Chapter 15

Paying with Samsung Pay

IN THIS CHAPTER

![]() Discovering why Samsung Pay is the coolest pay system

Discovering why Samsung Pay is the coolest pay system

![]() Setting up your phone for payments

Setting up your phone for payments

![]() Managing your credit card options

Managing your credit card options

Someday in the future, you will be able to leave your wallet at home and just use your smartphone for all the stuff that you carry with you today. We are not there yet, but Samsung has implemented some technology that moves us toward that day.

You may reasonably ask why not carrying your wallet is such a big deal. Fair enough. The two main reasons are that it is more convenient and more secure. Samsung Pay takes us a long way to this ultimate goal. The reality is you will need to continue to carry your wallet with credit cards and cash for now.

For now, you’ll need to decide for yourself whether the convenience that Samsung Pay does offer is worth the effort associated with setting it up. Samsung has gone to great lengths to make transactions more secure than simply using a credit card. Like so many of these things, the security is only as good as how the individual implements it.

With that awareness, some things about Samsung Pay are exceptionally cool. If you like to show off new technology to people, this is a good opportunity. In particular, you can one-up your smug friends who use Apple Pay with their iPhones. That capability alone is worth the price of admission for some of us.

How Mobile Payment Works

It helps to explain how mobile payments work to see how Samsung Pay helps you. The idea is that you walk up to the checkout stand at a retailer. You place your finger on the screen, place your phone near the card reader, and instantly your transaction is done. The receipt prints, and you take your purchase and go on your merry way. The charge shows up on your credit card.

Besides a fingerprint, you can enter a four-digit PIN. You choose the security option that is most convenient for you, and Samsung makes sure that everything flows securely. All the authorizations were set up when you set up the credit card with Samsung Pay.

Really. That’s all there is.

It sounds so simple. The interesting thing is that this capability has been around in one form or another for close to 30 years. Back in 1997, Mobil gas stations implemented contactless payment with their Speedpass. Users on the system would tap their Speedpass fobs that they would keep on the key ring on the reader installed on the gas pump.

Their credit card would be charged for the gas they pumped. Initially, the tap was all that it took to pay for the gas. Later, users needed to add their ZIP code to enhance security. In spite of Mobil’s best efforts, the system had only moderate success. There are a range of reasons, but a major concern was that people were already hesitant to even carry yet another thing. It is the inclusion of some new technology within smartphones that makes it so much more convenient.

Visa and MasterCard also tried contactless systems with limited success. One of their major challenges is that not enough credit card readers support the contactless payment system. After years of trying, fewer than 10 percent of all credit card readers as recently as 2015 have this capability. Those readers that do support contactless payment have the logo shown in Figure 15-1.

FIGURE 15-1: The contactless payment logo.

The contactless payment approach got a significant boost when Apple introduced the Apple Pay system on the iPhone in 2014. Like some other technologies that have struggled to find widespread acceptance, the implementation by Apple produced enough momentum to overcome resistance to its widespread use.

Examples include the Apple Macintosh with its use of a mouse, the Apple iPod revolutionizing the acceptance of MP3 players, and the Apple iPad creating a revolutionizing trend for tablets. All of these technologies were pioneered by other companies before Apple made them popular.

The Apple Pay system has seen significant success in an area where others have struggled. The retailers with the contactless credit card technology have seen a huge increase in its use from iPhone customers.

With Samsung Pay, however, Samsung has leapfrogged Apple. Samsung Pay works similarly to Apple Pay with contactless payment devices. It also works with the vast majority of standard credit card readers. Take that, Apple!

Although relatively few credit card readers in retailers today support contactless payment, almost all credit card readers at retailers have readers that can read the magnetic stripe on the back of your credit card. Samsung Pay along with your Galaxy S20 have the electronics built in to work with the contactless system but also the electronics to convince the magnetic stripe readers that you have swiped your card!

But what about the card readers that want you to insert your card so they can connect to the embedded chip? Samsung Pay is one step ahead of the game on this one. Most, if not all, of these card readers accept Samsung Pay just as if you inserted the chip without the hassle of finding the slot and orienting the card in the right direction.

Probably the biggest drawback in using this technology these days is that other customers in line freak out the first time they see this slick solution. They will want to ask you more about it, which will end up taking more time than if you were paying by writing a check and having to provide two forms of identification!

Getting Started with Samsung Pay

The first step in the process is to make sure that you have Samsung Pay on your Galaxy S20. As cool as this app is, there are many options to this technology, and your carrier may have preferred to not have it preloaded. No problem. Chapter 8 explains how to download apps from the Play Store. The Samsung Pay logo is seen in Figure 15-2.

FIGURE 15-2: The Samsung Pay and the Google Pay logos.

The app page description is shown in Figure 15-3. When you tap Install, you get the image on the right.

FIGURE 15-3: The Samsung Pay app Play Store images before and after installation.

The Samsung Pay app works a little different than most other apps. The first time you open Samsung Pay, you will be given information on how to use it and be asked to put in your credit card information (in a very convenient way, by the way) and asked all kinds of permissions and agreements.

Once you have given all this information, Samsung Pay waits patiently at the bottom of your home pages, ready to meet your payment needs with nothing more than a quick swipe from the bottom of the screen. Most people would simply not use this app if they had to go digging through their screens to find the app. This way, you do not have to search to find the app and wait for it to come up.

Figure 15-4 shows the Home screen with the Samsung Pay launch button sitting at the bottom ready to appear with a quick flick.

The launch button is also there on the Lock screen, so you don’t even need to unlock your phone because you’ll be using the exact same security steps before you can use your credit card.

FIGURE 15-4: The Samsung Pay quick launch button.

Setting Up Samsung Pay

When you open the Samsung Pay app, you’re greeted with a series of pages before you get to the Home screen seen in Figure 15-5. These pages include marketing introductions (which you don’t need because you read this chapter), permissions and agreements (which you should give if you want to move forward), and some pages that verify that Samsung Pay can work on your phone.

The app wants to make sure that your phone has the right parts (your Galaxy S20 does, but that is not the case for every Android phone) and that you are in one of the 27 countries where Samsung Pay is accepted. You’re set if you’re in the United States, Canada, China, or Kazakhstan (very nice!). You’re out of luck if you’re in, say, Yemen. Being in these countries is important for this app because each country has its own set of laws for payments, and Samsung may not have all the arrangements in place if you are not in one of these countries. New countries will be added as quickly as possible.

FIGURE 15-5: The Samsung Pay Home Page.

The next part of the initial setup process is to step through how you want to set up security. You have two security options when you are making a transaction: using your fingerprint or entering a PIN.

There are a few scenarios where using a Samsung Pay PIN rather than a fingerprint might make sense. In most cases, using your fingerprint is exceptionally convenient. If you haven’t set these up yet, the Samsung Pay app will walk you through the steps to do so. It’s quick and easy.

The next step is to enter your credit card information. When you tap the link that says Cards on the home page or the menu, you’re taken to a screen that shows you the images of the credit cards you’ve added. Initially, the screen will be empty. Figure 15-6 shows what it looks like after you have entered your first card.

FIGURE 15-6: The Samsung Pay Card page.

To add a new card, tap the blue circle in the lower-right corner with a silhouette of a credit card and a plus sign. You get a pop-up with some choices. Pick the Add Credit/Debit Card option to start this process. The left image in Figure 15-7 is when the screen first comes up and the right image in Figure 15-7 is when you have the desired credit card in the viewfinder.

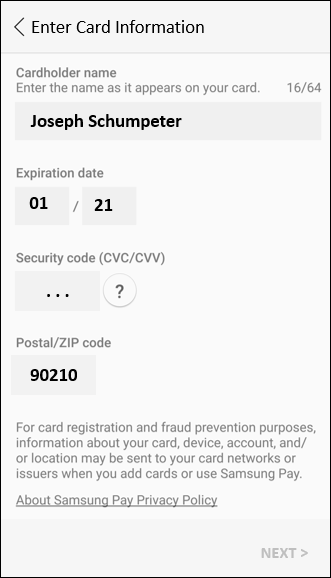

The app then interprets the information on the front of your credit card and populates as many screens as possible with your credit card information. It will ask you to fill out the form seen in Figure 15-8 if it can’t figure out the information on your card or the information is on the reverse side of the card.

FIGURE 15-7: The Samsung Pay credit card image processing screen.

FIGURE 15-8: The Populated credit card data fields.

Tap Next, and Samsung Pay will seek to confirm things with your credit card company. This does not cost you anything. It just wants to make sure that when you do make a charge, everything will flow smoothly. One of the things the company will want to verify is that you are authorized to use that credit card. This means that either you need to be the primary cardholder or you need to coordinate with that person.

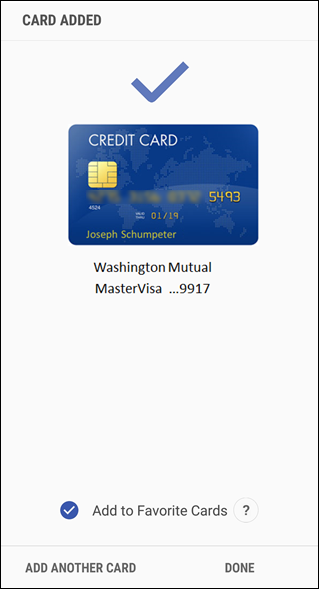

When the credit card company verifies that everything is on the up and up, you get an acknowledgement like the one shown in Figure 15-9.

FIGURE 15-9: Card Added verification screen.

Using Samsung Pay

First, pick something to buy at a store. Have a clerk ring it up and tell him you will pay with a credit card. Swipe the screen upward. You see the screen seen in Figure 15-10.

FIGURE 15-10: Samsung Pay payment screen before reading your fingerprint.

Enter your fingerprint by pressing the icon and you see a screen similar to Figure 15-11.

As seen in Figure 15-11, you should either hold your phone against where the credit card reader would read the magnetic stripe or where there is the contactless payment system logo if it is available.

The semicircle above your signature will start counting down, and your phone will vibrate to let you know that it is transmitting. You will hear a beep if it all goes through. If it fails for some reason, you can try again simply by reentering your security option.

FIGURE 15-11: Samsung Pay payment screen after reading fingerprint.

Managing Samsung Pay

As long as you pay your credit card bills and keep your credit card account at the bank, this app is relatively self-sufficient. Still, you will need to access the app settings from time to time. You get there by tapping the Samsung Pay logo on the app screen. This will bring up the screen shown in Figure 15-5.

To add a new credit or debit card, tap the Add link and go through the process described in the section “Setting Up Samsung Pay,” earlier in this chapter.

Adding a second card is easy, and the images will stack up when above each other on this page. The quick launch link brings up whatever card is on the top. If you want to change to use a different credit card, you can flip through the options. In addition to credit and debit cards, Samsung Pay is happy to help you with membership cards and loyalty cards. Don’t be shy. Give it a try and see if you like the convenience. My bet is that you will.

You tap the three dots to get a pop-up for the settings of Samsung Pay and select Settings. The Settings page is shown in Figure 15-12.

If you want to change the settings for or delete a credit card, all you have to do is tap on the Manage Favorite Cards link. All the information associated with that card will appear in the screen.

Enjoy your spending!

FIGURE 15-12: Samsung Pay Settings screen.

The technology within your phone that works with the standard credit card readers is called Magnetic Secure Transmission, or MST. When you place your phone near the magnetic stripe reader, it sends a very short-range signal to the magnetic stripe reader on your card that simulates the signals it gets when you physically swipe a magnetic stripe reader.

The technology within your phone that works with the standard credit card readers is called Magnetic Secure Transmission, or MST. When you place your phone near the magnetic stripe reader, it sends a very short-range signal to the magnetic stripe reader on your card that simulates the signals it gets when you physically swipe a magnetic stripe reader. It is easy to confuse Samsung Pay and Google Pay. These are two different applications. Google Pay is nice, but it does not have the Magnetic Secure Transmission capability that allows you to use mobile payments at many more retailers.

It is easy to confuse Samsung Pay and Google Pay. These are two different applications. Google Pay is nice, but it does not have the Magnetic Secure Transmission capability that allows you to use mobile payments at many more retailers.