Chapter 3

Keeping the Books

In This Chapter

![]() Distinguishing between bookkeeping and accounting

Distinguishing between bookkeeping and accounting

![]() Getting to know the bookkeeping cycle

Getting to know the bookkeeping cycle

![]() Making sure your bookkeeping and accounting systems are rock solid

Making sure your bookkeeping and accounting systems are rock solid

![]() Doing a double-take on double-entry accounting

Doing a double-take on double-entry accounting

![]() Deterring and detecting innocent errors and cunning fraud

Deterring and detecting innocent errors and cunning fraud

![]() Keeping books in the cloud and on the ground

Keeping books in the cloud and on the ground

I think it’s safe to say that most folks are not enthusiastic bookkeepers. You probably balance your checkbook against your bank statement every month and somehow manage to pull together all the records you need for your annual federal income tax return. But if you’re like me, you stuff your bills in a drawer and just drag them out once a month when you pay them. And when’s the last time you prepared a detailed listing of all your assets and liabilities (even though a listing of assets is a good idea for fire insurance purposes)? Personal computer programs are available to make bookkeeping for individuals more organized, but you still have to enter a lot of data into the program, and in my experience most people don’t put forth the effort.

Individuals can get along quite well without much bookkeeping — but the exact opposite is true for a business. First of all, a business needs a good bookkeeping system simply to operate day to day. An army marches on its stomach. A business marches on data and information, without which it literally could not make it through the day.

In addition to facilitating day-to-day operations, a company’s bookkeeping system serves as the source of information for preparing its periodic financial statements, tax returns, and reports to managers. The accuracy of these reports is critical to the business’s survival. If its accounting records are incomplete or inaccurate, its financial statements, tax returns, and management reports are incomplete or inaccurate. And inaccuracy simply won’t do. In fact, inaccurate and incomplete bookkeeping records could be construed as evidence of deliberate fraud (or at least of incompetence).

Obviously, then, business managers have to be sure that their company’s bookkeeping and accounting system is dependable and up to snuff. This chapter shows you what bookkeepers and accountants do, mainly so you have a clear idea of what it takes to be sure that the information coming out of the accounting system is complete, timely, and accurate.

Bookkeeping and Beyond

Bookkeepers spend most of their work time keeping the recordkeeping process running smoothly according to the system established by the business — and they also spend a fair amount of time dealing with problems that inevitably arise in recording so much information. Accountants, on the other hand, have a different focus. You can think of accounting as what goes on before and after bookkeeping. Accountants prepare reports based on the information accumulated by the bookkeeping process: financial statements, tax returns, and various confidential reports to managers.

Taking a Panoramic View of Bookkeeping and Accounting

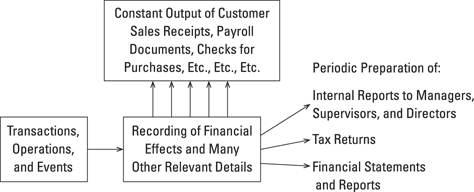

Figure 3-1 presents a panoramic view of bookkeeping and accounting for a business (and other entities that carry on business activities). This brief overview can’t do justice to all the details of bookkeeping and accounting, of course. But it serves to clarify important differences between bookkeeping and accounting. Bookkeeping has two main jobs: recording the financial effects and other relevant details of the wide variety of transactions and other activities of the entity; and generating a constant stream of documents and electronic outputs to keep the business operating every day.

Accounting, on the other hand, focuses on the periodic preparation of three main types of output — reports to managers, tax returns (income tax, sales tax, payroll tax, and so on), and financial statements and reports. These outputs are done according to certain schedules. For example, financial statements are usually prepared every quarter (3 months) and at the end of the year (12 months).

Figure 3-1: Panoramic view of bookkeeping and accounting.

This chapter offers a brief survey of bookkeeping, which you may find helpful before moving on to the financial and management accounting chapters of the book. Or, you may simply skim the rest of the chapter before moving on to later chapters. Or, you could stop right here and move on to the later chapters. I won’t be offended.

Pedaling Through the Bookkeeping Cycle

Figure 3-2 presents a condensed overview of the bookkeeping cycle. These are the basic steps in virtually every bookkeeping system. The steps are done in the order presented, although the methods by which the steps are done vary from business to business. For example, entering the details of a sale can be done by scanning bar codes in a grocery store, or could require an in-depth legal interpretation for a complex order from a customer for an expensive piece of equipment. Each basic step is explained briefly as follows. (See also “Double-Entry Accounting for Single-Entry Minded People,” later in this chapter, which explains how the books are kept in balance by using debits and credits for recording transactions.)

Figure 3-2: Basic steps of the bookkeeping cycle.

1. Prepare source documents for all transactions, operations, and other events of the business; source documents are the starting point in the bookkeeping process.

When buying products, a business gets a purchase invoice from the supplier. When borrowing money from the bank, a business signs a note payable, a copy of which the business keeps. When a customer uses a credit card to buy the business’s product, the business gets the credit card slip as evidence of the transaction. When preparing payroll checks, a business depends on salary rosters and time cards. All of these key business forms serve as sources of information into the bookkeeping system — in other words, information the bookkeeper uses in recording the financial effects of the activities of the business.

2. Determine the financial effects of the transactions, operations, and other events of the business.

The activities of the business have financial effects that must be recorded — the business is better off, worse off, or at least “different off” as the result of its transactions. Examples of typical business transactions include paying employees, making sales to customers, borrowing money from the bank, and buying products that will be sold to customers. The bookkeeping process begins by determining the relevant information about each transaction. The chief accountant of the business establishes the rules and methods for measuring the financial effects of transactions. Of course, the bookkeeper should comply with these rules and methods.

3. Make original entries of financial effects in journals, with appropriate references to source documents.

Using the source documents, the bookkeeper makes the first, or original, entry for every transaction into a journal; this information is later posted in accounts (see next step). A journal is a chronological record of transactions in the order in which they occur — like a very detailed personal diary.

Here’s a simple example that illustrates recording a transaction in a journal. Expecting a big demand from its customers, a retail bookstore purchases, on credit, 100 copies of Accounting For Dummies, 5th Edition, from the publisher, Wiley. The books are received and placed on the shelves. (One hundred copies is a lot to put on the shelves, but my relatives promised to rush down and buy several copies each.) The bookstore now owns the books and also owes Wiley $1,500, which is the cost of the 100 copies. Here we look only at recording the purchase of the books, not recording subsequent sales of the books and paying the bill to Wiley.

The bookstore has established a specific inventory asset account called “Inventory–Trade Paperbacks” for books like mine. And the purchase liability to the publisher should be entered in the account “Accounts Payable–Publishers.” Therefore, the original journal entry for this purchase records an increase in the inventory asset account of $1,500 and an increase in the liability accounts payable of $1,500. Notice the balance in the two sides of the transaction: an asset increases $1,500 on the one side and a liability increases $1,500 on the other side. All is well (assuming there are no mistakes.)

In ancient days, bookkeepers had to record journal entries by hand, and even today there’s nothing wrong with a good hand-entry (manual) bookkeeping system. But bookkeepers now can use computer programs that take over many of the tedious chores of bookkeeping (see the last section in this chapter, “Using Accounting Software in the Cloud and on the Ground”). Of course, typing has replaced hand cramps with carpal tunnel syndrome, but at least the work gets done more quickly and with fewer errors!

4. Post the financial effects of transactions to accounts, with references to and tie-ins to original journal entries.

As Step 3 explains the pair of changes for the bookstore’s purchase of 100 copies of my book is first recorded in an original journal entry. Then, sometime later, the financial effects are posted, or recorded in the separate accounts — one an asset and the other a liability. Only the official, established chart, or list of accounts, should be used in recording transactions. An account is a separate record, or page as it were, for each asset, each liability, and so on. One transaction affects two or more accounts. The journal entry records the whole transaction in one place; then each piece is recorded in the accounts that are affected by the transaction.

I can’t exaggerate the importance of entering transaction data correctly and in a timely manner. The prevalence of data entry errors is one important reason that most retailers use cash registers that read bar-coded information on products, which more accurately captures the necessary information and speeds up the entry of the information.

I can’t exaggerate the importance of entering transaction data correctly and in a timely manner. The prevalence of data entry errors is one important reason that most retailers use cash registers that read bar-coded information on products, which more accurately captures the necessary information and speeds up the entry of the information.

5. Perform end-of-period procedures — the critical steps for getting the accounting records up-to-date and ready for the preparation of management accounting reports, tax returns, and financial statements.

A period is a stretch of time — from one day (even one hour) to one month to one quarter (three months) to one year — that is determined by the needs of the business. A year is the longest period of time that a business would wait to prepare its financial statements. Most businesses need accounting reports and financial statements at the end of each quarter, and many need monthly financial statements.

Before the accounting reports can be prepared at the end of the period (refer to Figure 3-1), the bookkeeper needs to bring the accounts of the business up-to-date and to complete the bookkeeping process. One such end-of-period requirement, for example, is recording the depreciation expense for the period (see Chapter 4 for more on depreciation). Another thing is getting an actual count of the business’s inventory so that the inventory records can be adjusted to account for shoplifting, employee theft, and other losses.

Before the accounting reports can be prepared at the end of the period (refer to Figure 3-1), the bookkeeper needs to bring the accounts of the business up-to-date and to complete the bookkeeping process. One such end-of-period requirement, for example, is recording the depreciation expense for the period (see Chapter 4 for more on depreciation). Another thing is getting an actual count of the business’s inventory so that the inventory records can be adjusted to account for shoplifting, employee theft, and other losses.

The accountant needs to be heavily involved in end-of-period procedures and be sure to check for errors in the business’s accounts. Data entry clerks and bookkeepers may not fully understand the unusual nature of some business transactions and may have entered transactions incorrectly. One reason for establishing internal controls (discussed in “Enforce strong internal controls,” later in this chapter) is to keep errors to an absolute minimum. Ideally, accounts should contain very few errors at the end of the period, but the accountant can’t make any assumptions and should make a final check for any errors that may have fallen through the cracks.

6. Compile the adjusted trial balance for the accountant, which is the basis for preparing management reports, tax returns, and financial statements.

After all the end-of-period procedures have been completed, the bookkeeper compiles a comprehensive listing of all accounts, which is called the adjusted trial balance. Modest-sized businesses maintain hundreds of accounts for their various assets, liabilities, owners’ equity, revenue, and expenses. Larger businesses keep thousands of accounts, and very large businesses may keep more than 10,000 accounts. In contrast, external financial statements and tax returns contain a relatively small number of accounts. For example, a typical external balance sheet reports only 25 to 30 accounts (maybe even fewer). Apple, for example, reported only 20 accounts in its June 30, 2012 balance sheet. The annual income tax return (Form 1120) for a business corporation contains a relatively small number of accounts.

The accountant takes the adjusted trial balance and telescopes similar accounts into one summary amount that is reported in a financial report or tax return. For example, a business may keep hundreds of separate inventory accounts, every one of which is listed in the adjusted trial balance. The accountant collapses all these accounts into one summary inventory account that is presented in the balance sheet of the business. In grouping the accounts, the accountant should comply with established financial reporting standards and income tax requirements.

7. Close the books — bring the bookkeeping for the fiscal year just ended to a close and get things ready to begin the bookkeeping process for the coming fiscal year.

Books is the common term for a business’s complete set of accounts. (Well, okay, we should also include journal entries in the definition of books but you get the point.) A business’s transactions are a constant stream of activities that don’t end tidily on the last day of the year, which can make preparing financial statements and tax returns challenging. The business has to draw a clear line of demarcation between activities for the year (the 12-month accounting period) ended and the year yet to come by closing the books for one year and starting with fresh books for the next year.

Managing Your Bookkeeping and Accounting System

In my experience, too many business managers and owners ignore their bookkeeping and accounting systems or take them for granted — unless something goes wrong. They assume that if the books are in balance, everything is okay. The section “Double-Entry Accounting for Single-Entry Minded People,” later in this chapter, covers exactly what it means to have “books in balance” — it does not necessarily mean that everything is okay.

To determine whether your bookkeeping system is up to snuff, check out the following sections, which provide a checklist of the most important elements of a good system.

Categorize your financial information: The chart of accounts

Suppose that you’re the accountant for a corporation and you’re faced with the daunting task of preparing the annual federal income tax return for the business. For instance, the Internal Revenue Service (IRS) requires that you report the following kinds of expenses (and this list contains just the minimum!):

![]() Advertising

Advertising

![]() Bad debts

Bad debts

![]() Charitable contributions

Charitable contributions

![]() Compensation of officers

Compensation of officers

![]() Cost of goods sold

Cost of goods sold

![]() Depreciation

Depreciation

![]() Employee benefit programs

Employee benefit programs

![]() Interest

Interest

![]() Pensions and profit-sharing plans

Pensions and profit-sharing plans

![]() Rents

Rents

![]() Repairs and maintenance

Repairs and maintenance

![]() Salaries and wages

Salaries and wages

![]() Taxes and licenses

Taxes and licenses

You must provide additional information for some of these expenses. For example, the cost of goods sold expense is determined in a schedule that also requires inventory cost at the beginning of the year, purchases during the year, cost of labor during the year (for manufacturers), other costs, and inventory cost at year-end.

Where do you start? Well, if it’s March 1 and the corporate tax return deadline is March 15, you start by panicking — unless you were smart enough to think ahead about the kinds of information your business would need to report. In fact, when your accountant first designs your business’s accounting system, he or she should dissect every report to managers, the external financial statements, and the tax returns, breaking down all the information into basic account categories such as those I just listed.

The term general ledger refers to the complete set of accounts established and maintained by a business. The chart of accounts is the formal index of these accounts — the complete listing and classification of the accounts used by the business to record its transactions. General ledger usually refers to the actual accounts and often to the balances in these accounts at some particular time. The chart of accounts, even for a relatively small business, contains more than 100 accounts. Larger business organizations need thousands of accounts. The larger the number, the more likely that the accounts are given number codes according to some scheme — for example, all assets may be in the 100 to 300 range, all liabilities in the 400 to 500 range, and so on.

Standardize source document forms and processing procedures

Just like we need a constant circulation of blood to live, businesses need a constant flow of paperwork. Even in this modern age of the Internet, electronic communication, and computers a business generates and depends on a lot of paperwork. And, much of this paperwork is used in the accounting process. Placing an order to buy products, selling a product to a customer, determining the earnings of an employee for the month — virtually every business transaction needs paperwork, generally known as source documents. Source documents serve as legal evidence of the terms and conditions agreed upon by the business and the other person or organization that it’s dealing with. Both parties receive some kind of source document. For example, for a sale at a cash register, the customer gets a sales receipt, and the business keeps a running record of all the transactions in the register, which can be printed out later if need be.

Clearly, an accounting system needs to standardize the forms and procedures for processing and recording all normal, repetitive transactions and should control the generation and handling of these source documents. From the bookkeeping point of view, these business forms and documents are very important because they provide the input information needed for recording transactions in the business’s accounts. Sloppy paperwork leads to sloppy accounting records, and sloppy accounting records just won’t do when the time comes to prepare tax returns and financial statements.

Hire competent personnel

A business shouldn’t be penny-wise and pound-foolish: What good is meticulously collecting source documents if the information on those documents isn’t entered into your system correctly? You shouldn’t try to save a few bucks by hiring the lowest-paid people you can find. Bookkeepers and accountants, like all other employees in a business, should have the skills and knowledge needed to perform their functions. Here are some guidelines for choosing the right people to enter and control the flow of your business’s data and for making sure that those people remain the right people:

![]() College degree: Many accountants in business organizations have a college degree with a major in accounting. However, as you move down the accounting department, you find that more and more employees do not have a college degree and perhaps don’t even have any courses in accounting — they learned bookkeeping methods and skills through on-the-job training. Although these employees may have good skills and instincts, my experience has been that they tend to do things by the book. So you want to at least look twice at a potential employee who has no college-based accounting background.

College degree: Many accountants in business organizations have a college degree with a major in accounting. However, as you move down the accounting department, you find that more and more employees do not have a college degree and perhaps don’t even have any courses in accounting — they learned bookkeeping methods and skills through on-the-job training. Although these employees may have good skills and instincts, my experience has been that they tend to do things by the book. So you want to at least look twice at a potential employee who has no college-based accounting background.

![]()

CPA, CMA, and CGMA: When hiring higher-level accountants in a business organization, you want to determine whether they should be certified public accountants (CPAs). Larger businesses insist on this credential, along with a specific number of years’ experience in public accounting. Until recently the other main professional accounting credential was the CMA, or certified management accountant, sponsored by the Institute of Management Accountants (IMA). The CMA credential is American born and bred. In contrast, the Chartered Global Management Accountant, or CGMA designation, is co-sponsored by the American Institute of CPAs and the British Chartered Institute of Management Accountants. Unlike the CPA license, the CMA and CGMA designations recognize professional achievement and experience but the government does not regulate these credentials. (I discuss the CPA and CGMA in Chapter 1.)

CPA, CMA, and CGMA: When hiring higher-level accountants in a business organization, you want to determine whether they should be certified public accountants (CPAs). Larger businesses insist on this credential, along with a specific number of years’ experience in public accounting. Until recently the other main professional accounting credential was the CMA, or certified management accountant, sponsored by the Institute of Management Accountants (IMA). The CMA credential is American born and bred. In contrast, the Chartered Global Management Accountant, or CGMA designation, is co-sponsored by the American Institute of CPAs and the British Chartered Institute of Management Accountants. Unlike the CPA license, the CMA and CGMA designations recognize professional achievement and experience but the government does not regulate these credentials. (I discuss the CPA and CGMA in Chapter 1.)

Note: For bookkeepers, the American Institute of Professional Bookkeepers sponsors the Certified Bookkeeper designation. For more information, go to its website: www.AIPB.org.

In my opinion, a business is prudent to require the CPA, CGMA, or CMA credential for its chief accountant (who usually holds the title of controller). Alternatively, a business could regularly consult with a CPA in public practice for advice on its accounting system and on accounting problems that come up.

![]() Continuing education: Bookkeepers and accountants need continuing education to keep up with changes in the income tax law and financial reporting requirements, as well as changes in how the business operates. Ideally, bookkeepers and accountants should be able to spot needed improvements and implement these changes — to make accounting reports to managers more useful. Fortunately, many short-term courses, online programs, and the like are available at very reasonable costs for keeping up on the latest accounting developments. Many continuing education courses are available on the Internet, but you should be cautious and check out the standards of an Internet course. States require that CPAs in public practice take 30 to 40 hours per year of continuing education to keep their licenses.

Continuing education: Bookkeepers and accountants need continuing education to keep up with changes in the income tax law and financial reporting requirements, as well as changes in how the business operates. Ideally, bookkeepers and accountants should be able to spot needed improvements and implement these changes — to make accounting reports to managers more useful. Fortunately, many short-term courses, online programs, and the like are available at very reasonable costs for keeping up on the latest accounting developments. Many continuing education courses are available on the Internet, but you should be cautious and check out the standards of an Internet course. States require that CPAs in public practice take 30 to 40 hours per year of continuing education to keep their licenses.

![]() Integrity: Possibly the most important quality to look for is also the hardest to judge. Bookkeepers and accountants need to be honest people because of the control they have over your business’s financial records. Conduct a careful background check when hiring new accounting personnel. After you hire them, periodically (and discreetly) check whether their lifestyles match their salaries, but be careful not to invade their privacy. Small-business owners and managers have closer day-in and day-out contact with their accountants and bookkeepers, which can be a real advantage — they get to know their accountants and bookkeepers on a personal level. Even so, you can find many cases where a trusted bookkeeper has embezzled many thousands of dollars over the years. I could tell you many true stories about long-time, “trusted” bookkeepers that made off with some of the family fortune.

Integrity: Possibly the most important quality to look for is also the hardest to judge. Bookkeepers and accountants need to be honest people because of the control they have over your business’s financial records. Conduct a careful background check when hiring new accounting personnel. After you hire them, periodically (and discreetly) check whether their lifestyles match their salaries, but be careful not to invade their privacy. Small-business owners and managers have closer day-in and day-out contact with their accountants and bookkeepers, which can be a real advantage — they get to know their accountants and bookkeepers on a personal level. Even so, you can find many cases where a trusted bookkeeper has embezzled many thousands of dollars over the years. I could tell you many true stories about long-time, “trusted” bookkeepers that made off with some of the family fortune.

Enforce strong internal controls

Internal controls are like highway truck weigh stations, which make sure that a truck’s load doesn’t exceed the limits and that the truck has a valid plate. You’re just checking that your staff is playing by the rules. For example, to prevent or minimize shoplifting, most retailers now have video surveillance, as well as tags that set off the alarms if the customer leaves the store with the tag still on the product. Likewise, a business should implement certain procedures and forms to prevent (as much as possible) theft, embezzlement, kickbacks, fraud, and simple mistakes by its own employees and managers.

The Sarbanes-Oxley Act of 2002 applies to public companies that are subject to the federal Securities and Exchange Commission (SEC) jurisdiction. Congress passed this law mainly in response to Enron and other massive financial reporting fraud disasters. The act, which is implemented through the SEC and the Public Company Accounting Oversight Board (PCAOB), requires that public companies establish and enforce a special module of internal controls over their external financial reporting. Although the law applies only to public companies, some accountants worry that the requirements of the law will have a trickle-down effect on smaller private businesses as well. Personally, I don’t see this happening but you never know.

Get involved with end-of-period procedures

Suppose that all transactions during the year have been recorded correctly. Therefore, the accounts of the business are ready for preparing its financial statements, aren’t they? Not so fast! Certain additional procedures are necessary at the end of the period to make sure that the accounts are correct and complete for preparing financial statements and income tax returns for the year. Two main things have to be done at the end of the period:

![]() Record normal, routine adjusting entries: For example, depreciation expense isn’t a transaction as such and therefore isn’t included in the flow of transactions recorded in the day-to-day bookkeeping process. (Chapter 4 explains depreciation expense.) Similarly, certain other expenses and income may not have been associated with a specific transaction and, therefore, have not been recorded. In many businesses there is a normal lag in recording certain transactions, such as billing customers for services already provided. These “catch up” entries should be recorded. Year-end adjusting entries are necessary to have correct balances for determining profit for the period. The purpose is to make the revenue, income, expense, and loss accounts up-to-date and correct for the year.

Record normal, routine adjusting entries: For example, depreciation expense isn’t a transaction as such and therefore isn’t included in the flow of transactions recorded in the day-to-day bookkeeping process. (Chapter 4 explains depreciation expense.) Similarly, certain other expenses and income may not have been associated with a specific transaction and, therefore, have not been recorded. In many businesses there is a normal lag in recording certain transactions, such as billing customers for services already provided. These “catch up” entries should be recorded. Year-end adjusting entries are necessary to have correct balances for determining profit for the period. The purpose is to make the revenue, income, expense, and loss accounts up-to-date and correct for the year.

![]() Make a careful sweep of all matters to check for other developments that may affect the accuracy of the accounts: For example, the company may have discontinued a product line. The remaining inventory of these products may have to be removed from the inventory asset account, with a corresponding loss recorded in the period. Or the company may have settled a long-standing lawsuit, and the amount of damages needs to be recorded. Layoffs and severance packages are another example of what the chief accountant needs to look for before preparing reports.

Make a careful sweep of all matters to check for other developments that may affect the accuracy of the accounts: For example, the company may have discontinued a product line. The remaining inventory of these products may have to be removed from the inventory asset account, with a corresponding loss recorded in the period. Or the company may have settled a long-standing lawsuit, and the amount of damages needs to be recorded. Layoffs and severance packages are another example of what the chief accountant needs to look for before preparing reports.

Leave good audit trails

Good accounting systems leave good audit trails. An audit trail is a clear-cut, well-marked path of the sequence of events leading up to an entry in the accounts, starting with the source documents and following through to the final posting in the accounts. So an auditor can “re-walk” the path. Even if a business doesn’t have an outside CPA do an annual audit, the accountant has frequent occasion to go back to the source documents and either verify certain information in the accounts or reconstruct the information in a different manner. Suppose that a salesperson is claiming some suspicious-looking travel expenses; the accountant would probably want to go through all this person’s travel and entertainment reimbursements for the past year.

Keep alert for unusual events and developments

Don’t forget internal time bombs: A bookkeeper’s reluctance to take a vacation could mean that she doesn’t want anyone else looking at the books.

To some extent, accountants have to act as the eyes and ears of the business. Of course, that’s one of the main functions of a business manager as well, but the accounting staff can play an important role.

Design truly useful reports for managers

I have to be careful in this section because I have strong opinions on this matter. I have seen too many off-the-mark accounting reports to managers — reports that are difficult to decipher and not very useful or relevant to the manager’s decision-making needs and control functions. These bad reports waste the manager’s time, one of the most serious offenses in management accounting.

Part of the problem lies with the managers themselves. As a business manager, have you told your accounting staff what you need to know, when you need it, and how to present it in the most efficient manner? When you stepped into your position, you probably didn’t hesitate to rearrange your office, and maybe you even insisted on hiring your own support staff. Yet you most likely lay down like a lapdog regarding your accounting reports. Maybe you assume that the reports have been done a certain way and that arguing for change is no use.

On the other hand, accountants bear a good share of the blame for poor management reports. Accountants should proactively study the manager’s decision-making responsibilities and provide the information that is most useful, presented in the most easily digestible manner.

In designing the chart of accounts, the accountant should keep in mind the type of information needed for management reports. To exercise control, managers need much more detail than what’s reported on tax returns and external financial statements. And as I explain in Chapter 9, expenses should be regrouped into different categories for management decision-making analysis. A good chart of accounts looks to both the external and the internal (management) needs for information.

Double-Entry Accounting for Single-Entry-Minded People

Businesses and nonprofit entities use double-entry accounting. But I’ve never met an individual who uses double-entry accounting in personal bookkeeping. Instead, individuals use single-entry accounting. For example, when you write a check to make a payment on your credit card balance, you undoubtedly make an entry in your checkbook to decrease your bank balance. And that’s it. You make just one entry — to decrease your checking account balance. It wouldn’t occur to you to make a second, companion entry to decrease your credit card liability balance. Why? Because you don’t keep a liability account for what you owe on your credit card. You depend on the credit card company to make an entry to decrease your balance.

Total assets = Total liabilities + Total owners’ equity

The accounting equation reflects that there are claims against the assets, which are the liabilities and owners’ equity of the entity. Or, putting it differently, accounting keeps track of the sources of assets (liabilities and owners’ equity) as well as the assets.

The accounting equation is a very condensed version of the balance sheet. The balance sheet is the financial statement that summarizes a business’s assets on the one side and its liabilities plus its owners’ equity on the other side. As I just mentioned liabilities and owners’ equity are the sources of its assets. Each source has different types of claims on the assets, which I explain in Chapter 5.

One main function of the bookkeeping/accounting system is to record all transactions of a business — every single last one. If you look at transactions through the lens of the accounting equation, there is a beautiful symmetry in transactions (well, beautiful to accountants at least). All transactions have a natural balance. The sum of financial effects on one side of a transaction equals the sum of financial effects on the other side.

Suppose a business buys a new delivery truck for $65,000 and pays by check. The truck asset account increases by the $65,000 cost of the truck, and cash decreases $65,000. Here’s another example: A company borrows $2 million from its bank. Its cash increases $2 million, and the liability for its note payable to the bank increases the same amount.

Just one more example: Suppose a business suffers a loss from a tornado because some of its assets were not insured (dumb!). The assets destroyed by the tornado are written off (decreased to zero balances), and the amount of the loss decreases owners’ equity the same amount. The loss works its way through the income statement but ends up as a decrease in owners’ equity.

Figure 3-3: Rules for debits and credits.

An increase in an asset is tagged as a debit; an increase in a liability or owners’ equity account is tagged as a credit. Decreases are just the reverse. Following this scheme, the total of debits must equal the total of credits in recording every transaction. In brief: Debits have to equal credits. Isn’t that clever? Well, the main point is that the method works. Debits and credits have been used for centuries. (A book published in 1494 described how business traders and merchants of the day used debits and credits in their bookkeeping.)

Note: Sales revenue and expense accounts also follow debit and credit rules. Revenue increases owners’ equity (thus is a credit), and an expense decreases owners’ equity (thus is a debit).

The balance in an account at a point in time equals the increases less the decreases recorded in the account. Following the rules of debits and credits, asset accounts have debit balances, and liabilities and owners’ equity accounts have credit balances. (Yes, a balance sheet account can have a wrong-way balance in unusual situations, such as cash having a credit balance because the business has written more checks than it has in its checking account.) The total of accounts with debit balances should equal the total of accounts with credit balances. When the total of debit balance accounts equals the total of credit balance accounts, the books are in balance.

Juggling the Books to Conceal Embezzlement and Fraud

Some years ago we hosted a Russian professor who was a dedicated Communist. I asked him what surprised him the most on his first visit to the United States. Without hesitation he answered, “The Wall Street Journal.” I was puzzled. He then explained that he was amazed to read so many stories about business fraud and illegal practices in the most respected financial newspaper in the world. Many financial reporting fraud stories are on the front pages today, as when I wrote the previous editions of this book. And there are a number of stories of companies that agreed to pay large fines for illegal practices (usually without admitting guilt).

I’m fairly sure that none of this is news to you. You know that fraud and illegal practices happen in the business world. My point in bringing up this unpleasant topic is that fraud and illegal practices require manipulation of a business’s accounts. For example, if a business pays a bribe it does not record the amount in a bald-faced account called “bribery expense.” Rather the business disguises the payment by recording it in a legitimate expense account (such as repairs and maintenance expense, or legal expense). If a business records sales revenue before sales have taken place (a not uncommon type of financial reporting fraud), it does not record the false revenue in a separate account called “fictional sales revenue.” The bogus sales are recorded in the regular sales revenue account.

Here’s another example of an illegal practice. Money laundering involves taking money from illegal sources (such as drug dealing) and passing it through a business to make it look legitimate — to give the money a false identity. This money can hardly be recorded as “revenue from drug sales” in the accounts of the business. If an employee embezzles money from the business, he has to cover his tracks by making false entries in the accounts or by not making entries that should be recorded.

I think that most persons who engage in fraud also cheat on their federal income taxes; they don’t declare the ill-gotten income. Needless to say, the IRS is on constant alert for fraud in federal income tax returns, both business and personal returns. The IRS has the authority to come in and audit the books of the business and also the personal income tax returns of its managers and investors. Conviction for income tax evasion is a felony, I might point out.

Using Accounting Software in the Cloud and on the Ground

It would be possible, though not very likely, that a very small business would keep its books the old-fashioned way — record all transactions and do all the other steps of the bookkeeping cycle with pen and paper and by making handwritten entries. However, even a small business has a relatively large number of transactions that have to be recorded in journals and accounts, to say nothing about the end-of-period steps in the bookkeeping cycle (refer to Figure 3-2).

When mainframe computers were introduced in the 1950s and 1960s, one of their very first uses was for accounting chores. However, only large businesses could afford these electronic behemoths. Smaller businesses didn’t use computers for their accounting until some years after personal computers came along in the 1980s. A bewildering array of computer software packages is available today for small- and medium-size businesses. (Larger corporations tend to develop their own computer-based accounting systems; they write their own code.)

Many businesses do their accounting work in-house. They use their own computers and buy the accounting software they need. They may use an outside firm to handle certain accounting chores, such as payroll. Alternatively, a business can do some or most of its accounting in the cloud as it is called. The term cloud refers to large-scale offsite computer servers that a business connects with over the Internet. The cloud can be used simply as the backup storage location for the company’s accounting records. Cloud servers have the reputation of being very difficult to break into by hackers. Cloud providers offer a wide variety of accounting and business software and services that are too varied to discuss here. In short, a business can do almost all its accounting in the cloud. Of course, it still needs very strong controls over the transmission of accounting information to and from the cloud. More and more businesses seem to be switching to the cloud for doing more and more of their accounting tasks.

If I were giving a talk to owners/managers of small to middle-size businesses, I would offer the following words of advice about accounting software:

![]() Choose your accounting software very carefully. It’s hard to pull up stakes and switch to another software package. Changing even just one module, such as payroll or inventory, in your accounting software can be quite difficult.

Choose your accounting software very carefully. It’s hard to pull up stakes and switch to another software package. Changing even just one module, such as payroll or inventory, in your accounting software can be quite difficult.

![]() In evaluating accounting software, you and your accountant should consider three main factors: ease of use; whether it has the particular features and functionality you need; and the likelihood that the vendor will continue in business and be around to update and make improvements in the software.

In evaluating accounting software, you and your accountant should consider three main factors: ease of use; whether it has the particular features and functionality you need; and the likelihood that the vendor will continue in business and be around to update and make improvements in the software.

![]() In real estate, the prime concern is “location, location, location.” The watchwords in accounting software are “security, security, security.” You need very tight controls over all aspects of using the accounting software and who is authorized to make changes in any of the modules of the accounting software.

In real estate, the prime concern is “location, location, location.” The watchwords in accounting software are “security, security, security.” You need very tight controls over all aspects of using the accounting software and who is authorized to make changes in any of the modules of the accounting software.

![]() Although accounting software offers the opportunity to exploit your accounting information (mine the data), you have to know exactly what to look for. The software does not do this automatically. You have to ask for the exact type of information you want and insist that it be pulled out of the accounting data.

Although accounting software offers the opportunity to exploit your accounting information (mine the data), you have to know exactly what to look for. The software does not do this automatically. You have to ask for the exact type of information you want and insist that it be pulled out of the accounting data.

![]() Even when using advanced, sophisticated accounting software, a business has to design the specialized reports it needs for its various managers and make sure that these reports are generated correctly from the accounting database.

Even when using advanced, sophisticated accounting software, a business has to design the specialized reports it needs for its various managers and make sure that these reports are generated correctly from the accounting database.

![]() Never forget the “garbage in, garbage out” rule. Data entry errors can be a serious problem in computer-based accounting systems. You can minimize these input errors, but it is next to impossible to eliminate them altogether. Even barcode readers make mistakes, and the barcode tags themselves may have been tampered with. Strong internal controls for the verification of data entry are extremely important.

Never forget the “garbage in, garbage out” rule. Data entry errors can be a serious problem in computer-based accounting systems. You can minimize these input errors, but it is next to impossible to eliminate them altogether. Even barcode readers make mistakes, and the barcode tags themselves may have been tampered with. Strong internal controls for the verification of data entry are extremely important.

![]() Make sure your accounting software leaves good audit trails, which you need for management control, for your CPA when auditing your financial statements, and for the IRS when it decides to audit your income tax returns. The lack of good audit trails looks very suspicious to the IRS.

Make sure your accounting software leaves good audit trails, which you need for management control, for your CPA when auditing your financial statements, and for the IRS when it decides to audit your income tax returns. The lack of good audit trails looks very suspicious to the IRS.

![]() Online accounting systems that permit remote input and access over the Internet or a local area network with multiple users present special security problems. Think twice before putting any part of your accounting system online (and if you do, institute air tight controls).

Online accounting systems that permit remote input and access over the Internet or a local area network with multiple users present special security problems. Think twice before putting any part of your accounting system online (and if you do, institute air tight controls).

Smaller businesses, and even many medium-size businesses, don’t have the budget to hire full-time information system and information technology specialists. They use consultants to help them select accounting software packages, install software, and get it up and running. Like other computer software, accounting programs are frequently revised and updated. A consultant can help keep a business’s accounting software up-to-date, correct flaws and security weaknesses in the program, and take advantage of its latest features.

Perhaps you noticed in this chapter’s opening remarks that I use the terms

Perhaps you noticed in this chapter’s opening remarks that I use the terms  Tage Tracy, my son and coauthor (

Tage Tracy, my son and coauthor (