CHAPTER 18

Real Estate

________________

The global real estate sector includes companies that predominately own and manage real estate assets across a variety of property types from distribution centers to office skyscrapers, business parks, multi-family residential properties, shopping malls, data centers, cell towers, and self-storage facilities. Real estate offers unique characteristics that can enhance the risk-and-return profile of an investor's portfolio. It is generally regarded as a separate asset class from stocks and bonds, as real estate has historically exhibited relatively low correlations with other sectors of the market.

Publicly traded real estate companies are a preferred way for investors to gain access to real estate properties capable of generating consistent income and attractive capital gains. Investing in real estate through the public markets has four main benefits over private (direct) real estate investing. First, private real estate is illiquid. In addition to the lengthy sales process for an individual property, many fund investments in private real estate have a multi-year lockup period preventing investors from exiting. On the other hand, publicly traded real estate securities are exchange traded and can be transacted on during regular market hours. Second, most private investors limit themselves to more traditional property types like office, residential, industrial, and retail, but there are more niche opportunities in the public markets for emerging property types. These include data centers, cell towers, life sciences, and self-storage assets that can generate outsized growth. Third, the investment, asset, and property management of private real estate investing is specialized by property type and geography. Accessing best-in-class management for multiple property types and across multiple regions is therefore only feasible through the public markets. Finally, assembling a diversified portfolio of real estate requires a tremendous amount of capital. Well-diversified portfolios can be created through the public markets almost instantaneously and at a very modest cost.

Publicly traded real estate comes in two forms, a real estate investment trust (REIT) and a real estate operating company (REOC). A REIT is a corporation or business trust that combines the capital of many investors to buy properties or supply financing for income-producing real estate. In most countries, a REIT is not required to pay corporate income tax if it distributes the majority of its taxable income to shareholders. A REOC is a company whose primary business is similarly the ownership and/or operation of commercial real estate properties; however, the company has elected not to be taxed as a REIT.

Accounting methods employed by companies within the real estate sector are another important distinction from companies in other sectors. Cash flow does not equal accounting income because of depreciation, amortization, and straight-lining of leases. REITs use straight-line rents because generally accepted accounting principles (GAAP) requires it. Straight-lining averages the tenant's rent payments over the life of the lease but does not necessarily reflect the cash payments received during each period due to tenant concessions or other issues. Furthermore, company balance sheets reflect the acquisition price of the underlying assets, not their current market value.

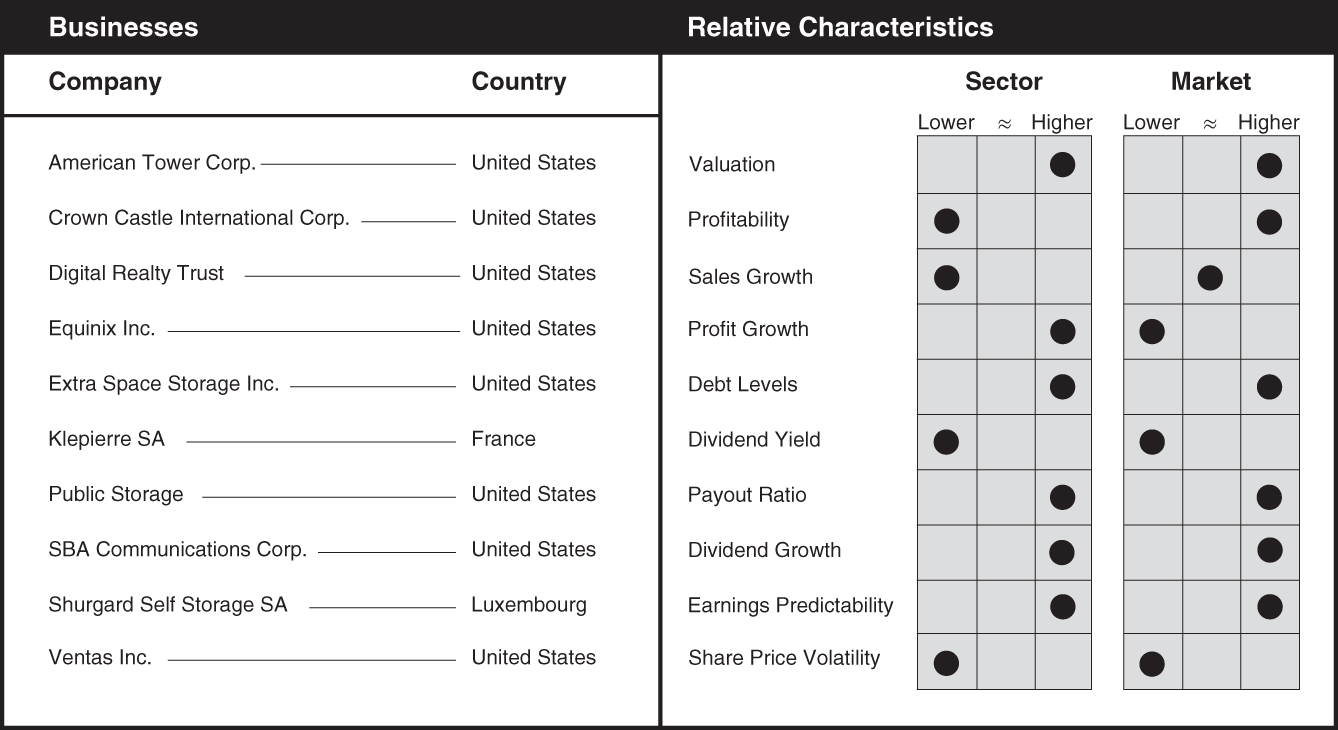

Data source: Bloomberg, as of March 18, 2022.

Sales and EBITDA growth in the real estate sector are typically higher and steadier than the market, given normally low vacancy rates and contractual rental rates (leases contractually bind both property owner and tenant to both rents and term). Higher earnings stability supports strong dividend yields and results in higher-than-normal earnings predictability, which facilitates financing at both the property and corporate level. However, it should be noted that consolidated company debt levels often vary by country. For example, the average debt-to-equity level of a REIT domiciled in the United States is much lower than that of a Canadian REIT.

Long-term trends affecting the real estate sector include housing shortages, the increasing need for senior living establishments, a shift to e-commerce from traditional retailing, working from home and the move toward smaller office spaces, offshoring or onshoring of manufacturing, urban and suburban office space demand shifts, and just-in-time manufacturing.

Companies within this sector vary in sensitivity to the economic cycle, and investors should note that since real estate assets are stationary, they are subject to economic events and demographic trends specific to that geographic region. When interest rates rise quickly, companies within the sector typically underperform and correlations between REITs and the universe of common stocks increase. Real estate companies tend to have a higher beta than the market average, reflecting the reactionary nature of investor sentiment on economic expectations, high fixed costs, high leverage, and thin operating margins. Real estate company performance during bear markets is influenced by the factor(s) that precipitated the bear market in relation to their underlying exposures. In general, during deteriorating economic conditions, REITs that are focused on residential properties and grocery-anchored shopping centers are a safer segment within the sector. However, these companies are often priced more aggressively (expensive) heading into a recession.

REIT operating performance is usually assessed by reviewing a company's funds from operations (FFO). FFO is equal to net income excluding gains or losses from sales of property plus depreciation, and it is considered a better measure of earnings than EPS. Adjusted funds from operations (AFFO) is another useful measure of operating performance. AFFO attempts to quantify cash flow generated by operations and is calculated by subtracting recurring expenditures (necessary to maintain a REIT's properties and its revenue) from FFO. It also straight-lines rents to spread rental rate incentives common to new tenants across the term of the lease. Investors can identify sector and industry income multiples, make any necessary adjustments, and apply that multiple to forecasted FFO and AFFO for a particular REIT to arrive at a fair value estimate.

Another commonly used valuation measure is net asset value (NAV), which is the net market value of a REIT's assets after subtracting its liabilities and obligations. Since most jurisdictions require REITs to only report book value, which likely differs substantially from market value, estimates of NAV vary widely by geographic region. Further, individual property or even aggregate net operating income (NOI) is not reported and has to be estimated. Investors must then attempt to apply a market capitalization rate (the inverse of a P/E multiple) to the aggregate NOI. Capitalization rates (commonly referred to as cap rates) are calculated by dividing a property's NOI by its current market value, and they reflect the estimated expected annual income return on a real estate investment.

In this chapter we take a closer look at eight main industry groupings within the real estate sector: (1) diversified REITs, (2) industrial REITs, (3) office REITs, (4) residential REITs, (5) retail REITs, (6) real estate development, (7) real estate services, and (8) specialty REITs.

Diversified REITs

Data source: Bloomberg, as of March 18, 2022.

Diversified REITs include those companies that have been in business for many years and after focusing on a single property type, have expanded their operations. As a result, these companies own and manage a wide array of property types, making them suitable for investors looking for diversified sector exposure. As these firms hold multiple property types, their performance is primarily determined by the economic strength of the geographies in which they operate and the types of properties they own. Diversified REITs typically generate more stable cash flows than property-specific REITs over the economic cycle. As a result, earnings predictability and dividend yields are typically higher than market. Further, the more stable cash flow allows them to invest in out-of-favor properties when REITs that focus on a single property type cannot. Management teams try to exploit their industry knowledge by concentrating on a limited geographic area or leveraging some other potential advantage. Important metrics for investors to monitor vary by the types of properties held, but often include occupancy, same-store sales growth, FFO, and AFFO. Investors can use a combination of valuation approaches including DCF, P/FFO and P/AFFO, and NAV.

Industrial REITs

Data source: Bloomberg, as of March 18, 2022.

Although companies within this segment are classified as industrial, many of the underlying real estate assets are warehouses or bulk distribution facilities. Compared to other industries within the real estate sector, industrial REITs can increase supply very quickly as the zoning, building, and leasing for warehouses are straightforward compared to all other property types. Furthermore, buildings constructed on “spec” (without a tenant) are more common, as warehouse space is often less expensive to construct per square foot versus other types of real estate. Land is typically inexpensive and leasing costs are also lower because of a reduced requirement for tenant improvements. Industrial REIT performance is highly correlated to GDP growth, since demand for warehouse and distribution space heavily depends on economic growth. The demand for warehouse space also depends on import and export activity in the region. Warehouse demand has increased because of trade restrictions, disruptions in global trade, and a shift by consumers to purchase goods online. This has led to increased demand for distribution facilities closer to population centers driving outsized EBITDA growth, exceedingly low vacancies, and rapidly increasing rents, all of which are positively skewing the segment metrics. Other macroeconomic factors that affect the industry include goods moving through the supply chain (shipping volumes), inventory levels, retail sales, industrial production and capacity utilization, population growth, and wage growth. Business confidence is also an important indicator. Important operational and financial metrics for investors to track include funds from operations (FFO) and adjusted funds from operations (AFFO). Investors can use a combination of approaches to value companies within the industry, including DCF, P/FFO, P/AFFO, and NAV.

Office REITs

Data source: Bloomberg, as of March 18, 2022.

Office REITs are unique within the real estate sector because the factors that drive office property performance are highly localized. A building in Frankfurt may perform quite differently than the exact same quality of building in Berlin or the building across the street. Despite swings in REIT prices, occupancy (and therefore cash flows) changes very little for office REITs because of the long-term nature of the leases (with 10-year terms being common) and the high (70–90%) probability of lease renewal. Rents, tenant improvement allowances (paid by the landlord to entice a new tenant), and other lease terms like rights and options vary through property cycles and by local custom. One important trend affecting the industry is a shift toward a smaller average amount of space per employee. In addition, new supply is typically state of the art with better amenities, design, and lower operating costs, weakening the demand for dated or poorly located buildings. Economic recessions are most harmful to office properties located outside major urban central business districts, as regional and satellite offices are often the first to be eliminated to cut costs. Office occupancy levels in urban centers are relatively stable when compared to suburban locations, particularly for strong assets in markets with significant supply constraints and barriers to entry. Since it is the local environment that drives the supply and demand for office space, it is essential to monitor local economies and their key industries. Macroeconomic factors that have the greatest impact on the industry include employment growth and changes in the level of interest rates. Office REITs often trade below NAV despite delivering above-average profitability and dividend yields. Important industry metrics that investors should track include new supply, tenant contraction or expansion, changes in the amount of office space available for sublease and changes in tenant improvement allowances (a component of net effective rent), and changes in the face or asking rent. Other metrics for investors to track include funds from operations (FFO) and adjusted funds from operations (AFFO). Investors can use a combination of approaches to value companies in the industry, including DCF, P/FFO, P/AFFO, and NAV.

Residential REITs

Residential is considered the most stable property type, given the ability to accurately forecast demand and supply. High earnings predictability supports high loan-to-value levels and dampens share price volatility. The demand for multi-family space depends on population growth and household formation, which is often regional in nature. Demand also depends on the cost of renting compared to the cost of owning. Higher interest rates will make homeownership more expensive, causing a shift toward renting. Therefore, mortgage rates are a key indicator of future performance. Geography is also critically important, since rental regulations and barriers to new supply vary significantly by country, state, and city. Multi-family properties typically have short-term leases, with one year being most common, so rents adjust to market quickly in an unregulated environment, which is an attractive feature in inflationary times. Tenants often pay utilities, but landlords have responsibility for building maintenance, capital expenditures, insurance, and taxes. Economic factors that have the greatest effect on the industry include interest and mortgage rates, employment and wage growth, property availability and affordability, median rent versus median income, geography (high barrier to entry markets versus low barrier to entry markets), government-imposed rental regulations, new unit construction, the inventory of unsold homes, immigration, and household formations. Residential REITs have generated strong profit and dividend growth over the past decade due to strong demand for housing aided by low-cost mortgages. Important operational and financial metrics for investors to track include funds from operations (FFO) and adjusted funds from operations (AFFO). Investors can use a combination of approaches to value companies in the industry, including DCF, P/FFO, P/AFFO, and NAV.

Data source: Bloomberg, as of March 18, 2022.

Retail REITs

Data source: Bloomberg, as of March 18, 2022.

Retail REITs are somewhat more insulated than their retailer tenants due to intermediate- to long-term lease durations. Retail is relatively management intensive compared to other property types and the perception of management skill is often reflected in differing FFO/AFFO multiples. Properties owned by retail REITs vary significantly in size and tenancy, resulting in differing performance for categories within this segment. Nonessential retail describes regional shopping centers or malls with large department stores or big-box retailers as anchors and numerous smaller in-line stores (focused on fashion or discretionary spending) between those anchors. These are the retail REITs that can experience high share price volatility, as nonessential retail performance is heavily influenced by GDP growth. Neighborhood shopping centers tend to have smaller anchor tenants and in-line tenants with a reduced focus on high-end retailers. Stand-alone properties usually represent grocery stores, home improvement stores, pharmacies, or restaurants. Grocery-anchored retail centers outperform in a recession due to stability of cash flows and strong covenants. Key economic factors that affect the industry include consumer confidence and job growth. On a relative basis, retail REITs have been trading at below-average valuations but have also delivered below-average growth and profitability in recent years. Important metrics for investors to track include same-store sales growth for key tenants, funds from operations (FFO), and adjusted funds from operations (AFFO). Investors can use a combination of approaches to value companies in this industry, including DCF, P/FFO, P/AFFO, and NAV.

Real Estate Development

Data source: Bloomberg, as of March 18, 2022.

Companies within the real estate development industry construct buildings commissioned by a specific user or by multiple users. The latter is categorized as “build to sell” (also called a merchant builder) or “build to hold.” Condo developers are merchant builders, fixing their selling price early in the process and often receiving a significant portion of their revenues upfront and prior to completion. In an inflationary environment, condo developers bear risks associated with escalating construction costs (labor and materials) and delays (interest expense). In contrast, the construction of a large new office building may only be feasible once a large portion of the building is preleased, reflecting the massive, long-term capital required for development. Few developers have sufficient funds to self-finance construction, but even for those that do, equity returns are usually enhanced by the use of debt. Lenders usually regard preleasing as a condition for financing a new development, but in periods of high demand and limited new supply, buildings may be financed and constructed before preleasing. Development companies that need to retain earnings for new projects and cannot meet the REIT distribution thresholds choose to list as REOCs, discussed earlier. Economic factors affecting the industry include economic growth, employment growth, interest rates, construction costs (such as labor and materials), and business confidence. Balance sheet values and cash flows are highly variable given the lack of liquidity of the assets, which makes FFO and AFFO calculations of limited use. Land values, for example, are dependent on marketability, which improves once density increases are approved by the local municipality. Companies within the industry have high variability of cash flows and differences in the riskiness of strategy, product type, and geography, which makes earnings-multiple comparisons of little use. Therefore, investors should use DCF and NAV to assess valuations.

Real Estate Services

Data source: Bloomberg, as of March 18, 2022.

Companies within the real estate services industry provide sales and leasing brokerage, property management services, equity and mortgage brokerage, due diligence and appraisal work, and other consulting or advisory services related to real estate. The cash flow volatility of these companies varies depending on the portion of income that is generated from highly profitable but highly volatile fees and commissions from property sales, but all are susceptible to periods in which transaction volumes fall. Interestingly, when the property market experiences a downturn, a portion of the service company's revenues grow because lenders need third-party expertise to appraise, operate, and sell foreclosed real estate. Most property management agreements base their fee (which is a fixed percentage) on effective gross income, a revenue measure that reflects not just rental income (lease rates and occupancy) but other ancillary income (parking and laundry), vacancy, and credit losses. Therefore, service company valuations are sensitive to expectations about the general health of the real estate business and are dependent on economic growth to increase both occupancy and rental rates. Companies within the industry often compete on cost for service agreements since many landlords seek to minimize the cost of these services to entice new tenants from competitors. Property management fees are passed through to tenants for offices, retail, and warehouse properties. Third-party appraisals are required regularly, providing a highly predictable, though low-margin, earnings stream. The volume of ad hoc work, such as sales and leasing brokerage work and consulting, is the main driver of earnings and share price volatility. Important operational and financial metrics for investors to track include funds from operations (FFO) and adjusted funds from operations (AFFO). Investors can use a combination of approaches to value companies in this industry, including DCF, P/FFO, P/AFFO, and NAV.

Specialty REITs

Data source: Bloomberg, as of March 18, 2022.

Companies within the specialty REIT segment include those focused on hospitals, medical office buildings, life science laboratories, self-storage, student housing, cell towers, and data centers. The ability to invest in these growing, niche areas is one of the attractive features of REITs. One potential caution to investors is that the higher returns typically associated with specialty REITs reflect the fact that the physical assets are usually built for a specific use and have a higher cost of construction (in most cases). The limited number of tenants for a location (and their unique design needs) increases the risk of long periods of negative cash flow and even the probability that the property cannot easily be leased to a new tenant. While the chance of vacancy is low, the cost of vacancy can be significant. This low vacancy, especially when averaged over a larger portfolio of properties, contributes to the lower share price volatility and higher earning predictability that the sector is known for. Economic factors that have the greatest effect on the industry are diverse and specific to the underlying properties. Population growth can be particularly impactful since population growth is a primary driver of economic growth. For example, a growing city will need more hospitals, student housing, cell towers, and self-storage units. Specialty REITs target assets in markets experiencing high population growth that should translate into higher economic growth. Important metrics for investors to track include funds from operations (FFO) and adjusted funds from operations (AFFO). Investors can use a combination of approaches to value companies in this industry, including DCF, P/FFO, P/AFFO, and NAV.