22

Savings, Borrowing, Income Strategies,and Taxes

They say there are two things that are certain in life and one of these two things is taxes. Since we can't avoid them, we're going to round out this section by diving right in while, at the same time, exploring concepts such as the benefits crypto provides via saving and borrowing.

Taxes

Taxes are pretty simple. Pay them. Do not fall into the trap of thinking that crypto is untraceable and anonymous, because that's just not the case. Exchanges such as Coinbase know who you are, they know what you have traded, and the law states that any gains made on the trade of any crypto asset are taxable. Let's say that Jane buys one bitcoin at $18,000. The price appreciates to $25,000, and she decides to sell it to buy a different asset, such as Ethereum. From the perspective of the government, it doesn't matter that Ethereum is still a crypto asset. When Jane sells her bitcoin at $25,000, she has made a gain of ($25,000 – $18,000) = $7,000, and that gain is taxable. Gains also must be calculated on any transaction in which crypto is transacted at a higher value, including trading it for dollars, buying other crypto, or even using it to buy a cup of coffee or a car. Any time there is a realized gain, taxes must be paid on that gain. Calculating this is relatively straightforward if you use one exchange and are just trading crypto assets; however, if you use many exchanges, you will want to consider implementing third‐party software such as CoinTracking, which is designed to calculate gains and losses across all exchanges that you use. (Author's note: We are not recommending any particular software package. As players in this space change all the time, we recommend that you research and find out who are the established players in your region with a history and a proven track record.)

There is one more nuance here that can work to your advantage because losses are also calculated the same way, so our dear Jane can work the opposite situation. Let's say, for example, that she bought her bitcoin at $25,000 and then the price drops to $18,000. By selling her bitcoin at that lower $18,000 price, she will have a loss of $7,000 that she can apply against her gains. Most importantly, unlike stocks, she can use this as a strategy. She can sell her bitcoin and immediately repurchase it again at the same price, locking in the loss while still retaining her asset. You can't do this with stocks because of the wash‐sale rule, which states that any time an equity is sold, it cannot be repurchased for at least 30 days. This is specifically to prevent tax loss harvesting, as described here. However, such a rule doesn't exist (yet) for crypto, so, until it does, have at it. Finally, and importantly, losses can generally only be used to offset gains of a like type, which is, in this case, crypto, so please do not think you can take a colossal crypto loss and then use it to offset your employment income. Instead, because you can carry losses forward, think about it as a way to lock in losses to offset your future crypto gains. As always, this is not tax advice, and laws do change, so our best recommendation is to check with your tax advisor before implementing any tax strategy.

Saving

Your dad, mom, uncle, sister, or someone you dated in college probably told you at some point that the way to make money is to have your money work for you. Ultimately, however, getting your money to work for you often entails risky investments, long‐term lockups, or complex structures that aren't for the faint of heart. A bazillion books have been written regarding saving money, ranging from tips and tricks to motivation to actual methods to make your money go further. We're not going to touch that. Instead, we're going to discuss a unique opportunity that exists in the world of crypto assets: the ability to generate yield.

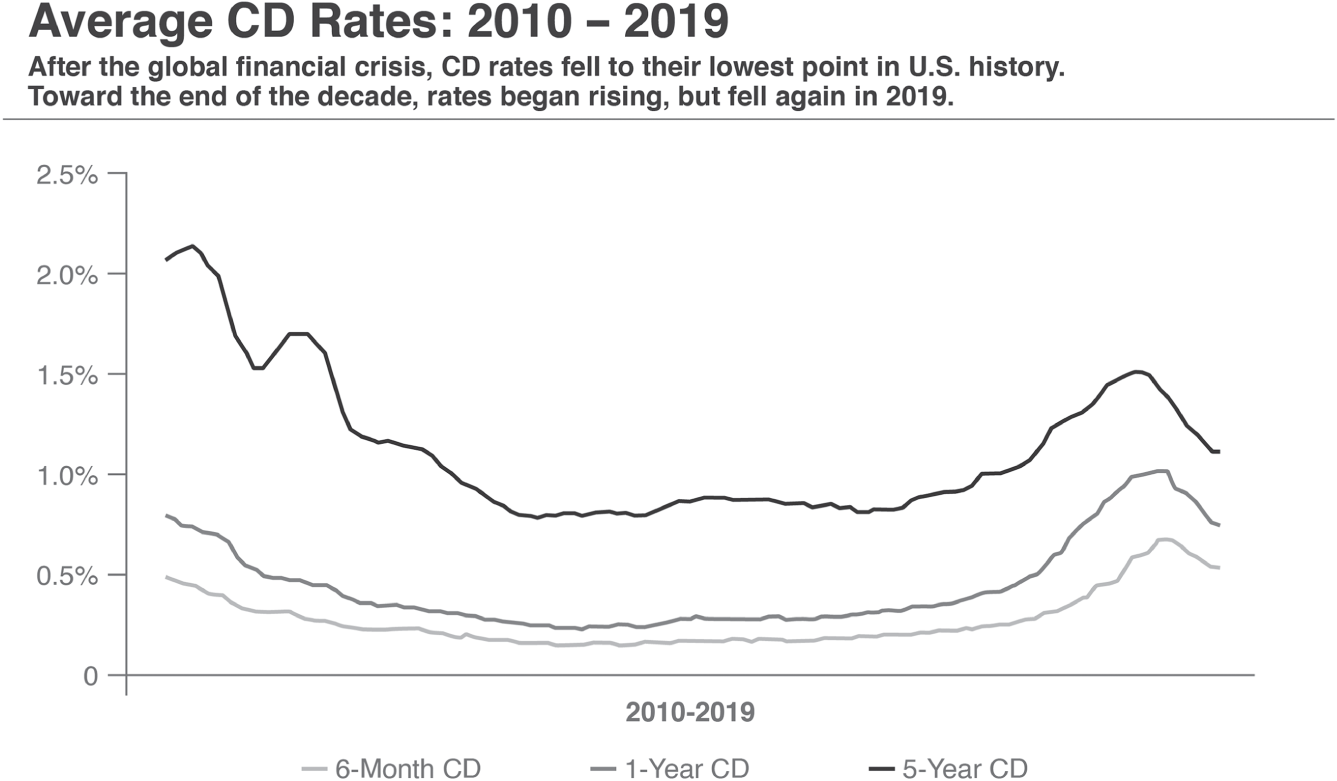

Figure 22.1 CD Rates, 2010–2019

Source: Bankrate National Survey.

Remember, if you will, the days of a savings account that earned any meaningful interest. It's been a while. Even worse, certificates of deposit – instruments where you commit to locking up your capital – have returned less than 1% for a one‐year CD and less than 2% for a five‐year CD over the past decade1 (see Figure 22.1). These aren't exactly inspiring numbers.

Well, there is another solution. Enter stablecoins. A stablecoin is a crypto asset that is directly pegged to another currency in a one‐to‐one relationship, generally a U.S. dollar. Because of this if you have $100, you can convert it to 100 USD Coin and it is worth the same $100. Once this is done, a world opens up, as many centralized and decentralized vendors will gladly pay you to use your money. They do this, just as banks have done for years, by offering interest against deposited funds. How much is earned depends on the size of the deposit, and the vendor. At the time of this writing, you can earn rates as high as 12%. What is exciting about this is that you can do this while keeping your principal in a relatively risk‐free item that has the value of a U.S. dollar. (Author's note: We're not doing this to discuss the impact of inflation, the position of the U.S. dollar in the world, or the fact that its buying power is consistently less over time. We're simply going to focus on the fact that a dollar does not have the volatility that most crypto assets, at least now, do.)

With regard to that relatively risk‐free comment, let's be clear: there are a few things to be aware of here. The first is that the U.S. government, among others, is really exploring regulation, and some lenders, for the moment, aren't offering this in the United States until there is absolute clarity. In addition, any time you have a counterparty (et tu, Celsius?), you have a risk that the counterparty could fail. We believe there is less risk in DeFi contracts, but as these are also new, there is always a chance that there could be a software problem that allows a breach. As the technology advances, however, we expect that over time regulation will be sorted out, central players will exist that provide minimal counterparty risk, and DeFi contracts will have matured to the point that, as well, the risk is minimized. This isn't magic, by the way. Entities can provide such great rates because, at least right now, demand for stablecoins far outweighs supply. We don't see this changing any time soon because stablecoins, since they are linked to fiat currencies, are poised to be the preferred way to transact in the blockchain world.

Borrowing

There is another way money can work for you in the blockchain world: borrowing against the crypto you own. This is called collateralized lending. Collateralized lending involves the process of, once again, depositing some principal in the form of a crypto asset, either in a DeFi contract or in an account at a counterparty like a bank or a lender. You can then borrow against this deposit. This allows you to gain access to liquidity – you can keep your asset while using the money. You may own, for example, $50,000 of a certain asset that you believe will be worth even more over time. Because of this, you want to keep it, but you also want access to cash. Voilà! Collateralized lending. How much you can borrow depends on your agreement with your lender and ultimately is a function of loan to value (LTV), which dictates how much you can borrow compared with the value of your deposit. So, for our earlier example, let's revisit Jane. If Jane has BTC worth $25,000 and deposits it with a lender that will give her 50% LTV, she can borrow $12,500 and use it for anything she likes. Now she has access to her money with no taxable gains. This, ladies and gentlemen, is one of the ways that the wealthy make their money work for them. They borrow against assets they own, which provides money they can use without incurring any taxes. Borrowed money is tax‐free and can be used to take that vacation, buy more assets such as real property, or even buy more crypto assets, depending on one's risk tolerance.

LTV gets a little tricky with volatile crypto assets, however, so let's look at some risks. If you have X dollars deposited in the form of Ethereum, for example, and that Ethereum drops in price by 50%, you could be outside your stated LTV. In such cases, you may be called upon to deposit more funds or the contract or company facilitating the loan may sell some of the collateral to bring you back into a reasonable LTV, so always pay attention to the rules and do your homework! Also, as we learned from Celsius, there is risk any time you have a counterparty holding your asset, whether that's an exchange, a bank, or a lender. Borrowing against your crypto sure is an excellent option to have if needed, so that you have access to money while holding on to an asset that you expect to appreciate.

Income Strategies

There are several good ways to generate income with digital assets. Just like in traditional investing, you want to have strategies for capital appreciation and for income generation. With traditional asset classes, you may invest in a variety of assets that generate income like REITs, bonds, preferred stock, and dividend‐paying equities. It's similar to investing in digital assets.

There are three main ways to generate income with digital assets. The first is to use CeFi or DeFi to lend out your digital assets and generate a yield. With CeFi, you can let the exchange lend your assets out on your behalf and there's generally not a particular duration. You can ask for your digital assets back, which typically takes two business days. With DeFi, there are several duration options, with each managed by a smart contract. The yield provided is typically better for longer duration just like with bonds or CDs in TradFi (traditional finance).

The second way to generate income is through staking of assets. If you own proof‐of‐stake (PoS) assets like $ETH, $DOT, or $SOL, you can generate a staking income by allowing your assets to be used as the collateral for a node validator. Remember that in PoS, the blockchain is secured by staked assets and the validator is putting up her assets to confirm the minting of a block has legitimate transactions. If the validator is wrong, they lose their staked assets for submitting an incorrect block. The income is generated not through lending but through transaction fees paid for managing transactions. This is interesting income because at present the IRS has stated that earning this income is not creating a taxable event.

The third way to generate income is by providing liquidity or market making services by providing a liquidity pool inside DeFi. A liquidity pool (LP) is typically two digital assets together submitted in a pool, for example, USDC:ETH. With an LP, inside DeFi like a service such as Compound, if DeFi users use your liquidity pool in their trade (in this example they are trading $USDC for $ETH), then you're providing liquidity in the marketplace and you will get paid a portion of the trading fees for providing such liquidity. This service is typically provided by big players in TradFi, but a user of almost any investment size can participate in this service in DeFi.

To summarize, there are 3 ways to generate income with digital assets:

- Lend out your digital assets and generate interest payments.

- Stake your digital assets, which help secure the blockchain network and therefore create staking yield payments to the staked asset holders that are paid by transaction fees generated through the use of the blockchain network.

- Create a liquidity pool by providing two digital assets paired together, which allow liquidity for the buying and selling of those trading pairs in a DeFi application.