Before You Choose an Activity

Learning About Your Product Users

Introduction

When starting work on a new project, your first objectives are to learn about the product (if it already exists), domain, and (target) users. It is key for you to ascertain as much as possible about any existing products and domain in terms of functionality, competitors, and customers so you do not duplicate work or spend time generating knowledge that already exists. This is done by using the product yourself; reading customer support comments, social sentiment analysis, log files, and web analytics; speaking with your marketing department; conducting a competitive analysis; and getting feedback from early adopters or partners (e.g., trusted testers). In addition, you need to assess what is currently understood about the users and begin to create user profiles. This information will enable you to choose appropriate user research activities, so you can ultimately improve your product. In this chapter, we will detail how to collect product information from a variety of sources and how to make sense of the information readily available to you. We will also discuss how to create user profiles, personas, scenarios, guiding principles, and antiprinciples and how to use these as design tools, so you can maximize the impact of your research. Finally, we discuss special user types that you should keep in mind when designing your product: international users, challenged users, children, and older adults.

Existing Research

It is a rare situation when people cannot learn something about their product domain by conducting a literature review. A search of a database dedicated to academic publications like Google Scholar can often yield insights that can jump-start your product development. You may be able to access some articles and patents for free, but other resources such as copyright-protected articles, will require a fee. You or your institution may be a member of an organization that provides access to certain resources. For example, if you are an ACM member, you have access to the ACM portal. If you work for a university, you will have access to many publications via your library.

Even if you do not have a membership, the process of searching can inform you of alternative terminology, related topics/domains, and new ways of thinking about your product. For example, when Kathy began working on a new domain (e-discovery) for Google, she began by doing a Google Scholar search for “e-discovery” and found some research articles. A general web search helped her identify alternative terms (e.g., ESI, digital forensics, spoliation) to do further searches on and expanded her understanding of the domain. Journal articles on your topic can also identify standardized questions for your future research.

Learn About Your Product

Before you even begin working with a single user, you need to understand the domain you are working in. We cannot stress enough how important it is to do your homework before jumping into one of the user research activities described in this book. You may be extremely pressed for time and think you can learn the domain while you are collecting data from users. Big mistake! You will need to answer many questions for yourself. What are the key planned or available functions of the product? Who are the competitors? Are there any known issues with the product? Who are the product’s perceived users? In addition to helping you collect effective requirements, this knowledge will also earn you necessary respect and trust from the product team (refer to Chapter 1, “Become a Virtual Team Member” section, page 19).

We hope that the product team you are working with is composed of experts in the domain and that they have done their homework as well, but this is not always the case. Particularly with new products, the product team is learning about the users and the domain at the same time as you. It is important to interview the product team and learn everything you can from them, but you must also supplement that information with data from other sources. In addition, the more you know about the product and domain, the more respect you get from the product team. If you are new to the domain, you may never know as much as an expert product manager; however, there are always some fundamentals they will expect you to know or to pick up quickly. In the very beginning, you can get away with being naive, but with time, stakeholders will expect you to understand what they are talking about.

Keep in mind that this section of the chapter is not intended to tell you what to do instead of conducting user research. It is intended to tell you about some of the research you will want to conduct before you even consider running a user research activity.

If you do not have a background in usability or user experience research, you will need to be aware of some of the founding principles. You need to understand what questions can be answered by a user experience research activity and what questions a design professional should answer.

Data are out there that can help you learn a lot about your product, if it currently exists. If it does not, you may be limited to a literature review and a competitive analysis (see page 32). In this section, we tell you how you can use log files, marketing, customers, and general research to help you become a domain expert.

Use Your Product

The best way to learn about your product is to use it (if it already exists). In the case of a travel app, you should search for a hotel and flight, make a reservation, cancel your reservation, ask for help, etc. Stretch the product to its limits. Be sure to note possible pain points so you spot them if your participants encounter them as well. It will be easier to identify patterns if you have some ideas of what to look for.

Networking

You are surrounded by people who know about your product and domain; you just have to get to know them. If you work at a company, start by finding out if it has ever conducted user research in the past (in-house or hired a vendor). Read any existing research reports to see if there are known issues and/or existing user requirements. Meet the content writers for the company. These are the folks who create the user manuals and online help (for websites and web applications). Ask them what is difficult to document. Is it because it is difficult to articulate, or is the product itself too complicated to explain?

If you work in academia, or if your company offers training courses, attend classes and speak with the folks who teach the courses. What is hard to teach? What types of question are users asking? What tips (not documented) are the instructors offering?

Customer Support Comments

If you are working on a product that already has an existing version and your company has a help desk or customer support group, you can learn a great deal about your product by visiting that department. If you work independently, you can often find customer comments available online.

People rarely call or e-mail with compliments to tell a company how wonderful their product is, so customer calls pertain to issues you should become familiar with. If you can access logs of customer questions, problems, and complaints over time, you will see trends of difficulties users are encountering. Perhaps the user’s manual or help is not helpful enough. Perhaps the product has a bug that was not captured during quality assurance (QA), or perhaps users do not like or cannot figure out a feature the product team thought every user had to have. This can give you a sense of where you will need to focus your efforts to improve the product.

Users may not be able to accurately describe the problem they are having or may misdiagnose the cause. Likewise, customer support may not have experience with the product under consideration. Although this should never be the case, it often is. If your support staff is not very familiar with the product in question, they may also misdiagnose the cause of the customer’s problem or may not capture the issue correctly. This means that once you have a log of customer feedback, you may need to conduct interviews or field studies with users to get a full understanding of the issues.

Social Sentiment Analysis

People could be talking about your product and brand right now! According to the Pew Research Center’s Internet and American Life Project, 73% of American online adults use social media (as of September 2013). Ninety-five percent of people say they share bad product experiences online and 45% share bad customer service experiences via Facebook, Twitter, and other platforms (Costa et al., 2013). However, 87% say they share good customer service interactions online, too. So whether you know it or not, you have a presence on social media.

Does your company have a Facebook or Google Plus page? A Twitter feed? If so, speak with the people at your company whose job it is to respond to user comments, often called “community managers” or the like. Whether you have a formal presence on a social networking site or not, do a search of the various sites and see what people have said. Using a tool like Radian6, Crimson Hexagon, Sysomos, or Clarabridge, you can analyze the sentiment of those comments. Using these tools, you can:

■ Learn what users are saying right now

■ Learn what users say they like and do not like about your product/service

■ Learn emerging trends or topics

■ See where your users are that are talking about you

■ Track how your customer base is changing over time and in response to campaigns

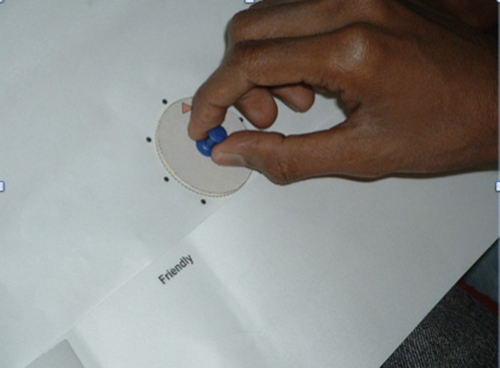

Figure 2.1 shows a photo of the Clemson University Social Media Listening Center as an example of what you might see. These tools can take a first pass at detecting positive and negative sentiment, but many will be labeled as “unknown.” You will have to manually review those and mark them as positive or negative. Good tools will learn based on your feedback, but be wary of sarcasm and slang, as many tools are unable to accurately categorize them.

Log Files and Web Analytics

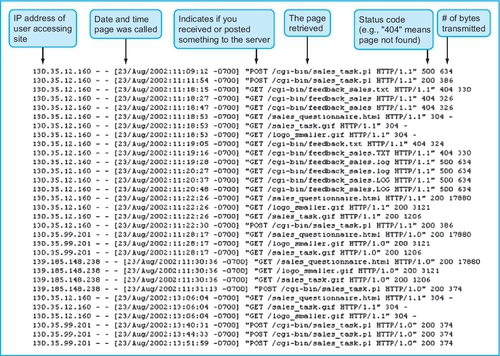

If you are responsible for the usability of a website, web server log files may provide an interesting perspective for you. When a file is retrieved from a website, server software keeps a record of it. The server stores this information in the form of text files.

The information contained in a log file varies but will typically include the source of a request, the file requested, the date and time of the request, the content type and length of the transferred file, the referring page, the user’s browser and platform, and error messages. Figure 2.2 shows a sample of a server log file.

Services like Google Analytics are available that capture user behavior across your site by implanting code on the website. There are also analytics tools to give more insight into what happens within pages (e.g., Crazy Egg, ClickTale) by recording user actions within a page in a more fine-grained way. However, you may need to work with your organization’s IT department to collect log data, store it, and extract it in order to conduct user research or usability analysis. Information that can be captured includes the following:

■ Unique ID for each visitor so you can see who is returning.

■ Click path (i.e., the pages users visit and the sequence in which they visit them).

■ Time spent per page.

■ Where visitors leave the site (what page).

■ Actions taken (e.g., purchases made, downloads completed, information viewed).

There are some issues or limitations that you should be aware of when interpreting the data you collect from log files:

■ The log files often contain an Internet Protocol (IP) address temporarily assigned by an Internet service provider (ISP) or a corporate proxy server. This prevents unique identification of each user. Be aware that under some circumstances (e.g., children, certain countries), IP addresses are considered personally identifiable information (PII). It is good practice to remove any potentially identifiable information from log files prior to analysis.

■ Browser caching leaves gaps in the recorded click stream. If a page is cached, the log files do not record the second, third, or hundredth time it is visited during the user’s stay at your site. Depending on your tools, you may or may not be able to capture the pages called when the back browser button is used. Consequently, the last page recorded in the log file may not be the last page viewed, if the user exited on a previously cached page. As a result, you cannot be sure what the “exit page” was for the user.

■ Log files record when a request was made for a page but not when the transfer was completed. Also, if a user spends 30 minutes on a single page, you do not know why. Did the user walk away or look at another site or program, or was the user viewing the page the entire time?

■ You cannot be sure whether the user completed his or her goal (i.e., purchasing, downloading, looking for information) if you do not know the user’s goal. Perhaps the user wanted to buy three CDs but could find only one. Perhaps the user was looking for information and never found it.

You can work with your IT department to address some of these issues, but it takes time and knowledge of what you need versus what can be captured. External companies like WebTrends (www.netiq.com/webtrends/default.asp) can be hired to help if you are unfamiliar with this. These companies are a great source of basic usage data once you have a website running (e.g., number of page views per hour or per day, what page the user came from, how the user got there, time spent on the homepage, number of excursions to other pages, time spent on each page, ads clicked on).

Examining the time users spend per page is a more meaningful measure than the number of page views per page. When analyzing time data in a log file, it is best to use median or trimmed mean rather than average times because they are less susceptible to outliers. You must look at your distribution and decide if throwing out clear high and low outliers will make a mean useful or if you really need a median. Unfortunately, if you are using web analytics tools, you probably will not get to see the variance in values. However, there is typically a cap on high outlying time values because if a user spends more than half an hour inactive, it will get counted as an exit and excluded from the time-on-page calculation.

Probably the most interesting data for you will be click-path analysis, segmenting users based on behavior on your site and then comparing those user types, seeing how users got to your site, and analyzing what they searched for. However, it is best to study log files and web analytics over a long period to discover data that complement or spur studies in greater depth. For example, you can identify areas of a site for further testing, look for seasonal trends, and see how redesigns in your site affect user behavior.

Your Marketing Department

Frequently, your company’s marketing department will conduct focus groups or competitive analysis (see next section) to determine the need for a product and how best to promote and place it. Although this information is meant to drive sales, it is an excellent source to learn about the product, as well as potential customers and competitors.

Marketing information should not be confused with user requirements. The data from the marketing department can reflect the end users’ needs, but not always. Marketing collects information about the value and perceived worth of a product, whereas user research professionals collect information about how something is used and how the product’s worth is realized.

Additionally, the information you collect from the marketing department is only part of the information needed when creating a user profile. It is often missing contextual information about circumstances and environment that can affect a user’s decision to use and how to use your product. This is often the case for products that are to be used by corporations rather than an individual (e.g., human resources applications versus a website designed to sell books to the public). In the case of corporate products, the marketing department is typically interested in the business needs of the marketplace (i.e., companies that could be potential buyers) rather than the end users. Regardless, this information can be very helpful to you when you are starting out.

When you contact the marketing department, you may want to ask them questions, such as:

■ Where are you collecting your data?

■ Who are our competitors?

■ What is the profile of the people you have spoken with, and how did you find them?

■ What activities have you conducted (e.g., focus groups, surveys)?

■ When is your next activity scheduled?

■ Have you conducted a competitive analysis?

■ What are the requirements you have collected?

Competitors

You can learn a lot from your competitors. A competitive analysis lists the features, strengths, weaknesses, user base, and price point for your competitors. It should include not only first-hand experience with the product(s) but also user reviews and analysis from external experts or trade publications.

This can be an effective way to gain an advantage over your competitors. It is beneficial to conduct a competitive analysis when you are creating an entirely new product or simply entering a new product domain. It can also be a great strategy if your product is failing, but your competitor’s product is thriving. It is wise to periodically check out your competition to see where you stand with the rest of the pack. Some companies have product analysts whose primary job is to keep tabs on the competitors and the market. Get to know this person and learn everything he or she knows. If the product does not have a product analyst, this is something that you can do.

Do not limit yourself to direct competitors. You should also examine surrogate products. These products may or may not compete directly with your product, but they have similar features to your product and should be studied to learn about your strengths and weaknesses. For example, if you are adding a shopping cart to your travel app, check out companies that have shopping carts, even if they do not compete with you (e.g., online book stores). Some people make the mistake of thinking their product or service is so innovative that no one else does it; therefore, they skip competitive analysis. No product is so revolutionary that there is not someone out there from which to learn.

Traditional competitive analysis focuses more on cost, buying trends, and advertising. A usability competitive analysis is more concerned with the user experience (e.g., user interface, features, user satisfaction, overall usability). The goals of both types of competitive analyses are to learn from your competitors and to snag a strategic advantage. Below, we will concentrate on conducting a usability competitive analysis.

To identify your competitors, speak with the product team and sales or marketing department, conduct a web search, read trade magazines, and conduct user surveys, interviews, or focus groups. Market analysts and researchers (e.g., CNET, ZDNet, Gartner, Anderson, Forrester Research, IDC) can be a great way to collect information about your product’s market space and competitors. These companies identify and analyze emerging trends in products and their impact on business.

Keep in mind primary competitors as well as secondary competitors. A secondary competitor can be a smaller company with a less threatening product offering, one having only a few features in common with your product, or one competing indirectly with your product. For example, the brick-and-mortar travel agency does not compete directly with your online travel company, but it is an alternative that should not be ignored.

Once you have identified your competitors, you should ascertain their:

■ Weaknesses

■ Customer base (profile of users, size of customer base, loyalty, etc.)

■ Availability

■ Functionality and unique features

■ Reputation

■ Requirements (hardware, software, etc.)

If a product can be bought off the shelf or is an easily accessible website, this should not be a problem. However, some products or services are sold only directly to companies. Many major software companies state in their licensing agreement that you are not allowed to conduct competitive tests against their product. They also state that you cannot show the installation of the product (or the product in use) to a competitor company. Check with your legal department for advice before proceeding.

If you are able to evaluate the competitor product yourself, you should identify a set of core tasks with which to compare your product (if you have one at this stage) and the competitor’s. This is particularly important if you plan to include functionality from the other product, because you may learn that a function does not work well. Take numerous screenshots or photos and record your interaction as you conduct the evaluation.

Whether or not you are able to access the product yourself, interviews (Chapter 9, page 220), surveys (Chapter 10, page 266), focus groups (Chapter 12, page 340), and evaluations (Chapter 14, page 432) will be valuable ways to learn about users’ perceptions of the product. By conducting these kinds of activities with users of your competitor’s products, you can learn about the strengths, weaknesses, and key features of these products. In a competitive analysis, the majority of your effort should be spent mining the competitor’s product for ideas (e.g., functionality, user interface style, widgets, task structure, terminology).

There are a number of companies available to measure the usability or user satisfaction of a website (e.g., Bizrate Insights, OpinionLab, User Focus). They can do this for your site or for your competitor’s site. These companies send actual or target customers to any website (i.e., yours or a competitor’s) and then collect qualitative, quantitative, and behavioral data as users pursue actual tasks in a natural environment, such as their own homes and offices. Most companies allow clients to easily analyze both the quantitative and qualitative data gathered during an evaluation. This approach can be quite beneficial, but it is often expensive and requires that users can easily access the website. If the web-based product must be purchased or is behind a firewall, you will have to provide the users with access. In the case of a competitor that sells licensed software, this option is more difficult and more expensive. For example, you may need to send participants to a dummy page where they get assigned a dummy product key, and proceed from there.

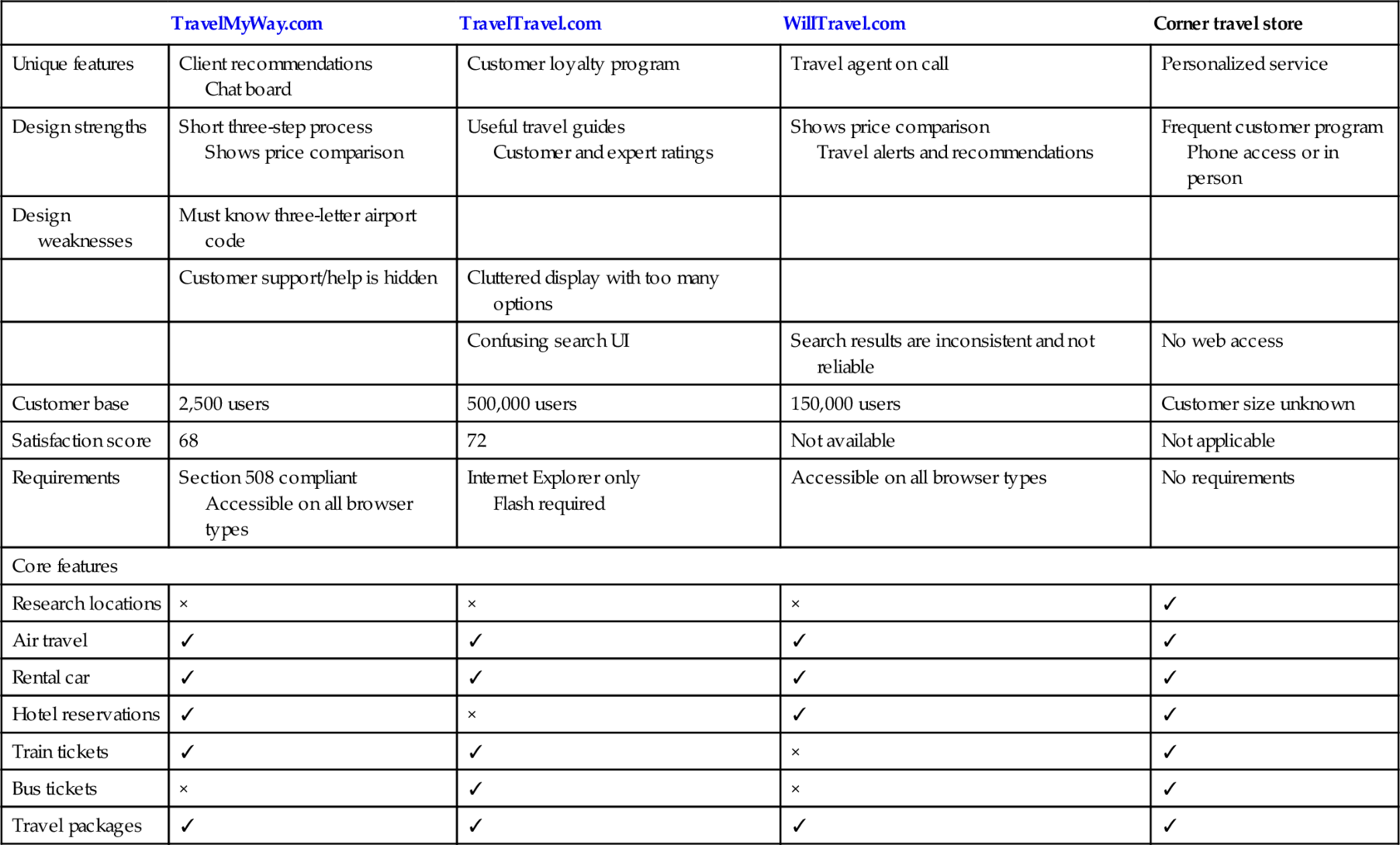

As you conduct your competitive analysis, it is helpful to create a grid comparing your product against the competitor’s (see Table 2.1). List the key features, design strengths and weaknesses, usability scores or issues, or anything you can learn. Tracking this information over time will show you how your product compares and how the market may be changing.

Table 2.1

Grid comparing TravelMyWay.com against three competitors

| TravelMyWay.com | TravelTravel.com | WillTravel.com | Corner travel store | |

| Unique features | Client recommendations Chat board | Customer loyalty program | Travel agent on call | Personalized service |

| Design strengths | Short three-step process Shows price comparison | Useful travel guides Customer and expert ratings | Shows price comparison Travel alerts and recommendations | Frequent customer program Phone access or in person |

| Design weaknesses | Must know three-letter airport code | |||

| Customer support/help is hidden | Cluttered display with too many options | |||

| Confusing search UI | Search results are inconsistent and not reliable | No web access | ||

| Customer base | 2,500 users | 500,000 users | 150,000 users | Customer size unknown |

| Satisfaction score | 68 | 72 | Not available | Not applicable |

| Requirements | Section 508 compliant Accessible on all browser types | Internet Explorer only Flash required | Accessible on all browser types | No requirements |

| Core features | ||||

| Research locations | × | × | × | ✓ |

| Air travel | ✓ | ✓ | ✓ | ✓ |

| Rental car | ✓ | ✓ | ✓ | ✓ |

| Hotel reservations | ✓ | × | ✓ | ✓ |

| Train tickets | ✓ | ✓ | × | ✓ |

| Bus tickets | × | ✓ | × | ✓ |

| Travel packages | ✓ | ✓ | ✓ | ✓ |

Early Adopter or Partner Feedback

Frequently, companies will align themselves with a small number of customers, sometimes referred to as “trusted testers,” in the early stages of development. These customers may play an active role in the design of the product and become partners in the process. They may implement early versions of the product on a small scale in their own companies. This relationship is beneficial to all parties. The customers get to help design the product to meet the needs of their own companies. On the other side, the product team gets early feedback to “fail fast” and iterate, as well as ask early adopters for references when selling the product to others.

The feedback early adopters provide can be enlightening because the product can be implemented and used in a real-world setting (as opposed to testing in the lab). You can leverage these existing relationships to learn about the product space and some of the product’s known issues. However, when you are ready to move on to the next stage and collect user requirements, be wary of basing your user requirements on the few early adopters as they may not be representative of all of your user base. You should obtain user requirements from a variety of users (refer to Section “Learn About Your Users” below).

Learn About Your Users

The single most critical activity in developing a quality product is to understand who your users are and what they need and to document what you have learned. This begins by developing a user profile—a detailed description of your users’ attributes (e.g., job title, experience, level of education, key tasks, age range, etc.). These characteristics will typically reflect a range, not a single attribute (e.g., ages 18-35). A user profile will help you understand who you are building your product for and will help you when recruiting for future user research activities.

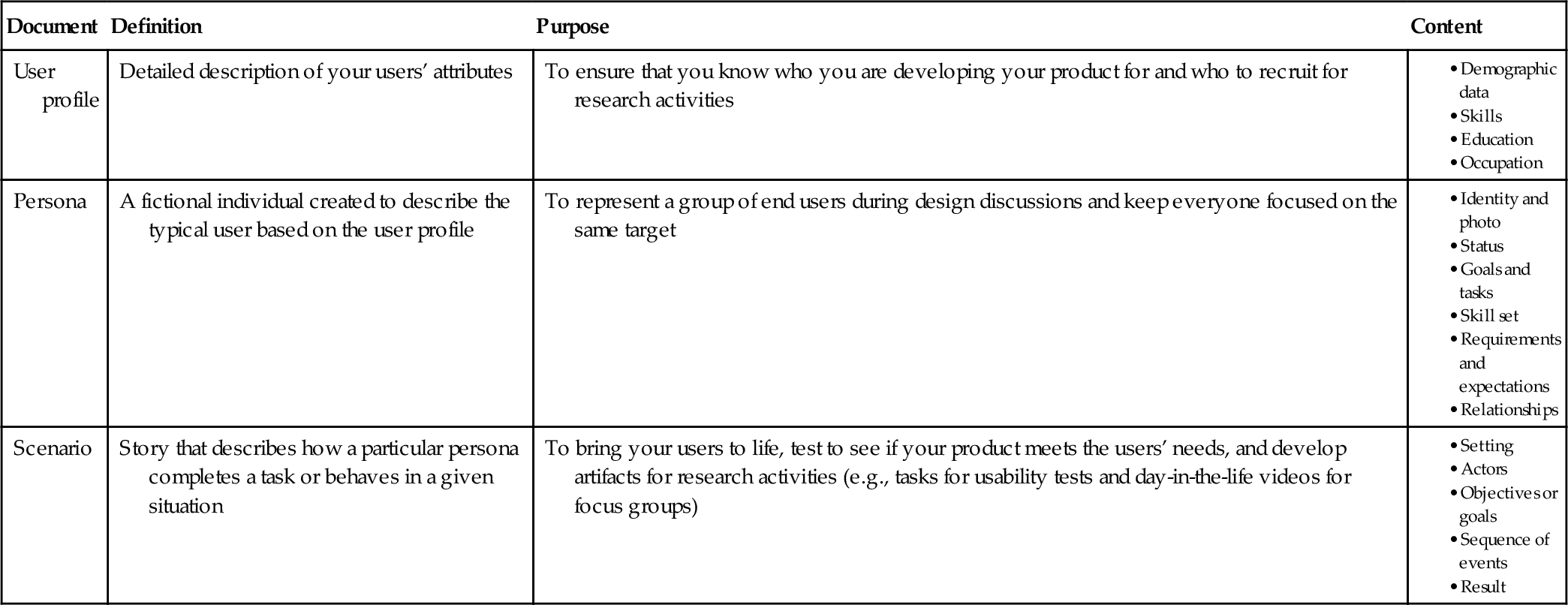

Once you have developed a thorough user profile, you can develop personas (exemplars of your end user) and scenarios (a day in the life of your end user).

■ Personas are designed to help keep specific users in focus during design discussions.

■ Scenarios help you test your system and build functionality into your product that users will actually want to use.

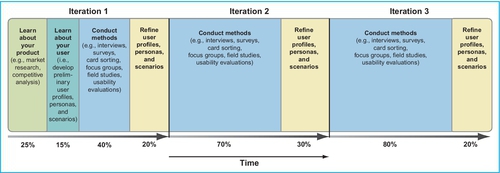

Table 2.2 compares these three types of user documents. You may have very little information to develop these initially—that is why you conduct user requirements activities. As you conduct user research activities, you will collect information to feed back into the user profiles, personas, and scenarios. Figure 2.3 illustrates the relative time to spend at each stage of the cycle. Please note its iterative nature; you should always feed the results of requirements activities back into your initial understanding of your users. User profiles, personas, and scenarios are discussed in detail in the following sections.

Table 2.2

Comparison of user profiles, personas, and scenarios

| Document | Definition | Purpose | Content |

| User profile | Detailed description of your users’ attributes | To ensure that you know who you are developing your product for and who to recruit for research activities |

• Skills • Education • Occupation |

| Persona | A fictional individual created to describe the typical user based on the user profile | To represent a group of end users during design discussions and keep everyone focused on the same target |

• Status • Goals and tasks • Skill set • Requirements and expectations • Relationships |

| Scenario | Story that describes how a particular persona completes a task or behaves in a given situation | To bring your users to life, test to see if your product meets the users’ needs, and develop artifacts for research activities (e.g., tasks for usability tests and day-in-the-life videos for focus groups) |

• Actors • Objectives or goals • Sequence of events • Result |

Keep in mind as you learn about your users that you should not focus on only the “best” or most experienced users. Someone who is considered an expert on a system may not be an expert on all parts of the system. It is much more likely that an individual will leverage only key areas of the product over and over while ignoring other parts. You should consider a range of users to ensure that your product works for the majority of your user population. The only way to know if your product works for the majority of your user population is by doing research. Depending on your user type or product, this may require a satisfaction survey of your users (see Chapter 10, page 266) or field study observations (see Chapter 13, page 380) or a usability evaluation (see Chapter 14, page 432).

Step 1: User Profile

The first step in understanding your users is to create a user profile.

Finding Information to Build Your User Profile

It is vital to get the right users for your research; otherwise, not only are the data you collect worthless, they can actually harm your product, your credibility, and the credibility of the research. But who are your users? What are their goals?

You should begin by developing a user profile. For example, the typical user might be between 18 and 35 years of age; have job titles like “travel specialist,” “travel agent,” or “travel assistant” and work for travel agencies with fewer than 50 employees.

Creating a user profile is an iterative process. You will likely have some idea of who your users are at first, but this will probably not be detailed and may even be just a guess. But it is a place to start. The example above is just our first, best guess of who our travel agent user might be. You can capture the initial information to build your user profile from the following:

■ Functional specifications

■ Industry analysts

■ Marketing studies

■ Market analysts

■ Customer support

■ Competitive benchmarking and analysis

■ Census bureau

■ Surveys

Understanding the Types of Users

You need to define what you mean by “user.” Most people consider the individuals who will interact directly with the product as their users, but you may need to consider other individuals as well:

■ The manager of your direct user

■ The system administrator who configures the product for the direct user

■ People who receive artifacts or information from the system

■ People deciding whether they will purchase your software

■ People who use competitors’ products (you want to convert them to use your product)

Try to categorize your users into one of three categories: primary, secondary, and tertiary. Primary users are those individuals who work regularly or directly with the product. Secondary users use the product infrequently or through an intermediary. Tertiary users are those who are affected by the system or the purchasing decision-makers. All of these individuals have an interest in the product. This does not mean that you have to conduct user requirements activities with the secondary and tertiary users, but you should at least know who they are. If the tertiary decision-makers do not purchase your product, the primary users will never use it. If the secondary system administrators cannot figure out how to customize and implement the product, the primary users will have a painful experience with it.

It is also important to realize that a single user may have several roles, and sometimes, these roles can have contradictory needs. For example, many online auction users are both buyers and sellers. Buyers want to pay the least they can, while sellers want to get as much as they can, and a single auction site must support both these contradictory roles without harming either. Additionally, the product should behave similarly for both roles—users should not have to learn a different interaction model, navigation, terminology, etc., based on their role. Only the information presented and some of the functions available should be different.

Creating a User Profile

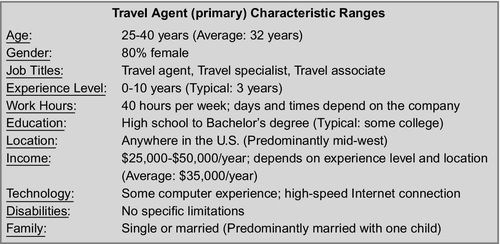

There are several characteristics you need to consider to develop a thorough user profile. We provide an ideal list of characteristics below, but you will likely not have access to all of this information. As you do further research and conduct additional user requirement activities, you will fill in these blanks, but you may never find the answers to some of the questions. Ideally, you should determine not only the typical or most frequent level for each of the characteristics but also the range and the percentage of users who fall along that range. As a final note, some of the characteristics on page 39 are more important than others in regard to your product and situation. Prioritize the characteristics and spend the majority of resources capturing information on those key characteristics for your product. For example, if a human resources administrator enters the wrong social security number into a financial application, an employee might not get paid. This is terrible, but if a medical professional enters the wrong social security number in an electronic chart, a patient might get the wrong medication. This is much more serious, so it is important to understand not only the tasks a user does but also the consequences of a possible error. Figure 2.4 shows a sample user profile. The US Census (census.gov) and Pew Research Center (www.pewinternet.org/) have well-tested questions and options for capturing demographic data, so we recommend referring to their surveys when designing yours:

■ Demographic characteristics—age, gender, location, socioeconomic status

■ Occupation experience—current job title, years at the company, years of experience at that position, responsibilities, previous jobs and job titles

■ Company information—company size, industry

■ Education—degree, major, courses taken

■ Computer experience—computer skills, years of experience

■ Specific product experience—experience with competitors’ products or other domain-specific products, usage trends

■ Tasks—primary tasks, secondary tasks

■ Domain knowledge—the users’ understanding of the product area

■ Technology available—computer hardware (monitor size, computing speed, etc.), software, other tools typically used

■ Attitudes and values—product preferences, fear of technology, etc.

■ Learning style—visual learner, audio learner, etc.

■ Criticality of errors—in general, the possible consequences of a user’s error

Once you determine the range of responses for each of the characteristics and the percentage of users along that range, you will want to categorize your users into groups based on their similarities. Some groupings you may use are the following:

■ Age (e.g., child, young adult, adult, older adult)

■ Experience (e.g., novice, expert)

■ Attitudes (e.g., first adopters, technophobe)

■ Primary task(s) (e.g., buyer, seller)

You can use an affinity diagram to organize the characteristics into groups (see Chapter 12, Focus Groups, page 363). The groups should be significantly different from each other in order to justify them as different user types. As with many things, this is more of an art than a science, and there are rarely clearly marked boundaries that put every user in one group or another. Having multiple stakeholders take part in the affinity diagram exercise can help when creating these groups and also assures stakeholder buy-in from the very beginning (refer to Chapter 1, “Getting Stakeholder Buy-in for Your Activity” section, page 16).

Now that you have a handle on your user population, you can develop personas, scenarios, and a recruitment screener (refer to Chapter 6, “Recruiting Participants” section, page 126).

Step 2: Personas

Alan Cooper developed a method called “Goal-Directed Design” in which personas are a key part. Personas were first introduced to the world in Cooper’s 1999 book The Inmates are Running the Asylum.

Benefits of Personas

Personas take a user profile and then fill in details to create a “typical” user. A persona is simply a fictional individual created to describe a specific user. Since you cannot possibly speak with every end user, you must create a model that can represent those end users.

There are many benefits to using personas. Because it can be difficult to feel connected to an abstract description of something, personas give your users life and help team members feel connected to them. They also get everyone on the same page by encouraging all team members to think about the same persona, instead of each individual working toward his or her own vision of who the end user is. Trying to build a product for the generic “user” is like trying to hit a moving target. Without a specific target to focus on, “the user” can change from the expert to the novice to your grandmother, all in the midst of a single conversation. Designing for a small set of personas will assure greater success of hitting that target. A persona can be used in meetings as a discussion tool (e.g., Zhiwei would never use that feature), in cognitive walk-throughs, storyboarding, role-playing, and other user research activities. Finally, personas can also help new team members quickly learn who the end user is. You should create at least one persona per user type (e.g., one for the travel agent, one for the travel customer).

Things to Be Aware of When Creating Personas

You may want to develop multiple personas for each user type. This will help you cover the range of characteristics for each user type. For example, if one of your user types is a “novice travel agent,” you may want to create multiple “novice” personas: one at a small company, one at a large company, one who received formal training, one who was self-taught, etc. By limiting your vision to just one persona, you may end up filtering out valuable data from end users who do not match that one profile. For example, if we did not create a persona for the self-taught travel agent, team members might assume all travel agents receive formal training and make all their design decisions based on that fact. Having multiple personas for each user type will prevent people from building the product around a single user and help develop a product that works for all of your users. However, you should keep the set of personas manageable. It is a balancing act. If you have too many personas to represent one user type, they will simply blur together in everyone’s mind and diminish their benefits. You want your personas to be memorable. Only create as many personas as needed based on significant behavioral differences.

You must also make sure that the personas you devise are specific to the product or feature you are developing. As we mentioned above, not all users use all parts of a product or system; therefore, it is unrealistic to assume that the same persona will work for all parts of your product.

As a final note, we want to stress that personas should never replace conducting user research activities with your end users. Personas should be based on the data from user research activities and not simply describe the ideal user the team wants to have.

Creating a Persona

There are several components to a persona. You can add as much detail to each of these areas as you have, but you may not be able to fill in all areas at first. The details will come from the information in your user profile. Just as developing a user profile is an iterative process, so is persona development. As you conduct user requirement activities, you should take what you learn to validate and beef up your personas. When creating a persona, it should be fictional but describe attributes from real users. Provide details and maintain authenticity. The list below is an idealized list—you may not have all the information below (fill in what you can):

■ Identity. Give this user a first and last name. Provide an age and other demographic data that would be representative of the user profile.

■ Status. Is this a primary user, secondary user, tertiary user, or antiuser of your system?

■ Goals. What are these user’s goals, particularly those related to your specific product or competitor products?

■ Skill set. What is the background and expertise of your user? This includes education, training, and specialized skills. Again, do not limit yourself to details related to your specific product.

■ Tasks. What are the basic or critical tasks the user conducts? What are the frequency, importance, and duration of those tasks? More detailed task information is included in scenarios (see below).

■ Relationships. Understanding with whom the user associates is important. Including relationships in the persona keeps you thinking about secondary and tertiary stakeholders.

■ Requirements. What does your user need in order to use your product or be successful using it (e.g., high-speed Internet connection, specific mobile phone OS, specific training or education)? Including quotes will really drive those needs home.

■ Expectations. How does the user think the product works? How does the user organize the information in his or her domain/job?

■ Photograph. Include a photo in your persona to put a human face to your end user.

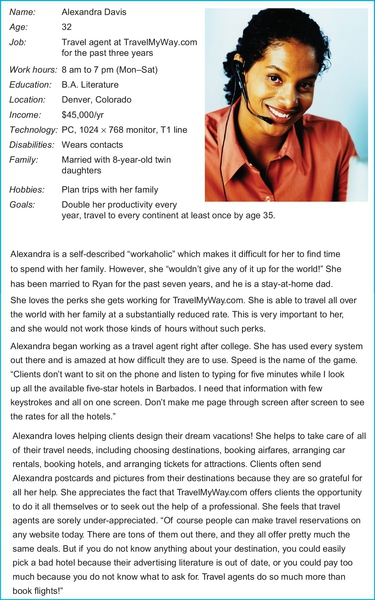

Just as there are several types of user profiles, there are several types of personas: primary user, secondary user, tertiary user, and the antiuser (or negative users). The primary, secondary, and tertiary users have been described. An antiuser is one who would not buy or use your product in any way. You want to keep this persona in mind to warn you when you are getting off track. For example, if you are designing a product for an expert user but find more and more instruction text, tutorials, and help dialogues creeping into the product, you should check your antiuser persona (a novice user in need of a “walk up and use” product) to see whether this product would now work for him or her. If so, you are on the wrong track. You want to be sure that you are designing for the primary user while considering the secondary and tertiary users. Figure 2.5 shows a persona for a travel agent.

Things to Be Aware of When Using Personas

There are a few risks one should be aware of when creating and using personas. The first is that any time one distills a lot of data down to a generalized description, some data will be lost. You will miss out on the exceptions or edge cases that can be important to consider. If you base recruiting off of your personas, you may end up excluding valid users who do not neatly fit into one of your personas. This limiting of data is something to be aware of and regularly evaluate.

Just as your product may change over time, so may your users and their needs. As a result, your personas must be updated to reflect those changes or you risk designing your product around inaccurate data.

If multiple teams across your organization are also developing personas, share your data. It is likely that the same people who are using your product are also using other products from your company. By collaborating, you can develop richer personas that highlight cross-product use rather than potentially contradicting each other.

Personas should never replace ongoing user research. They are a helpful tool, but they can never replace the actual voice of your user throughout the development process.

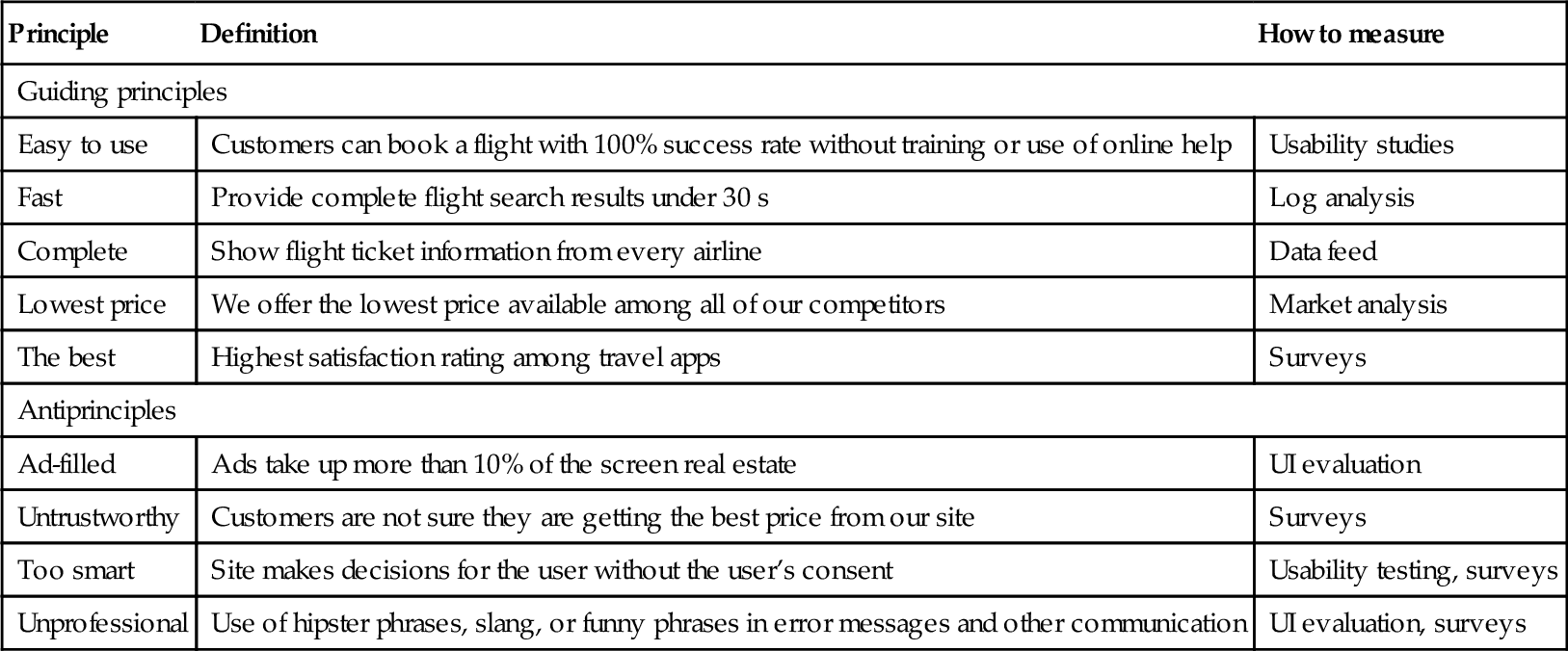

Step 3: Guiding Principles/Antiprinciples

Most products begin with some kind of design document or spec that states the goal or purpose of the product and planned functionality to meet that goal. Despite this, teams can still end up with different understandings about what the product should do. To address this, it is helpful to list the guiding principles (GPs) for the product. This is a qualitative description of the principles the product stands by. Similarly, antiprinciples (APs) should be documented to explicitly state what this product does not intend to address. If you find your product can be described by any of the APs, you know you are off track. Although the APs can be the opposite of the GPs, they oftentimes include unique considerations. For example, an AP might be “ad-generating revenue.” You are unlikely to have “negative ad revenue” or similar in your GPs. See Table 2.3 for an example.

Table 2.3

Example guiding principles and antiprinciples for TravelMyWay.com

| Principle | Definition | How to measure |

| Guiding principles | ||

| Easy to use | Customers can book a flight with 100% success rate without training or use of online help | Usability studies |

| Fast | Provide complete flight search results under 30 s | Log analysis |

| Complete | Show flight ticket information from every airline | Data feed |

| Lowest price | We offer the lowest price available among all of our competitors | Market analysis |

| The best | Highest satisfaction rating among travel apps | Surveys |

| Antiprinciples | ||

| Ad-filled | Ads take up more than 10% of the screen real estate | UI evaluation |

| Untrustworthy | Customers are not sure they are getting the best price from our site | Surveys |

| Too smart | Site makes decisions for the user without the user’s consent | Usability testing, surveys |

| Unprofessional | Use of hipster phrases, slang, or funny phrases in error messages and other communication | UI evaluation, surveys |

Brainstorm

With your user personas in hand, the team should brainstorm all of the words and phrases they would like to hear users, marketing, and/or those reviewing your product to say when describing it. These will be your GPs. The Microsoft product reaction cards (Benedek & Miner, 2002) are a great way to jumpstart the process, but do not limit yourself to just those words. We have found that writing each word or phrase on a sticky note and taking turns to call them out before posting them on the whiteboard is fast, and it makes it easy to group similar concepts. In the end, you ideally want no more than 10 GPs to remember. You want these to be easy to remember so everyone can adhere to them during product development. A laundry list of principles will be unwieldy to manage.

Define It to Measure It

Whatever your principles are for your product, they need to be measurable. In all likelihood, one of the GPs of your product will be “easy to use,” but what exactly does that mean? No training or help documentation for any of your features? Primary tasks are completed within a certain time frame or number of steps? A 100% task success rate in usability testing? You need to be specific in your definitions so that you can measure if your product is meeting the GPs or not.

Repeat for Antiprinciples

Conduct another team brainstorm using sticky notes, but this time, identify all of the words and phrases you do not want to hear your users, marketing, and/or reviewers say about your product. These are your APs. Again, group similar concepts, and keep the number of antiprinciples under 10 so it is manageable. It is equally important to define your APs so they, too, can be measured. One of the important benefits of APs is that they can prevent feature creep. You may find stakeholders suggesting the inclusion of features in the product just because it is technically impressive, sounds like a good idea, or is a pet project of someone in management. Evaluating every new feature against the GPs/APs offers a neutral method for assessing what should be included or not. It makes it a lot easier to say “No” when you can follow that up by saying, “This not only doesn’t fit into one our guiding principles; it is actually one of our antiprinciples.”

Evaluate

Unfortunately, it is common for teams to put a lot of effort into brainstorming and documenting the GPs/APs and not follow through with the evaluation step. With each version of your product, you should revisit your GPs/APs to make sure they are still relevant. Products, user needs, markets, competitors, and business goals all evolve over time, so your GPs/APs should, too. You may be able to evaluate your product against your GPs/APs prior to launch (e.g., usability testing, focus groups), but you may have to wait until after launch (e.g., log analysis, surveys), so put check points into your development timetable to do the evaluations.

Step 4: Scenarios

Scenarios, often referred to as “use cases,” are stories about the personas you created and should fit into the guiding principles you identified. A good scenario begins with a persona and then adds more detail based on your user requirements activities. The story describes how a particular persona completes a task or behaves in a given situation. It provides a setting; has actors, objectives or goals, and a sequence of events; and closes with a result.

Benefits of a Scenario

Scenarios are another way to bring your users to life during product development. They can be used to test a system during early evaluation. Is this a system that meets your users’ needs? Does it satisfy the goals and fit in the user’s workflow? You can also use scenarios to create “day-in-the-life” videos. These are useful artifacts for focus groups (refer to Chapter 12, page 340).

Things to Be Aware of When Creating Scenarios

Scenario development can be time-consuming. It is not necessary to create a library of scenarios that cover every conceivable task or situation the end users might encounter. Focus on developing scenarios for the primary tasks users will encounter, and then, if there is time, move to secondary tasks. Never let user profiles, personas, or scenarios replace user research activities with actual users. You need data from real users to build your product and to keep your profiles, personas, and scenarios fresh. People change over time. Their needs, expectations, desires, and skills are not permanent, so your scenarios should not be either.

Creating Scenarios

Scenarios normally include descriptions about the following:

■ The individual user (i.e., the persona)

■ The task or situation

■ The user’s desired outcome/goal for that task

■ Procedure and task flow information

■ A time interval

■ Envisioned features/functionality the user will need/use

You may also want to include exceptions. What are some of the rare events that happen? (Remember, frequency does not equate to importance!) By understanding the extreme or infrequent situations users encounter, you may identify situations where your product would be obsolete or even problematic. You could also identify key features that would benefit your end users.

Using the list of tasks in the user profile and/or persona, choose the critical tasks and begin creating scenarios with your stakeholders. In one scenario, describe the ideal way the persona might complete a given task. In another scenario, describe a problem (or problems) the persona might encounter while completing this task and how the persona would react. Continue building a set of scenarios for each of your personas until you feel you have covered the functionality of your product and the tasks/situations users encounter. As with user profiles and personas, you should use the information from user requirement activities to validate your scenarios and add more information to them.

Scenarios should not describe individual widgets. For example, you should avoid things like “and then Nikhil selected his preferred hotel from the droplist” or “Nikhil scrolled to the bottom of the page and clicked the ‘Submit’ button.” Instead, you should describe the basic actions, like “Nikhil selected his preferred airline” or “Nikhil submitted the information.” Below is an example of a very simple scenario:

Shikoh needs to plan a vacation for her family. She decides to check out the TravelMyWay app and do both the research and reservations there. She begins by researching the top family-friendly destinations as recommended by TravelMyWay app customers. She wants to compare the travel time, travel costs, hotel costs, hotel availability, and amusement activities for each destination. For each of those criteria, Shikoh gave a weighting to help her make her decision. She finally settled on the destination that required the least travel time, cheapest travel costs, moderate hotel costs, good availability, and a large selection of activities for the whole family. From that spot, Shikoh begins searching for the flights and hotels that meet her criteria. She decides to save those results for later because she wants to be sure the whole family is in agreement before she makes the reservations with her credit card.

Scenarios can be more sophisticated depending on the information you have collected. Often, they will start out small—based on the information you were able to collect initially—and then expand to give more detail as you gather data from user research activities.

To make scenarios more consistent among each other and more complete, a template is recommended for each scenario. One possible template is provided below (McInerney, 2003). The sections include the following:

■ Title. This provides a general description of the situation. Avoid being too specific or character-driven. For example, “Sally needs to research locations for a family vacation” should be worded instead as “Research vacation locations.”

■ Situation/task. In a paragraph or two, describe the initial situation, the challenge facing the user, and the user’s goal. Do not discuss how the user will accomplish his or her goal yet—that is covered next.

■ Method to address the situation. In either a bullet list or a task flow diagram, describe how the users cope with the situation. There are many ways in which the user could accomplish a given task. The task flow should show the different possibilities in about 5-15 steps. This section should be generic and technology-neutral (do not include specific design elements). The specific technology is discussed next.

■ Execution path. In a narrative form, describe how the task is completed and the user’s goal is reached. Now, you can discuss specific features or technology used. You will likely have multiple “Execution path” sections—one for each possible way of accomplishing the task shown in the “Method to address the situation” step. Alternatively, you may want to illustrate how different designs would accomplish each task. This section should be updated as design decisions are made. The other parts of the scenario will remain relatively unchanged over time.

Special Populations

International Users

Many global companies based in the United States develop products first for the United States and then think about how they might need to change that product for outside of the United States. At a minimum, this involves internationalization and localization or globalization (a combination of internationalization and localization). Internationalization is the process of developing the infrastructure in your product so that it can potentially be adapted for different languages and regions without requiring engineering changes each time. Localization means using the infrastructure created during internationalization to adapt your product to a specific language and/or region by adding local-specific components and translating text. This means adapting your product to support different languages, regional differences, and technical requirements. But it is not enough to simply translate the content and localize things like currency, time, measurements, holidays, titles, and standards (e.g., battery size, power source). If you rely on third-party sources for content or functionality, you need to adapt it or find alternative sources if they are not available for the country of interest. You also must be aware of any regulatory compliance that applies to your product/domain (e.g., taxes, laws, privacy, accessibility, censorship).

But even if you get all of that covered, you have not focused on the user. It is just as important to understand the user needs of your population and any cultural differences as it is to get the language, technical platform, and legal issues covered. It is unlikely that your product is going to work for every single person in the United States because the population in the United States is so diverse. The differences in context, background, technology, income, needs, etc., mean that a one-size-fits-all product will not support every person in the United States. The same is true for countries in the rest of the world. You cannot make assumptions about needs of users in China as a whole, much less a region as broad as Asia, and yet, many companies do. Once a product is localized, works on the major platforms for the region, and is in compliance with all laws and regulations, many companies think they are done. To truly support the users in a particular country or region, you must use the same techniques in this book to identify user profiles, scenarios, and needs of those users. You should spend as much time and effort developing your product for any country/region outside of the United States as you did developing it for the United States.

You will likely need to work with a researcher or at least recruiting vendor in the country of interest in order to get access to participants, incentives, and facilities to conduct the research. A vendor in the country can help not only with conducting the research (or conduct it for you), but they can also inform you about cultural issues you may not be aware of prior to the study. Being culturally aware in advance of the study will not only make your study go much more smoothly and help with the reliability and validity of the data collection, but can also help you avoid offending your participants.

Ethical Considerations for International Research

If you plan to conduct IRB-approved research in other countries, be sure to plan for additional review time. Research conducted outside a researcher’s home country is subject to additional review, including certifying translations of consent forms and other documents to the local language, letters of agreement from local officials, and reviews of ethical procedures from local researchers.

Accessibility

The best products and services adhere to the guidelines of universal design or inclusive design. The term “universal design” was coined by Ronald L. Mace (1985). It means that your product or service enables everyone to access and use regardless of one’s age, abilities, or status in life. Universal design is important because everyone has limitations at some point or another that makes accessing products or services difficult, and design that is inclusive is easier for everyone to use (Story, Mace, & Mueller, 1998):

■ Hearing impaired: People working in loud environments (e.g., construction sites) or those listening to music cranked up are going to have a difficult time hearing any audio signal from your product.

■ Visually impaired: Glare from the screens on mobile devices can make seeing anything, particularly low-contrast content, extremely difficult.

■ Color-blind: If your content depends on color-coding for interpretation, it will be lost when your users view it on displays with limited colors or print it out in black and white.

■ Limited dexterity: In cold winter climates, manipulating smartphones and tablets with gloves can be tricky unless you have purchased special gloves for that purpose.

■ Physically challenged: Few people have gone their whole lives without an injury that limits their movements. Parents carrying a child or heavy groceries tie up the use of their arms. Pushing a stroller, bike, walker, or rolling luggage prevents the use of stairs and pose a challenge with curbs.

■ Mentally challenged: Anyone that has suffered from sleep deprivation, is under the influence of medication, or dealt with short-term memory issues may not be able to comprehend your product or information in the same way you intended.

■ Illiterate: You may be able to read content in your language fluently, but the moment you step into a store, restaurant, or country where information is displayed in a different language, you become illiterate.

When you are conducting user research, you need to think about the full range of users, recruiting a broad range of ages, abilities, and statuses. The designer(s) for your product might be using the latest computers and monitors with the highest speed Internet connection, but there will be a segment of your user population that does not. What does your product look like for them? Can they even access it?

The Center for Universal Design offers seven principles for universal design (Copyright © 1997 NC State University, The Center for Universal Design):

1. Equitable use: The design is useful and marketable to people with diverse abilities.

2. Flexibility in use: The design accommodates a wide range of individual preferences and abilities.

3. Simple and intuitive use: Use of the design is easy to understand, regardless of the user’s experience, knowledge, language skills, or current concentration level.

4. Perceptible information: The design communicates necessary information effectively to the user, regardless of ambient conditions or the user’s sensory abilities.

5. Tolerance for error: The design minimizes hazards and the adverse consequences of accidental or unintended actions.

6. Low physical effort: The design can be used efficiently and comfortably with minimum fatigue.

7. Size and space for approach and use: Appropriate size and space are provided for approach, reach, manipulation, and use regardless of user’s body size, posture, or mobility.

Children

Increasingly, children are being exposed to tablets before they are able to read, and some elementary school children are getting their parents’ hand-me-down smartphones. If you are creating consumer products, there is a good chance children are using your products whether you intend them to or not. These are your future power users and a huge opportunity for you, so you would do well to at least consider children in your product development process. However, there are a number of things you need to be aware of when conducting research with children:

■ Nondisclosure agreements: Anyone under the age of 18 in the United States cannot sign legal documents. A legal guardian must sign NDAs on behalf of the children. You will also need to explain what confidentiality means in terms the child can understand.

■ Informed consent: Not only must parents be informed about the details of the study to consent on behalf of their child(ren), but also, you are ethically obligated to explain to children their rights prior to any study (see Chapter 3, “Ethical and Legal Considerations”) in words that the child can understand. Although parents must consent to the study, it is up to the child to decide whether or not he or she wants to participate and when he or she wishes to withdraw. Parents and children must be informed of this prior to the start of the study.

■ Incentives: Identify appropriate incentives for the age of your participants. A Visa gift card may not be as enticing for a child as a gift card to a toy store. Discuss the incentive with the parents in advance to ensure that the parents will not object to it. Nothing is worse than handing a gift to a child at the end of a study only to have a parent take it away.

■ Cognitive ability: Children will not have the same cognitive abilities or focus as the adults you typically conduct research with. Keep this in mind when designing the length of your study and tasks.

■ Regulations: Depending on the country, there are stricter regulations around personally identifiable information (PII) than for adults. This is certainly true in the United States.

■ Instructions: Children should be informed that this is not a test and that there are no right or wrong answers. They are not being evaluated; the product is. Just as adult participants may need to be reminded of this during the study, so must children.

■ Eye tracking: If you are conducting an evaluative study using an eye tracker, you must ensure that it is safe for children with no long-term exposure concerns, inform the parents during the screening process that an eye tracker will be used, and get both the parents’ and child’s consent. Be aware that some mobile eye trackers can actually cause nausea so you are obligated to advise both child and parent of the risk during recruitment.

Older Users

As we age, we experience changes in our cognitive and physical capabilities and limitations. While some abilities increase (e.g., verbal, wisdom), other abilities tend to decline (e.g., visual acuity). These changes mean you should consider the age of your target users and of your participants. Specifically, you should include older adults in your participant sample if you plan for older people to use your product. And with older adults (65 years and above) representing 13% of the population in 2010 and estimated to represent 19% in the United States by 2030 based on trends in the data (Department of Health and Services, 2010), it is likely that your product will be used by older people.

Just like other populations (e.g., children), there is a huge variation in what it means to be an older adult. “To compare a person who is 60 to a person who is 90 is not unlike comparing a 13-year-old to a 45-year-old” (Fisk, Rogers, Charness, Czaja, & Sharit, 2009). In aging research, there are three categories of “older adult:”

■ The “old”—74-84

■ The “oldest old”—85 +

When selecting older adult research participants for a study, you should carefully consider what inclusion/exclusion criteria are appropriate. Criteria could include the following:

■ Cognitive status (and impairments)—older adults, especially those in the “old” and “oldest old,” are more likely to have a cognitive impairment than younger adults. You can screen for cognitive impairment status using the Mini-Mental State Examination (MMSE; Folstein, Folstein, & McHugh, 1975).

■ Health status—the majority of older adults have at least one chronic health condition (AARP, 2009). You may be interested in perceived health status (how older adults feel about their health) or the number and specific types of health conditions your participants live with.

■ Living situation—while many older adults are “community dwelling,” meaning they live in their own home or apartment, many live in communities or institutions that provide various levels of care. While retirement communities typically offer convenience services such as yard maintenance, assisted living facilities may offer more extensive services, such as meal preparation and transportation assistance. Nursing homes offer skilled medical care on a daily basis.

Declines in speed of processing and working memory associated with aging mean that older adults will likely take longer to complete a study (Fisk et al., 2009). A guideline is to plan for a study protocol to take about one and a half times as long with an older adult as with a younger adult. If a study takes an hour for a younger adult, it will likely take an hour and a half for an older adult to complete.

Pulling It All Together

In this chapter, we have covered various sources you can turn to in order to learn more about your product domain and end users. Doing your homework is critical to the success of your product! It provides a solid foundation from which to build your future research activities and can save you a great deal of time and money further down the road.

It might seem odd to think that there are cultures where observation, think-aloud testing, and in-depth interviews are ineffective. But Asian users, for example, prefer more context in communication (Hall, 1989). They are more hesitant to make negative comments and are sensitive to cues of the hierarchy and subtext of communication. In addition, group dynamics affect Asian users more than users in most Western countries.

The adaptation of methods requires sensitivity to the triggers that enable communication within a culture. We must understand the root cause of hesitancy in communication, which can be different as we move between countries, or even across the river within a country (such as in India)!

In order to decide what triggers to use, we need to do our homework. This involves doing secondary research about that specific culture, speaking with local researchers, and forming a hypothesis about possible triggers that will work within that culture. Then we need to test whether our hypothesis is correct by pilot testing with local researchers. This pilot session is critical since this helps us design the final research method(s).

I developed the Bollywood usability testing method in 2001 (Plocher & Chavan, 2002) to deal with the challenge that “foreign” user research methods did not work well in India. Since then, we have used a range of methods for ecosystem research in various cultures. In this case study, I highlight some of the recent work we have done in India and Africa.

Rasas: India

Rasas are the essences of our emotions that exist in both the body and the mind. The central objective of classical Indian art and drama is to create the appropriate “rasa” for the spectators to communicate or suggest a kind of knowledge that cannot be clearly expressed in words.

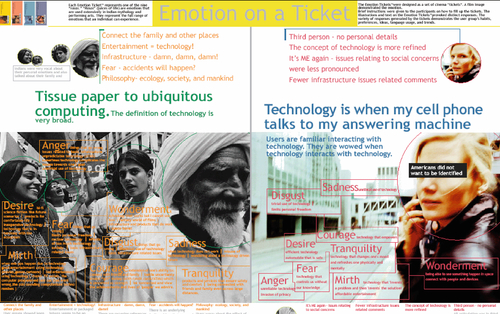

We incorporated the nine rasas that are most well known in India (Figure 2.6) in the form of cultural probes for a project in India to explore the emotions people felt when interacting with ATMs for the first time. These rasas were love, joy, anger, peace, courage, sadness, disgust, wonder, and fear.

This culture probe was designed as a set of cinema “emotion tickets,” carrying the omnipresent Bollywood theme forward (see Figure 2.7). Each rasa was expressed (in the emotion ticket) through images and dialogues from familiar Bollywood films (Chavan & Munshi, 2004). The “emotion tickets” were designed in a way that participants could identify a rasa (emotion) when interacting with an ATM and also note some details about the context of the interaction. Each user was given a booklet with a set of emotion tickets and asked to carry these around with them for 2 weeks (see Figure 2.8).

Participants were expected to articulate their feelings when interacting with any financial service and/or technology, by recording it using the appropriate rasa. We asked two questions: When? How? For example, “You laughed at money or technology. When? How?” Participants were instructed to answer these two questions every time they experienced one of the nine rasas.

At the end of two weeks, we collected the emotion tickets and analyzed them. The analysis led to the creation of an emotion map (see Figure 2.9) that helped us identify the dominant emotions people felt when interacting with ATMs and hence what innovations would make sense for a new design for these localized ATMs.

The Auto Rickshaw Radio: A New Representation for the Semantic Differential Scale

The semantic differential scale is used for measuring the meaning of things and concepts (Snider & Osgood, 1969). Participants indicate where they feel a product or experience lies on a 7-point scale between polar adjectives (e.g., strong-weak, good-bad). We noticed, over several projects done in India, that the semantic differential scale seemed to be a major stumbling block for participants, especially for semiliterate users. Whenever the semantic differential scale was presented, there was a tendency to select one of the two extreme options and nothing in between. This was very different from the experience these participants had expressed while using the product in question. So, in spite of an experience that was not black and white, everyone seemed to want to pick one of the two extremes.

After much probing and reflection, we realized that for these users, the concept of a difference in degree (moving from negative to positive) being represented by a horizontal straight line did not make sense. The feeling was that if the different points in the scale represented different degrees of an attribute, then they could not appear to be on the same (horizontal) level. Hence, a control was devised that resembled the volume control knob on a radio, with which all users were familiar. Transitioning from a low to high volume on a radio was very similar to what they needed to do when expressing the degree of an attribute (positive or negative) via the semantic differential scale. This alternative, nonlinear representation significantly improved comprehension among the participants. The stark difference in how the participants went from selecting one of the options at the two ends of the scale to wanting to fine-tune to a granular level was very insightful (Figure 2.10).

The Animal Picture Board: Kenya

We conducted research on the adoption and usage of financial institutions in rural Kenya to advise our client about innovative, localized strategies for various banking channels such as the bank branch, the ATM, mobile banking, and the contact center. See Figure 2.11.

We needed people to talk about their deep associations with different financial institutions/mechanisms, whether formal or informal. Since Kenya, like most of Asia, is a hierarchical and collectivist culture (Geert & Jan, 1991), we realized there was a strong likelihood they would have the same inhibitions we observed in Asia, where talking openly with a stranger would be a problem. Even though we would have a local researcher moderating the sessions, the fact that we (an Indian and South African research team) were going to be present would make it difficult for them to articulate what they really wanted to say. So we wondered, “What would resonate with these participants, triggering instant associations and hence instant responses without any ‘interference’ by the analytical part of the brain?” We observed that Kenya had a long and deep connection with wildlife. Wildlife was an area of shared knowledge in Kenyan culture.

We designed a method using images of animals common in Kenya on a board and asking questions around that picture board (see Figure 2.12). We tested this (and other methods) with our two local researchers as the pilot participants. The pilot sessions helped clarify the local association with each animal and tweak some of the pictures of the animals.

In the study, we asked participants about the different kinds of financial mechanisms they used (e.g., a money lender, an informal neighborhood group where they lend money to each other, the formal bank). We then asked which animal they associated with each financial mechanism and why.

The responses came without hesitation. “The cheetah is like this particular service, and the elephant reminds me of this institution.” Each person would make particular associations quickly. Responses reflected deep-seated patterns rather than being manufactured for us.

There were several interesting patterns that emerged from this exercise. For example, the elephant was repeatedly associated with a specific local bank. The reason was that participants felt this bank was strong and reliable like an elephant, and hence, they felt a sense of security and comfort in engaging with this bank.

On the other hand, many participants associated the cheetah with a new mobile transaction service. They felt this service was fast (in terms of time taken to complete a transaction) like the cheetah, but was also “cunning” like the cheetah. The cheetah, while appearing less intimidating than the lion or the leopard, had the speed to attack and kill its prey while seeming to appear out of nowhere. They also stated that the cheetah was always supposed to attack sneakily, from behind. So for the new mobile transaction service, while they greatly appreciated the speed with which they could make payments and receive money from across large distances, there was a hidden side to using this service. This was the gradual realization that they were, as a result of using this mobile transaction service, spending their money faster and on things that perhaps they did not really need. They felt that this was the “cunningness” of this service where and did not realize when they signed up that there was a flip side to the convenience of instant access. This duality made them apprehensive and not totally comfortable with the service.

Bizarre Bazaar: South Africa

This is a variation of an “informance” or informative performance method (i.e., a set of techniques in which actors and/or researchers study what is known about consumers and role-play with potential consumers) that has tested well with Asian users in our 15 years of ecosystem research and usability testing across Asia.

We used this recently in South Africa, when working on a banking project. We needed to understand low-income users’ motivational drives and blocks regarding mobile banking. The bank had introduced mobile banking, but adoption was minimal. We had to figure out why.

We were in the (supposedly) dangerous township of Umlazi near Durban. We knew that just asking the participants why they were not using mobile banking or specific mobile banking features/functions would be a challenge. Once again, since this specific segment was relatively collectivist and was also very uncomfortable being asked questions by “outsiders,” the chances of participants feeling comfortable enough to share the real reasons of their low adoption of mobile banking were slim.