8

The Value of Share Buybacks

Richard Dobbs and Werner Rehm

Share buybacks are all the rage. In 2004 companies announced plans to repurchase $230 billion in stock – more than double the volume of the previous year. During the first three months of this year, buyback announcements exceeded $50 billion.1 And with large global corporations holding $1.6 trillion in cash, all signs indicate that buybacks and other forms of payouts will accelerate.2

In general, markets have applauded such moves, making buybacks an alluring substitute if improvements in operational performance are elusive. Yet while the increases in earnings per share that many buybacks deliver help managers hit EPS-based compensation targets, boosting EPS in this way doesn't signify an increase in underlying performance or value. Moreover, a company's fixation on buybacks might come at the cost of investments in its long-term health.

A closer inspection of the market's response to buybacks illustrates these risks, since some companies' share price declined – or didn't respond at all. For example, Dell's announcement earlier this year that it would increase its buyback program by an additional $10 billion didn't slow the decline of its share price, which had begun to slide because of worries about operating results.

Buybacks aren't without value. It is crucial, however, for managers and directors to understand their real effects when deciding to return cash to shareholders or to pursue other investment options. A buyback's impact on share price comes from changes in a company's capital structure and, more critically, from the signals a buyback sends. Investors are generally relieved to learn that companies don't intend to do something wasteful – such as make an unwise acquisition or a poor capital expenditure – with the excess cash.

EPS MAY BE UP, BUT INTRINSIC VALUE REMAINS FLAT

Many market participants and executives believe that since a repurchase reduces the number of outstanding shares, thus increasing EPS, it also raises a company's share price. As one respected Wall Street analyst commented in a recent report, “Share buybacks … improve EPS, return on equity, return on capital employed, economic profit, and fundamental intrinsic value.” At first glance, this argument seems to make sense: the same earnings divided by fewer shares results in a higher EPS and so a higher share price. But this belief is wrong.

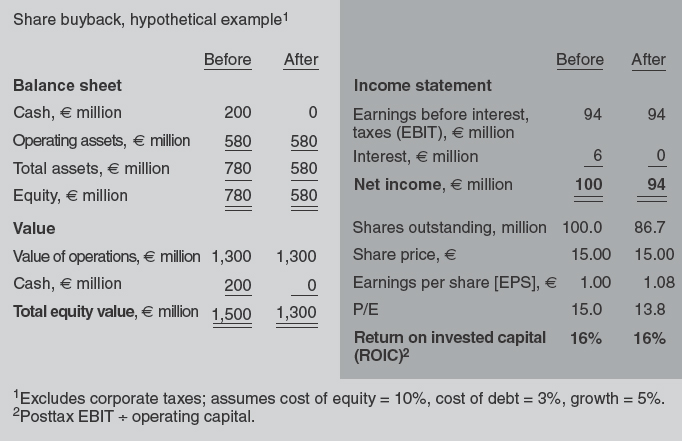

Consider a hypothetical example that illustrates how transferring cash to shareholders creates no fundamental value (setting aside for now a buyback's impact on corporate taxes), because any increase in EPS is offset by a reduction in the P/E ratio. The company's operations earn €94 million annually and are worth €1.3 billion.3 It has €200 million in cash, on which it earns interest of €6 million (Figure 8.1). What happens if the company decides to use all its excess cash to repurchase its stock – in this case, a total of 13.3 million shares?4

Since the company's operations don't change, its return on operating capital is the same after the buyback. But the equity is now worth only €1.3 billion – exactly the value of the operations, since there is no cash left. The company's earnings fall as a result of losing the interest income, but its EPS rises because the number of shares has fallen more than earnings have. The share price remains the same, however, as the total company value has fallen in line with the number of shares. Therefore, the P/E ratio, whose inputs are intrinsic value and EPS, drops to 13.8, from 15. The impact is similar if the company increases debt to buy back more shares.

Why does the P/E ratio decline? In effect, the buyback deconsolidates the company into two distinct entities: an operating company and one that holds cash. The former has a P/E of 13.8; the latter, 33.3.5 The P/E ratio of 15 represents a weighted average of the two. Once the excess cash is paid out, the P/E will go down to that of the operating company, since the other entity has ceased to exist. Thus the change of EPS and P/E is a purely mechanical effect that is not linked to fundamental value creation.

Figure 8.1 No fundamental value from buyback

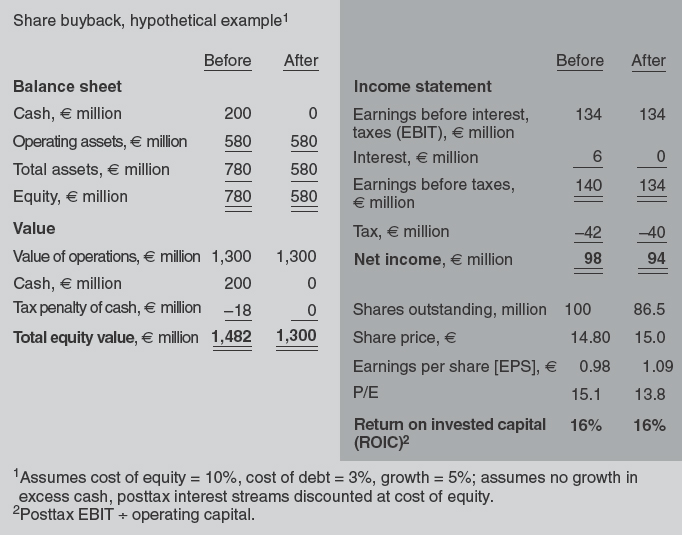

TAXES SHIELD VALUE FROM LEVERAGE

When corporate taxes are part of the equation, the company's value does increase as a result of share buybacks – albeit by a small amount – because its cost of capital falls from having less cash or greater debt. The cost of capital is lower when a company uses some debt for financing, because interest payments are tax deductible while dividends are not. Holding excess cash raises the cost of capital: since interest income is taxable, a company that maintains large cash reserves puts investors at a disadvantage. In general, having too much cash on hand penalizes a company by increasing its cost of financing.

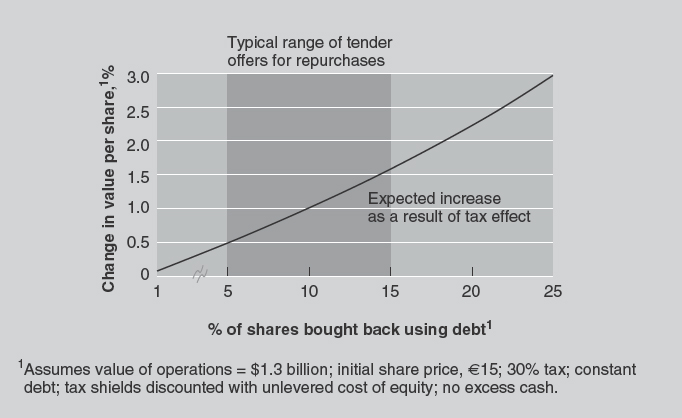

The share price increase from a buyback in theory results purely from the tax benefits of a company's new capital structure rather than from any underlying operational improvement. In the example, the company incurs a value penalty of €18 million from additional taxes on the income of its cash reserves.6 A buyback removes this tax penalty and so results in a 1.4 percent rise in the share price. In this case, repurchasing more than 13 percent of the shares results in an increase of less than 2 percent. A similar boost occurs when a company takes on more debt to buy back shares (Figure 8.2).

We can estimate the impact on share prices from this tax effect (Figure 8.3), but historical and recent buyback announcements typically result in a much bigger rise in share price than this analysis indicates. Research from both academics and practitioners consistently finds that companies initiating small repurchase programs see an average increase in their share price of 2 to 3 percent on the day of the announcement; those that undertake larger buybacks, involving around 15 percent or more of the shares, see prices increase by some 16 percent, on average.7 Other, more subtle reasons explain this larger positive reaction to share buybacks.

SENDING SIGNALS

The market responds to announcements of buybacks because they offer new information, often called a signal, about a company's future and hence its share price.

One well-known positive signal in a buyback is that management seems to believe that the stock is undervalued. Executives can enhance this effect by personally purchasing significant numbers of shares, since market participants see them as de facto insiders with privileged information about future earnings and growth prospects. A second positive signal is management's confidence that the company doesn't need the cash to cover future commitments such as interest payments and capital expenditures.

Figure 8.3 Expected tax impact of buyback

But there is a third, negative, signal with a buyback: that the management team sees few investment opportunities ahead, suggesting to investors that they could do better by putting their money elsewhere. Some managers are reluctant to launch buyback programs for this reason, but the capital market's mostly positive reaction to such announcements indicates that this signal isn't an issue in most cases. In fact, the strength of the market's reaction implies that shareholders often realize that a company has more cash than it can invest long before its management does.

Therefore, the overall positive response to a buyback may well result from investors being relieved that managers aren't going to spend a company's cash on inadvisable mergers and acquisitions or on projects with a negative net present value. In many cases, a company seems to be undervalued just before it announces a buyback, reflecting an uncertainty among investors about what management will do with excess funds.

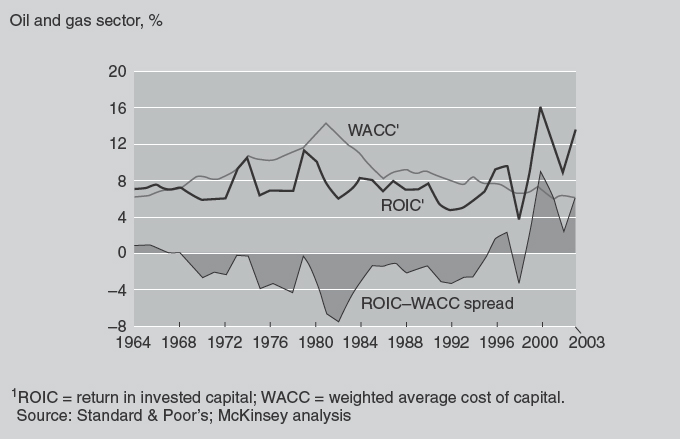

Such shareholder skepticism would be well founded. In many industries, management teams have historically allocated cash reserves poorly. The oil industry since 1964 is one example (Figure 8.4): a huge price umbrella for much of this period, courtesy of the Organization of Petroleum Exporting Countries (OPEC), provided oil companies with relatively high margins. Nevertheless, for almost three decades the spread between ROIC and cost of capital for the industry as a whole was negative. Convinced that on a sustained basis the petroleum industry could not deliver a balanced source of income, many companies committed their excess cash to what turned out to be value-destroying acquisitions or other diversification strategies. For example, in the 1970s, Mobil bought retailer Montgomery Ward; Atlantic Richfield purchased Anaconda, a metal and mining company; and Exxon bought a majority stake in Vydec, a company specializing in office automation. All of these cash (or mostly cash) acquisitions resulted in significant losses.

Figure 8.4 Poor returns on capital

With cash levels at an all-time high and mergers on the increase, managers risk repeating past behaviors. Clearly, for cash-rich industries with insufficient investment opportunities, a critical task for boards will be forcing management to pay out the excess cash sooner rather than later. But by allowing management compensation to be linked to EPS, boards run the risk of promoting the short-term effects of buybacks instead of managing the long-term health of the company. Similarly, value-minded executives in industries where good investment opportunities are still available must resist the pressure to buy back shares in order to reach EPS targets.

In most cases, buybacks create value because they help improve tax efficiency and prevent managers from investing in the wrong assets or pursuing unwise acquisitions. Only when boards and executives understand the difference between fundamental value creation through improved performance and the purely mechanical effects of a buyback program on EPS will they put share repurchases to work creating value.

NOTES

2. US listed companies (excluding financial institutions) valued at more than $1 billion have a total of $1 trillion in cash – nearly 9 percent of their market capitalization. Non-US companies with American Depositary Receipts on US exchanges have about $600 billion in cash and cash equivalents, a solid 12 percent of their market capitalization.

3. Based on a discounted-cash-flow valuation with 5 percent growth.

4. At €15 a share. The calculation assumes the shares are bought back at the current value.

5. A cash value of €200 million divided by €6 million of interest income.

6. Assuming $200 million in cash, a 3 percent interest rate, and a 30 percent tax rate, discounted at the cost of equity of 10 percent. See also Tim Koller, Marc Goedhart, and David Wessels, Valuation: Measuring and Managing the Value of Companies, fourth edition, Hoboken, New Jersey: John Wiley & Sons, 2005 (book information available online), for a discussion of using the cost of equity for discounting instead of the cost of debt. This calculation assumes that the amount of cash doesn't grow and that it is held in perpetuity.

7. Robert Comment and Gregg A. Jarrell, “The relative signaling power of Dutchauction and fixed-price self-tender offers and open-market share repurchases,” Journal of Finance, 1991, Volume 46, Number 4, pp. 1243–71; and Theo Vermaelen, “Common stock repurchases and market signaling: An empirical study,” Journal of Financial Economics, 1981, Volume 9, Number 2, pp. 138–83.

Reproduced from The McKinsey Quarterly, 2005 Number 3.

Copyright © 1992–2005 McKinsey & Company, Inc.