The Commercialization Model

In the first chapter, I suggested that there is an abundance of ideas, projects, and even companies to fulfill our need for innovative and entrepreneurial alternatives. Yet, the economic measurements of employment, financial growth, and wealth distribution lag behind this and suggest that we need to find even more sources. I looked at the disposition of the creative energy and output needed to achieve success in these efforts and realized that there may be a better way to focus on the commercial opportunity those ideas have. It is to learn how to turn those ideas into commercial activity. A process (model) was called for!

A model allows for the effective means of sharing ideas, and it serves as a platform for measuring progress and outcome effectiveness. It is based on the idea that the probability of success of the outcome can be improved by process discipline. It results in a more efficient allocation of resources and a more efficient and timely access to user markets.

Using a model or process methodology offers a more subtle advantage. Because the elements of the traditional process of commercialization tend to lose the nimbleness and flexibility needed for improved outcomes, a more vibrant approach is needed. Utilizing a visual, agreed upon central model constantly reminds us that there are alternatives at each step.

Let’s look at an example. It involves choice of pathway to exploit new ideas. Typically, startup models are used to begin the process.

Nimble behavior includes the lure of startups as a means for exploiting commercial success. Certainly, there are advantages of a startup alternative. They include a clean start, focused objectives, and the upside potential of equity participation. The excitement of a successful new enterprise is the ultimate draw. Yet, in many ways, it may be the most unlikely path for commercial success. There are alternatives to reaching the market in ways other than through startup ventures. The process model I present in this chapter offers a disciplined, more nimble approach to selecting the most probable effective pathway to commercial reality. It may not be a startup!

So Why a Model?

Certainly, the following is not meant to be treatise on business modeling. This chapter is, however, a platform for looking at business models as tools for delineating and understanding commercialization processes. Even more relevant is to see if the business model methodology can improve the probability of success of the outcome.

Jarkko Tapani Pellikka and Pasi Malinen, in the December 16, 2013 issue of the International Journal of Innovation Technology, published an article in which they argued that particularly in small technology firms that face increasingly severe competition, only effective (and documented) commercialization processes can secure survival of the venture. Additionally, they observed that smaller technology-based firms seemed to pursue more closed approaches to development, leaning heavily, for example, on R&D. In these firms there is little margin for error nor deep resources to start again.

What follows is not an absolute solution, nor is it a “one size fits all” static tool for improved success. That would be too simple and not reflective of the dynamic and innovative nature of commercialization. So, let’s look at what it the model is and what it does:

- In its simplest form, it is a graphic representation of multiple inputs to a process. It can represent collaboration and consensus in its formation and implementation. It also invites change as the information it requires to form decisions evolves.

- Effective models have the component of “learning” that improves outcomes through continuous feedback.

- It helps break down complex process elements of commercialization so they can be distributed to others and understood in their own right. The elements of the proposed model shown in this book will be first identified and later expanded in subsequent chapters.

- It invites measurement or quantification, so that the effort can be benchmarked to other projects and industry standards and thus be maintained. Once measured, the effort becomes an opportunity for continuous improvement by setting forward-looking metrics to be invoked. From this comes the final calculation of how the elements of a given project contribute to the probability of success, which is the end goal of positive commercialization processes!

- A model invites a discipline similar to a pilot’s preflight checklist. Even though pilots fly similar planes and similar routes, they always revert to an orderly checklist before starting or committing to the flight resources that the journey requires. It still amazes me how many projects are cited that have not been subjected to the rigor of a discipline similar to the pilot’s process or its equivalent.

Despite its many advantages, the model development is not without faults. A partial list might include:

- By adhering rigidly to a model’s constraints, the model can be self-defeating in that it produces actions using expertise in the model’s workings and thus encourages users to lose sight of its vitality. Using the pilot’s nomenclature again, we can allude to a term called situational awareness whereby the pilot makes decisions in the context of all that is happening to the aircraft at any one moment. Later we will look at workarounds that might overcome this issue.

- Although the predominant theme of this section is to argue that a strict, disciplined model serves an organization best, there needs to be a balance in how it is implemented. Certain computer tools, such as dashboards and other visual presentations, can present a pictorial representation of the variations of ideas that can then be compared to strict rules. It could also be argued that some small range of projects would be allowed rules other than those that fit the unifying goals.

- The model might be constructed in a manner that simply does not reflect the corporate (or project) goals or vision. Similarly, it may lack the ability to reflect the organization’s inherent capacity. Either is a recipe for suboptimal results.

- The model simply yields poor outcomes in a variety of metrics, including profits, market share, time to market, or other perceived measures of growth.

With a context for business models in hand, it becomes relevant to look at those issues that surround the process of commercialization. The basis for this is derived from graduate course that I teach at WPI in Technology Commercialization and discussions with product development and new venture professionals.

A Model for Commercialization

An early observation was that discussions about process were focused on specific issues such as the mechanics of funding or feasibility analysis. Very little was mentioned about the overall process. As mentioned later in the book, I consulted with a team at the Chrysler-Fiat research labs that focused on new product development. Almost consistently they focused on the issues of Opportunity Recognition and how to overcome the current (and later identified as chronic) logjam of more than anticipated flow of unsolicited proposals. If only that backlog could be overcome they felt they could improve overall performance.

In reality, failure of any element in the process can be a chance for the overall initiative to go astray. There are at least five separate sections to the generalized steps of the cycle. Cleary the number of steps will vary with the sectors, stages of growth, or the amount of capital required. For example, the regulatory impact of decisions in biotech or large capital equipment projects like a steel mill enlarge the model beyond a simple startup. The question now becomes how to define a generalized model that can be used as a foundation for more elaborate applications.

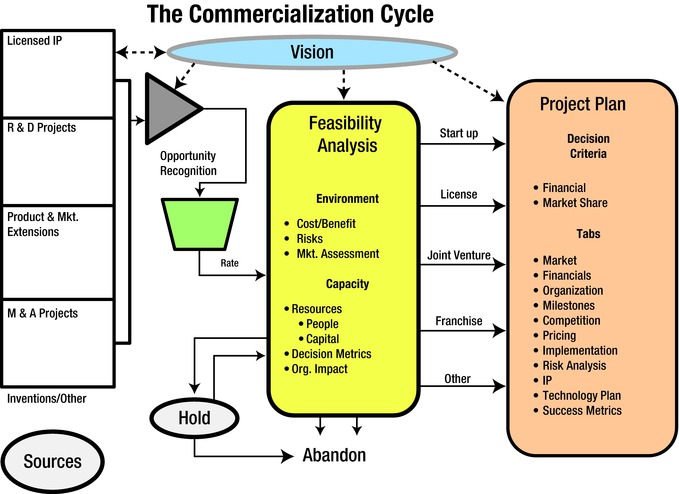

With these caveats in mind, let’s look at a possible graphic model for portraying a cycle of commercialization (Figure 2-1).

Figure 2-1. The commercialization cycle

While not meant to be inclusive, this somewhat elaborate presentation outlines a path of decisions and processes that describe the cycle of how ideas move from concepts to the reality of commercial viability. It suggests that if the disciplines outlined were followed, it would yield a higher probability of success as measured by defined metrics of market financial driven measures. The model is comprised of the following sections:

- Sources of ideas

- Opportunity recognition

- Feasibility analysis

- Going-to-market methods

- Project plan

What follows is a brief introduction to these sections. Subsequent chapters explore these topics in detail.

Sources of Ideas

Finding ideas worthy of becoming projects for successful commercialization is a daunting yet critical part of the entrepreneurial journey. As suggested in the last chapter, it isn’t that there are not enough ideas. Rather, it is an abundance of possible avenues for achieving the project’s goals that may confuse the selection process. Indeed, this is where the cycle begins.

![]() Note If a commercialization project arises within an existing organization, it becomes important to align a project proposal with the corporate vision and its stated goals. When you can couple the project directly to the stated vision, it will make it much easier to secure financial, human, and other resources required from the parent.

Note If a commercialization project arises within an existing organization, it becomes important to align a project proposal with the corporate vision and its stated goals. When you can couple the project directly to the stated vision, it will make it much easier to secure financial, human, and other resources required from the parent.

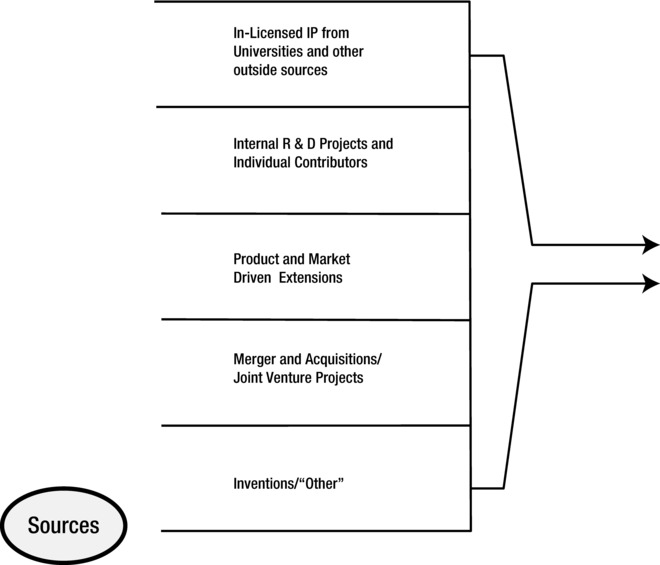

When sorting out multiple sources of innovation, it’s important to avoid blindly repeating the use of singular source channels. Actively and dynamically seeking out the best match of source to a given project becomes critical. In the graphic shown in Figure 2-1, you see five traditional groups of resources for technology commercialization. This is not meant to be an inclusive list, but rather a partial selection of alternatives. It includes “other” as a placeholder for newer and unconventional sources that may apply to a given project.

Aircraft pilots who are certified to fly airplanes in conditions that compromise outside visual references—such as when flying through cloud banks—follow Instrument Flight Rules (IFR). In their training for being certified to do, pilots learn to use six primary instruments to synthesize aircraft performance in such conditions. Training includes the skillset of scanning the instruments for multiple information inputs in real time. If the scan is broken and the pilot becomes fixated on any one instrument, it becomes a recipe for failure and a loss of control follows.

This parallels the quest for business opportunities quite well. Fixation on any one path invites failure.

It is tempting to look to invention first. Much has been written about creativity and role of developing fundamental ideas. Most of us can conjure an image of Edison diligently working over hundreds of lamp filaments in his West Orange, New Jersey and laboratory. One can relish the “a-ha” moment of invention.

Yet when we look at it on a model of probable outcomes, in-house invention is perhaps the least likely avenue to success. That’s why Figure 2-2 starts with looking at licensed technology and its inherent strengths and then encourages similar scrutiny from the other sources. (Chapter 3 examines each of the following category sources in more detail.)

Figure 2-2. Sources of ideas

Opportunity Recognition

Much has been written about how ideas are sorted out or distilled in the context of resource-allocation decisions. Simply stated, academics (and others) refer to this process as opportunity recognition. There is not much agreement in the literature about the various approaches to the process. Much of the decision processes default to analytical tools and approaches over intuitive approaches. Intuition has been significantly discounted. However, it is possible that intuition plays a larger role than we thought and needs to be looked at.

The Role of Intuition

Although a major premise of this text centers on the quest for systematic approaches to commercialization, it becomes important to acknowledge a “placeholder” for intuition or a “gut feel,” as it is sometimes called. Individuals with professional disciplines such as science and engineering reach for a more orderly process.

As decisions move upward in corporate hierarchy, their nature becomes increasingly more ambiguous and generalized and less susceptible to detailed analysis. The CEO who must drive the elements of a corporate vision as a basis for decisions lives in a very different domain than the middle manager who might be deciding to purchase a major piece of capital equipment. The latter’s metrics are more formula-driven and have succinct values and data to drive their decisions. Whether based on financial metrics like returns on investment or market penetration measurements, or even productivity gains, good decisions are driven by analysis.

Intuition and intuitive decisions are characterized by a range of scope and experience. Figure 2-1 attempts to show the myriad of factors that influence intuitive decisions as well as the range of expectations about the validity of the outcomes.

Another perspective about the value of intuitive decisions was amplified to me during a visit I made years ago to the Gibson Guitar division of Wurlitzer Music. It is located near Buffalo, NY. During a tour of the manufacturing process I noticed a somewhat senior individual playing each newly minted guitar and then signing his name to it. The process for manufacturing the instrument was quite elaborate. This step was at the end of the production process where the device under scrutiny had absorbed its maximum cost. Yet, this one individual became an important checkpoint and last (intuitive) step of manufacture. He was a quality control inspector. In spite of all the apparent automation and control, this one person relied on a well-honed intuitive feel for the quality of the instruments. It was his signature that appeared on the inner surfaces of each musical instrument.

A Disciplined Approach

I was once in a meeting with the Director of Innovation at Chrysler Corporation. He said they receive thousands of ideas and proposals from their employees, but that there was not an agreed-upon process within the organization to decide on which ones to move forward. They utilized a committee voting process but in reality, he agreed, it required a more methodical approach to improve.

What follows is an exposition of a process developed at WPI in a student major qualifying project (MQP) thesis. Among other things, it demonstrates a selection accuracy of one out of eleven. That means that when presented with 11 projects, the model can ascertain which project is most aligned to the organization’s vision. This resolution is important as it sets the stage for only considering projects that are closest to the overall vision and goals of the project or the company. Literature suggests that one out of five was considered adequate resolution.

At the time of the thesis existing approaches seem to peak out at a resolution at the one to five level. That means the methodology can only determine of one out five projects considered meeting the project criteria. The implied accuracy of one out of eleven is a marker to the effectiveness of the WPI approach. A higher resolution suggests that the process is more accurate. To extend this idea the overall objective of this book is to see if the probability of success can be improved. Better discrimination at the early part of the process suggests a more probable positive outcome.

The student who led the project, TJ Lynch, was a senior who wanted to pursue an entrepreneurial career upon graduation. Like many ambitious and curious students, he felt unable to decide which course of action to follow. He commented that “all of them looked good.” As his co-advisor I suggested that a more meaningful direction would be to develop the model in the context of selecting a project from multiple opportunities. He agreed and set the stage for the MQP and the research of project selection.

The process begins with an orderly examination of the goals of the project and its “vision.” That vision statement is broken into elements that will be quantified and used as weighting factors (multipliers) in the assessment process. For example, if the overall objective is to be a low cost, technology leader of widgets, larger weights (multiplier percentages) will be allocated to those projects that present widget technology and cost-effectiveness. These multipliers will then be applied to the assessments of the individual functional areas.

The actual project is then broken into functional elements, and the weighting factors are multiplied and summed to provide a project ranking. The details of process are delineated in the WPI MPQ entitled, “The Development and Application of a Multiple Analysis Tool for Entrepreneurs.” It is a public document and can be accessed through the WPI Library System.1 A detailed look at the process is contained in the report and will be further examined in Chapter 4.

There is a need to separate an opportunity from an idea. An opportunity can be held to a fairly rigorous set of tests of viability, financial metrics, impact on organizations, and so on, while ideas seem to fall into large buckets of “good” or “bad.” The Lynch model concentrates on defined opportunities and the need to quantify them in the context of their definable goals.

Again, there is a dichotomy between measurable attributes and a more subjective intuitive approach. In my many discussions with project managers and new market development mangers, they favor a consistent quest of more analytical approaches.

Referencing the Andicivili, Cardozo, and Ray 2000 article published in the Journal of Business Venturing, the authors focus on a concept of “Entrepreneurial Alertness” as a driving force for creating opportunities. Mr. Robert Kern of Waukesha, WI was the founder of the Generac Company. At retirement, he sold the company and used part of the proceeds to create the Kern Family Foundation, which is driven to help engineering schools instill the “entrepreneurial mindset” into their engineering disciplines. I was a Principal Investigator (PI) recipient of a Kern Foundation grant designed to develop courses in innovation and entrepreneurship for engineers. It is constantly oversubscribed. If these directions might be considered a continuum, then certainly Steve Jobs’ penchant for customer-driven design would be an end point.

Is It Real? The Role of Feasibility Analysis

Is the project (or product) real? Should we do it? Is the right time? Are we ready to do this? Are these the proper questions of uncertainty, or are they the proper assessments of whether to commit resources (both human and financial) to a given project?

The answer is, of course, “it depends.” Many sound decisions are made on intuition and the inertia of “we’ve always done it that way!” In a time when competitive global pressures and rates of decreasing technology lifecycles prevail, maybe it’s a signal for the pendulum of intuition versus method to shift toward orderly assessment processes.

Best practices in feasibility analysis fall into two broad categories. The first is the metrics of the opportunity as expressed in terms of market size, competitive forces, technology status, and consumer trends. The second category focuses on the readiness of the organization or project to commit and compete in the given space. Readiness is measured in balance sheet ratios of cash and liquidity, people in terms of availability and skillsets, and large capital metrics like available space and capital investments.

One of the great benefits of a disciplined feasibility analysis is the ability offered to the initiating organization to abandon a project or put it into a dynamic holding pattern that allows the proper conditions to be in place before proceeding.

The feasibility analysis issues will be further examined in Chapter 5.

Going to Market

Clearly, the domain of marketing and gathering the resources required for achieving market presence is the world of professionals. There is another dimension of going to market that is strategic and determines the path of commercialization. It is the set of decisions that determine which channel best serves the given project. Like the issues surrounding the sources of ideas where fixation on a singular channel dominate the thought process to its detriment, putting on your blinders when it comes to a go-to-market strategy is equally harmful.

Going to market via startup may be a good direction. Startups are most intriguing. Somehow the lure of a new venture complete with the excitement of the equity’s upside potential is a most glamorous alternative. Yet somehow it is hard to imagine that the risks and fragile dynamics of a startup make it the uniformly best platform for exploiting market presence. As the model shows, there are robust alternatives in licensing, joint ventures, and franchises that you need to consider. Each has its own positive and negative characteristics.

Marketing is the rich portal of bi-directional information that flows out of the organization and back into it. Advertising, pricing, promotional efforts, and trade shows were the traditional domains of marketing. Social media and the Internet have accelerated these channels at a rate that is hardly understood. These classical functions had tragically become confused and intertwined with the sales function in many companies. It becomes management’s responsibility to carefully delineate the two. Beyond these traditional aspects of outward information, marketing becomes the critical strategic lifeline for competitive information and is product feedback for later stage improvements. It also becomes a general bellwether for market and customer trends. A sharp CEO or senior manager learns to rely on the feedback and information. Options for going to market will be explored in Chapter 7.

I suspect that as early as the building of the Egyptian pyramids, there have been project plans to delineate and chart the path of complex human endeavors of all sorts. In recent times, there is renewed interest in project planning for significant undertakings such as putting an astronaut on the moon or even on Mars. Constructing large buildings or building technologically advanced aircraft certainly means utilizing careful planning techniques.

What has changed over the centuries are the tools and the sophistication of project-planning concepts and their enabling platforms, such as computer-driven models. Broadly, these tools fall into two categories that embrace decision alternatives and performance metrics.

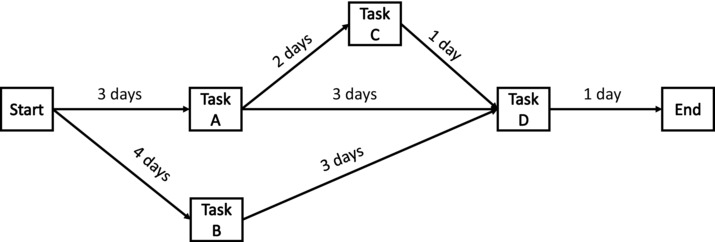

One of the earlier decision tools is the Program Evaluation Review Technique (PERT). It was issued created by the U.S. Navy to help manage the complex Polaris submarine project. It featured a series of nodes and vectors to represent the tasks and the time required to finish them. A graphical example is shown in Figure 2-3.

Figure 2-3. Sample PERT chart

This simplified PERT chart shown in Figure 2-3 shows the implication of two options on the timeline of a hypothetical project. The Options shown will consume additional resources of human and material capital. The logic of the PERT chart is that it allows enough time so that resources can be applied to “catch up” to the rate of the overall timeline. Although this figure is simplified, it can apply to such complex issues as submarine or weapons design and implementation. Those models require significant computational power to excise their full capacity. The additional planning capability it offers well outweighs the cost of implementation.

The PERT chart helps delineate tasks in an orderly manner and more importantly showed the interaction of tasks that would allow prediction of the overall project completion.

In the same time frame, the commercial version of PERT was released. It is called the Critical Path Method (CPM). The use of these techniques produced questionable results and was very complex to use. Their lifecycle has been extended as ordained by the Navy’s requirement that they be used by the procurement vendors.

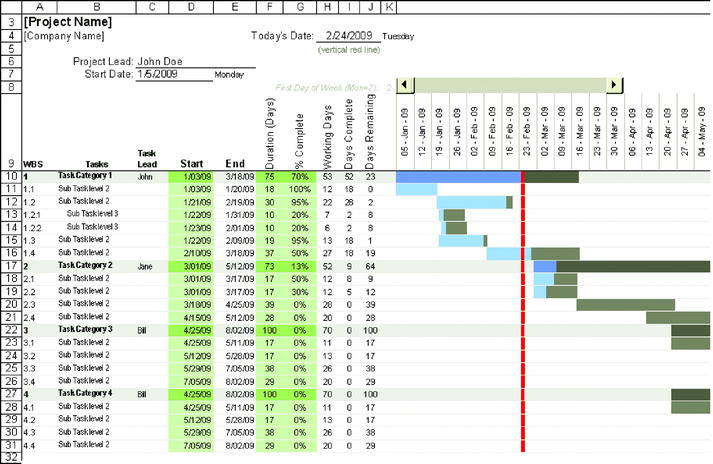

In the 1910s, an inventor named Henry Gantt created a bar graph version of a project-planning tool. It featured time-based graphics showing the time to complete tasks and the relation and dependencies of one task to another. There is also a budget-tracking element that allows monetary quantification of the tasks. Unlike the PERT chart, the Gantt chart has survived as a useful tool because of its ease of use and concise graphical presentation. A graphical sample of a Gantt chart is shown in Figure 2-4.

Figure 2-4. Sample Gantt chart

One further twist in the evolution of project-planning tools came with the popularity of computers and cloud-based technology. These developments led to real-time collaborative applications of the tools among multiple players. Online variations of Gantt charts are offered by LightHouse, SpringLamp, Jumpchart, Basecamp, and now Microsoft in their Office suites.

Measurement of performance includes statistical quantification of time and utilization of money. In the latter category, an example that is favorite of mine is Net Present Value (NPV). NPV is a formula that allows the user to bring various timelines to a present time value in terms of dollars. It works best in projects that tend to be more stable and when conditions such as interest rates and the cost of money don’t fluctuate too frequently. With project capital allocations now brought to a common time, it becomes possible to compare the performance of multiple projects’ performance and to better estimate which makes the most sense financially. In Chapter 6 we will explore the importance of planning and its use as a means of allocating resources to ensure successful commercial outcomes.

Does this Relate to Commercialization?—A Summary

In this text, I argue that a “model” of a commercialization process can improve the probability of success for the outcomes of projects considered by a process. At minimum, it allows for an orderly allocation of resources and establishes metrics for monitoring progress and that can lead to successful outcomes.

Is it absolute? Does it offer a process cookbook? Is it ubiquitous to all projects? Of course not. It does, however, offer a tool for collaboration and the coordination of people, space, and capital. Sometimes I suspect that the major advantage of developing a model is the dialogue that ensues among the participants as they attempt to envision the multiple steps, skills required, and common goals to prevail.

In 1972, I had the opportunity to be on panel discussion sponsored by the MIT Venture Forum in New York city on the role of venture capital in new ventures. I happened to be sitting next to the now deceased Bob Noyce, who was one of the founders of Intel (and an MIT graduate). At that point, the pioneering chip maker company was starting to grow. I asked him if knowing what he did at the time we met, would he have started the company. His immediate answer was, “Certainly not. One of our greatest assets was our naiveté. We didn’t know what we couldn’t do.”

There are varying degrees of uncertainty in the journey throughout the various steps of bringing ideas to commercial reality. One clear advantage of an orderly progression is that the uncertainties and the assumptions that surround them can be quantified in a logical and repetitive manner. That alone helps bring order to a complex and uncertain system. It also carries the risk that in something like commercialization model development, which requires a degree of creative innovation and intuition, we might lose those elements to a more rigorous process. But as you’ll see, disciplined program reviews—where the progress and creativity of the project’s progress can periodically be examined and of course altered to meet changing external conditions—can mitigate against that danger.

____________________

1https://www.wpi.edu/Pubs/E-project/Available/E-project-050509-091115/unrestricted/tjl-MQP-MOpA-Tool-D09.pdf