Chapter 3

Accounting Standards

LEARNING OBJECTIVES

After studying this chapter, you will be able to understand

Meaning and the Definition of Accounting Standards

The Constitution of Accounting Standard Board in India

The Scope of Accounting Standards in India

Procedure of Issuing Accounting Standards

Applicability of Accounting Standards – 3 Levels

Status of Accounting Standards AS–1 to AS–29 and their Respective Related Area

Compliance with Accounting Standards

Implementation of Accounting Standards

Salient Features of General Purpose Financial Statements and Accounting Standards Role Relating to them

Benefits of Accounting Standards

AS–1 and Disclosure of Accounting Policies

Case Study – Significant Accounting Policies

AS–2 and Valuation of Inventories

AS–3 and Cash Flow Statements

AS–4 and Contingencies and Events Occurring after Balance Sheet Date

AS–5 and Changes in Accounting Policies (Net Profit or Loss for the Period, Prior Period Items)

Introduction

As explained earlier, accounting is an information system. Its primary aim is to provide financial position and performance of an enterprise to all the parties interested. This is done by means of financial statements. It is of utmost importance that such financial statements should reflect “true and fair” view of financial results (net worth, profit, state of affairs and so on) of the business enterprises. In practise, wide ranges of accounting methods are in vogue in the preparation and presentation of the financial statements. “Necessity is the mother of invention” – is an age old adage. Accordingly, over a period of time, the accounting profession tried to standardise set of rules, and the necessary accounting procedure to present financial statements in order to achieve uniformity and comparability with precision and accountancy. Outcome of such tireless activities by the accounting professionals is the birth of “Accounting Standards.”

Generally Accepted Accounting Principles (GAPP) in India, are very lenient in permitting enterprises to adopt the accounting procedure at the discretion of individual entrepreneurs. The net result we are experiencing is the offing of Accounting Standards and the collapse of big corporate entities. (The latest in the series is the collapse of a leading IT company – is worthy to mention at this juncture.) In an era of globalisation, it is essential to adopt transparent accounting norms in valuation of fixed assets, revenue recognition, valuation of inventories, classification and valuation of investments, foreign currency translations, provision for risky assets, contingent liabilities, treatment of expenditure on research and development are for any type of business enterprises. It is imperative to highlight the need for accounting standard as the Indian companies have been trying access to global markets for issuing global depositary receipts. Under those circumstances, the financial statements must possess transparency, consistency, adequacy, accuracy and comparability, with adequate disclosures. With such a background, the objective of preparing and adopting the “Accounting Standards” has gained due significance.

OBJECTIVE 1: MEANING AND DEFINITION OF ACCOUNTING STANDARDS

Accounting Standards are written statements of accounting rules and guidelines to prepare financial statements. It may also be said that Accounting Standards are codified forms of GAPP. Accounting Standards consists of detailed rules to be adopted for the treatment of various items in accounting process so as to attain uniformity and consistency in internal and external reporting process. The main thrust in the preparation of Accounting Standards is to achieve global uniformity and comparability and thereby bridging the gap that exists in numerous and diverse accounting practises.

1.1 Objectives of Accounting Standards

- To provide information: The main objective of Accounting Standards is to provide information to the users. It sets the standards on which accounts have to be prepared.

- To harmonise different accounting processes: Accounting Standards are evolved to bridge the gap between various accounting procedure to harmonise the different accounting processes.

- To enhance the contents: Accounting Standards enhance the credibility and comparability of the financial statements.

1.2 Development of Accounting Standards

Due to the increase in malpractices in accounting, and increase in failure of business entities, there was a great demand for standardised accounting practises. The result is the formation of “Accountants International Study Group (AISG)” – an international body in 1967. Again in 1973, International Accounting Standards Committee (IASC) begun to function. The main objectives of IASC were:

- to formulate and publish the standards to be observed in the presentation of audited financial statements and to promote world wide acceptance and

- to work generally for the improvement and harmonisation of regulations, accounting standards and procedures relating to presentation of financial statements.

On 1972, Financial Accounting Standard Board (FASB) was established in USA. In India, Sec 209(1) of the Companies Act, 1956 stipulates that the financial statements of a company should give true and fair view of its (company’s) profits and financial position. This is the statutory provision for the companies registered under this Act regarding Accounting Standards.

IASC has so far issued 47 Exposure Drafts (comments and suggestions of leading professional bodies) and has come out with 41 International Accounting Standards (IAS) relating to various items in accounting process.

OBJECTIVE 2: CONSTITUTION OF ACCOUNTING STANDARD BOARD IN INDIA

Accounting Standard Board (ASB) was set up in India on Apr 21, 1977 with a view to harmonise the diverse accounting policies and practises in India. ASB was set up by the Council of the Institute of Chartered Accountants of India (ICAI). ICAI, being one of the members of IASC, while formulating the Accounting Standards, gives much weight to the standards issued by IASC. ICAI tries to incorporate those international standards in India, keeping in view with the conditions and practises prevailing in India.

2.1 Formation of the Accounting Standards Board

The composition of the ASB is fairly broad-based and ensures participation of all interested groups in the standard-setting process. Apart from the elected members of the Council of the ICAI nominated on the ASB, the following are represented on the ASB:

- Nominee of the central government representing the Department of Company Affairs on the council of the ICAI.

- Nominee of the central government representing the office of the Comptroller (Controller) and Auditor General of India on the council of ICAI.

- Nominee of the central government representing the Central Board of Direct Taxes on the council of ICAI.

- Representative of the Institute of Cost and Works Accountants of India.

- Representative of the Institute of Company Secretaries of India.

- Representatives of Industry Association from “Associated Chambers of Commerce and Industry (ASSOCHAM),” from Confederation of Indian Industry (CII) and from Federation of Indian Chambers of Commerce and Industry (FICCI).

- Representative of Reserve Bank of India (RBI).

- Representative of Securities and Exchange Board of India (SEBI).

- Representative of Controller General of Accounts.

- Representative of Central Board of Excise and Customs.

- Representatives of academic institutions from universities and from Indian institutes of management.

- Representatives of financial institutions.

- Eminent professionals co-opted by ICAI.

- Chairman of the Research Committee and chairman of the Expert Advisory Committee of the ICAI, if they are not otherwise members of the Accounting Standards Board.

- Representatives of any other body, as considered appropriate by the ICAI.

2.2 Objectives and Functions

The following are the objectives of the Accounting Standards Board.

- To conceive of the suggest areas in which Accounting Standards need to be developed.

- To formulate Accounting Standards with a view in assisting the council of ICAI in evolving and establishing Accounting Standards in India.

- To examine how far the relevant International Accounting Standard /International Financial Reporting Standard can be adapted, while formulating the Accounting Standards and to adapt the same.

- To review, at regular intervals, the Accounting Standards from the point of view of acceptance or changed conditions and, if necessary, revise the same.

- To provide, from time to time, interpretations and guidance on Accounting Standards.

- To carryout such other functions relating to Accounting Standards.

The main function of the Accounting Standards Board (India) is to formulate Accounting Standards so that such standards may be established by the ICAI in India.

According to the Companies (Amendment) Act, enacted in 1999, the central government is empowered to constitute as advisory committee, to be called the National Advisory Committee on Accounting Standards. Its objective is to advise the central government on the formulation and implementation of Accounting Standards in India. The advisory committee is more broad-based than the ASB.

OBJECTIVE 3: SCOPE OF ACCOUNTING STANDARDS IN INDIA

In its Preface to the Statements of Accounting Standards (Revised 2004), ASB outlined the scope of Accounting Standards.

- Efforts will be made to issue Accounting Standards, which are in confirmity with the provisions of the applicable laws, customs, usages and business environment of our country. However, if due to subsequent amendments in the law, a particular accounting standard is found to be not in conformity with such law, the provision of the said law will prevail and the financial statements should be prepared in confirmity with such law.

- The Accounting Standards by their very nature cannot and do not override the local regulations, which govern the preparation and presentation of financial statements in our country. However, the institute will determine the extent of disclosure to be made in financial statements and the related, auditor’s reports. Such disclosures may be, by way of appropriate notes, explaining the treatment of particular items. Such explanatory notes will be only in the nature of clarification and thereof, need not be treated as adverse comments on the related financial statements.

- The Accounting Standards are intended to apply only to items which are material. Any limitations with regard to the applicability of a specific standard will be made clear by the Institute from time to time. The date from which a particular standard will come into effect, as well as the class of enterprises to which it will apply, will also be specified by the Institute. However, no standard will have retrospective application, unless otherwise stated.

- The institute will use its best endeavours to persuade the government, appropriate authorities, industrial and business community to adopt these standards in order to achieve uniformity in the presentation of financial statements.

- In carrying out the task of formulation of Accounting Standards, the intention is to concentrate on basic matters. The endeavour would be to confine Accounting Standards to essentials and not to make them so complex that they cannot be applied effectively on nationwide basis.

- The standards formulated by the ASB include paragraphs in bold italic and plain type, which have equal authority. Paragraphs in bold italic type indicate the main principles. An individual standard should be read in the context of the objective stated in that standard and this preface.

- The ASB may consider any issue requiring interpretation on any Accounting Standards. Interpretations will be issued under the authority of the council. The authority of interpretation is the same as that of Accounting Standards to which it relates.

- In the years to come, it is to be expected that Accounting Standards will undergo revision and Accounting Standards with greater degree of sophistication may then be appropriate.

OBJECTIVE 4: PROCEDURE OF ISSUING ACCOUNTING STANDARDS

A summarised extract of the text of the “Preface to the Statements of Accounting Standards (Revised 2004),” issued by the council of the Institute of Chartered Accountants of India, explains the procedure of issuing Accounting Standards. They are:

- The ASB determines the broad areas requiring formulation of Accounting Standards and lists them according to priority.

- In the preparation of Accounting Standards, the ASB is assisted by a Study Group, constituted for this purpose. Views of government, public sector undertakings, industry and other organizations are obtained before formulating the Exposure Draft.

- The Exposure Draft comprises the following:

- Objective and scope of the standard.

- Definition of the terms used in the standard.

- The manner in which the accounting principles have been applied for formulating the standard.

- The presentations and disclosure requirements of it comply with the standard.

- Class of enterprises to which the standard will apply.

- Date from which the standard will be effective.

- The Exposure Draft will be published in professional journals and circulated to obtain views and comments.

- ASB will finalise the standard after taking into consideration the suggestions received, and submit to the council of ICAI.

- The council of the ICAI will consider and, if necessary, amend the standards after consulting the ASB. Then, in its final form, the council issues the standard under its authority.

- For a substantive revision of Accounting Standards, procedure is the same as that of the procedure followed for formulation of new Accounting Standard.

OBJECTIVE 5: APPLICABILITY OF ACCOUNTING STANDARDS

For the purpose of applicability of accounting periods, enterprises are classified into three categories: Level I enterprise, Level II enterprise, Level III enterprise.

5.1 Level-I Enterprise

Enterprises, which fall in any one or more of the following categories, at any time, during the accounting period, are classified as Level I enterprises:

- Enterprises whose equity or debt securities are listed in Stock Exchange, whether in India or outside India.

- Enterprises, which are in the process of listing in Stock Exchange, their equity or debt securities as evidenced by the Board of Directors” resolution in this regard.

- Banks including co-operative banks.

- Financial institutions.

- Enterprises carrying on insurance business.

- All commercial, industrial and business reporting enterprises, whose turnover for the immediately preceding accounting period on the basis of audited financial statements, exceeds Rs 50 crores. Turnover does not include “other income.”

- All commercial, industrial and business reporting enterprises having borrowings, including public deposits, in excess of Rs 10 crores at any time during the accounting period.

- Holding and subsidiary enterprises of any one of the above at any time during the accounting period.

5.2 Level-II Enterprise

Enterprises, which are not Level I enterprises but fall in any one or more of the following categories are classified as Level II enterprises.

- All commercial, industrial and business reporting enterprises, whose turnover for the immediately preceding accounting period on the basis of audited financial statements exceeds Rs 4 lakhs but does not exceed Rs 50 crores.

- All commercial, industrial and business reporting enterprises having borrowings, including public deposits, in excess of Rs 1 crore but not in excess of Rs 10 crores at anytime during the accounting period.

5.3 Level-III Enterprise

Enterprises, which are not covered under Level I and Level II are considered as Level III enterprises.

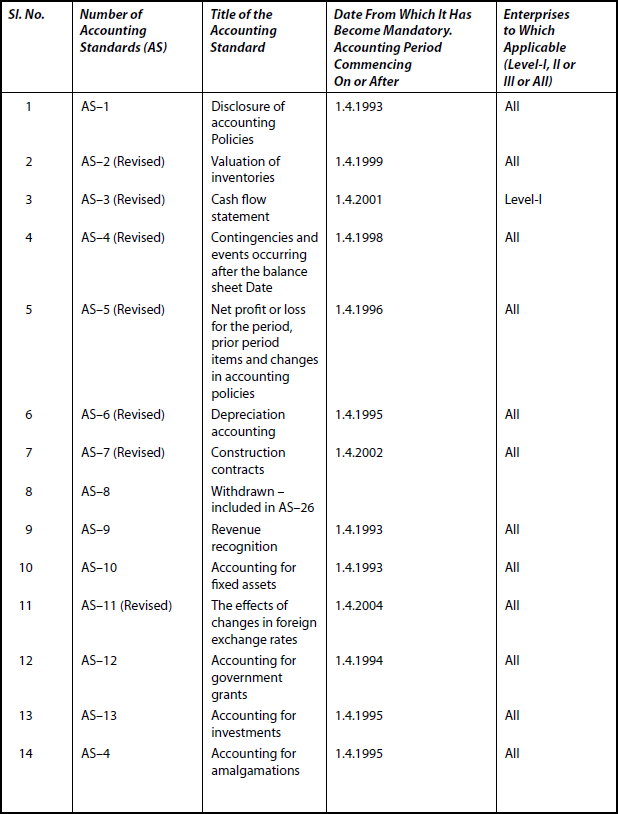

OBJECTIVE 6: STATUS OF THE ACCOUNTING STANDARDS ISSUED BY THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA

The details of the standards are provided in the tabular column as follows:

Notes:

- AS–21, AS–23, AS–27 (relating to consolidated financial statements) are required to be complied with by an enterprise, if the enterprise pursuant to the requirements of a statute regulator or voluntarily, prepares and presents consolidated financial statements.

- (AS–3, AS–17, AS–18, AS–20, AS–2 and AS–24) Accounting Standards are mandatory for enterprises whose securities are listed on a recognised state exchange in India or in the process of listing and all the other commercial, industrial and business reporting enterprises, whose turnover exceeds Rs 50 crores for the accounting period.

OBJECTIVE 7: COMPLIANCE WITH ACCOUNTING STANDARDS

Role of ICAI: Accounting Standards will be mandatory from the date specified in the Accounting Standards. It is the duty of the auditors (members of ICAI) to check whether provisions envisaged in the Accounting Standards are complied with or not complied. In case any deviation is noted, such deviations must be reported in the audit reports to make alert the users of financial statements.

Role of Companies Act

- Sec 211 of Companies Act 1956, provides that every profit and loss account and balance sheet shall comply with the Accounting Standards.

- Sec 211 (3B), non-compliance of Accounting Standards should be expressly stated in the disclosure to be attached to the balance sheet. Such disclosure provides details relating to

- deviation from the Accounting Standards

- the reason for such deviation and

- the net financial effect, if any, due to such deviation

OBJECTIVE 8: IMPLEMENTATION OF ACCOUNTING STANDARDS

The preparation of the financial statements with adequate disclosures in tune with Accounting Standards is to be done by the management of the enterprise. It is the responsibility of the Board of Directors. According to the new clause 2AA which was added to Sec 217 by the Companies Act (Amendment) in the year 2000, the report of the board should also include a director’s responsibility statement that must include therein:

- that in preparation of the annual accounts, the applicable Accounting Standards had been followed along with proper explanation relating to material departures;

- that the directors had selected such accounting policies and applied them consistently and made judgements and estimates that are reasonable and prudent so as to give a true and fair view of the state of affairs of a company at the end of financial year and of the profit or loss of the company for that period;

- that the directors had taken proper and sufficient care for the maintenance of adequate accounting records in accordance with the provisions of the act for safeguarding the assets of the company and for preventing and detecting fraud and other irregularities;

- that the directors had prepared the annual accounts on a going concern basis.

The entire responsibility rests with the directors of the company. The auditor’s responsibility is confined to form his opinion and to report on such financial statements. Auditors should ensure that the Accounting Standards are implemented in the preparation of financial statements. It is the auditor’s responsibility to disclose the deviations from prescribed standards and he has to inform this fact in his report to the users.

The strict adherence to Accounting Standards will definitely improve the quality of presentation of financial statements. It will also lead to provision of necessary information for a proper understanding of the financial statements. The importance can be understood from the Preface to the Statements of Accounting Standard (Revised 2004) issued by the ICAI Council. It highlights some guidelines on “General Purpose Financial Statements,” which may be of very much useful for the learners of Financial Accounting.

OBJECTIVE 9: SALIENT FEATURES OF “GENERAL PURPOSE FINANCIAL STATEMENTS”

- For discharging its functions, the ASB will keep in view the purposes and limitations of financial statements and the attest function of the auditors. The ASB will enumerate and describe the basic concept to which accounting principles should be oriented and state the accounting principles to which the practises and procedures should conform.

- The ASB will clarify the terms commonly used in the financial statements and suggest improvements in the terminology wherever necessary. The ASB will examine the various current alternative practises in vogue and endeavour to eliminate or reduce alternatives within the bounds of rationality.

- Accounting Standards are designed to apply to the general purpose financial statements and other financial reporting, which are subject to the attest function of the members of the ICAI. Applicability and non-applicability of standards are also explained here.

- The term “General Purpose Financial Statements” includes Balance Sheet, Statement of Profit and Loss, a cash flow statement, and statements and explanatory notes, which form part thereof, issued for the use of various stakeholders, government and their agencies and the public. References to financial statement in this Preface and in the standards issued from time to time will be construed to refer to General Purpose Financial Statement.

OBJECTIVE 10: BENEFITS OF ACCOUNTING STANDARDS

The benefits to be derived from Accounting Standards are:

1. “True and Fair” Financial Position: Of late, accounting information has attained much significance by its varied users. In order to present a true and fair view of financial position of business enterprises the use of Accounting Standards has become essential.

2. Value of Accounting Information: By providing the definite structure of accounting framework, use of Accounting Standards enhances the value of accounting information.

3. Easy Comparability: As the same set of accounting practises are followed by using Accounting Standards, comparison with other businesses of similar nature is made easy. The position where the business stands in a competitive world can be made known with such comparison, which can be made possible by the use of Accounting Standards.

4. Efficiency of Management: Accounting Standards assist in assessing the efficiency of the management covering all the aspects of the entities – profitability, liquidity, solvency and so on. In case, in the absence of Accounting Standards, the financial position of one entity cannot be compared and overall efficiency cannot be judged by way of such comparison.

5. Useful to Accountants and Auditors: Uniform accounting practises and policies lessen the work of accountants and auditors since their function is confined to a definite structure framework.

6. Credibility and Reliability: The use of Accounting Standards create a sense of confidence among the users of financial statements. By providing information in a transparent manner and by enforcing standardized rules and guidelines for accounting procedure, credibility and reliability of financial statements is enhanced.

Some important Accounting Standards are explained in the forthcoming pages with special emphasis on items relating to “Financial Accounting.”

OBJECTIVE 11: AS-1 – DISCLOSURE OF ACCOUNTING POLICIES

Accounting Standard-1 (AS–1) deals with the disclosure of significant accounting policies followed in preparing and presenting financial statements, namely, Profit and Loss Account, Balance Sheet and the Cash Flow Statement (wherever necessary and applicable). The main purpose of this AS–1 is to promote better understanding of financial statements by way of emphasising the enterprises to attach the following requirements alongwith statement in a transparent manner.

- Disclosure of all significant accounting policies followed in the preparation of Profit and Loss Account and the Balance Sheet.

- Consideration in the selection of accounting policies.

- Disclosure of fundamental accounting assumptions.

- Disclosure of changes in accounting policies.

11.1 Disclosure of Significant Accounting Policies

As accounting policies differ from one enterprise to other enterprise, it is necessary to provide guidelines and rules to be followed from the recording of transactions till the preparation and presentation of financial statements. This aims to level the differences exist in the treatment of various items. From the following examples, one can easily understand the nature of different accounting policies adopted by different enterprises:

The above list is only illustrative and not exhaustive. This is explained only to enlighten the readers, how accounting treatment differs for various items. This standard aims at disclosing which accounting policy is followed for the items relating to that particular enterprise.

11.2 Disclosure of Fundamental Accounting Assumptions

The following are the fundamental accounting assumptions on which the financial statements are to be prepared:

- Going concern: Going concern means the enterprise will be continuing in operation for the foreseeable future. Under this aspect, it is assumed that the enterprise has no intention to liquidate (wind up) in the near future.

- Consistency: It is assumed (as per this assumption) that accounting policies are consistent from period to period.

- Accrual: Revenues and costs (income and expenses) are accrued, recognised as they are earned or incurred (not as money is actually received or paid). On that assumption they are recorded in the financial statements of the accounting period to which they are involved.

Note

- In case, if nothing is noted on assumptions in the financial statements, it is understood that the above fundamental accounting assumptions have been followed in the preparation of the financial statements.

- If any of the fundamental assumptions has not been followed, this fact must be disclosed in the financial statements, as per the requirements of AS–1.

11.3 Selection of Accounting Policies

As accounting policies play a significant role in shaping the financial statements, major considerations governing the selection and application of accounting policies must be understood. They are:

- Prudence: Profits or gains are not recognised on the basis of anticipation. They are to be recognized only when realised in cash. On the other hand, all possible losses are anticipated. Based on such anticipated losses, provision has to be made for all known liabilities and losses. Even at certain stage it has to be written off.

- Substance over form: All transactions and events are governed by their substance and not by their legal form. For example, in true purchase transactions, the legal position (FORM) is that the hire purchaser does not become the legal owner of the asset until he pays the entire amount. But the hire purchaser acquires the (SUBSTANCE) asset immediately. Here, accounting transactions should relate to substance. As such, such assets are to be recorded at full cost price by the hire purchaser.

- Materiality: Financial statements should disclose all material items, that is, knowledge of which might influence the decisions of the users of financial statements.

- Changes in the accounting policies: It is impossible to provide a single list of accounting policies, which can be applicable to all kinds of business enterprises and at all times. As accounting policies differ from one enterprise to other and they may even vary within a single enterprise from one accounting period to another accounting period, it is difficult to frame a single accounting standard to enforce a single accounting policy. Keeping this aspect in mind, this Accounting Standards (AS–1) permits to effect a change in the accounting policy of an enterprise. But it should be disclosed in the financial statements, stating reasons for such change in accounting policies, which has a material effect.

11.4 Disclosure of Changes in Accounting Policies

Accounting Standards (AS–1) provides for the following matters on disclosure of accounting policies:

- In order to understand the financial statements effectively, enterprises should disclose all significant accounting policies adopted in the preparation and presentation of financial statements.

- Such disclosures should form part of financial statements.

- All disclosures should be disclosed at ONE PLACE, that is, at the end of financial statements.

OBJECTIVE 12: CASE STUDY

Significant accounting policies are usually disclosed as one of the schedules to the accounts in the Annual Report of enterprises. A typical specimen on “Significant Accounting Policies” of a business enterprise is given as follows:

X-LTD – Significant Accounting Policies

(Reproduced from its Annual Report for the year)

12.1 Convention

The financial statements have been prepared in accordance with applicable Accounting Standards in India. A summary of important accounting policies, which have been applied consistently, is set out below. The financial statements have also been in accordance with relevant presentational requirements of the Companies Act, 1956.

12.2 Basis of Accounting

The financial statements are prepared in accordance with the historical cost convention modified by revaluation of certain fixed assets as detailed below.

12.2.1 Fixed Assets

Gross Fixed Assets are stated at the cost of acquisition inclusive of Inward Freight, Duties and Taxes and Incidental Expenses related to acquisition. In respect of major projects involving construction, revalued pre-operational expenses form part of the value of assets capitalised.

12.3 Depreciation

The company follows Straight Line Method of depreciation in respect of all its fixed assets, except those revalued, as per Schedule XIV of the Companies Act, 1956. Leasehold properties are amortised over the period of the lease.

12.4 Inventories

Inventories including work-in-progress are valued at cost or below. The cost is calculated on Weighted Average Method. Raw materials, purchased finished goods in transit are valued at cost. Cost of manufactured inventories (finished goods and work-in-progress) is ascertained on the Absorption Costing Basis and finished goods are inclusive of duty.

12.5 Revaluation of Assets

Original book value of assets is revalued from time to time. The difference between the written up value of the fixed assets is revalued and depreciation adjustment is transferred to Revaluation Reserve. Revaluation Reserve Account is charged with annual depreciation on that portion of the value which is written up.

12.6 Investments

Current investments are valued at lower of cost and fair value. Long term investments are valued at cost where applicable. Provision is made where there is a permanent fall in valuation of long term investments.

12.7 Sale

Sale of goods is recognised at the point of dispatch of finished goods to customers.

12.8 Turnover

Turnover is stated on the basis of invoiced value of goods sold and services rendered, net of sales tax, inclusive of excise duties, luxury taxes and so on.

12.9 Investment Income

Income from investments are treated on accrual basis.

12.10 Retirement Benefits

Monthly contributions to various provident funds, pension funds and gratuity funds are charged against revenue. The amount paid to employees under Voluntary Retirement Scheme, included under miscellaneous expenditure in the Balance Sheet, is amortised over a period of six years. All contributions in respect of employee’s retirement benefit schemes are statutorily deposited with the government.

12.11 Provision for Income Tax

Provision for income tax is based on the assessable profits computed in accordance with the statutory provisions of Income Tax Act, 1961. Deferred tax is recognised, by creation of Deferred Tax Assets.

12.12 Lease Rentals

Equipments taken on lease, rentals payable are segregated into cost of asset and interest component by applying IRR (Internal Rate of Return). The cost component is amortised over the remaining useful life of the asset and the interest component is charged as period cost.

12.13 Research and Development

All revenue expenditure on research and development are written off in the year in which it is occurred. Capital expenditure is included under “Fixed Assets.”

12.14 Foreign Currency Transaction

Transactions in foreign currency are recorded at the exchange rates prevailing at the date of transactions. Gains/losses out of fluctuations in the exchange rates are recognised in profit and loss account. Material differences on translation of current assets and current liabilities (remaining unsettled at the year end) are recognised in profit and loss account.

12.15 Claims

Claims against the company not acknowledged as bad debts are disclosed after careful evaluation.

12.16 Financial and Management Information System

An integrated accounting system, which unifies both financial books and costing records is practised. The books of account and other records have been designed to facilitate compliance of the relevant provisions of the Companies Act on the one hand, and meet the internal requirements of information and systems for planning, review and internal control on the other. The cost accounts are designed to adopt costing systems, the basic tenets and principles of standing costing, budgetary control and marginal costing are appropriate.

As the preparation and presentation of financial statements function as a central nervous system in the accounting process, this Accounting Standard AS–1 has been dealt with in an elaborate manner.

The other Accounting Standards are presented in the summarised form as following.

OBJECTIVE 13: ACCOUNTING STANDARD-2 (AS–2) REVISED AND VALUATION OF INVENTORIES

According to AS–2, inventories are assets

- held for sale in the ordinary course of business

- in the process of production for such sale or

- in the form of materials or supplies to be consumed in the production process or in the rendering of services

Inventories do not include machinery spares which is dealt with in AS–10.

13.1 Valuation of Inventories

As per AS–2, inventories should be valued at the lower of cost and net realisable value.

Cost of Inventories: It should include the following as per AS–2:

- Cost of purchase.

- Cost of conversion.

- Other costs incurred in bringing the inventories to their present location and condition.

Exclusions from the Cost of Inventories: Some costs are excluded from the cost of inventories and are treated as expenses of the period in which they are incurred. Such costs are abnormal amount of wasted materials, labour, or other production costs, storage costs unless necessary in production process prior to a further production stage, administrative overheads, selling and distribution costs.

Cost Formulas: AS–2 recommend the following cost formulas on the basis of inventory flow assumptions. They are – Specific Identification Method, First-In-First-Out Method (FIFO), Weighted Average Method, Standard Cost and Retail Inventory Method. It recommends the application of lower cost or net realisable values.

AS–2 requires the following disclosure in financial statements:

- the accounting policies adopted in measuring inventories, including the cost formulas used;

- the total carrying amount of inventories and its classification appropriate to the enterprise;

- information about the carrying amounts held in different classification of inventories and raw materials and components, work-in-progress, finished goods, stores and spares and loose tools;

- in accordance with AS–1, disclosures must include a change in the accounting policy with respect to inventory and its effect on the financial statements of the current accounting period.

It is important to note that the valuation of items, by-products, consumable stores, reusable waste, non-reusable waste will have to be computed on the following basis:

OBJECTIVE 14: ACCOUNTING STANDARD-3 (AS–3) AND CASH FLOW STATEMENTS

A cash flow statement is a statement prepared for a period providing a summary of cash receipts and payments. Cash flows are classified as operating, financing and investing. This classification is explained in detail in Chapter 17.

AS–3 suggests two ways of reporting cash flows from operating activities

- Direct Method and

- Indirect Method

Investing and financing transactions that do not require the use of cash or cash equivalents should be excluded from a cash flow statement. Such transactions should be disclosed elsewhere in the financial statements, which provides all the relevant information about those investing and financing activities. Some examples of non-cash transactions are:

- acquisition of assets by assuming directly related liabilities

- acquisition of an enterprise by means of issuing share

- conversion of debt into equity

As per AS–3, enterprises should disclose the components of cash and cash equivalents. They should present a reconciliation of the amounts in Cash Flow Statement with equivalent items in the Balance Sheet. The management should also disclose the amount of significant cash and cash equivalent balances which are not available (held abroad) for use by the enterprises.

OBJECTIVE 15: AS–4: CONTINGENCIES AND EVENTS OCCURRING AFTER BALANCE SHEET DATE

This standard AS–4 deals with contingencies and events occurring after the Balance Sheet date. These two are separate items.

AS–4 defines a contingency as “a condition or situation, the ultimate outcome of which, gain or loss, will be known or determined only on the occurrence, or non-occurrence, of one or more uncertain future events.”

Examples of contingencies are:

- bills of exchange receivable, which has been discounted with recourse

- pending litigation

- financial guarantees given on behalf of other parties

- product warranties still unexpired

- pending insurance claims

The following are the facts that come under AS–4:

- The amount of a contingent loss should be provided for in the Statement of Profit and Loss, if the following are satisfied:

- There is a probability that future events will confirm, after considering any factor that is related, that an asset has been damaged or a liability has arisen.

- It is possible to estimate the loss on a reasonable basis.

- In case, if no provision has been made, the same should be disclosed.

- It is not necessary to recognise contingent gain. This is because, if contingent gain is recognised, it would lead to the recognition of revenue which has no chance of realisation.

- All major events whether favourable or unfavourable happening between the Balance Sheet date and the date of approval of financial statements by the Board of Directors or proper approving authority are events occurring after the Balance Sheet date.

- It is possible to classify such events into:

- Events happening after the Balance Sheet date that gives further indication relating to the conditions existing on the date of Balance Sheet.

- Events happening after the Balance Sheet date that indicate the conditions which take place after the date of Balance Sheet.

AS–4 requires adjustment of Assets and Liabilities in the case of events mentioned in classification (a) and only disclosures in the case of events mentioned in the second classification (b).

- There may be an indication from the events occurring after the Balance Sheet that the business enterprise stops to be a going concern. This calls for the review of a going concern concept.

- Disclosure:

- Contingencies: The following should be disclosed:

- The nature of contingency.

- The uncertainties that may affect the future income.

- An estimate of the financial effect, or a statement that such an estimate cannot be made.

- Events occurring after the Balance Sheet: the following should be provided.

- The nature of the event.

- An estimate of the financial effect or a statement that such an estimate cannot be made.

- Contingencies: The following should be disclosed:

OBJECTIVE 16: AS–5: NET PROFIT OR LOSS FOR THE PERIOD, PRIOR PERIOD ITEMS AND CHANGES IN ACCOUNTING POLICIES

- A time of determination of net profit or loss, all items of expense and income, which are recognized during a period should be considered. While preparing the profit and loss account, the basic principle should be followed and no deviation is allowed unless an accounting standard so provides.

- The following items should be disclosed in the Profit and Loss Account:

- Profit and loss from ordinary activities.

- Extraordinary items.

Activities which are carried out, be an enterprise as a part of its business and similar activities of related nature undertaken by it for furthering, supplementary to, or arising from these activities are known as ordinary activities.

Expenses or income arising, out of transactions or events that are quite different from ordinary activities are called extraordinary items.

All the other Accounting Standards are discussed in the respective, related chapters.

Summary

- Accounting Standards are written statements of accounting rules and guidelines. They are codified forms of GAPP.

- Objectives – to provide information, to harmonise different accounting processes and to enhance the contents.

- Constitution of Accounting Standard Board (ASB) in India.

- Scope of Accounting Standards in India.

- Procedure for issuing Accounting Standards – ASB assisted by Study Group – Exposure Draft – Circulation – ASB after incorporating suggestions submit to ICAI – ICAI will issue Standard.

- Applicability of Accounting Standards: Classification of enterprises into 3 levels – Accounting Standards 1 to Accounting Standards 29 (AS) –1 to AS–29 – their applicable areas.

- Compliance with Accounting Standards: Role of ICAI – Role of Companies Act Sec. 211 & Sec. 211 (3B).

- Implementation: Provision of Clause 2AA to Sec. 217

- Salient features of General Purpose Financial Statements and the role of ASB.

- Benefits of Accounting Standards – (i) true and fair financial position, (ii) easy comparability, (iii) enhances the value of accounting information, (iv) efficiency of management, (v) useful to accountants and auditors and (vi) enhances credibility and reliability.

- AS–1: Disclosure of Accounting Policies: (i) Disclosure of all significant accounting policies followed in the preparation of income statement and balance sheet, (ii) selection of accounting policies, (iii) disclosure of fundamental accounting assumptions and (iv) disclosure of changes in accounting policies.

- AS–2: Valuation of inventories – AS–2 recommends the cost formula: Specific identification method, FIFO, Weighted Average method, Standard Cost and Retail Inventory method, Application of lower of cost or net realisable values.

- Accounting Standard AS–3 – Suggests the ways of reporting cash flows – direct method and indirect method – exclusion of non-cash transactions from cash flow statements. AS–3 stipulates disclosure of cash and cash equivalents.

- AS–4 deals with Contingencies and events occurring after the Balance Sheet date.

- AS–5 deals with net profit or loss for the period – Prior period items and changes in accounting policies. It emphasises the disclosure of (i) profit and loss from ordinary activities and (ii) extraordinary items in the profit and loss account.

Key Terms

Accounting Standards: Accounting Standards are the codified forms of generally accepted accounting principles. They are designed to harmonise different accounting practises, propounded by an accounting or professional bodies.

Accounting Policies: They are the specific accounting principles and the method of applying those principles adopted by an entity in the preparation and presentation of financial statements.

Accounting Standard Board (ASB): The board constituted by ICAI to conceive, formulate, examine and review the Accounting Standards.

Disclosure: Statements attached to financial statements, explaining accounting policies adopted in the preparation and presentation of financial statements of an entity.

ICAI: Institute of Chartered Accountants of India – the apex body of accounting professionals in India.

NACAS: National Advisory Committee on Accounting Standards was set up to advise the central government on the formulation and laying down of accounting policies and Accounting Standards in India.

Reference

Compendium of Statements and Standards of Accounting, The Institute of Chartered Accountants of India, New Delhi.

A Objective-type Questions

I: State whether the following statements are True or False

- Accounting Standards aim to harmonise diverse accounting practises.

- Accounting Standards and Generally Accepted Accounting Principles (GAPP) are one and the same thing.

- Accounting Standards are statutory provisions and not mere guidelines.

- Accounting Standards are issued by amending the Companies Act, 1956.

- The Accounting Standards Board (India) need not take into consideration the applicable laws prevailing in India, which formulate the Accounting Standards.

- As per the Companies Act, every Profit and Loss Account and Balance Sheet shall comply with the Accounting Standards.

- For the purpose of applicability of Accounting Standards, enterprises are classified into three broad categories.

- Accounting Standard–1 is related to “Disclosure of Accounting Policies.”

- Accounting Standard (AS)–6 (Revised) is issued relating to “Revenue Recognition.”

- Accounting Standard–9 (AS)–9 is related to depreciation.

Answers

1. True |

2. False |

3. False |

4. False |

5. False |

6. True |

7. True |

8. True |

9. False |

10. False |

B Short Answer-type Questions

- Define the term “Accounting Standards.”

- What are the main differences between a concept and an accounting standard?

- What are the main objectives of Accounting Standards?

- What is the legal status of Accounting Standards in India?

- What are the three fundamental accounting assumptions underlying the preparation and presentation of financial statements as per AS–1?

- Explain the utility of Accounting Standards with special emphasis on accounting professionals.

C Essay-type Questions

- Explain the procedure for issuing and revising Accounting Standards in India.

- Explain in detail the applicability of Accounting Standards with special reference to various level of categories of enterprises.

- Explain the important provisions of Accounting Standard (AS)–1 (Revised)

- Explain the relevant Accounting Standards (Revised) with respect to

- Recognition Revenue,

- Depreciation Accounting,

- Cash Flow Statement,

- Inventories.