Fighting the Gravity of Average Performance

New research shows that market leadership is increasingly temporary. The challenge for companies no longer lies in just getting to the front of the pack — it’s staying there.

Strategy has always been about defying averages — doing something exceptional that earns a company correspondingly exceptional rewards in the market. Today, that is still true, but the relentless churn and volatility in the business environment mean that simply outperforming the average is not enough. Rather, the true test of leadership is continuing to outperform over time.

We recently studied the performance trajectories of 22,000 companies over the last four decades. The results show that across a wide range of metrics, strong performance has become far less sustainable than in the past. Companies that manage to beat the average for their industry must now struggle much harder to maintain their leading position.

Of the companies that significantly outperformed their sector average, our analysis found that just 17% were also able to maintain that performance advantage over the following five years. These companies — including organizations like Apple and Alphabet — continually find new sources of competitive advantage by reinventing their businesses and adapting to evolving market conditions. Their example offers lessons for leadership teams trying to fight the relentless pull to the mean.

Beating the Average Is Hard. Staying There Is Harder.

In the past, companies could often get along by being average and riding along with overall economic expansion. But that has long since ceased to be the case.1 Long-run economic growth has already declined in many countries, and demographic trends point to a further deceleration to come. In addition, the pace of globalization is slowing, and policy makers are reaching the limits of conventional economic stimulus measures, further threatening corporate growth and financial returns.2

As companies find it harder than ever to beat the average for their sector, they face the second, even more daunting challenge of maintaining their lead. Consider that the rate at which companies fall out of the Fortune 100 has increased by 60% in the last half-century. Many company leaders already sense the increased churn and volatility. We took a hard look at the numbers to quantify this intuition.

Measuring the Persistence of Performance

We recently studied the relative performance of 22,000 companies, looking specifically at how they compete within their sector and how long top performers can remain at the top. In other words, our goal was to measure the persistence of performance. (We used total shareholder return [TSR] and its underlying components — revenue growth, profit margins, and market expectations — as a gauge of performance.)

Within each sector, we selected the top-performing companies in a given year — those that attained top-quintile TSR performance relative to their sector median — and calculated the exponential “decay rate” of that performance differential in the following years.3 For example, consider a company with an average annual TSR that is 20 percentage points greater than its sector average. If that company has a 50% decay rate, its performance advantage would drop to 10 percentage points after one year, 5 percentage points after two years, and 2.5 percentage points after three years. A high decay rate indicates an unsustainable edge in performance — faster regression to the mean.

The results show that the decay rate of TSR outperformance has increased dramatically in the past four decades. For example, in the 1980s, the decay rate was about 15%: Top-quintile outperformers for the period from 1980 to 1985 saw a gentle decline in their TSR premium, compared with their industry average, over the following years. In contrast, the top-quintile companies for the 2008-2013 period experienced a decay rate of 100%. After a spike in performance, they were back down to the median for their sector within just one year. In fact, some of these previously strong performers actually underperformed their sector average just one year later. (See “Top-Performing Companies Return to Earth Much Faster Than in the Past.”)

Top-Performing Companies Return to Earth Much Faster Than in the Past

Companies that generated sector-leading TSR in the 1980s benefited from a stable business environment that helped them maintain their leadership position. In contrast, companies that outperformed in TSR three decades later experienced a much faster regression to sector averages.

Top performers are defined as companies with an average annual TSR in the top quintile for their sector, based on the trailing five years (1980-1985 and 2008-2013, respectively). All companies with inflation-adjusted revenue of more than $50 million at the start of the 10-year analysis period and with data throughout the entire period; top and bottom 5% of outliers winsorized to remove impact of extreme outliers. Sources: S&P Capital IQ, BCG Henderson Institute analysis.

Furthermore, our analysis indicates that this is not a temporary blip. Top TSR outperformance has been decaying at or near 100% for the last 15 years. And whereas decay rates used to vary substantially by sector, now most sectors have converged to the same decay rate. This pattern is not purely driven by changing investor expectations and the increased agility of financial markets: We also find that it is more difficult to outperform over time in terms of fundamental metrics (such as revenue growth, EBIT margin, and return on assets).

How Some Companies Defy Gravity

For leadership teams, these findings underscore the need to develop new sources of competitive advantage. Earlier eras were characterized by “classical” planning-based strategies predicated on stable and predictable industry dynamics.4 Competitive advantage came from durable and static factors such as lower operating costs — often generated through scale — and choosing the most attractive industries and segments to play in. The largest companies in one year were likely to remain so in the next, and companies rarely changed industries or markets.

Today, however, competition is moving toward a new logic.5 Disruption and technological change require dynamic capabilities (such as agility, innovation, and reinvention) that are often inversely related to size, offsetting the traditional advantages of scale.6 Moreover, new digital platform-based business models are blurring the boundaries between sectors.

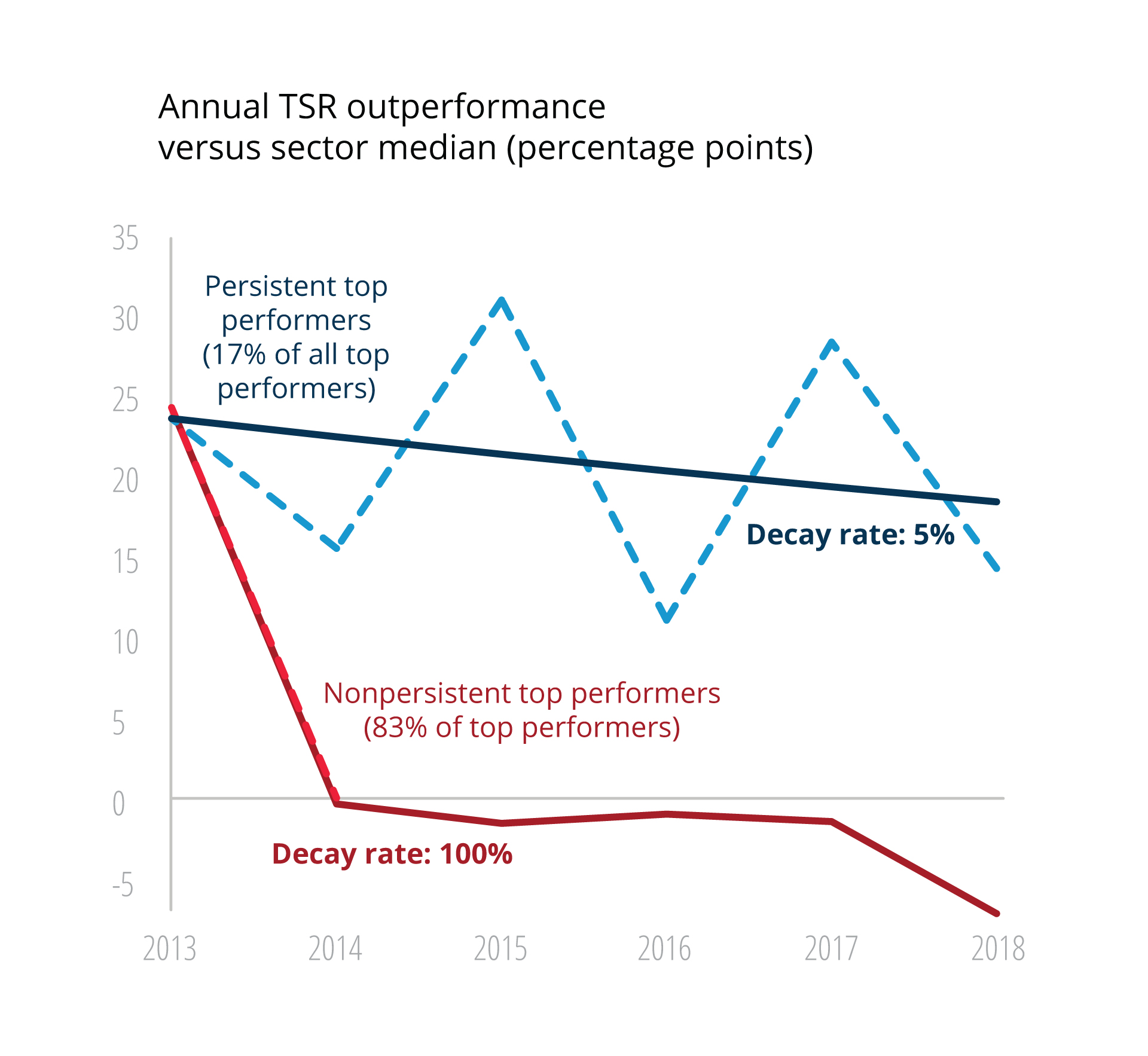

Despite long odds, our analysis shows that some companies do manage to persistently outperform their sector average. Over the last five years, 17% of top-quintile companies maintained their advantage and experienced minimal performance decay, even as their peers rapidly regressed to average. (See “A Minority of Companies Manage to Consistently Outperform Their Industry Average Over Time.”)

A Minority of Companies Manage to Consistently Outperform Their Industry Average Over Time

Roughly 1 in 6 companies with top-quintile TSR performance can retain that differential over the pack.

Top performers are defined as companies with an average annual TSR in the top quintile for their sector, based on the trailing five years (2008-2013). All companies with inflation-adjusted revenue of more than $50 million at the start of the 10-year analysis period and with data throughout the entire period; top and bottom 5% of outliers winsorized to remove the impact from extreme outliers. Sources: S&P Capital IQ, BCG Henderson Institute analysis.

What makes these companies different? They continually pursue new sources of growth and advantage and rapidly adapt to changing conditions. Companies that want to follow their lead must address four key challenges.

1. Resetting mental models. The first challenge is mental: avoiding the mindsets of complacency (advantage and performance will persist) and inevitability (today’s models and practices are underpinned by some immutable logic). Instead of thinking, “If it ain’t broke, don’t fix it,” leaders must create a sense of urgency and make the case for preemptive change.7 They must also maintain humility, recognizing that today’s models, even if successful, are unlikely to succeed forever.

For example, Amazon aims to maintain what it calls a “Day 1” culture, which promotes a belief that the market will continue to evolve and that reinvention is not just possible but necessary. Amazon’s culture also pushes against resting on the laurels of its success: CEO Jeff Bezos told employees at one all-hands meeting, “One day, Amazon will fail.”8 By instilling these values throughout the organization, the company avoids stasis and nurtures the capacity for change — enabling innovation in its offerings (such as its launch of free one-day shipping) and in its business as a whole (such as the development of Amazon Web Services).

2. Adopting new business metrics. Although past performance is far less likely to persist into the future, the most commonly used metrics in business (such as growth, market share, and profitability) only indicate what has happened in the past. These data points are useful for assessing and improving current performance, but in order to persistently outperform over time, leaders need to also use forward-looking metrics that assess the company’s fitness for the future, such as the “freshness” of its revenue mix (the share of sales from offerings based on recent innovations) or its vitality (the capacity to reinvent the business and grow sustainably).9

3. Embracing a multidimensional approach to strategy. Because tomorrow’s keys to success will be different from today’s, companies must be managed on multiple timescales simultaneously: running the current business in the short term (by exploiting existing niches and optimizing operations) and reinventing it for the long term (by exploring new possibilities and developing a pipeline of future bets). These challenges require fundamentally different skills and approaches, but organizations can be structured to accomplish both.

For example, Google restructured its business in 2015 to move emerging subsidiaries under the umbrella of a new parent company called Alphabet, where they could be managed separately from the core search and internet services business. This enabled the leaders of “moon shot” units, such as autonomous vehicles and life sciences, to more freely explore new ideas, while the core business continues to fine-tune its operations and generate cash.

4. Reinventing organizational capabilities. As the business environment evolves more rapidly, companies can no longer rely solely on static capabilities like efficiency and quality, which are most useful for harvesting a strong position over a long period. Instead, leaders must continuously experiment and scale up the initiatives that work. This requires new organizational characteristics, including a diversity of backgrounds and ways of thinking, an environment that encourages both challenge and collaboration, and the ability to accelerate the company’s rate of learning (by breaking down hierarchies and integrating technologies to act on new data rapidly).10

Outperforming the average is hard to achieve and even harder to sustain. By recognizing that superlative performance is less persistent than ever, leaders can help their organizations embrace the need for reinvention — and perhaps overcome the gravity of average performance.

Martin Reeves is a senior partner at Boston Consulting Group and chairman of the BCG Henderson Institute. Kevin Whitaker is the head of strategic analytics at the BCG Henderson Institute. Tom Deegan is a data scientist at the BCG Henderson Institute.

References

1. H-P. Bürkner, M. Reeves, H. Lotan, et al., “A Bad Time to Be Average,” Boston Consulting Group, July 22, 2019, www.bcg.com.

2. P. Carlsson-Szlezak and P. Swartz, “An Economic History of Now,” Bernstein U.S. Economics (a subscriber-only publication), November 2018.

3. Our analysis included all U.S.-listed companies with at least $50 million in inflation-adjusted revenue in any given year; top-quintile performers were identified based on average performance over the prior five years compared to the sector median.

4. M. Reeves, C. Love, and P. Tillmanns, “Your Strategy Needs a Strategy,” Boston Consulting Group, Oct. 16, 2012, www.bcg.com.

5. R. Kimura, M. Reeves, and K. Whitaker, “The New Logic of Competition,” Boston Consulting Group, March 22, 2019, www.bcg.com.

6. M. Reeves, G. Hansell, K. Whitaker, et al., “The Global Landscape of Corporate Vitality,” Boston Consulting Group, Oct. 18, 2018, www.bcg.com.

7. M. Reeves, L. Faeste, F. Hassan, et al., “Preemptive Transformation: Fix It Before It Breaks,” Boston Consulting Group, Aug. 17, 2018, www.bcg.com.

8. E. Kim, “Jeff Bezos to Employees: ‘One day, Amazon Will Fail,’ but Our Job Is to Delay It as Long as Possible,” CNBC.com, Nov. 15, 2018, www.cnbc.com.

9. M. Reeves, G. Hansell, K. Whitaker, et al., “Achieving Vitality in Turbulent Times,” Boston Consulting Group, Oct. 21, 2019, www.bcg.com.

10. M. Reeves and K. Whitaker, “Competing on the Rate of Learning,” Boston Consulting Group, Aug. 24, 2018, www.bcg.com.

Reprint 61305.

For ordering information, visit our FAQ page. Copyright © Massachusetts Institute of Technology, 2020. All rights reserved.