CHAPTER 2

U.S. Laws and Regulations

This chapter introduces the federal laws and legislation that all human resource (HR) professionals must know and understand. When you thoroughly read these laws and regulations, you will better understand the material in Part II of this book. Knowing these laws can sometimes make the difference in selecting the right answer on the Associate Professional in Human Resources (aPHR) exam. After studying this chapter and completing the practice questions, you should have an understanding of the relevance of these laws in the employment relationship. HR professionals in both small and large companies play an important role in dealing with day-to-day employment issues relating to recruiting, hiring, managing, and training employees. HR systems implementation must be guided by legal requirements.

Many times as you read this chapter, you will discover the phrase “engaged in interstate commerce.” This is a term used by Congress to identify which employers will be subject to a law’s requirements. Interstate commerce includes shipping a Maine lobster to a New Mexico restaurant for tonight’s dinner, for example. Also included are selling products on Amazon or eBay (and similar Internet sites) to customers in states other than the one you are in and purchasing products or components from a supplier in a state other than the one you are in. As you can tell, it is a broad application that captures a great many small employers as well as large employers.

The following sections cover what you need to know concerning laws and regulations that govern employment.

When You Have ONE or More Employees

Employers sometimes forget that the moment they hire their first employee they become subject to a host of legal requirements. Here are 53 laws that will impact an employer with one or more employees on the payroll.

The Clayton Act (1914)

This legislation modified the Sherman Anti-Trust Act by prohibiting mergers and acquisitions that would lessen competition. It also prohibited a single person from being a director of two or more competing corporations. The act also restricts the use of injunctions against labor and legalized peaceful strikes, picketing, and boycotts.

For more information, see 15 U.S.C. Sec.12 at www.law.cornell.edu/uscode/text/15/12 or perform an Internet search for the law by name.

The Consumer Credit Protection Act (1968)

Congress expressed limits to the amount of wages that can be garnished or withheld in any one week by an employer to satisfy creditors. This law also prohibits employee dismissal because of garnishment for any one indebtedness.

For more information, see www.dol.gov/compliance/laws/comp-ccpa.htm or perform an Internet search for the law by name.

The Copeland “Anti-Kickback” Act (1934)

This act precludes a federal contractor or subcontractor from inducing an employee to give up any part of his or her wages to the employer for the benefit of having a job. For more information, see www.dol.gov/whd/regs/statutes/copeland.htm or perform an Internet search for the law by name.

The Copyright Act (1976)

The Copyright Act offers protection of “original works” for authors so others may not print, duplicate, distribute, or sell their work. In 1998, the Copyright Term Extension Act further extended copyright protection to the duration of the author’s life plus 70 years for general copyrights and to 95 years for works made for hire and works copyrighted before 1978. If anyone in the organization writes technical instructions, policies and procedures, manuals, or even e-mail responses to customer inquiries, it would be a good idea to speak with your attorney and arrange some copyright agreements to clarify whether the employer or the employee who authored those documents will be designated the copyright owner. Written agreements can be helpful in clearing any possible misunderstandings. For more information, see www.copyright.gov/title17/92appa.pdf or perform an Internet search for the law by name.

The Davis-Bacon Act (1931)

This law requires contractors and subcontractors on certain federally funded or assisted construction projects worth more than $2,000 in the United States to pay wages and fringe benefits at least equal to those prevailing in the local area where the work is performed. This law applies only to laborers and mechanics. It also allows trainees and apprentices to be paid less than the predetermined rates under certain circumstances. For more information, see www.dol.gov/whd/regs/statutes/dbra.htm or perform an Internet search for the law by name.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (2010)

This law offers a wide range of mandates affecting all federal financial regulatory agencies and almost every part of the nation’s financial services industry. It includes a nonbinding vote for shareholders on executive compensation, golden parachutes, and return of executive compensation based on inaccurate financial statements. Also included are requirements to report chief executive officer (CEO) pay compared to the average employee compensation and provision of financial rewards for whistle-blowers. Watch your federal law resources for updates on regulations implementing changes to this law. For more information, see www.sec.gov/about/laws/wallstreetreform-cpa.pdf or perform an Internet search for the law by name.

The Economic Growth and Tax Relief Reconciliation Act (EGTRRA) (2001)

Here are modifications to the Internal Revenue Code that adjust pension vesting schedules, increasing retirement plan limits, permitting pretax catch-up contributions by participants older than 50 in certain plans (which are not tested for discrimination when made available to the entire workforce), and modifying distribution and rollover rules. For more information, see www.irs.gov/pub/irs-tege/epchd104.pdf or perform an Internet search for the law by name.

The Electronic Communications Privacy Act (ECPA) (1986)

This is a unique law composed of two pieces of legislation, the Wiretap Act and the Stored Communications Act. Combined, they provide rules for access, use, disclosure, interpretation, and privacy protections of electronic communications, and they provide the possibility of both civil and criminal penalties for violations. They prohibit interception of e-mails in transmission and access to e-mails in storage. The implications for HR have to do with recording employee conversations. Warnings such as “This call may be monitored or recorded for quality purposes” are intended to provide the notice required by this legislation. Having cameras in the workplace to record employee or visitor activities is also covered, and notices must be given to anyone subject to observation or recording. Recording without such a notice can be a violation of this act. If employers make observations of employee activities and/or record telephone and other conversations between employees and others and proper notice is given to employees, employees will have no expectation of privacy during the time they are in the workplace.

For more information, see www.justice.gov/jmd/ls/legislative_histories/pl99-508/pl99-508.html or perform an Internet search for the law by name.

The Employee Polygraph Protection Act (1988)

Before 1988, it was common for employers to use “lie detectors” as tools in investigations of inappropriate employee behavior. That changed when this act prohibited the use of lie detector tests for job applicants and employees of companies engaged in interstate commerce. Exceptions are made for certain situations, including law enforcement and national security. There is a federal poster requirement. Note: Many state laws also prohibit the use of lie detector tests. Be sure you understand state laws where you have work locations.

For more information, see www.dol.gov/compliance/laws/comp-eppa.htm or perform an Internet search for the law by name.

The Employee Retirement Income Security Act (ERISA) (1974)

This law doesn’t require employers to establish pension plans but governs how those plans are managed once they have been established. It establishes uniform minimum standards to ensure that employee benefit plans are established and maintained in a fair and financially sound manner; protects employees covered by a pension plan from losses in benefits due to job changes, plant closings, bankruptcies, or mismanagement; and protects plan beneficiaries. It covers most employers engaged in interstate commerce. Public-sector employees and many churches are not subject to ERISA. Employers that offer retirement plans must also conform with the Internal Revenue Service (IRS) code in order to receive tax advantages. For more information, see www.dol.gov/compliance/laws/comp-erisa.htm or perform an Internet search for the law by name.

The Equal Pay Act (an Amendment to the FLSA) (1963)

Equal pay requirements apply to all employers. The act is an amendment to the Fair Labor Standards Act (FLSA) and is enforced by the Equal Employment Opportunity Commission (EEOC). It prohibits employers from discriminating on the basis of sex by paying wages to employees at a rate less than the rate paid to employees of the opposite sex for equal work on jobs requiring equal skill, effort, and responsibility and which are performed under similar working conditions. It does not address the concept of comparable worth. For more information, see www.eeoc.gov/laws/statutes/epa.cfm or perform an Internet search for the law by name.

The FAA Modernization and Reform Act (2012)

Congress took these actions in 2012 to amend the Railway Labor Act to change union certification election processes in the railroad and airline industries and impose greater oversight of the regulatory activities of the National Mediation Board (NMB). This law requires the Government Accountability Office (GAO) initially to evaluate the NMB’s certification procedures and then audit the NMB’s operations every 2 years. For more information, see www.faa.gov/regulations_policies/reauthorization/media/PLAW-112publ95[1].pdf or perform an Internet search for the law by name.

The Fair and Accurate Credit Transactions Act (FACT) (2003)

The financial privacy of employees and job applicants was enhanced in 2003 with these amendments to the Fair Credit Reporting Act, providing for certain requirements in third-party investigations of employee misconduct charges. Employers are released from obligations to disclose requirements and obtain employee consent if the investigation involves suspected misconduct, a violation of the law or regulations, or a violation of preexisting written employer policies. A written plan to prevent identity theft is required. For more information, see www.gpo.gov/fdsys/pkg/PLAW-108publ159/pdf/PLAW-108publ159.pdf or perform an Internet search for the law by name.

The Fair Credit Reporting Act (FCRA) (1970), as Amended in 2011

This was the first major legislation to regulate the collection, dissemination, and use of consumer information, including consumer credit information. It requires employers to notify any individual in writing if a credit report may be used in making an employment decision. Employers must also get a written authorization from the subject individual before asking a credit bureau for a credit report. The Fair Credit Reporting Act also protects the privacy of background investigation information and provides methods for ensuring that information is accurate. Employers who take adverse action against a job applicant or current employee based on information contained in the prospective or current employee’s consumer report will have additional disclosures to make to that individual. For more information, see www.ftc.gov/os/statutes/031224fcra.pdf or perform an Internet search for the law by name.

The Fair Labor Standards Act (FLSA) (1938)

The FLSA is one of a handful of federal laws that establish the foundation for employee treatment. It is a major influence in how people are paid, in employment of young people, and in how records are to be kept on employment issues such as hours of work. The law introduced a maximum 44-hour 7-day workweek, established a national minimum wage, guaranteed “time-and-a-half” for overtime in certain jobs, and prohibited most employment of minors in “oppressive child labor,” a term that is defined in the statue. It applies to employees engaged in interstate commerce or employed by an enterprise engaged in commerce or in the production of goods for commerce, unless the employer can claim an exemption from coverage. It is interesting to note that FLSA, rather than the Civil Rights Act of 1964, is the first federal law to require employers to maintain records on employee race and sex identification.

Provisions and Protections

Employers covered under the “enterprise” provisions of this law include public agencies; private employers whose annual gross sales exceed $500,000; those operating a hospital or a school for mentally or physically disabled or gifted children; and a preschool, an elementary or secondary school, or an institution of higher education (profit or nonprofit). Individuals can still be covered even if they don’t fit into one of the enterprises listed. If the employees’ work regularly involves them in commerce between the states, they would be covered. These include employees who work in communications or transportation; regularly use the mail, telephone, or telegraph for interstate communication or keep records of interstate transactions; handle shipping and receiving goods moving in interstate commerce; regularly cross state lines in the course of employment; or work for independent employers who contract to do clerical, custodial, maintenance, or other work for firms engaged in interstate commerce or in the production of goods for interstate commerce. The FLSA establishes a federal minimum wage that has been raised from time to time since the law was originally passed. The FLSA prohibits shipment of goods in interstate commerce that were produced in violation of the minimum wage, overtime pay, child labor, or special minimum wage provisions of the law.

Recordkeeping Requirements

The FLSA proscribes methods for determining whether a job is exempt or nonexempt from the overtime pay requirements of the act. If a job is exempt from those requirements, incumbents can work as many hours of overtime as the job requires without being paid for their overtime. Exempt versus nonexempt status attaches to the job, not the incumbent. So, someone with an advanced degree who is working in a clerical job may be nonexempt because of the job requirements, not their personal qualifications. Employers are permitted to have a policy that calls for paying exempt employees when they work overtime. That is a voluntary provision of a benefit in excess of federal requirements. State laws may have additional requirements. People who work in nonexempt jobs must be paid overtime according to the rate computation methods provided for in the act. Usually, this is a requirement for overtime after 40 hours of regular time worked during a single workweek. The act also describes how a workweek is to be determined.

Each employer covered by the FLSA must keep records for each covered, nonexempt worker. Those records must include the following:

• Employee’s full name and Social Security number.

• Address, including ZIP code.

• Birth date, if younger than 19.

• Sex.

• Occupation.

• Time and day of week when employee’s workweek begins.

• Hours worked each day and total hours worked each workweek. (This includes a record of the time work began at the start of the day, when the employee left for a meal break, the time the employee returned to work from the meal break, and the time work ended for the day.)

• Basis on which employee’s wages are paid (hourly, weekly, piecework).

• Regular hourly pay rate.

• Total daily or weekly straight-time earnings.

• Total overtime earnings for the workweek.

• All additions or deductions from the employee’s wages.

• Total wages paid each pay period.

• Date of payment and the pay period covered by the payment.

There is no limit in the FLSA to the number of hours employees age 16 and older may work in any workweek. There is a provision for employers to retain all payroll records, collective bargaining agreements, sales, and purchase records for at least 3 years. Any time card, piecework record, wage rate tables, and work and time schedules should be retained for at least 2 years. A workplace poster is required to notify employees of the federal minimum wage.

The federal child labor provisions of the FLSA, also known as the child labor laws, were enacted to ensure that when young people work, the work is safe and does not jeopardize their health, well-being, or educational opportunities. These provisions also provide limited exemptions. Workers younger than 14 are restricted to jobs such as newspaper delivery to local customers; baby-sitting on a casual basis; acting in movies, TV, radio, or theater; and working as a home worker gathering evergreens and making evergreen wreaths. Under no circumstances, even if the business is family owned, may a person under 18 work in any of the 17 most hazardous jobs. See Figure 2-1 for a list of the 17 most hazardous jobs.

Figure 2-1 Seventeen most dangerous jobs that may not be performed by workers younger than 18

For workers aged 14 and 15, all work must be performed outside school hours, and these workers may not work

• More than 3 hours on a school day, including Friday.

• More than 18 hours per week when school is in session.

• More than 8 hours per day when school is not in session.

• More than 40 hours per week when school is not in session.

• Before 7 A.M. or after 7 P.M. on any day, except from June 1 through Labor Day, when nighttime work hours are extended to 9 P.M.

• A work permit from the school district is required.

Until employees reach the age of 18 it is necessary for them to obtain a work permit from their school district. For workers aged 16 through 17, there are no restrictions on the number of hours that can be worked per week. There continues to be a ban on working any job among the 17 most hazardous positions. All of these conditions must be met or the employer will be subject to penalties from the U.S. Department of Labor.

Overtime Computation

Overtime is required at a rate of 1.5 times the normal pay rate for all hours worked over 40 in a single workweek. An employer may designate that their workweek begins at a given day and hour and continues until that same day and hour 7 days later. Once selected, that same workweek definition must be maintained consistently until there is a legitimate business reason for making a change. That change must be clearly communicated in advance to all employees who will be affected by the change. No pay may be forfeit because the employer changes its workweek definition. Compensating time off is permitted under the FLSA if it is given at the same rates required for overtime pay.

Enforcement

Provisions of the FLSA are enforced by the U.S. Department of Labor’s Wage and Hour Division. With offices around the country, this agency is able to interact with employees on complaints and follow up with employers by making an on-site visit if necessary. If violations are found during an investigation, the agency has the authority to make recommendations for changes that would bring the employer into compliance. Retaliation against any employee for filing a complaint under the FLSA, or in any other way availing himself or herself of the legal rights it offers, is subject to additional penalties. Willful violations may bring criminal prosecution and fines up to $10,000. Employers who are convicted a second time for willfully violating FLSA can find themselves in prison.

The Wage and Hour Division may, if it finds products produced during violations of the act, prevent an employer from shipping any of those goods. It may also “freeze” shipments of any product manufactured while overtime payment requirements were violated. A 2-year limit applies to recovery of back pay unless there was a willful violation, which triggers a 3-year liability. For more information, see www.dol.gov/whd/regs/statutes/FairLaborStandAct.pdf or perform an Internet search for the law by name.

The Foreign Corrupt Practices Act (FCPA) (1997)

The FCPA prohibits American companies from making bribery payments to foreign officials for the purpose of obtaining or keeping business. Training for employees who are involved with international negotiations should include a warning to avoid anything even looking like bribery payment to a foreign company or its employees. For more information, see www.justice.gov/criminal/fraud/fcpa/ or perform an Internet search for the law by name.

The Health Information Technology for Economic and Clinical Health (HITECH) Act (2009)

The HITECH Act requires that anyone with custody of personal health records send notification to affected individuals if their personal health records have been disclosed, or the employer believes they have been disclosed, to any unauthorized person. Enacted as part of the American Recovery and Reinvestment Act (ARRA), this law made several changes to the Health Insurance Portability and Accountability Act, including the establishment of a federal standard for security breach notifications that requires covered entities, in the event of a breach of any personal health information (PHI), to notify each individual whose PHI has been disclosed without authorization. For more information, see www.hhs.gov/ocr/privacy/hipaa/administrative/enforcementrule/hitechenforcementifr.html or perform an Internet search for the law by name.

The Health Insurance Portability and Accountability Act (HIPAA) (1996)

This law ensures that individuals who leave or lose their jobs can obtain health coverage even if they or someone in their family has a serious illness or injury or is pregnant. It also provides privacy requirements related to medical records for individuals as young as 12. It also limits exclusions for preexisting conditions and guarantees renewability of health coverage to employers and employees, allowing people to change jobs without the worry of loss of coverage. It also restricts the ability of employers to impose actively-at-work requirements as preconditions for health plan eligibility, as well as a number of other benefits. For more information, see www.hhs.gov/ocr/privacy or perform an Internet search for the law by name.

The Immigration and Nationality Act (INA) (1952)

The INA is the first law that pulled together all of the issues associated with immigration and is considered the foundation on which all following immigration laws have been built. It addresses employment eligibility and employment verification. It defines the conditions for the temporary and permanent employment of aliens in the United States.

The INA defines an alien as any person lacking citizenship or status as a national of the United States. The INA differentiates aliens as follows:

• Resident or nonresident

• Immigrant or nonimmigrant

• Documented and undocumented

The need to curtail illegal immigration led to the enactment of the Immigration Reform and Control Act (IRCA). For more information, see www.dol.gov/compliance/laws/comp-ina.htm or perform an Internet search for the law by name.

The Immigration Reform and Control Act (IRCA) (1986)

This is the first law to require new employees to prove both their identity and their right to work in this country. Regulations implementing this law created the Form I-9,1 which must be completed by each new employee and the employer. Form I-9 has been updated many times since 1986. Please be sure you are using the most current version of the form. There are document retention requirements. The law prohibits discrimination against job applicants on the basis of national origin or citizenship. It establishes penalties for employers who hire illegal aliens. For more information, see www.eeoc.gov/eeoc/history/35th/thelaw/irca.html or perform an Internet search for the law by name.

The IRS Intermediate Sanctions (2002)

Here we find guidelines for determining reasonable compensation for executives of nonprofit organizations. It was enacted by the IRS and applied to nonprofit organizations that engage in the transactions that inure to the benefit of a disqualified person within the organization. These rules allow the IRS to impose penalties when it determines that top officials have received excessive compensation from their organizations. Intermediate sanctions may be imposed either in addition to or instead of revocation of the exempt state of the organization. For more information, see www.irs.gov/pub/irs-tege/eotopice03.pdf or perform an Internet search for the law by name.

The Labor-Management Relations Act (LMRA; Taft-Hartley Act) (1947)

Also called the Taft-Hartley Act, this is the first national legislation that placed controls on unions. It prohibits unfair labor practices by unions and outlaws closed shops, where union membership is required in order to get and keep a job. Employers may not form closed-shop agreements with unions. It requires both parties to bargain in good faith and covers nonmanagement employees in private industry who are not covered by the Railway Labor Act.

For more information, see 29 U.S.C. Sec.141 at www.casefilemethod.com/Statuters/LMRA.pdf or search the Internet for the law by name.

The Labor-Management Reporting and Disclosure Act (Landrum-Griffin Act) (1959)

Also called the Landrum-Griffin Act, this law outlines procedures for redressing internal union problems, protects the rights of union members from corrupt or discriminatory labor unions, and applies to all labor organizations. Specific requirements include the following:

• Unions must conduct secret elections, the results of which can be reviewed by the U.S. Department of Labor.

• A Bill of Rights guarantees union members certain rights, including free speech.

• Convicted felons and members of the Communist Party cannot hold office in unions.

• Annual financial reporting from unions to the Department of Labor is required.

• All union officials have a fiduciary responsibility in managing union assets and conducting the business of the union.

• Union power to place subordinate organizations in trusteeship is limited.

• Minimum standards for union disciplinary action against its members are provided.

For more information, see www.dol.gov/compliance/laws/comp-lmrda.htm or perform an Internet search for the law by name.

The Mine Safety and Health Act (1977)

Following a series of deadly mining disasters, the American people demanded that Congress take action to prevent similar events in the future. This law converted the existing Mine Enforcement Safety Administration (MESA) to the Mine Safety and Health Administration (MSHA). For the first time, it brought all coal, metal, and nonmetal mining operations under the same Department of Labor jurisdiction. Regulations and safety procedures for the coal mining industry were not altered, just carried into the new agency for oversight. For more information, see www.dol.gov/compliance/laws/comp-fmsha.htm or perform an Internet search for the law by name.

Provisions and Protections

This law requires the secretaries of Labor and Health, Education, and Welfare to create regulations governing the country’s mines. All mines are covered if they are involved in commerce, which any active mining operation would be. Regulations that implement this law specify that employees must be provided with certain protective equipment while working in a mine. These devices relate to respiration and fire prevention, among other protections. Protecting against “black lung disease” is a key concern, even today, in the coal mining industry.

Recordkeeping Requirements

Employers engaged in mining operations must inspect their worksites and document the results, reflecting hazards and actions taken to reduce or eliminate the hazards. Employees are to be given access to information related to accident prevention, fatal accident statistics for the year, and instructions on specific hazards they will face while working in the mine. Requirements detail the content of written emergency response plans, emergency mapping, and rescue procedures. Individual employee exposure records must be maintained. Each mine operator is required to conduct surveys of mine exposures and hazards, a plan to deal with those problems, and a record of the results. This information must be made available to MSHA inspectors if they request it.

MSHA Standards

The agency enforces mine safety standards that involve ventilation, chemical exposure, noise, forklifts and other mining equipment, mine shoring, and more. Material Safety Data Sheets (MSDSs) must be available to employees in mining as they are in other industries overseen by the OSHA agency.

MSHA Enforcement

MSHA has a team of federal inspectors that conduct on-site audits of mining operations. MSHA has the authority to cite mine operators for violations of its regulations, and citations can carry a $1,000 per day penalty in some circumstances.2

The National Industrial Recovery Act (1933)

This was an attempt to help the country get out from the Great Depression. It proposed the creation of “Codes of Fair Competition” for each of several different industries. Essentially, every business would have to identify with and belong to a trade association. The association would then be required to create a Code of Fair Competition for the industry. Antitrust laws would be suspended in favor of the code. Of course, the code would have to be approved by the president of the United States, and the administration would issue federal licenses to every business in the country. If a business refused to participate in the code, its license could be suspended, and that would be the signal for that business to end all operations. There were financial penalties as well. This law didn’t fare very well. It was declared unconstitutional by the U.S. Supreme Court in 1935 and was replaced by the National Labor Relations Act later that same year.

For more information, see www.ourdocuments.gov/doc.php?flash=true&doc=66 or perform an Internet search for the law by name.

The National Labor Relations Act (NLRA; Wagner Act) (1935)

This is the “granddaddy” of all labor relations laws in the United States. It initially provided that employees have a right to form unions and negotiate wage and hour issues with employers on behalf of the union membership. Specifically, the NLRA grants to employees the right to organize, join unions, and engage in collective bargaining and other “concerted activities.” It also protects against unfair labor practices by employers.

Following on the heels of the National Industrial Recovery Act’s failures, this law stepped into the void and addressed both union and employer obligations in labor relations issues. It established the National Labor Relations Board (NLRB), which would help define fair labor practices in the following decades. The NLRB has the power to accept and investigate complaints of unfair labor practices by either management or labor unions. It plays a judicial role within an administrative setting. This law is sometimes called the Wagner Act. The following are some key provisions:

• The right of workers to organize into unions for collective bargaining

• The requirement of employers to bargain in good faith when employees have voted in favor of a union to represent them

• Requirement that unions represent all members equally

• Covers nonmanagement employees in private industry who are not already covered by the Railway Labor Act

For more information, see www.nlrb.gov/national-labor-relations-act or perform an Internet search for the law by name.

The Needlestick Safety and Prevention Act (2000)

This law modifies the Occupational Safety and Health Act by introducing a new group of requirements in the medical community. Sharps, as they are called, are needles, puncture devices, knives, scalpels, and other tools that can harm either the person using them or someone else. The law and its regulations provides rules related to handling these devices, disposing of them, and encouraging invention of new devices that will reduce or eliminate the risk associated with injury due to sharps. Sharps injuries are to be recorded on the OSHA 300 log with “privacy case” listed and not the employee’s name. Blood-borne pathogens and transmission of human blood-borne illnesses such as AIDS/HIV and hepatitis are key targets of this law. Reducing the amount of injury and subsequent illness due to puncture, stab, or cut wounds is a primary objective. There are communication requirements including employment poster content requirements.

For more information, see www.gpo.gov/fdsys/pkg/PLAW-106publ430/html/PLAW-106publ430.htm or perform an Internet search for the law by name.

The Norris-LaGuardia Act (1932)

Remember that this was still 3 years before the NLRA came to pass. When unions tried to use strikes and boycotts, employers would trot into court and ask for an injunction to prevent such activity. More often than not, they were successful, and judges provided the injunctions. Congress had been pressured by organized labor to restore their primary tools that could force employers to bargain issues unions saw as important. The following are key provisions of this law:

• It prohibited “yellow-dog” contracts. Those were agreements in which employees promised employers that they would not join unions. This new law declared such contracts to be unenforceable in any federal court.

• It prohibited federal courts from issuing injunctions of any kind against peaceful strikes, boycotts, or picketing when used by a union in connection with a labor dispute.

• It defined labor dispute to include any disagreement about working conditions.

For more information, see 29 U.S.C., Chapter 6, at http://uscode.house.gov/download/pls/29C6.txt or perform an Internet search for the law by name.

The Occupational Safety and Health Act (OSHA) (1970)

Signed into law by President Richard M. Nixon on December 29, 1970, the Occupational Safety and Health Act created an administrative agency within the U.S. Department of Labor called the Occupational Safety and Health Administration (OSHA). It also created the National Institute of Occupational Safety and Health (NIOSH), which resides inside the Centers for Disease Control (CDC).

Provisions and Protections

Regulations implementing this legislation have grown over time. They are complex and detailed. It is important that HR professionals understand the basics and how to obtain additional detailed information that applies to their particular employer circumstance. There are many standards that specify what employers must do to comply with their legal obligations. Overall, however, the law holds employers accountable for providing a safe and healthy working environment. The “General Duty Clause” in OSHA’s regulations says employers shall furnish each employee with a place of employment free from recognized hazards that are likely to cause death or serious injury. It also holds employees responsible for abiding by all safety rules and regulations in the workplace. Some provisions require notices be posted in the workplace covering some of the OSHA requirements. Posters are available for download from the OSHA web site without charge. The law applies to all employers regardless of the employee population size.

Recordkeeping Requirements

OSHA regulations require that records be kept for many purposes. It is necessary to conduct and document inspections of the workplace, looking for safety and health hazards. It is necessary to document and make available to employees records about hazardous materials and how they must be properly handled. Employers with ten or more people on the payroll must summarize all injury and illness instances and post that summary in a conspicuous place within the workplace. That report must remain posted from February 1 to April 30 each year. Certain employers are exempt from some OSHA recordkeeping requirements. They generally are classified by industry Standard Industrial Classification (SIC) Code. A list is available on OSHA’s web site at www.OSHA.gov. Any time there is a serious or fatal accident, a full incident report must be prepared by the employer and maintained in the safety file. These records must be maintained for a minimum of 5 years from the date of the incident. Known as a log of occupational injury or illness, it must include a record of each incident resulting in medical treatment (other than first aid), loss of consciousness, restriction of work or motion, or transfer or termination of employment. If you are in the medical industry, construction industry, or manufacturing industry, or if you use nuclear materials of any kind, there are other requirements you must meet. Key to compliance with OSHA rules is communication with employees. Training is often provided by employers to meet this hazard communication requirement. In summary, then, OSHA recordkeeping involves the following:

• Periodic safety inspections of the workplace

• Injury or illness incident reports

• Annual summary of incidents during the previous calendar year

• Injury and Illness Prevention Program (if required by rules governing your industry)

• Employee training on safety procedures and expectations

• Records of training participation

• Material Safety Data Sheets for each chemical used in the workplace (made available to all employees in a well-marked file or binder that can be accessed at any time during work hours)

Occupational Safety and Health Act Enforcement

OSHA inspections may include the following:

• On-site visits that are conducted without advance notice Inspectors can just walk into a place of employment and request that you permit an inspection. You don’t have to agree unless the inspector has a search warrant. In the absence of the warrant, you can delay the inspection until your attorney is present.

• On-site inspections or phone/fax investigations Depending on the urgency of the hazard and agreement of the person filing the complaint, inspectors may telephone or fax inquiries to employers. The employer has 5 working days to respond with a detailed description of inspection findings, corrective action taken, and additional action planned.

• Highly trained compliance officers OSHA Training Institute provides training for OSHA’s compliance officers, state compliance officers, state consultants, other federal agency personnel, and the private sector.

Inspection priorities include the following:

• Imminent danger Situations where death or serious injury are highly likely. Compliance officers will ask employers to correct the conditions immediately or remove employees from danger.

• Fatalities and catastrophes Incidents that involve a death or the hospitalization of three or more employees. Employers must report these incidents to OSHA within 8 hours.

• Worker complaints Allegations of workplace hazards or OSHA violations. Employees may request anonymity when they file complaints with OSHA.

• Referrals Other federal, state, or local agencies, individuals, organizations, or the media can make referrals to OSHA so the agency may consider making an inspection.

• Follow-ups Checks for abatement of violations cited during previous inspections are also conducted by OSHA personnel in certain circumstances.

• Planned or programmed investigations OSHA can conduct inspections aimed at specific high-hazard industries or individual workplaces that have experienced high rates of injuries and illnesses. These are sometimes called targeted investigations.

Two Types of Standards

The law provides for two types of safety and health standards. The agency has therefore developed its regulations and standards in those two categories.

Normal Standards If OSHA determines that a specific standard is needed, any of several advisory committees may be called upon to develop specific recommendations. There are two standing committees, and ad hoc committees may be appointed to examine special areas of concern to OSHA. All advisory committees, standing or ad hoc, must have members representing management, labor, and state agencies, as well as one or more designees of the Secretary of Health and Human Services (HHS). The occupational safety and health professions and the general public also may be represented.3

Emergency Temporary Standards “Under certain limited conditions, OSHA is authorized to set emergency temporary standards that take effect immediately. First, OSHA must determine that workers are in grave danger due to exposure to toxic substances or agents determined to be toxic or physically harmful or to new hazards and that an emergency standard is needed to protect them. Then, OSHA publishes the emergency temporary standard in the Federal Register, where it also serves as a proposed permanent standard. It is then subject to the usual procedure for adopting a permanent standard except that a final ruling must be made within 6 months. The validity of an emergency temporary standard may be challenged in an appropriate U.S. Court of Appeals.”4 For more information, see www.dol.gov/compliance/guide/osha.htm or perform an Internet search for the law by name.

The Omnibus Budget Reconciliation Act (OBRA) (1993)

Signed into law by President Bill Clinton on August 10, 1993, this legislation reduces compensation limits in qualified retirement programs and triggers increased activity in nonqualified retirement programs. It also calls for termination of some plans. For more information, see www.gpo.gov/fdsys/pkg/BILLS-103hr2264enr/pdf/BILLS-103hr2264enr.pdf or perform an Internet search for the law by name.

The Pension Protection Act (PPA) (2006)

Focused solely on pensions, this law requires employers that have underfunded pension plans to pay a higher premium to the Pension Benefit Guarantee Corporation (PBGC). It also requires employers that terminate pension plans to provide additional funding to those plans. This legislation impacted nearly all aspects of retirement planning, including changes to rules about individual retirement accounts (IRAs). For more information, see www.dol.gov/ebsa/pensionreform.html or perform an Internet search for the law by name.

The Personal Responsibility and Work Opportunity Reconciliation Act (1996)

This law requires all states to establish and maintain a new hire reporting system designed to enhance enforcement of child support payments. It requires welfare recipients to begin working after 2 years of receiving benefits. States may exempt parents with children younger than 1 from the work requirements. Parents with children younger than 1 may use this exemption only once; they cannot use it again for subsequent children. These parents also are still subject to the 5-year time limit for cash assistance. HR professionals will need to establish and maintain reporting systems to meet these tracking requirements. For more information, see www.acf.hhs.gov/programs/css/resource/the-personal-responsibility-and-work-opportunity-reconcilliation-act or perform an Internet search for the law by name.

The Portal-to-Portal Act (1947)

By amending the FLSA, this law defines “hours worked” and establishes rules about payment of wages to employees who travel before and/or after their scheduled work shift. The act provides that minimum wages and overtime are not required for “traveling to and from the actual place of performance of the principal activity or activities which such employee is to perform” or for “activities which are preliminary to or postliminary to said principal activity or activities,” unless there is a custom or contract to the contrary. For more information, see 29 U.S.C., Chapter 9, at http://uscode.house.gov/download/pls/29C9.txt or perform an Internet search for the law by name.

The Railway Labor Act (1926)

Originally, this law was created to allow railway employees to organize into labor unions. Over the years, it has been expanded in coverage to include airline employees. Covered employers are encouraged to use the Board of Mediation, which has since morphed into the National Mediation Board, a permanent independent agency. For more information, see www.nmb.gov/documents/rla.html or perform an Internet search for the law by name.

The Rehabilitation Act (1973), as Amended in 1980

This replaced the Vocational Rehabilitation Act and created support for states to create vocational rehabilitation programs. The term originally used in this legislation was handicapped. The law was later modified to replace that term with disabled.

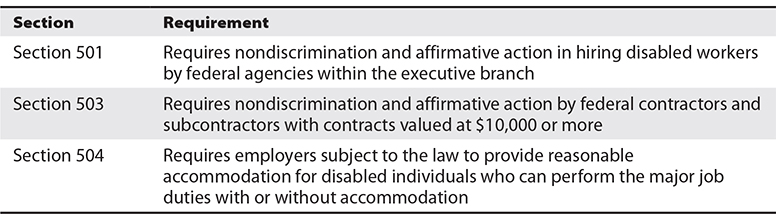

Table 2-1 notes some of the most important sections of the Rehabilitation Act.

Table 2-1 Key Employment Provisions of the Rehabilitation Act of 1973

For more information see https://www.disability.gov/rehabilitation-act-1973/ or perform an Internet search for the law by name.

The Retirement Equity Act (REA) (1984)

Signed into law by President Ronald Reagan on August 23, 1984, the REA provides certain legal protections for spousal beneficiaries of qualified retirement programs. It prohibits changes to retirement plan elections, spousal beneficiary designations, or in-service withdrawals without the consent of a spouse. Changing withdrawal options does not require spousal consent. It permits plan administrators to presume spousal survivors annuity and reduce primary pension amounts accordingly. Specific written waivers are required to avoid spousal annuity. For more information, see www.law.cornell.edu/uscode/text/29/1055 or perform an Internet search for the law by name.

The Revenue Act (1978)

This law added two important sections to the Internal Revenue Tax Code relevant to employee benefits: Section 125, Cafeteria Benefit Plans, and Section 401(k), originally a pretax savings program for private-sector employees known as Individual Retirement Accounts (IRAs), subsequently expanded to a second plan opportunity known as “Roth IRA” that permitted funding with after-tax savings. For more information, see www.irs

.gov/pub/irs-utl/irpac-br_530_relief_-_appendix_natrm_paper_09032009.pdf or perform an Internet search for the law by name.

The Sarbanes-Oxley Act (SOX) (2002)

In response to many corrupt practices in the financial industry and the economic disasters they created, Congress passed the Sarbanes-Oxley Act to address the need for oversight and disclosure of information by publicly traded companies.

Provisions and Protections

This law brought some strict oversight to corporate governance and financial reporting for publicly held companies. It holds corporate officers accountable for proper recordkeeping and reporting of financial information, including internal control systems to assure those systems are working properly. There are also requirements for reporting any unexpected changes in financial condition, including potential new liabilities such as lawsuits. Those lawsuits can involve things such as employee complaints of illegal employment discrimination.

It requires administrators of defined contribution plans to provide notice of covered blackout periods and provides whistle-blower protection for employees.

This law protects anyone who reports wrongdoing to a supervisor, appointed company officials who handle these matters, a federal regulatory or law enforcement agency, or a member or committee of Congress. It even extends to claims that prove to be false as long as the employee reasonably believed the conduct is a violation of Security Exchange Commission (SEC) rules or a federal law involving fraud against shareholders.

On March 4, 2014, the U.S. Supreme Court issued its opinion in the case of Lawson v. FMR LLC. (No. 12–3).5 The 6–3 decision held that all contractors and subcontractors of publicly held companies are subject to the Sarbanes-Oxley Act, even if they are not publicly held. The takeaway from this ruling is that nearly everyone is now subject to the whistle-blower provisions of the Sarbanes-Oxley Act. As Justice Sotomayor suggested in her dissenting opinion:

For example, public companies often hire “independent contractors,” of whom there are more than 10 million, and contract workers, of whom there are more than 11 million. And, they employ outside lawyers, accountants, and auditors as well. While not every person who works for a public company in these nonemployee capacities may be positioned to threaten or harass employees of the public company, many are.

Under [the majority opinion] a babysitter can bring a … retaliation suit against his employer if his employer is a checkout clerk for the local PetSmart (a public company) but not if she is a checkout clerk for the local Petco (a private company). Likewise the day laborer who works for a construction business can avail himself of [this ruling] if her company has been hired to remodel the local Dick’s Sporting Goods store (a public company), but not if it is remodeling a nearby Sports Authority (a private company).

Recordkeeping Requirements

Internal control systems are required to assure that public disclosure of financial information is done as required. The registered accounting firm responsible for reviewing the company’s financial reports must attest to the proper implementation of internal control systems and procedures for financial reporting.

SOX Enforcement

Enforcement of the law is done by private-firm audits overseen by the Public Company Accounting Oversight Board (PCAOB). The PCAOB is a nonprofit corporation created by the act to oversee accounting professionals who provide independent audit reports for publicly traded companies. It essentially audits the auditors.

Companies and corporate officers in violation of the act can find themselves subject to fines and/or up to 20 years imprisonment for altering, destroying, mutilating, concealing, or falsifying records, documents, or tangible objects with the intent to obstruct, impede, or influence a legal investigation. For more information, see http://taft.law.uc.edu/CCL/SOact/soact.pdf or perform an Internet search for the law by name.

The Securities and Exchange Act (1934)

When companies “go public” by issuing common stock for trade, it is done on the “primary market.” This law provides for governance in the “secondary market,” which is all trading after the initial public offering. It also created the Securities and Exchange Commission, which has oversight authority for the trading of stocks in this country. It extends the “disclosure” doctrine of investor protection to securities listed and registered for public trading on any of the U.S. exchanges. For more information, see www.law

.cornell.edu/wex/securities_exchange_act_of_1934 or perform an Internet search for the law by name.

The Service Contract Act (1965)

Applying to federal contractors (and subcontractors) offering goods and services to the government, this law calls for payment of prevailing wages and benefit requirements to all employees providing service under the agreement. All contractors and subcontractors, other than construction services, with contract values in excess of $2,500 are covered. Safety and health standards also apply to such contracts.

The compensation requirements of this law are enforced by the Wage and Hour Division in the U.S. Department of Labor (DOL). The SCA safety and health requirements are enforced by the Occupational Safety and Health Administration, also an agency within DOL. For more information, see 41 U.S.C. 351 at www.dol.gov/oasam/regs/statutes/351.htm or perform an Internet search for the law by name.

The Sherman Anti-Trust Act (1890)

If you travel back in time to the latter part of the nineteenth century, you will find that big business dominated the landscape. There were Standard Oil, Morgan Bank, U.S. Steel, and a handful of railroads. They were huge by comparison with other similar enterprises at the time. And people were concerned that they were monopolizing the marketplace and holding prices high just because they could. John Sherman, a Republican senator from Ohio, was chairman of the Senate Finance Committee. He suggested that the country needed some protections against monopolies and cartels. Thus, this law was created and subsequently used by federal prosecutors to break up the Standard Oil Company into smaller units. Over the years, case law has developed that concludes that attempting to restrict competition, or fix prices, can be seen as a violation of this law. Restraint of trade is also prohibited. For more information, see 15 U.S.C. Secs. 1–7 at www.law

.cornell.edu/uscode/text/15/1 or perform an Internet search for the law by name.

The Small Business Job Protection Act (1996)

This law increased federal minimum wage levels and provided some tax incentives to small business owners to protect jobs and increase take-home pay. It also amended the Portal-to-Portal Act for employees who use employer-owned vehicles. It created the SIMPLE 401(k) retirement plan to make pension plans easier for small businesses. Other tax incentives created by this law include the following:

• Employee education incentive—allowed small business owners to exclude up to $5,250 from an employee’s taxable income for educational assistance provided by the employer

• Increased the maximum amount of capital expense allowed for a small business to $7,000 per year

• Replaced the Targeted Jobs Tax Credit with the Work Opportunity Tax Credit

• Provided a tax credit to individuals who adopted a child (up to $5,000 per child) and a tax credit of up to $6,000 for adoption of a child with special needs

For more information, see www.ssa.gov/legislation/legis_bulletin_082096.html or perform an Internet search for the law by name.

The Social Security Act (1935)

The Social Security program began in 1935 in the heart of the Great Depression. It was initially designed to help senior citizens when that group was suffering a poverty rate of 50 percent. It currently includes social welfare and social insurance programs that can help support disabled workers who are no longer able to earn their wages.

The Social Security program is supported through payroll taxes with contributions from both the employee and the employer. Those payroll tax rates are set by the Federal Insurance Contributions Act (FICA) and have been adjusted many times over the years. There are many programs currently under the control of the Social Security Act and its amendments. These include the following:

• Federal old-age benefits (retirement)

• Survivors benefits (spouse benefits, dependent children, and widow/widower benefits)

• Disability insurance for workers no longer able to work

• Temporary Assistance for Needy Families

• Medicare Health Insurance for Aged and Disabled

• Medicaid Grants to States for Medical Assistance Programs

• Supplemental Security Income (SSI)

• State Children’s Health Insurance Program (SCHIP)

• Patient Protection and Affordable Care Act

There is currently a separate payroll deduction for Medicare Health Insurance, which is also funded by both the employee and employer. And the Patient Protection and Affordable Care Act is rolling out over the next few years and offers the opportunity to provide medical insurance coverage to a greater number of people.

A personal Social Security number is used as a tax identification number for federal income tax, including bank records, and to prove work authorization in this country. Social Security numbers can be used in completing Form I-9, which must be completed for every new employee on the payroll. Also required for the I-9 is proof of identity. For more information, see www.ssa.gov/history/35act.html or perform an Internet search for the law by name.

The Tax Reform Act (1986)

This law made extensive changes to the Internal Revenue Service tax code, including a reduction in tax brackets and all tax rates for individuals. Payroll withholdings were affected, many passive losses and tax shelters were eliminated, and changes were made to the alternative minimum tax computation. This is the law that required all dependent children to have Social Security numbers. That provision reduced the number of fraudulent dependent children claimed on income tax returns by 7 million in its first year. For HR professionals, answers to employee questions about the number of exemptions to claim on their Form W-4 are greatly influenced by this requirement for dependent Social Security numbers. For more information, see http://archive.org/stream/summaryofhr3838t1486unit/summaryofhr3838t1486unit_djvu.txt or perform an Internet search for the law by name.

The Taxpayer Relief Act (1997)

Congress wanted to give taxpayers a couple of ways to lower their tax payments during retirement, so the Taxpayer Relief Act was passed to create new savings programs called Roth IRAs and Education IRAs. Many individuals were able to achieve a better tax position through these tools. For more information, see www.gpo.gov/fdsys/pkg/BILLS-105hr2014enr/pdf/BILLS-105hr2014enr.pdf or perform an Internet search for the law by name.

The Trademark Act (1946)

This is the legislation that created federal protections for trademarks and service marks. Officially it was called the Lanham (Trademark) Act, and it set forth the requirements for registering a trademark or service mark to obtain those legal protections. HR people may well have a role to play in training employees in how to properly handle organizational trademarks and the policies that govern those uses. For more information, see www.uspto.gov/trademarks/law/tmlaw.pdf or perform an Internet search for the law by name.

The Unemployment Compensation Amendments (UCA) (1992)

This law established 20 percent as the amount to be withheld from payment of employee savings accounts when leaving an employer and not placing the funds (rolling over) into another tax-approved IRA or 401(k). For more information, see www.socialsecurity.gov/policy/docs/ssb/v56n1/v56n1p87.pdf or perform an Internet search for the law by name.

The Uniformed Services Employment and Reemployment Rights Act (USERRA) (1994)

USERRA provides instructions for handling employees who are in the reserves and receive orders to report for active duty. The law protects the employment, reemployment, and retention rights of anyone who voluntarily or involuntarily serves or has served in the uniformed services. It requires that employers continue paying for the employee’s benefits to the extent they paid for those benefits before the call to duty. It also requires that employers continue giving credit for length of service as though the military service was equivalent to company service. There are specific detailed parameters for how long an employee may wait to engage the employer in return-to-work conversations after being released from active military duty.

This law and its provisions cover all eight U.S. military services and other uniformed services. They are

• Army

• Navy

• Air Force

• Marines

• Public Health Service Commissioned Corps

• National Oceanic and Atmospheric Administration Commissioned Corps

• Coast Guard

• National Guard groups that have been called into active duty

For more information, see www.dol.gov/compliance/laws/comp-userra.htm or perform an Internet search for the law by name.

The Vietnam Era Veterans Readjustment Assistance Act (1974), as Amended by the Jobs for Veterans Act (JVA)

Current covered veterans include the following:

• Disabled veterans

• Veterans who served on active duty in the U.S. military during a war or campaign or expedition for which a campaign badge was awarded

• Veterans who, while serving on active duty in the Armed Forces, participated in a U.S. military operation for which an Armed Forces service medal was awarded pursuant to Executive Order 12985

• Recently separated veterans (veterans within 36 months from discharge or release from active duty)

These requirements apply to all federal contractors with a contract valued at $25,000 or more, regardless of the number of total employees.

This veteran support legislation requires all employers subject to the law to post their job openings with their local state employment service. These are the three exceptions to that requirement:

• Jobs that will last 3 days or less

• Jobs that will be filled by an internal candidate

• Jobs that are senior executive positions

Affirmative action outreach and recruiting of veterans are required for federal contractors meeting the contract value threshold. For more information, see www.dol.gov/compliance/laws/comp-vevraa.htm or perform an Internet search for the law by name.

The Wagner-Peyser Act (1933), as Amended by the Workforce Investment Act (WIA) (1988)

The Wagner-Peyser Act created a nationwide system of employment offices known as Employment Service Offices. They were run by the U.S. Department of Labor’s Employment and Training Administration (ETA). These offices provided job seekers with assistance in their job search, assistance in searching jobs for unemployment insurance recipients, and recruitment services for employers.

The Workforce Investment Act created the “One Stop” centers within Employment Service Offices. The federal government contracts with states to run the Employment Service Offices and One Stop centers. Funds are allocated to states based on a complicated formula. For more information, see www.doleta.gov/programs/w-pact_amended98

.cfm or perform an Internet search for the law by name.

The Walsh-Healey Act (Public Contracts Act) (1936)

President Franklin Roosevelt signed this into law during the Great Depression. It was designed to assure the government paid a fair wage to manufacturers and suppliers of goods for federal government contracts in excess of $10,000 each. The provisions of the law included the following:

• Overtime pay requirements for work done over 8 hours in a day or 40 hours in a week.

• A minimum wage equal to the prevailing wage.

• Prohibition on employing anyone under 16 years of age or a current convict.

• The Defense Authorization Act (1968) later excluded federal contractors from overtime payments in excess of 8 hours in a day.

For more information, see www.dol.gov/compliance/laws/comp-pca.htm or perform an Internet search for the law by name.

The Work Opportunity Tax Credit (WOTC) (1996)

This law provides federal income tax credits to employers who hire from certain targeted groups of job seekers who face employment barriers. The amount of tax credit is adjusted from time to time and currently stands at $9,600 per employee.

Targeted groups include the following:

• Qualified recipients of Temporary Assistance to Needy Families (TANF).

• Qualified veterans receiving food stamps (referred to as Supplemental Nutrition Assistance Program [SNAP] today) or qualified veterans with a service-connected disability who

• Have a hiring date that is not more than 1 year after having been discharged or released from active duty, or

• Have aggregate periods of unemployment during the 1-year period ending on the hiring date that equals or exceeds 6 months

• WOTC also includes family members of a veteran who received food stamps (SNAP) for at least a 3-month period during the 15-month period ending on the hiring date or a disabled veteran entitled to compensation for a service-related disability hired within a year of discharge or unemployed for a period totaling at least 6 months of the year ending on the hiring date.

• Ex-felons hired no later than 1 year after conviction or release from prison.

• Designated Community Resident—an individual who is between the ages of 18 and 40 on the hiring date and who resides in an Empowerment Zone, Renewal Community, or Rural Renewal County.

• Vocational rehabilitation referrals, including Ticket Holders with an individual work plan developed and implemented by an Employment Network.

• Qualified summer youth ages 16 through 17 who reside in an Empowerment Zone, Enterprise Community, or Renewal Community.

• Qualified SNAP recipients between the ages of 18 and 40 on the hiring date.

• Qualified recipients of Supplemental Security Income (SSI).

• Long-term family assistance recipients.

These categories change from time to time.

In addition to these specific federal laws, there are laws dealing with payroll that HR professionals need to understand. While it is true that accounting people normally handle the payroll function in an employer’s organization, occasionally HR professionals get involved and have to work with accounting people to explain deductions and provide input about open enrollment for healthcare benefit programs, among other things. Those things can include garnishments, wage liens, savings programs, benefit premium contributions, and income tax, FICA, and Medicare withholdings. For more information, see www.gao.gov/new.items/d01329.pdf or perform an Internet search for the law by name.

The Labor Management Reporting and Disclosure Act (1959)

Finally, this law provides for the reporting and disclosure of certain financial transactions and administrative practices of labor organizations and employers to prevent abuses in the administration of trusteeships by labor organizations and to provide standards with respect to the election of officers of labor organizations. It created a Bill of Rights for members of labor organizations (29 U.S.C. 401–402; 411–415; 431–441; 461–466; 481–484; 501–505).

For more information, see www.dol.gov/olms/regs/statutes/lmrda-act.htm or perform an Internet search for the law by name.

Whistle-Blowing

It is important to highlight the issue of whistle-blowing. Protections against retaliation are embedded in various laws we cover in this chapter; laws with those provisions and protections include the Civil Rights Acts, OSHA, MSHA, the Sarbanes-Oxley Act, ADA, and more.

Whistle-blower laws usually apply to public-sector employees and employees of organizations contracting with the federal government or state governments. They are designed to protect individuals who publicly disclose information about corrupt practices or illegal activities within their employer’s organization. Often, such events occur when someone is mishandling money, contracts, or other assets. Construction projects not being built to specifications can result in whistle-blowing by governmental employees. Employees of financial services companies (banks, credit unions, stock brokerages, and investment firms) have been in the headlines during recent years. They uncovered and disclosed misbehavior among people in their companies and were protected under whistle-blower provisions of various laws. Whistle-blowers are protected from disciplinary action, termination, or other penalty. For more information, see www.osc.gov/documents/pubs/post_wb.htm or perform an Internet search for the law by name.

For FIFTEEN or More Employees

Once employers have added 15 or more employees to their payroll, it becomes necessary to comply with an additional 11 major federal laws.

The Americans with Disabilities Act (ADA) (1990), as Amended by the Americans with Disabilities Act Amendments Act (ADAAA) (2008)

Prior to this legislation, the only employees who were protected against employment discrimination were the ones working for the federal, state, or local government and federal government contractors. They were captured by the Rehabilitation Act. As a matter of fact, it was the Rehabilitation Act that was used as a model for developing the ADA. Five years after the Rehabilitation Act, the Developmental Disabilities Act of 1978 spoke specifically to people with developmental disabilities. It provided for federally funded state programs to assist people in that category of the population. The ADA had been first proposed in 1988, and it was backed by thousands of individuals around the country who had been fighting for rights of their family members, friends, and co-workers. They thought it was only appropriate for those people to have equal access to community services, jobs, training, and promotions. It was signed into law by President George H. W. Bush on July 26, 1990. It became fully effective for all employers with 15 or more workers on July 26, 1992.

Provisions and Protections

Title I—Employment—applies to employers with 15 or more workers on the payroll. Those employers may not discriminate against a physically or mentally disabled individual in recruitment, hiring, promotions, training, pay, social activities, and other privileges of employment. Qualified individuals with a disability are to be treated as other job applicants and employees are treated. If a job accommodation is required for a qualified individual to perform the assigned job, employers are required to provide that accommodation or recommend an alternative that would be equally effective. The interactive process between employers and employees should result in an accommodation or explanation about why making the accommodation would provide an undue hardship on the employer. Title I is enforced by the Equal Employment Opportunity Commission. Part of the interactive discussion about accommodation requests involves the employer investigating other accommodations that may be equally effective yet lower in cost or other resource requirements. Employers are not obligated to accept the employee’s request without alteration.

U.S. Supreme Court Interpretation of the ADA

There were several U.S. Supreme Court cases that interpreted the ADA very narrowly. They limited the number of people who could qualify as disabled under the Court’s interpretation of Congress’s initial intent. Reacting to those cases, Congress enacted the ADA Amendment Act in September 2008. It became effective on January 1, 2009.

ADA Amendments Act of 2008

Following the U.S. Supreme Court decisions in Sutton v. United Airlines6 and in Toyota Motor Manufacturing, Kentucky, Inc., v. William,7 Congress felt that the Court had been too restrictive in its interpretation of who qualifies as disabled. It was the intent of Congress to be broader in that definition. Consequently, Congress passed the ADA Amendments Act to capture a wider range of people in the disabled classification. A disability is now defined as “an impairment that substantially limits one or more major life activities, having a record of such an impairment, or being regarded as having such an impairment.” Although the words remain the same as the original definition, the Amendments Act went further. It said, when determining whether someone is disabled, there may be no consideration of mitigating circumstances. In the past, we used to say people who had a disability under control were not disabled. An employee with a prosthetic limb did everything a whole-bodied person could do. An employee with migraines that disappeared with medication wasn’t considered disabled. Under the old law, epilepsy and diabetes were not considered disabilities if they were controlled with medication. Now, because the law prohibits a consideration of either medication or prosthesis, they are considered disabilities. You can see that a great many more people are captured within the definition of disabled as a result of these more recent changes. The only specifically excluded condition is the one involving eye glasses and contact lenses. Congress specifically said having a corrected vision problem if eye glasses or contact lenses are worn may not constitute a disability under the law.

An individual can be officially disabled but quite able to do his or her job without an accommodation of any sort. Having more people defined as disabled doesn’t necessarily mean there will be more people asking for job accommodations. For more information, see www.eeoc.gov/laws/statutes/adaaa.cfm or perform an Internet search for the law by name.

“Substantially Limits”

Employers are required to consider as disabled anyone with a condition that “substantially limits,” but does not “significantly restrict,” a major life activity. Even though the limitation might be reduced or eliminated with medication or other alleviation, the treatment may not be considered when determining the limitations. So, people who use shoe inserts to correct a back problem or who take prescription sleeping pills may now be classified as disabled. The same might be said of people who are allergic to peanuts or bee stings. Yet there may be no need for any of them to request a job accommodation.

“Major Life Activities”

Caring for oneself, seeing, hearing, touching, eating, sleeping, walking, standing, sitting, reaching, lifting, bending, speaking, breathing, learning, reading, concentrating, thinking, communicating, interacting with others, and working all are considered “major life activities.” Also included are major bodily functions such as normal cell growth, reproduction, immune system, blood circulation, and the like. Some conditions are specifically designated as disabilities by the EEOC. They include diabetes, cancer, human immunodeficiency virus and acquired immunodeficiency syndrome (HIV/AIDS), multiple sclerosis (MS), cerebral palsy (CP), and cystic fibrosis (CF) because they interfere with one or more of our major life activities.

“Essential Job Function”

An essential job function is defined as “a portion of a job assignment that cannot be removed from the job without significantly changing the nature of the job.” An essential function is highly specialized, and the incumbent has been hired because he or she has special qualifications, skills, or abilities to perform that function, among others.

“Job Accommodation”

Someone with a disability doesn’t necessarily need a job accommodation. Remember that we select people and place them in jobs if they are qualified for the performance of the essential functions, with or without a job accommodation. Someone with diabetes may have the disease under control with medication and proper diet. No accommodation would be required. However, if it were essential that the employee had food intake at certain times of the day, there could be a legitimate request for accommodating that need. The employer might be asked to consistently permit the employee to have meal breaks at specific times each day.

Job accommodations are situationally dependent. First, there must be a disability and an ability to do the essential functions of the job. Next, there must be a request for accommodation from the employee. If there is no request for accommodation, no action is required by the employer. It is perfectly acceptable for an employer to request supporting documentation from medical experts identifying the disability. There might even be recommendations for specific accommodations, including those requested by the employee.

Once an accommodation is requested, the employer is obliged to enter into an interactive discussion with the employee. For example, an employee might ask for something specific, perhaps a new piece of equipment (a special ergonomic chair) that will eliminate the impact of disability on their job performance. The employer must consider that specific request. Employers are obligated to search for alternatives that could satisfy the accommodation request only when the specific request cannot be reasonably accommodated. This is the point where the Job Accommodation Network (JAN)8 can become a resource. It can often provide help for even questionable and unusual situations.

The employer must consider if making that accommodation would be an “undue hardship” considering all it would involve. You should note that most job accommodations carry a very low cost. Often they cost nothing. The larger an employer’s payroll headcount, the more difficult it is to fully justify using “undue hardship” as a reason for not agreeing to provide an accommodation. Very large corporations or governments have vast resources, and the cost of one job accommodation, even if it does cost some large dollar amount, won’t likely cause an undue hardship on that employer.

Recordkeeping Requirements

There is nothing in the Americans with Disabilities Act of 1990, or its amendments, that requires employers to create job descriptions. However, smart employers are doing that in order to identify physical and mental requirements of each job. Job descriptions also make it easy to identify essential job functions that any qualified individual would have to perform, with or without job accommodation. It is easier to administer job accommodation request procedures and to defend against false claims of discrimination when an employer has job descriptions that clearly list all of the job’s requirements. It also makes screening job applicants easier because it shows them in writing what the job will entail. Then, recruiters may ask, “Is there anything in this list of essential job functions that you can’t do with or without a job accommodation?”

If a job requires an incumbent to drive a delivery truck, driving would be an essential function of that job. A disability that prevented the incumbent from driving the delivery truck would likely block that employee from working—unless an accommodation could be found that would permit the incumbent to drive in spite of the disability.

People are sometimes confused about temporary suspension of duty being a permanent job accommodation. If that temporary suspension means the incumbent no longer is responsible for performing an essential job function, the job could not be performed as it was designed by the employer. It is not necessary for an employer to redesign job content to make a job accommodation. It is possible for such voluntary efforts to be made on behalf of an employee the organization wants to retain. Those situations are not job accommodations, however. They are job reassignments.