Chapter 4

Playing a Bookkeeper’s Rhythm

In This Chapter

Meeting the deadlines for GST reporting

Keeping tabs on payroll obligations

Scheduling reports for management, tax and more

Pulling together a record-keeping system

Creating your bookkeeper’s calendar

Most books about bookkeeping focus purely on the technicalities of debits and credits, balancing bank accounts and creating financial reports. This stuff is good, but doesn’t address the core questions many novice bookkeepers ask: How do I organise my paperwork? What deadlines need to be met? How often should I do my books?

In my own business, while I get a real kick out of the results that bookkeeping yields (essential reports, sales figures and so on), I don’t relish all that data-entry, and I really, really hate filing. As a result, I do my own books with a ruthless efficiency, and with a personal motto never to handle a single piece of paper more than once.

So dear readers, this chapter is not about sharing the love. Nay, this chapter is about laying down a battle plan so that you organise your own bookkeeping to achieve maximum results with minimum fuss, meeting all of a bookkeeper’s regular deadlines along the way.

Reporting for GST

Reporting for GST tends to be a tyranny of existence for most bookkeepers. Everything else can fall behind, but the date for submitting GST activity statements or returns is set in stone. If you don’t make the date, then before you know it, a personalised love letter arrives from the powers that be, complete with a substantial fine.

So grab your calendar, figure out whether you live on the eastern or western side of the Tasman, and read on . . .

Scraping by in Oz

So how often do you have to report for GST? Depending on the size of your business and what choices you make when you register, you have to submit reports monthly, quarterly or annually (for more about this choice, skip ahead to Chapter 7). Most businesses choose to report quarterly. However, calculating your true ‘deadline’ can be a tricky business.

If you pay monthly, your deadline is 21 days after the end of each month.

If you pay quarterly, your deadline is 28 days after the end of each quarter, except for the second quarter of the year (October to December) when you get an extra four weeks.

If you lodge activity statements electronically using the Tax Office portal, you automatically get a two-week extension on the due date.

If you get your accountant to lodge activity statements electronically, you get a handsome four-week extension.

Even if you’re strapped for cash, lodge your activity statement anyway. (The Tax Office only issues fines for lodging forms late, it doesn’t issue fines for paying late. The only punishment administered is an interest charge for late payments.) For most businesses, so long as you pay within a couple of weeks of lodging the form, the Tax Office won’t so much as blink an eye. If you can’t pay within a couple of weeks, contact the Tax Office and request a payment extension.

Muddling through in Middle Earth

Whoops, I mean New Zealand (must cut back on watching those Lord of the Rings movies). So, how often do you have to report for GST in New Zealand? Depending on the size of your business and what choices you make when you register, you have to submit reports and pay monthly, bi-monthly (which is the standard period) or six-monthly (for more about this choice, skip ahead to Chapter 7). Most businesses report bi-monthly. You have to submit your GST return (by mail or electronically) and make payments to the Inland Revenue Department (IRD) by the 28th of the month following the period that you’re reporting for.

Lynley (who writes the NZ content for this title) once spotted a man racing up the steps to the Auckland city branch of the IRD, bashing on the glass doors desperate to hand in his GST return and payment. It was the 28th day of the month but unfortunately for him, it was 4 pm and the IRD was already closed for business.

You do get a couple of exceptions to the 28-day rule:

Where the GST payment and return would normally be due on 28 December, the due date is actually 15 January to allow for the silly season.

Where the GST return and payment would normally be due on 28 April, the due date is actually 7 May to allow for the Easter break.

If the due date falls on a weekend, public holiday or regional anniversary day, then you can pay and file the GST return on the next business day.

If the IRD doesn’t receive both your GST return and GST payment by the due date, you may get stung with both penalties and interest. If you’re strapped for cash then ring up, quick smart. You may be able to get out of the late penalty fee, especially if this is the first time you’ve transgressed (although interest always gets charged for late payments, however pitiful and eloquent your plea).

Managing cashflow, wherever you are

Even though the fun and games of sending in activity statements or GST returns occurs only every couple of months, you may prefer to put money aside on a much more regular basis. This way, you can be confident that you have enough cash by the time the deadlines strikes.

So, if you’re on the hunt for a stress-free existence, follow these steps.

1. Keep accounts up to date.

Dull, I know. But unless you’re up to date recording sales and expenses, how else can you figure out where you stand with GST?

2. Print a GST report at the end of each month.

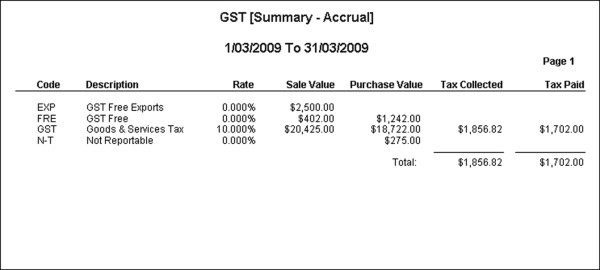

Notice how the report in Figure 4-1 summarises both GST collected and paid? I used MYOB software to produce this report, but you can get the same information using any accounting software.

3. Subtract the amount of GST you pay from the amount of GST you collect.

The difference between these two figures is the amount of GST you owe.

4. Calculate how much tax you withheld from employee wages for the month.

Look up how much tax you deducted from employee wages — if any.

5. Look up previous activity statements or GST returns to see whether you’re up for any additional taxes this month.

For example, in Australia, you may have to pay PAYG instalment tax or fringe benefits tax in addition to GST and PAYG withholding tax.

6. Total the amounts that you calculated in Steps 3–5 above.

7. Transfer the total amount from Step 6 into a savings account.

8. Sleep well . . . no nasty surprises waiting around the corner.

With the exception of those four, big green bogeymen, of course.

Figure 4-1: Print reports regularly to find out how much GST you owe.

Staying on Top of Payroll

With employees, the regular payroll run becomes a bookkeeping deadline that you live with from week to week, or from one fortnight to the next. However, your bookkeeping schedule needs to include more than just processing employee pay. You also need to cater to a coterie of government requirements, lodging various bits of paperwork almost as often as you change your undies.

Meeting payroll deadlines (Australia)

Grab your diary and note the following:

Every payday: Every payday, your job is to calculate employee wages, PAYG withholding tax, superannuation and employee deductions (for more on these topics, skip to Chapter 10). You’re also legally obliged to provide every employee with a pay advice, detailing info such as hours worked, hourly rates, tax deducted and so on.

Every time you hire a new employee: Get employees to complete a Tax file number declaration and send this form to the Tax Office within 14 days. Also, depending on what award or agreement your employees fall under, you may need to provide employees with a Superannuation Choice Form within 28 days (this form enables employees to choose their own super fund).

Every month (or quarter): If you report for PAYG withholding tax every month, you get to have fun submitting an activity statement within 21 days of the end of each month. If you report for PAYG withholding tax every quarter (lumped together with GST), then you include PAYG as part of your quarterly BAS payment, due 28 days after the end of each quarter.

Every month (or quarter): Depending on the fund your employees belong to, the minimum superannuation guarantee charge of 9 per cent is due either 28 days after the end of each month or 28 days after the end of each quarter.

Every July: Payment summaries (a summary issued to each employee of wages earned and tax deducted) are due by 14 July each year. (For more details, see Chapter 12.)

Every August: Your Annual withholding declaration (a form summarising total wages and tax for each employee) is due by 14 August each year. (For more details, see Chapter 12.)

Every 12 months: You renew your workers compensation policy annually (and, depending where you are in Australia, this renewal date may or may not coincide with the end of your financial year). As part of the renewal policy, you complete both a declaration of actual wages for the previous 12 months along with an estimate of future wages for the next 12 months.

Meeting payroll deadlines (New Zealand)

Grab your diary and note the following:

Every payday: Every payday, your job is to calculate employee wages, PAYE tax, student loan repayments, KiwiSaver (employee and employer contributions) and any other employee deductions (for more on these topics, skip to Chapter 10). You don’t have to provide every employee with a pay advice, but if you’re using payroll software, then why not?

Every time you hire a new employee: Get employees to complete a Tax code declaration form (IR330) before you calculate their first pay. This form includes the employee’s IRD number and tax code, and unless you get a completed copy back from the employee, you must deduct PAYE tax from their wages at a monster rate of 47.6 per cent. (There’s no need to send this form to the IRD but you must keep a file copy.) Within seven days, you must also start the automatic enrolment process for joining KiwiSaver and give new employees a KiwiSaver employee information pack (KS3). This pack includes a KiwiSaver deduction form (KS2) which employees can use to let you know whether they want 2 per cent, or more, of their pay deducted.

Every month: Keep things sweet and either mail or lodge the Employer monthly schedule (IR348) and Employer deductions form (IR345), along with your payment, by the 20th day after the end of each month.

Every April: Print Earnings Certificates for each of your employees. These certificates aren’t an IRD requirement but are useful for employees who file a personal tax return (for more details, see Chapter 12).

Generating Reports

You get two different kinds of reports for a business: management reports and financial statements. Management reports provide vital info for the day-to-day running of your business, such as sales reports, commission reports, customer receivables reports, interim Profit & Loss reports and so on. Financial statements are the formal end-of-year accounts that your accountant generates as part of doing your tax, and usually include a Profit & Loss report and a Balance Sheet as a minimum.

As a bookkeeper, you earn extra brownie points if you can figure out what reports are going to prove most useful to the business, and provide these reports on a regular basis. Here’s a starting point if you’re not sure what to print when:

Balance Sheet report: The Balance Sheet goes hand-in-hand with your Profit & Loss report. Every time you print a Profit & Loss, print a Balance Sheet as well.

Bank reconciliation reports: Print a bank reconciliation report every time you reconcile your bank account and pop this in the folder where you file bank statements.

Budget reports: If you set budgets for the year, then print a report that compares actuals against budgets every month.

GST reports: Although you may only lodge GST reports every couple of months, it pays to print up a GST report at the end of each fortnight so that you know how much to salt away in your savings account. (See ‘Managing cashflow, wherever you are’ earlier in this chapter for more details.)

Payables reports: I tend to print up this report every time I do a payment run for suppliers. (Smaller businesses may not need this report however.)

Profit & Loss report: Sure, you only need this report once a year for tax purposes, but I suggest you print this report once a month.

Receivables reports: I talk more about chasing money in Chapters 9 and 20, but the key thing to remember is to stay on top of who owes you what. Print an Aged Receivables report every time you chase money.

Sales analysis reports: If you purchase items for resale (maybe you’re a retailer, wholesaler or manufacturer), then sales analysis reports are the lifeblood of your business. Depending on the size of your business, you’ll want to print these reports weekly, fortnightly or monthly.

Most accounting software has features where you can set up report batches for your favourite reports, and schedule to produce these batches weekly or monthly. After you figure out what reports you need, see whether you can organise these reports into automatic batches.

Devising a Record-keeping System

Organising business paperwork into some kind of order is a crucial part of a bookkeeper’s job. Hey, you may think to yourself, don’t I just whack stuff in a folder in date order and forget about it? Well, you could, but chances are you would waste heaps of time in the coming months looking for things. You’re best to devise a system that keeps records as accessible as possible.

Filing that needle in the haystack

What goes where? Here are some ideas:

Cash receipts: Ah, petty cash. How you organise receipts depends on what method you use. A fair slab of Chapter 8 is devoted to this topic.

Copies of customer invoices: If you use accounting software, you don’t need to keep a printed copy of customer invoices, because you already have a copy in your accounting file. (My own proviso is you must ensure you have a rock solid backup system in place.) If you generate customer invoices using any other system (such as a word processor or docket book), then make sure to keep a copy of each invoice, filed in invoice number order.

Credit card or EFTPOS receipts: If you receive a receipt for something paid by credit card (a tank of fuel for example), then you need to keep this receipt for tax purposes, as a credit card statement by itself isn’t enough of a record to satisfy a tax audit. However, you don’t really need to refer to this receipt again for bookkeeping purposes (most bookkeepers prefer to record credit card transactions by working through the credit card statement, rather than sorting through a pile of dockets). I tend to stuff credit card and EFTPOS receipts in my wallet, then tip them out once a month and stuff them into an envelope labelled ‘Credit card and EFTPOS receipts’. However, if you’re doing the books for a business where a lot of employees have corporate credit card accounts, ask each employee to supply you with receipts and then staple these receipts onto the back of each credit card statement.

Electronic payments: If you pay accounts electronically, then check whether your Internet banking provides a history of past payments that goes back at least 12 months. If not, I suggest you keep a copy of the payment confirmation messages. Probably the simplest approach is to print the confirmation message and file in date order in a ring binder. (Alternatively, if you’re a tech-head like me, you can copy and paste the confirmation message into an email message, email it to yourself, and then file this email in an Outlook folder called Electronic Payments.)

Paid supplier bills: I prefer to file supplier bills alphabetically by name, and within each name, in date order. With my own business, I have two lever arch folders with coloured dividers for each letter of the alphabet. The bills for each supplier are grouped together, with the most recent bill at the top. At the end of each financial year I move the bills into an archive box, and start afresh with a new folder.

Unpaid supplier bills: The simplest system is to pop unpaid supplier bills in manila folders awaiting payment, with one folder for weekly accounts, and another for monthly accounts. After you pay a bill, transfer it to the ‘Paid’ folder.

With my business, I organise all my utility bills (gas, electricity, phone and so on) so that I receive the bill by email, and when the bill falls due, my business account is debited automatically. When I receive a utility bill, I quickly check the total and then archive this email in a special Outlook folder called Tax Invoices. I don’t worry about printing the bill — in the event of an audit, I still have an electronic copy. I simply make sure that I back up my Outlook data every week (something that’s a good idea in any case).

Deciding what to keep and how long for

In Australia, you need to keep your business records for a full five years after your return is lodged. However, the legal statute of limitations says that you can be sued for a transaction up to seven years afterwards, so for most transactions, seven years is actually a safer bet than five. As well as this, any records relating to capital gains tax may need to be kept for even longer because you may need to substantiate the purchase price of assets purchased years, or even decades, earlier.

In New Zealand, you need to keep all your business records for at least seven years from the end of the tax year to which they belong.

If you use accounting software, remember to archive your company file at the end of each financial year onto a CD or removable hard drive. Store these archives away from the office and, if you use a password to get into your accounting file, write this password down, maybe even on the CD itself. (Years ago, I remember assisting with an audit where the client needed to show wage records for the past five years. She had all her backup CDs close to hand, but guess what? She’d forgotten what her password used to be. What a nightmare.)

Developing a Bookkeeping Calendar

I suggest that you create your very own bookkeeping calendar, scheduling all the deadlines you need to meet throughout the year. Because these deadlines vary so much between the two countries, I start first with Australia (hence the reference to golden soil) and move next to peace-loving New Zealand.

With golden soil and wealth for toil

I like the fact that even the Australian Taxation Office recognises that everything grinds to a halt for weeks on end over summer, and provides extensions to summer deadlines. By the way, you may find that not all the deadlines listed below apply to your business. For example, many smaller businesses don’t incur fringe benefits tax, and a business with no employees doesn’t have to worry about PAYG withholding tax, payment summaries or payroll.

The Tax Office provides a neat way to create a personalised tax calendar for your business. Visit www.ato.gov.au and search on the term ‘tax calendar’ to arrive at a page where you can download a nifty little utility that schedules every tax that applies to you, incorporating tax payment plans and any extensions of time that you’ve been given. You can see an example of this calendar in Figure 4-2.

Figure 4-2: Use Tax Office software to create a personalised calendar of tax deadlines.

Fringe benefits tax (FBT): Usually your accountant is responsible for lodging the FBT annual return (due 21 May each year). However, you need to ensure that books are up to date as far as 31 March (the FBT year runs from 1 April to 31 March) so that you can give your accountant the information that they require.

GST: If you lodge activity statements quarterly, the due dates are 28 October, 28 February, 28 April and 28 July. The February extension is due to the summer holiday silly season. If you lodge activity statements monthly, the due dates are 21 days after the end of each month, with no merciful extension of time given in summer.

Income tax: If you lodge your tax return yourself, the deadline is 31 October each year. If you use an accountant to lodge your return, you usually receive an extension, which can be up to May the following year.

PAYG instalment tax: Companies and individuals often have to pay PAYG instalment tax (income tax instalments paid in advance) either monthly or quarterly. If monthly, payment is due 21 days after the end of each month; if quarterly, payment is due 28 days after the end of the quarter, as part of your regular Business activity statement.

PAYG withholding tax: Employers have to pay PAYG withholding tax (tax deducted from employee wages) either monthly or quarterly. If monthly, payment is due 21 days after the end of each month; if quarterly, payment is due 28 days after the end of the quarter, as part of your regular Business activity statement.

Payment summaries: Payment summaries are due to be given to employees by 14 July every year. Your Annual withholding declaration is due by 14 August every year.

Superannuation: Unless the super fund stipulates that you need to pay monthly, super is due 28 days after the end of each quarter (in other words 28 July, 28 October, 28 January and 28 April).

Tax file number declarations: These declarations must be forwarded to the Tax Office within 14 days of you receiving them.

Where a due date falls on a day that isn’t a business day (that is, the due date is a Saturday, a Sunday or a public holiday), then you’re okay to lodge stuff on the first business day after the due date.

Peace, not war, shall be our boast

New Zealand may be a green and verdant land with a sense of time standing still, but the bureaucracy still churns out a set of chilling deadlines, many of which I list below. Of course, you may find that not all these deadlines apply to your business. For example, most smaller businesses don’t incur fringe benefits tax, and a business with no employees doesn’t have to worry about PAYE tax or KiwiSaver superannuation.

The IRD provides a neat way to create a personalised tax calendar for your business. Visit www.ird.govt.nz and search on the term ‘calculator due dates’. Answer a few simple questions and you end up with a simple list of due dates scheduled just for you.

Fringe benefits tax (FBT): The FBT return is due and paid quarterly. Deadline dates are 20 January, 31 May, 20 July and 20 October for the previous quarter.

GST: If you lodge GST bi-monthly, the due dates are 15 January for the period ending November, 28 February for the period ending January, 7 May for the period ending March, 28 June for the period ending May, 28 August for the period ending July and 28 October for the period ending September. If you lodge GST six-monthly, then returns and payment are due by 31 October for the April to September period, and 30 April for the November to March period.

Income tax: Assuming you have a standard balance date of 31 March (balance date means the last day of your financial year, which is 31 March for 99.9 per cent of NZ businesses), your deadlines are as follows: If you lodge your tax return yourself, the deadline is 7 July every year. If you use an accountant or tax agent to lodge your return, the deadline is usually any time between July and March. If you pay GST bi-monthly, provisional tax is due 28 August, 15 January and 7 May. If you pay GST six-monthly, then you have just two payment dates, 28 October and 7 May.

KiwiSaver: You must pay both employee and employer contributions at the same time as PAYE tax and student loan repayments. The only form you need to submit is the IR345 (Employer deductions form) and the incredibly scintillating IR348 (Employer monthly schedule). Also, don’t forget to submit any KS1 forms (KiwiSaver employee details) or KS10 forms (New employee opt-out request) that may have come your way that month. If you use payroll software and file electronically, then all the paperwork happens automatically.

PAYE tax: If you pay PAYE tax monthly, then your due date for both paying tax and lodging the IR348 (Employer monthly schedule) is the 20th day after the end of each month. (This deadline only changes if you’re a large employer that deducts more than half a million dollars PAYE tax every year, when you must pay twice monthly by the 5th and 20th of each month.)