Chapter 17

Cash Flow Statement

LEARNING OBJECTIVES

After studying this chapter, you will be able to understand

Meaning of Cash Flow and Cash Flow Statement

Uses of Cash Flow Statement

Limitations of Cash Flow Statement

Classification of Business Transactions into Operating Activities, Investing Activities, and Financing Activities According to Accounting Standard (AS)–3 (Revised)

Preparation of Cash Flow Statement as per AS–3 by Both Direct Method and Indirect Method.

Accounting Treatment of Special Items (Non-cash Expenses and Non-operating Income)

Various Stages Involved in the Preparation of Cash Flow Statement (Six Stages With Illustrations) in Accordance With AS–3 (Revised).

Introduction

The end product of the accounting process is “Financial Statement.” Financial Statements are nothing but the summarised statements of accounting data produced at the end of the accounting process by a business entity. It communicates accounting information to its users. The Balance Sheet and Profit and Loss Account (Income Statement) are the traditional financial statements of any business entity. A Balance Sheet shows the financial position of a business enterprise on the last day of an accounting period. It is only a Statement of Assets and Liabilities stating the financial position of an enterprise at a given date. A Profit and Loss Account (Income Statement) shows the financial performance (i.e., profit or loss) of a business entity during the specified period (i.e., accounting period). But revenues recorded in Profit and Loss Account will not reflect cash inflows. Likewise, some of the expenses shown in Profit and Loss Account will be non-cash expenses (like depreciation amortisation) and some will not be paid in full like goods purchased, on credit, outstanding expenses. As such, the periods of profit or loss will not bear any direct relationship with cash flows relating to that specified accounting period. No exact information will be obtained from these two traditional financial statements with regard to investing or financing activities of business entities. Hence, the need arises to assess the inflows and outflows of cash during the accounting period. Keeping in view of this aspect, the Institute of Chartered Accountants of India (ICAI) introduced one more essential component of financial statements – known as Cash Flow Statement. As per AS–3 (revised), the preparation of cash flow statement as the third financial statement has become statutory for any companies registered under the Companies Act 1956. The other forms of business organisations also prepare this third financial statement, viz. Cash Flow Statement. This Cash Flow Statement has to be prepared to provide information about the cash flows associated with operating, investing and financing activities of business entities during accounting period. Cash Flow Statement to put it in a nutshell reflects “sources and uses of cash.” This statement reveals “where cash comes from and where it goes.” This chapter describes in detail on this financial statement.

OBJECTIVE 1: MEANING OF CASH FLOW AND CASH FLOW STATEMENT

- Cash flow refers to movement both, inflow and outflow, of cash and cash equivalents during a period.

- Inflow of cash refers to all transactions that lead to increase in cash and cash equivalents.

- Outflow of cash refers to all transactions that lead to decrease in cash and cash equivalents.

- Cash Flow Statement is a statement that shows flow of cash and cash equivalents during a period.

OBJECTIVE 2: USES OF CASH FLOW STATEMENT

1. Short-term Planning: It gives information for a specific period. It is useful in short-term planning of an enterprise.

2. Easy Analysis of Liquidity and Solvency: Periodical cash flow statements assist in ascertaining liquidity and solvency of a concern.

3. Cash Management: This provides information about cash – surplus or deficit, thereby resulting in an efficient cash management.

4. Prediction: This predicts about the soundness of financial status of a concern.

5. Cash Budget: Cash Flow Statement is useful in preparing cash budgets of an enterprise.

6. Cash Position: This not only ascertains the cash position but also explains the reasons for such cash position (lower or higher).

7. Management Decisions: This is useful in determining the urgeness of management decisions and thereby acting as a deterrent against incorrect decisions.

8. A Tool of Planning: All future investments may be effectively planned with the help of Cash Flow Statements.

9. Dividend Policy: This statement also helps an enterprise in planning a good dividend policy.

OBJECTIVE 3: LIMITATIONS OF CASH FLOW STATEMENT

- All non-cash transactions are not covered, since this statement is based on the limited concept of cash and cash equivalents.

- It is not a proper substitute as this statement reveals the net cash flow only and it may not be useful as a substitute for income statement.

- It is not an effective tool, since this is not a good indicator of the financial position of a concern as it ignores mainly the working capital part.

- It is based on past records. No future planning can be properly made unless and otherwise it is accompanied by some other documents. It is historical in nature.

3.1 Meaning of Cash Flow, Cash and Cash Equivalents

- Cash flows are inflows and outflows of cash and cash equivalents.

- Cash: Cash on hand and demand deposits in banks.

- Cash equivalents: They are usually of short term and highly liquid investments. Treasury bills, commercial papers, money market funds and investment in preference shares are some of cash equivalents.

OBJECTIVE 4: PREPARATION OF CASH FLOW STATEMENTS

As per the syllabus, cash flow statements are to be prepared as per revised standard issued by ICAI. This revised standard is better known among professional accountants as AS–3 (revised).

This AS–3 requires a Cash Flow Statement to be prepared and presented in a manner that it shows cash flow from business transactions during a period classified as follows:

- Operating Activities

- Investing Activities

- Financing Activities

These classifications of business transactions as per AS–3 may be represented as follows for easy comprehension.

Note:

- Except B, all items relate to manufacturing concerns.

- Students should not misunderstand about the above representation.

This is not a distinction or difference between cash inflow and cash outflow. This only facilitates easy comprehension and better remembrance of cash inflow and cash outflow for each of the activities classified.

Illustration: 1

From the following activities, classify them as (1) Operating Activities, (2) Investing Activities and (3) Financing Activities

Requirements

- Issue of debentures

- Sale of machinery

- Sale of investment

- Sale of patent

- Bank balance

- Investment in marketable securities (only short term)

- Buy back of equity shares

- Income tax paid

- Office expenses

- Repayment of a long-term loan

Solution

Financing Activities |

: |

Issue of debenture, buy back of shares, repayment of long-term loan (manufacturer concern) |

Operating Activities |

: |

Sale of investment, income tax paid, office expenses |

Investing Activities |

: |

Sale of machinery, sale of investment (financial concerns) and sale of patent |

Cash equivalents |

: |

Bank balance, investment in marketable securities (short term) |

OBJECTIVE 5: CASH FLOW STATEMENT: PREPARATION

AS–3 requires that the Cash Flow Statement should show separately the activities, viz.

- Cash Flow from Operating Activities

- Cash Flow from Investing Activities

- Cash Flow from Financing Activities

Before preparation of cash flow statements, one should be familiar with the pro forma or format of Cash Flow Statement under two different methods – (i) Direct Method and (ii) Indirect Method.

These are the revised formats as issued by ICAI (revised) as per AS–3 (revised).

5.1 Direct Method Pro-forma or Format of Cash Flow Statement for the Year Ended

| Particulars | Rs | Rs |

|---|---|---|

Cash from Operating Activities |

|

|

A. Operating Cash Receipts |

|

|

(i) Cash Sales |

|

|

(ii) Cash Received from Customers |

– |

|

(iii) Trading Commission Received |

– |

|

(iv) Royalties Received |

– |

|

(v) Others |

– |

xxxx(A) |

B. Operating Cash Payments |

|

|

(i) Cash Purchases |

– |

|

(ii) Cash Paid to Suppliers |

– |

|

(iii) Cash Paid to Business Expenses (office expenses, manufacturing expense, selling expense) |

– |

|

(iv) Others |

– |

xxxx(B) |

C. Cash Generated from Operation (A−B) |

|

xxx |

D. Income Tax Paid |

|

xxx |

E. Cash Flow before Extraordinary Items |

|

xxxx |

F. Extraordinary items (Receipts/payments) |

|

xxxx |

G. Net Cash from Operating Activities |

± |

(–) |

2. Cash flow from Investing Activities (As in Indirect Method) |

|

xxxxx |

3. Cash Flow from Financing Activities (As in Indirect Method) |

|

xxxx |

4. Net Increase/Decrease in Cash and Cash Equivalents (as in Indirect Method) (1 + 2 + 3) |

|

xxxx |

5. Add Cash and Cash Equivalents |

|

xxxxx |

In the beginning of the year (same as in Indirect Method) |

|

|

6. Cash and Cash equivalent in the end of the year |

|

xxxxx |

5.2 Indirect Method Pro-forma or Format Cash Flow Statement for the Year Ended

| Particulars | Rs | Rs |

|---|---|---|

1. Cash Flow from Operating Activities |

|

xxx |

A. Net profit before taxation and extraordinary items |

|

|

B. Add: Items to be added |

|

|

• Depreciation |

– |

|

• Preliminary expenses written off |

– |

|

• Discount on issue of shares and debentures written off |

– |

|

• Goodwill written off |

– |

|

• Patents and Trade marks written off |

– |

|

• Interest on Borrowings and Debentures (Only for non-finance companies to be shown – under Financial Activities) |

– |

|

• Loss on Sale of Fixed Assets |

– |

xxx |

C. Less: Items to be Deducted |

|

|

• Interest Income (only for non-finance companies to be shown under Investment Activities) |

– |

|

• Dividend Income (for non-finance companies to be shown under investment activities) |

– |

|

• Rental Income |

– |

|

• Profit on Sale of Fixed Assets (to be shown under Investment Activities – Sale Price) Operating Profit before Working Capital Charges Operating Profi t before working capital charges |

– |

xxx |

D. Operating Profit before Working Capital Changes (A + B – C) |

– |

|

E. Add: Decrease in Current Assets and Increase in Current Liabilities Detail: |

||

• Decrease in Stock/inventories |

– |

|

• Decrease in Debtors/B/R |

– |

|

• Decrease in Accrued Incomes |

– |

|

• Decrease in Prepaid Expenses |

– |

|

• Increase in Creditors/B/P |

– |

|

• Increase in Outstanding Expenses |

– |

|

• Increase in Advanced Income |

– |

|

• Increase in Provision for Doubtful Debt |

– |

x-x |

F. Less: Increase in Current Assets and Decrease in Current Liabilities |

||

• Increase in Stock/inventories |

||

• Increase in Debtors/B/R |

– |

|

• Increase in Accrued Incomes |

– |

|

• Increase in Prepaid Expenses |

– |

|

• Decrease in Creditors/B/P |

– |

|

• Decrease in Outstanding Expenses |

– |

|

• Decrease in Advanced Income |

– |

|

• Decrease in Provision for Doubtful Debt |

– |

|

|

– |

– |

G. Cash Generated from Operations (D + E – F) |

xxx |

|

H. Less: Income Tax Paid |

– |

|

I. Cash flow before extraordinary items, extraordinary items (±) |

* * * |

|

J. Net Cash from (or used in) Operating Activities |

xxx |

|

2. Cash Flow from Investing Activities |

||

• Proceeds from Sale of Fixed Assets |

– |

|

• Proceeds from Sale of Investments |

– |

|

• Proceeds from Sale of Intangible Assets |

– |

|

• Interest and Dividend Received (for non-finance companies only) |

– |

|

• Rent Income |

– |

|

• Purchase of Fixed Assets |

– |

|

• Purchase of Investments |

– |

|

• Purchase of Intangible Assets, e.g. Goodwill |

– |

|

• Extraordinary Items (± or) |

– |

|

Net Cash from (used in Investing Activities) |

___ |

|

3. Cash Flow from Financing Activities |

xxx |

|

• Proceeds from Issue of Shares and Debentures |

– |

|

• Proceeds from other Long-Term Borrowings |

– |

|

• Final Dividend paid |

– |

|

• Interim Dividend paid |

– |

|

• Interest on Loans and Debentures |

– |

|

• Repayment of Loans |

– |

|

• Redemption of Debentures/pret |

– |

|

• Extraordinary Items ( + or −) |

– |

|

Net Cash from (or used in) Financing Activities |

– |

|

|

– |

|

4. Net Increase/Decrease in Cash and Cash Equivalents (1 + 2 + 3) |

xxx |

|

5. Cash and Cash Equivalents in the beginning of the year |

||

• Cash in Hand |

– |

|

• Cash at Bank (less: O/D) |

– |

____ |

• Short-Term Deposits |

– |

xxx |

• Marketable Securities |

– |

– |

6. Cash and Cash Equivalents at the end of the year |

||

• Cash in Hand |

||

• Cash at Bank (less: O/D) |

||

• Short-Term Deposits |

||

• Marketable Securities |

Illustration: 2

You are required to calculate cash inflow from debtors from the following data.

| Particulars | Rs |

|---|---|

Opening Balance |

5,00,000 |

Cash Sales |

2,00,000 |

Opening Debtors |

50,000 |

Closing Debtors |

80,000 |

Sales Returns |

20,000 |

Solution: Cash inflow from debtors has to be computed. This can be prepared by two methods.

Method 1: Cash Inflow from Debtors: First the format has to be drawn. Then transfer the items as follows:

Cash Inflow from Debtors

| Particulars | Rs | |

|---|---|---|

Opening Balance |

Rs |

50,000 |

ADD Credit Sales: Total Sales |

5,00,000 |

|

Less: Cash Sales |

2,00,000 |

3,00,000 |

Closing Balance of Debtors |

3,50,000 |

|

Cash inflow from Debtors |

||

Less: |

||

Sales Returns |

20,000 |

|

Closing Balance of Debtors |

80,000 |

1,00,000 |

Cash Inflow from Debtors |

2,50,000 |

Step A: |

Opening Debtors has to be taken as base (given in the question) |

Step B: |

With this Credit Sales (Total Sale − Cash Sale) is ADDED |

Step C: |

Then, Sales Returns and Closing Balance of Debtors to be deducted |

Step D: |

The result shows Cash Infl ow from Debtors |

Method 2

Total Debtors Account

Total Debtors Account (ledger) is computed, as above.

Note

- Cash Inflow from Debtors is the balancing figure (Rs 2,50,000).

- Any one method may be adopted. The result will be same under both the methods, i.e. Cash Inflow from Debtors: Rs 2,50,000.

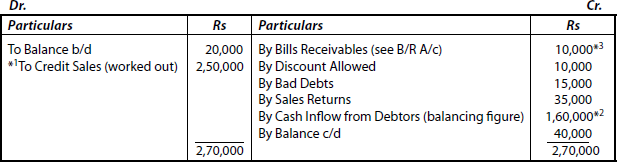

Illustration: 3

From the following calculate cash inflow from debtors

| Particulars | Rs |

|---|---|

Opening Debtors |

20,000 |

Closing Debtors |

40,000 |

Opening Bills Receivables |

15,000 |

Closing Bills Receivables |

25,000 |

Total Sales |

3,00,000 |

Cash Sales |

25% of credit sales |

Discount Allowed |

10,000 |

Bad Debts |

15,000 |

Discount Allowed |

20,000 |

Sales Returns |

35,000 |

Solution: First value of credit sales is to be calculated irrespective of the method to be adopted.

Let Credit Sales be taken as |

= |

X |

Cash Sales |

= |

25% of X |

|

= |

X/5 |

Method 1: Cash Inflow from Debtors

| Particulars | Rs | |

|---|---|---|

| Opening Debtors | 20,000 |

|

| Opening Bills Receivable | 15,000 |

|

| *1Add: Credit Sales (worked out above) | Rs |

2,50,000 |

| Less: Discount Allowed | (10,000) |

2,85,000 |

| Bad Debts | (15,000) |

|

| Sales Returns | (35,000) |

|

| Closing Debtors | (40,000) |

|

| Closing Bills Receivables | (25,000) |

|

1,25,000 |

||

1,60,000*2 |

Total Debtors Account

Bills Receivables

Method 2: Cash Inflow from Trading Commission

Illustration:4

Calculate the amount of trading commission received during the year 2006 from the following data.

|

Jan 2006 |

Dec 31, 2006 |

Accrued Trading Commission |

10,000 |

45,000 |

Advance Trading Commission |

15,000 |

60,000 |

Trading Commission earned during the year 2006 is Rs 1,70,000 |

||

Solution: Trading Commission received can also be computed in two different ways (1) Statement Form and (2) Account Form.

1. Statement Form

| Particulars | Rs | Rs |

|---|---|---|

Trading Commission earning during 2006 |

1,70,000 |

|

Add: 1. Accrued Trading Commission as on Jan 1, 2006 |

10,000 |

|

2. Advance Trading Commission as on Dec 31, 2006 |

60,000 |

70,000 |

|

2,40,000 |

|

Less: 1. Accrued Trading Commission as on Dec 31, 2006 |

15,000 |

|

2. Advance Trading Commission as on Jan 1, 2006 |

45,000 |

60,000 |

Total Commission earned during 2006 |

1,80,000 |

2. Account Form Trading Commission Account

5.3 Calculation of Cash Outflow on Purchases

Purchases include both cash and credit purchases.

5.3.1 Credit Purchases

|

+ ■ Credit Purchases + |

|

|

+ ■ Opening Creditors + |

Items to be added |

|

+ ■ Opening Bills Payable |

|

|

− ■ Closing Creditors |

|

|

− ■ Closing Bills Payable |

|

|

− ■ Discount Received |

Items to be deducted |

|

− ■ Purchase Returns |

|

This can also be calculated by preparing Total Creditors Account. [The balancing figure and bills payable can be inserted in the A/c by preparing Bills Payable A/c (balancing fig).]

Illustration: 5

Calculate cash outflow to creditors from the following:

Total Purchases |

: |

Rs 1,80,000 |

Cash Purchases |

: |

50% of credit purchases |

Opening Creditors |

: |

Rs 5,000 |

Closing Creditors |

: |

Rs 20,000 |

Purchase Returns |

: |

Rs 25,000 |

Discount (Received) |

: |

Rs 10,000 |

Solution

First, we have to calculate credit purchase. Credit purchase is not given in the problem. So, let us assume,

Credit purchases = Rs x.

Cash purchase is given as 50% of credit purchase

So, Cash purchase = x/2

Total purchases = Cash purchase + Credit purchase

Method 1: Calculation of Cash Outflow to Creditors

| Particulars | Rs | |

|---|---|---|

Opening Balance of Creditors |

5,000 |

|

Add: Credit Purchases |

1,20,000 |

|

Less: |

Rs |

|

(i) Closing Balance of Creditors |

(20,000) |

|

(ii) Discount Received |

(10,000) |

|

(iii) Purchase Returns |

(25,000) |

55,000 |

Cash Outfl ow to Creditors |

70,000 |

Method 2:

Total Creditors Account

(Note: Balancing figure = Rs 1,25,000 – 55,000) = Rs 70,000

Illustration: 6

Complete cash outflow to creditors from the following:

|

|

Rs |

|

Cost of Goods Sold |

3,00,000 |

|

Operating Stock |

5,000 |

|

Closing Stock |

15,000 |

|

25,000 |

|

|

Return Outwards |

10,000 |

|

Discount Received |

15,000 |

|

Opening Bills Payable A/c |

40,000 |

|

Closing Bills Payable A/c |

50,000 |

|

Closing Balance of Creditors |

40,000 |

|

Cash Purchases |

60,000 |

Solution: Credit purchases will have to be calculated first. For this, from the figures, total purchases are calculated.

Total Purchases = Cost of Sales (Cost of Goods Sold) + Closing Stock − Opening Stock

Students should note that cost of sales and cost of goods sold are one and the same

= Rs 3,00,000 + 15,000 – 5,000 = Rs 3,10,000

Then, Credit Purchases = Total Purchases – Cash Purchases

|

= |

Rs 3,10,000 ‒ Rs 60,000 |

|

= |

Rs 2,50,000 |

Method 1: Cash Outflow to Creditors Account

| Particulars | Rs | |

|---|---|---|

Opening Balance of Creditors A/c |

25,000 |

|

Opening Balance of Bills Payable A/c |

40,000 |

|

Add: Credit Purchases |

2,50,000 |

|

Less: |

Rs |

3,15,000 |

1. Discount Received |

15,000 |

|

2. Returns Outwards |

10,000 |

|

3. Closing Balance of Creditors |

40,000 |

|

4. Closing Balance of Bills Payable |

50,000 |

1,15,000 |

Cash Outfl ow to Creditors |

2,00,000 |

Method 2

Total Creditors Account

Bills Payable A/c

5.4 Cash Outflow on Expenses Incurred

To find out cash outflow, the amount of expenses (given in P & L A/c) has to be adjusted.

| Step 1: | For this * (i) amount outstanding in the beginning and (ii) prepaid at the end to be added with expenses (given in P & L A/c). |

| Step 2: | (i) Amount outstanding in the end and (ii) prepaid at the beginning have to be deducted from P & L A/c. |

| Step 3: | Net figure arrived will be cash paid for expenses. |

| Note 1: | All non-cash expenses have to be ignored because no cash payment is involved (i.e., cash flow does not take place). |

Treatment of non-cash expenses: Such expenses are as follows:

- Depreciation

- Preliminary expenses written off

- Discount on issue of shares and debentures written off

- Goodwill written off

- Patents and copyrights written off

- Underwriting commission written off

Note 2: All appropriations: To be ignored: Outflow of cash does not occur

Appropriations:

- Proposed dividend

- Provision for taxation

- Transfers to General Reserves

Note 3: All items relating to investing activities and financing activities are ignored because they are taken into calculation of cash flow from investing or financing activities. For example, profit/loss on sale of fixed assets.

Illustration: 7

Compute Cash Outflow on Business Expenses from the following (taken from P & L A/c)

|

|

Rs |

|

Expenses occurred during the year 2006 |

25,000 |

|

Opening Outstanding Expenses |

3,000 |

|

Closing Outstanding Expenses |

5,000 |

|

Opening Prepaid Expenses |

4,000 |

|

Closing Prepaid Expenses |

2,500 |

Solution

Method I: Cash Outflow on Business Expenses

| Particulars | Rs | Rs |

|---|---|---|

Expenses incurred during the year |

25,000 |

|

Add: Opening Outstanding Expenses Closing Prepaid Expenses |

3000 |

|

Less: Closing Outstanding Expenses Opening Prepaid Expenses |

2500 |

5,500 |

|

30,500 |

|

Less: Closing Outstanding Expenses |

5000 |

|

Opening Prepaid Expenses |

4000 |

9,000 |

Cash Outflow on Expenses |

21,500 |

Method II

Expenses Account

Calculation of Cash from Operating Activities (Direct Method)

Illustration: 8

Direct Method illustrated:

Calculate cash flow from the following data by Direct Method.

|

|

Rs |

|

Cash Sales |

6,00,000 |

|

Cash Purchases |

3,00,000 |

|

Royalties Received |

25,000 |

|

Commission Paid |

15,000 |

|

Rent Paid |

12,000 |

|

Tax Paid |

33,000 |

|

Tax Refund Received |

13,000 |

|

Cash Received from Debtors |

15,000 |

|

Cash Paid to Creditors |

5,000 |

|

Wages and Salaries Paid |

30,000 |

|

Manufacturing Expenses Paid |

10,000 |

|

Office Expenses Paid |

8,000 |

|

Insurance Claim for Tsunami Loss |

35,000 |

Solution

Cash flow from Operating Activities

| Particulars | Rs | |

|---|---|---|

A. Operating Cash Receipts |

|

|

Cash Sales |

|

6,00,000 |

Cash Received from Debtors |

|

15,000 |

Royalties Received |

|

25,000 |

|

|

6,40,000 |

B. Operating Cash Payments |

Rs |

|

Cash Paid to Creditors |

5,000 |

|

Cash Purchases |

3,00,000 |

|

Commission Paid |

15,000 |

|

Rent Paid |

12,000 |

|

Wages and Salaries |

30,000 |

|

Manufacturing Expenses |

10,000 |

|

Office Expenses |

8,000 |

3,80,000 |

C. Cash From Operations Before Tax |

Rs |

2,60,000 |

D. Income Tax Paid |

33,000 |

|

Less: Refund Received |

13,000 |

20,000 |

E. Cash Flow from Operations before Extraordinary Items |

|

2,40,000 |

F. Extraordinary Items: Insurance Claim for Tsunami |

|

35,000 |

G. Net Cash Flow From Operating Activities |

|

2,05,000 |

Cash Flow from Operating Activities (Indirect Method)

So far, we have discussed the calculation of cash flow (Operating Activities) by Direct Method, stage by stage. Now we have to discuss this by the following Indirect Method.

One has to make adjustments on net profit arrived as in P & L Account.

To put in a nutshell, the net operating profit before working capital charges has to be adjusted as:

Items to be added

Items that lead to increase in cash have to be added.

They are as follows:

- Decrease in Current Assets

- Increase in Current Liabilities

Items to be deducted

Items that lead to decrease in cash have to be deducted.

They are as follows:

- Increase in Current Assets

- Decrease in Current Liabilities

Illustration: 9

Calculate Cash Flow from Operating Activities from the Following P & L A/c by Indirect Method

Solution: First, net profit before tax has to be calculated

|

Adjustment |

Net profit as per P & L A/c |

Rs 15,000 |

|

Items to be added: |

1. Proposed Dividend |

Rs 10,000 |

|

|

2. Provision for Tax |

Rs 5,000 |

|

|

|

30,000 |

|

Items to be deducted: |

1. Refund of Tax |

Rs 3,000 |

|

|

2. Net Profit before Tax |

Rs 27,000 |

|

|

|

30,000 |

Now we have to compute cash flow.

Cash Flow from Operating Activities

| Particulars | Rs | |

|---|---|---|

Net Profit Before Tax |

|

27,000 |

Adjustments |

Rs |

|

Add: Depreciation |

3,000 |

|

Goodwill Written off |

5,000 |

|

Loss on Sale of Machinery |

2,000 |

10,000 |

|

|

37,000 |

Less: Profit on Sale of Building |

|

12,000 |

Operating Profit before Working Capital Charges |

|

25,000 |

I.T. Refund Received |

|

3,000 |

Net Cash flow from Operating Activities |

|

28,000 |

Illustration: 10

The following is the position of Current Assets and Current Liabilities of a Company

| Particulars | 1.1.2009 Rs | 31.12.2009 Rs |

|---|---|---|

|

Rs |

|

Provision for Bad Debts |

5,000 |

– |

Short-Term Loan |

20,000 |

30,000 |

Creditors |

25,000 |

20,000 |

Bills Receivable |

30,000 |

50,000 |

The company incurred a loss of Rs 70,000 during the year 2009. Calculate cash flows from operating activities by Indirect Method.

Solution

Calculation of cash flow from Operating Activities: Indirect Method

| Particulars | Rs | |

|---|---|---|

Loss During 2009 |

|

–70,000 |

Adjustments |

|

|

(a) Increase in Current Assets |

Rs |

|

Bills Receivable |

(20,000) |

|

(b) Decrease in Current Liabilities Creditors |

(5,000) |

|

Provision for Bad Debts |

(5,000) |

|

|

|

–30,000 |

Cash used in Operating Activities |

|

(–1,00,000) |

Negative Cash from Operations Illustrated:

- Here, students should note that Net Loss is given instead of Net Profit. The result is negative one. This means (negative cash from operation) that there is net outflow of cash from Operating Activities.

- Short-Term Loan: This is financing activity. So it has to be shown under cash flow from financing activities.

- So, increase in short-term loan is ignored.

5.5 Adjustments

For sale and purchase of (non-current) fixed assets (as per revised standard)

- Cash received from sale of an item of (non-current) fixed assets is not to be considered as cash flows from investing activities.

- Profit/Loss on sale of (non-current) fixed assets is taken into account in calculating cash flow from operating activities.

- While preparing (non-current) fixed assets account much care should be taken into accounts.

There are two methods for this:

Treatment of (non-current) fixed assets – on original basis and – on W.D.V. basis.

5.5.1 On Original cost basis

- Look at the Balance Sheet

- If there is “Provision for Depreciation” or “Accumulated Depreciation” for both years, it shows that fixed assets are shown at their original cost.

- In such cases, both “Fixed Assets Account” and “Provision for Depreciation Account” will have to be prepared to arrive at purchase and sale of fixed assets and the actual amount of depreciation.

5.5.2 On Written Down Value basis

- If there is no such item, depreciation appears in the Balance Sheet, it means that fixed assets are shown at written down value (i.e., after depreciation).

- Only fixed asset account has to be prepared and current year’s depreciation has to be credited to Fixed Assets Account (i.e., no need to prepare Provision for Depreciation Account).

Illustration: 11

Compute Cash Flow from Operating Activities by Indirect Method

| Particulars | Opening Balance Rs |

Closing Balance Rs |

|---|---|---|

P & L Account |

45,000 |

55,000 |

General Reserve |

25,000 |

30,000 |

Provision for Depreciation on Plant |

40,000 |

45,000 |

Outstanding Expenses |

5,000 |

2,000 |

Goodwill |

25,000 |

15,000 |

Sundry Debtors |

60,000 |

50,000 |

An item of plant costing Rs 50,000 having book value of Rs 40,000 was sold for Rs 45,000 during the year.

Solution

Step 1: First, net profit before tax is to be calculated

Net profit for the year |

|

Difference between opening and closing balances in the problem (i.e. Rs 55,000 − Rs 45,000) |

Rs 10,000 |

Adjustment |

|

Add General Reserve (Difference Rs 30,000 − 25,000) |

Rs 5,000 |

Net Profit before Tax |

Rs 15,000 |

Step 2: Next,

Treatment of Plant A/c

- Plant A/c has to be prepared

- This has to be prepaid to arrive at depreciation, as cost, book value and sale of plant were given

- Balancing figure in the plant account is the figure arrived at for depreciation

- Profit on Sale = Sale Price – Book Price

= Rs 45,000 – 40,000 = Rs 5,000

Plant Account

Step 3

- Next, provision for Depreciation of Plant A/c has to be prepared

- Balancing figure in this account is the amount provided for depreciation during the year

- Depreciation arrived at as in Plant Account has to be transferred here under “Plant A/c.”

Treatment of Provision for Depreciation

Provision for Depreciation on Plant Account

Step 4

Finally, now computation of cash flow from operating activities has to be worked out as follows:

Calculation of Cash Flows from Operating Activities

| Particulars | Rs |

|---|---|

Net Profit Before Tax |

15,000 |

Adjustments |

|

Add: Non-cash expenses |

| Particulars | Rs | |

|---|---|---|

|

Rs |

|

Depreciation |

15,000 |

|

Goodwill written off |

10,000 |

25,000 |

|

|

40,000 |

Less: Non-cash incomes |

|

|

Profit on Sale of Plant |

|

(5,000) |

Operating Profit before Working Capital Charges |

|

35,000 |

Add: Decrease in Current Assets: Sundry Debtors Debtors |

|

10,000 |

|

|

45,000 |

Less: Decrease in Current Liabilities: Outstanding Expenses |

|

(3,000) |

Cash Flows from Operating Activities |

|

42,000 |

Illustration: 12

Calculate cash flows from Operating Activities from the following information

| Particulars | 2008 (Rs) | 2009 (Rs) |

|---|---|---|

Debtors |

42,000 |

46,000 |

Prepaid Expenses |

2,000 |

2,700 |

Accrued Income |

1,500 |

1,200 |

Income Revised in Advance |

800 |

1,000 |

Creditors |

26,000 |

29,000 |

Bills Payable |

13,000 |

11,000 |

Outstanding Expenses |

8,000 |

6,000 |

Profit made during 2009 amounted to Rs 1,00,000 after taking into account the following adjustments

- Profit on Sale of Investment : Rs 2,000

- Loss on Sale of Machine : Rs 900

- Goodwill Amortised : Rs 3000

- Depreciation Charged : Rs 2900

Answer: Cash flow for Operating Activities

| Particulars | Rs | |

|---|---|---|

Profit for the Year |

|

1,00,000 |

Items to be added back to profit |

Rs |

|

Add: Depreciation |

2,900 |

|

Goodwill Amortised |

3,000 |

|

Loss on Sale of Machine |

900 |

6,800 |

|

|

1,06,800 |

Less. Profit on Sale of Investment |

(2,000) |

(2,000) |

Cash Generated from Operation before |

|

1,04,800 |

Working Capital Charges (operation profit) |

|

|

Add: Decrease in Current Assets and Increase |

|

|

in Current Liabilities |

300 |

|

Accrued Income |

200 |

|

Income Received in Advance |

|

| Particulars | Rs | Rs |

|---|---|---|

Creditors |

2,000 |

2,500 |

|

|

1,07,300 |

Less: Increase in Current Assets and Decrease in Current Liabilities: |

||

Debtors |

(4,000) |

|

Prepaid Expenses |

(200) |

|

Bills Payable |

(2,000) |

|

Outstanding Expenses |

(2,000) |

(8,700) |

Net Cash Flow from Operating Activities |

98,600 |

Illustration: 13

The net profit of a company before tax is Rs 12,50,000 as on Mar 31, 2009 after considering the following:

|

Rs |

Depreciation on Fixed Assets |

25,000 |

Goodwill Written off |

15,000 |

Loss on Sale of Machine |

12,000 |

The current assets and current liabilities on the beginning and at the end of the year were as follows:

| Particulars | Mar 31, 2008 (Rs) | Mar 31, 2009 (Rs) |

|---|---|---|

Bills Receivables |

25,000 |

15,000 |

Bills Payable |

10,000 |

12,500 |

Debtors |

30,000 |

38,800 |

Stock in Hand |

18,000 |

14,000 |

Outstanding Expenses |

8,000 |

7,000 |

Calculate cash flow from Operating Activities.

Answer: Students should once again remember the steps in preparing cash flow from Operating Activities:

Step 1: |

Net profit before tax is taken as the base. |

Step 2: |

Items to be added back to the net profit have to be written one by one and add with net profit. |

Step 3: |

This added value is “operating profit before working capital charges.” |

Step 4: |

With this the following items to be added: |

|

Decrease in the value of Current Assets |

|

Increase in the value of Current Liabilities |

Step 5: |

Then, the following items have to be deducted: |

|

Increase in the value of Current Assets |

|

Decrease in the value of Current Liabilities |

Step 6: |

Net result is “net cash flow from operating activities” |

Calculation of Cash Flow from Operating Activities

| Particulars | Rs | |

|---|---|---|

A. Net Profi t before Tax |

|

12,50,000 |

B. Add: (Items to be added back to Net Profit) |

Rs |

|

Depreciation on Fixed Assets |

25,000 |

|

Goodwill Written off |

15,000 |

|

Loss on Sale of Machine |

12,000 |

52,000 |

(A + B) C. Operating Profi t before Working Capital Charges (A + B) |

|

13,02,000 |

D. Add: (Decrease in Current Assets and Increase in Current Liabilities |

|

|

Decrease in Bills Receivables |

9,500 |

|

Decrease in Stock |

4,000 |

|

Increase in Bills Payable |

2,500 |

16,000 |

E. (Deduct) Less: (Increase in Current Assets and Decrease in Current Liabilities |

|

13,18,000 |

Increase in Debtors |

8,000 |

|

Decrease in Outstanding Expenses |

1,000 |

(9,000) |

(C + D − E) F. Net Cash Flow from Operating Activities (C + D − E) |

|

13,08,200 |

5.6 Cash Flow from Investing Activities

- The investing activities of a concern relate to the acquisition and disposal of long-term assets and other reinvestments not included in cash equivalents.

- The cash flow from investing activities is ascertained by analysing the changes in fixed assets and long-term investments in the beginning and at the end of the year.

- The cash inflow and cash outflow (i.e. cash flow) of items included in this category of investing activities are as follows:

Payments (Cash Outflow)

- Cash payments to acquire fixed assets.

- Cash payments to acquire shares, warrants or debt instruments of other enterprises and interests in joint ventures.

- Cash advances and loans to third parties.

Receipts (Cash Inflow)

- Cash receipts from disposal of fixed assets.

- Cash receipts from disposal of shares, warrants or debt instruments of other enterprises and interests in joint ventures.

- Cash receipts from the repayment of loans and advances made to third parties.

5.6.1 Accounting Treatment

5.6.1.1 Fixed Assets: There are two categories: (i) Fixed assets are shown at Written Down Value (W.D.V.). No additional information will be shown.

- To compute the missing figures, fixed asset account is opened and all items are recorded.

- To ascertain purchase of fixed assets → balancing figure on the debit side of the A/c.

- To ascertain sale of fixed assets → balancing figure on the credit side of the A/c.

- To ascertain depreciation → balancing figure on the credit side of the account.

- In cases, if both sale and depreciation are not given, it may be assumed to be either sale or depreciation and such assumption should be expressly recorded.

- In case of land → no depreciation recorded.

- In case of patents, trade marks, goodwill, etc. → the amount has to be written off.

Illustration:14

A public limited company has plant and machinery whose written down value on Apr 1, 2009 was Rs 7,50,000 and on Mar 31, 2010 was Rs 9,00,000. Depreciation for the year was Rs 30,000. At the beginning of the year a part of the plant was sold for Rs 20,000 which had written down value of Rs 17,500. Calculate the net cash flow from investing activities.

Solution

Note: Fixed assets are shown at written down value

Stage 1: Purchasing amount has to be calculated. So Plant and Machinery A/c has to be opened

Plant and Machinery Account

* Cash payment to acquire plant and machinery is ascertained as Rs 1,97,500

Stage 2: Cash flow from Investing Activities

| Particulars | Rs | Rs |

|---|---|---|

Cash Payments to Acquire Plant and Machinery |

(1,97,500) |

|

Cash Receipts from Sale of Plant and Machinery (given in question) |

20,000 |

(1,77,500) |

Cash Flow from Investing Activities |

__________ (1,77,500) |

Second Category

5.6.1.2 Fixed Assets are shown: At cost and accumulated depreciation (separately maintained) or provision for depreciation

- In this case, depreciation is not directly charged to the Fixed Assets Account.

- Depreciation for the year is ascertained from Provision for Depreciation Account (Accumulated Depreciation A/c).

This can be explained with the help of the following illustration.

From the following information, calculate the cash flow from Investing Activities.

| Particulars | Mar 31, 2008 (Rs) | Mar 31, 2009 (Rs) |

|---|---|---|

Machinery (at cost) |

5,00,000 |

5,50,000 |

Accumulated Depreciation |

1,00,000 |

1,20,000 |

Patents |

3,00,000 |

1,90,000 |

Additional Information

- During 2008–2009, a machine costing Rs 50,000 with accumulated depreciation Rs 30,000 was sold for Rs 25,000.

- Patents were written off to the extent of Rs 55,000 and some patents were sold at a profit of Rs 25,000.

Solution

- Fixed Assets value is shown at cost

- Accumulated depreciation is also shown

- Further information particulars are also in the problem

- In this question details on patents are also shown

- So, we have to open separate accounts for

- Machinery

- Accumulate Depreciation Account

- Patents Account

to ascertain all the missing figures.

Step 1

|

Profit on sale of machinery is to be calculated. |

|

Profit on Sale of Machinery = Sale Price − Book Value |

|

= Rs 25,000 − (Cost − Accumulated Depreciation) |

|

= Rs 25,000 − (Rs 50,000 − Rs 30,000) |

|

= Rs 25,000 − (Rs 20,000) |

|

= Rs 5,000 |

This amount has to be debited to Machinery A/c as P & L A/c.

Step 2

Machinery Account

Step 3

Accumulated Depreciation Account

Step 4

Patents Account

Step 5

Cash Flow from Investing Activities

| Particulars | Rs |

|---|---|

Inflow from Sale of Machinery |

25,000 |

*1 Outflow on Purchase of Machinery |

(1,00,000) |

*3 Inflow from Sale of Patents |

80,000 |

Net Cash Flow from Investing Activities |

5,000 |

Illustration: 16

From the following particulars, calculate the cash flows from investing activities.

| Purchases Rs | Sales Rs | |

|---|---|---|

Investments |

3,00,000 |

2,00,000 |

Goodwill |

1,50,000 |

– |

Machinery |

6,50,000 |

2,10,000 |

Patents |

– |

1,00,000 |

Dividend received on shares held as investment Rs 30,000. Interest received on debentures held as investment Rs 40,000. A building purchased for investment purposes (out of surplus funds) was let out and rent proceeds received thereby Rs 1,20,000.

This is a different problem.

- All purchases and sales are given straight.

- No need to prepare separate account for any item.

- So, cash flow from investing activities can straight away be calculated as follows:

Cash Flow from Investing Activities

| Particulars | Rs |

|---|---|

Investments Purchased |

(3,00,000) |

Proceeds from Sale of Investments |

2,00,000 |

Goodwill Purchased |

(1,50,000) |

Machinery Purchased |

(6,50,000) |

Proceeds from Sale of Machinery |

2,10,000 |

Proceeds from Sale of Patents |

1,00,000 |

Interest Received on Debentures |

40,000 |

Dividend Received on Shares |

30,000 |

Rent Received |

1,20,000 |

Net Cash Flow from Investing Activities |

(4,00,000) |

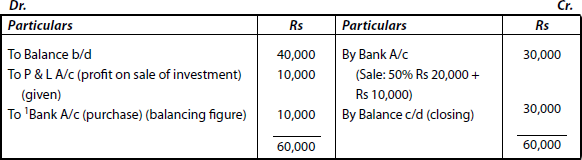

5.7 Cash Flow from Investing Activities

Illustration:17

A company has investments at the beginning of the year Rs 40,000 and at the end of the year Rs 30,000. During the year the company had sold 50% of its investments held in the beginning of the year at a profit of Rs 10,000. Compute cash flow from Investing Activities.

Solution

Step 1: First, cost of sales is to be calculated at 50% of the investment held in the beginning.

With this, profit has to be added to arrive at cash inflow from sale of investment.

So Sale of Investment = Rs 20,000 + Rs 10,000 = Rs 30,000

Step 2: Next, investment account is to be prepared to compute outflow on purchase of investment (i.e., the balancing figure in this account)

Investment Account

Step 3

Calculation of Cash Flow from Investing Activities

| Particulars | Rs | |

|---|---|---|

Inflow from Sale of Investment |

Rs |

|

Cost of Investment Sold |

20,000 |

|

Add: Profit on Sale |

10,000 |

30,000 |

Less: Outflow on Purchase of Investment |

(10,000) |

|

Net Cash Flow from Investing Activities |

20,000 |

Illustration: 18

Calculate Cash Flow from Investing Activities

| Particulars | Rs | |

|---|---|---|

|

Rs |

|

Machinery (at Cost) |

6,00,000 |

6,25,000 |

Accumulated Depreciation |

1,10,000 |

1,25,000 |

During the year, one of the machines costing Rs 60,000 with accumulated depreciation for this machine Rs 35,000 was sold for Rs 30,000.

Solution

Step 1: |

Computation of profit on sale of fixed assets and book value of assets. |

Step 2: |

Book value is to be found out |

Step 3: |

Profit on sale of machinery |

Step 4: |

Then machinery account is to be prepared |

Machinery Account

Step 5: Accumulated Depreciation Account is to be prepared

Accumulated Depreciation Account

Step 6: Cash flow from investing activities is prepared

Cash Flow from Investing Activities

| Particulars | Rs |

|---|---|

Inflow from Sale of Machinery |

30,000 |

Outflow from Purchase of Machinery |

(85,000) |

(Balancing Figure in Machinery A/c) |

|

Net Cash Flow from Investing Activities |

(55,000) |

5.8 Cash Flow from Financing Activities

5.8.1 Meaning

Activities that result in change in the size and composition of owners’ capital and borrowing of the enterprises are termed as financing activities.

Items included in financing activities are as follows:

- Proceeds from issue of shares

- Proceeds from issue of debentures

- Proceeds from long-term borrowings

- Receipts by way of loan

- Proceeds from issue of bonds

- Redemption of preferences shares/debentures

- Repayment of long-term borrowings, loans, etc.

- Interest paid (non-financial concerns only)

- Dividend paid (in all concerns)

Note

- Issue of Bonus Shares – (by which the increase in share capital) is not to be shown as a financing activity in the cash flow statement.

- But in case, when shares are issued at premium will be shown in cash flow statements.

- The cash flow from financing activities is ascertained by analysing the changes in equity share capital, preference share capital, debentures and other borrowings.

Illustration: 19

Calculate the cash flow from financing activities of a concern from the following information

| Particulars | Mar 31, 2008 (Rs) | Mar 31, 2009 (Rs) |

|---|---|---|

Equity Share Capital |

5,00,000 |

6,75,000 |

9% Debentures |

2,00,000 |

1,50,000 |

Securities Premium |

50,000 |

70,000 |

Additional Information: Interest paid on debentures = Rs 18,000

Solution

Note

Treatment of change in share capital and changes in debentures and redemption.

- Change in share capital (Rs 6,75,000 – 5,00,000) reveals issue of shares.

- Premium increase, also included.

- Change in debentures (Rs 2,00,000 – 1,50,000) reflects redemption, included.

- Interest paid on debentures, also included.

Calculation of Net Cash Flow from Financing Activities

| Particulars | Rs | Rs |

|---|---|---|

Cash Receipts from Issue of Shares |

1,75,000 |

|

Add: Proceeds from Premium |

20,000 |

1,95,000 |

Redemption of Debentures |

(50,000) |

|

Interest Paid on Debentures |

(18,000) |

(68,000) |

Net Cash Flow from Financing Activities |

1,27,000 |

Illustration: 20

A public limited company extends the following information. Calculate the net cash flow from Financing Activities.

| Particulars | Rs | Rs |

|---|---|---|

Equity Shares Capital |

20,00,000 |

30,00,000 |

12% Debentures |

1,00,000 |

– |

9% Debentures |

– |

3,00,000 |

Additional Information

- Dividend paid Rs 75,000

- Interest paid on debentures Rs 12,000

- During the year 2008–2009, the company issued bonus shares in the ratio of 2:1 by capitalizing reserve

Solution

Note

Treatment of new issue of debentures – Interest and Dividend Bonus share

- 9% debentures – shown for the year 2009 – proceeds from new issue of debentures – included

- 12% debentures – redeemed in full – included

- Interest paid and dividends paid – included

- Capital increase due to issue of bonus share not to be included (capitalisation of reserve)

So, care should be taken before ascertaining the cash flow from financing activities, whether that items form part of financing activities and whether it should be included or not.

Calculation of Net Cash Flow from Financing Activities

| Particulars | Rs |

|---|---|

Cash Proceeds from the Issue of 9% Debentures |

3,00,000 |

Payments on Redemption of 12% Debentures |

(1,00,000) |

Interest Paid on Debentures |

(12,000) |

Payment of Dividend |

(75,000) |

Net Cash Flow from Financing Activities |

1,13,000 |

5.9 Accounting Treatment of Special Items

5.9.1 Interest and Dividend

This depends on

- The nature of business entities (i.e. financial or non-financial)

- The nature of transactions (i.e. received or paid)

- Dividends paid is always treated as financing activity (financial or non-financial)

- Dividends received: for financial enterprises operating activity

For non-financial concerns

↓

Investing activity

↓

- Interest: both paid and received:

–For financial enterprises;

↓

–Operating activity

–For non-financial enterprises:

↓

Interest paid → financing activity

Interest received → investing activity

These can be represented by the tabular column as follows:

5.9.2 Proposed Dividend

- Proposed dividend for current year:

To be added back to current year's profit to ascertain cash flow from Operating Activities.

- Proposed dividend for previous year:

To be treated as Financing Activity.

5.9.3 Interim Dividend

- To be added back to current year's profits to ascertain cash flow from operating activities.

- Further, it has to be treated as cash used in a financing activity.

5.9.4 Discount on Issue of Shares or Debentures

- Discounts are to be written off through Profit and Loss Account.

- Discount written off: To be added back to current year's profits to ascertain cash from Operating Activities.

- Treatment of special items.

- Discount allowed during the year: To be treated as Financing Activity.

5.9.5 Non-cash Transactions

- As no cash flow takes place, they are not included in preparation of Cash Flow Statement.

- But AS–3 (revised) stipulates that such items have to be disclosed as footnote in the statement.

- For example

- Issue of shares for consideration other than cash

- Conversion of debentures into shares

5.9.6 Taxes on Income

- In general, it is treated as an Operating Activity.

- But at times, if it is associated with any specific activity, then it may be treated as investing or financing activity depending on the nature of transactions.

5.9.7 Extraordinary Items

- Extraordinary items have to be classified under appropriate activity. It may be either one of the three activities. For example

- Insurance claims

- Buy-back of shares

- Compensation – land acquisition

Illustration: 21

From the following information, calculate the cash flow from Investing Activities and Financing Activities.

| Particulars | Apr 1, 2008 (Rs) | Mar 31, 2009 (Rs) |

|---|---|---|

Furniture (at cost) |

25,000 |

35,000 |

Accumulated Depreciation on Furniture |

5,000 |

8,000 |

Capital |

2,00,000 |

2,75,000 |

Loan |

50,000 |

30,000 |

During the year 2008–2009, furniture costing Rs 7,000 was sold at a profit of Rs 2,500. Depreciation on furniture charged during the year amounted to Rs 6,000.

Solution

- In this question, items relating to Investing Activities and Financing Activities are shown. So cash flows have to be computed for each separately.

- Changes in capital and loan relate to Financing Activities and the remaining items relate to Investing Activities.

Step 1: First, cash flow from Financing Activities is to be computed as follows:

Cash Flow from Financing Activities

| Particulars | Rs |

|---|---|

Cash Inflow by Issue of Fresh Capital {i.e. Increase in Capital = Rs 2,75,000 – 2,00,000} |

75,000 |

Cash Outflow on Repayment of Loan {i.e. Loan Decreased: Rs 50,000 – 30,000} |

(20,000) |

Net Cash from Financing Activities |

|

|

55,000 |

Next, Furniture Account and Accumulated Depreciation Accounts have to be computed.

Sale Price |

= |

Cost – Accumulated Depreciation + Profit on Sale |

|

= |

Rs 7,000 − 3,000*2 + 2,500 = Rs 6,500* |

Step 2

Accumulated Depreciation Account

Step 3

Furniture Account

Step 4: Finally, cash flow from Investing Activities has to be ascertained.

Cash Flow from Investing Activities

| Particulars | Rs |

|---|---|

Cash Inflow by Sale of Furniture *1 |

6,500 |

Cash Outflow on Purchase of Furniture *3 |

(17,000) |

Net Cash Flow from Investing Activities |

(10,500) |

Note: Here, negative net cash flow indicates net cash used in Investing Activities.

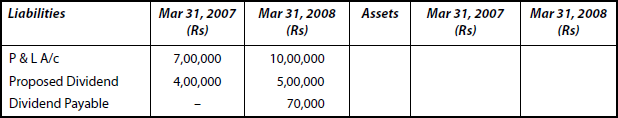

Illustration: 22

An Extract from the Balance Sheets of ABC Ltd

You are required to prepare the cash flow statement for the year ended Mar 31, 2008.

Solution: Computation of Cash Flow Statement of ABC Ltd. for the year ended Mar 31, 2008.

| Rs | Rs | |

|---|---|---|

A. Cash Flow from Operating Activities |

||

Closing Balance as per P & L A/c |

10,00,000 |

|

Less: Opening Balance as per P & L A/c |

7,00,000 |

|

Net Profit |

3,00,000 |

|

Add: Proposed Dividend during the Year |

5,00,000 |

|

Net Cash from Operating Activities |

8,00,000 |

|

B. Cash Flow from Financing Activities |

||

Final Dividend paid, |

4,00,000 |

|

i.e. Proposed Dividend (previous year) Payable |

(70,000) |

3,30,000 |

Net Cash used in Financing Activities |

3,30,000 |

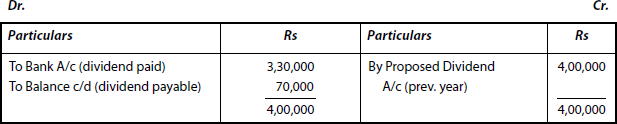

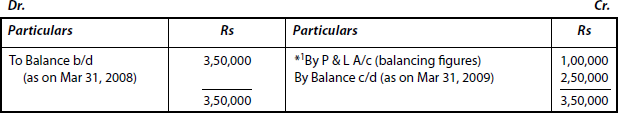

Proposed Dividend Account

Dividend Payable Account

Illustration: 23

Extract from the Balance Sheets of XY Ltd is as follows

Additional Information

The final dividend on preference shares and an interim dividend of Rs 60,000 on equity shares were paid on Mar 31, 2009. How these items will be recorded in the Cash Flow Statement?

Solution

- Items shown in the Balance Sheet extract relate to Operating Activities and Financing Activities. Computation of both cash flow from Operating Activities and Financing Activities

- First cash flow from Operating Activities is calculated

| Rs | Rs | |

|---|---|---|

Cash Flow from Operating Activities |

||

Closing Balance as per P &L A/c |

5,50,00 |

|

Less: Opening Balance as per P & L A/c |

3,00,000 |

|

Net Profit |

2,50,000 |

|

Add: Proposed Dividend during the year 2008–2009 |

2,50,000 |

|

Dividend Paid on Preference Shares |

60,000 |

|

Interim Dividend Paid |

60,000 |

3,70,000 |

Net Cash from Operating Activities |

6,20,000 |

|

Cash Flow from Financing Activities |

||

Final Dividend paid on Equity Shares (Rs 1,75,000 – 55,000) |

(1,20,000) |

|

Final Dividend paid on Preference Shares |

(60,000) |

|

Interim Dividend paid on Equity Shares |

(60,000) |

|

Net Cash used in Financing Activities |

(2,40,000) |

Illustration: 24

Extract of the Balance Sheet of Renu Ltd is as follows

Solution

- In this problem also items relating to both Operating Activities and Financing Activities appear.

- First, Discount on Issue of Shares Account and then Discount on Issue of Debenture Account have to be prepared.

- A separate account for 10% Debenture A/c has also to be prepared.

- After ascertaining the missing figures, we can compute the cash flows.

Step 1

Discount on Issue of Shares Account

Step 2

Discount on Issue of Debentures Account

Step 3

10% Debentures Account

Step 4

An Extract of Cash Flow Statement for the year ended Mar 31, 2009

| Rs | |

|---|---|

1. Cash Flow Operating Activities |

|

Closing Balance as per P & L A/c |

2,50,000 |

Less: Discount Balance as per P & L A/c |

(2,00,000) |

Add: Discount on Issue of Shares (from – *1) |

1,00,000 |

Interest on Debentures (Rs 15,00,000 × 10/100) |

1,50,000 |

Net Cash from Operating Activities |

3,00,000 |

2. Cash Flow from Financing Activities |

|

Proceeds from Issue of Debentures (from – *3) |

4,25,000 |

Interest paid on Debentures (Rs 1,50,000 – 25,0000) |

(1,25,000) |

(as calculated) (unpaid) |

|

Net Cash from Financing Activities |

3,00,000 |

Illustration: 25

An Extract of Balance Sheet of Verma Ltd. is as follows

Additional Information

Discount on the issue of debentures written off during the year 2008–2009 was Rs 25,000.

You are required to depict the related items in the Cash Flow Statement.

Solution

- Steps will be the same as explained in the previous illustration.

- Only additional adjustment to be made is for written off amount on debentures.

Step 1

Discount on Issue of Shares Account

Step 2

Discount on Issue of Debentures Account

Step 3

10% of Debentures Account

Step 4

An extract of cash flow statement for the year ended on Mar 31, 2009

| Rs | |

|---|---|

1. Closing Balance as per P & L A/c |

2,25,000 |

Less: Opening Balance as per P & L A/c |

(1,50,000) |

Add: Discount on Issue of Shares *1 |

70,000 |

Discount on Issue of Debentures *2 |

75,000 |

Interest on Debentures |

1,50,000 |

Net Cash from Operating Activities |

3.70,000 |

2. Cash Flow from Operating Activities |

|

Proceeds from Issue of Debentures |

4,25,000 |

Interest paid on Debentures |

(1,30,000) |

Net Cash from Financing Activities |

2,95,000 |

Illustration: 26

From the following information, prepare a Cash Flow Statement for the year ending on Mar 31, 2008.

Depreciation provided during the year 2007–2008 = Rs 10,000

[B. Com (Madras) – Modified]

Solution

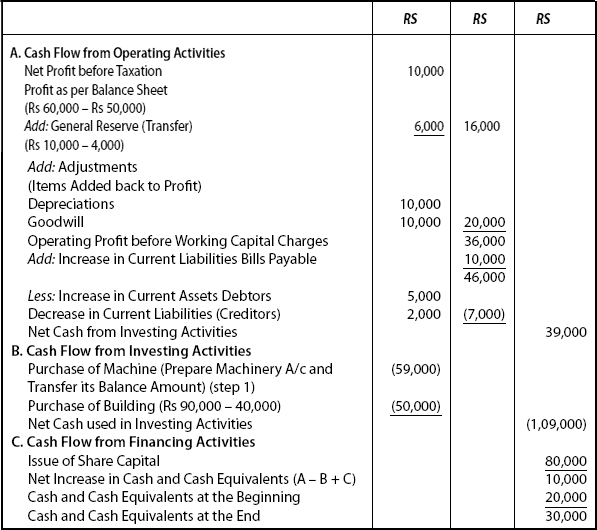

Stage I: (A) Cash flow from Operating Activities has to be calculated first.

Step 1: For this profi t as per Balance Sheet has to be taken as base fi gure (Rs 60,000 − 50,000)

Step 3: Here, depreciation and goodwill

Important Step: SUM of (i), (ii) and (iii) = Operating profi t before working capital charges

Step 4: With this

- Increase in Current Liabilities (here – Bills Payable only): Rs 25,000 – 15,000 (given) have to be added. And

↓↓(given)(given)

-

- Increase in Current Assets (here – Debtors: Rs 20,000 − 15,000) and Decrease in Current Liabilities (here – creditors: Rs 5,000 – 3,000) have to be deducted.

↓↓(2007)(2008)

- Increase in Current Assets (here – Debtors: Rs 20,000 − 15,000) and Decrease in Current Liabilities (here – creditors: Rs 5,000 – 3,000) have to be deducted.

Step 5: Result – Net Cash from Operating Activities

Stage II: (B) Cash flow from Investing Activities has to be calculated:

Here in this question, cash outflows occurs on (i) purchase of machine and (ii) building

Step 1: *Accrual cash flow – amount spent on purchase of machineries – is ascertained by separately preparing Machinery Account and the balancing figure from that account has to be transferred here.

Step 2: Purchase of Building

Rs 90,000 − 40,000

↓ |

↓ |

(2007) |

(2008) |

[These two items are recorded one by one]

Note: The values are written without brackets which means outflow of cash:

Stage III: (C) Cash flow from Financing Activities has to be computed

Step 1: Here, in the problem, cash fl ow or share capital (Rs 1,60,000 − 80,000) is recorded.

↓ |

↓ |

(2008) |

(2007) |

Stage IV: Net increase in cash and cash equivalents is to be computed as

Add |

= |

A (Stage 1) |

Less |

= |

B (Stage 2) |

Add |

= |

C (Stage 3) |

[(i.e.) A − B + C] shows as

↓

Net increase in cash and cash equivalents

Stage V: |

With this |

|

Add: Cash and cash equivalents at the beginning |

Stage VI: |

Finally, we arrive at |

|

Cash and cash equivalents at the end. |

|

These are represented into the format as shown below |

Cash Flow Statement

Calculation of cash flow statement as per AS–3.

A. Cash Flow Statement from Operating Activities

| Rs | Rs | |

|---|---|---|

Net Profit before Taxation |

||

Profit as per Balance Sheets |

10,000 |

|

(Rs.60,000 – 50,000) (Ref: Stage 1. Step 1) |

||

Add: General Reserve |

6,000 |

16,000 |

(Rs 10,000 – 4,000) (Ref: Stage 1. Step 2) |

||

Add: Adjustments |

||

Depreciation (from information) (from step iii) |

10,000 |

|

Goodwill (Rs 30,000 – 20,000) (step iii) |

10,000 |

20,000 |

Operating Profit before Working Capital Charges |

36,000 |

|

Add: Increased in Current Liabilities |

||

Bills Payable (Rs 25,000 – 15,000) (step 4a) |

10,000 |

|

Less: Increase in Current Assets |

46,000 |

|

Debtors (step 4b) |

5,000 |

|

Decrease in Current Liabilities (Creditors) (step 4b) |

2,000 |

(7,000) |

Net Cash from Investing Activities |

39,000 |

B. Cash Flow from Investing Activities

| Rs | ||

|---|---|---|

Purchase of Machine (transferred from Machinery A/c) (Step 1) |

(59,000) |

|

Purchase of Building (Rs 90,000 – 40,000) (Step 2) |

(50,000) |

|

Net Cash used in Investing Activities |

(1,09,000) |

C. Cash Flow from Financing Activities

| Rs | |

|---|---|

Issue of Share Capital (Stage 3 – Step 1) |

80,000 |

A − B + C Net Increase in Cash and Cash Equivalents (Stage IV) |

10,000 |

Cash and Cash Equivalents at the Beginning (Stage V) (given 2007) |

20,000 |

Cash and Cash Equivalents at the End (Stage VI) |

30,000 |

*Machinery A/c

OBJECTIVE 6: IMPORTANT STEPS (STAGES) IN THE PREPARATION OF CASH FLOW STATEMENT

6.1 Stage I: A. Cash Flow from Operating Activities

Step 1: Net profit before tax is taken as base. Instead of showing separately the closing balances and opening balances of P & L A/c straight away, net profit (closing balance – opening balance) amount can be recorded and with this transfer the General Reserve is added

Step 2: Add:

- Transfer to General Reserve

- Other adjustments (items added back to profit, i.e. depreciation; goodwill loss on sale, etc.)

Step 3: Figure arrived at this stage is termed as operating profit before working capital charges

Step 4: With this, the following items have to be added

Add:

- Decrease in the value of Current Assets

- Increase in the value of Current Liabilities

Step 5: Less: following items have to be deducted

- Increase in the value of Current Assets

- Decrease in the value of Current Liabilities

Step 6: Figure arrived at this stage is termed as Net Cash Flow from Operating Activities. Now we have to go to next stage.

6.2 Stage II: B. Cash Flow from Investing Activities

Purchase of plant, machinery, land and buildings, etc. has to be recorded here.

Important Note: |

If depreciation amount is given in additional information, separate accounts (Plants A/c – Building A/c) have to be prepared to ascertain the value of their purchase which are cash flows from Investing Activities. |

(In this stage, such items as described above are to be recorded and the sum of all items to be shown within brackets, which means that due to investing activities cash outflow actually takes place).

Figure arrived is termed as Net Cash from Financing Activities.

6.3 Stage III: C. Cash Flow from Financing Activities

Step 1: Issue of share capital to be recorded, etc.

Step 2: Less: If any redemption, such amount has to be recorded and deducted from Step 1.

Step 3: Figure arrived at this stage is termed as “Net Cash from Financing Activities”.

6.4 Stage IV: Net Increase/Decrease in Cash and Cash Equivalents

6.5 Stage V: Cash and Cash Equivalents at the Beginning of the Year to be Added

6.6 Stage VI: Cash and Cash Equivalents at the End of the Year to be Recorded

Note: |

This is a simplified form. One or two items only are shown. Students should practice with this first and then proceed to all the other items mentioned in the standardised format as prescribed by AS–3. |

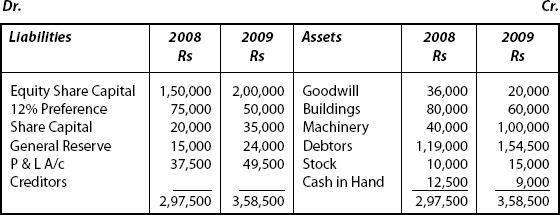

Illustration: 27

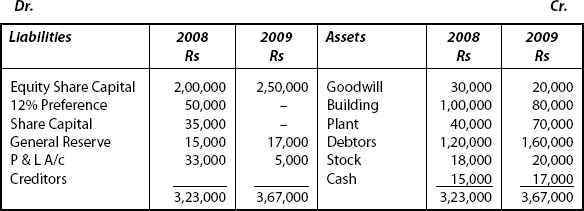

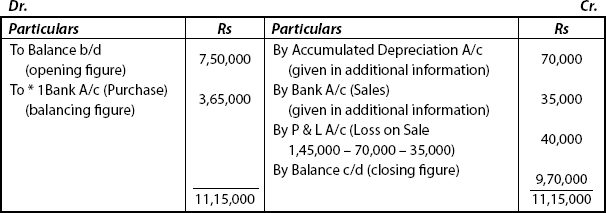

The following is the financial position as on Mar 31

During the year Rs 60,000 was paid as dividend, you are required to prepare Cash Flow Statement as per AS–3 (revised)

Solution: |

First, net profit has to be calculated because all adjustments have to be carried on units net profit as base. |

|

Rs |

Profit as on Mar 31, 2009 |

1,60,000 |

Profit as on Mar 31, 2008 |

1,40,000 |

(Difference) Profit for the year |

20,000 |

Add: Dividend paid during the year |

60,000 |

and Net profit before Tax and Extraordinary Items |

80,000*1 |

Cash Flow Statement for the Year Mar 31, 2009

| Particulars | Rs | Rs |

|---|---|---|

A. Cash Flow from Operating Activities |

||

*1Net Profit before Tax and Extraordinary Items |

*1 80,000 |

|

(as calculated above) |

||

Add: Depreciation |

10,000 |

|

Operating Profit before Working Capital Charges |

90,000 |

|

Add: Decrease in Stock |

14,000 |

|

Increase in Current Liabilities |

20,000 |

|

Increase in Debtors |

(5,000) |

|

Net Cash from Operating Activities |

1,19,000 |

|

B. Cash Flow from Investing Activities |

||

Purchase of Building |

(20,000) |

|

Purchase of Land |

(20,000) |

|

Purchase of Machinery |

(30,000) |

|

Net Cash used in Investing Activities |

(70,000) |

|

C. Cash Flow from Financing Activities |

||

Proceeds of Loan from Ram Ltd. |

40,000 |

|

Repayment of Bank loan |

(30,000) |

|

Payment of Dividend |

(60,000) |

(50,000) |

Net Decrease in Cash and Cash Equivalents |

(1,000) |

|

Cash and Cash Equivalents at the Beginning |

12,000 |

|

Cash and Cash Equivalents at the End |

11,000 |

Notes:

- Figures mentioned within brackets mean negative items (minus items – to be deducted)

- If there is negative cash from activities, then it is understood that there is net outflow of cash from such activities.

OBJECTIVE 7: SOME IMPORTANT HINTS

Hint 1: Instead of profit/loss, capital alone may be given in the problem. In such cases, profit is arrived at as follows:

Treatment of Capital and Drawings

|

|

Rs |

|

Capital at the end of the period.:… |

xx |

|

Less: Capital at the beginning of the period |

xx |

|

Profit for the year |

xx |

Hint 2: In case, if capital at the beginning and at the end of the period is given, students have to prepare Capital Account, and the balancing figure is taken as “Drawings.”

Format Capital A/c

|

Calculation of Drawings : |

|

|

Opening Capital : |

……… |

|

Add: Net Profit : |

……… |

|

Less: Closing Profit : |

……… |

|

Drawings |

__________ |

This amount has to be included in cash flow from financing activities under “Drawings.”

Hint 3: Loss on sale of fixed assets is calculated as follows:

Loss on Sale of Fixed Assets: Cost – Selling Price

And if in case of any depreciation: Cost – Accumulated Depreciation – Selling Price

Hint 4: Provision for Taxation

Case 1: Item, “Provision for Taxation” appears on the liabilities side of previous year’s Balance Sheet.

- This shows that the taxes were paid during the year.

- So, while calculating net cash from operating activities, this has to be deducted.

Case 2: This item “Provision for Taxation” appears on the liabilities side of the currents year’s balance sheet.

- This amount is to be added to profits.

- “Net profit before tax” is to be shown.

Under cash flow from Operating Activities

- This treatment (adjustment) is done, if tax paid during the year is not given in the problem.

- If “Tax paid” is given in question, then the “Provision for Tax Account” is prepared and the amount of tax paid is found out (balancing figure) (provision for taxation).

Format Provision for Tax Account

Hint 5: Dividend paid during the year

- Interim dividend for the year is calculated as

- Net profit for the year is first calculated.

- This amount is added with opening balance of P & L A/c.

- Then it is deduced by closing balance of P & L A/c.

Dividend Paid: Opening Balance of P & L + Net Profit – Closing Balance of P &L A/c.

Hint 6: If appropriate adjustments have to be made for both provision for tax and interim dividend to arrive at net profit before tax, then the following adjustments are to be made as

|

|

Rs |

|

Profit at the end of the period (Closing) |

– |

|

Less: Profit at the beginning (Opening) |

− |

|

Profit of the Year |

− |

|

Appropriations |

|

|

Add: 1. Interim Dividend paid |

– |

|

2. Provision for Tax |

− |

|

Profit Before Tax |

xx |

Illustration: 28

From the following information, prepare a Cash Flow Statement as on Mar 31, 2009.

Depreciation provided during the year on machine was Rs.10,000.

Solution

Cash Flow Statement

Illustration: 29

Comprehensive illustrations from 28 to 37

From the following Balance Sheet of Raja Ltd, prepare a Cash Flow Statement.

Depreciation charged on plant was Rs 10,000 and on building was Rs 60,000.

Solution: As depreciation is given in additional information, Plant A/c and Building A/c have to be prepared separately to ascertain the value of their purchase which are cash flow from Investing Activities.

Plant A/c

Building A/c

Cash Flow Statement for the year ended Dec 31, 2009

| Net Profit before Taxation | Rs | Rs |

|---|---|---|

Closing Balance of P & L A/c |

24,000 |

|

Add: Transfer of General Reserve |

15,000 |

|

|

39,000 |

|

Less: Opening Balance of P & L A/c |

15,000 |

24,000 |

Note: Instead of showing separately closing and opening balance adjustments, straight away net profit can be found as (Closing Balance – Opening Balance) as Rs 9,000 and with this transfer to General Reserve is added.

| Rs | Rs | |

|---|---|---|

A. Net Profit before Tax and Extraordinary Items |

|

|

Adjustments for |

10,000 |

|

Depreciation on Plant |

60,000 |

|

Depreciation on Building |

16,000 |

|

Goodwill written off |

|

86,000 |

Operation Profit before Working Capital Charges |

|

1,10,000 |

Adjustments for: |

|

|

Add: Increase in Creditors |

12,000 |

|

Less: Increase in Debtors |

(35,000) |

|

Increase in Stock |

(5,000) |

(28,500) |

Net Cash from Operating Activities |

|

81,500 |

B. Cash Flow from Investing Activities |

|

|

Purchase of Plant |

70,000 |

|

Purchase of Building |

40,000 |

|

Net Cash in Investing Activities |

|

(1,10,000) |

C. Cash Flow from Financing Activities |

|

|

Issue of Share Capital |

50,000 |

|

Redemption of 12% Preference Share Capital |

(25,000) |

|

Net Cash from Financing Activities |

|

25,000 |

|

|

(3,500) |

Cash and Cash Equivalents at the Beginning of the Year |

|

(12,5,00) |

Cash and Cash Equivalents at the End of the Year |

|

9,000 |

Illustration: 30

From the following Balance Sheet of Vivek Ltd., prepare Cash Flow Statement.

Depreciation charged on plant was Rs 30,000 and on building was Rs 50,000.

Solution

Cash Flow Statement for the Year Ended Dec 31, 2009

Illustration: 31

What is meant by Investing Activities? From the following particulars prepare cash flow from Investing Activities.

| Purchased Rs | Sold Rs | |

|---|---|---|

1. Machinery |

4,00,000 |

2,00,000 |

2. Investments |

2,00,000 |

3,00,000 |

3. Goodwill |

1,00,000 |

|

4. Patents |

– |

1,50,000 |

5. Interest received or debentures held as investments |

10,000 |

|