2

Behavioral Finance

Jay R. Ritter

1. INTRODUCTION

Behavioral finance is the paradigm where financial markets are studied using models that are less narrow than those based on Von Neumann-Morgenstern expected utility theory and arbitrage assumptions. Specifically, behavioral finance has two building blocks: cognitive psychology and the limits to arbitrage. Cognitive refers to how people think. There is a huge psychology literature documenting that people make systematic errors in the way that they think: they are overconfident, they put too much weight on recent experience, etc. Their preferences may also create distortions. Behavioral finance uses this body of knowledge, rather than taking the arrogant approach that it should be ignored. Limits to arbitrage refers to predicting in what circumstances arbitrage forces will be effective, and when they won't be.

Behavioral finance uses models in which some agents are not fully rational, either because of preferences or because of mistaken beliefs. An example of an assumption about preferences is that people are loss averse – a $2 gain might make people feel better by as much as a $1 loss makes them feel worse. Mistaken beliefs arise because people are bad Bayesians. Modern finance has as a building block the Efficient Markets Hypothesis (EMH). The EMH argues that competition between investors seeking abnormal profits drives prices to their “correct” value. The EMH does not assume that all investors are rational, but it does assume that markets are rational. The EMH does not assume that markets can foresee the future, but it does assume that markets make unbiased forecasts of the future. In contrast, behavioral finance assumes that, in some circumstances, financial markets are informationally inefficient.

Not all misvaluations are caused by psychological biases, however. Some are just due to temporary supply and demand imbalances. For example, the tyranny of indexing can lead to demand shifts that are unrelated to the future cash flows of the firm. When Yahoo was added to the S&P 500 in December 1999, index fund managers had to buy the stock even though it had a limited public float. This extra demand drove up the price by over 50% in a week and over 100% in a month. Eighteen months later, the stock price was down by over 90% from where it was shortly after being added to the S&P.

If it is easy to take positions (shorting overvalued stocks or buying undervalued stocks) and these misvaluations are certain to be corrected over a short period, then “arbitrageurs” will take positions and eliminate these mispricings before they become large. But if it is difficult to take these positions, due to short sales constraints, for instance, or if there is no guarantee that the mispricing will be corrected within a reasonable timeframe, then arbitrage will fail to correct the mispricing.1 Indeed, arbitrageurs may even choose to avoid the markets where the mispricing is most severe, because the risks are too great. This is especially true when one is dealing with a large market, such as the Japanese stock market in the late 1980s or the U.S. market for technology stocks in the late 1990s. Arbitrageurs that attempted to short Japanese stocks in mid-1987 and hedge by going long in U.S. stocks were right in the long run, but they lost huge amounts of money in October 1987 when the U.S. market crashed by more than the Japanese market (because of Japanese government intervention). If the arbitrageurs have limited funds, they would be forced to cover their positions just when the relative misvaluations were greatest, resulting in additional buying pressure for Japanese stocks just when they were most overvalued!

2. COGNITIVE BIASES

Cognitive psychologists have documented many patterns regarding how people behave. Some of these patterns are as follows:

Heuristics

Heuristics, or rules or thumb, make decision-making easier. But they can sometimes lead to biases, especially when things change. These can lead to suboptimal investment decisions. When faced with N choices for how to invest retirement money, many people allocate using the 1/N rule. If there are three funds, one-third goes into each. If two are stock funds, two-thirds goes into equities. If one of the three is a stock fund, one-third goes into equities. Recently, Benartzi and Thaler (2001) have documented that many people follow the 1/N rule.

Overconfidence

People are overconfident about their abilities. Entrepreneurs are especially likely to be overconfident. Overconfidence manifests itself in a number of ways. One example is too little diversification, because of a tendency to invest too much in what one is familiar with. Thus, people invest in local companies, even though this is bad from a diversification viewpoint because their real estate (the house they own) is tied to the company's fortunes. Think of auto industry employees in Detroit, construction industry employees in Hong Kong or Tokyo, or computer hardware engineers in Silicon Valley. People invest way too much in the stock of the company that they work for.

Men tend to be more overconfident than women. This manifests itself in many ways, including trading behavior. Barber and Odean (2001) recently analyzed the trading activities of people with discount brokerage accounts. They found that the more people traded, the worse they did, on average. And men traded more, and did worse than, women investors.

Mental Accounting

People sometimes separate decisions that should, in principle, be combined. For example, many people have a household budget for food, and a household budget for entertaining. At home, where the food budget is present, they will not eat lobster or shrimp because they are much more expensive than a fish casserole. But in a restaurant, they will order lobster and shrimp even though the cost is much higher than a simple fish dinner. If they instead ate lobster and shrimp at home, and the simple fish in a restaurant, they could save money. But because they are thinking separately about restaurant meals and food at home, they choose to limit their food at home.

Framing

Framing is the notion that how a concept is presented to individuals matters. For example, restaurants may advertise “early-bird” specials or “after-theatre” discounts, but they never use peak-period “surcharges.” They get more business if people feel they are getting a discount at off-peak times rather than paying a surcharge at peak periods, even if the prices are identical. Cognitive psychologists have documented that doctors make different recommendations if they see evidence that is presented as “survival probabilities” rather than “mortality rates,” even though survival probabilities plus mortality rates add up to 100%.

Representativeness

People underweight long-term averages. People tend to put too much weight on recent experience. This is sometimes known as the “law of small numbers.” As an example, when equity returns have been high for many years (such as 1982–2000 in the U.S. and western Europe), many people begin to believe that high equity returns are “normal.”

Conservatism

When things change, people tend to be slow to pick up on the changes. In other words, they anchor on the ways things have normally been. The conservatism bias is at war with the representativeness bias. When things change, people might underreact because of the conservatism bias. But if there is a long enough pattern, then they will adjust to it and possibly overreact, underweighting the long-term average.

Disposition Effect

The disposition effect refers to the pattern that people avoid realizing paper losses and seek to realize paper gains. For example, if someone buys a stock at $30 that then drops to $22 before rising to $28, most people do not want to sell until the stock gets to above $30. The disposition effect manifests itself in lots of small gains being realized, and few small losses. In fact, people act as if they are trying to maximize their taxes! The disposition effect shows up in aggregate stock trading volume. During a bull market, trading volume tends to grow. If the market then turns south, trading volume tends to fall. As an example, trading volume in the Japanese stock market fell by over 80% from the late 1980s to the mid-1990s. The fact that volume tends to fall in bear markets results in the commission business of brokerage firms having a high level of systematic risk.2

One of the major criticisms of behavioral finance is that by choosing which bias to emphasize, one can predict either underreaction or overreaction. This criticism of behavioral finance might be called “model dredging.” In other words, one can find a story to fit the facts to ex post explain some puzzling phenomenon. But how does one make ex ante predictions about which biases will dominate? There are two excellent articles that address this issue: Barberis and Thaler (2002), and Hirshliefer (2001). Hirshliefer (p. 1547) in particular addresses the issue of when we would expect one behavioral bias to dominate others. He emphasizes that there is a tendency for people to excessively rely on the strength of information signals and under-rely on the weight of information signals. This is sometimes described as the salience effect.

3. THE LIMITS TO ARBITRAGE

Misvaluations of financial assets are common, but it is not easy to reliably make abnormal profits off of these misvaluations. Why? Misvaluations are of two types: those that are recurrent or arbitrageable, and those that are non-repeating and long-term in nature. For the recurrent misvaluations, trading strategies can reliably make money. Because of this, hedge funds and others zero in on these, and keep them from ever getting too big. Thus, the market is pretty efficient for these assets, at least on a relative basis. For the long-term, nonrepeating misvaluations, it is impossible in real time to identify the peaks and troughs until they have passed. Getting in too early risks losses that wipe out capital. Even worse, if limited partners or other investors are supplying funds, withdrawals of capital after a losing streak may actually result in buying or selling pressure that exacerbates the inefficiency.

Just who are these investors who make markets efficient? Well, one obvious class of investors who are trying to make money by identifying misvaluations are hedge funds. A relative value hedge fund takes long and short positions, buying undervalued securities and then finding highly correlated securities that are overvalued, and shorting them. A macro hedge fund, on the other hand, takes speculative positions that cannot be easily hedged, such as shorting Nasdaq during the last two years.

How well do efforts by arbitrageurs to make money work in practice at making markets more efficient? As Shleifer and Vishny argue in their 1997 “Limits to Arbitrage” article, the efforts of arbitrageurs to make money will make some markets more efficient, but they won't have any effect on other markets.

Let's look at an example, that of a giant hedge fund, Long Term Capital Management. LTCM was founded about nine years ago by Myron Scholes, Robert Merton, John Meriwether, and others. For their first three or four years, they were spectacularly successful. But then, four years ago, they had one bad quarter in which they lost $4 billion, wiping out their equity capital and forcing the firm to liquidate. But they were right in the long run!

LTCM mainly traded in fixed income and derivative markets. But one of the ways that they lost money was on the Royal Dutch/Shell equity arbitrage trade.

In 1907, Royal Dutch of the Netherlands and Shell of the UK agreed to merge their interests on a 60-40 basis, and pay dividends on the same basis. It is easy to show that whenever the stock prices are not in a 60-40 ratio, there is an arbitrage profit opportunity. Finance theory has a clear prediction. Furthermore, these are large companies. Until July 2002, Royal Dutch was in the S & P 500, and Shell is in the FTSE.

How well does this prediction work?

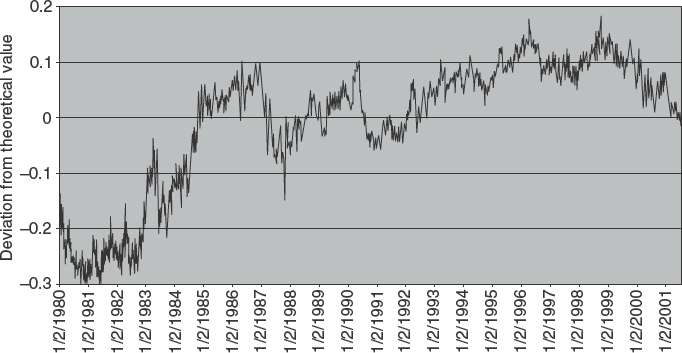

For the last 22 years, from 1980 to 2001, Figure 2.1 demonstrates that there have been large deviations from the theoretical relation. In 1998, LTCM shorted the expensive stock and bought the cheap one. Did they make money? No, they lost money when prices diverged further from their theoretical values during the third quarter of 1998. To meet liquidity needs, LTCM and other hedge funds were forced to sell out their positions, and this selling pressure made markets more inefficient, rather than more efficient. So the forces of arbitrage failed.

The data plotted in Figure 2.1 end in December 2001, with the price ratio close to its theoretical value. Has it stayed there? In July 2002, Standard & Poors announced that Royal Dutch would be dropped from the S&P 500 because they were deleting non-American companies. Royal Dutch dropped by 17% in the week of the announcement, although there is no suggestion that the present value of dividends changed.

Figure 2.1 Deviations from Royal Dutch/Shell parity from January 1980 to December 2001, as computed by Froot and Dabora (1999) and updated by Ken Froot.

So what is the bottom line on market efficiency? It is useful to divide events into two categories – high-frequency events, which occur often, and low-frequency events, which occur only infrequently, and may take a long time to recover from.

The high-frequency evidence supports market efficiency. It is hard to find a trading strategy that is reliably profitable. And mutual funds have difficulty beating their benchmarks. The low-frequency evidence, however, does not support market efficiency. Examples of enormous misvaluations include:

- The undervaluation of world-wide stock markets from 1974–1982.

- The Japanese stock price and land price bubble of the 1980s.

- The Taiwanese stock price bubble that peaked in February 1990.

- The October 1987 stock market crash.

- The technology, media, and telecom (TMT) bubble of 1999–2000.

4. APPLICATIONS OF BEHAVIORAL FINANCE

I would now like to talk about some specific applications of behavioral finance. While I could choose from many applications, I am going to briefly discuss two of my recent publications. The first application concerns inflation and the stock market. I'm going to start out with a simple valuation question. Below, I list some specific assumptions about a hypothetical firm, and the question is, “How much is the equity of this firm worth?”

Assumptions: The inflation rate is 6%, and the equity risk premium is zero, so the nominal cost of capital is 10% (a real cost of capital of 4%). The firm wants to keep the real value of its debt unchanged, so it must increase the nominal amount of debt by 6% each year. There is no real growth, and all free cash flow (if any) is paid out in dividends.

| Revenue | $1,200,000 |

| Cost of Goods Sold | $600,000 |

| Administrative Expenses | $400,000 |

| Interest Expense | $200,000 |

| Taxes | $0 |

| After-tax profits | $0 |

| Debt | $2,000,000 |

| Book Equity | $1,500,000 |

| Shares outstanding | 10,000 |

| Interest rate on debt | 10% |

With inflation at 6% and $2 million in debt, the firm must issue $120,000 more debt next year to keep the real value of its debt constant. This cash can be used to pay dividends. This is $12 per share, and using the growing perpetuity formula

P = Div1/(r − g)

with r = 10% and g = 6%, P = $12/(0.10 − 0.06) = $300 per share.

So the equity is worth $3 million, or $300 per share. Earnings are zero because the accountants treat nominal interest expense as a cost, but they don't treat the inflation-induced decrease in the real value of debt as a benefit to equity holders. In other words, the true economic earnings are higher than the accounting earnings, because accountants measure the cost, but not the benefit to equityholders, of debt financing when there is inflation.

This is an example of where framing makes a difference. Nominal interest expense appears on the income statement. The decrease in the real value of nominal liabilities due to inflation does not appear on the income statement. Because it doesn't appear, I would argue that investors don't take it into account, and hence undervalue equities when inflation is high. If you find this implausible, ask yourself “how many finance professors with PhDs get the valuation correct?” If the market makes this mistake, then stocks become riskier, because they fall more than they should when inflation increases, and they rise more than they should when inflation decreases. Over a full inflation cycle, these two effects balance out, which is why stocks are less risky in the long run than they are in the short run (Siegel (1998), Chapter 2).

Modigliani and Cohn (1979) argued that the U.S. stock market was grossly undervalued in the mid- and late 1970s because investors had irrational beliefs about earnings, given the high inflation that existed then. Richard Warr and I, in our March 2002 JFQA article on the decline of inflation and the bull market of 1982–1999, conduct an out-of-sample test of the Modigliani-Cohn hypothesis. We argue that part of the bull market of the 1980s was attributable to a recovery from the undervaluation. We also argue that the continued stock market rise in the 1990s was an overshooting – the stock market became overvalued – and we predicted that 2000–2002 would have low stock returns. Fortunately, I believe in my research, and I've had much of my retirement assets in inflation-indexed bonds the last three years. These have been the best-performing asset class.

The second application of behavioral finance that I would like to briefly discuss concerns the underpricing of IPOs.

Prospect theory is a descriptive theory of choice under uncertainty. This is in contrast to expected utility theory, which is normative rather than descriptive. Prospect theory focuses on changes in wealth, whereas expected utility theory focuses on the level of wealth. Gains and losses are measured relative to a reference point. Prospect theory also assumes loss aversion. Prospect theory also incorporates framing – if two related events occur, an individual has a choice of treating them as separate events (segregation) or as one (integration). For example, if a person goes to the racetrack and makes two bets, winning one and losing one, the person may integrate the outcome and focus on the net payoff. If the net payoff is positive, a gain has occurred, and focusing on this makes the better happy. If there is a net loss, segregating the two bets allows the better to feel disappointed once, but happy once.

Tim Loughran and I use prospect theory in our 2002 RFS paper “Why Don't Issuers Get Upset About Leaving Money on the Table in IPOs?” to explain the severe underpricing of some IPOs. If an IPO is underpriced, pre-issue stockholders are worse off because their wealth has been diluted. We argue that if an entrepreneur receives the good news that he or she is suddenly unexpectedly wealthy because of a higher than expected IPO price, the entrepreneur doesn't bargain as hard for an even higher offer price. This is because the person integrates the good news of a wealth increase with the bad news of excessive dilution. The individual is better off on net. Under-writers take advantage of this mental accounting and severely underprice these deals. It is these IPOs where the offer price has been raised (a little) that leave a lot of money on the table when the market price goes up a lot.

5. CONCLUSIONS

This brief introduction to behavioral finance has only touched on a few points. More extensive analysis can be found in Barberis and Thaler (2003), Hirshliefer (2001), Shefrin (2000), and Shiller (2000).

It is very difficult to find trading strategies that reliably make money. This does not imply that financial markets are informationally efficient, however. Low frequency misvaluations may be large, without presenting any opportunity to reliably make money. As an example, individuals or institutions who shorted Japanese stocks in 1987–1988 when they were substantially overvalued, or Taiwanese stocks in early 1989 when they were substantially overvalued, or TMT stocks in the U.S., Europe, and Hong Kong in early 1999 when they were substantially overvalued, all lost enormous amounts of money as these stocks became even more overvalued. Most of these short-sellers, who were right in the long run, were wiped out before the misvaluations started to disappear. Thus, the forces of arbitrage, which work well for high frequency events, work very poorly for low frequency events.

Behavioral finance is, relatively speaking, in its infancy. It is not a separate discipline, but instead will increasingly be part of mainstream finance.

NOTES

1. Technically, an arbitrage opportunity exists when one can guarantee a profit by, for example, going long in an undervalued asset and shorting an overvalued asset. In practice, almost all arbitrage activity is risk arbitrage – making trades where the expected profit is high relative to the risk involved.

2. During the bear market beginning in April 2000 in the U.S., aggregate stock market volume has not dropped. This is apparently due to increased trading by institutions, since stock trading by individuals has in fact declined. The significant drop in transaction costs associated with the move to decimalization and technological advances partly accounts for this. Another reason is that many firms split their shares in late 1999 and the first half of 2000, which, ceteris paribus, would have resulted in higher trading volume. The drop in commission revenue from individuals (predicted by the disposition effect) has resulted in revenue declines for retail-oriented brokerage firms such as Charles Schwab & Co.

REFERENCES

Barber, Brad, and Terry Odean, 2001. “Boys will be boys: Gender, overconfidence, and common stock investment.” Quarterly Journal of Economics 116, 261– 292.

Barberis, Nicholas, and Richard Thaler, 2003. “A survey of behavioral finance.” In G. Constantinides, M. Harris, and R. Stulz (editors) Handbook of the Economics of Finance, North-Holland, Amsterdam.

Benartzi, Shlomo, and Richard Thaler, 2001. “Naïve diversification strategies in defined contribution savings plans.” American Economic Review 91, 79–98.

Froot, Kenneth A., and Emil A. Dabora, 1999. “How are stock prices affected by the location of trade?” Journal of Financial Economics 53, 189–216.

Hirshleifer, David, 2001. “Investor psychology and asset pricing.” Journal of Finance 56, 1533–1597.

Loughran, Tim, and Jay R. Ritter, 2002. “Why don't issuers get upset about leaving money on the table in IPOs?” Review of Financial Studies 15, 413–443. Modigliani, Franco, and Richard Cohn, 1979. “Inflation, rational valuation and the market.” Financial Analysts Journal 35, 24–44.

Ritter, Jay R., and Richard Warr, 2002. “The decline of inflation and the bull market of 1982–1999.” Journal of Financial and Quantitative Analysis 37, 29–61.

Shefrin, Hersh, 2000. Beyond Greed and Fear, Harvard Business School Press, Boston.

Shiller, Robert J., 2000. Irrational Exuberance, Princeton University Press, Princeton.

Shleifer, Andrei, and Robert Vishny, 1997. “The limits of arbitrage.” Journal of Finance 52, 35–55.

Siegel, Jeremy J., 1998. Stocks for the Long Run, Second Edition, McGraw-Hill, New York.

Reproduced, with minor modifications, from the Pacific-Basin Finance Journal, Vol. 11, No. 4 (September 2003), pp. 429–37.