Chapter 14

Dissolution of Partnership

LEARNING OBJECTIVES

After studying the chapter, you will be able to understand

The Meaning of Dissolution of Partnership and Factors Responsible for Dissolution of Partnership and Firms

The Destruction Between Dissolution of Partnership and Dissolution of Firm

Provisions Envisaged Under Section 48(a), 48(b) and 49 of Indian Partnership Act, 1932

Meaning, Features and Preparation of Realisation Account

Accounting Treatment of (i) Partner’s Loan Amount, (ii) Partner’s Capital Account, (iii) Bank and Cash Account, (iv) Goodwill and (v) Unrecorded Assets and Liabilities

Preparation of Balance Sheet as on Date of Dissolution

The Concept and Accounting Treatment of Return of Premium

Accounting Treatment of Gift of Firm Asset to Partners

Meaning and Features of Insolvency of Partners and the Application of Garner vs. Murray Principle (i) When Capitals are Fixed and (ii) When Capitals are Fluctuating

Accounting Treatment of Dissolution When All Partners are Insolvent.

To Compute the Amount Recoverable from Insolvent Partners Using Algebraic Equation

The Provisions of Section 30 Relating to the Position of Minor and Dissolution of Partnership and Accounting Treatment of Minor and Insolvency.

Measuring and Features of “Sale of a Firm to a Limited Company”

Accounting Entries Relating to Sale of a Firm to a Company and Preparation of Necessary Accounts to Close the Books of the Firm, Including Calculation of Purchase Consideration

Meaning and Features of Piecemeal Distribution

Proportionate or Surplus Capital Method and Maximum Possible Loss Method: For Distribution of Cash (Realised) Among the Partners

INTRODUCTION

Dissolution means breaking of relationship among the partners. As per Section 39 of the Indian Partnership Act 1932, the dissolution of firm implies that not only partnership is dissolved but the firm loses its existence, i.e. after dissolution the firm does not remain in business.

The only business to be carried out, after dissolution, is that all the assets are disposed off and liabilities are paid off and only the balance left out is to be paid to partners in settlement of their accounts. At this stage, one has to understand the basic salient features of Dissolution of Partnership and Dissolution of Firm.

OBJECTIVE 1: DISSOLUTION OF PARTNERSHIP

A partner’s change, without affecting the continuity of business, may be said as dissolution of partnership. When a partnership may be dissolved? A partnership is dissolved in any one of the following cases:

1.1 When May a partnership may be dissolved?

- Change in profit sharing ratio among partners

- Admission of a new partner

- Retirement of a partner

- Death of a partner

- Expiry of the period of partnership

- Completion of firm’s venture

- Insolvency of a partner

- Merger of one partnership firm into another

1.2 Dissolution of a Firm

Dissolution of a firm occurs in the following cases:

- Dissolution by agreement:

- All the partners agree to dissolve the firm.

- As per the terms of partnership agreement.

- Compulsory dissolution: Firm is dissolved compulsorily:

- In case, all the partners or all except one partner become insolvent or insane.

- If the business becomes illegal.

- Where all the partners except one decide to retire from the firm.

- Where all the partners except one die.

1.3 Dissolution by Notice

In case of partnership at capital, notice by one partner, seeking dissolution of the firm.

1.4 Dissolution by Court

A court may order for dissolution if a suit is filed by a partner, as per Section 44 of Indian Partnership Act, 1932 situations:

- A partner becomes insane

- A partner commits breach of agreement willfully

- If a partner’s conduct affects the business

- If a partner transfers his interest to a third party

- If the business cannot be continued

- If a partner becomes incapable of doing business

- If a court thinks dissolution to be just and equitable on any ground

After studying the features of dissolution of partnership and dissolution of firm, one can easily distinguish between dissolution of partnership and dissolution of firms which is depicted in the tabular form below:

OBJECTIVE 2: DISTINCTION BETWEEN DISSOLUTION OF PARTNERSHIP AND DISSOLUTION OF FIRM

| Basis of Difference | Dissolution of Partnership | Dissolution of Firm |

|---|---|---|

1. Discontinuance of business |

It does not affect the continuation of business |

It affects the business. Firm is closed |

2. Assets and liabilities |

Assets and liabilities are revalued. New Balance Sheet is prepared |

Assets are sold and realised. Liabilities are paid off |

3. Closure of books |

No need to close account books, as the business continues to operate |

All the books of accounts are closed |

4. Intervention by court |

Court does not intervene |

Court has inherent powers to intervene. By its order, a firm can be dissolved |

5. Economic relationship |

Economic relationship among partners may remain or change |

Economic relationship among partners comes to an end |

OBJECTIVE 3: TREATMENT OF SOME ACCOUNTS AT THE TIME OF DISSOLUTION

3.1 Treatment of Loss: Section 48 (a)

Losses should be treated in the following order. Losses should be paid

- out of profit of the business, then

- out of capital, then and finally

- by partners in their sharing ratio

3.2 Treatment of Assets: Section 48 (b)

The assets of the firm shall be applied in the following order:

- Payment of firm’s debts to third parties

- Payment of partner’s advances (loans)

- Payment to each partner’s capital

- Any amount left out after these, is to be divided among the partners in their sharing ratio

3.3 Treatment of Firm’s Debts and Private Debts

Following are the provisions as per Section (49):

- A business property is to be used first to settle firm’s debt and then only to his private debt

- A private property is to be used first to settle private debts and then only to firm’s debt

Now, one has to understand the difference between firm’s debt and private debt. They are as follows:

| Basis of Difference | Firm’s Debt | Private Debt |

|---|---|---|

1. Meaning |

Debts owed by a firm to outsiders |

Debt owed by a partner to any other person |

2. Liability |

All the partners are liable jointly and severally to firm’s debt |

Only the concerned partner is held liable |

3. Application of firm’s property |

Firm’s debts will be applied first |

Excess, if any, will be applied to private debts |

4. Application of private property |

Last priority, i.e. after the disposal of private debts |

First priority to individual, i.e. private debts |

OBJECTIVE 4: ACCOUNTING TREATMENT

In the event of dissolution of firms, books of accounts are to be closed.

4.1 Preparation of Realisation Account

The account, which has to be prepared to determine profit of loss on realising the assets and discharge of liabilities, is referred to as “Realisation Account.”

4.2 Meaning and Features of Realisation Account

Features of Realisation Account:

- In Realisation Account, sale of assets is recorded at its realised value.

- Payment to creditors is recorded at the settlement value.

- After all the transactions have been recorded, there will be balance –which may be profit or loss.

- Profit arises when

- assets are realised at more than their Book Value

- liabilities are settled at less than their Book Value

- If the two conditions are vice versa, the net result will be loss.

- The net profit or loss on realisation is to be transferred to partner’s Capital Accounts in their ratio.

Distribution between Revaluation Account and Realisation Account

| Basis of Distinction | Revaluation Account | Realisation Account |

|---|---|---|

1. Meaning |

It records the effect of revaluation of assets and liabilities |

It records the actual realization of assets and settlement of all liabilities |

2. Time of preparation |

It is prepared at the time of admission, retirement or death of a partner |

It is prepared at the time of dissolution of a firm |

3. Items to be recorded |

In this account only the items that cause change in the value of change of assets and liabilities are recorded |

In this account, all the items – all assets and liabilities are recorded |

4. Aim or object |

Its main aim of preparation is to make necessary adjustments and liabilities |

Its main aim of preparation is to determine the net profit/loss on realisation of assets and settlement of liabilities |

5. Number of times |

This may be prepared on a number of occasions during the life time of the firm |

This is prepared only once, i.e. at the time of dissolution of the firm |

4.3 Procedure to record entries for various items and preparation of Realisation Account

Step 1: Account of all assets has to be closed. To close the accounts of assets, entry is:

|

Realisation Account |

Dr. |

|

To All Assets A/c |

|

|

(Closure of all assets accounts by transferring to Realisation A/c) |

|

Note:

- Cash in hand/at bank shall not be transferred here.

- Only gross value will have to be transferred

- Factious assets are not transferred to Realisation A/c

For example, accumulated loss and deferred revenue expenses are not transferred to Realisation Account. They have to be transferred to their Capital Accounts separately in their sharing ratio.

Step 2: Accounts of all liabilities/credits have to be closed.

|

Sundry Creditors A/c |

Dr. |

|

Bills Payable A/c |

Dr. |

|

To Realisation A/c |

|

|

(Liabilities accounts are closed by transferring to Realisation A/c) |

|

Note: Accumulated profits, reserves, loan should not be transferred to Realisation Account.

Step 3: For realisation of assets:

The amount actually received (realised) is to be debited to Cash/Bank A/c and Realisation A/c is credited with the amount realised (received).

|

Cash/Bank A/c |

Dr. |

|

To Realisation A/c |

|

|

(Amount realised on assets) |

|

Step 3a: At times, a partner may take an asset. In such case, instead of Cash/Bank Account, his Capital Account has to be debited.

|

Partner’s Capital A/c |

Dr. |

|

To Realisation A/c |

|

|

(Asset taken over by the partner) |

|

Step 4: For payment of liabilities:

|

Realisation A/c |

Dr. |

|

To Cash A/c |

|

|

(Payment of liabilities) |

|

Step 4a: At times, a partner may take over a liability

|

Realisation A/c |

Dr. |

|

To Partner’s Capital A/c (partner discharged a liability) |

|

Step 5: For expenses on realisation:

|

Case 1: Expenses met by the firm |

||

|

Realisation A/c |

Dr |

|

|

To Cash A/c |

||

|

(Realisation expenses) |

||

|

Case 2: Partners bear the expenses |

||

|

Realisation A/c |

Dr. |

|

|

To partner’s Capital A/c |

||

|

(Expenses met by the partner) |

||

|

Case 2A: Sometimes (case 2) is treated as drawing’s by the partners |

||

|

Partner’s Capital A/c |

Dr. |

|

|

To Bank A/c |

|

|

|

(Expenses treated as partner’s drawings) |

||

Step 6: For closing of Realisation Account:

After making all the entries closing balance, i.e. profit or loss on realisation, is transferred to Capital Accounts of the partners in their profit sharing ratio.

Step 6a: Profit on realisation:

|

Realisation A/c |

Dr. |

|

To partner’s Capital A/c or Current A/c |

|

|

(profit on realisation transferred to partner’s Capital Account) |

|

Step 6b: Loss on realisation:

|

Partner’s Capital A/c |

Dr. |

|

To Realisation A/c |

|

|

(Loss on realisation transferred to Partner’s Capital Account) |

|

Illustration: 1

R and S are partners sharing profits equally and they have decided to dissolve the firm. Their liabilities are bills payable Rs 10,000; creditors Rs 20,000. Their capitals are Rs 50,000 and Rs 30,000, respectively. All the assets of the firm are realised at Rs 1,50,000. You area required to pass necessary journal entries and prepare Realisation Account.

Solution

Students must take into account all the six steps discussed. After passing entries, Realisation Account is prepared.

Step 1: Value of assets is not given in the question. So it has to be determined first. Value of Sundry Assets may be determined by preparing “Memorandum Balance Sheet.” It is prepared as:

Memorandum Balance Sheet

or

The same can be determined by applying the equation

|

Assets |

= |

Capital + Liabilities |

|

|

= |

{Rs 50,000 + Rs 30,000} + {Rs 10,000 + Rs 20,000} |

|

|

|

(R) (S) (Bills Payable) (Creditors) |

|

|

|

(Given) (Given) (Given) (Given) |

|

|

= |

Rs 80,000 + 30,000 |

|

|

= |

Rs 1,10,000 |

Step 2: Journal entries to be recorded in the order as

For closing the asset (values):

Here, value of Sundry Assets as determined in Step 1 is Rs 1,10,000

|

|

Rs |

Rs |

Realisation Account |

Dr. |

1,10,000 |

|

To All Assets A/c |

|

|

1,10,000 |

(Closure of all assets accounts by transferring to Realisation A/c) |

|||

Step 3: For closing of accounts of all liabilities:

Sundry Creditor A/c |

Dr. |

20,000 |

|

Bills Payable A/c |

Dr. |

10,000 |

|

To Realisation A/c |

|

|

30,000 |

(Liabilities accounts are closed by transferring to Realisation A/c) |

|||

Step 4: For assets realised (actual amount):

Cash/Bank Account |

Dr. |

1,50,000 |

|

To Realisation A/c |

|

|

1,50,000 |

(Realised value of accounts) |

|||

Step 5: For payment of liabilities

Realisation A/c |

Dr. |

30,000 |

|

To Cash/Bank A/c |

|||

To Bills Payable A/c |

|

|

10,000 |

Creditors |

|

|

20,000 |

(All liabilities are paid off) |

|||

Step 6: After having entered all entries, the net result, i.e. profit or loss on realization, has to be recorded (refer the next step). Here it is profit. This amount Rs 40,000 has to be apportioned in the profit sharing ratio among the partners. Here Rs 40,000 has to be divided equally (given in the question), i.e. for R: Rs 20,000 and for S: Rs 20,000. This amount is transferred to their Capital Accounts finally.

|

Realisation Account |

Dr. |

40,000 |

|

|

To Partner’s Capital A/c |

|||

|

R’s Capital A/c |

|

|

20,000 |

|

*S’s Capital A/c |

|

|

20,000 |

(Net profit on realisation transferred to the Capital Accounts of the partners)

Step 7: Preparation of Realisation Account

In the Books of R and S

Illustration: 2

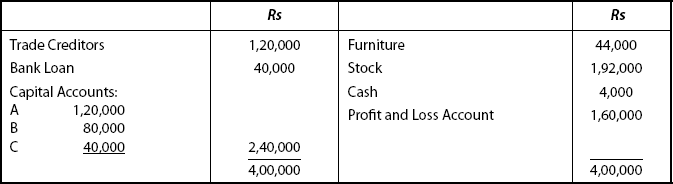

X, Y and Z are partners sharing profit in the ratio (5:3:2). They decided to dissolve the firm. On Dec 31, 2009 the Balance Sheet of the firm was as follows:

Additional Information: X took over the building at the value of Rs 80,000; cash realised: Investments Rs 4,500; Book Details Rs 1,500; Stock Rs 11,000, Z agreed to take over the creditor at 20% discount. Realisation expenses amounted to Rs 1,000. You are required to pass necessary normal entries and prepare Realisation Account.

Solution

Step 1: All assets accounts have to be closed. For this refer the assets in the Balance Sheet. Transfer one after one and the total value of all assets to be debited with the Realisation Account (except cash).

|

|

Rs |

Rs |

Realisation Account |

Dr. |

89,000 |

|

To Building A/c |

|

|

70,000 |

To Investment A/c |

|

|

5,000 |

To Sundry Debtors A/c |

|

|

2,000 |

To Stock A/c |

|

|

12,000 |

(All assets except cash are transferred to Realisation A/c) |

|||

Step 2: For closing of liabilities:

Sundry Creditors A/c |

Dr. |

5,000 |

|

To Realisation A/c |

|

|

5,000 |

(Liabilities transferred to Realisation A/c) |

|||

Step 3: Amount actually realised on assets:

Cash/Bank A/c |

Dr. |

17,000 |

|

To Realisation A/c |

|

|

17,000 |

[Investments — Rs 4,500; Debtors Rs 500 Stock Rs 11,000 — Realisation of Assets] |

|||

Step 3a: For assets taken over by a partner:

X’s Capital A/c |

Dr. |

80,000 |

|

To Realisation A/c |

|

|

80,000 |

(Value of Asset taken by X) |

|||

Step 4: Discharge of liabilities:

(Z – a partner agreed to battle the creditors at 20% discount)

Step 4a:

Realisation A/c |

Dr. |

4,000 |

|

To Z’s Capital A/c |

|

|

4,000 |

(Z agreed to discharge the liability Rs 5,000 − 20% of Rs 5,000, i.e. 1,000 = Rs 4,000) |

|||

Step 5: For realisation expenses

Realisation A/c |

Dr. |

1,000 |

|

To Cash/Bank A/c |

|

|

1,000 |

(Realisation expenses entered) |

|||

Step 6: For profit/loss in Realisation Account

Realisation A/c |

Dr. |

8,000 |

|

To X’s Capital A/c |

|

|

4,000 |

To Y’s Capital A/c |

|

|

2,000 |

To Z’s Capital A/c |

|

|

1,600 |

(Profit is realisation transferred to Capital Accounts of partners in the ratio 5:3:2) |

|||

Step 7: Preparation of Realisation Account.

So far, we have discussed the important six steps for recording Journal Entries to compute “Realisation Account.” Now, we have to discuss three more important items to be considered for treatment of accounts at the time of dissolution of firm.

Case(1): Partner’s Loan Amount

Entries for Partner’s Loan, Partner’s Capital Account, Bank and Cash Account, Goodwill and Unrecorded Assets and Liabilities.

Step 7:

- A loan to firm by a partner is credited in this account

- Then this loan is paid off after payment of liabilities to outsiders Entry is:

Partner’s Loan A/c Dr.

To Cash/Bank A/c

(Payment of Partner’s Loan)

Case (2): Partner’s Capital Account

- Balances of Capital Accounts and Current Accounts are recorded here

- In case, if partners take over firm’s assets, these items are recorded on the Debit side of their Capital Account

- If the partners take over firm’s liabilities, these items are recorded on the Credit side of their Capital Accounts

Step 8a: Entry for undistributed profit or reserve:

|

Profit and Loss A/c |

Dr. |

|

Reserve Fund A/c |

Dr. |

|

To Partner’s Capital A/c |

|

Step 8b: Cash brought by partners for deficiency in capital:

|

Cash/Bank A/c |

Dr. |

|

To Partner’s Capital A/c |

|

Step 8c: Payment to partners or to close partners Capital Accounts:

|

Partner’s Capital A/c |

Dr. |

|

To Cash/Bank A/c |

|

Case 3: Bank and Cash Account:

If both cash and bank balances are given, for convenience a single account is opened for both cash and bank transactions.

Other miscellaneous item:

Case 4 Goodwill

Step 9b: Goodwill appears in books:

|

Realisation A/c |

Dr. |

|

To Goodwill A/c |

|

|

(Goodwill is transferred to Realisation A/c) |

|

Step 9b: Amount is realised on goodwill:

|

Realisation Account |

Dr. |

|

To Realisation A/c |

|

Step 9c: Partner purchases goodwill:

|

Partner’s Capital A/c |

Dr. |

|

To Realisation A/c |

|

Case 5 Unrecorded assets and liabilities:

Step 10a: Cash realised from unrecorded assets:

|

Cash/Bank A/c |

Dr. |

|

To Realisation A/c |

|

Step 10b: Payment of unrecorded liability:

|

Realisation A/c |

Dr. |

|

To Cash/Bank A/c |

|

Step 10c: A partner takes over unrecorded assets:

|

Partner’s Capital A/c | Dr. |

|

To Realisation A/c |

|

Step 10d: A partner takes over unrecorded liabilities:

|

Realisation A/c |

Dr. |

|

To Partner’s Capital A/c |

|

Illustration: 3

X and Y were partners sharing profits and losses equally. They mutually dissolved the firm in 2006. The Balance Sheet on that date was as follows:

The firm was dissolved on the given date and the following transactions took place:

- X took over 40% of the stock at a discount of 25%.

- Remaining stock was disposed off at a profit of 40%.

- Rs 10,000 of the book debts proved bad.

- Y undertook to pay Mrs. Y’s loan.

- Land and building was realised at Rs 2,00,000.

- Bills payable were paid in full.

- 50% of trade creditors accepted plant and machinery at 20% less than the book value and cash of Rs 6,000 in full settlement of their claims.

- Remaining trade creditors were discharged at 20% discount.

- Realisation expenses were Rs 3,000.

- The Joint Life Policy was surrendered for Rs 15,000.

- A customer’s liability (not provided for) of Rs 2,000 was discharged.

- An old customer, whose account was written off as bad in the last year, paid Rs 1,000, which is not stated in the above stated books. Give necessary journal entries and ledger accounts.

Solution

Step 1: All assets (excluding cash and deferred revenue advertising expenditure) are credited with their book value one after one and total of these are debited to Realisation A/c:

| Rs | Rs | |

|---|---|---|

Realisation A/c Dr. |

2,72,000 |

|

To Stock |

70,000 |

|

To Book Debts |

55,000 |

|

To Plant and Machinery |

30,000 |

|

To Land and Buildings |

80,000 |

|

To Joint Life Policy |

15,000 |

|

To Goodwill |

20,000 |

|

To Prepaid Insurance(expense) |

2,000 |

(Being the transfer of all assets to Realisation A/c)

Note:

- Cash in Hand

- Cash at Bank and

- Deferred Revenue Advertisement Expenditure. These three items are not taken into account. Students should further note that Book Debts Value (without considering provision for Doubtful Debts) is taken as it is without adjustment. Students should once again refer the problem and make clear which assets are taken into account and at what value.

Step 2: Transfer of liabilities to Realisation A/c:

All liabilities (each item one after one) are debited and their total is credited to Realisation A/c (Joint Life Policy Resource, Credited Reserve and Profit and Loss A/c items are excluded in this Step).

| Rs | Rs | |

|---|---|---|

Provision for Doubtful Debts Dr. |

5,000 |

|

Trade Creditors Dr. |

60,000 |

|

Bills Payable Dr. |

30,000 |

|

Mrs Y’s Loan Dr. |

20,000 |

|

To Realisation A/c |

1,15,000 |

|

(Being transfer of liabilities to Realisation A/c) |

Note: Provision for doubtful debts (appearing on assets side) is to be transferred here as it is a liability.

Step 3: For realisation of assets:

When assets are realised, Cash or Bank A/c credited with actual amount realised. Here, each item need not be shown separately.

Bank A/c |

Dr. |

3,18,000 |

|

To Realisation A/c |

|

|

3,18,000 |

(Being Stock, Debtors, Joint Life Policy, Land and Building realised)

Workings:

(i) |

Stock: Remaining Stock = 60% |

Rs |

|

60% of Rs 70,000 |

42,000 |

|

Add: 60% was disposed at a profit of 40% |

16,800 |

|

|

58,800 |

(ii) |

Book Debts |

55,000 |

|

Less: Bad Debts |

10,000 |

|

(refer further information) |

45,000 |

(iii) |

Land and Building (refer Information) |

2,00,000 |

(iv) |

Joint Life Policy (Surrendered value) |

15,000 |

|

Total Value of Assets Realised |

58,800 |

|

|

45,000 |

|

|

2,00,000 |

|

|

15,000 |

|

|

3,18,800 |

Step 4: For taking over of an asset by a partner:

X’s Capital A/c Dr. |

21,000 |

|

To Realisation A/c |

|

21,000 |

(Being 40% of stock taken over by X @ 25% discount) |

||

[Workings: 40% of stock = 40/100 of Rs 70,000] |

||

|

|

Rs |

|

|

28,000 |

|

Less: 25% of Discount |

7,000 |

|

|

21,000 |

Note: If an asset is taken over by a partner (after adjustment) it has to be debited to the partner’s Capital Account instead of Cash A/c (as in Step 3).

The difference is that instead of cash the concerned partner’s Capital Account is debited.

Step 5: For expenses realisation

Realisation A/c |

Dr. |

3,000 |

|

To Bank A/c |

|

|

3,000 |

(Being realisation expenses paid) |

|||

Note: Suppose realisation expenses are borne by a partner, then partner’s Capital A/c has to be credited instead of Bank A/c

Step 6: For payment of liabilities:

Realisation A/c |

Dr. |

60,000 |

|

To Cash/Bank A/c |

|

|

60,000 |

(Being payment made to credits and bills payable holders) (Rs 30,000 + Rs 30,000) |

|||

Step 7: For closing partner’s Loan A/c:

Realisation A/c |

Dr. |

20,000 |

|

To Y’s Capital A/c |

|

|

20,000 |

(Being payment of Mrs. Y’s loan by Y) |

|||

Step 8: For debt, previously written off, recovered)

Bank A/c |

Dr. |

1,000 |

|

To Realisation A/c |

|

|

1,000 |

(Being a debt, previously written off, recovered) |

|||

Step 9: For contingent liability discharged:

Realisation A/c |

Dr. |

2,000 |

|

To Bank A/c |

|

|

2,000 |

(Being a contingent liability discharged) |

|||

Step 10: For transfer of profit on realisation

Realisation A/c |

Dr. |

98,800 |

|

To X’s Capital A/c |

|

|

49,400 |

To Y’s Capital A/c |

|

|

49,400 |

(Being transfer of profit on realisation) |

|||

Step 11: For transfer of accumulated profit.

General Reserve A/c |

Dr. |

45,800 |

|

Joint Life Policy Reserve A/c |

Dr. |

15,400 |

|

Profit and Loss A/c |

Dr. |

25,400 |

|

To X’s Capital A/c |

|

|

42,500 |

To Y’s Capital A/c |

|

|

42,500 |

(Being accumulated profit transferred) |

|||

Note: General Reserve J.L.P. Reserve. Profit and Loss added and distributed among partner’s ratio and credited to their Capital Accounts.

Step 12: For transfer of accumulated loss:

X’s Capital A/c |

Dr. |

25,00 |

|

Y’s Capital A/c |

Dr. |

25,00 |

|

To Deferred Reserve Expenditure A/c |

|

|

5,000 |

(Being transfer of accumulated losses) |

|||

Note: Deferred revenue expenditure is accumulated loss. It has to be divided in the partner’s profit sharing ratio and debited to their Capital Accounts.

Step 13: For final payment made to partners:

X’s Capital A/c |

Dr. |

1,59,400 |

|

Y’s Capital A/c |

Dr. |

1,28,400 |

|

To Bank A/c |

|

|

2,87,8000 |

(Being final payment made to partners) |

|||

Ledger Accounts Realisation Account

Note: Students may transfer entries from Journal to this Ledger A/c. But if straightaway ledger accounts are to be recorded they should be able to remember various items to be recorded on debit and credit side. So they are numbered serially and entries are recorded.

Bank Account

Capital Accounts of Partners

OBJECTIVE 5: ACCOUNTING TREATMENT ON DISSOLUTION

- Our dissolution of a firm, forms and books (accounts of various items) will have to be closed.

- The following accounts have to be opened for this purpose.

5.1 Account Treatment on Distortion of a Firm

- Realisation Account

- Bank/Cash Account

- Partner’s Loan Account

- Partner’s Capital Account

5.2 Realisation Account

The net effect on realisation of assets and reassessment of liabilities is shown in this account. To find the net effect (profit/loss on realisation), the following steps have to be adhered.

Step 1: For closing assets accounts:

First, all assets (except cash, fictitious assets, debt balances of capital and current account as partner) are transferred to Realisation A/c as their book values:

|

Realisation A/c |

Dr. |

|

To Various Assets A/c |

|

Effect: This entry will close the accounts of various assets.

Step 2: For closing outside creditors accounts:

All liabilities (except loan from partners, reserve) are transferred to the Realisation A/c

|

Various Liabilities A/c |

Dr. |

|

To Realisation A/c |

|

Effect: This will close the accounts of liabilities.

Step 3: For realisation of assets:

Cash/Bank A/c will be debited and Realisation A/c credited with actual amount realised on assets.

|

Cash A/c |

Dr. |

|

To Realisation A/c |

|

Step 4: When a partner takes over a new asset.

|

Partner’s Capital A/c |

Dr. |

|

To Realisation A/c |

|

Effect: Partner’s share, other than cash, is ascertained.

Step 5: For expenses on realisation:

Expenses will incur and each expense have to be debited to Realisation A/c and credited to Cash A/c

|

Realisation A/c |

Dr. |

|

To Cash A/c |

|

Step 5a: If realisation expenses are borne by partner

|

Realisation A/c |

Dr. |

|

To Partner’s Capital A/c |

|

Step 6: For payment of liabilities:

On payment of liabilities, actual account paid will be debited to Realisation A/c and credited to Cash A/c

|

Realisation A/c |

Dr. |

|

To Cash A/c |

|

Step 6a: When a partner takes over a liability:

|

Realisation A/c |

Dr. |

|

To Partner’s Capital A/c |

|

Step 7: For closing partner’s Loan A/c:

|

Partner’s Loan A/c |

Dr. |

|

To Cash A/c |

Step 8: For closing reserve and undistributed profit A/c

|

Reserve fund A/c |

Dr. |

|

or |

Dr. |

|

Profit and Loss A/c Dr. |

Dr. |

|

To Partner’s Capital or Current A/c |

|

Step 9: For closing Realisation Account:

This is the stage at which this Realisation A/c will reveal profit or loss

[Profit if credit side is higher

Loss if debt side is higher]

|

If Profit: Realisation A/c |

Dr. |

|

To Partner’s Capital A/c |

|

|

If Loss: Partner’s Capital A/c |

|

|

To Realisation A/c |

|

Step 10: Accumulated loss (Debit balance in Profit and Loss A/c)

|

Partner’s Capital or Current A/c | Dr. |

|

To Accumulated Losses A/c |

|

Step 11:For bringing cash equal to debit balance in his Capital Account by a partner

|

Cash A/c |

Dr. |

|

To Partner’s Capital A/c |

|

Step 12: For closing partner’s Capital Accounts:

|

Partner’s Capital A/c |

Dr. |

|

To Cash A/c |

|

Usually, all the accounts related to dissolution are closed with these entries, so transferring them to the respective ledger accounts.

5.3 Cash or Bank Account (Ledger)

Opening balance of cash (both cash in hand and cash at Bank)

- Amount received on sale of assets (realised)

- Amount brought by partners, etc. are to be recorded on the debt side of this account

- Payment of various expenses

- Payment to discharge various liabilities

- Amount paid to partners is to be recorded on the credit side of this account

Note: Student at this level should take care to record transactions relating to cash and bank, it is desirable to record either as Cash A/c or as Bank A/c and not both accounts separately and has to be treated under one head only, either Cash or Bank A/c.

5.4 Partner’s Capital Account

- Assets taken over by the partners are recorded on the debit side of this account

- Liabilities taken over by the partners are entered on the credit side of the account

- Balances of partner’s capital accounts are entered

- In addition, Entry No. 11 and No. 12 discussed above finds place in this account

- For transfer of balance in Current A/c of partners:

- For debit balance:

Partner’s Capital A/c Dr.

To Partner’s Current A/c

- For credit balance:

Partner’s Current A/c

To Partner’s Capital A/c

- For debit balance:

5.5 Partners Loan Account: (Loan by Partner)

Partners Loan A/c Dr.

To Cash A/c

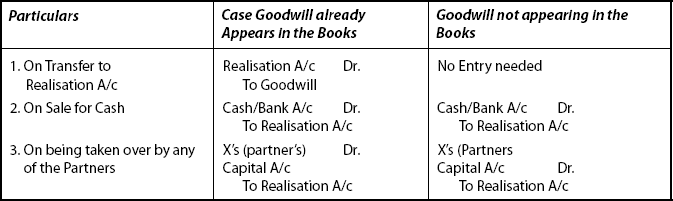

OBJECTIVE 6: GOODWILL

6.1 Accounting Treatment

Dissolution of firm and goodwill:

- If goodwill appears in the balance sheet, it is transferred to Realisation A/c at book value, like other assets.

Realisation A/c

Dr.

To Goodwill A/c

- If goodwill does not appear in Balance Sheet, no entry for transfer.

- If anything is realised for goodwill

Cash/Bank A/c

Dr.

To Realisation A/c

- If goodwill is purchased by one of the partners

Partner’s Capital A/c Dr. To Realisation A/c

6.2 Unrecorded Assets and Liabilities

At the time of dissolution of the firm, some assets and liabilities may not appear in the books.

6.2.1 Unrecorded Assets:

- Cash received from unrecorded assets:

Cash A/c

Dr.

To Realisation A/c

(Being cash realised on unrecorded assets)

- When a partner takes over unrecorded assets:

Partner’s Capital A/c Dr. To Realisation A/c

(Being the partner took over unrecorded assets)

6.2.2 Unrecorded Liabilities:

- For payment of unrecorded liability

Realisation A/c

Dr.

To Cash A/c

(Being unrecorded liability discharged)

- When a partner takes over unrecorded liability

Realisation A/c

Dr.

To Partner’s Capital A/c

(Being a partner took over unrecorded liability)

6.3 Memorandum Balance Sheet

- At times, value of sundry assets is not given in the problem.

- Only partner’s capitals and other liabilities are given but not the total value of sundry assets.

- Realised value on assets is given.

- In such cases, total amount of assets is ascertained by preparing a Balance Sheet which is called as Memorandum Balance Sheet.

Illustration: 4

A and B are partners in a firm. Their capitals are Rs 2,20,000 and Rs 1,80,000, respectively. The creditors are Rs 1,00,000. The assets of the firm realised Rs 5,60,000. You are required to prepare Realisation A/c, Partner’s Capital A/c and Bank Account.

Solution

- The amount of total Sundry Assets is not given.

- So it has to be calculated by preparing Memorandum Balance Sheet.

Memorandum Balance Sheet

Note: Creditors and Capitals are added and this total is transferred to assets side of the Balance Sheet (Balancing figure), to ascertain the value of Sundry Assets.

Realisation Account

Capital Accounts of Partners

Cash/Bank A/c

Illustration: 5

The following is the Balance Sheet of Kashyap and Verma as on Dec 31, 2006.

The firm was dissolved on Dec 31, 2006 and the following were agreed upon:

- Kashyap agreed to pay off Mrs. Kashyap’s loan

- Kashyap took away the stock at Rs 8,000

- Verma took 50% of the investment at a discount of 10%

- Debtors were realised at Rs 25,000

- Creditors and bills payable were discharged at a discount of Rs 200 and Rs 100, respectively

-

Other assets realised at

Rs

Plant and Machinery

40,000

Land and Buildings

80,000

Goodwill

20,000

Investments (balance)

9,000

- There was an old computer which had been written off completely in the books, which is nonestimated to realise Rs 3,000. It was taken away by Verma at the estimated price.

- Realisation expenses amounted to Rs 2,000, you are required to

- pass necessary journal entries and

- prepare the necessary ledger accounts

Journal

Ledger Accounts Realisation Account

Partner’s Capital Accounts

Treatment of goodwill in case of dissolution of a firm may be put in a nut-shell

Note: Accounting treatment differs only in the case of goodwill not appearing in the Books for transfer to Realisation A/c.

OBJECTIVE 7: PREPARATION OF BALANCE SHEET AS ON THE DATE OF DISSOLUTION

Need to prepare:

To ascertain the missing information (e.g. value of any asset or liability) on the date of dissolution of a firm, Balance Sheet as on that date has to be prepared.

Method of drawing Balance Sheet.

Care should be taken to record.

7.1 Preparation of Balance Sheet as on the Date of Dissolution

- Balances in the given Balance Sheet and

- Transactions that took place between the date of the given Balance Sheet and the date of dissolution

Illustration: 6

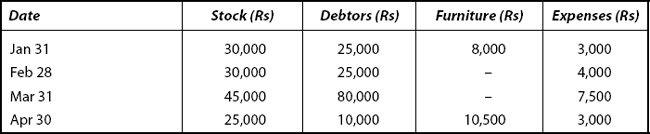

You are required to draw the Balance Sheet of the firm as at Mar 31, 2009 being the date of dissolution of loss incurring in firm from the following particulars:

Solution

Note:

- Generally, any one of the following items may be found missing:

- Sundry Assets

- Sundry Liabilities

- Profit and Loss

- Cash and Bank Balance

- Study the particulars. Ascertain what item is missing

- Classify the items into assets and liabilities and transfer them to the respective side in the Balance Sheet.

- The balancing figure is the needed figure relating to that missing item.

Illustration: 7

On Apr 1, 2007, A, B and C commenced business in partnership sharing the profits and losses in the ratio of 5:3:2, respectively with capitals of Rs 50,000, Rs 30,000 and Rs 20,000, respectively. During 2007–2008 and 2008–2009 they made profits of Rs 50,000 and Rs 80,000 (before allowing interest on capital @ 10%). Drawings of each partner were Rs 1,000 p.m. The creditors stood at Rs 20,000 as on Mar 31, 2009. Draw a Balance Sheet as on Dec 31, 2009.

Solution

In this problem,

- Interest on capital

- Drawings

- Profit

were given. So Capital Account for each partner has to be prepared first and only then the Balance Sheet has to be drawn up.

Stage I

Statement Showing Capitals of Partners as on Mar 31, 2009

Stage II

Balance Sheet as on Mar 31, 2009

7.1.1 Model

When all partners agree to dissolve the firm:

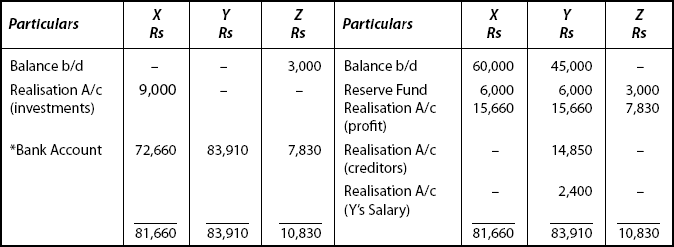

Illustration: 8

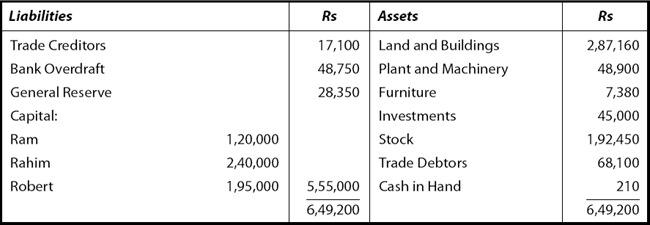

X, Y and Z sharing in the ratio of 2:2:1 agreed upon dissolution of their partnership on Dec 31, 2008 on which date their Balance Sheet was as follows:

Investments were taken over by X at Rs 9,000; Creditors of Rs 15,000 were taken over by Y who agreed to settle account with them at Rs 14,850; Remaining Creditors were paid at Rs 11,250; Joint Life Policy was surrendered and fixed assets realised Rs 1,05,000; Stock and debtors realised Rs 10,5000 and Rs 13,500, respectively. One customer whose account was written as bad, now paid Rs 1,200 which is included in Rs 15,000 above. There was an unrecorded asset of Rs 4,500 half of which was handed over to settle half of an unrecorded liability of Rs 7,500 and the balance of the unrecorded asset was sold in the market which realised Rs 1,950; Y took over the responsibility of completing dissolution and he is granted salary of Rs 600 per month. Actual realisation expenses amounted to Rs 1,650. Dissolution was completed and final payments were made on Apr 30, 2009. Prepare necessary ledger accounts in the books of the firm.

[B. Com (Hons.) – Delhi]

Solution

Stage I

Preparation of Realisation A/c

Stage II

Preparation of Capital A/c

Stage III: Finally Bank Account has to be prepared.

7.1.2 Model

Dissolution on death of a partner.

Illustration: 9

X, Y and Z are partners of a firm whose balance sheet as on Mar 31, 2009 was as follows:

The value of Joint Life Policy shown in the Balance Sheet represents the surrender value of the policy taken by the firm of Rs 1,50,000 to enable the settlement of accounts with a partner’s legal execute in case of death of a partner during the continuance of the firm. X died on Apr 10, 2009.

The remaining partners could not arrive at any understanding with the legal representative of X with the result the firm was dissolved immediately subject to the following adjustments afterwards:

- Plant and Machinery realised only 70% of the book value

- Furniture and Fittings were taken over by Z at a market value of Rs 9,360

- Bills Receivable and Sundry Debtors had to be discounted at 4%

- Stock in Trade comprised

- easily marketable items – 70% of the inventory which realised in its full value

- obsolete items – 10% of the total items which has to be discarded

- the rest of the items which realised 50% of their book value

- a liability of Rs 10,640 had to be paid in addition to the given above.

Draw up the necessary accounts to close the books of the firm.

Solution

Stage I: Preparation of Current Account of Partners

Current Account

Capital Account

Cash and Bank A/c

X, Y, Z Realisation Account

Note: Fraction of 0.50 was rounded off in the Current Account of Partners.

7.1.3 Model

Dissolved firm (assets and liabilities) taken over by some partners or only one partner.

7.2 Accounting Procedure

In general, accounting procedure for this case is similar to other cases of dissolution that we have discussed so far.

In addition, the following should also be followed.

7.3 Assets and Liabilities taken over by Partner(s) Accounting Procedure

- For taking over of assets:

Joint Account of Partners (concerned) A/c

Dr.

To Realisation A/c

- For taking over of liabilities:

Realisation A/c

Dr.

To Joint Account of Partners.

Note:

- In case if only the partners take over the firm then such a partner’s personal account is opened instead of joint account of partners.

- Partners who are going to shoulder the responsibility of taking over the firm must bring in cash in the ratio in which they decide to purchase it.

- The capital accounts of partners taking over the business should be transferred to the joint account of the partners or the Partners Personal Account depending on the case whether single partner or more than one partner.

Illustration: 10

A, B and C who were sharing profits and losses in the ratio of 2:2:1 decided to dissolve the partnership on Mar 31, 2009 on which date their Balance Sheet was as follows:

B and C continued the business, agreeing to purchase A’s share in the capital of the firm in the proportion in which they shared profits and losses. Mrs. A agreed to allow her loan to remain in the business. B and C utilised the available bank balance to pay A and contributed the balance. Assets were valued as follows:

Fixed Assets Rs 54,600; Stocks Rs 27,000; Debtors as in the Balance Sheet, subject to Rs 3,300 as Provision for Doubtful Debts and an allowance of 5% for discounts. The liability of creditors is taken over by B and C subject to an allowance of Rs 600 for discount. B and C continue to share profits and losses in the same proportion as before.

You are required to prepare

- Realisation A/c

- Bank A/c

- Partner’s Capital Account

- Opening Balance Sheet

Solution

Step 1: First, Net Debtors has to be computed

|

|

Rs |

|

(i) As per Balance Sheet |

42,000 |

|

(ii) Less: Provision for Doubtful Debts |

3,300 |

|

(iii) Good Debts (i–ii) |

______ 38,700 |

|

(iv) Less: 5% Allowance for Discount |

1,935 |

|

(v) Net Debtors (iii–iv) |

______ 36,765 ______ |

Step 2: Preparation of Realisation Account

Realisation Account

Step 3: Preparation of capital accounts of partners

Capital Account of Partners

Step 4: Preparation of B and C Joint A/c

B and C Joint Account

OBJECTIVE 8: RETURN OF PREMIUM (GOODWILL) (SECTION 51)

The Indian Partnership Act 1932 (Section 51) stipulates that where a partner has been admitted to the partnership and that the firm would be for a fixed period, then such partner will be eligible to claim refund of such amount of premium. But this refund is subject to:

- Terms of admission

- Length of the period agreed

- Expiry of the agreed period

Such refundable claim is also debited to other partners in their profit sharing ratio (the agreement should not be contrary).

No refund claim can be possible when

- the dissolution of firm occurs due to the death of a partner

- the dissolution is due to misconduct of the partners claiming the refund

- the dissolution in confirmity with agreement

Illustration: 11

P, Q and R were in partnership sharing profits and losses in the ratio of 6:3:1. R was admitted to the firm on Apr 1, 2004 paying Rs 30,000 as premium (share of goodwill) with the stipulation that the term for the newly constituted firm will be 10 years. But this newly constituted firm had to be dissolved on Apr 1, 2009. R demands the refund of his premium.

How will you deal with the claim of R in each of the following alternative cases?

- The dissolution is due to the death of P

- The dissolution is on account of mutual agreement by the partners themselves without any reference to such claim

- The dissolution is an account of continuous misconduct of R

- The dissolution is due to insolvency of Q on Mar 31, 2009

- The dissolution is due to persistent negligence of P

- The dissolution is by mutual consent with the clear stipulation as to the refund of premium

The account has to be closed on Mar 31 every year.

Solution

Step 1

Under Section 51 of Indian Partnership Act 1932, no claim can be made for the cases (i), (ii) and (iii). For the other cases (iv), (v) and (vi), the amount of refund is calculated by applying the formula:

Return of Premium = Total Premium Paid × Unexpired Term/Total Term

|

Here Total premium paid |

Rs 30,000 |

|

Unexpired Term from Apr 1, 2009 to Apr 1, 2014 |

|

|

Apr 1, 2009 to Apr 1, 2014 |

60 months |

|

Total Term |

120 months |

|

i.e. from = Apr 1, 2004 to 10 years, i.e. Apr 1, 2001 |

|

|

Hence return of premium = Rs 30,000 × 60/120 = Rs 15,000 |

|

Step 2: Accounting Entry

This claim, i.e. Rs 15,000 has to be apportioned in the ratio of 6:3 and distributed among others and transferred into their respective capital.

| Accounts | Rs | Rs |

|---|---|---|

P’s Capital A/c Dr. |

10,000 |

|

Q’s Capital A/c Dr. |

5,000 |

|

To R s Capital A/c |

15,000 |

|

(Being the refund of Premium become by P&Q in the ratio of 6:3) |

8.1 Gift of Firm – Asset to Partners

At times, some asset of the firm may be gifted to partner(s) in recognition of service, when a firm is dissolved.

There are two cases:

Case 1: Gift by the firm:

In this case, no accounting entry is made because the firm as a whole bears it (loss).

Case 2: Gift by one or more than one partner:

In case if the gift is given by one partner, his account will be debited and Realisation Account will be credited.

The Journal Entry is

Concerned Partner’s Capital A/c Dr.

To Realisation A/c

In case, if there are three partners and two of them give gift, the accounts of the partners giving the gift will be debited in their profit sharing ratio and Realisation Account will be credited with the total value of the asset.

8.2 Gift to a Partner

Illustration: 12

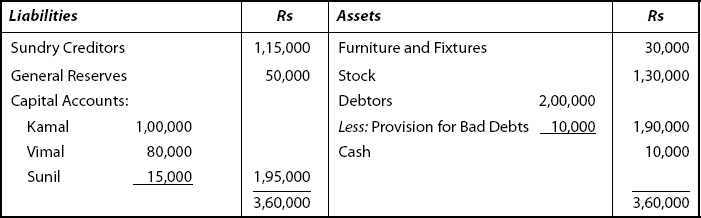

A, B and C were partners in a firm sharing profit and losses in the ratio of 5:3:2, respectively. Their Balance Sheet as on Dec 31, 2008 was as follows:

The firm has a fully depreciated computer that can fetch Rs 2,500. In addition, there is a liability for bonus payable to employees amounting to Rs 15,000.

The firm was dissolved on the above date due to disagreement among the partners. It was found that goods amounting to Rs 5,000 were purchased in Oct 2008 and has been received in Dec but were not recorded in the books.

Some of the fixed assets realised Rs 1,25,000, stock Rs 50,039 and debtors 5% less. The creditors allowed discount at 3% on an average.

Fixed assets included two scooters one of which was taken over by C for Rs 7,500 and the other was gifted by A and C to B in recognition of his services to the firm. The market value of this gifted scooter was Rs 10,500. A agreed to take over his wife’s loan. B is entitled to a commission on the amount collected from debtors. Overall expenses on realisation amounted to Rs 4,225.

You are required to prepare necessary accounts to close the books of the firm.

Solution

Step 1: Preparation of Realisation Account

Realisation Account

Step 2: Preparation of Current Account of Partners

A, B and C Current Account

Step 3: Preparation of Capital Account of Partners

A, B and C Capital Account

Step 4: Preparation of Bank Account

Bank Account

OBJECTIVE 9: INSOLVENCY OF PARTNER(S)

9.1 Meaning of Insolvency

- The capital account of a partner may show debit balance (after all adjustments). That means such a partner is a debtor to the firm.

- Such a partner has to bring in cash needed to make up the deficiency (i.e., debit balance) in his capital account.

- In case, if such a partner is unable to bring in the needed amount, he is said to be insolvent.

- In such insolvent situation, this amount (debit balance irrecoverable) must be borne by the other solvent partners, in addition to the loss on realisation. Why this additional burden? This is due to the statutory provisions as stipulated in the Indian Partnership Act 1932, whereby liability of partners is unlimited.

- Then arises the important question, in what ratio (proportion) this deficiency will have to be apportioned among the solvent partners?

- The Indian Partnership Act 1932 is silent on this matter. There is no specific provision on this matter.

- Here comes the role of Partnership Deed. A separate clause may be inserted clearly stating the way in which such deficiency may be divided among the solvent partners. Such agreement will be binding on the partners and the same will be upheld in court of law.

- The real difficulty arises when there is no specific provision existing in the Partnership Deed. In such a situation, we have to rely on English laws.

9.2 Garner vs. Murray Rule

An important landmark case relating to this matter came up in the Court of England called as Garner vs. Murray (1903). The decision of the court in this case is a guiding principle followed in our country till date.

9.2.1 Decision of the Court in Garner vs. Murray

The deficiency on the insolvent partner’s capital account must be borne by the other solvent partners, in proportion to their capitals, after each solvent partner has brought in cash to the extent of his own share of loss on realisation.

9.2.2 Important ingredients of Garner vs. Murray decision

- First, the solvent partners must bring in cash equal to the loss on realisation debited to their respective capital accounts (status: capital accounts prior to dissolution).

- Then the deficiency on the Capital Account of the insolvent partner must be divided between solvent partners in proportion to their capitals.

9.2.3 To apply Garner vs. Murray decision, the following criteria are to be fulfilled

- In a partnership firm, on the date of dissolution there must be two or more than two solvent partners, of course, with credit balances.

- One or more partners are insolvent (i.e., with debit balances in their capital accounts).

- The capitals are not in profit sharing ratio.

- There should not be any agreement relating to this aspect among the partners.

9.3 Students Should Remember These Criteria

When they should apply Garner vs. Murray decision in solving problems in partnership?

Implications of Garner vs. Murray decision: This decision puts much emphasis on “last agreed capital.” What does it mean really?

So necessity arises to know exactly the quantum of “last agreed capital.” It means or indicates the capitals of partners just before dissolution took place. As it relates to capitals of partners, the partners may be maintaining under Fixed Capital System or Fluctuating Capital System. As such accounting treatment will also vary depending on the nature of partner’s capital “Fixed” or “Fluctuating.”

9.4 Accounting Procedure When Capitals are Fixed

The accounting entries are:

- Transfer of accumulated profits: in profit sharing ratio

Profit and Loss A/c

Dr.

Reserve Fund Account

Dr.

Any other Fund Account

Dr.

To Partner’s Current A/c

- Profit on realisation:

Realisation A/c

Dr.

To Partner’s Current A/c Dr.

Note (Reserve for loss on Realisation)

- For bringing in cash by other solvent partners:

Bank A/c

Dr.

To Solvent Partner’s Current A/c

- Transfer of current account balance of the insolvent partners:

- For Debit Current Account balance:

Insolvent Partner’s Current Account Dr. To Insolvent Partner’s Capital Account

- For Credit Current Account Dr.

Insolvent Partner’s Current Account Dr. To Insolvent Partner’s Capital A/c

- For Debit Current Account balance:

- Deficiency; Distribution:

Solvent Partner’s Respective Current Account Dr. To Insolvent Partner’s Capital Account

- Finally, the current accounts of the solvent partners will be transferred to their respective capital accounts and then closed (on that basis, each partner will be paid, i.e. the due amount to each partner).

9.5 Accounting Procedure When Capitals are Fluctuating or Floating

- In this case, capital of each partner is determined by adjustment of items (reserve fund, profit/loss account balance, etc.) straightly.

- Loss/gain on realisation is adjusted straight on the capital account of the partners.

- To maintain the level of original capital balance unaffected, it is presumed that each such partner brings in the needed cash, in case of loss on realisation.

- In case of gain on realisation, the share of each partner is credited to his respective capital account.

- Care should be taken to see that the basis for apportioning the insolvent partner’s deficiency should be the balance on capital account of each solvent partner existing just prior to this adjustment.

To put in a nutshell:

- When Capitals are Fixed: The given capital on the date of dissolution will constitute the capital ratios.

- When Capitals are Fluctuating: Capital ratios will be arrived at after making adjustments to the existing capitals on the date of dissolution.

Students are advised to follow these principles while solving problems in applying Garner vs. Murray decision.

9.5.1 Insolvency – Comprehensive

(Garner vs. Murray – Application)

Illustration: 13

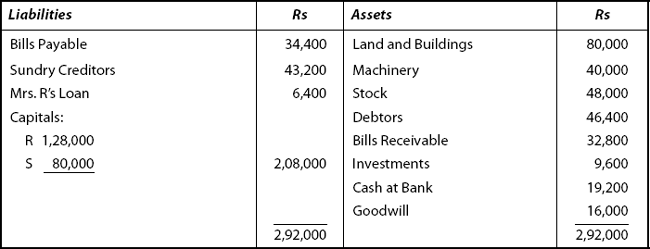

X, Y and Z were equal partners in a firm. They decided to dissolve the firm on Mar 31, 2009 due to financial difficulties. Their Balance Sheet as on that date was as follows:

At the time of dissolution, it was found that Z was insolvent and the creditors agreed to allow a discount of Rs 2,000. Assuming that Z could not bring in anything towards his capital deficiency. Prepare the necessary ledger account when

- Garner vs. Murray rule is not applied

- Garner vs. Murray rule is applied

- Capitals are fixed

- Capitals are fluctuating

(B. Com. Bangalore – Modified)

Important Notes

- In this problem, Realisation Account on the Assets side of the Balance Sheet as on that date of dissolution is given as Rs 92,000. As such, in the Realisation Account (assets have been realized already), it has to be shown as ‘balance b/d.’

- Under both the cases i.e., when Garner vs. Murray rule is applied and when it is not applied, preparation of Creditors Account and Realisation Account will be the same. As such, these two accounts are to be prepared first.

- When capitals are fixed, loss on realization and debit balance in P & L A/c are to be transferred to Current Accounts of the partners.

- When capitals are fluctuating, loss on realization and debit balance in P & L A/c are to be transferred to Capital Accounts of the partners.

- In this problem, capital ratio will be 1:1:1, as it was mentioned – equal partners in the firm – they share equally.

- But while apportioning the deficiency, the ratio will be on the basis of capital (after all adjustments) which stood just before to dissolution.

Solution

First Creditors Account and then Realisation Account will have to be prepared, as these two accounts form the basis for other accounts.

Step 1: Preparation of Creditors Account

Creditors Account

Step 2: Preparation of Realisation Account

Realisation Account

Step 3

Now we have to workout, when Garner vs. Murray rule is not applicable: Capital Account of Partners is to be prepared

X, Y and Z Capital Account

In this case Garner vs. Murray rule is not applied. As such deficiency in Z’s Capital Account, i.e. Rs 12,000 is shared by solvent partners, here X and Y in their profit sharing ratio, i.e. equally (1:1)

Step 4

When Garner vs. Murray rule is applied when capitals are fixed: When capitals are fixed, first current accounts of partner’s have to be prepared and then capital account of partners have to be computed. First, necessary adjustments have to be carried out in the current account and the end result is to be transferred to capital accounts of the partners.

Current Account

Step 5: Preparation of Capital Accounts

Capital Accounts

Important Notes

- As per Garner vs. Murray rule, realisation loss has brought in cash by solvent partners X and Y. It should be noted that in practice it need not be entered.

- Capital deficiency of the insolvent partner (Rs 12,000 – Z) is divided in the Capital Ratio of solvent partners X and Y, 8:4 or 4:2 (or) i.e. X: Rs 8,000 Y: Rs 4,000.

Step 6: Preparation of Cash Account

Cash Account

Step 7: When capitals are fluctuating

In this case, no need to prepare current accounts and capital accounts will have to be prepared straight.

Capital Account

Step 8: Preparation of Cash Account

Cash Account

Important Notes

Capital deficiency of the insolvent partner Z is shared by the solvent partners X and Y in their capital ratio 156:76 (or) 78:38 (or) 39:19. This is based on capitals on the date of dissolution. Debit balance of Profit and Loss Account is adjusted.

As it is stated in the problem: equal partners, all the partners share profit and losses equally, i.e. 1:1:1. This is the profit sharing ratio.

9.5.2 Pre-dissolution Adjustments

Illustration: 14

Amar, Akbar and Antony are partners sharing profits and losses in the proportion of 3:2:1. The partnership was dissolved on Mar 31, 2009, on which date the Balance Sheet of the firm was as follows:

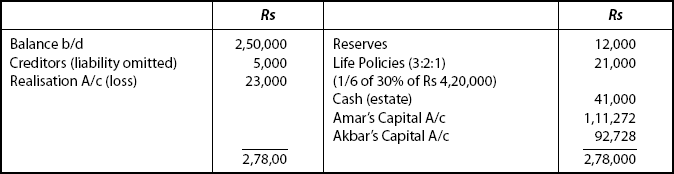

The lives of partners were insured severally for Amar Rs 2,00,000, Akbar Rs 1,00,000 and Antony Rs1,20,000. The premium was treated as business expenses. On the date of dissolution, the surrender value of each of the policies was 30% of the sum assured. Amar took over his policies but the policies of Akbar and Antony were surrendered.

In the course of dissolution, it was found

- that a liability of Rs 30,000 for purchase of goods in the year 2008–2009 had been omitted from the Balance Sheet and that goods had been included in the stock.

- that bills receivable amounting to Rs 70,000 were discounted by the firm and were dishonored and proved to be worthless.

- Amar agreed to take over the goodwill of the firm at Rs 50,000. The bills receivable were retired by the acceptor for Rs 48,000 and the remaining assets realised Rs 1,87,980. The expenses on realization amounted to Rs 10,000.

- Antony is insolvent but his estate pays Rs 41,000.

You are required to prepare the necessary accounts to close the books of the firm

[B.Com (Hons) – Modified]

Solution

Note: This problem is solved by applying Garner vs. Murray rule

- Capitals are fluctuating. As such, the undisclosed (unrecorded) assets and liabilities have to be recorded by debiting or crediting the capital accounts, to ascertain the capitals on the date of dissolution.

- As some items are not recorded in the books, they have to be brought into records and adjustments have to be made before dissolution.

- Capitals of Amar and Akbar are to be adjusted, and only on the adjusted capital, ratio in which deficiency of Antony to be borne has to be computed. This is done as follows:

| Amar Rs |

Amar Rs |

|

|---|---|---|

Capital as per Balance Sheet |

1,56,000 |

1,44,000 |

Add: Reserves (Rs 72,000 in 3:2:1) |

36,000 |

24,000 |

Life Policies: |

63,000 |

42,000 |

(Amar = ⅓ of 30% of Rs 2,10,000 |

||

Akbar = ⅓ of 30% of Rs 2,10,000 |

||

|

—— |

—— |

|

2,55,000 |

2,10,000 |

Less: Creditors omitted in the Balance Sheet |

15,000 |

10,000 |

Adjusted Capital: |

2,40,000 |

2,00,000 |

Therefore, Ratio = 2,40,000:2,00,000 |

||

24:20 |

||

12:5 |

Deficiency of Antony’s capital will have to be borne by Amar and Akbar in this ratio, i.e. 12:5. Now, the needed accounts are to be prepared in the sequence as follows:

Realisation Account

Amar’s Capital Account

Akbar’s Capital Account

Cash Account

9.5.3 Model

Partner’s Debit balance in the Capital Account on the date of dissolution.

Illustration: 15

P, Q, R and S were partners sharing profits and losses in the ratio of 3:3:2:2, respectively. Their Balance Sheet on Dec 31, 2008 was as follows:

It was decided to dissolve the firm with effect from Dec 31, 2008 and Q was appointed to liquidate the assets and pay the creditors. He was entitled to receive 5% commission on the amounts finally paid to other partners including loans, if any. He was to bear the expenses of realisation that amounted to Rs 1,500. The assets realised Rs 1,62,000. Creditors were paid in full. In addition a sum of Rs 15,000 was also paid to staff on retrenchment in full settlement of their claims. S was insolvent and the partners accepted Rs 22,200 from his estate in settlement. Applying the rule in Garner vs. Murray, prepare necessary ledger accounts.

Commission payable to Q is note to be treated as firm’s expense.

(B.Com (Delhi) – Adapted and Modified)

Here, students have to note one more information.

- In the Balance Sheet, in addition to the insolvent partner (S), the other partner R also has a debit balance.

- In such cases, such partners need not take the burden of shouldering the deficiency in the Capital Account of S.

- Only P and Q have to share the deficiency of S in the ratio of their capital Rs 1,20,000:90,000, i.e. 4:3.

- R has paid his own deficiency because he is not insolvent.

- Now Realisation Account has to be prepared. Here, actual expenses on realisation paid by Q may not be taken into account, assuming it was met by him personally.

- Further, cash representing loss on realisation brought by solvent partners has to be recorded in partner’s capital accounts. Hence it is ignored in the preparation of Realisation Account.

Realisation Account

*Balancing figure Rs 72,000 is the total loss on realisation. This amount is applied in the ratio of 3:3:2:2 (i.e., P: 3/10 Q: 3/10 R: 2/10 S: 2/10) and transferred to other respective capital accounts.

P’s Capital Account

Q’s Capital Account

S’s Capital Account

Bank Account

Working Notes:

Calculation of Commission Payable to Q |

Rs |

Amount Due before Charging Commission |

1,29,600 |

Less: Cash brought before Realisation Loss |

21,600 |

|

1,08,000 |

Commission = 1,08,000 × 5/105 = Rs 5,142 (rounded off)

Illustration: 16

The following Balance Sheet is presented to you

The partners shared profit and losses in the ratio of 2:3:3:2.

The position of partners was as follows:

| Private Estate Rs |

Private Liability Rs |

|

|---|---|---|

A |

1,00,000 |

1,50,000 |

B |

2,00,000 |

60,000 |

C |

50,000 |

40,000 |

D |

80,000 |

90,000 |

The assets realised was Rs 2,60,000 and expenses of realisation was Rs 10,000. Prepare ledger accounts giving effect to the dissolution.

B. Com (Hons) Delhi

B. Com (pass) Madras

Adapted and Modified

Solution

B’s Loan Account

A, B, C and D Realisation Account

A’s Capital Account

C’s Capital Account

D’s Capital Account

Cash Account

Working Notes:

- There are deficits in capital accounts of partners B, C and D resulting in three insolvent partners. In such a case, Garner vs. Murray rule cannot be applied because there must be at least two solvent partners. Here only one partner, i.e. A is solvent.

- B’s capital account shows a deficit of Rs 20,000. But he has surplus from his private estate. He brings in Rs 20,000 and settles his account.

- C’s Capital Account shows a deficit of Rs 20,000 (Rs 45,000 +Rs 15,000 +Rs 20,000 – Rs 60,000). He has a surplus of Rs 10,000 from his private estate. His deficit of Rs 10,000 has been transferred to A’s Capital A/c.

- D’s deficit is Rs 10,000 (Rs 30,000 +Rs 10,000 – Rs 30,000). No surplus from his private estate. This deficit is also borne by A as he is the only solvent partner.

- A’s Capital Account has a surplus of Rs 60,000 (Rs 1,00,000 – Rs 30,000 – Rs 10,000). A can bear the deficit of all the other partners up to Rs 60,000. Here the deficit of C is Rs 10,000 and the deficit of D is Rs 10,000 (total Rs 20,000). After meeting these deficits, final payment due to him from the firm will be only Rs 40,000.

OBJECTIVE 10: ALL PARTNERS ARE INSOLVENT

At times, situations may arise for a firm which will not be in a position to meet the claims of its creditors in full due to insufficiency of firm’s assets as well as private estates of partners. In such a situation, all the partners are said to be insolvent. Even we can call it as insolvency of the firm.

10.1 Acconting Treatment

- The realisation account is to be prepared without transferring liabilities.

- Loss on realisation is to be debited to capital accounts of partners in the profit sharing ratio.

- The capital accounts of the partners are closed by transferring the debit balance or credit balance to a newly opened account – Deficiency Account.

Illustration: 17

The Balance Sheet of X, Y and Z who are sharing profits in the ratio of 2:2:1 was as follows on Mar 31, 2009, the date of dissolution.

Stock realised Rs 26,000, and other assets were sold for Rs 45,000, Expenses on realisation amounted to Rs 1,500. Assuming that all the partners are insolvent, prepare the necessary ledger accounts to close the books of the firm.

[B.Com (Hons) – Delhi Modified]

Solution

- As all the partners are insolvent, given in the question, a new account Deficiency Account has to be prepared, after preparing capital account of partners.

- Liabilities need not be transferred while preparing Realisation Account.

Realisation Account

Sundry Creditors Account

Capital Account

Deficiency Account

Cash Account

10.2 Use of Algebraic Equation

Under the following circumstances, we have to see the help of algebraic equation to compute the amount recoverable from the insolvent partners.

- The firm is not in a position (not enough cash) to pay its outside liabilities completely.

- The amount of contribution from the private estate of the insolvent partners is not shown explicitly.

- Notwithstanding the fact that the firm is not in a position (not enough cash) to meet its outside liabilities in full, problems will require the realisation of assets and payment of liabilities through Realisation Account.

This can be best illustrated as follows.

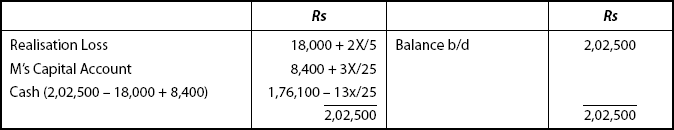

P, Q and R were in partnership sharing profits and losses in the ratio of 2:3:5. They prepared the following Balance Sheet on Mar 31, 2009, when they decided to dissolve.

Balance Sheet as on Mar 31, 2009

Plant and Machinery realised Rs 1,75,000; debtors Rs 15,000 and stock Rs 20,000. P has a private estate, valued at Rs 50,000 and his liabilities amounted to Rs 20,000. The private estate realised only Rs 30,000. Q is insolvent. R can pay only 50 paise in the rupee of what is payable on his own account to the firm. Prepare the necessary ledger accounts, assuming that the loss on realisation is to be determined after considering the amount ultimately paid to all the creditors.

[B. Com (Hons) – Modified]

Solution

Study the problem – The sentence “R can pay only 50 paise in the rupee of what is payable on his own account to the firm” – indicates the use of algebraic equation to compute the amount recoverable from the insolvent partner.

So, before applying the equation, provisional accounts have to be prepared for Realisation Account, Bank Account and R’s Capital A/c.

Important Note: Let the amount payable by R be taken as X (assumption)

Step 1:

(Provisional) Realisation Account

(Provisional) Bank Account

Step 3

(Provisional) R’s Capital Account

Now R’s Capital Account is to be completed for this value of X is to be ascertained.

Calculation of the amount to be brought in by R:

R will bring cash X (assumed)

Then his Capital Account (refer Provisional Capital A/c of R) is credited with Rs 30,000 and Rs 20,000. and

Debited with Rs 37,000 and ½ of ×+17,500

Net position is:

30,000 + 20,000 − (37,500 + X/2 + 17,500) (1)

(All Credit Items)—(All Debit Items)

(1) is rearranged as:

Rs 37,000 + X/2 + 17,500 − Rs 30,000 − Rs 20,000

This will be equal to cash + X/2 (Debit Balance)

Hence 37,500 + X/2 + 17,500 − Rs 30,000 − Rs 20,000 = Rs 5,000 + X/2

R’s contribution is 50 paise in the rupee which means 50% of what is payable on his own account (given in the question).

∴R will contribute 50% of (Rs 5,000 + X/2)

This will be equal to the R’s contribution to capital, i.e. × (assumed already)

∴ 50% of (5,000 + X/2) = X

(50/5,000) × 1/2 (5,000 + X/2) = X

5,000/2 + X/4 = X

2,500 + X/4 = X (2)

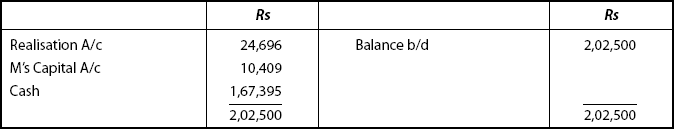

Now, we have to substitute this value 3,333 in the place of X and prepare the completed form of Realisation Account, Bank Account and R’s Capital Account and other accounts in the usual manner.

Realisation Account

R’s Capital Account

P’s Capital Account

Q’s Capital Account

Bank Account

(*Rounded off here)

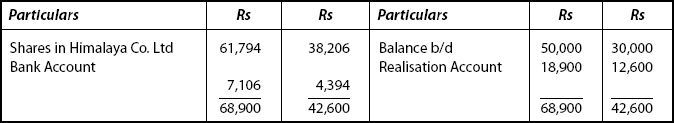

L, M and N are partners in a firm sharing profit/loss in the ratio of 5:3:2. The Balance Sheet of the firm as at Mar 31, 2009 was as follows:

The bank loan was secured by charge on buildings. Assets realised as under:

|

|

Rs |

|

Buildings |

1,20,000 |

|

Furniture |

12,000 |

|

Investment |

42,000 |

M’s private estate realised Rs 36,000 and his private liabilities are Rs 30, 000. N was insolvent and L could just contribute one-third of what was finally due from him on his own account. Show the ledger accounts closing the books of the firm.

[B.Com (Hons) – Adapted and Modified]

Solution

Study the problem: The sentence “L could contribute one-third of what was finally due from him on his own account.” Such version also indicates the use of algebraic equation to compute the amount recoverable from the insolvent partners.

So here also provisional accounts have to be prepared, algebraic equation is to be applied and then only Realisation Account, Bank Account and Capital Account of Partners can be computed.

Let L’s contribution be taken as X (assumption).

(Provisional) Realisation Account

(Provisional) L’s Capital Account

Total deficiency in L’s capital account is 3,000 +X/2. As per instructions given in the question, L is expected to contribute 1/3 of his deficiency, i.e. 1/3 of (3,000 +X/2)

|

Then his contribution is (3,000/3 + X/6) |

||

|

Our assumption on his contribution = X |

||

|

∴ 3,000/3 + X/6 |

= |

X |

|

6,000 + X/6 |

= |

X |

|

6,000 + X |

= |

6X |

|

6,000 |

= |

6X – X |

|

5X |

= |

6,000 |

|

X |

= |

6,000/5 = 1,200 |

Substituting the value of X, main accounts have to be prepared.

Realisation Account

L’s Capital Account

M’s Capital Account

N’s Capital

Deficiency Account

Note: Deficiency in the Capital Account of L and N is also to be transferred to M’s Capital Account.

Illustration: 20

A, B and C shared profits and losses in the ratio of 5:3:2. On Mar 31, 2009, their balance sheet was as follows:

The bank had a charge on all the assets. Furniture realised Rs 12,000 while the entire stock was sold for Rs 1,00,000, B’s private estate realised Rs 24,000; his private creditors were Rs 20,000. C was unable to contribute anything. A paid one-third of what was finally due from him (taking the payment also into account) except on account of other partners. Prepare Realisation Account, Cash Account and Partner’s Capital Accounts, passing all matters relating to realisation of assets and payments of liabilities through the Realisation Account. Clearly show your calculation regarding cash brought in by A.

(B.Com – Modified)

Solution

- First note whether there is any specific catch word in the problem. One can note “A paid one third of what was finally due from him….” in the problem.

- Then we have to use algebraic equation. Before that Realisation Account and A’s Capital Account has to be prepared provisionally.

- Let the amount paid by A (one-third of what was finally due form him) be taken as X (assumed).

Total cash available is computed as:

| Assets realised | Rs |

|---|---|

Furniture |

12,000 |

Stock |

1,00,000 |

Total |

1,12,000 |

Add Cash |

4,000 |

|

1,16,000 |

Add: From B’s Private estate |

4,000 (24,000 – 20,000) |

Total Cash available |

1,20,000 |

(Provisional) Realisation Account

[A’s Share =½(84,000 +X) = 42,000 +X/2]

(Provisional)A’s Capital

Debit Balance in A’s Capital Account = 2,000 +X/2

A has to pay ⅓of total deficiency (i.e.)

⅓ of (2,000 +X/2)

2,200/3 +X/6 = X

2,000/3 +*X/6 = X

4,000 +X = 6X

4,000 = 5X

X = 4,000/5 = 800

A has to contribute Rs 800

*Creditors will be able to get = 80,800 (80,000 +X)

Realisation Account

B’s Capital Account

C’s Capital Account

Deficiency Account

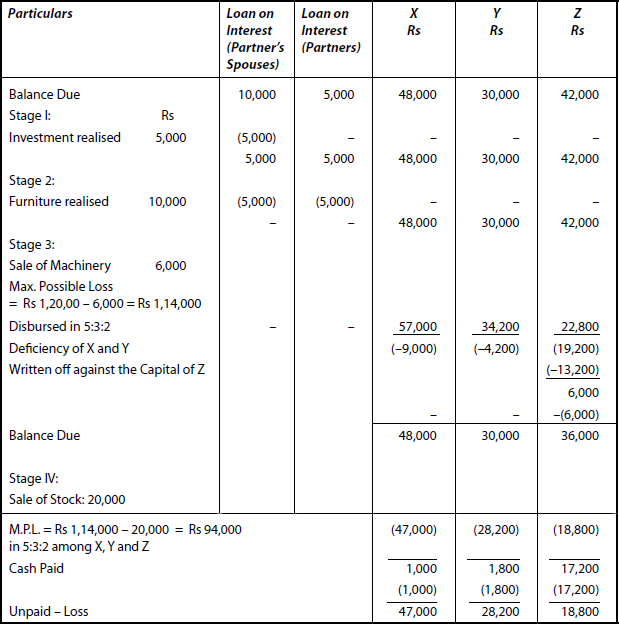

OBJECTIVE 11: MINOR AND PARTNERSHIP DISSOLUTION