9. Man Versus Machine

“One of the most helpful things that anybody can learn is to give up trying to catch the last eighth—or the first. These two are the most expensive eighths in the world. They have costs stock traders, in the aggregate, enough millions of dollars to build a concrete highway across the continent.”

—Jesse Livermore

It’s a classic story, and one with a seemingly certain ending: The human pits his emotion, intelligence, and passion against the cold logic of the machine. Sometimes the human ekes out a victory, but in the long run, the machine invariably wins—first in chess, then in Jeopardy, and now apparently in trading. This rule appears inexorable, but it need not be so.

For example, two Norwegian traders were able to outwit “the machine,” and in the process make substantial profits. The traders learned how the computer algorithm of one trader (Timber Hill) reacted to certain trades. Armed with this knowledge they created traps for the machine. They were so successful that the (human) owners of the automated trading system convinced the Norwegian authorities to prosecute the pair for market abuse. One of the defense attorneys, Mr. Anders Brosveet, argued the actions of the defendants was not market manipulation because:

“They had an idea of how the computer would change the prices but that does not make them responsible for what the computer did....1

The prosecutors argued that the defendants’ actions disadvantaged other investors and constituted market manipulation (although the same argument would apply any time a smarter investor wins at trading). The defendants, who were given suspended prison sentences for market manipulation and ordered to pay substantial fines equal to their trading profits, appealed the verdict to Norway’s Supreme Court. On May 2, 2012, much to the delight of many in the human trading community, Norway’s Supreme Court overturned the verdict and cleared the pair of market manipulation in part because their trades were so transparent.2

By using their ingenuity, these traders turned all the strengths of a computerized system—speed, consistency, and reliability—into weaknesses, proving that in the game of trading, the battle of man versus machine is still ultimately in man’s favor.

The emergence of automated trading systems has led some observers to conclude that individual traders cannot make money from trading. This is not true. The earlier example illustrates how the rise of algorithmic trading has changed financial markets, and that profit opportunities persist for humans to exploit even in a world where trading is dominated by algorithms. Although the two Norwegian traders profited from “outwitting” the machine (anticipating its actions or reactions), many opportunities exist for humans to trade profitably without dueling with machines.

Algorithmic and High-Frequency Trading

What is algorithmic trading? Hendershott, Jones, and Menkveld [2011] define algorithmic trading broadly as any situation where computers are used to enter or cancel orders.3 Under this interpretation high-frequency trading (HFT) is a subset of algorithmic trading. As Easely, Lopez de Prado, and O’Hara [2012] point out: “Not all algorithmic trading occurs in high frequency, but all high frequency [trading] requires algorithmic trading.”4 Although some observers distinguish between high frequency and algorithmic trading, for simplicity, this book uses the terms interchangeably.

Despite the seeming complexity and high speeds involved, much of the trading activity of algorithmic trading firms is directed at market making. There are some obvious parallels with the typical behavior of scalpers or locals in an open outcry pit environment and HFTs. Both are trying to make money from market making. Both do not want to hold a position overnight or for very long during the trading day, preferring to be flat most of the time.5 Indeed, many high-frequency trading strategies can be most easily understood by imagining the behavior of pit traders in former times. Basically, many high-frequency traders are simply using old strategies, with new technology, and creating new ramifications in the process.

High-frequency trading firms have been immensely profitable. A recent study of all trades in the e-mini S&P 500 stock index futures market during August 2010 reported that HFT firms made $23 million in aggregate profits with Sharpe ratios ranging from 3 to 20 with a median Sharpe ratio of 4.5. The study divided the HFT firms into three categories (passive, mixed, and aggressive) based on the frequency of liquidity taking. For example, aggressive HFT firms were liquidity takers more than 60% of the time, whereas passive HFT firms were liquidity takers less than 20% of the time. Speed also mattered as most profits were earned very quickly. The study found that HFT firms that were both quick and aggressive earned the most.6

Old Strategies

In the days when futures markets were dominated by pit traders, many “locals” or “scalpers” tried to make a market for public order flow (orders coming from outside the pit). The objective was to buy at the bid and sell at the offer, in order to profit from the difference between the two, which is known as the bid/ask spread.

Anyone who has exchanged currency or bought a used car knows that the price merchants buy from you is going to be lower than the price they will sell to you. That’s how they make money, and that’s how scalpers in the pit made money. But to lower the risk that a big price move might wipe away their profits, scalpers try to hold positions for as short a time as possible. By liquidating their positions quickly, scalpers protect themselves from negative price moves and lock up their profit.

The amount of money to be made from the bid/ask spread is relatively small—sometimes pennies on the dollar; but the risk is small, too. By buying and selling as soon as possible, scalpers lock in their small, but real profits. In general, scalpers don’t know or care whether the price is going up or down in the long run. They just want to buy and sell as fast as possible to lock in a profit. Most pit traders would hold positions for a very short time period—seconds or minutes and be flat at other times. Because of this, scalpers were effectively flat during large parts of the trading day to limit their exposure to the risk of an adverse price move. They also generally went home flat (holding no position), to avoid the risk of loss from an adverse price move overnight.

But how could these traders do this? Being in the pit gave locals an advantage or edge over other traders off the exchange floor. Because they were literally in the center of the market, they could exploit price moves before traders off the floor could act. Some observers estimated that locals or scalpers accounted for 30%–40% of trading volume in many futures contracts when pit trading was active.

Traders on the floor were literally at “the center” of the market. Electronic trading has displaced many pits. Nowadays, the real power, the real center of the market, is the data center at the exchanges. This is where the exchange server matches electronic orders. High-frequency traders pay a premium to be as close to the exchange server as possible. In the extreme case, trading firms locate their server near the exchange’s server in an exchange facility. This practice is known as co-location.7 Firms are also willing to pay exchanges a hefty premium for the privilege of doing so. High-frequency traders have replaced scalpers in the pit and have taken many of their profit-making techniques with them.

Many high-frequency traders are middlemen. They buy from Tom and sell to John before Tom and John can react, making small, but risk-free profits. But that doesn’t do HFT systems justice. They are so fast that they can buy from Tom and sell to John before Tom even knows that John wants to buy his stock—and that’s not an exaggeration.

Like the scalpers in the pit, many high-frequency systems don’t know or care whether the market is going up or down. They just want to make money by making a market for public order flow. So if humans stop trading, the algorithms will, too. This was apparent from the behavior of trading volume on the New York Stock Exchange (NYSE) when Tiger Woods made his public apology for the damage that his affair caused to his wife and family.8 Trading volume dropped sharply even though Bloomberg News reported in early 2010 that almost 61% of all trades on the NYSE are executed by high-frequency computerized trading systems. It resumed after the press conference ended. Unless the bots were also transfixed by Tiger’s apology, it is likely that trading volume fell because human trading volume fell (public order flow) and with it algorithmic trading volume. The robots were trying to make money by making markets, not by predicting where Apple stock was going.

Identifying orders from human traders is another dimension of successful market making by HFTs. Human traders often provide HFTs with telltale signals that their orders are from humans rather than competing machines. For instance, humans are more likely to submit large orders or orders for a round number of contracts. Knowing that they are likely dealing with a human on the other side of the order gives HFT firms an edge.

A trader in a futures or options market makes money only if one or more other traders lose money. However, the pit community as a whole makes money only if there is public order flow. If public orders aren’t coming in, then a pit trader can only make money by “picking the pocket” of another pit trader. However, when outside orders come in, the pit community as a whole usually makes money although some individual pit traders may lose. Pit traders perform the economic function of market making with a key difference. Scalpers make a market only when it is in their interest to do so. That is, there are no designated market makers in most futures pits. No one is obligated to make a market. When a market starts to move pit traders exacerbate the order imbalances rather than reduce them by adding to the one-way pressure on prices. This phenomenon occurs in markets dominated by high-frequency traders.

But how does a middleman make money if no one is buying or selling? They can’t. However, not all HFT algorithms are designed for market making. Some trade off new information and race to be the first to respond by using machine-readable news feeds, allowing machines to digest news before humans can. Some prey on other traders, including other high-frequency traders. This creates a danger for HFTs attempting to act as market makers. One way to protect against predatory behavior by other HFTs is to trade in small sizes. As a result, average trade size has declined in recent years as both the number of trades and high-frequency trading has increased. Another way market-making HFTs protect themselves from predatory HFTs is to use orders as a means of testing the waters or to encourage others to enter the market so that the HFT firm can trade with them. HFT is characterized by many order amendments and high rates of order cancellations.

New Technology

The strategies HF traders employ are nothing new; they are just being implemented faster and more efficiently than in days gone by. What’s amazing about high-frequency trading is not the strategies firms use—it’s the way they do it. So, just how do HFTs execute these strategies? Speed.

Speed is the bread and butter of high-frequency trading in two ways: fast, quality decision making, and fast execution. Fast decision-making comes from:

• The quality of the algorithms designed by the firm

• The power of the computers operated by the firm

• In those cases where HFT firms trade off of news, having access to machine-readable news feeds

However, good algorithms and processing power are largely irrelevant without easy access to information. High-frequency traders need fast inputs and outputs to both process information as soon as possible and then act on it. These machines are nothing without high-quality information that they can respond to quickly. Likewise, many of their strategies are disadvantaged if their orders arrive even a millisecond too late. It is important to point out, that for many HFT firms, the information they are acting upon is not news in the conventional sense but information internal to the market such as whether the order likely came from a human. The origin of order flow may be more important to HFT firms than the news that motivated order placement.

The speed arms race continues unabated as trading firms compete to build the fastest systems to get their orders in first. For long-distance communication, for example, between New York and Chicago, companies compete to build shorter cables or innovate using new forms of communication.

An article about high-frequency trading in Wired magazine described the millisecond differences that can make or break a HFT outfit. Even among HFT systems, there are winners and losers. For instance, companies transmitting information from New York to Chicago using fiber-optic cable from the 1980s can expect a round trip speed of no faster than 14.5 milliseconds. That seems fast, but is actually slower than it could be because the cable runs an indirect route through Pittsburgh. Because fiber-optic cables are already so fast, planners tended to maximize the population served instead of finding the absolute shortest distance for a cable. So, another company quietly bought the rights to lay its own cable and shaved that down to 13.1 milliseconds. But the competition didn’t stop there. Another two companies decided to bypass cables altogether, transmitting information using microwave. This led to transmission times of around 9 milliseconds.9

This competition for speed is vital to HFT trading. In this world, speed is king. That’s why Hibernia Atlantic is laying a new cable to connect London and New York. Cost? Approximately $300 million. Benefit? A near monopoly on the fastest speed across the Atlantic. This cable will give traders who pay high fees a 5.2 millisecond advantage.10 It also gives us a good estimation of the value of speed.

For New York to London communication, the value of 5.2 milliseconds is at least $300 million dollars. How’s that for the money value of time?

Not surprisingly, an electronic trading system gives a significant advantage to those who can act more quickly. As previously noted, high-frequency traders share many of the same attributes as the stereotypical pit trader of years gone by but are able to act faster. In a fascinating research presentation on high-frequency trading in electronic markets, Professor Pete Kyle notes that high-frequency traders tend to enter positions with limit orders and frequently exit positions with “orders which move prices.”11 He also observes that high-frequency traders:

“...participate in about 30% of trades, have inventories with a half-life of about two minutes, and rarely hold aggregate net positions exceeding 0.2% of average daily volume.”12

In some ways, many high-frequency traders are just scalpers 2.0.13 However, they are faster, more efficient, more effective, and more dangerous than the scalpers of old. Because of their speed advantage, high-frequency traders operate with small inventories of stocks (or other securities), protecting them from unpredictable price moves.

Moreover, today’s high-frequency traders are so fast that they are able to cancel many of their orders before trades occur. An estimated 95% to 98% of HFT orders in some markets are cancelled before they are executed and result in trades.14 This is something scalpers in the pit could never have dreamed of doing. In the blink of an eye, a high-frequency trader might place thousands of orders, and then retain only the ones most likely to turn a profit when they become trades.

But this new speed does not mean that all HFTs make money all the time. In fact, this new emphasis on millisecond communication has created an entire set of new ramifications and, as discussed later this chapter, HFT mistakes can be very costly.

“New” Strategies

Some HFT strategies could be classified as “new” yet just play an updated role of scalpers in the pit. A 2012 article suggested that speed alone is not the defining characteristic of algorithmic traders because HFT was made possible by legislative not technological change per se.15 Easley, Lopez de Prado, and O’Hara [2012] suggest that algorithmic traders look at the markets in ways humans find difficult to comprehend. For instance, many algorithms look at the market not in terms of chronological time, but volume-time. Thus, an algorithmic trading system might forecast prices over a set of shares traded, not over the time it takes to trade them.

By looking at trades based on volume not time, machines can more accurately predict future prices within the market microstructure. This makes controlling risks easier as well. There is also a fundamental difference in the behavior of prices over very short time periods rather than periods humans are used to seeing. Namely, changes in prices can be predictable rather than fluctuate randomly as the theory of efficient markets would suggest.

Predictable patterns may exist. These might arise from the trade-matching process the exchange uses or from the preferences of human traders. Through the use of sophisticated algorithms and viewing the market from a different perspective (volume time), these algorithms are able to predict and profit from small inefficiencies at the microsecond level. This amounts to a revolution in tactics, but not a revolution in strategy. Moreover, Easley, Lopez de Prado, and O’Hara argue HFT strategies may differ across markets as HFT firms seek to exploit the unique features of each market.16

Essentially, Easley, Lopez de Prado, and O’Hara [2012] liken HFT to a game and note the often-secondary role that speed plays in it. They argue:

“There are sacrifices, calculated “mistakes” and a lot of deception....[S]peed makes HFTs more effective, but slowing them down won’t change their basic behavior....17

There is another important implication that arises from their article. Namely, it also means that algorithmic trading would still exist even if high-frequency traders no longer enjoyed a speed advantage over other market participants or if impediments to trading such as a Tobin tax (a tax of financial market transactions in order to discourage speculation) were introduced.

Human traders never used the same tactics of predicting prices over volume-time at the millisecond level. The limitations of the human brain make this impossible. However, the strategy of predicting small price moves in the short term has existed for a very long time. The only difference is what constitutes “small,” and what constitutes “short term.”

In the past, scalpers and traders at the center of the market could in some cases predict the movement of the market from their experience and judgment. Some unscrupulous market participants abused their locational advantage and knowledge of public order flow by engaging in practices such as front running (trading in front of public orders). Predicting and profiting from small price moves has not changed at all; it is only the window of time to profit that has changed, and computers with pre-programmed algorithms are necessary to trade at the millisecond level.

Speed and strategy advantages have always existed. The Tiger Woods example, and many others left unsaid, shows that machines are dependent on humans, not that humans are dependent on machines.

The time advantages have been far larger in the past. For instance, in the U.S. Supreme Court’s opinion of a 1907 lawsuit (Hunt v. the New York Cotton Exchange), Justice McKenna wrote:

“[The price quotations] come sometimes not more than a quarter of a minute or a half of a minute apart, and are copied from the tape and placed upon a blackboard, where all can see them. When new quotations are received the old ones are generally wiped out. The ticker service is very slow, and the value of it depends on the time it is received. After it is put upon the blackboard it becomes public property so far as concerns the value of it. And it was testified that a firm by the name of Gamong & Fitzgerald received their quotations about five minutes before appellant, they having better wire service. And also there was a wire running into the Memphis Cotton Exchange, and that not quite a minute elapsed from the time the ticker registers the market quotations to the time they are registered on the blackboard in the city of Memphis and open to the public.”18

At the end of the day, even with the use of a volume clock, HFT is just another form of using speed and information advantages, just like the pit traders of old. What are the ramifications of high-frequency traders for markets and market participants?

Ramifications

Arguably, the most significant periodic economic report is the monthly U.S. Employment Situation Report, which is usually released on the first Friday of the following month at 8:30 a.m. EST. The news is available in conventional form and in machine-readable form (at a substantial fee) from news vendors. Machine-readable news can be digested by a computer before the same news is recognized and understood by humans when delivered via conventional media. Humans take around .20 to .25 seconds to react to visual stimuli, yet computers can make sophisticated trades from complex information in a fraction of the same timeframe. This means computers can get in and out of a position before a human even finishes reading the headline—let alone click a computer mouse.

The U.S. Employment Situation Report for September 2010 was released by the U.S. Department of Labor at 8:30 a.m. EST on Friday, October 8, 2010. The report stated that the unemployment rate remained unchanged at 9.6% while 95,000 jobs were lost during the month. (159,000 government jobs were lost while 64,000 private sector jobs were created.) This was mixed news for the economy given that the consensus forecasts were for a loss of only 5,000 jobs for the month and the unemployment rate was expected to increase to 9.7%.19

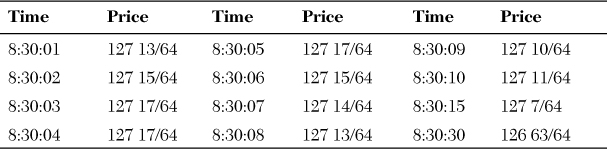

Fixed-income markets are sensitive to news contained in the Employment Situation Report. Consider the reaction to the report of the December 2010 ten-year Treasury note futures contract traded on the Chicago Board of Trade (CBOT) division of the CME Group to the news. The contract is traded in 64ths—each tick is equal to .015625 of a point with a dollar value of $15.625. Because of the large number of trades, multiple trades at the same price and time are ignored.

An analysis of the time and sales data shows that the price immediately before the announcement was 126.9675 or 126 and 62/64. The first trade after the announcement was 127 and 4/64. This represents a jump of 6/64 or $93.75 per contract ($15.625 × 6). Prices then rose 1/64 each time prices changed and reached 127 and 17/64 71 milliseconds later. Prices fell by 2/64 and then by 5/64 and then by 6/64 within 12 milliseconds after the high before declining by 1/64 in two steps to 127 2/64 18 milliseconds after the high. Prices started to rise again jumping by 3/64 and then by 1/64 and then by 7/64 before falling by 1/64 and then by 4/64 only to rise by 9/64 to 127 and 17/64—the previous high. This second high was reached 31 milliseconds after the identical first high. Much of the price action for the second high occurred during a single millisecond. The range during this millisecond was 11/64. After remaining at 127 17/64 for 34 milliseconds the price suddenly plunged by 7/64 and then by another 4/64 only to rise by 11/64 in the next trade. Prices bounced around falling to 127 4/64 only to rise to 127 12/64 417 milliseconds after the announcement was made.

Futures prices at selected times during the first 30 seconds are shown in Table 9-1.

Table 9-1. Reaction of December 2010 Delivery CBOT 10-Year Treasury Note Futures Prices to the September 2010 U.S. Employment Report on October 8, 2010

The range was greater during the first 4/10 second (126 56/64 to 127 17/64) following the announcement than in the first 30 seconds. Most of the volatility occurred during the first half of a second following the announcement.

Virtually all of that is from robot trading. Any human trades would have to be from previously placed limit or stop-loss orders. Interestingly, the price at the end of the first 30 seconds following the announcement was only one tick greater than it was before the announcement. Simply stated, a huge amount of trading occurred in the first half second, causing large price changes that did not last for 30 seconds.

The important point is that even if you’re a high-frequency trader with access to machine-readable news, you still might lose. For example, suppose you’re the fastest HFT trader and you buy at 127 4/64—the first price after the report comes out—anticipating that prices would rise. You beat everyone else to the market. Yet, milliseconds later, you’ve lost $187.50 per contract as the price stood at 126 56/64.

The market is cutthroat even at the millisecond level, and if you’re a few milliseconds too slow, you probably bought at the high of the day or sold at the low. Computers don’t get tired, don’t feel pain, and don’t take lunch breaks.

Another lesson is the appropriate trade horizon, how long a trading position is held. Although the market returned after 30 seconds to about where it stood a moment before the report was released, it moved sharply once again right after. This raises the question of what the appropriate trade horizon for a trade is. The answer depends on how much pain you are willing to bear before the desired move occurs.

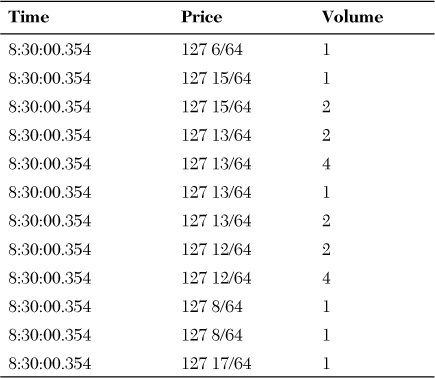

Table 9-2 provides a closer examination of the trades (and the associated volumes) that occurred during the 8:30:00:354 millisecond period.

Table 9-2. Behavior of December 2010 Delivery CBOT 10-Year Treasury Note Futures Prices During 8:30:00:354 on October 8, 2010.

Table 9-2 shows that the smallest possible trade—1 contract—is associated with a jump up of 9/64 (that is, from 127 6/64 to 127 15/64 in one case and from 127 8/64 to 127 17/64 in another case). This shows a high degree of illiquidity at the millisecond level and suggests that price changes may be driven by standing orders. Again, a one lot moved the price 9/64 or $140.625.

Markets are actually very illiquid when differences in time are small. In such cases, large price moves are not induced by large orders but rather by a widening bid/offer spread. This means more volatility as prices bounce between bid and offer. Price jumps like those observed in the preceding example are almost certainly induced by algorithmic trading in a market where there are no designated market makers.

But that’s not the only way algorithmic and high-frequency trading have changed the market. In the past, the volume and volatility of trades were predictable following a “U” (or “W”) shape with greater volatility and volume at the open and close of trading than during the trading day. This meant many trades at the open, perhaps a spike in trading volume halfway through the day, and a rush of trades at the end of the day. Although trading at the open and close remain relatively heavy, the growth of algorithmic trading has made intraday volatility and volume far more even. A spike in trading volume can happen any time the market is open, but now it’s much more likely to take place at an unpredictable time, catching traders off guard. Spikes and sudden price moves have always existed. Modern technology has arguably increased their frequency.

Does the presence of high-frequency traders increase market depth and reduce transaction costs? Much evidence indicates that it does even though not all HFT firms are passive market makers. However, the issue remains controversial in the academic literature. One question is whether algorithmic trading improves all the securities in the market or only the most actively traded securities. Another question is whether the positive impact of HFT extends to difficult-to-trade days or difficult-to-trade securities. The basic idea is that in bad times, like any other rational investor, the HFT systems and their owners look out for their own interests. This is because HFTs firms are not required to make a market. Boehmer, Fong, and Wu [2012] report evidence that liquidity decreases and volatility increases with the intensity of algorithmic trading. Moreover, they report evidence that liquidity decreases and volatility increases for small stocks and for the overall market on difficult-to-trade days in markets with algorithmic trading.20

If market-making HFT firms are acting in their own interest during difficult-to-trade days, this means that during a sudden crash, market-making HFT systems will not act as middlemen by rushing in to buy when prices start to fall. Instead, they might exacerbate the price decline by not participating. This behavior is nothing new—in the old days, scalpers in futures pits did the same thing. Anyone who had money at risk acted the same way. Specialists on the New York Stock Exchange were accused of not answering their phones during the 1987 stock market crash and not stepping in as required during a sudden fall in stock prices on May 28, 1962.21 But with changing technology, risks have changed as well. The high-frequency nature of these systems exacerbates the order imbalance. With their superior speed and information about pending orders, HFT systems can react to a potential crash before humans see it coming.

Concern over perceived greater volatility and potential abuses by HFT firms has led to calls to restrict or regulate HFT.22 As noted earlier, the literature on the impact of HFT is mixed. Much of it suggests that HFT improves liquidity by reducing bid offer spreads and increasing depth. (See, for example, Hendershott, Jones, and Menkveld [2011]; Brogaard, Hendershott, and Riordan [2012]; Menkveld [2012]; Chaboud, Hjalmarsson, Vega, and Chiquoine [2009].)23 There is more disagreement about HFT’s impact on volatility. Some studies suggest that volatility declines as HFT increases (such as Hasbrouck and Saar [2012]) while others suggest that volatility increases with HFT and increases even more during turbulent periods (such as Boehmer, Fong, and Wu [2012] and Zhang [2010]).24 Yet, another academic study by Chaboud, Hjalmarsson, Vega, and Chiquoine [2009] suggests that the volatility of FX rates is basically unaffected by high-frequency trading. As noted earlier, some observers argue that HFT reduces the bid/ask spread and liquidity in good times but decreases liquidity and increases volatility in bad times. If this is true, HFT is a double-edged sword for the market.

There is a very simple way in which the “problem” of automated trading can be reduced: namely, by reverting back to a periodic call market—where orders are batched together and executed at a single price with trading occurring periodically. The presumption that you need to trade all the time is questionable for most investors. Indeed, continuously open markets attract some individuals to trade too frequently incurring greater transactions costs and lowering their returns. Should trading be driven by how fast you can trade? Should the speed on highways be determined by how fast a vehicle can travel? Should there be speed limits in school zones? If so, should there be speed zones or trading halts in markets? A periodic call auction market arguably determines prices better than a continuous market because it allows orders to be batched. The HFT informational advantage would disappear in such a market. The change would not disadvantage value investors with a longer trade horizon. In fact, periodic call auctions are used in many markets. Many exchanges use opening and closing calls to ensure a more reliable opening or closing price.

Avoiding HFT

Easely, Lopez de Prado, and O’Hara [2012] suggest a number of ways that individuals can avoid being taken advantage of by HFT. Specifically, among other things, they suggest to

• Trade when volume is typically higher, such as at the open or close. In many markets, opening and closing prices are determined by a call auction that batches orders together. The advice to trade during such periods is somewhat ironic in that it implicitly advocates a retreat from today’s continuous markets to the periodic markets of yesteryear.

• Avoid telegraphing your order as a human order. They note that humans tend to trade in even amounts. Thus, another tactic is to place orders in odd amounts to avoid identifying your order as a human order to HFT firms.

• Trade only on exchanges that monitor and penalize toxic order flow. Such exchanges should have greater liquidity because they reduce the risk of adverse selection for market makers.

• Avoid easily predictable behavior. As Easely, Lopez de Prado, and O’Hara [2012] state:

“Predatory algos exploit humans’ inclination for seasonal habits, such as end-of-day hedges, weekly strategy decisions, monthly portfolio duration rebalances, calendar rolls, etc.”25

Trading Lessons

The rise of algorithmic and high-frequency trading has eliminated some trading opportunities and created new ones. It has also created new risks for individual traders. One of the dangers that the flash crash exposed was the risk of having outstanding stop-loss orders executed by sudden market moves. Ironically enough, these orders to sell or buy—thus locking in some profit or limiting a loss—can end up hurting a trader. For example, suppose you bought stock X at 45 and it is now trading at 50. You put in a trailing stop-loss order at 46 to preserve a small profit if the stock starts to fall. It sounds like a good strategy, because no matter what happens to the stock, if the stock starts to fall, you can’t lose money right? Wrong.

Imagine stock X is a victim of a flash crash and plummets to 35 where it stabilizes, only to rise back to around 50 by the end of the day. Orders to sell stock are fulfilled at the market price after the target price is reached or passed. If the price of stock X suddenly plummets to 35, your order will be fulfilled at 35. Instead of preserving a small profit, the stop-loss order at 46 resulted in a sale at 35. Thus, a stop-loss order that appeared to ensure a minimum of a $1 per share profit delivered a $10 loss per share.

So what possible advantages could human traders have over bots? For one thing, most of the bots have only been programmed to go after the easiest profits. Their edge is speed. In any race where speed is the deciding criterion, the bots are likely to win. Smart human traders still have an edge playing the long game, thinking of new strategies, and being able to adapt in unorthodox ways.

What can’t you do in the wake of algorithmic and high-frequency trading? For one thing, doing arbitrage becomes difficult, if not impossible. You are too slow as a human. Also, you are going to buy at the offer or sell at the bid price when you trade. This raises your transaction costs.

However, markets may not always react as fast to news as you might expect. This is true when the price action in one market affects related markets. Sometimes getting there first may not be best if the market is extremely volatile—witness the reaction to the September 2010 Employment Situation Report. Moreover, perceived relationships are subject to sudden changes.

Human traders are more flexible as well. Markets conditions change. Sometimes the changes are caused by market sentiment. One area where human traders should behave more like robots is in taking emotion out of trading decisions. This requires the development of a trading game plan and the discipline to stick with it.

The bottom line is that individuals should accept the fact that most of the time, they must plan to make money by correctly anticipating changes in market prices. Individual traders should also plan on having a longer trade horizon than their algorithmic trading or investment banking counterparts. They should also accept the fact that it’s imperative that they have a sound trading game plan established to limit their losses and maximize their gains.

Endnotes

1. Ward, Andrew, “Norwegian Day Traders Convicted for Outwitting Trading System.” Financial Times. October 13, 2010. http://www.ft.com/intl/cms/s/0/f9d1a74a-d6f3-11df-aaab-00144feabdc0.html#axzz21Zmk1lQe.

2. Stothard, M., “Norwegian Day Traders Cleared of Wrongdoing.” Financial Times. May 2, 2012. http://www.ft.com/intl/cms/s/0/e2f6d1cc-9447-11e1-bb47-00144feab49a.html#axzz21Zmk1lQe.

3. Hendershott, T., C. M. Jones, and A. J. Menkveld, “Does Algorithmic Trading Improve Liquidity?” Journal of Finance, 2011, Vol. 66, pp. 1–33.

4. Easley, D., M. Lopez de Prado, and M.O’Hara, “The Volume Clock: Insights into the High Frequency Paradigm.” (March 30, 2012). The Journal of Portfolio Management (Fall 2012); Johnson School Research Paper Series No. 9-2012. Available at SSRN: http://ssrn.com/abstract=2034858 or http://dx.doi.org/10.2139/ssrn.2034858.

5. Menkveld [2012] examines the behavior of a single HFT firm in the equity market and concludes that it closely resembles “an electronic version of the classic market maker.”

6. Baron, M., J. Brogaard, and A. Kirilenko, “The Trading Profits of High Frequency Traders.” Princeton University working paper, November 2012.

7. Traders who co-locate near an exchange server are given cables of identical length to the exchange server. This means that there is no advantage for one trader over another in terms of reducing the latency or time it takes to receive information from the exchange. There is another source of latency in trading and that is the time it takes for a market participant to make a trading decision. Algorithmic traders who are co-located must rely on lower latency elsewhere in the trading decision process to be faster than other algorithmic traders who are also co-located, or better proprietary trading methods, to be profitable.

8. On February 19, 2010, Bloomberg News reported: “Trading on all U.S. bourses declined during the press conference, falling to 456 million shares from an average of 576.8 million during the five previous 15-minute segments ...”

9. Adler, J., “Raging Bulls: How Wall Street Got Addicted to Light-Speed Trading.” Wired. August 3, 2012. http://www.wired.com/business/2012/08/ff_wallstreet_trading/all/.

10. http://www.businessweek.com/articles/2012-03-29/trading-at-the-speed-of-light.

11. Kyle, Albert, “High Frequency Trading in Electronic Markets: Implications for Public Policy.” Quantitative Finance on Fridays Seminar, University of Illinois, Chicago, August 26, 2011. http://www.uic.edu/cba/icfd/20110826_Kyle_UIC_07.pdf.

12. Ibid.

13. Ibid.

14. “SEC May Ticket Speeding Traders.” Wall Street Journal, February 23, 2012. http://online.wsj.com/article/SB10001424052970203918304577239440668644280.html.

15. Easley, D., M. Lopez de Prado, and M. O’Hara, “The Volume Clock: Insights into the High Frequency Paradigm.” (March 30, 2012). The Journal of Portfolio Management (Fall, 2012); Johnson School Research Paper Series No. 9-2012. Available at SSRN: http://ssrn.com/abstract=2034858 or http://dx.doi.org/10.2139/ssrn.2034858.

16. Ibid.

17. Ibid.

18. Hunt v. New York Cotton Exchange, 205 US 322 - 1907.

19. Honan, T., “Payrolls Decline More Than Forecast as Teachers Fired.” Bloomberg News, October 8, 2010. http://www.bloomberg.com/news/2010-10-08/employers-in-u-s-cut-more-jobs-in-september-than-economists-had-estimated.html.

20. Boehmer, E., K. Y. L. Fong, and J. Wu, “International Evidence on Algorithmic Trading.” (March 14, 2012). Available at SSRN http://ssrn.com/abstract=2022034 or http://dx.doi.org/10.2139/ssrn.2022034.

21. Zweig, J., “Back to the Future: Lessons from the Forgotten ‘Flash Crash’ of 1962.” Wall Street Journal, May 29, 2010. http://online.wsj.com/article/SB10001424052748703957604575272791511469272.html.

22. Brokers in the foreign exchange markets have attempted to reduce the perceived adverse influence of HFT by restricting certain types of orders. The Financial Times reported on July 11, 2012, that the brokers: “...are hitting back against the growth of ultra-fast traders in the forex market by clamping down on potential predatory practices...such as ‘flash orders[md]automatic trades made at lightning speed....” “Forex brokers curb ultra-fast traders,” by Phillip Stafford and Michael Mackenzie, Financial Times, July 11, 2012.

23. Brogaard, J., T. Hendershott, and R. Riordan, “High Frequency Trading and Price Discovery.” (July 30, 2012). Available at SSRN: http://ssrn.com/abstract=1928510 or http://dx.doi.org/10.2139/ssrn.1928510.

Menkveld, A.J., “High Frequency Trading and the New-Market Makers.” (February 6, 2012). EFA 2011 Paper; AFA 2012 Paper; EFA 2011 Paper. Available at SSRN at http://ssrn.com/abstract=1722924 or http://dx.doi.org/10.2139/ssrn.1722924.

Chaboud, A., E. Hjalmarsson, C. Vega, and B. Chiquoine, “Rise of the Machines: Algorithmic Trading in the Foreign Exchange Market.” (June 13, 2011). FRB International Finance Discussion Paper No. 980. Available at SSRN: http://ssrn.com/abstract=1501135 or http://dx.doi.org/10.2139/ssrn.1501135.

24. Boehmer, E., K. Y. L. Fong, and J. Wu, “International Evidence on Algorithmic Trading.” (March 14, 2012). Available at SSRN: http://ssrn.com/abstract=2022034 or http://dx.doi.org/10.2139/ssrn.2022034.

Zhang, F., “High Frequency Trading, Stock Volatility, and Price Discovery.” (December 2010). Available at SSRN: http://ssrn.com/abstract=1691679 or http://dx.doi.org/10.2139/ssrn.1691679.

25. Easley, D., M. Lopez de Prado, and M. O’Hara, “The Volume Clock: Insights into the High Frequency Paradigm.” (March 30, 2012). The Journal of Portfolio Management (Fall 2012), Johnson School Research Paper Series No. 9-2012. Available at SSRN: http://ssrn.com/abstract=2034858 or http://dx.doi.org/10.2139/ssrn.2034858. An analysis of the time and sales data shows that the price immediately before the announcement was 126.9675 or 126 and 62/64.

The first trade after the announcement was 127 and 4/64. This represents a jump of 6/64 or $93.75 per contract ($15.625 × 6). Prices then rose 1/64 each time prices changed and reached 127 and 17/64 71 milliseconds later. Prices fell by 2/64 and then by 5/64 and then by 6/64 within 12 milliseconds after the high before declining by 1/64 in two steps to 127 2/64 18 milliseconds after the high. Prices started to rise again jumping by 3/64 and then by 1/64 and then by 7/64 before falling by 1/64 and then by 4/64 only to rise by 9/64 to 127 and 17/64—the previous high. This second high was reached 31 milliseconds after the identical first high. Much of the price action for the second high occurred during a single millisecond. The range during this millisecond was 11/64. After remaining at 127 17/64 for 34 milliseconds, the price suddenly plunged by 7/64 and then by another 4/64 only to rise by 11/64 in the next trade. Prices bounced around falling to 127 4/64 only to rise to 127 12/64 417 milliseconds after the announcement was made.