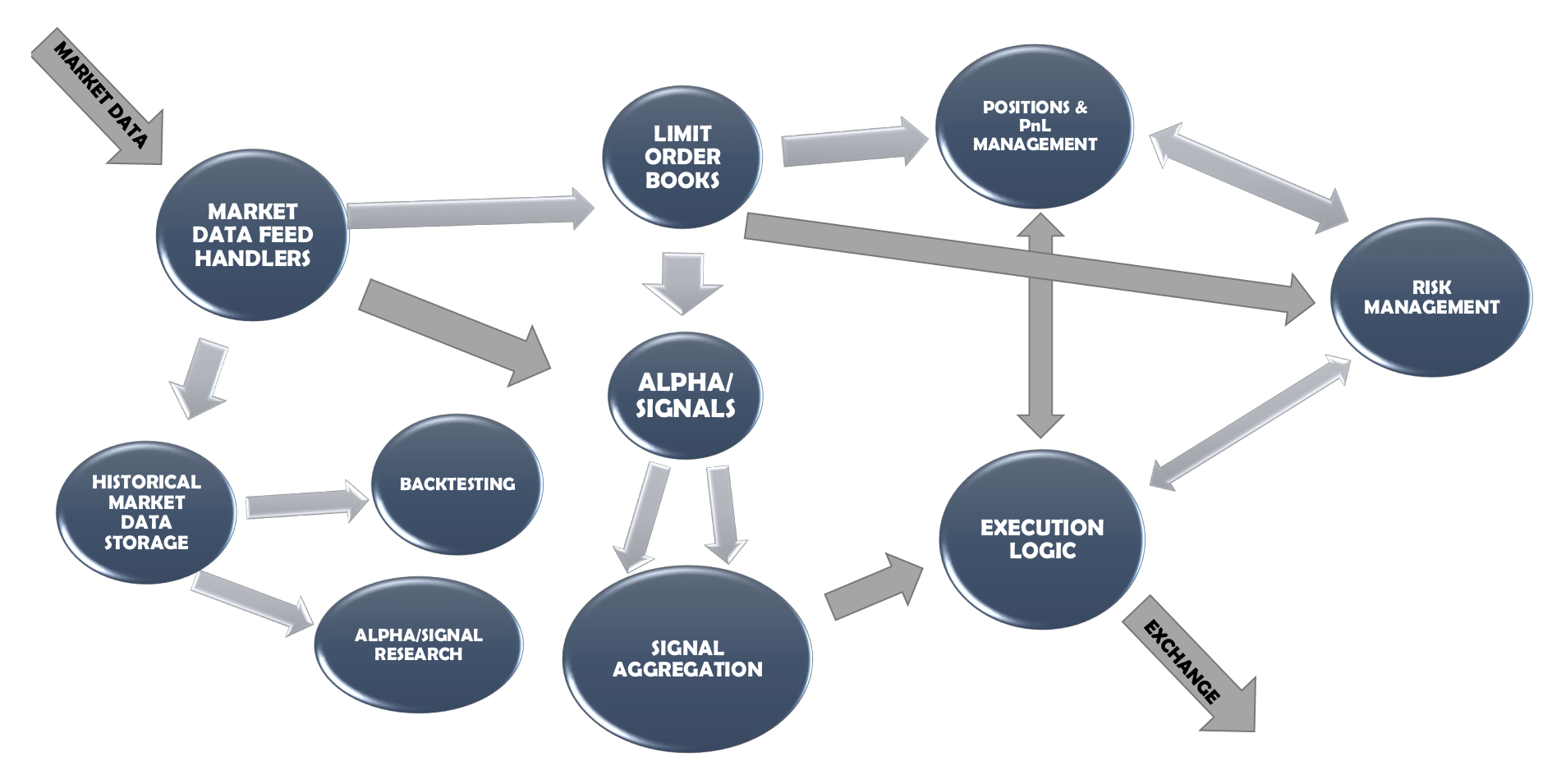

In an earlier section, we provided a top-level view of the entire algorithmic trading setup and many of the different components involved. In practice, a complete algorithmic trading setup is divided into two sections, as shown in the following diagram:

- Core infrastructure deals with exchange-facing market data protocol integration, market data feed handlers, internal market data format normalization, historical data recording, instrument definition recording and dissemination, exchange order entry protocols, exchange order entry gateways, core side risk systems, broker-facing applications, back office reconciliation applications, addressing compliance requirements, and others.

- Algorithmic trading strategy components deal with using normalized market data, building order books, generating signals from incoming market data and order flow information, the aggregation of different signals, efficient execution logic built on top of statistical predictive abilities (alpha), position and PnL management inside the strategies, risk management inside the strategies, backtesting, and historical signal and trading research platforms: