Liquidity

Perhaps one of the most underappreciated advantages of the rational portfolio is its excellent liquidity. The rational portfolio will outperform most actively managed portfolios in the long run, while being tax efficient and tailored to our individual risk profile. But it is also advantageous from a liquidity perspective.

Liquidity is one of those things you mainly hear about in a negative context because things went wrong and there wasn’t enough of it. The rational portfolio is also affected by liquidity issues in the market; times of decreasing liquidity are typically synonymous with declining markets. And the rational portfolio with some risky equity exposure will probably lose money in declining markets, like most other portfolios with risky assets. But compared to most portfolios the rational portfolio is less at risk from a liquidity perspective as the index-tracking investments are very liquid.

The importance of having liquidity in your portfolio depends on your circumstances. One friend commented to me that liquidity is his number one requirement when considering new investments, while some endowments and foundations have predicted their capital needs decades into the future and are more relaxed about being able to sell their investments for cash within days or hours. Most investors are perhaps between the two extremes regarding liquidity requirements. Some investments that are meant to be held for the very long term, perhaps for retirement, but there is also a desire to have available liquidity for unexpected needs.

Selling your investment

Liquidity is really a question of how quickly you can transact your investment portfolio. If you hold 10,000 shares in Microsoft that may be a lot of money to you (about $300,000 at the time of writing) and a significant share of your investment portfolio. But if you needed to sell the stock, you could do so in minutes without moving the share price. Around 50 million Microsoft shares trade every day so your entire holding represents a tiny portion of a day’s volume.

If on the other hand you owned $300,000 worth of shares in a company that trade only $100,000 worth of stock every day, then you would have a problem if you needed the money quickly. Let’s say the share price is $20 and there are 5,000 shares traded every day, then you own about three days’ volume of the stock. But as a rule of thumb you can trade about 10% of the average volume of a stock without affecting the price too much, so in normal markets you would own 30 days’ volume of shares, not three.

Suppose you were looking at your illiquid investments in the middle of a crisis like the one in 2008–09. You knew that the stock was illiquid, but in your mind there was no need to sell quickly. You had other stocks and generally felt good about the portfolio.

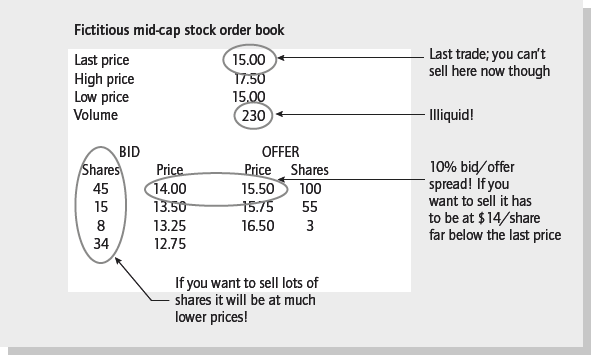

Now the world has changed and you need liquidity. You look at this stock and to your horror see that it is no longer a $20 stock, but a $15 one (see Figure 12.1). But not only has the $300,000 investment become a $225,000 one, but the liquidity in the market has dried up, and the bid/offer spread has widened massively.1 To make matters worse the bid/offer spread looks erratic and selling now will really affect the share price. These are panic markets and everyone worries that there is something about the company that they don’t know. They are jumpy at any suggestion of bad news, including the prospect of other investors needing liquidity – why are they selling? Who knows how low a stock like this one can fall?

You are now panicking. The value of the company and your ability to raise cash from selling the stock is evaporating simultaneously. If you didn’t before, you now certainly realise why you should have a broadly diversified portfolio and not just be holding potentially illiquid investments. But not only that, this is probably all happening at the same time as everything else is going wrong in your life.

A similar version of this could be faced by the manager of a fund that invests in small- and medium-sized companies facing redemptions from many investors. While she has more stocks that she can choose to liquidate from, she also has more potential investors that want to sell when things are bad (and if she sold only the most liquid stock, the remaining portfolio would be even less liquid). So even if you are one of the investors in the fund who doesn’t have to liquidate in the crisis, the performance of your investment will still be hurt as other investors in the fund scramble for the door.

Compare that to the Microsoft investors. They have also taken a hit as the stock is down of about the same magnitude as the smaller company, but although liquidity has also declined, they can still realise the value of their holdings quickly. And when panic hits the market, cash is truly king!

Minimal risk liquidity

The minimal risk asset consists of high-credit-quality government bonds. There are literally trillions of dollars of these government bonds outstanding and many billions in each currency and maturity, and the trading of them is extremely liquid. But also, consider for a moment what actually happens during a crisis. People sell their risky assets like equity investments, sometimes in a complete panic, and realise cash from their investments. The cash from the sale will be deposited into an account with their bank or custodian once the trade has settled. Now what? Particularly after the last few crises many people are, quite rightly, not content to leave a lot of cash sitting in an account; they want to move the money into something secure. And there are no investable assets more secure than the minimal risk asset.

As a result of the flight to safety that happens during any crisis the value of the minimal risk asset typically goes up in value with the longer-term bonds experiencing the greatest gains.2 People worry less about the low return on offer and more about not losing more money. Minimal risk assets become like a bullet-proof insurance policy and they often go up in value.

The equity portfolio and ‘risky’ bonds are highly liquid

The world equity portfolio is among the most liquid of investments you can find. Let’s remind ourselves that a large fraction of the world equity portfolio consists in part of the largest traded companies in the largest economies of the world. As a result the portfolio consist of companies like Apple, Exxon, Vodafone, PetroChina, General Electric, Nestlé, Google, IBM, Royal Dutch Shell, Petrobras, etc. While you also have some exposure to smaller companies in the broadest equity indices, the proportion of those stocks in the portfolio is far below what it would be in a portfolio of exclusively small- or medium-sized companies.

Unless you have an investment portfolio the size of a sovereign wealth fund there should not be much of a liquidity concern with the world equity portfolio. Even if the values of your holding are dropping, you would be able to liquidate your portfolio in far less than a day without causing price movements.

Likewise the liquidity of a rational portfolio that includes sub-AA rated government bonds and corporate bonds is very good. As with the case of the broad equity indices, these are broad and diversified exposures. The underlying securities in these exposures are mainly individually liquid and considering that each security only represents a small fraction of the overall portfolio, the aggregate risky government and corporate bond exposure is very liquid as a result. But not only that. For many index-tracking products, ‘authorised participants’ (think of them as brokers or market makers) are actually able to ‘disaggregate’ the tracker into its constituent parts, ensuring liquidity. So if the authorised participants held an exchange traded fund (ETF) of the FTSE 100, instead of holding the tracker, they have the choice of getting the underlying 100 stocks instead, ensuring that other market participants have similar liquidity. You therefore indirectly have the choice of the liquidity of the index tracking FTSE 100 ETF or the liquidity of the underlying 100 stocks.

The exposure of the rational portfolio is indirectly an exposure to literally thousands of underlying securities all over the world. While the rational portfolio will suffer in falling markets, along with the rest of the world, the exposure to liquidity issues is far more limited.

Since liquidity only ever seems important when you don’t have it we forget about it in our daily lives. Most people don’t live their lives like a portfolio manager with live prices feeding into an excel spreadsheet, and live updates on volume statistics. We look at our portfolio on occasion and perhaps pay more attention when we add to it or sell something, or when there are major price movements. Otherwise we leave it and get on with our lives.

By having our equity exposure in a large and broad index, like the world equity index, we avoid taking a liquidity risk that is incredibly real, but typically only rears its head when we really don’t want it to. If you hold in your portfolio a number of smaller companies, property, private equity investments, private investments, etc. then make sure you understand what your liquidity position would be in the case of a crisis with its typically resulting liquidity squeeze.

Getting paid – illiquid investments should generate better returns

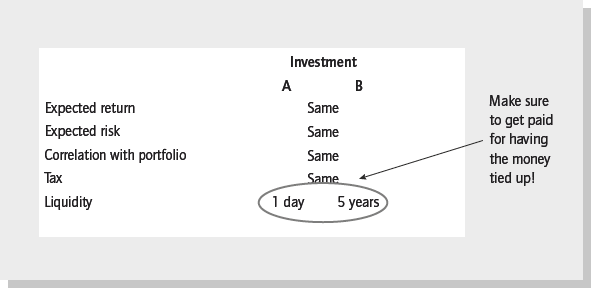

Investors need to be paid for the lack of liquidity. Imagine the scenario where you have two investments that are very similar. Both have the same risk/return profile, tax profile, and diversifying effect on our portfolio. I now tell you that you can unwind one of them today, but that you have to hold the other one for five years or potentially longer, as you do in most private equity or many property investments. Hopefully, it’s obvious that you would rather have the option of cashing out of your investment, even if you don’t use that option. The illiquid five-year investment needs something else to make it as attractive as the liquid investment (see Figure 12.2).

In some illiquid investments there is virtually no price to get out at (traders would say there is ‘no bid’ to buy the investment). Because of this, illiquid investments have to offer a return premium which compensates you for the fact that your money is tied up. The size of the premium demanded by investors varies a great deal. For me personally, the world is just too uncertain a place and the potential future opportunities for my money too great for me to want to sign up for something which ties up capital for five years unless there are massive expected returns. But people differ. If you know that you don’t need the money for 20 years or have only a small fraction of your assets invested in illiquid assets, then perhaps there is less of an issue with tying capital up for longer periods of time.

The example above points to one of the main issues I have with private equity, property, private investments or long-term investments. But structured products or hedge funds are not immune to liquidity issues either. During the 2008–09 crisis many hedge funds suspended redemptions as the underlying investments the fund had made were out of sync with the liquidity terms of the investors. As a result of the hedge funds’ failure to honour their liquidity terms, many investors were left in a bind.

While comparing products with easy daily liquidity, like products for the rational portfolio, to alternatives with five-year lock-ups may seem unfair, finance literature is often guilty of simplifying the issue. Certain works will say things like ‘buy a UK small-cap index or emerging markets mid-cap fund’ sometimes without discussing the liquidity constraints and issues with those products.

Liquidity rethought

Just as tax is a topic which is difficult to generalise, individual liquidity concerns vary a great deal. But while this is the case, investors must look closely at the overall liquidity of their investment portfolio and consider how drastic changes in their ability to realise the value of their investments would affect them. There is a great tendency for liquidity to be something we consider only when we are forced to do so, and that is rarely at an opportune moment.

Furthermore, the potential risk of being caught short of liquidity in some investments increases the attractiveness of very liquid and broad portfolios like the rational portfolio, without compromising the return expectation. I imagine that some people underestimate the importance of these issues and hope that they are never forced to face them. But in the unfortunate case that you need to raise capital quickly, the ownership of the most liquid instruments on offer will lessen the distress caused by having to sell.

1 The bid/offer spread is the difference between what you can buy the stock at and what you can sell it for.

2 In the panic, investors demand lower interest rates for the security of these bonds. For short-term bonds the price rally will be limited as the bonds will already be trading at close to par, but longer-term bonds could rally more substantially.