8

Myth – Crypto Is Bad for the Environment

Like many of our colleagues in the crypto investing world, we feel strongly that our sector has the potential to lead in mitigating climate change. I understand that may sound like an oxymoron, but it's not. We absolutely believe blockchain can be a major positive factor. That's why it's frustrating to read headlines like “Bitcoin is a disaster for the planet.” Slow down, cowboy. We need to agree on some basic facts before we start hardening our positions and making business and policy decisions that will determine the future of our economy and planet.

Before we point out the underreported benefits of the crypto sector for climate change, energy conservation, and emerging adaptations for energy sustainability, we won't soft‐soap the facts. We're not going to underestimate the scope of the issue or the concerns about crypto assets' impact on energy use – they are real and we acknowledge that. That's where some advocates mess up. The crypto sector represents a massive transformation of the global economy and, yes, some hard issues must be addressed, which we can do within the industry and within the scientific and policy community. Bitcoin uses a lot of energy. There, we said it. Now that the not‐so‐genie is out of the bottle, let's explore some additional implications.

Bitcoin Energy Consumption

In order to accomplish this, we'll turn to a comprehensive and exceedingly well‐crafted new federal report, “Climate and Energy Implications of Crypto‐Assets in the United States.” This was just released in September 2022 and written and published by the Office of Science and Technology Policy (OSTP), drawing on a wide number of interagency nonpartisan experts.1 Some key findings:

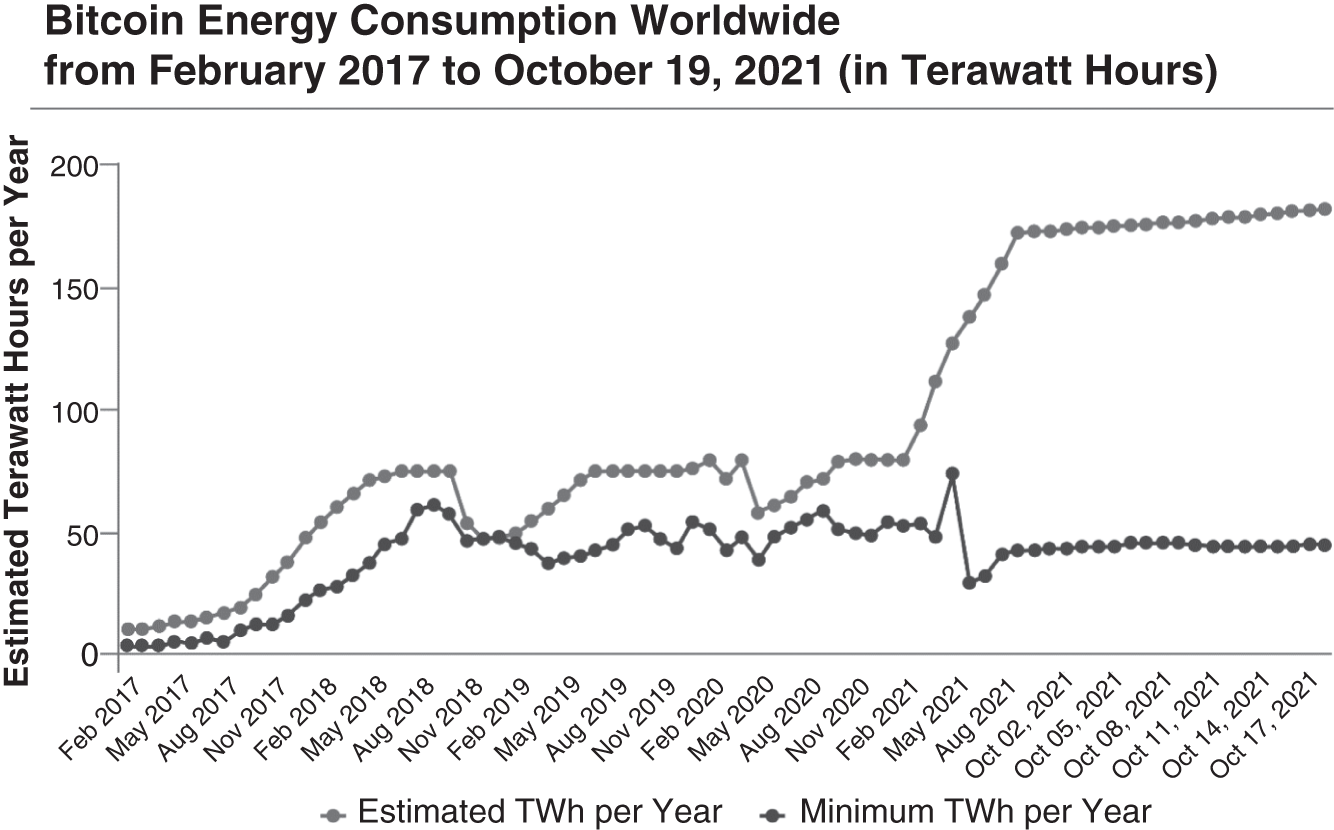

- From 2018 to 2022, annualized electricity usage from global crypto assets multiplied, with estimates of electricity usage doubling to quadrupling. As of August 2022, published estimates of the total global electricity usage for crypto assets are between 120 and 240 billion kilowatt‐hours per year, a range that exceeds the total annual electricity usage of many individual countries, such as Argentina or Australia. This is equivalent to 0.4% to 0.9% of global yearly electricity usage and is comparable to the annual electricity usage of all conventional data centers worldwide (see Figure 8.1).

- The United States is estimated to host about a third of global crypto‐asset operations, which currently consume about 0.9% to 1.7% of total U.S. electricity usage. This range of electricity usage is similar to all home computers or residential lighting in the United States. Crypto‐asset mining is also highly mobile. The United States currently hosts the world's largest Bitcoin mining industry, totaling more than 38% of global Bitcoin activity, up from 3.5% in 2020. Despite the potential for rapid growth, future electricity demand from crypto‐asset operations is uncertain, demonstrating the need for better data to understand and monitor electricity usage from crypto assets.

Figure 8.1 Bitcoin Energy Consumption Worldwide, 2017–2021

Source: BitcoinEnergyConsumption.com © Statista 2021.

Additional information: Worldwide; Digiconomist; February 2017–October 19, 2021.

- The energy efficiency of mining equipment has been increasing, but electricity usage continues to rise. Other less energy‐intensive crypto‐asset ledger technologies exist, with different attributes and uses.

- Global electricity generation for the crypto assets with the largest market capitalizations resulted in 140 ± 30 million metric tons of carbon dioxide per year (Mt CO2/y) or about 0.3% of global annual greenhouse gas emissions. Crypto‐asset activity in the United States is estimated to result in approximately 25 to 50 Mt CO2/y, which is 0.4% to 0.8% of total U.S. greenhouse gas emissions. This range of emissions is similar to emissions from diesel fuel used in railroads in the United States.

- Besides purchased grid electricity, crypto‐asset mining operations can also cause local noise and water impacts, electronic waste, air and other pollution from any direct usage of fossil‐fired electricity, and additional air, water, and waste impacts associated with all grid electricity usage. These local impacts can exacerbate environmental justice issues for neighboring communities, which are often already burdened with other pollutants, heat, traffic, or noise.

This is pretty damning stuff on its own. Having said that, let's put it in context. Yes, Bitcoin mining eats up a lot of electricity – this isn't news. According to the Cambridge Bitcoin Electricity Consumption Index, worldwide bitcoin mining uses about 105 terawatt hours of electricity per year – comparable to the consumption of the entire nation of Finland. But even that is a fraction of the energy required to run the world's traditional banking infrastructure. A 2021 report from Galaxy Digital found that the Bitcoin network consumes less than half the energy consumed by the banking or gold industries. No one barks about the energy the gold industry uses, but it's double that of Bitcoin. Double.

Drilling down a bit more, electricity use is not the same as measuring carbon emissions. So far, there's not a precise way to measure the source of energy bitcoin miners use – was it generated by coal plants? Or was it clean energy, like hydroelectric dams? Perhaps it was some combination of the two? The simple fact is that bitcoin miners can be located anywhere, which puts them in a good position to use so‐called stranded renewables (sources of energy that otherwise go untapped). These are often the cheapest energy source out there, and some bitcoin miners are flocking to places where renewable power is abundant.

A fundamental aspect of electricity is that you can't use it unless you are located at the source of production or if there's an infrastructure in place (wires, grids, etc.) to transport it to where there's demand. That creates a dilemma for many remote wind, solar, and thermal energy operations. Depending on the weather, they produce too little or too much power to use locally, and the excess often goes to waste. Enter bitcoin miners – they can be located anywhere. And because so‐called stranded renewables are usually the cheapest source of energy out there, miners are flocking to places where renewable power is abundant. It's become a new business model. Companies like Seetee exist to establish mining operations that transfer stranded electricity without stable demand locally into economic assets, like bitcoin, that can be used anywhere.

Until 2021–2022, hydropower in China and Scandinavia played a big part in keeping Bitcoin's energy consumption carbon‐neutral, mainly due to the abundance of hydropower in the area. The percentage of bitcoin mining powered by renewables is anywhere from 20% to 70%, according to the Cambridge Bitcoin Electricity Consumption Index.

According to the New York Times, a 2022 study published in Joule by researchers from Vrije Universiteit Amsterdam, the Technical University of Munich, ETH Zurich, and the Massachusetts Institute of Technology found the Bitcoin network's use of renewable energy dropped from an average of 42% in 2020 to 25% in August 2021. China's action on hydropower‐driven mining operations was the primary catalyst of this decrease. “China's crackdown on cryptocurrencies upended the world of Bitcoin last year, triggering a mass exodus of ‘miners’ – who use power‐hungry computers to mine, or create, new bitcoins – to new locations around the world,”2 reported Hiroko Tabuchi. But where China has pushed down, other opportunities are popping up.

In June 2021, the president of El Salvador announced that the country's state‐run geothermal energy utility would begin using power derived from volcanoes for bitcoin mining. In other words, bitcoin mining will allow the country to translate local resources into global currency. The implications are mind‐boggling.

The operation was underway and rolling by October 2021 at the Berlin Geothermal plant, two hours' drive east of the capital. The specialized mining machines on the site are using 1.5 megawatts of the 102 megawatts the plant produces, according to the AP news service; El Salvador's other geothermal plant in Ahuachapán produces another 95 megawatts. Together the plants provide power to 1.5 millions of El Salvador's 6.5 million citizens.

Blockchain Technologies and Climate Mitigation

In evaluating blockchain's social and environmental implications, numerous scholars agree that blockchain and distributed ledger technologies have potential benefits that would offset some of the short‐term ecological impact.

As found by the OSTP report “Climate and Energy Implications of Crypto‐Assets in the United States,” blockchain “may have a role to play in enhancing market infrastructure for a range of environmental markets like carbon credit markets. Use cases are still emerging, and like all emerging technologies, there are potential positive and negative use cases yet to be imagined. Responsible development of this technology would encourage innovation in distributed ledger applications while reducing energy intensity and minimizing environmental damages.” This is an interesting, if uncommon, opinion, but it points to the fact that there may well be more here than meets the eye, and blockchain technologies may well be part of the solution if weighed properly.

Susan Jones of The Aerospace Project agrees that crypto mining could be a catalyst for renewable energy projects and could move its energy needs into space:

Crypto mining companies are often located near power sources to feed their power‐hungry computers. As a result, crypto mining can be a catalyst or market driver for new renewable energy projects. For instance, Digital Power Optimization, in New York, now runs 400 mining computers from spare electricity produced by a hydroelectric dam in Hatfield, Wisconsin. There are many remote geographic areas where the energy demand market is not large enough to support a utility scale renewable energy site.3

There's incentive on the miners' side as well for, as miners, the lower the energy cost, the higher their profit margin, incentivizing the entire community to switch to cleaner energy where prices are cheaper. A bonus to that is its ripple effect. As miners turn to clean energy, utility companies will want to expand their capacity for renewable energy. This gives miners the option to buy more energy to fuel their process while benefiting and encouraging utility companies to pour more effort into expanding their green resources.

One salient example is flare gas. Flare gas is natural gas that is burned off at an oil rig, primarily because there is no cost‐efficient distribution network for the resource. This is a boon for miners that, as noted, can be set up almost anywhere. A bitcoin mining rig that would use flare gas as an energy source would not only be more efficient; it would provide a double benefit in consuming what would be an otherwise wasted resource.

Bitcoin and its technology can provide some profound benefits to the global energy markets. It's well known that necessity is the mother of invention. As bitcoin specifically, and crypto in general, garner more and more adoption and demand, it is entirely reasonable to predict that ever greener solutions will be explored, identified, and implemented. Even Elon Musk, once a detractor and now a member of the Bitcoin Mining Counsel, is pushing for the move to renewable energy. The simple fact is, this is a problem that we want to solve, and we are well on the way to solving it.

All this being said, at the end of the day the most important factor in operating a mining operation is the input cost of energy. It is the more efficient operations that will win the right to mint new bitcoin and because of this, inefficient operators get forced out into bankruptcy and it's the efficient miners who win over time. Because of this, the miners who have near‐free energy to power their operations will be the winners. Therefore, the winners will be ones who deploy renewable energy or sources of free energy.

In addition, it is relevant to note that all cryptocurrencies and platforms are not the same. They differ in many ways, including a consensus mechanism – the technology used on a blockchain to settle transactions and secure the network. As we've discussed, Bitcoin runs on a proof‐of‐work (PoW) consensus mechanism that requires using many powerful computers (bitcoin miners) running around the clock. People are understandably concerned that the energy costs may be too high, but they're missing an important part of the picture. There's a new generation of apps that uses a proof‐of‐stake (PoS) consensus mechanism. The Ethereum merge changed the blockchain to PoS, which does not require an energy‐intensive mining task. Other, newer, blockchains like Polkadot and Polygon use a PoS consensus mechanism as well. Now, Ethereum has made this switch and continues to position itself as a force to be reckoned with. As a crypto enthusiast, we would encourage you to apply critical thinking and look at the entire landscape, not just the click‐bait or generally perceived reality.

Notes

- 1. The Office of Science and Technology Policy (OSTP) was established by the National Science and Technology Policy, Organization, and Priorities Act of 1976 to provide the President and others within the Executive Office of the President with advice on the scientific, engineering, and technological aspects of the economy, national security, homeland security, health, foreign relations, the environment, and the technological recovery and use of resources, among other topics. OSTP leads interagency science and technology policy coordination efforts, assists the Office of Management and Budget (OMB) with an annual review and analysis of federal research and development in budgets, and serves as a source of scientific and technological analysis and judgment for the President with respect to major policies, plans, and programs of the federal government.

- 2. https://www.nytimes.com/2022/02/25/climate/bitcoin-china-energy-pollution.html.

- 3. https://www.channelchek.com/news-channel/could-cryptocurrency-become-a-catalyst-for-renewable-energy-projects.