Chapter 3. Leading US Mobile Payment Experiences

Today there are mobile payment initiatives by everyone from traditional financial networks like Visa and MasterCard to upstarts like Loop and Clinkle looking to cash in on the gold rush for consumer mindshare of the mobile payments space. Figure 3-1 illustrates what the US mobile payments field looks like to date, with startups like LevelUp giving established financial institutions and technology companies like Google and MNOs (Isis) a run for their money.

As we saw in Chapter 2, there are three primary ecosystems that power mobile commerce: NFC, cloud, and closed loop payments. The structure and performance of these distinct ecosystems have a significant impact on the mobile consumer’s experience at the point of sale. In this chapter, we’ll closely examine some leading experiences in the US mobile brick-and-mortar payments market, highlighting the innovations and shortcomings of their designs. In particular, we’ll focus on three key aspects of payments design that I feel are the most crucial to the success of a mobile payment experience:

- Payments

Using the app at a point of sale

- Feedback

Instructing the user before and after transactions

- Security

Protecting the user’s financial privacy

NFC

Google Wallet

The first NFC-based wallet widely available in the US, Google Wallet made brave first steps into the world of mobile transacting in September 2011. The Wallet team aligned with key players in financial and mobile networks to set NFC payments in motion. First Data provided TSM services, while Citibank was the first to issue prepaid MasterCards enabled with PayPass. Sprint provided access to secure elements on a select range of Android phones, starting by collaborating with Samsung to produce one of the first Google flagship phones, the Nexus S.

Early adopters of Google Wallet encountered a clean, friendly UI (indicative of the design paradigm shift at Google that would soon permeate all of its products). The launch was supplemented with strong online, print, and in-store campaigns that helped educate users about using NFC for payments and finding participating merchants. Each Wallet came with a $10 prepaid card, which users could reload by linking a credit card if they weren’t Citibank MasterCard customers.

Users could enroll their rewards cards from merchants like American Eagle, Office Max, and Macy’s. Google Offers was also seamlessly integrated, including a collection of NFC-only discounts at stores like Gap and Banana Republic as an added incentive to start using the Wallet. The current iteration of the Wallet is a thinner, more focused experience: all payments are processed by way of a digital card profile temporarily stored on the phone via host-card emulation (as opposed to being on the SIM, like Isis). Offers are now redeemed by barcode.

Overall design

Strengths:

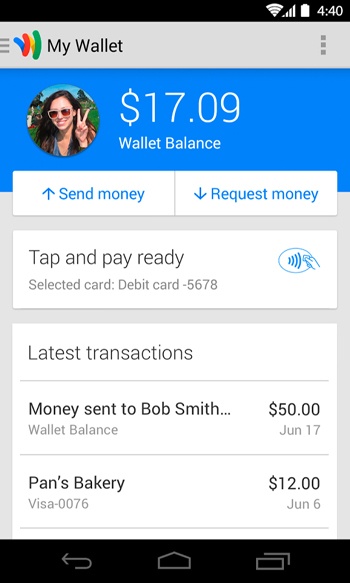

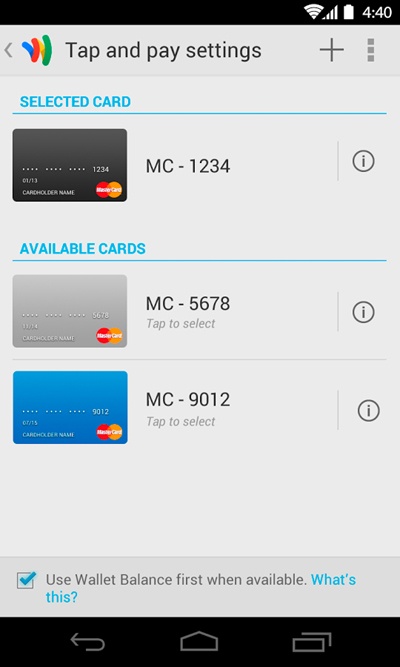

Google products’ latest design philosophy is in full effect here, with a clean, card-based UI (see Figure 3-2), clear calls to action, and Android OS best practices at work.

Google Wallet 2.0 features a slide-out navigation menu for key features like cards, money transfers, loyalty programs, and local offers.

Friendly tone and labels guide the user through payment experiences.

Users who are reluctant to add a credit or debit card to their phone can opt instead to preload their Google Wallet Balance (Figure 3-3), which can be used at the time of purchase, similar to a prepaid card.

Weaknesses:

Card images are generic, and do not reflect the actual card that was registered (i.e., a Wells Fargo or Citibank card).

Payments

Strengths:

The app-launch-to-payment flow is very fast; the user needs only to have the app open and unlocked (with his PIN) for payments to take place (Figure 3-4 shows what payments look like with Google Wallet). The first few times you use the app, there’s a helpful message that tells you when your app is ready to pay.

There is an audio cue and short vibration when the phone comes into contact with the reader.

There isn’t always an indicator that the card is turned “on” and ready to pay. Users may not understand that when the app is open and their phone’s NFC antenna is on, their payment card is considered “armed and ready.”

Except during the onboarding process, no instruction is given to the user regarding how to pay—that is, how to hold the phone over the reader or what to look for in a store that accepts NFC (only when reader is tapped without opening the app do you see an instructional diagram with tips on how it works).

Feedback

Strengths:

When something goes wrong, Google Wallet displays helpful instructions, telling the user to try the tap again or check with the cashier for confirmation (Figure 3-5).

If the NFC antenna of the phone is turned off, or another NFC wallet is in use,[45] Google Wallet informs the user as soon as she opens the app rather than waiting until she attempts to pay (Figure 3-6). The error messages also give the user a button to tap that will bring her to the screen in her device’s Settings menu where she can quickly rectify the issue.

Weaknesses:

Transaction feedback (refer back to Figure 3-4, center) is vague: “Requesting transaction...” feels like the app is asking permission to make a payment, when in fact the payment has already happened. Something less robotic-sounding, like simply “Paying now...” or “Payment completing...” would be more effective.

Even on “smarter” readers that can return rich transaction data (amount, currency, merchant name, address) the Transaction History in the app may not reflect this information right away. More information about the purchase may not display until the payment is processed and reported back via the Wallet’s cloud services (which requires data network access).

Security

Strengths:

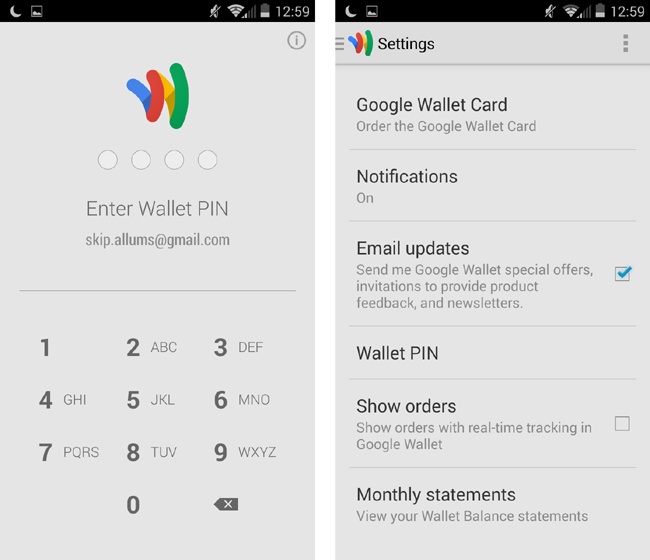

The user is greeted with his account identifier (Gmail address) when the app starts up (Figure 3-7, left), which is a nice touch of personalization that says, “this app remembers me.”

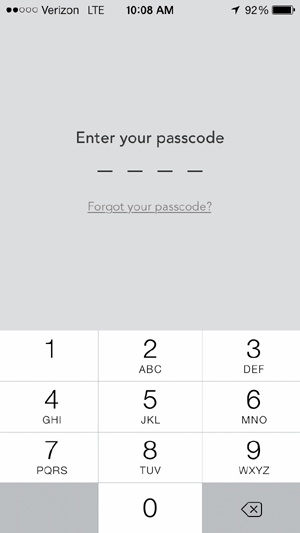

The passcode lockout feature activates after 15 minutes or 1 day of user inactivity. The passcode is also used to “lock” the app to prevent fraud, and allow for authorization of larger purchases—say, over $150.

Progressive numeric fields are used as opposed to one long field, allowing for quick passcode entry, in four taps (similar to a phone lock screen). The app uses a custom keypad, rather than the stock OS one, which prevents eavesdropping by any malicious apps that may be installed somewhere on the device (Figure 3-7, left).

The user (or thief) has six attempts to get the passcode correct. Exceeding this limit locks the app and blocks any card data present in the OS memory to be invalidated by the cloud service.

Weaknesses:

The wallet passcode is labeled as a “PIN,” so debit card users might be tempted to reuse their ATM PIN, which is risky. A safer label might be mPIN or passcode.

There’s no indication of help if the user forgets his passcode until he enters an incorrect one, at which point a “Forgot PIN?” link displays.

Isis

Isis is the other significant NFC wallet in the US, and is a joint venture between the three major carriers: Verizon, AT&T, and T-Mobile. Because Isis is managed by network carriers, customers’ card information is usually stored in a secure element installed on their SIM card. The service first trialed in Austin and Salt Lake City, and launched to a wider audience in the fall of 2013. Isis reports having up to 20,000 activations per day as of April 2014, and now is often preloaded by the carriers on supported Android phones.[46]

Like Google Wallet, Isis navigated some rough waters at the outset in terms of merchant/carrier alignment and hasty redesigns, resulting in a series of launch dates being pushed back. Now the service is poised to gain significant adoption in the US market, given its availability on the big three carriers. Isis has made preemptive strikes to address the key challenges of the mobile wallet experience: adoption and value-added services, like offers and loyalty cards. In the two cities where the app was piloted (Salt Lake City and Austin), Isis took on the cost of upgrading many local merchants’ POS systems to support NFC payments. This allowed more merchants to accept it, leading to around 10 transactions a week from Isis wallet users.[47] Isis also incorporated an NFC offer and loyalty card system from participating merchants, which could be redeemed at the register with one tap (i.e., payment plus an offer, payment plus loyalty point, etc.).

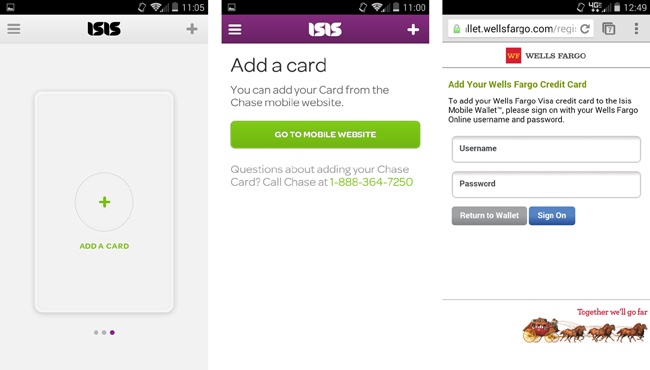

Isis was also able to bring more card issuers on board, allowing for customers of Chase, American Express, and Wells Fargo to download their cards to the wallet.

Overall design

Strengths:

Helpful instructions are displayed during the onboarding process (Figure 3-8), guiding the user through setup and payments.

The app includes familiar navigation patterns, and has a contemporary look and feel.

Like Google Wallet, Isis comes with a prepaid card from American Express Serve, so the user doesn’t have to add her bank cards to the app if she’s hesitant due to security concerns.

Users are rewarded with cash back for purchases made with the app, and given discounts from a handful of large brands that have partnered with Isis (e.g., Jamba Juice, Foot Locker, Toys R Us, and Coca Cola).

Users can also add a few loyalty cards to the app, which automatically count any purchases made to the merchant’s loyalty system or points aggregator.

A map search is included for nearby participating merchants.

Weaknesses:

There is no customization of cards or card nicknames.

There is no transaction history to show the user a log of payment activity, acting as a digital receipt.

The onboarding process is somewhat fragmented, with web-based enrollment of cards, rather than enrollment being handled within the app (Figure 3-9). When the user taps the Add Card button, she’s taken to the phone’s web browser to fill out her card issuer’s enrollment form. This was likely to accommodate the disparate authentication requirements for the three card issuers. It’s a subtle difference, but a significant one—users may view jumping around between parallel apps to be too much trouble, and this design opens up the probability of navigation issues or service errors. More importantly, it may discourage users who are wary of logging into their bank’s web services using their phone.

Payments

Strengths:

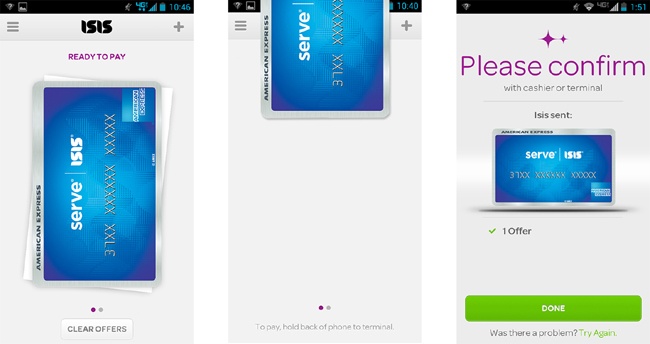

The Ready to Pay indicator (Figure 3-10, left) shows when a card is ready to pay.

Subtle instructions tell the user how to hold the phone over the reader, by placing the back of the phone (where the NFC antenna is) over the reader at the register.

The card slides up when the reader (Figure 3-10, center) is detected, giving a clear indication that a payment has begun.

Weaknesses

When an Offer (e.g., $5 off at Jamba Juice) is turned on by the user, there is not much indication on the Pay screen (Figure 3-10, left) of which offer is turned on. The only clue is a button with a vague label, Clear Offers.

Likewise, when the payment is done (Figure 3-10, right), it doesn’t tell the user which offer was applied to the purchase. He has to rely on the cashier or the paper receipt for this confirmation.

Feedback

Strengths:

The animation, sounds, and vibration paired with messaging is general enough to show that a payment has been attempted, without any conflicting messaging from the point-of-sale reader (for instance, if the card was declined, or did not complete for some other reason).

The confirmation screen clearly shows which card was used for the transaction (Figure 3-11).

Flipping a card image over reveals basic details about each card in the wallet, such as the last four or five digits of the card, and the type of card it is. The back of the Serve prepaid card is especially helpful. It shows the last known balance, so the user knows how much she can spend, and has links to add more money or use the cards for bill payments online.

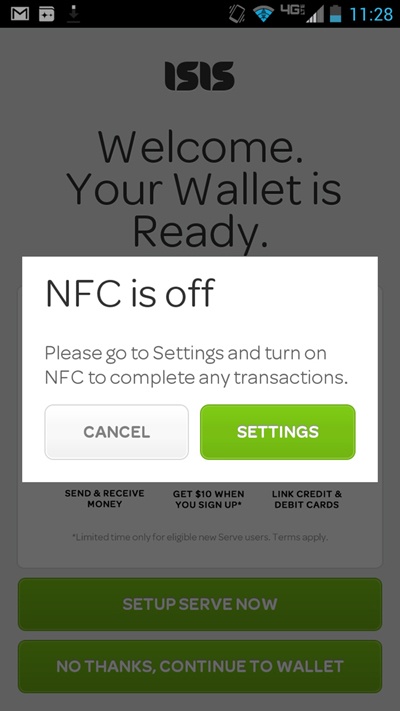

If the user opens the app when her phone’s NFC antenna is switched off, an alert pops up to inform her and show her where to turn it back on (Figure 3-12).

The display of transaction details is fairly vague (Figure 3-11). For example, it doesn’t display the amount of the purchase, the name of the merchant, which offer was redeemed, or which loyalty card was used. The screen doesn’t seem definitive.

The user must still rely on the cashier or the POS to tell her whether the payment was successful.

Security

Strengths:

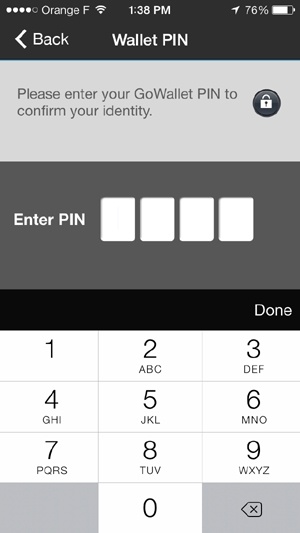

The PIN screen uses a large, custom numeric keypad, instead of using the stock OS keypad (see Figure 3-13, left).

The user can lock his app using his PIN at any time—a Lock Wallet button is readily available from the slide-out menu (see Figure 3-13, right).

As with most NFC wallets, the user’s card data is stored inside the device on the SIM card, in an encrypted container.

The user’s name, email address, or full card numbers are never stored or displayed in the UI, which reduces exposure of financial data.

Weaknesses:

As with Google Wallet, the passcode is labeled as a PIN (which may put cardholders at risk if they use their debit card PIN).

The letters on the keypad aren’t really necessary, as most users opt for numeric passcodes, especially when they are meant to be four digits or characters.

Cloud Wallets

PayPal

PayPal was one of the first innovators in mobile money, dating back to the company’s inception as a way to send money between Palm Pilots. It came to prominence in payments when it became part of the eBay ecosystem, facilitating payments between buyers and sellers over the Web.

PayPal acts more like a banking app: you can send money to others, take pictures of checks to deposit money into your balance, or simply use it as a helpful proxy for web shopping carts so you don’t have to enter all your credit card information to check out. In-store payments are just one feature in a suite of mobile money functions.

As we saw in the previous chapter, though PayPal stores all your funding sources in the cloud (linked cards, bank accounts, or prepaid balance), the app is agnostic when it comes to how users pay once they find a shop that uses it. They might check in to the merchant if they are within range, and the merchant sees the user pop up on its own PayPal POS app. The user might place an order for pickup from the app. PayPal has also partnered with large retailers like Home Depot and Dollar General to let users enter their mobile phone and PIN at the register—no phone required. It doesn’t stop there. PayPal is usually on the cusp of any new technology that could aid in faster and safer mobile transactions, including using Bluetooth Low Energy beacons to check users into a store, scanning QR codes on a bill at a restaurant, and employing fingerprint scanning technology to unlock the app or authorize purchases.

Overall design

Strengths:

Users can link several cards and bank accounts to the app, or preload their Wallet Balance. This gives them more options to check out with.

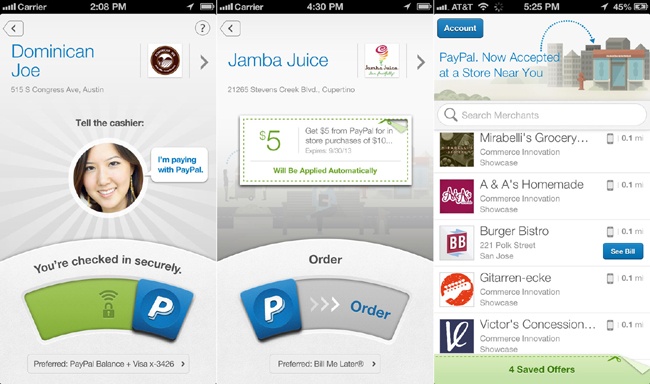

Because PayPal uses various payment methods, the list of accepting merchants is greater than that for most cloud-based wallets (see Figure 3-14 for an example of two payment options, and a list of merchants).

Users can browse nearby merchants without having to log in first.

The app is available for Apple, Android, and Windows devices.

Weaknesses:

The app depends on data connectivity in order for the user to be able to log in, pay, place an order, or really do anything other than browse for nearby merchants.

Payments

Strengths:

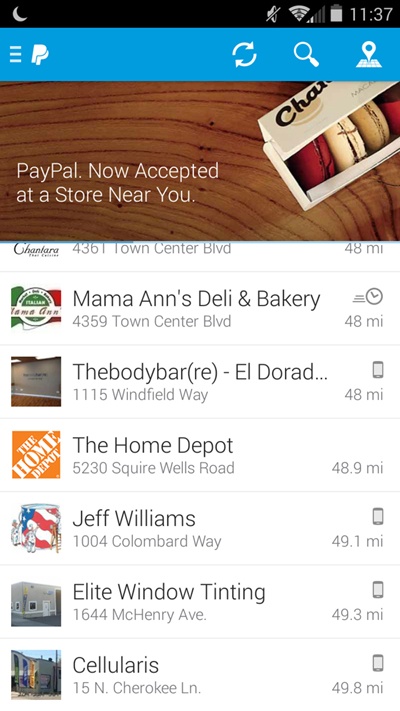

The app shows the user a comprehensive list of all the nearby merchants, which can be browsed in map or list views (Figure 3-15). The distance and the address of each shop are easy to find.

Icons and buttons clue users in as to which kind of payment they take: a clock or button for pre-paying for something they’ll come in to pick up later or have delivered, a phone for merchants who will see users check in and charge their PayPal account for the order, and no icon for larger chains that accept just a phone number and PIN at checkout (Figure 3-16).

Weaknesses:

Experiences are fragmented. Though it is convenient that so many merchants accept PayPal, the three different checkout flows are so drastically different that the user isn’t quite sure what to expect from each transaction (Figure 3-16).

For remote ordering, PayPal may pass the user off to a third-party site, like EAT24, to complete the transaction.

Remote ordering and check-in payments require a data connection.

Feedback

Strengths:

The user is kept informed with helpful error messaging written in plain English, without any technical jargon.

Users are provided a transaction history with a robust record of recent payments (Figure 3-17). Wallet balances are clearly displayed.

A data connection is required, so a digital receipt is not immediate and may be delayed if the connection is slow.

The user is still fairly reliant on the store cashier to verbally confirm whether the payment was successful.

Security

Strengths:

The full details of the user’s linked cards and bank accounts are never displayed on screen (just the last four card or account numbers).

Most activities like transfers and payments or changing account settings can be accessed only in password-protected areas of the app.

Users can lock the app with either their PayPal email and password, or their phone number and PIN (Figure 3-18). This lets them enter the app with the security credential they feel most comfortable with (or can remember at the time).

Weaknesses:

Sensitive user data, such as home addresses and expiration dates, is displayed for some stored cards. These are completely unnecessary to show in the app. If this information is cached in the OS memory, it can be exposed.

Complex passwords (mix of letters, symbols, and numbers) are not required.

The PIN fields in the app use the OS keyboard (Figure 3-18), which could expose users’ PINs to any malicious apps that may be running in parallel on the device.

LevelUp

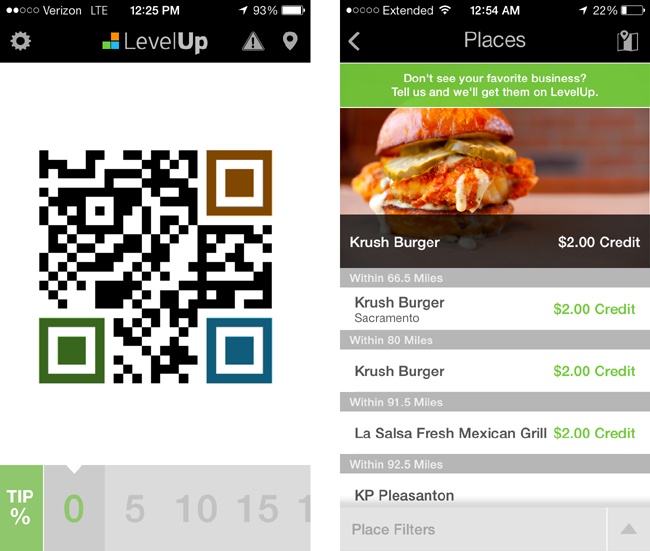

Founded by Boston-based mobile gaming shop SCVNGR, LevelUp payments are centered on the use of QR codes to transact, while tying in loyalty points and offers for a growing number of participating merchants. LevelUp boasts a user base of a million people and close partnerships with small businesses and financial institutions. LevelUp links its QR code payments to the user’s credit or debit card, which is stored outside the LevelUp servers by payment processor Braintree. Merchants use a phone or tablet with the LevelUp POS app, and can scan customers’ QR codes with their own device’s camera or a proprietary scanner accessory. LevelUp is exploring the use of code scanner/NFC reader combinations, which suggests a more agnostic approach to conducting transactions on a mobile device.

Overall design

LevelUp maintains a cheerful and consistent design across several platforms (iPhone, Android, and Windows Phone).

The design is simple, with no frills. There are no overwhelming menus or processes, and onboarding (which starts from the screen shown in Figure 3-19) is fairly quick and pain free.

The merchant directory search results (Figure 3-20, right) are displayed in a logical manner, calling out enticing offers.

Payments

Strengths:

The app is ready to present to the reader as soon as it opens (Figure 3-20, left); no additional taps or loading times are needed.

Users can add a tip to their bill using the tip slider at the bottom of the screen, which changes the QR code accordingly.

The QR code itself is large, so it’s easy for merchants to scan.

Weaknesses:

A data connection is required for the user to get a digital receipt in the form of an SMS or push notification.

It can only be used at merchants that also have the LevelUp POS app.

Feedback

Strengths:

Within a minute or so after the merchant accepts payment, the user can view an itemized receipt.

The receipt is usually accompanied by a visualization showing how much more the user needs to spend at a particular shop to earn cash back (Figure 3-21).

Weaknesses:

A data connection is required, so the receipt takes some time to display and may be delayed if the connection is slow.

The transaction history is oddly buried under Settings; it could be more prominent in the navigation.

Security

Strengths:

LevelUp lets the user set an optional four-digit passcode or PIN to lock the app (Figure 3-22).

The app uses a custom keypad, rather than using the stock OS keypad.

Detailed information about credit or debit cards is never shown in the app, and in fact the user’s card information is stored by payment gateway Braintree. The app relies on a tokenization system instead to process payments via the QR codes, which are randomly generated for each user.

Weaknesses:

There’s no clear way for users who have forgotten their passcode to reset it or receive a reminder, unless they block the app after five incorrect attempts.

Closed Loop

Starbucks

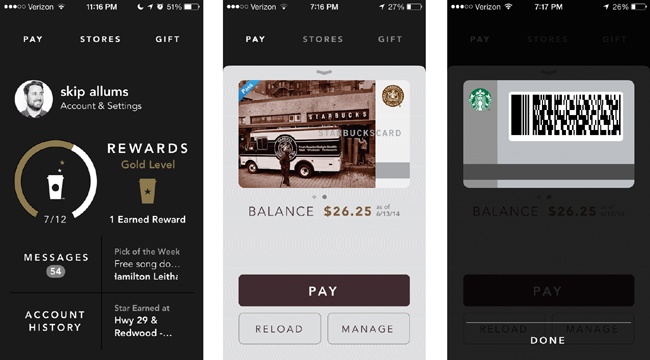

Starbucks is the most widely used mobile payment app in the US, with 10 million active users as of March 2014.[48] The Starbucks app acts as a “gateway drug” for consumers who are hesitant about using their phones to pay for goods and services. If their phone is lost or stolen, consumers are only at risk of losing the money they’ve added to their reloadable Starbucks card. Credit cards and PayPal accounts can be linked to the app for autoreloads as well.

The app stores the barcode and card number of the user’s Starbucks gift cards, which can be reloaded as needed. The barista scans the card’s barcode to process payment. The payment experience is part of a suite of features like a store locator, rewards tracker, and gift card ordering. Starbucks is also integrated with Apple’s Passbook, which aggregates gift card and ticketing features from a variety of iOS apps.

Overall design

Strengths:

Rather than using a more traditional tab bar or slide-out menu, the app has a dashboard (Figure 3-23, left) that gives the user fast access to payments, as well as spending history and a store locator.

The app encourages repeat visits with free drink rewards by showing graphs and animations to indicate the user’s progress to the next reward milestone.

Payments

Strengths:

Payments with the Starbucks app are very simple: present the barcode of the user’s registered Starbucks card to a barcode scanner attached to the point of sale.

Users may also redeem drink rewards using the same barcode.

Screen brightness is automatically adjusted to the brightest setting for easier scanning.

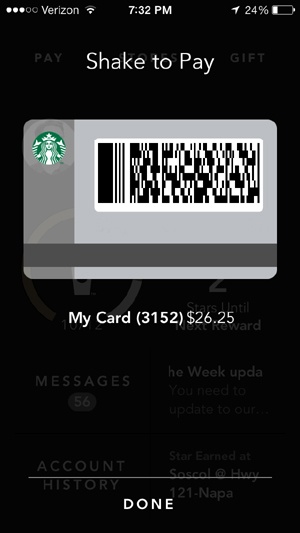

A shortcut feature called “Shake to Pay” (Figure 3-24) lets users pull up their Starbucks card to pay from any point in the experience.

Payments can still be processed even if there is no data connectivity.

Weaknesses:

The dashboard is heavily weighted to rewards and marketing messages.

The button for Pay is at the top left of the screen, which makes it difficult to reach during one-handed use.

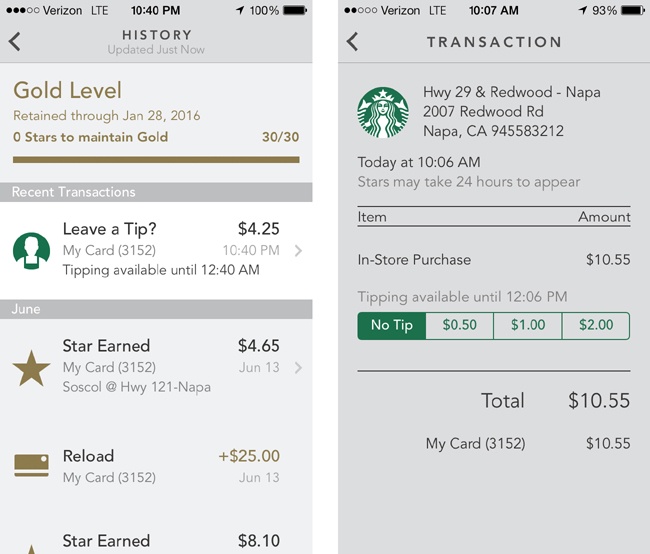

Feedback

Strengths:

Shortly after the purchase, the user is shown a receipt, which displays the store information, time, and date, along with the amount and which card was used (Figure 3-25, left).

The tip feature lets users choose from preset amounts to add after the payment has already been made.

Weaknesses:

The user must still rely on the cashier to confirm whether the card has scanned correctly.

The app never shows a confirmation of payment during the interaction, unless the user actively goes back to the Dashboard and taps on Account History.

An itemized receipt is sometimes delayed, though the user eventually receives a push notification with an updated balance.

It may take a few minutes for the card balance to update within the app, if the data connection is slow.

Security

Strengths:

Even though the financial risk to consumers is low, Starbucks still allows them to lock the app with a four-digit passcode (Figure 3-26).

The app uses the term passcode instead of PIN and follows best practices for numeric passcode patterns.

The passcode is “offline,” so no data connection is needed to access the app.

Weaknesses:

Because the app uses a barcode, a thief could just as easily take a screenshot of your barcode if the phone is left unattended, and use that at checkout.

GoWallet

GoWallet is an app built by the Blackhawk Network, which provides payment card technology services to major financial institutions and retailers. GoWallet offers a mobile version of its impressive catalog of aggregated retailer gift cards. You have probably seen its gift card mall kiosks and end caps in large grocery or retail chains.

Remember that stack of gift cards that you got for Christmas from distant relatives? The cards will probably sit in the back of your junk drawer, until you find them months later when digging around for a flashlight. Around $1 billion in gift cards goes unused every year, often because we forget to put them in our wallet or purse before we head out to shop.[49] With GoWallet, consumers can import their gift cards (say, from Safeway, Burger King, or Home Depot) into the app, and use them at the register by displaying a barcode. This helpful feature does away with the need to carry around that $20 Applebee’s gift card “just in case”; now it’s right there in your phone! GoWallet also has a large catalog for purchasing digital gift cards from its product line, which you can then send to your friends.

Overall design

Strengths:

GoWallet uses familiar navigation patterns that follow the relevant platform (e.g., iOS, Android) guidelines.

Gift cards are presented in an easy-to-use list view (Figure 3-27, left), which resembles slots in a physical wallet.

The app is complemented by features like balance tracking and reloading for each card.

The app can store several cards from any supported retailer, so it reduces the number of plastic gift cards the user must carry around.

Weaknesses:

Many UI elements have no visual touch feedback, leaving the app feeling somewhat flat and unresponsive.

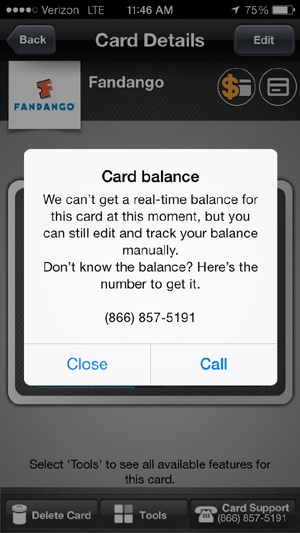

There are several buttons with mysterious icons that require excessive pop ups and dialogs to explain their function. In Figure 3-28, for example, the dollar sign icon means “real-time balances may not be available,” and the card icon means “please keep your original plastic card.”

Payments

Strengths:

Tapping the Redeem button on a GoWallet card displays a large barcode in landscape view, which makes for easy scanning at the register (Figure 3-28).

If the barcode can’t be read by the scanner, a numeric redemption code is also clearly displayed, so that the merchant can read it if necessary.

Weaknesses:

There is often an excessive lag (a loading dialog) between the time the user taps the Redeem button and the barcode displays, which slows down the checkout experience.

Feedback

GoWallet can’t really tell the user when a payment has happened or for how much. He has to rely on POS for confirmation.

The card’s balance does not update after the user closes the barcode screen after a payment. He must tap the Refresh button to get a new balance update. It’s best to avoid extra steps like these.

Some cards don’t have balance checks at all, so users are directed to track it “manually” or to call a service number to check the balance (Figure 3-29).

Security

GoWallet allows the user to set a PIN for protecting her stored gift cards (Figure 3-30).

Weaknesses:

The app allows several incorrect entries, which opens it up to brute-force PIN hacking.

GoWallet uses a native keypad, which opens it up to malicious pattern-recognition attacks (especially on rooted Android devices).

There’s no clear way for the user to reset her PIN if she has forgotten it.

Summary

Though all of the apps covered in this chapter are essentially doing one thing—enabling users to make purchases using their phones—the user experience of each has subtle differences. Regardless of the technology these apps are built upon (the cloud, NFC, etc.), the more successful experiences have solid payment flows and clear feedback at the point of sale. Personal privacy is top of mind for most mobile payment users, so payment apps must also have some kind of locking or failsafe mechanisms to prevent theft or misuse. Less successful interactions are those that are ambiguous, leaving users unsure of what has transpired once they’re checking out.

[45] This tends to happen with Android phones running OS 4.4 or above, where HCE (host card emulation) allows for multiple NFC wallets on one phone. The phone’s NFC controller can use only one wallet at a time, and the user can usually set one wallet as the “default.”

[46] Michael Abbott, “Averaged 20,000 New Isis Wallets Per Day Over the Last Month; Growth Rate Doubled Over Prior Month; Preloaded on 14 Devices with More Coming,” May 14, 2014 (http://bit.ly/1oewyiH).

[47] Dan Balaban, “Isis Gears Up for National Launch Despite Challenges Ahead,” NFC Times, May 23, 2013 (http://bit.ly/1oewIXg).

[48] “Starbucks Mobile Payment App Nears 4M Transactions Per Week,” Mobile Payments Today, March 12, 2014 (http://onforb.es/1wRlyfV).

[49] Quentin Fottrell, “$1 Billion in Gift Cards Go Unredeemed in 2013,” MarketWatch.com, December 2, 2013 (http://on.mktw.net/1oewYWg).