On Formulating and Solving Portfolio Decision and Asset Pricing Problems

Yu Chena, Thomas F. Cosimanob and Alex A. Himonasc, aDepartment of Mathematics, Idaho State University, USA, bDepartment of Finance, Mendoza College of Business, University of Notre Dame, USA, cDepartment of Mathematics, University of Notre Dame, USA, [email protected]

Abstract

This chapter discusses computational methods for approximating portfolio and asset pricing problems. Formulation of these problems is usually specified along with components, preferences, payoffs, etc., that are analytic functions. This implies that the solutions to these problems acquire this property, so that these solutions can be accurately approximated by polynomials within a specified region. It is also possible to obtain a uniform upper bound for the approximation error within a subset of this region. Sections 2 and 3 address each problem in discrete time, while Sections 4 and 5 examine these problems in continuous time.

Keywords

Computational methods; Portfolio decisions; Asset pricing problems

JEL Classification Codes

C63; G11; G12

1 Introduction

This chapter discusses the computational methods for portfolio decision and asset pricing problems.1 Financial economists have a common toolkit of assumptions and techniques used to examine portfolio decision and asset pricing problems. For example, in a representative agent model of asset pricing, Menzly et al. (2004) modify a continuous time version of Campbell and Cochrane’s (1999) external habit model by using logarithmic preferences and a linear sensitivity function so that the price-consumption ratio is linear in the state variable. In heterogeneous agent models, Lo and Wang (2006) and Vayanos and Wang (2012) assume a constant absolute risk averse utility and independently and identically distributed shocks to the state variables. The reason is that the equilibrium price and investor’s stock holding are also linear in the state variables. Menzly et al. (2004) and Lo and Wang (2006) motivate their models of marginal utility of wealth using the habit models of Abel (1990) and Campbell and Cochrane (1999). Yet, one can demonstrate that these habit models do not lead to price-dividend functions which are linear in the state variables. For portfolio decision problems, Brennan and Xia (2002, 2005) and Wachter (2002b, 2003) are able to find the closed form solutions to investors’ problems in the face of predictable returns. However, it is well known that these preferences are inconsistent with predictable returns. In each of these papers, the researchers must make a compromise between the needs of the toolkit and realistic financial behavior. In this chapter, we argue that quick and accurate computational methods exist which mitigate the need to make these compromises.

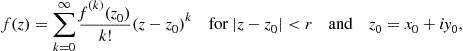

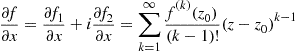

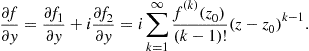

Financial economic problems are usually specified with fundamental components, such as preferences and dividend processes in asset pricing models, that have desirable mathematical properties. Specifically, they are usually assumed to be analytic functions. A function ![]() is analytic on an open interval

is analytic on an open interval ![]() if it can be represented by a power series in some open neighborhood of each

if it can be represented by a power series in some open neighborhood of each ![]() . The radius of convergence,

. The radius of convergence, ![]() , determines the largest interval

, determines the largest interval ![]() in which this power series converges to

in which this power series converges to ![]() . It turns out that the properties of the components of financial models transfer to their solutions for several well-known financial economic problems in both discrete and continuous time. This means that the solutions to these models can be approximated by polynomials within a certain region. In addition, a uniform upper bound for the approximation error can be found in some subset of this region.

. It turns out that the properties of the components of financial models transfer to their solutions for several well-known financial economic problems in both discrete and continuous time. This means that the solutions to these models can be approximated by polynomials within a certain region. In addition, a uniform upper bound for the approximation error can be found in some subset of this region.

The first two sections of this chapter deal with discrete time portfolio decision and asset pricing problems. In discrete time, the models lead to integral equations with unknown functions representing the solutions. As a result, care must be taken to prove that a solution exists within a well-defined vector space. For portfolio decision problems, the integral equations are nonlinear so that there is limited information about the properties of the solutions to these problems. The work of Jin and Judd (2002) can be used to prove that the solutions to these problems are analytic, but little is known about the radii of convergence. As a result, Jin and Judd use polynomial methods, such as the projection method, to approximate the solution. Yet, the error analysis must rely on the relative errors in investor’s Euler equations to assess the accuracy of the approximation.

More is known about the solutions to the representative agent asset pricing problems. In this case, the integral equation is linear in the unknown function. We have shown that several well-known asset pricing models, including Mehra and Prescott (1985), Abel (1990), and Campbell and Cochrane (1999), yield analytic solutions which can be approximated by polynomials in the regions large enough to include any value of interest to financial economists. Having established the radius of convergence about a point of interest, we are able to find a uniform upper bound for the approximation error. The Taylor polynomial approximations to the Mehra and Prescott (1985) and Abel (1990) models can be calculated quickly using Maple. The polynomial approximations to the Campbell and Cochrane (1999) model are more problematic, since the parameter space associated with the existence of a solution restricts the stochastic process for the surplus consumption ratio to be too close to a unit root.2 So, the Taylor polynomial approximations are ill conditioned which suggests the need to use other numerical methods to solve this model. In general, we have found that the Taylor polynomial approximations are accurate representations of solutions to one-dimensional asset pricing models.

Less is known about higher-dimensional asset pricing problems in discrete time. In particular, heterogeneous agent models are a combination of the discrete time portfolio decision and asset pricing problems. In these models, one must solve the decisions of individual agents, which determine the evolution of the distribution of wealth for all investors. Understanding this distribution is essential for solving these models, since investors’ wealth impacts the demand for assets, and subsequently the equilibrium prices of assets. The work by Judd et al. (2000, 2003) has made progress on characterizing when the unique solutions exist for these models. In addition, they rely on alternative polynomial methods to approximate the solutions to these models. As in portfolio decision problems, they use relative errors to determine the accuracy of the approximations.

In the second part of this chapter, we turn to continuous time portfolio decision and asset pricing problems. We start with continuous time portfolio decision problems under stochastic differential utility of Duffie and Epstein (1992a,b) with Kreps and Porteus (1978) functional form, which leads to a second order nonlinear partial differential equation (PDE) depending on the investment horizon and expected return on assets. Currently, this problem is solved for the case of constant relative risk averse utility. Given a solution to the PDE one must check whether this solution satisfies growth conditions. These conditions assure that this solution represents the expected value of the lifetime utility. Given this analysis one must specify the PDE such that it becomes an initial boundary value problem. Consequently, existing methods in mathematics need to be explored to solve and accurately represent the solution to these portfolio problems.

Given the optimal behavior of representative investors we examine asset pricing problems. These problems can be modeled as initial value problems of linear or nonlinear second order differential equations. For this type of problem, the Cauchy-Kovalevsky Theorem can be used to prove that the initial value problem has a unique analytic solution, estimate the radius of convergence, and identify a uniform upper bound on the approximation error. As an example, the one-dimensional asset pricing problem of Campbell and Cochrane (1999) is shown to have an accurate polynomial approximation. The improved behavior, relative to the discrete time Campbell and Cochrane (1999) model, is attributed to two properties of continuous time models. First, the differential equation relies on the local properties rather than the global properties needed for the integral equation. Second, the procedure for calculating the coefficients of the Taylor polynomial approximation is recursive in continuous time, while they have to be determined simultaneously in discrete time. The Cauchy-Kovalevsky Theorem applies to higher-dimensional asset pricing models such as the Wachter (2002a) model which generalizes the Campbell and Cochrane (1999) model. In addition, the Taylor polynomial approximations for the solution to these problems can be calculated quickly. However, additional work needs to be done to bound the approximation error.

We go on to explore the role of initial conditions in the context of the asset pricing problem with stochastic differential utility. In this case the asset pricing problem leads to a differential equation which is mathematically comparable to the investment problem. We first explain how to introduce the initial conditions for this problem when the investor has an infinite investment horizon. We show why the approximation by Campbell et al. (2004) is a first order perturbation of the solution to the original PDE, so that this approximation can be used to estimate initial conditions for the PDE. Given initial conditions it is shown that the Cauchy-Kovalevsky Theorem can be used to quickly and accurately solve the asset pricing problem. This problem can be solved given the initial conditions. Finally, we discuss how one could represent the PDE for the investor’s problem or the asset pricing problem as an initial boundary value problem.

2 Discrete Time Portfolio Decision Making

We follow the development by Chow (1997) for discrete and continuous time dynamic programming. All portfolio decision problems are of the following form: Let ![]() be a vector of

be a vector of ![]() control variables, such as how much to consume and invest in stocks, and

control variables, such as how much to consume and invest in stocks, and ![]() be a vector of

be a vector of ![]() state variables, such as the wealth of the investor and the expected rate of return on stocks. The reward

state variables, such as the wealth of the investor and the expected rate of return on stocks. The reward ![]() of each period is a function of the state and control variables at that time. An example of a reward function is the utility that the investor receives from consuming goods. The problem is to pick

of each period is a function of the state and control variables at that time. An example of a reward function is the utility that the investor receives from consuming goods. The problem is to pick ![]() such that it maximizes the expected present value of future rewards, which formally is stated as:

such that it maximizes the expected present value of future rewards, which formally is stated as:

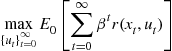

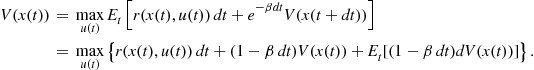

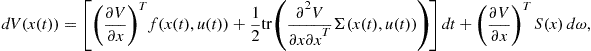

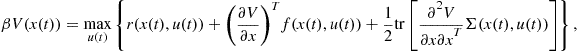

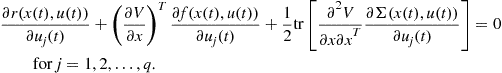

(1)

(1)

![]() (2)

(2)

Here, ![]() is a vector of

is a vector of ![]() random shocks. The actual distributions of these random shocks are specified in the problem.

random shocks. The actual distributions of these random shocks are specified in the problem. ![]() represents the expectation of the reward conditional on information at time

represents the expectation of the reward conditional on information at time ![]() , which in this case would be

, which in this case would be ![]() . The constraint (2) is called the equation of motion for the state variables.

. The constraint (2) is called the equation of motion for the state variables. ![]() determines the expected future value of the state variables given its current value and the control variables.

determines the expected future value of the state variables given its current value and the control variables.

Now introduce a vector ![]() of

of ![]() Lagrange multipliers which are time dependent. The Lagrangian function is

Lagrange multipliers which are time dependent. The Lagrangian function is

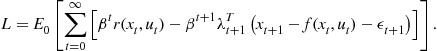

(3)

(3)

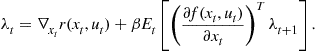

Here, the superscript ![]() refers to the transpose of a vector. Take partial derivatives with respect to

refers to the transpose of a vector. Take partial derivatives with respect to ![]() for

for ![]() and

and ![]() for

for ![]() , respectively, and set these derivatives equal to zero, where

, respectively, and set these derivatives equal to zero, where ![]() is the initial state vector. The first order conditions are

is the initial state vector. The first order conditions are

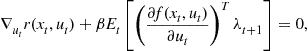

(4)

(4)

and

(5)

(5)

Here, ![]() and

and ![]() are the gradient operators with respect to

are the gradient operators with respect to ![]() and

and ![]() , respectively. The first order conditions (4) and (5) are integral equations since

, respectively. The first order conditions (4) and (5) are integral equations since ![]() refers to an integral. As a result, enough structure has to be placed on the problem so that these integral equations have solutions.

refers to an integral. As a result, enough structure has to be placed on the problem so that these integral equations have solutions.

2.1 Investor’s Problem

To illustrate the investor’s problem, let the reward of the investor be the constant relative risk averse utility used by Mehra and Prescott (1985, 2003).

![]() (6)

(6)

where the consumption ![]() is a control variable for the investor. This reward is not a function of the state variable. Assume that the investor can purchase a risk-free bond with constant logarithmic return

is a control variable for the investor. This reward is not a function of the state variable. Assume that the investor can purchase a risk-free bond with constant logarithmic return ![]() or a stock which pays a logarithmic return

or a stock which pays a logarithmic return ![]() . The return on a portfolio of bonds and stocks,

. The return on a portfolio of bonds and stocks, ![]() , is given by

, is given by

![]() (7)

(7)

where the control variable, ![]() , is the percentage of investor’s wealth invested in stocks,

, is the percentage of investor’s wealth invested in stocks, ![]() , and

, and ![]() . The equation of motion for investor’s wealth is

. The equation of motion for investor’s wealth is

![]() (8)

(8)

where ![]() is the current wealth of the investor.

is the current wealth of the investor.

Since Kandel and Stambaugh (1996), the expectation of the logarithm of the return on stocks, ![]() , has been represented by a first order autoregressive process with long run value

, has been represented by a first order autoregressive process with long run value ![]() .

.

![]() (9)

(9)

which is independent of ![]() and

and ![]() .

. ![]() is a random shock to the expected return on stocks. Consequently, the return on stocks is given by

is a random shock to the expected return on stocks. Consequently, the return on stocks is given by

![]() (10)

(10)

Here, it is generally assumed that the correlation between ![]() and

and ![]() is negative based on the evaluation of the data of the return on stocks. In this example, the current wealth

is negative based on the evaluation of the data of the return on stocks. In this example, the current wealth ![]() and the expected return

and the expected return ![]() on stocks are two state variables.

on stocks are two state variables.

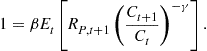

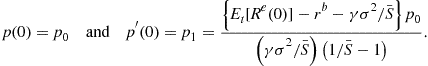

In this case, the first order conditions are

![]() (11)

(11)

![]() (12)

(12)

and

![]() (13)

(13)

There is also a transversality or terminal condition at time ![]()

![]() (14)

(14)

In the terminal period, the investor expects to consume all her wealth and any additional wealth in the last period is expected to provide no additional utility.

Combining (11) and (13) yields

![]()

This means that the marginal value of wealth to the investor is equal to the marginal utility of consumption. Substituting this into (13) results in the following equation which determines the consumption by the investor.

(15)

(15)

The investor compares her loss of utility from consumption today, ![]() , with her gain in utility from payment on the optimal portfolio at a future time,

, with her gain in utility from payment on the optimal portfolio at a future time, ![]() , since she saves part of her initial wealth. Thus, this is just a more sophisticated version of the comparison of present value with future value in which the stochastic discount factor,

, since she saves part of her initial wealth. Thus, this is just a more sophisticated version of the comparison of present value with future value in which the stochastic discount factor, ![]() , is

, is

![]()

Consequently, (15) may be written as

![]() (16)

(16)

In addition, the choice between stocks and bonds in (12) is such that

![]() (17)

(17)

This condition says that the investor chooses the allocation between stocks and bonds so that the expected marginal values of the payoffs from stocks and bonds are identical.

The functional Eqs. (15) and (17) determine the optimal consumption of the investor and the percentage of her wealth allocated to stocks. We seek the functions ![]() and

and ![]() in which

in which ![]() is the current wealth of the investor and

is the current wealth of the investor and ![]() is the expected return on stocks. Once these functions are found, (8) tells us how the wealth of the investor evolves. The equation of motion for the investor’s wealth under this optimal behavior is

is the expected return on stocks. Once these functions are found, (8) tells us how the wealth of the investor evolves. The equation of motion for the investor’s wealth under this optimal behavior is

![]() (18)

(18)

where ![]() refers to the value of wealth at the end of the next period. Here we have used the equations of motion for the return on stocks (10) and its expected value (9). This stochastic difference equation also needs to satisfy the terminal condition (14).

refers to the value of wealth at the end of the next period. Here we have used the equations of motion for the return on stocks (10) and its expected value (9). This stochastic difference equation also needs to satisfy the terminal condition (14).

By assuming a particular cumulative probability distribution for ![]() , say

, say ![]() , we end up with the following integral equation which satisfies the investor’s optimal decisions (15) and (17).

, we end up with the following integral equation which satisfies the investor’s optimal decisions (15) and (17).

(19)

(19)

As a result, the stochastic discount factor is

The choice between stocks and bonds is such that

(20)

(20)

We are looking for the investor’s consumption ![]() and allocation

and allocation ![]() to stocks, which satisfy Eqs. (19) and (20). These functions are independent of time so that the path of consumption and allocation to stocks evolves over time as different random shocks to the return on stocks and its expected value impact the stochastic difference equations for the state variables, wealth (18), and the expected return on stocks (9).

to stocks, which satisfy Eqs. (19) and (20). These functions are independent of time so that the path of consumption and allocation to stocks evolves over time as different random shocks to the return on stocks and its expected value impact the stochastic difference equations for the state variables, wealth (18), and the expected return on stocks (9).

Except for certain simple examples, there are no known explicit solutions to these nonlinear integral equations. Altug and Labadie (1994, 2008) provide an analysis of the necessary conditions for the existence of the solution for consumption and allocation to stocks when the support of the probability density function is compact and a general utility function is specified. Researchers appeal to this analysis to suppose that a solution does exist, and immediately proceed to some approximation methods.

2.2 A Survey of Approximation Methods

Campbell (1993), Campbell and Viceira (1999, 2001), and Campbell et al. (2003) use a first order Taylor polynomial approximation of the logarithm of the wealth Eq. (8). In addition, they assume that the return on stocks and consumption growth have a joint log-normal distribution. This transforms the integral equation so that Campbell (1993) can use Euler conditions (15) and (17) to infer the properties of consumption growth. Subsequently, Campbell and Viceira (1999) guess and verify the solution to the approximated problem is log-linear in the state variable for the allocation to stocks and quadratic in the state variable for consumption growth. Campbell and Viceira (2002) use the same method to analyze the investment in long-term bonds. Campbell et al. (2003) extend this work to the case of more than two state variables.

Kandel and Stambaugh (1996) examine a more limited problem in which the investor cares only about the terminal wealth. They use Bayesian priors to specify the probability distribution, ![]() , for the return on stocks. Given the probability distribution, a search is constructed for the optima using a parabolic interpolation. The exact form of this numerical procedure is not specified. The reader is referred to Brent (1973) which is a standard reference on the use of polynomial methods to approximate integrals. Brandt (1999) estimates the first order conditions using the general method of moments.3 For a fixed number of states, he finds the optimal consumption and allocation to stocks in which the Euler conditions (19) and (20) are satisfied. The procedure for finding these fixed states is not specified. Balduzzi and Lynch (1999) and Lynch and Balduzzi (2000) use backward recursion on the value function to find the optimal investment in which the investor cares about only the terminal wealth. Brennan et al. (1997) use finite difference methods to approximate the PDE in the same case. These decisions are being made in the face of transaction cost and predictable return on stocks. The optimal investment choices are the solution to the Bellman equation at discrete points in the interval

, for the return on stocks. Given the probability distribution, a search is constructed for the optima using a parabolic interpolation. The exact form of this numerical procedure is not specified. The reader is referred to Brent (1973) which is a standard reference on the use of polynomial methods to approximate integrals. Brandt (1999) estimates the first order conditions using the general method of moments.3 For a fixed number of states, he finds the optimal consumption and allocation to stocks in which the Euler conditions (19) and (20) are satisfied. The procedure for finding these fixed states is not specified. Balduzzi and Lynch (1999) and Lynch and Balduzzi (2000) use backward recursion on the value function to find the optimal investment in which the investor cares about only the terminal wealth. Brennan et al. (1997) use finite difference methods to approximate the PDE in the same case. These decisions are being made in the face of transaction cost and predictable return on stocks. The optimal investment choices are the solution to the Bellman equation at discrete points in the interval ![]() so that short selling and borrowing are not allowed. They increase the number of discrete points until there is virtually no change in the approximate solution. Barberis (2000) also looks at an investor interested in the terminal wealth. Given a posterior distribution for the return on stocks, he finds the percentage of wealth allocated to stocks among a finite number of points in the interval

so that short selling and borrowing are not allowed. They increase the number of discrete points until there is virtually no change in the approximate solution. Barberis (2000) also looks at an investor interested in the terminal wealth. Given a posterior distribution for the return on stocks, he finds the percentage of wealth allocated to stocks among a finite number of points in the interval ![]() , which maximizes the expected utility of wealth.

, which maximizes the expected utility of wealth.

A similar problem is analyzed in the life-cycle literature. In Carroll (1997) and Gourinchas and Parker (2002), the return on investment is constant and the focus is on permanent labor income so that the second state variable ![]() is expected labor income.4 Both papers use backward induction to calculate the optimal conditions. Carroll (1997) uses a discrete state space and a

is expected labor income.4 Both papers use backward induction to calculate the optimal conditions. Carroll (1997) uses a discrete state space and a ![]() -point cumulative probability distribution function for

-point cumulative probability distribution function for ![]() . Gourinchas and Parker (2002) use Gauss-Hermite quadrature rules from Judd (1998) to form the expectations in (19). They then use a discrete state space to iterate backwards to obtain the optimal consumption rule. Both of these papers provide appendices to explain the algorithms used to find the solution.

. Gourinchas and Parker (2002) use Gauss-Hermite quadrature rules from Judd (1998) to form the expectations in (19). They then use a discrete state space to iterate backwards to obtain the optimal consumption rule. Both of these papers provide appendices to explain the algorithms used to find the solution.

Brandt et al. (2005) provide a more systematic algorithm for solving the optimal consumption and investment problem. First, they use a fourth order Taylor polynomial approximation of the investor’s utility function in the neighborhood of the wealth associated with investing in the risk-free bond and consumption in a deterministic problem.5 Under these circumstances optimal consumption and investment are approximated using the first four moments from the integrals in (19) and (20). The conditional probability distribution for the return on investment is then used to create sample paths for the return and the investor’s information set. Next, they use the sample paths to solve backwards from a terminal date for the optimal consumption and investment decisions of the investor. Finally, they use the parameterized expectations following Den Haan and Marcet (1990) to calculate all the moments in which they use monomials as basis to represent the information set of the investor. To check the accuracy of their method, they rely on the special cases in which the solutions are known. In these circumstances, they can check to see how close their approximate solutions are to the true solutions.

Chacko et al. (2005) use the second order Taylor polynomial approximation to solve the consumption and portfolio problem with CRRA utility and time-varying standard deviation of the return on stocks. They only use the second order Taylor polynomial approximation, since the error of their approximate solution is small for the case in which they know the true solution.

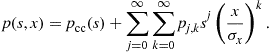

2.3 Polynomial Methods

The projection method of Judd (1992, 1996, 1998) can generalize the approximation method of Chacko et al. (2005) by using orthogonal polynomials. To apply this procedure, we need to assume a probability distribution on the shocks. Suppose that ![]() and

and ![]() are two log-normally distributed random variables, which are consistent with Campbell and Viceira (1999, 2001).6 We then replace the integration with double summation using the Gauss-Hermite quadrature procedure (see Judd, 1998, pp. 261–271). In addition, replace the unknown policy functions for consumption and investment with a linear combination of orthogonal polynomials such as the Chebyshev functions (see Judd, 1998, p. 206):

are two log-normally distributed random variables, which are consistent with Campbell and Viceira (1999, 2001).6 We then replace the integration with double summation using the Gauss-Hermite quadrature procedure (see Judd, 1998, pp. 261–271). In addition, replace the unknown policy functions for consumption and investment with a linear combination of orthogonal polynomials such as the Chebyshev functions (see Judd, 1998, p. 206):

![]() (21)

(21)

and

![]() (22)

(22)

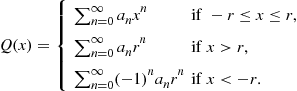

These two functions are only defined in the region ![]() . However, the probability distribution which determines

. However, the probability distribution which determines ![]() and

and ![]() is defined over the entire real line. To account for this possibility we can follow Chen et al. (2008b) by extending

is defined over the entire real line. To account for this possibility we can follow Chen et al. (2008b) by extending ![]() and

and ![]() to

to ![]() .

.

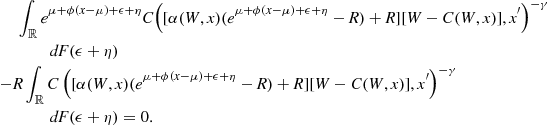

By substituting these hypothesized functions (21) and (22) into the Euler conditions (19) and (20), we end up with two residual equations. These equations are represented by

![]() (23)

(23)

These equations are evaluated at the nodes of Chebyshev polynomials. Newton’s method can then be used to find the vector of coefficients ![]() following

following

(24)

(24)

Each of the four partial derivatives in (24) are ![]() matrices, where

matrices, where ![]() is the order of the Chebyshev polynomials in (21) and (22). Fortunately, each of these partial derivatives has the same functional form, since they are made up of Chebyshev polynomials and their derivatives. Also, in the implementation of the projection method, the iteration in (24) can be more precise and quicker, since the actual derivatives can be found by using the derivatives of Chebyshev polynomials in (21) and (22).

is the order of the Chebyshev polynomials in (21) and (22). Fortunately, each of these partial derivatives has the same functional form, since they are made up of Chebyshev polynomials and their derivatives. Also, in the implementation of the projection method, the iteration in (24) can be more precise and quicker, since the actual derivatives can be found by using the derivatives of Chebyshev polynomials in (21) and (22).

It is frequently argued that the polynomial method cannot be used in circumstances with occasionally binding constraints such as the cost of security transactions. The Chebyshev parameterized expectation algorithm of Christiano and Fisher (2000) can be used to overcome this problem. Consequently, the above algorithm for solving the investor’s problem can be modified to handle transaction costs. However, the degree of accuracy of such an approximation is still an unresolved problem.

3 Discrete Time Asset Pricing

Another major problem in finance is determining the equilibrium behavior of asset prices. In this problem, it is presumed that investors behave optimally as in the previous section. In addition, this behavior is coordinated within financial markets by the appropriate adjustment of asset prices. To illustrate the problem, suppose that we have a representative investor with utility function (6).7 Previously, we took the return on stocks as given by (10) and chose consumption and the allocation of wealth to stocks. Now suppose that consumption is given and we determine the equilibrium return on stocks. Since there is only one investor and only one asset which pays the dividend ![]() per period, it must be the case in equilibrium that

per period, it must be the case in equilibrium that

![]() (25)

(25)

The problem is to determine the price of a financial asset, ![]() , that yields a random dividend

, that yields a random dividend ![]() each period. The gross return on stocks,

each period. The gross return on stocks, ![]() , is given by the future stock price and dividend relative to the current stock price.

, is given by the future stock price and dividend relative to the current stock price.

![]() (26)

(26)

Combining Eqs. (15), (26), and (25), one finds

![]() (27)

(27)

This equation is rewritten in the form

(28)

(28)

where ![]() is the price-dividend function. To complete the model, a stochastic process for dividend is necessary. Let

is the price-dividend function. To complete the model, a stochastic process for dividend is necessary. Let

![]() (29)

(29)

where ![]() , given by (9), is future dividend growth.

, given by (9), is future dividend growth.

Combining (28) with (29) and (9) yields

![]() (30)

(30)

Here, ![]() is the probability density function of the continuous random variable

is the probability density function of the continuous random variable ![]() . The stochastic discount factor in this case is

. The stochastic discount factor in this case is

![]()

where ′ refers to the future value. This integral equation is simpler than that found in the investor’s problem, since this integral equation is linear in the unknown price-dividend function ![]() . This problem was originally specified by Lucas (1978) for a general utility function. Mehra and Prescott (1985) numerically solve this problem for a Bernoulli distributed random variable. Tauchen and Hussey (1991) introduce the quadrature method to approximate the solution of this type of integral equation.

. This problem was originally specified by Lucas (1978) for a general utility function. Mehra and Prescott (1985) numerically solve this problem for a Bernoulli distributed random variable. Tauchen and Hussey (1991) introduce the quadrature method to approximate the solution of this type of integral equation.

3.1 Analytic Method

Calin et al. (2005) introduce the analytic method to solve this problem. The benefit of this method is that it identifies when the solution may be approximated by a polynomial within a certain interval. In addition, the approximation errors can be estimated. In Chen et al. (2008a,b), they apply this method to the more general utility functions developed by Abel (1990) and Campbell and Cochrane (1999), respectively. The analytic method to solve these asset pricing problems may be illustrated with the Mehra and Prescott model.

Step 1: Simplify the integral equation and identify the solution space.

Use the change of variable, ![]() , to rewrite (30).

, to rewrite (30).

![]() (31)

(31)

The advantage of this change of variable is that the properties of the probability density function ![]() are known. For example, Calin et al. (2005) use the Gaussian distribution with mean

are known. For example, Calin et al. (2005) use the Gaussian distribution with mean ![]() and standard deviation

and standard deviation ![]() . The integral equation is

. The integral equation is

![]() (32)

(32)

where ![]() ,

, ![]() , and

, and ![]() . The support of the Gaussian distributed probability density function is not compact, so the usual contraction mapping theorem (see Altug and Labadie, 2008) is not applicable. Yet, once the integral function is written in this form, the price-dividend function cannot grow faster than

. The support of the Gaussian distributed probability density function is not compact, so the usual contraction mapping theorem (see Altug and Labadie, 2008) is not applicable. Yet, once the integral function is written in this form, the price-dividend function cannot grow faster than ![]() . As a result, the solution lies in the following vector space.

. As a result, the solution lies in the following vector space.

Step 2: Verify the existence and uniqueness of the solution to the integral equation (32) in ![]() .

.

Calin et al. construct a linear transformation ![]() given by

given by

![]() (33)

(33)

where ![]() and

and ![]() . The mapping (33) has a unique fixed point in the vector space

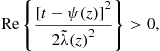

. The mapping (33) has a unique fixed point in the vector space ![]() , which turns out to be the solution to the integral equation (32), as long as a new combination of parameters satisfies

, which turns out to be the solution to the integral equation (32), as long as a new combination of parameters satisfies

where ![]() . This condition is satisfied for the Mehra and Prescott parameters.

. This condition is satisfied for the Mehra and Prescott parameters.

Step 3: Verify that the solution to the integral equation (32) is analytic.

Whether or not a particular asset pricing problem has an analytic solution relies on the properties of the pricing kernel, the equation of motion for the state variable, and the probability density function. Each of these contributes to the integrand in the integral equation (32) so that the analyticity may be established in some interval. First, a summary of analytic functions is provided.

Analytic functions: To understand analytic functions, a brief introduction to holomorphic functions in one complex variable follows. These properties are also valid in several complex variables with some additional technical complications. Let ![]() be a complex-valued function of

be a complex-valued function of ![]() defined in an open set (domain)

defined in an open set (domain) ![]() of the complex plane

of the complex plane ![]() . Suppose that this function is smooth and it can be expressed as

. Suppose that this function is smooth and it can be expressed as

(34)

(34)

where ![]() denotes the

denotes the ![]() order complex derivative of

order complex derivative of ![]() at

at ![]() (the usual calculus formulas for real differentiation hold true for complex differentiation, too). Separating this function into its real and imaginary parts

(the usual calculus formulas for real differentiation hold true for complex differentiation, too). Separating this function into its real and imaginary parts ![]() , we obtain

, we obtain

and

Multiplying the second equation by ![]() and adding it to the first yields8

and adding it to the first yields8

![]() (35)

(35)

This equation is called the Cauchy-Riemann equation, which can also be written in the form:

![]()

This motivates the following definition.

In fact, it can be shown that ![]() is holomorphic in

is holomorphic in ![]() if

if ![]() in the sense of distribution theory (weak derivatives). A proof of this fact can be found in Hörmander (1983, p. 110, Theorem 4.4.1). The basic theory of holomorphic functions can be found in the classical text of Ahlfors (1979) or in Hörmander (1979), where it is presented in the more general context. There, it is proved that a holomorphic function has derivatives of any order, and therefore its Taylor series can be formed. Moreover, for each

in the sense of distribution theory (weak derivatives). A proof of this fact can be found in Hörmander (1983, p. 110, Theorem 4.4.1). The basic theory of holomorphic functions can be found in the classical text of Ahlfors (1979) or in Hörmander (1979), where it is presented in the more general context. There, it is proved that a holomorphic function has derivatives of any order, and therefore its Taylor series can be formed. Moreover, for each ![]() there is a (maximal) number

there is a (maximal) number ![]() , called the radius of convergence for

, called the radius of convergence for ![]() at

at ![]() , such that

, such that ![]() can be represented by its Taylor series, like (34), for

can be represented by its Taylor series, like (34), for ![]() .

.

The “calculus” definition of an analytic function ![]() of a real variable

of a real variable ![]() in an open interval

in an open interval ![]() is that it is in

is that it is in ![]() and at each point

and at each point ![]() the remainder

the remainder ![]() of the

of the ![]() degree Taylor polynomial approximation of

degree Taylor polynomial approximation of ![]() tends to zero as

tends to zero as ![]() when

when ![]() . By complexifying

. By complexifying ![]() to

to ![]() , we obtain a holomorphic function

, we obtain a holomorphic function ![]() in an open subset

in an open subset ![]() of

of ![]() , and we may think of

, and we may think of ![]() as the restriction of

as the restriction of ![]() from

from ![]() to

to ![]() .

.

Using complex variables allows us to determine the precise radius of convergence, ![]() .

.

Now we are ready to show that the solution to the integral equation (32) is analytic in ![]() . Suppose that the function

. Suppose that the function ![]() in the vector space

in the vector space ![]() is the solution to this integral equation. It suffices to show that

is the solution to this integral equation. It suffices to show that

![]() (36)

(36)

is analytic at each ![]() . In this step, we complexify

. In this step, we complexify ![]() so that

so that

![]() (37)

(37)

![]() is analytic if

is analytic if

![]() (38)

(38)

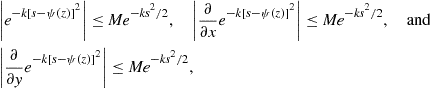

Since ![]() is bounded on any compact set in the complex plane, there exists

is bounded on any compact set in the complex plane, there exists ![]() depending on

depending on ![]() such that

such that

(39)

(39)

where ![]() and

and ![]() . By the Dominated Convergence Theorem (see Folland, 1984, pp. 53–54),

. By the Dominated Convergence Theorem (see Folland, 1984, pp. 53–54), ![]() has continuous partial derivatives with respect to

has continuous partial derivatives with respect to ![]() and

and ![]() , and the partial derivatives can pass through the integral sign in (37). Consequently, we get

, and the partial derivatives can pass through the integral sign in (37). Consequently, we get ![]() for

for ![]() , since

, since

![]() (40)

(40)

Thus, the price-dividend function ![]() is analytic over

is analytic over ![]() .

.

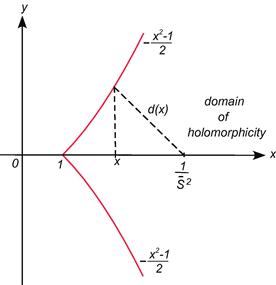

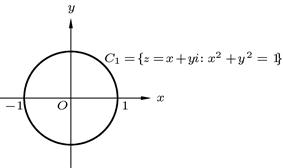

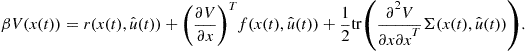

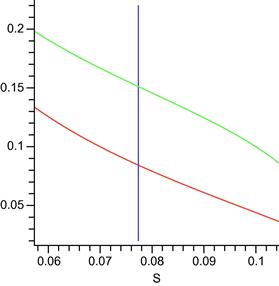

Figure 1 Finding radius of convergence for Example 1.

Step 4: Find the numerical solution to the integral equation (32).

Having established the mathematical properties of the solution to the integral Eq. (32), one can proceed to the numerical approximation of the solution. It is easier to work with a transformed price-dividend function

![]() (41)

(41)

since it reduces the number of summations necessary in the numerical algorithm. As a result, the integral equation (32) is changed to

![]() (42)

(42)

The solution of the integral equation (42) can be approximated by the ![]() order Taylor polynomial around the point

order Taylor polynomial around the point ![]()

![]() (43)

(43)

Alternatively, one could use orthogonal polynomials such as (21) to construct the approximation, which have superior numerical properties. As in the projection method, the polynomial approximation (43) is substituted into the integral equation (42) to yield a system of equations in the undetermined coefficients ![]() , which is given in Calin et al. In this case, the system is linear, since the integral equation (42) is linear in the unknown function.

, which is given in Calin et al. In this case, the system is linear, since the integral equation (42) is linear in the unknown function.

Step 5: Estimate the approximation error.

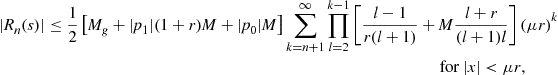

An important benefit of the analytic method is that one can estimate the difference between the polynomial approximation and the true solution. In particular, Cauchy’s integral formula can be used to bound all the derivatives of the transformed price-dividend function which is used to estimate the approximation error. Let ![]() be the circle of radius

be the circle of radius ![]() centered at

centered at ![]() in the complex plane. Figure 1 provides an example when

in the complex plane. Figure 1 provides an example when ![]() and

and ![]() . Cauchy’s integral formula (see Corollary 5.9 in Conway, 1973) gives

. Cauchy’s integral formula (see Corollary 5.9 in Conway, 1973) gives

![]() (44)

(44)

![]() is the contour integral on the path

is the contour integral on the path ![]() . Each point

. Each point ![]() on

on ![]() satisfies

satisfies ![]() and

and ![]() . The proof of the existence and uniqueness of

. The proof of the existence and uniqueness of ![]() provides an upper bound

provides an upper bound ![]() on

on ![]() where

where ![]() so that

so that

![]() (45)

(45)

Let ![]() be the

be the ![]() order Taylor polynomial of

order Taylor polynomial of ![]() about

about ![]() . Then the Taylor remainder, given by

. Then the Taylor remainder, given by ![]() , satisfies

, satisfies

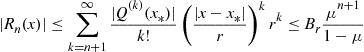

(46)

(46)

for ![]() , where

, where ![]() . Thus, the approximation error is estimated by

. Thus, the approximation error is estimated by

![]() (47)

(47)

Up to now the error in the second summand in (47) has not been calculated. This error occurs because the coefficients ![]() in

in ![]() could be different from the true values of

could be different from the true values of ![]() . In practice, these differences are small when

. In practice, these differences are small when ![]() is small.

is small.

Having estimated the approximation error, we may examine other numerical schemes to learn the tradeoffs of these schemes. For example, Calin et al. solve the Mehra and Prescott model using both the analytic method and Tauchen and Hussey’s (1991) procedure. In the analytic method ![]() is increased to at least

is increased to at least ![]() in (43) for the approximation error to be less than

in (43) for the approximation error to be less than ![]() . Consequently, even for the basic Mehra and Prescott model, a lower degree (

. Consequently, even for the basic Mehra and Prescott model, a lower degree (![]() or

or ![]() ) polynomial is not sufficient to get an accurate representation of the true solution. They also find that using

) polynomial is not sufficient to get an accurate representation of the true solution. They also find that using ![]() for the interval of integration in Tauchen and Hussey’s procedure is not sufficient to obtain an accurate solution. In this case, the price-dividend ratio is about

for the interval of integration in Tauchen and Hussey’s procedure is not sufficient to obtain an accurate solution. In this case, the price-dividend ratio is about ![]() below the true price-dividend ratio, and the interval of integration must increase to

below the true price-dividend ratio, and the interval of integration must increase to ![]() to remove this error. Thus, Tauchen and Hussey’s procedure should use a larger support than what one would expect from intuition.

to remove this error. Thus, Tauchen and Hussey’s procedure should use a larger support than what one would expect from intuition.

3.2 More Complicated Models

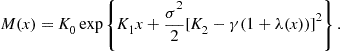

Chen et al. (2008a,b) have used the analytic method to study the solution to Abel’s (1990) and Campbell and Cochrane’s (1999) models, respectively. In Abel’s model, (6) is replaced with

(48)

(48)

where ![]() is the vector of state variables.9 Everything else stays the same as in the Mehra and Prescott (1985) model.

is the vector of state variables.9 Everything else stays the same as in the Mehra and Prescott (1985) model. ![]() represents what you consumed in the past period, while

represents what you consumed in the past period, while ![]() is the consumption of your neighbor. The equations of motion for these two state variables are trivial, i.e.,

is the consumption of your neighbor. The equations of motion for these two state variables are trivial, i.e., ![]() and

and ![]() .10 If

.10 If ![]() , then this reduces to the Mehra and Prescott model.

, then this reduces to the Mehra and Prescott model.

In this case, the integral equation (30) becomes

(49)

(49)

where ![]() ,

, ![]() ,

, ![]() , and

, and ![]() . The stochastic discount factor is more complicated and is given by

. The stochastic discount factor is more complicated and is given by

While the integral equation (49) is more complicated, a new transformed price-dividend function is introduced.

![]() (50)

(50)

so that this integral equation becomes

(51)

(51)

where

![]() (52)

(52)

The transformed integral equation (49) is similar to (32) so that the analytic method applies to this model as well. Step 2 leads to an explicit formula for the transformed price-dividend function. In addition, Chen et al. (2008a) show that this explicit solution is an analytic function so that the analytic method is not necessary.

The main lesson from the analysis of the price-dividend function in the Abel model is the importance of the specification of the probability distribution for the future dividend growth.11 Following the Mehra and Prescott model, the probability distribution in (49) is assumed to be a Gaussian distribution; however, the price-dividend function ![]() is only defined on the interval

is only defined on the interval ![]() . This restriction occurs since the marginal utility of consumption

. This restriction occurs since the marginal utility of consumption ![]() is non-positive outside this interval. Consequently, one has to be careful to specify a probability distribution such that the economic properties of the model are sensible. Chen et al. (2008a) show that by restricting to

is non-positive outside this interval. Consequently, one has to be careful to specify a probability distribution such that the economic properties of the model are sensible. Chen et al. (2008a) show that by restricting to ![]() such that

such that ![]() , an error in the numerical approximation is introduced. This error is bounded by

, an error in the numerical approximation is introduced. This error is bounded by ![]() cents out of a million dollars worth of stock for dividend growth within

cents out of a million dollars worth of stock for dividend growth within ![]() , when the parameter values are chosen to match the equity premium.

, when the parameter values are chosen to match the equity premium.

Chen et al. (2008b) solve the model by Campbell and Cochrane (1999). Here the reward function (6) becomes

![]() (53)

(53)

where ![]() is the individual’s consumption at time

is the individual’s consumption at time ![]() is the surplus consumption ratio at time

is the surplus consumption ratio at time ![]() is the average consumption of all individuals at time

is the average consumption of all individuals at time ![]() , and

, and ![]() is their habitual level of consumption at time

is their habitual level of consumption at time ![]() .12

.12

The control variable is now ![]() and the state variable is

and the state variable is ![]() . To maintain positive values for these variables, Campbell and Cochrane define

. To maintain positive values for these variables, Campbell and Cochrane define ![]() and

and ![]() . The equation of motion for the state variable is given as follows: The surplus consumption ratio

. The equation of motion for the state variable is given as follows: The surplus consumption ratio ![]() satisfies the AR(1) process with

satisfies the AR(1) process with ![]() ,

,

![]() (54)

(54)

Consumption growth follows a normal distribution such that

![]() (55)

(55)

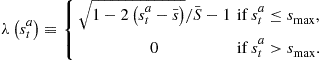

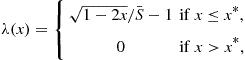

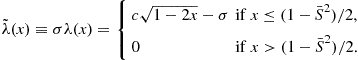

To introduce heteroscedasticity of the random shock to the consumption growth, Campbell and Cochrane introduce the sensitivity function:

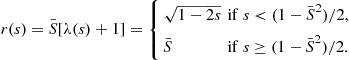

(56)

(56)

Here,13

![]() (57)

(57)

Campbell and Cochrane assume that the dividend growth follows

![]()

As a result, the dividend growth (9) is the same as consumption growth plus a random shock which is correlated with the random shock to consumption growth. The random shock to the dividend growth follows a log-normal distribution.

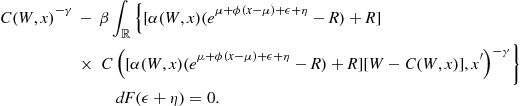

The integral equation for the price-dividend function is

![]() (58)

(58)

(59)

(59)

Now, the state variable is ![]() and the constants are

and the constants are

![]() (60)

(60)

In this case the stochastic discount factor is

![]()

Thus, each asset pricing model makes the stochastic discount factor more complex, so that it better represents the empirical properties of the price-dividend and asset returns.

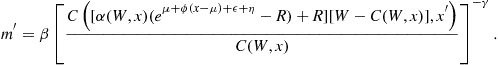

The integral equation (58) is similar to that found in the Mehra and Prescott model and the Abel model. The main difference is that the sensitivity function is written as

(61)

(61)

where ![]() . This sensitivity function is designed to magnify uncertainty during bad times and to minimize it during good times. The purpose of this modification is to introduce volatility in the return on stocks, which is low (high) during good (bad) times. This mimics the empirical properties of stock returns. Chen et al. (2008b) show that this generates multiple problems in the implementation of the analytic method. On the other hand, it illustrates the ability of the analytic method to handle more complicated integral equations. In step 1 of the analytic method, the form of

. This sensitivity function is designed to magnify uncertainty during bad times and to minimize it during good times. The purpose of this modification is to introduce volatility in the return on stocks, which is low (high) during good (bad) times. This mimics the empirical properties of stock returns. Chen et al. (2008b) show that this generates multiple problems in the implementation of the analytic method. On the other hand, it illustrates the ability of the analytic method to handle more complicated integral equations. In step 1 of the analytic method, the form of ![]() , which measures how much the investors discount the future, determines the conditions for the existence and uniqueness of the price-dividend function.

, which measures how much the investors discount the future, determines the conditions for the existence and uniqueness of the price-dividend function. ![]() has the property that

has the property that ![]() for all

for all ![]() , where

, where

(62)

(62)

As a result, one would seek a solution in the following vector space:

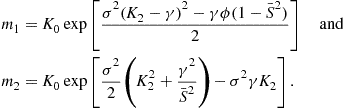

Chen et al. (2008b) show that under the assumptions ![]() , and

, and ![]() , the integral equation (58) has a unique solution in the space

, the integral equation (58) has a unique solution in the space ![]() . The problem is that the parameters of Campbell and Cochrane do not satisfy the condition

. The problem is that the parameters of Campbell and Cochrane do not satisfy the condition ![]() , so that the discounting factor is too big. Given that Campbell and Cochrane want to match the Sharpe ratio, which is the ratio of excess return on stocks relative to its standard deviation. It turns out that the persistence of the surplus consumption ratio must be almost a unit root, i.e.,

, so that the discounting factor is too big. Given that Campbell and Cochrane want to match the Sharpe ratio, which is the ratio of excess return on stocks relative to its standard deviation. It turns out that the persistence of the surplus consumption ratio must be almost a unit root, i.e., ![]() . The problem can be traced to the term

. The problem can be traced to the term ![]() in the exponent of

in the exponent of ![]() . Campbell and Cochrane show that this term is approximately the Sharpe ratio at the steady-state value for the surplus consumption ratio, which is about

. Campbell and Cochrane show that this term is approximately the Sharpe ratio at the steady-state value for the surplus consumption ratio, which is about ![]() per quarter. This value is enough to push the discounting factor above one so that a solution in

per quarter. This value is enough to push the discounting factor above one so that a solution in ![]() cannot be found.

cannot be found.

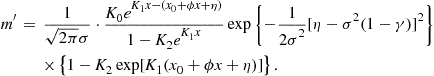

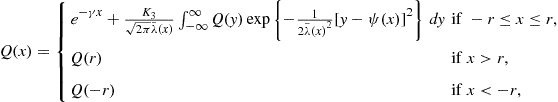

Chen et al. (2008b) presumed that Campbell and Cochrane did not want dividend growth to be unbounded both above and below. In fact, they explicitly ruled this out in their computer program. As a result, they restricted the price level outside a reasonable range for dividend growth. In this case, the transformed price-dividend function is

(63)

(63)

where ![]() ,

, ![]() ,

, ![]() , and

, and

(64)

(64)

Here, ![]() .

.

In the new integral equation (63), one can see why the original integral equation fails to have a solution over the entire real line. In the calculation of the expected transformed price-dividend function, the probability distribution is a Gaussian distribution with mean ![]() and standard deviation

and standard deviation ![]() . The functional form of

. The functional form of ![]() implies that the standard deviation of the transformed price-dividend ratio tends to

implies that the standard deviation of the transformed price-dividend ratio tends to ![]() as the dividend growth approach

as the dividend growth approach ![]() . Consequently, the integral in (63) tends to

. Consequently, the integral in (63) tends to ![]() for extreme negative dividend growth. To avoid this possibility, the new integral equation restricts the transformed price-dividend function to

for extreme negative dividend growth. To avoid this possibility, the new integral equation restricts the transformed price-dividend function to ![]() (

(![]() ) for dividend growth less (more) than

) for dividend growth less (more) than ![]() (

(![]() ). In the calibration of the model,

). In the calibration of the model, ![]() was set at

was set at ![]() per month so that the model applies for all historically observed dividend growth.

per month so that the model applies for all historically observed dividend growth.

This new integral equation for the Campbell and Cochrane model has a unique solution ![]() in the vector space of all continuous and bounded functions defined in

in the vector space of all continuous and bounded functions defined in ![]() when

when ![]() . In addition, the supremum norm of the transformed price-dividend function satisfies

. In addition, the supremum norm of the transformed price-dividend function satisfies

![]() (65)

(65)

Thus, step 2 can be successfully completed for the Campbell and Cochrane model. Consequently, the value of correctly identifying the vector space in step 2 is demonstrated in this model.

The new integral equation (63) does have a solution under the parameter values of Campbell and Cochrane. However, the supremum norm is too small so that the price-dividend function and Sharpe ratio cannot match their historic values. Chen et al. (2008b) demonstrate that a feasible solution, consistent with the Sharpe ratio, can occur for a coefficient of risk aversion ![]() and a persistence of the surplus consumption ratio

and a persistence of the surplus consumption ratio ![]() .

.

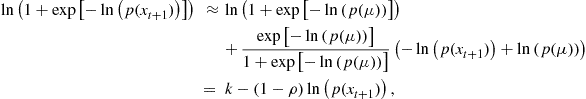

Step 3 can also be completed for the Campbell and Cochrane model. In this case, the problem is to find the domain ![]() in the complex plane

in the complex plane ![]() such that

such that

(66)

(66)

where Re refers to real part. This domain is

![]()

As a result, the solution to the transformed price-dividend function is analytic within this domain, since the integral in (63) and its derivative are well defined. The final part of this step is to find the radius of convergence which is the minimum distance ![]() from the point

from the point ![]() on the real line to the boundary of

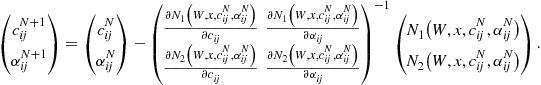

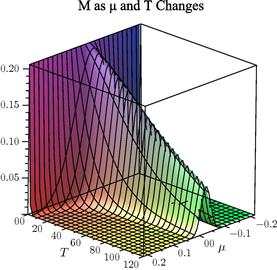

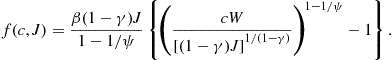

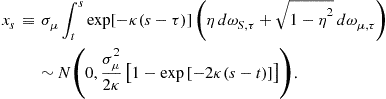

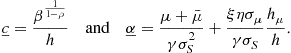

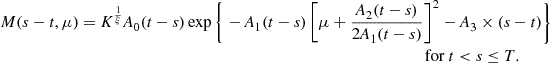

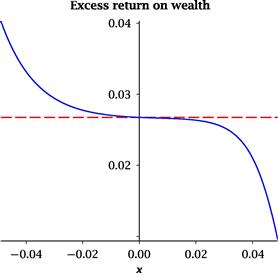

on the real line to the boundary of ![]() . This problem is illustrated in Figure 2. This is a simple maximization problem which yields a radius of convergence around

. This problem is illustrated in Figure 2. This is a simple maximization problem which yields a radius of convergence around ![]() for

for ![]() . This value is close to the point

. This value is close to the point ![]() at which the sensitivity function (64) becomes non-differentiable. Thus, the analytic method can be applied to this more complicated model.

at which the sensitivity function (64) becomes non-differentiable. Thus, the analytic method can be applied to this more complicated model.

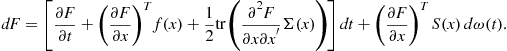

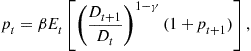

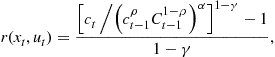

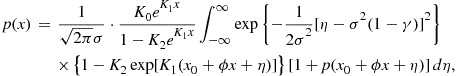

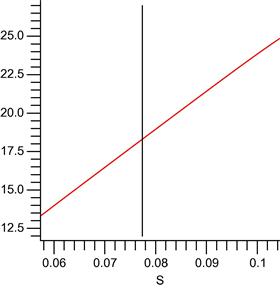

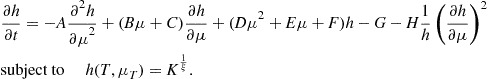

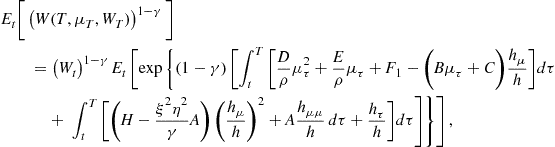

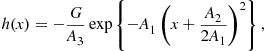

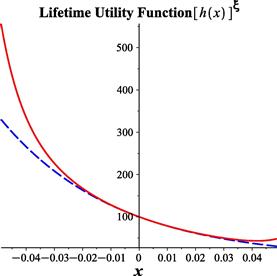

Figure 3 Fundamental solution (121) as time horizon ![]() quarters and expected excess return on stocks

quarters and expected excess return on stocks ![]() , given parameters in Table 1 and

, given parameters in Table 1 and ![]() , and

, and ![]() .

.

Step 4 is also straightforward when one chooses ![]() to satisfy the additional condition:

to satisfy the additional condition:

![]() (67)

(67)

Since the Taylor series of ![]() about the origin converges to

about the origin converges to ![]() for

for ![]() satisfies equation:

satisfies equation:

(68)

(68)

Chen et al. (2008b) derive a system of linear equations which solves for the coefficients ![]() in (68). This derivation includes all algebraic manipulations necessary to design an efficient computer program.

in (68). This derivation includes all algebraic manipulations necessary to design an efficient computer program.

Finally, step 5 is completed for the Campbell and Cochrane model as in the Mehra and Prescott model. In this case, the upper bound ![]() in (45) depends on the supremum norm of the transformed price-dividend function (65) and the radius of convergence. Thus, the analytic method can be used to systematically approximate the solution to an asset pricing model as complicated as that posed by Campbell and Cochrane.

in (45) depends on the supremum norm of the transformed price-dividend function (65) and the radius of convergence. Thus, the analytic method can be used to systematically approximate the solution to an asset pricing model as complicated as that posed by Campbell and Cochrane.

Step 2 shows that the persistence of the surplus consumption ratio must be close to a unit root. This means that a large number of coefficients need to be calculated for the solution to be stable. Unfortunately, Chen et al.’s (2008b) Fortran program does not allow for higher precision so that the calculation of the coefficients was not feasible in this case. Their Maple program does allow for higher precision but is too slow to calculate the required number of coefficients.

3.3 Alternative Asset Pricing Models

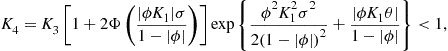

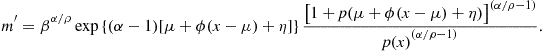

More recently, Bansal and Yaron (2004) use the recursive preferences of Epstein and Zin (1989, 1990, 1991) and functional form of Kreps and Porteus (1978) to examine the empirical behavior of stock returns. In this case, the reward becomes

![]() (69)

(69)

Here, the utility today, ![]() , depends on the consumption today,

, depends on the consumption today, ![]() , and the utility that the investor expects to receive in the future,

, and the utility that the investor expects to receive in the future, ![]() . As a result, the control variable is

. As a result, the control variable is ![]() and the state variable is

and the state variable is ![]() . The intertemporal rate of substitution,

. The intertemporal rate of substitution, ![]() , measures how much the investor is willing to substitute the consumption today for more utility in the future.

, measures how much the investor is willing to substitute the consumption today for more utility in the future.

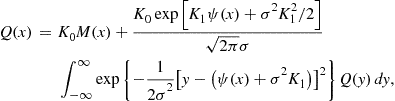

For the representative agent economy, in which consumption equals dividends, the equilibrium condition for the price-dividend function becomes

(74)

(74)

This model leads to the integral equation

![]() (75)

(75)

This integral equation is no longer linear in the unknown price-divided function ![]() , since the stochastic discount factor is nonlinear.

, since the stochastic discount factor is nonlinear.

As a result, the analytic method outlined for the Mehra and Prescott model cannot directly be applied to the Epstein and Zin model. In particular, the integral equation (74) is nonlinear as in the portfolio decision problem (19) and (20), so Judd’s (1992) projection method has been used by Bansal and Yaron (2004) to approximate the solution of this model.

In summary, the analytic method can be used to solve most one-dimensional discrete time asset pricing models. In all of these models, the price-dividend ratio and hence the return on stocks (26) can be accurately approximated by a high order polynomial. For example, the order of the polynomial is ![]() in the Mehra and Prescott case. The analytic method also points out the need to use a large support for the probability density function when the Gaussian quadrature procedure of Tauchen and Hussey (1991) is used. In particular, there is an error of

in the Mehra and Prescott case. The analytic method also points out the need to use a large support for the probability density function when the Gaussian quadrature procedure of Tauchen and Hussey (1991) is used. In particular, there is an error of ![]() in the price-dividend ratio when the support is

in the price-dividend ratio when the support is ![]() even though the relative error is driven to zero. To minimize this error, one must consider the support of

even though the relative error is driven to zero. To minimize this error, one must consider the support of ![]() . Chen et al. (2008b) need to use even higher order polynomial approximations to accurately solve the Campbell and Cochrane (1999) model.

. Chen et al. (2008b) need to use even higher order polynomial approximations to accurately solve the Campbell and Cochrane (1999) model.

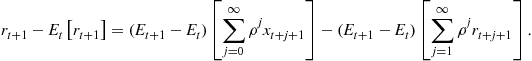

3.4 A Survey of Log-Linearized Approximations

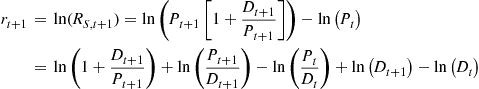

The conclusion from using the analytic method to solve well-known asset pricing models begs the question: How many anomalies in financial markets are the result of low order polynomial approximations commonly used in the research on financial markets? For example, ever since Campbell and Shiller (1988a,b) it is common to explain the logarithm of the return on stocks in terms of unanticipated changes in the future dividends or discount rate. Campbell and Shiller start with (26) which may be written as

(76)

(76)

Campbell and Shiller do not have the solution to any particular asset pricing model so they do not know ![]() or

or ![]() . As a result, they calculate a first order Taylor’s polynomial approximation of the first term near the point

. As a result, they calculate a first order Taylor’s polynomial approximation of the first term near the point ![]() , where

, where ![]() is the stationary point of dividend growth (9).15

is the stationary point of dividend growth (9).15

where ![]() and

and ![]() . Substitute this approximation into (76) to yield a first order stochastic difference equation in

. Substitute this approximation into (76) to yield a first order stochastic difference equation in ![]() , which has forcing term

, which has forcing term ![]() , such that

, such that

![]() (77)

(77)

If this difference equation is solved for ![]() and substituted back into (77), then one finds that the unanticipated changes in stock returns are given by

and substituted back into (77), then one finds that the unanticipated changes in stock returns are given by

(78)

(78)

The first term is the news about future dividend growth, while the second term refers to the news about future rates of return. Campbell (1991), Campbell and Vuolteenaho (2004), and Campbell et al. (2010) among others find that most of the unanticipated changes in the return on stocks may be associated with the news on the future return on stocks rather than the news on the dividend growth. For example, Campbell finds that less than one half of the variation in the return on stocks is due to the news on the dividend growth. Yet, if one has the solution to one of the various models for the price-dividend function ![]() such as Campbell and Cochrane (1999) or Bansal and Yaron (2004), then it is clear from (76) that the unanticipated changes in the return on stocks should only be a function of the unanticipated changes in the state variables

such as Campbell and Cochrane (1999) or Bansal and Yaron (2004), then it is clear from (76) that the unanticipated changes in the return on stocks should only be a function of the unanticipated changes in the state variables ![]() , i.e.,

, i.e., ![]() . Thus, the unanticipated movement in the return on stocks from the news must be associated with a nonlinear relation between the future state variables and return on stocks. Future research should examine how the nonlinear relation between the state variables and the return on stocks color the understanding of what causes the return on stocks to move.

. Thus, the unanticipated movement in the return on stocks from the news must be associated with a nonlinear relation between the future state variables and return on stocks. Future research should examine how the nonlinear relation between the state variables and the return on stocks color the understanding of what causes the return on stocks to move.

Bansal and Yaron (2004) also rely on the Campbell and Shiller (1988a,b) approximation to solve their model with Epstein and Zin preferences. In their model, they separate out the dividend growth from the consumption growth, which they assume is driven by the same state variable, ![]() . This state variable is assumed to be a first order autoregressive process such as (9) with

. This state variable is assumed to be a first order autoregressive process such as (9) with ![]() . As a result, they hypothesize a function for the logarithm of the price-dividend function, which is linear in this state variable. Next, they log-linearize the return on stocks as in Campbell and Shiller. The guess for the price-dividend function and the approximation for the return on stocks are then substituted into the Euler condition (74). They then determine the two coefficients in the guess for the price-dividend function.16 Subsequently, Bansal and Yaron use the projection method to find the approximate solution of the model, which they say is “quite close to” the first order approximation. Yet, they do not say the order of the polynomial approximation used in the projection method.17 Given the close relation between the integral in (75) and that found in the Mehra and Prescott model (32), one would expect the need for at least a 9th order polynomial for an accurate approximation of the solution to the Bansal and Yaron model. Consequently, the long run risk models should also be examined to see whether or not the interpretations and approximation errors are influenced by low order polynomial approximations.

. As a result, they hypothesize a function for the logarithm of the price-dividend function, which is linear in this state variable. Next, they log-linearize the return on stocks as in Campbell and Shiller. The guess for the price-dividend function and the approximation for the return on stocks are then substituted into the Euler condition (74). They then determine the two coefficients in the guess for the price-dividend function.16 Subsequently, Bansal and Yaron use the projection method to find the approximate solution of the model, which they say is “quite close to” the first order approximation. Yet, they do not say the order of the polynomial approximation used in the projection method.17 Given the close relation between the integral in (75) and that found in the Mehra and Prescott model (32), one would expect the need for at least a 9th order polynomial for an accurate approximation of the solution to the Bansal and Yaron model. Consequently, the long run risk models should also be examined to see whether or not the interpretations and approximation errors are influenced by low order polynomial approximations.

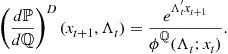

An alternative approach to developing log-linearized empirical models of asset returns is illustrated by Gabaix (2009). In this case, he identifies a linear generating process. Here, the stochastic process for dividend growth is found such that the price-dividend ratio is linear in the current state variable. A more sophisticated version of this approach is developed by Le et al. (2010) who incorporate the properties of continuous time affine term structure models into discrete time asset pricing models.18 The idea is to find a probability density function which yields an affine moment generating function under the risk neutral distribution

![]() (79)

(79)

Here ![]() indicates the expectation is with respect to the risk neutral distribution and

indicates the expectation is with respect to the risk neutral distribution and ![]() is now a vector of all state variables. They show that a gamma probability distribution in which the random parameters follow a Poisson probability distribution leads to this affine moment generating function. In this case the functions

is now a vector of all state variables. They show that a gamma probability distribution in which the random parameters follow a Poisson probability distribution leads to this affine moment generating function. In this case the functions ![]() and

and ![]() have explicit formulas so that one can derive the affine bond prices using well-known recursive rules.19 Consequently, the probability distribution under the risk neutral measure,

have explicit formulas so that one can derive the affine bond prices using well-known recursive rules.19 Consequently, the probability distribution under the risk neutral measure, ![]() , has an explicit functional form. One then specifies a market price of risk

, has an explicit functional form. One then specifies a market price of risk ![]() such that the Radon-Nikodym derivative has the functional form

such that the Radon-Nikodym derivative has the functional form

(80)

(80)

Thus, the physical distribution ![]() of the state vector is known and given by

of the state vector is known and given by

![]() (81)

(81)

As a result, the stochastic discount factor is given by

(82)

(82)

since ![]() . Also,

. Also, ![]() is the risk-free interest rate which is assumed to be linear in the current state variables,

is the risk-free interest rate which is assumed to be linear in the current state variables, ![]() . Given the stochastic discount factor one can proceed to price any financial asset.20 To illustrate how this procedure can be applied to a particular asset pricing model Le, Singleton, and Dai specify a stochastic process for the inverse of the surplus consumption ratio in Campbell and Cochrane (1999) and Wachter (2006). This stochastic process has the risk neutral probability distribution with moment generating function (79). In addition, they derive a new sensitivity function for (56) which satisfies the local properties in Campbell and Cochrane’s original model.

. Given the stochastic discount factor one can proceed to price any financial asset.20 To illustrate how this procedure can be applied to a particular asset pricing model Le, Singleton, and Dai specify a stochastic process for the inverse of the surplus consumption ratio in Campbell and Cochrane (1999) and Wachter (2006). This stochastic process has the risk neutral probability distribution with moment generating function (79). In addition, they derive a new sensitivity function for (56) which satisfies the local properties in Campbell and Cochrane’s original model.

This approach establishes a theoretical foundation for the log-linearized asset pricing models. However, the analytic method shows that even the Mehra and Prescott model needs a higher order Taylor polynomial to accurately represent asset returns in this model. Consequently, the stochastic discount factor from the original asset pricing models is not given by (82). Thus, an open question is how close the stochastic discount factor from the original asset pricing models matches the empirical model (82) developed by Le, Singleton, and Dai.

3.5 Heterogeneous Agents

Asset pricing models with heterogeneous characteristics for investors significantly increase the level of complexity of the computational algorithms. The heterogeneity takes many forms including differences in risk aversion, income, beliefs, and access to information. The complexity arises from the need to keep track of the differences among investors, as well as the coordination of their behavior with market equilibrium.

To illustrate these issues, consider the differences among investors’ incomes as in Lucas (1994) and Heaton and Lucas (1996). The budget constraint of the investors (8) now becomes

![]() (83)

(83)

for each individual investor ![]() . The cash in hand for investing,

. The cash in hand for investing, ![]() , includes the initial wealth of the investor,

, includes the initial wealth of the investor, ![]() , plus her labor income,