Understanding Accounting and Financial Statements

![]() Discuss the users of accounting information.

Discuss the users of accounting information.

![]() Describe accounting professionals.

Describe accounting professionals.

![]() Identify the foundation of the accounting system.

Identify the foundation of the accounting system.

![]() Outline the steps in the accounting cycle.

Outline the steps in the accounting cycle.

![]() Explain financial statements.

Explain financial statements.

![]() Discuss financial ratio analysis.

Discuss financial ratio analysis.

![]() Describe the role of budgeting.

Describe the role of budgeting.

![]() Outline international accounting practices.

Outline international accounting practices.

BKD LLP: An Accounting Firm for the 21st Century

If you are thinking about a career in accounting, you would do well to consider BKD LLP, one of the top ten CPA and advisory firms in the United States. The 90-year-old firm reports more than $400 million a year in revenue, serving businesses and individuals in 30 offices in the South and Southwest.

BKD provides a wide range of accounting and audit services. It helps its corporate clients with mergers and acquisitions, sales, risk management, employee benefit plans, management buyouts, IPOs, and other financing operations. It advises individual clients on wealth planning, investments, estate planning, and insurance, and it also operates the BKD Foundation. The BKD Foundation, the firm's charitable arm, empowers partners and employees to contribute through a combination of sponsorships, grants, and volunteerism. Donations made through the foundation totaled nearly $1 million in a recent year. Outside of the foundation, BKD partners and employees contributed nearly $1 million to the United Way and also volunteered for a variety of groups, including Court Appointed Special Advocates (CASA), Salvation Army, Toys for Tots, Alzheimer's Association, March of Dimes, and the American Cancer Society. “I think every person in our firm believes it's their responsibility to give back to their communities. They are givers and not takers. It's in our cultural DNA,” said the BKD CEO.1

Overview

Accounting professionals prepare the financial information that organizations present in their annual reports. Whether you begin your career by working for a company or by starting your own firm, you need to understand what accountants do and why their work is so important in contemporary business.

accounting process of measuring, interpreting, and communicating financial information to enable people inside and outside the firm to make informed decisions.

Accounting is the process of measuring, interpreting, and communicating financial information to enable people inside and outside the firm to make informed decisions. In many ways, accounting is the language of business. Accountants gather, record, report, and interpret financial information in a way that describes the status and operation of an organization and aids in decision making.

Millions of men and women throughout the world describe their occupation as an accountant. In the United States alone, more than 1.2 million people work as accountants. According to the U.S. Bureau of Labor Statistics, the number of accounting-related jobs is expected to increase by around 16 percent between now and 2020.2 The availability of jobs and relatively high starting salaries for talented graduates have made accounting one of the most in-demand majors on college campuses.3

This chapter begins by describing who uses accounting information. It discusses business activities involving accounting statements: financing, investing, and operations. It explains the accounting process, defines double-entry bookkeeping, and presents the accounting equation. We then discuss the development of financial statements from information about financial transactions. The methods of interpreting these statements and the roles of budgeting in planning and controlling a business are described next. The chapter concludes with a discussion of the development and implementation schedule of a uniform set of accounting rules for global business.

Users of Accounting Information

Users of Accounting Information

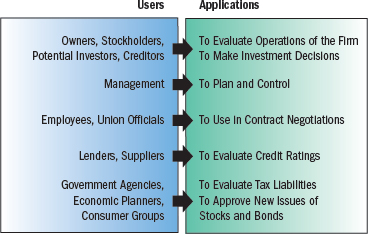

People both inside and outside an organization rely on accounting information to help them make business decisions. FIGURE 15.1 lists the users of accounting information and the applications they find for that information. Firms like Deloitte Consulting provide such information and help their customers make the best use of it.

Managers with a business, government agency, or not-for-profit organization are the major users of accounting information because it helps them plan and control daily and long-range operations. Business owners and boards of directors of not-for-profit groups also rely on accounting data to determine how well managers are operating the organizations. Union officials use accounting data in contract negotiations, and employees refer to it as they monitor their firms' productivity and profitability performance.

To help employees understand how their work affects the bottom line, many companies share sensitive financial information with their employees and teach them how to understand and use financial statements. Proponents of what is often referred to as open book management believe that allowing employees to view financial information helps them better understand how their work contributes to the company's success, which in turn benefits them.

Outside a firm, potential investors evaluate accounting information to help them decide whether to buy a firm's stock. As will be discussed in more detail later in the chapter, any company whose stock is traded publicly is required to report its financial results on a regular basis. So anyone can find out, for example, what Costco's sales were last year or how much money Intel made during the last quarter. Bankers and other lenders use accounting information to evaluate a potential borrower's financial soundness. The Internal Revenue Service (IRS) and state tax officials use it to determine a company's tax liability. Citizens' groups and government agencies use such information in assessing the efficiency of operations such as Massachusetts General Hospital; the Topeka, Kansas, school system; Community College of Denver; and the Art Institute of Chicago.

Accountants play a key role in organizations by providing services to businesses, individuals, government agencies, and not-for-profit organizations.

Accountants play fundamental roles not only in business but also in other aspects of society. Their work influences each of the business environments discussed earlier in this book. They clearly contribute important information to help managers deal with the competitive and economic environments.

Less obvious contributions help others understand, predict, and react to the technological, regulatory, and social and cultural environments. For instance, thousands of people volunteer each year to help people with their taxes. One of the largest organized programs is Tax-Aide, sponsored by AARP (formally known as the American Association of Retired Persons). For more than 40 years this volunteer program has assisted about 50 million low- and middle-income Americans—especially people age 60 and older—with their income tax preparation.4

BUSINESS ACTIVITIES INVOLVING ACCOUNTING

The natural progression of a business begins with financing. Subsequent steps, including investing, lead to operating the business. All organizations, profit oriented and not-for-profit, perform these three basic activities, and accounting plays a key role in each one:

- Financing activities provide necessary funds to start a business and expand it after it begins operating.

- Investing activities provide valuable assets required to run a business.

- Operating activities focus on selling goods and services, but they also consider expenses as important elements of sound financial management.

Quick Review

![]() Define accounting.

Define accounting.

![]() Who uses accounting information?

Who uses accounting information?

![]() What three business activities involve accounting?

What three business activities involve accounting?

Accounting Professionals

Accounting Professionals

Accounting professionals work in a variety of areas in and for business firms, government agencies, and not-for-profit organizations. They can be classified as public, management, government, and not-for-profit accountants.

PUBLIC ACCOUNTANTS

public accountant accountant who provides accounting services to individuals or business firms for a fee.

A public accountant provides accounting services to individuals or business firms for a fee. Most public accounting firms provide three basic services to clients: (1) auditing, or examining, financial records; (2) tax preparation, planning, and related services; and (3) management consulting. Because public accountants are not employees of a client firm, they can provide unbiased advice about the firm's financial condition.

Although there are hundreds of public accounting firms in the United States, a handful of firms dominate the industry. The four largest public accounting firms—Deloitte & Touche, PricewaterhouseCoopers (PwC), Ernst & Young, and KPMG—bill well over $36 billion annually. In contrast, McGladrey & Pullen, the nation's fifth-largest accounting firm, has annual revenue of approximately $1.3 billion.5

Some years ago, public accounting firms came under sharp criticism for providing management consulting services to many of the same firms they audited. Critics argued that when a public accounting firm does both—auditing and management consulting—an inherent conflict of interest is created. In addition, this conflict of interest may undermine confidence in the quality of the financial statements that accounting firms audit. The bankruptcies of some high-profile firms increased pressure on public accounting firms to end this practice. Legislation also established strict limits on the types of consulting services auditors can provide.

A growing number of public accountants are also certified as forensic accountants, and some smaller public accounting firms actually specialize in forensic accounting. These professionals, and the firms that employ them, focus on uncovering potential fraud in a variety of organizations.

Certified public accountants (CPAs) demonstrate their accounting knowledge by meeting state requirements for education and experience and successfully completing a number of rigorous tests in accounting theory and practice, auditing, law, and taxes. Other accountants who meet specified educational and experience requirements and pass certification exams carry the title certified management accountant, certified internal auditor, or certified fraud examiner.

MANAGEMENT ACCOUNTANTS

An accountant employed by a business other than a public accounting firm is called a management accountant. Such a person collects and records financial transactions and prepares financial statements used by the firm's managers in decision making. Management accountants provide timely, relevant, accurate, and concise information that executives can use to operate their firms more effectively and more profitably than they could without this input. In addition to preparing financial statements, a management accountant plays a major role in interpreting them. A management accountant should provide answers to many important questions:

- Where is the company going?

- What opportunities await it?

- Do certain situations expose the company to excessive risk?

- Does the firm's information system provide detailed and timely information to all levels of management?

Management accountants frequently specialize in different aspects of accounting. A cost accountant, for example, determines the cost of goods and services and helps set their prices. An internal auditor examines the firm's financial practices to ensure that its records include accurate data and that its operations comply with federal, state, and local laws and regulations. A tax accountant works to minimize a firm's tax bill and assumes responsibility for its federal, state, county, and city tax returns. Some management accountants achieve a certified management accountant (CMA) designation through experience and passing a comprehensive examination.

GOVERNMENT AND NOT-FOR-PROFIT ACCOUNTANTS

Federal, state, and local governments also require accounting services. Government accountants and those who work for not-for-profit organizations perform professional services similar to those of management accountants. Accountants in these sectors concern themselves primarily with determining how efficiently the organizations accomplish their objectives.

Not-for-profit organizations, such as churches, labor unions, charities, schools, hospitals, and universities, also hire accountants. In fact, the not-for-profit sector is one of the fastest growing segments of accounting practice. An increasing number of not-for-profits publish financial information because contributors want more accountability from these organizations and are interested in knowing how the groups spend the money that they raise.

Quick Review

![]() List the three services offered by public accounting firms.

List the three services offered by public accounting firms.

![]() What tasks do management accountants perform?

What tasks do management accountants perform?

The Foundation of the Accounting System

The Foundation of the Accounting System

generally accepted accounting principles (GAAP) guidelines on the conventions, rules, and procedures for determining acceptable accounting and financial reporting practices.

To provide reliable, consistent, and unbiased information to decision makers, accountants follow guidelines, or standards, known as generally accepted accounting principles (GAAP). These principles encompass the conventions, rules, and procedures for determining acceptable accounting and financial reporting practices.

All GAAP standards are based on four basic principles: consistency, relevance, reliability, and comparability. Consistency means that all data should be collected and presented in the same manner across all periods. Any change in the way in which specific data are collected or presented must be noted and explained. Relevance states that all information being reported should be appropriate and assist users in evaluating that information. Reliability implies that the accounting data presented in financial statements are reliable and can be verified by an independent party such as an outside auditor. Comparability ensures that one firm's financial statements can be compared with those of similar businesses.

Accountants and other financial professionals use GAAP to assure their customers that the statements they provide conform to well-established accounting practices.

Financial Accounting Standards Board (FASB) an organization responsible for evaluating, setting, or modifying GAAP in the United States.

In the United States, the Financial Accounting Standards Board (FASB) is primarily responsible for evaluating, setting, or modifying GAAP. The U.S. Securities and Exchange Commission (SEC), the chief federal regulator of the financial markets and accounting industry, actually has the statutory authority to establish financial accounting and reporting standards for publicly held companies.

The FASB carefully monitors changing business conditions, enacting new rules and modifying existing rules when necessary. It also considers input and requests from all segments of its diverse constituency, including corporations and the SEC. One major change in accounting rules recently dealt with executive and employee stock options. Stock options give the holder the right to buy stock at a fixed price. The FASB now requires firms that give employees stock options to calculate the cost of the options and treat the cost as an expense, similar to salaries.

In response to well-known cases of accounting fraud and questions about the independence of auditors, the Sarbanes-Oxley Act—commonly known as SOX—created the Public Accounting Oversight Board. The five-member board has the power to set audit standards and to investigate and sanction accounting firms that certify the books of publicly traded firms. Members of the Public Accounting Oversight Board are appointed by the SEC. No more than two of the five members of the board can be certified public accountants.

In addition to creating the Public Accounting Oversight Board, SOX also added to the reporting requirements for publicly traded companies. For example, senior executives including the CEO and chief financial officer (CFO) must personally certify that the financial information reported by the company is correct. As noted earlier, these requirements have increased the demand for accounting professionals, especially managerial accountants. One result of this increased demand has been higher salaries.

Foreign Corrupt Practices Act federal law that prohibits U.S. citizens and companies from bribing foreign officials in order to win or continue business.

The Foreign Corrupt Practices Act is a federal law that prohibits U.S. citizens and companies from bribing foreign officials in order to win or continue business. This law was later extended to make foreign officials subject to penalties if they in any way cause similar corrupt practices to occur within the United States or its territories.

Quick Review

![]() Define GAAP.

Define GAAP.

![]() Name the four basic requirements to which all accounting rules must adhere.

Name the four basic requirements to which all accounting rules must adhere.

![]() What role does the FASB play?

What role does the FASB play?

The Accounting Cycle

The Accounting Cycle

accounting cycle set of activities involved in converting information and individual transactions into financial statements.

Accounting deals with financial transactions between a firm and its employees, customers, suppliers, and owners; bankers; and various government agencies. For example, payroll checks result in a cash outflow to compensate employees. A payment to a vendor results in receipt of needed materials for the production process. Cash, check, and credit purchases by customers generate funds to cover the costs of operations and to earn a profit. Prompt payment of bills preserves the firm's credit rating and its future ability to earn a profit. The procedure by which accountants convert data about individual transactions to financial statements is called the accounting cycle.

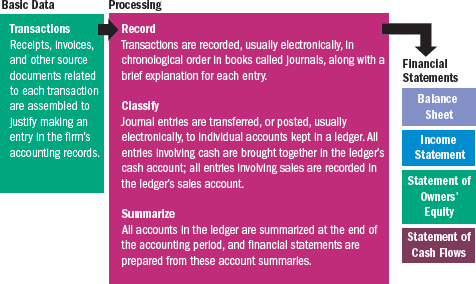

FIGURE 15.2 illustrates the activities involved in the accounting cycle: recording, classifying, and summarizing transactions. Initially, any transaction that has a financial impact on the business, such as wages or payments to suppliers, should be documented. All these transactions are recorded in journals, which list transactions in chronological order. Journal listings are then posted to ledgers. A ledger shows increases or decreases in specific accounts such as cash or wages. Ledgers are used to prepare the financial statements, which summarize financial transactions. Management and other interested parties use the resulting financial statements for a variety of purposes.

THE ACCOUNTING EQUATION

asset anything of value owned or leased by a business.

Three fundamental terms appear in the accounting equation: assets, liabilities, and owners' equity. An asset is anything of value owned or leased by a business. Assets include land, buildings, supplies, cash, accounts receivable (amounts owed to the business as payment for credit sales), and marketable securities.

Although most assets are tangible assets, such as equipment, buildings, and inventories, intangible possessions such as patents and trademarks are often some of a firm's most important assets. This kind of asset is especially essential for many companies, including computer software firms, biotechnology companies, and pharmaceutical companies. For instance, Johnson & Johnson—which has both biotechnology and pharmaceutical operations—reported more than $51 billion in intangible assets (including goodwill) in one recent year, out of a total of almost $121 billion in assets.6

liability anything owed to creditors—the claims of a firm's creditors.

Two groups have claims against the assets of a firm: creditors and owners. A liability of a business is anything owed to creditors—that is, the claims of a firm's creditors. When a firm borrows money to purchase inventory, land, or machinery, the claims of creditors are shown as accounts payable, notes payable, or long-term debt. Wages and salaries owed to employees also are liabilities (known as wages payable or accrued wages).

owners' equity the owner's initial investment in the business plus profits that were not paid out to owners over time in the form of cash dividends.

Owners' equity is the owner's initial investment in the business plus profits that were not paid out to owners over time in the form of cash dividends. A strong owners' equity position often is used as evidence of a firm's financial strength and stability.

Although tangible assets like buildings, equipment, and inventories may look impressive, they are sometimes less important to a company than intangible assets, such as patents and trademarks.

accounting equation formula that states that assets must equal liabilities plus owners' equity.

The accounting equation (also referred to as the accounting identity) states that assets must equal liabilities plus owners' equity. This equation reflects the financial position of a firm at any point in time:

![]()

Because financing comes from either creditors or owners, the right side of the accounting equation also represents the business's financial structure.

double-entry bookkeeping process by which accounting transactions are recorded; each transaction must have an offsetting transaction.

The accounting equation also illustrates double-entry bookkeeping—the process by which accounting transactions are recorded. Because assets must always equal liabilities plus equity, each transaction must have an offsetting transaction. For example, if a company increases an asset, either another asset must decrease, a liability must increase, or owners' equity must increase. So if a company uses cash to purchase inventory, one asset (inventory) is increased while another (cash) is decreased by the same amount. Similarly, a decrease in an asset must be offset by either an increase in another asset, a decrease in a liability, or a decrease in owners' equity. If a company uses cash to repay a bank loan, both an asset (cash) and a liability (bank loans) decrease, and by the same amount.

The relationship expressed by the accounting equation underlies development of the firm's financial statements. Three financial statements form the foundation of the financial statements: the balance sheet, the income statement, and the statement of owners' equity. The information found in these statements is calculated using the double-entry bookkeeping system and reflects the basic accounting equation. A fourth statement, the statement of cash flows, is also prepared to focus specifically on the sources and uses of cash for a firm from its operating, investing, and financing activities.

THE IMPACT OF COMPUTERS AND THE INTERNET ON THE ACCOUNTING PROCESS

For hundreds of years, bookkeepers recorded, or posted, accounting transactions as manual entries in journals. They then transferred the information, or posted it, to individual accounts listed in ledgers. Computers have streamlined the process, making it both faster and easier. For instance, point-of-sale terminals in retail stores perform a number of functions each time they record a sale. These terminals not only recall prices from computer system memory and maintain constant inventory counts of individual items in stock but also automatically perform accounting data entry functions.

Because the accounting needs of entrepreneurs and small businesses differ from those of larger firms, accounting software makers have designed programs that meet specific user needs. Some examples of accounting software programs designed for entrepreneurs and small businesses, and designed to run on personal computers, include QuickBooks, Peachtree, and BusinessWorks. Software programs designed for larger firms, often requiring more sophisticated computer systems, include products from Oracle and SAP.

For firms that conduct business worldwide, software producers have introduced new accounting programs that handle all of a company's accounting information for every country in which it operates. The software handles different languages and currencies as well as the financial, legal, and tax requirements of each nation in which the firm conducts business.

The Internet also influences the accounting process. Several software producers offer Web-based accounting products designed for small and medium-sized businesses. Among other benefits, these products allow users to access their complete accounting systems from anywhere using a standard Web browser.

Quick Review

![]() List the steps in the accounting cycle.

List the steps in the accounting cycle.

![]() What is the accounting equation?

What is the accounting equation?

![]() Explain how double-entry bookkeeping works.

Explain how double-entry bookkeeping works.

Financial Statements

Financial Statements

Financial statements provide managers with essential information they need to evaluate the liquidity position of an organization—its ability to meet current obligations and needs by converting assets into cash; the firm's profitability; and its overall financial health. The balance sheet, income statement, statement of owners' equity, and statement of cash flows provide a foundation on which managers can base their decisions. By interpreting the data provided in these statements, managers can communicate the appropriate information to internal decision makers and to interested parties outside the organization.

Of the four financial statements, only the balance sheet is considered to be a permanent statement; its amounts are carried over from year to year. The income statement, statement of owners' equity, and statement of cash flows are considered temporary because they are closed out at the end of each year.

Public companies are required to report their financial statements at the end of each three-month period as well as at the end of each fiscal year. Annual statements must be examined and verified by the firm's outside auditors. These financial statements are public information available to anyone. A fiscal year need not coincide with the calendar year, and companies set different fiscal years. For instance, Starbucks' fiscal year runs from October 1 to September 30 of the following year. Nike's fiscal year consists of the 12 months between June 1 and May 31. By contrast, GE's fiscal year is the same as the calendar year, running from January 1 to December 31.

The balance sheet shows the firm's financial position on a particular date and its amounts are carried over from year to year.

THE BALANCE SHEET

balance sheet statement of a firm's financial position on a particular date.

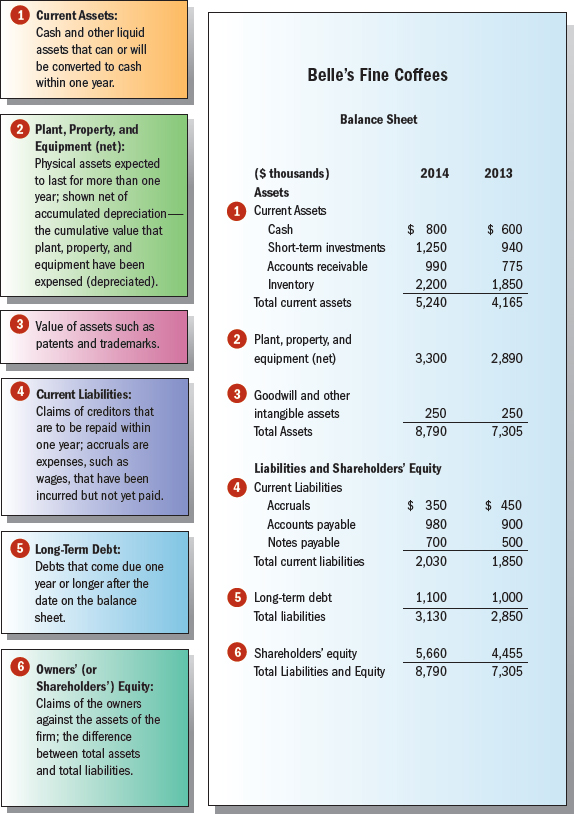

A firm's balance sheet shows its financial position on a particular date. It is similar to a photograph of the firm's assets together with its liabilities and owners' equity at a specific moment in time. Balance sheets must be prepared at regular intervals because a firm's managers and other internal parties often request this information every day, every week, or at least every month. On the other hand, external users, such as stockholders or industry analysts, may use this information less frequently, perhaps every quarter or once a year.

The balance sheet follows the accounting equation. On the left side of the balance sheet are the firm's assets—what it owns. These assets, shown in descending order of liquidity (in other words, convertibility to cash), represent the uses that management has made of available funds. Cash is always listed first on the asset side of the balance sheet.

On the right side of the equation are the claims against the firm's assets. Liabilities and shareholders' equity indicate the sources of the firm's assets and are listed in the order in which they are due. Liabilities reflect the claims of creditors—financial institutions or bondholders that have loaned the firm money; suppliers that have provided goods and services on credit; and others to be paid, such as federal, state, and local tax authorities. Shareholders' equity represents the owners' claims (those of stockholders, in the case of a corporation) against the firm's assets. It also amounts to the excess of all assets over liabilities.

FIGURE 15.3 shows the balance sheet for Belle's Fine Coffees, a small coffee wholesaler. The accounting equation is illustrated by the three classifications of assets, liabilities, and shareholders' equity on the company's balance sheet. Remember, total assets must always equal the sum of liabilities and shareholders' equity. In other words, the balance sheet must always balance.

THE INCOME STATEMENT

income statement financial record summarizing a firm's financial performance in terms of revenues, expenses, and profits over a given time period, such as a quarter or a year.

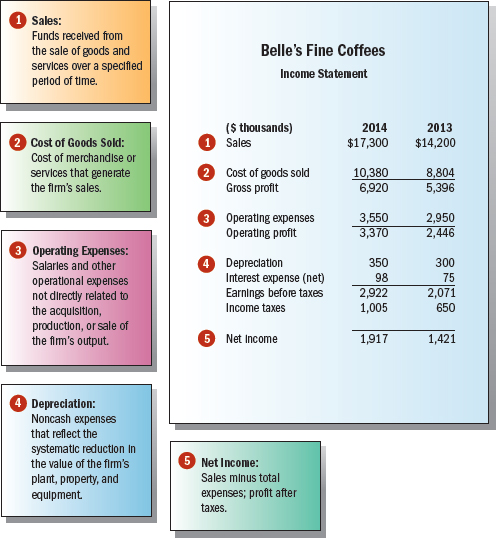

Whereas the balance sheet reflects a firm's financial situation at a specific point in time, the income statement indicates the flow of resources that reveals the performance of the organization over a specific time period. Resembling a video rather than a photograph, the income statement is a financial record summarizing a firm's financial performance in terms of revenues, expenses, and profits over a given time period, say, a quarter or a year.

In addition to reporting the firm's profit or loss results, the income statement helps decision makers focus on overall revenues and the costs involved in generating these revenues. Managers of a not-for-profit organization use this statement to determine whether its revenues from contributions, grants, and investments will cover its operating costs. Finally, the income statement provides much of the basic data needed to calculate the financial ratios managers use in planning and controlling activities. FIGURE 15.4 shows the income statement for Belle's Fine Coffees.

An income statement (some times called a profit-and-loss, or P&L, statement) begins with total sales or revenues generated during a month, a quarter, or a year. Subsequent lines then deduct all of the costs related to producing the revenues. Typical categories of costs include those involved in producing the firm's goods or services, operating expenses, interest, and taxes. After all of them have been subtracted, the remaining net income may be distributed to the firm's owners (stockholders, proprietors, or partners) or reinvested in the company as retained earnings. The final figure on the income statement—net income after taxes—is literally the bottom line.

Keeping costs under control is an important part of running a business. Too often, however, companies concentrate more on increasing revenue than on controlling costs. Regardless of how much money a company collects in revenues, it won't stay in business for long unless it eventually earns a profit.

STATEMENT OF OWNERS' EQUITY

statement of owners' equity record of the change in owners' equity from the end of one fiscal period to the end of the next.

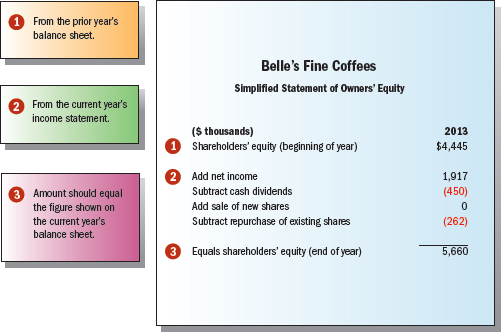

The statement of owners', or shareholders', equity is designed to show the components of the change in equity from the end of one fiscal year to the end of the next. It uses information from both the balance sheet and income statement. A somewhat simplified example is shown in FIGURE 15.5 for Belle's Fine Coffees.

Note that the statement begins with the amount of equity shown on the balance sheet at the end of the prior year. Net income is added, and cash dividends paid to owners are subtracted (both are found on the income statement for the current year). If owners contributed any additional capital, say, through the sale of new shares, this amount is added to equity. On the other hand, if owners withdrew capital, for example, through the repurchase of existing shares, equity declines. All of the additions and subtractions, taken together, equal the change in owners' equity from the end of the last fiscal year to the end of the current one. The new amount of owners' equity is then reported on the balance sheet for the current year.

FIGURE 15.5 Belle's Fine Coffees Simplified Statement of Owners' Equity (Fiscal Year Ending December 31)

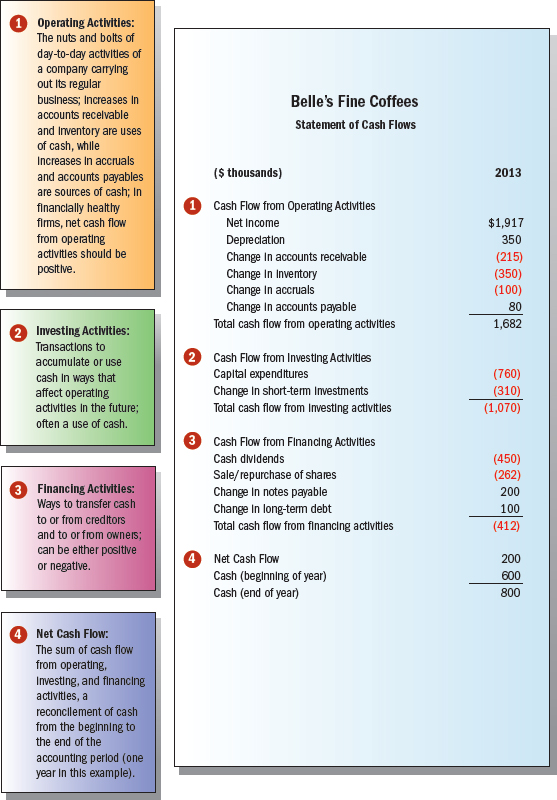

THE STATEMENT OF CASH FLOWS

In addition to the statement of owners' equity, the income statement, and the balance sheet, most firms prepare a fourth accounting statement—the statement of cash flows. Public companies are required to prepare and publish a statement of cash flows. In addition, commercial lenders often require a borrower to submit a statement of cash flows. The statement of cash flows provides investors and creditors with relevant information about a firm's cash receipts and cash payments for its operations, investments, and financing during an accounting period. FIGURE 15.6 shows the statement of cash flows for Belle's Fine Coffees.

accrual accounting accounting method that records revenues and expenses when they occur, not necessarily when cash actually changes hands.

Companies prepare a statement of cash flows due to the widespread use of accrual accounting. Accrual accounting recognizes revenues and costs when they occur, not when actual cash changes hands. As a result, there can be differences between what is reported as sales, expenses, and profits, and the amount of cash that actually flows into and out of the business during a period of time. An example is depreciation. Companies depreciate fixed assets—such as machinery and buildings—over a specified period of time, meaning that they systematically reduce the value of the asset. Depreciation is reported as an expense on the firm's income statement (see Figure 15.4) but does not involve any actual cash. The fact that depreciation is a noncash expense means that what a firm reports as net income (profits after tax) for a particular period actually understates the amount of cash the firm took in, less expenses, during that period of time. Consequently, depreciation is added back to net income when calculating cash flow.

The fact that cash flow is the lifeblood of every organization is evidenced by the business failure rate. Many owners of failed firms blame inadequate cash flow for their company's demise. Those who value the statement of cash flow maintain that its preparation and scrutiny by various parties can prevent financial distress for otherwise profitable firms, too many of which are forced into bankruptcy due to a lack of cash needed to continue day-to-day operations.

Even for firms for which bankruptcy is not an issue, the statement of cash flows can provide investors and other interested parties with vital information. For instance, assume that a firm's income statement reports rising earnings. At the same time, however, the statement of cash flows shows that the firm's inventory is rising faster than sales—often a signal that demand for the firm's products is softening, which may in turn be a sign of impending financial trouble.

Quick Review

![]() List the four financial statements.

List the four financial statements.

![]() How is a balance sheet organized?

How is a balance sheet organized?

![]() Define accrual accounting.

Define accrual accounting.

Financial Ratio Analysis

Financial Ratio Analysis

Accounting professionals fulfill important responsibilities beyond preparing financial statements. In a more critical role, they help managers interpret the statements by comparing data about the firm's current activities to those for previous periods and to results posted by other companies in the industry. Ratio analysis is one of the most commonly used tools for measuring a firm's liquidity, profitability, and reliance on debt financing, as well as the effectiveness of management's resource utilization. This analysis also allows comparisons with other firms and with the firm's own past performance.

LIQUIDITY RATIOS

A firm's ability to meet its short-term obligations when they must be paid is measured by liquidity ratios. Increasing liquidity reduces the likelihood that a firm will face emergencies caused by the need to raise funds to repay loans. On the other hand, firms with low liquidity may be forced to choose between default and borrowing from high-cost lending sources to meet their maturing obligations.

Two commonly used liquidity ratios are the current ratio and the acid-test, or quick, ratio. The current ratio compares current assets to current liabilities, giving executives information about the firm's ability to pay its current debts as they mature. The current ratio of Belle's Fine Coffees can be computed as follows (unless indicated, all amounts from the balance sheet or income statement are in thousands of dollars):

![]()

In other words, Belle's Fine Coffees has $2.58 of current assets for every $1.00 of current liabilities. In general, a current ratio of 2:1 is considered satisfactory liquidity. This rule of thumb must be considered along with other factors, such as the nature of the business, the season, and the quality of the company's management team. Belle's Fine Coffees' management and other interested parties are likely to evaluate this ratio of 2.58:1 by comparing it with ratios for previous operating periods and with industry averages.

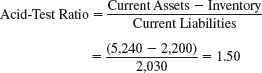

The acid-test (or quick) ratio measures the ability of a firm to meet its debt payments on short notice. This ratio compares quick assets—the most liquid current assets—against current liabilities. Quick assets generally consist of cash and equivalents, short-term investments, and accounts receivable. So, generally quick assets equal total current assets minus inventory.

Belle's Fine Coffees' current balance sheet lists total current assets of $5.24 million and inventory of $2.2 million. Therefore, its quick ratio is as follows:

Because the traditional rule of thumb for an adequate acid-test ratio is around 1:1, Belle's Fine Coffees appears to have a strong level of liquidity. However, the same cautions apply here as for the current ratio. The ratio should be compared with industry averages and data from previous operating periods to determine whether it is adequate for the firm.

ACTIVITY RATIOS

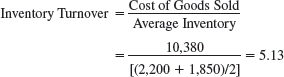

Activity ratios measure the effectiveness of management's use of the firm's resources. One of the most frequently used activity ratios, the inventory turnover ratio, indicates the number of times merchandise moves through a business:

Average inventory for Belle's Fine Coffees is determined by adding the inventory as of December 31 of the current year ($2.2 million) with the inventory as of December 31 of the previous year ($1.85 million) and dividing it by 2. Comparing the 5.13 inventory turnover ratio with industry standards gives a measure of efficiency. It is important to note, however, that inventory turnover can vary substantially, depending on the products a company sells and the industry in which it operates.

If a company makes a substantial portion of its sales on credit, measuring receivables turnover can provide useful information. Receivables turnover can be calculated as follows:

![]()

Because Belle's Fine Coffees is a wholesaler, let's assume that all of its sales are credit sales. Average receivables equals the simple average of current year's receivables and previous year's receivables. The ratio for the company is:

![]()

Dividing 365 by the figure for receivables turnover, 19.6, equals the average age of receivables, 18.62 days. Assume Belle's Fine Coffees expects its retail customers to pay outstanding bills within 30 days of the date of purchase. Given that the average age of its receivables is less than 30 days, Belle's Fine Coffees appears to be doing a good job collecting its credit sales.

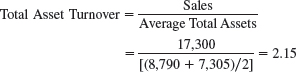

Another measure of efficiency is total asset turnover. It measures how much in sales each dollar invested in assets generates:

Average total assets for Belle's Fine Coffees equals total assets as of December 31 of the current year ($8.79 million) plus total assets as of December 31 of the previous year ($7.305 million) divided by 2.

Belle's Fine Coffees generates about $2.15 in sales for each dollar invested in assets. Although a higher ratio generally indicates that a firm is operating more efficiently, care must be taken when comparing firms that operate in different industries. Some industries simply require higher investment in assets than do other industries.

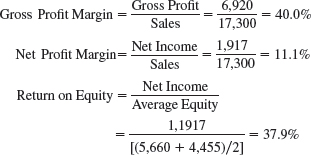

PROFITABILITY RATIOS

Some ratios measure the organization's overall financial performance by evaluating its ability to generate revenues in excess of operating costs and other expenses. These measures are called profitability ratios. To compute these ratios, accountants compare the firm's earnings with total sales or investments. Over a period of time, profitability ratios may reveal the effectiveness of management in operating the business. Three important profitability ratios are gross profit margin, net profit margin, and return on equity:

All of these ratios indicate positive evaluations of the current operations of Belle's Fine Coffees. For example, the net profit margin indicates that the firm realizes a profit of slightly more than 11 cents on each dollar of merchandise it sells. Although this ratio varies widely among business firms, Belle's Fine Coffees compares favorably with wholesalers in general, which have an average net profit margin of around 5 percent. However, like other profitability ratios, this ratio should be evaluated in relation to profit forecasts, past performance, or more specific industry averages to enhance the interpretation of results. Similarly, although the firm's return on equity of almost 38 percent appears outstanding, the degree of risk in the industry also must be considered.

Starbucks chairman and CEO Howard Schultz walks on stage to address Starbucks shareholders at a recent meeting and to discuss various topics. Return on equity may be one such topic.

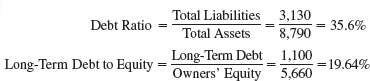

LEVERAGE RATIOS

Leverage ratios measure the extent to which a firm relies on debt financing. They provide particularly interesting information to potential investors and lenders. If management has assumed too much debt in financing the firm's operations, problems may arise in meeting future interest payments and repaying outstanding loans. As Chapter 17 points out, borrowing money does have advantages. However, relying too heavily on debt financing may lead to bankruptcy. More generally, both investors and lenders may prefer to deal with firms whose owners have invested enough of their own money to avoid overreliance on borrowing. The debt ratio and long-term debt to equity ratio help interested parties evaluate a firm's leverage:

A total liabilities to total assets ratio greater than 50 percent indicates that a firm is relying more on borrowed money than on owners' equity. Because Belle's Fine Coffees' total liabilities to total assets ratio is 35.6 percent, the firm's owners have invested considerably more than the total amount of liabilities shown on the firm's balance sheet. Moreover, the firm's long-term debt to equity ratio is only 19.64 percent, indicating that Belle's Fine Coffees has only about 19.6 cents in long-term debt to every dollar in equity. The long-term debt to equity ratio also indicates that Belle's Fine Coffees hasn't relied very heavily on borrowed money.

The four categories of financial ratios relate balance sheet and income statement data to one another, help management pinpoint a firm's strengths and weaknesses, and indicate areas in need of further investigation. Large multiproduct firms that operate in diverse markets use their information systems to update their financial ratios every day or even every hour. Each company's management must decide on an appropriate review schedule to avoid the costly and time-consuming mistake of overmonitoring.

In addition to calculating financial ratios, managers, investors, and lenders should pay close attention to how accountants apply a number of accounting rules when preparing financial statements. GAAP gives accountants leeway in reporting certain revenues and expenses. Public companies are required to disclose, in footnotes to the financial statements, how the various accounting rules were applied.

Quick Review

![]() List the four categories of financial ratios.

List the four categories of financial ratios.

![]() Define the following ratios: current ratio, inventory turnover, net profit margin, and debt ratio.

Define the following ratios: current ratio, inventory turnover, net profit margin, and debt ratio.

Budgeting

Budgeting

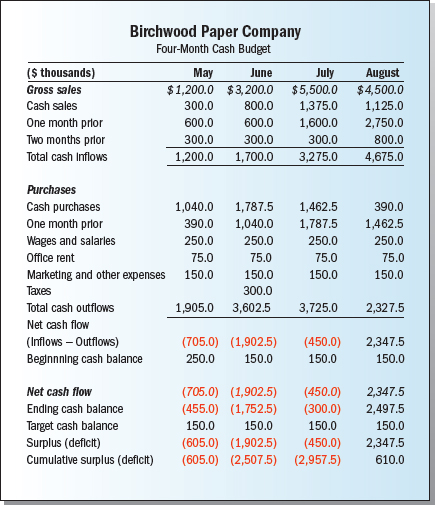

budget a planning and controlling tool that reflects the firm's expected sales revenues, operating expenses, and cash receipts and outlays.

Although the financial statements discussed in this chapter focus on past business activities, they also provide the basis for planning in the future. A budget is a planning and controlling tool that reflects the firm's expected sales revenues, operating expenses, and cash receipts and outlays. It quantifies the firm's plans for a specified future period. Because it reflects management estimates of expected sales, cash inflows and outflows, and costs, the budget is a financial blueprint and can be thought of as a short-term financial plan. It becomes the standard for comparison against actual performance.

Budget preparation is frequently a time-consuming task that involves many people from various departments within the organization. The complexity of the budgeting process varies with the size and complexity of the organization. Large corporations such as United Technologies, Paramount Pictures, and Verizon maintain complex and sophisticated budgeting systems. Besides being planning and controlling tools, their budgets help managers integrate their numerous divisions. But budgeting in both large and small firms is similar to household budgeting in its purpose: to match income and expenses in a way that accomplishes objectives and correctly times cash inflows and outflows.

Because the accounting department is an organization's financial nerve center, it provides many of the data for budget development. The overall master, or operating, budget is actually a composite of many individual budgets for separate units of the firm. These individual budgets typically include the production budget, the cash budget, the capital expenditures budget, the advertising budget, the sales budget, and the travel budget. When you travel for business, you are responsible for keeping track of and recording your own financial transactions for the purpose of preparing your expense report.

Technology has improved the efficiency of the budgeting process. The accounting software products discussed earlier—such as QuickBooks—all include budgeting features. Moreover, modules designed for specific businesses are often available from third parties. Many banks now offer their customers personal financial management tools (PFMs) developed by software companies. Whether or not your bank offers PFM, there are many providers offering low or no cost software to help individuals and businesses keep track of their finances. Many of these software solutions integrate with smart phones and tablets allowing consumers to manage their finances remotely.7

One of the most important budgets prepared by firms is the cash budget. The cash budget, usually prepared monthly, tracks the firm's cash inflows and outflows. FIGURE 15.7 illustrates a sample cash budget for Birchwood Paper, a small paper products company. The company has set a $150,000 target cash balance. The cash budget indicates months in which the firm will need temporary loans—May, June, and July—and how much it will need (close to $3 million). The document also indicates that Birchwood will generate a cash surplus in August and can begin repaying the short-term loan. Finally, the cash budget produces a tangible standard against which to compare actual cash inflows and outflows.

Quick Review

![]() What is a budget?

What is a budget?

![]() How is a cash budget organized?

How is a cash budget organized?

International Accounting

International Accounting

Today, accounting procedures and practices must be adapted to accommodate an international business environment. The Coca-Cola Company and McDonald's both generate more than half their annual revenues from sales outside the United States. Nestlé, the giant chocolate and food products firm, operates throughout the world. It derives 98 percent of its revenues from outside Switzerland, its home country. International accounting practices for global firms must reliably translate the financial statements of the firm's international affiliates, branches, and subsidiaries and convert data about foreign currency transactions to dollars. Also, foreign currencies and exchange rates influence the accounting and financial reporting processes of firms operating internationally.

INTERNATIONAL ACCOUNTING STANDARDS

International Accounting Standards Board (IASB) organization established in 1973 to promote worldwide consistency in financial reporting practices.

International Financial Reporting Standards (IFRS) standards and interpretations adopted by the IASB.

The International Accounting Standards Committee (IASC) was established in 1973 to promote worldwide consistency in financial reporting practices and soon developed its first set of accounting standards and interpretations. In 2001, the IASC became the International Accounting Standards Board (IASB). International Financial Reporting Standards (IFRS) are the standards and interpretations adopted by the IASB. The IASB operates in much the same manner as the FASB does in the United States, interpreting and modifying IFRS.

Because of the boom in worldwide trade, there is a real need for comparability of and uniformity in international accounting rules. Trade agreements such as NAFTA and the expansion of the European Union have only heightened interest in creating a uniform set of global accounting rules. In addition, an increasing number of investors are buying shares in foreign multinational corporations, and they need a practical way to evaluate firms in other countries. To assist global investors, more and more firms are beginning to report their financial information according to international accounting standards. This practice helps investors make informed decisions.

How does IFRS differ from GAAP? Although many similarities exist, they have some important differences. For example, under GAAP plant, property, and equipment are reported on the balance sheet at the historical cost minus depreciation. Under IFRS, on the other hand, plant, property, and equipment are shown on the balance sheet at current market value. This gives a better picture of the real value of a firm's assets. Many accounting experts believe IFRS is less complicated than GAAP overall and more transparent.8

Quick Review

![]() What is the IASB and what is its purpose?

What is the IASB and what is its purpose?

![]() Why is uniformity in international accounting rules important?

Why is uniformity in international accounting rules important?

What's Ahead?

This chapter describes the role of accounting in an organization. The next two chapters discuss the finance function of an organization: the planning, obtaining, and managing of an organization's funds to accomplish its objectives efficiently and effectively. Chapter 16 outlines the financial system, the system by which funds are transferred from savers to borrowers. Chapter 17 discusses the role of finance and the financial manager in an organization.

Weekly Updates spark classroom debate around current events that apply to your business course topics. http://www.wileybusinessupdates.com

NOTES

1. Jason Bramwell, “Community Service Is a Responsibility BKD Takes Full Throttle,” AccountingWeb, June 3, 2013, http://www.accountingweb.com; company Web site, www.bkd.com, accessed May 20, 2013.

2. Bureau of Labor Statistics, Occupational Outlook Handbook, 2012–2013, http://data.bls.gov, accessed May 20, 2013.

3. National Association of Colleges and Employers, Job Outlook 2013, http://www.naceweb.org, accessed June 10, 2013.

4. AARP Foundation Tax-Aide Locator, http://www.aarp.org, accessed May 20, 2013.

5. “2013 Accounting Today Top 100 Firms & Regional Leaders,” March 11, 2013, http://digital.accountingtoday.com.

6. Company Web site, Johnson & Johnson, “2012 Historical Financial Review,” http://www.investor.jnj.com, accessed June 10, 2013.

7. Jill Duffy, “The Best Personal Finance Software,” PCMag.com, May 16, 2013, http://www.pcmag.com.

8. Ra'id Marie, “IFRS vs. GAAP—What Does This Have to Do with the Financial Crisis?” Meirc Training and Consulting, http://www.meirc.com, accessed May 20, 2013; Michael Cohn, “Investors Predict U.S. Will Adopt IFRS,” Accounting Today, November 16, 2012, http://www.accountingtoday.com.

CHAPTER FIFTEEN: REVIEW

Summary of Learning Objectives

![]() Discuss the users of accounting information.

Discuss the users of accounting information.

Accountants measure, interpret, and communicate financial information to parties inside and outside the firm to support improved decision making. Accountants gather, record, and interpret financial information for management. They also provide financial information on the status and operations of the firm for evaluation by outside parties, such as government agencies, stockholders, potential investors, and lenders. Accounting plays key roles in financing activities, which help start and expand an organization; investing activities, which provide the assets it needs to continue operating; and operating activities, which focus on selling goods and services and paying expenses incurred in regular operations.

accounting process of measuring, interpreting, and communicating financial information to enable people inside and outside the firm to make informed decisions.

![]() Describe accounting professionals.

Describe accounting professionals.

Public accountants provide accounting services to other firms or individuals for a fee. They are involved in such activities as auditing, tax return preparation, management consulting, and accounting system design. Management accountants collect and record financial transactions, prepare financial statements, and interpret them for managers in their own firms. Government and not-for-profit accountants perform many of the same functions as management accountants, but they analyze how effectively the organization or agency is operating, rather than its profits and losses.

public accountant one who provides accounting services to individuals or business firms for a fee.

![]() Identify the foundation of the accounting system.

Identify the foundation of the accounting system.

The foundation of the accounting system in the United States is GAAP (generally accepted accounting principles), a set of guidelines or standards that accountants follow. There are four basic requirements to which all accounting rules should adhere: consistency, relevance, reliability, and comparability. The Financial Accounting Standards Board (FASB), an independent body made up of accounting professionals, is primarily responsible for evaluating, setting, and modifying GAAP. The U.S. Securities and Exchange Commission (SEC) also plays a role in establishing and modifying accounting standards for public companies, firms whose shares are traded in the financial markets.

generally accepted accounting principles (GAAP) guidelines on the conventions, rules, and procedures for determining acceptable accounting and financial reporting practices.

Financial Accounting Standards Board (FASB) an organization responsible for evaluating, setting, or modifying GAAP in the United States.

Foreign Corrupt Practices Act federal law that prohibits U.S. citizens and companies from bribing foreign officials in order to win or continue business.

![]() Outline the steps in the accounting cycle.

Outline the steps in the accounting cycle.

The accounting process involves recording, classifying, and summarizing data about transactions and then using this information to produce financial statements for the firm's managers and other interested parties. Transactions are recorded chronologically in journals, posted in ledgers, and then summarized in accounting statements. Today, much of this activity takes place electronically. The basic accounting equation states that assets (what a firm owns) must always equal liabilities (what a firm owes creditors) plus owners' equity. This equation also illustrates double-entry bookkeeping, the process by which accounting transactions are recorded. Under double-entry bookkeeping, each individual transaction must have an offsetting transaction.

accounting cycle set of activities involved in converting information and individual transactions into financial statements.

asset anything of value owned or leased by a business.

liability anything owed to creditors—the claims of a firm's creditors.

owners' equity the owner's initial investment in the business plus profits that were not paid out to owners over time in the form of cash dividends.

accounting equation formula that states that assets must equal liabilities plus owners' equity.

![]()

double-entry bookkeeping process by which accounting transactions are recorded; each transaction must have an offsetting transaction.

![]() Explain financial statements.

Explain financial statements.

- The balance sheet shows the financial position of a company on a particular date. The three major classifications of balance sheet data are the components of the accounting equation: assets, liabilities, and owners' equity.

- The income statement shows the results of a firm's operations over a specific period. It focuses on the firm's activities—its revenues and expenditures—and the resulting profit or loss during the period. The major components of the income statement are revenues, cost of goods sold, expenses, and profit or loss.

- The statement of owners' equity shows the components of the change in owners' equity from the end of the prior year to the end of the current year.

- The statement of cash flows records a firm's cash receipts and cash payments during an accounting period. It outlines the sources and uses of cash in the basic business activities of operating, investing, and financing.

balance sheet statement of a firm's financial position on a particular date.

income statement financial record summarizing a firm's financial performance in terms of revenues, expenses, and profits over a given time period, such as a quarter or a year.

statement of owners' equity record of the change in owners' equity from the end of one fiscal period to the end of the next.

statement of cash flows statement showing the sources and uses of cash during a period of time.

accrual accounting method that records revenues and expenses when they occur, not necessarily when cash actually changes hands.

![]() Discuss financial ratio analysis.

Discuss financial ratio analysis.

Financial ratios help managers and outside evaluators compare a firm's current financial information with that of previous years and with results for other firms in the same industry.

- Liquidity ratios measure a firm's ability to meet short-term obligations. Examples are the current ratio and the quick, or acid-test, ratio.

- Activity ratios— such as the inventory turnover ratio, accounts receivable turnover ratio, and the total asset turnover ratio—measure how effectively a firm uses its resources.

- Profitability ratios assess the overall financial performance of the business. The gross profit margin, net profit margin, and return on owners' equity are examples of profitability ratios.

- Leverage ratios, such as the total liabilities to total assets ratio and the long-term debt to equity ratio, measure the extent to which the firm relies on debt to finance its operations.

![]() Describe the role of budgeting.

Describe the role of budgeting.

Budgets are financial guidelines for future periods and reflect expected sales revenues, operating expenses, and cash receipts and outlays. They reflect management expectations for future occurrences and are based on plans that have been made. Budgets are important planning and controlling tools because they provide standards against which actual performance can be measured. One important type of budget is the cash budget, which estimates cash inflows and outflows over a period of time.

budget a planning and controlling tool that reflects the firm's expected sales revenues, operating expenses, and cash receipts and outlays.

![]() Outline international accounting practices.

Outline international accounting practices.

The International Accounting Standards Board (IASB) was established to provide worldwide consistency in financial reporting practices and comparability of and uniformity in international accounting standards. It has developed International Financial Reporting Standards (IFRS). Many countries have already adopted IFRS, and the United States is in the process of making the transition to it.

International Accounting Standards Board (IASB) organization established in 1973 to promote worldwide consistency in financial reporting practices.

International Financial Reporting Standards (IFRS) standards and interpretations adopted by the IASB.

Quick Review

LO1

![]() Who uses accounting information?

Who uses accounting information?

![]() What three business activities involve accounting?

What three business activities involve accounting?

LO2

![]() List the three services offered by public accounting firms.

List the three services offered by public accounting firms.

![]() What tasks do management accountants perform?

What tasks do management accountants perform?

LO3

![]() Define GAAP.

Define GAAP.

![]() Name the four basic requirements to which all accounting rules must adhere.

Name the four basic requirements to which all accounting rules must adhere.

![]() What role does the FASB play?

What role does the FASB play?

LO4

![]() List the steps in the accounting cycle.

List the steps in the accounting cycle.

![]() What is the accounting equation?

What is the accounting equation?

![]() Explain how double-entry bookkeeping works.

Explain how double-entry bookkeeping works.

LO5

![]() List the four financial statements.

List the four financial statements.

![]() How is a balance sheet organized?

How is a balance sheet organized?

![]() Define accrual accounting.

Define accrual accounting.

LO6

![]() List the four categories of financial ratios.

List the four categories of financial ratios.

![]() Define the following ratios: current ratio, inventory turnover, net profit margin, and debt ratio.

Define the following ratios: current ratio, inventory turnover, net profit margin, and debt ratio.

LO7

![]() What is a budget?

What is a budget?

![]() How is a cash budget organized?

How is a cash budget organized?

LO8

![]() What is the IASB and what is its purpose?

What is the IASB and what is its purpose?

![]() Why is uniformity in international accounting rules important?

Why is uniformity in international accounting rules important?