Setting Up Cash-Operating Procedures

,Before you open the doors of your new business, you need to set up a bank account for the business. Certainly, you hope to be adding to that account daily with all your new business. You definitely want to select a bank conveniently located to your business and one that operates at times when you need to use it. (Of course, banking hours are not necessarily designed for your business.)

Visit your area banks and find out what type of business services they offer. Find out if you will have the personal attention you need to handle questions and deal with problems that could arise. Of course, check on the fees for services. Fees vary greatly for business accounts. It never hurts to shop around, but don’t necessarily choose a bank based on the fact that it has the lowest fees, because the services offered may not meet your business needs.

Some banks today are even charging if you go to a teller for individual service rather than use the automated teller machines or drop boxes. Others require you to call a centralized office rather than work with people at your local branch. Some banks charge for every transaction regardless of whether it’s a deposit, a withdrawal, or a check. Others have standard monthly fees, and some banks waive these fees if you maintain a certain amount on deposit or carry a certain level of credit. Many banks offer Internet services, which certainly can make managing your accounts easier.

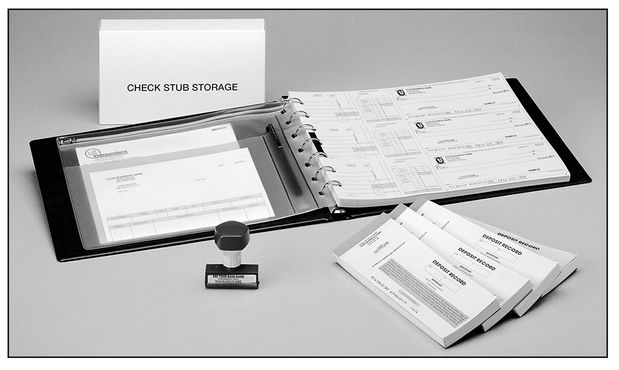

After you’ve selected your bank, your next choice is what type of account or accounts you want to establish. Your primary account, Cash in Checking (account 1000), should be operated using business voucher checks. Business voucher checks offer you excellent control over your cash accounts. As you see in the picture from Expresschecks.com, there are three checks to a page and a check stub on which to record all the critical information for journal entries: date, business or person paid, and purpose of the check. Checks are numbered by the bank, and you can quickly see whether any checks are missing or not properly used. Most banks will also give you printed deposit slips and a stamp for check endorsement that has all the proper account information included for deposits.

Expresschecks.com shows an example of what you can order if your bank doesn’t provide you with business voucher checks.

Before taking a deposit to the bank, make a copy of all checks being deposited. Attach these copies to the receipt the teller gives you for the deposit and file them. Be sure the deposit receipt from the bank matches the total you put on the deposit slip. If not, question the difference at the bank immediately. Following these procedures will give you excellent backup if any problems occur with the deposit later.

BIZ TIPS

You should assume that the cash is used as soon as you send out a check to make a payment. Never send a check with the anticipation that funds will be deposited in a day or two. Checks are clearing much more quickly today, and you certainly don’t want to get socked with hefty charges for a returned check. Most times, you’ll not only be forced to pay fees to your bank for a returned check, you will also be asked to pay the fees incurred by your vendor for the bad check.

This voucher check system can give you up-to-date information about your available cash provided that you total each page and carry that total forward to the next. If you do make a mistake, totaling accounts on each page will help you to quickly figure out where the mistake was made.

..................Content has been hidden....................

You can't read the all page of ebook, please click here login for view all page.