6

A ROAD MAP TO ENHANCED

ANALYTICAL CAPABILITIES

Progressing Through the Five Stages

of Development

BY THIS POINT, DEVELOPING an analytical capability may seem straightforward. Indeed, some organizations such as Marriott and Procter & Gamble have been using intensive data analysis for decades. Others, such as Google, Amazon.com, Netflix, and Capital One, were founded with the idea of using analytics as the basis of competition. These firms, with their history of close attention to data, sponsorship from senior management, and enterprise use of analytics, have attained the highest stage of analytical capability.

The overwhelming majority of organizations, however, have neither a finely honed analytical capability nor a detailed plan to develop one. For companies that want to become analytical competitors, a quick and painless journey cannot be promised. There are many moving pieces to put in place, including software applications, technology, data, processes, metrics, incentives, skills, culture, and sponsorship. One executive we interviewed compared the complexity of managing the development of analytical capabilities to playing a fifteen-level chess game.

Once the pieces fall into place, it still takes time for an organization to get the large-scale results it needs to become an analytical competitor. Changing business processes and employee behaviors is always the most difficult and time-consuming part of any major organizational change. And by its nature, developing an analytical capability is an iterative process, as managers gain better insights into the dynamics of their business over time by working with data and refining analytical models. Our research and experience suggests that it takes eighteen to thirty-six months of regularly working with data to start developing a steady stream of rich insights that can be translated into practice. Many organizations, lacking the will or faced with other pressing priorities, will take much longer than that.

Even highly analytical companies have lots of work left to do to improve their analytical capabilities. For example, Sprint, which used analytics to realize more than $1 billion of value and $500 million in incremental revenue over five years, believes that it has just scratched the surface of what it can accomplish with its analytical capability. And managers at a bank that has been an analytical competitor for years reported that different units are slipping back into silos of disaggregated customer data. Analytical competitors cannot rest on their laurels.

Nevertheless, the benefits of becoming an analytical competitor far outweigh the costs. In this chapter, we will introduce a road map that describes how organizations become analytical competitors and the benefits associated with each stage of the development process.

Overview of the Road Map

The road map describes typical behaviors, capabilities, and challenges at each stage of development. It provides guidance on investments and actions that are necessary to build an organization’s analytical capabilities and move to higher stages of analytical competition.

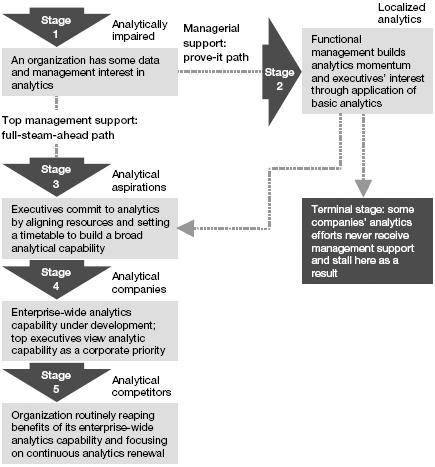

Figure 6-1 provides an overview of the road map to analytical competition and the exit criteria for each stage.

Stage 1: Prerequisites to Analytical Competition

At stage 1, organizations lack the prerequisites for analytics. These companies need first to improve their transaction data environment in order to have consistent, quality data for decision making. If a company has poor-quality data, it should postpone plans for analytical competition and fix its data first. Dow Chemical’s path is instructive. It began installing one of the first SAP systems in the United States in the late 1980s but did not begin serious initiatives to use data analytically until enough transaction data had been accumulated.

Road map to becoming an analytical competitor

Even if an organization has some quality data available, it must also have executives who are predisposed to fact-based decision making. A “data-allergic” management team that prides itself on making gut-based decisions is unlikely to be supportive. Any analytical initiatives in such an organization will be tactical and limited in impact.

Once a company has surmounted these obstacles, it is ready to advance to a critical juncture in the road map.

Assessing Analytical Capabilities

Once an organization has some useful data and management support in place, the next task is to take stock and candidly assess whether it has the strategic insight, sponsorship, culture, skills, data, and IT needed for analytical competition.

Barbara Desoer, Bank of America’s global technology, service, and fulfillment executive, offers sage advice to anyone getting started: “Begin with an assessment—how differentiated is your offering versus what you and your customers want it to be? If it needs to be more, then you’ve got to find ways to create more value that comes from the knowledge you have. You have to come to that realization first; otherwise, don’t bother with building data warehouses and CRM systems. You have to have that vision of what value looks like if you are going to figure out how to unleash that vision.”1

While each stage of the road map reflects the ability of an enterprise to compete on analytics, different parts of the organization may be in very different stages of development. For example, actuarial work requires an appreciation of statistical methods that may not exist to the same extent in other parts of an insurance company. Or a pharmaceutical firm’s marketing analytics in the United States may be far more sophisticated than they are in other countries or regions simply because the U.S. operation has greater access to data and an analytically minded manager in charge.

Just as some business units or processes may be more or less advanced than others in the enterprise, some aspects of the business are likely to be more analytically astute than others. For example, an organization may have a tightly integrated, highly standardized, and flexible IT environment but little demand for analytics, or, conversely, the demand for analytics far outstrips the capabilities of the IT organization. There may be many user departments and even individuals with their own analytical applications and data sources but little central coordination or synergy.

Organizations need to assess their level of analytical capability in three areas. (Table 6-1 provides an overview of the key attributes, each of which is equally vital to successful analytical competition.) One cautionary note: executives are often tempted to just obtain the data and analytical software they need, thinking that analytics are synonymous with technology. But unless executives consciously address the other elements, they will find it difficult to progress to later stages.

TABLE 6-1

The key elements in an analytical capability

| Capabilities | Key elements |

| Organization | • Insight into performance drivers |

| • Choosing a distinctive capability | |

| • Performance management and strategy execution | |

| • Process redesign and integration | |

| Human | • Leadership and senior executive commitment |

| • Establishing a fact-based culture | |

| • Securing and building skills | |

| • Managing analytical people | |

| Technology | • Quality data |

| • Analytic technologies |

We’ll address the organizational issues in this chapter and go into greater detail on the human factors in chapter 7 and the technical ones in chapter 8.

A company needs a clear strategy in order to know which data to focus on, how to allocate analytical resources, and what it is trying to accomplish. For example, the business strategy at Harrah’s Entertainment dictated the company’s analytical strategy as well. When the explosion of newly legalized gaming jurisdictions in the mid-1990s ground to a halt, Harrah’s managers realized that growth could no longer come from the construction of new casinos. They knew that growth would need to come from existing casinos and from an increase of customer visits across Harrah’s multiple properties. To achieve this goal, the company set a new strategic focus to drive growth through customer loyalty and data-driven marketing operations. This strategic focus enables Harrah’s to concentrate its investments on the activities and processes that have the greatest impact on financial performance—its distinctive capability. Implementing this strategy required the company to expand and exploit the data it had amassed on the gaming behaviors and resort preferences of existing customers. (See the box “Choosing a Strategic Focus” for examples of where companies chose to focus their initial analytical investments.)

Choosing a Strategic Focus

Organizations initially focus on one or two areas for analytical competition:

- Harrah’s: Loyalty plus service

- New England Patriots: Player selection plus fan experience

- Dreyfus Corporation: Equity analysis plus asset attrition

- UPS: Operations plus customer data

- Wal-Mart: Supply chain plus marketing

- Owens & Minor: Internal logistics plus customer cost reduction

- Progressive: Pricing plus new analytical service offerings

To have a significant impact on business performance, analytical competitors must continually strive to quantify and improve their insights into their performance drivers—the causal factors that drive costs, profitability, growth, and shareholder value in their industry (only the most advanced organizations have attempted to develop an enterprise-wide model of value creation). In practice, most organizations build their understanding gradually over time in a few key areas, learning from each new analysis and experiment.

To decide where to focus their resources for the greatest strategic impact, managers should answer the following questions:

- How can we distinguish ourselves in the marketplace?

- What is our distinctive capability?

- What key decisions in those processes, and elsewhere, need support from analytical insights?

- What information really matters to the business?

- What are the information and knowledge leverage points of the firm’s performance?

As organizations develop greater insights, they can incorporate them into analytical models and adapt business processes to leverage them and increase competitive differentiation. These strategically focused insights, processes, and capabilities form the basis of the organization’s distinctive capability.

Analytical competitors design effective decision making into their processes to ensure that analytical insights get translated into action and ultimately enhance business performance. They incorporate a way of thinking, putting plans into place, monitoring and correcting those plans, and learning from the results to help shape future actions.2 For example, U.K. police analysts learned that they could predict from early behaviors which juveniles were likely to become adult criminals. The analysis concluded that if the U.K. police could proactively intervene when kids began to pursue the criminal path, and prevent them from going in that direction, they could dramatically reduce the number of crimes ultimately committed.3 However, in order for this insight to have any impact on crime rates requires more than awareness; it requires a close collaboration between police, educators, and human services workers to establish programs and practices aimed at eliminating the root causes of crime.

Finally, to ensure that strategy is converted into operational results, organizations must define and monitor metrics that are tied to strategic enterprise objectives, and align individual incentives and metrics with business objectives. (Table 6-2 summarizes the typical situation at each stage of development for each of the three major capability areas.)

Choosing a Path

After an organization has realistically appraised its analytical capabilities, it must next choose which path to pursue. Organizations blessed with top management commitment and passion for analytics can move quickly through the “full steam ahead” path, while the rest are forced to take the slower “prove it” detour.

Full Steam Ahead

A committed, passionate CEO can put the organization on the fast track to analytical competition. To date, firms pursuing this path have usually been start-ups (Google, Yahoo!, Amazon.com, Capital One) whose strategy from the beginning has been to compete on analytics, although occasionally a new CEO at an established firm (such as Gary Loveman of Harrah’s or the new general managers at the Oakland A’s and Boston Red Sox in baseball) has led a major organizational transformation with analytics.

TABLE 6-2

Maturity of analytical capability by stage

| STAGE | ORGANIZATION | HUMAN | TECHNOLOGY | |||

| Analytical objective | Analytical process | Skills | Sponsorship | Culture | ||

| 1 Analytically impaired |

Limited insight into customers, markets, competitors | Doesn’t exist | None | None | Knowledge allergic—pride on gutbased decisions | Missing/poorquality data, multiple defines. Unintegrated systems |

| 2 Localized analytics |

Autonomous activity builds experience and confidence using analytics; creates new analytically based insights | Disconnected, very narrow focus | Pockets of isolated analysts (may be in finance, SCM, or marketing/CRM) | Functional and tactical | Desire for more objective data, successes from point use of analytics start to get attention | Recent transaction data unintegrated, missing important information. Isolated BI/analytic efforts |

| 3 Analytical aspirations |

Coordinated; establish enterprise performance metrics, build analytically based insights | Mostly separate analytic processes. Building enterpriselevel plan | Analysts in multiple areas of business but with limited interaction | Executive—early stages of awareness of competitive possibilities | Executive support for fact-based culture—may meet considerable resistance | Proliferation of BI tools. Data marts/data warehouse established/expands |

| 4 Analytical companies |

Change program to develop integrated analytical processes and applications and build analytical capabilities | Some embedded analytics processes | Skills exist, but often not aligned to right level/right role | Broad C-suite support | Change management to build a fact-based culture | High-quality data. Have an enterprise BI plan/strategy, IT processes, and governance principles in place |

| 5 Analytical competitors |

Deep strategic insights, continuous renewal and improvement | Fully embedded and much more highly integrated | Highly skilled, leveraged, mobilized, centralized, outsourced grunt work | CEO passion. Broad-based management commitment | Broadly supported fact-based culture, testing and learning culture | Enterprise-wide BI/BA architecture largely implemented |

For a start-up, the primary challenge on this path is acquiring and deploying the human and financial resources needed to build its analytical capabilities. Established companies face a more complex set of challenges because they already have people, data, processes, technology, and a culture. The existence of these resources is a double-edged sword—they can either provide a head start on building an analytical capability or be a source of resistance to using new methods. If organizational resistance is too great, it may be necessary to take a slower path to build support by demonstrating the benefits of analytics.

The organization going full steam ahead is easily recognized, because the CEO (or other top executive) regularly articulates the burning platform for competing on analytics. He or she consistently invests and takes actions designed to build the organization’s strategic analytical capability. At such firms the top priority is integrating analytics into the organization’s distinctive capability, with an eye to building competitive differentiation. Success is characterized in enterprise-wide terms; company metrics emphasize corporate performance, such as top-line growth and profitability, rather than departmental goals or ROI.

An executive sponsor planning to follow this path must get the rest of the organization on board. The first step is to set a good example. Executives send a powerful message to the entire organization when they make decisions based on facts, not opinions. They must also demand that subordinates support their recommendations with analytically based insights. Second, they must articulate a clear and urgent need for change. It’s always easier, of course, to move an organization in an entirely new direction when it is facing a dramatic crisis. Executives at highly successful companies confide that it is difficult to persuade (or compel) employees to become more analytical when no clear need to change is present.

Third, the CEO must also be able to commit the necessary resources. Seriously ailing companies (though they have a clear mandate to do things differently in order to survive) may lack the resources needed for analytical competition. In such cases, pursuing an analytical strategy is like proposing “wellness sessions” to a patient undergoing cardiac arrest. Those organizations will have to revive themselves before pursuing the full-steam-ahead path to analytical competition.

An organization that makes competing on analytics its top priority can expect to make substantial strides in a year or two. While we are convinced that the full-steam-ahead path is ultimately faster, cheaper, and the way to the greatest benefits, we have found relatively few companies prepared to go down this road. If top management lacks the passion and commitment to pursue analytical competition with full force, it is necessary to prove the value of analytics through a series of smaller, localized projects.

Stage 2: Prove-It Detour

To those already convinced of the benefits of analytical competition, having to avoid the fast track feels like an unnecessary detour. Indeed, this path is much slower and circuitous, and there is a real risk that an organization can remain stalled indefinitely. We estimate that having to “prove it” will add one to three years to the time needed to become an analytical competitor. But executives unwilling to make the leap should take a test-and-learn approach—trying out analytics in a series of small steps.

For organizations taking the detour, analytical sponsors can come from anywhere in the organization. For example, at one consumer packaged goods manufacturer, a new marketing vice president was shocked to discover that the analytical capabilities he took for granted at his former employer did not exist at his new company. Rather than try to garner support for a major enterprise-wide program, he logically chose to start small in his own department, by adopting an analytically based model for planning retail trade promotions. In situations like this, initial applications should often be fairly tactical, small in scale, and limited in scope.

Despite its drawbacks, there are also important advantages to taking the slower path. Any true analytical competitor wants to have a series of experiments and evidence documenting the value of the approach, and the prove-it path helps the organization accumulate that empirical evidence. As managers get more experience using smaller, localized applications, they can gain valuable insights that can be translated into business benefits. Each incremental business insight builds momentum within the organization in favor of moving to higher stages of analytical competitiveness.

There are practical reasons for taking the prove-it road as well. By starting small, functional managers can take advantage of analytics to improve the efficiency and effectiveness of their own departments without having to get buy-in from others. This approach also requires a lower level of initial investment, since stand-alone analytical tools and data for a single business function cost less than any enterprise-wide program.

In stage 2, it is best to keep things simple and narrow in scope. The steps essentially boil down to:

- Finding a sponsor and a business problem that can benefit from analytics

- Implementing a small, localized project to add value and produce measurable benefits

- Documenting the benefits and sharing the news with key stakeholders

- Continuing to build a string of localized successes until the organization has acquired enough experience and sponsorship to progress to the next stage

An organization can linger in stage 2 indefinitely if executives don’t see results, but most organizations are ready to move to the next stage in one to three years. By building a string of successes and carefully collecting data on the results, managers can attract top management attention and executive sponsorship for a broader application of analytics. At that point, they are ready to progress to stage 3.

Table 6-3 summarizes some of the major differences in scope, resources, and approach between the full-steam-ahead and the prove-it paths.

For an example of a company that chose the prove-it path, we will now look at the experiences of an organization that has begun to develop its analytical capabilities. (We have disguised the company and the names of the individuals.)

PulpCo: Introducing Analytics to Combat Competitive Pressure

PulpCo is a successful company engaged in the sale of pulp, paper, and lumber-based products, including consumer goods such as paper cups, industrial products like newsprint, and lumber-based products such as particleboard for residential construction. It has successfully sold these products in the United States and Europe for more than twenty years but has been facing increasing pressure from new entrants from developing economies, newly competitive European firms, and providers of substitute materials for construction and consumer products. The PulpCo management team has been with the company for years; most began their careers working at the mills. Traditionally, analytics have taken a back seat to PulpCo’s more intuitive understanding of the industry and its dynamics.

TABLE 6-3

Attributes of two paths to analytical competition

| Full steam ahead | Prove it | |

| Management sponsorship | Top general manager/CEO | Functional manager |

| Problem set | Strategic/distinctive capability | Local, tactical, wherever there’s a sponsor |

| Measure/demonstrate value | Metrics of organizational performance to analytics—e.g., revenue growth, profitability, shareholder value | Metrics of project benefits: ROI, productivity gains, cost savings |

| Technology | Enterprise-wide | Proliferation of BI tools, integration challenges |

| People | Centralized, highly elite, skilled | Isolated pockets of excellence |

| Process | Embedded in process, opportunity through integration supply/demand | Stand-alone or in functional silo |

| Culture | Enterprise-wide, large-scale change | Departmental/functional, early adopters |

Under increasing competitive pressure, the CEO, at a board member’s urging, broke with long-standing tradition and hired a new CFO from outside the industry. Azmil Yatim, the new CFO, had been lured by PulpCo’s scale of operations and major market position. But after a month on the job, he was wondering whether he had made a career mistake. The members of PulpCo’s management team behaved as though they had limited awareness of the financial implications of their actions. Major investment decisions were often made on the basis of inaccurate, untested assumptions. In operations, managers had grown used to having to make decisions without the right data. They had an incomplete understanding of their costs for major products such as particleboard, construction lumber, toilet paper, and newsprint. As a result, they made some costly mistakes, from unnecessary capital investments in plants and machinery to poor pricing.

The CFO resolved to improve the financial and decision-making capabilities of the organization. Sensing that chief operating officer (COO) Daniel Ghani, a widely respected insider, would be critical to his efforts, Yatim initially sought his support for a bold and far-ranging change initiative to transform the organization. Ghani rejected it as too radical. But the COO was tired of constantly dealing with one crisis after another, and after talking with Yatim, he began to realize that many of these crises resulted from a lack of accurate financial information, which in turn produced poor decisions. Ghani became convinced that the organization could not afford to continue to make decisions in an analytical vacuum. He urged the CFO to devise a new plan that would make effective use of financial data generated by the company’s newly installed enterprise system. Better financial information and control became a shared priority of the two executives.

Using a recent series of embarrassing missteps—including a major customer defection to a key competitor—as a rallying point, the CFO (together with the CIO, who reported to him) gained approval and funding for an initiative to improve financially based insights and decision making. He began by reviewing the skills in the finance function and at the mills and realized that operating managers needed help to leverage the new system. He arranged for formal training and also created a small group of analysts to help managers at the mills use and interpret the data. He also provided training to employees engaged in budgeting and forecasting.

As the CFO began to analyze the new data he was receiving, an unsettling picture emerged. PulpCo was actually losing money on some major accounts. Others that were deemed less strategically valuable were actually far more profitable. Armed with these insights, the CFO and his analysts worked with individual executives to interpret the data and understand the implications. As he did, the executive team became more convinced that they needed to instill more financial discipline and acumen in their management ranks.

A breakthrough occurred when detailed financial analysis revealed that a new plant, already in the early stages of construction, would be a costly mistake. Management realized that the company could add to capacity more cost-effectively by expanding and upgrading two existing plants, and the project was canceled. Managers across the company were shocked, since “everyone knew” that PulpCo needed the new plant and had already broken ground.

The executive team then declared that all major investments under way or planned in the next twelve months would be reviewed. Projects that were not supported by a business case and facts derived from the company’s enterprise system would be shut down. New projects would not be approved without sufficient fact-based evidence. Managers scrambled to find data to support their projects. But it wasn’t until a new managerial performance and bonus program was introduced that managers really began to take financial analysis seriously.

After a year of concerted effort, initial hiccups, and growing pains, PulpCo is a changed organization. Major financial decisions are aligned with strategic objectives and based on facts. Management is largely positive about the insights gained from better financial analysis and supportive of further analytical initiatives in other parts of the business. Forecasts are more accurate, and managers are better able to anticipate and avoid problems. The culture is no longer hostile to the use of data. Operational managers at the mills and at corporate headquarters have increased their financial acumen and are more comfortable interpreting financial analyses. The use of analytics has begun to spread as the organization’s managers realize that better insight into costs and profitability can give them an edge in competitive situations. Inspired by analytical companies such as CEMEX, PulpCo has begun a test program to bypass the lumberyard and deliver products directly to the construction site. Not surprisingly, PulpCo is also enjoying better financial performance.

Initially, PulpCo’s CFO just wanted improved financial data for decision making. With limited sponsorship and inadequate systems, the CFO realized that he needed to conduct some experiments and build credibility within the organization before attempting a broader change program. With each success, PulpCo’s leadership team became more enthusiastic about using analytics and began to see their broader potential. PulpCo is not an analytical competitor and may never reach stage 5, but today management is enthusiastic about the benefits of analytics and is considering whether it should make the leap to stage 3.

Stage 3: Analytical Aspirations

Stage 3 is triggered when analytics gain executive sponsorship. The executive sponsor becomes an outspoken advocate of a more fact-based culture and builds sponsorship with others on the executive team.

Executive sponsorship is so vital to analytical competition that simply having the right sponsor is enough to move an organization to stage 3 without any improvement in its analytical capabilities. However, those organizations pursuing the prove-it path will have already established pockets of analytical expertise and will have some analytical tools in hand. The risk is that several small groups will have their own analytical fiefdoms, replete with hard-to-integrate software tools, data sets, and practices.

Whether an organization has many analytical groups or none at all, it needs to take a broader, more strategic perspective in stage 3. The first task, then, is to articulate a vision of the benefits expected from analytical competition. Bolstered by a series of smaller successes, management should set its sights on using analytics in the company’s distinctive capability and addressing strategic business problems. For the first time, program benefits should be defined in terms of improved business performance and care should be taken to measure progress against broad business objectives. A critical element of stage 3 is defining a set of achievable performance metrics and putting the processes in place to monitor progress. To focus scarce resources appropriately, the organization may create a centralized “business intelligence competency center” to foster and support analytical activities.

In stage 3, companies will launch their first major project to use analytics in their distinctive capability. The application of more sophisticated analytics may require specialized analytical expertise and adding new analytical technology. Management attention to change management is critical because significant changes to businesses processes, work roles, and responsibilities are necessary.

If it hasn’t already done so, the IT organization must develop a vision and program plan (an analytical architecture) to support analytical competition. In particular, IT must work more aggressively to integrate and standardize enterprise data in anticipation of radically increased demand from users.

The length of stage 3 varies; it can be as short as a few months or as long as two years. Once executives have committed resources and set a timetable to build an enterprise-wide analytical capability, they are ready to move to the next stage.

BankCo (again, we have disguised the company and other names) is an example of an organization moving from stage 3 toward stage 4.

BankCo: Moving Beyond Functional Silos to Enterprise Analytics

Wealth management has been a hot topic within the banking industry over the last decade, and banks have traditionally been well positioned to offer this service. In-house trust departments have provided advice and services to generations of wealthy clients. But over the past several years, new competitors have emerged. Banks have moved away from using individual investment managers, taking a more efficient but less personalized approach. A trend toward greater regulatory oversight is further transforming the industry. At the same time, customers are more open to alternatives to traditional money management. This confluence of factors threatens bank trust departments’ hold on the service of managing individuals’ wealth.

At BankCo, the executive vice presidents of marketing, strategy, and relationship management were asked by the bank’s senior management team to create a strategic response to this threat. They quickly concluded that significant changes were needed to improve the bank’s relationships with its customers. BankCo’s trust department assets had declined by 7 percent over two years, despite a positive market that had produced increased assets overall and good performance in individual trust accounts. The decline was attributed to discounting by more aggressive competition and to cannibalism of accounts by the bank’s brokerage business. BankCo had tried introducing revamped products to retain customers but with limited success.

As in many banks, each department (retail, brokerage, trust) maintained its own customer data that was not available to outsiders. As a result, executives could not get a complete picture of their clients’ relationships throughout the bank, and valuable relationships were jeopardized unnecessarily. For example, one client with a $100 million trust was charged $35 for bouncing a check. When he called his retail banker to complain, he was told initially that his savings account wasn’t large enough for the bank to justify waiving the fee.

After analyzing these issues, the team concluded that an enterprise-wide focus on analytics would not only eliminate the majority of these problems but also uncover cross-selling opportunities. The team realized that a major obstacle to building an enterprise-level analytical capability would be resistance from department heads. Their performance measures were based on the assets of their departments, not on enterprise-wide metrics. The bank’s senior management team responded by introducing new performance metrics that would assess overall enterprise performance (including measures related to asset size and profitability) and cross-departmental cooperation.

These changes cleared the path for an enterprise-wide initiative to improve BankCo’s analytical orientation, beginning with the creation of an integrated and consistent customer database (to the extent permitted by law) as well as coordinated retail, trust, and brokerage marketing campaigns. At the same time, an enterprise-wide marketing analytics group was established to work with the marketing teams on understanding client values and behavior. The group began to identify new market segments and offerings, and to help prioritize and coordinate marketing efforts to high-net-worth individuals. It also began to develop a deeper understanding of family relationships and their impact on individual behavior. By bringing together statisticians and analysts scattered throughout the business, BankCo could deploy these scarce resources more efficiently. As demand quickly outstripped supply, it hired analytical specialists with industry expertise and arranged to use an offshore firm to further leverage its scarce analytical talent.

At first, there were occasional breakdowns in decision-making processes. When a competitor restructured its brokerage pricing, BankCo did not notice until several clients left. On another occasion, an analysis identified a new market segment, and management authorized changes to marketing, but the organization was slow to implement the changes. To overcome these hurdles, process changes were implemented to make sure that decisions were translated into action. Managers received training and tools so that they were equipped to make decisions analytically and understood how to develop hypotheses, interpret data, and make fact-based decisions. As the organization’s analytical capabilities improved, these breakdowns became less frequent.

As more tangible benefits began to appear, the CEO’s commitment to competing on analytics grew. In his letter to shareholders, he described the growing importance of analytics and a new growth initiative to “outsmart and outthink” the competition. Analysts expanded their work to use propensity analysis and neural nets (an artificial intelligence technology incorporating nonlinear statistical modeling to identify patterns) to target and provide specialized services to clients with both personal and corporate relationships with the bank. They also began testing some analytically enabled new services for trust clients. Today, BankCo is well on its way to becoming an analytical competitor.

Stage 4: Analytical Companies

The primary focus in stage 4 is on building world-class analytical capabilities at the enterprise level. In this stage, organizations implement the plan developed in stage 3, making considerable progress toward building the sponsorship, culture, skills, strategic insights, data, and technology needed for analytical competition. Sponsorship grows from a handful of visionaries to a broad management consensus; similarly, an emphasis on experimentation and analytics pervades the corporate culture. As the organization learns more from each analysis, it obtains a rich vein of new insights and ideas to mine and exploit for competitive advantage. Building analytical capabilities is a major (although not the only) corporate priority.

While there are many challenges at this stage, the most critical one is allocating sufficient attention to managing cultural and organizational changes. We’ve witnessed many organizations whose analytical aspirations were squelched by open cultural warfare between the “quant jocks” and the old guard. A related challenge is extending executive sponsorship to the rest of the management team. If only one or two executives are committed to analytical competition, interest will immediately subside if they suddenly depart or retire. In one case, the CEO of a financial services firm saw analytical competition as his legacy to the organization he had devoted his life to build. But his successors did not share his enthusiasm, and the analytical systems developed under his leadership quickly fell into disuse.

As each analytical capability becomes more sophisticated, management will gain the confidence and expertise to build analytics into business processes. In some cases, they use their superior insight into customers and markets to automate key decision processes entirely.

In stage 4, many organizations realign their analysts and information workers to place them in assignments that are better suited to their skills. As a company becomes more serious about enterprise-wide analytics, it often draws together the most advanced analysts into a single group to focus on strategic issues. This provides the organization with a critical mass of analysts to focus on the most strategic issues, and provides the analysts with greater job satisfaction and opportunity to develop their skills.

Once an organization has an outstanding analytical capability combined with strategically differentiating analytics embedded into its most critical business processes and has achieved major improvements to its business performance and competitiveness, it has reached the final stage.

ConsumerCo: Everything but “Fire in the Belly”

At a large consumer products company, analytical competition is at stage 4. ConsumerCo has everything in place but a strong executive-level commitment to compete on this basis. It has high-quality data about virtually every aspect of its business, and a capable IT function. It has a group of analysts who are equal to any company’s. The analysts have undertaken projects that have brought hundreds of millions of dollars in value to the company. Still, they have to justify their existence by selling individual projects to functional managers.

The CEO of ConsumerCo is a strong believer in product innovation and product-oriented research but not particularly in analytics. The primary advocate for analytics is the COO. Analytics are not discussed in annual reports and analyst calls, though the company does have a culture of fact-based decision making and uses a large amount of market research. ConsumerCo is doing well financially but has been growing primarily through acquisitions. In short, analytics are respected and widely practiced but are not driving the company’s strategy. With only a bit more “fire in the belly” from senior executives, it could become a true analytical competitor in a short time.

Stage 5: Analytical Competitors

In stage 5, analytics move from being a very important capability for an organization to the key to its strategy and competitive advantage. Analytical competitors routinely reap the benefits of their enterprise-wide analytical capability. Proprietary metrics, analytics, processes, and data create a strong barrier to competitors, but these companies are always attempting to move the analytical bar further.

Executive commitment and passion for analytical competition in this stage is resolute and widespread. The organization’s expertise in analytical competition is discussed in annual reports and in discussions with investment analysts. Internal performance measures and processes reinforce a commitment to scientific objectivity and analytical integrity.

However, analytical competitors must avoid complacency if they are to sustain their competitive advantage. They need to build processes to continually monitor the external environment for signs of change. They must also remain vigilant in order to recognize when changing market conditions require them to modify their assumptions, analytical models, and rules.

We’ve described a large number of these companies already, so we won’t give an example here. Each stage 5 company is different in terms of the strategic capability it emphasizes, the applications it employs, and the path it followed to success. But they have in common an absolute passion for analytics and a resulting strong financial performance.

Progressing Along the Road Map

The path to success with analytics will contain speed bumps along the way. Managers not yet on the full-steam-ahead path may be tempted to either shift resources away from or shut down completely an analytics initiative if business conditions put pressure on the organization. Also, the shift to analytics will most likely require employees to change their decision-making processes. It takes time for the organization to adjust to new skills and behaviors, but without them, no real change can occur. As a result, the most important activity for the leadership team is to keep analytical initiatives on track and to monitor outcomes to ensure that anticipated benefits are achieved.

At every stage of development, companies need to manage outcomes to achieve desired benefits, setting priorities appropriately and avoiding common pitfalls.

Managing for Outcomes

Three types of outcomes are critical to measuring an initiative’s performance: behaviors, processes and programs, and financial results. While financial results may be all that matter in the end, they probably won’t be achieved without attention to intermediate outcomes.

Behaviors. To a large extent, improved financial outcomes depend on changing employee behaviors. Implementing new analytical insights into pricing, for example, can require thousands of individuals to change their behaviors. Managers and employees may initially believe that their own pricing experience is better than that of any system. Managers have to monitor measures and work with employees who don’t comply with policies. Executives have to send out frequent messages to reinforce the desired change of direction.

Processes and programs. Fact-based analyses often require process and program changes to yield results. For example, insights into the best way to persuade wireless customers not to defect to another carrier need to be translated into actions—such as developing a new program to train customer-facing employees.

One way to ensure that insights are incorporated into business processes is to integrate analytics into business applications and work processes. Incorporating analytical support applications into work processes helps employees accept the changes and improves standardization and use. For more advanced analytical competitors, automated decision-making applications can be a powerful way of leveraging strategic insights.

Financial results. It is important to specify the financial outcomes desired from an analytical initiative to help measure its success. Specific financial results may include improved profitability, higher revenues, lower costs, or improved market share or market value. Initially, cost savings are the most common justification for an analytical initiative because it is much easier to specify in advance how costs will be cut. Revenue increases are more difficult to predict and measure but can be modeled with analytical tools and extrapolated from small tests and pilot studies. As an organization’s analytical maturity increases, it will be more willing to invest in initiatives targeted at exploiting growth opportunities and generating revenue.

Establishing Priorities

Assuming that an organization already has sufficient management support and an understanding of its desired outcomes, analytical orientation, and decision-making processes, its next step is to begin defining and prioritizing actions. Critical questions managers should use to assess the potential of an analytical initiative are in the box entitled: “Questions to Ask When Evaluating New Analytical Initiatives.” Projects with the greatest potential benefit to the organization’s distinctive capabilities and competitive differentiation should take precedence. Taking an analytical approach to investment decisions, requiring accountability, and monitoring outcomes will help reinforce the analytical culture and maximize investments where they are likely to have the greatest impact.

A common error is to assume that merely having analytical technology is sufficient to transform an organization. The Field of Dreams approach—“If you build it, they will come”—usually disappoints. If you build a data warehouse or a full-blown analytical technical infrastructure without developing the other analytical attributes, the warehouse will just sit there.

Avoiding the Potholes

Since every organization is different, we won’t attempt to provide detailed instructions to navigate around all the potential hazards encountered along the road map. Hazards can appear suddenly at any stage of development. However, we can provide guidelines to help make the planning and implementing efforts go as smoothly as possible.

Questions to Ask When Evaluating New Analytical Initiatives

- How will this investment make us more competitive?

- How does the initiative improve our enterprise-wide analytical capabilities?

- What complementary changes need to be made in order to take full advantage of new capabilities, such as developing new or enhanced skills; improving IT, training, and processes; or redesigning jobs?

- Does the right data exist? If not, can we get it? Is the data timely, consistent, accurate, and complete?

- Is the technology reliable? Is it cost-effective? Is it scalable? Is this the right approach or tool for the right job?

First, some missteps are due primarily to ignorance. The most common errors of omission are:

- Focusing excessively on one dimension of analytical capability (e.g., too much technology)

- Attempting to do everything at once

- Investing excessive resources on analytics that have minimal impact on the business

- Investing too much or too little in any analytical capability, compared with demand

- Choosing the wrong problem, not understanding the problem sufficiently, using the wrong analytical technique or the wrong analytical software

- Automating decision-based applications without carefully monitoring outcomes and external conditions to see whether assumptions need to be modified

Of greater concern to many executives is the intentional undermining of analytical competition. Many managers share Benjamin Disraeli’s suspicion that there are “lies, damned lies, and statistics.”4 Data analysis has the potential for abuse when employed by the unscrupulous, since statistics, if tortured sufficiently, will confess to anything.5 Applying objective criteria and data for decision making is highly threatening to any bureaucrat accustomed to making decisions based upon his or her own self-interest. Analytical competition cannot thrive if information is hoarded and analytics manipulated. Executives must relentlessly root out self-serving, manipulated statistics and enforce a culture of objectivity.6

Conclusion

This chapter has explored the key attributes of an analytical capability and provided a directional guide to the steps that lead to enhanced analytical capabilities. We wish you rapid movement to the full-steam-ahead path to becoming an analytical competitor. In the next chapter, we will explore ways to successfully manage an organization’s commitment to key people who are—or need to be—using analytics.