Conceptual building blocks

Abstract:

In this chapter, we review the core conceptual building blocks for the research conducted in this book. The building blocks focus on the growth and development strategy of MNC overseas subsidiaries and the role and functional strategies of MNC overseas subsidiaries. They also include strategy, based on the SWOT model, and strategic evolution of MNC overseas subsidiaries.

Multinational corporations (MNCs)

The concept of the MNC has a very broad meaning. Traditionally, the definition of MNCs tends to be concentrated mainly in structural standards, such as those adopted in the form of the trans-border distribution, production or service facilities, and as an extension of the parent corporation’s domestic operations. With globalisation, distinctions among businesses, countries and marketing are becoming increasingly blurred, thereby generating an evolution in the concept of the MNC. Contractor and Lorange (1988) note, ‘traditionally, multinational corporations can be viewed as a transnational force of nature, the enterprises’ own internal control chain, but in today’s complicated, competitive world, it should be seen as quasi-market transactions inter-dependent on each other.’ Both organisational theory and organisational behaviour factors are becoming important in conceptualising MNCs. Perlmutter (1969), for instance, notes how the values and modes of behaviour of the MNCs usually evolve in three stages: orientation of home country, orientation of host country and orientation of the world. Perlmutter believes that an enterprise can be considered truly a multinational corporation only when it enters the ‘orientation of the world’.

According to the United Nations Commission on Multinational Corporations, MNCs are ‘companies that set up headquarters in another country or region, by two or more countries in the form of public entities, or through private or mixed-ownership enterprises. They have the following common characteristics: (1) they share the title as a link to connect to each other; (2) they rely on the resources in common, such as currency and credit, information systems, trademarks, patents, and technology, etc; (3) they are controlled by a common strategy’ (Zhao, 1996).

For the purposes of this study, the definition of MNCs includes two major aspects: (1) MNCs set up their headquarters in one country and, through direct investments in two or more countries, they set up branches or subsidiaries in the enterprise system; (2) MNCs have a global operational strategy – they endeavour to maximise the overall benefit of synergetic efforts while maintaining a global strategic system as their target, instead of a one-sided pursuit of the best interests of a particular nation.

MNC subsidiaries

When a parent MNC invests directly in a host country, it creates a local subsidiary that has a filial relationship to the parent company (Teng, Huang and Zhang, 1992). Foreign subsidiaries are an extension of the parent MNC, entrusted to achieve specific goals. The concept of MNC subsidiaries has a legal dimension beyond the filial concept in that they are also an individual entity that must operate under the laws of the host country. The subsidiaries have certain autonomy in management and have independent legal status.

A parent MNC maintains strategic control over the subsidiaries in three major ways: equity, organisation and knowledge (Yang, 2000). Organisational control and knowledge control are usually predicated on leveraging securities and shares. The manner in which the parent company exercises equity control over the subsidiary – such as wholly or partially owned structure or joint venture – determines the amount of influence the parent company can exert. Theoretically speaking, an MNC that owns a majority 51 per cent or more of the equity of a subsidiary is able to acquire absolute control. In practice, dispersion of ownership and the diversification of investors allow control with much less than a majority interest of the shares. In all cases, the MNC can also control and coordinate the production and business activities of subsidiaries through many additional means, including strategy, culture, human resources, marketing and financial systems. The parent MNCs also frame and enact strategic direction of their subsidiaries through perpetual executive intervention.

Growth and development strategy system

In this book, the focus is on the strategy of growth and development of multinational subsidiaries. The focus is on the ability of these overseas subsidiaries to invest in the sustainable development of the host country, through strategic choices that consider external and internal environmental factors and resource availability. These choices are both gradually coordinated from the higher levels of business’s hierarchy as well as integrated into the lower levels of the strategic system. The subsidiary growth and development strategic system comprises three synergic levels: corporate, operational and functional.

Corporate-level role of MNC subsidiaries

The overseas subsidiaries of MNCs are controlled by the parent company, while simultaneously engaging in a complex relationship with other subsidiaries and affiliate subsidiaries. Their role is a function of the MNCs’ global network system and is responsible for matching the internal and external resources within this system and exercising specific functions aligned with these resources. The strategic motive of the parent MNC prescribes the strategic mission for the subsidiary and defines certain roles for them, right from the initial and early set-up stage. From the internal analysis of network systems, the subsidiaries have different strategic positions and roles in an MNC network system. The strategic positions are defined by competitive ability and other variances among subsidiary resources. These varying positions are associated with the differences in their global strategy, showing different strategic autonomy, priorities in resource allocation and varying degrees of dependence on the parent company.

Operational strategies of MNC subsidiaries

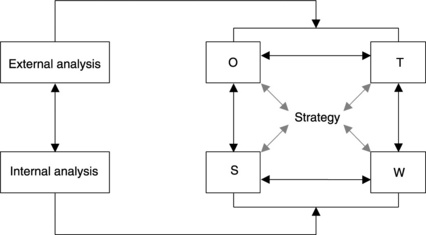

The complex corporate-level role of the subsidiaries makes their strategic choice of organizations–environment analysis different from the usual analysis. Therefore, to identify operational strategies or strategic posture of MNC subsidiaries, it is useful to conduct subsidiary SWOT – identifying the strengths, weaknesses, opportunities and threats of the subsidiary (S-SWOT). Figure 2.1 shows the relationship between S-SWOT analysis and strategy, highlighting four operational choices for growth and development strategy.

1 Strength–opportunity (SO) strategy

The SO strategy works if the enterprise has many external opportunities and a powerful internal advantage. It depends on the internal advantage of a company and its utilisation of external opportunities. If an enterprise has abundant capital, advanced technology and a highly skilled workforce, it should find a market in a country with great development potential and adopt the SO strategy to carve out this new foreign market.

2 Weakness–opportunity (WO) strategy

The WO strategy works if an enterprise has external opportunity but a weak internal system. It stabilises development using the external opportunity to ameliorate the internal disadvantage. An enterprise that is faced with growth in market demand but that lacks technical resources should adopt this strategy.

3 Weakness–threat (WT) strategy

The WT strategy works to improve a poor internal situation, avoid threat and eliminate disadvantages of the external environment. It directly overcomes internal disadvantages and avoids external threat. It helps an enterprise to strengthen internal management and improve product quality.

4 Strength–threat (ST) strategy

The ST strategy works if an enterprise has internal advantage, but faces external threat. It is a strategy of diversification into new markets, to leverage internal advantage and avoid external threats. For example, a pharmaceutical company has strong capital and many marketing channels; however, when domestic demand has gradually shrunk, it should adopt the ST strategy to drive operational growth through the diversification process to decentralised operational risks.

Functional strategies of MNC subsidiaries

This study focuses on three strategic functions: marketing, human resource, and research and development (R&D).

Marketing strategy function includes the marketing strategy’s posture and tropism, competitive marketing strategy, blueprint and marketing combination, blueprint of the subsidiaries, and marketing strategy as a guide to marketing tactics and strategies to implement.

Human resources strategy function is a game plan to develop plans and methods for human talents, to implement such measures and to achieve the strategic goals of the enterprise through human resource management activities. As Wiseman and Gomez-Mejia (1998) noted: ‘enterprises’ careful use of human resources is to help enterprises to obtain and maintain their competitive advantage; it is a plan or method to organise the effective activities of the staff to achievement of the organisational goals.’ Human resource strategy functions include recruitment, selection, pay, training and development, and performance evaluation. The human resource strategy of MNC subsidiaries works at two levels: the vertical interactions between the parent or holding company and its subsidiaries; and the horizontal interactions among subsidiaries within the enterprise group. The vertical interactions between the parent and its subsidiary companies are guided by the human resource policies of the parent corporation, along with investment motivation factors, and by the strategy tropism, role and resource allocation of the overseas subsidiaries. The horizontal interactions among the subsidiaries are usually associated with the MNC competitive strategy and its relation with the MNC human resource management strategy.

The R&D strategy of overseas subsidiaries refers to subsidiaries’ initiatives for their own development, or actions for following the strategic requirements of the global R&D network system of the parent company through the establishment of R&D institutions. It includes allocation of R&D resources including investment in R&D funding, recruitment and training. Multinational subsidiaries are involved in R&D to win sustainable competitive advantage via mapping of future strategic moves.

Strategy evolution of MNC subsidiaries

Changes in global industry and national macroeconomic environment impact the demand for organisational resources, internal networks and accepted roles within an MNC network system and generate strategy evolution of MNC subsidiaries in terms of strategic characteristics, abilities and positions.

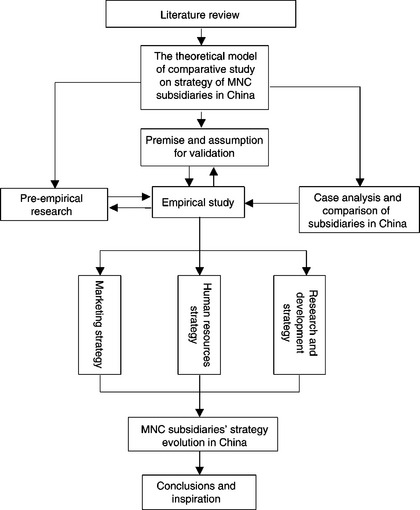

Figure 2.2 summarises the analytical model based on the conceptual building blocks.