11

ASC 260 Earnings Per Share

- Perspective and Issues

- Definitions of Terms

- Concepts, Rules, and Examples

- Simple Capital Structure

- Complex Capital Structure

- Diluted Earnings Per Share

- Identification of Potentially Dilutive Securities

- Convertible Securities

- Options and Warrants

- Participating Securities and Two-Class Common Stocks

- Financial Instruments with Characteristics of Both Liabilities and Equity

- Contingent Issuances of Common Stock

- Computation of DEPS

- Examples of EPS Computation—Complex Capital Structure

- Participating Securities and the Two-Class Method

- Effect of Contracts That May Be Settled in Stock or Cash on the Computation of DEPS

- Inclusions/Exclusions from Computation of DEPS

- The Effect of Contingently Convertible Instruments on DEPS

- Consolidated DEPS

- Partially Paid Shares

- Effect of Certain Derivatives on EPS Computations

- Effect on EPS of Redemption or Induced Conversion of Preferred Stock

- EPS Impact of Tax Effect of Dividends Paid on Unallocated ESOP Shares

- Earnings Per Share Implications of ASC 718

- Presentation

- Other Disclosure Requirements

- Comprehensive Example

- Diluted EPS (DEPS)

- Note X: Earnings per Share (Illustrative Disclosure Based on Facts from the Example)

- Example of the Presentation and Computation of Earnings Per Share2

- Other Sources

Perspective and Issues

Subtopic

ASC 260, Earnings per Share, consists of one subtopic:

- ASC 260-10, Overall, that provides the guidance for computation, presentation, and disclosure for earnings per share (EPS) for entities with publicly held common stock or potential common stock.

The subtopic also includes master limited partnership subsections that clarify the application to master limited partnership of the Other Presentation Matters subsection.

Scope and Scope Exceptions

ASC 260 applies to all entities:

- Whose common stock or potential common stock is traded in a public market, or

- Who have made a filing or are in the process of making a filing to trade their stock publicly.

If an entity that is not required to report under ASC 260 chooses to provide EPS information, the entity must comply with the ASC 260 guidance.

The guidance does not apply to investment companies who comply with ASC 946 or in statements of wholly owned subsidiaries.

Overview

Earnings per share (EPS) is an indicator widely used by investors to gauge the profitability of a corporation. Its purpose is to indicate how effective an enterprise has been in using the resources provided by its common stockholders. In its simplest form, EPS is net income (loss) divided by the weighted-average number of shares of outstanding common stock. The EPS computation becomes more complex with the existence of securities that are not common stock but have the potential of causing additional shares of common stock to be issued to dilute EPS upon conversion or exercise (e.g., convertible preferred stock, convertible debt, options, and warrants). Diluted EPS considers the potential dilution that could occur from other financial instruments that would increase the total number of outstanding shares of common stock. Omission of an EPS number that takes into account the potential dilutive effects of such securities would be misleading. In addition, a lack of standardization in the way in which these securities are included in such an EPS computation would make comparisons among corporations extremely difficult.

Publicly traded corporations with a complex capital structure are obligated to report basic EPS and diluted EPS. The dual presentation is required on the face of the corporation's income statement even if both of these computations result in the same EPS amount. In addition, a reconciliation of the numerator and the denominator of the basic EPS computation to the numerator and denominator of the diluted EPS computation is required.

Definitions of Terms

Source: ASC 260-10-20, Glossary. See also Appendix A for definitions of Call Option, Employee Stock Ownership Plan, Fair Value, Noncontrolling Interest, Option, Put Option, Security, Subsidiaries, and Warrants.

Antidilution. An increase in earnings per share amounts or a decrease in loss per share amounts.

Basic Earnings Per Share. The amount of earnings for the period available to each share of common stock outstanding during the reporting period.

Consolidated Financial Statements. The financial statements of a consolidated group of entities that include a parent and all its subsidiaries presented as those of a single economic entity.

Consolidated Group. A parent and all its subsidiaries.

Contingent Issuance. A possible issuance of shares of common stock that is dependent on the satisfaction of certain conditions.

Contingent Stock Agreement. An agreement to issue common stock (usually in connection with a business combination) that is dependent on the satisfaction of certain conditions. See Contingently Issuable Shares.

Contingently Convertible Instruments. Contingently convertible instruments are instruments that have embedded conversion features that are contingently convertible or exercisable based on either of the following:

- A market price trigger

- Multiple contingencies if one of the contingencies is a market price trigger and the instrument can be converted or share settled based on meeting the specified market condition.

A market price trigger is a market condition that is based at least in part on the issuer's own share price. Examples of contingently convertible instruments include contingently convertible debt, contingently convertible preferred stock, and the instrument described by paragraph 260-10-45-43, all with embedded market price triggers.

Contingently Issuable Shares. Shares issuable for little or no cash consideration upon the satisfaction of certain conditions pursuant to a contingent stock agreement. Also called contingently issuable stock. See Contingent Stock Agreement.

Conversion Rate. The ratio of the number of common shares issuable upon conversion to a unit of a convertible security. For example, $100 face value of debt convertible into 5 shares of common stock would have a conversion ratio of 5:1. Also called conversion ratio.

Convertible Security. A security that is convertible into another security based on a conversion rate. For example, convertible preferred stock that is convertible into common stock on a two-for-one basis (two shares of common for each share of preferred).

Diluted Earnings Per Share. The amount of earnings for the period available to each share of common stock outstanding during the reporting period and to each share that would have been outstanding assuming the issuance of common shares for all dilutive potential common shares outstanding during the reporting period.

Dilution. A reduction in EPS resulting from the assumption that convertible securities were converted, that options or warrants were exercised, or that other shares were issued upon the satisfaction of certain conditions.

Dropdown. A transfer of certain net assets from a sponsor or general partner in exchange for consideration. (Effective upon implementation of ASU 2015-06.)

Earnings Per Share. The amount of earnings attributable to each share of common stock. For convenience, the term is used to refer to either earnings or loss per share.

Exercise Price. The amount that must be paid for a share of common stock upon exercise of an option or warrant.

If-Converted Method. A method of computing EPS data that assumes conversion of convertible securities at the beginning of the reporting period (or at time of issuance, if later).

Income Available to Common Stockholders. Income (or loss) from continuing operations or net income (or net loss) adjusted for preferred stock dividends.

Participating Security. A security that may participate in undistributed earnings with common stock, whether that participation is conditioned upon the occurrence of a specified event or not. The form of such participation does not have to be a dividend—that is, any form of participation in undistributed earnings would constitute participation by that security, regardless of whether the payment to the security holder was referred to as a dividend.

Potential Common Stock. A security or other contract that may entitle its holder to obtain common stock during the reporting period or after the end of the reporting period.

Preferred Stock. A security that has preferential rights compared to common stock.

Purchased Call Option. A contract that allows the reporting entity to buy a specified quantity of its own stock from the writer of the contract at a fixed price for a given period. See Call Option.

Reverse Treasury Stock Method. A method of recognizing the dilutive effect on EPS of satisfying a put obligation. It assumes that the proceeds used to buy back common stock (pursuant to the terms of a put option) will be raised from issuing shares at the average market price during the period. See Put Option.

Rights Issue. An offer to existing shareholders to purchase additional shares of common stock in accordance with an agreement for a specified amount (which is generally substantially less than the fair value of the shares) for a given period.

Stock Dividend. An issuance by a corporation of its own common shares to its common shareholders without consideration and under conditions indicating that such action is prompted mainly by a desire to give the recipient shareholders some ostensibly separate evidence of a part of their respective interests in accumulated corporate earnings without distribution of cash or other property that the board of directors deems necessary or desirable to retain in the business. A stock dividend takes nothing from the property of the corporation and adds nothing to the interests of the stockholders; that is, the corporation's property is not diminished and the interests of the stockholders are not increased. The proportional interest of each shareholder remains the same.

Treasury Stock Method. A method of recognizing the use of proceeds that could be obtained upon exercise of options and warrants in computing diluted EPS. It assumes that any proceeds would be used to purchase common stock at the average market price during the period.

Weighted-Average Number of Common Shares Outstanding. The number of shares determined by relating the portion of time within a reporting period that common shares have been outstanding to the total time in that period. In computing diluted EPS, equivalent common shares are considered for all dilutive potential common shares.

Concepts, Rules, and Examples

Simple Capital Structure

Simple capital structures are those with only common stock outstanding, having no potential common shares that upon conversion or exercise could dilute EPS. Simple capital structures only have basic EPS.

All other entities are considered to have a complex capital structures. Entities with a complex capital structure have potential common stock in the form of potentially dilutive securities, options, warrants, or other rights that upon conversion or exercise have the potential to dilute earnings per common share.

Basic EPS Calculation

Computational Guidelines

The basic EPS calculation is income available to common stockholders (the numerator) divided by the weighted-average number of common shares outstanding (the denominator) during the period. (ASC 260-10-45-10) The objective of the basic EPS calculation is to measure the performance of the entity over the reporting period. This calculation becomes complex when net income does not necessarily represent the earnings available to the common stockholder, and a simple weighted-average of common shares outstanding does not necessarily reflect the true nature of the situation.

Numerator

The net income available to common stockholders used as the numerator in any of the EPS computations must be reduced by any preferential claims against it by other securities. (ASC 260-10-45-11) The justification for this reduction is that the preferential claims of the other securities must be satisfied before any income is available to the common stockholder. These other securities are usually in the form of preferred stock, and the deduction from income is the amount of the dividend declared (whether or not paid) during the year on the preferred stock. If the preferred stock is cumulative,1 the dividend is deducted from income (added to the loss) whether or not declared. Dividends in arrears do not affect the calculation of EPS in the current period; those dividends have been included in prior periods' EPS computations. However, the entity must disclose the amount in arrears and the effects on the EPS calculation of the rights given to holders of preferential securities.

If an entity is presenting consolidated financial statements with less than wholly owned subsidiaries, then it should exclude from net income the income attributable to the noncontrolling interest in subsidiaries. (ASC 45-11A)

Denominator

The computation of the weighted-average of common stock shares outstanding is complicated by the effect that various transactions have on the computation of common shares outstanding. While it is impossible to analyze all the possibilities, ASC 260 provides discussion of some of the more common transactions affecting the number of common shares outstanding. By analogy, the theoretical model set forth in these relatively simple examples can be applied to situations that are not explicitly discussed.

Treasury Stock

If a company reacquires its stock (treasury stock), the number of shares reacquired is excluded from EPS calculations as of the date of reacquisition. The same theory holds for the issuance of common stock during the period. The number of shares newly issued is included in the computation only for the period after their issuance date. The logic for this treatment is that the proceeds from issuance of the shares were not available to the company to generate earnings until the shares were issued. This same logic applies to the reacquired shares, because the cash paid to reacquire those shares was no longer available to generate earnings after the reacquisition date.

Stock Dividend or Stock Split

When an entity issues a dividend in the form of its own stock or splits its stock, it does not receive any consideration, but it does increase the number of shares outstanding. ASC 260 states that the increase in shares as a result of a stock split or dividend, or decrease in shares as a result of a reverse split, should be given retroactive recognition as an appropriate equivalent charge for all periods presented. Thus, even if a stock dividend or split occurs at the end of the period, it is considered outstanding for the entirety of each period presented. The reasoning is that a stock dividend or split has no effect on the ownership percentage of the common stockholder. To show a dilution in the EPS reported would erroneously give the impression of a decline in profitability when in fact it was merely an increase in the shares outstanding due to the stock dividend or split. ASC 260 carries this principle one step further by requiring the retroactive adjustment of outstanding shares for stock dividends or splits occurring after the end of the period, but before the release of the financial statements. The rationale for this adjustment is that the primary interest of the financial statement user is considered to be the company's current capitalization. If this situation occurs, disclosure of both the end-of-year outstanding shares and those used to compute EPS is required.

When shares are issued in connection with a business combination that occurs during the period, they are treated as issued and outstanding as of the date of the acquisition.

Exhibit––Effect of Certain Transactions or Amounts on the Weighted-Average Computation

| Weighted-Average Computations | |

| Transaction/Amount | Effect on weighted-average computation |

| •Common stock outstanding at the beginning of the period | •Included in number of shares outstanding |

| •Issuance of common stock | •Increase number of shares outstanding by the number of shares issued times the portion of the year outstanding |

| •Conversion into common stock | •Increase number of shares outstanding by the number of shares converted times the portion of the year outstanding |

| •Reacquisition of common stock | •Decrease number of shares outstanding by number of shares reacquired times portion of the year since reacquisition |

| •Stock dividend or split | •Increase number of shares outstanding by number of shares issued for the dividend or resulting from the split retroactively as of the beginning of the earliest period presented |

| •Reverse split | •Decrease number of shares outstanding by decrease in shares retroactively as of the beginning of the earliest period presented |

| •Business combination | •Increase number of shares outstanding by number of shares issued times portion of year since acquisition |

The Exhibit above does not provide for all of the possible complexities arising in the EPS computation; however, most of the others occur under a complex capital structure. The complications arising under a complex capital structure are discussed and illustrated in detail later in this chapter and in the final section, “Comprehensive Example.” The illustration below applies some of the foregoing concepts to a simple capital structure.

Preferred Stock Dividends Payable in Common Shares

All dividends represent distributions of accumulated earnings, and accordingly are not reported as expenses on the income statement under GAAP. However, as illustrated above, for purposes of computing EPS, preferred dividends must be deducted in order to ascertain how much income is available for common stockholders. In some cases, preferred dividends are not payable in cash, but rather in common shares (based on market value as of the date of declaration, typically). In certain cases, the dividends may be payable in common shares or cash at the issuer's option.

ASC 260 defines income available to common stockholders as “income (or loss) from continuing operations or net income (or net loss) adjusted for preferred stock dividends.” This adjustment in computing income available to common stockholders is consistent with the treatment of common stock issued for goods or services. (ASC 260-10-45-12)

Effect of Preferred Stock Dividends Payable in Common Shares on Computation of EPS

At the option of the issuer, preferred stock dividends are sometimes payable in either cash or common stock. According to ASC 260-10-45, the form of payment is not a determinant in accounting for the effect of the preferred dividend on net income available to common stockholders. Therefore, for the purposes of the numerator in EPS computations, net income or loss is adjusted to compute the portion available to common stockholders.

Material Limited Partnerships—Dropdown Transactions

General partners, limited partners, and incentive distribution rights holders have different rights to participate in distributable cash flow under the guidance in ASC 260. This results in a two-class method of calculating earnings per unit.

A general partner may transfer or “drops down” net assets to a master limited partnership. If that transaction is accounted for as a transaction between entities under common control, the statements of operations of the master limited partnership are adjusted retrospectively to reflect the dropdown transaction as if it occurred on the earliest date during which the entities were under common control. If a dropdown transaction occurs after the formation of a master limited partnership, ASC 260 requires that all earnings or losses of a transferred business related to periods prior to the date of the dropdown transaction be allocated entirely to the general partner.

Complex Capital Structure

The computation of EPS under a complex capital structure involves all of the complexities discussed under the simple structure and many more. A complex capital structure is one that includes securities that grant rights with the potential to be exercised and reduce EPS (dilutive securities). The denominator is increased to include the number of additional shares that would have been outstanding had the dilutive shares been issued. The numerator is also adjusted for any change in income or loss that would have resulted from the conversion. Any antidilutive securities (those that increase EPS) are not included in the computation of EPS.

Note that a complex capital structure requires dual presentation of basic EPS and diluted earnings per share (DEPS). The common stock outstanding and all other dilutive securities are used to compute DEPS.

Diluted Earnings Per Share

DEPS represents the earnings attributable to each share of common stock after giving effect to all potentially dilutive securities which were outstanding during the period. The computation of DEPS requires that the following steps be performed:

- Identify all potentially dilutive securities.

- Compute dilution, the effects that the other dilutive securities have on net income and common shares outstanding.

Identification of Potentially Dilutive Securities

Dilutive securities are those that have the potential of being exercised and reducing the EPS figure. Some examples of dilutive securities identified by ASC 260 are convertible debt, convertible preferred stock, options, warrants, participating securities, two-class common stocks, and contingent shares.

Convertible Securities

A convertible security is one type of potentially dilutive security. A security of this type has an inherent dual nature. Convertibles are comprised of two distinct elements:

- The right to receive dividends or interest, and

- The right to potentially participate in earnings by becoming a common stockholder.

This security is included in the DEPS computation due to the latter right.

Options and Warrants

Options, warrants, and their equivalents generally derive their value from the right to obtain common stock at specified prices over an extended period of time.

Participating Securities and Two-Class Common Stocks

The capital structure of some entities includes securities that may participate in dividends with common stocks according to a predetermined formula, or a class of common stock with different dividend rates from those of another class of common stock but without prior or senior rights. If the effect is dilutive, entities do not have the option of using the if-converted method for those securities that are convertible into common stock. For these securities, participating securities, and two-class common stocks, the two-class method of computing EPS, as described below, is used.

Financial Instruments with Characteristics of Both Liabilities and Equity

ASC 480 specifies that certain freestanding financial instruments (as distinguished from compound financial instruments) that may resemble equity are nevertheless required to be classified as liabilities on the issuer's statement of financial position. Such instruments include mandatorily redeemable financial instruments (including mandatorily redeemable common or preferred stock) and certain forward contracts that require physical settlement by repurchase of a fixed number of the issuer's equity shares. Issuers of these instruments are required to:

- Exclude any shares of common stock that are required to be redeemed or repurchased from the denominator of the EPS and DEPS computations, and

- Apply the two-class method described below to deduct from income available to common stockholders (the numerator of EPS and DEPS computations) any amounts that are attributable to shares that are to be redeemed or repurchased, including contractual dividends and participation rights in undistributed earnings.

The deduction described in (2) is limited to amounts not recognized in the issuer's financial statements as interest expense. More information can be found in the chapter on ASC 480.

Contingent Issuances of Common Stock

Another consideration is contingent issuances of common stock (e.g., stock subscriptions). If shares are to be issued in the future with no restrictions on issuance other than the passage of time, they are considered issued and treated as outstanding in the computation of DEPS.

Other issuances that are dependent upon certain conditions being met should be evaluated in a different manner. ASC 260 uses as examples the maintenance of current earnings levels and the attainment of specified earnings increases. The following table lists examples and the accounting treatment for each.

Exhibit—Issuances Contingent on Certain Conditions

| Shares Issued Contingent Upon: | Treatment |

| Merely maintaining the earnings levels currently being attained | The shares are considered outstanding for the entire period and considered in the computation of DEPS if the effect is dilutive. |

| Increasing earnings over a period of time | The DEPS computation should include those shares that would be issued based on the assumption that the current amount of earnings will remain unchanged if the effect is dilutive. |

| An earnings level attainment | Previously reported DEPS are not restated. |

| The lapsing of time and the market price of the stock (which generally affects the number of shares issued) | Both conditions must be met to include the contingently issuable shares in the DEPS computation. |

| Fluctuations in the market price occurring in future periods | Restatement of DEPS data is prohibited. |

| (ASC 260-10-45-48 through 45-55) |

Computation of DEPS

The second step in the process is the actual computation of DEPS. There are basically two methods used to incorporate the effects of other dilutive securities on EPS (excluding participating and two-class common securities for which the two-class method described above is used):

- The treasury stock method, and

- The if-converted method.

The Treasury Stock Method

The treasury stock method, used for the exercise of most warrants or options, requires that DEPS be computed as if:

- The options or warrants were exercised at the beginning of the period (or actual date of issuance, if later), and

- That the funds obtained from the exercise were used to purchase (reacquire) the company's common stock at the average market price for the period.

The incremental shares (the difference between the number of shares assumed issued and the number of shares assumed purchased) is included in the denominator of the diluted EPS computation. (ASC 260-10-45-23)

The if-Converted Method

The if-converted method is used for those convertible securities that are currently sharing in the earnings of the company through the receipt of interest or dividends as preferential securities, but that have the potential for sharing in the earnings as common stock (e.g., convertible bonds or convertible preferred stock). The if-converted method logically recognizes that the convertible security can only share in the earnings of the company as one or the other, not both. Thus, the dividends or interest less income tax effects applicable to the convertible security as a preferential security are not recognized in income available to common stockholders used to compute DEPS, and the weighted-average number of shares is adjusted to reflect the assumed conversion as of the beginning of the year (or actual date of issuance, if later). (ASC 260-10-45-40)

Exceptions

Generally, the if-converted method is used for convertible securities, while the treasury stock method is used for options and warrants. There are some situations specified by ASC 260 for which this does not hold true:

- If options or warrants permit or require that debt or other securities of the issuer be tendered for all or a portion of the exercise price, the if-converted method is used.

- If options or warrants require that the proceeds from the exercise are to be used to retire existing debt, the if-converted method is used.

- If convertible securities require cash payment upon conversion, and are, therefore, considered equivalent to warrants, the treasury stock method is used.

(ASC 260-10-55-9 through 55-11)

Dual Presentation of EPS

DEPS is a pro forma presentation which reflects the dilution of EPS that would have occurred if all contingent issuances of common stock that would individually reduce EPS had taken place at the beginning of the period (or the date actually issued, if later). The presentation of the concept of dual EPS provides the reader with factually supportable EPS that range from no dilution to the maximum potential dilution. DEPS assumes that all issuances that have the legal right to become common stock exercise that right (unless the exercise would be antidilutive), and therefore anticipates and measures all potential dilution. The underlying basis for the computation is that of conservatism. The DEPS considers all other potentially dilutive securities, but only uses those securities that are dilutive. Thus, in most cases, the DEPS is less than the basic EPS. DEPS can never be greater than the basic EPS, but it could potentially be the same if all of the convertible securities were antidilutive.

Examples of EPS Computation—Complex Capital Structure

Each of the following independent examples is presented to illustrate the foregoing principles. The procedural guidelines are detailed to enable the reader to understand the computation without referring back to the preceding explanatory text.

In the preceding example, all of the potentially dilutive securities were outstanding the entire year and no conversions or exercises were made during the year. If a potentially dilutive security was not outstanding the entire year, then the numerator and denominator effects would have to be time-weighted. For instance, suppose the convertible bonds in the above example were issued during the current year on July 1. If all other facts remain unchanged, DEPS would be computed as follows:

Since the DEPS of $3.39 is still less than the EPS of $4.60, the convertible debt is dilutive whether or not it is outstanding the entire year.

If actual conversions or exercises take place during a period, the common shares issued upon conversion will be outstanding from their date of issuance and therefore, will be included in the computation of the weighted-average number of common shares outstanding. These shares are then weighted from their respective dates of issuance. Assume that all the bonds in the above example are converted on July 1 into 8,000 common shares; the following effects should be noted:

- For basic EPS, the weighted-average of common shares outstanding will be increased by (8,000 shares) (6 months outstanding/12 months in the period) or 4,000. Income will increase $4,200 net of income tax, because the bonds were only outstanding for the first half of the year.

- For DEPS, the if-converted method is applied to the period January 1 to June 30 because it was during this period that the bonds were potentially dilutive. The interest expense, net of income tax, of $4,200 is added to the net income in the numerator, and 4,000 shares are added to the denominator.

- Interestingly, the net effect of items 1 and 2 is the same for the period, whether these dilutive bonds were outstanding the entire period or converted during the period.

Participating Securities and the Two-Class Method

Reporting entities that issue securities that are entitled to participate in dividends with common shares will report lower EPS under the guidance in ASC 260-10-55. This issue addresses the computation of EPS by entities that have issued securities, other than common stock, that entitle the holder to participate in dividends when, and if, dividends are declared on common stock. In addition, ASC 260-10-55 provides further guidance on calculating EPS using a two-class method and requires companies to retroactively restate EPS amounts presented. (ASC 260-10-45-59)

Participation rights are defined based solely on whether the holder is entitled to receive any dividends if the entity declares them during the period. The codification also requires the use of the two-class method for computing basic EPS when participating convertible securities exist. The use of the two-class method encompasses other forms of participating securities, including options, warrants, forwards, and other contracts to issue an entity's common shares (including unvested share-based compensation awards).

Presentation and Disclosure

Presentation of participating securities' basic and diluted EPS is not required, but is permitted for other than common stock. What is required by ASC 260-10-55 is adjustment to the earnings that are used to compute EPS for the common stock.

Participating Security Defined

ASC 260-10-55 formally defines participating securities as any “security that may participate in undistributed earnings with common stock, whether that participation is conditioned upon the occurrence of a specified event or not…regardless of the whether the payment to the security holder was referred to as a dividend.”

Additional guidance clarifies that instruments granted in share-based payment transactions can be participating securities prior to the requisite service having been rendered. However, the right to receive dividends or dividend equivalents that the holder will forfeit if the award does not vest does not qualify as a participation right, as the award does not meet the definition of a participation security. Also not considered to be participation rights are dividends, or their equivalents, that can be transferred to the holder of a share-based payment award as a reduction in the exercise price of the award.

Allocating Earnings and Losses

In addition to the amount of dividends declared in the current period, net dividends must be reduced by the contractual amount of dividends or other participation payments that are paid or accumulated for the current period. The allocation of undistributed earnings for a period should be done for a participating security based on the contractual participation rights of the security to share in the current earnings assuming all earnings for the period are distributed. The allocation process is not based on a fair-value analysis, but is based on the term of the securities. For losses, an entity would allocate to the participating securities a portion of the net losses of the entity in accordance with the contractual provisions that may require the security to have an obligation to share in the issuing entity's losses. This occurs when the participating security holder has an obligation to share in the losses of the issuing entity if the holder is obligated to fund the issuing authority's losses or if losses incurred by the issuing entity reduce the security's principal or mandatory redemption amount.

Two-Class Method

This is an earnings allocation formula for computing EPS. It determines EPS for each class of common stock and participating securities according to dividends declared/accumulated and participation rights in undistributed earnings. The codification requires that the two-class method be applied for participating convertible securities when computing basic EPS. This changes earlier guidance, which permitted reporting entities to make an accounting policy election to use the if-converted method, rather than the two-class method, in the basic EPS calculation, as long as the if-converted method was not less dilutive.

Use of the two-class method is dependent upon having no unsatisfied contingencies or objectively determinable contingent events. Thus, if preferred shares are entitled to participate in dividends with common shareholders only if management declares the distribution to be “extraordinary,” this would not invoke the use of the two-class computation of EPS. However, if classification of dividends as extraordinary is predetermined by a formula, then undistributed earnings would be allocated to common stock and the participating security based on the assumption that all of the earnings for the period are distributed, with application of the defined sharing formula used for the determination of the allocation to the participating security.

If the participating security participates with common stock in earnings for a period in which a specified event occurs, regardless of whether a dividend is actually paid during the period (e.g., achievement of a target market price or achievement of threshold earnings), then undistributed earnings would be allocated to common stock and the participating security based on the assumption that all of the earnings for the period are distributed. Undistributed earnings would be allocated to the participating security if the contingent condition would have been satisfied at the reporting date, even if no actual distribution were made.

Effect of Contracts That May Be Settled in Stock or Cash on the Computation of DEPS

There is an issue regarding how the option to settle contracts (e.g., written puts on the reporting entity's shares) in stock or cash influences the computation of EPS. FASB staff concluded that in calculating EPS, adjustments should be made to the numerator for contracts that are classified, in accordance with ASC 815-40-15, as equity instruments, but for which the company has a stated policy or for which past experience provides a reasonable basis to believe that such contracts will be paid partially or wholly in cash (in which case there will be no potential common shares included in the denominator). Thus, a contract that is reported as an equity instrument for accounting purposes may require an adjustment to the numerator for any changes in income or loss that would result if the contract had been reported as an asset or liability for accounting purposes during the period.

For purposes of computing diluted EPS, the adjustments to the numerator described above are only permitted for instruments for which the effect on net income (the numerator) is different depending on whether the instrument is accounted for as an equity instrument or as an asset or liability (e.g., those that are within the scope of ASC 480 or ASC 815-40-15). The provisions of ASC 260 require that for contracts that provide the company with a choice of settlement methods, the company will assume that the contract will be settled in shares. That presumption may be overcome if past experience or a stated policy provides a reasonable basis to believe that it is probable that the contract will be paid partially or wholly in cash.

ASC 260-10-55-36 also states that, for contracts in which the holder controls the means of settlement, past experience or a stated policy is not determinative. In those situations, the more dilutive of cash or share settlement should be used.

Adjustment to the numerator in year-to-date diluted EPS calculations may be required in certain circumstances. ASC 260-10-55-34 cites the example of contracts in which the holder controls the method of settlement and that would have a more dilutive effect if settled in shares, where the numerator adjustment is equal to the earnings effect of the change in the fair value of the asset/liability recorded during the year-to-date period. In that situation, the number of incremental shares included in the denominator is to be determined by calculating the number of shares that would be required to settle the contract using the average share price during the year-to-date period.

ASC 260-10-55 also notes that antidilutive contracts, such as purchased put options and purchased call options, should be excluded from diluted EPS.

ASC 480 requires entities that issue mandatorily redeemable financial instruments or that enter into forward purchase contracts that require physical settlement by repurchase of a fixed number of shares in exchange for cash to exclude the common shares that are to be redeemed or repurchased in calculating EPS and DEPS. Amounts attributable to shares that are to be redeemed or repurchased that have not been recognized as interest costs (e.g., amounts associated with participation rights) are deducted in computing the income available to common shareholders (the numerator of the EPS calculations) consistently under the “two-class” method. Therefore, ASC 480's requirements for calculating EPS partially nullify ASC 260-10-55 for those financial instruments. For other financial instruments, including those that are liabilities under ASC 480, the guidance in ASC 260-10-55 remains applicable.

Inclusions/Exclusions from Computation of DEPS

Certain types of instruments and contracts having characteristics of both liabilities and equity require special treatment using the two-class method described previously; if under ASC 480, they are required to be classified as liabilities on the statement of financial position of the issuer. Examples of these instruments include mandatorily redeemable common or preferred stock; and forward purchase contracts or written put options on the issuer's equity shares that require physical settlement or net cash settlement.

The computations of DEPS also does not include contracts such as purchased put options and purchased call options (options held by the entity on its own stock). The inclusion of such contracts would be antidilutive.

Sometimes entities issue contracts that may be settled in common stock or in cash at the election of either the issuing entity or the holder. The determination of whether the contract is reflected in the computation of DEPS is based on the facts available each period. It is presumed that the contract will be settled in common stock and the resulting common shares will be included in DEPS if the effect is dilutive. This presumption may be overcome if past experience or a stated policy provides a reasonable basis to believe that the contract will be paid partially or wholly in cash. If during the reporting period the exercise price exceeds the average market price for that period, the potential dilutive effect of the contract on EPS is computed using the reverse treasury stock method. Under this method:

- Issuance of sufficient common shares is assumed to have occurred at the beginning of the period (at the average market price during the period) to raise enough proceeds to satisfy the contract.

- The proceeds from issuance of the shares are assumed to have been used to satisfy the contract (i.e., to buy back shares).

- The denominator of the DEPS calculation includes the incremental number of shares (the difference between the number of shares assumed issued and the number of shares assumed received from satisfying the contract).

The Effect of Contingently Convertible Instruments on DEPS

In recent years contingently convertible securities have become more common. ASC 260-10-45 addresses the impact of the existence of such instruments on the computation of EPS. Contingently convertible instruments are those that have embedded conversion features that are contingently convertible or exercisable based either on a market price trigger or on multiple contingencies, if one of the contingencies is a market price trigger and the instrument can be converted or share settled based on meeting the specified market condition. A market price trigger is a condition that is based at least in part on the reporting entity's share price. Examples include contingently convertible debt and contingently convertible preferred stock. A typical trigger occurs when the market price exceeds a defined conversion price by a specified percentage (e.g., when the market price first equals or exceeds 20% more than the conversion price of $33 per share). Others have floating market price triggers for which conversion is dependent upon the market price of the reporting entity's stock exceeding the conversion price by a specified percentage(s) at specified times during the term of the debt. Yet other contingently convertible instruments require that the market price of the issuer's stock exceed a specified level for a specified period (for example, 20% above the conversion price for a 30-day period). In addition, these instruments may have additional features such as parity features, issuer call options, and investor put options.

ASC 260-10-45-44 requires that contingently convertible instruments are to be included in diluted EPS, if dilutive, regardless of whether the market price trigger has been met. The reasoning is that there is no substantive economic difference between contingently convertible instruments and conventional convertible instruments with a market price conversion premium. ASC 260-10-45-44 is to be applied to instruments that have multiple contingencies, if one of these is a market price trigger and the instrument is convertible or settleable in shares based on a market condition being met—that is, the conversion is not dependent on a substantive non-market-based contingency.

Basic EPS is ($80,000 ÷ 20,000 shares =) $4.00 per share. Applying the if-converted method to the debt instrument dilutes EPS to $3.77. (To compute DEPS, net income is increased by the after-tax effect of interest, and this is then divided by the total of outstanding plus potential common shares.)

Consolidated DEPS

When computing consolidated DEPS entities with subsidiaries that have issued common stock or potential common shares to parties other than the parent company (minority interests) follow these general guidelines:

- Securities issued by a subsidiary that enable their holders to obtain the subsidiary's common stock are included in computing the subsidiary's EPS. Per-share earnings of the subsidiary are included in the consolidated EPS calculations based on the consolidated group's holding of the subsidiary's securities.

- For the purpose of computing consolidated DEPS, securities of a subsidiary that are convertible into its parent company's common stock, along with subsidiary's options or warrants to purchase common stock of the parent company, are all considered among the potential common shares of the parent company.

Partially Paid Shares

If an entity has common shares issued in a partially paid form and the shares are entitled to dividends in proportion to the amount paid, the common-share equivalent of those partially paid shares is included in the computation of basic EPS to the extent that they were entitled to participate in dividends. Partially paid stock subscriptions that do not share in dividends until paid in full are considered the equivalent of warrants and are included in the calculation of DEPS using the treasury stock method.

Effect of Certain Derivatives on EPS Computations

ASC 260 did not contemplate certain complex situations having EPS computation implications. In ASC 815-40-15, the accounting for derivative financial instruments that are indexed to, and potentially to be settled in, the reporting entity's own shares has been addressed. It establishes a model for categorization of a range of such instruments and deals with the EPS effects of each of these. This approach assumes that when the entity can elect to settle these instruments by payment of cash or issuance of shares, the latter will be chosen; if the holder (counterparty) has that choice, payment of cash must be presumed. (Certain exceptions exist when the settlement alternatives are not economically equivalent; in those instances, accounting is to be based on the economic substance of the transactions.) Statement of financial position classification of such instruments is based on consideration of a number of factors, and classification may change from period to period if there are certain changes in circumstances.

For EPS computation purposes, for those contracts that provide the company with a choice of either cash settlement or settlement in shares, ASC 815-40-15 states that settlement in shares should be assumed, although this can be overcome based on past experience or stated policy. If the counterparty controls the choice, however, the more dilutive assumption must be made, irrespective of past experience or policy.

ASC 260 requires the use of the “reverse treasury stock method” to account for the dilutive impact of written put options and similar derivative contracts, if they are “in the money” during the reporting period. Using this method, an incremental number of shares is determined to be the excess of the number of shares that would have to be sold for cash, at the average market price during the period, to satisfy the put obligation over the number of shares obtained via the put exercise. ASC 815-40-15 states that, for contracts giving the reporting entity a choice of settlement methods (stock or cash), it should assume share settlement, although this can be overcome if past behavior makes it reasonable to presume cash settlement. If the holder controls the settlement method, however, the more dilutive method of settlement must be presumed.

Effect on EPS of Redemption or Induced Conversion of Preferred Stock

Companies may redeem shares of their outstanding preferred stock for noncash consideration such as by exchanges for other securities. Sometimes the company induces conversion by offering additional securities or other consideration to the holders. Such offers are sometimes referred to as “sweeteners.” The accounting for “sweeteners” offered to convertible debt holders was addressed by ASC 470-20-05, and is explained in the chapter on ASC 470. ASC 260-10-S99 deals with the anomalous situation of “sweeteners” offered to induce conversion of convertible preferred shares.

The position of the SEC staff is that any excess of the fair value of consideration given over the book value of the preferred stock represents a return to the preferred stockholder and, consequently, is to be accounted for similar to dividends paid to the preferred stockholders for purposes of computing EPS. This means that the excess should be deducted from earnings to compute earnings available for common stockholders in the calculation of EPS.

If the converse is true, with consideration given being less than carrying value, including when there is an excess of the carrying amount of the preferred stock over the fair value of the consideration transferred, this should be added to net income to derive earnings available for common stockholders in the calculation of EPS.

This SEC staff position applies to redemptions of convertible preferred stock, whether or not the embedded conversion feature is “in the money” or not at the time of redemption.

If the redemption or induced conversion is effected by offering other securities, rather than cash, fair values would be the referent to determine whether an excess was involved. If the conversion includes the reacquisition of a previously recognized beneficial conversion feature, then reduce the fair value of the consideration by the intrinsic value of the conversion option on the commitment date.

Furthermore, per ASC 260-10-S99, in computing the carrying amount of preferred stock that has been redeemed or been subject to an induced conversion, the carrying amount of the preferred stock is to be reduced by the related issuance costs irrespective of how those costs were classified in the stockholders' equity section of the statement of financial position upon initial issuance.

Since ASC 480-10-25-4 defines mandatorily redeemable preferred stock as a liability, not as equity, the guidance in ASC 260-10-S99 would not apply. Rather, any excess or shortfall offered in an induced conversion situation involving mandatorily redeemable preferred stock would be reported as gain or loss on debt extinguishment, not as a dividend.

In a related matter, ASC 260-10-S99 discusses the accounting required when a reporting entity effects a redemption or induced conversion of only a portion of the outstanding securities of a class of preferred stock. Reflecting an SEC staff position, any excess consideration should be attributed to those shares that are redeemed or converted. Thus, for the purpose of determining whether the “if-converted” method is dilutive for the period, the shares redeemed or converted should be considered separately from those shares that are not redeemed or converted. It would be inappropriate to aggregate securities with differing effective dividend yields when determining whether the “if-converted” method is dilutive, which would be the result if a single, aggregate computation was made for the entire series of preferred stock.

EPS Impact of Tax Effect of Dividends Paid on Unallocated ESOP Shares

Under the provisions of ASC 718-40, dividends paid on unallocated shares are not charged to retained earnings. Since the employer controls the use of dividends on unallocated shares, these dividends are not considered dividends for financial reporting purposes. Consequently, the dividends do not affect the DEPS computation.

Earnings Per Share Implications of ASC 718

ASC 718 mandates that share-based employee compensation arrangements must, with very few exceptions, be recognized as expenses over the relevant employee service period. ASC 260-10-45-28A requires that employee equity share options, nonvested shares, and similar equity instruments granted to employees be treated as potential common shares in computing diluted EPS. DEPS is to be based on the actual number of options or shares granted and not yet forfeited, unless doing so would be antidilutive. If vesting in or the ability to exercise (or retain) an award is contingent on a performance or market condition (e.g., as the level of future earnings), the shares or share options shall be treated as contingently issuable shares. If equity share options or other equity instruments are outstanding for only part of a reporting period, the shares issuable are to be weighted to reflect the portion of the period during which the equity instruments are outstanding.

ASC 260 provides guidance on applying the treasury stock method for equity instruments granted in share-based payment transactions in determining DEPS.

Presentation

The reason for the differentiation between simple and complex capital structures is that ASC 260 requires different financial statement presentation for each. ASC 260 mandates that EPS be shown on the face of the income statement for each of the following items (when applicable):

- Income from continuing operations

- Net income.

An entity that reports a discontinued operation or the cumulative effect of a change in accounting principle presents basic and diluted EPS amounts for these line items either on the face of the income statement or in the notes to the financial statements. These requirements must be fulfilled regardless of whether the capital structure is simple or complex. The difference in the two structures is that a simple capital structure requires presentation of only a single EPS number for each item, while a complex structure requires the dual presentation of basic EPS and DEPS for each item.

EPS data is to be presented for all periods for which an income statement or summary of earnings is presented. If DEPS is reported for at least one period, it is to be reported for all periods presented, regardless of whether or not DEPS differs from basic EPS. (ASC 260-10-45-7) However, if basic and diluted EPS are the same amounts for all periods presented, dual presentation may be accomplished in one line on the face of the income statement.

Rights Issue

A rights issue whose exercise price at issuance is below the fair value of the stock contains a bonus element. If a rights issue contains a bonus element (somewhat similar to a stock dividend) and is offered to all existing stockholders, basic and diluted EPS are adjusted retroactively for the bonus element for all periods presented. However, if the ability to exercise the rights issue is contingent on some event other than the passage of time, this retroactive adjustment does not apply until the contingency is resolved.

Restated EPS

When a restatement of the results of operations of a prior period is required to be included in the income statement, EPS for the prior period(s) is also restated. The effect of the restatement, expressed in per-share terms, is disclosed in the period of restatement. Restated EPS data is computed as if the restated income (loss) had been reported in the prior period(s).

Year-to-Date Diluted EPS

ASC 260-10-45 addresses the matter of how to compute year-to-date diluted EPS (1) when a company has a year-to-date loss from continuing operations including one or more quarters with income from continuing operations, and (2) when in-the-money options or warrants were not included in one or more quarterly diluted EPS computations because there was a loss from continuing operations in those quarters.

ASC 260 directs that in applying the treasury stock method in year-to-date computations, the number of incremental shares to be included in the denominator is to be determined by computing a year-to-date weighted-average of the number of incremental shares included in each quarterly diluted EPS computation.

However, ASC 260 includes a prohibition against antidilution, which states that the computation of diluted EPS is not to assume conversion, exercise, or contingent issuance of securities that would have an antidilutive effect on EPS. There may be a conflict between these provisions when a period longer than three months has an overall loss but includes quarters with income. For periods with year-to-date income (as in quarterly filings on Form 10-Q), in computing year-to-date diluted EPS, SEC staff believes that year-to-date income (or loss) from continuing operations should be the basis for determining whether or not dilutive potential common shares not included in one or more quarterly computations of diluted EPS should be included in the year-to-date computation.

According to ASC 260-10-45, (1) when there is a year-to-date loss, potential common shares should never be included in the computation of diluted EPS, because to do so would be antidilutive, and (2) when there is year-to-date income, if in-the-money options or warrants were excluded from one or more quarterly diluted EPS computations because the effect was antidilutive (there was a loss from continuing operations in those periods), then those options or warrants should be included in the diluted EPS denominator (on a weighted-average basis) in the year-to-date computation as long as the effect is not antidilutive. Similarly, contingent shares that were excluded from a quarterly computation solely because there was a loss from continuing operations should be included in the year-to-date computation unless the effect is antidilutive.

Other Disclosure Requirements

The additional items required to be disclosed for all periods for which an income statement is presented can be found in the Disclosure and Presentation Checklist for Commercial Businesses at www.wiley.com/go/GAAP2018 .

Comprehensive Example

The previous examples used a simplified approach for determining whether or not options, warrants, convertible preferred stock, or convertible bonds have a dilutive effect on DEPS. If the DEPS number computed was lower than basic EPS, the security was considered dilutive. This approach is adequate when the company has only one potentially dilutive security. If the firm has more than one potentially dilutive security, a more complex ranking procedure must be employed. (ASC 260)

For example, assume the following facts concerning the capital structure of a company:

- Income from continuing operations and net income are both $50,000. Income from continuing operations is not displayed on the firm's income statement.

- The weighted-average number of common shares outstanding is 10,000 shares.

- The income tax rate is a flat 40%.

- Options to purchase 1,000 shares of common stock at $8 per share were outstanding all year.

- Options to purchase 2,000 shares of common stock at $13 per share were outstanding all year.

- The average market price of common stock during the year was $10.

- 200 7% convertible bonds, each convertible into 40 common shares, were outstanding the entire year. The bonds were issued at par value ($1,000 per bond) and no bonds were converted during the year.

- 4% convertible, cumulative preferred stock, par value of $100 per share, 1,000 shares issued and outstanding the entire year. Each preferred share is convertible into one common share. The preferred stock was issued at par value and no shares were converted during the year.

Note that reference is made below to some of the tables included in the body of the chapter because the facts above represent a combination of the facts used for the examples in the chapter.

To determine both basic EPS and DEPS, the following procedures must be performed:

- Calculate basic EPS as if the capital structure were simple.

- Identify other potentially dilutive securities.

- Calculate the per-share effects of assuming issuance or conversion of each potentially dilutive security on an individual basis.

- Rank the per-share effects from smallest to largest.

- Recalculate EPS (Step 1 above) adding the potentially dilutive securities one at a time in order, beginning with the security with the smallest per-share effect.

- Continue adding potentially dilutive securities to each successive calculation until all have been added or until the addition of a security increases EPS (antidilution) from its previous level.

Applying these procedures to the facts above:

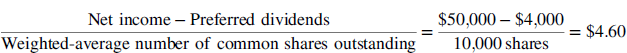

- Basic EPS

- Identification of other potentially dilutive securities:

- Options (two types)

- 7% convertible bonds

- 4% convertible cumulative preferred stock.

Diluted EPS (DEPS)

- Per-share effects of conversion or issuance of other potentially dilutive securities calculated individually:

- Options—Only the options to purchase 1,000 shares at $8.00 per share are potentially dilutive. The options to purchase 2,000 shares of common stock are antidilutive because the exercise price is greater than the average market price. Thus, they are not included in the computation.

Proceeds if options exercised:

Shares that could be acquired:

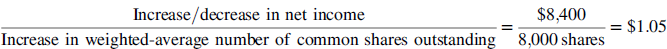

- 7% convertible bonds (see Table 11.3).

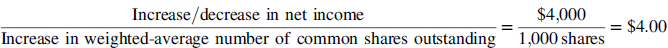

- 4% convertible cumulative preferred stock—The outstanding common shares increase by 1,000 when all shares are converted. This results in total dividends of $4,000 not being paid.

- Options—Only the options to purchase 1,000 shares at $8.00 per share are potentially dilutive. The options to purchase 2,000 shares of common stock are antidilutive because the exercise price is greater than the average market price. Thus, they are not included in the computation.

- Rank the per-share effects from smallest to largest:

a. Options $ 0 b. 7% convertible bonds 1.05 c. 4% convertible cumulative preferred stock 4.00 - Recalculate the EPS in rank order starting from the security with the smallest per-share dilution and adding one potentially dilutive security at a time:

- DEPS—options added:

- DEPS—options and 7% convertible bonds added:

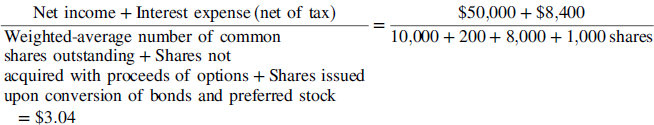

- DEPS—options, 7% convertible bonds, and 4% convertible cumulative preferred stock added:

- DEPS—options added:

DEPS = $2.99

Since the addition of the 4% convertible cumulative preferred stock raises DEPS from $2.99 to $3.04, the preferred stock is antidilutive and is therefore excluded from the computation of DEPS.

A dual presentation of basic EPS and DEPS is required. The dual presentation on the face of the income statement would appear as follows:

Note X: Earnings per Share (Illustrative Disclosure Based on Facts from the Example)

The following adjustments were made to the numerators and denominators of the basic and diluted EPS computations:

| Year Ended December 31, 20X1 | |||

| Income (numerator) | Weighted-average number of outstanding shares (denominator) | Amount per share | |

| Net income | $50,000 | ||

| Less: Preferred stock dividends | (4,000) | ||

| Basic EPS | |||

| Income available to common stockholders | 46,000 | 10,000 | $4.60 |

| Effects of Dilutive Securities | |||

| Options to purchase common stock | 200 | ||

| 7% convertible bonds | 8,400 | 8,000 | |

| Diluted EPS | |||

| Income available to common stockholders adjusted for the effects of assumed exercise of options and conversion of bonds | $54,400 | 18,200 | $2.99 |

There were 1,000 shares of $100 par value, 4% convertible, cumulative preferred stock issued and outstanding during the year ended December 31, 20X1, that were not included in the above computation because their conversion would not have resulted in a dilution of EPS.

Other Sources

| See ASC Location—Wiley GAAP Chapter | For information on… |

| ASC 710-10-45 | The effects of employer shares held by a rabbi trust in computing basic and diluted EPS. |

| ASC 718-10-45 | The effects of employee equity share options, nonvested shares, and similar equity instruments in computing diluted EPS. |

| ASC 718-40-45 and 718-40-50 | The effects of issues resulting from the existence of employee stock ownership plans in computing basic and diluted EPS and the related disclosure requirements. |