8

Overhead Rates

CHAPTER OUTLINE

LEARNING OBJECTIVES

After reading this chapter, you will be able to understand:

Overhead rates

Absorption of overheads

Machine hour rate

8.1 INTRODUCTION

For a proper understanding of the topic, overheads are split into overhead analysis and overhead rates. In overhead rates, the calculations done are cost per unit, cost per hour, cost per machine or cost per machine hour rate (MHR). These rates are calculated to find out the method of recovery of overheads.

Overhead rates are fixed in order to absorb the overhead to cost units on equitable basis.

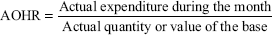

- Actual Overhead Rate (AOHR): It is the rate of overhead absorption, which is calculated by dividing the actual overheads to be absorbed by the actual quantity or value of the base selected.

- Predetermined Overhead Rate (POHR): It is the rate of overhead absorption, which is calculated in advance of occurrence of overhead.

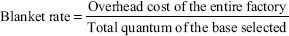

- Blanket Overhead Rate: Single overhead rate computed for the factory, as a whole is known as blanket rate.

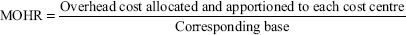

- Multiple Overhead Rate (MOHR): It is the different overhead rate that is computed for each producing department and service department is known as multiple rate.

8.2 ABSORPTION OF OVERHEADS

Charging of overheads to specific product is known as absorption. Overhead absorption is also known as application of overheads. In other words, absorption refers to charging of overheads of a department to different cost units in a way that each cost unit bears an appropriate portion of its share of overheads.

Absorption of overheads is done in the following ways.

- Raw material consumed

- Wages

- Prime cost

- Units produced

- Labour hours

- Machine hours

8.2.1 Underabsorption of overheads and overabsorption of overheads

Generally, overheads are charged on the basis of actual rate or estimated rate. When overheads are charged on actual rate, then there is no difference between the charged and incurred overheads. But when overheads are charged on estimated rate, there is a difference between the charged and incurred overheads. Such difference is known as underabsorption or overabsorption.

Absorption of overhead using predetermined rate may cause either underrecovery or overrecovery of overheads. If the actual overheads work out to be different from the budgeted overheads or if the actual base becomes different from the budgeted base, this results in either underrecovery or overrecovery.

Underabsorption– If the amount estimated is less than the amount actually incurred, it is said to be underabsorption. In other words, if the amount applied is the shortfall of the actual overhead in production, it is said to be the underabsorption of overheads.

The over or underabsorption of overheads is termed as overhead variance.

When the overheads charged is less than the overheads incurred, it is known as underabsorption, that is, estimated overheads are less than the actual overheads.

Overabsorption– If the amount estimated is more than the amount actually incurred, it is said to be overabsorption. In other words, if the amount applied exceeds, the actual overhead, it is said to be an overabsorption of overheads. When the overheads charged is more than the overheads incurred, it is known as overabsorption, that is, estimated overheads are more than the actual overheads.

Overabsorption = Actual expenses < estimated/absorbed expenses

Causes of under or overabsorption of overheads

- Error in estimating overhead expenses

- Unexpected changes in the production methodsM08

- Unexpected changes in the production capacity

- Seasonal fluctuation in the overhead expenses

Methods of absorption of overheads

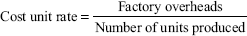

- Cost Unit Rate: It is calculated by dividing the overheads to be absorbed by the number of units produced. It is suitable for industries producing a single product. This method is also known as production unit or output method.

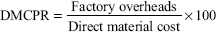

- Direct Material Cost Percentage Rate (DMCPR): It is calculated by dividing the amount of overhead to be absorbed by the direct material cost incurred or expected to be incurred.

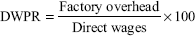

- Direct Wages Percentage Rate (DWPR): It is calculated by dividing the overhead to be absorbed by the direct wages to be incurred. This rate is suitable where the rates of pay and the grades of labour remain constant.

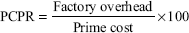

- Prime Cost Percentage Rate (PCPR): It is calculated by dividing the overheads to be absorbed by prime cost. It is a simple method and takes into account both material and labour element. Its disadvantage is it ignores the time factor.

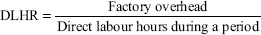

- Direct Labour Hour Rate (DLHR): It is calculated by dividing the overhead to be absorbed by the labour hours expected. It is applicable where labour is the main factor of production.

Effectively working hours = Number of average workers employed during a period Number × of hours for which the factory works durinng each day

While calculating effective working hours of the factory, normal idle time must be considered.

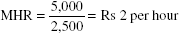

- Machine Hour Rate: In simple words, MHR means the cost or expenses incurred in running a machine for one hour. The MHR is obtained by dividing the amount of factory overheads concerning a machine by the number of machine hours. For example

Overheadsofmachine x = Rs5,000

No. of machine hours = 2,500

8.3 MACHINE HOUR RATE

This is one of the most scientific methods for the absorption of factory overheads. However, this method is not applicable in the case of limited operation of machines.

There are two methods of calculating MHR. They are (a) ordinary MHR and (b) composite MHR.

8.3.1 The advantages of MHR

- It helps to compare the effective deficiencies and the cost of operating different machines.

- It brings light to the existence of the idle time of machine.

- It is the most scientific practical and accurate method of recovery of manufacturing overheads.

- It provides useful data for estimating the cost of production setting of standards and for fixing the selling prices for quotations.

- It enables management to decide how far the machine work is preferable over manual work.

8.3.2 Ordinary MHR

Only the indirect expenses that are directly connected with the running of the machine are considered. For example, depreciation, power, repairs and maintenance, oiling and insurance cleaning are considered.

8.3.3 Composite MHR

In addition to the indirect expenses, other expenses such as supervisory labour, rent, lighting and heating are also included, and a composite rate is set up covering both the type of expenses.

8.3.4 Disadvantages of MHR

- It is costly because it involves additional work in finding out the working hours.

- It does not consider certain expenses that are not proportional to the working hours of machines.

- It does not give accurate results in which labour is predominantly used.

- It is difficult to estimate the machine hours when information related to production is not available in advance.

- Blanket rate cannot be used and it makes the method more costly.

8.3.5 Computation of MHR

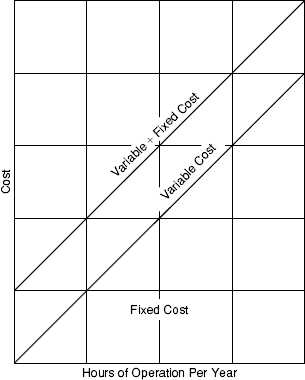

- Machine overheads are of two types: fixed and variable.

- Fixed charges are rent, rates, supervision, cost of reserve equipment, insurance etc.

- Variable charges are depreciation, repairs, electric power, maintenance etc.

- Fixed charges are estimated for a given period for every machine. The estimated charges are divided by the total working hours of the period.

- Variable charges are estimated separately and then divided by the normal working hours.

- Normal working hours are calculated by giving allowance for idle time, maintenance, setting up etc.

- The sum of the fixed charges rate and the variable charges rate will give MHR.

- Fixed charges are known as standing charges.

- Variable charges are also known as running charges or machine charges.

Bases for the appointment of expenses for the computation of MHR

| Expenses | Bases |

|---|---|

| 1. Consumable stores | Store requisition slips |

| 2. Depreciation | Value of machines |

| 3. Insurance | Value of machines and assets |

| 4. Lighting and heating | No. of points or floor area |

| 5. Power | Horse power of machines |

| 6. Repairs | Value of machines |

| 7. Rent and rates | Floor area occupied |

| 8. Supervision | Time spent on each machine |

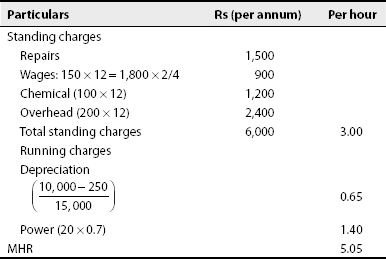

Illustration 1

Calculate the MHR for machine no. 33 from the following particulars.

| Cost of machine | Rs 10,000 |

| Estimated scrap value | Rs 250 |

| Estimated working life | 15,000 hours |

| Working hours per year | 2,000 hours |

| Cost of repairs per year | Rs 1,500 |

| Wages of operator per month | Rs 150 |

| Chemical per month | 100 |

| Overheads chargeable to this machine per month | Rs 200 |

| Power per hour | 20 units at 7 paise per unit |

| No. of operators looking after 4 machine | 2 persons |

Note: The MHR is a comprehensive MHR since operator's wages are included.

Solution: Computation of MHR

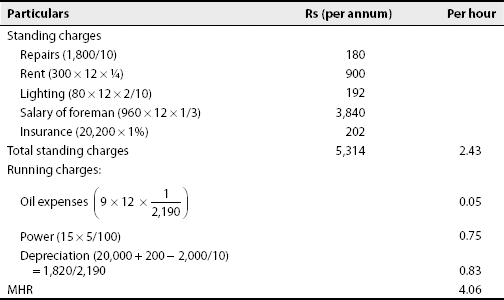

Illustration 2

A machine costing Rs 20,000 is expected to run for 10 years. At the end of 10 years, its scrap value is estimated to be Rs 2,000. Its installation charges are Rs 200.

| Estimated cost of repairs for a 10-year life | Rs 1,800 |

| No. of hours the machine is expected to run in a year | 2,190 |

| Its power consumption would be 15 units per hour | Rs 5 per 100 units |

The machine occupies ¼th of the area of the department and has 2/10 points for lighting.

The foreman has to spend about one-third of his time to this machine.

| The rent for the department | Rs 300 per month |

| The charges for lighting | Rs 80 per month |

| Salary paid for the foreman | Rs 960 per month |

Find out the hourly rate, assuming insurance is at 1% per annum and expenses on oil etc. are Rs 9 per month.

Solution: Computation of MHR

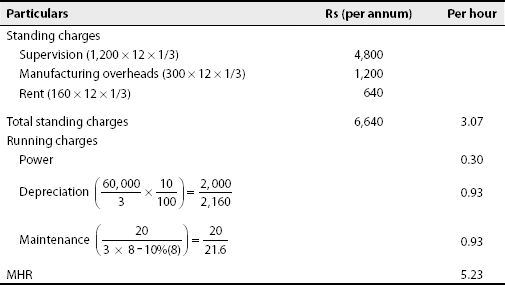

Illustration 3

Calculate the MHR for the recovery of overheads for a group of three machines from the following data.

| Original cost of three machines | Rs 60,000 |

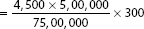

| Depreciation at 10% per annum (straight line method) | |

| Repairs and average maintenance cost | Rs 20 per day |

| Power | 30 paise per running hour per machine |

| Supervision for the group of machines | Rs 1,200 per month |

| Allocation of rent for three machines on a floor area basis | Rs 160 per month |

| Share of manufacturing overheads | Rs 300 per month for the group of machines |

| No. of working days | 300 in a year |

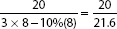

| Normal operation | 1 shift of 8 hours |

| Normal allowance for repairs, maintenance, change over, idle time etc. | 10% |

| Effective running hours per annum (300 × 8 × 90/100) | 2,160 |

Solution: Computation of MHR

Illustration 4

The following annual charges are incurred in respect of a machine in a shop where manual labour is almost nil and work is done by means of five machines of exactly same type of specification.

| Rent and rates (proportional to the floor space) for the shop | Rs 6,000 | |

| Depreciation on each machine | 1,000 | |

| Repairs and maintenance for the five machines | 1,200 | |

| Power consumed (as per meter) at 5 paise per unit for the shop | Rs 3,000 | |

| Electric charges for lights used in the shop | Rs 600 | |

| Attendants: There are two attendants for the five machines and they are each paid Rs 80 per month | ||

| Supervision: For the five machines in the shop there is one supervisor whose emoluments are Rs 300 per month | ||

| Sundry supplies for the shop | Rs 500 | |

| Hire purchase installments payable for the machine (including Rs 300 as interest) | Rs 1,200 |

The machine uses 10 units of power per hour. Calculate the MHR for the machine for the year.

Solution: Computation of MHR

| Particulars | Rs (per annum) | Per hour |

|---|---|---|

| Standing charges | ||

| Rent and rates (6,000 × 1/5) | 1,200 | |

| Lighting charges (600 × 1/5) | 120 | |

| Attendants’ salary (80 × 2 × 12 × 1/5) | 384 | |

| Supervision (300 × 12 × 1/5) | 720 | |

| Sundry supplies (500 × 1/5) | 100 | |

| Total standing charges | 2,524 | 2.10 |

| Machine expenses | ||

| Depreciation (1,000/1,200) | 0.83 | |

| Repairs and maintenance (1,200 × 1/5 × 1/1,200) | 0.20 | |

| Power 10 units at 0.05 per unit (10 × 0.05) | 0.50 | |

| Machine hour rate | 3.63 |

Working Notes:

Total amount of power consumed = Rs 3,000

Rate of power = 0.50 per unit

Total working hours = 3,000/0.50 = 6,000 hours

No. of machines = 5

Hours per machine = 6,000/5 = 1,200 hours per annum

8.4 MISCELLANEOUS ILLUSTRATIONS

Illustration 1

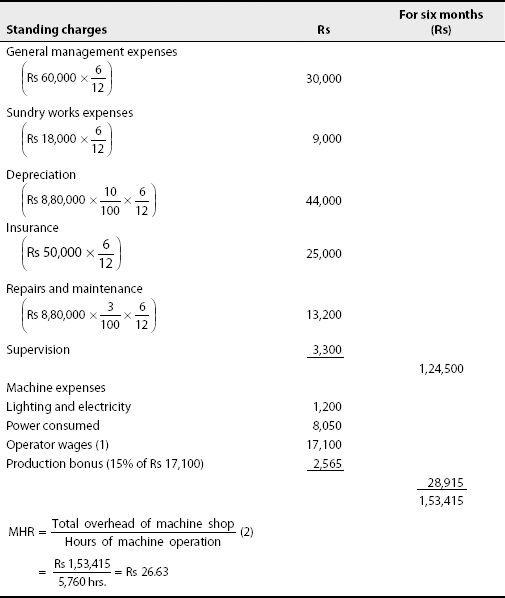

A machine shop has 8 identical drilling machines manned by 6 operators. The machines cannot be worked without an operator wholly engaged on it. The original cost of all these 8 machines works out to be Rs 8,80,000. These particulars are furnished for a 6-month period

| Normal available hours per month | 208 |

| Absenteeism (without pay) hours | 18 |

| Leave (with pay) hours | 30 |

| Wages for 8 hours | Rs 20 |

| Production bonus estimated 15% on wages | |

| Value of power consumed | Rs 8,050 |

| Supervision and indirect labour | Rs 3,300 |

| Lighting and electricity | Rs 1,200 |

| These particulars are for a year |

Repairs and maintenance including consumables of 3% on the value of a machine.

| Insurance | Rs 50,000 |

| Depreciation | 10% on original cost |

| Other sundry works expenses | Rs 18,000 |

| General management expenses allocated | Rs 60,000 |

You are required to work out comprehensive MHR for the machine shop.

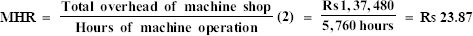

Solution: Computation of comprehensive MHR of machine shop.

Working Notes:

- No. of hours per month for which wages are paid = 190 hours (208 – 18)

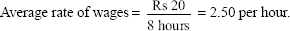

- Total wages for 6 operators for 6 months = 190 × 6 × 6 × Rs 2.50 = Rs 17,100

- No. of hours of machine operation = 190 -20 (leave with pay) = 170 hours

- Total hours for machine shop for 6 months for 6 machines = 170 × 6 × 6 = 5,760 hours (8 machines cannot work at a time. Six operators can work only 6 machines because machines cannot work without an operator wholly engaged on each machine)

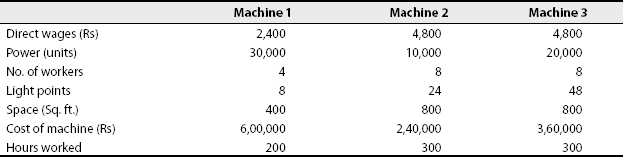

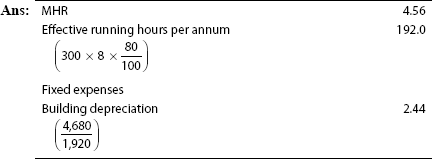

Problem 1. A department is having three machines. The figures below indicate the departmental expenses. Calculate the MHR in respect of three machines from the information given below

| Rs | |

| Depreciation of machinery | 24,000 |

| Depreciation of building | 5,760 |

| Repairs of machinery | 8,000 |

| Insurance of machinery | 1,600 |

| Indirect wages | 12,000 |

| Power | 12,000 |

| Lighting | 1,600 |

| Miscellaneous expenses | 8,400 |

| 73,360 |

[Chennai, M. Com., September 1985]

[Ans: Overhead apportioned—Machine 1 = Rs 28,612, Machine 2 = Rs 19,454, Machine 3 = Rs 25,294; MHR—Machine 1 = Rs 143.06, Machine 2 = Rs 64.85; Machine 3 = Rs 84.31; Composite or comprehensive MHR—Machine 1 = Rs 155.06, Machine 2 = Rs 80.85, Machine 3 = Rs 100.31 (including direct wages of machines)]

Hint: Apportion indirect wages on direct wages basis and miscellaneous expenses on hours worked basis.

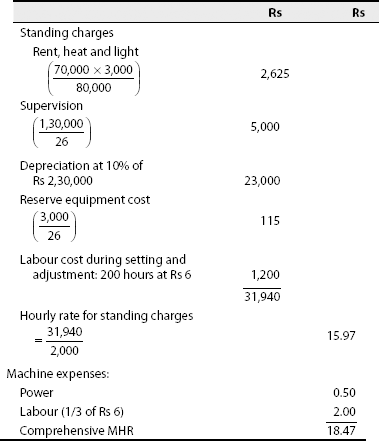

Illustration 2

- Compute comprehensive MHR from the following data:

- Total cost of machine to be depreciated: Rs 2,30,000

- Life: 10 years

- Depreciation on straight line

- Departmental overheads (annual):

Rs Rent 50,000 Heat and light 20,000 Supervision 1,30,000 - Departmental area: 80,000 square metres

Machine area: 3,000 square metres

- Machines in the department = 26

- Annual cost of reserve equipment for the machines = Rs 3,000

- Hours run on production = 2,000

- Hours for setting and adjusting = 200

- Power cost Re 0.50 per hour of running time

- Labour:

- When setting and adjusting, there should be full time attention

- When machine is producing, one worker can look after 3 machines

- Labour rate: Rs 6 per hour

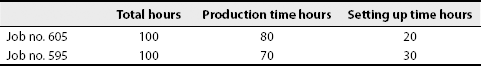

- Using the MHR as calculated above, work out the amount of factory overhead to be absorbed on the following:

Solution: (A) Computation of comprehensive MHR

Note: It is assumed that there is no power cost when the machine is being set or adjusted.

(B) If the MHR as calculated in (A) is adopted, the overheads absorbed over the various jobs will be as follows:

Job no. 605 = 18.47 × 80 = Rs 1,478

Job no. 595 = 18.47 × 70 = Rs 1,293

Problem 2. Calculate the MHR from the following particulars of machine no. 33

| Rs | |

|---|---|

| Cost of machine | 10,000 |

| Estimated scrap value | 250 |

| Estimated working life | 15,000 hours |

| Working hours per year | 2,000 hours |

| Cost of repairs per year | 1,500 |

| Wages of operator per month | 150 |

| Chemical per month | 100 |

| Overheads chargeable to this machine per month | 200 |

| Power per hour | 20 units at 7 paise per unit |

| No. of operators looking after four machines | 2 persons |

[Chennai, B.Com., March 1997]

[Ans: MHR = Rs 4.45]

Note: The MHR is a comprehensive MHR since operator's wages are included.

Illustration 3

A machine costs Rs 1,00,000 and is deemed to have a scrap value of 5% at the end of its effective life (19 years). Ordinarily, the machine is expected to run 2,400 hours per annum, but it is estimated that 150 hours will be lost for normal repairs and maintenance and further 750 hours will be lost due to staggering. The other details in respect of the machine shop are as follows

| Rs | |

|---|---|

| Wages, bonus and provident fund, contribution of each of two operators (each operator is in charge of two machines) | 6,000 per year |

| Rent and rates of the shop | 4,500 per year |

| General lighting of the shop | 250 per month |

| Insurance premium for the machine | 200 per quarter |

| Cost of repairs and maintenance per machine | 250 per month |

| Shop supervisor's salary | 500 per month |

| Power consumption of the machine hour 20 units | |

| Rate of power per hundred units = Rs 10 | |

| Other factory overheads attributable to the shop = 5,000 per year |

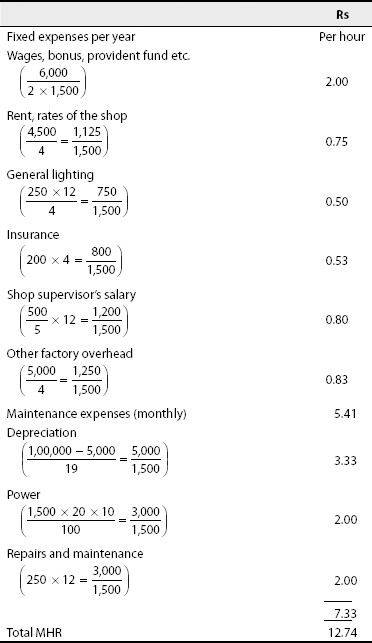

There are 4 identical machines in the shop. The supervisor is expected to devote one-fifth of his time for supervising the machine. Compute a comprehensive MHR from the above details.

Solution: Computation of MHR

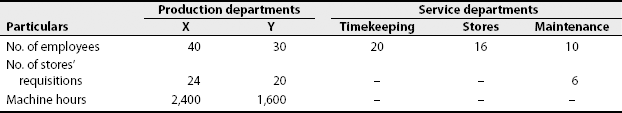

Problem 3. A manufacturing company has two production departments X and Y and three service departments—timekeeping, stores and maintenance. The departmental summary showed the following expenses for October.

| Production department | Rs | Rs |

|---|---|---|

| X | 16,000 | |

| Y | 10,000 | 26,000 |

| Service department: | ||

| Timekeeping | 4,000 | |

| Stores | 5,000 | |

| Maintenance | 3,000 | |

| 12,000 | ||

| 38,000 |

The other information are as follows:

You are required to make departmental allocation of expenses.

[B.Com., Madurai]

[Ans: X = Rs 22,845; Y = Rs 15,155]

Illustration 4

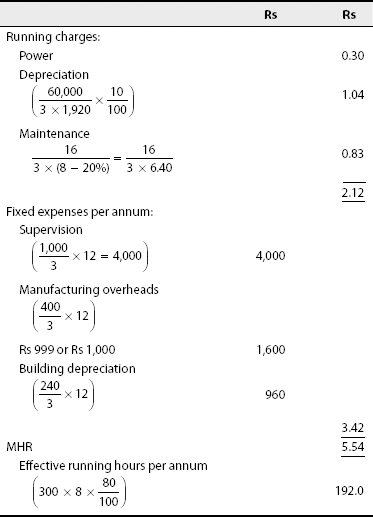

Calculate the MHR for the recovery of overheads for a group of 3 machines from the following data.

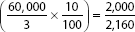

| Original cost of 3 machines | Rs 60,000 |

| Depreciation at 10% per annum (straight line method) | |

| Repairs and maintenance cost average | Rs 16 per day |

| Power | 30 paise per running hour per machine |

| Supervision for the group of machines | Rs 1,000 per month |

| Allocation of rent for 3 machines on a floor area basis | Rs 240 per month |

| Share of manufacturing overheads | Rs 400 per month for the group of machines |

| Normal working days | 300 in a year |

| Normal operation | 1 shift of 8 hours |

| Normal allowance for repairs, maintenance, change over, idle time etc. | 20% |

Solution: Computation of MHR

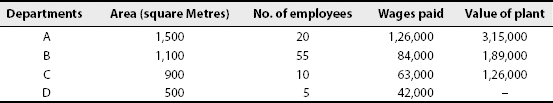

Problem 4. A company has four departments A, B, C, which are production departments, and D, which is a service department. Costs of the department D are apportioned on the basis of the wages paid.

The actual costs for the year were as follows:

| Rent | Rs 21,000 |

| Repairs to plant | Rs 1,26,000 |

| Depreciation of plant | Rs 9,450 |

| Light and power | Rs 2,100 |

| Supervision | Rs 31,500 |

| Repairs to building | Rs 8,400 |

The following information about the departments is available and is used as a basis for the distribution of costs.

These costs are apportioned to production departments.

[Ans: A = Rs 1,08,547.50, B = Rs 83,220.50, C = Rs 48,682.00]

Illustration 5

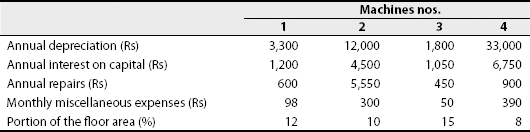

A factory works on an average for 168 hours in a month. There are four machines in the factory for which the necessary particulars are provided:

The monthly charges for rent and taxes for the entire factory are Rs 16,500. One foreman supervises all these four machines and his salary is Rs 2,520 per month. An attendant looks after all these four machines and his salary is Rs 250 per month.

In the execution of certain work, Machine 1 is used for 84 hours, Machine 2 for 72 hours, Machine 3 for 100 hours and Machine 4 for 120 hours. The cost of materials is Rs 1,79,650 and that of direct labour is Rs 3,350. Calculate the cost of the work order.

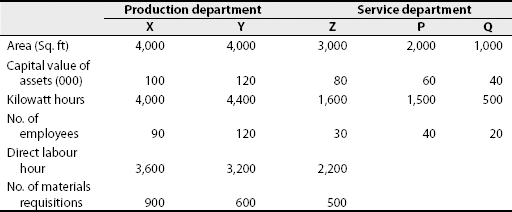

Problem 5. Following figures have been extracted from the accounts of a manufacturing concern for the month of January

| Rs | |

|---|---|

| Indirect Materials: | |

| Production department X | 950 |

| Production department Y | 1,200 |

| Production department Z | 200 |

| Maintenance department P | 1,500 |

| Stores department Q | 400 |

| Indirect wages: | |

| Production department X | 900 |

| Production department Y | 1,100 |

| Production department Z | 300 |

| Maintenance Department P | 1,000 |

| Stores department Q | 650 |

| Power and Light | 6,000 |

| Rent and Rates | 2,800 |

| Insurance on assets | 1,000 |

| Meal charges | 3,000 |

Depreciation at 6% on capital value of assets.

From the following additional information, calculate the share of overheads of each production department.

[B.Com., Chennai]

[Ans: A, Rs 9,000; B, Rs 9,600; C, Rs 4,400]

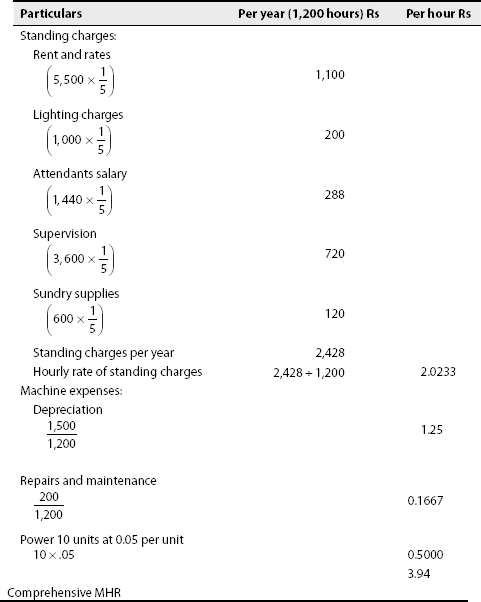

Illustration 6

The following annual charges are incurred in respect of a machine in a shop where manual labour is almost nil and work is done by means of five machines of exactly same type of specification.

| Rs | ||

|---|---|---|

| (i) Rent and rates (proportional to the floor space) for the shop | 5,500 | |

| (ii) Depreciation on each machine | 1,500 | |

| (iii) Repairs and maintenance for the five machines | 1,000 | |

| (iv) Power consumed (as per meter) at 5 paise per unit for the shop | 3,000 | |

| (v) Electric charges for light in the shop | 1,000 | |

| Attendants: There are two attendants for the five machines, and they are each paid Rs 60 per month | ||

| (vii) Supervision: For the five machines in the shop, there is one supervisor whose emoluments are Rs 300 per month | ||

| Sundry supplies for the shop | 600 | |

| Hire purchase instalments payable for the machine (including Rs 300 as interest) | 1,200 |

The machine uses 10 units of power per hour. Calculate the MHR for the machine for the year.

Solution: Computation of MHR for the year

Note: (1) Calculations are made up to the fourth decimal to minimise the effect of approximations.

Note: (2) When attendants’ salary or wages is also included in the calculation, the MHR is called ‘comprehensive MHR’ or ‘composite MHR’.

Working Note: Annual working hours per machine

Total amount of power consumed = Rs 3,000

Rate of power = 0.50 per hour

![]()

No. of machines = 5

![]()

Problem 6. A machine costing Rs 20,000 is expected to run for 10 years, at the end of which its scrap value is estimated to be Rs 2,000. Its installation charges are Rs 200

| Repairs for 10 years’ life is estimated to be | Rs 1,800 |

| The machine is expected to run for 2,190 hours in a year | |

| Its power consumption would be 15 units per hour | Rs 5 per 100 units. |

The machine occupies ¼th of the area of the department and has 2/10 points for lighting.

The foreman has to spend about one-third of his time for this machine.

| The rent for the department is | Rs 300 per month |

| The charges for lighting are | Rs 80 per month |

| The foreman is paid a salary of | Rs 960 per month |

Find out the hourly rate, assuming insurance is at 1% per annum and expenses on oil etc. are Rs 9 per month.

[B.Com. Hons., Delhi]

[Ans: Rs 4.056]

Illustration 7

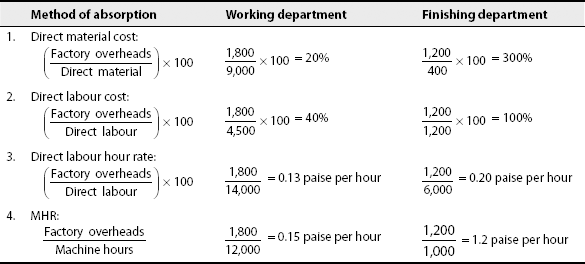

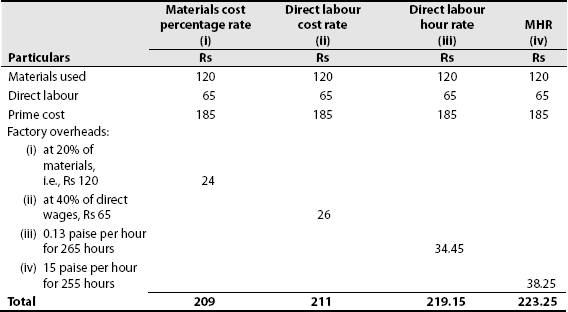

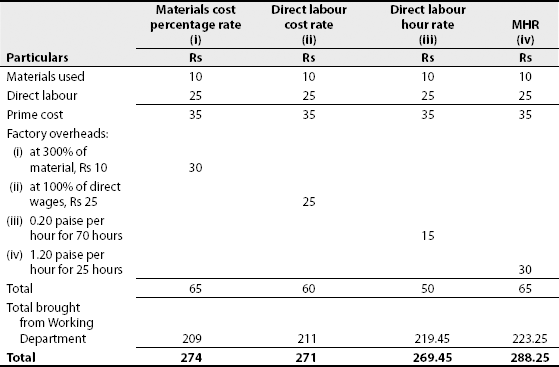

The following figures have been extracted from the books of a manufacturing company. All jobs pass through the company's two departments.

| Working department (Rs) | Finishing department (Rs) | |

|---|---|---|

| Materials used | 9,000 | 400 |

| Direct labour | 4,500 | 1,200 |

| Factory overheads | 1,800 | 1,200 |

| Direct labour hours | 14,000 | 6,000 |

| Machine hours | 12,000 | 1,000 |

The following information relates to Job no. 17.

| Working department (Rs) | Finishing department (Rs) | |

|---|---|---|

| Materials used | 120 | 10 |

| Direct Labour | 65 | 25 |

| Direct Labour Hours | 265 | 70 |

| Machine Hours | 255 | 25 |

You are required (a) to enumerate four methods of absorbing factory overheads by jobs showing the rates for each department under the methods quoted and (b) to prepare a statement showing the different cost results for job no. 17 under each of four methods referred to.

Solution:

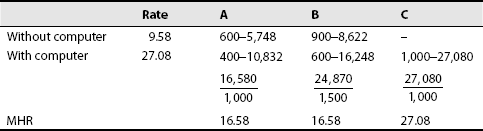

Comparative statement of job no. 17 for working department

Comparative statement of job no. 17 for finishing department

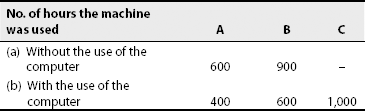

8.5 ADVANCED-TYPE SOLVED PROBLEMS

- Lion enterprises undertakes three different jobs A, B and C. All of them require the use of both a special machine and a computer. The computer is hired and the hire charges work out to Rs 4,20,000 per annum. The expenses regarding the machine are estimated to be as follows:

Rent for the quarter Rs 17,500 Depreciation per annum Rs 2,00,000 Indirect charges per annum Rs 1,50,000 During the first month of operation, the following details were taken from the job register.

You are required to compute the MHR:

- For the firm as a whole for the month when the computer was used and was not used.

- For the individual jobs A, B and C.

Solution:

Machine hours per month (1,000 + 1,500 + 1,000) 3,500 When the computer was used (400 + 600 + 1,000) 2,000 The machine overheads per month: Rent (17,500/4) 4,375 Depreciation (2,00,000/12) 16,667 Indirect charges (15,00,000/12) 12,500 33,542 Computer hire charges (4,20,000 × 12) 35,000 Overhead per month for the machine with

Computer overhead for the machine

Hire charges for the month 35,000 54,167 MHR when the computer not used:

MHR when the computer not used:

MHR for individual jobs

- A machine costs Rs 90,000 and is deemed to have a scrap value at 5% at the end of its effective life of 19 years. Usually, the machine is expected to run for 2,400 hours per annum, but it is estimated that 150 hours will be lost for normal repairs and maintenance and further 750 hours will be lost due to staggering. The other details in respect of the machine shop are as follows:

(a) Wages, bonus and provident fund contribution of each of the two operators (each operator is in charge of two machines) Rs 6,000 (b) Rent and rates of the shop Rs 3,000 per annum (c) General lighting of the shop Rs 250 per month (d) Insurance premium for the machine 200 per month (e) Cost of repairs and maintenance per machine 250 per month (f) Shop supervisor's salary 500 per month (g) Power consumption of the machine would be 20 units per hour, rate of power per 100 units Rs 10 (h) Other factory overhead attributable to shop Rs 4,000 per annum There are four identical machines in the shop. The supervisor is expected to spend one-fifth of his time for supervising machines. Compute a comprehensive MHR from the above details:

Solution:

Machine hour rate

Standing charges per annum per machine:

Rent rates 750 General lighting 750 Insurance 800 Supervisor's salary

300 Allocated overhead 1,000 Standing charges per machine hour 3,600/1,500 = 2.4 Variable charges: Wages (6,000/2) 3,000 Power 3,000 Repairs and maintenance 3,000 Depreciation

4,500 13,500/1,500 Variable charges per machine hour = 9 MHR = 2.4 + 9 = 11.40 - In a machine shop, the MHR is worked out at the beginning of a year on the basis of 1 to 3 weeks of period, which equals to three calendar months. The following estimates for operating a machine are relevant:

Total working hours available per week: 48 hours Operator's wages (per month): 650 Supervisor's salary (per month, common supervisor for three machines): 1,500 Written Down Value of machine (depreciation at 10% plus 2% on an average for extra shift allowance: 1,80,000 Repairs and maintenance (per annum): 16,000 Consumable stores (per annum): 30,000 Rent, rates and taxes (for the quarter apportioned): 5,000 Power consumed at 15 units per hour at 40 paise per unit. Power required for productive hours only. Setting up time is part at productive time, but no power is required for setting up jobs. The operators and supervisors are permanent. Repairs and maintenance and consumable stores are variable.

You are required to:

- Work out the MHR

- Work out the rate for quoting the outside party for utilizing the idle capacity in the machine shop, assuming a profit at 20% above variable cost.

Solution: Computation of MHR

Rent, rates and taxes Rs 5,000 Supervision Rs 1,500 Operator's wages Rs 1,950 Total outstanding charges Rs 8,450 Effective hours (46 × 13) 598 Fixed costs per hour (8,450/598) Rs 14.13 Variable cost per hour:

Power

5.74 Repairs = (4,000/598) 6.69 Consumable stores (7,500/598) 12.54 Depreciation

9.03 34.00 48.13 (b) Quotation for outside parties:

Variable cost per hour 34.00 Add : 20% profit 6.80 Minimum to be quoted 40.80 - Calculate the MHR.

- Cost of the machine: Rs 24 lakh

- Custom duty, insurance, freight etc. Rs 11 lakhs.

- Installation expenses: Rs 3 lakh

- Cost of tools adequate for 2 years only: Rs 4 lakh

- Cost of machine room: Rs 3 lakh

- Cost of air conditioning for machine room: Rs 2 lakh

- Rate of interest on term loan to finance the above capital expenditure: 12%

- Salaries etc. for operators and supervisory staff: Rs 2 lakh per year

- Cost of electricity: Rs 11 per hour

- Consumption of stores: Rs 5,000 per month

- Other expenses: Rs 5 lakh per annum

- Assumed rate of depreciation at 10% per annum on fixed assets

- Total working hours in the machine room: 200 hours per month.

- Loading and unloading time: 10% of machine time

- You can make suitable assumptions, if necessary, for the purpose of your computation

Solution: Computation of MHR

Machine expenses: Cost of machine Rs 24,00,000 Customs duty, Insurance and freight Rs 11,00,000 Installation expenses Rs 3,00,000 Cost of machine room Rs 3,00,000 Cost of air conditioning of the machine room Rs 2,00,000 Total cost Rs 43,00,000 Depreciation per annum at 10% Rs 4,30,000 199.07 Cost of electricity 11.00 Cost of tools Rs 2,00,000 92.59 Standing charges: Salaries Rs 2,00,000 Interest @ 12% p.a. on total capital investment including cost of tools i.e. on Rs 47,00,000 Rs 5,64,000 Consumption stores Rs 60,000 Other expenses Rs 5,00,000 ______ Rs 13,24,000 613.00 Cost per hour standing charges = Rs 915.66

MHR (1,32,400/2,160)

- A machine was purchased on February 2000 for Rs 5 lakh. The total cost of all machinery inclusive of the new machine was Rs 75 lakh. The further particulars of the machine are available as follows.

Expected life of the machine: 10 years Scrap value at the end of the 10 years: Rs 5,000 Repairs and maintenance for the machine during the year: Rs 2,000 Expected number of working hours of the machine per year: 4,000 hours Insurance premium annually for the machines: Rs 4,500 Electricity consumption for the machine per hour at 75 paise per unit: 25 units Area occupied by one machine: 100 sq. ft. Area occupied by other machine: 1,500 sq. ft. Rent per month of the department: Rs 800 Lighting charges for 20 points for the whole department, out of which three points are for the machine: Rs 120 per month Compute the MHR for the two machines on the basis of the data given above.

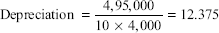

Solution: Computation of MHR

Standing charges Rs (per annum) Per hour Insurance premium 300 Repairs and maintenance 2,000 Rent 600 Light charges 216 Total 3,116 Hourly rate for standing charges (3,116/4,000) 0.779 Machine expenses

Depreciation (1:1) 12.375 Electricity consumption: 25 units per hour at Re 0.75 per unit 18.750 MHR 31.904 Working Notes:

- Depreciation

Cost of the new machine 5,00,000 Less: scrap value 5,000 4,95,000

- Insurance

Total cost of all the machines = 75,00,000 Total insurance premium paid for all the machines = 4,500 Total annual insurance premium of the new machine

- Rent

Rent paid per annum 9,600 Total area occupied 1,600 sq.ft. Rent for the area occupied by the New machine (100 sq. ft.)

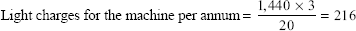

600 - Lighting charges for the machine

Total annual light charges of 20 points for the whole department is Rs 1,440.

- Depreciation

- Calculate the MHR from the following particulars of machine no. 33.

Cost of machine Rs 10,000 Estimated scrap value Rs 250 Estimated working life 15,000 hours Working hours per year 2,000 hours Cost of repairs per year Rs 1,500 Wages of operator per month Rs 150 Chemical per month Rs 100 Overheads chargeable to this machine per month Rs 200 Power per hour 20 units at 7 paise per unit No. of operators looking after four machines 2 persons Note: The MHR is a comprehensive MHR since operator's wages are included.

Solution: Computation of MHR

Particulars Rs (per annum) Per hour Standing charges: Repairs 1,500 Wages 150 × 12 = 1,800 × 2/4 900 Chemical (100 × 12) 1,200 Overhead (200 × 12) 2,400 Total standing charges 6,000 3.00 Running charges: Depreciation

0.65 Power (20 × 0.7) 1.40 MHR 5.05 - A machine costing Rs 20,000 is expected to run for 10 years at the end of which its scrap value is estimated to be Rs 2,000. Its installation charges are Rs 200.

Repairs for 10 years’ life is estimated to be Rs 1,800 The machine is expected to run for 2,190 hours in a year Its power consumption would be 15 units per hour Rs 5 per 100 units. The machine occupies one-fourth of the area of the department and has 2/10 points for lighting.

The foreman has to spend about one-third of his time for this machine.

The rent for the department is Rs 300 per month The charges for lighting are Rs 80 per month The foreman is paid a salary of Rs 960 per month Find out the hourly rate, assuming insurance is at 1% per annum and expenses on oil etc. are Rs 9 per month.

Solution: Computation of MHR

Particulars Rs (per annum) Per hour Standing charges: Repairs (1,800/10) 180 Rent (300 × 12 × ¼) 900 Lighting (80 × 12 × 2/10) 192 Salary of foreman (960 × 12 × 1/3) 3,840 Insurance (20,200 × 1%) 202 Total standing charges 5,314 2.43 Running charges: Oil expenses

0.05 Power (15 × 5/100) 0.75 Depreciation (20,000 + 200–2,000/10) = 1,820/2,190 0.83 MHR 4.06 - Calculate the MHR for the recovery of overheads for a group of 3 machines from the following data.

Original cost of 3 machines Rs 60,000 Depreciation at 10% per annum (straight line method) Repairs and maintenance cost average Rs 20 per day Power 30 paise per running hour per machine Supervision for the group of machines Rs 1,200 per month Allocation of rent for 3 machines on a floor area basis Rs 160 per month Share of manufacturing overheads Rs 300 per month for the group of machines Normal working days 300 in a year Normal operation 1 shift of 8 hours Normal allowance for repairs, maintenance, change over, idle time etc. 10% Solution:

Effective running hours per annum (300 × 8 × 90/100) = 2,160

Computation of MHR

Particulars Rs (per annum) Per hour Standing charges: Supervision (1,200 × 12 × 1/3) 4,800 Manufacturing overheads (300 × 12 × 1/3) 1,200 Rent (160 × 12 × 1/3) 640 Total standing charges 6,640 3.07 Running charges: Power 0.30 Depreciation

0.93 Maintenance

0.93 MHR 5.23 - The following annual charges are incurred in respect of a machine in a shop where manual labour is almost nil and work is done by means of five machines of exactly same type of specification:

(i) Rent and rates (proportional to the floor space) for the shop Rs 6,000 (ii) Depreciation on each machine Rs 1,000 (iii) Repairs and maintenance for the five machines Rs 1,200 (iv) Power consumed (as per meter) at 5 paise per unit for the shop Rs 3,000 (v) Electric charges for light in the shop Rs 600 (vi) Attendants: There are two attendants for the five machines, and they are each paid Rs 80 per month. (vii) Supervision: For the five machines in the shop, there is one supervisor whose emoluments are Rs 300 per month. (viii) Sundry supplies for the shop is Rs 500. (ix) Hire purchase instalments payable for the machine (including Rs 300 as interest) is Rs 1,200. The machine uses 10 units of power per hour. Calculate the MHR for the machine for the year.

Solution: Computation of MHR

Particulars Rs (per annum) Per hour Standing charges: Rent and rates (6,000 × 1/5) 1,200 Lighting charges (600 × 1/5) 120 Attendants salary (80 × 2 × 12 × 1/5) 384 Supervision (300 × 12 × 1/5) 720 Sundry supplies (500 × 1/5) 100 Total standing charges 2,524 2.10 Machine expenses Depreciation (1,000/1,200) 0.83 Repairs & maintenance (1,200 × 1/5 × 1/1,200) 0.20 Power 10 units @ 0.05 per unit (10 × 0.05) 0.50 MHR 3.63 Working Notes:

Total amount of power consumed = Rs 3,000

Rate of power = 0.50 per unit

Total working hours = 3,000/0.50 = 6,000 hours

No. of machines = 5

Hours per machine = 6,000/5 = 1,200 hours per year

CHAPTER SUMMARY

This chapter primarily deals with MHR, in which depreciation plays a vital role. It is to be understood that the machine continues to depreciate as the time pass by. The more the asset is used, the more the depreciation is caused. While calculating depreciation, two factors are considered: time factor and usage factor, or both.

EXERCISE FOR YOUR PRACTICE

Objective-Type Questions

I. State whether the following statements are true or false:

- When actual overheads are more than absorbed overheads, it is known as overabsorption.

- A blanket overhead rate is a single overhead rate computed for the entire factory.

- MHR is separately computed for each machine.

- Underabsorption of overhead results in understatement of cost.

- Underabsorption of overheads means that actual overheads are more than absorbed overheads.

- Basis of apportionment of store's service expenses is the value of the material consumed.

- Basis of apportionment of welfare department expenses is the number of employees.

- Basis of apportionment of Crèche expense is the number of male employees.

- Rent is apportioned based on the floor area.

- For calculating depreciation, scrap value is irrelevant.

[Ans: 1, false; 2, true; 3, false; 4, false; 5, true; 6, true; 7, true; 8, false; 9, true; 10, false]

II. Choose the Correct Answer:

- Aggregate of indirect materials, labour and expenses is termed as

- income

- overhead

- expenses

- tax

Ans: (b)

- The allotment of whole items of cost to cost centres or cost units is known as

- allocation

- absorption

- measurement

- apportionment

Ans: (a)

- Wages of machine operator is included in

- ordinary MHR

- depreciation

- plant

- comprehensive MHR

Ans: (d)

- When the amount of overhead absorbed is less than the amount of overhead incurred, it is known as

- underabsorption of overhead

- overabsorption of overhead

- proper absorption of overhead

- none of these

Ans: (a)

- The difference between the practical capacity and the capacity based on sales expectancy is termed as

- idle capacity

- ideal capacity

- return capacity

- ordinary capacity

Ans: (a)

- Allotment of proportions of items of cost to cost centres or cost units is known as

- allocation

- absorption

- measurement

- apportionment

Ans: (d)

- Which of the following is usually classified as stepped cost?

- telephone

- raw materials

- rates

- supervisor's wages

Ans: (d)

- Factory overheads include all of the following except

- salary of plant manager

- depreciation on delivery department

- small tool expenses

- taxes on factory building

Ans: (b)

- MHR is computed for

- factory

- all the machines

- each machine

- computers

Ans: (c)

- The process of grouping costs according to their common characteristics is called

- cost allocation

- cost apportionment

- cost department

- cost classification

Ans: (d)

DISCUSSION QUESTIONS

Short Answer-Type Questions

- Explain the terms underabsorption and overabsorption.

- Discuss the importance of MHR.

- What do you understand by absorption of overheads?

- Describe the various methods of absorption of overheads?

- Why do underabsorption and overabsorption arise?

- Explain ordinary MHR and composite MHR.

Essay-Type Questions

- Explain actual overhead rate and predetermined overhead rate

- Explain blanket overhead rate and multiple overhead rate

- List out the advantages of calculating MHR

PROBLEMS

- Calculate the MHR for Machine A from the following data:

Cost of machine Rs 16,000 Estimated scrap value Rs 1,000 Effective working life 10,000 hours Running time per 4 weekly period 160 hours Average cost of repairs and maintenance per 4 weekly period Rs 120 Standing charges allocated to Machine A per 4 weekly period Rs 40 Power used by the machine 4 units per hour at a cost of 5 paise per unit [Chennai, 1996]

[Ans: MHR = Rs 2.70]

- Calculate the MHR from the following:

(1) Cost of the machine Rs 19,200 (2) Estimated scrap value Rs 1,200 (3) Average repairs and maintenance Rs 150 p.m. (4) Standing charges allocated Rs 50 p.m. (5) Effective working life of the machine 10,000 hours (6) Running time per month 166 hours (7) Power used by the machine; 5 units per hour at 20 paise per unit [B.Com., Punjab]

[Ans: Rs 4]

- Work out the MHR for the following machine:

Cost of machine Rs 95,000 Installation charges Rs 10,000 Scrap value after 10 years Rs 5,000 Working hours per month 200 hours Lighting Rs 150 per month Rent Rs 200 per month Insurance premium Rs 500 per year Repair charges 50% of depreciation Other standing charges Rs 1,000 per month Power, 10 units per hour at Rs 10 per 100 units [Chennai, 1998]

[Ans: MHR = Rs 14.205 (or) 14.21]

- Calculate the MHR for Machine A from the following data:

Electric power: 75 paise per hour Repairs: Rs 530 per annum Steam: 10 paise per hour Rent: Rs 270 per annum Water: 2 paise per hour Running hours: 2,000 per annum Original cost of machine: Rs 12,500 Book value: Rs 2,870 Present replacement value: Rs 11,500 Depreciation:  per annum

per annum[Ans: Rs 1.75]

- Calculate MHR from the following:

(a) Cost of machine Rs 12,000 (b) Average repairs and maintenance charges per month Rs 150 (c) Estimated scrap value Rs 1,200 (d) Standing charges allocated to machine per month Rs 50 (e) Effective working life of machine 10,000 hours (f) Running time per month 166 hours (g) Power used by machine 5 units per hour at 19 paise per unit [Chennai, 1989]

[Ans: MHR = Rs 3.23 (approx.)]

- From the following particulars, calculate the MHR for a drilling machine.

Cost of the drilling machine Rs 42,000 Estimated scrap value Rs 2,000 Estimated working life 10 years of 2,000 hours each Running time for a 4-week period 150 hours Estimated repairs for life Rs 10,000 Standing charges allocated to this machine for a 4 week Rs 300 Power consumed per hour 5 units at 10 paise per unit [B.Com., 1980]

[Ans: Rs 5.00]

- The overhead expenses of a factory are allocated on the machine-hour method. You are required to calculate the hourly rate for a certain machine from the following information:

Cost Rs 58,000 Estimated scrap value Rs 3,000 Estimated working life 20,000 hours Estimated cost of maintenance for whole life (machine) Rs 12,000 Power used for machine Rs 1 per hour Rent per month (10% for this machine) Rs 1,500 Normal machine running hours during a month: 180 Standing charges other than rent, rates etc. per month Rs 200 [I.C.W.A. Inter]

[Ans: Rs 6.29]

- Calculate MHR from the following data.

Cost of machine Rs 58,000 Estimated scrap value Rs 3,000 Estimated working life 20,000 hours Estimated cost of maintenance during working life of machine Rs 12,000 Power used Re 1 per hour Rent & Rates per month (10% should be charged to this machine) Rs 1,500 Normal machine running hours during a month 180 hours Standing charges per month Rs 200 [Chennai, 1983]

[Ans: MHR Rs 6.294 (or) Rs 6.29]

- Calculate the MHR for Machine A from the following data:

Cost of machine Rs 1,600 Estimated scrap value Rs 100 Effective working life 10,000 hours Running time per 4 weekly period 160 hours Average cost of repairs and maintenance charges per four-weekly period Rs 12.00 Standing charges allowed to Machine A per four-weekly period Rs 4.00 Power used by machine 4 units per hour at a cost of 0.35 paise per unit [B.Com., Andhra Pradesh]

[Ans: Rs 1.66]

- Calculate from the following data the MHR for Machine A.

Cost of machine Rs 1,050 Estimated scrap value Rs 50 Effective working life 20,000 hours Running time in 4 weekly periods 150 hours Weekly amount payable under maintenance agreement covering all repairs Rs 7.50 Standing charges allocated to machine per 4 weekly periods Rs 6.00 Power used by machine 5 units per hour at 6 paise per unit [Chennai, 1990]

[Ans: MHR = Re 0.59]

- Compute the MHR from the following.

Cost of the machine Rs 2,00,000 Installation charges Rs 20,000 Estimated scrap value after expiry of its life of 15 years Rs 10,000 Rent for the shop Rs 400 per month General lighting for the shop Rs 600 per month Insurance premium for the machine Rs 1,920 per annum Repairs expenses Rs 2,000 per annum Power 10 units per hour Rate of power per 100 units Rs 40 Estimated working hours 2,000 per annum Shop supervisor's salary Rs 1,200 per month The machine occupies one-fourth of the area of the shop.

The supervisor spend one-third of his time for this machine.

[B.Com., Osmania]

[Ans: Rs 16.86]

- A machine was purchased on 01 January 1998. The following relate to the machine.

Cost of the machine Rs 40,000 Estimated life 15 years of 1,800 hours per year Estimated scrap value Rs 2,500 Estimated repairs for whole life Rs 10,500 Power consumed per hour 15 units at 0.07 paise per unit Insurance Rs 75 per month Consumable stores Rs 25 per month The machine is installed in a department whose monthly rent is Rs 500, and this machine occupies one-fifth of the area. Total monthly lighting cost is Rs 40 for 10 light points, of which three relate to the machine. A supervisor with a monthly salary of Rs 500 spend one-fourth of his time for this machine. Calculate the MHR.

[Chennai, 1999]

[Ans: MHR = Rs 5.0744 (or) Rs 5.07]

- Work out the MHR for the following machine for January 1989.

Cost of the machine Rs 90,000 Freight and installation Rs 10,000 Working life 10 years Working hours 2,000 per annum Repair charges 50% of depreciation Power 10 units per hour at 10 paise per unit Lubricating oil at Rs 2 per day of 8 hours Stores at Rs 10 per day of 8 hours Wages of operator at Rs 4 per day [Chennai, 1998]

[Ans: MHR = Rs 10]

Hint: Ignore wages of the operator. If it is also included, the MHR will be comprehensive or composite, Machine Hour Rate will be 10 + 0.50 = Rs 10.50.

- Calculate MHR for machine no. 7, which is one of seven machines in operation in a department of a factory.

(a) Cost of the machine no. 7: Rs 1,000 (b) Estimated scrap value at finish of working life (10 years): Rs 100. (c) Normal running hours per year: 1,800 hours (d) Machine no. 7 occupies one-fifth of the floor space of the department; the rent, rates, lighting etc. of which amounted to Rs 350 per annum (e) Charges for electric power supplied to machine no. 7: Rs 200 per annum (f) Charges for oil, waste etc. supplied to machine no. 7: Rs 30 per annum (g) Repair and maintenance machine estimated: Rs 360 per annum. (h) Cost of supervision and other expenses applicable to Machine no. 7 estimated at Rs 150 per annum. Labour cost of operating the machine should be ignored in your calculations. [B.Com., Mysore]

[Ans: Re 0.50]

- Calculate the MHR from the following.

Cost of the machine Rs 80,000 Cost of installation Rs 20,000 Scrap value after 10 years Rs 20,000 Rent and rates per quarter for the shop Rs 3,000 General lighting (per month) Rs 200 Shop supervision per quarter Rs 6,000 Insurance premium per annum Rs 600 Estimated repairs per annum Rs 1,000 Power 2 units per hour at Rs 50 per 100 units Estimated working hours per annum 2,000 hours The machine occupies one-fourth of the total area of the shop. The supervisor spend one-sixth of his time for supervising this machine. General lighting is to be apportioned on the basis of floor area.

[Chennai, 1998]

[Ans: MHR = Rs 9.60]

- Compute MHR from the following data.

Cost of the machine Rs 1,00,000 Installation charges Rs 10,000 Estimated scrap value after the expiry of its life (15 years) Rs 5,000 Rent and rates for the shop per month Rs 200 General lighting for the shop per month Rs 300 Insurance premium for the machine per annum Rs 960 Repairs and maintenance per annum Rs 1,000 Power consumption 10 units per hour Rate of power per 100 units Rs 20 Estimated working hours per annum, which includes setting up time of 200 hours 2,200 Shop supervisor's salary per month Rs 600 The machine occupies one-fourth of the total area of the shop. The shop supervisor is expected to spend one-fifth of his time for supervising the machine.

[B.Com., Delhi]

[Ans: Rs 7.95]

- A machine was purchased on 01 January 1990 for Rs 5 lakh. The total cost of all machinery inclusive of the new machine was Rs 75 lakh. Further particulars are available as follows:

Expected life of machine: 10 years Scrap value at the end of 10 years: Rs 5,000 Repairs and maintenance for the machine during the year: Rs 2,000 Expected number of working hours of the machine per year: 4,000 hours Insurance premium annually for all the machines: Rs 4,500 Electricity consumption for the machine per hour (at 75 paise per unit): 25 units Area occupied by the machine: 100 sq. ft. Area occupied by other machines: 1,500 sq. ft. Rent per month of the department: Rs 800 Lighting charges for 20 points for the whole department, out of which three points are for the machine: Rs 120 per month. Compute the MHR for the two machines on the basis of the data given above.

[Chennai, 1997]

[Ans: MHR = Rs 31.904 or Rs 31.90]

- The production department of a factory furnishes the following information for the month of August.

Materials used Rs 54,000 Direct wages Rs 45,000 Labour hours worked 36,000 Hours of machine operation Rs 30,000 Overheads chargeable for the department Rs 36,000 For an order executed by the department during the period, the relevant information was as follows:

Materials used Rs 6,000 Direct wages Rs 3,200 Labour hours worked Rs 3,200 Hours of machine operation Rs 2,400 Calculate the overhead charges chargeable to the job by the following methods: (1) Direct materials cost percentage rate, (2) labour hours rate (3) MHR.

[B.Com., Delhi]

[Ans: (1) Rs 4,000, (2) Rs 3,200, (3) Rs 2,880]

- Compute the MHR from the following data:

Cost of machine Rs 1,00,000 Installation charges Rs 10,000 Estimated scrap value after the expiry of life (15 years) Rs 5,000 Rent and rates for the shop per month Rs 200 General lighting for the shop per month Rs 300 Insurance premium for the machine per annum Rs 960 Repair and maintenance per annum Rs 1,000 Power consumption of 10 units per hour Rate of power per 100 units 20 Estimated working hours per annum 2,200 This includes setting up time of 200 hours Shop supervisor's salary per month 600 The machine occupies one-fourth of the total area. The supervisor is expected to devote one-fifth of his time for supervising the machine.

[Chennai, 1994]

[Ans: MHR = Rs 7.95]

Hint: Assume setting up time of 200 hours as normal. Compute the rate for productive hours: 2,200 -200 = 2,000.

- From the following information, calculate the MHR.

1. Cost of asset: Rs 1,05,000 with a scrap value of Rs 15,000 at the end of its working life 2. Installation charges: Rs 10,000 3. Life of asset: 10 years at 2,000 working hours per year 4. Repair charges: 50% of depreciation 5. Lubricating oil: Rs 2 per day of 8 hours 6. Consumable stores at Rs 10 per day of 8 hours 7. Direct wages of operator at Rs 4 per day 8. Consumption of electric power: 10 units per hour at 7 paise per unit [Poona]

- An engineering company gives you the following details about a new machine installed by them. Calculate the MHR for the machine.

(1) Cost of the machine Rs 24,000,000 (2) Customs duty, insurance, freight etc. Rs 11,00,000 (3) Installation expenses Rs 3,00,000 (4) Cost of tools for the first 2 years Rs 4,00,000 (5) Cost of machine room Rs 3,00,000 (6) Cost of air conditioning machine room Rs 2,00,000 (7) Rate of interest on loan to finance the purchase 12% per annum (8) Salaries of operators Rs 2,00,000 per annum (9) Cost of electricity Rs 11 per hour (10) Consumption of stores Rs 5,000 per annum (11) Other expenses Rs 5,000 per annum (12) Rate of depreciation at 10% per annum on fixed assets (13) Total working hours of machine 200 hours per month (14) Loading and unloading time 10% of the machine time [Madurai, 1982]

[Ans: Rs 915.66]

- The following annual charges are incurred in respect of a machine in a shop where manual labour is almost nil and work is done by means of five machines of exactly similar type.

(a) Rent and rates for the shop: Rs 4,000 (b) Depreciation on each machine: Rs 400 (c) Power consumed (as per metre) at 10 paise per unit for shop: Rs 3,00 (d) Electric charges for light in the shop: Rs 540 (e) Attendants: There are two attendants for the five machines, and they are each paid Rs 60 per month. The machine uses 10 units of power per hour. Calculate the MHR of the machine.

[Chennai, 1994]

[Ans: MHR = Rs 3.66; machine hours per annum per machine based on power cost = 600 hours]

Note: The MHR is a comprehensive MHR since attendants’ wages are also included.

- A machine costs Rs 90,000 and is deemed to have a scrap value of 5% at the end of its effective 19 years. Usually, the machine is expected to run for 2,400 hours per annum, but it is expected that 150 hours will be lost for normal repairs and maintenance and further 750 hours will be lost due to staggering. The other details in respect of the machine shop are as follows:

(a) Wages, bonus and provident fund contribution of each of the two operators (each operator is in charge of two machines) Rs 6,000 per annum (b) Rent and rates of the shop Rs 3,000 per annum (c) General lighting of the shop Rs 250 per month (d) Insurance premium for the machine per quarter Rs 200 (e) Cost of repairs and maintenance per machine Rs 250 per month (f) Shop supervisor's salary Rs 500 (g) Other factory overhead attributable to the shop Rs 4,000 per month (h) Power consumption of the machine per hour: 20 units; rate of power per 100 units Rs 10 There are four identical machines in the shop. The supervisor is expected to devote one-fifth of his time for supervising the machine. Compute a comprehensive MHR from the above details.

[C.A. Inter]

[Ans: Rs 12.00]

- From details furnished below, compute a comprehensive MHR.

(1) Original purchase price of the machine (subject to depreciation at 10% per year on original cost) Rs 21,600 (2) Normal working hours for the month (the machine works to only 75% of capacity) 200 hours (3) Wages of machine man Rs 4 per day (hours) (4) Wages of a helper Rs 2 per day (8 hours) (5) Power consumption (Horse Power) is estimated at Rs 150 per month for the time worked (6) Supervision charges apportioned for the machine Rs 300 per month (7) Electricity and lighting Rs 75 per month (8) Repairs and maintenance (machine) including consumable store per month Rs 150 (9) Insurance of plant and building (apportioned) Rs 1,000 per year (10) Other general expenses overhead per annum Rs 2,160 (11) Production bonus payable to workers:  in terms of an award of basicwages and dearness allowance

in terms of an award of basicwages and dearness allowance(12) Workers are also paid a fixed dearness allowance of Rs 75 per month (13) Add 10% of the basic wages and dearness allowance against leave wages and holidays with pay to arrive at a comprehensive labour cost for debit to production [Calcutta]

[Ans: Rs 10.32]

- The following particulars relate to a machine:

Purchase price of machine Rs 80,000 Installation expenses Rs 20,000 Rent per quarter Rs 3,000 General lighting for the whole area Rs 200 per month Supervisor's salary Rs 6,000 per quarter Insurance premium for the machine Rs 600 per annum Estimated repair for the machine Rs 1,000 per annum Estimated consumable stores Rs 800 per annum Power: 2 units per hour at Rs 50 per 100 units The estimated life of machine is 10 years, and the estimated scrap value is Rs 20,000. The machine is expected to run 20,000 hours in its life. The machine occupies 25% of the total area. The supervisor devotes one-sixth of his time for the machine.

You are required to work out MHR.

[Madurai]

[Ans: Rs 10]

- The following particulars relate to a processing machine treating a typical material:

1. Cost of the machine Rs 10,000 2. Estimated life 10 years 3. Scrap value Rs 1,000 4. Yearly working time (50 weeks of 44 hours each) 2,200 hours 5. Machine maintenance 200 hours per annum 6. Setting up time estimated at 5% of total productive time and is regarded as productive time 7. Electricity is 16 units per hour at 10 paise per unit 8. Chemical required weekly Rs 20 9. Maintenance cost per year Rs 1,200 10. Two attendants control the operations of machine together with six other machines. Their combined weekly wages are Rs 140 11. Departmental overhead allocated to this machine per annum Rs 2,000 You are required to calculate the MHR.

[CA]

[Ans: Rs 4.81]

- A machine costs Rs 90,000 and is deemed to have a scrap value of 5% at the end of its effective life of 19 years. Usually, the machine is expected to run for 2,400 hours per annum, but it is estimated that 150 hours will be lost for normal repairs and further 750 hours will be lost due to staggering. The other details in respect of the machine shop are as follows:

(a) Wages, bonus and provident fund contribution of each of the two operators (each operator is in charge of two machines): Rs 6,000 per annum (b) Rent and rates of the shop: Rs 3,000 per annum (c) General lighting for the shop: Rs 250 per month (d) Insurance premium per machine: Rs 200 per quarter (e) Cost of repairs and maintenance per machine: Rs 250 per month (f) Shop supervisor's salary: Rs 500 per month (g) Power consumption of the machine per hour: 20 units at Rs 10 per 100 units (h) Other factory overheads chargeable to the shop: Rs 4,000 per annum There are four identical machines in the shop. The supervisor is expected to spend

of his time for supervising the machine. Form the above particulars, compute comprehensive MHR.

of his time for supervising the machine. Form the above particulars, compute comprehensive MHR.[Mysore]

[Ans: Rs 12]

- Calculate the MHR from the following:

Cost of the machine Rs 8,000 Cost of installation Rs 2,000 Scrap value after 10 years Rs 2,000 Rates and rent for a quarter for the shop Rs 300 General lighting Rs 20 per month Shop supervisor's salary Rs 600 per quarter Insurance premium for a machine Rs 60 per annum Estimated repair Rs 100 per annum Power: 2 units per hour Rs 50 per 100 units Estimated working hours 2,000 hours per annum The machine occupies one-fourth of the total area of the shop. The supervisor is expected to spend one-sixth of his time for supervising the machine. General lighting expenses are to be apportioned on the basis of floor area.

[Delhi]

[Ans: Rs 1.86]

- A machine shop contains four newly purchased machines each occupying practically equal amount of space and costing, respectively, A: Rs 20,000; B: Rs 25,000; C: Rs 30,000 and D: Rs 40,000.

The following are the expenses per annum of the machine shop.

Rent Rs 10,000 Rates and water Rs 4,250 Light and heat Rs 3,150 Power for A Rs 5,100 Power for B Rs 5,000 Power for C Rs 12,000 Power for D Rs 14,500 Administration Rs 9,500 Running expenses works sundries Rs 20,000 Prepare an MHR for each machine, assuming 45 hours in a week and 50 weeks a year, 80% utilisation and life of machine being 10 years without scrap value.

(C.A)

[Ans: A, Rs 9.61; B, Rs 10.32; C, Rs 14.97; D, Rs 17.88]

EXAMINATION PROBLEMS

- A machine shop has 8 identical drilling machines manned by 6 operators. The machines cannot be worked without an operator wholly engaged on it. The original cost of all these 8 machines works out to Rs 8 lakh. These particulars are furnished for a 6-month period.

Normal available hours per month 208 Absenteeism (without pay) hours 18 Leave (with pay) hours 30 Wages for 8 hours Rs 20 Production bonus estimated 15% on wages Value of power consumed Rs 8,050 Supervision and indirect labour Rs 3,300 Lighting and electricity Rs 1,200 These particulars are for a year Repairs and maintenance including consumables 3% on the value of the machine

Insurance Rs 40,000 Depreciation 10% on original cost Other sundry works’ expenses Rs 12,000 General management expenses allocated Rs 54,530 You are required to work out comprehensive MHR for the machine shop.

-

- Compute comprehensive MHR from the following data:

- Total cost of machine to be depreciated: Rs 2,30,000

- Life: 10 years

- Depreciation on straight line

- Departmental overheads (annual):

Rent Rs 50,000 Heat and light Rs 20,000 Supervision Rs 1,30,000 -

Departmental area 70,000 square metres Machine area 2,500 square metres - No. of machines in the department: 26

- Annual cost of reserve equipment for the machines: Rs 1,500

- Hours run on production: 1,800

- Hours for setting and adjusting: 200

- Power cost: Re 0.50 per hour of running time

- Labour:

- When setting and adjusting, there should be a full-time attention

- When machine is producing, one worker can look after three machines

- Labour rate: Rs 6 per hour

- Using the MHR as calculated above, work out the amount of factory overhead to be absorbed on the following:

Ans: Comprehensive MHR = 20.14

Note: It is assumed that there is no power cost when the machine is being set or adjusted.

(B) If the MHR as calculated in (A) is adopted, the overheads absorbed over the various jobs will be as follows

Job no. 605 = 20.14 × 80 = Rs 1,611.20 Job no. 595 = 20.14 × 70 = Rs 1,409.80

- Compute comprehensive MHR from the following data:

- A machine costs Rs 90,000 and is deemed to have a scrap value of 5% at the end of its effective life (19 years). Usually, the machine is expected to run 2,400 hours per annum, but it is estimated that 150 hours will be lost for normal repairs and maintenance and further 750 hours will be lost due to staggering. The other details in respect of the machine shop are as follows:

Wages, bonus and provident fund, contribution of each of two operators (each operator is in charge of two machines) Rs 6,000 per year Rent and rates of the shop Rs 3,000 per year General lighting of the shop Rs 250 per month Insurance premium for the machine Rs 200 per quarter Cost of repairs and maintenance per machine Rs 250 per month Shop supervisor's salary Rs 500 per month Power consumption of the machine hour 20 units Rate of power per hundred units Rs 10 Other factory overheads attributable to the shop 4,000 per year There are four identical machines in the shop. The supervisor is expected to devote 1/5th of his time for supervising the machine. Compute a comprehensive MHR from the above details.

Ans: Total MHR = 12.00

- Calculate the MHR for the recovery of overheads for a group of three machines from the following data:

Original cost of 3 machines Rs 56,800 Depreciation at 10% per annum (straight line method) Repairs and maintenance cost average Rs 16 per day Power 30 paise per running hour per machine Supervision for the group of machines Rs 800 per month Allocation of rent for 3 machines on a floor area basis Rs 120 per month Share of manufacturing overheads Rs 250 per month for the group of machines Normal working days 300 in a year Normal operation 1 shift of 8 hours Normal allowance for repairs, maintenance, change over, idle time etc 20%

- The following annual charges are incurred in respect of a machine in a shop where manual labour is almost nil and work is done by means of five machines of exactly same type of specification.

(i) Rent and rates (proportional to the floor space) for the shop Rs 4,800 (ii) Depreciation on each machine 500 (iii) Repairs and maintenance for the five machines 1,000 (iv) Power consumed (as per meter) @ 5 p. per unit for the shop Rs 3,000 (v) Electric charges for light in the shop Rs 540 (vi) Attendants: There are two attendants for the five machines and they are each paid Rs 60 per month. (vii) Supervision: For the five machines in the shop there is one supervisor whose emoluments are Rs 250 per month (viii) Sundry supplies for the shop Rs 450 (ix) Hire purchase instalments payable for the machine (including Rs 300 as interest): 1,200 The machine uses 10 units of power per hour. Calculate the MHR for the machine for the year.

Ans: Comprehensive MHR = 2.7884 or 2.79

Note: (1) Calculations are made up to the fourth decimal to minimise the effect of approximations.

(2) When attendants’ salary or wages is also included in the calculation, the MHR is called ‘comprehensive MHR’ or ‘composite MHR’.

Working Note: annual working hours per machine

Total amount of power consumed: Rs 3,000

Rate of power: 0.50 per hour

Total working hours =

= 6,000 hours

= 6,000 hoursNo. of machines = 5

Hours per machine =

= 1,200 hours per annum

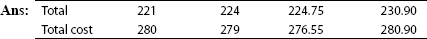

= 1,200 hours per annum - The following figures have been extracted from the books of a manufacturing company. All jobs pass through the company's two departments:

Working department (Rs) Finishing department (Rs) Materials used 6,000 500 Direct labour 3,000 1,500 Factory overheads 1,800 1,200 Direct labour hours 12,000 5,000 Machine hours 10,000 2,000 Following information relates to Job no. 17.

Working department (Rs) Finishing department (Rs) Materials used 120 10 Direct labour 65 25 Direct labour hours 265 70 Machine hours 255 25 You are required (a) to enumerate four methods of absorbing factory overheads by jobs showing the rates for each department under the methods quoted and (b) to prepare a statement showing the different cost results for job no. 17 under each of four methods referred to.