Pipelines, Platforms, and the New Rules of Strategy

by Marshall W. Van Alstyne, Geoffrey G. Parker, and Sangeet Paul Choudary

BACK IN 2007 the five major mobile-phone manufacturers—Nokia, Samsung, Motorola, Sony Ericsson, and LG—collectively controlled 90% of the industry’s global profits. That year, Apple’s iPhone burst onto the scene and began gobbling up market share.

By 2015 the iPhone single-handedly generated 92% of global profits, while all but one of the former incumbents made no profit at all.

How can we explain the iPhone’s rapid domination of its industry? And how can we explain its competitors’ free fall? Nokia and the others had classic strategic advantages that should have protected them: strong product differentiation, trusted brands, leading operating systems, excellent logistics, protective regulation, huge R&D budgets, and massive scale. For the most part, those firms looked stable, profitable, and well entrenched.

Certainly the iPhone had an innovative design and novel capabilities. But in 2007, Apple was a weak, nonthreatening player surrounded by 800-pound gorillas. It had less than 4% of market share in desktop operating systems and none at all in mobile phones.

As we’ll explain, Apple (along with Google’s competing Android system) overran the incumbents by exploiting the power of platforms and leveraging the new rules of strategy they give rise to. Platform businesses bring together producers and consumers in high-value exchanges. Their chief assets are information and interactions, which together are also the source of the value they create and their competitive advantage.

Understanding this, Apple conceived the iPhone and its operating system as more than a product or a conduit for services. It imagined them as a way to connect participants in two-sided markets—app developers on one side and app users on the other—generating value for both groups. As the number of participants on each side grew, that value increased—a phenomenon called “network effects,” which is central to platform strategy. By January 2015 the company’s App Store offered 1.4 million apps and had cumulatively generated $25 billion for developers.

Apple’s success in building a platform business within a conventional product firm holds critical lessons for companies across industries. Firms that fail to create platforms and don’t learn the new rules of strategy will be unable to compete for long.

Pipeline to Platform

Platforms have existed for years. Malls link consumers and merchants; newspapers connect subscribers and advertisers. What’s changed in this century is that information technology has profoundly reduced the need to own physical infrastructure and assets. IT makes building and scaling up platforms vastly simpler and cheaper, allows nearly frictionless participation that strengthens network effects, and enhances the ability to capture, analyze, and exchange huge amounts of data that increase the platform’s value to all. You don’t need to look far to see examples of platform businesses, from Uber to Alibaba to Airbnb, whose spectacular growth abruptly upended their industries.

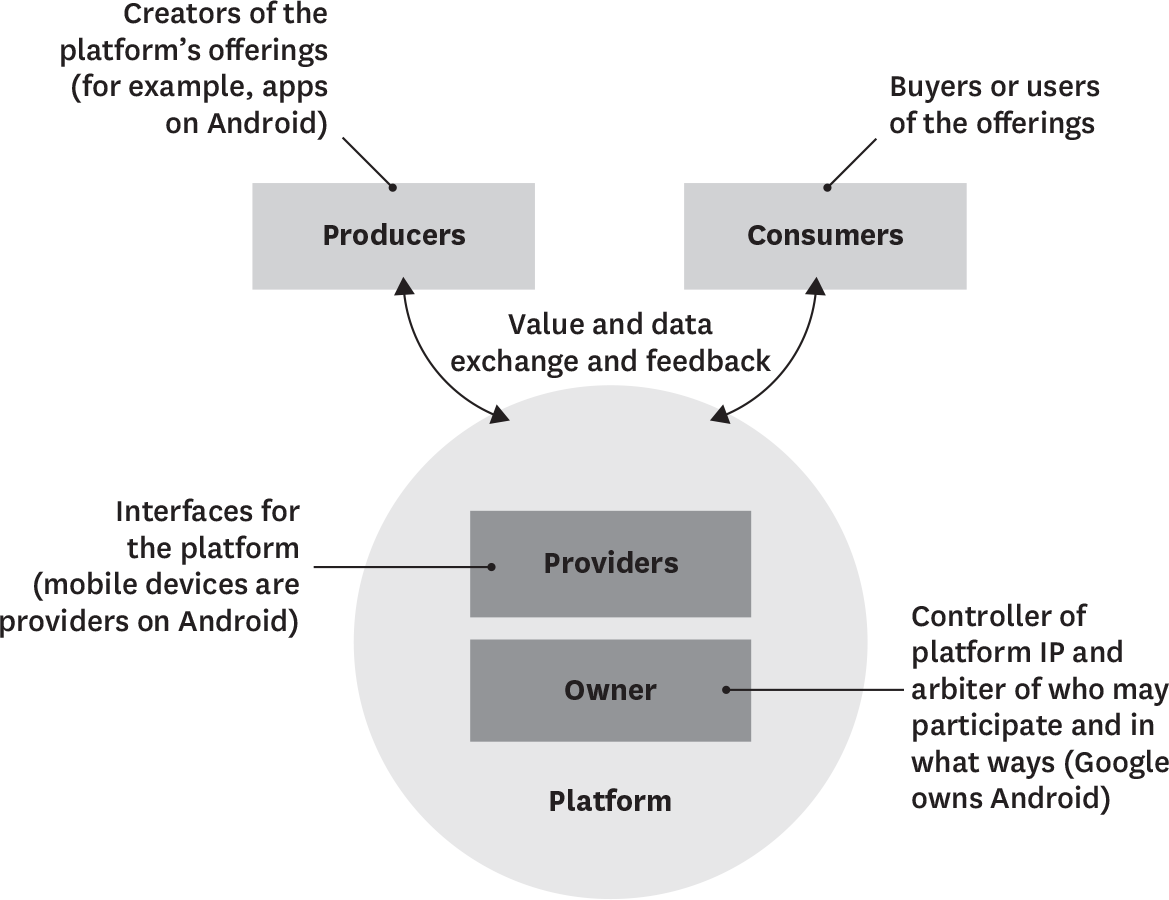

Though they come in many varieties, platforms all have an ecosystem with the same basic structure, comprising four types of players. The owners of platforms control their intellectual property and governance. Providers serve as the platforms’ interface with users. Producers create their offerings, and consumers use those offerings. (See the exhibit “The players in a platform ecosystem.”)

To understand how the rise of platforms is transforming competition, we need to examine how platforms differ from the conventional “pipeline” businesses that have dominated industry for decades. Pipeline businesses create value by controlling a linear series of activities—the classic value-chain model. Inputs at one end of the chain (say, materials from suppliers) undergo a series of steps that transform them into an output that’s worth more: the finished product. Apple’s handset business is essentially a pipeline. But combine it with the App Store, the marketplace that connects app developers and iPhone owners, and you’ve got a platform.

As Apple demonstrates, firms needn’t be only a pipeline or a platform; they can be both. While plenty of pure pipeline businesses are still highly competitive, when platforms enter the same marketplace, the platforms virtually always win. That’s why pipeline giants such as Walmart, Nike, John Deere, and GE are all scrambling to incorporate platforms into their models.

The players in a platform ecosystem

A platform provides the infrastructure and rules for a marketplace that brings together producers and consumers. The players in the ecosystem fill four main roles but may shift rapidly from one role to another. Understanding the relationships both within and outside the ecosystem is central to platform strategy.

The move from pipeline to platform involves three key shifts:

1. From resource control to resource orchestration. The resource-based view of competition holds that firms gain advantage by controlling scarce and valuable—ideally, inimitable—assets. In a pipeline world, those include tangible assets such as mines and real estate and intangible assets like intellectual property. With platforms, the assets that are hard to copy are the community and the resources its members own and contribute, be they rooms or cars or ideas and information. In other words, the network of producers and consumers is the chief asset.

2. From internal optimization to external interaction. Pipeline firms organize their internal labor and resources to create value by optimizing an entire chain of product activities, from materials sourcing to sales and service. Platforms create value by facilitating interactions between external producers and consumers. Because of this external orientation, they often shed even variable costs of production. The emphasis shifts from dictating processes to persuading participants, and ecosystem governance becomes an essential skill.

3. From a focus on customer value to a focus on ecosystem value. Pipelines seek to maximize the lifetime value of individual customers of products and services, who, in effect, sit at the end of a linear process. By contrast, platforms seek to maximize the total value of an expanding ecosystem in a circular, iterative, feedback-driven process. Sometimes that requires subsidizing one type of consumer in order to attract another type.

These three shifts make clear that competition is more complicated and dynamic in a platform world. The competitive forces described by Michael Porter (the threat of new entrants and substitute products or services, the bargaining power of customers and suppliers, and the intensity of competitive rivalry) still apply. But on platforms these forces behave differently, and new factors come into play. To manage them, executives must pay close attention to the interactions on the platform, participants’ access, and new performance metrics.

We’ll examine each of these in turn. But first let’s look more closely at network effects—the driving force behind every successful platform.

The Power of Network Effects

The engine of the industrial economy was, and remains, supply-side economies of scale. Massive fixed costs and low marginal costs mean that firms achieving higher sales volume than their competitors have a lower average cost of doing business. That allows them to reduce prices, which increases volume further, which permits more price cuts—a virtuous feedback loop that produces monopolies. Supply economics gave us Carnegie Steel, Edison Electric (which became GE), Rockefeller’s Standard Oil, and many other industrial era giants.

In supply-side economies, firms achieve market power by controlling resources, ruthlessly increasing efficiency, and fending off challenges from any of the five forces. The goal of strategy in this world is to build a moat around the business that protects it from competition and channels competition toward other firms.

The driving force behind the internet economy, conversely, is demand-side economies of scale, also known as network effects. These are enhanced by technologies that create efficiencies in social networking, demand aggregation, app development, and other phenomena that help networks expand. In the internet economy, firms that achieve higher “volume” than competitors (that is, attract more platform participants) offer a higher average value per transaction. That’s because the larger the network, the better the matches between supply and demand and the richer the data that can be used to find matches. Greater scale generates more value, which attracts more participants, which creates more value—another virtuous feedback loop that produces monopolies. Network effects gave us Alibaba, which accounts for over 75% of Chinese e-commerce transactions; Google, which accounts for 82% of mobile operating systems and 94% of mobile search; and Facebook, the world’s dominant social platform.

The five forces model doesn’t factor in network effects and the value they create. It regards external forces as “depletive,” or extracting value from a firm, and so argues for building barriers against them. In demand-side economies, however, external forces can be “accretive”—adding value to the platform business. Thus the power of suppliers and customers, which is threatening in a supply-side world, may be viewed as an asset on platforms. Understanding when external forces may either add or extract value in an ecosystem is central to platform strategy.

How Platforms Change Strategy

In pipeline businesses, the five forces are relatively defined and stable. If you’re a cement manufacturer or an airline, your customers and competitive set are fairly well understood, and the boundaries separating your suppliers, customers, and competitors are reasonably clear. In platform businesses, those boundaries can shift rapidly, as we’ll discuss.

Forces within the ecosystem

Platform participants—consumers, producers, and providers—typically create value for a business. But they may defect if they believe their needs can be met better elsewhere. More worrisome, they may turn on the platform and compete directly with it. Zynga began as a games producer on Facebook but then sought to migrate players onto its own platform. Amazon and Samsung, providers of devices for the Android platform, tried to create their own versions of the operating system and take consumers with them.

The new roles that players assume can be either accretive or depletive. For example, consumers and producers can swap roles in ways that generate value for the platform. Users can ride with Uber today and drive for it tomorrow; travelers can stay with Airbnb one night and serve as hosts for other customers the next. In contrast, providers on a platform may become depletive, especially if they decide to compete with the owner. Netflix, a provider on the platforms of telecommunication firms, has control of consumers’ interactions with the content it offers, so it can extract value from the platform owners while continuing to rely on their infrastructure.

As a consequence, platform firms must constantly encourage accretive activity within their ecosystems while monitoring participants’ activity that may prove depletive. This is a delicate governance challenge that we’ll discuss further.

Forces exerted by ecosystems

Managers of pipeline businesses can fail to anticipate platform competition from seemingly unrelated industries. Yet successful platform businesses tend to move aggressively into new terrain and into what were once considered separate industries with little warning. Google has moved from web search into mapping, mobile operating systems, home automation, driverless cars, and voice recognition. As a result of such shape-shifting, a platform can abruptly transform an incumbent’s set of competitors. Swatch knows how to compete with Timex on watches but now must also compete with Apple. Siemens knows how to compete with Honeywell in thermostats but now is being challenged by Google’s Nest.

Competitive threats tend to follow one of three patterns. First, they may come from an established platform with superior network effects that uses its relationships with customers to enter your industry. Products have features; platforms have communities, and those communities can be leveraged. Given Google’s relationship with consumers, the value its network provides them, and its interest in the internet of things, Siemens might have predicted the tech giant’s entry into the home-automation market (though not necessarily into thermostats). Second, a competitor may target an overlapping customer base with a distinctive new offering that leverages network effects. Airbnb’s and Uber’s challenges to the hotel and taxi industries fall into this category. The final pattern, in which platforms that collect the same type of data that your firm does suddenly go after your market, is still emerging. When a data set is valuable, but different parties control different chunks of it, competition between unlikely camps may ensue. This is happening in health care, where traditional providers, producers of wearables like Fitbit, and retail pharmacies like Walgreens are all launching platforms based on the health data they own. They can be expected to compete for control of a broader data set—and the consumer relationships that come with it.

Focus

Managers of pipeline businesses focus on growing sales. For them, goods and services delivered (and the revenues and profits from them) are the units of analysis. For platforms, the focus shifts to interactions—exchanges of value between producers and consumers on the platform. The unit of exchange (say, a view of a video or a thumbs-up on a post) can be so small that little or no money changes hands. Nevertheless, the number of interactions and the associated network effects are the ultimate source of competitive advantage.

With platforms, a critical strategic aim is strong up-front design that will attract the desired participants, enable the right interactions (so-called core interactions), and encourage ever-more-powerful network effects. In our experience, managers often fumble here by focusing too much on the wrong type of interaction. And the perhaps counterintuitive bottom line, given how much we stress the importance of network effects, is that it’s usually wise to ensure the value of interactions for participants before focusing on volume.

Most successful platforms launch with a single type of interaction that generates high value even if, at first, low volume. They then move into adjacent markets or adjacent types of interactions, increasing both value and volume. Facebook, for example, launched with a narrow focus (connecting Harvard students to other Harvard students) and then opened the platform to college students broadly and ultimately to everyone. LinkedIn launched as a professional networking site and later entered new markets with recruitment, publishing, and other offerings.

Access and governance

In a pipeline world, strategy revolves around erecting barriers. With platforms, while guarding against threats remains critical, the focus of strategy shifts to eliminating barriers to production and consumption in order to maximize value creation. To that end, platform executives must make smart choices about access (whom to let onto the platform) and governance (or “control”—what consumers, producers, providers, and even competitors are allowed to do there).

Platforms consist of rules and architecture. Their owners need to decide how open both should be. An open architecture allows players to access platform resources, such as app developer tools, and create new sources of value. Open governance allows players other than the owner to shape the rules of trade and reward sharing on the platform. Regardless of who sets the rules, a fair reward system is key. If managers open the architecture but do not share the rewards, potential platform participants (such as app developers) have the ability to engage but no incentives. If managers open the rules and rewards but keep the architecture relatively closed, potential participants have incentives to engage but not the ability.

These choices aren’t fixed. Platforms often launch with a fairly closed architecture and governance and then open up as they introduce new types of interactions and sources of value. But every platform must induce producers and consumers to interact and share their ideas and resources. Effective governance will inspire outsiders to bring valuable intellectual property to the platform, as Zynga did in bringing FarmVille to Facebook. That won’t happen if prospective partners fear exploitation.

Some platforms encourage producers to create high-value offerings on them by establishing a policy of “permissionless innovation.” They let producers invent things for the platform without approval but guarantee the producers will share in the value created. Rovio, for example, didn’t need permission to create the Angry Birds game on the Apple operating system and could be confident that Apple wouldn’t steal its IP. The result was a hit that generated enormous value for all participants on the platform. However, Google’s Android platform has allowed even more innovation to flourish by being more open at the provider layer. That decision is one reason Google’s market capitalization surpassed Apple’s in early 2016 (just as Microsoft’s did in the 1980s).

However, unfettered access can destroy value by creating “noise”—misbehavior or excess or low-quality content that inhibits interaction. One company that ran into this problem was Chatroulette, which paired random people from around the world for webchats. It grew exponentially until noise caused its abrupt collapse. Initially utterly open—it had no access rules at all—it soon encountered the “naked hairy man” problem, which is exactly what it sounds like. Clothed users abandoned the platform in droves. Chatroulette responded by reducing its openness with a variety of user filters.

Most successful platforms similarly manage openness to maximize positive network effects. Airbnb and Uber rate and insure hosts and drivers, Twitter and Facebook provide users with tools to prevent stalking, and Apple’s App Store and the Google Play store both filter out low-quality applications.

Metrics

Leaders of pipeline enterprises have long focused on a narrow set of metrics that capture the health of their businesses. For example, pipelines grow by optimizing processes and opening bottlenecks; one standard metric, inventory turnover, tracks the flow of goods and services through them. Push enough goods through and get margins high enough, and you’ll see a reasonable rate of return.

As pipelines launch platforms, however, the numbers to watch change. Monitoring and boosting the performance of core interactions becomes critical. Here are new metrics managers need to track:

Interaction failure. If a traveler opens the Lyft app and sees “no cars available,” the platform has failed to match an intent to consume with supply. Failures like these directly diminish network effects. Passengers who see this message too often will stop using Lyft, leading to higher driver downtimes, which can cause drivers to quit Lyft, resulting in even lower ride availability. Feedback loops can strengthen or weaken a platform.

Engagement. Healthy platforms track the participation of ecosystem members that enhances network effects—activities such as content sharing and repeat visits. Facebook, for example, watches the ratio of daily to monthly users to gauge the effectiveness of its efforts to increase engagement.

Match quality. Poor matches between the needs of users and producers weaken network effects. Google constantly monitors users’ clicking and reading to refine how its search results fill their requests.

Negative network effects. Badly managed platforms often suffer from other kinds of problems that create negative feedback loops and reduce value. For example, congestion caused by unconstrained network growth can discourage participation. So can misbehavior, as Chatroulette found. Managers must watch for negative network effects and use governance tools to stem them by, for example, withholding privileges or banishing troublemakers.

Finally, platforms must understand the financial value of their communities and their network effects. Consider that in 2016, private equity markets placed the value of Uber, a demand economy firm founded in 2009, above that of GM, a supply economy firm founded in 1908. Clearly Uber’s investors were looking beyond the traditional financials and metrics when calculating the firm’s worth and potential. This is a clear indication that the rules have changed.

![]()

Because platforms require new approaches to strategy, they also demand new leadership styles. The skills it takes to tightly control internal resources just don’t apply to the job of nurturing external ecosystems.

While pure platforms naturally launch with an external orientation, traditional pipeline firms must develop new core competencies—and a new mind-set—to design, govern, and nimbly expand platforms on top of their existing businesses. The inability to make this leap explains why some traditional business leaders with impressive track records falter in platforms. Media mogul Rupert Murdoch bought the social network Myspace and managed it the way he might have run a newspaper—from the top down, bureaucratically, and with a focus more on controlling the internal operation than on fostering the ecosystem and creating value for participants. In time the Myspace community dissipated and the platform withered.

The failure to transition to a new approach explains the precarious situation that traditional businesses—from hotels to health care providers to taxis—find themselves in. For pipeline firms, the writing is on the wall: Learn the new rules of strategy for a platform world, or begin planning your exit.

Originally published in April 2016. Reprint R1604C