7

Myth – Crypto Is a Bubble

Yes, during the crypto winter of 2022, all markets took a beating, and crypto took a serious beating. In June, bitcoin was down approximately –55% year to date (YTD) and the widespread crypto markets were down roughly –70% YTD. There was a ridiculous amount of fear in the markets; much of it came from centralized finance companies like Celsius blowing up, along with actions the Federal Reserve was taking to unwind previous actions they'd taken during the pandemic to boost the economy.

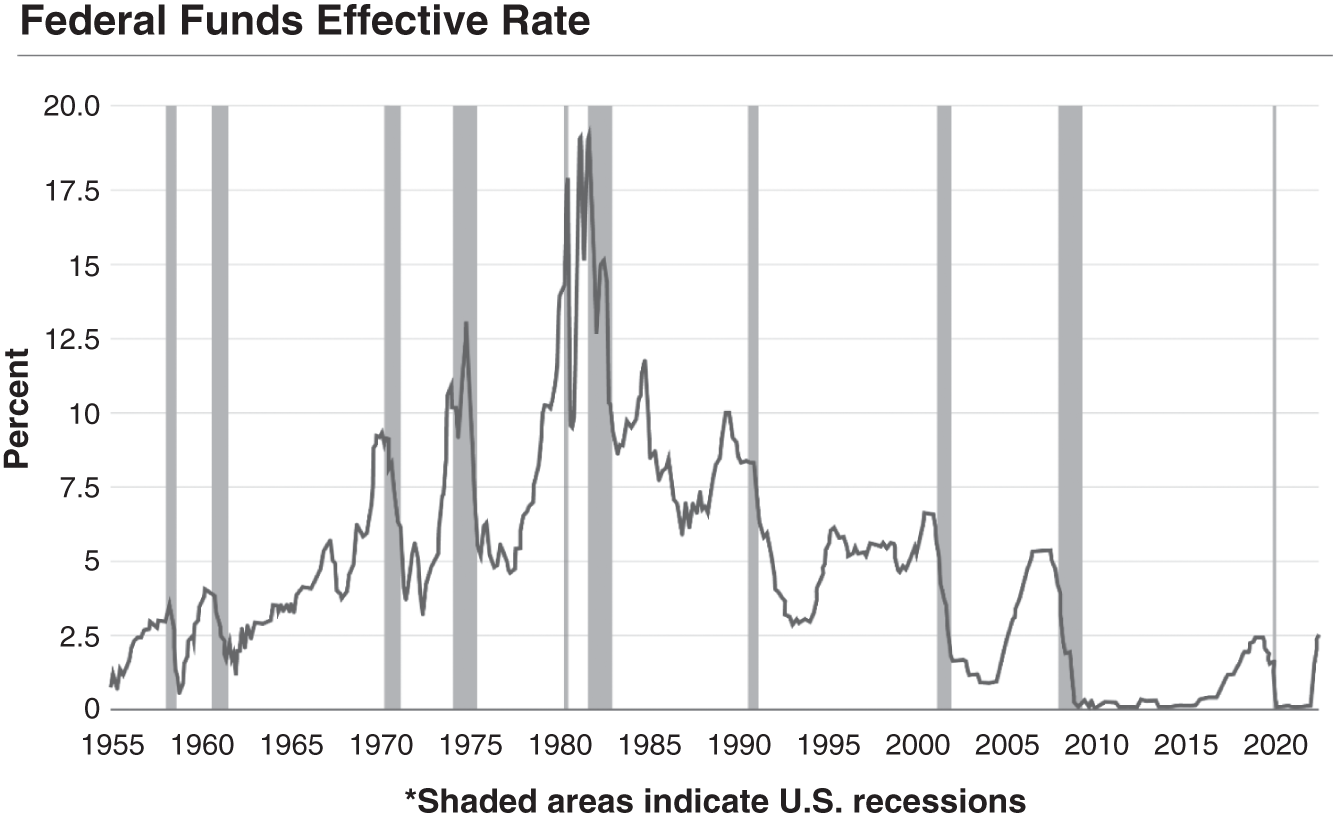

Many investors acted out of fear. We were coming out of a pandemic. Interest rates were rising notably, with the Fed hiking rates by three‐quarters of a percentage point in June, then again in July, again in September, and an additional three‐quarters of a point in November. In summer 2022 the Fed laid out its agenda of pain, which eliminated uncertainty. “In a further sign of the Fed's deepening concern about inflation,” the Associated Press reported, “it will also likely signal that it plans to raise rates much higher by year's end than it had forecast three months ago – and to keep them higher for a longer period. Economists expect Fed officials to forecast that their key rate could go as high as 4% by the end of this year. They're also likely to signal additional increases in 2023, perhaps to as high as roughly 4.5%.”1

Figure 7.1 Fed Funds Rate

Source: Board of Governors of the Federal Reserve System (U.S.).

Additional information: fred.stlouisfed.org.

During the summer of 2022, inflation was at a 40‐year high. Many believed a recession was imminent. It was a scary time if you were long on crypto because there is so much volatility in its trading. Unless, perhaps, as we said at the time, you've lived through this before (see Figure 7.1).

In 2014 and again in 2018, we saw the market pull back in similar trends, with bitcoin being 70% and 80% off its all‐time high before rocketing to 1,200% and 1,800% gains, respectively. We've seen this pattern. It's a cycle! We were at the exact same kind of bottom. Market conditions were unusual but that didn't change the fact that for those who want massive gains, well, bottoms are the best time to deploy.

These trends did provide investors with generational buys on select assets, opportunities that may never happen again, and, although this manuscript was sent off to the editor before the upswing, we fully anticipate it, just like in other cycles. While 2022 reminded us that crypto hype and volatility can be excessive, that doesn't mean crypto is, by default, a bubble. It's a new technology that will be valuable for endless purposes. It means smart investors look for the signals in the noise. Our philosophy is based on our belief in technology and the norms of functioning markets – that they experience cycles.

Carlota Perez offers essential insights in her book, Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages. Going back hundreds of years, she shows how any technological revolution will go through a bubble or mania phase. It's happened five times in the past 200 years, from the Age of Industrialization through the Age of Information.

We are at the beginning of a new crypto economy. As the technology evolves, we will see more use cases emerge. We can remember how during the Internet Age in 1995, early adopters of home computers, many who had Internet connections to AOL (AmericaOnline!) and the Internet, were talking about how these technologies were going to revolutionize communications. I remember being excited myself, running around to local businesses in Austin to try and sign them up to build websites. I would tell them that anyone would be able to find out about their product or service and they could have a website explaining and presenting their business online. They would ask me, “Great, how's anyone going to find me?,” and I didn't have a good answer. Why? Because search engines hadn't been widely adopted yet, so few knew how to go to a search engine (remember, this was eight years before Google was widely used, in 2003) and look up whatever they wanted to search!

So, the sale of new websites kind of died right there when I couldn't answer that simple question of “how are they going to find me?” It's similar now in the Age of Autonomy®. We've got a lot of early adopters running around saying how great crypto and blockchain are, but we don't have all the basic tools built yet to make wide adoption easier and more compelling. We still need to build the “search engines” for crypto.

Spring Follows Winter

Who doesn't enjoy a beautiful summer's day on our favorite beach or lake, wearing short sleeves and sipping a cold drink? And when we have a portfolio of assets, we love when they're hot and the arrows are trending up. Crypto is fun; like any other investment, when the markets are roaring, the fanfare is loud and pronounced. When crypto is cold and in a deep downturn, the naysayers and skeptics emerge.

There's an adage, “Buy low; sell high.” Well, we know crypto prices crash really, really low during crypto winters. It's difficult to compete with human psychology, however, and when things are down, we are in a state of fear. What if it goes lower? It could certainly go lower, just as we had a falling knife in March 2020, but trying to catch the bottom of a bottom can be as challenging as trying to catch the top of a top. Timing the market is a fool's errand, so it's worth looking to see if value is present. We see an upside for 2023 and beyond, with crypto markets down approximately 85% of all‐time highs as of this writing in September 2022. A quote from Warren Buffett, the famed investor, comes to mind: “When people are fearful, be greedy. When people are greedy, be fearful.” According to Mr. Buffett, this would undoubtedly be a good time for greed.

We are here to provide perspective, particularly as it relates to the crypto markets, and to shed some light on why the top investors in the world remain bullish on crypto. Quoting Paul Tudor Jones, “It's hard not to want to be long crypto.”

Do You Believe in Technology?

During 2022, many commented about the strength of our convictions in crypto. What we said then is what we continue to affirm. We're crypto bulls in both balmy summer and ice‐cold winter. My fellow investors, the question is not “Will crypto go up?,” the question is “Do I believe in blockchain? Do I believe in the technology?” If the answer is yes, the first question is best restated as “When will crypto go up?” Blockchain is a technology play.

Institutional and financial players continue to lean into blockchain and crypto investments and haven't backed away. In fact, early big‐bank naysayers are now scrambling to get their blockchain strategies in order. This is because it's now a given that this technology is here to stay. Paradigm‐shattering technologies are rare, but they exert their influences in diverse, unpredictable, and frankly thrilling ways when they arrive.

We can look back to the last long‐wave economic cycle, during the Information Age, when the Internet was invented in 1969. It was called Arpanet back then and originally consisted of just four nodes (i.e., computer servers networked together). For decades, it was primarily a product of academia with some repurposing by the government, then by large online companies for the first retail use cases (CompuServe, anyone?). It wasn't until 1994, when Marc Andreessen and James Clark founded Netscape, that the Internet began to take off. That was due to the World Wide Web – the information superhighway, as it were. It's the reason web addresses started with “www.” It was the first web browser, Netscape Navigator, that allowed everyone to “go online” and opened the door to the Internet as a technology for the masses that everyone could access and benefit from.

On that timeline, it took 25 years from its inception for the Internet to gain any kind of real accessibility, and another five before it became usable. It was then another 12 or so before we started to see the first instance of smartphones, which have made us all quasi‐cyborgs. In the Netscape era, we were just figuring this Internet thing out. Businesses were formed. Some survived (Amazon), and some collapsed spectacularly (AltaVista, Pets.com), but, as history unfolded, it was the technology that carried the day.

At the same time in 1995, just as the Internet was gaining traction with a paltry 16 million users, opinions were everywhere, one famously stating that the Internet was a fad and would not make it past 1996. (I'll just let that sit and pause for a moment for dramatic impact . . . Okay, good.) There was even a famous Daily Mail article on December 5, 2000, that was titled, “Internet ‘may be a passing fad as millions give up on it.’” Yes, that article was published in 2000!

We're way past the fad point with blockchain and crypto. Companies will come, and companies will go. During this crypto winter, Luna took a spectacular belly flop, Celsius filed for bankruptcy, and BlockFi stock investors got wiped out and FTX bought it to save it (and get a great deal), then promptly imploded a few months later. Three Arrows Capital, one of the top five largest crypto hedge funds at the time, managing $10 billion, shuttered. Many rich people lost money. Many smart people lost money.

That's what happens in growing markets during a new technology adoption cycle. Not every business is going to succeed. In fact, most don't. Indeed, not every company will be Amazon, and it took Amazon nine years to make any kind of profit at all, with plenty of naysayers along the way.

Any new technology adoption is rife with challenges. So, when we talk about crypto, we're talking about technology. From an investor standpoint, it is a technology investment. Blockchain, having solved one of the top 10 computer science problems of all time, the Byzantine Generals Problem, allows us to transact in a peer‐to‐peer way without a central authority. This impact cannot be measured now, just as it would have been impossible back in 1994 to imagine the effects of smartphones and how they would shape our lives. If you're not clear on what the Byzantine Generals Problem is, you're not alone. This is the breakthrough and one that we will discuss completely in Chapter 12.

Blockchain is not going away. As one more data point, college campuses, such as the one at University of Texas at Austin, are now combining their computer science and blockchain programs. This sends a clear message not only about the relevance and projected future of blockchain, but also where the talent will be focused in the coming years.

Of Course It's a Cycle!

Which brings us to the fear part of our program. During 2022, we saw bitcoin dip as much as 70% from all‐time highs. This was as bad as it was in 2014 before it then soared 1,200%. It was about as bad as it was in 2018 – before it then rocketed 1,800%. Dips represent the time where deployed capital has an opportunity to enjoy significant upside gain. How much?

Well, many experts still predict $100,000 bitcoin (or more). According to them, it's not an if, it's a when. We argue that select crypto assets representing solid technology projects will outpace that. Importantly, cycles have been pretty consistent, and we see nothing that points to this cycle changing. We even see greater support for a strong recovery as we have giant banks, government, credit cards, and businesses of all types all jumping into the crypto fray. Yes, the macro environment must get cleaned up – and it will. Yes, we're going to have businesses rise and fall. But this is why investments in this industry are measured in years, not months.

The events of 2022 remind us that crypto is a longer‐term play, and we expect such cycles to repeat again. Don't play this game if you need a return in two months. Don't get in if you want a return in nine months. However, if you believe in the technology and understand these cycles, then you know that down cycles represent the best time to get in and, if you are in, also a great time to double down.

Centralized Crypto Exchange Celsius Melts Down

One of the reasons crypto took a huge hit in 2022 is Celsius, a centralized company that allowed individuals to earn interest on deposited collateral and take collateralized loans against their crypto. They were a market giant. As a quick synopsis, Celsius Network LLC had over $8 billion lent out to clients and $12 billion in assets under management as of May 2022. However, in a surprising announcement, on June 12, the firm stopped all withdrawals from its platform, citing “extreme market conditions.” In July Celsius filed for bankruptcy.

That's bad news. When people can't get their money, it's terrible news. (We saw the writing on the wall, and our fund had no exposure to Celsius when it halted funds. Unfortunately, not everyone had this foresight.) The company, it seems, was overleveraged, and didn't have the capital to honor its obligations.

The Department of Justice, state regulators, and advocates for unsecured creditors (customers who aren't getting their money back) have been accumulating damning evidence against Celsius. According to PC Gamer reporting and court documents, “To put it mildly, the regulators don't like what they see. The Vermont Department of Financial Regulation has now filed against the firm in New York, and the state regulator is ‘especially concerned about losses suffered by retail investors; for example, middle‐class, unaccredited investors who may have invested entire college funds or retirement accounts with Celsius.’ Vermont state prosecutors support the DOJ's request for a legal Examiner to protect such interests.” According to the bankruptcy court filing, “This shows a high level of financial mismanagement and suggests that at least at some point in time, yields to existing investors were probably being paid with the assets of new investors.”

Celsius apparently experienced losses of $454,074,042 between May 2, 2022, and May 12, 2022. “This $450 million loss in 10 days meant depositor funds were not safe, but Mashinsky and Celsius continued to pretend they were financially healthy,” PC Gamer reports. In other words, they were running a Ponzi scheme.2

We deplore Celsius's mismanagement and misleading statements. Indeed, continued spin by the now‐former CEO and others that Celsius will make a comeback sure sounds like whistling by the graveyard. With the DOJ and regulators involved, there's a chance that Celsius will release some funds to its customers. We have dear friends who have money locked and we understand how this meltdown really impacts people. However, as more facts are uncovered, it is becoming clear that what happened with Celsius isn't so much about the nature of crypto market investing as it is about ambitious founders/executives misleading investors and regulators. This is a centralized business that failed. In the crypto investing sphere, as in other financial sectors, be careful of firms that make a marketing promise that proves impossible to sustain, such as “deposit your digital assets and receive interest as high as 18 percent.”3

This is crypto's too‐good‐to‐be‐true cautionary tale; what's more, not every business operating in a new technological field succeeds. Businesses come and businesses go. Some succeed, and some fail. This does not inherently mean that blockchain and crypto lending institutions are bad, any more than AltaVista's failure meant that search engines are bad. What is important to note at this point is that, while Celsius imploded, DeFi contracts kept chugging right along. It turns out that Celsius's implosion is actually a case for crypto.

Professor Krugman Is (Still) Wrong

We have tracked the columns of New York Times columnist Paul Krugman, who has made several passionate attacks on crypto. He's a famous economist and won the Nobel Prize in Economics. He's also best known for being the guy who said, “the Internet's Effect on the World Economy Would Be ‘No Greater Than the Fax Machine's’” in 1998. We're just going to let that statement sit for a moment to sink in. We assert that his views on crypto, equally passionate, are also equally wrong.

In a January 10, 2022, op‐ed, he wrote, “I've been in many meetings in which crypto skeptics ask, as respectfully as they can, for simple examples of things you can do better or more cheaply with cryptocurrency than via other forms of payment. I still haven't heard a clear example that didn't involve illegal activity – which may, to be fair, be easier to hide if you use crypto.”

In July 2022, Professor Krugman filed the inevitable gloating installment of his crusade in which he attempts to spike the ball after crypto's downturn, repeating variations of the failed arguments in the January piece. One of those is that crypto doesn't have uses in the “real” economy, even as he cites examples (Venmo) of how crypto is used in household name financial tools:

My answer is that while the crypto industry has never managed to come up with products that are much use in the real economy, it has been spectacularly successful at marketing itself, creating an image of being both cutting edge and respectable. It has done so, in particular, by cultivating prominent people and institutions.

Suppose, for example, that you use a digital payments app like Venmo, which has amply demonstrated its usefulness for real‐world transactions (you can even use it to buy produce at sidewalk fruit stands). Well, if you go to Venmo's home page, you encounter an invitation to use the app to “begin your crypto journey”; in the app itself, a “Crypto” tab appears right after “Home” and “Cards.”

First, there is the unintentional irony of Professor Krugman's point. The characteristics of Venmo he praises are true and will be true of crypto with no intermediary taking a fee. Second, he doesn't cite any research or knowledge that would indicate that Venmo (and by extension all the “prominent people and institutions”) thinks crypto sucks and promotes it solely for the money.

This is also a lazy argument. Is he saying that, since he's been in meetings where no one could come up with a cryptocurrency use case that wasn't criminal, there isn't one? This is ludicrous. It's clear that Professor Krugman's not attending the right meetings. Here are three things you can do better with bitcoin and other cryptocurrencies:

- Send money online 24/7 without waiting for or paying a middleman like a bank or payment processor. According to Coinbase, sending bitcoin is typically 60 times more cost‐effective and up to 48 times faster than an international wire transfer.

- Gain access to banking, investing, savings, loans, and other financial services no matter where you live. All you need is a smartphone.

- Store value in a place that is not subject to the vicissitudes of local currencies and governmental monetary policy.

Professor Krugman makes a common logical mistake, that of modus ponens – affirming the consequent. For example, if I say, “Jim likes pizza; Susie doesn't like pizza; therefore, Susie doesn't like Jim,” I would have made the same logical fallacy. While I can't prove my argument by invalidating Krugman's, I can prove that Krugman's argument is invalid. Just because Bitcoin can be used for harmful or illegal activity doesn't mean it is illegal or bad. It's just a tool. So are guns, knives, and hundred‐dollar bills. They are used for unlawful activity all the time, but you don't hear people running around saying a hundred‐dollar bill is bad or illegal, do you?

We also find Krugman's political analysis unfounded. He sees the seeds of right‐wing extremism. He asserts in his January 31 opinion, “… Bitcoin plays into a fantasy of self‐sufficient individualism, of protecting your family with your personal AR‐15, treating your Covid with an anti‐parasite drug or urine [usatoday.com] and managing your financial affairs with privately created money, untainted by institutions like governments or banks.”

That's like saying that seditious extremists used private messaging services like Signal and Telegram to attack the U.S. capital, so therefore, private messaging apps are dangerous or bad. Signal and Telegram both allow users to encrypt communications to protect the data from being analyzed by third parties, including law enforcement. Does this technology help criminals? Sure. Does it also serve people with noncriminal intent? Yes. Like bitcoin – a hammer or a hundred‐dollar bill – it's simply a tool. There is no agenda.

In July, Krugman slammed crypto's appeal as being due to “a combination of technobabble and libertarian derp,” which must be news to Paul Tudor Jones, Starbucks, BlackRock, McKinsey, Goldman Sachs, and other globally significant investors and institutions that have invested heavily in blockchain and crypto.

In a January 27th opinion, Krugman conjures another boogie man: subprime mortgages. In this essay he asserts that, like people who signed up for subprime mortgages, individual crypto investors are being lured into a risky financial scheme they don't understand. “It turned out, however, that many borrowers didn't understand what they were getting into. Ned Gramlich, a Federal Reserve official who famously warned in vain about the growing financial dangers, asked [kansascityfed.org], ‘Why are the riskiest loan products sold to the least sophisticated borrowers?’” He then declared, “The question answers itself.”4

We don't think the question “answers itself.” While we agree that there are plenty of fraudulent crypto schemes, and the market is extremely volatile, there's no logical comparison between a mortgage instrument designed to induce people to take on loans they can't afford and a new technology that could be used for an endless array of purposes. Seriously – what else can you use a subprime mortgage for?

Krugman proved his opinions quite wrong during the Age of Information and it looks like he's continuing that error in true form into the Age of Autonomy®. At least he is consistent.

As we've said, we advise the average individual investor (and opinion writer) to take some time to learn about the breakthrough of blockchain technology and with it, crypto assets, before jumping in, financially or rhetorically. There is an abundance of resources to get you started, this book being one, and, thanks to the unique nature of cryptocurrency (and certainly in bear markets), the price of entry is low. Unlike buying stock in Tesla, you can buy a small percentage of a bitcoin for $25, or even $1, for that matter. Start slow, stay curious, and educate yourself. There is a fascinating new world to discover for those willing to do their homework. Will you use your new crypto assets to mount a crime spree or launch a nonprofit? Well, like all things in life, that's entirely up to you.

Our Silver Lining Playbook

The Fed's hawkish policy on rates is a fact of life for investors in 2022, the time of this book's writing. The Fed announced the doubling of efforts of quantitative tightening (QT) starting in September 2022. They are raising the sales of Treasury bonds from $45 billion to $90 billion per month, thereby reducing the balance sheet at twice the initial rate to reduce the monetary supply and pulverize inflation into oblivion.

Markets don't like tightening and dislike twice the tightening twice as much. When you combine this with a strengthening dollar that is nearing all‐time highs and battering other economies, it's clear that the Fed wrecking ball will tamp down growth. Our silver lining is that this is a (comparatively) short‐term issue. Rates may continue to rise for a while, but we're already seeing signs of a lower CPI. Should this trend continue, we think the current tightening of the tightening may indeed be short‐lived.

For years bitcoin has been touted as a hedge against inflation, but right now bitcoin (and the rest of the crypto markets) seems pretty tied to the Fed's actions. That's actually okay because, distinguished as such, this correlation can be used to one's advantage. Bitcoin is a hedge against monetary inflation, not consumer price inflation. Against monetary inflation, it does its job just fine. When we start to see more money printing from the Fed, we expect bitcoin will go up once again like it's done the past four times. For those who like value and understand that any crypto investment is a technology investment that will take a little time to mature, we argue that there may be no better time to buy than right now. For the contrarians, even if these markets don't go any lower, that would make this the bottom.

If you'd like another silver lining, consider the world's largest money manager – the one, the only, the titan, BlackRock. BlackRock, a firm that manages almost $5.7 trillion, announced a historic deal with Coinbase to allow their clients to trade via the Coinbase platform. This can only be the beginning of the next big step for the institutional players, and the validation here is obvious. Importantly, institutional money now being able to access these markets with a green light from their counterparties (banks, managers) is one of the harbingers of growth for which we have been waiting. Once the naysayers, the banks are now beating the drum. It is a glorious sound.

The Amazing Merge

Another big silver lining in 2022 is what the crypto world took to calling “The Merge,” involving the king of smart contract platforms, Ethereum. Ethereum has market share and is the dominant chain, but it's (generally) slow, expensive, and doesn't scale well. Ethereum currently processes about 13 transactions a second, which is a woefully inadequate number considering that there are over one million transactions a day demanding attention on the chain. The Merge intends to solve this problem by setting the stage for future enhancements by moving to a new consensus mechanism.

Consensus is the process of all the nodes on a blockchain agreeing that a transaction is valid. Bitcoin and currently Ethereum use a proof‐of‐work (PoW) consensus mechanism, which, as we discussed in the previous chapter, means that there is a network of machines (miners) that have to spend a lot of computational processing power (energy) to confirm transactions.

Ethereum's proposed new consensus mechanism is called proof‐of‐stake (PoS), which, again simplified, has each computer running on the network (validators) pledging a certain amount of Ethereum (staking), which gives them the right to participate in the confirmation of transactions. This new methodology will be vastly more energy efficient. Some speculate that it will reduce the carbon footprint by as much as 95%. This efficiency opens the door for the next steps. It will not immediately impact the transaction fees and speed, but this new consensus mechanism will set the stage for sharding, which is processing transactions off‐chain in a faster manner, as well as other enhancements.

The Merge is one of the seminal events in the world of blockchain technology and should fulfill its promises to reduce power consumption, set the stage for a faster and less expensive Ethereum and, importantly, create a more deflationary token. Some even think that, with its success, the Ethereum market cap will exceed that of Bitcoin.

This is yet another event that positions the technological footprint of blockchain to grow in the coming years. In the late 1990s, there was a massive battle for search engine dominance and, as we all know, Google won. This doesn't mean that there aren't other engines out there, but the fact is for the vast majority of humans, when looking for something on the web, we “Google” it. There were engines out before Google, such as AltaVista and Lycos, and, as noted, AltaVista went from market‐dominating Internet darling to black sheep of the search world in a very short period of time.

Many other platforms exist that currently have this PoS consensus mechanism. They don't have the market share that Ethereum does, but better products tend to win over time, so this is a crucial juncture for Ethereum.

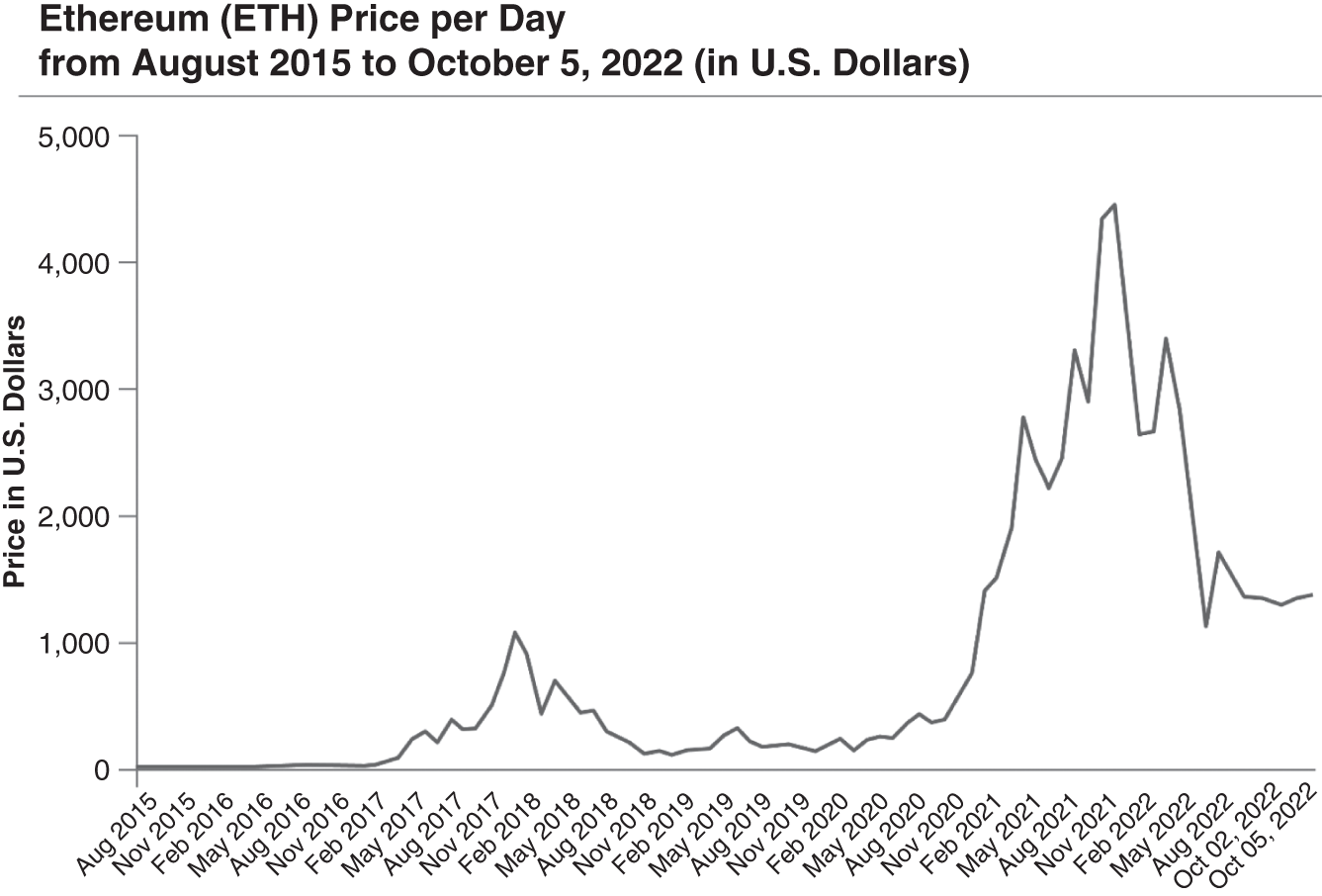

Watch Ethereum's price as The Merge evolves in global crypto marketplaces (see Figure 7.2).

Figure 7.2 Ethereum Price per Day

Source: CoinGecko © Statista 2022.

Additional information: Worldwide; January 2019 to October 5, 2022; monthly figures are as of the end of that particular month; opening price.

For those of you looking at investing in blockchain technology (yes, I'm looking at you), this is a seminal event because it sets the stage for the landscape for years. Ethereum is set to rule the world as the premier Level 1 blockchain technology if they can successfully continue to upgrade their technology. This will allow them to not only keep market share but also address the cost/scalability dragon. The Merge was the next step to that. This puts them on the path of being like a Google to the search engine world.

The bear market hurt lots of investors and exposed some charlatans. We, and most every crypto pundit, want the bums out of our business. Focus on the technology; that's the driver of wealth and growth. What Professor Krugman and others haven't seen in the colder days of the bear market are events such as The Merge that demonstrate the resiliency and innovation of blockchain and Bitcoin.

Notes

- 1. https://apnews.com/article/inflation-economy-prices-jerome-powell-839eaf55d57958b96fe18f9bc0884397.

- 2. https://www.pcgamer.com/us-regulators-say-multi-billion-dollar-crypto-lender-celsius-was-operating-like-a-ponzi-scheme/.

- 3. https://www.nytimes.com/2022/09/13/technology/celsius-network-crypto.html.

- 4. https://www.usatoday.com/videos/news/health/2021/08/24/covid-misinformation-fda-warns-ivermectin-covid-treatment/5578920001/.