| Chapter 1 | Accounting in Action |

The Navigator is a learning system designed to prompt you to use the learning aids in the chapter and set priorities as you study.

Learning Objectives give you a framework for learning the specific concepts covered in the chapter.

Learning Objectives

After studying this chapter, you should be able to:

1 Explain what accounting is.

2 Identify the users and uses of accounting.

3 Understand why ethics is a fundamental business concept.

4 Explain accounting standards and the measurement principles.

5 Explain the monetary unit assumption and the economic entity assumption.

6 State the accounting equation, and define its components.

7 Analyze the effects of business transactions on the accounting equation.

8 Understand the four financial statements and how they are prepared.

![]()

Feature Story

Knowing the Numbers

Many students who take this course do not plan to be accountants. If you are in that group, you might be thinking, “If I'm not going to be an accountant, why do I need to know accounting?” In response, consider the quote from Harold Geneen, the former chairman of a major international company: “To be good at your business, you have to know the numbers—cold.”

Success in any business comes back to the numbers. You will rely on them to make decisions, and managers will use them to evaluate your performance. That is true whether your job involves marketing, production, management, or information systems.

In business, accounting is the means for communicating the numbers. If you don't know how to read financial statements, you can't really know your business.

Many companies spend significant resources teaching their employees basic accounting so that they can read financial statements and understand how their actions affect the company's financial results. Employers need managers in all areas of the company to be “financially literate.”

Taking this course will go a long way to making you financially literate. In this book, you will learn how to read and prepare financial statements, and how to use basic tools to evaluate financial results.

Appendices A, B, and C of this textbook provide real financial statements of three companies from different countries that report under International Financial Reporting Standards (IFRS): Samsung Electronics Co., Ltd. (KOR), Nestlé S.A. (CHE), and Zetar plc (GBR). Throughout this textbook, we increase your familiarity with financial reporting by providing numerous references, questions, and exercises that encourage you to explore these financial statements. In addition, we encourage you to visit each company's website where you can view its complete annual report. In examining the financial reports of these three companies, you will see that the accounting practices of companies in specific countries that follow IFRS sometimes differ with regard to particular details. However, more importantly, you will find that the basic accounting principles are the same. As a result, by learning these basic principles, as presented in this textbook, you will be well equipped to begin understanding the financial results of companies around the world.

The Feature Story helps you picture how the chapter topic relates to the real world of accounting and business. You will find references to the story throughout the chapter.

![]()

Preview of Chapter 1

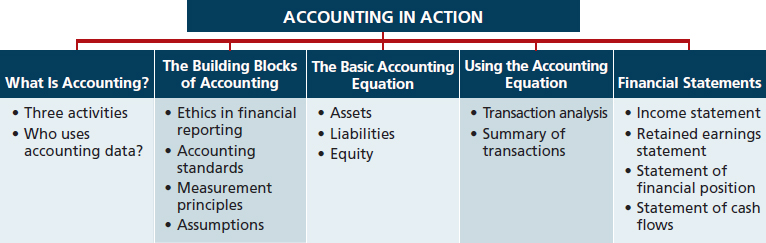

The Feature Story highlights the importance of having good financial information and knowing how to use it to make effective business decisions. Whatever your pursuits or occupation, the need for financial information is inescapable. You cannot earn a living, spend money, buy on credit, make an investment, or pay taxes without receiving, using, or dispensing financial information. Good decision-making depends on good information.

The purpose of this chapter is to show you that accounting is the system used to provide useful financial information. The content and organization of Chapter 1 are as follows.

The Preview describes and outlines the major topics and subtopics you will see in the chapter.

![]()

What Is Accounting?

LEARNING OBJECTIVE 1

Explain what accounting is.

What consistently ranks as one of the top career opportunities in business? What frequently rates among the most popular majors on campus? Accounting.1 Why do people choose accounting? They want to acquire the skills needed to understand what is happening financially inside a company. Accounting is the financial information system that provides these insights. In short, to understand an organization of any type, you have to know the numbers.

Essential terms are printed in blue when they first appear, and are defined in the end-of-chapter glossary.

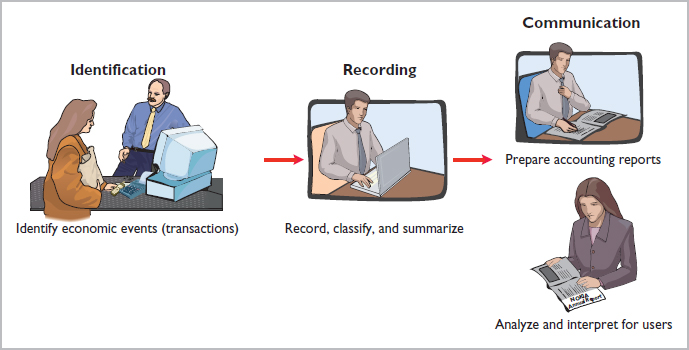

Accounting consists of three basic activities—it identifies, records, and communicates the economic events of an organization to interested users. Let's take a c loser look at these three activities.

Three Activities

As a starting point to the accounting process, a company identifies the economic events relevant to its business. Examples of economic events are the sale of food and snacks by Unilever (GBR and NLD), the providing of telephone services by Chunghwa Telecom (TWN), and the manufacture of motor vehicles by Tata Motors (IND).

Once a company like Unilever identifies economic events, it records those events in order to provide a history of its financial activities. Recording consists of keeping a systematic, chronological diary of events, measured in monetary units. In recording, Unilever also classifies and summarizes economic events.

Finally, Unilever communicates the collected information to interested users by means of accounting reports. The most common of these reports are called financial statements. To make the reported financial information meaningful, Unilever reports the recorded data in a standardized way. It accumulates information resulting from similar transactions. For example, Unilever accumulates all sales transactions over a certain period of time and reports the data as one amount in the company's financial statements. Such data are said to be reported in the aggregate. By presenting the recorded data in the aggregate, the accounting process simplifies a multitude of transactions and makes a series of activities understandable and meaningful.

A vital element in communicating economic events is the accountant's ability to analyze and interpret the reported information. Analysis involves use of ratios, percentages, graphs, and charts to highlight significant financial trends and relationships. Interpretation involves explaining the uses, meaning, and limitations of reported data. Appendix A of this textbook shows the financial statements of Samsung Electronics (KOR). Appendix B illustrates the financial statements of Nestlé (CHE), and Appendix C includes the financial statements of Zetar (GBR). We refer to these statements at various places throughout the textbook. (In addition, in the Another Perspective section at the end of each chapter, the U.S. company Tootsie Roll Industries is analyzed.) At this point, these financial statements probably strike you as complex and confusing. By the end of this course, you'll be surprised at your ability to understand, analyze, and interpret them.

Illustration 1-1 summarizes the activities of the accounting process.

Illustration 1-1 The activities of the accounting process

You should understand that the accounting process includes the bookkeeping function. Bookkeeping usually involves only the recording of economic events. It is therefore just one part of the accounting process. In total, accounting involves the entire process of identifying, recording, and communicating economic events.2

Who Uses Accounting Data?

LEARNING OBJECTIVE 2

Identify the users and uses of accounting.

The specific financial information that a user needs depends upon the kinds of decisions the user makes. There are two broad groups of users of financial information: internal users and external users.

INTERNAL USERS

Internal users of accounting information are managers who plan, organize, and run the business. These include marketing managers, production supervisors, finance directors, and company officers. In running a business, internal users must answer many important questions, as shown in Illustration 1-2.

Illustration 1-2 Questions that internal users ask

To answer these and other questions, internal users need detailed information on a timely basis. Managerial accounting provides internal reports to help users make decisions about their companies. Examples are financial comparisons of operating alternatives, projections of income from new sales campaigns, and forecasts of cash needs for the next year.

EXTERNAL USERS

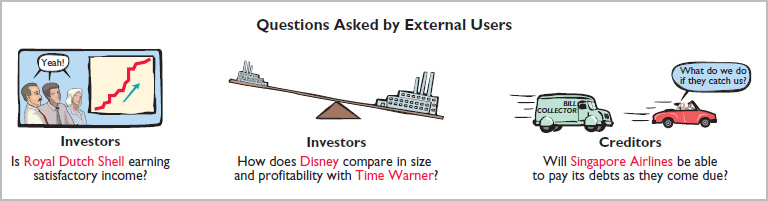

External users are individuals and organizations outside a company who want financial information about the company. The two most common types of external users are investors and creditors. Investors (owners) use accounting information to make decisions to buy, hold, or sell ownership shares of a company. Creditors (such as suppliers and bankers) use accounting information to evaluate the risks of granting credit or lending money. Illustration 1-3 shows some questions that investors and creditors may ask.

Illustration 1-3 Questions that external users ask

Financial accounting answers these questions. It provides economic and financial information for investors, creditors, and other external users. The information needs of external users vary considerably. Taxing authorities, such as the State Administration of Taxation in the People's Republic of China (CHN), want to know whether the company complies with tax laws. Regulatory agencies, such as the Autorité des Marchés Financiers (FRA) or the Federal Trade Commission (USA), want to know whether the company is operating within prescribed rules. Customers are interested in whether a company like General Motors (USA) will continue to honor product warranties and support its product lines. Labor unions, such as the German Confederation of Trade Unions (DEU), want to know whether the companies have the ability to pay increased wages and benefits to union members.

The Building Blocks of Accounting

A doctor follows certain standards in treating a patient's illness. An architect follows certain standards in designing a building. An accountant follows certain standards in reporting financial information. For these standards to work, a fundamental business concept must be at work—ethical behavior.

Ethics in Financial Reporting

LEARNING OBJECTIVE 3

Understand why ethics is a fundamental business concept.

People won't gamble in a casino if they think it is “rigged.” Similarly, people won't play the securities market if they think share prices are rigged. In recent years, the financial press has been full of articles about financial scandals at Enron (USA), Parmalat (ITA), Satyam Computer Services (IND), AIG (USA), and others. As the scandals came to light, mistrust of financial reporting in general grew. One article in the financial press noted that “repeated disclosures about questionable accounting practices have bruised investors' faith in the reliability of earnings reports, which in turn has sent share prices tumbling.” Imagine trying to carry on a business or invest money if you could not depend on the financial statements to be honestly prepared. Information would have no credibility. There is no doubt that a sound, well-functioning economy depends on accurate and dependable financial reporting.

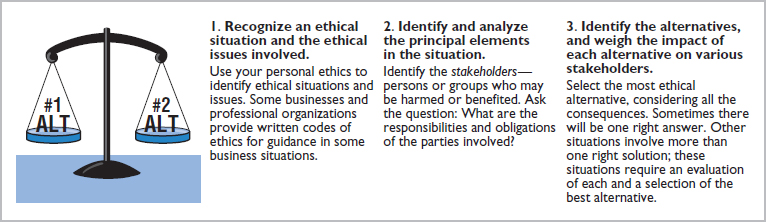

The standards of conduct by which one's actions are judged as right or wrong, honest or dishonest, fair or not fair, are ethics. Effective financial reporting depends on sound ethical behavior. To sensitize you to ethical situations in business and to give you practice at solving ethical dilemmas, we address ethics in a number of ways in this book:

- A number of the Feature Stories and other parts of the textbook discuss the central importance of ethical behavior to financial reporting.

- Ethics Insight boxes and marginal Ethics Notes highlight ethics situations and issues in actual business settings.

- Many of the People, Planet, and Profit Insight boxes focus on ethical issues that companies face in measuring and reporting social and environmental issues.

- At the end of the chapter, an Ethics Case simulates a business situation and asks you to put yourself in the position of a decision-maker in that case.

When analyzing these various ethics cases, as well as experiences in your own life, it is useful to apply the three steps outlined in Illustration 1-4.

Illustration 1-4 Steps in analyzing ethics cases and situations

Insights provide examples of business situations from various perspectives—ethics, investor, international, and corporate social responsibility.

ETHICS INSIGHT ![]()

The Numbers Behind Not-for-Profit Organizations

Accounting plays an important role for a wide range of business organizations worldwide. Just as the integrity of the numbers matters for business, it matters at least as much for not-for-profit organizations. Proper control and reporting help ensure that money is used the way donors intended. Donors are less inclined to give to an organization if they think the organization is subject to waste or theft. The accounting challenges of some large international not-for-profits rival those of the world's largest businesses. For example, after the Haitian earthquake, the Haitian-born musician Wyclef Jean was criticized for the poor accounting controls in a relief fund that he founded. Since then, he has hired a new accountant and improved the transparency regarding funds raised and spent.

![]() What benefits does a sound accounting system provide to a not-for-profit organization? (See page 46.)

What benefits does a sound accounting system provide to a not-for-profit organization? (See page 46.)

Accounting Standards

LEARNING OBJECTIVE 4

Explain accounting standards and the measurement principles.

In order to ensure high-quality financial reporting, accountants present financial statements in conformity with accounting standards that are issued by standard-setting bodies. Presently, there are two primary accounting standard-setting bodies—the International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB). More than 130 countries follow standards referred to as International Financial Reporting Standards (IFRS). IFRSs are determined by the IASB. The IASB is headquartered in London, with its 15 board members drawn from around the world. Most companies in the United States follow standards issued by the FASB, referred to as generally accepted accounting principles (GAAP).

As markets become more global, it is often desirable to compare the results of companies from different countries that report using different accounting standards. In order to increase comparability, in recent years the two standard-setting bodies have made efforts to reduce the differences between IFRS and U.S. GAAP. This process is referred to as convergence. As a result of these convergence efforts, it is likely that someday there will be a single set of high-quality accounting standards that are used by companies around the world. Because convergence is such an important issue, we provide at the end of each chapter a section called Another Perspective, to provide a comparison with IFRS.

Measurement Principles

Helpful Hint

Relevance and faithful representation are two primary qualities that make accounting information useful for decision-making.

IFRS generally uses one of two measurement principles, the historical cost principle or the fair value principle. Selection of which principle to follow generally relates to trade-offs between relevance and faithful representation. Relevance means that financial information is capable of making a difference in a decision. Faithful representation means that the numbers and descriptions match what really existed or happened—they are factual.

Helpful Hints further clarify concepts being discussed.

HISTORICAL COST PRINCIPLE

The historical cost principle (or cost principle) dictates that companies record assets at their cost. This is true not only at the time the asset is purchased, but also over the time the asset is held. For example, if Gazprom (RUS) purchases land for ![]() 300,000, the company initially reports it in its accounting records at

300,000, the company initially reports it in its accounting records at ![]() 300,000. But what does Gazprom do if, by the end of the next year, the fair value of the land has increased to

300,000. But what does Gazprom do if, by the end of the next year, the fair value of the land has increased to ![]() 400,000? Under the historical cost principle, it continues to report the land at

400,000? Under the historical cost principle, it continues to report the land at ![]() 300,000.

300,000.

FAIR VALUE PRINCIPLE

The fair value principle states that assets and liabilities should be reported at fair value (the price received to sell an asset or settle a liability). Fair value information may be more useful than historical cost for certain types of assets and liabilities. For example, certain investment securities are reported at fair value because market value information is usually readily available for these types of assets. In determining which measurement principle to use, companies weigh the factual nature of cost figures versus the relevance of fair value. In general, even though IFRS allows companies to revalue property, plant, and equipment and other long-lived assets to fair value, most companies choose to use cost. Only in situations where assets are actively traded, such as investment securities, do companies apply the fair value principle extensively.

The Korean Discount

If you think that accounting standards don't matter, consider recent events in South Korea. International investors expressed concerns that the financial reports of some South Korean companies were inaccurate. Accounting practices sometimes resulted in differences between stated revenues and actual revenues. Because investors did not have complete faith in the accuracy of the numbers, they were unwilling to pay as much for the shares of these companies relative to shares of comparable companies in different countries. This difference in share price was referred to as the “Korean discount.”

In response, Korean regulators decided to require companies to comply with international accounting standards. This change was motivated by a desire to “make the country's businesses more transparent” in order to build investor confidence and spur economic growth. Many other Asian countries, including China, India, Japan, and Hong Kong, have also decided either to adopt international standards or to create standards that are based on the international standards.

Source: Evan Ramstad, “ End to ‘Korea Discount'?” Wall Street Journal (March 16, 2007).

![]() What is meant by the phrase “make the country's businesses more transparent”?

What is meant by the phrase “make the country's businesses more transparent”?

Why would increasing transparency spur economic growth? (See page 46.)

Assumptions

LEARNING OBJECTIVE 5

Explain the monetary unit assumption and the economic entity assumption.

Assumptions provide a foundation for the accounting process. Two main assumptions are the monetary unit assumption and the economic entity assumption.

MONETARY UNIT ASSUMPTION

The monetary unit assumption requires that companies include in the accounting records only transaction data that can be expressed in money terms. This assumption enables accounting to quantify (measure) economic events. The monetary unit assumption is vital to applying the historical cost principle.

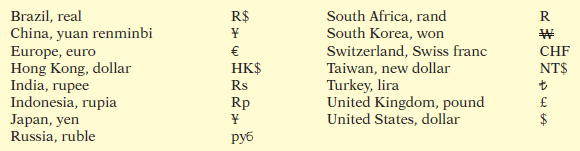

This assumption prevents the inclusion of some relevant information in the accounting records. For example, the health of a company's owner, the quality of service, and the morale of employees are not included. The reason: Companies cannot quantify this information in money terms. Though this information is important, companies record only events that can be measured in money. Throughout this textbook, we use a variety of currencies in our examples and end-of-chapter materials. The currencies and the associated country or region are shown in Illustration 1-5.

Illustration 1-5 Currencies used in this textbook

ECONOMIC ENTITY ASSUMPTION

Ethics Notes help sensitize you to some of the ethical issues in accounting.

An economic entity can be any organization or unit in society. It may be a company [such as Telefónica (ESP)], a governmental unit (the city-state of Singapore), a municipality (Toronto, Canada), a school district (St. Louis District 48), or a church (Southern Baptist). The economic entity assumption requires that the activities of the entity be kept separate and distinct from the activities of its owner and all other economic entities. To illustrate, Sally Rider, owner of Sally's Boutique, must keep her personal living costs separate from the expenses of the boutique. Similarly, Metro (DEU) and Coca-Cola (USA) are segregated into separate economic entities for accounting purposes.

![]() Ethics Note

Ethics Note

The importance of the economic entity assumption is illustrated by scandals involving Adelphia (USA). In this case, senior company employees entered into transactions that blurred the line between the employees' financial interests and those of the company. For example, Adelphia guaranteed over $2 billion of loans to the founding family.

PROPRIETORSHIP A business owned by one person is generally a proprietorship. The owner is often the manager/operator of the business. Small service-type businesses (plumbing companies, beauty salons, and auto repair shops), farms, and small retail stores (antique shops, clothing stores, and used-book stores) are often proprietorships. Usually only a relatively small amount of money (capital) is necessary to start in business as a proprietorship. The owner (proprietor) receives any profits, suffers any losses, and is personally liable for all debts of the business. There is no legal distinction between the business as an economic unit and the owner, but the accounting records of the business activities are kept separate from the personal records and activities of the owner.

PARTNERSHIP A business owned by two or more persons associated as partners is a partnership. In most respects a partnership is like a proprietorship except that more than one owner is involved. Typically a partnership agreement (written or oral) sets forth such terms as initial investment, duties of each partner, division of net income (or net loss), and settlement to be made upon death or withdrawal of a partner. Each partner generally has unlimited personal liability for the debts of the partnership. Like a proprietorship, for accounting purposes the partnership transactions must be kept separate from the personal activities of the partners. Partnerships are often used to organize retail and service-type businesses, including professional practices (lawyers, doctors, architects, and chartered public accountants).

CORPORATION A business organized as a separate legal entity under corporation law and having ownership divided into transferable shares is a corporation. The holders of the shares (shareholders) enjoy limited liability; that is, they are not personally liable for the debts of the corporate entity. Shareholders may transfer all or part of their ownership shares to other investors at any time (i.e., sell their shares). The ease with which ownership can change adds to the attractiveness of investing in a corporation. Because ownership can be transferred without dissolving the corporation, the corporation enjoys an unlimited life.

Although the combined number of proprietorships and partnerships in the world significantly exceeds the number of corporations, the revenue produced by corporations is much greater. Most of the largest companies in the world—for example, ING (NLD), Royal Dutch Shell (GBR and NLD), Wal-Mart Stores Inc. (USA), Fortis (BEL), and Toyota (JPN)—are corporations.

Basic Concepts

Indicate whether each of the five statements presented below is true or false.

- The three steps in the accounting process are identification, recording, and communication.

- The two most common types of external users are investors and company officers.

- Shareholders in a corporation enjoy limited legal liability as compared to partners in a partnership.

- The primary accounting standard-setting body outside the United States is the International Accounting Standards Board (IASB).

- The historical cost principle dictates that companies record assets at their cost. In later periods, however, the fair value of the asset must be used if fair value is higher than its cost.

The DO IT! exercises ask you to put newly acquired knowledge to work. They outline the Action Plan necessary to complete the exercise, and they show a Solution.

Action Plan

- Review the basic concepts learned to date.

- Develop an understanding of the key terms used.

Solution

1. True 2. False. The two most common types of external users are investors and creditors. 3. True. 4. True. 5. False. The historical cost principle dictates that companies record assets at their cost. Under the historical cost principle, the company must also use cost in later periods.

Related exercise material: E1-1, E1-2, E1-3, E1-4, and ![]() 1-1.

1-1.

![]()

ACCOUNTING ACROSS THE ORGANIZATION ![]()

Spinning the Career Wheel

One question that students frequently ask is, “How will the study of accounting help me?” It should help you a great deal because a working knowledge of accounting is desirable for virtually every field of endeavor. Some examples of how accounting is used in other careers include:

General management: Imagine running Volkswagen (DEU), Massachusetts General Hospital (USA), a Subway (USA) franchise, or a Fuji (JPN) bike shop. All general managers need to understand where the enterprise's cash comes from and where it goes in order to make wise business decisions.

Marketing: A marketing specialist at a company like Hyundai Motor (KOR) develops strategies to help the sales force be successful. But making a sale is meaningless unless it is a profitable sale. Marketing people must be sensitive to costs and benefits, which accounting helps them quantify and understand.

Finance: Do you want to be a banker for Société Générale (FRA) or an investment analyst for Goldman Sachs (USA)? These fields rely heavily on accounting. In all of them, you will regularly examine and analyze financial statements. In fact, it is difficult to get a good finance job without two or three courses in accounting.

Real estate: Are you interested in being a real estate broker for Prudential Real Estate (USA)? Because a third party—the bank—is almost always involved in financing a real estate transaction, brokers must understand the numbers involved: Can the buyer afford to make the payments to the bank? Does the cash flow from an industrial property justify the purchase price? What are the tax benefits of the purchase?

![]() How might accounting help you? (See page 47.)

How might accounting help you? (See page 47.)

The Basic Accounting Equation

LEARNING OBJECTIVE 6

State the accounting equation, and define its components.

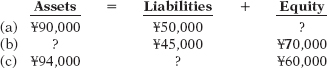

The two basic elements of a business are what it owns and what it owes. Assets are the resources a business owns. For example, adidas (DEU) has total assets of approximately €10.6 billion. Liabilities and owner's equity are the rights or claims against these resources. Thus, adidas has €10.6 billion of claims against its €10.6 billion of assets. Claims of those to whom the company owes money (creditors) are called liabilities. Claims of owners are called equity. adidas has liabilities of €6.0 billion and equity of €4.6 billion.

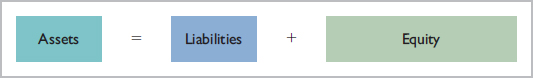

We can express the relationship of assets, liabilities, and equity as an equation, as shown in Illustration 1-6.

Illustration 1-6 The basic accounting equation

This relationship is the basic accounting equation. Assets must equal the sum of liabilities and equity.

The accounting equation applies to all economic entities regardless of size, nature of business, or form of business organization. It applies to a small proprietorship such as a corner grocery store as well as to a giant corporation such as adidas. The equation provides the underlying framework for recording and summarizing economic events.

Let's look in more detail at the categories in the basic accounting equation.

Assets

As noted above, assets are resources a business owns. The business uses its assets in carrying out such activities as production and sales. The common characteristic possessed by all assets is the capacity to provide future services or benefits. In a business, that service potential or future economic benefit eventually results in cash inflows (receipts). For example, consider Campus Pizza, a local restaurant. It owns a delivery truck that provides economic benefits from delivering pizzas. Other assets of Campus Pizza are tables, chairs, jukebox, cash register, oven, tableware, and, of course, cash.

Liabilities

Liabilities are claims against assets—that is, existing debts and obligations. Businesses of all sizes usually borrow money and purchase merchandise on credit. These economic activities result in payables of various sorts:

- Campus Pizza, for instance, purchases cheese, sausage, flour, and beverages on credit from suppliers. These obligations are called accounts payable.

- Campus Pizza also has a note payable to First National Bank for the money borrowed to purchase the delivery truck.

- Campus Pizza may also have salaries and wages payable to employees and sales and real estate taxes payable to the local government.

All of these persons or entities to whom Campus Pizza owes money are its creditors.

Creditors may legally force the liquidation of a business that does not pay its debts. In that case, the law requires that creditor claims be paid before ownership claims.

Equity

The ownership claim on total assets is equity. It is equal to total assets minus total liabilities. Here is why: The assets of a business are claimed by either creditors or shareholders. To find out what belongs to shareholders, we subtract creditors' claims (the liabilities) from the assets. The remainder is the shareholders' claim on the assets—equity. It is often referred to as residual equity—that is, the equity “left over” after creditors' claims are satisfied.

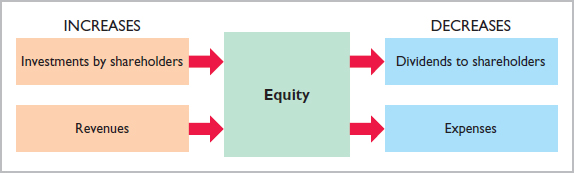

Equity generally consists of (1) share capital—ordinary and (2) retained earnings.

SHARE CAPITAL—ORDINARY

A corporation may obtain funds by selling ordinary shares to investors. Share capital—ordinary is the term used to describe the amounts paid in by shareholders for the ordinary shares they purchase.

RETAINED EARNINGS

Retained earnings is determined by three items: revenues, expenses, and dividends.

Helpful Hint

The effect of revenues is positive—an increase in equity coupled with an increase in assets or a decrease in liabilities.

REVENUES Revenues are the gross increases in equity resulting from business activities entered into for the purpose of earning income. Generally, revenues result from selling merchandise, performing services, renting property, and lending money.

Revenues usually result in an increase in an asset. They may arise from different sources and are called various names depending on the nature of the business. Campus Pizza, for instance, has two categories of sales revenues—pizza sales and beverage sales. Other titles for and sources of revenue common to many businesses are sales, fees, services, commissions, interest, dividends, royalties, and rent.

Helpful Hint

The effect of expenses is negative—a decrease in equity coupled with a decrease in assets or an increase in liabilities.

EXPENSES Expenses are the cost of assets consumed or services used in the process of earning revenue. They are decreases in equity that result from operating the business. Like revenues, expenses take many forms and are called various names depending on the type of asset consumed or service used. For example, Campus Pizza recognizes the following types of expenses: cost of ingredients (flour, cheese, tomato paste, meat, mushrooms, etc.); cost of beverages; wages expense; utilities expense (electric, gas, and water expense); telephone expense; delivery expense (gasoline, repairs, licenses, etc.); supplies expense (napkins, detergents, aprons, etc.); rent expense; interest expense; and property tax expense.

DIVIDENDS Net income represents an increase in net assets which is then available to distribute to shareholders. The distribution of cash or other assets to shareholders is called a dividend. Dividends reduce retained earnings. However, dividends are not an expense. A corporation first determines its revenues and expenses and then computes net income or net loss. If it has net income, and decides it has no better use for that income, a corporation may decide to distribute a dividend to its owners (the shareholders).

In summary, the principal sources (increases) of equity are investments by shareholders and revenues from business operations. In contrast, reductions (decreases) in equity result from expenses and dividends. These relationships are shown in Illustration 1-7 (page 14).

Illustration 1-7 Increases and decreases in equity

![]() DO IT!

DO IT!

Equity Effects

Classify the following items as issuance of shares (I), dividends (D), revenues (R), or expenses (E). Then indicate whether each item increases or decreases equity.

(1) Rent Expense

(2) Service Revenue

(3) Dividends

(4) Salaries and Wages Expense

Action Plan

- Understand the sources of revenue.

- Understand what causes expenses.

- Review the rules for changes in equity: Investments and revenues increase equity. Expenses and dividends decrease equity.

- Recognize that dividends are distributions of cash or other assets to shareholders.

Solution

1. Rent Expense is an expense (E); it decreases equity. 2. Service Revenue is a revenue (R); it increases equity. 3. Dividends is a distribution to shareholders (D); it decreases equity. 4. Salaries and Wages Expense is an expense (E); it decreases equity.

Related exercise material: BE1-1, BE1-2, BE1-3, BE1-4, BE1-5, BE1-8, BE1-9, E1-5, E1-6, E1-7, and ![]() 1-2.

1-2.

![]()

Using the Accounting Equation

LEARNING OBJECTIVE 7

Analyze the effects of business transactions on the accounting equation.

Transactions (business transactions) are a business's economic events recorded by accountants. Transactions may be external or internal. External transactions involve economic events between the company and some outside enterprise. For example, Campus Pizza's purchase of cooking equipment from a supplier, payment of monthly rent to the landlord, and sale of pizzas to customers are external transactions. Internal transactions are economic events that occur entirely within one company. The use of cooking and cleaning supplies are internal transactions for Campus Pizza.

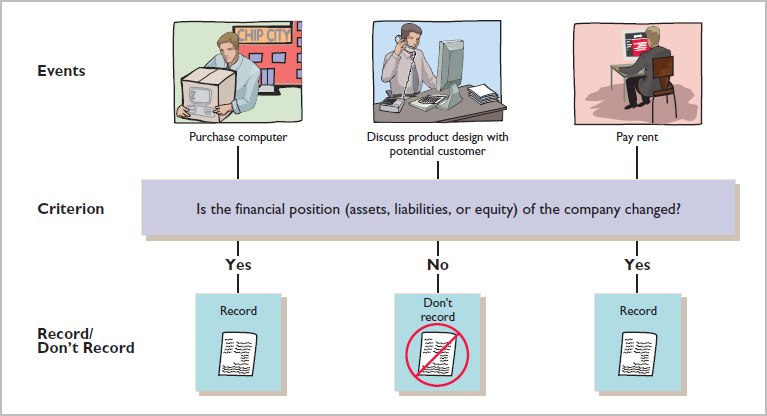

Companies carry on many activities that do not represent business transactions. Examples are hiring employees, answering the telephone, talking with customers, and placing merchandise orders. Some of these activities may lead to business transactions: Employees will earn wages, and suppliers will deliver ordered merchandise. The company must analyze each event to find out if it affects the components of the accounting equation. If it does, the company will record the transaction. Illustration 1-8 demonstrates the transaction-identification process.

Illustration 1-8 Transaction-identification process

Each transaction must have a dual effect on the accounting equation. For example, if an asset is increased, there must be a corresponding (1) decrease in another asset, (2) increase in a specific liability, or (3) increase in equity.

Two or more items could be affected. For example, as one asset is increased $10,000, another asset could decrease $6,000 and a liability could increase $4,000. Any change in a liability or ownership claim is subject to similar analysis.

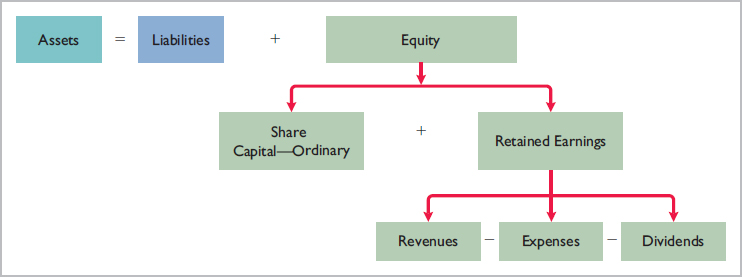

Transaction Analysis

In order to analyze transactions, we will examine a computer programming business (Softbyte Inc.) during its first month of operations. As part of this analysis, we will expand the basic accounting equation. This will allow us to better illustrate the impact of transactions on equity. Recall that equity is comprised of two parts: share capital—ordinary and retained earnings. Share capital—ordinary is affected when the company issues new ordinary shares in exchange for cash. Retained earnings is affected when the company earns revenue, incurs expenses, or pays dividends. Illustration 1-9 (page 16) shows the expanded accounting equation.

If you are tempted to skip ahead after you've read a few of the following transaction analyses, don't do it. Each has something unique to teach, something you'll need later. (We assure you that we've kept them to the minimum needed!)

Illustration 1-9 Expanded accounting equation

Helpful Hint

You will want to study these transactions until you are sure you understand them. They are not difficult, but understanding them is important to your success in this course. The ability to analyze transactions in terms of the basic accounting equation is essential in accounting.

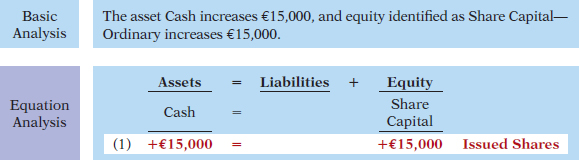

TRANSACTION 1. INVESTMENT BY SHAREHOLDERS Ray and Barbara Neal decide to open a computer programming company that they incorporate as Softbyte Inc. On September 1, 2014, they invest €15,000 cash in the business in exchange for €15,000 of ordinary shares. The ordinary shares indicates the ownership interest that the Neals have in Softbyte Inc. This transaction results in an equal increase in both assets and equity.3

Observe that the equality of the basic equation has been maintained. Note also that the source of the increase in equity (in this case, issued shares) is indicated. Why does this matter? Because investments by shareholders do not represent revenues, and they are excluded in determining net income. Therefore, it is necessary to make clear that the increase is an investment rather than revenue from operations. Additional investments (i.e., investments made by shareholders after the corporation has been initially formed) have the same effect on equity as the initial investment.

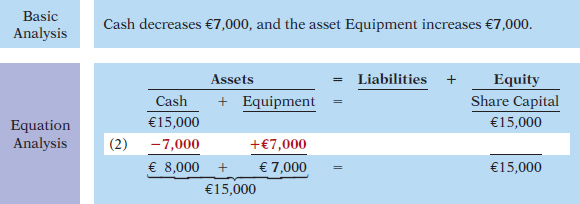

TRANSACTION 2. PURCHASE OF EQUIPMENT FOR CASH Softbyte Inc. purchases computer equipment for €7,000 cash. This transaction results in an equal increase and decrease in total assets, though the composition of assets changes. Observe that total assets are still €15,000. Share Capital—Ordinary also remains at €15,000, the amount of the original investment.

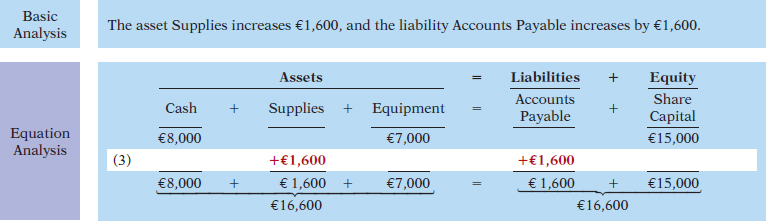

TRANSACTION 3. PURCHASE OF SUPPLIES ON CREDIT Softbyte Inc. purchases for €1,600 from Acme Supply Company computer paper and other supplies expected to last several months. Acme agrees to allow Softbyte to pay this bill in October. This transaction is a purchase on account (a credit purchase). Assets increase because of the expected future benefits of using the paper and supplies, and liabilities increase by the amount due Acme Company.

Total assets are now €16,600. This total is matched by a €1,600 creditor's claim and a €15,000 ownership claim.

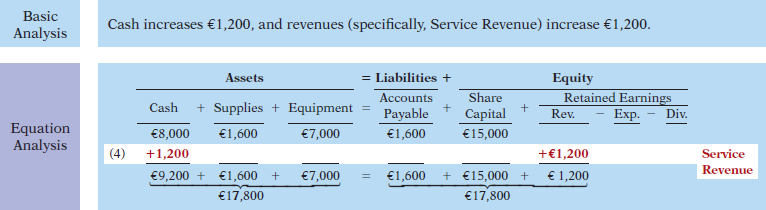

TRANSACTION 4. SERVICES PROVIDED FOR CASH Softbyte Inc. receives €1,200 cash from customers for programming services it has provided. This transaction represents Softbyte's principal revenue-producing activity. Recall that revenue increases equity.

The two sides of the equation balance at €17,800. Service Revenue is included in determining Softbyte's net income.

Note that we do not have room to give details for each individual revenue and expense account in this illustration. Thus, revenues (and expenses when we get to them) are summarized under one column heading for Revenues and one for Expenses. However, it is important to keep track of the category (account) titles affected (e.g., Service Revenue) as they will be needed when we prepare financial statements later in the chapter.

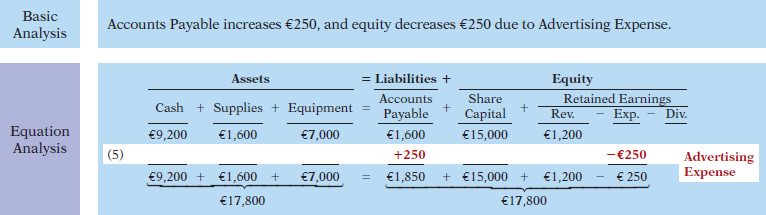

TRANSACTION 5. PURCHASE OF ADVERTISING ON CREDIT Softbyte receives a bill for €250 from the Daily News for advertising but postpones payment until a later date. This transaction results in an increase in liabilities and a decrease in equity.

The two sides of the equation still balance at €17,800. Retained Earnings decreases when Softbyte incurs the expense. Expenses do not have to be paid in cash at the time they are incurred. When Softbyte pays at a later date, the liability Accounts Payable will decrease and the asset Cash will decrease (see Transaction 8). The cost of advertising is an expense (rather than an asset) because Softbyte has used the benefits. Advertising Expense is included in determining net income.

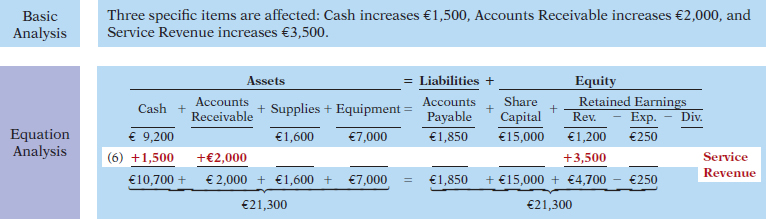

TRANSACTION 6. SERVICES PROVIDED FOR CASH AND CREDIT Softbyte Inc. provides €3,500 of programming services for customers. The company receives cash of €1,500 from customers, and it bills the balance of €2,000 on account. This transaction results in an equal increase in assets and equity.

Softbyte earns revenues when it provides the service, and therefore it recognizes €3,500 in revenue. In exchange for this service, it received €1,500 in Cash and Accounts Receivable of €2,000. This Accounts Receivable represents customers' promise to pay €2,000 to Softbyte in the future. When it later receives collections on account, Softbyte will increase Cash and will decrease Accounts Receivable (see Transaction 9).

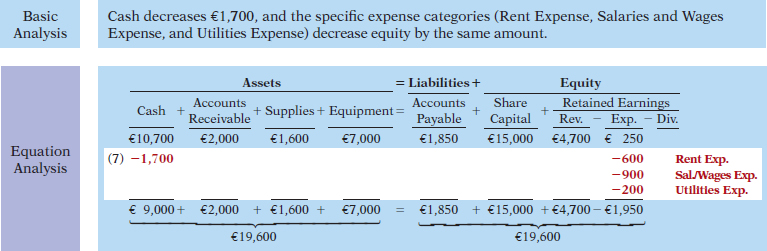

TRANSACTION 7. PAYMENT OF EXPENSES Softbyte pays the following expenses in cash for September: store rent €600, salaries and wages of employees €900, and utilities €200. These payments result in an equal decrease in assets and expenses.

The two sides of the equation now balance at €19,600. Three lines are required in the analysis to indicate the different types of expenses that have been incurred.

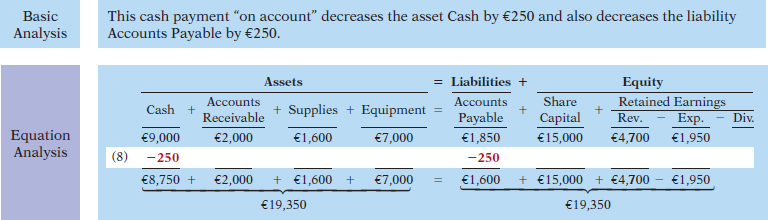

TRANSACTION 8. PAYMENT OF ACCOUNTS PAYABLE Softbyte pays its €250 Daily News bill in cash. The company previously (in Transaction 5) recorded the bill as an increase in Accounts Payable and a decrease in equity.

Observe that the payment of a liability related to an expense that has previously been recorded does not affect equity. Softbyte recorded the expense (in Transaction 5) and should not record it again.

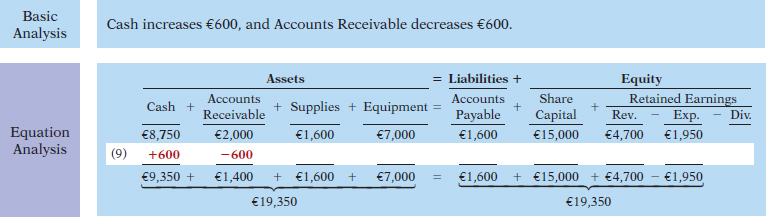

TRANSACTION 9. RECEIPT OF CASH ON ACCOUNT Softbyte receives €600 in cash from customers who had been billed for services (in Transaction 6). This transaction does not change total assets, but it changes the composition of those assets.

Note that the collection of an account receivable for services previously billed and recorded does not affect equity. Softbyte already recorded this revenue (in Transaction 6) and should not record it again.

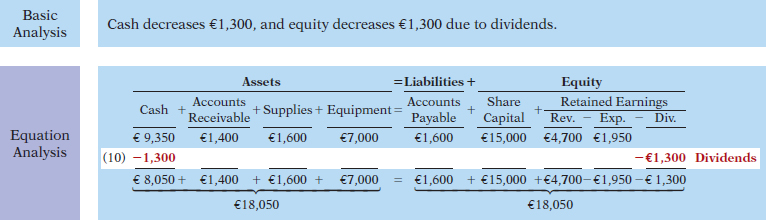

TRANSACTION 10. DIVIDENDS The corporation pays a dividend of €1,300 in cash to Ray and Barbara Neal, the shareholders of Softbyte Inc. This transaction results in an equal decrease in assets and equity.

Note that the dividend reduces retained earnings, which is part of equity. Dividends are not expenses. Like shareholders' investments, dividends are excluded in determining net income.

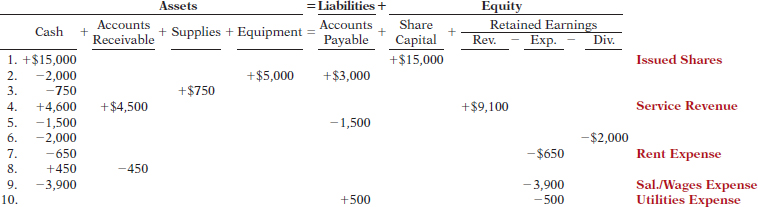

Summary of Transactions

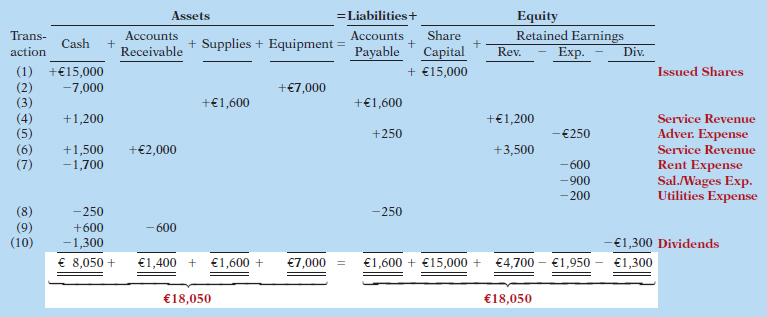

Illustration 1-10 summarizes the September transactions of Softbyte Inc. to show their cumulative effect on the basic accounting equation. It also indicates the transaction number and the specific effects of each transaction. Finally, Illustration 1-10 demonstrates a number of significant facts:

- Each transaction must be analyzed in terms of its effect on:

(a) The three components of the basic accounting equation.

(b) Specific types (kinds) of items within each component.

- The two sides of the equation must always be equal.

- The Share Capital—Ordinary and Retained Earnings columns indicate the causes of each change in the shareholders' claim on assets.

Illustration 1-10 Tabular summary of Softbyte Inc. transactions

There! You made it through transaction analysis. If you feel a bit shaky on any of the transactions, it might be a good idea at this point to get up, take a short break, and come back again for a brief (10- to 15-minute) review of the transactions, to make sure you understand them before you go on to the next section.

![]() DO IT!

DO IT!

Tabular Analysis

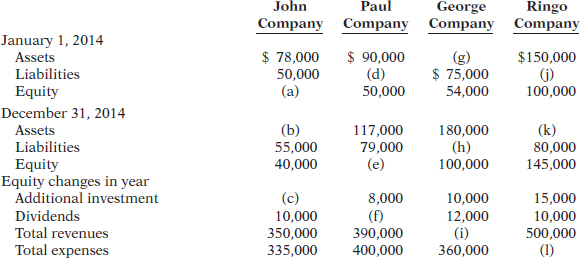

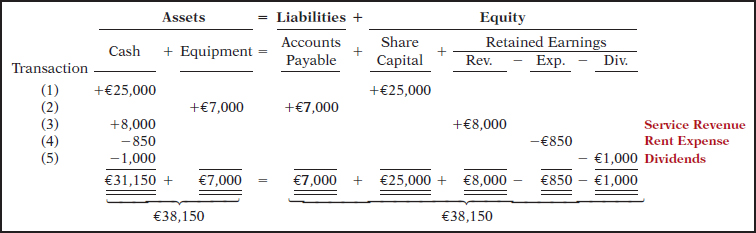

Transactions made by Virmari & Co., a public accounting firm in France, for the month of August are shown below. Prepare a tabular analysis which shows the effects of these transactions on the expanded accounting equation, similar to that shown in Illustration 1-10.

- The company issued ordinary shares for €25,000 cash.

- The company purchased €7,000 of office equipment on credit.

- The company received €8,000 cash in exchange for services performed.

- The company paid €850 for this month's rent.

- The company paid a dividend of €1,000 in cash to shareholders.

Action Plan

- Analyze the effects of each transaction on the accounting equation.

- Use appropriate category names (not descriptions).

- Keep the accounting equation in balance.

Solution

Related exercise material: BE1-6, BE1-7, E1-6, E1-7, E1-8, and ![]() 1-3.

1-3.

![]()

Financial Statements

LEARNING OBJECTIVE 8

Understand the four financial statements and how they are prepared.

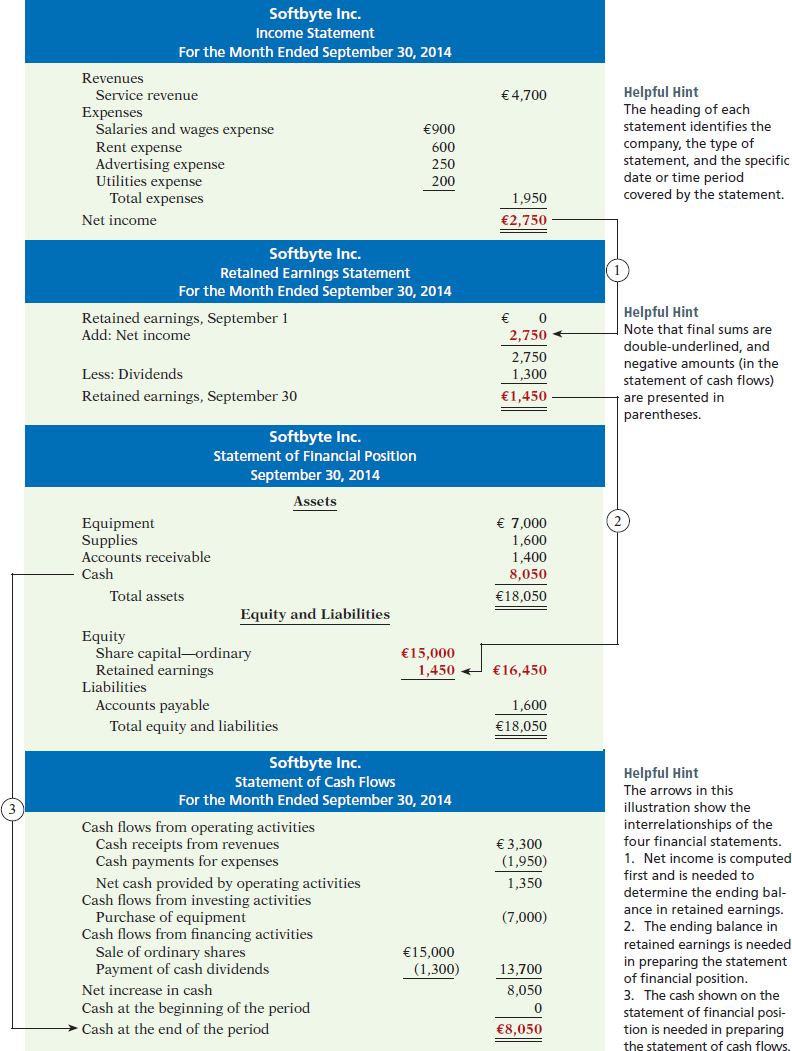

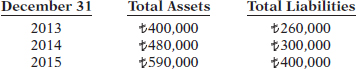

Companies prepare four financial statements from the summarized accounting data:

- An income statement presents the revenues and expenses and resulting net income or net loss for a specific period of time.

- A retained earnings statement summarizes the changes in retained earnings for a specific period of time.

- A statement of financial position (sometimes referred to as a balance sheet) reports the assets, liabilities, and equity of a company at a specific date.

- A statement of cash flows summarizes information about the cash inflows (receipts) and outflows (payments) for a specific period of time.

These statements provide relevant financial data for internal and external users. Illustration 1-11 shows the financial statements of Softbyte Inc. Note that the statements shown in Illustration 1-11 are interrelated:

Helpful Hint

The income statement, retained earnings statement, and statement of cash flows are all for a period of time, whereas the statement of financial position is for a point in time.

- Net income of €2,750 on the income statement is added to the beginning balance of retained earnings in the retained earnings statement.

- Retained earnings of €1,450 at the end of the reporting period shown in the retained earnings statement is reported on the statement of financial position.

- Cash of €8,050 on the statement of financial position is reported on the statement of cash flows.

Also, explanatory notes and supporting schedules are an integral part of every set of financial statements. We illustrate these notes and schedules in later chapters of this textbook.

Be sure to carefully examine the format and content of each statement in Illustration 1-11. We describe the essential features of each in the following sections.

Income Statement

Alternative Terminology

The income statement is sometimes referred to as the statement of operations, earnings statement, or profit and loss statement.

The income statement reports the success or profitability of the company's operations over a specific period of time. For example, Softbyte Inc.'s income statement is dated “For the Month Ended September 30, 2014.” It is prepared from the data appearing in the revenue and expense columns of Illustration 1-10 (page 21). The heading of the statement identifies the company, the type of statement, and the time period covered by the statement.

The income statement lists revenues first, followed by expenses. Finally, the statement shows net income (or net loss). When revenues exceed expenses, net income results. When expenses exceed revenues, a net loss results.

Alternative Terminology notes present synonymous terms that you may come across in practice.

Although practice varies, we have chosen to list expenses in order of magnitude in our illustrations. (We will consider alternative formats for the income statement in later chapters.)

Note that the income statement does not include investment and dividend transactions between the shareholders and the business in measuring net income. For example, as explained earlier, the cash dividend from Softbyte Inc. was not regarded as a business expense. This type of transaction is considered a reduction of retained earnings, which causes a decrease in equity.

Retained Earnings Statement

Softbyte Inc.'s retained earnings statement reports the changes in retained earnings for a specific period of time. The time period is the same as that covered by the income statement (“For the Month Ended September 30, 2014”). Data for the preparation of the retained earnings statement come from the retained earnings columns of the tabular summary (Illustration 1-10) and from the income statement (Illustration 1-11).

Illustration 1-11 Financial statements and their interrelationships

The first line of the statement shows the beginning retained earnings amount. Then come net income and dividends. The retained earnings ending balance is the final amount on the statement. The information provided by this statement indicates the reasons why retained earnings increased or decreased during the period. If there is a net loss, it is deducted with dividends in the retained earnings statement.

Statement of Financial Position

Softbyte Inc.'s statement of financial position reports the assets, liabilities, and equity at a specific date (September 30, 2014). The company prepares the statement of financial position from the column headings and the month-end data shown in the last line of the tabular summary (Illustration 1-10).

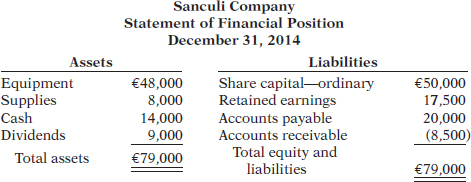

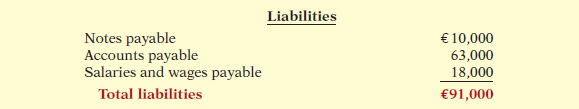

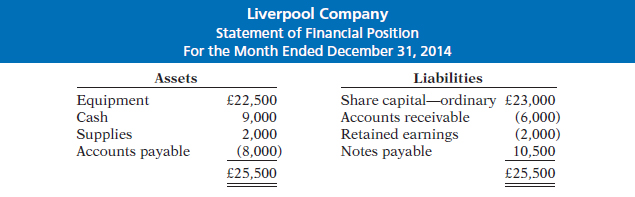

Observe that the statement of financial position lists assets at the top, followed by equity and then liabilities. Total assets must equal total equity and liabilities. Softbyte Inc. reports only one liability, Accounts Payable, on its statement of financial position. In most cases, there will be more than one liability. When two or more liabilities are involved, a customary way of listing is as shown in Illustration 1-12.

Illustration 1-12 Presentation of liabilities

The statement of financial position is like a snapshot of the company's financial condition at a specific moment in time (usually the month-end or year-end).

ACCOUNTING ACROSS THE ORGANIZATION ![]()

What Do Vodafone, Walt Disney, and JJB Sports Have in Common?

Not every company uses December 31 as the accounting year-end. Some companies whose year-ends differ from December 31 are Vodafone Group (GBR), March 31; Walt Disney Productions (USA), September 30; and JJB Sports (GBR), the Sunday that falls before, but closest to, January 31. Why do companies choose the particular year-ends that they do? Many choose to end the accounting year when inventory or operations are at a low. Compiling accounting information requires much time and effort by managers, so companies would rather do it when they aren't as busy operating the business. Also, inventory is easier and less costly to count when it is low.

![]() What year-end would you likely use if you owned a ski resort and ski rental business? What if you owned a college bookstore? Why choose those year-ends? (See page 47.)

What year-end would you likely use if you owned a ski resort and ski rental business? What if you owned a college bookstore? Why choose those year-ends? (See page 47.)

Statement of Cash Flows

Helpful Hint

Investing activities pertain to investments made by the company, not investments made by the owners.

The statement of cash flows provides information on the cash receipts and payments for a specific period of time. The statement of cash flows reports (1) the cash effects of a company's operations during a period, (2) its investing transactions, (3) its financing transactions, (4) the net increase or decrease in cash during the period, and (5) the cash amount at the end of the period.

Reporting the sources, uses, and change in cash is useful because investors, creditors, and others want to know what is happening to a company's most liquid resource. The statement of cash flows provides answers to the following simple but important questions.

- Where did cash come from during the period?

- What was cash used for during the period?

- What was the change in the cash balance during the period?

As shown in Softbyte Inc.'s statement of cash flows in Illustration 1-11, cash increased €8,050 during the period. Net cash flow provided from operating activities increased cash €1,350. Cash flow from investing transactions decreased cash €7,000. And cash flow from financing transactions increased cash €13,700. At this time, you need not be concerned with how these amounts are determined. Chapter 13 will examine in detail how the statement is prepared.

PEOPLE, PLANET, AND PROFIT INSIGHT ![]()

Beyond Financial Statements

Should we expand our financial statements beyond the income statement, retained earnings statement, statement of financial position, and statement of cash flows? Some believe we should take into account ecological and social performance, in addition to financial results, in evaluating a company. The argument is that a company's responsibility lies with anyone who is influenced by its actions. In other words, a company should be interested in benefiting many different parties, instead of only maximizing shareholders' interests.

A socially responsible business does not exploit or endanger any group of individuals. It follows fair trade practices, provides safe environments for workers, and bears responsibility for environmental damage. Granted, measurement of these factors is difficult. How to report this information is also controversial. But, many interesting and useful efforts are underway. Throughout this textbook, we provide additional insights into how companies are attempting to meet the challenge of measuring and reporting their contributions to society, as well as their financial results, to shareholders.

![]() Why might a company's shareholders be interested in its environmental and social performance? (See page 47.)

Why might a company's shareholders be interested in its environmental and social performance? (See page 47.)

![]() DO IT!

DO IT!

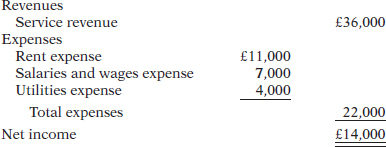

Financial Statement Items

Presented below is selected information related to Flanagan Company at December 31, 2014. Flanagan reports financial information monthly.

| Equipment | £10,000 |

| Cash | 8,000 |

| Service Revenue | 36,000 |

| Rent Expense | 11,000 |

| Accounts Payable | 2,000 |

| Utilities Expense | £ 4,000 |

| Accounts Receivable | 9,000 |

| Salaries and Wages Expense | 7,000 |

| Notes Payable | 16,500 |

| Dividends | 5,000 |

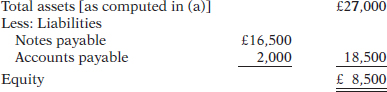

(a) Determine the total assets of Flanagan at December 31, 2014.

(b) Determine the net income that Flanagan reported for December 2014.

(c) Determine the equity of Flanagan at December 31, 2014.

Action Plan

- Remember the basic accounting equation: assets must equal liabilities plus equity.

- Review previous financial statements to determine how total assets, net income, and equity are computed.

Solution

(a) The total assets are £27,000, comprised of Equipment £10,000, Accounts Receivable £9,000, and Cash £8,000.

(b) Net income is £14,000, computed as follows.

(c) The ending equity of Flanagan is £8,500. By rewriting the accounting equation, we can compute equity as assets minus liabilities, as follows.

Note that it is not possible to determine the company's equity in any other way, because the beginning total for equity is not provided.

Related exercise material: BE1-10, BE1-11, E1-9, E1-12, E1-13, E1-14, E1-15, E1-16, and ![]() 1-4.

1-4.

![]()

![]() Comprehensive DO IT!

Comprehensive DO IT!

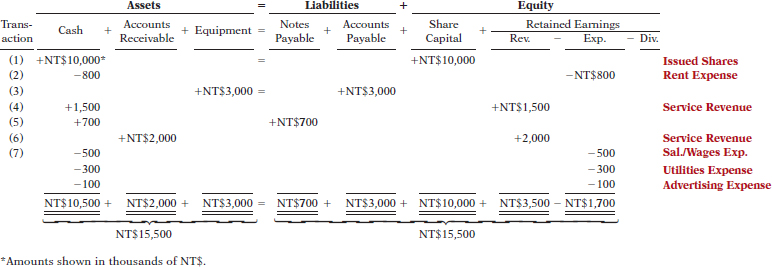

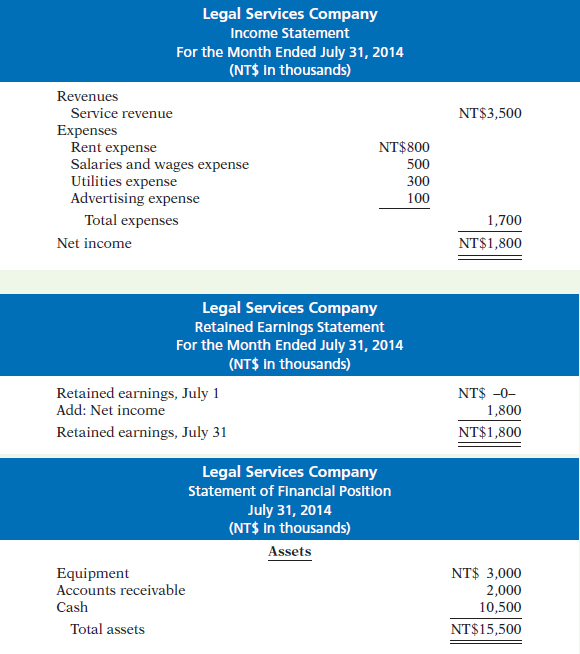

Legal Services Company was incorporated on July 1, 2014. During the first month of operations, the following transactions occurred.

- Shareholders invested NT$10,000,000 in cash in exchange for ordinary shares of Legal Services Company.

- Paid NT$800,000 for July rent on office space.

- Purchased office equipment on account NT$3,000,000.

- Provided legal services to clients for cash NT$1,500,000.

- Borrowed NT$700,000 cash from a bank on a note payable.

- Performed legal services for client on account NT$2,000,000.

- Paid monthly expenses: salaries NT$500,000, utilities NT$300,000, and advertising NT$100,000.

The Comprehensive DO IT! is a final review of the chapter. The Action Plan gives tips about how to approach the problem, and the Solution demonstrates both the form and content of complete answers.

Instructions

(a) Prepare a tabular summary of the transactions. (Present using NT$ in thousands.)

(b) Prepare the income statement, retained earnings statement, and statement of financial position at July 31 for Legal Services Company. (Present using NT$ in thousands.)

- Make sure that assets equal liabilities plus equity after each transaction.

- Investments and revenues increase equity. Dividends and expenses decrease equity.

- Prepare the financial statements in the order listed.

- The income statement shows revenues and expenses for a period of time.

- The retained earnings statement shows the changes in retained earnings for the same period of time as the income statement.

- The statement of financial position reports assets, liabilities, and equity at a specific date.

Solution to Comprehensive ![]()

(a)

(b)

SUMMARY OF LEARNING OBJECTIVES

![]()

1 Explain what accounting is. Accounting is an information system that identifies, records, and communicates the economic events of an organization to interested users.

2 Identify the users and uses of accounting. The major users and uses of accounting are as follows. (a) Management uses accounting information to plan, organize, and run the business. (b) Investors (owners) decide whether to buy, hold, or sell their financial interests on the basis of accounting data. (c) Creditors (suppliers and bankers) evaluate the risks of granting credit or lending money on the basis of accounting information. Other groups that use accounting information are taxing authorities, regulatory agencies, customers, labor unions, and economic planners.

3 Understand why ethics is a fundamental business concept. Ethics are the standards of conduct by which actions are judged as right or wrong. Effective financial reporting depends on sound ethical behavior.

4 Explain accounting standards and the measurement principles. Accounting is based on standards, such as International Financial Reporting Standards (IFRS). IFRS generally uses one of two measurement principles, the historical cost principle or the fair value principle. Selection of which principle to follow generally relates to trade-offs between relevance and faithful representation.

5 Explain the monetary unit assumption and the economic entity assumption. The monetary unit assumption requires that companies include in the accounting records only transaction data that can be expressed in terms of money. The economic entity assumption requires that the activities of each economic entity be kept separate from the activities of its owner(s) and other economic entities.

6 State the accounting equation, and define its components. The basic accounting equation is:

Assets = Liabilities + Equity

Assets are resources a business owns. Liabilities are creditor' claims on total assets. Equity is the ownership claim on total assets.

The expanded accounting equation is:

Assets = Liabilities + Share Capital—Ordinary + Revenues − Expenses − Dividends

Share capital—ordinary is affected when the company issues new ordinary shares in exchange for cash. Revenues are increases in assets resulting from income-earning activities. Expenses are the costs of assets consumed or services used in the process of earning revenue. Dividends are payments the company makes to its shareholders.

7 Analyze the effects of business transactions on the accounting equation. Each business transaction must have a dual effect on the accounting equation. For example, if an individual asset increases, there must be a corresponding (1) decrease in another asset, or (2) increase in a specific liability, or (3) increase in equity.

8 Understand the four financial statements and how they are prepared. An income statement presents the revenues and expenses, and resulting net income or net loss, for a specific period of time. A retained earnings statement summarizes the changes in retained earnings for a specific period of time. A statement of financial position reports the assets, liabilities, and equity at a specific date. A statement of cash flows summarizes information about the cash inflows (receipts) and outflows (payments) for a specific period of time.

GLOSSARY

Accounting The information system that identifies, records, and communicates the economic events of an organization to interested users. (p. 4).

Assets Resources a business owns. (p. 12).

Basic accounting equation Assets = Liabilities + Equity. (p. 12).

Bookkeeping A part of accounting that involves only the recording of economic events. (p. 5).

Convergence Effort to reduce differences between U.S. GAAP and IFRS to enhance comparability. (p. 8).

Corporation A business organized as a separate legal entity under corporation law, having ownership divided into transferable shares. (p. 10).

Dividend A distribution of cash or other assets by a corporation to its shareholders. (p. 13).

Economic entity assumption An assumption that requires that the activities of the entity be kept separate and distinct from the activities of its owner and all other economic entities. (p. 10).

Equity The ownership claim on a corporation's total assets. (p. 13).

Ethics The standards of conduct by which one's actions are judged as right or wrong, honest or dishonest, fair or not fair. (p. 7).

Expanded accounting equation Assets = Liabilities + Share Capital—Ordinary + Revenues − Expenses − Dividends. (p. 15).

Expenses The cost of assets consumed or services used in the process of earning revenue. (p. 13).

Fair value principle An accounting principle stating that assets and liabilities should be reported at fair value (the price received to sell an asset or settle a liability). (p. 8).

Faithful representation Numbers and descriptions match what really existed or happened—they are factual. (p. 8).

Financial accounting The field of accounting that provides economic and financial information for investors, creditors, and other external users. (p. 6).

Financial Accounting Standards Board (FASB) An organization that establishes generally accepted accounting principles in the United States (GAAP). (p. 8).

Generally accepted accounting principles (GAAP) Accounting standards issued in the United States by the Financial Accounting Standards Board. (p. 8).

Historical cost principle (cost principle) An accounting principle that states that companies should record assets at their cost. (p. 8).

Income statement A financial statement that presents the revenues and expenses and resulting net income or net loss of a company for a specific period of time. (p. 22).

International Accounting Standards Board (IASB) An accounting standard-setting body that issues standards adopted by many countries outside of the United States. (p. 8).

International Financial Reporting Standards (IFRS) International accounting standards set by the International Accounting Standards Board (IASB). (p. 8).

Liabilities Creditor claims on total assets. (p. 12).

Managerial accounting The field of accounting that provides internal reports to help users make decisions about their companies. (p. 6).

Monetary unit assumption An assumption stating that companies include in the accounting records only transaction data that can be expressed in terms of money. (p. 9).

Net income The amount by which revenues exceed expenses. (p. 22).

Net loss The amount by which expenses exceed revenues. (p. 22).

Partnership A business owned by two or more persons associated as partners. (p. 10).

Proprietorship A business owned by one person. (p. 10).

Relevance Financial information that is capable of making a difference in a decision. (p. 8).

Retained earnings statement A financial statement that summarizes the changes in retained earnings for a specific period of time. (p. 22).

Revenues The gross increase in equity resulting from business activities entered into for the purpose of earning income. (p. 13).

Share capital—ordinary Amounts paid in by shareholders for the ordinary shares they purchase. (p. 13).

Statement of cash flows A financial statement that summarizes information about the cash inflows (receipts) and cash outflows (payments) for a specific period of time. (p. 22).

Statement of financial position (balance sheet) A financial statement that reports the assets, liabilities, and equity of a company at a specific date. (p. 22).

Transactions The economic events of a business that are recorded by accountants. (p. 14).

APPENDIX 1A ACCOUNTING CAREER OPPORTUNITIES

LEARNING OBJECTIVE 9

Explain the career opportunities in accounting.

Why is accounting such a popular major and career choice? First, there are a lot of jobs. In many cities in recent years, the demand for accountants exceeded the supply. Not only are there a lot of jobs, but there are a wide array of opportunities. As one accounting organization observed, “accounting is one degree with 360 degrees of opportunity.”

Accounting is also hot because it is obvious that accounting matters. Interest in accounting has increased, ironically, because of the attention caused by the turmoil over toxic (misstated) assets at many financial institutions. These widely publicized scandals revealed the important role that accounting plays in society. Most people want to make a difference, and an accounting career provides many opportunities to contribute to society. Finally, recent internal control requirements dramatically increased demand for professionals with accounting training.

Accountants are in such demand that it is not uncommon for accounting students to have accepted a job offer a year before graduation. As the following discussion reveals, the job options of people with accounting degrees are virtually unlimited.

Public Accounting

Individuals in public accounting offer expert service to the general public, in much the same way that doctors serve patients and lawyers serve clients. A major portion of public accounting involves auditing. In auditing, an independent accountant, such as a chartered accountant (CA) or a certified public accountant (CPA), examines company financial statements and provides an opinion as to how accurately the financial statements present the company's results and financial position. Analysts, investors, and creditors rely heavily on these “audit opinions,” which CAs and CPAs have the exclusive authority to issue.

Taxation is another major area of public accounting. The work that tax specialists perform includes tax advice and planning, preparing tax returns, and representing clients before governmental agencies.

A third area in public accounting is management consulting. It ranges from installing basic accounting software or highly complex enterprise resource planning systems, to providing support services for major marketing projects and merger and acquisition activities.

Many accountants are entrepreneurs. They form small- or medium-sized practices that frequently specialize in tax or consulting services.

Private Accounting

Instead of working in public accounting, you might choose to be an employee of a for-profit company such as Starbucks (USA), Nokia (FIN), or Samsung (KOR). In private (or managerial) accounting, you would be involved in activities such as cost accounting (finding the cost of producing specific products), budgeting, accounting information system design and support, and tax planning and preparation. You might also be a member of your company's internal audit team. In response to corporate failures, the internal auditors' job of reviewing the company's operations to ensure compliance with company policies and to increase efficiency has taken on increased importance.

Alternatively, many accountants work for not-for-profit organizations, such as the International Red Cross (CHE) or the Bill and Melinda Gates Foundation (USA), or for museums, libraries, or performing arts organizations.

Governmental Accounting

Another option is to pursue one of the many accounting opportunities in governmental agencies. For example, tax authorities, law enforcement agencies, and corporate regulators all employ accountants. There is also a very high demand for accounting educators at colleges and universities and in governments.

Forensic Accounting

Forensic accounting uses accounting, auditing, and investigative skills to conduct investigations into theft and fraud. It is listed among the top 20 career paths of the future. The job of forensic accountants is to catch the perpetrators of theft and fraud occurring at companies. This includes tracing money-laundering and identity-theft activities as well as tax evasion. Insurance companies hire forensic accountants to detect insurance frauds such as arson, and law offices employ forensic accountants to identify marital assets in divorces.

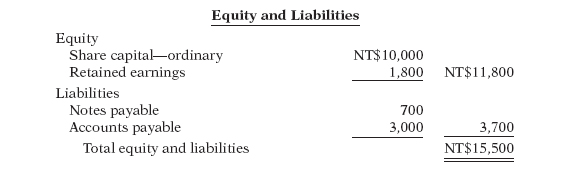

“Show Me the Money”

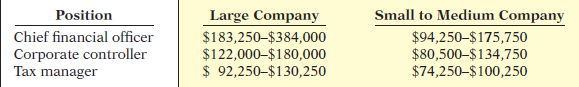

How much can a new accountant make? Take a look at the average salaries for college graduates in U.S. public and private accounting.4

Illustration 1A-1 Salary estimates for jobs in U.S. public and corporate accounting

Serious earning potential over time gives accountants great job security. Here are some examples of upper-level salaries for U.S. managers in corporate accounting.

Illustration 1A-2 Upper-level U.S. management salaries in corporate accounting

For up-to-date salary estimates, as well as a wealth of additional information regarding accounting as a career, check out www.startheregoplaces.com.

SUMMARY OF LEARNING OBJECTIVE FOR APPENDIX 1A

![]()

9 Explain the career opportunities in accounting. Accounting offers many different jobs in fields such as public and private accounting, government, and forensic accounting. Accounting is a popular major because there are many different types of jobs, with unlimited potential for career advancement.

GLOSSARY FOR APPENDIX 1A

Auditing The examination of financial statements by an independent accountant in order to express an opinion as to the fairness of presentation. (p. 30).

Forensic accounting An area of accounting that uses accounting, auditing, and investigative skills to conduct investigations into theft and fraud. (p. 30).

Management consulting An area of public accounting ranging from development of accounting and computer systems to support services for marketing projects and merger and acquisition activities. (p. 30).

Private (or managerial) accounting An area of accounting within a company that involves such activities as cost accounting, budgeting, design and support of accounting information systems, and tax planning and preparation. (p. 30).

Public accounting An area of accounting in which the accountant offers expert service to the general public. (p. 30).

Taxation An area of public accounting involving tax advice, tax planning, preparing tax returns, and representing clients before governmental agencies. (p. 30).

Self-Test, Brief Exercises, Exercises, Problem Set A, and many more components are available for practice in WileyPLUS.

Self-Test, Brief Exercises, Exercises, Problem Set A, and many more components are available for practice in WileyPLUS.

*Note: All asterisked Questions, Exercises, and Problems relate to material in the appendix to the chapter.

SELF-TEST QUESTIONS

Answers are on page 47.

- Which of the following is not a step in the accounting process? (LO 1)

(a) Identification.

(b) Verification.

(c) Recording.

(d) Communication.

- Which of the following statements about users of accounting information is incorrect? (LO 2)

(a) Management is an internal user.

(b) Taxing authorities are external users.

(c) Present creditors are external users.

(d) Regulatory authorities are internal users.

- The historical cost principle states that: (LO 4)

(a) assets should be initially recorded at cost and adjusted when the fair value changes.

(b) activities of an entity are to be kept separate and distinct from its owner.

(c) assets should be recorded at their cost.

(d) only transaction data capable of being expressed in terms of money be included in the accounting records.

- Which of the following statements about basic assumptions is correct? (LO 5)

(a) Basic assumptions are the same as accounting principles.

(b) The economic entity assumption states that there should be a particular unit of accountability.

(c) The monetary unit assumption enables accounting to measure employee morale.

(d) Partnerships are not economic entities.

- The three types of business entities are: (LO 5)

(a) proprietorships, small businesses, and partnerships.

(b) proprietorships, partnerships, and corporations.

(c) proprietorships, partnerships, and large businesses.

(d) financial, manufacturing, and service companies.

- Net income will result during a time period when: (LO 6)

(a) assets exceed liabilities.

(b) assets exceed revenues.

(c) expenses exceed revenues.

(d) revenues exceed expenses.

- Performing services on account will have the following effects on the components of the basic accounting equation: (LO 7)

(a) increase assets and decrease equity.

(b) increase assets and increase equity.

(c) increase assets and increase liabilities.

(d) increase liabilities and increase equity.

- As of December 31, 2014, Stoneland Company has assets of €3,500 and equity of €2,000. What are the liabilities for Stoneland Company as of December 31, 2014? (LO 7)

(a) €1,500.

(b) €1,000.

(c) €2,500.

(d) €2,000.

- Which of the following events is not recorded in the accounting records? (LO 7)

(a) Equipment is purchased on account.

(b) An employee is terminated.

(c) A cash investment is made into the business.

(d) The company pays a cash dividend.

- During 2014, Gibson Company's assets decreased $50,000 and its liabilities decreased $90,000. Its equity therefore: (LO 7)

(a) increased $40,000.

(b) decreased $140,000.

(c) decreased $40,000.

(d) increased $140,000.

- Payment of an account payable affects the components of the accounting equation in the following way: (LO 7)

(a) decreases equity and decreases liabilities.

(b) increases assets and decreases liabilities.

(c) decreases assets and increases equity.

(d) decreases assets and decreases liabilities.

- Which of the following statements is false? (LO 8)

(a) A statement of cash flows summarizes information about the cash inflows (receipts) and outflows (payments) for a specific period of time.

(b) A statement of financial position reports the assets, liabilities, and equity at a specific date.

(c) An income statement presents the revenues, expenses, changes in equity, and resulting net income or net loss for a specific period of time.

(d) A retained earnings statement summarizes the changes in retained earnings for a specific period of time.

- On the last day of the period, Jim Otto Company buys a $900 machine on credit. This transaction will affect the: (LO 8)

(a) income statement only.

(b) statement of financial position only.

(c) income statement and retained earnings statement only.

(d) income statement, retained earnings statement, and statement of financial position.

- The financial statement that reports assets, liabilities, and equity is the: (LO 8)

(a) income statement.

(b) retained earnings statement.

(c) statement of financial position.

(d) statement of cash flows.

- * Services provided by a public accountant include: (LO 9)

(a) auditing, taxation, and management consulting.

(b) auditing, budgeting, and management consulting.

(c) auditing, budgeting, and cost accounting.

(d) internal auditing, budgeting, and management consulting.

Go to the book's companion website, www.wiley.com/college/weygandt, for additional Self-Test Questions.

![]()

- “Accounting is ingrained in our society and it is vital to our economic system.” Do you agree? Explain.

- Identify and describe the steps in the accounting process.

(a) Who are internal users of accounting data?

(b) How does accounting provide relevant data to these users?

- What uses of financial accounting information are made by (a) investors and (b) creditors?

- “Bookkeeping and accounting are the same.” Do you agree? Explain.

- Jackie Remmers Travel Agency purchased land for $85,000 cash on December 10, 2014. At December 31, 2014, the land's value has increased to $93,000. What amount should be reported for land on Jackie Remmers' statement of financial position at December 31, 2014? Explain.

- What is the monetary unit assumption?