5 A behavioral model of path dependency

Introduction

The conventional wisdom’s understanding of long- run equilibrium paths of growth and development as well as of equilibrium product market development has been challenged by the pioneering theoretical research of Paul David (1985) and Brian Arthur (1989, 1990) on path dependency.1 They argue that in a world of increasing returns to scale, there may be a multiplicity of possible equilibrium solutions to identical economic problems and for the dominant solution to be suboptimal. The prevalent economic outcome in terms of product type, industry, or labor market institutions, for example, can itself be a product of some seemingly inconsequential and random event that, through the process of increasing returns, ultimately gives this outcome a first mover advantage over other possible outcomes even if the latter happen to be more economically efficient.

Path dependency theory has been critiqued on various levels. In particular, the view that it is possible for an inefficient outcome to persist has been challenged as being implausible, if it is at all reasonable to assume that economic agents eventually respond to economic opportunities afforded to them by suboptimal economic outcomes by adopting the relatively more efficient available and known solutions to particular economic problems.

In this chapter, a model of path dependency is developed that is grounded in behavioral economics. The argument presented is that it is possible and reasonable to expect there to be a multiplicity of equilibrium solutions to identical economic problems and for the dominant solution to be suboptimal, even under the assumption of diminishing or constant returns to scale. In a world where x-inefficiency is both possible and probable, and where productivity and working conditions/labor relations as well as institutional and cultural parameters are intimately related, inefficient or suboptimal economic outcomes might be the dominant long- run equilibrium outcome to particular economic problems.

In contrast to the David’s and Arthur’s modeling of path dependency, in the behavioral model presented below, suboptimal outcomes need not provide economic opportunities for economic agents to exploit in the context of their particular objective functions. It is the existence of such opportunities that go unexploited in equilibrium that constitute the Achilles heel of path dependency theory from the perspective of the conventional wisdom. The behavioral approach to path dependency is, therefore, able to help address many of the important questions tackled by David and Arthur, such as the macro question of the persistence of relative underdevelopment and the micro question of the survival on the market of inefficiently produced products, while not being subject to the substantive critiques levied at path dependency theory by the conventional wisdom.2

Path dependency theory: standard approaches and criticisms

The fundamental argument in the traditional path dependency literature is that the free market typically generates suboptimal long- run equilibrium solutions to a variety of economic problems and the probability of suboptimal equilibrium outcomes increases where increasing returns (positive feedbacks) prevail. Increasing returns need not be firm specific (local). They might very well be industry or even economy wide (global)—of the variety discussed in some detail by Allyn Young (1928)—thereby bringing into play the role of positive externalities. The economic problem might be which product type or standard should be adopted in an economy or which path of development should an economy follow. This argument is couched in a discussion of there being possible multiple equilibrium solutions to identical economic problems with suboptimal solutions being among a larger set of solutions. A random shock to an economic system, be it large or small, will have a determining impact on which equilibrium solution becomes the dominant one, where the dominant solution can be the suboptimal one. Whichever solution is, in effect, chosen by the random event, this solution might be locked in or become a permanent or a stable equilibrium. It is even possible for efficient and inefficient (suboptimal) solutions to prevail simultaneously in the world of path dependency delineated by David and Arthur. For this reason, one cannot expect the free market to force the economy to converge to unique equilibrium solutions to economic problems. And, it follows, that in this case it becomes impossible to predict which solution to a particular problem will be adopted, for the chosen solution ultimately depends on random indeterminate events taken at some critical juncture in the past. More specifically, one cannot predict that the eventual stable equilibrium solution will be the optimal one, even under conditions of competitive markets.

That there might be a multiplicity of equilibrium solutions to a variety of economic problems would not necessarily be a controversial one from the perspective of the conventional economic wisdom. Neoclassical economic theory clearly predicts that a variety of products can exist to meet the needs of utility maximizing consumers characterized by different preferences and incomes. It is even possible for chance events to result in the dominance of particular products or systems as long as these are consistent with consumer preferences. But in this world characterized by much variety, in equilibrium no product or system would be suboptimal or inefficient.

In the David—Arthur world of path dependency, however, in equilibrium prevailing products and economic systems might very well be suboptimal or inefficient. They argue that increasing returns produce a first mover advantage to products or economic systems that are chosen first, an advantage that increases over time. It is assumed that productivity and related costs are time dependent so that newcomers to a product market or to the development process would face a competitive disadvantage compared to the first movers and this would preclude them from beginning the process of catch-up. This would hold true even if the newcomers’ productivity would eventually, over time, rise above or, at least equal, that of the first mover and this fact were known to the newcomers.3

In the conventional path dependency story, the first mover advantage, reinforced by increasing returns and externalities, becomes a permanent roadblock to newcomers. The obvious economic superiority of alternative equilibrium solutions that are known to economic agents do not generate the economic forces expected by the conventional wisdom to challenge, and eventually, displace the inefficient economic regimes—it becomes too costly for private economic agents to adopt the superior economic regimes.

This argument is illustrated in Figure 5.1 where, ceteris paribus, average cost is assumed to be negative function of historical time. Curves 1 and 2 illustrate a

Figure 5.1 Path dependency.

scenario where increasing returns to time eventually level off. Curve 1 represents the initial and suboptimal economic regime. Curve 2 represents the optimal, least cost, economic regime. At time t1 the average cost of economic regime 1 is 0C. If the economic regime represented by curve 2 were in place for the same period of time (t0t1), its costs would be even lower, at 0D. However, if economic regime 2 comes on line at t0, only after economic regime 1 has been in place for t0t1, regime 2 would face an initial competitive disadvantage of BC. This disadvantage would be eliminated at time t* if the suboptimal regime is given by curve 1.

The persistence of inefficiency is given by the dominance of the economic regime given by curve 1 over time. This would represent a market failure. And, what is clearly suggested by the David–Arthur paradigm is the likelihood of a free market dominated by such market failures in spite of the clear and manifest superiority of existing and known alternatives to private economic agents, such as represented by curve 2 as compared to curve 1. Once locked in, the inefficient solutions to economic problems cannot be displaced by market forces alone. Society becomes a prisoner to the inefficiencies established through increasing returns, while externalities and the absence of perfect future markets play a crucial role in locking in the suboptimal equilibria in a world of increasing returns. Presumably, in a world of no externalities and perfect futures markets economic agents would be able to take advantage of the economic opportunities afforded by alternative and more efficient products or systems.

That the market cannot eventually displace the type of inefficiencies elaborated upon in the conventional path dependency story, given the incentives to economic agents to do so in terms of the unexhausted gains from trade has been subject to severe criticism. The most poignant of these critiques have been enunciated by Liebowitz and Margolis (1990, 1994). They have systematically challenged the empirics underlying David’s and Arthur’s theoretical cases supporting inefficient equilibria. Moreover, they have raised questions with regards to the theory of path dependency. Most generally, they argue that differences in efficiency between standards or products should generate economic opportunities that would be typically taken advantage of, ultimately causing the elimination of inefficient standards even in a world of imperfect futures markets. One should not simply assume that economic agents will not exploit known potential gains from trade or that the marginal benefits from shifting to a superior standard rarely, if ever, outweigh the marginal costs.

Liebowitz and Margolis argue that the David–Arthur modeling of the world ignores the role of entrepreneurship that involves risk- taking in the expectation of profits in an uncertain future. They maintain that it is the expectation of future, albeit uncertain, profits by risk-taking entrepreneurs that has driven the adoption and development of superior products and systems, which has occurred over historical time. In Figure 5.1, the profit opportunities are given by the difference in cost between regime 1 and 2 after regime 1 has been in place for more than t0t*of time. After this point, regime 2 captures the economic rents determined by this difference so long as price is determined by the marginal suboptimal economic regime. After an uncertain and unpredictable period of time a new equilibrium price is established consistent with the costs of the optimal economic regime—this is the classic Schumpeterian process of technical change (Schumpeter 1974, Ch. 4). For the optimal economic regime to be chosen the anticipated losses, given by B*FH, must be exceeded by the anticipated but uncertain rents. Liebowitz and Margolis (1994) conclude that:

A transition to a standard or technology that offers benefits greater than costs will constitute a profit opportunity for entrepreneurial activities that can arrange the transition and appropriate some of the benefits. . . . Economies do, in fact, move from one state to another. This is not to say that mistakes are never made, in markets or elsewhere. But we do have overwhelming evidence that markets do make transitions to superior products and standards—from horses and buggies to automobiles, from typewriters to computers, from mail to fax.

(pp. 133–150)

Central to the Liebowitz and Margolis critique is that the assumptions underlying the predictions of the conventional path dependency theory are faulty largely because David and Arthur presume that economic agents typically will not or cannot take advantage of known economic opportunities and that this results in the prevalence of market failure in any given point in time.4 It is assumed that known gains from trade exist in the form of superior products and standards that economic agents fail to take advantage of, even over the long term. But is this particular assumption critical to the hypothesis embedded in path dependency theory, that suboptimal economic systems and products can persist over time after being adopted for whatever reason? Is it possible for superior standards or products to exist without there being the erstwhile gains from trade to attract economic agents to move toward optimal equilibrium solutions?

5 A behavioral approach to path dependency

The David–Arthur configuration of path dependency theory assumes, along with conventional economic wisdom, that effort is not a discretionary variable and that the quantity and quality of effort per unit of labor input is maximized at any given point in time. Since effort inputs into the production process are assumed to be, in this sense, maximized, variations in productivity are independent of variations of effort inputs and differentials in labor productivity are, in turn, independent of differentials in effort input. If effort discretion exists, labor productivity is affected by the quantity and quality of effort inputted into the process of production per unit of time. In this case, the traditional production function, where output is a function of labor, capital, and technology is augmented by the quantity and quality of effort inputted into the production process. What would be the implications for path dependency theory if one assumes no externalities and constant returns or constant cost industries while at the same time assuming the existence of effort variability—that effort discretion exists? The latter can be a product of, for example, both informal and formal contracts being incomplete as a consequence of the transaction costs involved in drawing up, monitoring, and enforcing contracts (Akerlof and Yellen 1990; Altman 1996, 1998; Miller 1992; Stiglitz 1987; Chapters 2 and 3).

The introduction of effort discretion into the modeling of the economic agent and path dependency theory allows for the existence and persistence of multiple suboptimal equilibria. It also allows for the possibility and helps to explain the existence and development of inefficient economic regimes even under severe competitive pressures. In a nutshell, in a world of effort discretion there need not exist the private economic incentives for economic agents to adopt superior economic regimes and for the inferior, suboptimal regimes to be displaced. Under these circumstances, market failures can result that are consistent with the constrained utility maximization of rational optimizing economic agents, thereby reducing a society’s level of material welfare from what it might otherwise be. Assuming no externalities, constant returns and optimizing economic agents bias my results in favor of the conventional wisdom and allow for the isolation of effort discretion as a causal variable in the modeling of path dependency. Introducing externalities, increasing returns, and nonoptimizing economic agents, which characterize the David–Arthur world, would only strengthen the case in favor of path dependency since, as discussed above, these characteristics provide some protection to the suboptimal economic regimes. In other words, the case is made that even in a theoretical world favored by the conventional economic wisdom, persistent inefficiencies that are path dependent are possible and might even be pervasive.

Given effort discretion, the quantity and quality of effort supplied on the job can be affected by important variables such as the organization of the firm, inclusive of the structure and level of wage rates; working conditions; the state of competitive pressures; and an individual’s, community’s, or society’s work culture. Under these conditions, workers would not automatically or mechanically maximize their effort inputs into the production process nor could members of the firm hierarchy easily or mechanically induce workers into maximizing effort per unit of time and, thereby, output per unit of labor. Indeed, they themselves do not necessarily maximize the quantity and quality of effort that they supply to the firm. Their behavior would be more in line with utility maximization as opposed to profit maximization, where their objective function includes arguments other than profit. Furthermore, in a realistically modeled world of effort variability, there is no rational reason to expect utility maximizing workers to choose to work as hard and as well as they can in an economy characterized by noncooperative, if not outright antagonistic, industrial relations where they are treated poorly and unfairly. In addition, utility maximizing members of the firm hierarchy may prefer to live with or even develop more antagonistic industrial relations if such an environment is consistent with their objective functions. This holds true even if it means that labor productivity and even total factor productivity is lower than it would otherwise be.5

Why would “rational” members of the firm hierarchy not pursue policies designed to maximize productivity? Higher productivity that is a product of more and higher quality of effort inputs requires a more highly paid labor force and often the investment by members of the firm hierarchy of more time, effort, and money to reorganize the effort inputs to facilitate higher levels of productivity. These represent investments in organizational capital (Tomer 1987), which are largely the start-up costs of establishing a different organizational environment. Moreover, it is also possible that members of the firm hierarchy would suffer a lower income if a more cooperative industrial relations regime is part of the package which ultimately generates increased productivity. In addition, when all is said and done, in a high productivity regime unit costs need not be lower and profits need not be higher than in a low productivity regime since the higher labor productivity is generated by increased expenditures by the firm. Under these conditions, there are no definitive incentives for members of the firm hierarchy to develop a higher productivity work environment. Unless their utility function contains arguments related to improving the material and psychological well- being of workers, it would be quite rational for members of the firm hierarchy to maximize their utility in a low wage environment, increasing their earnings by redistributing income away from labor into their own hands. In this case, the firm would be producing less. It would realize a lower level of labor productivity than it would under a more conducive system of industrial relations (Altman 1996). In effect, they would be producing below their potential, that is producing x-inefficiently.6

In the long run, under competitive product market conditions, firms can produce x-inefficiently if doing so does not threaten the survival of the firm by raising unit costs above or reducing profits below competitive levels (Altman 1996). For this reason, the x-inefficient firm must keep input costs relatively low in order to compensate for its relatively low level of productivity. Keep in mind that average costs (AC) are a product of the weighted input costs deflated by the weighted average productivity of factor inputs. In a simple world with labor (L) as the only factor input and the wage rate (w) as the only factor price, this translates into:

where Q is real output. In this model, the wage rate also serves as a proxy for a particular system of industrial relations, where a low wage is a proxy for a work environment that is antagonistic and non-participatory with little investment in organizational capital, and a high wage is a proxy for the opposite. One significant way of maintaining low unit costs is to keep the rates of labor compensation relatively low, while low rates of labor compensation serve to keep productivity at a relatively low level. For this reason, low rates of labor compensation protect the x-inefficient firm from the relatively more productive firms, just as imperfect product markets, tariffs, or subsidies would. So long as the x-inefficient firm can be afforded such protection, it can be viable over the long haul even in the face of severe competitive pressures. And, x-inefficient levels of levels of production would constitute one option available to utility maximizing members of the firm hierarchy. On the other hand, relatively high wage firms could not survive on a competitive market unless these relatively high input costs are compensated for by higher levels of labor productivity. The higher productivity allows the higher wage firm to remain competitive even in the face of severe competitive pressures. In fact, higher wages and a higher wage environment serve to induce higher levels of labor productivity as a means of keeping the firm competitive.7 In this case, members of the firm hierarchy would be facing the constraint of relatively high wages when maximizing their utility.

As long as productivity rises and falls sufficiently with movements in the level labor compensation, there is no reason for increasing labor benefits to generate higher production costs or for lower benefits to yield lower costs. It is, in fact, possible for there to be a range of labor benefits associated with a unique unit cost of production—changes in productivity would just compensate for changes in labor benefits. This assumes, that there no unique wage rate or labor compensation package that will minimize unit production costs, at least over a significant range of wage rates (Akerlof and Yellen 1990; Altman 1996; Chapter 2).8 In other words, two identical plants producing the same output can produce at the same unit costs, even when rates of labor compensation are relatively higher in one plant, if labor productivity is sufficiently higher in the high wage plant. However, it also possible for low wage plants to produce at a lower unit cost than high wage plants if labor productivity differential between the two does not quite compensate for the wage differential. In this case, it pays the utility maximizing members of the firm hierarchy to produce in the low wage plants and low wage plants would dominate the market in long- run equilibrium in spite of being x-inefficient.

In a simple model of the firm, one assumes that labor and capital inputs as well as technical change are constant and that wages and effort per unit of labor input varies. Effort per unit of labor input is assumed to be positively related to the wage rate:

where e is effort and t is time. This, in turn, causes variation in labor productivity:

From equation (5.1) since average cost is given by

variations in labor productivity can affect average cost. The average cost equation can be denoted by

where

is given by q. The inverse of

yields the elasticity of labor productivity relative to changes in the rate of labor compensation where this elasticity (η) is given by:

Only when η is greater than 1 does an increase in wages, that is an improvement in the system of industrial relations, yield a decrease in average cost through its impact on effort and, hence, upon labor productivity. When η is less than 1, average costs rise with increasing wages. Finally, an η of 1 yields no change in average cost as wages rise and at this point average cost is at a minimum.

Conventional neoclassical theory assumes an η of 0 since changing the wage rate and the work environment is assumed to have no effect on effort inputs and, therefore, upon labor productivity.

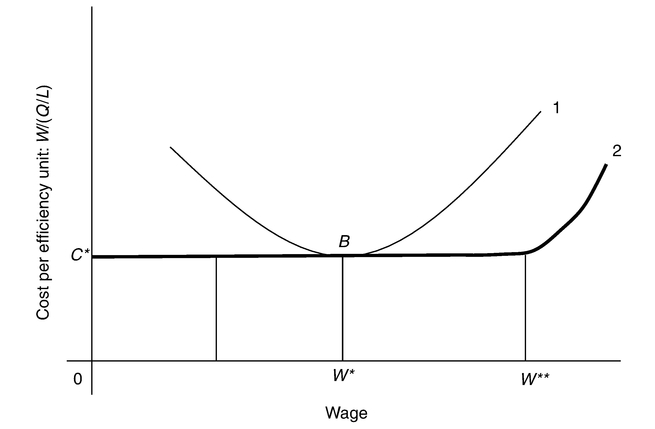

On the other hand, the well-known result from efficiency wage literature is that there is a unique wage rate, referred to as the efficiency wage, which minimizes unit costs by rather mechanically maximizing effort in a world in which effort is variable. In this case, it is assumed that η is 1 for a unique value of w. In effect, the wage rate becomes inflexible given the assumption that the logistic production function best reflects the reality of the firm. In contrast, in the behavioral model of the firm discussed in this chapter, there is no unique wage, at least over a range of wage rates, which will yield a unique cost minimizing level of effort. Therefore, in the behavioral model η is one for a range of wage rates and there is no unique point of cost minimization over this range.

This argument is easily illustrated, borrowing from Stiglitz’s (1987) treatment of efficiency wages. In Figure 5.2, this unique wage or efficiency wage is given uniquely by W* assuming a U- shaped average cost curve, relating changes in average costs as the wage rate varies. The U-shaped average cost curve is, in turn, derived from a labor productivity wage curve, which takes the form of a logistic function (Figure 5.3). In this case, average productivity is maximized (average cost is minimized) at e where the wage is W*. At this point, η is 1. To the left of e, η exceeds 1 and, to its right, η is less than 1. The logistic productivity function yields a unique wage- productivity-average cost- effort set that is

Figure 5.2 Wage and cost.

invariably and ultimately chosen by the firm. But the functional form of the productivity curve underlying such a unique set is not the only possible functional form; the functional form of the productivity curve is embedded in the assumptions one makes about the relationship between changes in effort relative to changes in wages. In the behavioral model, discussed above (see also Chapter 2), one assumes that some linearity characterizes the production function, from 0 to e, for example in Figure 5.3. Along 0e the elasticity of changes in productivity to changes in wages is unity. This, in turn, generates an L-shaped average curve in Figure 5.2, with C*B becoming a component of curve 1. In this case, over a certain range of wage rates, there is no unique wage rate. A range of wage rates or systems of industrial relations is consistent with a unique level of average cost such as 0C* in Figure 5.2. There is no efficiency wage per se. Over this range, changes in wages are just compensated for by changes in labor productivity. Moreover, over this space there is an array of firms, spanning from the most x-inefficient (low wage) to the most x-efficient (high wage), all of which are cost competitive and, therefore, economically viable.

How would the explicit introduction of technological change affect the arguments presented above? At the most basic analytical level, according to the conventional neoclassical wisdom, a new technology to produce a particular product should dominate the old technology if it can produce that product at a lower cost, holding the quality of the product constant. This argument should hold where factor prices are identical across all firms and where x-inefficiency does not exist or where the level of x-inefficiency is the same for all firms. In Figure 5.1, if curve 2 represents the new technology, this technology should eventually

Figure 5.3 Wages and productivity.

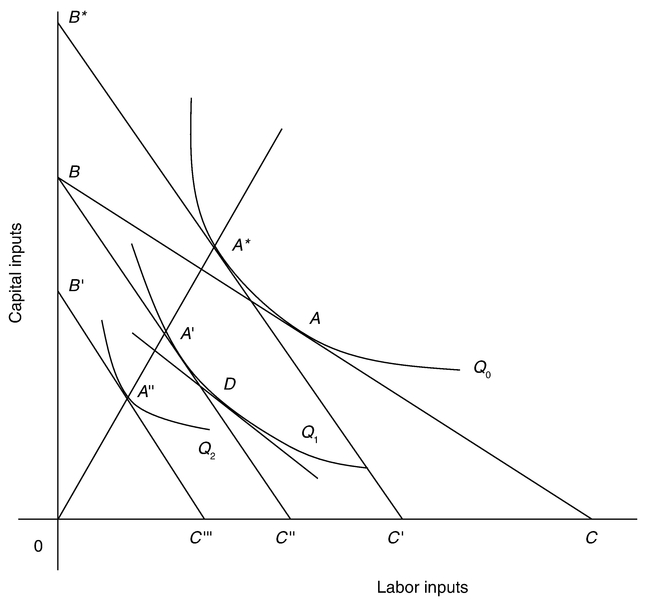

dominate the old technology represented by curve 1 for reasons of lower costs. In Figure 5.4, where capital and labor inputs are mapped out along the vertical and horizontal axes respectively, technological change can be illustrated by a shift inward of the production isoquant from Q0 to Q1, where the level of output produced by both isoquants is identical.

If the initial equilibrium is given by point A along Q0 and the new equilibrium is given by point A′ along Q1—relative factor prices have not changed—the new technology should dominate the old in terms of unit production costs as the isocost curve shifts inward from B*C′ to BC′′. However, this type of scenario need not be the only reasonable representation of economic reality (see Chapter 3, for more details).

In the tradition of Leibenstein (1973), one can assume that the pace of technological change is affected by the extent to which x-inefficiency and, therefore, effort discretion exists and can be expected to persist in the firm. If one begins with a scenario wherein the new technology is exogenously introduced into an environment where x-inefficiency characterizes all firms in the economy, the new technology might not be viable if the level of x-inefficiency prevents the new technology from realizing its potential. In other words, if the new technology corresponds with a relatively high level of x-inefficiency such that the production isoquant remains at Q0 unit production costs associated with the new technology would not be less than those associated with the old technology and the new technology would not dominate the old even though it is potentially a

Figure 5.4 Technological change and path dependency.

superior one in terms of unit costs. With no x-inefficiency, technological change would have shifted the production isoquant to Q1 and the new technology would be expected to dominate the old.

If reducing the level of x-inefficiency requires changing and investing in the organizational capital of the firm, for example illustrated by a pivot in the isocost curve from BC to BC′′, unit production costs for the old and the new technology would be identical. Producing at point A along Q0 yields the same unit costs as producing at point D along Q1, where Q1 represents the new technology that is now incorporated into a relatively x-efficient firm. The “high tech” firm fails to dominate the “low tech” firm even though the high tech firm serves to increase the economy’s per capita output. Only if the new technology, inclusive of its embodied level of x-inefficiency, serves to reduce unit costs, will the new technology dominate. In this case, the lower costs are illustrated by the shift in the isocost curve from BC′′ to B′C′′′ (Altman 1996, Ch. 4; Altman 1998; see also, Chapter 3).

As opposed to exogenously determined technological change, one might assume that technological change as well as corresponding reductions in the level of x-inefficiency is endogenously determined and one that is a costly process induced by changes in factor prices (Altman 1996, ch. 4; Altman 1988; Habbakkuk 1962; Ruttan 1997; Chapter 3). Assume that the change in factor prices is once again illustrated by a pivot in the isocost curve from BC to BC′′. If the new technology, inclusive of the residual level of embodied x-inefficiency, is given by Q1 and the old by Q0, the new technology will once again fail to dominate the old since unit production costs at point A would be the same as at point D. This is given by isocost curves BC and BC′′. In this case, for technological change along with the necessary reduction in the level of x-inefficiency to transpire, requires investment in the firm. Technological change is here a costly process. Without technological change cost minimizing production would take place at point A* along Q0 generating higher unit production costs. Only if the change in factor prices induced technical change and reductions in the level of x-inefficiency such that the isoquant moves below Q1 to Q2, for example, will the new technology dominate the old. In this sense, the old technology remains competitive if it is path dependent on a low wage system of industrial organization while the new technology is path dependent on a high wage system of industrial organization and, given these constraints, the new technology does not yield lower unit costs than the old technology. Even in a world with no x-inefficiency, a movement from point A to point D will not result in the dominance of the new technology if technological change is a costly process since unit costs at point A would be the same as at point D.

How does the introduction of effort discretion and induced technical change impact upon path dependency theory? Without deviating from the conventional assumptions of (constrained) utility maximizing individuals and long- run competitive product markets, the introduction of effort discretion into the modeling of the economic agent allows for the existence of path dependent high and low productivity firms producing identical products in long-run equilibrium. At a more general level, it also allows for the existence of path dependent high and low productivity economies in long- run equilibrium. This is true even without the assumption of increasing returns and externalities that provide some initial advantage to the suboptimal economic regimes. To generalize further, there can exist in long- run competitive equilibrium an array of firms or economies characterized by an array of productivities, producing at identical unit production costs, with only one component of the array of firms or economies being efficient. This is so for the simple reason that when productivity is positively correlated with labor compensation packages that, in turn, encompass the industrial relations environment in which production takes place, different levels of productivity need not be associated with different levels of unit cost or profit. Under these circumstances, market forces cannot easily eliminate the low productivity economic entities when they are no less competitive than their high productivity counterparts. This is true even if one introduces into the argument technological change since technological change is a costly process.

The crux of the Liebowitz and Margolis (1990) critique of the path dependency theory’s prediction of the persistence of inefficient economic outcomes, is that the existence of known relatively efficient alternatives should be expected to trigger an entrepreneurial response which would take advantage of the lower unit costs and higher profits afforded by more efficient alternatives. Their critique does not hold when the more efficient higher productivity regime does not carry with it lower unit costs and higher profits and when the more efficient regime is inconsistent with the utility function of members of the firm hierarchy. In this case, it would be possible for both efficient and inefficient regimes to exist simultaneously in long-run equilibrium.

The economic opportunities that might trigger the elimination of the inefficient economic systems or products need not exist when economic agents behave in a fashion consistent with effort discretion or when induced technical change is a costly process. In fact, it would be possible for the inefficient (low productivity/ x-inefficient) system to dominate if the relatively low labor costs yield low unit production costs for an identical product. In addition, even if the x-inefficient system yields the same unit costs as the more efficient system, the former might dominate if it is consistent with the preferences of members of the firm hierarchy since they have traditionally determined which path an economic regime should follow. If the efficient system generates relatively higher unit costs, but also produces an output of a higher quality the lower unit cost system need not dominate. In this case, however, one would no longer be modeling identical outputs. The different economic regimes could also be a product of past random events and would then be path dependent. And, one could not easily predict the convergence of the economy toward the efficient equilibrium. The modeling of the economic agent presented in this chapter is, therefore, able to contribute toward addressing the critical question asked by Liebowitz and Margolis of path dependency theory: why should we expect inefficient economic regimes to persist over time? Of course, if productivity differentials between two systems generate lower unit costs and higher profits to the high productivity system the critique of Liebowitz and Margolis kicks in and market forces might very well, as they argue, displace the inefficient with the efficient economic system.9

The persistence of inefficiency: some examples

In this chapter I model the possibility that inefficient economic regimes can dominate or exist simultaneously with the relatively inefficient regimes because the more efficient regimes do not provide the mechanism to displace them—a mechanism which clearly exists in the David and Arthur modeling of path dependency in terms of known and unexploited economic rents. This modeling narrative helps to address a variety of important apparent paradoxes of economic life such as the persistence of inefficient or low productivity economic regimes.10

Douglas North (1990), for example, has made the case that throughout world history inefficient economic regimes have dominated:

I will approximate the conditions in many Third World countries today as well as those that have characterized much of the world’s economic history.

The opportunities for political and economic entrepreneurs are still a mixed bag, but they overwhelmingly favour activities that promote redistributive rather than productive activities, that create monopolies rather than competitive conditions, and that restrict opportunities rather than expand them. The organizations that develop in this institutional framework will become more efficient—but more efficient at making the society even more unproductive and the basic institutional structure even less conducive to productive activity. Such a path can persist because the transaction costs of the political and economic markets of those economies together with the subjective models of the actors do not lead them to move incrementally toward more efficient outcomes.11

(p. 9)

But can low productivity regimes survive in the face of competitive pressures? They can, but only under particular circumstances. Certainly, unproductive economic regimes can survive if well protected from competitive pressures. Such protection was more easily afforded in the past than in the present. However, in face of competitive pressures, unproductive economic regimes will have a difficult time of it, if relatively low productivity translates into relatively high production costs. This need not be the case when low productivity is balanced by low rates of labor compensation or low rates of investment in organizational capital. And, as outlined above, the low rates of labor compensation and low wage environment bundle, in itself, can be a key cause of low productivity. Members of firm hierarchy or, more generally, of the economic hierarchy, can fare quite well under these low productivity conditions since their own incomes can remain high through redistributive as opposed to productive activities. The existence of low and high productivity regimes might be a product of history, of random or deliberate actions taken sometime in the past. Once a particular path to development is taken an economy might even be locked into that path due to the high costs of transition—a point emphasized by North. But lock in can be characterized by a certain degree of stability only when a particular economic regime remains competitive. The modeling of the economic agent presented above is suggestive of important mechanisms that might account for multiple types of economic regimes in long-run equilibrium.

Another intriguing and important paradox of economic life is related to labor market structures. Of particular interest, is the survival of slavery in the United States into the late nineteenth century and serfdom into the nineteenth century throughout most of Eastern Europe as forms of labor organization that paralleled the existence of free labor in the United States and Europe. Does the survival of slavery and serfdom suggest that these were both efficient forms of labor organization which were close substitutes for free labor, where all three general forms of labor organization contributed to equally efficient systems of production?12 The latter argument would follow from the conventional assumptions made about the economic agent and the assumption that relatively inefficient regimes generate the incentives for their eventual displacement by relatively more efficient regimes. An alternative argument would be that unfree labor was relatively inefficient. But if it was inefficient, how could unfree forms of labor organization persist over time; practically speaking for centuries on end? Should they not have been displaced by their relatively more efficient systems of free labor? The empirical debate on the subject is far from resolved.13

In terms of a modeling of the economic agent, one cannot predict the disappearance of slavery or serfdom in competition with free labor even if free labor is relatively more productive. The self- interested landlord or slaveowner will refuse to institute a free labor regime unless the productivity differential in favor of free labor exceeds the cost of labor differential in favor of coerced labor. Only under these circumstances would the unit costs of using free labor be less than the unit costs of using unfree labor. If unit costs under both regimes of labor organization are equivalent, the profit maximizing landlord would be indifferent between using free and unfree labor and both regimes can exist simultaneously. In addition, ceteris paribus, unfree labor remains viable in face of free labor becoming increasingly productive, if the income of the unfree labor can be further depressed without an attendant fall in labor productivity. Suboptimal or inefficient regimes of labor organization can persist over time or even dominate an economy as long as they remain cost competitive and privately profitable for members of the economic hierarchy.14

Conclusion

Scholars arguing on either side of the path dependency debate agree that producing at a relatively low level of productivity, ceteris paribus, is indicative of a market failure, where the opportunity cost to society of producing inefficiently is the loss of output incurred by the inefficient economic regimes as compared to what could be produced by the relatively efficient regimes. What has been subject to debate is the ability of the market to correct for such market failures within a reasonable period of time, even under competitive conditions. Modeling the economic agent in terms of more realistic behavioral assumptions allows for the persistence of the inefficient economic regimes, either on a micro or macro level, even in a highly competitive environment. Unlike in the David–Arthur modeling of path dependency, where inefficient paths can persist as a consequence of the inability of economic agents to take advantage of available and known economic opportunities, in the model presented above there need be no economic benefits to be gained by private economic agents from shifting from inefficient to efficient economic regimes. Moreover, both efficient and inefficient economic regimes can be cost competitive, and, inefficiencies in production can be consistent with constrained utility maximization on the part of economic agents. In these circumstances, there is no easy mechanism to direct economic agents from inefficient to efficient paths. This results in a market failure. Ceteris paribus, society would be better off if the economy produced x-efficiently as this would increase the standard of material well-being of most individuals in society. In addition, x-efficient production could be achieved by modifying the incentive system in the work place. However, if the members of the firm or economic hierarchy prefer the inefficient economic regime and this utility maximizing preference does not threaten the competitiveness of the firm, the economy will traverse along the inefficient path and such a path will continue to be chosen since it is the members of the economic hierarchy who ultimately decide which path to take.15

Whether or not an economy moves along an inefficient path depends on the preferences of members of the firm hierarchy given the constraints that they face and the economic viability of choosing the inefficient path. The behavioral model of path dependency does not predict that inefficient or suboptimal solutions to economic problems are inevitable but, rather, that inefficient economic regimes can be viable and, if so, will be chosen by members of the firm hierarchy when such a regime is most consistent with their preferences. Once locked into the inefficient path, there is no good economic reason to expect the economy to break out of this path, especially if there are economic or psychological costs involved in a transition to a new more efficient path. Institutional factors can, therefore, play an important role in affecting the capacity of the market to motivate economic agents to choose the relatively more efficient path or, once on the inefficient path, to shift to the more efficient path. Institutional factors, on the other hand, can also play a determining role in encouraging economic agents to choose the inefficient path. Therefore, economic agents choosing optimal solutions to particular economic problems is not inevitable. Chance events as well as carefully crafted policy can affect whether society takes the efficient or inefficient route and whether it locks in or breaks out of one particular equilibrium to another. A behavioral modeling of path dependency suggests that one cannot predict that market forces, in and of themselves, will consistently generate efficient solutions to important economic problems. Moreover, one cannot predict which equilibrium solution from a subset of solutions economic agents will choose since economic agents are not necessarily constrained by the market, even a highly competitive one, into choosing the most efficient of the available solutions to economic problems.