A Market Share Multiple Regression Model

Chapter 7 Preview

When you have completed reading this chapter you will be able to:

- Identify what constitutes a market share multiple regression model.

- Arrange your data for use in a market share multiple regression model.

- Determine whether a particular variable ought to be in the model.

- Evaluate the market share model.

- Make a point estimate from the model.

- Calculate a confidence interval for your estimate.

In the previous chapters, you have seen examples of simple linear regressions (those with a single independent variable) and multiple linear regressions (those with more than one independent variable). Now, you will apply these concepts of regression analysis to estimate a model for the market share of a company. Table 7.1 contains the data used in this example: three years of quarterly data related to the market share for Miller’s Foods. The objective is to develop a regression model that explains how Miller’s Foods’ price (P) and advertising (AD), as well as an index of competitors’ advertising (CAD), have influenced the firm’s market share (MS).

Table 7.1 Three years of Miller’s Foods’ market share multiple regression data

|

Period (quarter) |

Market share in M$ (MS) |

Price in $ (P) |

Advertising in $ (AD) |

Competitors’ advertising index (CAD) |

|

1 |

19 |

5.20 |

500 |

11 |

|

2 |

17 |

5.32 |

550 |

11 |

|

3 |

14 |

5.48 |

550 |

12 |

|

4 |

15 |

5.60 |

550 |

12 |

|

5 |

18 |

5.80 |

550 |

9 |

|

6 |

16 |

6.03 |

660 |

10 |

|

7 |

16 |

6.01 |

615 |

10 |

|

8 |

19 |

5.92 |

650 |

10 |

|

9 |

23 |

5.90 |

745 |

9 |

|

10 |

27 |

5.85 |

920 |

10 |

|

11 |

23 |

5.80 |

1,053 |

11 |

|

12 |

21 |

5.85 |

950 |

11 |

Source: Proprietary data.

Estimating a Simple Linear Regression Market Share Model

It would be reasonable to assume that the market share for MF would be related to their price variable. If you estimate a simple linear regression to represent this assumption, using only price as an independent variable, you receive the following result (MS as a function of P):

MS = –2.047 + 3.673(P)

This is a rather disappointing result in at least two dimensions. First, this estimated coefficient for price (+3.673) has a positive sign! How would you interpret this? The positive sign and the value of 3.673 infer that if price were to increase by one, market share would increase by 3.673 (measured in percentage terms, thus 3.673%). That is a very unusual result to say the least. If this is correct, you could increase the market share (a good thing) by simply raising prices. But is this logical? No! This clearly violates the economic Law of Demand which states that “if you change nothing else other than raising price, sales, or quantity demanded, will decrease.” Secondly, the t-stat on the coefficient of the independent variable (price) is far below the “rule-of-thumb” value of 2; this would infer that the estimated coefficient (+3.673) is not significantly different from zero. In other words, the coefficient is not statistically significant; it is not a reliable coefficient and you should be suspect of using it in any manner even if it was logical. Note that if the coefficient is actually zero (and that could very well be the case with this computed test statistic) there is no demonstrated relationship between price and sales. The inference would be that raising price has no effect on sales! That also is a very unlikely occurrence.

So, this model should not be used. Is the regression result incorrect? No, the estimated regression result is accurate, but you may have made an incorrect assumption by constricting the regression model to relate market share to only a single independent variable. In statistical terms we might say that the “form” of the regression model is incorrect; it does not appear to mimic what is taking place in the real world. It appears that in the real world of MF, market share depends upon more than just price (the model is underspecified). That is the reason you use multiple linear regression; you recognize that not only price is important in determining market share, but also their advertising effort, and some measure of their competitors’ advertising effort. Leaving out important explanatory variables will affect the coefficients of the remaining variables and “cloud” the picture you receive of the way each affects the dependent variable. There are many variables that affect the sales at Miller’s Foods and we know we will not be able to include every one of them, but we do need to include those that have the most effect on sales.

Estimating a Multiple Linear Regression Market Share Model

Putting this disappointing simple linear regression result away, you can estimate a multiple linear regression using three independent variables: price (P), advertising (AD), and an index of their competitors’ advertising (CAD). This is based on the assumption that these are the three most important variables affecting Miller’s Food sales.

Table 7.2 Excel regression results for Miller’s Foods’ market share model

|

Regression Statistics |

|||||

|

Multiple R |

0.929 |

DW = 2.17 |

|||

|

R-square |

0.863 |

||||

|

Adjusted R-square |

0.812 |

||||

|

Standard error |

1.676 |

||||

|

Observations |

12 |

||||

|

ANOVA |

|||||

|

df |

SS |

MS |

F |

Sig F |

|

|

Regression |

3 |

141.537 |

47.179 |

16.802 |

0.001 |

|

Residual |

8 |

22.463 |

2.808 |

||

|

Total |

11 |

164 |

|||

|

Coefficients |

Std error |

t Stat |

p-Value |

P/2 |

|

|

Intercept |

80.011 |

19.479 |

4.107 |

0.003 |

0.002 |

|

P |

–8.458 |

2.705 |

–3.127 |

0.014 |

0.007 |

|

AD |

0.020 |

0.003 |

6.404 |

0.000 |

0.000 |

|

CAD |

–2.541 |

0.647 |

–3.924 |

0.004 |

0.002 |

The Excel regression results for this example are summarized in Table 7.2. From the results given in Table 7.2, you could write the estimated regression equation as:

MS = 80.011 – 8.458(P) + 0.020(AD) – 2.541(CAD)

Evaluating the Estimated Market Share Model

In order to complete the examination of this model, you should use the five-step process described previously (see Chapter 6) to evaluate multiple regression models.

Evaluation Step 1: Evaluate Whether the Model Makes Sense

Does the model make sense? The signs on the coefficients for all three independent variables do make economic sense as described next. The interpretation of the slope terms for price, advertising, and the competitors’ advertising index are as follows:

- Price. The coefficient –8.458 has a negative sign, which indicates that as price goes up, market share goes down. Note that this is different from the sign you received in the simple linear regression. The negative sign makes economic sense; it implies that for every $1 increase in price, market share is expected to fall by 8.458 market share percentage points; or for every 10 cent increase in price, market share would be expected to fall by .8458 market share percentage points. The relationship is symmetric. Price cuts would be expected to increase market share by like amounts.

- Advertising. The coefficient 0.02 has a positive sign, which indicates that increasing advertising is expected to increase market share. This result also follows economic reasoning. With everything else held constant we should expect that expenditures on advertising would have a positive effect on sales. Each $100 increase in advertising is expected to increase market share by 2.0 market share percentage points. Again, the result is assumed to be symmetric. Decreases in advertising would lower market share in a like manner.

- Index of Competitors’ Advertising. The negative sign for the index indicates that this firm’s market share would fall when competitors advertise more. This is also what we would expect from economic theory; with everything else held constant, if our competitor ramps us advertising, we should expect to see a dip in our sales. Every 1 unit rise in the index is expected to lower market share by 2.541 market share percentage points. Decreases in the index would be expected to increase market share in a like manner.

Therefore, this model passes our test for sound business/economic logic.

Evaluation Step 2: Check for Statistical Significance

Are the slope terms significantly different from zero? That is, does each of the independent variables have a statistically significant influence on the dependent variable? The hypotheses you would want to evaluate for each of the slope terms are as follows:

|

For price (Case 2) |

H0 : β1 ≥ 0, |

H1 : β1 < 0 |

|

For advertising (Case 3) |

H0 : β2 ≤ 0, |

H1 : β2 > 0 |

|

For Comp. Ad (Case 2) |

H0 : β3 ≤ 0, |

H1 : β3 < 0 |

These all imply a one-tailed test. From the t-table presented earlier (Appendix 4B), you find that the critical value of t at 8 degrees of freedom (df = 12 – (3 + 1) = 8) and a 95 percent confidence level (5 percent confidence level) for a one-tailed test is 1.860. Thus,

- For price, you reject H0, since the absolute value of tc(|–3.13|) is greater than the critical t-table value (1.860). This implies that the coefficient for price is statistically less than zero.

- For advertising, you reject H0, since the absolute value of tc(|6.40|) is greater than the critical t-table value (1.860). This implies that the coefficient for advertising is statistically greater than zero.

- For competitors’ advertising, the absolute value of tc(|–3.92|) is greater than the critical t-table value (1.860). This implies that the coefficient for competitors’ advertising is statistically less than zero.

Two of the computed test statistics are negative (the one on price and the one on competitors’ advertising). This is not abnormal; a t-stat will always be negative when the coefficient is negative. We always evaluate the absolute value of the t-statistic as we have done above. Also, note that, in Table 7.2, all the p-values divided by 2 (relevant for one tailed tests) are far below the desired level of significance (0.05) also implying statistical significance.

Based on rejecting all three of these null hypotheses you conclude, at a 95 percent confidence level, that all three independent variables have a significant effect on the market share of Miller’s Foods. In other words, you can rely on the three coefficients and use them in describing how Miller’s market share is affected by each of the variables. We are confident that the real values of the coefficients are not equal to zero and that the best estimate of the actual value is the one given by the regression equation. Note that when you ran the simple linear regression with only price as an independent variable, you were not able to rely on the estimated slope of the price variable. That is, it was somewhat likely that that the true value of the price coefficient was zero. What has changed? The market share and price variables are identical in the simple regression and the multiple regression. But, what has changed is the addition of the two independent variables in the multiple regression; the multiple linear regression recognizes that market share is not only dependent upon price, but it is also dependent upon advertising and competitors’ advertising at the same time. It is the “form” of the equation that has changed; we now believe this is a more accurate representation of what takes place in the real world and that the estimated coefficients tell us how each variable independently affects Miller’s sales.

Evaluation Step 3: Determine Explanatory Power of Model

How much of the variation (i.e., “up and down movement”) in Miller’s Foods’ market share does this regression model explain? In other words, how much of the variation in sales is due to the variation in price, the variation in advertising, and the variation in Miller’s competitors’ advertising? Because this is a multiple linear regression model you want to use the adjusted R2 to answer this question. Recall that it is adjusted for the degrees of freedom lost when we added two additional explanatory variables. From Table 7.2, you see that the adjusted R2 is 0.812. Thus, over 81 percent of the variation in Miller’s Foods’ market share (MS) is explained by this model. You can infer that most of the change you see in market share over the three years for which you have data is due to changes in price, advertising, and Miller’s competitors’ advertising. There are in fact other variables that effect Miller’s sales but these three account for most (81 percent) of the variation.

You can also use the F-test to evaluate the overall statistical significance of this model. The calculated F-statistic from Table 7.2 is compared with the critical F-table value (Appendix 6A) at k degrees of freedom for the numerator and n – (k + 1) degrees of freedom for the denominator. In this example for the numerator df = 3 and the denominator df = 8. From the F-table (Appendix 6A) you see that the critical F-table value is 4.07. Since the computed F-statistic from Table 7.2 (16.8) is greater than the critical F-table value (4.07) you would reject the null hypothesis that all of the slope terms are simultaneously equal to zero (or alternatively that the adjusted R2 equals zero). Thus, this full regression test infers that the estimated relationships are reasonably accurate.

Evaluation Step 4: Check for Serial Correlation

You need to check for serial correlation because the Miller’s Foods’ Market Share regression uses time-series data. To do this, you need to evaluate the Durbin–Watson statistic explained previously. Your calculated value is DW = 2.17 (refer to Appendix 4D on how to calculate the DW statistic). Recall that the DW values may range from 0 to 4. If the DW is exactly 2, there is little chance of serial correlation. However, if the calculated DW is close to 0, or close to 4, the chance of serial correlation is high. A shortcut (or an approximation) often used by practitioners is to examine whether the DW statistic is between 1.5 and 2.5. If the calculated value is between these limits, you might assume that serial correlation is not a serious problem. In this case, the calculated value for DW of 2.17 is between dl (0.368) and du (2.287) of the DW table (Appendix 4C). This satisfies Test 5 of Table 4.2, so the result is actually indeterminate.

Evaluation Step 5: Check for Multicollinearity

You should evaluate the model for possible multicollinearity since you have multiple independent variables in the regression. This step is necessary if you are using more than one independent variable (as we are in this case). The signs for the coefficients all make sense and the t-ratios are all high so there is no suggestion on these grounds to suspect multicollinearity (the model does not appear to be overspecified). It is still, however, prudent to test for multicollinearity using the correlation coefficients. The correlation coefficients for all pairs of independent variables can be found in the correlation matrix in Table 7.3.

Obviously, each variable is perfectly correlated with itself (i.e., correlations of 1). Since none of the other correlation coefficients is particularly large (all below 0.7 in absolute value), it is unlikely that there is a significant multicollinearity problem in this regression.

Table 7.3 Correlation matrix for independent variables in Miller’s Foods’ market share regression

|

P |

AD |

CAD |

|

|

P |

1 |

||

|

AD |

0.468 |

1 |

|

|

CAD |

–0.590 |

–0.092 |

1 |

Making an Estimate from the Market Share Model

Suppose you want to know what market share would be expected if MF set their price at $5.70 and spent $700 on advertising, and if the competitors’ advertising index was expected to be 10 percent. You could make this point estimate by substituting these values into the regression model as follows:

MS = 80.011 – 8.458(P) + 0.020(AD) – 2.541(CAD)

MS = 80.011 – (8.458 × 5.70) + (0.02 × 700) – (2.541 × 10)

MS = 20.39

The correctly calculated point estimate is a market share of 20.39, but how would you estimate an approximate 95 percent confidence interval for market share? From the Excel regression results in Table 7.2, you see that the standard error of the estimate (SEE) is 1.676. Thus, the approximate 95 percent confidence interval is

MS = 20.39 ±(2 × 1.676)

MS = 17.038 to 23.742

This means that you would be 95 percent confident that the market share of Miller’s Foods would fall in the interval from 17.038 percent through 23.742 percent if the firm set a $5.70 price and spent $700 on advertising, and if the competitors’ advertising index was expected to be 10 percent.

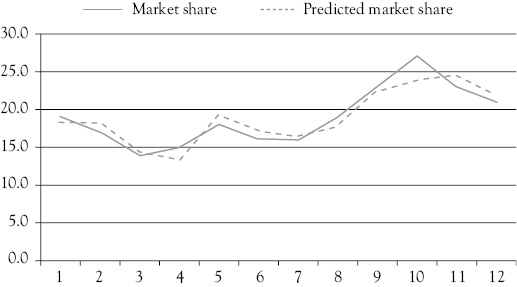

The graph in Figure 7.1 further illustrates how well this regression model explains variations in MF’s market share. You see that the estimated market share follows the actual market share quite well, except during the second quarter of the final year. You will learn more about this quarter in the next chapter.

Figure 7.1 Miller’s Foods’ market share: actual and regression estimates. The dotted line representing the estimated market share for Miller’s Foods’ is derived from the following regression model: MS = 80.011 – 8.458(P) + 0.020(AD) – 2.541(CAD)

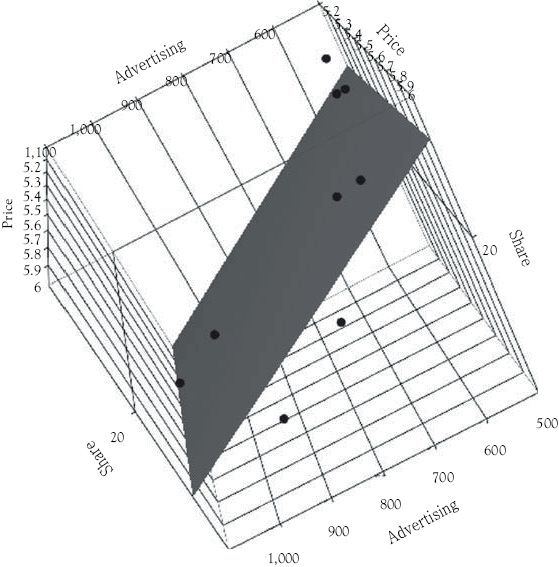

A Three-Dimensional Visual Representation

To help you get a visual feel for what a multiple regression data set might look like, see the three-dimensional plot of market share, price, and advertising in Figure 7.2. You could not include the third independent variable in such a plot since the human mind cannot visualize beyond three dimensions. The regression plane for market share (MS) as a function of price (P) and advertising (AD) is shown in Figure 7.2. The equation for that plane is:

MS = 17.790 – 1.866(P) + 0.017(AD)

The actual data points in Figure 7.2 are shown by the dark circles and the regression plane is the shaded rectangle. Note that the estimated linear plane (this is the visual representation of the estimated regression equation) very closely approximates the placement of the data points on the scatterplot. The closer the data points in total to the regression plane, the better the regression R2 or we could say, the better the fit of the regression. In this case the regression plane appears to be a very close fit to the data points.

Figure 7.2 The market share multiple regression data 3D scatterplot. This figure shows the three-dimensional relationship between market share, price, and advertising

What You Have Learned in Chapter 7

- You know what constitutes a market share multiple regression model.

- You know how to arrange your data for use in a market share multiple regression model.

- You know how to determine whether a particular variable ought to be in the model.

- You know how to evaluate the market share model.

- You know how to make a point estimate from the model.

- You know how to estimate a confidence interval for your estimate.