Computational Methods for Derivatives with Early Exercise Features

Carl Chiarellaa, Boda Kangb, Gunter Meyerc and Andrew Ziogasd, aFinance Discipline Group, UTS Business School, University of Technology, Sydney, Australia, bDepartment of Mathematics, University of York, Heslington, York, UK, cDepartment of Mathematics, Georgia Institute of Technology, Atlanta, GA, USA, dLloyds Bank – Commercial Banking, Sydney, Australia

Abstract

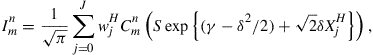

In this paper we consider various computational methods for pricing American style derivatives. We do so under both jump diffusion and stochastic volatility processes. We consider integral transform methods, the method of lines, operator-splitting, and the Crank-Nicolson scheme, the latter being used to generate the benchmark solution. Overall, we find that the method of lines approach is quite competitive with other methods for the problems considered in this paper. As one goes to higher dimensions it may be necessary to use methods such as the sparse grid approach.

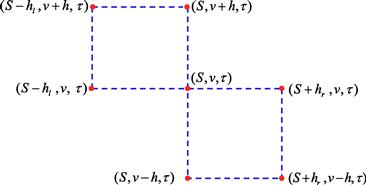

Keywords

American option pricing; Stochastic volatility; Jump dynamics; Fourier transforms; Crank-Nicolson scheme

JEL Classification Codes

G3; C02

1 General Introduction

The American option pricing problem has been explored in great depth in the option pricing literature. The survey by Barone-Adesi (2005) provides an overview of this research for the case of the American put under the classical Brownian motion process for asset returns.

An array of approaches have been proposed in the vast literature on this topic. It will not be possible in this paper to survey all of these. Rather we shall focus on the methods that the authors and their co-workers have found to be the most useful. In particular we shall focus first on the formulation of the problem. In order to capture the market reality that the underlying asset returns are not well modeled by Brownian motion, it is necessary to consider both stochastic volatility and jump-diffusion dynamics as these are the processes most widely used to capture these effects. More recently there has been a great deal of work on the use of Lévy processes, which is nicely surveyed in the book by Cont and Tankov (2003). Space limitations do not allow us to go into all of these approaches here.

In particular in this paper we shall survey the integral transform approach, which in higher dimensions can only work for specific correlation structures, and the partial differential equation approach. For the latter we shall propose a number of finite difference approaches, projected successive over-relaxation (PSOR), which when used with a high level of discretization will yield a benchmark solution against which we can compare other methods, the method of lines (MOL) which the authors have found applies quite successfully to low dimensional problems, and sparse grid and operator-splitting methods for higher dimensional problems.

The paper is structured as follows. In Section 2 we shall give a formulation of the American option pricing problem, first of all in the case of geometric Brownian motion and then, for more general dynamics, for the underlying asset price that allows both stochastic volatility and poisson jump dynamics. Section 3 will introduce the integral transform approach, first in one dimension and then in several dimensions. Section 4 will introduce the method of lines (MOL) for the situation when the underlying asset is driven by both stochastic volatility and Poisson jump dynamics. The performance of the MOL approach is compared against the operator-splitting approaches, in particular the componentwise splitting method and the finite difference method with PSOR, both of which are discussed in Section 4 as well. Section 5 will conclude.

2 The Problem Statement—In the Case of Stochastic Volatility and Poisson Jump Dynamics

Let ![]() be the price of an American call option written on a stock of price

be the price of an American call option written on a stock of price ![]() with time to expiry

with time to expiry ![]() 1and strike price

1and strike price ![]() . For the underlying dynamics, we assume that the stochastic differential equation (SDE) for

. For the underlying dynamics, we assume that the stochastic differential equation (SDE) for ![]() is given by the jump-diffusion process proposed by Merton (1976), in conjunction with the square root variance process of Heston (1993). Thus the dynamics for

is given by the jump-diffusion process proposed by Merton (1976), in conjunction with the square root variance process of Heston (1993). Thus the dynamics for ![]() under the so-called historical measure

under the so-called historical measure ![]() are governed by the SDE system

are governed by the SDE system

![]() (1)

(1)

![]() (2)

(2)

In (1), ![]() is the instantaneous stock return per unit time,

is the instantaneous stock return per unit time, ![]() is the instantaneous squared stock variance per unit time, and

is the instantaneous squared stock variance per unit time, and ![]() is a standard Wiener process under

is a standard Wiener process under ![]() . Furthermore, we define the Poisson jump arrival process

. Furthermore, we define the Poisson jump arrival process ![]() by

by

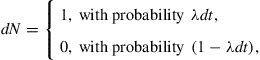

and set

![]() (3)

(3)

where ![]() is the continuous probability density function for the multiplicative jump sizes,

is the continuous probability density function for the multiplicative jump sizes, ![]() , generated by the measure

, generated by the measure ![]() . In (2),

. In (2), ![]() is the long-run mean for

is the long-run mean for ![]() is the rate of mean reversion,

is the rate of mean reversion, ![]() is the instantaneous volatility of

is the instantaneous volatility of ![]() per unit time (the so-called vol-of-vol), and

per unit time (the so-called vol-of-vol), and ![]() is a standard Wiener process under

is a standard Wiener process under ![]() correlated with

correlated with ![]() such that

such that ![]() . Note that

. Note that ![]() ,

, ![]() , and

, and ![]() are otherwise uncorrelated.

are otherwise uncorrelated.

Let ![]() (assumed constant) be the risk-free rate of interest, and assume that the stock pays a continuously compounded dividend yield at the rate

(assumed constant) be the risk-free rate of interest, and assume that the stock pays a continuously compounded dividend yield at the rate ![]() (also assumed constant). We assume, following Heston (1993), that the market price of variance risk is proportional to

(also assumed constant). We assume, following Heston (1993), that the market price of variance risk is proportional to ![]() , and is of the form

, and is of the form ![]() , where

, where ![]() is a constant. Using standard hedging arguments and an application of Ito’s lemma for jump-diffusion processes, it can be shown2 that

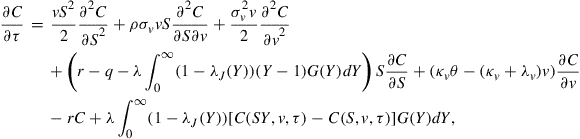

is a constant. Using standard hedging arguments and an application of Ito’s lemma for jump-diffusion processes, it can be shown2 that ![]() satisfies the partial integro-differential equation (PIDE)

satisfies the partial integro-differential equation (PIDE)

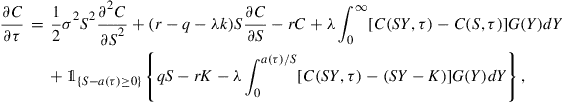

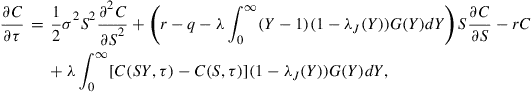

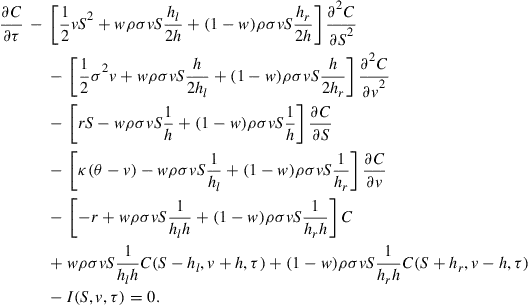

(4)

(4)

in the region ![]() , and

, and ![]() . Here

. Here ![]() denotes the early exercise boundary at time to maturity

denotes the early exercise boundary at time to maturity ![]() and variance level

and variance level ![]() , and

, and ![]() denotes the market price of risk associated with a jump in the value of the stock with magnitude

denotes the market price of risk associated with a jump in the value of the stock with magnitude ![]() (that is a jump from

(that is a jump from ![]() to

to ![]() ). The initial condition for (4) is the American call payoff function, given by

). The initial condition for (4) is the American call payoff function, given by

![]() (5)

(5)

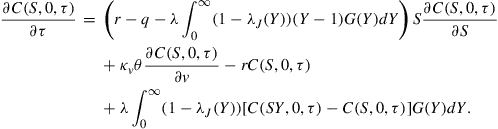

The boundary condition at ![]() is less obvious. Some authors (such as Clarke and Parrott (1999), and Ikonen and Toivanen (2007)) prefer to use the exercise payoff condition

is less obvious. Some authors (such as Clarke and Parrott (1999), and Ikonen and Toivanen (2007)) prefer to use the exercise payoff condition ![]() . Alternatively we note that by setting

. Alternatively we note that by setting ![]() in (4) we find that

in (4) we find that ![]() is given by the solution of the PIDE

is given by the solution of the PIDE

(6)

(6)

We have preferred to let the model itself yield the boundary condition by extrapolating the solution for ![]() to

to ![]() as detailed in Section 4.1. This procedure is justified by the fact that the boundary condition at

as detailed in Section 4.1. This procedure is justified by the fact that the boundary condition at ![]() is an outflow condition as demonstrated in Chiarella et al. (2009). Also we have found that it yields the same solution as solving (6) but is computationally more efficient to implement.

is an outflow condition as demonstrated in Chiarella et al. (2009). Also we have found that it yields the same solution as solving (6) but is computationally more efficient to implement.

Since, in the limit as ![]() the option price becomes insensitive to the variance we have

the option price becomes insensitive to the variance we have

![]() (7)

(7)

In the asset domain, the boundary conditions are

![]() (8)

(8)

![]() (9)

(9)

Condition (8) is the trivial condition that the option is worthless when the stock price falls to zero. Condition (9) follows because the option value is equal to the payoff at the free boundary and is known as the value-matching condition. Finally we require two additional conditions along the early exercise surface, namely

![]() (10)

(10)

The boundary conditions (10) are referred to in the literature as the smooth-pasting conditions, and follow by assuming the elimination of arbitrage opportunities. Mathematically, this is equivalent to ensuring that ![]() and

and ![]() will be continuous for all values of

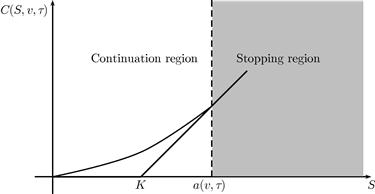

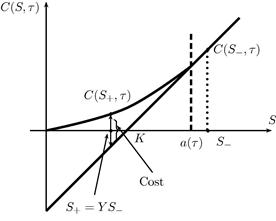

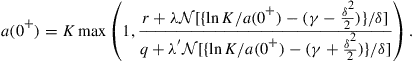

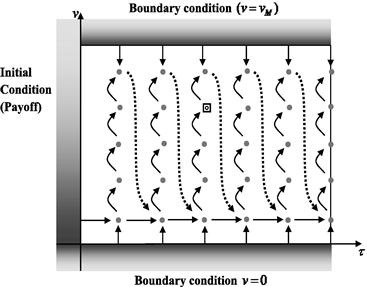

will be continuous for all values of ![]() . Figure 1 demonstrates the payoff, price profile, and early exercise boundary for the American call under consideration.

. Figure 1 demonstrates the payoff, price profile, and early exercise boundary for the American call under consideration.

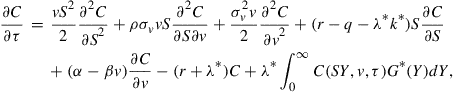

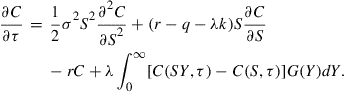

The PIDE (4) may be written in the form

(11)

(11)

![]() (12)

(12)

and

![]() (13)

(13)

with ![]() and

and ![]() , and we note that

, and we note that

![]()

where ![]() is a density function under the risk-neutral pricing measure

is a density function under the risk-neutral pricing measure ![]() . The relevant boundary conditions are (5–9), and the domain for the problem is

. The relevant boundary conditions are (5–9), and the domain for the problem is ![]() , and

, and ![]() .

.

Option pricing under stochastic volatility and jump-diffusion dynamics of course involves market incompleteness since both the variance risk and the jump risk are not priced in the market. When the market is incomplete option pricing formulae are not unique. In (11) the non-uniqueness is reflected in the market price of variance risk parameter ![]() (embedded in the parameter

(embedded in the parameter ![]() ) and the market price of jump risk

) and the market price of jump risk ![]() that is embedded in the parameter

that is embedded in the parameter ![]() and jump-size distribution under the adjusted measure

and jump-size distribution under the adjusted measure ![]() (see Eq. (12)). There is a large literature on how these parameters may be chosen, for instance, by minimizing the variance of hedging cost or some entropy measure. Here we shall simply assume that the parameters

(see Eq. (12)). There is a large literature on how these parameters may be chosen, for instance, by minimizing the variance of hedging cost or some entropy measure. Here we shall simply assume that the parameters ![]() as well as the parameters of the distribution

as well as the parameters of the distribution ![]() have somehow been obtained either by the methods referred to or simply by calibration to market data.

have somehow been obtained either by the methods referred to or simply by calibration to market data.

Our main task in Sections 3 and 4 is to develop approaches to solving the PIDE (11) subject to the boundary conditions (5–10). In later sections we shall consider some higher dimensional problems. As we indicated in the Introduction we shall survey both the integral transform approach and the discretisation of the PIDE. The main numerical challenges in solving (11) arise from (i) the two spatial dimensions (![]() and

and ![]() ) so that we are seeking an early exercise surface, and (ii) the integral term over the jump-size distribution which will involve the unknown option price over a whole set of values of

) so that we are seeking an early exercise surface, and (ii) the integral term over the jump-size distribution which will involve the unknown option price over a whole set of values of ![]() .

.

3 American Call Options Under Jump-Diffusion Processes

In this section we shall drop the stochastic volatility component from the dynamics by assuming that the variance is constant and merely discuss how to handle the jump term in the integral transform approach. Option pricing under jump-diffusion dynamics was originally investigated by Merton (1976) for the case of the European option.

3.1 Introduction

The integral transform technique can be applied to solving the option pricing problem under a range of underlying dynamics and payoff types. There are numerous examples where integral transforms have been used in the option pricing literature. Scott (1997) uses Fourier transforms to value European options under jump-diffusion with both stochastic volatility and stochastic interest rates. Carr and Madan (1999) with a particular focus on the variance gamma model use Fourier transforms to motivate numerical algorithms using the fast Fourier transform. The American strangle has been analyzed by Chiarella and Ziogas (2005) using a Fourier transform approach, under the assumption that the underlying dynamics are the classic geometric Brownian motion.

The main advantage of the Fourier transform method is that the solution may be expressed in terms of a general initial value or payoff function, so that a wider variety of American options, such as puts, calls, butterflies, spread options, and max-options can all be handled systematically.

In this section we derive the linked system of integral equations for the price and early exercise boundary of an American call under Merton’s jump-diffusion dynamics. We also derive the limit of the early exercise boundary at maturity, and discuss a numerical algorithm for solving the linked integral equation system. We do so by extending to the jump-diffusion situation the quadrature integration technique of Kallast and Kivinukk (2003). The algorithm used has the added advantage of generating values for the price, delta, and early exercise boundary. The issue of the existence and uniqueness of the solution to the nonlinear integral equation that arises in the solution of the free boundary value problem was raised by Myneni (1992) and finally settled by Peskir (2005) in the case of pure diffusion dynamics. It still remains to extend that analysis to the case of jump-diffusion dynamics.

We focus on deriving solutions to the partial differential equation (PDE) for the American call price. A natural solution technique here is the integral transform approach, which (see Debnath, 1995) has been very successfully employed in a wide range of PDE problems in the natural sciences. One of the difficulties with dealing with American options using this technique arises from the fact that one has to solve the PDE on a region restricted by the early exercise, or free, boundary. McKean (1965), who seems to have been the first to consider the American option pricing problem, solves the homogeneous PDE in a restricted domain by using an incomplete Fourier transform. An alternative approach, developed by Jamshidian (1992), replaces the homogeneous PDE with an equivalent inhomogeneous PDE on an unrestricted domain. The solution to this alternative formulation can then be derived by using the standard Fourier transform, and then through an application of Duhamel’s principle. In this section we provide this extension of Jamshidian’s formulation to the jump-diffusion case.

While some authors, in particular Pham (1997) and Gukhal (2001), derive integral equations for the price and free boundary of American options under jump-diffusion they do not discuss how they can be solved numerically. In this section we solve the linked integral equation system that arises for the American call and its free boundary in the case of jump-diffusion. In developing a numerical scheme for the linked integral equation system we obtain a simplification of the integral terms over the jump-size distribution that reduces the computational burden by reducing the dimension of the multiple integration involved. We give some results on the behavior of the early exercise boundary at expiry that are needed to start the numerical procedure. We use the proposed numerical integration scheme to find the price, delta, and early exercise boundary of American calls with log-normal jump sizes. We also demonstrate that the method is often more efficient than a simple two-pass Crank-Nicolson finite difference scheme and is competitive with the method of lines of Meyer (1998) (alternatively, see Meyer, 2012).

Section 3.2 outlines the free boundary problem that arises from pricing an American call option under Merton’s jump-diffusion model. Section 3.3 applies Jamshidian’s method to derive an inhomogeneous PIDE for the American call price, which is then solved using Fourier transforms. We thus obtain the linked integral equation system for the free boundary and option price. We derive the limit of the free boundary at expiry in Section 3.4, and find that this limit is different from that found for pure diffusion models. Section 3.5 analyzes the integral equations in the case where the jump sizes follow a log-normal distribution, as suggested by Merton (1976). Section 3.7 outlines the numerical integration method used to solve the linked integral equation system for the free boundary, price, and delta of the American call. Since the integral equation for the call value and the integral equation for the free boundary are interdependent, we provide a method to handle this interdependence in order to use the two-pass sequential procedure that works well in the non-jump case. Numerical results detailing the efficiency of this algorithm are provided in Section 3.8. As this section summarizes the paper by Chiarella and Ziogas (2009) we shall refer the reader to that paper for many of the proofs.3

3.2 Problem Statement—Merton’s Model

As we drop the stochastic volatility component of Section 2 we simply write ![]() to denote the price of an American option written on the underlying asset

to denote the price of an American option written on the underlying asset ![]() at time to expiry

at time to expiry ![]() . In this case the free boundary only depends on

. In this case the free boundary only depends on ![]() so we write it as

so we write it as ![]() . Because in this section

. Because in this section ![]() is constant the dynamics for

is constant the dynamics for ![]() follows the jump-diffusion process

follows the jump-diffusion process

![]() (14)

(14)

where in addition to the notation introduced in Section 2 we set the instantaneous variance per unit time as a constant ![]() and

and ![]() is a standard Wiener process under the physical measure.

is a standard Wiener process under the physical measure.

The PIDE (4) for ![]() in the current case becomes4

in the current case becomes4

(15)

(15)

which has to be solved in the region ![]() and

and ![]() . Given a form for

. Given a form for ![]() , we can define a new intensity,

, we can define a new intensity, ![]() , and jump-size distribution,

, and jump-size distribution, ![]() , which fully incorporate the term

, which fully incorporate the term ![]() , such that (15) can be written as

, such that (15) can be written as

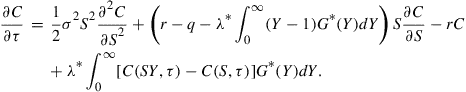

(16)

(16)

The market incompleteness of the jump-diffusion option pricing problem is reflected in the fact that the choice of ![]() and

and ![]() is at the discretion of the model builder, so that the associated risk-neutral density is non-unique. As stated earlier, we take the view here that the model builder would calibrate

is at the discretion of the model builder, so that the associated risk-neutral density is non-unique. As stated earlier, we take the view here that the model builder would calibrate ![]() and

and ![]() directly to market data without needing to determine a risk-neutral density for the pricing problem at hand. Henceforth, for ease of notation, we shall simply refer to the jump risk-adjusted intensity and jump-size density in (16) as

directly to market data without needing to determine a risk-neutral density for the pricing problem at hand. Henceforth, for ease of notation, we shall simply refer to the jump risk-adjusted intensity and jump-size density in (16) as ![]() and

and ![]() respectively.

respectively.

By use of (3), the PIDE (16) can be written as

(17)

(17)

In the case of an American call option, the initial and boundary conditions (5, 7–10) become

![]() (18)

(18)

![]() (19)

(19)

![]() (20)

(20)

![]() (21)

(21)

and the PIDE (17) is solved subject to these.5

If we were to use the approach of McKean (1965) we would introduce an incomplete version of the Fourier transform, defined by (note that ![]() , and

, and ![]() )

)

![]() (22)

(22)

Inversion of the transform is readily carried out, and the end result is a linked system of integral equations for ![]() and

and ![]() . This solution method comes at the expense of the drawbacks reported by Chiarella and Ziogas (2009).6

. This solution method comes at the expense of the drawbacks reported by Chiarella and Ziogas (2009).6

We instead seek a more efficient alternative for solving (17–21) using the standard Fourier transform.

3.3 Jamshidian’s Representation

One of the major difficulties in solving the PIDE (17) subject to the boundary conditions (18–21) is that the solution is sought on a restricted domain for the stock price ![]() , and furthermore the boundary of this domain is itself unknown a priori and needs to be determined as part of the solution process. In the pure diffusion case, Jamshidian (1992) demonstrates that by evaluating the PDE for the American call price when

, and furthermore the boundary of this domain is itself unknown a priori and needs to be determined as part of the solution process. In the pure diffusion case, Jamshidian (1992) demonstrates that by evaluating the PDE for the American call price when ![]() , one can reformulate the free boundary problem in the restricted domain

, one can reformulate the free boundary problem in the restricted domain ![]() as an inhomogeneous PDE in the unrestricted domain

as an inhomogeneous PDE in the unrestricted domain ![]() . This inhomogeneous PDE can then be more readily solved by traditional solution techniques such as Fourier transforms. We note that the free boundary value problem (FBVP) given by (17–21) involves a homogeneous PIDE to be solved in the restricted asset price domain

. This inhomogeneous PDE can then be more readily solved by traditional solution techniques such as Fourier transforms. We note that the free boundary value problem (FBVP) given by (17–21) involves a homogeneous PIDE to be solved in the restricted asset price domain ![]() . We shall apply Jamshidian’s approach to reformulate the PIDE (17) and associated boundary conditions as an inhomogeneous PIDE on an unrestricted domain.

. We shall apply Jamshidian’s approach to reformulate the PIDE (17) and associated boundary conditions as an inhomogeneous PIDE on an unrestricted domain.

We highlight the fact that ![]() and

and ![]() are continuous for

are continuous for ![]() and

and ![]() , as given by the value-matching condition (20) and smooth-pasting condition (21). Jamshidian’s approach can only be applied with confidence when such continuity holds. We now state the main result that converts the homogeneous PIDE on a restricted domain to an inhomogeneous PIDE on an unrestricted domain.

, as given by the value-matching condition (20) and smooth-pasting condition (21). Jamshidian’s approach can only be applied with confidence when such continuity holds. We now state the main result that converts the homogeneous PIDE on a restricted domain to an inhomogeneous PIDE on an unrestricted domain.

Gukhal (2001) provides clear economic interpretation for the inhomogeneous term that arises in Eq. (23). The ![]() term represents the net cash flows received from holding the portfolio

term represents the net cash flows received from holding the portfolio ![]() whenever

whenever ![]() is in the stopping region. This is already familiar from the pure diffusion case (see, for example, Kim, 1990). The integral term arises entirely because of the introduction of jumps in the price process for

is in the stopping region. This is already familiar from the pure diffusion case (see, for example, Kim, 1990). The integral term arises entirely because of the introduction of jumps in the price process for ![]() . Note that if no jumps were present (

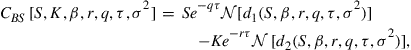

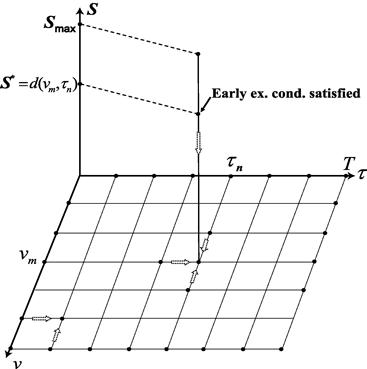

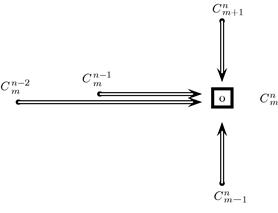

. Note that if no jumps were present (![]() =0) then this term would be zero, and the inhomogeneous term would become the same one presented by Jamshidian (1992). This additional term captures the rebalancing costs incurred by the option holder whenever the price of the underlying jumps down from the stopping region back into the continuation region. Figure 2 illustrates this effect in detail. Consider the case where, during the life of the option contract, the underlying asset price is at

=0) then this term would be zero, and the inhomogeneous term would become the same one presented by Jamshidian (1992). This additional term captures the rebalancing costs incurred by the option holder whenever the price of the underlying jumps down from the stopping region back into the continuation region. Figure 2 illustrates this effect in detail. Consider the case where, during the life of the option contract, the underlying asset price is at ![]() . Since the value of

. Since the value of ![]() is in the stopping region, the holder of the option will currently possess the portfolio

is in the stopping region, the holder of the option will currently possess the portfolio ![]() . If a jump of size

. If a jump of size ![]() occurs such that

occurs such that ![]() , then the portfolio held by the investor will now be worth less than the unexercised American call. This difference is the cost being captured by the integral in the inhomogeneous term in (23).

, then the portfolio held by the investor will now be worth less than the unexercised American call. This difference is the cost being captured by the integral in the inhomogeneous term in (23).

Having derived the inhomogeneous PIDE for ![]() we next use Fourier transforms to find the solution. Our first step is to transform the PIDE to an equation with constant coefficients and a “standardized” strike of 1. Let

we next use Fourier transforms to find the solution. Our first step is to transform the PIDE to an equation with constant coefficients and a “standardized” strike of 1. Let ![]() and

and ![]() , with

, with ![]() . The transformed PIDE for

. The transformed PIDE for ![]() is then

is then

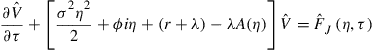

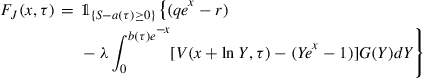

(25)

(25)

where ![]() . Equation (25) is to be solved in the time domain

. Equation (25) is to be solved in the time domain ![]() , and the unrestricted region

, and the unrestricted region ![]() , subject to the initial and boundary conditions

, subject to the initial and boundary conditions

![]() (26)

(26)

![]() (27)

(27)

![]() (28)

(28)

It is worth noting that the smooth-pasting condition still holds, although we do not explicitly require it when solving (25) for ![]() since it is incorporated in the inhomogeneous term.7

since it is incorporated in the inhomogeneous term.7

Since the ![]() -domain is now the unrestricted region

-domain is now the unrestricted region ![]() , the Fourier transform of the inhomogeneous PIDE (25) can be found. Define the Fourier transform of

, the Fourier transform of the inhomogeneous PIDE (25) can be found. Define the Fourier transform of ![]() , as

, as

![]() (29)

(29)

with the corresponding inversion formula

![]() (30)

(30)

where ![]() is the complex number. Applying this Fourier transform to (25), we can reduce the inhomogeneous PIDE for

is the complex number. Applying this Fourier transform to (25), we can reduce the inhomogeneous PIDE for ![]() to an inhomogeneous ordinary differential equation (ODE) for

to an inhomogeneous ordinary differential equation (ODE) for ![]() , whose solution is readily found.

, whose solution is readily found.

When taking the Fourier transform of (25), we note that ![]() and

and ![]() do not approach zero as

do not approach zero as ![]() . A number of approaches have been suggested for dealing with this difficulty. Carr and Madan (1999) and Lee (2004) suggest introducing a damping function of the form

. A number of approaches have been suggested for dealing with this difficulty. Carr and Madan (1999) and Lee (2004) suggest introducing a damping function of the form ![]() for some positive constant

for some positive constant ![]() , and then apply the transform to the dampened option price

, and then apply the transform to the dampened option price ![]() , which does tend to zero, along with

, which does tend to zero, along with ![]() , as

, as ![]() . The desired function

. The desired function ![]() can be readily recovered after the solution in transform space has been inverted. Lewis (2000) gives another approach which proves that the Fourier transform is still valid when solving for

can be readily recovered after the solution in transform space has been inverted. Lewis (2000) gives another approach which proves that the Fourier transform is still valid when solving for ![]() in this case, although one must instead take the complex Fourier transform in a strip of the complex plane. Regardless of which approach is used to make the Fourier transform applicable, it turns out that both methods are equivalent to simply assuming that

in this case, although one must instead take the complex Fourier transform in a strip of the complex plane. Regardless of which approach is used to make the Fourier transform applicable, it turns out that both methods are equivalent to simply assuming that ![]() and

and ![]() tend to zero as

tend to zero as ![]() , and applying the standard transform accordingly. Thus in order to simplify the technical discussion, we shall simply apply this assumption and suppress the finer details involved.8,9

, and applying the standard transform accordingly. Thus in order to simplify the technical discussion, we shall simply apply this assumption and suppress the finer details involved.8,9

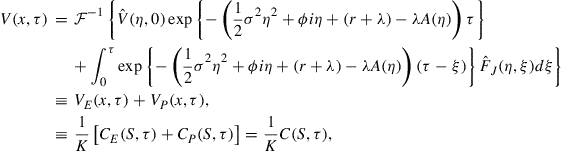

The first term on the right-hand side in (34) is the Fourier transform of the PIDE (25) in the case of a European call option under jump-diffusion dynamics. In this case the last term of the right-hand side of (25) does not appear, and it is the latter term involving the free boundary that gives rise to the second term in Eq. (34).

Now that ![]() has been found, we may use the inversion formula (30) to recover

has been found, we may use the inversion formula (30) to recover ![]() , the American call price in the

, the American call price in the ![]() -

-![]() plane. By taking the inverse Fourier transform of (34), we have

plane. By taking the inverse Fourier transform of (34), we have

(35)

(35)

where ![]() is the value of the corresponding European call written on

is the value of the corresponding European call written on ![]() and

and ![]() is the early exercise premium for

is the early exercise premium for ![]() . By performing the inversions, we can determine the analytic forms of

. By performing the inversions, we can determine the analytic forms of ![]() and

and ![]() and these are given in Propositions 3.3 and 3.4 below.

and these are given in Propositions 3.3 and 3.4 below.

Equation (36) is of course Merton’s (1976) solution for a European call option under jump-diffusion, with general jump size density ![]() . Next we shall determine the early exercise premium

. Next we shall determine the early exercise premium ![]() .

.

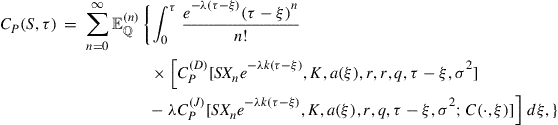

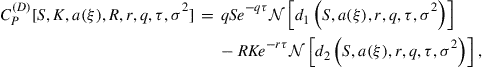

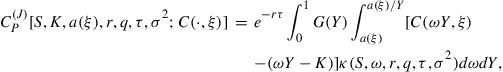

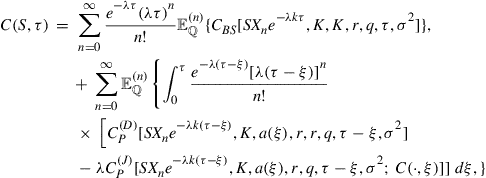

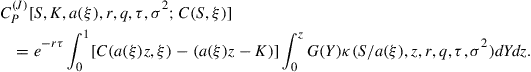

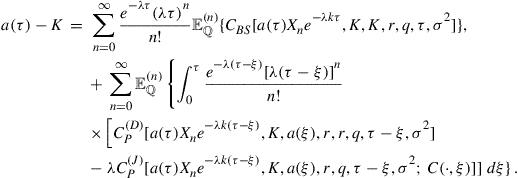

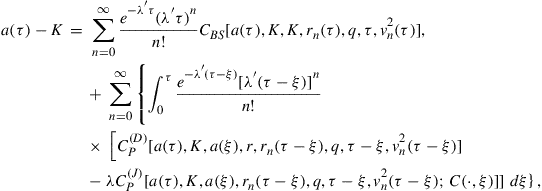

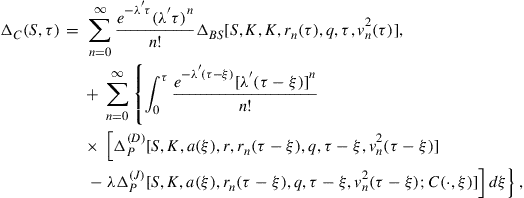

On the left-hand side in (40) we introduce the notation ![]() to indicate that the dependence on the option price is that of a functional (rather than of a function). It in fact has the form

to indicate that the dependence on the option price is that of a functional (rather than of a function). It in fact has the form

![]() (42)

(42)

for an appropriate function ![]() , a notation that will recur in many of the subsequent formulae.

, a notation that will recur in many of the subsequent formulae.

Each of the linear terms in (38) represents discounted expected cash flows incurred by the option holder when ![]() , as discussed previously for the interpretation of the inhomogeneous term in (23); the

, as discussed previously for the interpretation of the inhomogeneous term in (23); the ![]() term is the expected value at time to maturity

term is the expected value at time to maturity ![]() of the

of the ![]() component in (23), and the

component in (23), and the ![]() term is the expected value of the integral term in (23). Combining

term is the expected value of the integral term in (23). Combining ![]() and

and ![]() , we can now write down the integral equation for the American call option price,

, we can now write down the integral equation for the American call option price, ![]() .

.

Equation (43) is indeed an integral equation since the unknown option price also appears under the time integral on the right-hand side, in particular through the ![]() term. This is in contrast to the pure diffusion case where the equation corresponding to (43) (when

term. This is in contrast to the pure diffusion case where the equation corresponding to (43) (when ![]() and so that the

and so that the ![]() term drops out) is simply an integral expression for the option price that can be evaluated once the free boundary has been determined.

term drops out) is simply an integral expression for the option price that can be evaluated once the free boundary has been determined.

The solution (43) is readily compared with that of Gukhal (2001), who derives (43) by generalizing the compound option approach of Kim (1990) to the jump-diffusion case. The three additive components of the call value in Eq. (43) each have a clear economic interpretation, as outlined by Gukhal (2001). The first term, ![]() , represents the European component of the American call option’s value, while the remaining two terms combine to form the total early exercise premium. The middle term is a natural extension of the early exercise premium that arises in the pure diffusion case. More specifically, this term calculates the dividend received when holding the underlying, less the interest payable on a loan of size

, represents the European component of the American call option’s value, while the remaining two terms combine to form the total early exercise premium. The middle term is a natural extension of the early exercise premium that arises in the pure diffusion case. More specifically, this term calculates the dividend received when holding the underlying, less the interest payable on a loan of size ![]() . Thus

. Thus ![]() captures the potential income to the option holder should the option be exercised to buy the underlying by borrowing

captures the potential income to the option holder should the option be exercised to buy the underlying by borrowing ![]() at the risk-free rate. The third term,

at the risk-free rate. The third term, ![]() , arises entirely due to the introduction of jumps in the price process for

, arises entirely due to the introduction of jumps in the price process for ![]() , and captures the rebalancing costs incurred by the option holder whenever the price of the underlying jumps down from the stopping region into the continuation region as illustrated in Figure 2.

, and captures the rebalancing costs incurred by the option holder whenever the price of the underlying jumps down from the stopping region into the continuation region as illustrated in Figure 2.

In Eq. (43), the value of the American call option is expressed as a function of the underlying asset price ![]() , and time to maturity

, and time to maturity ![]() . As we have already noted, Eq. (43) also depends upon the unknown early exercise boundary,

. As we have already noted, Eq. (43) also depends upon the unknown early exercise boundary, ![]() . By requiring the expression for

. By requiring the expression for ![]() to satisfy the early exercise boundary condition (20), we can derive the integral equation for

to satisfy the early exercise boundary condition (20), we can derive the integral equation for ![]() , namely

, namely

(44)

(44)

Note that the integral Eq. (44) depends upon the unknown call value ![]() , which arises entirely from the integral terms that have been introduced by the presence of jumps in the dynamics for

, which arises entirely from the integral terms that have been introduced by the presence of jumps in the dynamics for ![]() .

.

The structure of the integral equation system consisting of (43) and (44) can be made more transparent by writing it succinctly as

![]() (45)

(45)

![]() (46)

(46)

where the definitions of the functions ![]() and

and ![]() can be inferred from the right-hand sides of Eqs. (43) and (44), respectively. The interdependence of (45) and (46) is obvious, and it is this interdependence that makes numerical implementation more involved than for the corresponding no-jump problem. There the dependence is sequential, that is, first one solves for the free boundary, which then feeds into an integral expression for the option price. In fact, Eqs. (43) and (44) form a linked system of non-linear Volterra integral equations of the second kind. Thus in order to implement these integral equations for the free boundary and call price, we need to develop numerical techniques to solve the linked integral equation system (43) and (44).

can be inferred from the right-hand sides of Eqs. (43) and (44), respectively. The interdependence of (45) and (46) is obvious, and it is this interdependence that makes numerical implementation more involved than for the corresponding no-jump problem. There the dependence is sequential, that is, first one solves for the free boundary, which then feeds into an integral expression for the option price. In fact, Eqs. (43) and (44) form a linked system of non-linear Volterra integral equations of the second kind. Thus in order to implement these integral equations for the free boundary and call price, we need to develop numerical techniques to solve the linked integral equation system (43) and (44).

Before concluding this subsection, we present an alternative form for the double integral involving the function ![]() in Eq. (40) and defined in (41).

in Eq. (40) and defined in (41).

From an economic point of view, the modified representation in (47) is less intuitive than the original; however, it offers significant advantages when attempting to evaluate (40) numerically for specific forms of ![]() . In particular, we will see in Section 3.5 that when

. In particular, we will see in Section 3.5 that when ![]() is the log-normal density function given by Merton (1976), the innermost integral in (47) can be evaluated analytically. In this way we are able to reduce (47) to a one-dimensional integral, which makes the task of numerically evaluating (47) much simpler. We remind the reader that the

is the log-normal density function given by Merton (1976), the innermost integral in (47) can be evaluated analytically. In this way we are able to reduce (47) to a one-dimensional integral, which makes the task of numerically evaluating (47) much simpler. We remind the reader that the ![]() term in turn must be integrated over time to maturity so that altogether the jump term would in this case involve the evaluation of a double integral.

term in turn must be integrated over time to maturity so that altogether the jump term would in this case involve the evaluation of a double integral.

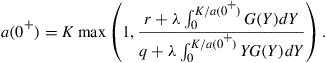

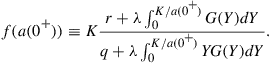

3.4 Limit of the Early Exercise Boundary at Expiry

In order to implement numerical schemes we need to know the value of the free boundary just prior to expiry, at ![]() . Early literature, for instance, Amin (1993) and Carr and Hirsa (2003), simply assumed that this limit is identical to the corresponding pure diffusion case. However, Chiarella and Ziogas (2009) show that this limit is in fact more subtle. They derive the limit by analyzing the inhomogeneous term in the PIDE (23), and find that the presence of jumps does in fact have an impact on the early exercise boundary at expiry. This difference is expressed analytically in Proposition 3.7 below, and is based on the analysis of Wilmott et al. (1993). The simple, intuitive method used here is taken from Chiarella et al. (2004) who demonstrate that the approach of Wilmott et al. (1993) is equivalent to setting the inhomogeneous term in Jamshidian’s (1992) form for the PDE to zero, setting

. Early literature, for instance, Amin (1993) and Carr and Hirsa (2003), simply assumed that this limit is identical to the corresponding pure diffusion case. However, Chiarella and Ziogas (2009) show that this limit is in fact more subtle. They derive the limit by analyzing the inhomogeneous term in the PIDE (23), and find that the presence of jumps does in fact have an impact on the early exercise boundary at expiry. This difference is expressed analytically in Proposition 3.7 below, and is based on the analysis of Wilmott et al. (1993). The simple, intuitive method used here is taken from Chiarella et al. (2004) who demonstrate that the approach of Wilmott et al. (1993) is equivalent to setting the inhomogeneous term in Jamshidian’s (1992) form for the PDE to zero, setting ![]() , and solving for the free boundary.

, and solving for the free boundary.

It is worthwhile to observe that when ![]() Eq. (48) simplifies to the limit derived by Kim (1990) for the pure diffusion American call free boundary. Note that (48) is an implicit expression for

Eq. (48) simplifies to the limit derived by Kim (1990) for the pure diffusion American call free boundary. Note that (48) is an implicit expression for ![]() , but it can be solved quickly and accurately using standard root-finding techniques. Furthermore, as

, but it can be solved quickly and accurately using standard root-finding techniques. Furthermore, as ![]() the solution to the implicit part of Eq. (48) increases without bound. Thus when

the solution to the implicit part of Eq. (48) increases without bound. Thus when ![]() ,

, ![]() becomes infinite, and we observe the well-known property that it is never optimal to exercise an American call option early in the absence of dividends.

becomes infinite, and we observe the well-known property that it is never optimal to exercise an American call option early in the absence of dividends.

Before concluding this subsection, we shall take a closer look at the properties of Eq. (48), specifically with a view to better understanding the solution to

![]() (49)

(49)

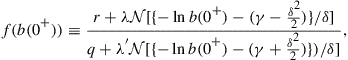

where

Once (49) is solved, then the ![]() operator can be applied. Since the value of the underlying is always non-negative, we consider the domain

operator can be applied. Since the value of the underlying is always non-negative, we consider the domain ![]() when solving (49). It is not possible to provide a simple, explicit summary of the behavior of (49) for various values of

when solving (49). It is not possible to provide a simple, explicit summary of the behavior of (49) for various values of ![]() , because the integral terms depend upon

, because the integral terms depend upon ![]() , and the function

, and the function ![]() involves the parameters

involves the parameters ![]() and

and ![]() , as well as the jump-size density

, as well as the jump-size density ![]() .

.

First, we see that it is simple to evaluate ![]() at the limits of the domain. Specifically, we can show that

at the limits of the domain. Specifically, we can show that

![]() (50)

(50)

and

![]() (51)

(51)

Thus for ![]() to be finite at each extremity of the domain, it is sufficient that we have

to be finite at each extremity of the domain, it is sufficient that we have ![]() . In this case, it is clear that

. In this case, it is clear that ![]() is continuous, and (49) will have at least one solution. Since

is continuous, and (49) will have at least one solution. Since ![]() appears only in the limits of the integral terms over the density

appears only in the limits of the integral terms over the density ![]() within

within ![]() , we can safely claim that the behavior of

, we can safely claim that the behavior of ![]() with respect to

with respect to ![]() will be bounded by the behavior of

will be bounded by the behavior of ![]() . Further exploration appears difficult without specifying the form of

. Further exploration appears difficult without specifying the form of ![]() , and we provide a more detailed analysis in Section 3.5.

, and we provide a more detailed analysis in Section 3.5.

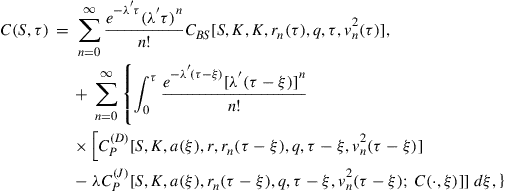

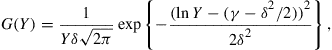

3.5 American Call with Log-Normal Jumps

Before we begin exploring a numerical solution method for the integral equation system (43) and (44), we shall consider the specific example when the jump-size density, ![]() is a log-normal distribution as in the original model of Merton (1976). The probability density function for

is a log-normal distribution as in the original model of Merton (1976). The probability density function for ![]() is given by

is given by

(52)

(52)

where we set ![]() , and

, and ![]() is the variance of

is the variance of ![]() . Furthermore we note that for this choice of

. Furthermore we note that for this choice of ![]() we have

we have ![]() .

.

The last term of (53), which involves a double integral, may be further simplified before implementing (53) numerically.

We note that in the form (54) the ![]() term in (53) now only involves a single integral, which results in a considerable saving in computational effort.

term in (53) now only involves a single integral, which results in a considerable saving in computational effort.

By use of (44), the integral equation for the early exercise boundary, ![]() , in the case of log-normal jump sizes, is given by

, in the case of log-normal jump sizes, is given by

(56)

(56)

where ![]() and

and ![]() are given by (39) and (54), respectively.

are given by (39) and (54), respectively.

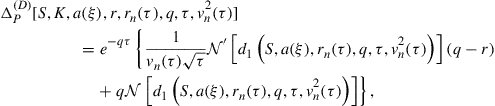

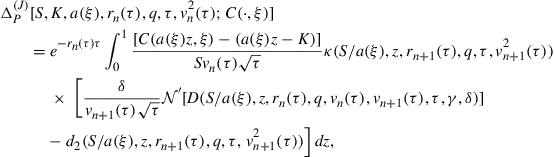

3.5.1 Delta for the American Call

We now provide one further result regarding the delta of the American call option, ![]() . This quantity is obviously important for hedging purposes, but it is also required by the numerical algorithm we consider in Section 3.7.

. This quantity is obviously important for hedging purposes, but it is also required by the numerical algorithm we consider in Section 3.7.

By differentiating (53) with respect to ![]() , we find that

, we find that

(57)

(57)

where

(58)

(58)

(59)

(59)

and we note that ![]() . Once we have found the price and free boundary for the American call option, we can readily evaluate (57) numerically to find delta.

. Once we have found the price and free boundary for the American call option, we can readily evaluate (57) numerically to find delta.

3.6 Properties of the Free Boundary at Expiry

Since we are now considering a specific form for ![]() , we consider again the topic of analyzing the behavior of the early exercise boundary,

, we consider again the topic of analyzing the behavior of the early exercise boundary, ![]() , as

, as ![]() . First we evaluate (48) for the log-normal density

. First we evaluate (48) for the log-normal density ![]() .

.

To develop an understanding of the case where ![]() , we explore numerically the equation

, we explore numerically the equation

![]() (61)

(61)

where

and we recall that ![]() . It is not possible to provide a simple, explicit summary of the behavior of (61) for various values of

. It is not possible to provide a simple, explicit summary of the behavior of (61) for various values of ![]() because the cumulative normal density functions depend upon

because the cumulative normal density functions depend upon ![]() , and the function

, and the function ![]() involves the parameters

involves the parameters ![]() ,

, ![]() ,

, ![]() ,

, ![]() , and

, and ![]() , all of which have a significant impact on the value of

, all of which have a significant impact on the value of ![]() . Nevertheless, we can use numerical examples to offer some additional insight into the nature of the solution of (61).

. Nevertheless, we can use numerical examples to offer some additional insight into the nature of the solution of (61).

For log-normal jump-sizes we can show that

![]() (62)

(62)

When ![]() it is clear that

it is clear that ![]() is continuous, and (61) will have at least one solution. We can demonstrate by example that

is continuous, and (61) will have at least one solution. We can demonstrate by example that ![]() is not monotonic, nor is it strictly bounded by the end values in (62). This makes it difficult to prove that for

is not monotonic, nor is it strictly bounded by the end values in (62). This makes it difficult to prove that for ![]() Eq. (61) has at most one solution. Since

Eq. (61) has at most one solution. Since ![]() appears only inside cumulative normal functions within

appears only inside cumulative normal functions within ![]() , the behavior of

, the behavior of ![]() with respect to

with respect to ![]() will be bounded by the behavior of

will be bounded by the behavior of ![]() . We recall that

. We recall that ![]() and that

and that ![]() is a smooth, continuous function of

is a smooth, continuous function of ![]() for

for ![]() . From this we postulate that the function

. From this we postulate that the function ![]() will not display any oscillatory features within the domain under consideration.

will not display any oscillatory features within the domain under consideration.

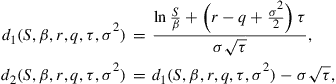

To provide numerical evidence in support of our claims regarding Eq. (61), we now present a plot of (62) which is typical of what we have obtained for a range of empirically relevant parameter values. Setting ![]() ,

, ![]() , and

, and ![]() , we plot in Figure 3 the functions

, we plot in Figure 3 the functions ![]() and

and ![]() for various values of

for various values of ![]() and

and ![]() . When

. When ![]() and

and ![]() , we can see that

, we can see that ![]() . On the other hand, when

. On the other hand, when ![]() and

and ![]() , we now have

, we now have ![]() . In both cases it is clear that

. In both cases it is clear that ![]() is not bounded by these endpoint values, and we can see that the relative values of

is not bounded by these endpoint values, and we can see that the relative values of ![]() and

and ![]() directly influence the values of

directly influence the values of ![]() and

and ![]() .

.

Figure 3 Behavior of Eq. (61) that determines the American call free boundary value at ![]() for various values of

for various values of ![]() with

with ![]() ,

, ![]() , and

, and ![]() . For

. For ![]() we set

we set ![]() , and for

, and for ![]() we take

we take ![]() .

.

Changing the values of the jump-parameters ![]() will vary the value of

will vary the value of ![]() . In addition, changes to

. In addition, changes to ![]() ,

, ![]() , and

, and ![]() will resize the curve

will resize the curve ![]() , although the basic shape remains unchanged. This claim is based on further numerical examples, which can be found in Chiarella and Ziogas (2009).

, although the basic shape remains unchanged. This claim is based on further numerical examples, which can be found in Chiarella and Ziogas (2009).

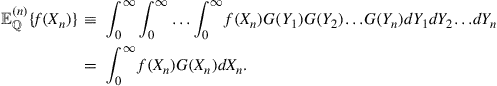

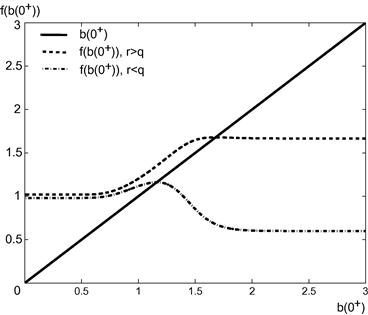

The last and most important scenario we consider here is when ![]() . In this case,

. In this case, ![]() is no longer finite, instead increasing without bound as

is no longer finite, instead increasing without bound as ![]() . Figure 4 demonstrates the behavior of

. Figure 4 demonstrates the behavior of ![]() with

with ![]() for a different selection of parameter values. It is clear from the plot that there is no solution to

for a different selection of parameter values. It is clear from the plot that there is no solution to ![]() . Furthermore, the only way that Eq. (61) will be satisfied when

. Furthermore, the only way that Eq. (61) will be satisfied when ![]() is by taking the limit as

is by taking the limit as ![]() , in which case both sides of (61) will increase without bound. This reflects in yet another way the fact that when

, in which case both sides of (61) will increase without bound. This reflects in yet another way the fact that when ![]() , the free boundary at

, the free boundary at ![]() becomes infinite, and it is never optimal to exercise an American call early in the absence of dividends.

becomes infinite, and it is never optimal to exercise an American call early in the absence of dividends.

Figure 4 Behavior of Eq. (61) that determines the American call free boundary value at ![]() when

when ![]() . Other parameter values are

. Other parameter values are ![]() ,

, ![]() , and

, and ![]() .

.

3.7 Numerical Implementation

We now provide a numerical scheme with which to evaluate the linked integral equation system for the option price and free boundary formed by (53–56). The proposed method is an extension of the quadrature scheme used by Kallast and Kivinukk (2003) for the pure diffusion case. Here we focus on the adjustments that are needed to deal with the introduction of jumps into the dynamics for ![]() . We first discretize the time to maturity variable,

. We first discretize the time to maturity variable, ![]() , into

, into ![]() equally spaced intervals of length

equally spaced intervals of length ![]() . Thus

. Thus ![]() for

for ![]() , and

, and ![]() . We denote the call price profile at time step

. We denote the call price profile at time step ![]() by

by ![]() , and similarly the free boundary at time step

, and similarly the free boundary at time step ![]() by

by ![]() =

= ![]() . Using a standard numerical technique that is applied to Volterra integral equations, we can solve the system (53–56) for increasing values of

. Using a standard numerical technique that is applied to Volterra integral equations, we can solve the system (53–56) for increasing values of ![]() , until eventually the entire free boundary and price profile are found. When calculating the infinite summations, we continue adding terms until the size of the Poisson coefficient for a given value of

, until eventually the entire free boundary and price profile are found. When calculating the infinite summations, we continue adding terms until the size of the Poisson coefficient for a given value of ![]() is less than

is less than ![]() . For the parameter values considered here, this typically results in the use of around 30 terms in the summation. In order to start the algorithm we require the initial value of

. For the parameter values considered here, this typically results in the use of around 30 terms in the summation. In order to start the algorithm we require the initial value of ![]() , which is simply the payoff function, and

, which is simply the payoff function, and ![]() , where

, where ![]() , which is given by Eq. (60).

, which is given by Eq. (60).

Since the integral term in (54) depends upon ![]() , an approximation will be needed for

, an approximation will be needed for ![]() . At each time step we have found that a suitable approximation is given by

. At each time step we have found that a suitable approximation is given by ![]() , which is simply the American call price at the previous time step. The price at the

, which is simply the American call price at the previous time step. The price at the ![]() time step is calculated for a suitably large number of evenly spaced

time step is calculated for a suitably large number of evenly spaced ![]() values. Here we use 25 points in the range

values. Here we use 25 points in the range ![]() . All necessary interpolation is conducted using cubic splines fitted locally through seven values of

. All necessary interpolation is conducted using cubic splines fitted locally through seven values of ![]() . We then use Newton’s method to solve for the early exercise boundary, as in Kallast and Kivinukk (2003), with two necessary additions. The first addition addresses the evaluation of the inner integral (54) over the interval

. We then use Newton’s method to solve for the early exercise boundary, as in Kallast and Kivinukk (2003), with two necessary additions. The first addition addresses the evaluation of the inner integral (54) over the interval ![]() . This is computed using Gaussian integration of moments, with parameter

. This is computed using Gaussian integration of moments, with parameter ![]() . Full details of this Gauss quadrature scheme can be found in Abramowitz and Stegun (1970) (Chapter 25, p. 921). The second addition relates to finding the derivative of (56) with respect to

. Full details of this Gauss quadrature scheme can be found in Abramowitz and Stegun (1970) (Chapter 25, p. 921). The second addition relates to finding the derivative of (56) with respect to ![]() for use in Newton’s method. This is given by (57) for

for use in Newton’s method. This is given by (57) for ![]() , evaluated at

, evaluated at ![]() . Since it is difficult to determine the limit of the integrands in (57) as

. Since it is difficult to determine the limit of the integrands in (57) as ![]() , we resolve this by taking the limits as

, we resolve this by taking the limits as ![]() for the option price integrands in (53) and differentiating these with respect to

for the option price integrands in (53) and differentiating these with respect to ![]() , as is done by Kallast and Kivinukk (2003). These limits are all finite, including the new limit required for the jump-related integral term, and the required derivatives are easily determined. Since we need to evaluate the expression (57) for

, as is done by Kallast and Kivinukk (2003). These limits are all finite, including the new limit required for the jump-related integral term, and the required derivatives are easily determined. Since we need to evaluate the expression (57) for ![]() for use in Newton’s method, there is no significant additional computation time required to evaluate the American call delta once the free boundary has been estimated.

for use in Newton’s method, there is no significant additional computation time required to evaluate the American call delta once the free boundary has been estimated.

Having determined the discretized forms for the price and delta of ![]() , we then use Newton’s method to solve for

, we then use Newton’s method to solve for ![]() . Before proceeding to the next time step, we use

. Before proceeding to the next time step, we use ![]() to calculate a new approximation for

to calculate a new approximation for ![]() , which is required when evaluating the double integral term at all subsequent time steps. This update for

, which is required when evaluating the double integral term at all subsequent time steps. This update for ![]() is essential to ensure that the estimated free boundary remains monotonic. Note that as the value of

is essential to ensure that the estimated free boundary remains monotonic. Note that as the value of ![]() increases, the computational burden will also increase at a “faster than linear” rate (the reason being that the integration at step

increases, the computational burden will also increase at a “faster than linear” rate (the reason being that the integration at step ![]() depends on all values of

depends on all values of ![]() and

and ![]() for

for ![]() ).

).

It should be noted that the proposed numerical scheme does not involve any iterations with respect to the approximation of the integral term. It is possible to improve the accuracy of the algorithm by updating the approximation for the integral term at the ![]() th time step using the most recently computed estimates for

th time step using the most recently computed estimates for ![]() and

and ![]() . In practice we have found that such an iteration does not add significantly to the accuracy of the results (up to the order of accuracy considered in Section 3.8), and that computation time is at least doubled by the introduction of the iteration process. Thus we have chosen not to iterate with respect to the integral term approximation.

. In practice we have found that such an iteration does not add significantly to the accuracy of the results (up to the order of accuracy considered in Section 3.8), and that computation time is at least doubled by the introduction of the iteration process. Thus we have chosen not to iterate with respect to the integral term approximation.

To explore the efficiency of the proposed numerical integration method, we compare it with two alternative numerical methods. The first method involves a finite difference solution for the PIDE (17). We apply the Crank-Nicolson scheme to all terms except for the integral. We initially estimate the integral term by approximating ![]() with the explicit approximation

with the explicit approximation ![]() , as in Carr and Hirsa (2003). We then evaluate the integral using the Hermite-Gauss quadrature scheme (see Abramowitz and Stegun, 1970). The resulting tridiagonal matrix is inverted using LU-decomposition, and the early exercise condition is then applied to the solution at each time step. An evenly spaced grid is used, and the free boundary is estimated at each time step using cubic spline interpolation of the price profile, combined with the bisection method.

, as in Carr and Hirsa (2003). We then evaluate the integral using the Hermite-Gauss quadrature scheme (see Abramowitz and Stegun, 1970). The resulting tridiagonal matrix is inverted using LU-decomposition, and the early exercise condition is then applied to the solution at each time step. An evenly spaced grid is used, and the free boundary is estimated at each time step using cubic spline interpolation of the price profile, combined with the bisection method.

To improve the accuracy of the Crank-Nicolson solution, we use a two-step procedure at each time step, details of which are given by Chiarella and Ziogas (2009).

The second method we consider is the method of lines approach as presented by Meyer (1998). Meyer only considers discrete jump-size distributions. Here we extend this method to allow for a continuous jump-size density, ![]() , again evaluating the integral term using a Hermite-Gauss quadrature scheme, combined with local cubic spline interpolation of the price profile at each iteration. The method of lines readily provides estimates for both the price and delta for the American call option, without the need for additional computation. Unlike the Crank-Nicolson scheme, the method of lines solution is allowed to iterate until the largest observed change in the option price profile is less than

, again evaluating the integral term using a Hermite-Gauss quadrature scheme, combined with local cubic spline interpolation of the price profile at each iteration. The method of lines readily provides estimates for both the price and delta for the American call option, without the need for additional computation. Unlike the Crank-Nicolson scheme, the method of lines solution is allowed to iterate until the largest observed change in the option price profile is less than ![]() . The scheme we use is second-order accurate in time, and a first-order scheme is applied for the first three time steps.

. The scheme we use is second-order accurate in time, and a first-order scheme is applied for the first three time steps.

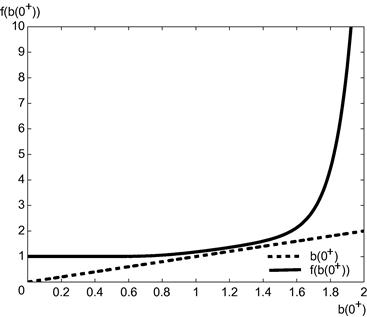

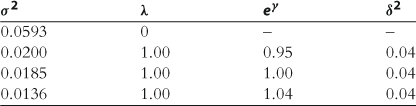

3.8 Numerical Results

To analyze the efficiency of the numerical integration method, we compute the price and delta of an American call option with 6 months to maturity, and a strike price of ![]() . The global variance11 of returns,

. The global variance11 of returns, ![]() , is set equal to

, is set equal to ![]() . The jump intensity is set to

. The jump intensity is set to ![]() , and the jump variance is

, and the jump variance is ![]() . We then consider six different parameter sets, specifically

. We then consider six different parameter sets, specifically ![]() taking values of 0.95, 1.00, and 1.04, along with the combinations

taking values of 0.95, 1.00, and 1.04, along with the combinations ![]() ,

, ![]() and

and ![]() ,

, ![]() . Note that

. Note that ![]() implies upward jumps on average, and

implies upward jumps on average, and ![]() implies downward jumps on average. When

implies downward jumps on average. When ![]() , the expected price change from a jump is zero. The diffusion coefficient,

, the expected price change from a jump is zero. The diffusion coefficient, ![]() , is chosen such that the global variance was preserved for varying values of

, is chosen such that the global variance was preserved for varying values of ![]() . Table 1 summarizes the values of

. Table 1 summarizes the values of ![]() used to ensure that the global variance was the same for each combination of

used to ensure that the global variance was the same for each combination of ![]() and

and ![]() .

.

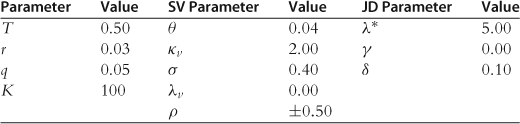

Table 1

Parameter values used for the diffusion variance and jump component. The global variance is fixed at ![]() , determined by

, determined by ![]() .

.

We compute the root mean-square error (RMSE) using option prices and deltas with ![]() , and

, and ![]() . This is repeated for each of the six parameter sets, from which the average runtime and RMSE are then calculated. Note that in all cases the runtimes include the time required to compute the free boundary, price, and delta for the American call. For the integration method we use 20 integration points for the Gauss quadrature scheme, and consider a sequence of 10 different time step values, with

. This is repeated for each of the six parameter sets, from which the average runtime and RMSE are then calculated. Note that in all cases the runtimes include the time required to compute the free boundary, price, and delta for the American call. For the integration method we use 20 integration points for the Gauss quadrature scheme, and consider a sequence of 10 different time step values, with ![]() .

.

For the Crank-Nicolson method the integral term is approximated using 50 integration points, and we again use 10 time step values, with ![]() . We set the number of space steps equal to double the number of time steps. Similarly, we use 50 integration points to estimate the integral term in the method of lines. We also use 10 time step values, with

. We set the number of space steps equal to double the number of time steps. Similarly, we use 50 integration points to estimate the integral term in the method of lines. We also use 10 time step values, with ![]() , and the number of space steps is set to five times the number of time steps. The code for all methods has been implemented using LAHEYTMFORTRAN 95 running on a PC with a Pentium 4 2.40 GHz processer, 512 MB of RAM, and running the Windows XP Professional operating system.

, and the number of space steps is set to five times the number of time steps. The code for all methods has been implemented using LAHEYTMFORTRAN 95 running on a PC with a Pentium 4 2.40 GHz processer, 512 MB of RAM, and running the Windows XP Professional operating system.

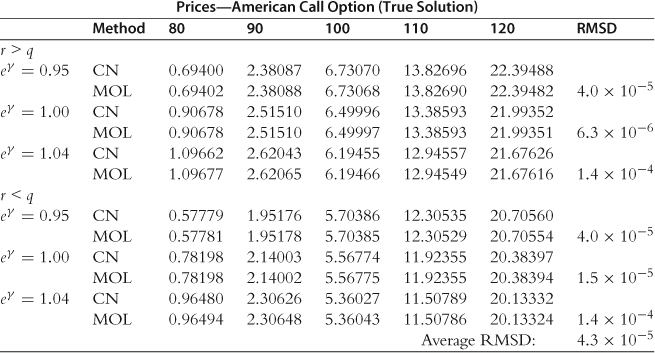

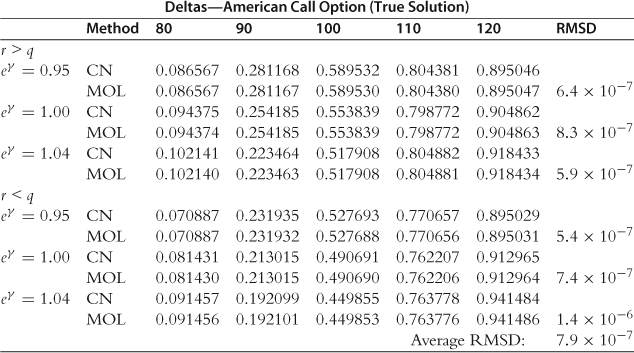

In assessing the efficiency of the numerical integration method, we use a Crank-Nicolson solution with 10,000 time steps and 5000 space steps for the true solution. Since the numerical integration scheme requires evaluation of the option delta as part of the solution, it is also worthwhile to consider the efficiency with which delta is calculated. The true delta is estimated from the Crank-Nicolson solution using the central difference approximation for ![]() . To demonstrate that this is a valid choice for the true solution, we also compute the prices and deltas using the method of lines approach with 1000 time steps and 5000 space steps. As mentioned previously, the method of lines computes the price, delta, and early exercise boundary simultaneously. The prices are provided in Table 2, with the deltas given in Table 3. We also provide the root mean-square differences (RMSD) between the two methods for each set of parameters, along with an average RMSD value. In both cases we find that for the values of

. To demonstrate that this is a valid choice for the true solution, we also compute the prices and deltas using the method of lines approach with 1000 time steps and 5000 space steps. As mentioned previously, the method of lines computes the price, delta, and early exercise boundary simultaneously. The prices are provided in Table 2, with the deltas given in Table 3. We also provide the root mean-square differences (RMSD) between the two methods for each set of parameters, along with an average RMSD value. In both cases we find that for the values of ![]() under consideration these methods are consistent to at least four decimal places, and thus we conclude that the Crank-Nicolson method using 10,000 time steps and 5000 steps in the space variable provides a satisfactory estimate for the true price and delta.

under consideration these methods are consistent to at least four decimal places, and thus we conclude that the Crank-Nicolson method using 10,000 time steps and 5000 steps in the space variable provides a satisfactory estimate for the true price and delta.

Table 2

Demonstrating the accuracy of the true American call prices using the Crank-Nicolson method with 10,000 time steps and 5000 space steps. The method of lines solution uses 1000 time steps and 5000 space steps. The values used for ![]() and

and ![]() were

were ![]() and

and ![]() , with

, with ![]() and

and ![]() . Other parameter values used are given in Table 1.

. Other parameter values used are given in Table 1.

Table 3

Demonstrating the accuracy of the true American call deltas found by applying a central difference approximation to the price estimates given by the Crank-Nicolson method with 10,000 time steps and 5000 space steps. The method of lines solution uses 1000 time steps and 5000 space steps. The values used for ![]() and

and ![]() were

were ![]() and

and ![]() , with

, with ![]() and

and ![]() . Other parameter values used are given in Table 1.

. Other parameter values used are given in Table 1.

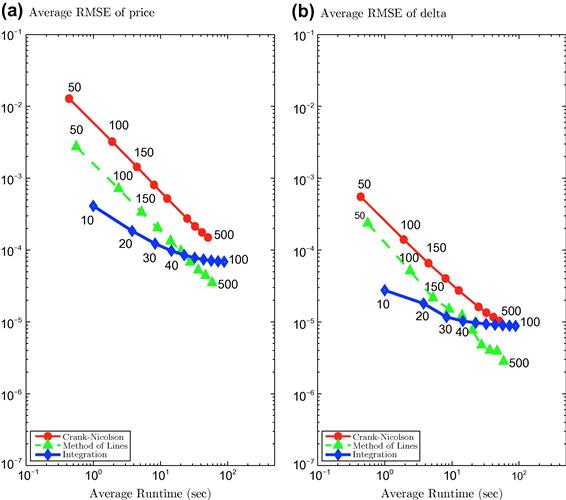

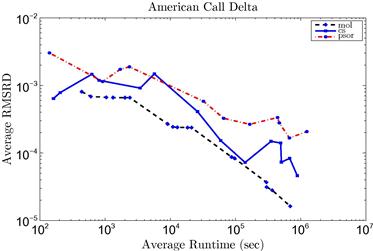

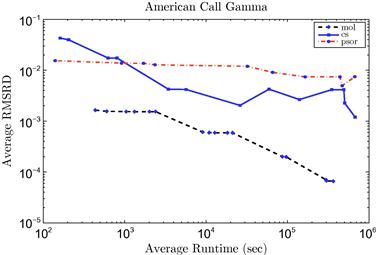

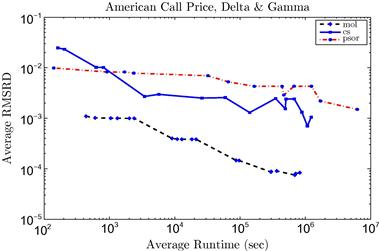

The relative efficiency of each method is shown in Figure 5 by comparing the RMSE as a function of runtime. Figure 5a shows the average RMSE error for the American call price, and Figure 5b displays the same information for the delta. Note that the average runtimes for each discretization level are the same in Figure 5a and b since the price and delta were found using a single algorithm. Firstly, we find that for the parameters and discretizations considered, the numerical integration method consistently displays greater efficiency than the Crank-Nicolson scheme for the American call price, and furthermore, numerical integration is more efficient than Crank-Nicolson when computing delta for computation times of up to 50 s.

Figure 5 Comparing the efficiency of numerical integration, Crank-Nicolson and the method of lines for the price and delta of American call options with log-normal jump sizes. We set ![]() , and

, and ![]() . The RMSE is found using

. The RMSE is found using ![]() , and

, and ![]() . The average RMSE and runtimes have been determined using six parameter sets, with

. The average RMSE and runtimes have been determined using six parameter sets, with ![]() ,

, ![]() , and

, and ![]() ,

, ![]() , along with

, along with ![]() , and

, and ![]() . (a) displays the price efficiency, while (b) shows the delta efficiency. Numbers on the plot indicate the time steps associated with a given point.

. (a) displays the price efficiency, while (b) shows the delta efficiency. Numbers on the plot indicate the time steps associated with a given point.

We find that the method of lines consistently outperforms the Crank-Nicolson scheme, and in the majority of cases, the delta values computed by the method of lines are more accurate than those obtained using numerical integration. When computing prices for runtimes of between 1 and 20 s, however, numerical integration is able to outperform the method of lines. We also note that the numerical integration algorithm has a slower rate of convergence for the delta relative to the other two methods. This could be attributed to cumulative numerical integration error as the number of time steps, and hence integration points, is increased. The rate of convergence for the numerical integration method is clearly better when computing the option price.

Thus from Figure 512 we conclude that of the three methods under consideration, the method of lines is consistently more accurate for runtimes beyond 20 s. We also find that the numerical integration method consistently outperforms the Crank-Nicolson scheme when computing the option price, and is competitive with Crank-Nicolson when computing the delta for runtimes of less than 50 s. Thus we can see that a simple extension of the numerical integration scheme presented by Kallast and Kivinukk (2003) to include log-normal jumps produces a numerical method that is comparable with both the method of lines and the Crank-Nicolson scheme; however, there is room for improvement in the computation of delta, in particular when the number of time steps is increased beyond 40. We also note that since the magnitude of the RMSE is much larger for the option price, the best way to select the optimal numerical method is to maximize the pricing efficiency while being aware of the RMSE for the deltas. For example, for a runtime of 20 s the method of lines is more efficient than numerical integration, since both methods have similar pricing accuracy, but the method of lines offers a better delta estimate in this case. Alternatively, for a runtime of 5 s, numerical integration is the most efficient, since it provides better price estimates than the method of lines for the same accuracy in delta.

Chiarella and Ziogas (2009) give a lengthy discussion of the impact of jumps on the free boundary and option prices. However, lack of space prevents us from summarizing that discussion here so we refer the interested reader to the paper.

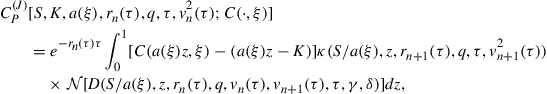

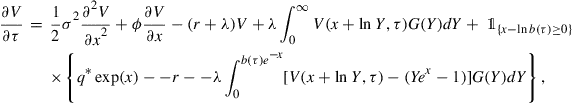

4 American Call Options under Jump-Diffusion and Stochastic Volatility Processes

In the previous section, we considered the simpler case of geometric Brownian motion plus jump-diffusion dynamics. In this section, we consider the case which combines stochastic volatility and jump-diffusion as was postulated in Section 2. In Section 4.1 we apply the method of lines which turns out to work quite well in the present context as the numerical results in Section 4.4 indicate. We refer the reader to Cheang et al. (2012) for the solution of this problem using integral transform methods. Of course this method can only work in a particular case whereas the method of lines can handle quite general situations.

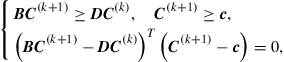

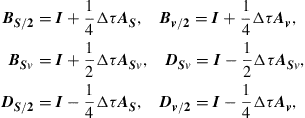

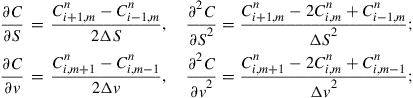

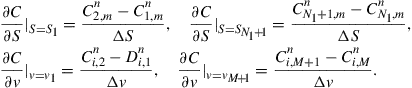

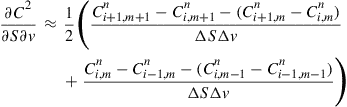

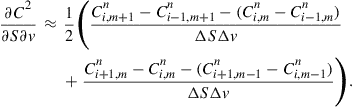

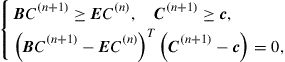

4.1 Numerical Solution Using the Method of Lines