Assessing Your Sales-Marketing Interface

A Three-Step Interface Assessment Process

In Chapter 3 we looked under the hood of the sales-marketing interface and identified a range of potential causes of dysfunctional interfaces, ranging from individual differences to misaligned organizational systems and processes. We followed this in Chapter 4 by outlining a broad spectrum of solutions that companies may put to use to deal with these root causes and improve their sales-marketing interfaces. These solutions exist at three levels: The sales or marketing function, the interface, and the company. Thus, we used a very large canvas to paint the sales-marketing interface in great detail, warts and all.

However, as a manager in a company, how do you identify and implement the appropriate solutions to improve an ailing sales-marketing interface in your company? While the answer to this question is different for each company, and depends on a multitude of idiosyncratic circumstances, it is grounded in a detailed assessment of the sales-marketing interface. In this chapter, we present a systematic three-step process, along with the required tools, that you need to assess the quality and nature of the relationship between sales and marketing in your company.

As practicing managers, you are likely to be putting out multiple fires on a daily basis when it comes to issues related to your sales-marketing interface. You are probably also intrigued (and frustrated, at times) because sales and marketing, with such similar backgrounds and working on such closely related issues, have so much difficulty working together as a team. The sales-marketing interface is very much like any other long-term relationship. As discussed in the previous chapters, each function possesses its own unique characteristics, which can create challenges in their relationship as they work together on a day-to-day basis. Despite these challenges, it is important that each function maintains its uniqueness, because a company stands to benefit from both sales and marketing personnel’s individual strengths and their collective interface dynamics. This means that the ideal solution is never for a company to merge its sales and marketing departments to create a hybrid entity that understands both the marketing and sales side of the business. Instead, we strongly recommend that sales and marketing maintain their uniqueness and work tirelessly to find common ground, manage their differences, and come together as a team on important occasions.

Such teamwork is only possible if sales and marketing personnel remain keenly aware of, and deeply invested in each other’s activities and the associated challenges, because this allows them to empathize with each other. A failure to find common ground often means that sales and marketing exist at opposite ends of the spectrum, fighting over every tactical and strategic issue, and not supporting (and in some cases even sabotaging) each other’s initiatives. Such a dysfunctional sales-marketing dynamic has a negative impact on the company’s business performance and future prospects.

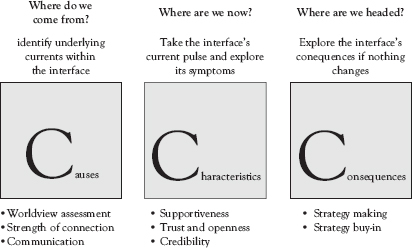

To ensure that a company’s sales and marketing personnel are able to develop and maintain a healthy and productive interface we suggest a three-step interface assessment process (Figure 5.1):

•Step 1: Identify the underlying currents (“Where do we come from?”). Whether your company’s interface is healthy or in dire need of intervention, the first step is to understand the underlying elements that have brought the interface to its current state.

•Step 2: Take the interface pulse and check its characteristics (“Where are we now?”). The underlying issues identified in Step 1 may manifest themselves in a variety of symptoms on a day-to-day basis. An accurate understanding of the interface’s current dynamic can be obtained by taking its pulse.

•Step 3: Assess the interface’s consequences (“Where are we headed?”). Any troubled interface has potential negative effects on business performance. The best way to avoid unwanted consequences is to explore them in detail. This paves the way for the development of appropriate solutions.

Figure 5.1 The sales-marketing interface assessment C3 toolkit

Going through this process, you will come to realize that assessing your sales-marketing interface is no quick and easy task. On the contrary, it requires a thoughtful, systematic approach. To help you design and implement a tailor-made change program for your company, we present the Sales-Marketing Assessment C3 Toolkit. The tools in this toolkit are based on our collective experience of over 15 years of rigorous research in this area, involving conversations with hundreds of sales and marketing personnel across the globe, as well as the results from other studies in this field.1–12

While the tools are designed to give managers a working understanding of what is going on within their sales-marketing interfaces, the actual development and implementation of an effective change program requires significant customization.

How to Use the Sales-Marketing Interface Assessment C3 Toolkit

The tools presented in this chapter will help you to carry out the three steps of our sales-marketing interface assessment process. Each of the tools is designed to capture a specific element of the sales-marketing interface. Most of the tools consist of a series of statements and require company employees to indicate the extent of their agreement with each specific statement on a seven-point scale, where 1 indicates “complete disagreement” and 7 indicates “complete agreement” with the statement.

Before we explain how to use these tools, there are three brief remarks about the language used in these tools. (1) In many of the statements you will read the term “counterparts,” which refers to “people from the other function.” When someone from sales is completing the tool, “counterparts” refers to the marketing colleagues; when someone from marketing completes the tool, the “counterparts” are salespeople. (2) Throughout all the tools, you will read the term “function.” This refers to either sales or marketing, depending on where and how it is used. (3) The terms “salespeople” and “marketers” are used generically to refer to marketing and sales personnel, irrespective of their place within the organizational hierarchy.

Because the tools are designed to assess the sales-marketing dynamic, unless stated otherwise, it is important that both sales and marketing personnel complete each of these tools. Letting sales and marketing leaders ask their deputies and rank and file to complete the tools anonymously ensures that honest opinions are captured and results in the most detailed insights. While a comparison of individual scores is helpful, because it provides insight into the spread of opinions within a group, we will focus on a comparison between the average scores from the sales and marketing teams. Another alternative would be to ask your top management to complete the tools as well, because this will generate useful information about management’s perceptions of the sales-marketing interface. Especially when these perceptions can be compared with the opinions from sales and marketing employees themselves.

Depending on your objectives, you may use all tools or focus on a specific set of tools. Viewed collectively, the C3 toolkit allows managers to complete a comprehensive assessment of the quality of their sales-marketing interface and its likely effects on business performance. Alternatively, you may also decide to pick and choose a subset of tools to investigate a specific area depending on your specific situation.

A one-time project to assess your company’s sales-marketing interface provides many useful insights, but a better approach is to revisit these tools periodically (every 9 through 12 months) and reassess your interface on an ongoing basis. Comparing data-points over time will help you understand whether your interface is progressing or regressing.

Each description of a tool consists of two parts:

•The actual tool: A series of statements that the respondent must complete

•A guideline to help interpret the scores, as well as some suggestions about how you may address the issue.

Using a tool requires the respondents to express the extent to which they agree with a series of statements. These scores can then be used to calculate average individual scores (summing the ratings for the various statements, divided by the number of statements) and average team scores (summing the average scores of the individual team members, divided by the number of team members). The results can be used to assess differences between individuals (for instance, different salespeople), between teams (sales versus marketing), and between hierarchical levels (for instance, sales managers and sales reps).

Step 1: Identify Underlying Currents Within the Interface

The assessment of the sales-marketing interface starts with an exploration of the underlying currents (i.e., root causes) that afflict a typical sales-marketing relationship. Drawing on our extensive research in this area that informs much of the materials presented in Chapter 3, we provide three tools that help you make a comprehensive assessment of the many root causes we discussed in Chapter 3, which have wide-ranging effects on your current interface: (a) Sales and marketing’s worldviews, (b) The strength of the connection between sales and marketing, and (c) The communication between the two functions. Each of these three areas is explored with a separate tool.

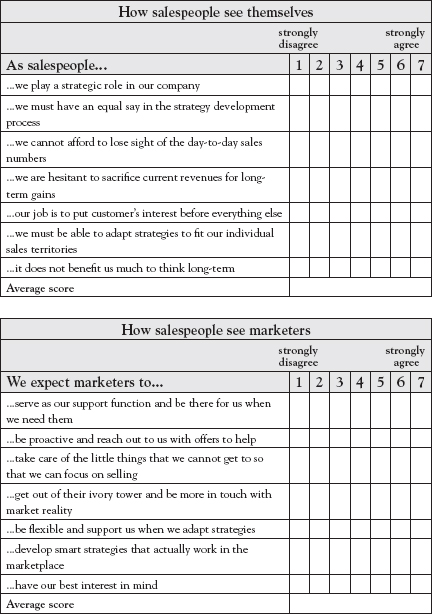

The worldview assessment tool allows you to assess how your marketers and sales personnel view their own and their counterpart function’s role in the company. Since we know from prior research that worldviews of both sales and marketing are different, there are separate tools for both functions. (See Tables 5.1A and 5.1B.)

To assess the worldviews of your sales and marketing personnel, you need to calculate the average scores for your sales and marketing teams. Table 5.1C helps you to interpret the average scores for the sales and marketing teams.

Once you have an understanding of how salespeople and marketers view their and their counterpart’s roles in the company, you may compare their perspectives to assess the extent and nature of the cultural divide between the two functions. For instance, if the marketing team scores high on how they see themselves (that is, if they see their role as being very strategic), while the salespeople score low on how they see themselves (which means that they see their role as being very operational), the two teams play very different roles in the company. On the other hand, if both teams score high on how they see themselves, each function thinks that they drive the strategy and that the other function must play the second fiddle. In these cases, there is a great likelihood of a power struggle and culture clash between sales and marketing, which will affect strategy development and implementation.

Table 5.1A Worldview assessment tool: sales

Table 5.1B Worldview assessment tool: marketing

Table 5.1C Worldview assessment tool: interpretation

Scores |

Interpretation |

How salespeople see themselves |

|

| If the sales team’s average score is above 4.5 | Salespeople desire to maintain much control over strategy development and implementation |

| If the sales team’s average score is in the range of 3–4.5 | Salespeople do not view their role as being strategic; yet, they want to retain some control over the strategy process |

| If the sales team’s average score is below 3 | Salespeople are likely to follow directives and work with their marketing colleagues |

How salespeople see marketers |

|

| If the sales team’s average score is above 4.5 | Salespeople view marketers as simply a support function; they expect marketing to support them while they lead |

| If the sales team’s average score is in the range of 3–4.5 | Salespeople think of marketers as more than just a support function |

| If the sales team’s average score is below 3 | Salespeople believe that marketers will not always go out of their way to support salespeople |

How marketers see themselves |

|

| If the marketing team’s average score is above 4.5 | Marketers view their role to be purely strategic; they are not likely to give up control to salespeople |

| If the marketing team’s average score is in the range of 3–4.5 | Marketers view their role as strategic; they are somewhat open to working with salespeople, albeit with some reservations |

| If the marketing team’s average score is below 3 | Marketers view salespeople as partners that they must fully support |

How marketers see salespeople |

|

| If the marketing team’s average score is above 4.5 | Marketers expect salespeople to simply follow their directives and not exert any autonomy |

| If the marketing team’s average score is in the range of 3–4.5 | Marketers expect salespeople to follow their directives, although they are aware that it may not happen all the time |

| If the marketing team’s average score is below 3 | Marketers expect salespeople to influence strategy implementation; they do not expect them to simply take orders |

#2: Strength of Connection Tool

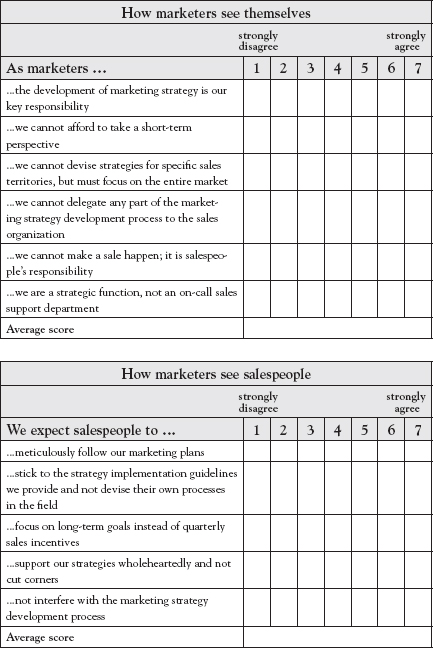

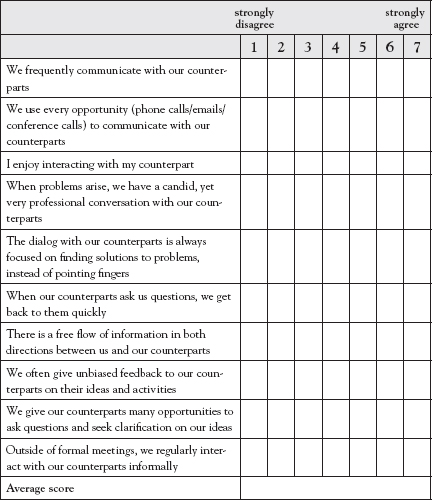

The strength of connection tool helps you assess the strength of the bond between your sales and marketing functions. Do sales and marketing communicate frequently with each other? Do they have a good personal rapport? Do they share common objectives? (See Table 5.2A)

In interpreting the scores (See Table 5.2B), the general rule is: The higher the average scores for both teams, the more connected the teams feel with each other. If there are significant differences between the two average team scores, both functions have very different perceptions of the bond with their counterparts. These different perceptions may result in less trust and an overall less effective sales-marketing interface.

Table 5.2A Strength of connection tool

Table 5.2B Strength of connection tool: Interpretation

Scores |

Interpretation |

| If the average team score is above 4.5 | The function views their counterparts in a favorable light and feels that they share a strong bond; the higher the score, the stronger the perceived connection |

| If the average team score is in the range of 3–4.5 | The function feels quite neutral about their counterparts; they feel neither greatly connected nor disconnected with their counterparts |

| If the average team score is below 3 | The function feels that their counterparts are disconnected from them and that the bond is weak; the lower the score, the weaker the perceived connection |

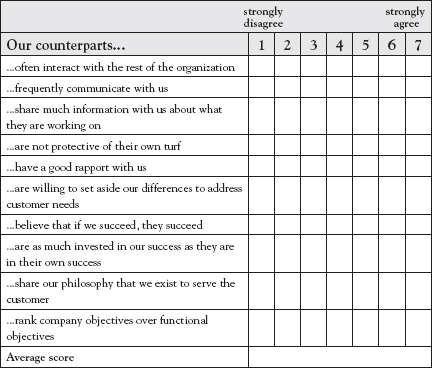

To focus more deeply on the interaction between sales and marketing personnel, the communication tool is designed to help you assess the quality of communications between the two functions. Do salespeople and marketers like to interact with each other? Is the exchange of information open and constructive? Does communication flow freely in both directions? (See Table 5.3A)

Table 5.3A Communication tool

The higher the average scores for both teams (See Table 5.3B), the more positive they are about the quality of the dialog between sales and marketing. If the scores for both teams are very different, both functions have very different perceptions of how they communicate. This might indicate that one of the functions is more focused on its own problems and objectives than on those of their counterparts.

Table 5.3B Communication tool: Interpretation

Scores |

Interpretation |

| If the average team score is above 4.5 | The function believes that they engage in free flowing, transparent, and objective communications with their counterparts; the higher the score, the higher the perceived quality of the dialog |

| If the average team score is in the range of 3–4.5 | The function does not exhibit much enthusiasm toward establishing strong communications with their counterparts; communication is likely to happen only on a need basis |

| If the average team score is below 3 | The function perceives the communication with their counterparts to be poor and feels a need for improved communications; the lower the score, the poorer the perceived quality of the dialog |

Step 2: Take the Interface Pulse

While Step 1 allows you to identify and explore the underlying currents that may afflict the sales-marketing interface, Step 2 focuses on how these currents play out in the interface. It is all about taking the pulse of the sales-marketing interface to assess the status quo. We have developed three tools to help you understand the extent to which sales and marketing (a) support each other’s activities, (b) trust and are open with each other, and (c) perceive each other as credible partners.

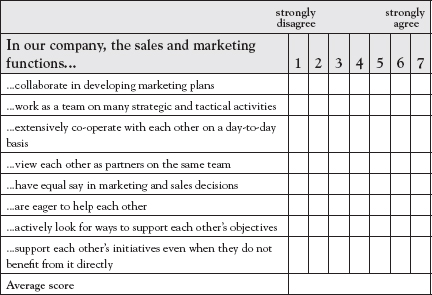

#4: Supportiveness Tool

A first key characteristic of a sales-marketing interface concerns the extent to which both functions support each other. After all, sales and marketing perform complementary and partly overlapping tasks and a successful interface requires both groups to support each other in both strategic and tactical activities. Do salespeople and marketers collaborate? Do they view each other as partners? Do they actually want to help each other? The supportiveness tool helps you to understand what salespeople and marketers think of the support they receive from their counterparts on a day-to-day basis (See Table 5.4A).

Table 5.4B helps interpret the scores. A low average score reflects a low perceived supportiveness from sales or marketing. While this may be problematic, it is also telling when the average scores from the sales and marketing teams are very different. This means that both functions have very different perceptions of the level of support provided in the interface, which may be indicative of ineffective communication or a lack of empathy.

Table 5.4A Supportiveness tool

Table 5.4B Supportiveness tool: Interpretation

Scores |

Interpretation |

| If the average team score is above 4.5 | The function believes that sales and marketing functions support each other’s activities, initiatives, and objectives extensively; they feel that sales and marketing are truly part of the same team |

| If the average team score is in the range of 3–4.5 | The function feels indifferent about their counterparts; they neither feel supportive of nor supported by their counterparts; the functions probably have to go out of their way to generate support from their counterparts for their ideas and initiatives |

| If the average team score is below 3 | The function believes that sales and marketing do not support each other very much; the lower the score, the lower the perceived supportiveness |

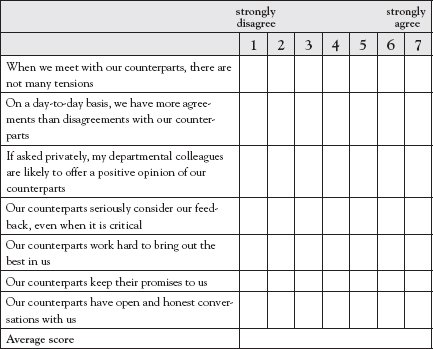

A second characteristic of a sales-marketing interface describes the amount of trust and openness that exists between the two functions. Is there tension between the two functions? Do people keep their promises? Can they be relied on to give honest opinions and feedback? The trust and openness tool captures these elements of the sales-marketing interface (See Table 5.5A).

The higher the average team score, the better their perception of trust and openness in their interactions with their counterparts. If the average team scores for sales and marketing are very different this may be a reflection of a lack of open communication between the two functions and one of the two groups not putting enough effort into the interface (See Table 5.5B).

Table 5.5A Trust and openness tool

Table 5.5B Trust and openness tool: Interpretation

Scores |

Interpretation |

| If the average team score is above 4.5 | The function perceives that they share a high quality relationship with their counterparts; the higher the score, the better the perceived relationship quality |

| If the average team score is in the range of 3–4.5 | The function is indifferent toward their counterparts; they do not engage much with each other, which leads to a neutral relationship between the two functions |

| If the average team score is below 3 | The function views the relationship quality between them and their counterparts to be suboptimal; they feel that the relationship lacks trust and openness, and suffers from conflict |

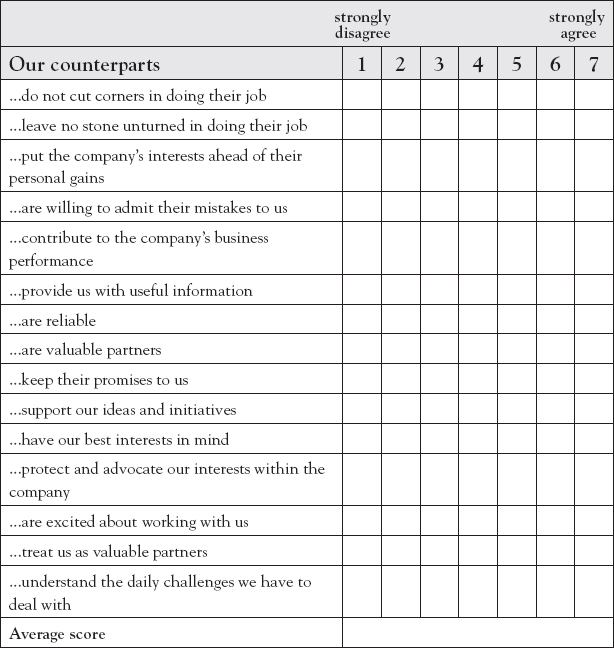

The final characteristic describing the nature of the sales-marketing interface, captured by the credibility tool, concerns the extent to which sales and marketing personnel view their counterparts as credible partners. Do they think that their counterparts provide them with useful information? That they are reliable and valuable partners? (See Table 5.6A)

The higher the average team score, the better their perception of their counterparts’ credibility. If the average team scores for sales and marketing are very different this reflects an unbalanced relationship in which expectations are not always met and disappointment is likely to abound (See Table 5.6B).

Table 5.6A Credibility tool

Table 5.6B Credibility tool: Interpretation

Scores |

Interpretation |

| If the average team score is above 4.5 | The function views their counterparts as highly credible partners; they view them as trustworthy team members who will work in the best interest of the company; the higher the score, the stronger the perceived credibility |

| If the average team score is in the range of 3–4.5 | The function has an ambivalent view of their counterparts; they do not view them as highly credible but also have no reasons to distrust them; they are quite neutral toward them |

| If the average team score is below 3 | The function views their counterparts as not very credible partners, which indicates a lack of trust in the counterparts’ abilities or intentions; the lower the score, the worse the perceived credibility |

Step 3: Assess the Interface Consequences

Having identified the underlying causes that influence the current state of your sales-marketing interface, and how they manifest themselves within your interface, Step 3 takes a closer look at the effects of the sales-marketing interface on your company. It aims to help you understand how the interactions between sales and marketing personnel within your company affect your company’s ability to successfully develop and implement marketing strategies and maintain a competitive edge. We present two tools that help you assess (a) whether your company is able to develop and implement marketing strategies successfully and (b) the extent to which marketers are likely to achieve a “buy-in” for their marketing strategies from the sales force.

#7: Strategy Making Tool

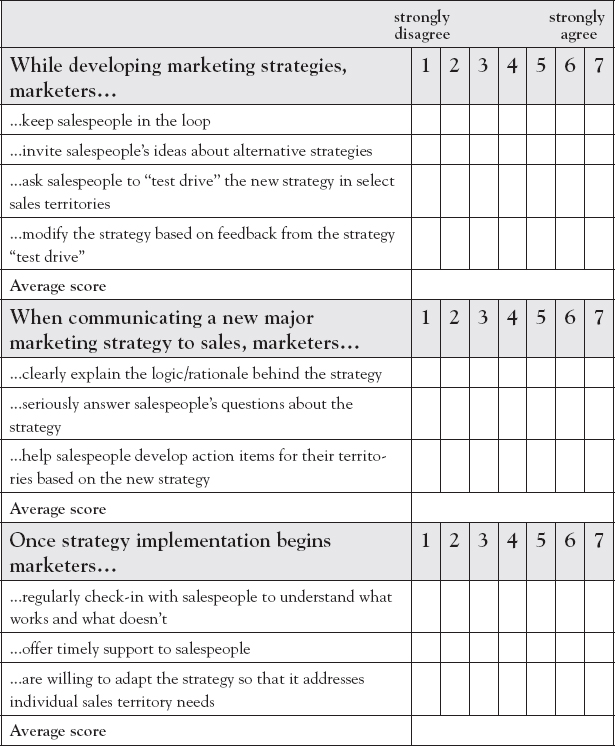

The most critical activity in which marketing and sales are jointly involved is the development and implementation of marketing strategy. The strategy making tool is designed to explore how successful your company is likely to be in developing and implementing new marketing strategies. This tool captures the key elements of the discussion about strategy making presented in Chapter 2. The tool consists of three sections: (1) Developing strategy, (2) Communicating strategy to the sales force, and (3) Implementing strategy (See Table 5.7A).

The interpretation of the results of the strategy making tool is a bit different than the other tools. For each of the three sections of the tool (strategy development, communication, and implementation) the average team scores for sales and marketing can be compared. In general, a higher team score means that the function completing the tool believes that marketing is doing a good job of including sales personnel in the various stages of the strategy process. When the average team scores for sales and marketing are markedly different from each other, both functions obviously hold very different perceptions of how they interact while developing and implementing a new marketing strategy.

Table 5.7A Strategy making tool

Table 5.7B Strategy making tool: Interpretation

Scores |

Interpretation |

Strategy development |

|

| If average team score is above 4.5 | The function believes that marketing adequately involves sales personnel in the strategy development process |

| If the average team score is in the range of 3–4.5 | The function is ambivalent about marketing involving sales personnel in the strategy process; this suggests a lack of well-developed processes within the company to encourage sales involvement in the strategy development processes |

| If the average team score is below 3 | The function believes that sales personnel are removed from the strategy development process and have no say in what and how strategies are developed |

Strategy communication |

|

| If the average team score is above 4.5 | The function believes that marketing spends enough time communicating marketing strategy, and strategy is not forced on to the sales force |

| If the average team score is in the range of 3–4.5 | The function thinks that the communication about strategy to salespeople is half-hearted and sporadic; this suggests a lack of thought within the company to involve salespeople in the strategic process |

| If the average team score is below 3 | The function believes that marketing spends little time communicating the strategy to salespeople and answering their questions; this suggests that the function believes strategies are thrust upon salespeople |

Strategy implementation |

|

| If the average team score is above 4.5 | The function believes that marketers stay in touch with and help salespeople out when the strategy is rolled out in the field |

| If the average team score is in the range of 3–4.5 | The function thinks that marketing’s support to salespeople is sporadic and may depend on the individual marketing manager; there is no systemic approach followed by marketing |

| If the average team score is below 3 | The function believes that marketing does insufficiently stay in touch with and support the field force after the strategy is rolled out; this indicates that marketing simply hands-off the strategy and does not support it afterwards |

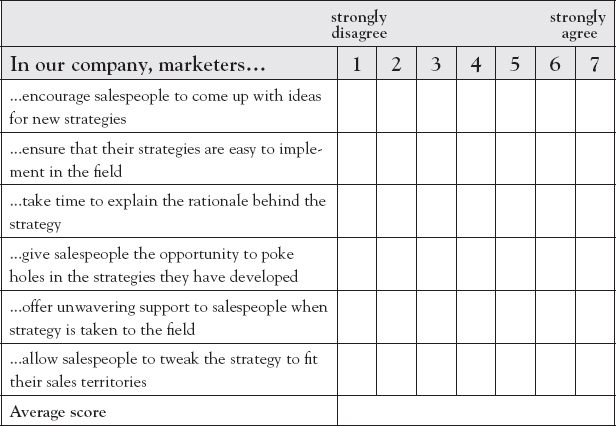

A company’s strategy making process will only be successful if the marketers are able to achieve a buy-in of their marketing strategies from the field force. Do marketers encourage salespeople to contribute ideas to new strategies? Do marketers allow salespeople to adapt the marketing strategy if the specific conditions of a sales territory warrant it? This is captured by the strategy buy-in tool, which is to be completed by sales personnel only (See Table 5.8A).

The higher the average score of the sales team, the more salespeople believe that marketers treat them as equal partners in the strategy making process. Such perception may increase the likelihood that they will buy-into the marketing strategies (See Table 5.8B).

Table 5.8A Strategy buy-in tool

Table 5.8B Strategy buy-in tool: Interpretation

Scores |

Interpretation |

| If the average team score is above 4.5 | Salespeople believe that marketers treat them as equal partners and that they have adequate say in the strategy process; as a result, salespeople are very likely to embrace the strategies wholeheartedly |

| If the average team score is in the range of 3–4.5 | Salespeople do not feel that their voice is adequately represented in the strategy process; they may do the minimum work needed to implement the strategy but may not embrace it wholeheartedly |

| If the average team score is below 3 | Salespeople feel alienated from the strategy development process; they may not take any ownership of the strategy and may not implement it in the field |

Designing A Program for Improvement

When you use our C3 Toolkit, you will generate many insights about the workings of your sales-marketing interface. First of all, you will probably notice that sales and marketing personnel have different perceptions of the same issues (such as the interfunctional dialog or the overall quality of the relationship), as indicated by significant differences in their average team scores. You are also likely to notice that even within each function, the perceptions and opinions around specific issues (such as the strategy making process) are different depending on who completed the tool. For example, sales and marketing leadership is likely to view things very differently compared to their functional colleagues at the middle or lower levels of the organizational hierarchy. These differences in perceptions are very powerful indicators of how different sales and marketing executives within your company have a varying perspective on how your sales-marketing interface functions. And it is these perceptions that affect how people act on a day-to-day basis and therefore on the functioning of the interface.

Of course, identifying the strengths and weaknesses of your sales-marketing interface, as well as their effects on corporate processes and business performance, should be followed by the design and implementation of a program for improvement.

We strongly believe that there is no “one size fits all” solution that every company or executive using the toolkit can just pick off the shelf and start implementing. The reality of organizational complexity means that the solutions to these issues are numerous, as illustrated in Chapter 4, and depend on numerous factors that are specific to your company as discussed in Chapter 3; such as your organizational structure, culture, the nature of your business, the background of your sales and marketing personnel, or your sales-marketing relationship history and configuration. In addition, several external factors may also be relevant; for instance, the industry you are in, the nature of competition, and environmental, and economic uncertainty. This means that every company needs to develop the set of specific solutions that best matches their circumstances.

Therefore, although our toolkit does not include ready-made solutions for identified problems; to get you started on developing customized solutions for your specific needs, we offer a framework. This framework requires you to examine the critical issues that you have identified through three different lenses: Sales, marketing, and organizational leadership. In short, this requires you to look at each of the concern areas and assess what (a) the sales organization, (b) the marketing organization, and (c) company leadership may do to address the concerns. Exploring critical issues from these three perspectives will result in a more realistic and stronger solution. By way of example, Table 5.9 presents a problem area that was identified using the toolkit (in this case a lack of supportiveness) and outlines some questions that you may ask yourself to identify appropriate solutions.

As we conclude this chapter, we revisit the relationship analogy we used at the beginning. We reiterate that sales and marketing departments and personnel are like companions in a long-term relationship. Just as in any relationship, problems are likely to crop up between sales and marketing departments. When challenges arise, it is crucial that neither the interface personnel nor the company leadership jump to conclusions and try to find a quick fix. There are no quick fixes to these issues. It is always prudent to dig deeper, examine the issue systematically, and invite multiple perspectives on how the issue could be addressed. This is indeed a time-consuming process, but it is the only process that will provide long-term benefits. You may be tempted to find short-term, quick fixes to the problem areas—but remember, they are just “short-term” fixes with a significant likelihood that the issues you “fixed quickly” will crop up again and take a more severe form.

To conclude, this chapter offered a series of tools that you can use to assess the quality and nature of the sales-marketing interface in your company. They can be used to identify pain points and start exploring possible solutions. But we also emphasized that there are no quick fixes, because sales-marketing interfaces are complex and problems within them may not be amenable to such quick fixes. The next, and final chapter, adds to that complexity by exploring several organizational challenges that have a direct impact on the sales-marketing interface.

Table 5.9 Analyzing a problem area

Problem area: The sales and marketing functions have a very low perception of supportiveness; they feel that they do not receive optimal support from their counterparts on a day-to-day basis |

||

|

Marketing must investigate |

Sales must investigate |

Leadership must investigate |

|

•How do we contribute to salespeople’s perceptions? •What does the sales function expect from us? •Do we fully understand salespeople’s expectations? •Is there a systematic process to capture salespeople’s expectations? Do we follow that process diligently? Why/why not? •Once we understand salespeople’s expectations, how do we use that information? Do we analyze their expectations seriously? •In response to their expressed needs, what support do we offer to our salespeople on a day-to-day basis? •What do we fail to offer? Why? •What prevents effective teamwork between sales and marketing? •How can we proteet salespeople’s interests while asking them to support our long-term plans? |

•How are we contributing to marketers’ perceptions? •When marketers say, “salespeople must support us,” what do they really mean? •How can we better understand marketers’ expectations? What processes do we currently use to capture these expectations and how can we improve them? •If we introspect, do we believe that we offer our marketing colleagues the optimal support they need? •In which areas do we collaborate well with marketing? What makes that tick? •What collaborative avenues have we not explored yet? •Have we worked (advertently or inadvertently) at cross-purposes with our marketing colleagues? •How can we support marketing’s initiatives while not losing focus on our day-to-day sales activities? |

•Why did we not see this coming earlier? •Have there been any instances or events in the recent past that may have decreased the supportiveness within the interface? •Where does the problem lie – is it an interpersonal issue, a resource issue, a priority issue, or something else entirely? •How could we intervene to enhance interface supportiveness? •Going forward, what support do we need to extend to optimize interface supportiveness? •How can we monitor the level of supportiveness within the interface on an ongoing basis so that it does not become a problem area in the future? |

•The process of improving your sales-marketing interface starts with an honest assessment of the nature and quality of the interface in your company.

•Assessing the quality of a sales-marketing interface involves more than simply looking at how salespeople and marketers interact inside your company.

•We suggest a three-step process and provide a C3 toolkit to assess your sales-marketing interface: (1) Identify the underlying currents that have brought the interface to where it is today, (2) Explore the characteristics of the interface to understand its current dynamics, and (3) Assess the consequences if the interface remains unchanged.

•When management has used the tools to assess its sales-marketing interface, the next step is to identify the most critical issues that need to be dealt with and to design a change program. Such a change program needs to account for the complexity of the organization in question and requires the design of a custom-made solution.