Chapter 14

Due Diligence, Property Inspections, and Closing

IN THIS CHAPTER

![]() Getting the ball rolling on escrow

Getting the ball rolling on escrow

![]() Taking care of your due diligence and property inspections

Taking care of your due diligence and property inspections

![]() Renegotiating the deal or seeking credits in escrow

Renegotiating the deal or seeking credits in escrow

![]() Considering various title-holding arrangements

Considering various title-holding arrangements

![]() Finishing up the transaction

Finishing up the transaction

Your work as a buyer is just beginning when you have an accepted offer for your proposed acquisition, the property is under contract, and an escrow account has been opened. You control the property and can begin to determine whether the seller has accurately represented it.

In Chapters 11 and 12, we cover the pre-offer due diligence, which is essential in weeding out properties that clearly fail to meet your investment goals. Now the formal due diligence period begins. Due diligence is the pre-escrow closing process you (and/or your representatives) perform to investigate the property’s physical and fiscal condition.

Only complete the transaction if the property physically and fiscally meets your needs and the financing is satisfactory. But the property may actually still be worth pursuing if the seller is willing to correct deficiencies or give you a monetary credit to cover your costs, plus your time and a reasonable risk-related return, to complete the necessary work yourself.

In this chapter, we focus on some of the important issues in opening an escrow, conducting formal due diligence, performing property inspections, handling credits in escrow, the various methods of taking title, and ultimately closing the transaction and taking over your new property.

Opening Escrow

Escrow is a method of completing a real estate transaction in which a disinterested third party acts as the intermediary to coordinate the closing activities. The first step after the buyer and the seller sign the purchase agreement is for the earnest money funds (the money you give the seller upfront as partial payment and confirmation of your good faith and intent to close the deal) to be deposited with the escrow holder and put in an escrow account in the name of the buyer. (Check out the Appendix for a sample purchase agreement.)

A real estate transaction for even small investment properties can be complicated, because the buyer and seller have different interests that need to be fairly represented. The escrow holder acts as a neutral third party who handles the details of the transaction and often serves as the referee when disagreements develop between buyer and seller. In some parts of the country, the role of the escrow officer is much more limited. Your real estate agent can guide you as to the custom and practice in your area.

An escrow officer at an escrow company or a title company can handle escrow. Although escrow officers handle most escrows, in some areas of the country, attorneys act as the intermediary throughout the transaction. We refer to escrow officers, escrow agents, and real estate attorneys who handle the closing simply as escrow officers throughout this chapter.

Escrow instructions

The escrow officer prepares the escrow instructions that guide the transaction between the parties. The escrow instructions are derived from the specific terms found in the purchase agreement and in any other written documents mutually agreed upon by both the buyer and seller.

The escrow instructions are critical. To minimize surprises, carefully review the instructions before you sign them, because that’s the document that the escrow holder relies upon exclusively to determine what to do in the event of a dispute. Unless allowed in the escrow instructions, the escrow officer can’t make any changes or respond to any requests without a written agreement signed by all parties.

Preliminary title report

Soon after the escrow instructions have been signed, your title company should send you a copy of the preliminary title report (or prelim). Have this extremely important document reviewed by an attorney unless you have a lot of personal experience and the prelim contains relatively few indicated items.

The preliminary title report indicates the current legal owner of the property and any mortgage liens, unpaid income tax liens, property tax liens, judgment liens, or other recorded encumbrances against the property. It also shows any easements, restrictions, or third-party interests that limit your use of the property such as the Covenants, Conditions, and Restrictions (C, C, and Rs) commonly found with planned unit developments, community associations, or condominiums.

The preliminary title report gives you a good idea as to whether the seller can provide you with marketable title to the property, but it isn’t the same thing as title insurance, which we cover later in this chapter.

Removing contingencies

As we discuss in Chapter 13, the purchase agreement should contain a number of contingencies that allow the buyer and seller the opportunity to cancel the transaction if certain items aren’t satisfactory. It’s the escrow officer’s job to track these contingencies and receive and follow the instructions from the buyer and seller. One of three things happens with contingencies:

- Contingencies can be approved or satisfied.

- The beneficiary of the contingency can unilaterally agree to waive or remove the contingency.

- A contingency can be rejected or fail.

Contingencies create a sort of option and are critical elements that can make or break a transaction. The purchase agreement and escrow instructions usually contain deadlines — the parties have certain rights pertaining to contingencies for a limited period of time. For example, the physical inspection contingency may provide only ten days to make the inspection; after that the contingency is considered approved (or satisfied) and the seller has the legal right to refuse access for a physical inspection.

Estimating the closing date

After all of the buyer’s and seller’s contingencies pertaining to items such as the financing, appraisal, books and records, and the physical inspection have been met or waived, the escrow officer advises the parties of the estimated closing date for the transaction.

This suggestion doesn’t mean that the escrow should be allowed to drag on for many months, but the more costly the property in escrow, the more likely you are to encounter unexpected challenges in satisfying or removing contingencies. Nonresidential property transactions tend to take longer to complete because the leases are more complicated to analyze and the buyer wants estoppel certificates from each tenant. (See Chapter 11 for more on estoppel certificates.) For example, lenders, with their layers of approvals and particular requirements, often cause unforeseen delays, including phase I reports (discussed later in the chapter) on potential environmental issues (particularly for nonresidential properties). Also, when the real estate market is active, appraisers can be backlogged and your appraisal delayed; your loan application won’t go far toward approval before the appraisal is complete.

Conducting Formal Due Diligence

The formal due diligence period (the time period between the acceptance of an offer and the close of escrow or completion of the sale), is the time to ask those tough questions. Don’t be shy. Talk to the tenants, the neighbors, any homeowners’ or commercial association, governmental agencies, and the contractors or suppliers to the property, and be sure that you know what you’re getting. Communicate regularly and work closely with the seller and his representatives, but only rely on information provided in writing. This time period may be your best or only opportunity to seek adjustments, if important issues have been represented inaccurately. After the property sale is completed, it’s too late to ask the seller to fix the leaky roof unless she has engaged in an intentional effort to cover up the true condition of the property. Your remedies may only be in court, which can be costly and reserved only for the most serious or expensive issues.

Practical examples of due diligence include collecting economic data about the region and neighborhood, calling competitive (similar) properties for current market rental rates and concessions, verifying the accuracy of the financial information and leases presented by the seller, and conducting a thorough physical inspection of the property by a licensed general contractor or property inspector. Although you may have completed some of these items before presenting your initial offer (see Chapter 13), some of the information may have only become apparent from a review of the seller’s actual books and records plus the unlimited access to the property that’s generally only available during the formal due diligence.

Reviewing the books and records

Although savvy real estate investors conduct pre-offer due diligence and often receive a copy of a pro forma operating statement, you likely won’t have an opportunity to review the actual books and records until you’re formally under contract and in the due diligence period. Here are some things to make sure you have on hand before the deal is final:

- Seller-verified income and expense statement for at least the past 12 months: The actual income and expense history reveals any surprises that may not have been obvious from the pro forma statement you received from the seller. The best source of this information is the seller’s Schedule E from her federal income tax return — you can be fairly sure that she’s unlikely to overstate income or understate expenses to the IRS! After you have the most accurate numbers, you may find that the property has a serious problem with collections, or your anchor tenant’s suite has several large refrigerator units tied to your common electric house meter. This statement also gives you a good idea of where to look for opportunities to improve on the financial performance of the property.

- Seller-verified rent roll: A rent roll is a list of all rental units with the tenant name, move-in date, lease expiration date, current and market rent, and the security deposit. Also, get a seller statement that no undisclosed verbal agreements, concessions, or side agreements have been made with any tenant regarding the rent, renewal options, security deposits, payment of the utilities, or any other aspects of the financial terms of the lease or rental agreement.

Seller-verified list of all tenant security deposits on hand: When acquiring a new rental property, follow state or local laws in properly handling the tenant’s security deposit. Many state laws require the seller and/or purchaser of a rental property to advise the tenants in writing of the status of their deposit. The law usually gives the seller the right to either return the deposit to the tenant or transfer it to the new owner.

If the seller refunds the security deposits, you have the challenge of collecting deposits from tenants already in possession of the rental unit or suite, which is never easy. For this reason, strongly urge the seller to provide you a credit for the full amount of the security deposits on hand in escrow and have each tenant agree in writing to the amount of the security deposit transferred during the sale. This strategy streamlines the process and prevents you from having to recollect security deposits from current tenants. To avoid problems at the time of move-out, send your tenant a letter confirming the security deposit amount.

- Copies of the entire tenant file of each current tenant: Make sure you have the rental application, current and past leases or rental agreements, any options to renew or increase/decrease space, all legal notices, maintenance work orders, and correspondence for every tenant. The tenant-completed move-in checklist and/or photos/video showing the condition of the rental unit at lease commencement can also be extremely helpful when the tenant ultimately vacates the property. Also, insist that the seller advise you in writing about any pending legal action involving your tenant’s occupancy.

- Copies of every service agreement or contract: Review all current contractors and service providers the current owner uses (maintenance, landscaping, pest control, boiler maintenance, and so on). If you plan to terminate the services of a contractor or service provider, the seller may be willing to send a written conditional notice of termination indicating that, if the property sells as planned, that contractor’s services will no longer be needed as of the close of escrow. You can then find new contractors or maybe even renegotiate better terms with the current company.

- Copies of all required governmental licenses and permits: In many areas, rental property owners are now required to have business licenses, certificates, or permits or register their rental units with a rent control board. Contact the appropriate governmental office in writing and make sure that they’re properly notified of the change in ownership and/or billing address. Often these governmental entities have stiff penalties if you fail to notify them of a change in ownership in a timely manner. And they’ll eventually discover the change in ownership, because they usually monitor the local recording of deeds and receive notification of changes in billing responsibility from local utility companies. Make sure that you have current copies of all state and local rental laws and ordinances that affect your rental property.

- Comprehensive list of all personal property included in the purchase: This inventory may include appliances, equipment, and supplies owned by the current property owner. Remember: Don’t assume anything is included in the sale unless you have it in writing.

Copies of the latest utility billing: Get all the account and payment information for every utility provider, which may include electricity, natural gas, water/sewer, trash collection, telephone, cable, and internet access. Prior to the close of escrow, contact each company and arrange for the transfer of utilities or a change in the billing responsibility as of the estimated escrow closing date. If provided with sufficient advance notice, many utility companies can have the meters read and/or the billing cutoff coincide with the close of escrow, preventing the need to prorate any of the utility billings between the owners.

Also find out whether the seller has any deposits on hand with the utility company and whether you need to place a deposit for service. You may be able to simply handle the transfer of the deposit through escrow with a written deposit transfer acknowledgment from the utility.

If a review of the property expenses indicates that utility costs are unusually high, you may want to insist on reviewing copies of the actual historical bills in order to determine whether there was a one-time variance or whether the property may benefit from conservation efforts.

- Copy of the seller’s current insurance policy (if available) and the loss history: One of the most important steps in the takeover of your new rental property is securing insurance coverage. Make sure that you have the proper insurance policy in place at the time that you legally become the new owner. Most lenders won’t fund your loan until they have written evidence that the property is adequately insured. Although the seller’s policy can’t protect you, request a copy of her policy or declaration of coverage and the loss history, because this information can be helpful to your insurance broker or agent when analyzing the property to determine the proper coverage.

Inspecting the property

The condition of a property directly affects its value. The prudent real estate investor always insists on a thorough physical inspection before purchasing an investment property even if the property is brand new.

A new investment property may look good on paper and your pre-offer due diligence may reveal no legal or financial issues or concerns. But your investment is only as good as the weakest link, and a physically troubled property is never a good investment (unless you’re buying the property for the land and plan to demolish the current buildings).

Our experience shows that an inspection usually pays for itself. Inevitably, you’re going to find items that the seller needs to correct that are greater in value or cost to repair than the nominal sum you spend on the inspection. This value isn’t just a marketing ploy by inspection firms, but it also isn’t a game that you “win” if you can offset the inspection cost by finding enough items that the seller must correct or provide credit in escrow for — as some real estate gurus seem to believe. Instead, the inspection is a serious matter and not just a way to squeeze more from the seller.

The best result is if the inspection reveals no problems. Although you’ve spent money, it’s a great relief to know that your property (at least at the time of the inspection) is in good condition. That doesn’t mean there won’t be repair or replacement items that need your attention in the future, possibly even the very near future. In Robert’s early days in real estate investing, he worked for an apartment developer whose favorite saying was “To own is to maintain!”

Savvy real estate investors actually have a two-step inspection process with their initial pre-offer walk-through of the property as a prelude to even making the offer. If the offer is made and accepted, the professional inspection is to identify any deal-killer problems with the property or any items that warrant renegotiation. You’re looking for two types of defects:

- Patent defects: Defects that are readily visible by simply looking at the property. Patent defects may be a broken window, cracked drives or walks, or a leaking faucet.

- Latent defects: Hidden and hard-to-see defects that require intrusive or even destructive testing. Examples include corroding copper pipes underneath the slab, or ceiling or window leaks that the owner has cosmetically repaired through patching and painting to hide from potential buyers. That is why disclosures are so important.

Disclosure requirements

With purchases of a residential rental property with four or fewer units, many states have seller disclosure requirements: Sellers must provide the buyer with a written transfer disclosure statement that outlines all known structural and mechanical deficiencies. In many areas, sellers must also complete a comprehensive information questionnaire. The agents, if any, for both parties also complete a written disclosure indicating that they’ve made a reasonably diligent visual inspection of the interior and exterior of the property.

Whether the transfer disclosure statement form is legally required or not, sellers in some states still have a legal duty to disclose any and all material facts that could impact the value or intended use of the property. For example, if the property had severe roof leaks last winter and the roof hasn’t been competently repaired, the seller must disclose this fact. Even if the roof had major leaks and was professionally repaired, an ethical seller will disclose this fact and provide you with a copy of the invoice outlining the specific work done and the individual or firm that performed the repairs. You should contact that contractor and find out as much as you can about the repair and the likelihood of future similar problems.

“As-is” sales

“As is” sales are common in many areas of the country. Many sellers simply prefer to put as much of the onus as possible on the buyer to perform a very comprehensive and diligent pre-purchase due diligence investigation of the property. But, that doesn’t change the legal disclosure requirements of sellers to fully disclose any and all known material issues with the property, particularly with current physical condition and/or a complete history of all maintenance and repair issues.

Some sellers attempt to avoid any disclosures by proposing that their property is being sold to you strictly on an as-is and where-is basis. The theory (which is supported by some late-night real estate gurus) is that an as-is sale means that the seller isn’t required to correct any deficiencies in the property before the completion of the sale and they’re not responsible for any issues that arise after the sale. They erroneously believe that such terms are legally enforceable under all conditions and act as a blanket disclaimer against claims of misrepresentation, fraud, or negligence. However, in most areas of the country, the as-is strategy only offers minimal protection to the seller who fails to disclose known (or easily could have been known) defects or maintenance and repair issues that haven’t been properly addressed. Our point isn’t that these sales are automatically to be avoided, just be extra careful when buying a property being offered on an “as is” basis and be sure to have the appropriate experts review all aspects of the property thoroughly before you close the sale.

Likewise, when you’re selling your investment property, don’t attempt to hide behind the as-is language. This technique isn’t effective and hurts your reputation as a real estate investor. Our advice, regardless of any legal requirements, is to disclose, disclose, disclose. Fully document all disclosures in writing, with copies of any invoices or reports, because failure to disclose material facts that affect the value or use of the property is a serious issue and one that often finds its way to the courthouse for resolution.

Types of inspections

If you can get full access to the property, go ahead and conduct your own brief physical exterior and interior inspection before making your offer. This initial overview doesn’t cost anything other than your time and keeps you from wasting further time on properties that have obvious major problems. But this walk-through is no substitute for a professional inspection.

There are generally three types of professional inspections performed during the due diligence period while your property is in escrow, and we cover them in the following sections.

PHYSICAL OR STRUCTURAL INSPECTION

Naturally, you as the buyer want to have all of the physical aspects of the structures on your property inspected. However, your lender may also require you to pay for a separate physical assessment or property inspection report by a firm of its choice. This stipulation is typical only for medium to large residential and commercial types of properties.

Areas in which you want to hire people to help you inspect include

- Overall condition of property

- Structural integrity

- Foundation/slab, crawl space, basements, subflooring, and decks

- Roof and attic

- Plumbing systems, including fixtures, supply lines, drains, and water heating devices

- Electrical systems, including all service panels, generators, and ground-fault circuit interrupters (GFCIs)

- Life safety systems, including smoke detectors, carbon monoxide detectors, radon detectors, intrusion alarms, and fire alarms or fire panels

- Heating and air-conditioning systems

- Landscaping, irrigation, drainage, and grounds/paved surfaces

- Doorways, walls, and windows

- Moisture intrusion, weatherproofing, and insulation

- Seismic, land movement, or subsidence (sinking) and flood risk

- Illegal construction or additions and zoning violations

- Cracks: Look at the entire property, including foundation, floor coverings, walls, ceilings, window and door frames, chimney, and any retaining walls, for cracks. Don’t let the seller or her agent tell you these cracks are merely settlement cracks; let your qualified property inspector or other qualified professional make that determination. A few isolated hairline cracks may be due to naturally occurring settlement of the structure over time, but if the cracks are greater than 3/8 of an inch wide or you can easily stick a screwdriver into the crack, something else is going on.

- Unleveled or squishy floors: As you walk through the property, pay attention to any slant or sloping of the floors (you can easily check by using a minimum 4-foot beam level). Also watch for any soft spots in the flooring on upper levels, including the ground floor if the property has a raised foundation with a crawl space or basement.

- Misaligned structure: Buy one of those handy laser levels and walk through the property looking for floors, walls, and ceilings that are uneven or out of plumb. Another sign of misalignment is when doors or windows stick and don’t open or close easily (although that can also happen from being painted shut).

- Soil issues: Excess groundwater, poor drainage, or cracked/bulging retaining walls or concrete hardscape can be signs of soil issues such as slope failure or ground subsidence that requires inspection by a civil or soils engineer. Be sure that the property drains properly and that all drains are properly installed and maintained.

- Moisture intrusion: Look for current and historical indications of leaks such as discoloration and stains on ceilings, walls, and particularly around window and door frames. Musty odors or the smell of mold may be merely stale air or poor housekeeping, or they may indicate ongoing moisture issues. Sump pumps anywhere on the property are a red flag that should be explored in detail.

Plumbing leaks: Have a qualified plumbing contractor or other expert check all possible sources of leaks or moisture — under sinks; supply lines for faucets, toilets, dishwashers, ice makers and washing machines; plus roofs, windows, sprinklers, and drainage away from the building.

Don’t buy a property with the polybutylene (PB) domestic water supply systems (Qest was the most widely known brand and was manufactured from 1978 through 1995). The track record for these products hasn’t been acceptable. Many properties experienced an extremely high rate of failure that resulted in class-action lawsuits and settlement funds for redoing these plumbing-affected properties. Unfortunately, the deadline for claims in the most prominent of these settlements was in 2008 and 2009, so don’t let anyone tell you now that you can simply replumb such a property and make a claim for reimbursement. PB systems are not the same as a newer product on the market called PEX (cross-linked polyethylene), which is being used more often as a replacement for copper. If you are buying a property with PEX, be sure you have such a system evaluated to ensure that the specific use meets state and local building codes and installation was done per the manufacturer’s recommendations and guidelines.

Don’t buy a property with the polybutylene (PB) domestic water supply systems (Qest was the most widely known brand and was manufactured from 1978 through 1995). The track record for these products hasn’t been acceptable. Many properties experienced an extremely high rate of failure that resulted in class-action lawsuits and settlement funds for redoing these plumbing-affected properties. Unfortunately, the deadline for claims in the most prominent of these settlements was in 2008 and 2009, so don’t let anyone tell you now that you can simply replumb such a property and make a claim for reimbursement. PB systems are not the same as a newer product on the market called PEX (cross-linked polyethylene), which is being used more often as a replacement for copper. If you are buying a property with PEX, be sure you have such a system evaluated to ensure that the specific use meets state and local building codes and installation was done per the manufacturer’s recommendations and guidelines.

And to minimize the chance of having to deal with unpleasant calls from tenants in the middle of the night, we strongly advise that you immediately install steel-braided supply lines on all water sources — including sinks, toilets, dishwashers, ice makers, and washing machines. Also, make sure to check that sink and bathtub overflow drains aren’t clogged and are properly connected.

PEST CONTROL AND PROPERTY DAMAGE

Pest control firms are the natural choice for this type of inspection, but what they inspect is actually more than just infestations by termites, cockroaches, bedbugs, carpenter ants, powder post beetles, and other wood-destroying insects. A thorough pest control and property damage inspection also looks at property damage caused by organisms that infect and incessantly break down and destroy wood and other building materials. These conditions are commonly referred to as dry rot, but ironically, they’re actually a fungus that requires moisture to flourish.

The report you receive from your pest control and property damage inspector usually includes a simple diagram of the property with notations as to the location of certain conditions noted. Some require attention immediately; others are simply areas to watch in the future:

- Part I items: The most serious problems are infestations or infections that must be dealt with at once to protect the structure from serious damage. These recommendations may also include the repair and replacement of compromised structural elements. Unless otherwise agreed, the seller is virtually always required to pay for this work. Your lender won’t fund the property loan until a professional pest control firm and/or licensed contractor completes such required work.

- Part II items: These items are recommended but not required work; as a prudent real estate investor, you’ll address them yourself right after the close of escrow or will require the seller to take care of them before completing the purchase. These items may not be a current structural deficiency that endangers the property or occupants, but if not corrected, they may cost substantially more to repair in the future. If not resolved now, these conditions will continue to fester and develop into required items that must be addressed when you sell the property later on.

ENVIRONMENTAL ISSUES

For commercial and residential rental investment properties with five or more units, a lender usually requires a phase I environmental report, which reviews the property records for the site, including all prior owners, historical uses of the property, and aerial photographs, and may include a site visit, but no testing.

Most properties don’t have problems, and the phase I report is all that is required. But Robert has had clients whose purchase came to a complete halt over something as simple as car engine crankcase oil in the dumpster area of an apartment building. Such a condition results in a negative phase I report, making further investigation and remediation necessary. Problems found in the phase I report can be ridiculously expensive and cause delays of several weeks or even months while additional testing and analysis takes place, a phase II environmental assessment report is prepared, and contractors complete the required work per the specifications outlined by the environmental engineers and consultants.

Have an environmental engineer check drains and pipes that connect to the storm drain system or sewer to ensure that toxic or hazardous materials haven’t been disposed of through your proposed property. If the EPA or comparable state agency later determines that the source of the contaminants was your property, you could face a budget-busting cleanup bill. The governmental agencies don’t care that these violations occurred under prior ownership.

Lenders are extremely concerned about making a loan on a property with the potential for environmental hazards. They know that many buyers would simply walk away from the property and leave them with the devastating cost of cleaning up the property. That’s why most lenders now require buyers to remain personally responsible for environmental issues even if the loan is nonrecourse (the lender can only foreclose on the underlying property in the event of a default). This provision is commonly referred to as a carve-out and is designed to protect the lender from owners who may be tempted to bail out and leave the lender on the hook for a contaminated property.

Qualifying the inspectors

Just like selecting the closing agent, many real estate investors pick inspectors as an afterthought or simply take the recommendation of their real estate agent. But inspect the property inspectors before you hire one. As with other service professionals, interview a few inspectors before making your selection. You may find that they don’t all share the same experience, qualifications, and ethical standards. For example, don’t hire an inspector who hesitates or refuses to allow you to be present during the inspection or won’t review the findings with you upon completion of the inspection.

Only consider full-time, professional inspectors. Hire an inspector who performs at least 100 comprehensive inspections per year and carries errors and omissions insurance. Such coverage isn’t cheap and is another key indicator that the person is working full-time in the field and is participating in ongoing continuing education.

Review a copy of inspectors’ résumés to see what certifications and licenses they hold. A general contractor’s license and certification as a property inspector are important, but also find out whether they’ve had any specialized training and whether they hold any specific sublicenses in areas such as roofing, electrical, or plumbing. These can be particularly important if your proposed property has evidence of potential problems in any of these areas. For example, if a property has a history of roofing or moisture intrusion problems, an inspector who’s a general contractor and roofer is an extra plus.

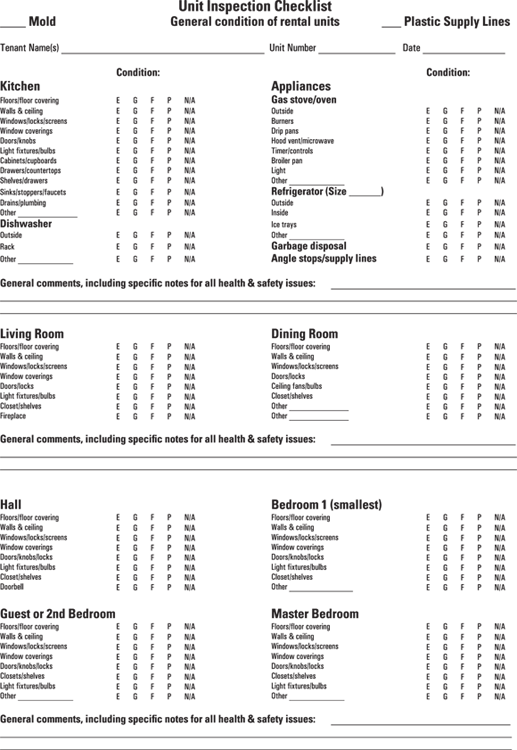

The inspection report must be written. To avoid surprises, request a sample of one of the recent inspection reports that has been prepared for a comparable property. This simple request may eliminate several potential inspectors but is essential so that you can see whether an inspector is qualified and how detailed a report he will prepare for you. Check out Figures 14-1 and 14-2 for a sample interior inspection checklist.

FIGURE 14-1: Sample interior unit inspection checklist Robert uses for large multifamily apartment communities (page 1 of 2).

Source: Robert S. Griswold

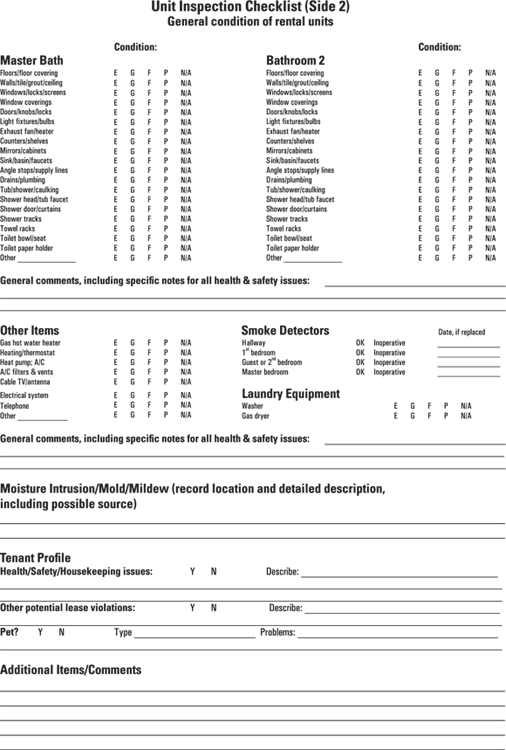

FIGURE 14-2: Sample interior unit inspection checklist (page 2 of 2).

Although the cost of the inspection should be set and determined in advance, the price should be a secondary concern because inspection fees often pay for themselves. Just like many other professional services, there is a direct correlation between the pricing of your inspection and the amount of time the inspector takes to conduct the inspection and then prepare the report. If the inspector only spends a couple of hours at your new 20-unit apartment building, the report will surely be insufficient and your money not well spent.

Finally, require the finalists to provide the names and phone numbers of at least ten people who used the company’s services within the past six months. Randomly call and make sure that these clients were satisfied and that the inspector acted professionally and ethically.

Negotiating Credits in Escrow

Most purchase agreements require the seller to deliver the property in good physical condition with all basic systems in operational order unless otherwise indicated. But the inspection process often reveals deficiencies that need to be corrected. For example, the physical and structural inspection by the property inspector may indicate the need to repair a defective ground-fault circuit interrupter (GFCI), or the pest control and property damage report may show evidence of drywood termites that need to be eradicated.

So with your inspection reports in hand, preferably with digital photos (or infrared imaging for water intrusion), you’re prepared to contact the seller’s representative(s) and arrange for the seller to correct the noted items at his expense. The seller may debate some of the items and claim that the property is being sold as-is even if he didn’t previously indicate any such thing. Be prepared to refer him to the warranty of condition clause in your copy of the purchase agreement; hopefully, he takes care of the problems without any further grumbling or delay.

A buyer who receives a credit in escrow is often anxious to get started on making improvements to get the property in rent-ready condition immediately upon the close of escrow. Although tempting, you should be wary of making significant renovation or repairs to the property before the close of escrow. If the sale of the property doesn’t go through, you may have spent considerable sums to upgrade the seller’s property without any recourse.

Determining How to Hold Title

You must bear many issues in mind when deciding how to take title to your new investment property. Maintaining your privacy, minimizing your tax burden, and protecting your assets from claims and creditors are critical elements to most real estate investors. Take the time to evaluate and decide the most opportune way to take title to your property.

Of course, there’s no one single right answer to the question of how to hold title, because each real estate investor or investment group has different perspectives and needs. The legal forms of ownership vary from state to state, so check your options with the assistance of legal, accounting, and tax advisors. To make the best decision, you need the assistance of your real estate team (see Chapter 6). Consult with your tax advisor and attorney to understand the current ramifications as well as consider the impact on your estate planning needs and goals.

In the following sections, we review some of the basics of each form of ownership — including privacy, taxation, and protection considerations — so you can build a working understanding of the pros and cons of each of the primary alternatives available.

Sole proprietorship

A sole proprietorship is certainly the easiest and cheapest form of ownership and requires no special prerequisites. Simply have title to the property vested in the name of an individual person on the deed, and you have a sole proprietorship. Other advantages include the following:

- Exclusive rights of ownership: You have complete control and discretion over the use of the property and the right to sell, bequeath, or encumber the property any way you see fit.

- Minimal legal costs to establish: You may need a business license or to register with your state as a DBA (doing business as), but generally there are no additional legal expenses to set up and maintain a sole proprietorship.

- Simple record keeping: This can be a negative if you aren’t disciplined.

- Unlimited liabilities: You have no legal protections against lawsuits or other claims (even if caused by an employee), and your name is easily obtained through public records. Other forms of ownership can create a barrier between you and claimants and creditors.

- No real tax advantages: Sole proprietorships offer no real advantages in the area of death and taxes! All income and expenses are reported directly on your personal tax return, and there is no preferential tax treatment or avoidance of the probate courts in the event of your death.

- Possible marriage complications: A sole proprietorship can become complicated if you’re married or later get married and intend to keep your investment property as a separately held asset. Check with your tax advisor before making any significant changes in your marital status because you need to keep detailed accounting records to avoid any commingling of funds from community property that could create an interest for a spouse in the real property.

Joint tenancy

Joint tenancy is a way in which two or more individuals may hold title to a property together where they own equal shares of the property. Joint tenancy is only available to individuals (not legal corporate entities) because a unique feature of holding title in a joint tenancy is the right of survivorship. Upon the death of one of the joint tenants, the entire ownership automatically vests in equal shares to the surviving individual or individuals without going through the probate process.

In order to form a joint tenancy, there must be unity of time, title, interest, and possession. Unity of time means that all joint tenants must take title by the same deed at the same time. Another requirement is that each joint tenant own an equal interest or percentage of the property — so if you have two joint tenants, they each own 50 percent, whereas four joint tenants would each own 25 percent of the entire property. Any ownership of a property in disproportionate shares can’t be a joint tenancy.

Each joint tenant is legally entitled to the right of possession and can’t be excluded by the others. Some states specifically require the joint tenancy deed to include the wording “joint tenants with right of survivorship.”

One concern is that joint tenants can sell, bequeath, or encumber their portion of the property without the consent of the other owners. It’s possible for the joint tenancy to be terminated in the event of a judgment lien or bankruptcy. Likewise, a new joint tenant can only be added by executing a new deed. Income and expenses from operations of the property are reported on each individual’s tax return.

For example, suppose two joint tenants buy a property for $200,000. Many years later, one of the joint tenants dies, and the property is appraised at $300,000. The new adjusted basis for the surviving joint tenant is $250,000, representing the original basis of $100,000 plus $150,000 (one half of $300,000) for the deceased joint tenant’s interest. This basis is important when calculating the gain or loss upon sale of the property, so having the basis increase can dramatically lower your taxable capital gain (see Chapter 18 for details).

Tenancy in common

One of the most common forms of co-ownership is tenancy in common (also known as tenants in common or TIC). A tenancy in common is the ownership of real property in which several owners each own a stated portion or share of the entire property. In most states, if the deed is silent as to the form of ownership, tenancy in common is the presumed method of holding title.

Unlike joint tenancy, in a tenancy in common, each owner can own a different percentage, can take title at any time, and can sell his interest at any time. Another distinguishing characteristic is that each owner has complete control over her portion of the property and can sell, bequeath, or mortgage her interest as she personally decides without any feedback from or recourse for the other owners. Further, upon her death, her share becomes part of her estate and can be willed as she sees fit.

Tenants in common products are now being aggressively touted by financial advisors as an investment product of choice for the owners of appreciated real estate who are looking for a more passive investment without the challenges of property management. These investments offer the investor a way to own fractionalized interests in real estate and can be structured as direct ownership of property with a deed for their interest, or many are actually security interests. The sponsored tenants in common products usually have a management agreement or governing document to address issues of control and avoid the problems discussed later in this chapter.

- Death of an owner: You may find that a co-owner has left his interest in a property you partially own to someone that you don’t get along with or one who has different or incompatible goals and expectations for the property.

- Sale by an owner: Because each owner has equal rights of control over the property, serious conflicts may arise when one owner wants to sell or borrow against the property. Or an owner may decide to sell to an individual or entity, which disrupts the spirit of cooperation among the various owners.

- Financial problems of an owner: You’re financially tied to your co-owners for better or worse even in their activities other than the jointly owned property. A judgment against one of the co-owners can lead to the creditor foreclosing on that co-owner’s interest in the property to satisfy a monetary judgment. Or a bankruptcy by one co-owner can lead to the bankruptcy court ordering a forced sale of the property to satisfy the bankruptcy creditors unless the other co-owners are willing to pay off the creditors and buy out the financially challenged co-owner.

- Different plans: Each co-owner may have different goals and strategies for the property or the way it should be managed. With tenancy in common ownership, absent a written governing document, there’s no majority rule or simple way to arbitrate differences in opinions. Because a single owner can thwart the mutual plans of all the others, disagreements about whether to borrow money by using the property as collateral or whether to sell the property can result in a legal action. Robert has served as a court-appointed referee in several of these actions (called partitions), and they can be quite stressful for the parties — who can’t seem to agree on anything!

Partnerships

A real estate partnership is a form of business enterprise in which two or more persons join together to pool their capital and talent to purchase, manage, and ultimately sell real estate. Investors in a real estate partnership don’t have actual title or ownership interest directly in the property but actually own a partnership interest.

A partnership isn’t a corporation, and generally takes one of two forms:

- In a general partnership, each partner has the right to fully participate in the management and operations of the property, and each partner is fully responsible for the debt, legal obligations, and any business losses incurred. General partnerships are easy to establish, but a serious concern is that each individual partner is able to contract on behalf of the partnership and all partners are then legally liable for these actions. Another disadvantage of a general partnership is that the death, bankruptcy, or withdrawal of one of the general partners may require the dissolution and complete reorganization of the general partnership.

- A limited partnership consists of one or more general partners along with one or more limited partners. The general partner (who can be an individual or a corporation) handles management and operations and has unlimited liabilities. The limited partners are restricted from participating in management and operations of the property and only have their actual cash investment at risk. Limited partnerships have been popular because they allow folks to invest relatively small amounts into larger real estate deals. Also, a limited partnership can continue on even if one of the partners dies, files bankruptcy, withdraws, or sells his partnership share.

Partnerships have been a common and successful way for individuals to work together to purchase larger real estate investment properties. Often, they bring together individuals with complementary resources and skills. For example, a good partnership may include a real estate broker, a property manager, a real estate financial analyst or appraiser, and a real estate lender. The complementary skills of this partnership offer insight into each phase of the investment. In another common arrangement, one of the partners doesn’t have any real estate expertise or acumen, but instead provides a significant portion of the investment capital.

The expertise of the general partner can be an advantage of real estate partnerships over TICs, where the TIC governing documents typically provide that each owner can vote his proportionate share and the majority makes the decisions. The problem is that a collective majority in a TIC may not have the real estate experience to make the best decision. In a real estate partnership, the owners of minority interests often find they have little input into the major decisions of the partnership (such as refinancing and selling or exchanging the property). But this hands-off approach can actually be beneficial and a lot less stressful if the general partner is competent and knows what she’s doing.

From a taxation standpoint, real estate partnerships must prepare an IRS form 1065 tax return and pass through the respective share of all profits and losses and depreciation to each individual partner. Each partner then reports these numbers on her personal tax returns. At the time of death of a partner, there are several tax-related issues concerning the handling of the partnership interest, so consult a tax advisor.

Limited liability company

Now available in all 50 states, the limited liability company (LLC) is a hybrid form of doing business that combines characteristics of a partnership and a corporation. This setup is an unbeatable combination for many real estate investors and a great way to hold title to real estate holdings. LLCs have essentially replaced corporations and partnerships as the most common way to hold title to real estate because they offer the advantages of allowing each member to have a say in the management while extending limited liability to all members, without the burden of double taxation that occurs with corporations. (Profits of corporations are first taxed at the corporate level, and then the profits distributed to individual shareholders are taxed again on their personal returns.)

An LLC is a separate entity like a corporation and therefore carries liability protection for all of its members, but it can be structured like a partnership so that the taxation flows through to each member individually. This feature simply requires the LLC to declare itself a joint venture with the IRS and indicate how it wants to allocate the taxation of income and expenses. Like a partnership, an LLC is required to prepare and file an IRS Form 1065, Partnership Tax Return, unless it makes the joint venture election.

The owners of an LLC are called members and can be virtually any entity, including individuals, partnerships, trusts, corporations, pension plans, or even other LLCs. Typically, LLCs have multiple members that can own different percentages; however, virtually all states permit single-member LLCs (but not without some potential issues with the IRS that you should discuss with your tax advisor in advance). Fortunately, a husband and wife are considered two members when forming an LLC.

- IRS limitations: IRS regulations have some limitations on the characteristics of the LLC. An attorney can advise you on the best structure to establish — one that emphasizes the importance of limited liability and centralized management while foregoing continuity of life and easy transferability of interests. In addition to filing a partnership tax return with the IRS, most states also require an annual or biennial report of activity along with filing fees, withholding, or even franchise fees; however, many states don’t have any minimum charges or they are equal to or less than $100 per year.

- Costs: The costs can be much greater than for other forms of ownership. Be sure to consult with a local tax advisor for details on the typical costs for operating an LLC in your state. Currently, the highest base cost for an LLC is found in California: a minimum franchise tax fee of $800 per year plus additional taxes based on gross receipts.

Corporations

A partnership consists of people, but a corporation is a legal entity owned by one or more shareholders. The most well-known form that corporations take is that of public corporations like Google and Johnson & Johnson, which have shares traded on a stock exchange. Real estate investors can also create their own private or closely held corporations to own real estate.

A real estate investor can establish a corporation by filing articles of incorporation and bylaws with the appropriate state agency, usually the secretary of state’s office. Corporate requirements vary from state to state, so consult your tax and legal advisors prior to implementing a corporate form of ownership for real estate assets. Nevada and Delaware are two of the more popular states in which to incorporate, but your legal and tax advisors can tell you if these states provide any advantages for your personal situation. Typically, you’re best off to incorporate in your state of residence.

Two types of corporations are available:

- C Corporation: Although C Corporations (the most well-known and popular type of corporation) have the advantage of continuity of life in the event a shareholder dies, their downside is the double taxation of profits. Another negative is that if the corporation has losses, it has to carry them over to the next tax year because the shareholders can’t use C Corporation losses on their personal returns.

- S Corporation: A primary benefit of this type of corporation is the ability to avoid double taxation by passing through the profits and losses directly to the individual shareholders. But S Corporations are rarely used in the ownership of real estate because their primary disadvantage is that a liquidation of the S Corporation is a taxable event. So even if the shareholders of the S Corporation can agree to an equitable distribution of the assets, the IRS deems the liquidation as taxable and the shareholders must pay capital gains taxes and possibly sell some of the assets. (Note that in a liquidation of an LLC, the assets may be distributed to the members without a taxable event occurring.) There is also difficulty for shareholders that aren’t involved in the day-to-day operations. The IRS requires material participation (an IRS term that indicates whether an investor worked and was involved in a business activity on a regular basis) for the realization of tax benefits.

Closing the Transaction

The closing of escrow is the consummation of the real estate transaction and the goal of the buyer, the seller, the brokers, and all the other professionals who were part of the effort. It’s the culmination of numerous individual acts and of often constant negotiation right up until the last moment. The closing of escrow occurs only when all conditions of the escrow instructions and purchase agreement are fulfilled, including any funding of the loan. Quite a few details must come together before the escrow officer can actually close the transaction and record the deed.

The actual process or formalities of closing the escrow are handled in different ways throughout the country. Some areas bring all the parties together; an attorney acts as the closing agent, and funds are transferred among the parties after all the documents have been signed and notarized. Your escrow officer is at the center of activity as the essential elements come together to make your goal of purchasing an investment property a reality. The inspectors, appraisers, lenders, and attorneys on your team all have roles in completing the due diligence required to ensure that there are no surprises with your potential new property acquisition.

- Lender requests: You need to make sure that you’re in contact with your lender to avoid any last-minute snafus. Lenders are notorious for needing just one more signature or asking questions at the last minute about the source of your down payment. These questions aren’t as random as they may seem and are usually brought up by the loan committee or final person who must sign off on your loan.

- Document errors: Don’t assume the documents are correct. They’re prepared by people who may not be careful or who even cut and paste from documents used in prior escrows that have nothing to do with your transaction. Robert completed a large refinance loan of a commercial property, and while proofreading the lender-prepared documents, he noted that they contained several mistakes, including an incorrect loan amortization term.

- Availability of parties and busy periods: You need to be available to review and sign the loan documents, so let the lender or your mortgage broker know if you’re going to be unavailable for any reason around closing time. But during certain times of the year, things just take a lot longer. The December holidays are the worst, but spring break and major three- or four-day weekends can also be times when your favorite property inspector, loan officer, or escrow officer may be planning to be out of the office.

Estimated closing statement

Several days before the projected date for the close of your escrow, both the buyer and the seller receive a copy of the estimated closing statement with the various charges. You may receive this statement at the time you sign some or all of the documents, or it may be sent to you separately. This is an extremely important document because this is the best time to raise any issues or concerns if you feel that an error has been made.

The estimated amounts can, and usually do, change slightly. Often the escrow officer or closing agent estimates these expenses a little on the high side because any shortage of funds prevents the escrow from closing, but any overage can easily be credited or refunded back to the buyer or seller.

The buyer should pay particular attention to the estimated closing statement because it indicates the funds expected to be received from the lender or credited from the seller if there’s seller financing. It also indicates the amount of additional cash funds that the buyer needs to deposit in the form of a wire transfer, cashier’s check, or other certified funds. The buyer must provide these good funds in plenty of time for the escrow to close — your personal check will take up to a week to clear and credit cards and PayPal or Venmo aren’t accepted! Remember: If you have a large sum of money deposited in escrow, arrange for the escrow company to place the funds in an interest-bearing account.

Title insurance

Title insurance has evolved to become a vital element in most real estate transactions. Title insurance companies track all recorded documents and transfers of interests in real estate so that they can issue title insurance — policies that assure the purchaser that the title to the property being transferred is legally valid and unblemished. This kind of title is commonly referred to as a clean and marketable title. Title insurance is like any form of insurance in that it defends and pays the claims made against the insured. There are two types of title insurance policies issued in most transactions:

- The seller provides one to the buyer to protect herself against claims that the purchase of the property wasn’t a marketable title. For example, maybe the heir to a former owner suddenly claim that there was a fraudulent transfer of the property years ago. If you bought title insurance when you purchased the property, the title company defends any legal action or compensates you in the event that the claim is valid and you lose the property.

- Mortgage lenders require title insurance to protect against someone else claiming legal title to your property. The lender provides funds toward the purchase of the property and wouldn’t be protected if the property ownership were to change based on a claim of an improper transfer of title. There are many ways that a title can be transferred improperly — for instance, when a husband and wife split up and the one who remains in the home decides to sell and take off with the money. If the title lists both spouses as owners, the spouse who sells the property (possibly by forging the other’s signature) has violated the law. The short-changed spouse can reclaim rights to the home even after it has been sold. In this event, both you and the lender can get stuck holding the bag in the absence of title insurance.

Most state insurance departments monitor and regulate title insurance companies because a company’s ability to pay claims is always important. Although title insurers rarely fail, and most states do a good job shutting down financially unstable ones, check with your state’s insurance department if you’re concerned. Title insurance companies receive ratings from insurance-rating companies, so you can ask the insurer for copies of the latest report.

Don’t simply use the company that your real estate agent or lender suggests — shop around. Because many title companies provide escrow services, you need to watch out for companies that quote very low prices on one service and make up for it by overcharging in other areas. When you call around for title insurance and escrow fee quotes, get a handle on all the charges; there may be miscellaneous or hidden administrative fees that can sneak up on you and become major items — document preparation, notary services, courier fees, and express mail. If you find a company with lower prices, consider asking for an itemization in writing so that you don’t run into any surprises.

Property insurance

You must have insurance, often one of the larger expenses for investment properties. Unless you purchase the property entirely for cash, you can’t close the transaction and take over the property until you have a certificate of insurance in place. Your lender, or even the seller if he’s providing any financing of your purchase, will prudently insist that you have adequate insurance coverage with policy limits that effectively protect your financer’s collateral or financial interest in the property.

In accounting terms, property insurance is a fixed expense (like your property taxes), which means that although you may be able to turn off the natural gas (a variable expense) when your property is unoccupied, you must have insurance coverage — even if your property is vacant. In fact, insurance is likely more important if your property is vacant for an extended time frame.

Another benefit of getting your insurance early in the due diligence process is that your insurance agent or an underwriter from the insurance company may even inspect the property before providing you with a quote. Of course, any inspection by the insurance company is limited in scope and is never a substitute for your own inspection or the detailed written inspections you need from your property inspector and other industry professionals or experts (see “Inspecting the property” earlier in the chapter). But it can be important to know whether the insurance company is going to require any upgrades or changes to the property as a condition of offering insurance.

For example, many companies no longer write policies for multifamily residential properties that have balcony- or pool-fence wrought-iron railings with pickets spaced more than 4 inches apart, due to the potential hazards to small children. The cost to correct this condition can be expensive, and you would want to include such costs in your negotiations with the seller or at least include the amount in your capital budget. (We discuss the role of insurance in an effective risk management program in Chapter 16.)

Final closing statement

Just before your transaction is complete and escrow is closed, you receive a closing statement from the escrow officer. Besides the actual purchase price, there are several expenses incurred in the process of purchasing real estate that must be worked out between the buyer and the seller. For example, the seller may have paid the property taxes for the balance of the year, and the buyer should reimburse him for the amount attributable to his ownership period after the close of escrow.

The buyer and seller need to pay some expenses, such as escrow and recording fees. Who pays what is usually outlined in the escrow instructions and is determined by a combination of the purchase agreement negotiations between the parties and custom and practice in the local real estate market. Table 14-1 contains a breakdown of the allocation of expenses that are typical in the purchase of investment properties.

TABLE 14-1 Typical Allocation of Expenses

Item |

Paid by Seller |

Paid by Buyer |

Broker’s commission |

X |

|

Escrow fees |

Split 50-50 |

Split 50-50 |

Recording fees: Loan payoff |

X |

|

Recording fees: Transfer |

X |

|

Transfer tax |

X |

|

State or local revenue stamps |

X |

|

Seller’s title policy |

X |

|

Lender’s title policy |

X |

|

Loan origination fee |

X |

|

Loan commitment fee |

X |

|

Appraisal |

X |

|

Credit report |

X |

|

Loan prepayment penalty, if any |

X |

In addition to the allocation of expenses between the buyer and seller, the final closing statement contains credits (items that accrue to the benefit of the party receiving the credit) and debits (items that are paid out of escrow on behalf of the party being debited). Table 14-2 has a breakdown of the usual accounting of the debits and credits on the closing or settlement statement.

TABLE 14-2 Usual Accounting on Closing Statement

Item |

Buyer Credit |

Buyer Debit |

Seller Credit |

Seller Debit |

Prorated |

Selling price |

X |

X |

|||

Buyer’s loan principal |

X |

||||

Buyer’s loan points/fees |

X |

||||

Prepaid interest |

X |

||||

Property inspection fees/appraisal |

X |

||||

Payoff seller’s loan |

X |

||||

Tenant’s security deposits |

X |

X |

|||

Buyer’s earnest money deposit |

X |

X |

|||

Additional cash down payment |

X |

X |

|||

Unpaid bills (for example, utility charges) |

X |

X |

X |

||

Prepaid property taxes |

X |

X |

X |

||

Prepaid insurance |

X |

X |

X |

||

Prepaid expenses (for example, utility deposit) |

X |

X |

X |

||

Supplies left by seller for buyer’s use |

X |

X |

X |

The escrow officer or closing agent usually processes the mandatory reporting of the real estate transaction to the Internal Revenue Service and the state tax authorities, if required. If she doesn’t file the required 1099-S form, the brokers or the buyer and seller may be required to handle the reporting, which includes the identity of the property transferred, the sales price, and the Social Security numbers of the buyer and seller.

Deed recording and property takeover

Although the escrow officer may have all of the signed documents, and funds have been transferred to the proper accounts, you aren’t the proud owner of your investment property until the deed is recorded. The procedure for recording the documents varies throughout the country but is becoming more standardized. Nearly every county utilizes a county recorder to record documents like real estate deeds, mortgages, deeds of trust, and other real estate documents as a public notice. Typically, there is an office of the county clerk and recorder, sometimes in the county courthouse in smaller jurisdictions.

Electronic document processing technology has made great strides in improving the efficiency in recording and retrieving documents at virtually all recorders’ offices. Now documents can be retrieved by computers in a matter of seconds and are usually indexed by grantor and grantee.

- Conducting a final walk-through and inspection of both the property’s exterior and interior to make sure that the property hasn’t been damaged prior to the close of escrow.

- Verifying that all items indicated on the personal property inventory list are present.

- Making sure that all keys were received (if the property is vacant, you should change the locks as an added precaution).

- Checking the utility meters to make sure that the utility company has switched the billing as of the close of escrow so you don’t get billed for the former owner’s usage.

- Meeting with tenants and assuring them that you’re a responsive and concerned property owner who wants to cooperatively resolve issues.

Another issue to address right after the closing is the possession and control by the former owner. Because the escrow closing and recording can often happen during the day without any specific notice, it’s best to wait until the following calendar day and personally verify that only the tenants that should be there are occupying the property. If the owner is still residing on the premises or is using some of the property for his own use, you need to immediately ask that he turn over full possession unless you’ve made other formal written arrangements in advance. To minimize this prospect, we suggest that you include significant daily monetary damages in the purchase contract for any unauthorized holdover usage by the seller.

Congratulations! You’re now ready to begin managing your property and increasing its value as you build the foundation of your real estate portfolio.

Our good friend Ray Brown (and coauthor with Eric of Home Buying For Dummies [Wiley]) recommends that you remember that the escrow officer is a human being. Pick up the phone and introduce yourself. Ask if she has everything she needs for the transaction to go forward efficiently. Also let her know how she can reach you at various times of the day or week. Although the professional escrow officer remains an unbiased and fair intermediary, this personal touch never hurts and may make things easier if your escrow doesn’t proceed smoothly.

Our good friend Ray Brown (and coauthor with Eric of Home Buying For Dummies [Wiley]) recommends that you remember that the escrow officer is a human being. Pick up the phone and introduce yourself. Ask if she has everything she needs for the transaction to go forward efficiently. Also let her know how she can reach you at various times of the day or week. Although the professional escrow officer remains an unbiased and fair intermediary, this personal touch never hurts and may make things easier if your escrow doesn’t proceed smoothly. Obtain and review copies of the detailed backup materials for each item so that you know exactly what’s encumbering the property. The approval of the preliminary title report by the buyer is one of the basic contingencies in most real estate transactions (see

Obtain and review copies of the detailed backup materials for each item so that you know exactly what’s encumbering the property. The approval of the preliminary title report by the buyer is one of the basic contingencies in most real estate transactions (see  The importance of conducting a final property inspection prior to closing escrow is illustrated by one of Robert’s expert witness cases. The buyers of a single-family home failed to close escrow as planned because they decided they didn’t want to put the 20 percent down payment in cash but instead were negotiating with their mortgage broker to arrange a second loan that could be combined with their first trust deed to give them 100 percent financing. The seller had moved out on the original estimated closing date, and the home sat vacant for several weeks until the buyers were able to arrange and fund the second loan. With the transaction dragging on past the expected close of escrow, the anxious buyers failed to inspect the home that one last time before finally closing escrow. Unfortunately, sometime between when the seller moved out and the buyers first saw the property after they had closed escrow and taken title, the property experienced a severe water leak (from a rupture in the refrigerator ice-maker line) that completely flooded a good portion of the home and created a serious mold issue. The remediation cost was in the tens of thousands of dollars, and litigation ensued because the insurance companies for both the seller and buyer refused coverage on the basis that no one could determine precisely when the damage occurred. Ultimately, the buyers’ insurance covered much of the out-of-pocket repair costs, but the matter wasn’t resolved for over two years, and the buyers didn’t have loss of rent coverage to make up for rent lost during that period.

The importance of conducting a final property inspection prior to closing escrow is illustrated by one of Robert’s expert witness cases. The buyers of a single-family home failed to close escrow as planned because they decided they didn’t want to put the 20 percent down payment in cash but instead were negotiating with their mortgage broker to arrange a second loan that could be combined with their first trust deed to give them 100 percent financing. The seller had moved out on the original estimated closing date, and the home sat vacant for several weeks until the buyers were able to arrange and fund the second loan. With the transaction dragging on past the expected close of escrow, the anxious buyers failed to inspect the home that one last time before finally closing escrow. Unfortunately, sometime between when the seller moved out and the buyers first saw the property after they had closed escrow and taken title, the property experienced a severe water leak (from a rupture in the refrigerator ice-maker line) that completely flooded a good portion of the home and created a serious mold issue. The remediation cost was in the tens of thousands of dollars, and litigation ensued because the insurance companies for both the seller and buyer refused coverage on the basis that no one could determine precisely when the damage occurred. Ultimately, the buyers’ insurance covered much of the out-of-pocket repair costs, but the matter wasn’t resolved for over two years, and the buyers didn’t have loss of rent coverage to make up for rent lost during that period.