Herding in Middle Eastern Frontier Markets: Are Local and Global Factors Important?

Abstract

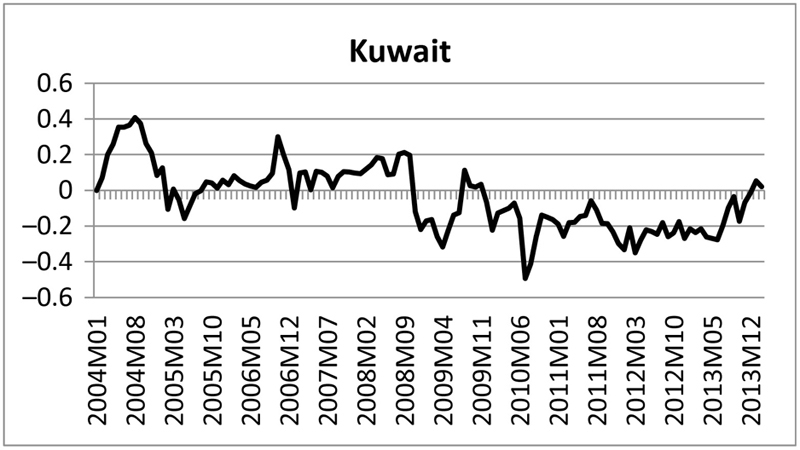

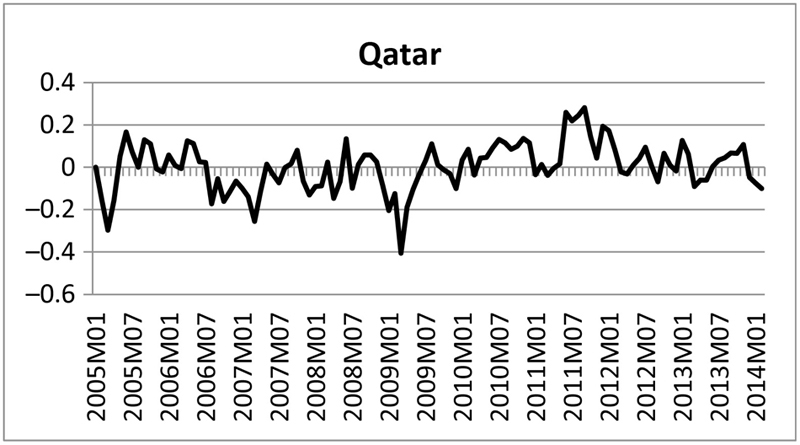

In this study we look for sentimental herding in a sample of frontier markets in the Middle East, using a state-space approach. The stock markets we consider are Oman, Bahrain, Qatar, and Kuwait. We use daily data to estimate monthly betas from a market model and test to see whether estimated monthly betas are biased, which would indicate the existence of herding or adverse herding. We also analyze the effect of extreme global and local events, and market conditions, on herding behavior. For extreme global market conditions we use major events such as the 2007–08 global financial crisis, as well as extreme variations in market returns. Furthermore, given the significance of petroleum in these markets, extreme price changes in spot-oil prices are also used for extreme market conditions. As for local events, we also test to see if events during the so-called Arab Spring in the region—eg, the Syrian internal war and Egyptian political movements—have had any impact on herd behavior. We find the existence of herding and adverse herding in Kuwait and Qatar, but not in Bahrain and Oman, revealing that market category is not a determinant of herding. In addition, our results show that while herding in Kuwait is influenced by local and global factors, herding in Qatar is influenced by oil returns and oil return volatility.

Keywords

JEL Classification

1. Introduction

2. The Empirical Model

(1.1)

(1.1)

(1.6)

(1.6)

(1.7)

(1.7)3. Data and Findings

Table 1.1

Estimation Results for Sentimental Herding (Model 6)

| Parameters | Herding detected | No herding | ||

| Kuwait | Qatar | Bahrain | Oman | |

| μm | −3.126** | −3.568** | −2.077** | −2.713** |

| ϕm | 0.915** | 0.797** | 0.822n | 0.438n |

| σmη | 0.044** | 0.046** | 0.000n | 0.0203* |

| σmv | 0.011** | 0.446** | 0.144** | 0.044** |

| Market ret. | −21.01** | 8.72n | −12.678n | −19.589n |

| Market vol. | 0.521** | 0.552** | −0.430** | −0.512** |

| σmη/SDLnβ % | 5.20 | 8.20 | ||

| Log-lik. | 13.32 | −61.02 | −54.775 | −6.951 |

| Akaike | −0.12 | 1,193 | 0.996 | 0.259 |

Highly significant, **; significant, *; insignificant, n.

Table 1.2

Data Coverage of Sample Countries

| Month–year range | Bahrain | Kuwait | Oman | Qatar |

| Begins | Jan. 2004 | Jan. 2004 | Nov. 2005 | Jan. 2005 |

| Ends | May. 2014 | Feb. 2014 | May. 2014 | May. 2014 |

| No. of months | 122 | 122 | 100 | 110 |

Table 1.3

The Effect of Local and Global Factors on Herding

| Variables | Kuwait | Qatar |

| Mortgage crisis | 0.082 (0.037)** | −0.039 (0.017) |

| Syrian Civil War | −0.233 (0.040)** | 0.036 (0.028) |

| Egypt’s Coup D’état | 0.159 (0.063)** | −0.052 (0.044) |

| Oil returns | −0.026 (0.034) | −0.054 (0.025)** |

| Oil return volatility | −0.011 (0.020) | −0.033 (0.015)** |

| Adj. R-square | 0.306 | 0.125 |

| No. of observations | 122 | 110 |

Standard errors are provided in parentheses.

Highly significant, **α=0.01; significant, *α=0.05; insignificant, no script.