11

Spicy investing

Day trading, forex, options, crypto and NFTs … I call them spicy trading as they don't fall under the rules of long‐term investing, but they can still have space in an investor's portfolio under the section of speculative investments. Every responsible financial book will tell you to abstain from these, but this one will tell you that if you're going to try it (which you probably are), at least have all the facts and be safe.

There are a few assets that you can invest or speculate into, many of which you will probably learn about through social media. That doesn't mean to say they're all scams, but this chapter is going to cut through the noise and explain exactly what is involved, how you might possibly make money and how to actually invest in these ‘spicier’ assets.

Day trading

Day trading is the idea of buying a stock and selling it within a 24‐hour period. Remember how stocks can fluctuate within a single day? Day traders attempt to take advantage of this market movement and buy stocks at lower prices and then sell them quickly. This requires being vigilant, often using day trading software to watch the movement of the market. It falls within the realm of what we used to assume investing looked like — someone staring at multiple screens with lots of graphs.

Day trading is buying into a stock when it is $5 at 10 am and then selling it when it is $11 at 12 pm. You end up profiting $6, and then you take that $6 and keep going with the hope that you keep adding more money and snowballing your profits.

Investors in training know that day trading may be a short‐term option, but professional traders recommend never putting more than 1 per cent of your portfolio into a single trade due to the high level of risk involved.

Day trading isn't lucrative by any stretch of the imagination. Up to 95 per cent of traders fail to make a profit. It also requires a large amount of capital (money) to begin with.

The Financial Industry Regulatory Authority (FINRA) in the US recommends that day traders keep a fund of at least US$25 000 in their account at a minimum. This is to protect investors from getting too over‐leveraged (borrowing too much money to invest) and so they have enough in their accounts to weather the downfalls during trading.

While it might look exciting, and can come with big wins, most often it does not. Investors in training know that the wealthiest investors in the world grew their money through buy and hold strategies, not through day trading.

Options trading

Options trading is a bit like day trading in terms of risk but the trade lasts longer than a few hours. Essentially it is betting that a stock will go up or down in price and, if you are correct, you make money from it. If you are wrong, you lose money, and you can lose more than just your initial investment — sometimes much more. Options fall under a larger category called derivatives. In simple terms, it means the price depends on the price of something else. It's like buying a bunch of concert tickets in the hopes of reselling them for a profit … but the concert tickets' values are affected by how many shows the artist decides to put on (supply).

Options trading can be done by placing bets on stocks, bonds, ETFs or mutual funds. You're essentially putting a deposit down to buy or sell something in the future:

- When you make a call option, you are saying you want to buy shares at a certain price at a certain time. This isn't an obligation, however.

- When you make a put option you are saying you want to sell a certain number of shares at a certain time. This is not an obligation.

- You can ‘long’ or ‘short’ a stock, which is essentially betting that the stock price will rise or fall.

- You can also buy or sell other people's calls and puts. Buying them is ‘longing’ them and selling them is ‘shorting’ them.

It can all seem a bit confusing so let's go over a real example: GameStop in 2021.

When shorting goes wrong: GameStop

Remember how in chapter 5 I spoke about hedge funds making risky moves to try beat the market? Shorting stocks is one of them.

Some hedge funds saw GameStop as a company that was on the downfall, so they shorted it: essentially, they bet its stock price would drop. However, if the stock price went up they'd lose money.

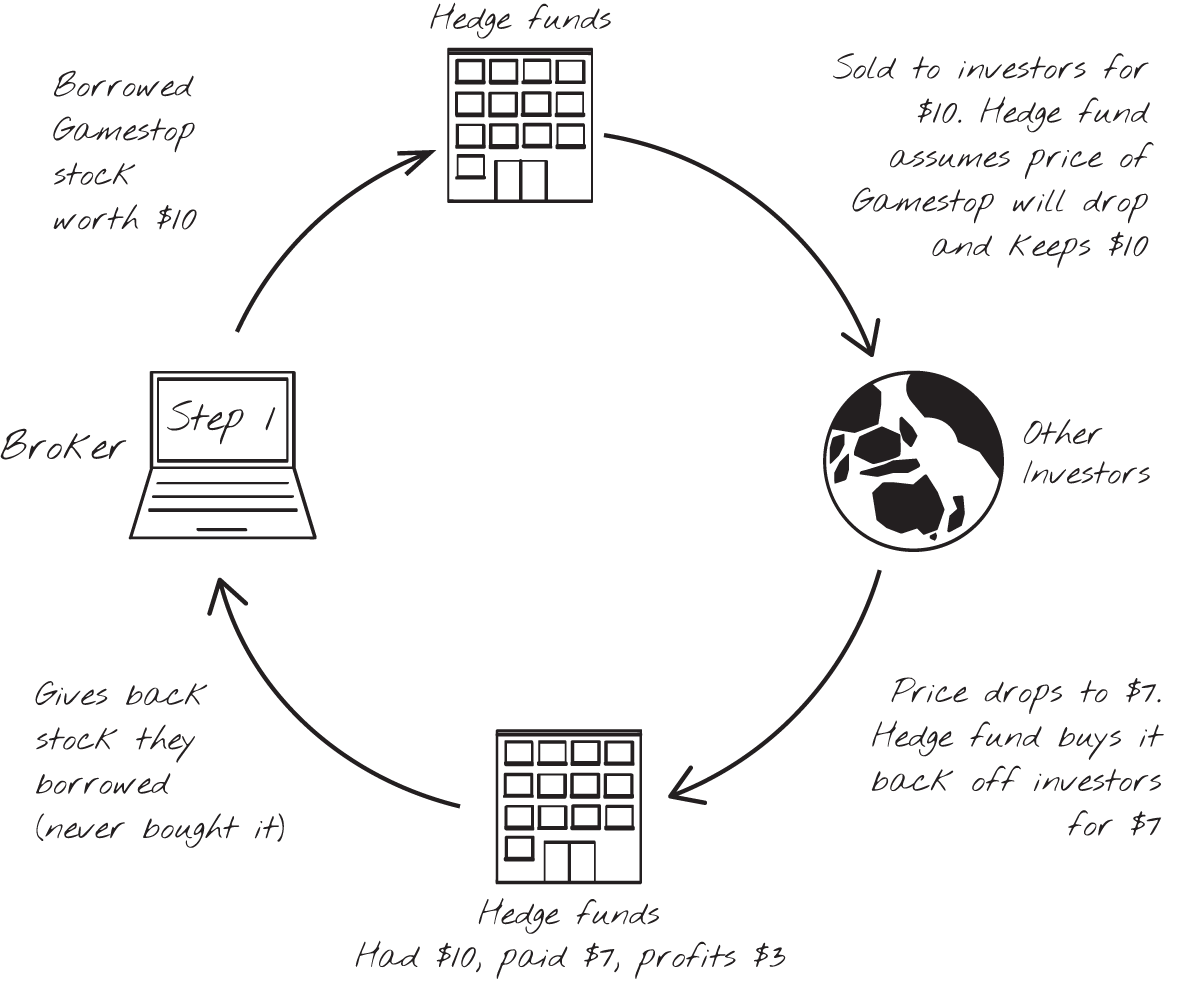

Essentially, the hedge fund borrows (doesn't buy) a stock of GameStop, which at the time is around $10, from a broker. They sell it for $10 to an investor. They promise to buy back the stock from the investor at a certain time, regardless of its price at that time. So if the price of GameStop has dropped down to $7 by the time they have to buy it back, they buy that stock back from the investor for $7, making $3.

They borrowed a stock for free, charged someone $10 to buy it off them and then paid $7 for it back. The hedge fund has now profited $3. They then give the borrowed stock back to the broker. See figure 11.1 for an illustration of this.

Figure 11.1: how hedge funds short stocks

The whole situation happened because retail investors (particularly those who were on Reddit's r/wallstreetbets forum) noticed that the hedge fund Melvin Capital was betting on the price dropping. They intentionally worked together to attempt to drive the price up, buying lots of GameStop stock. Due to much more demand than supply of the shares, the price rose quickly — from US$17.69 to US$325.

Melvin Capital then had to buy these shares back, now at a higher price — causing them to lose $6.8 billion in one month. The stock price has since come down considerably from its high, and those who bought at the peak of the frenzy have lost a lot of money. While it was a pretty one‐off event, it's a great example of the downsides of shorting, the dangers of FOMO investing, and how speculative bubbles can form in the age of social media.

Forex trading

Forex (FX) is short for foreign exchange. It's very similar to day trading, but rather than trading stocks you are trading currencies. The price of currencies fluctuates throughout the day too. $1 USD may equal $1.37 AUD at 9 am but can be worth $1.39 by 8 pm.

The idea behind forex trading is that you buy into a currency when it is cheaper in price, and then when the currency goes up you sell it for a profit. Currencies are traded in pairs (e.g. USD/NZD).

For example, I could buy $100 USD when it's worth $150 NZD and then when $100 USD is worth $200 NZD I can sell it, making a $50 profit. It's not like gambling, however, as there are factors such as upcoming elections or trade deals that can indicate a change in currency price.

Forex trading is done on the foreign exchange market, also known as the currency market. This and the cryptocurrency exchange are the only two nonstop trading markets in the world. They don't stop at 4.30 pm and aren't closed on weekends.

The forex market is as volatile as the ‘nice guy’ who starts swearing at you when you reject his advances. But unlike with nice guys, you want volatility in the forex market. Factors such as interest rates, tourism and politics can affect the supply and demand of the currencies and thus cause them to fluctuate.

It's one of the most heavily traded markets in the world; banks use it, companies use it and retail investors can have access to it as well.

In the same way you can long and short stocks, you can long and short currencies, making money when the price of them increases or drops. The thing that makes forex trading interesting is leverage: you can use other people's money to make a lot of money very quickly, but in the same way you can lose that money just as fast.

Some companies also hedge through forex. For example, say you run a skincare company that is based in the US but you sell your products to New Zealand.

If a product costs you US$50 to make and you sell it for NZ$100, you'll run into the problem of the cost and sale price fluctuating and you may not have the stability you need to pay your employees.

If you short the NZD and buy USD, then the rise of the USD will offset any loss in profit from the sale of the skincare. And if the USD drops then you lose the short but the profit from the product itself makes up for it. As a result, you get to protect your company profits from the up and down of the market.

Investors in training know that with forex trading you're a small fish in a big pond, trading alongside major investment banks, full‐time forex traders and hedge fund managers. In fact, retail investors only make up 5.5 per cent of forex traders, and they are more likely to lose money.

Cryptocurrency

Spanx, the shapewear brand, was founded by a young woman in her basement with a few thousand dollars. Now it's worth billions of dollars. Someone who doesn't understand shapewear may ask, why was it made and why is it so successful?

Cryptocurrency falls into the same category. It solves a problem, but the problem isn't so obvious.

‘Normal’ currency such as the USD or the British pound is at the mercy of governments and banks. Cryptocurrency was made to solve the issue of what would happen if governments or banks ‘turned bad’ and abused their power to control currency. It's hard to imagine that our governments and banks could lock all our bank accounts away from us forever, but I've lived through 2020 and it feels like crazier things have happened.

After the 2008 Global Financial Crisis, people wanted a currency that was completely decentralised from any government or institutions. An anonymous person going by the pseudonym Satoshi Nakamoto created the first cryptocurrency, Bitcoin, in January 2009. They released it with a document to explain how it worked, and then, like Cinderella, disappeared from the ball.

Except unlike Cinderella, Nakamoto has never been found.

Bitcoin

Bitcoin was created to be immune from government intervention or manipulation. It was created on blockchain technology which, in simple terms, is just like a long piece of paper that records and verifies every single Bitcoin transaction into blocks. Lots of computers around the world match this up and as a result everything is accounted for and verified.

Through the blockchain you can see where each Bitcoin has moved from. From my pocket to yours, to your neighbour's and then back to me. It's all tracked, and as a result it's almost impossible to counterfeit.

Cryptocurrencies aren't an investment like a stock of Coca‐Cola or Apple — they're like currency, like the USD or rupees. It's basically forex trading.

When you invest in one Bitcoin, which was only worth US$1 in 2011, you make money when the value of the coin goes up. For example if you were lucky enough to purchase a Bitcoin for $1 in 2011, you could have sold it for US$1000 in 2013, making a profit of US$999. Or US$64 000 in 2021, making a profit of US$63 999.

The benefit of Bitcoin is that it is finite; there is a maximum number of Bitcoins. Some suggest that because of this it can be used as a hedge against inflation, in the same way gold or silver is.

Ethereum

Ethereum is the second‐largest cryptocurrency by market capitalisation (the total number of coins multiplied by the value of each coin), founded by a 17‐year‐old Russian named Vitalik Buterin. Vitalik worked for a Bitcoin magazine (yes, a literal magazine about Bitcoin) where he would pitch ideas to his team on how to make improvements, which often got ignored. He ended up creating Ethereum in 2015. The system that it runs on is called Ethereum and the currency itself is called Ether.

Ethereum uses nodes, computer transactions and blockchaining, however, it has two main points of difference compared to Bitcoin.

The first is that the blockchain (list) is designed in such a way that transactions can only take place if all conditions are met. There's a thing called a smart contract that decides on the restrictions or rules.

The second is Decentralized Applications or dApps. Ethereum is basically flexible enough to allow other digital applications and programs to run on the Ethereum blockchain. In simple terms, Ethereum can be used to host gaming, social media and even financial services.

The downsides of crypto

One of the downsides of cryptocurrency is its real‐world impact on climate change. The electricity used by Bitcoin alone is more than the electricity usage of entire countries such as UAE or the Netherlands. Bitcoin also causes over 30 kilotons of electronic waste (discarded computers, hardware etc.) every year. And this is just one cryptocurrency.

Another worrying point is the use of cryptocurrency by criminals. Due to the decentralised nature of cryptocurrency, it also can be used on the black market for illegal purchases that criminals don't want banks or governments to see. In 2020 alone, over $10 billion worth of cryptocurrency was used for illicit activities. This may result in an ethical dilemma for some investors, while others may not have an issue with it. Again, it's a personal choice.

Cryptocurrency alternative (alt) coins

Alt coins are the Wild West of the cryptocurrency world. See, anyone can make a cryptocurrency: there's Trump coin, garlic coin or coinYe (named after and officially sued by Kanye West).

There are more than 17 000 types of cryptocurrencies available, and this number continues to grow. Bitcoin and Ethereum make up 60 per cent of the total market of crypto, which leaves 40 per cent to the alt coins. After Bitcoin and Ethereum, some of the largest alt coins include XRP, Cardano, Litecoin, Dogecoin and Stellar.

Cryptocurrencies are already highly speculative investments, but at least Bitcoin (ticker: BTC) and Ethereum (ticker: ETH) have some real world use, such as hedging against inflation or being used as a blockchain to host new software and apps. Investors in training understand that the only kinds of investments that last are those with intrinsic value, which can be measured by their real‐world applications.

Alternative coins, on the other hand, are even more speculative than ETH and BTC and have even less real‐world value. They may prove useful on a smaller scale, but the rule of thumb is that, if it doesn't make sense to you, it probably doesn't make sense for a reason and you should consider minimising your position in it. That rule of not investing in what you don't understand can be transferred here.

Alt coin pump and dumps

One of the main issues with alt coins is that they can be the perfect vehicle for pump and dump schemes. Let me explain what I mean. Imagine I was a scammer. I create an alt coin with an attractive name like rainbowcoin (there probably is a rainbow coin out there already) and commission a cute picture of a rainbow to be the coin's icon. I can convince two to three really wealthy investors to drop some money into that coin.

When they do this the price of the coin rises, so I can take this graph and convince everyday investors that this is an ‘up‐and‐coming coin’. With social media, my reach for this type of content has never been easier. I don't have to cold call people to try and prey on them (this concept is called boiler rooms); instead I can post content on social media and Reddit forums to create hype.

Retail investors would see the rise of the coin due to the original investors, and then pour more money into it, raising the price higher. It would continue and even more people would invest as they kept watching the price get higher and higher.

Then my original wealthy investors and I would sell all of our coins. This would make us, the scammers, extremely wealthy and leave the everyday investors holding essentially worthless cryptocurrency.

This is a modern pump and dump scheme, with the ‘pump’ caused by retail investors pouring in their money and the ‘dump’ achieved by scammers who dump their coins at a high price, take their gains and move on. (Pump and dump schemes were how Jordan Belfort, the real‐world Wolf of Wall Street, made his money, but rather than pumping and dumping alt coins he used penny stocks, which can be thought of as alternative stocks from smaller, riskier, sometimes fake companies.)

Does cryptocurrency have a place in an investor's portfolio? An aggressive or growth investor may consider keeping cryptocurrency in their wallets, but investors in training must be wary of alternative cryptocurrencies and do thorough unbiased research on the creation of the cryptocurrency and its real‐world usefulness.

A good rule of thumb is if you try to explain its use to a friend or family member and they don't really get it, it may not actually be all that useful.

NFTs

It's always easier explaining why something exists based off the problem it solves, so let's take that approach to NFTs.

It's very difficult to prove you own something digital, whether that be a piece of artwork, a video or even a tweet; it's easy for people to create counterfeits. It's very difficult to authenticate an item.

This is where NFTs come in. Short for nonfungible tokens, they are online tokens, like cryptocurrencies, that work using the blockchain. The similarities, however, stop there. Cryptocurrencies are fungible tokens, which means their value is the same. One Bitcoin in your pocket is worth the same as one Bitcoin in my pocket, in the same way that US$1 in your hand is worth the same as US$1 in my hand.

With nonfungible tokens, the value of one token is not the same as the value of another token. Each coin is unique and can't be replaced with something else. It's like a one‐of‐a‐kind trading card.

The value of an NFT lies in the media attached to them. The most common NFTs are attached to art or music, but there is the potential to tokenise any real‐world asset.

NFTs are a part of the Ethereum blockchain. It's like a digital fingerprint on an original item, and every time the ownership of that item gets transferred it can be recorded online on the blockchain, thus keeping the authenticity clear.

One of the benefits of NFTs is the real‐world impact it has on artists. Artists can now mint (tokenise) their artwork on a network and bypass the galleries and companies that normally take a large percentage of the sale price. It should not be brushed over that NFTs have opened up a great way for artists in emerging countries to make a living for themselves. One of the benefits of NFTs to artists is that artists can continue to earn royalties even when the NFT is sold between customers; an artist continues to earn a 2 per cent cut from each future transaction.

These are what I like to refer to as aesthetic NFTs. They support artists but, besides this, they have no real‐world implication. When you invest in an NFT project like this, you are basing your investing decision on the highly speculative idea that someone else will value the artwork to be worth more, and thus buy it off you for more, giving you a profit.

There are some useful NFTs out there. Useful NFTs are those that have some real‐world implication and are probably the only NFTs worth your time if you're looking to make money from them.

Think of things like NFTs that can be used to purchase tickets for live events. They allow users to get verified and get opportunities for extras such as access to interviews, bonus music downloads and backstage passes.

Ticketmaster and the National Football League in the US recently decided to offer NFTs on special game passes, embracing the value the new technology can provide.

The issue with NFTs is that, unlike investing in companies where the intrinsic value is based off the company's products, management and revenue, the value of NFTs is entirely speculative. When an investment's value is solely based on what the next person is willing to pay for it, the power lies with the people. Making money from an NFT can be lucrative if you buy low and sell high, but it's a bit like a hot potato — you don't want to be the last person standing holding a US$10 000 NFT that no‐one is interested in buying.

***

Spicy investments in general are much riskier than your average ETF, however, that doesn't mean they can't fit into an investor's portfolio — although they should be approached with caution. The main concern surrounding them is that, while some have intrinsic value, most are overhyped and can lose value very quickly. It's not unheard of to have an alt coin or NFT drop 70 per cent in value in a matter of hours, and for most investors in training, that's just a bit too much, too soon.

Options, forex and day trading, on the other hand, involve much more complicated materials and theories that investors in training should understand before diving in. The time involved compared to the outcome does not make sense for investors, beginner or experienced.