1.1 INTRODUCTION

It was a sunny and warm Thursday of midsummer. Some dark clouds in the previous days suggested that sudden showers had been expected to fall in the short term, but no one would have forecast the magnitude of the incoming financial tsunami.

But, citing L. McDonald [87], Wall Street's most sinister troubles occasionally arrive without the thunder of the guns and the clash of mounted cavalry on the trading floor. Some deadly problems come creeping in unannounced and often unnoticed, when financial players unobtrusively arrive at a single conclusion at around the same time. No one can say anything about collective changes: suddenly there is a lightning bolt of fear crackling through the market, and the consequences are there.

That day was August 9, 2007. Some years later, that day be referred to as the dawn of the worst crisis to hit financial markets in the last two decades. It begun with newswires reporting the announcement by some BNP Paribas funds to freeze redemptions, citing difficulties in valuing their assets due to the lack of liquidity in subprime mortgage markets. In a few hours the international money market had been seriously deadlocked: central banks had to inject an enormous and unprecedented amount of liquidity into the system to settle its daily payment obligations (e.g., the special refinancing operation conducted by the ECB with overnight maturity registered a request record for EUR95 billion; on the same day the Fed injected USD24 billion). The day of reckoning had eventually come: the financial market started the long-awaited process of risk reappreciation, which had been evoked by regulators and supervisors several times in previous months.

On July 24 the major US home loan lender, Countrywide Financial Corp., announced an earnings drop. The market rumoured that almost one in four of all Countrywide's subprime loans were delinquent (10% of those were 90 days delinquent or more). With the ABCP market finally faltering, there was no easy access to cheap, fast money for this shadow bank that was going to be in a deadly situation.

On July 30 German bank IKB warned of losses related to subprime mortgage fail-lout: as a consequence the five-year European iTraxx Crossover index reached a peak of 500 bp and liquidity in the European government bond market declined sharply.

On July 31 American Home Mortgage Investment Corp. announced its inability to fund lending obligations, and it subsequently declared bankruptcy on August 6.

What was going to happen?

1.2 THE FIRST WAVE

During the previous years the combination of (i) large financial market liquidity; (ii) increasing risk appetite; (iii) rising leverage in market strategies and derivative products led to an aggressive search for higher yield by investors. This process was suddenly reversed when the number of delinquencies in the US hugely increased from early 2007. The related sharp decline in the credit quality in the subprime mortgage market impacted on the fundamentals of structured credit products. It ignited rising concerns that the delinquency rate could have risen to unprecedented levels and led some rating agencies to downgrade several issues of ABS, backed by pools of subprime mortgages. Moreover, they announced a revision of their methodologies for assigning new ratings.

At this point investors realized that (i) risk assessment and (ii) pricing methods for a large proportion of complex instruments were definitely inadequate. These factors produced great uncertainty about the fundamentals of the ABS market and increased trading frictions. At last, they translated to bid–ask spreads that grew wider and wider up to the point where all the ABS markets dried up.

Why did the announcement of these downgrades and methodology revisions impact so heavily on the market and spread far beyond a risk reappraisal and a simple shock related to the subprime sector?

First, claims on the cash flows generated by subprime loans used to be embedded by the financial industry in a broad array of structured credit products (starting with RMBS, followed by CDOs containing some exposure to these RMBS, and ultimately by CDO squared). This partly explained why indirect exposures to US subprime loans through ABS had been widespread much more than initially forecast by regulators and financial firms.

On the May 4 UBS shut down its internal hedge fund, Dillon Read, after suffering about USD 125 million of subprime-related losses. In mid-June two hedge funds run by Bear Stearns and involved in the subprime market experienced serious trouble in fulfilling their margin calls, leading the bank to inject USD 3.2 billion in order to protect its reputation. These were not the first episodes about a possible spill-over from the US mortgage market: on the February 27, 2007 global equity markets dropped on fears about Asian equity markets and growing concerns over further deterioration in the US subprime mortgage sector. The relatively small correction (Dow Jones Euro STOXX −8%, S&P 500 −6%) ended on March 14 when equity markets resumed their upward trend.

Box 1.3. The warning of Cassandra

According to Homer, the princess Cassandra was gifted a prophecy by Apollo; but afterwards the god, offended with her, rendered the gift unavailing by ordaining that her predictions should never be believed. Like the Trojan Cassandra, not listened, the former ECB president Jean-Claude Trichet often warned the financial community about the reassessment of risk.

From the Q&A session of the ECB press conference on March 8, 2007:

Question: “When we were all in Madrid last year and the financial markets were doing their gymnastics then, you stressed that an appropriate assessment of risk was not the worst thing in the world and that perhaps some valuable lessons were being learnt. We have a similar situation now, albeit with different kinds of contours, and I wanted to see if you might be of a similar sentiment today?”

Mr Trichet's answer: “Concerning the recent events that we have observed, it is true that the Governing Council of the ECB widely felt—and I would say that it was very largely a consensus, a consensus that I myself have expressed on a number of occasions as the chairman of the G10 group of central bank governors—that we were perhaps in a phase in global finance where risks in general were not necessarily assessed at their real price. This was materializing in the levels of spreads and risk premia and in a number of other considerations, perhaps including low real interest rates. This was our diagnosis. What we have been observing for a number of days has been a certain reassessment of risks on the upside and across the board and a higher level of volatility. This is a phenomenon that we are following very carefully. It has positive aspects, obviously. It represents a more realistic appreciation of risks in general. It must also of course be monitored very carefully because what is of the essence in our view is that such corrections are orderly and smooth and are not abrupt.

On July 10 Chuck Prince, the former Citigroup's CEO, by referring to Keynes' analogy between bubbles and musical chairs, said: “When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you've got to get up and dance. We're still dancing” (see Brunnermeier [38]).

From the Q&A session of the ECB press conference on August 2, 2007:

Question: “The current phase of market movements that we see, is that something that you would characterise as a smooth reappreciation of risk or is that something that is abrupt and undesirable?”

Mr Trichet's answer: “We are in an episode where prices that were under-assessing an element of risk in a number of markets are normalising. I will not give any other qualification to the situation: it is a process of normalisation. The first quality to be demonstrated in circumstances when we see significant increases in measures of volatility in a large range of markets and asset classes by market participants and investors, and of course by authorities is to keep their composure. That is something important and it would permit the evolution of the market to be as effective as possible in terms of going back to a normal assessment of risks in general.”

Second, questioning the methodology to assign ratings to these products implied questioning underlying assumptions about the distribution of returns on a wider variety of ABS products. ABS secured by pools of different assets, such as corporate bonds, bank loans, automobile loans and credit cards, were structured, rated and priced by using a similar methodology. Investors abruptly realized that similar properties could no longer be used for both corporate bonds and structured credit products. Without essential data about rating transition probabilities and market liquidity risk, they could no longer quantify the risk in these structured products with any degree of confidence. Many of these instruments, tailor-made to the risk–reward profile of investors and illiquid by definition, were valued by models. These models no longer worked when input data, such as market prices for ABS indices, were either not available or unreliable. Then the calculation of the fair value for most products became simply impossible.

Other market sectors were already negatively influenced: the issuance volumes of CDOs/CLOs registered a sharp decline. Growing uncertainties toward those products led to widespread refusal by financial investors to maintain their ABCP when they matured. Some ABCP issuers had to roll their debt into issues of only a few days' maturity: as a result, the average maturity of new issued paper significantly lowered. The weekly figures published by the Fed, unknown until then by a large part of market players, became one of the principal market drivers. Going on, this risk reappreciation process hit the refinancing strategies of SPV/SIV: with their usual funding channels dried up, they had to draw on their committed credit lines from their sponsoring banks. In the first half of August two German banks, 1KB and Sachsen LB, were unable to honour their liquidity and credit commitments. Given the aggregate large exposures relative to the size of the sponsoring banks' balance sheets, after hectic negotiations, emergency rescues from a number of other financial institutions had to be arranged.

Under the ongoing pressure of the turmoil, financial firms finally began to wonder about the soundness of their liquidity policies. Some of them were targeted by bank runs and heavily hit by the growing credit crunch. As a result a number of small credit institutions failed, others were saved by the public sector (Northern Rock in the UK) or the private sector (Bear Stearns).

More enterprises received capital injections from governments (i.e., Citigroup, Royal Bank of Scotland, Fannie Mae, Freddie Mac, Indie Mac). A lot of them recorded profit warnings and credit losses. Spreads in interbank funding and other credit-related products rose sharply and funding strains were experienced in the secured financing market.

In mid-September 2008 the financial turmoil reached its peak. After pre-announcing its disappointing third-quarter figures, Lehman Brothers, one of the four major US investment banks, was unable to raise capital or find strategic investors: it experienced a destructive run on its liquid assets and was forced to file for creditor protection under Chapter 11 on September 15, 2008. On the same day Merrill Lynch accepted being taken over by Bank of America and, only two days later, the giant insurer AIG was rescued by the US government as it teetered on the edge of collapse due to rising requests for post-collateral payments on derivatives trades after its rating downgrading. Eventually, Morgan Stanley and Goldman Sachs decided to transform themselves from investment banks into commercial bank holding companies to gain advantage from lender-of-last-resort support and the deposit insurance scheme, and to use deposits as a source of funding.

These events ignited concerns about the scale and distribution of counterparty losses, and challenged the widespread view that any large bank too big to fail would need public support. Fear and rumours of further defaults in financial sectors resulted in some banks struggling to obtain funds at any market level.

A dangerous mix of credit problems, wholesale deposit runs and incipient retail deposit runs led to the collapse of some financial institutions on both sides of the Atlantic Ocean (Washington Mutual, Bradford & Bingley, Icelandic banks).

In late September, two large European banks, Dexia and Fortis, with cross-border activities in Benelux and France, came under intense pressure, due to perceptions of low asset quality, liquidity and capital shortages, and needed public and private support. In Germany a major commercial property lender, Hypo RE, had to be saved from the brink of collapse.

At that point the unsecured money market was definitely deadlocked: prime banks were unable to get funds for terms longer than one or two weeks. Eventually, banks with liquid balances preferred to hoard liquidity or to deposit it in central banks, for fear of economic losses related to the counterparty credit risk and uncertainty about (i) the mark-to-market of illiquid assets and (ii) the effective amount of liquidity in their balance sheet. As a result money market spreads climbed higher and higher.

1.3 BANKS AS LEMONS?

To the eyes of investors all banks were going to become “lemons”, according to the famous example provided by Akerlof [3] in the 1970s. In this classical paper Akerlof showed how the interaction of quality differences in products and the uncertainty about them may impact on market equilibrium, producing frequent cases of adverse selection and moral hazard.

Adverse selection is related to asymmetric information about the quality of goods, services and products. For instance, if an insurer is unable to classify customers according to their risk level, he is likely to select more risky customers who will find the initial premium cheaper and will buy more protection than needed: as a result the insurance premium will rise, by excluding the safest customers from the market. Instead, asymmetric information concerning players' behaviours can lead to moral hazard. In this case it arises because an individual does not take the full consequences of his actions, and therefore tends to act less carefully than he otherwise would (after being insured, a customer could be less cautious about locking his car). If the information about products, services or behaviours was available for all market players in the same quantity and quality, they would be priced and exchanged with more contracts at different levels. Both adverse selection and moral hazard can prevent us from reaching Pareto-efficient allocation: departures of the economy state from the complete markets paradigm.

Box 1.4. The growing avalanche

A subprime mortgage is a short-reset loan where the interest rate is not constant during the life of the deal. The rate initially charged is much lower than for a standard mortgage but it is normally reset to a much higher rate, usually after a two/three-year period.

Thanks to this kind of reset the rising of short-term US interest rates from mid-2004 onwards was not immediately translated into higher mortgage repayment burdens, but delayed it until sometime later. Moreover, the high rates of house price inflation recorded during the previous decade fuelled the interest rate for these mortgages for some householders, who borrowed for house purchases with the intention of refinancing or repaying the mortgage before the reset date. Once mortgage interest rates started to rise and house prices began to fall, many borrowers became delinquent on their loans sometimes even before the reset period.

Box 1.5. Some mysterious initials

An asset-backed security is a financial product whose value and income payments are derived from and “backed” (collateralized) by a specific pool of underlying assets. These assets are typically illiquid and unable to be sold individually (such as payments from credit cards, auto loans, residential mortgages, aircraft leases, royalty payments, movie revenues). By the process of securitisation these assets can be sold to investors and the risk related to the underlying product diversified because each security represents only a fraction of the total value of the pool of different assets.

An RMBS (CMBS) is a residential (commercial) mortgage-backed security (i.e., an ABS backed by a pool of residential or commercial mortgages). A CDO is a collateralized debt obligation, while a CLO means a collateralized loan obligation. Last, a CDO squared is a CDO collateralized by another CDO.

The most amazing acronym is surely the NINJA mortgage, where NINJA stands for “no income no job (or) asset” and describes one of many documentation types used by lenders and brokers for those people with hard-to-verify incomes. It also works as an allusion to the fact that for many loans borrowers used to disappear like ninjas. Such mortgages were granted under the premise that background checks were not necessary because house prices could only rise, and a borrower could thus always refinance a loan using the increased value of the house.

According to Akerlof, in the automotive market, where people buy new automobiles without knowing whether the car they buy will be good or bad (“lemon”), the price for equilibrium is defined by demand and supply for a given average quality. Good cars and lemons must still sell at the same price (the fair price for the average quality of used cars), since it is impossible for a buyer to tell the difference between a good and a bad car, and only sellers have accurate knowledge about the car quality.

With information not uniformly distributed among market participants, the demand for used cars depends most strongly on two variables, the price and the average quality: the latter still depends on the price. As the price falls, the quality perceived by the market will also fall.

Then asymmetrical information can lead good cars to be driven out of the market by lemons and can create worse pathologies in a more continuous case with different grades of goods: it ignites such a sequence of events that no markets can exist at all. For instance, the bad drives out the not so bad which drives out the medium which drives out the not so good which drives out the good.

Box 1.6. The funding strategy of SIVs through ABCP

The asset-backed commercial paper (ABCP) market lies at the crossroads between the cash money market and structured credit markets. An ABCP programme creates a means of removing assets, which have a risk-weighted capital requirement, from the bank's balance sheet while retaining some economic interest through income generation from the management of their special purpose vehicles (SPVs) which issue ABCP (asset-backed commercial paper) or MTNs (medium-term notes). There are a variety of ABCP structures, depending on the type of collateral, the liability structure and the amount of third-party liquidity/credit enhancement required. On the one hand there are traditional cash flow structures such as ABCP conduit issues with close-to-complete liquidity support, credit enhancement, short-term funding and no marking-to-market of assets. On the other hand there are structured investment vehicles (SIVs) and SIV-lites, which issue paper which depends primarily on the market value of assets for both liquidity and credit enhancement and consequently mark their assets to market.

These vehicles operate a maturity transformation as “virtual” banks, by earning the spread between their long-term assets and short-term liabilities sold to public investors. Unluckily, their liabilities are more volatile than a bank's, because they miss retail deposits, which are stable on longer periods and are less dependent on market conditions. Therefore, their funding strategies rely boldly on being able to continuously roll over their short-term issues when matured. Traditional ABCP conduits are not capitalized as they depend totally on liquidity provision to solve any funding problems, whereas market value structures have their own capital. In case of difficulty, conduits have to turn to their sponsoring banks which are committed to support them with backstop liquidity via credit lines, letters of credit and cash reserve accounts. (For more details, see FRS [14].)

In our case illiquid banks play the role of good cars while insolvent banks are the lemons. When market spreads climbed, the average quality of banks' balance sheets was perceived poorer and poorer: it was impossible for cash-giver banks to distinguish between illiquid and insolvent banks. Central bank intermediation became vital to restoring orderly functioning of the market.

1.4 THE RESPONSE

Even so, despite the delay, the response of central banks to this drastic list of events was impressive, by using several and, in some cases, unprecedented tools to achieve their goals. First of all, in early October they cut interest rates by 50 bp in a coordinated worldwide action. The only inactive central bank, the Bank of Japan, unable to do the same due to the already close-to-zero level of its key rates, obviously welcomed and strongly supported this decision.

In March 2008 the spread between agency and Treasury bonds started to widen again, leading to a Dutch hedge fund, Carlyle Capital, seizing and partially liquidating its collateralized assets due to unmatched margin calls. One of Carlyle's major creditors was Bear Stearns, which was targeted in the meantime by some rumours related to the Term Securities Lending Facility announced by the Fed on March 11, 2008. This programme allowed investment banks to swap agency and other mortgage-related issues for Treasury bonds, without disclosure about participants. Markets started to speculate that the Fed knew that some investment bank might be in trouble and was going to save it. The easiest target became the smallest, most leveraged investment bank with large mortgage exposure: Bear Stearns.

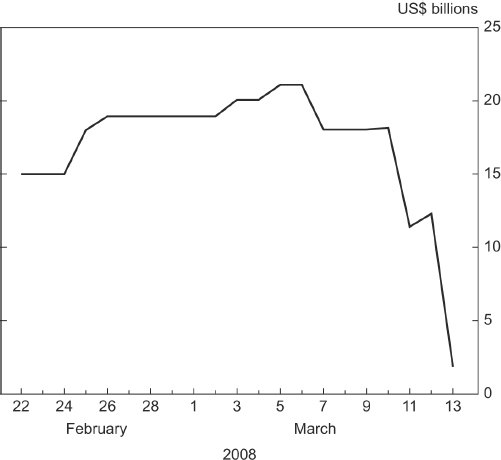

Moreover, a late acceptance of the proposed novation by Goldman Sachs of some contracts between a hedge fund and Bear Stearns ignited other speculation about the actual soundness of Bear Stearns, which was targeted by an immediate run by its hedge fund clients and other financial counterparties. Its liquidity situation worsened dramatically the next day and it became unable to secure funding on the repo market. You can see in Figure 1.1 how quickly the Bear Stearns liquidity pool had dramatically deteriorated over a few days. Over the weekend the Fed helped broker a deal, through which JPMorgan Chase would acquire the US's fourth largest investment bank for USD236 million, at USD2 per share, ultimately increased to USD10 per share. (For more on these events, see [38].)

Figure 1.1. Bear Stearn's liquidity pool

Source: Bank of England

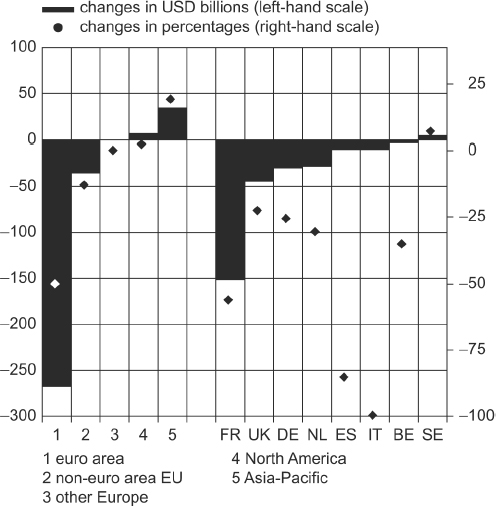

Figure 1.2. US government Money Market Fund variations between May and October 2011.

Source: Security and Exchange Commission and ECB calculations

Under its Troubled Asset Relief Programme the Federal Reserve pledged USD700 billion for the purchase of obligations directly issued by government-sponsored enterprises, such as Fannie Mae and Freddie Mac, or mortgage-backed securities underwritten by them. Eventually, the US government used a portion of this amount to recapitalize all major US banks to prevent any loss of confidence about their financial soundness. The Fed also widened the criteria of collateral eligible under its Primary Dealer Credit Facility and expanded its Term Securities Lending Facility, as well as holding various US dollar auctions in coordination with the other major central banks (Term Auction Facility). The TAF succeeded in mitigating some money market tensions which were going to transmit from the US to the euro money market by means of the foreign exchange swap market and helped to address non-US financial institutions' funding needs in US dollars.

In the UK the Bank of England made available to the banking system GBP200 billion under the Special Liquidity Scheme. It was one of the three parts of the bank rescue package (around GBP500 billion) promoted by the government. The other two were capital injection in the eight major banks, with further provisions if needed, and a temporary bank loans guarantee for up to GBP250 billion, subsequently converted into a new issued bond guarantee. In Switzerland, the government injected CHF6 billion in UBS, and the Swiss National Bank bought troubled assets for USD60 billion.

In Europe the ample liquidity provided by the ECB in its main refinancing operations (MROs), which allowed banks to frontload their reserve requirements during maintenance periods, and in its supplementary long term refinancing operations (LTROs) was no longer enough to alleviate liquidity pressures. The ECB recorded frequent recourses to its marginal lending facility in spite of the abundant liquidity into the system. At the same time, amounts lodged in the deposit facility rose as well, testifying that the redistribution of interbank liquidity had become extremely impaired. Consequently, the participation of banks in ECB tenders and bidding rates submitted by treasurers both increased. The unsecured interbank money market was facing severe dysfunctionality, with no lending available for maturities longer than overnight, and banks increasingly dependent on central bank liquidity.

Box 1.8. The foreign exchange swap market

One of the traditional US dollar funding channels for non US-financial institutions has always been the foreign exchange swap market. This market allows banks not headquartered in the US to cover their US dollar needs without assuming a substantial foreign exchange balance sheet exposure. FX swaps enable banks which have raised funds in one currency to swap those proceeds and their subsequent interest payments in another currency over a finite period: they broaden the availability of funding to cover multiple currency markets.

Under the significant stress produced by the financial turmoil, banks experienced considerable difficulty in attracting liquidity from US providers: therefore, they increased recourse to this liquidity channel. As a result of the positive correlation between foreign exchange swap and euro money market spreads, (i) higher counterparty risk and (ii) the greater importance of liquidity as a valuable asset in turbulent times in the US market led to increased euro money market spreads, ignited by increased swap rates as a result of the unsecured euro interbank market.

The 2008 Financial Stability Review [15] published the results of an analysis based on a cointegrated VaR framework to model the direction of the transmission of USD, GBP and EUR market tensions. It showed that, in the short term, unexpected tensions are transmitted from USD and GBP to EUR, but not vice versa.

On October 8 the ECB announced its intention to conduct its MROs through a fixed rate tender procedure with full allotment (a sort of “eat all you want”), and to reduce the money market corridor defined by its standing facility rates from 200 bp to 100 bp, as long as needed. Moreover, on October 15 it further expanded the list of assets eligible as collateral in its refinancing operations and added other longer term tenders to fully meet increasing bank demands for liquidity at three and six-month maturities.

Box 1.9. The three letters that sustain govies

Under the SMP, the ECB can buy in the secondary market public and private debt securities of euro area countries to ensure depth and liquidity in dysfunctional market sectors and to restore the proper functioning of the monetary policy transmission mechanism. SMP interventions are temporary by nature, limited and fully sterilized to avoid effects on the monetary base.

These measures succeeded to halt, at least temporarily, the vicious cycle between liquidity constraints and counterparty credit risk, which was going to produce negative spillover effects of the financial crisis with huge impacts on the real economy. Obviously, they were not able to fix the root causes of the financial issues that have generated the turmoil and need to be addressed by means of new and strong regulation and supervision.

1.5 THE SECOND WAVE

Sadly enough, after almost five years, many of these interventions are still in place, testifying to the difficulty of addressing the main problems of the worst financial crisis since WW2. Concerns related to the financial sector have been replaced by fears of insolvency of European peripheral countries such as Greece, Ireland and Portugal, which had to apply for assistance from the EU/IMF. The contagion eventually spread to the heart of Europe, pushing Spain and Italy to the edge of collapse. Amid rising financial tensions and lack of credible responses by European politicians, only the reactivation of the Securities Market Programme (SMP) by the ECB in early August 2011 temporarily avoided the worst and reduced the adverse feedback loop between the sovereign and financial sectors.

As stressed in the 2011 Financial Stability Review [16], a combination of weakening macroeconomic growth prospects and the unprecedented loss of confidence in sovereign signatures, ratified by several downgrades, both within and outside the euro area, by major credit rating agencies, had increased risks to euro area financial stability. Contagion effects in larger euro area sovereigns gathered strength amid rising headwinds from the interplay between the vulnerability of public finances and the financial sector. The heightened uncertainty was going to affect views on the backstop potential of governments to support national banking systems. In the meantime, high government refinancing needs created concerns that the public sector may in some cases compete with, and even crowd out, the issuance of debt securities by banks.

Box 1.10. MMF liquidity dries up

In October 2011, total holdings of European paper by the US government's MMF (Money Market Fund) declined by 9% relative to the previous month and by 42% (!!) since May (see Figure 1.2). It is worth stressing that the fall in the supply of such funding was global during the crisis in 2008, while the change over the summer of 2011 was basically a European phenomenon. Within the euro area, the impact of this development focused on a few banking sectors (France, Italy, Spain). For instance, French banks' commercial paper and certificate of deposit holdings declined by USD34 billion between May and August 2011. This reduction in outstanding volumes was joined by a marked shortening of maturities (the average maturity of French CP/CDs decreased from about 80 days to 40 days), making reliance on this source of funding more fragile and volatile.

Box 1.11. The drivers behind the EUR/USD basis

Prior to the financial crisis, many banks used unsecured USD funding as an attractive source of funding. The favourable funding conditions in USD reflected the size of the wholesale USD money market and the fact that unsecured funding was available for longer maturities than in the euro market. Many European banks used to raise more USD funds than needed and swapped back their surplus into EUR. At the time, the cost of swapping EUR into USD, measured by the 3-month EUR/USD basis swap, was close to zero, meaning that the cost of funding in USD was in line with the Libor fixing and that there was no significant imbalances in the demand for USD or EUR from market participants. The so-called basis is the premium or the discount paid by market participants to obtain USD. The premium is calculated as the difference between the USD interest rate implicit in the swap (by assuming the 3-month EURIBOR fixing as the 3-month EUR rate) and the unsecured USD interest rate, normally the Libor fixing.

With the propagation of the financial crisis and the introduction of regulatory changes impacting the US MMF, the EUR/USD basis has been negative since January 2010, underscoring a structural need for European banks to borrow USD via the FX swap market. After the collapse of Lehman Brothers, the USD rate implied in 3-month FX swaps reached a peak of 200 bp above Libor, but in a few months it declined rapidly to levels close to those prevailing before September 2008, thanks to the use of the swap lines between central banks (at the end of 2008, the USD liquidity provided by the ECB to European banks peaked at almost USD300 billion).

In the first part of 2011 any increase in the EUR/USD basis was subdued due to the favourable funding conditions on shorter maturities for European banks, and the building of USD cash buffers on the balance sheets of their US branches or subsidiaries, as recorded by Federal Reserve figures. The re-emergence of financial tensions in the second part of 2011 ignited a sharp increase in basis swaps and called for a reopening of the swap lines as a precautionary measure. Moreover, the shape of the basis swap curve remained upward sloping, mainly reflecting that not only short- term but also medium-term funding was impaired, and suggesting that forward-looking concerns were uppermost relative to immediate funding tensions. This was the opposite of the situation in 2008 when the EUR/USD basis curve inverted. Unlike previous cases, however, the actual use of the swap line established by central banks over the last year appears to be hampered by negative reputational costs (the so-called “stigma”). (On this topic, see also the 2011 Financial Stability Review [16].)

The first victim of this second wave of the financial crisis was Dexia, which avoided default only by the intervention of the French and Belgian governments in October 2011. With the euro area banking sector engaged in a de-leveraging process the ECB once again had to introduce some “non-conventional” measures to reduce market funding strains. While unsecured medium and long-term funding markets have been closed to a number of European banks, access to collateralized term funding has been warranted for ECB counterparties by the aforementioned full allotment procedure used by the central bank in its main refinancing operations, as well as by its complementary and longer term operations. For the future, the ECB has decided on two three-year refinancing operations with a monthly early repayment option after one year. It also broadened the pool of eligible collateral and lowered the reserve requirements from 2 to 1% on December 8, 2011. In order to increase the collateral available to banks, the ECB has lowered the rating threshold for certain asset-backed securities, and has allowed national central banks, on a temporary basis, to accept some performing credit claims (i.e., for Italy linked to the factoring and leasing business) not eligible at the Eurosystem level.

In order to alleviate further funding vulnerability stemming from the heavy reliance of some large European banks on short-term and highly risk-sensitive US dollar funding, mainly through credit provided by money market funds in the US, which reduced their exposures to European financial institutions in terms of both amounts and maturities since May, on November 30, 2011 the ECB, the Bank of Canada, the Bank of England, the Bank of Japan, the Federal Reserve and the Swiss National Bank agreed to lower the pricing of US dollar liquidity swap arrangements by 50 bp, so that the new allotment rate will be the US dollar OIS rate plus 50 bp instead of 100 bp. As a consequence of this announcement, the 3-month EUR/USD basis dropped by 25 bp in a day.

1.6 CONCLUSION

Analysis of the timing, methods and effectiveness of the interventions of central banks over these years is beyond the scope of this book. Certainly, they tried to address banks' liquidity issues by offering enormous amounts of central bank liquidity to restore the interbank money market and, by doing so, to halt the vicious circle between funding and market liquidity that fuelled liquidity risk.

In order to understand where the root cause of liquidity risk lies, it is therefore useful to analyse in detail the three aforementioned different types of liquidity.