%.

The borrowing of 30 that is invested in capital employed generates operating profit after tax of 3 which, after post-tax interest expense (1.2), is fully attributable for an amount of 1.8 to shareholders. This surplus amount (1.8) is added to operating profit generated by the equity-financed investments (70 × 10% = 7) to give net income of 7 + 1.8 = 8.8. The company's return on equity now stands at 8.8/70 = 12.6%.

The leverage effect of debt thus increases the company's return on equity by 2.6%, or the surplus generated (1.8) divided by shareholders' equity (1.8/70 = 2.6%).

Long Answer

The leverage effect explains a company's return on equity in terms of its return on capital employed and cost of debt.

All the capital provided by lenders and shareholders is used to finance all uses of funds, i.e. the company's capital employed. These uses of funds generate operating profit, which itself is apportioned between net financial expense (returns paid to debt holders) and net income attributable to shareholders.

If we compare a company's return on equity with its return on capital employed (after tax, to remain consistent), we note that the difference is due to its financial structure, apart from nonrecurring items and items specific to consolidated accounts.

The leverage effect works as follows. When a company raises debt and invests the funds it has borrowed in its industrial and commercial activities, it generates operating profit that normally exceeds the interest expense due on its borrowings. If this is not the case, it is not worth investing. So, the company generates a surplus consisting of the difference between the return on capital employed and the cost of debt related to the borrowing. This surplus is attributable to shareholders and is added to shareholders' equity. The leverage effect of debt thus increases the return on equity: hence its name.

Debt can therefore be used to boost a company's return on equity without any change in return on capital employed.

But readers will surely have noticed the prerequisite for the return on equity to increase when the company raises additional debt, i.e. its ROCE must be higher than its cost of debt. Otherwise, the company borrows at a higher rate than the returns it generates by investing the borrowed funds in its capital employed. This gives rise to a deficit, which reduces the rate of return generated by the company's equity. Its earnings decline and the return on equity dips below its return on capital employed.

When the return on capital employed falls below the cost of debt, the leverage effect of debt shifts into reverse and reduces the return on equity, which in turn falls below the return on capital employed.

Let's now formulate a leverage effect equation, with i representing the cost of debt, D the debt and E the equity:

![]()

Book return on capital employed, return on equity and cost of debt do not reflect the returns required by shareholders, providers of funds and creditors. These figures cannot be regarded as financial indicators because they do not take into account risk or valuation, two key parameters in finance. Instead, they reflect the historical book returns achieved and belong to the realms of financial analysis and control.

The leverage effect helps to identify the source of a good return on equity, which may come from either a healthy return on capital employed or merely from a company's capital structure, i.e. the leverage effect. This is its only real point. In the long run, only a healthy return on capital employed will ensure a decent return on equity. As we shall see, the leverage effect does not create any value. Although it may boost return on equity, it leads to an increase in risk that is proportional to the additional profit.

References and Further Reading

Campello, M. and Fluck, Z., Market Share, Financial Leverage and the Macroeconomy: Theory and Empirical Evidence, University of Illinois, Working Paper, 3 February 2004.

Dugan, M., Minyard, G. and Shriver, K., A Re-examination of the Operating Leverage—Financial Leverage Tradeoff, Quarterly Review of Economics & Finance, 327–334, Fall 1994.

Lang, L., Ofek, E. and Stulz, R., Leverage, Investment and Firm Growth, Journal of Financial Economics, 3–29, January 1996.

Nissim, D. and Penman, S., Financial Statement Analysis of Leverage and how it Informs about Profitability and Price-to-book Ratios, Review of Accounting Studies, 8, 531–560, 2003.

Reilly, F., The Impact of Inflation on ROE, Growth and Stock Prices, Financial Services Review, 6(1), 1997.

14. What are Efficient Markets?

Short Answer

An efficient market is one in which the prices of financial securities at any time rapidly reflect all available relevant information.

Example

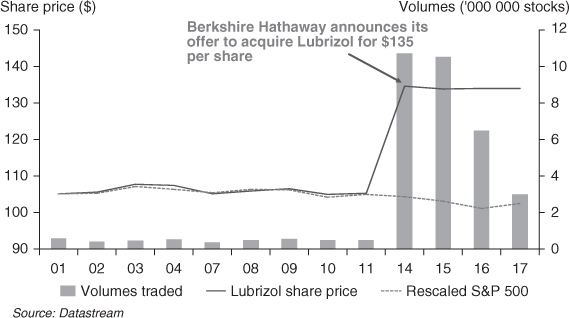

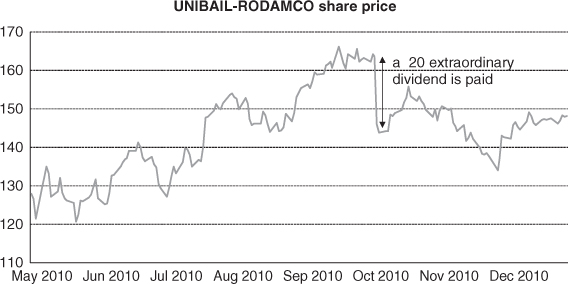

On March 14, 2011 before market opening, Berkshire Hathaway, the investment vehicle of Warren Buffett announced it would launch an agreed takeover bid on Lubrizol, a specialty chemical company. Lubrizol's share price immediately reached the offer price of $135 with a very high level of shares exchanged (Figure 1.8).

Figure 1.8: Lubrizol share price variations in March 2011

Example

A counterexample: speculative bubble and insider trading phenomena demonstrate that markets are inefficient at least under the strong hypothesis.

Long Answer

Eugene Fama (1970) has developed three tests to determine whether a market is efficient.

In a weak-form efficient market, it is impossible to predict future returns. Existing prices already reflect all the information that can be gleaned from studying past prices and trading volumes, interest rates and returns. This is what is meant by the ‘weak form’ of efficiency.

Extra returns can be obtained only if investors have future or privileged information.

According to the weak-form of efficiency, the price of an asset is the sum of three components:

1. the last available price (P−1);

2. the expected return from the security; and

3. a random component due to new information that might be learned during the period in question. This component of random error is independent from past events and unpredictable in the future.

![]()

When prices follow this model, they follow a random walk.

The efficient market hypothesis says that technical analysis has no practical value, nor do martingales.

A semi-strong efficient market reflects all publicly available information, as found in annual reports, newspaper and magazine articles, prospectuses, announcements of new contracts, of a merger, of an increase in the dividend, etc.

Semi-strong efficiency is superior to weak-form efficiency because it requires that current prices include historical information (as assumed by the weak-form efficiency) and publicly available information. The latter, for example, is available in:

- financial statements;

- research on the company performed by external financial analysts; and

- company announcements.

This hypothesis can be empirically tested by studying the reaction of market prices to company events (event studies). In fact, the price of a stock reacts immediately to any announcement of relevant new information regarding a company. In an efficient market, no impact should be observable prior to the announcement, nor during the days following the announcement. In other words, prices should adjust rapidly only at the time any new information is announced.

In a strongly efficient financial market, investors with privileged or insider information or with a monopoly on certain information are unable to influence securities' prices. This is the ‘strong form’ of efficiency.

This holds true only when financial market regulators have the power to prohibit and punish the use of insider information.

In theory, professional investment managers have expert knowledge that is supposed to enable them to post better performances than the market average. However, without using any inside information, the efficient market hypothesis says that market experts have no edge over the layman. In fact, in an efficient market, the experts' performance is slightly below the market average, in a proportion directly related to the management fees they charge!

Actual markets approach the theory of an efficient market when:

- participants have low-cost access to all information;

- transaction costs are low;

- the market is liquid; and

- investors are rational.

In general, if we try to explain why financial markets have different degrees of efficiency, we could say that:

1. The lower transaction costs are, the more efficient a market is.

2. The more liquid a market is, the more efficient it is.

3. The more rational investors are, the more efficient a market is.

The last assumption in particular is the most feeble, because human beings and their feelings cannot be reduced to a series of mathematical equations. It has been demonstrated that the Dow Jones Industrial Average turns in below-average performance when it rains in Central Park, that stock market returns are lower on Monday than on Friday, and so on. These phenomena have given rise to behavioral finance, which takes psychology into account when analyzing investor decisions. This field of research provides recent evidence that investors can make systematic errors in processing new information—information that is profitably exploited by other investors.

The vast majority of evidence regarding market efficiency has concerned the weak and semi-strong forms of efficiency.

The weak form of efficiency has been proven by the absence of serial correlation in daily returns.

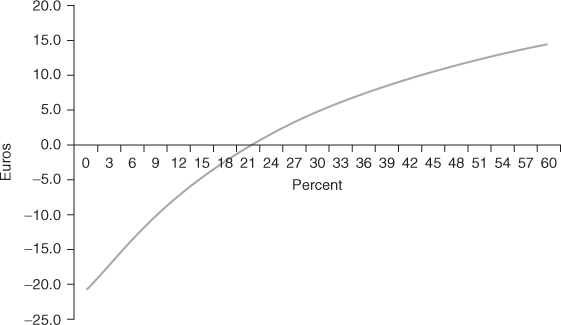

The theory of semi-strong efficiency can be measured by looking at the event studies that examine the market's reaction to price-sensitive announcements from companies. More specifically, event-studies also estimate the cumulative abnormal returns (CAR), which are the sum of subsequent abnormal returns. Abnormal returns are measured by:

![]()

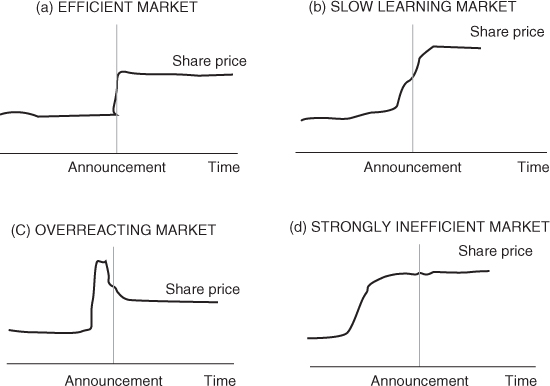

If the market is efficient, the CAR before the announcement should be nil or very low. Thus, if abnormal returns grew during the previous period, there is good evidence that some investors might have received information before others. The analysis of ex-post CAR is also interesting because, in efficient markets, abnormal returns should be zero (Figure 1.9).

Figure 1.9: Analysis of ex-post CAR

In short, the abnormal return should be confined to the announcement day and ideally no abnormal return should be registered before or after the announcement (graph a).

The higher the deviation from the fair market value and the more slowly it fades away, the less efficient is the financial market. In this instance we are faced with two alternative situations: the first is typical of a slow learning market (graph b) and the second is characteristic of excessive reaction (market overreaction—graph c).

If there is a clear (and otherwise inexplicable) trend in prices before the announcement, then it is reasonable to assume that a few privileged investors had access to the information before the formal announcement was made to the entire market (graph d).

References and Further Reading

Bhattacharya, U. and Daouk, H., The world price of insider trading, Journal of Finance, 57(1), 75–108, February 2002.

Bressand, A. and Distler, C. (eds.), Enhanced Transparency: Meeting European Investors' Needs, Promethee publication for Standard & Poor's, 2003.

Dimson, E. and Mussavian, M., A brief history of market efficiency, European Financial Management, 4(1), 91–103, March 1998.

Fama, E., Efficient capital markets: A review of theory and empirical work, Journal of Finance, 383–417, May 1970.

Fama, E., Efficient capital market II, Journal of Finance, 1575–1617, December 1991.

Fama, E., Market efficiency, long-term returns and behavioral finance, Journal of Financial Economics, 49(3), 283–306, September 1998.

Fox, J., The Myth of the Rational Market, Harper Business, 2009.

Fuller, J. and Jensen, M., Just say no to Wall Street: Putting a stop to the earnings game, Journal of Applied Corporate Finance, 14(4), 27–40, Winter 2002.

Gibbons, M. and Patrick, H., Day of the week effects and asset returns, Journal of Business, 54, 579–596, October 1981.

Haugen, R. and Lakonishok, J., The Incredible January Effect, Irwin, 1989.

Hawawini, G. and Keim, D., The Cross Section of Common Stock Returns: A Review of the Evidence and some New Findings, Working Paper, Wharton School, University of Pennsylvania, May 1997.

Loughran, T., Book-to-market across firm size, exchange, and seasonality: Is there an effect? Journal of Financial and Quantitative Analysis, 32, 249–268, September 1997.

Loughran, T. and Ritter, J., The new issue puzzle, Journal of Finance, 50(1), 23–51, March 1995.

Malkiel, B., A Random Walk down Wall Street, 10th ed., New York, W.W. Norton & Company, 2011.

Marsh, P., Myths surrounding short-termism, in G. Bickerstaffe (ed.), Mastering Finance, London, FT/ Pitman Publishing, 1998.

Ritter, J., The long-run performance of IPOs, Journal of Finance, 46(1), 3–27, March 1991.

Rubinstein, M., Rational markets: yes or no? The affirmative case, Financial Analysts Journal, May–June 2001.

15. What do We Mean by Discounting a Sum?

Short Answer

To discount means to calculate the present value of a future cash flow.

Example

Consider an offer whereby someone will give you €1000 in five years' time. As you will not receive this sum for another five years, you can apply a discounting factor to it, for example, 0.6. The present, or today's, value of this future sum is then €600. Having discounted the future value to a present value, we can then compare it to other values. For example, it is preferable to receive €650 today rather than €1000 in five years, as the present value of €1000 five years ahead is €600, and that is below €650.

Long Answer

Discounting into today's euros helps to compare a sum that will not be produced until later. Technically speaking, what is discounting?

To discount is to ‘depreciate’ the future. It is to be more rigorous with future cash flows than present cash flows, because future cash flows cannot be spent or invested immediately. First, take tomorrow's cash flow and then apply to it a multiplier coefficient below one, which is called a discounting factor. The discounting factor is used to express a future value as a present value, thus reflecting the depreciation brought on by time.

Discounting makes it possible to compare sums received or paid out at different dates.

Discounting is based on the time value of money. After all, ‘time is money’. Any sum received later is worth less than the same sum received today.

Remember that investors discount because they demand a certain rate of return. If a security pays you €110 in one year and you wish to see a return of 10% on your investment, the most you would pay today for the security (i.e. its present value) is €100.

At this price (€100) and for the amount you know you will receive in one year (€110), you will get a return of 10% on your investment of €100. However, if a return of 11% is required on the investment, then the price you are willing to pay changes. In this case, you would be willing to pay no more than €99.1 for the security because the gain would have been €10.9 (or 11% of €99.1), which will still give you a final payment of €110.

Discounting is calculated with the required return of the investor. If the investment does not meet or exceed the investor's expectations, he or she will forego it and seek a better opportunity elsewhere.

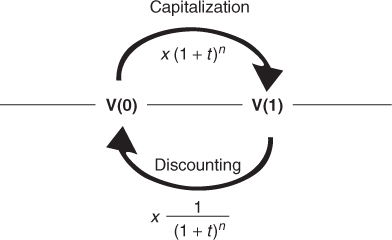

Discounting converts a future value into a present value. This is the opposite result of capitalization (Figure 1.10).

Figure 1.10: Capitalization and discounting

Discounting converts future values into present values, while capitalization converts present values into future ones.

Hence, to return to the example above, €1,800,000 ten years in the future discounted at 33.5% is today worth €100,000. €100,000 today will be worth €1,800,000 when capitalized at 33.5% over ten years:

![]()

16. How do Companies Measure Value Creation?

Short Answer

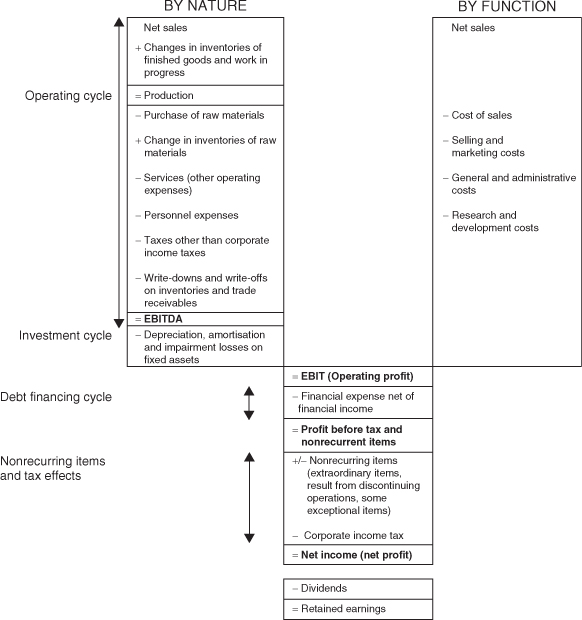

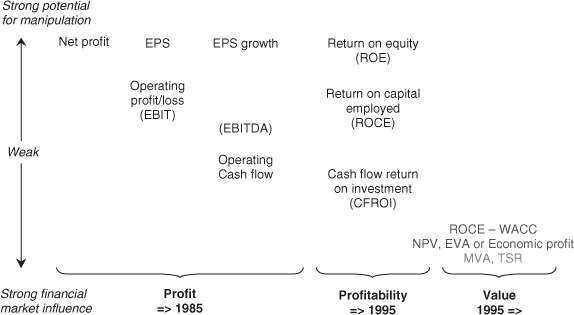

The tools used for measuring creation of value (Figure 1.11) can be classified under three headings:

- Economic indicators: NPV, EVA and CFROI.

- Market indicators: MVA and TSR.

- Accounting indicators: EPS, ROE, ROCE and Equity per share.

Figure 1.11: Evolution of financial indicators

Example

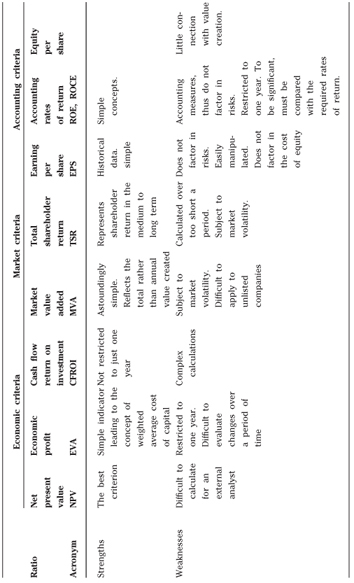

We show here in Table 1.11 a comparison between the different criteria.

Table 1.11: Comparison between the different criteria

Long Answer

Economic indicators

The factor in returns required by investors (the weighted average cost of capital) does not depend directly on the sometimes erratic price movements of markets.

NPV (net present value) is the most important of these (see Question 17 for further details).

Obviously, one should only allocate resources if the net present value is positive, in other words, if the market value is lower than the present value. Net present value reflects how allocation of the company's resources has led to the creation or destruction of value. On the one hand, there is a constant search for anticipated financial flows—while keeping in mind the uncertainty of these forecasts. On the other hand, it is necessary to consider the rate of return (k) required by the investors and shareholders providing the funds. The value created is thus equal to the difference between the capital employed and its book value. Book value is the amount of funds invested in the company's operations.

![]()

The creation of value reflects investors' expectations. Typically, this means that, over a certain period, the company will enjoy a rent with a present value allowing its capital employed to be worth more than its book value! The same principle applies to choosing a source of financing for allocating resources. To do so, one must disregard the book value and determine instead the value of the financial security issued and deduct the required rate of return. This approach represents a shift from the explicit or accounting cost to the financial cost, which is the return required on this category of security.

EVA (economic value added), the popular term for economic profit, measures how much the shareholder has increased his or her wealth over and above standard remuneration.

The key aspect of EVA is that it identifies the income level at which value is created. This is because EVA is calculated after deducting the capital charge, i.e. the remuneration of the funds contributed by creditors and shareholders. Economic profit or EVA first measures the excess of ROCE over the weighted average cost of capital. Then, to determine the value created during the period, the ratio is multiplied by the book value of the capital employed at the start of the reporting period.

![]()

Economic profit is related to net present value, because NPV is the sum of the economic profits discounted at the weighted average cost of capital.

![]()

However, since EVA has the drawback of being restricted to the financial period in question, it can thus be manipulated to yield maximum results in one period at the expense of subsequent periods.

The simplified version of cash flow return on investment (CFROI) compares EBITDA with gross capital employed, i.e. before amortization and depreciation of fixed assets.

![]()

This ratio is used particularly in business sectors wherein charges to depreciation do not necessarily reflect the normal deterioration of fixed assets, e.g. in the hotel business.

Market indicators measure MVA (market value added), or the difference between the company's enterprise value and its book value:

![]()

It is easy to demonstrate the relationship between MVA and intrinsic value creation in equilibrium markets, since:

![]()

Total shareholder returns (TSR) is the rate of shareholder returns given the increase in the value of the share and the dividends paid out. These market tools are only useful over the medium term, because to be meaningful they should avoid the market fluctuations that can distort economic reality.

Accounting indicators have the main drawback of being designed for accounting purposes, i.e. they do not factor in risk or return on equity. They include:

1. Earnings per share (EPS) linked to the value of the share by the price earnings ratio (P/E). It can be a reliable indicator of value creation under three conditions only:

- the risk on capital employed remains the same from one period to the next, or before and after operations such as mergers, capital increases or share buybacks, investments, etc.;

- earnings growth remains the same before and after any given operation; and

- the company's financial structure remains the same from one period to the next, or before and after a given operation.

2. Accounting rates of return (ROE and ROCE). In general, if the investment yields more than the required rate of return, the increase in the value of the company will exceed that of the sums invested. Financial managers should approach book rates of return with caution. These ratios are accounting measures, but not external measures. They assume that the company is operating in a closed system! The minimum criterion should be the return required by the financial system.

3. Equity per share is one way of measuring shareholder value. It therefore seems logical to assume that there is a coefficient linking the price of the share with equity per share. This is called the price-to-book ratio (PBR). However, the warnings against the P/E ratio apply to the PBR as well. Bear in mind that if equity has been correctly valued in the accounts, that is, if it includes unrealized capital gains on assets, the price-to-book ratio will be:

- lower than 1 if the expected return on equity is lower than the return required by shareholders; and

- higher than 1 if the expected return is higher than that required by the shareholders.

References and Further Reading

Andrade, G., Do Appearances Matter? The Impact of EPS Accretion and Dilution on Stock Prices. Harvard Business School Working Paper 00–07.

Boston Consulting Group, Shareholder Value Metrics, Shareholder Value Management, Boston Consulting Group, 1996.

Copeland, T., What do practitioners want? Journal of Applied Finance, 12(1), 5–11, Spring/Summer 2002.

Deelder, B., Goedhart, M. and Agrawal, A., A better way to understand TSR, The McKinsey Quartely, 28, 26–30, Summer 2008.

Dobbs, R. and Koller, T., Measuring long-term performance, The McKinsey Quarterly, special edition Value and Performance, 17–27, 2005.

Fama, E. and French, K., The corporate cost of capital and the return on corporate investment, Journal of Finance, 54, 1939–1967, December 1999.

Monographic issue on ‘EVA and incentive compensation’ in the Journal of Applied Corporate Finance, 12(2), Summer 1999.

17. What is the NPV of a Project?

Short Answer

Net present value (NPV) is the difference between present value (PV) of future flows and the current market value of a security (V0):

Example

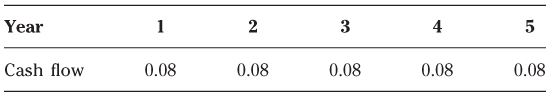

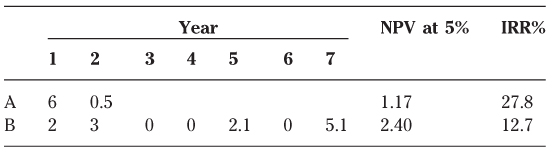

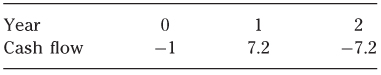

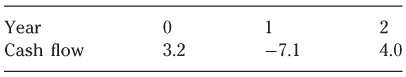

Consider the following example in Table 1.12 of an asset (e.g. a financial security or a capital investment) whose market value is 2 and whose cash flows are as follows:

Table 1.12: Cash flow

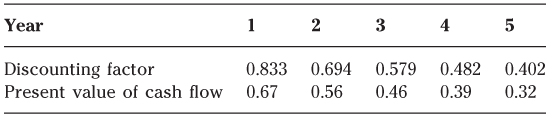

A 20% discounting rate would produce the following discounting factors (Table 1.13)

Table 1.13: Discounting factors

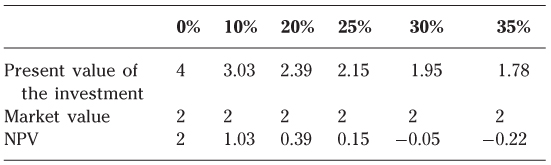

As a result, the present value of this investment is about 2.4. As its market value is 2, its NPV is approximately 0.4. If the discounting rate changes, the following values (Table 1.14) are obtained

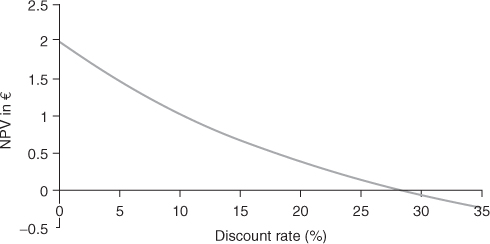

Table 1.14: Values discounting rate

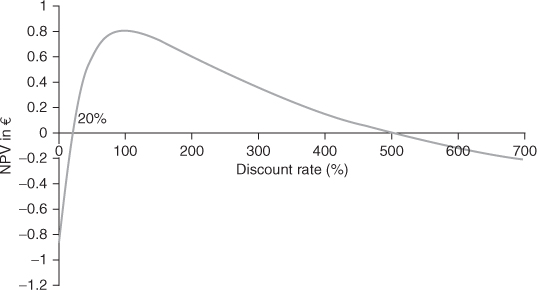

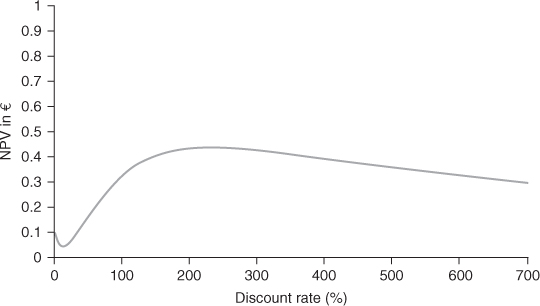

These values would then look like this graphically (Figure 1.12):

Figure 1.12: Net present value (NPV) and the discount rate

Long Answer

The present value (PV) of a security is the sum of its discounted cash flows; i.e.:

where Fn are the cash flows generated by the security, r is the applied discounting rate and n is the number of years for which the security is discounted.

All securities also have a market value, particularly on the secondary market. Market value is the price at which a security can be bought or sold.

Net present value (NPV) is the difference between present value and market value (V0):

If the NPV of a security is greater than its market value, then it will be worth more in the future than the market has presently valued it. Therefore, you will probably want to invest in it, i.e. to invest in the upside potential of its value.

If, however, the security's present value is below its market value, you should sell it at once, for its market value is sure to diminish.

If an imbalance occurs between a security's market value and its present value, efficient markets will seek to re-establish balance and reduce net present value to zero. Investors acting on efficient markets seek out investments offering positive NPV, in order to realize that value. When they do so, they push NPV towards zero, ultimately arriving at the fair value of the security.

In efficient, fairly valued markets, NPVs are zero, i.e. market values are equal to present values.

Up to this point, the discussion has been limited to financial securities. However, the concepts of present value and NPV can easily be applied to any investment, such as the construction of a new factory, the launch of a new product, the takeover of a competing company or any other asset that will generate positive and/or negative cash flows.

The concept of NPV can be interpreted in three different ways:

1. The value created by an investment—for example, if the investment requires an outlay of €100 and the present value of its future cash flow is €110 then the investor has become €10 wealthier.

2. The maximum additional amount that the investor is willing to pay to make the investment—if the investor pays up to €10 more, he or she has not necessarily made a bad deal, as he or she is paying up to €100 for an asset that is worth €110.

3. The difference between the present value of the investment (€100) and its market value (€110).

Calculating the NPV of a project is conceptually easy. There are basically two steps to be followed:

1. Write down the net cash flows that the investment will generate over its life.

2. Discount these cash flows at an interest rate that reflects the degree of risk inherent in the project.

The resulting sum of discounted cash flows equals the project's NPV. The NPV decision rule says to invest in projects when the present value is positive (greater than zero):

- NPV > 0 invest

- NPV < 0 do not invest

The NPV rule implies that firms should invest when the present value of future cash inflows exceeds the initial cost of the project. Why does the NPV rule lead to good investment decisions? The firm's primary goal is to maximize shareholder wealth. The discount rate r represents the highest rate of return (opportunity cost) that investors could obtain in the marketplace in an investment with equal risk. When the NPV of cash flow equals zero, the rate of return provided by the investment is exactly equal to investors' required return. Therefore, when a firm finds a project with a positive NPV, that project will offer a return exceeding investors' expectations.

Although this question highlights many of the advantageous qualities of the NPV approach, there are also a few weaknesses that are worth mentioning:

- it is less intuitive than other methodologies, such as the payback rule or the accounting return rule;

- it does not take into account the value of managerial flexibility, in other words the options that managers can exploit after an investment has been made in order to increase its value; and

- the NPV has a major competitor in the internal rate of return (IRR), whose use seems more widespread among corporations. In most cases, the two decision rules give the same information, but the IRR is more appealing to managers because it delivers a number that is more easily interpreted.

References and Further Reading

Hirshleifer, J., On the theory of optimal investment decision, Journal of Political Economy, 66, 329–352, August 1958.

Tobin, J., Liquidity preference as behaviour towards risk, Review of Economic Studies, February 1958.

18. What is the IRR of a Project?

Short Answer

The discounting rate that makes NPV equal to zero is called the internal rate of return (IRR) or yield to maturity.

Example

To calculate IRR, make r the unknown and simply use the NPV formula again. The rate r is determined as follows:

Let's input some numbers:

![]()

In other words, an investment's IRR is the rate at which its market value is equal to the present value of the investment's future cash flows.

It is possible to use trial-and-error to determine IRR. This will result in an interest rate that gives a negative NPV and another that gives a positive NPV. These negative and positive values constitute a range of values, which can be narrowed until the yield to maturity is found, which in this case is about 28.6%.

Long Answer

The internal rate of return (IRR) is frequently used in financial markets because it immediately tells the investor the return to be expected for a given level of risk. The investor can then compare this expected return to his or her required return rate, thereby simplifying the investment decision.