14

Impact of Suppliers Network on SCM of Indian Auto Industry: A Case of Maruti Suzuki India Limited

Ruchika Pharswan1*, Ashish Negi2 and Tridib Basak3

1Bharti School of Telecommunication Technology and Management, Indian Institute of Technology, Delhi, New Delhi, India

2Department of Electronics and Communication Engineering, HMR Institute of Technology and Management, Hamidpur, New Delhi, India

3Department of Computer Science Engineering, HMR Institute of Technology and Management, Hamidpur, New Delhi, India

Abstract

Maruti Suzuki India Limited (MSIL) has been the most fascinating story among automobile manufacturing enterprises, and it is India’s largest car manufacturer. After Maruti merged with Suzuki, it acquired high acceleration in automaker industry. MSIL has a vast network of vendor deals and service networks across the country and primarily focuses on providing cost-effective products with high customer satisfaction. The proposed report is single case analysis and aims to provide a comprehensive view of goal, strategic perspectives, and various aspects implemented in the supply chain, inventory, logistics management, and the benefits inferred by MSIL in order to gain a competitive advantage. We have also tried to figure out how the current epidemic (COVID-19) has affected their SCM and how they have adapted their business strategy to deal with it. This case study reveals that MSIL has been working hard to improve its supply chain and logistics management in order to achieve positive results.

Keywords: Automotive industry, Maruti Suzuki India Limited, COVID-19, supply chain management

14.1 Introduction

Automotive industry is one of the predominant pillars of the growing Indian economy and, to a huge extent, serves as a bellwether for its modern state. In 2018 alone, the automotive sector contributed 7.5% of total gross domestic product (GDP) of India. Owing to COVID-19 this year, this percentage dipped to 7%. The Government of India and automotive industry experts expect it to transpire as the worldwide third-largest passenger vehicle market by the end of 2021 with an increase of 5% from existing percentage and draw US $ 8 to 10 billion local and foreign investment by 2023. In fiscal year 2016-2020 (FY16-20), annual growth rate of the Indian automotive market was over 2.36% compound annual growth rate (CAGR), indicating a positive trend in step forward [1]. The automotive industry is likely to generate five crore direct and indirect jobs by 2030. India Energy Storage Alliance (IESA), published its 2nd annual “India Electric Vehicle Market Overview Report 2020–2027” on the Indian Market, which states that in India during FY 19-20, EV sales stood at 3,80,000, and on the other hand the EV battery market accounted for 5.4 GWh, pointing to the growth of the Indian EV market at a CAGR of 44% between 2020 and 2027. In FY20, India was the fifth largest auto market worldwide [2]. And in 2019, India secured the seventh position among top 10 nations, in commercial vehicle manufacturing. Recent reports show that in April to June 21 Indian automotive exports stood at 1,419,439 units, which is approximately three times more than that of the export of 436,500 units during the same period last year [3].

Starting from the era, when Indian manufacturers disbursed upon foreign ties, to now developing their own innovation, the Indian auto sector has come a long way. While looking up for top 10 automobile players in India, Maruti Suzuki has always been on top of the table [4]. A consistent dominant leader standing deep rooted with big names like Tata Motors, Hyundai Motors, Toyota, Mahindra & Mahindra, and Kia. With a good start to 2021, Maruti Suzuki India Ltd topped the four wheelers chart with a 45.74% market cap. MSIL was formerly known as Maruti Udyog Limited, and is a subsidiary of Suzuki Motor corporation primarily known for its services, was founded by the Indian Government in 1981 [5]. Later on, it was sold to Suzuki Motor Corporation in 2003. Hyundai with a 17.11% market share ended in second place. Hyundai Motor India Ltd (HMIL) is a proprietary company of Hyundai Motor Company, established in 1998 and is headquartered in Chennai, Tamil Nadu. It deals across nine models across segments and exports to nearly 88 countries across the globe. Tata Motors, the biggest Gainers of January 2021 bagged third position with a market share of 8.88%. While Mahindra & Mahindra sold 20,498 units against 19,55 units in 2020 with a market share of 6.27%.Whereas, Honda, Kia, Nissan, and Toyota bagged 3.72%, 6.27%, 1.49%, and 2.70% market cap, respectively.

As a matter of fact, over the past two decades, the global auto industry sales have declined almost 5%, that is approximately down to less than 92.2 million vehicles. These, however, are very different from the declines that the companies in the industry have seen since 2019 owing to COVID-19. In a report by Boston Consulting group, it highlights a wide range of actions, including revitalizing the supply chain, cost reduction in operations, and reinventing user-based makeovers in the marketing strategies that were adopted by various players of the auto sector, which made them survive the pandemic. Another article by KPMG draws one’s attention to India-specific strategies, such as localization and sustainability of supply chain, mobilization of marketing strategies and growth of subscription models, such as virtual vehicle certification, which helped to revive the Indian automobile industry. Keeping a close eye on the strategies followed by the most of the stakeholders can help us to admit the choice pattern why these firms walked a specific strategy and bounced back post COVID-19 [7]. Thus, stakeholders may be able to seek a series of incremental strategies than those who can be a pause from the past. The International Organization of Motor Vehicle Manufacturers, a.k.a. “Organization Internationale des Constructeurs d’Automobiles” (OICA) in its report mentions that a 16% decline of 2020 global automobile production has pushed back up to 2010 equivalent sales levels. Europe, which represents an almost 22% share of global production, dipped more than 21%, on average ranging from 11% to almost 40% across the European countries. And Africa on the other hand has also faced a sharp decline of more than 35%. Meanwhile, America, which upholds 20% share of global production, dropped by 19%. Moving to the south, the South America continent declined by more than 30%, whereas Asia declined with only 10% even after the fact that it is the world’s largest manufacturing region, with a market share of 57% global production [8].

While India’s automotive sector has experienced numerous hurdles in recent years, including the disastrous COVID-19 pandemic, it continues to thrive, and has made its way through most of the challenges and many are now in the rear-view mirror [9]. From global supply-chain rebalancing, an outlay of ₹ 26,058 crore Government incentives boosting exports and high-value advance automotive technology and technology disruptions creating white spaces have created opportunities at all stages of local automotive value chain strategies. Globally, a few original equipment manufacturers (OEMs) have started showing their presence in downstream value chain ventures like BMW’s secure assistance now offering finance and insurance services. Ford’s agreement with GeoTab opened its door to the vehicle data value chain [10]. Even in India, experiments like iAlert, e-diagnostics, Service Mandi by Ashok Leyland, True valued by Maruti Suzuki in downstream ventures have provided opportunities to shape a digitally enabled ecosystem. Which provided a comprehensive solution creating a world-class ownership experience, with services like scheduled services, breakdown service, resale, or purchase. Innovative brands, like Tesla, expect the fact that going through digital channels is the future against traditional brick and mortar channels [11]. In view of MSIL’s experiences in the Indian automotive business, this current study aims to investigate and broaden the horizon by examining the environment for factors that contributed to MSIL’s long-term viability when other important participants were unable to, both during and after the COVID-19 pandemic. Various aspects implemented in the supply chain, inventory, and logistics management, benefited MSIL. And the strategic viewpoints that propelled MSIL to the forefront of the Indian automotive market [12].

The remaining sections of this study are organized as follows: Section 14.2 presents the multiple perspectives and researches on Automotive Industry from the expert contributors and overall themes within literature. Section 14.3 exhibits the workflow and methods used in this case study. Section 14.4 details the key findings and statistics of the study using secondary resources [5]. Section 14.5 depicts the discussion on the key automotive industry related topics relating to the challenges, opportunities and the research agenda presented by the expert contributors. The study is concluded in section 14.6.

14.2 Literature Review

The automotive sector is rapidly developing and integrating cutting-edge technologies into its spectrum. We reviewed a number of research papers and media house articles/publications and selected the ones that were related to our study and overall themes in the literature [13].

In their research paper, M. Krishnaveni and R. Vidya illustrated the growth of the Indian automobile industry. They looked into how the globalization process has influenced the sector in terms of manufacturing, sales, personal research and development, and finance in their report. They also came to the conclusion that, in order to overcome the challenges provided by globalization, Indian vehicle makers must ensure technological innovation, suitable marketing tactics, and an acceptable customer care feedback mechanism in their businesses [14]. The impact of COVID19 on six primary affected sectors, including automobiles, electricity and energy, electronics, travel, tourism and transportation, agriculture, and education, has been highlighted in the article, authored by Janmenjoy Nayak and his five fellow mates [15]. They also looked at the downstream effects of the automobile sector, such as auto dealers, auto suppliers, loan businesses, and sales, in their report. They also mentioned some of the difficulties that have arisen as a result of COVID-19, such as crisis management and response, personnel, operations and supply chain, and financing and liquidity [16].

Shuichi Ishida examines in her research, how product supply chains should be managed in the event of a pandemic using examples from three industries: automobiles, personal computers (PCs), and household goods. In their study, it was found that vehicle production bases had been transformed into “metanational” firms, whereas earlier they had built a primarily local SCN center on the company’s home location [17]. As a result, in the future, switching to a centralized management style that takes advantage of the inherent strength of a “closed-integral” model, which maximizes the closeness of suppliers to manufacturing sites, would be advantageous. The study by Zhitao Xu and his fellow researchers intends to investigate the COVID-19 impacts on the efficacy and responsiveness of global supply chains and provide a set of managerial insights to limit their risks and strengthen their resilience in diverse industrial sectors using critical reading and causal analysis of facts and figures [18]. In which they stated that global output for the automotive sector is anticipated to decrease by 13%. Volkswagen halted its vehicle facilities in China due to travel restrictions and a scarcity of parts. General Motors restarted its Chinese facilities for the same reasons, although at a relatively modest manufacturing pace. Due to a shortage of parts from China, Hyundai’s assembly plants in South Korea were shut down. Nissan’s manufacturing sites in Asia, Africa, and the Middle East have all shut down [19].

In their study paper, Pratyush Bhatt and Sumeet Varghese described the current state of the automobile sector and how it may strategize in the face of economic uncertainty [20]. They pointed out that material expenses (which are the greatest in absolute terms compared to the rest) have risen from 56.3 percent to 52.3 percent to a quick increase of 62.6 percent, resulting in a relative increase of 0.4 percent over three years, thanks to steady investment in people. Avoiding the need for an intermediary between the company and the client, as well as preparing deliveries to arrive at the customer directly from the service centre, are two more cost-cutting measures (Maruti Suzuki Readies Strategy, n.d.). As a result, in order to reverse the profit decline trend, they should contemplate proportionately divesting in both divisions while maintaining their borrowing pattern, which is “keeping it less.” Manjot Kaur Shah and Sachin Tomer, in their research paper discussed how different businesses in India interacted with the public during COVID-19 in order to preserve a healthy relationship with their fan base as a marketing strategy [4]. Automobile manufacturers’ brands were also emphasized in this study. Maruti Suzuki, for example, advised customers not to drive during the shutdown and to stay inside. #FlattenTheCurve, #GearUpForTomorrow, and #BreakTheChain were among the hashtags used. Furthermore, they made a contribution by distributing 2 million face masks. Hyundai was a frequent Instagram user. They urged their followers to be safe, emphasizing that staying at home is the key to staying safe [21]. #HyundaiCares, #WePledgeToBeSafe, and #0KMPH were among the hashtags they used. People were also instructed to take their foot off the pedal and respect the lockdown. The first post from Toyota India was made on March 21, 2020, ahead of a one-day shutdown in India on March 22, 2020. They used the hashtag #ToyotaWithIndia to show that Toyota is standing with India in its fight against COVID-19. Hero MotoCorp has extended their guarantee until June 30, 2020. They offered advice on how to keep bikes when they are not in use. #Stayhomestaysafe was one of the hashtags they used [22].

14.2.1 Prior Pandemic Automobile Industry/COVID-19 Thump on the Automobile Sector

COVID-19 was proclaimed as a global pandemic by the World Health Organization (WHO) as soon as it was found, a lot of industries have been affected by the same including the Automobile sector worldwide and in India as well. The worldwide epidemic caused by the coronavirus struck at a time when both the Indian economy and the Automobile industry were anticipating recuperation and firm growth [23]. While the GDP gain forecasts were expected to be scaled by 5.5%, the pandemic resulted in a negative impact of 1-2% on the awaited magnification rates for the same .In India, the introduction of Covid-19 had a negative impact on the automotive industry. A cumulative impact of $1.5-2.0 billion each month was noticed and evaluated across the industry. Despite phase wise unlocking and opening up, a steep decline in passenger vehicle demand played and is still playing a major role in the industry and its lack in exponential growth [24].

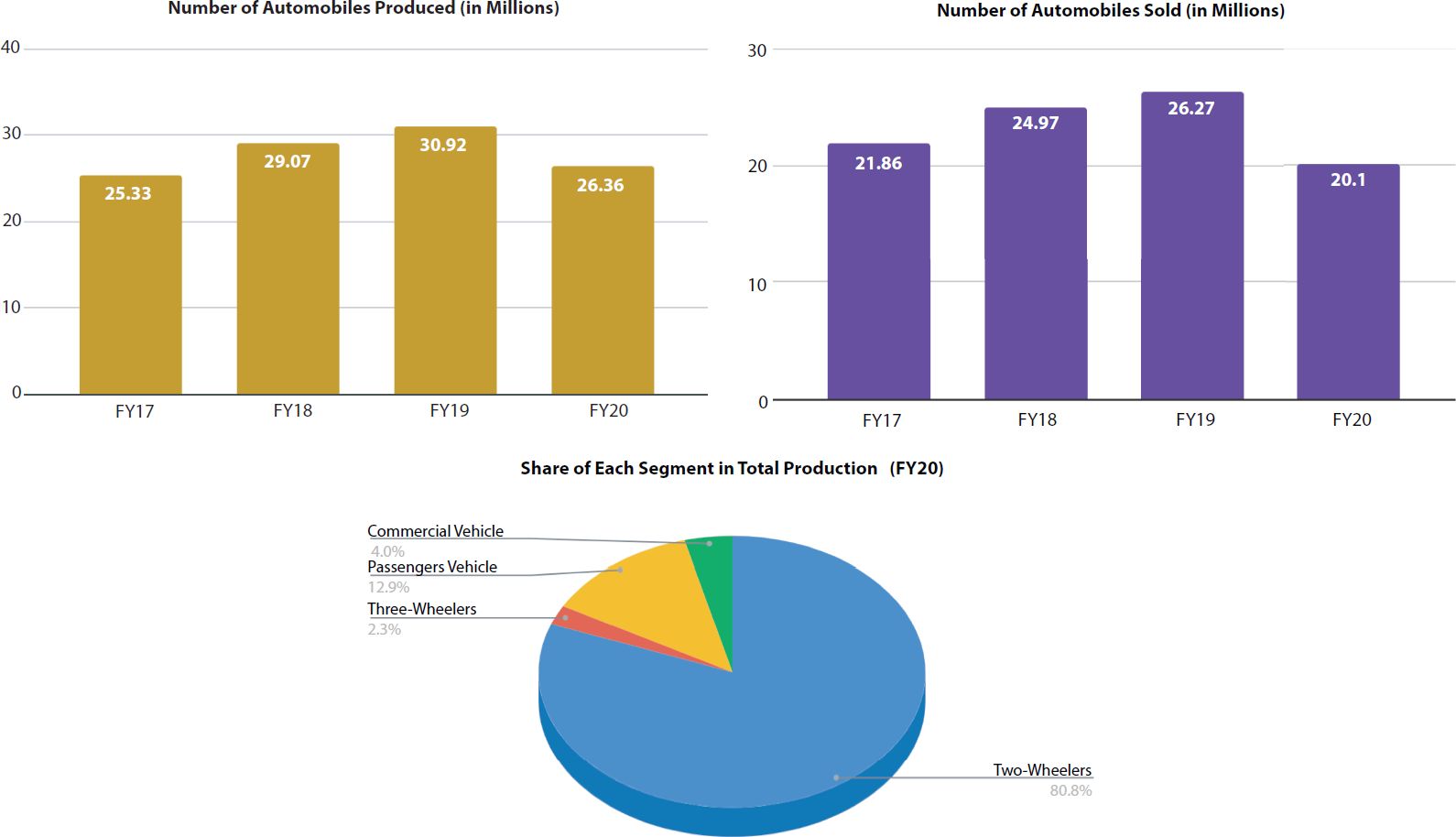

The Society of Indian Automobile Manufacturers (SIAM) said that overall automotive sales in the fiscal year that ended in March, India, the fifth-largest global market, hit a six year low (SIAM) that can be depicted using Figure 14.1. In 2019-20, a skeletal slowdown fueled by a slew of regulatory measures, as well as a stagnant economy, has placed vehicle sales on hold. In addition to the pandemic, which compounded sluggish sales [25]. In the midst of the rampant epidemic, restrictions, and lockdowns. For the third year in a row, the automobile sector is bracing for a difficult year. The overall auto industry’s compound annual growth rate (CAGR) over the next five years (2015-16 to 2020-21, or FY21) is now negative at 2%, down from 5.7 percent in the previous five years (from 2010 - 16).The automotive industry’s decadal growth has now fallen from 12.8 percent to 1.8 percent, demonstrating that there is more to the downturn than the pandemic, and that the epidemic solely cannot be cursed for multiple year lows in any segment in FY21 [26].

The shown below Figure 14.2 reveal the sales of the top two competitors of Maruti Suzuki in the Four-Wheeler industry and only Maruti Suzuki India Limited (MSIL) seems to have a positive magnification in terms of growth as compared to other homogeneous players out in the market. Sales in each segment literally approached multi-year lows in FY21, making it one of the industry’s worst years ever. Passenger conveyance purchases in the domestic market fell to a six-year low with 2,711,457 units sold. In the domestic market, motorcycle and scooter purchases were also brushed off to the 2014–2015 figures, with a volume of 15,119,000 units [18]. With 216,000 units sold, three-wheelers were the hardest hit, with volumes falling to a 19 years lowest sale. Furthermore, Commercial vehicle sales have also plummeted to their lowest point in over a decade.

Figure 14.1 Automobile Production trends 2015–2021.

Figure 14.2 Domestic sales growth for four-wheelers segment.

14.2.2 Maruti Suzuki India Limited (MSIL) During COVID-19 and Other Players in the Automobile Industry and How MSIL Prevailed

India’s largest four-wheeler producer, Maruti Suzuki, appears to be in command of the situation, not only have monthly sales increased, but year-over-year growth rates have also increased by around 1.3 percent. Sales figures have experienced a very substantial positive build-up in Monthly Growth rates compared to the pre-Covid-19 scenario, because practically all manufacturers have already reached 70-80 percent production capacity [27]. As expected, quarter-year reports revealed a bleak picture of the sector’s whereabouts. Tata Motors, a market leader in the production of four-wheelers, had a poor “first quarter”—FY21. The scar that Covid-19 has left on the automobile market is reflected in compiled net-revenues and retail sales, which plummeted by nearly 48 percent and 42 percent, respectively [16].

In India, the size of the used automobile market/second-hand four-wheeler market is approximately 1.4 times that of new ones (in comparison to 4-5 times in the developed countries) and has a high magnification capacity [15]. Pre-COVID-19, Second-hand car sales were growing at a far quicker rate than new car sales, and industry insiders are already noticing an uptick in such sales. During the April-June period, it eventually led to used automobile online platform Droom to an increase of 175 percent in activity and a 250 percent increase in leads. From Figure 14.2, it can be concluded that during the same time period, Maruti Suzuki Veridical Value recorded a 15% increase in used car sales over the previous year. In June, Mahindra First Cull Wheels reported stronger demand than the previous year. Hyundai Motor India reported a magnification of 2% in domestic sales at 46, 866 units in August 2021 [4]. In the same period last year, the carmaker sold 45,809 vehicles, with sales hampered by the COVID and national restrictions on the import and export of components and implements.

14.3 Methodology

The methodology employed for this study to examine the impact of supplier networks on SCM of the Indian automotive sector and logistics management process post COVID-19 epidemic and how MSIL topped the Indian automotive list used a combination of literature review, single case study, and flexible methodology systematic approach [16] and the same is depicted using the flowchart in Figure 14.3. Secondary data was used in the research, which included a literature study as well as printed media, social media and website articles. Information was gathered from research papers, news stories, related books, websites and company brochures [20].

Figure 14.3 Flowchart of the research methodology.

The essay methodically arranged this material after a thorough examination of the same to capture the challenges and their solutions adopted by MSI, the chain of events that led to the case situation, and the steps made by MSIL to address the same in comparison to rivals’ strategies. The data for this study came mostly from secondary sources, including the expert research and analytical articles, journals. Media coverage of the Indian auto industry, secondary data available in print and online/social media were also included [24]. SIAM Automotive Industry publications and annual reports and MSIL’s own source via annual reports, press briefings, and other means.

14.4 Findings

14.4.1 Worldwide Economic Impact of the Epidemic

The effect of COVID-19 had a huge role to play in the direct sales and work flow of various industries especially in India. The impact of COVID-19 left a huge negative impact and will remain to be a big dent on our economy for the next years and generations to come as a prediction done by industrial experts and economists [27, 29]. Some sectors failed to hit a significant revenue generation mark during the crisis period whereas some of the industries and sectors had an impact on a very small scale or rather it will not be incorrect to mention that they made a significant amount of growth instead. The categorized list is mentioned below in Table 14.1.

14.4.2 Effect on Global Automobile Industry

The COVID-19 crisis and global pandemic have been causing disruption and economic hardship around the world and across the nations with boundaries being no limit for the hit taken by the market. No country has been spared its effects, which have resulted in significant economic stagnation and poor growth, as well as the closure of certain enterprises and organizations due to massive losses and crises [3]. Similarly, the disease has impacted other key sectors, and the global unified automobile sector has not been relinquished. The shutdown and forced closure of manufacturing companies, as well as the supply chain being impeded and disrupted as a result, decreased/lack of demand, have all taken their toll. As a result of their inability to cope with the losses, several auto dealers would close permanently, causing market share to plummet [6].

Table 14.1 Indian economy driving sectors Real Gross Value Added (GVA) growth comparison.

| Real GVA Growth (in percentage) | |||||

|---|---|---|---|---|---|

| Sector | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 |

| I. Agriculture, Forestry and Fishing | 6.8 | 6.6 | 2.6 | 4.3 | 3 |

| II. Industry | 8.4 | 6.1 | 5 | –2 | –7.4 |

| II.i. Mining and Quarrying | 9.8 | –5.6 | 0.3 | –2.5 | –9.2 |

| II.ii. Manufacturing | 7.9 | 7.5 | 5.3 | –2.4 | –8.4 |

| II.iii. Electricity, Gas, Water Supply and Other Utility | 10 | 10.6 | 8 | 2.1 | 1.8 |

| III. Services | 8.1 | 6.2 | 7.1 | 6.4 | –8.4 |

| III.i. Construction | 5.9 | 5.2 | 6.3 | 1 | –10.3 |

| III.ii. Trade, Hotels, Transport, Communication & Services related to Broadcasting | 7.7 | 10.3 | 7.1 | 6.4 | –18 |

| III.iii. Financial, Real Estate and Professional Services | 8.6 | 1.8 | 7.2 | 7.3 | –1.4 |

| III.iv. Public Administration, Defence and Other Services | 9.3 | 8.3 | 7.4 | 8.3 | –4.1 |

| IV. GVA at Basic Prices | 8 | 6.2 | 5.9 | 4.1 | –6.5 |

Car sales were one of the few businesses that existed prior to COVID-19, that had opposed the industry being shifted to the online platforms and converted it majorly to the E-Commerce market. The common pattern and research study have revealed that consumers browse out for vehicles over the internet and then visit the dealership stores to make the final purchase. So, the idea of it being shifted to complete online has been a major crack of an Idea and implementing it is under the works with major dealers having their own websites and online portfolios, it is a possibility that due to COVID and its impact online platforms and complete dealership being via online mode is not a lucid dream or imagination [14]. During the pandemic, surveys indicated that the percentage of customers who bought 50 percent or more of their total transactions online climbed from 25 percent to 80 percent, giving many businesses a chance to recoup their losses and weather the economic resurgence [28]. Despite the fact that recent market readings and figures showed hints of improvement month-over-month in August 2021, (MoM). The impact of this on many regions around the world has been discussed and defined as follows using the graph in Figure 14.4.

United States: The automotive industry in the United States is still in a precarious state. In August, sales dropped by nearly 20% (YoY). The shares of various major car brands being categorized below according to their stats are: Toyota suffered a 24.6 percent decrease, Honda at a net significant economic impact of (-23%). Hyundai, as compared to the other players out in the market performed significantly better with only an 8.4% decline overall [10].

Figure 14.4 Global impact of COVID-19 on automotive sector.

European Union: In Europe, easing of lockdowns and recovery from COVID-19 has been better than other standout nations [18]. As a result, it surpassed 1.2 million manufactured items, down 16 percent on a year-over-year basis in comparison to previous year and is recovering at a better pace with each passing quarter and a far better improvement than others.

Japan: In Japan the chances of a speedier recovery and at a faster pace is suggested. Making it stand out to be better than the rest of the global competing nations. Following that, car sales increased by 11.6 percent year over year to 2.47 million units in H1 202 [15].

China: China’s vehicle sales business continues to recover at a rapid pace. In August, vehicle shipments totaled close to 2.2 million units, up 11.6 percent year over year. Overall shipments during the January-August 2020 period were 10% lower on a year-over-year basis than they are now [28].

14.4.3 Effect on Indian Automobile Industry

The COVID-19 induced lockdown has had a major effect on the Automobile industry on a global basis, India as an economic zone has not been spared and has also faced a lot of shutdowns and closure of companies who could not survive the economic crisis surge. The same has also led to the disruption of the entire market chain system and the rotation of products as exports from India and auto parts as imports due to the shutdown of the whole nation on an emergency basis [27]. Adding to it the reduction in customer demand also had a huge role to play and it being the main source and contributory factor in the loss in revenue and severe liquidity crisis in the automobile sector. The other main reasons for the roadblock in the sales are as follows: the leapfrogging to BS6 emissions norms (effective from April 1 of 2020) from earlier BS4, constructive charges like GST. According to the studies and research done by the Society of Indian Automobile Manufacturers, the car industry in India alone witnessed a negative growth in sales of PVs (Passenger Vehicles) in FY21 a total of 2.24% decline as compared to earlier records, 13.19% fall in the sales of 2-wheelers, a hefty 20.77% negative growth in sales of CVs(Commercial vehicles) and an overall loss of 66.06% in sales of 3- wheelers [28]. Now coming up individually to the Auto Sector and its segmental analysis below, the stats show the comparison of sales and production of automobiles in FY 17’-20 in Figure 14.1. And the share of each segment in total production done in FY 2020 divided on the basis of vehicle types mainly prevailing in India, which can be inferred using Figure 14.5.

Maruti Suzuki India Limited (MSIL) cut down the temporary workforce by 6% due to the petty number of sales and drop in demand in the market. The auto sector which contributed around almost 7% of the nation’s GDP is currently feeling the heat and is now facing a steep decline in the growth rate due to the COVID-19 scenario [24]. Along with MSIL the other players in the market altogether have observed a loss of more than 30% in recent months. Now, a recent study done in 2021 provided the facts on the analysis of the sales performance of the Auto Market participants and firms that is provided below in Table 14.2.

When compared to the same time the previous year, PV sales fell 17.88 percent in April-March FY 20’. In terms of PVs, sales of passenger cars and vans dipped by 23.58 percent and 39.23 percent, respectively, in April-March 2020, while sales of utility vehicles UVs ticked up by 0.48 percent [16]. The overall Commercial Vehicles segment fell by 28.75 percent in comparison to the same period last year, with Commercial Vehicles, Medium & Heavy Commercial Vehicles (M&HCVs), and Light Commercial Vehicles falling by 42.47 percent, 20.06 in FY 20’ with record sales done during the same period in FY ‘19 which can be clearly seen using the above Table 14.2. [24] The sale of three-wheelers has decreased by 9.1 percent. In comparison to April-March 2019, passenger and goods carriers in the 3-Wheelers lost 8.28 percent and 13.27 percent, respectively in April-March 2020. In April-March 2020, the number of 2-wheelers decreased by 17.76 percent compared to the same period in 2019. Scooters and Motorcycles both lost 16.94 percent and 17.53 percent, respectively, in the 2-Wheelers market over the same time period [26].

MSIL leads the PVs segment and has a whooping share of 45.6% despite it being valued for being more than 50% in previous years. The next in the ladder was taken by Hyundai motors with 16.4% even though they saw a significant decline in their numbers for previous years. Third on the list being Tata motors with 9.3% in March and 8.8% in Feb 2021 another significant players Kia Motors, M&M, Toyota, Renault etc. being 6.0%, 5.2%, 4.7% ,3.9% respectively and other their MoM change during Feb’-Mar’21 is being represented in the tabular and graphical representations given below in Table 14.3 and Figure 14.6.

Figure 14.5 Sales percentage of vehicles according to their type.

Table 14.2 Stats during FY 19’-20’ reflecting effect on sales.

| PV Domestic Sales (Volume in Units) | Mar’21 | Mar’20 | YoY% | Feb’21 | MoM% | FY21 (in Lakh) | FY20 (in Lakh) | YoY% |

|---|---|---|---|---|---|---|---|---|

| Maruti Suzuki | 1,46,203 | 76,240 | 92% | 1,44,761 | 1% | 12.93 | 14.14 | –8.50% |

| Hyundai Motors | 52,600 | 26,300 | 100% | 51,600 | 2% | |||

| Tata Motors | 29,654 | 5,676 | 422% | 27,225 | 9% | 2.22 | 1.31 | 69% |

| Kia Motors | 19,100 | 8,583 | 123% | 16,702 | 14% | |||

| M&M | 16,700 | 3,383 | 394% | 15,391 | 9% | 1.57 | 1.87 | –16% |

| Toyota | 15,001 | 7,023 | 114% | 14,075 | 7% | |||

| Renault | 12,356 | 3,279 | 278% | 11,043 | 12% | |||

| Ford | 7,746 | 3,519 | 120% | 5,775 | 34% | |||

| Honda | 7,103 | 3,697 | 92% | 9,324 | –24% |

Table 14.3 Stats during Mar’21 and Feb’21 reflecting effect on sales.

| Passengers Vehicle | Mar’21 | Feb’21 | MoM Change |

|---|---|---|---|

| Maruti Suzuki | 45.60% | 46.90% | –1.30% |

| Hyundai Motors | 16.40% | 16.70% | –0.30% |

| Tata Motors | 9.30% | 8.80% | 0.40% |

| Kia Motors | 6.00% | 5.40% | 0.60% |

| M&M | 5.20% | 5.00% | 0.20% |

| Toyota | 4.70% | 4.60% | 0.10% |

| Renault | 3.90% | 3.60% | 0.30% |

| Ford | 2.40% | 1.90% | 0.60% |

| Honda | 2.20% | 3.00% | –0.80% |

| MG | 1.70% | 1.40% | 0.30% |

| Nissan | 1.30% | 1.40% | –0.10% |

| Volkswagen | 0.63% | 0.70% | –0.10% |

| Jeep | 0.42% | 0.40% | 0.10% |

| Skoda | 0.36% | 0.30% | 0.10% |

Figure 14.6 Market shares of different automotive sector players.

14.4.4 Automobile Industry Scenario That Can Be Expected Post COVID-19 Recovery

By the end of FY 2026, the $118 billion automobile market is expected to have grown to $300 billion. In FY 2020, India’s year-out output was 26.36 million automobiles [27]. In FY20, the Pan-India automobile market, which includes two-wheelers and passenger vehicles, had an 80.8 percent and 12.9 percent net worth impact, respectively, resulting in a total turnover of nearly 20.1 million automobiles. In the coming years, passenger vehicles will dominate the market, closely followed by the mid-sized automobile industry. India’s vehicle exports totaled 4.77 million units in FY20, representing a 6.94 percent CAGR from FY16 to FY20. Two-wheelers accounted for 73.9 percent of overall vehicle exports, with 14.2 percent going to passenger and mid-sized cars, 10.5 percent to three-wheelers, and 1.3 percent to commercial vehicles. Overall, we have witnessed a minor stabilization and recovery in majorly damaged industries, with automobiles being the only one where growth is entirely dependent on the individual success of multiple enterprises and market giants (across the country and via exports) [27].

Further in times to come, the auto industry can be boosted by government policies and decisions, such as reducing the basic cost of raw materials at a national level, implementing lower taxes and relaxation on taxes especially targeting the automobile sector. Steps like this can help the automobile industry recover at a much faster and stronger rate than expected and reach the global target researched by FY 2026 [25].

14.5 Discussion

There are a number of players in the car manufacturing industry who have given numerous options to customers and increased the competition among the manufacturers. Different customers are attracted by different values added to the product like low cost, good quality, fast and reliable delivery, availability, after-sale support etc. So understanding the customer requirements and providing the best in that is a challenging task [19].

14.5.1 Competitive Dimensions

MSIL’s most significant competitors are Tata, Hyundai, Ford and Volkswagen. MSIL objective is to furnish low cost with the right quality product for the average income individual and as opposed to acquiring a broad segment it deals with niche and rule the industry. Following are the competitive dimensions it remains over others [8]:

- Cost: high customer satisfaction rating concerning the cost of ownership of Maruti Suzuki vehicles over the entirety of its range. MSIL concentrated on the niche market of compact cars offering useful features at a moderate cost.

- Quality: Maruti Suzuki car owners encounter fewer problems in their vehicle than some other car manufacturers in India. High quality is given inside at a reasonable price. In the premium compact car segment, Alto was chosen as number one.

- Delivery reliability and Speed: Maruti Suzuki has more than 307 state-of-the-art showrooms spread across 189 locations. Maruti Suzuki can provide faster service than its competitors in India because of its high localization.

- Flexibility and New product introduction speed: Maruti Suzuki has Japan based R&D. MSIL uses advanced innovation and technology to introduce models that fit in the current lifestyle with powerful engine efficiency. MSIL comes up with new variants in close intervals.

- Supplier after-sale product: this is one of the most significant advantages that Maruti has over others, cost of ownership, as well as the cost of maintenance, is very reasonable in case of Maruti Suzuki and high availability of its spare parts as well.

14.5.2 MSIL Strategies

MSIL’s significant strategies for maintaining its position atop the Indian car market segment during multiple downturns include:

In 1991, the first phase of liberalization was declared, and automobile segments were permitted to have foreign collaboration. The Government of India teamed up with Suzuki Inc. (Japan) to create India’s most popular car, the “Maruti.” Suzuki helped Maruti component makers to overhaul their technology and appropriation of Japanese benchmarks of quality. The Indian passenger automobile market was driven and guided up to a maximum proportion of it from that point forward [19].

The competition raised with the new entries of global car makers and analyzing heat of competition from global carmakers, MSIL implemented an extensive strategy for accruing and retaining the customers. The strategy was to provide finance and insurance of cars and sell out or purchase a pre-owned car and this led MSIL into another business and carried huge customers and additional revenue to MSIL thus expanding its network and pulling customers for MSIL [8].

Maruti always attempts to reduce the cost and reinforce the quality throughout its value chain, which led to substantial progress of MSIL. The company propelled five vehicles in CNG variants in a day (Estilo, Alto, SX4, WagonR, and Eeco).In Manesar, MSIL established two new Greenfield production lines, which boosted production and allowed the company to produce 1.85 million units by the end of 2012 [19].

MSIL aims to strengthen its network in rural sector dealers and suppliers to make a firm grasp over the rustic market. The aim is to get more and more local vendors to reduce logistic cost, crude material cost and maintain JIT and diminish inventory cost also. MSIL focuses on providing new models, fuel-efficient and cost-effective products that do not squeeze the customer pocket much and furthermore satisfy their aspirants. So customer satisfaction at least expense is their definitive objective [22]. As a result, Maruti Suzuki had to maintain its quality while delivering a less expensive vehicle. Also, if it imports components from Japan, it would be reasonably expensive; thus, it started putting efforts in developing its domestic component makers while not only reducing the cost but also increasing the availability.

MSIL stepped forward to make firm and cohesive suppliers and dealer’s network by hedging bank financing for them. By assisting their suppliers, MSIL strengthened its hold over them, getting additional values and more favorable conditions for the company for present and future deals. MSIL ruled the car manufacturing industry in small car segments with its two most profitable products, Maruti 800 and Alto. This segment of car manufacturing is becoming profoundly competitive, with quickly expanding the number of players coming up with new models. One of the most appropriate examples is Tata –Nano which competes with Maruti 800 and brings down its share. MSIL decided for contraction defense strategy wherein it ceased the Maruti 800 production and left Nano to move over the lower segment of the car market [21].

14.5.3 MSIL Operations and Supply Chain Management

Comprehensively Supply chain the management (SCM) can be described as the way toward planning, executing, implementing, tracking and controlling the tasks that go into improving how an organization buys the crude segments it needs to make products or services further fabricates or manufactures those products or services and lastly supply it to the customers in the most effective way possible [27]. A supply chain includes all parties involved in satisfying a consumer request, whether directly or indirectly, such as transporters, warehouses, retailers, and customers themselves. A supply chain is a dynamic system that incorporates the continuous flow of information, products, and assets between phases. Operational information related to the production process ought to be shared among manufacturers and suppliers so as to make supply chains effective. The ultimate goal is to build, establish, and coordinate the production process across the supply chain in such a way that the competition will struggle to find a match. MSIL is one of the most prominent and greatest supply chain and logistics management tales in the automotive industry. Throughout the years, it has worked hard to transform problems into possibilities and obstacles into opportunities [4].

14.5.4 MSIL Suppliers Network

Ten percent of the components in Maruti production is directly sourced from foreign markets and its local vendor’s imports another 10% to 15% of the components. There are 800 local suppliers, including Tier I, Tier II, and Tier III providers, as well as 20 foreign suppliers who work together in a consistent manner. MSIL intends to reduce its disclosure to the foreign trade by half over the next few years in order to reduce turbulence. Maruti’s domestic Tier I is leaner, with only 246 suppliers, 19 of which it has formed joint ventures with and maintains significant equity stakes in to maintain a state of production and quality [21].

Top management of MSIL have analyzed that one the significant thing for prevailing upon challenges in this competitive market scenario is to have vast and cohesive suppliers or vendors network and therefore from the beginning, MSIL attempts to improve conditions at vendors end as follows [18]:

- Localization of suppliers and components: To avoid the fluctuation in currency shifts and high cost of logistics, localization is one of the significant mantras of Maruti Suzuki’s supply chain development over the previous decade.

- Huge supplier base: They cooperate with a large number of suppliers just as they manage suppliers to accomplish profound cost decrease year on year. Also, if it imports components from Japan, it would be reasonably expensive; thus, it started putting efforts in developing its domestic component makers while not only reducing the cost but also increasing the availability.

- Massive investment in suppliers: some measures are designed and implemented to help and support suppliers. Maruti gets authorization from India’s central bank to hedge currency for the benefit of Indian suppliers. The carmaker also acquires crude material in bulk for suppliers and orchestrates low-cost borrowing for suppliers to help companies obtain a better deal. Payments are also designed for a little cost, with only a nine-day cycle from the date of invoice accommodation.

- Shared savings programs: a mutual savings program has been presented by Maruti for its suppliers, called “value analysis value engineering.” This program says rather than importing crude, suppliers should localize it and saving benefits will be shared among all.

14.5.5 MSIL Manufacturing

- Maruti Suzuki was tasked with creating a “people’s automobile” that was both affordable and of high quality. Maruti Suzuki’s first move was to create a high production standard. MSIL’s plan for lowering production costs and improving quality was to use economies of scale.

- Phased Manufacturing Program: PMP ordered foreign firms to promote localization. MSIL deals with 50% local suppliers in the first 3 years then 70% by 5th year. MSIL’s early focus was on the local market rather than export, which allowed it to negotiate less on the quality of components provided by producers, something it could not do if it were exporting.

- Location of supplier: Conventional automobile industry was in Tamil Nadu, and Maharashtra Maruti Suzuki has its manufacturing plant away from them, which makes transportation very inefficient. Thus for a better supply of material, it was required to locate the suppliers, and component makers close to the manufacturing plant of MSIL and JIT system added more necessity to it. In this manner, MSIL persuaded its suppliers from various Indian states to locate their manufacturing facilities near MSILs.

- Just In Time (JIT): MSIL was the first automaker in India to implement the JIT technique. The JIT system demanded that all manufacturers and suppliers be adequately trained to meet the manufacturer’s needs in a timely manner [20]. Furthermore, for quick, reliable and on-time delivery of material MSIL has localized its suppliers nearby manufacturing plant. This likewise diminishes detailed on-site inspections and testing of material done by MSIL.

- Lean manufacturing: Maruti Production System (MPS) uses lean manufacturing where they accelerate the speed of manufacturing and lower the cost, add more value to the customer so that customer would be willing to pay for it and reduce the waste by doing the right thing at the first time and eliminating the things that do not add value to the customer or less required. In lean production, they use JIT, Pull system/Kanban, continuous flow of work, and eliminate wastes: overproduction, excessive inventory, underutilization of workforce, waiting. They use the Kaizen improvement method for employees. They try to build quality into their process, which saves additional audits later, and also uses mistake-proofing [21].

14.5.5 MSIL Distributors Network

Previously, buyers would place an order for a vehicle and wait for over a year to receive it. Furthermore, the concept of Showrooms was non-existent, and the state of after-sales support was far worse. Maruti stepped up with the purpose of changing this situation and providing better client service. Maruti Suzuki built up a distinctive distribution network for gaining the competitive advantage. The company currently has 802 sales centers in 555 towns and cities, as well as 2740 customer support workshops in 1335 towns and cities. The primary goal of establishing such a vast distribution network was to reach out to clients in remote places and deliver the company’s products. MSIL utilized the following techniques to boost dealer competitiveness and hence their profit margins.

The corporation would occasionally give out special awards for certain categories of sales. Various Opportunities were offered to dealers by Maruti Suzuki to earn more profits by different avenues given by MSIL like preowned car sales and purchase or finance and insurance services. MSIL established 255 customer service facilities in 2001-02 in combination with 21 highway segments, dubbed the Non Stop Maruti Express Highway. Out of 15,000 dealer sales executives, 2,500 were rural dealer sales executives in the year 2008 in MSIL [15].

14.5.6 MSIL Logistics Management

Since more than 30 per cent in transportation there are logistics costs, therefore operating productively and efficiently makes great financial sense [15]. Additionally, there is a crucial role in customer service levels as well as a geographic location in this plant set up decisions. For efficacious management of transportation Shipment sizes and routing and scheduling of equipment are one of the most important things to be considered. For better coordination and logistics management, sensitive demand and sales data, updated to date inventory data, stock and all shipment status information must flow on time between whole networks [17]. Transparency in Supply chain networks increases the visibility and adaptability characterized by the SCM can frequently lead to effective logistics management. In 1992 the lead time of MSIL was 57 days, but it has reduced to 19 days in 2013 and has diminished all the more at present [18].

14.6 Conclusion

The Indian Automobile market today is very dynamic & has been very competitive and will additionally get more with a scope of more players and products to enter. In the present vicious rivalry, it is extremely hard to endure. In India, MSIL is leading Automaker Company which possesses eminent position because of its extensive local supplier network and its implemented strategies in supply chain and logistics management improves the efficiency and performance of the entire value chain while also providing numerous benefits to all value chain partners in terms of lowering inventory and transportation costs, achieving lean operations and shorter time to manufacture a product, integrating valuable partners, and increasing product availability.

References

- 1. Alaadin, M., Covid-19: The Impact on the Manufacturing Industry. Marsh, 202019, https://www.marsh.com/content/dam/marsh/Documents/PDF/MENA/energy_and_power_industry_survey_results.pdf.

- 2. Alam, M.N., Alam, M.S., Chavali, K., Stock market response during COVID-19 lockdown period in India: An event study. J. Asian Finance, Econ. Bus., 7, 7, 131–137, 2020, doi: https://doi.org/10.13106/jafeb.2020.vol7.no7.131.

- 3. Belhadi, A., Kamble, S., Jabbour, C.J.C., Gunasekaran, A., Ndubisi, N.O., Venkatesh, M., Manufacturing and service supply chain resilience to the COVID-19 outbreak: Lessons learned from the automobile and airline industries. Technol. Forecast. Soc Change, 163, 120447, 2021 October 2020, doi: https://doi.org/10.1016/j.techfore.2020.120447.

- 4. Bhatt, P. and Varghese, S., Strategizing under economic uncertainties: Lessons from the COVID-19 pandemic for the Indian auto sector. J. Oper. Strateg. Plan., 3, 2, 194–225, 2020, doi: https://doi.org/10.1177/2516600x20967813.

- 5. Bhattacharya, S., Supply chain management in Indian automotive industry: complexities, Challenges and way ahead. Int. J. Manage. Value Supply Chain., 5, 2, 49–62, 2014, doi: https://doi.org/10.5121/ijmvsc.2014.5206.

- 6. Breja, S.K., Banwet, D.K., Iyer, K.C., Quality strategy for transformation: A case study. T QM J., 23, 1, 5–20, 2011, doi: https://doi.org/10.1108/17542731111097452.

- 7. Cai, M. and Luo, J., Influence of COVID-19 on manufacturing industry and corresponding countermeasures from supply chain perspective. J. Shanghai Jiaotong Univ.,Sci, 25, 4, 409–416, 2020, doi: https://doi.org/10.1007/s12204-020-2206-z.

- 8. Corporation, S. M. (n.d.), Supplier development in Indian auto industry: Case of maruti suzuki india limited. https://core.ac.uk/download/pdf/230430874.pdf.

- 9. Frohlich, M.T. and Westbrook, R., Arcs of integration: An international study of supply chain strategies. J. Oper. Manage., 19, 2, 185–200, 2001, doi: https://doi.org/10.1016/S0272-6963(00)00055-3.

- 10. Ishida, S., Supply chain management in Indian automotive industry :complexities, Challenges and way ahead. IEEE Eng. Manage. Rev., 48, 3, 146–152, 2020, doi: https://doi.org/10.1109/EMR.2020.3016350.

- 11. Jha, H.M., Srivastava, A.K., Bokad, P.V., Deshmukh, L.B., Mishra, S.M., Countering disruptive innovation strategy in Indian passenger car industry: A case of Maruti Suzuki India Limited. South Asian J. Bus. Manag. Cases, 3, 2, 119–128, 2014.

- 12. Julka, T., Administration, B., College, S. S. J. S. P. G., Suzuki, M., Supply chain and logistics management innovations at Maruti Suzuki India Limited. Int. J. Manage. Soc. Sci. Res., 3, 3, 41–46, 2014.

- 13. Krishnaveni, M. and Vidya, R., Growth of indian automobile industry, International Journal of Current Research and Academic Review-(IJCRAR) ISSN - 2347 - 3215, vol. 3, pp. 110–118, 2015.

- 14. Kumar, R., Singh, R.K., Shankar, R., Study on coordination issues for flexibility in supply chain of SMEs: A case study. Glob. J. Flex. Syst. Manage., 14, 2, 81–92, 2013, doi: https://doi.org/10.1007/s40171-013-0032-y.

- 15. Kumar, V. and Gautam, V., Maruti Suzuki India Limited: The celerio. Emerald Emerg. Mark. Case Stud., 5, 1, 1–13, 2015, doi: https://doi.org/10.1108/EEMCS-03-2014-0058.

- 16. Lokhande, M.A. and Rana, V.S., Marketing strategies of Indian automobile companies: A case study of Maruti Suzuki India Limited. SSRN Electron. J., 1, 2, 40–45, 2016, doi: https://doi.org/10.2139/ssrn.2719399.

- 17. Nayak, J., Mishra, M., Naik, B., Swapnarekha, H., Cengiz, K., Shanmuganathan, V., An impact study of COVID-19 on six different industries: Automobile, energy and power, agriculture, education, travel and tourism and consumer electronics, in: Expert systems, 2021.

- 18. Okorie, O., Subramoniam, R., Charnley, F., Patsavellas, J., Widdifield, D., Salonitis, K., Manufacturing in the time of COVID-19: An assessment of barriers and enablers. IEEE Eng. Manage. Rev., 48, 3, 167–175, 2020, doi: https://doi.org/10.1109/EMR.2020.3012112.

- 19. Paul, S.K. and Chowdhury, P., A production recovery plan in manufacturing supply chains for a high-demand item during COVID-19. Int. J. Phys. Distrib. Logist. Manage., 51, 2, 104–125, 2021, doi: https://doi.org/10.1108/IJPDLM-04-2020-0127.

- 20. R., R., Flexible business strategies to enhance resilience in manufacturing supply chains: An empirical study. J. Manuf. Syst., 60, October 2020, 903– 919, 2021, doi: https://doi.org/10.1016/j.jmsy.2020.10.010.

- 21. Kiran Raj KM, Nandha Kumar KG -Impact of Covid-19 pandemic in the automobile industry: A case study, International Journal of Case Studies in Business, IT and Education (IJCSBE), Volume 5 Issue 1 Pages 36-49, 2021

- 22. Sahoo, T., Banwet, D.K., Momaya, K., Strategic technology management in the auto component industry in India: A case study of select organizations. J. Adv. Manage. Res., 8, 1, 9–29, 2011, doi: https://doi.org/10.1108/09727981111129282.

- 23. Shah, M.K. and Tomer, S., How brands in India connected with the audience amid Covid-19. Int. J. Sci. Res. Publ., 10, 8, 91–95, 2020, doi: https://doi.org/10.29322/ijsrp.10.08.2020.p10414.

- 24. Since january 2020 Elsevier has created a COVID-19 resource centre with free information in English and Mandarin on the novel coronavirus COVID-19, in: The COVID-19 resource centre is hosted on elsevier Connect , the company’s public news and information . (2020), January, 2020–2022.

- 25. Singh, N. and Salwan, P., Contribution of Parent company in growth of its subsidiary in emerging markets: Case study of Maruti Suzuki. J. Appl. Bus. Econ., 17, 1, 24, 2015.

- 26. Singh, T., Challenges in automobile industry in india in the aftermath of Covid-19, 17, 6, 6168–6177, 2020.

- 27. Wu, X., Zhang, C., Du, W., An analysis on the crisis of “chips shortage” in automobile industry - Based on the double influence of COVID-19 and trade friction. Journal of Physics: Conference Series, vol. 1971, 2021, doi: https://doi.org/10.1088/1742-6596/1971/1/012100.

- 28. Xu, Z., Elomri, A., Kerbache, L., El Omri, A., Impacts of COVID-19 on global supply chains: Facts and perspectives. IEEE Eng. Manage. Rev., 48, 3, 153–166, 2020, doi: https://doi.org/10.1109/EMR.2020.3018420.

- 29. Swetha, K.R. and N. M, A. M. P and M. Y. M, Prediction of pneumonia using big data, deep learning and machine learning techniques. 2021 6th International Conference on Communication and Electronics Systems (ICCES), pp. 1697–1700, 2021, doi: 10.1109/ICCES51350.2021.9489188.

Note

- *Corresponding author: [email protected]