CHAPTER 9

DRIPs and Direct Purchase Plans

I hope by now you see the wisdom of reinvesting dividends if you’re attempting to build wealth for the long term.

Typically, the easiest way to do it is through your broker. Most brokers do not charge commissions or fees for reinvesting dividends. If yours does, find a new one. There’s really no reason to pay a fee or commission on such a small transaction.

When you allow your broker to reinvest the dividends for you, all of your portfolio information is in one convenient place.

However, not everyone likes to keep his or her stock in their brokerage account. Some like to deal directly with the company they’re invested in.

Those people can usually reinvest their dividends through the company itself in what is known as a Dividend Reinvestment Plan (DRIP). You can also buy more stock directly from the company if it offers a Direct Stock Purchase Plan (DSPP).

With a Direct Stock Purchase Plan, you send your check right to the company, and it credits your account with more shares. If you own 100 shares of a $20 stock and send the company another $200, your account will show that you are the proud owner of 110 shares (assuming there are no fees, which there often are—we’ll get to that in a minute).

But here’s why I don’t like DRIPs and DSPPs: They often have fees and commissions that are higher than those of a broker.

For example, let’s take a look at Altria (NYSE: MO), a company that qualifies under the 10-11-12 System. Its yield is 5.7% and has averaged over 10% dividend growth for the past ten years.

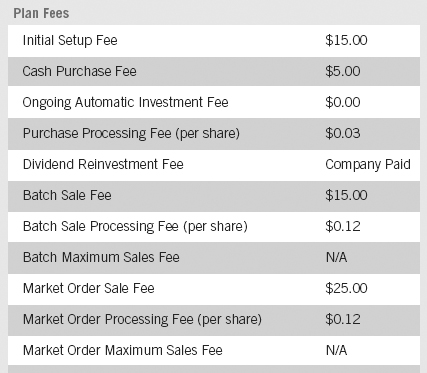

Figure 9.1 shows the list of fees you would have to pay to reinvest your dividends or purchase stock directly from Altria.

Let’s break down these fees. First it will cost you $10 to set up the plan. If you want to purchase stock directly, it will cost $5 plus $0.03 per share. If you buy more than 167 shares at any one time, the cost likely will be more expensive than using a discount broker that normally charges $10 to buy stock.

You can see it will cost you a bunch of money to sell any of your shares—a lot more than you’ll pay at a discount broker. The only way this plan makes sense is if you’re using a full-service broker that charges you more than you would pay in the direct purchase plan.

But what really steams my britches (is that a saying? Sounds like it should be) is that it will cost you as much as $3 to reinvest your dividends.

If you receive $100 in dividends, using the DRIP, you’ll get to reinvest only $97 because Altria is charging you $3 each time you reinvest your dividends. That’s money that belongs in your pocket. It’s money that will stay in your pocket if you’re using most brokers to reinvest the dividend.

Let’s look at another company. (See Figure 9.2.) Clorox has similar fees to Altria for direct purchase. However, you won’t pay anything to reinvest (other than the $15 initial setup fee).

In my mind, there is no reason to pay these fees. If investing or reinvesting directly is more convenient than using a broker, you’d have to weigh the pros and the cons and decide if the additional fees are worth the added convenience.

But for a portfolio of stocks, it actually is far less convenient to keep track of 5, 10, or 15 separate accounts rather than one brokerage account containing all of your stocks, where, by the way, you’ll probably pay less out of pocket for all of your transactions.

The one wrinkle in all of this, where it may be worth your time to consider a DRIP, is when the company offers the stock at a discount.

You heard me right. There are some (not too many) companies that allow you to reinvest your dividends at a discount to the current market price. That’s free money right there.

For example, water utility Aqua America (NYSE: WTR) offers a 5% discount when you reinvest your dividends.

As I write this, the stock is trading at $21.57. If you were to reinvest your dividends today, you’d pay $20.50 per share. Not too shabby. That’s a built-in extra 5% on all shares that you buy through reinvested dividends over the lifetime of the account. Considering we’re only banking on a long-term average of 7.48% annual gain in the stock to meet our goals, you’re nearly already there with the portion of your money that’s reinvested. (The shares bought with the original principal still need to gain their 7.48% per year.)

You’ve seen the power of compounding dividends. You understand that you want to buy stocks as cheaply as you can. Here’s a way to do it for $0.95 on the dollar. The discount will help you accumulate more shares that will generate more dividends that will lead to more shares, and on and on.

Healthcare Realty Trust (NYSE: HR), a Real Estate Investment Trust (REIT) specializing in healthcare, charges no fees or commissions for direct purchases or reinvestment of dividends and also allows you to reinvest the dividend at a 5% discount.

Not many companies offer discounts to shareholders—a little over 100 at the moment. If you’re interested in a DRIP, be sure to visit the company’s investor relations page on its website and closely examine all fees, commissions, discounts, and the like so that you have a clear understanding of what your costs will be versus keeping the stock with your broker.

As you can tell, I think the only time it makes sense to reinvest directly with the company is if you’re getting a discount or if you’re with a full-service broker that will charge you more than the company charges for each transaction. But even the full-service guys often allow you to reinvest your dividends for free, so look at all of the costs involved before making a decision.