Appendix H

Other Significant Liabilities

LEARNING OBJECTIVES

After studying this appendix, you should be able to:

- Describe the accounting and disclosure requirements for provisions and contingent liabilities.

- Contrast the accounting for operating and finance leases.

- Identify additional fringe benefits associated with employee compensation.

APPENDIX PREVIEW

In addition to the current and non-current liabilities discussed in Chapter 10, several more types of liabilities may exist that could have a significant impact on a company's financial position and future cash flows. These other significant liabilities will be discussed in this appendix. They are (a) provisions and contingent liabilities, (b) lease liabilities, and (c) additional liabilities for employee fringe benefits (paid absences and postretirement benefits).

Provisions and Contingent Liabilities

Learning Objective 1

Describe the accounting and disclosure requirements for provisions and contingent liabilities.

When Siemens AG reports an accounts payable, there is an invoice or formal agreement as to the existence of the liability and its amount. Similarly, when Siemens accrues interest for interest payable, the timing and the amount of the liability are known. But suppose Siemens is involved in a dispute (lawsuit) with taxing authorities over the amount of its income tax liability. In this case, both the existence and the amount of the liability may be uncertain. How does Siemens determine whether to report a liability and at what amount? The following IFRS guidelines are used by Siemens to determine how to report this tax dispute.

- If it is probable (that is, more than a 50% chance) that Siemens will lose the lawsuit and if a reasonable estimate can be made of the amount, then Siemens should record a liability. This type of liability, which is uncertain in timing or amount, is called a provision.

- If it is not probable that Siemens will lose the lawsuit (less than a 50% chance), then it should not record a liability. In this case, Siemens should disclose the details of the tax dispute in the notes to its financial statements. This type of event, which is a potential liability that may become an actual liability in the future, is called a contingent liability. It should be noted that if the chance of losing the lawsuit is less than 10% , Siemens does not have to disclose the tax dispute in the notes to the financial statements.

Recording a Provision

Product warranties are an example of a provision that companies should record in the accounts. Warranty contracts result in future costs that companies may incur in replacing defective units or repairing malfunctioning units. Generally, a manufacturer, such as NEC (JPN), knows that it will incur some warranty costs. From prior experience with the product, the company usually can reasonably estimate the anticipated cost of servicing (honoring) the warranty.

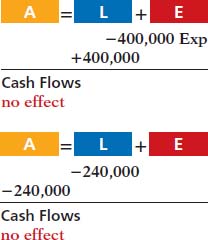

The accounting for warranty costs is based on the expense recognition principle. The estimated cost of honoring product warranty contracts should be recognized as an expense in the period in which the sale occurs. To illustrate, assume that in 2017 Zhang Manufacturing Ltd. sells 10,000 washers and dryers at an average price of NT$6,000 each. The selling price includes a one‐year warranty on parts. Zhang expects that 500 units (5%) will be defective and that warranty repair costs will average NT$800 per unit. In 2017, the company honors warranty contracts on 300 units, at a total cost of NT$240,000.

At December 31, it is necessary to accrue the estimated warranty costs on the 2017 sales. Zhang computes the estimated warranty liability as follows.

Illustration H-1 Computation of estimated product warranty liability

The company makes the following adjusting entry.

The company reports warranty expense of NT$400,000 under selling expenses in the income statement. It classifies estimated warranty liability of NT$160,000 (NT$400,000 − NT$240,000) as a current liability on the statement of financial position.

In the following year, Zhang should debit to Warranty Liability all expenses incurred in honoring warranty contracts on 2017 sales. To illustrate, assume that the company replaces 20 defective units in January 2018, at an average cost of NT$800 in parts and labor. The summary entry for the month of January 2018 is:

Disclosure of Contingent Liabilities

As noted earlier, sometimes an event makes it probable that a company will experience a cash outflow but it cannot reasonably estimate the amount. Or, sometimes the probability of the cash outflow is higher than remote but less than probable. Situations such as these, where the company faces a potential liability that may become an actual liability, are referred to as contingent liabilities. Contingent liabilities should be disclosed in the notes to the financial statements. The disclosure should identify the nature of the item and, if known, the amount of the contingency and the expected outcome of the future event. An excerpt from the contingent liability note from the financial statements of Cathay Pacific (HKG) is presented in Illustration H-2.

Illustration H-2 Disclosure of contingent liability

The required disclosure for contingencies is a good example of the use of the full disclosure principle. The full disclosure principle requires that companies disclose all circumstances and events that would make a difference to financial statement users. Some important financial information, such as contingencies, is not easily reported in the financial statements. Reporting information on contingencies in the notes to the financial statements will help investors be aware of events that can affect the financial health of a company.

Lease Liabilities

Learning Objective 2

Contrast the accounting for operating and finance leases.

A lease is a contractual arrangement between a lessor (owner of a property) and a lessee (renter of the property). It grants the right to use specific property for a period of time in return for cash payments. Leasing is big business worldwide. The global leasing market has recently been between $600 to $700 billion for capital equipment. This represents approximately one‐third of equipment financed in a year. The two most common types of leases are operating leases and finance leases.

Operating Leases

The renting of an apartment and the rental of a car at an airport are examples of operating leases.In an operating lease, the intent is temporary use of the property by the lessee, while the lessor continues to own the property.

In an operating lease, the lessee records the lease (or rental) payments as an expense. The lessor records the payments as revenue. For example, assume that a sales representative for Western Inc. leases a car from Hertz Car Rental (USA) at the Paris airport and that Hertz charges a total of €275. Western, the lessee, records the rental as follows.

The lessee may incur other costs during the lease period. For example, in the case above, Western will generally incur costs for gas. Western would report these costs as an expense.

Finance Leases

In most lease contracts, the lessee makes a periodic payment and records that payment in the income statement as rent expense. In some cases, however, the lease contract transfers to the lessee substantially all the benefits and risks of ownership. Such a lease is in effect a purchase of the property. This type of lease is a finance lease. The lessee company capitalizes the present value of the cash payments for the lease and records that amount as an asset. Illustration H-3 indicates the major difference between operating and finance leases.

Illustration H-3 Types of leases

• HELPFUL HINTA finance lease situation is one that, although legally a rental transaction, is in substance an installment purchase by the lessee. Accounting standards require that substance over form be used in such a situation.

IFRS does not prescribe criteria for determining classification. It does, however, provide examples of situations that would typically result in finance lease treatment. For example, if any one of the following conditions exists, the lessee should record a lease as an asset—that is, as a finance lease:

- The lease transfers ownership of the property to the lessee. Rationale: If during the lease term the lessee receives ownership of the asset, the lessee should report the leased asset as an asset on its books.

- The lease contains a bargain purchase option. Rationale: If during the term of the lease the lessee can purchase the asset at a price substantially below its fair value, the lessee will exercise this option. Thus, the lessee should report the lease as a leased asset on its books.

- The lease term is a major portion of the economic life of the leased property. Rationale: If the lessee uses the asset for much of the asset’s useful life, the lessee should report the asset as a leased asset on its books.

- The present value of the lease payments represents substantially all of the fair value of the leased property. Rationale: If the present value of the lease payments is equal to or almost equal to the fair value of the asset, the lessee has essentially purchased the asset. As a result, the lessee should report the leased asset as an asset on its books.

To illustrate, assume that Gonzalez SA decides to lease new equipment. The lease period is four years; the economic life of the leased equipment is estimated to be five years. The present value of the lease payments is €190,000, which is equal to the fair value of the equipment. There is no transfer of ownership during the lease term, nor is there any bargain purchase option.

In this example, Gonzalez has essentially purchased the equipment. Conditions 3 and 4 have been met. First, the lease term is 80% of the economic life of the asset. Second, the present value of cash payments is equal to the equipment’s fair value. Gonzalez records the transaction as follows.

The lessee reports a leased asset on the statement of financial position under plant assets. It reports the lease liability on the statement of financial position as a liability. The portion of the lease liability expected to be paid in the next year is a current liability. The remainder is classified as a non‐current liability.

Most lessees do not like to report leases on their statements of financial position. Why? Because the lease liability increases the company’s total liabilities. This, in turn, may make it more difficult for the company to obtain needed funds from lenders. As a result, companies attempt to keep leased assets and lease liabilities off the statement of financial position by structuring leases so as not to meet any of the four conditions mentioned previously (see page H‐4). The practice of keeping liabilities off the statement of financial position is referred to as off‐balance‐sheet financing. (Recall that the statement of financial position is sometimes referred to as the balance sheet.)

Additional Liabilities for Employee Fringe Benefits

Learning Objective 3

Identify additional fringe benefits associated with employee compensation.

In addition to the three payroll tax fringe benefits discussed in Appendix I (FICA taxes and state and federal unemployment taxes), employers incur other substantial fringe benefit costs. We discuss two of the most important fringe benefits—paid absences and postretirement benefits—in this section.

Paid Absences

Employees often are given rights to receive compensation for absences when certain conditions of employment are met. The compensation may be for paid vacations, sick pay benefits, and paid holidays. When the payment for such absences is probable and the amount can be reasonably estimated, a liability should be accrued for paid future absences. When the amount cannot be reasonably estimated, companies should instead disclose the potential liability. Ordinarily, vacation pay is the only paid absence that is accrued because this liability often extends into future periods. The other types of paid absences are only disclosed.

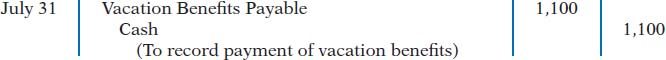

To illustrate, assume that Academy Company employees are entitled to one day’s vacation for each month worked. If 30 employees earn an average of $110 per day in a given month, the accrual for vacation benefits in one month is $3,300. The liability is recognized at the end of the month by the following adjusting entry.

This accrual is required by the expense recognition principle. Academy would report Vacation Benefits Expense as an operating expense in the income statement, and Vacation Benefits Payable as a current liability in the statement of financial position.

Later, when Academy pays vacation benefits, it debits Vacation Benefits Payable and credits Cash. For example, if the above benefits for 10 employees are paid in July, the entry is:

The magnitude of unpaid absences has gained employers’ attention. Consider the case of an assistant superintendent of schools who worked for 20 years and rarely took a vacation or sick day. A month or so before she retired, the school district discovered that she was due nearly $30,000 in accrued benefits. Yet, the school district had never accrued the liability.

Postretirement Benefits

Postretirement Benefits are benefits provided by employers to retired employees for (1) health care and life insurance and (2) pensions. Companies account for both types of postretirement benefits on the accrual basis.

POSTRETIREMENT HEALTH‐CARE AND LIFE INSURANCE BENEFITS

Providing medical and related health‐care benefits for retirees was at one time an inexpensive and highly effective way of generating employee goodwill. This practice has now turned into one of the corporate world’s most worrisome financial problems. Runaway medical costs, early retirement, and increased longevity are sending the liability for retiree health plans through the roof.

Companies estimate and expense postretirement costs during the working years of the employee because the company benefits from the employee’s services during this period. However, the company rarely sets up funds to meet the cost of the future benefits. It follows a pay‐as‐you‐go basis for these costs. The major reason is that the company does not receive a tax deduction until it actually pays the medical bill.

PENSION PLANS

A pension plan is an agreement whereby an employer provides benefits (payments) to employees after they retire. The need for good accounting for pension plans becomes apparent when we consider the size of existing pension funds.

Three parties are generally involved in a pension plan. The employer (company) sponsors the pension plan. The plan administrator receives the contributions from the employer, invests the pension assets, and makes the benefit payments to the pension recipients (retired employees). Illustration H-4 indicates the flow of cash among the three parties involved in a pension plan.

Illustration H-4 Parties in a pension plan

Companies record pension costs as an expense while the employees are working because that is when the company receives benefits from the employees’ services. Generally, the pension expense is reported as an operating expense in the company’s income statement. Frequently, the amount contributed by the company to the pension plan is different from the amount of the pension expense. A liability is recognized when the pension expense to date is more than the company’s contributions to date. An asset is recognized when the pension expense to date is less than the company’s contributions to date. Further consideration of the accounting for pension plans is left for more advanced courses.

The two most common types of pension arrangements for providing benefits to employees after they retire are defined contribution plans and defined benefit plans.

DEFINED CONTRIBUTION PLAN In a defined contribution plan, the plan defines the employer’s contribution but not the benefit that the employee will receive at retirement. That is, the employer agrees to contribute a certain sum each period based on a formula.

The accounting for a defined contribution plan is straightforward. The employer simply makes a contribution each year based on the formula established in the plan. As a result, the employer’s obligation is easily determined. It follows that the company reports the amount of the contribution required each period as pension expense. The employer reports a liability only if it has not made the contribution in full.

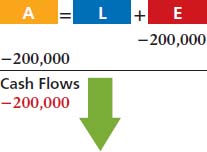

To illustrate, assume that Alba Office AG has a defined contribution plan in which it contributes €200,000 each year to the pension fund for its employees. The entry to record this transaction is:

To the extent that Alba did not contribute the €200,000 defined contribution, it would record a liability. Pension payments to retired employees are made from the pension fund by the plan administrator.

DEFINED BENEFIT PLAN In a defined benefit plan, the benefits that the employee will receive at the time of retirement are defined by the terms of the plan. Benefits are typically calculated using a formula that considers an employee’s compensation level when he or she nears retirement and the employee’s years of service. Because the benefits in this plan are defined in terms of uncertain future variables, an appropriate funding pattern is established to ensure that enough funds are available at retirement to meet the benefits promised. This funding level depends on a number of factors such as employee turnover, length of service, mortality, compensation levels, and investment earnings. The proper accounting for defined benefit plans is complex and is considered in more advanced accounting courses.

POSTRETIREMENT BENEFITS AS NON‐CURRENT LIABILITIES

While part of the liability associated with (1) postretirement health‐care and life insurance benefits and (2) pension plans is generally a current liability, the greater portion of these liabilities extends many years into the future. Therefore, many companies are required to report significant amounts as non‐current liabilities for postretirement benefits.

GLOSSARY REVIEW

- Contingent liability

- A potential liability that may become an actual liability in the future. (p. H-1).

- Defined benefit plan

- A pension plan in which the benefits that the employee will receive at retirement are defined by the terms of (p. H-7).

- Defined contribution plan

- A pension plan in which the employer’s contribution to the plan is defined by the terms of the plan. (p. H-7).

- Finance lease

- A contractual arrangement that transfers substantially all the benefits and risks of ownership to the lessee so that the lease is in effect a purchase of the property.(p. H-4).

- Lease

- A contractual arrangement between a lessor (owner of a property) and a lessee (renter of the property).(p. H-3).

- Operating lease

- A contractual arrangement giving the lessee temporary use of the property, with continued ownership of the property by the lessor.(p. H-3).

- Pension plan

- An agreement whereby an employer provides benefits to employees after they retire.(p. H-6).

- Postretirement benefits

- Payments by employers to retired employees for health care, life insurance, and pensions.(p. H-6).

- Provision

- A liability of uncertain timing or amount.(p. H-1).

WileyPLUS

Many more resources are available for practice in WileyPLUS.

QUESTIONS

What is a provision? Give an example of a provision that is usually recorded in the accounts.

Under what circumstances is a contingent liability disclosed in the notes to the financial statements? Under what circumstances is a contingent liability not disclosed in the notes to the financial statements?

(a) What is a lease agreement? (b) What are the two most common types of leases? (c) Distinguish between the two types of leases.

Kuchin Company rents a warehouse on a month‐to‐month basis for the storage of its excess inventory. The company periodically must rent space when its production greatly exceeds actual sales. What is the nature of this type of lease agreement, and what accounting treatment should be accorded it?

Palmer SA entered into an agreement to lease 12 computers from Wendt Electronics. The present value of the lease payments is €186,300. Assuming that this is a finance lease, what entry would Palmer make on the date of the lease agreement?

Identify three additional types of fringe benefits associated with employees’ compensation.

Often during job interviews, the candidate asks the potential employer about the firm’s paid absences policy. What are paid absences? How are they accounted for?

What are the two types of postretirement benefits? During what years does the IASB advocate expensing the employer’s costs of these postretirement benefits?

Identify the three parties in a pension plan. What role does each party have in the plan?

Jesse Dorner and Corey Robb are reviewing pension plans. They ask your help in distinguishing between a defined contribution plan and a defined benefit plan. Explain the principal difference to Jesse and Corey.

BRIEF EXERCISES

Prepare adjusting entry for warranty costs.

BEH-1 On December 1, Jiang Ltd. introduces a new product that includes a 1‐year warranty on parts. In December, 1,000 units are sold. Management believes that 4% of the units will be defective and that the average warranty costs will be HK$680 per unit. Prepare the adjusting entry at December 31 to accrue the estimated warranty cost.

Prepare entries for operating and finance leases.

BEH-2 Prepare the journal entries that the lessee should make to record the following transactions.

The lessee makes a lease payment of €68,000 to the lessor in an operating lease transaction.

Perzan Company leases a new building from Wedell Construction. The present value of the lease payments is €900,000. The lease qualifies as a finance lease.

Record estimated vacation benefits..

BEH-3 At Estrada SA, employees are entitled to 1 day’s vacation for each month worked. In January, 35 employees worked the full month. Record the vacation pay liability for January assuming the average daily pay for each employee is €150.

EXERCISES

Record estimated liability and expense for warranties.

EH-1 Huerta Company sells automatic can openers under a 75‐day warranty for defective merchandise. Based on past experience, Huerta Company estimates that 3% of the units sold will become defective during the warranty period. Management estimates that the average cost of replacing or repairing a defective unit is £15. The units sold and units defective that occurred during the last 2 months of 2017 are as follows.

Month |

Units Sold |

Units Defective Prior to December 31 |

|---|---|---|

| November | 28,000 |

620 |

| December | 33,000 |

500 |

Instructions

Determine the estimated warranty liability at December 31 for the units sold in November and December.

Prepare the journal entries to record the estimated liability for warranties and the costs (assume actual costs of £16,800) incurred in honoring 1,120 warranty claims.

Give the entry to record the honoring of 500 warranty contracts in January at an average cost of £15.

Prepare the current liabilities section of the statement of financial position.

EH-2 Kesete Online AG has the following liability accounts after posting adjusting entries: Accounts Payable €63,000, Unearned Ticket Revenue €21,000, Warranty Liability €18,000, Interest Payable €8,000, Mortgage Payable €120,000, Notes Payable €80,000, and Sales Taxes Payable €10,000. Assume the company’s operating cycle is less than 1 year, ticket revenue will be earned within 1 year, warranty costs are expected to be incurred within 1 year, and the notes mature in 3 years.

Instructions

Prepare the current liabilities section of the statement of financial position, assuming €40,000 of the mortgage is payable next year.

Comment on Kesete Online’s liquidity, assuming total current assets are €300,000.

Prepare journal entries for operating lease and finance lease.

EH-3 Presented below are two independent situations.

Speedy Car Rental leased a car to Metnik SA for 1 year. Terms of the operating lease agreement call for monthly payments of R$720.

On January 1, 2017, Burke SA entered into an agreement to lease 20 computers from Cloud Electronics. The terms of the lease agreement require three annual rental payments of R$40,000 (including 8% interest) beginning December 31, 2017. The present value of the three rental payments is R$103,084. Burke considers this a finance lease.

Instructions

Prepare the appropriate journal entry to be made by Metnik for the first lease payment.

Prepare the journal entry to record the lease agreement on the books of Burke on January 1, 2017.

Prepare adjusting entries for fringe benefits.

EH-4 Legaspi SpA has two fringe benefit plans for its employees:

It grants employees 2 days’ vacation for each month worked. Ten employees worked the entire month of March at an average daily wage of €96 per employee.

It has a defined contribution pension plan in which the company contributes 8% of gross earnings. Gross earnings in March were €30,000. The payment to the pension fund has not been made.

Instructions

Prepare the adjusting entries at March 31.

PROBLEMS: SET A

Prepare current liability entries, adjusting entries, and current liabilities section.

PH-1A On January 1, 2017, the ledger of Russell Software contains the following liability accounts.

| Accounts Payable | €42,500 |

| Sales Taxes Payable | 5,800 |

| Unearned Service Revenue | 15,000 |

During January, the following selected transactions occurred.

| Jan. | 1 |

Borrowed €15,000 in cash from Landmark Bank on a 4-month, 8%, €15,000 note. |

5 |

Sold merchandise for cash totaling €9,752, which includes 6% sales taxes. | |

12 |

Performed services for customers who had made advance payments of €9,000. (Credit Service Revenue.) | |

14 |

Paid revenue department for sales taxes collected in December 2016 (€5,800). | |

20 |

Sold 700 units of a new product on credit at €52 per unit, plus 6% sales tax. This new product is subject to a 1-year warranty. | |

25 |

Sold merchandise for cash totaling €13,144, which includes 6% sales taxes. |

Instructions

Journalize the January transactions.

Journalize the adjusting entries at January 31 for (1) the outstanding notes payable, and (2) estimated warranty liability, assuming warranty costs are expected to equal 4% of sales of the new product.

Prepare the current liabilities section of the statement of financial position at January 31, 2017. Assume no change in accounts payable.

Analyze three different lease situations and prepare journal entries.

PH-2A Presented below are three different lease transactions in which Amsrud Enterprises engaged in 2017. Assume that all lease transactions start on January 1, 2017. In no case does Amsrud receive title to the properties leased during or at the end of the lease term.

Instructions

Identify the leases above as operating or finance leases. Explain.

How should the lease transaction with Haber Co. be recorded on January 1, 2017?

How should the lease transactions for Lennon Ltd. be recorded in 2017?

PROBLEMS: SET B

Prepare current liability entries, adjusting entries, and current liabilities section.

PH-1B On January 1, 2017, the ledger of Khan plc contains the following liability accounts.

| Accounts Payable | €52,000 |

| Sales Taxes Payable | 7,700 |

| Unearned Service Revenue | 16,000 |

During January, the following selected transactions occurred.

| Jan. | 5 |

Sold merchandise for cash totaling £17,496, which includes 8% sales taxes. |

12 |

Performed services for customers who had made advance payments of £10,000. (Credit Service Revenue.) | |

14 |

Paid revenue department for sales taxes collected in December 2016 (£7,700). | |

20 |

Sold 600 units of a new product on credit at £54 per unit, plus 8% sales tax. This new product is subject to a 1-year warranty. | |

21 |

Borrowed £18,000 from Commerce Bank on a 3-month, 6%, £18,000 note. | |

25 |

Sold merchandise for cash totaling £12,420, which includes 8% sales taxes. |

Instructions

Journalize the January transactions.

Journalize the adjusting entries at January 31 for (1) the outstanding notes payable, and (2) estimated warranty liability, assuming warranty costs are expected to equal 5% of sales of the new product. (Hint: Use one‐third of a month for the Commerce Bank note.)

Prepare the current liabilities section of the statement of financial position at January 31, 2017. Assume no change in accounts payable.

Analyze three different lease situations and prepare journal entries.

PH-2B The following are three different lease transactions that occurred for McKay A/S in 2017. Assume that all lease contracts start on January 1, 2017. In no case does McKay receive title to the properties leased during or at the end of the lease term.

Instructions

Which of the leases above are operating leases and which are finance leases? Explain.

How should the lease transaction with Dunbar Co. be recorded in 2017?

How should the lease transaction for Block Delivery be recorded on January 1, 2017?