CHAPTER 7

Geopolitical Risk

________________

The last major category of risk that we consider is that of geopolitical risk. Geopolitical risks arise from the actions and interactions of countries. Globalization has served to increase the frequency of contact between countries as well as increase competition for scarce goods, raising the possibility of disagreements and conflict. On the other hand, globalization has also led to greater integration and alignment of economic interests, which incentivizes countries to favor diplomacy as a tool of foreign policy. Although greater economic integration between the world's economies is likely to lead to fewer military confrontations, Russia's attack on Ukraine in 2022 reminded us that a peaceful solution to disputes is not always guaranteed.

While most disagreements between countries are resolved peacefully through diplomatic channels, the threat of a disagreement escalating to economic or military conflict must be continuously monitored by global investors. This chapter considers how competing national agendas and resulting geopolitical events can affect equity markets, and how investors can monitor and respond to them effectively. The severity of any given situation is dependent on the importance placed by each party on a particular issue, and the level of urgency for an outcome. Shared interests must also be considered. Issues where the desired outcomes are incompatible and deemed vital to both parties have a greater probability of escalating than those not considered vital to national interests, or where some common ground exists.

Types of Geopolitical Risk

In this chapter we separate geopolitical risk into two broad types: internal risks and external risks. Internal geopolitical risks originate from an individual country while external geopolitical risks emanate from the interactions of two or more countries. Internal risks include regulation, changes to restrictions on foreign ownership, and changes to tax regimes or other laws that can impact the profitability of a given business or industry. External risks include diplomatic and economic sanctions, trade wars, and, in extreme situations, military conflicts. As discussed in Chapter 3, the global supply chain also poses risks for businesses, especially in cases where companies rely heavily on outsourcing. As businesses have sought to lower costs by moving production to (or sourcing components from) lower-cost regions of the world, they expose their business operations to foreign jurisdictions and possibly to risks associated with shipping bottlenecks. Supply chain relationships can be extremely complex and may not be fully disclosed by the company, meaning that most investors will not fully comprehend the underlying risks. For example, you may invest in a company that has outsourced the production of a critical component from a firm in another country. Problems in that foreign jurisdiction could cause the firm you invested in to struggle. Similarly, if you invest in a company that has outsourced its client service functions to a foreign country, civil strife or labor disruptions in that country could cause significant difficulties for the companies you own.

To stay abreast of internal risks, investors must continuously scrutinize social and political developments in countries in which they are invested. Government policy can change quickly, and so there is a need to be aware of statements made by government authorities that could foreshadow upcoming tax or regulatory changes. Perhaps the most dramatic events result from an outright change in political leadership, where a political party comes to power with a radically different policy agenda. Social unrest is another potential precursor to significant political change. While such events often have only a modest impact on businesses, it is imperative that the global investor watch these developments closely.

Perhaps more challenging is effectively protecting your portfolio from external geopolitical risks. With an increasingly interconnected world economy comes a heightened potential for disagreements and conflicts to arise. This is primarily because countries around the world often have national interests that clash with those of other countries. In some instances, these disagreements are of small enough concern that the parties involved might be willing to overlook them. When this is not the case, there are several ways that disagreements between countries can be resolved peacefully, including through various mechanisms provided by trade agreements and the intergovernmental organizations discussed earlier. If these mechanisms fail, or if the issue exists outside of the scope of those entities, countries may have other options available to help them achieve their goals, depending largely on their comparative economic and military strength. I refer to these as the tools of international politics. When countries find themselves in a dispute, there are three main categories of tools that can be employed to achieve their goals: diplomacy, economic influence, and military coercion.

Diplomacy

The first tool usually employed by a country seeking to achieve a certain outcome while resolving a dispute with another country is diplomacy. Diplomacy is often conducted by direct contact between state officials, such as ambassadors or trade negotiators. However, as global telecommunications have evolved and made people more politically aware, influencing the citizens of other countries has become an increasingly important aspect of international relations. Convincing foreign citizens that your policies are the most desirable path for them to follow is not a new concept, but modern technology has certainly made it easier for governments to disseminate propaganda. The art of diplomacy therefore includes the use of propaganda as a key policy tool. Propaganda is often benign, where a country tries to promote a particular political cause. In its more sinister form, however, propaganda can be used to undermine the policy and political structure of a rival country, even to the point of destabilizing foreign political regimes. A former professor of mine, political scientist K. J. Holsti, noted that “[t]he officials making propaganda hope that these foreign groups or the entire population will in turn influence the attitudes and actions of their own government.”1 Propaganda can therefore be aimed at an entire population, or a specific subsegment of the population, both with the desired objective of influencing a foreign government's policy decisions. Propaganda can take many forms, including persistent and repeated advertisements of ideas and slogans.

As well, diplomatic relations are more than simply symbolic. They are a valuable commodity, providing structure and assurance of a willingness to resolve disputes peacefully, and, where possible, to the general advantage of both parties. Having an immediate presence on foreign soil in the form of an embassy or consulate therefore shows a desire from both countries to maintain good relations. When relations break down, the withdrawal of embassy or consular staff is often one of the first actions taken by governments to try and coerce the other country into a desired course of action. Breaking diplomatic relations should therefore be viewed as an extreme measure and cause investors to reassess the businesses they own in those countries. Depending on the parties involved and the reason for severing diplomatic relations, investors should consider looking for a safer investment opportunity elsewhere.

Economic Incentives

Countries that are unable to resolve conflicts through diplomacy may pursue their goals using economic incentives. Concessions on trade or other economic matters, as well as supplying economic aid, may entice the opposing country to agree with the desired settlement. Naturally, not every country is able to use economic incentives as a policy tool effectively. Wealthy countries, especially those with exceptionally large economies like China and the United States, are in the enviable position of being able to use their economic power to achieve their economic and political goals. Reducing trade tariffs, aiding the foreign country in developing its infrastructure, supplying goods or loans, and loan forgiveness are examples of economic incentives that may be used to achieve foreign policy goals.

Trade Wars and Sanctions

If economic incentives prove to be ineffective, countries may resort to economic coercion. These measures include trade wars and sanctions. A trade war involves “tit-for-tat” tariff increases which makes the exports of the target country more expensive to domestic buyers, thus reducing demand and hurting the foreign country economically. In extreme cases, this can have a dramatic effect on the economy of both countries involved. In most instances, however, tariffs are used in a tactical manner, focusing on specific industries in a move designed to force concessions from the opposing country. Tariffs are often used to cause the greatest amount of economic pain to a specific industry, with the goal of either appeasing one's domestic voting base or weakening political support for the opponent.

Escalating the use of economic coercion further would involve imposing sanctions. Economic sanctions are usually employed to achieve specific political aims, such as preventing another country from developing nuclear weapons, engaging in a military conflict, or supporting terrorist organizations. Sanctions may be reactionary and used to punish another state for an action already taken, or they may be preventive and meant to deter a specific action. There are numerous examples of sanctions being employed, often meeting with mixed results. Sanctions can target an entire country or specific individuals within a country's political regime. Freezing assets of politically influential individuals, for example, makes it difficult for them to travel or conduct financial transactions. Another form of economic sanction prevents the target state from importing certain goods, such as weapons, sensitive technology, or machine parts. Sanctions could also be designed to prevent the target country from exporting certain goods (such as oil) that it relies on to earn revenue and support the economy. The purpose of economic sanctions is to starve the targeted individuals or country of the access to critical goods or financial capital. The use of economic tools to achieve political goals is also referred to as geoeconomics.

Military Coercion

The final tool available to countries for resolving disputes is military coercion, which is the threat or use of force. In situations where one country has a clear military advantage over another, the simple threat of force may be sufficient to convince the weaker country to concede. However, the threat or use of force may have unexpected consequences, including more powerful countries coming to the defense of the weaker country, drawing ridicule on the world stage, or causing other countries to employ economic or diplomatic sanctions against the aggressor.

Figure 7.1 shows the relative military power of select countries. These rankings are based on conventional (nonnuclear) military capability, but include all countries known to possess nuclear weapons.

It is not coincidence that the world's top military powers have large economies since wealth is needed to supply and support a military establishment. Economic and military strength enable a country to exert its influence throughout a region, or even around the world. This is referred to as the country's sphere of influence, and in world politics, a country that has considerable influence or control over a large geographic region is commonly referred to as a hegemon. Hegemons have great power and are capable of using all of the tools of international relations to protect their interests and project their influence. A country that is able to exert its influence over a significant portion of the world is referred to as a superpower.

FIGURE 7.1 Countries Ranked by Military Power

Source: Adapted from Global Firepower, “2022 Military Strength Ranking,” https://www.globalfirepower.com/countries-listing.php, and The Federation of American Scientists, “Status of World Nuclear Forces,” https://fas.org/issues/nuclear-weapons/status-world-nuclear-forces/, both accessed February 5, 2022.

War is one of the most terrible afflictions faced by humanity. The amount of human suffering and the destruction of property caused by conventional warfare is unimaginable for most people. All-out nuclear war would be far worse and could bring about the end of our species. For this reason, it is extremely unlikely that any country would intentionally use nuclear weapons, whose main purpose should be to deter others from attacking. Any reference to warfare in this book therefore relates to conventional (nonnuclear) warfare, and any notion of the financial markets being able to recover from a war assumes that nuclear weapons are not used. The devastation caused by nuclear weapons is so vast that the global economy and even the existence of humanity would be threatened in the event of their use.

It may come as a surprise that humanity's ability to adapt to even the most difficult circumstances means that conventional war usually has a minimal, or at least short-lived, impact on one's investments. Figure 7.2 shows the impact that wars have had on the US capital markets. The wars considered in this figure include World War II, the Korean War, the Vietnam War, and the Gulf War.

While large-cap stocks returned an average of 10.0% annually from 1926 to 2013, the return during wartime was actually slightly higher, at 11.4%. Small-cap stocks also performed slightly better than average during wartime. Not only were stock returns higher during wartime, but their level of risk (measured by the volatility of their returns) actually fell. Curiously, long-term government bonds and long-term credit (corporate bonds) generated lower returns during times of war. This may be because historically inflation has been higher during wartimes and bonds react negatively to rising inflation (bond returns are negatively correlated with inflation). Another possible explanation is that governments borrow more during wars, thus driving bond yields up and bond prices down.2

FIGURE 7.2 Capital Market Performance During Wartime

Source: Adapted from Mark Armbruster, “What Happens If America Goes to War?” CFA Institute, 2013.

While the higher returns and lower risk shown by stocks during wartime may seem counterintuitive, it is often the period leading up to war and the early days of a war that uncertainty and risk are highest. Once a conflict breaks out and investors become familiar with the scope and size of the conflict, the stock market tends to recover fairly quickly. In addition, corporate earnings may actually get a boost from warfare, as governments increase spending to pay for the goods and services consumed while conducting the war.

Figure 7.3 shows how the US stock market reacted to the outbreak of the Korean War in 1950, and it illustrates how brief stock market reactions can be to war. In this case, the US stock market fell by 20.5%, technically entering into a bear market. However, the effect was short-lived, and the US stock market fully recovered to its prewar level by September 14 that same year, a mere 56 days after the war began.

The US stock market's reaction to the outbreak of the Gulf War is another example of a muted response to military conflict. The S&P 500 began to fall in July, just two weeks before Iraq's invasion of Kuwait on August 2, 1990. Once again, the market fell by slightly more than 20%, bottoming in mid-October but then fully recovering to prewar levels by February of the following year.

FIGURE 7.3 Korean War Impact on the S&P 500 Index

Data source: Standard & Poor's Financial Services, LLC, accessed via Bloomberg.

It is important to note that the data shown here relates to the US capital markets. Since the United States enjoys a significant economic and military advantage compared to most other countries and because the wars were fought in other parts of the world, any assessment made based on these examples may understate the effects of war on the capital markets. These wars would have had a more dramatic and enduring impact on the economies and financial markets of those countries where the war was actually being waged. The impact of war on individual stock markets will therefore depend greatly on the nature and location of the conflict and the countries involved.

Geopolitical Hotspots

Eastern Europe

Eastern Europe (Figure 7.4) is a focal point in the rivalry between Russia and members of the North Atlantic Treaty Organization (NATO). NATO is a military alliance that was formed in 1949 between 12 countries, including the United States, Canada, France, Italy, the United Kingdom, and several other European countries. Since that time, NATO has grown to 30 member states with numerous other countries aspiring to join the alliance, some of which are former members of the Soviet Union. As new members have joined the alliance, Russia has expressed concern over NATO's expansion eastward and tensions between the two military powers have escalated. Russia is a key supplier of energy to several NATO member countries, making the economies of both parties vulnerable to a potential conflict in the region.

While drafting the manuscript for this book, this situation deteriorated to the point that the largest conflict since World War II broke out in Europe. Russia's invasion of Ukraine on the pretense of self-defense in 2022 threatened to destabilize the entire region. Although the probability of the conflict widening to engulf more of Europe is low, there is still a risk of it escalating into a direct conflict between Russia and NATO, and thereby the United States. Both the United States and Russia know that a war between the two countries would be devastating and would increase the risk of nuclear warfare. The sanctions imposed on Russia by NATO members in response to the invasion are unprecedented and intended to apply pressure on Russian leaders to withdraw their forces from Ukraine. Russia retaliated with threats to cut off the supply of energy to Europe, which would have a significant negative impact on European and global economic growth. While higher levels of interdependence can help reduce the risk of disagreements becoming violent, it can also lead countries to underestimate how their opponents will react to the actions they take. It is clear that this is what has occurred between Russia and Western powers in 2022. Can it happen again in other regions and between different countries? Absolutely, especially when ambiguity exists and where countries do not fully understand one another's political agenda.

FIGURE 7.4 Eastern Europe

Iran and the Middle East

Iran (Figure 7.5) is a regional military power in the Middle East that is trying to develop nuclear weapon capability. Some Western countries see Iran as a threat to regional stability and have used economic and political sanctions, diplomacy, and propaganda in an attempt to pressure Iran into giving up on its nuclear aspirations. Iran has a strong conventional military, and some countries believe it may pose a threat to several US allies in the region, including Israel, Saudi Arabia, and the United Arab Emirates.

FIGURE 7.5 Iran and the Middle East

The Korean Peninsula

Like Iran, North Korea is viewed by most Western powers as a potential threat to regional stability. Although North Korea does not have the same conventional military power as Iran, it already possesses nuclear weapons. North Korea's proximity to US allies Japan and South Korea (Figure 7.6) also adds to the importance of this region on the world stage.

FIGURE 7.6 The Korean Peninsula

India and Pakistan

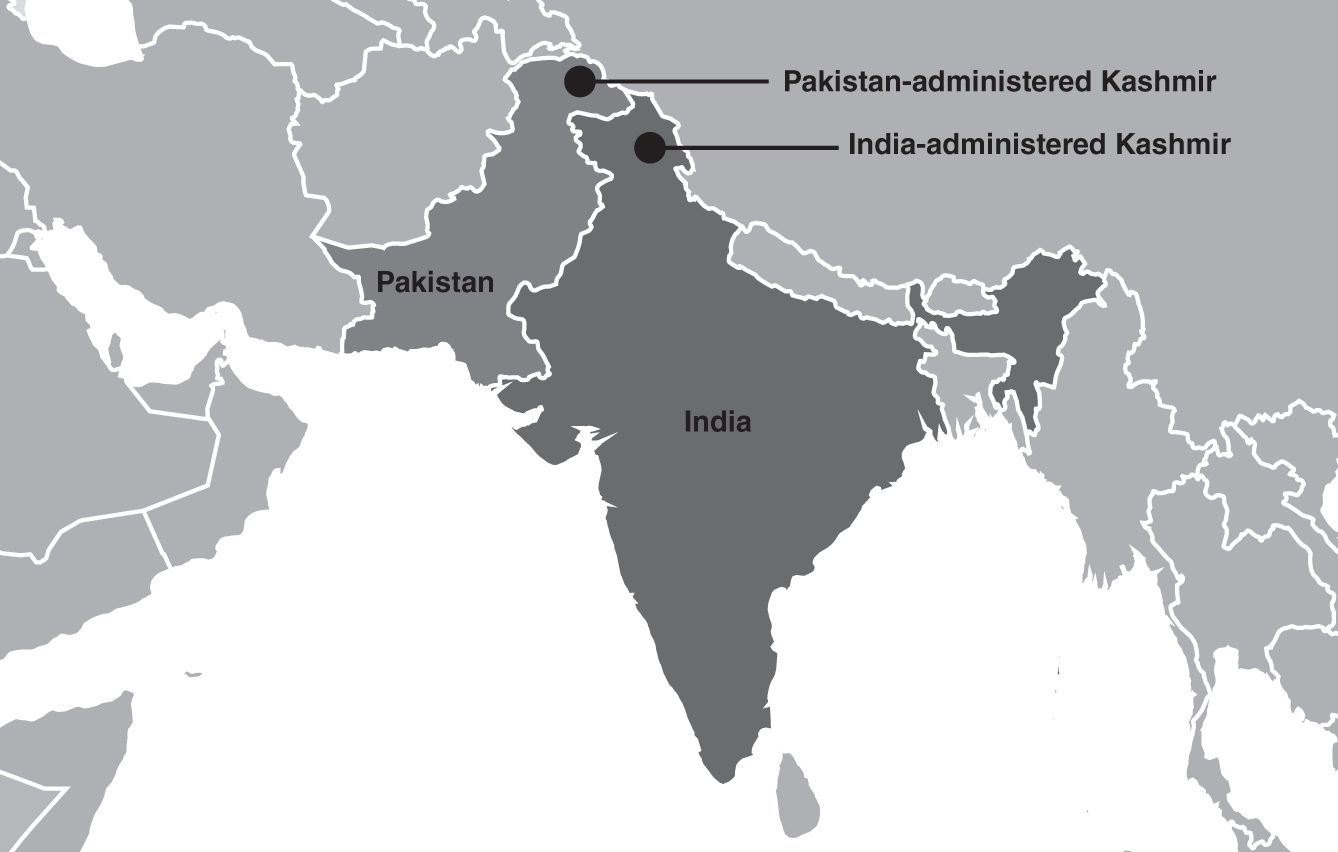

Another geopolitical hotspot is the disputed Kashmir region of India and Pakistan (Figure 7.7). Kashmir is split into two segments, one administered by each country. Skirmishes have broken out along the line of control between the two countries, resulting in some military and civilian casualties. Any one of these clashes had the potential of causing a broader military conflict. It is important to note that both Pakistan and India have strong conventional military capabilities and that they each possess nuclear weapons. Not far from Kashmir along the border between China and India, there have also been instances where Indian and Chinese forces have exchanged fire. Fortunately, none of these armed clashes has led to a major conflict.

FIGURE 7.7 India and Pakistan

The South China Sea

One of the most important geopolitical regions today is centered around the South China Sea. This is where the interests of the world's first truly global superpower, the United States, come into close contact with the interests of the world's emerging superpower, China. As the evolutionary cycle evolves, the probability of conflict between the current leading power (the United States) and an emerging world power (China) become elevated. This is especially true when the emerging power increases defense spending to match its economic growth. Rapid improvements in military capability by an emerging power are often perceived as a threat to the world's current leading power. This is precisely what we see happening today, with China's emerging strength seen as a potential threat to the current world order and the leading role played in it by the United States.

For millennia, China was the dominant economic and cultural center of Asia. In fact, China's role in Asia could be equated to that of the Roman Empire in Europe. The two empires coexisted, unaware of the other's existence, but each ruling their known world at the time. China's dominance ended in the first half of the nineteenth century when it collided with the more industrialized and militarily advanced countries of Western Europe. Today, China has recovered much of its economic, political, and military power and views most of the East and South China Seas as its sovereign territory, including the Taiwan region, shown in Figure 7.8 by what is known as the “nine-dash line.” This area includes smaller islands as well, some of which are claimed by competing countries, such as Japan. As we noted earlier, the South China Sea is strategically important to the global economy, with significant amounts of trade flowing through its waters. This fact, combined with defense alliances between the United States and several Asian countries, including Japan and the Philippines, places Chinese and United States’ interests at odds in the region.

FIGURE 7.8 The South China Sea

China views the United States as an interloper in the region, while the United States wants China to accept and adhere to the current world order that the US established out of the ashes of World War II. The United States has therefore resisted China's attempts to expand its political sphere of influence in the region. The United States often sends navy convoys to the South China Sea to ensure the freedom of navigation for foreign vessels, while China responds by sending its own naval vessels to the region to deter what it views as interference in its internal affairs. There have been several near-misses between the warships of the two countries, and there is a risk that an accident could quickly escalate and lead to a military conflict. Although the odds of a conflict between the United States and China are increasing over time, war between the two countries is not inevitable. In the words of Graham Allison, “[h]istory shows that major ruling powers can manage relations with rivals, even those that threaten to overtake them, without triggering a war.”3

Geopolitical hotspots deserve special attention, but they do not preclude investing in businesses of the countries involved. While close calls and skirmishes will surely continue, and have the potential to develop into broader conflicts, there are some simple ways investors can limit the potential damage caused by these events.

Managing Geopolitical Risk

The first step to managing geopolitical risk is to stay vigilant. Investing globally requires you to stay abreast of world affairs, noting potential areas of concern as they arise and monitoring them. Based on the various tools used by countries in managing their foreign relations described previously, you must learn to recognize when a disagreement between two or more countries is likely to escalate to a point where economic or military coercion is used. Economic coercion could be as mild as symbolic trade tariffs on noncritical goods, or it could lead to all-out economic warfare, including broad-based tariffs as well as the complete suspension of trade or the imposing of economic sanctions. It is also important for investors to be aware of the geopolitical hotspots noted earlier.

How do we recognize when a situation is likely to deteriorate enough to negatively affect our investments? One simple approach to managing internal geopolitical risk is to set a minimum credit rating for each country you plan to invest in as an investment constraint. This is referred to as the country's sovereign credit rating, and it reflects the safety of investing in the country. Sovereign credit ratings are issued by a number of leading credit rating agencies and are generally available on their websites (some of which are provided at the end of the book). The major rating agencies include Fitch, Moody's, and S&P Global. Monitoring sovereign credit ratings can be a helpful tool in ensuring that the countries you have invested in remain attractive and are shareholder friendly. These credit ratings can also protect you to an extent from external geopolitical risk, although credit-rating agencies may not adjust their ratings quickly enough to account for a confrontation that is rapidly escalating. For that reason, it is important to watch propaganda and political statements issued by countries whose actions could affect the businesses in which you have invested. Where disputes between countries arise, it is vital that you keep an eye on those issues and, if a military conflict is likely, avoid investing in companies that are domiciled in the countries involved. This is especially true when a military confrontation is likely to inflict considerable damage to a country's economy. In situations where a conflict is possible but the expected impact to your portfolio is minor your best bet is to stay the course and continue to focus on the fundamentals of the businesses you own.

Geopolitical risk may also be mitigated by ensuring that your portfolio is properly diversified and that you own businesses that are not overly exposed or reliant on a region or country whose economy is at risk of wars or other geopolitical events. Proper portfolio construction (discussed in Chapter 20) is a critical part of risk mitigation and successful investing, and we continue advancing toward that goal now by looking more closely at how to identify and analyze good businesses from around the world.

Notes

- 1. K. J. Holsti, International Politics: A Framework for Analysis (Prentice-Hall, 1988), p. 191.

- 2. Mark Armbruster, “What Happens If America Goes to War?,” CFA Institute, September 25, 2013, https://blogs.cfainstitute.org/insideinvesting/2013/09/25/u-s-capital-market-returns-during-periods-of-war/.

- 3. Graham Allison, Destined for War: Can America and China Escape Thucydides's Trap? (First Mariner Books, 2018).