10

Contract Costing

CHAPTER OUTLINE

LEARNING OBJECTIVES

After reading this chapter, you will be able to understand:

The features of contract costing

The different types of contract costing

Recording of transactions in contract costing

The concept of incomplete contract

Contracts lasting for more than a year

10.1 INTRODUCTION

Contract costing applies to jobs undertaken as per the requirements of the clients. Generally, it lasts for more than a year. Contract costing includes activities like building of bridges, roads, dams, ships, buildings, complexes and so on.

10.2 MEANING OF CONTRACT COSTING

Contract costing is a type of job costing and it applies to civil construction works like: building contractors, dams, roads, etc.; civil engineering firms like building repairing firms, landscaping firms, etc.; mechanical engineering firms like ship building, aircraft building, etc.

A contract has the following features:

- A high price.

- The period taken for completion is in years.

- The place of work and office may be in different places.

- The work in connection with each contract is carried out at the site of the contract.

- The expenses incurred by the contractor are considered as direct.

- The indirect expenses, mostly consists of office expenses of the yards, stores and works.

- A separate account is usually maintained for each contract.

- The cost unit in contract costing is the contract itself.

Contract costing is the method of costing used to find out the cost and profit of each contract for a given period. Contract costing enables the contractor to ascertain and control the cost of each job or contract.

Contract is one form of application of the principles of job costing. It is also called terminal costing. In fact, a bigger job is referred to as a contract. Contract costing is usually adopted by building contractors engaged in the task of executing civil contracts. Contract costing have the following distinct features.

10.2.1 Accounting procedure of contract costing

- Contract account. All costs relating to a particular contract are recorded in the individual contract account.

- Materials. Material purchased and directly supplied to a contract is debited to a contract account. Any material returned to stores is credited to the contract account.

- Labour. All the labour engaged on a particular work is directly allocated to work and is debited to the contract account.

- Plant and machinery. Purchased value of plant is debited and depreciated value of plant is credited to the contract account.

- Direct expenses. All direct expenses are debited to the contract account.

- Indirect expenses. All indirect expenses are debited to the contract account.

- Work-in-progress. Work-in-progress consists of work certified and work uncertified. Both these are shown in the credit side of the contract account.

- Work completed. It is the extent to which the agreed work is executed or done

- Work certified. It is that portion of the work completed, which is approved by the contractee or architect. Work certified represents that portion of the contract that has been duly approved by the architect or the contractee. This is denoted in terms of money value in contract account and appears on the credit side of the contract account.

- Work uncertified. It is that portion of the work completed, which is not approved by the contractee or architect. It is the work done but uncertified. Work uncertified refers to that portion of work completed by the contractor but disapproved by the architect on the ground that it has not reached a stipulated stage. The value of work uncertified also appears on the credit side of the contract account.

- Retention money. Money withheld by the contractee is known as retention money. The purpose of retaining some amount is to ensure that the contractor has performed all work relating to contract on the most satisfactory manner and that no repair work arises within agreed time limit.

- Cost plus contract. They are also known as Lime and Line Contracts. These types of contracts are given where it is extremely difficult to carry out the work due to economical, political or social reasons or the contractor is undertaking a contract, which has no precedence, i.e. no one has ever done this type of contract or there is an urgency of the contract to be done. In this case, the contractor charges a specified percentage of cost plus cost as his contract price.

It is an adjusted contract account. This method is considered when it is not possible to determine the contract in advance. It is also used in places and situations where the prices of material and labour are unpredictable. In that case, the contractee agrees to pay the contractor an agreed percentage of profit. This type of contract is mostly followed during the period of emergency when certain types of products are to be manufactured and supplied as in the case of war like situations, natural calamities, defence products, special component parts, etc.

It is a contract entered into when the cost of materials and labour are not stable. Under this contract, the contract price is arrived at by adding up a certain percentage of profit to the cost of work.

- Escalation clause. Due to raise in the prices of materials and labour costs, the contract price is altered so that neither party suffers the loss arising out of the change in price level. To protect the interest of the parties concerned, a special clause is introduced known as escalation clause. Under which, the contractee will be obliged to pay the increased price of the contract because of increase in the rates of materials, labour and other expenses. Similarly, to protect the interest of the contractee against the fall in the rates of materials, labour and overheads, a ‘de-escalation clause’ is inserted. However, it is to be noted that the terms and conditions under which the contract price is to be altered is to be specifically mentioned.

- Profit on incomplete contracts. Big contract take several year for completion. The exact amount of profit can be ascertained only after the completion of the contract. But one has to ascertain profit at the end of every financial year when the work is in progress. Such profits are only anticipated, and are known as “notional profits”.

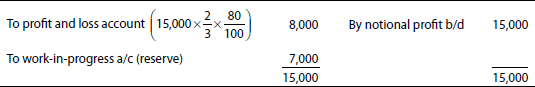

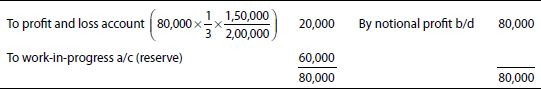

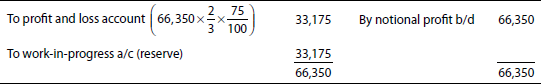

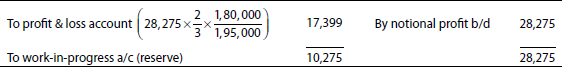

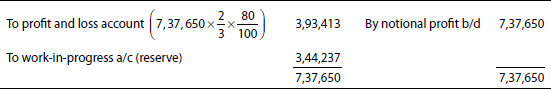

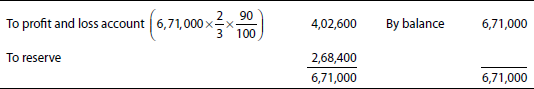

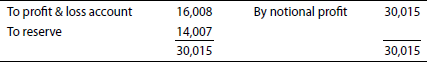

10.2.2 Treatment of profit on incomplete contract

- If the work completed is ¼ or less than ¼ of the total work, no profit should be transferred to profit and loss account.

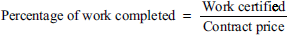

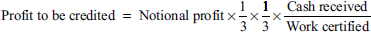

- If the work completed is more than ¼ but less than ½, 1/3rd of the notional profits are credited by using the following formula.

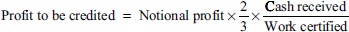

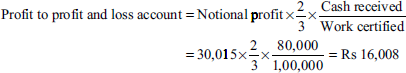

- If the work completed is ½ or more than ½, 2/3rd of the notional profits are credited by using the formula

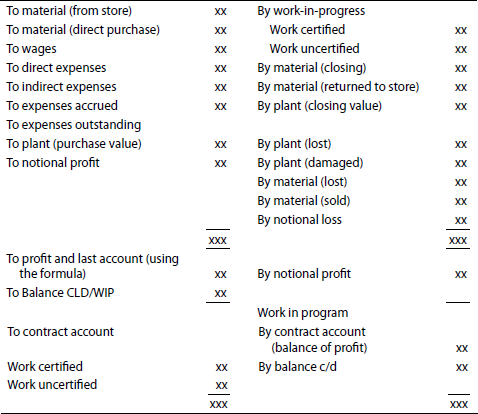

Format of a Contract Account

Contract account

NP = Notional profit

EP = Estimated profit

WC = Work certified

WUC = Work uncertified

CP = Contract price

CPL = Costing profit and loss account

CTD = Cost to date

ETC = Estimated total cost

RUP = Reserve for unrealized profit

CPL = Costing profit and loss account

10.2.3 Contract lasting for more than one year

When a contract lasts for more than one year, contract account should be prepared for each year. The following points are to be kept in mind while preparing contract for the subsequent years.

- Previous year work-in-progress should be carried forward to the following year (debited).

- Closing balance of plant and material at site should be carried forward (debited).

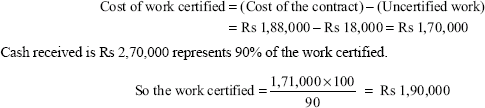

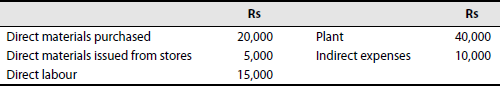

Illustration 1

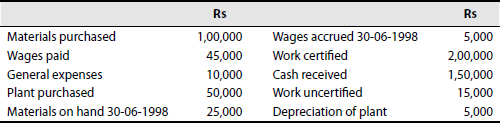

How much of profit, if any, would you allow to be considered in the following case

| Rs | ||

|---|---|---|

| Contract cost | 1,88,000 | Up-to-date |

| Contract value | 3,00,000 | |

| Cash received | 1,71,000 | |

| Uncertified work | 18,000 | |

| Deduction from bills | ||

| By way of security | 10% |

Solution:

Problem 1. How much of profit, if any, would you allow to be considered in the following case?

| Rs | ||

|---|---|---|

| Contract cost | 2,88,000 | Up-to-date |

| Contract value | 4,00,000 | |

| Cash received | 2,71,000 | |

| Uncertified work | 28,000 | |

| Deduction from bills | ||

| By way of security | 10% |

[Ans:]

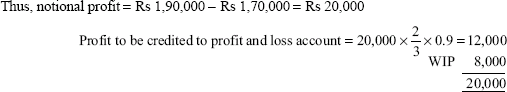

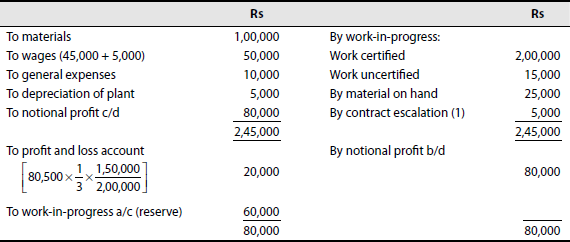

Illustration 2

The following was the expenditure on a contract for Rs 12,00,000 commenced in January.

| Rs | |

|---|---|

| Materials | 1,80,000 |

| Wages | 2,30,000 |

| Plant | 26,667 |

| Overheads | 15,000 |

Cash received on account of the contract up to 31st December was Rs 3,50,000 being 80% of the work certified. The value of materials in hand was Rs 13,333. The plant had undergone 20% depreciation. Prepare contact account.

Solution:

Contract account

Problem 2. The contract ledger of a company showed the following expenditure on account of contract number 12345 on 31st March 1998.

| Rs | |

|---|---|

| Materials | 1,88,000 |

| Plant | 24,000 |

| Wages | 2,06,000 |

| Establishment charges | 13,400 |

The contract commenced on 1st April 1997 and the contract price is Rs 8,00,000. The value of work certified by the architect is Rs 4,30,000 of which 80% has been received in cash to date. The value of material on hand is Rs 9,000 and the work certified is Rs 8,000.

Assuming depreciation on plant at 10% p.a., prepare the contract account showing the profit the firm would be justified in taking to the credit of profit and loss account of the year.

(Madras, 1999)

[Ans: Notional profit: Rs 37,200; Profit transferred to profit and loss account: Rs 19,840]

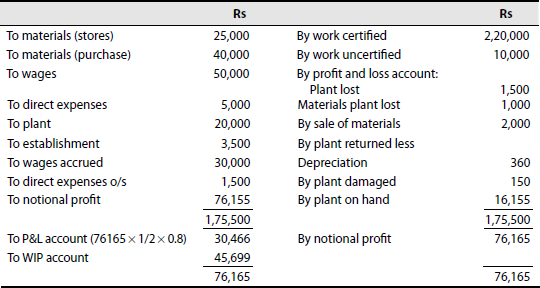

Illustration 3

On 1st January, A undertook a contract for Rs 5,00,000. He incurred the following expenses during the year

| Rs | |

|---|---|

| Materials issued from stores | 25,000 |

| Material purchased for the contract | 40,000 |

| Plant installed at cost | 20,000 |

| Wages paid | 50,000 |

| Wages occurred due on 31st December | 30,000 |

| Direct expenses paid | 5,000 |

| Direct expenses accrued due on 31st December | 1,500 |

| Establishment | 3,500 |

Of the plant and materials charged to the contract, the plant which cost Rs 1,500 and the materials costing Rs 1,000 were lost. Some of the materials costing Rs 1,500 were sold for Rs 2,000. On 31st December, the plant, which cost Rs 400, was returned to the stores, and a part of the plant, which cost Rs 150, was damaged, rendering itself useless.

The work certified was Rs 2,20,000 and 80% of the same was received in cash. The cost of work done, but uncertified was Rs 10,000. Charge 10% p.a. depreciation on plant and prepare the contract account for the year ended 31st December, by transferring to the profit and loss account the portion of the profit, if any, which you think is reasonable. Show also the particulars relating to the contract in the balance sheet of the contractor as on 31st December.

Solution:

Contract account for the year ended 31st December

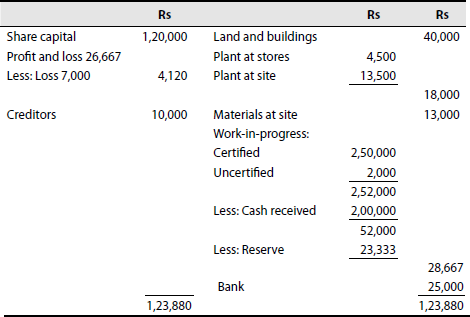

Balance sheet as on 31st December

Problem 3. A contractor obtained a contract for Rs 6,00,000 on 1st January 1988. The expenses incurred during the year ended 31st December 1988 were as under.

| Rs | |

|---|---|

| Materials | 1,80,000 |

| Wages paid | 1,60,000 |

| Wages accrued | 10,000 |

| Other expenses | 25,000 |

The plant, specially installed for the contract, worth Rs 45,000 was returned to the stores subject to a depreciation of 20%. Materials at site on 31-12-1988 were valued at Rs 24,000.

The contractor had received Rs 3,60,000 in cash up to 31-12-1988, representing 80% of the work certified. Work uncertified was estimated at Rs 4,000.

Prepare the contract account, showing the profit for the year. Also show how the value of work-in-progress would appear in the balance sheet as on 31st December 1988.

[Ans: Notional profit: Rs 94,000; Profit taken to profit and loss account: Rs 50,133; Profit kept in reserve: Rs 43,867; Work-in-progress in balance sheet: Rs 50,133]

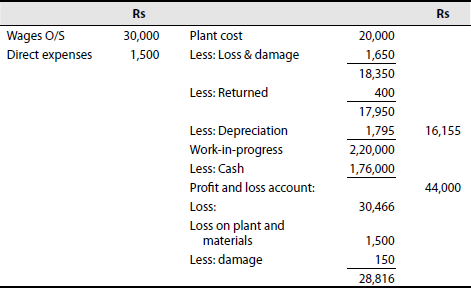

Illustration 4

M/s Anand Associates commenced the work on a particular contract on 1st April 1994. They close their books of accounts for the year on 31st December each year. The following information is available from their costing records on 31st December 1994.

| Rs | |

|---|---|

| Materials sent to site | 40,000 |

| Foreman's salary | 12,000 |

| Wages paid | 1,20,000 |

A machine costing Rs 40,000 remained in use on site for 1/5th of the year. Its working life was estimated at 5 years and scrap value at Rs 1,500. A supervisor is paid Rs 1,500 per month and he had devoted one-half of his time on the contract.

All other expenses were Rs 8,000. The materials on site were Rs 1,500. The contract price was Rs 3,00,000. On 31st December 1994, 2/3rd of the contract was completed; however, the architect gave a certificate only for Rs 1,80,000 on which 80% was paid. Prepare the contract account.

Contract account for the year ended 31st December 1994

Work uncertified:

Rs 1,86,790 = Rs 1,88,290 – Rs 1,500

Rs 1,86,790 represents the cost of two-thirds of the work

Therefore, full cost of the contract ![]()

Therefore, half of full cost ![]()

Therefore, the difference of ⅔ and ½ of contract price = Rs 1,86,790 – Rs 1,40,093 = Rs 46,697 (work not certified).

Problem 4. The following balances were extracted from the books of a building contractor on 31st March 1976.

| Rs | |

|---|---|

| Materials issued to site | 62,720 |

| Wages paid | 73,455 |

| Wages outstanding as on 31-3-1976 | 720 |

| Plant issued to site | 6,000 |

| Direct charges paid | 2,515 |

| Direct charges outstanding on 31-3-1976 | 210 |

| Establishment charges | 5,650 |

| Stock of materials at site on 31-3-1976 | 1,200 |

| Value of work certified on 31-3-1976 | 1,65,000 |

| Cost of work not yet certified | 3,500 |

| Cash received on account of architect's certificate | 1,41,075 |

The work was commenced on 1st April 1975 and the contract price agreed at Rs 2,45,000. Prepare contract account for the year, providing for depreciation of plant at 25%. Calculate the profit or loss on the contract to date and make such provision in the contract account, as you consider desirable. Set out also the contractor's balance sheet so far as it relates to the contract.

(Madras, 1990)

[Ans: Notional profit: Rs 22,930; Profit credited to profit and loss account: Rs 13,070; Profit kept in reserve: Rs 9,860; Work-in-progress shown in balance sheet: Rs 17,565]

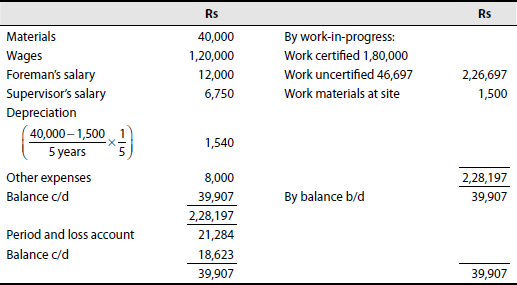

Illustration 5

A company of contractors began to trade on 1st January 1994. During 1994, the company was engaged on only one contract of which the contract price was Rs 5,00,000.

Of the plant and materials charged to contract, plant costing Rs 5,000 and material costing Rs 4,000 were lost in an accident.

On 31st December 1994, plant costing Rs 5,000 was returned to the stores. Cost of work uncertified, but finished Rs 2000 and materials costing Rs 13,000 were in hand on site.

Charge 10% depreciation on plant and compile contract account and balance sheet from the following:

| Rs | Rs | |

|---|---|---|

| Share capital | 1,20,000 | |

| Creditors | 10,000 | |

| Cash received (80% of work certified) | 2,00,000 | |

| Land and buildings | 40,000 | |

| Bank balance | 25,000 | |

| Charged to contract: | ||

| Materials | 90,000 | |

| Plant | 25,000 | |

| Wages | 1,20,000 | |

| Expenses | 7,000 | ______ |

| 2,78,000 | 3,30,000 |

Solution:

Contract account for the year ended 31st December 1994

Balance Sheet as on 31st December 1994

Problem 5. The following particulars relating to contract ‘A’ are obtained at the year end. Date of commencement is April 1.

| Rs | |

|---|---|

| Contact price | 6,00,000 |

| Materials delivered direct to site | 1,20,000 |

| Materials issued from store | 40,000 |

| Materials returned to store | 4,000 |

| Materials at site on December 31 | 22,000 |

| Direct labour | 1,40,000 |

| Direct expenses | 60,000 |

| Architect's fees | 2,000 |

| Establishment charges | 25,000 |

| Plant installed at cost | 80,000 |

| Value of plant on December 31 | 65,000 |

| Accrued wages on December 31 | 10,000 |

| Accrued expenses on December 31 | 6,000 |

| Cost of contract not yet certified | 23,000 |

| Value of contract certified | 4,20,000 |

| Cash received from contractee | 3,78,000 |

| Materials transferred to contract ‘B' | 9,000 |

You are required to show:

- Contract account

- Contractee's account

- Extracts from the balance sheet as on 31st December, clearly showing the calculation of work-in-progress.

(Madras, 1990)

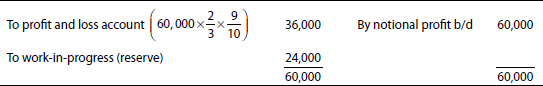

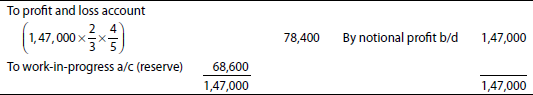

[Ans: Notional profit: Rs 60,000; Profit taken to profit and loss account: Rs 36,000; Profit kept in reserve: Rs 24,000; Contractee's account balance: Rs 3,78,000; Work-in-progress in balance sheet: Rs 41,000]

Illustration 6

The following was the expenditure on a contract for Rs 6,00,000 commenced in January, 1997:

| Rs | |

|---|---|

| Material | 1,20,000 |

| Wages | 1,64,400 |

| Plant | 20,000 |

| Business charges | 9,000 |

Cash received on account to 31st December 1997 amounted to Rs 2,60,000 being 80% of work certified; the value of materials in hand on 31-12-1997 was Rs 25,000. Prepare the contract account for 1997 showing the profit to be credited to the year's profit and loss account. Plant is to be depreciated at 10%.

Solution:

Contract account

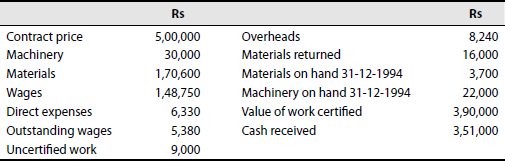

Problem 6. The following are the particulars relating to a contract, which was begun on 1st January 1994:

Prepare the contract account for the year 1994 showing the amount of profit that may be taken to the credit of the profit and loss account of the year. Also show the amount of the work-in-progress, as it appears in the balance sheet of the year.

(B.Com., Madurai)

[Ans: Profit: Rs 34,200; WIP: Rs 25,200]

Illustration 7

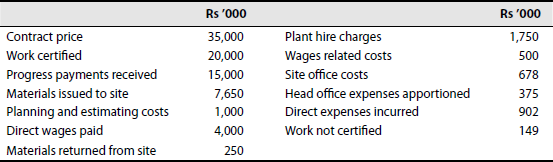

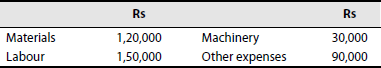

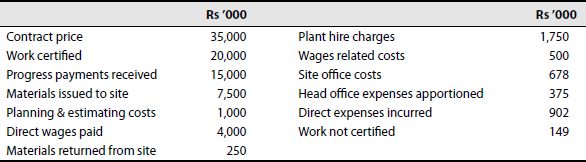

A company undertook a contract for construction of a large building complex. The construction work commenced on 1st April 1997 and the following data are available for the year ended 31st March 1998.

The contractors own a plant, which originally cost Rs 20,00,000, has been continuously in use in this contract throughout the year. The residual value of the plant after 5 years of life is expected to be Rs 5,00,000. Straight-line method of depreciation is in use.

As on 31st March 1998, the direct wages due and payable amounted to Rs 3,00,000 and the materials at site were estimated at Rs 3,00,000.

Required:

- Prepare the contract account for the year ended 31st March 1998.

- Show the calculation of profit to be taken to the profit and loss account of the year.

- Show the relevant balance sheet entries.

(C.A. Inter)

Solution:

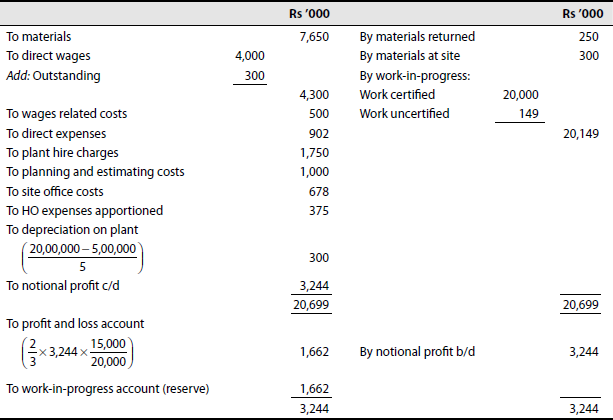

Contract account for the year ended 31st March 1998

Balance sheet (extracts as on 31-03-1998)

Problem 7. The following is the summary of the entries in a contract ledger as on 31st December 1994 in respect of contract no. 51:

Further information is as follows:

- The amount that accrued as on 31st December 1994 were wages: Rs 900 and direct expenses: Rs 1,200.

- The cost of the work uncertified included: materials: Rs 2,600, wages: Rs 1,000 and expenses: Rs 1,500.

- Rs 2,000 worth of plant was sold for Rs 3,000 and Rs 3,000 worth of materials were destroyed by the fire.

- Rs 5,000 worth of plant was sold for Rs 3,000 and materials costing Rs 5,000 were sold for Rs 6,000.

- Depreciation till 31st December 1994 on plant was Rs 10,000.

- Materials at site were valued at Rs 5,000.

- Cash received from the contractee was Rs 60,000 being 80% of the work certified.

- Contract price was Rs 1,00,000.

Show the contract account and work-in-progress account. Show the same in the balance sheet.

(B.Com., Madurai)

[Ans: Profit: Rs 4,170; WIP: Rs 16,450]

Illustration 8

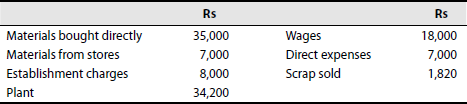

A firm of building contractors began to trade on 1st April 1997. The following was the expenditure on the contract for Rs 3,00,000:

Materials issued to contract: Rs 50,000; Plant used for contract: Rs 15,000; Wages incurred: Rs 75,000; Other expenses incurred: Rs 2,000.

Cash received on account to 31st March 1998 amounted to Rs 1,28,000 being 80% of the work certified. Of the plant and materials charged to the contract, plant which cost Rs 3,000 and materials which cost Rs 2,500 were lost. On 31st March 1998 plant which cost Rs 2,000 was returned to store, the cost of work done but uncertified was Rs 1,000 and materials costing Rs 2,300 were in hand on site.

Charge 15% depreciation on plant, and take to the profit and loss account 2/3rd of the profit received. Prepare the contract account, contractee's account and balance sheet from the above particulars.

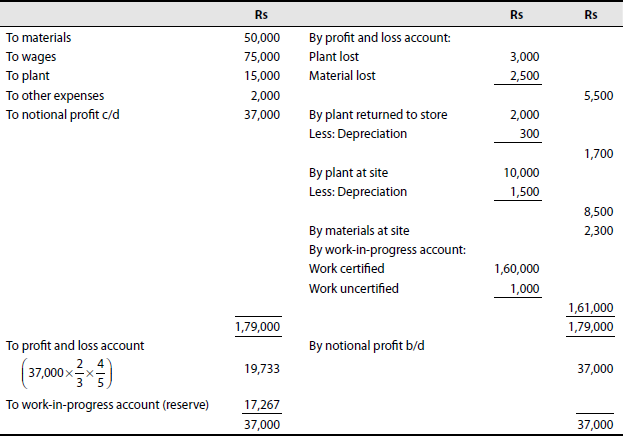

Solution:

Contract account

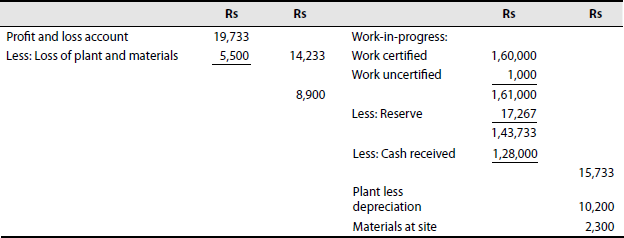

Contractee's account

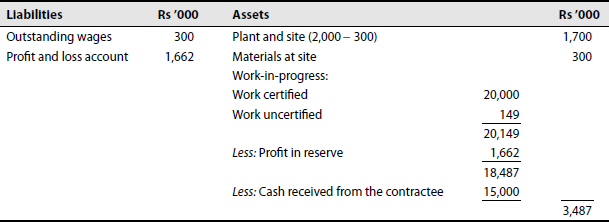

Balance sheet (extracts as on 31-03-1998)

Problem 8. A firm of building contractors began to trade on 1st April 1996. The following was the expenditure on the contract for Rs 3,00,000.

| Rs | |

|---|---|

| Materials issued to contract | 51,000 |

| Plant used for contract | 15,000 |

| Wages incurred | 81,000 |

| Other expenses incurred | 5,000 |

Cash received on account to 31st March 1997 amounted to Rs 1,28,000 being 80% of the work certified. Of the plant and materials charged to the contract, plant which cost Rs 3,000 and materials which cost Rs 2,500 were lost. On 31st March 1997 plant which cost Rs 2,000 were returned to stores. The cost of work done but uncertified was Rs 1,000 and materials costing Rs 2,300 were in hand on site.

Charge 15% depreciation on plant, and take to the profit and loss account 2/3rd of the profit received. Prepare a contract account, contractee's account and extracts from balance sheet from the above particulars.

(Madras, 1997)

[Ans: Notional profit: Rs 27,000; Profit taken to profit and loss account: Rs 14,400; Profit kept to reserve: Rs 12,600; Work-in-progress shown in balance sheet: Rs 20,400]

Hint: As instructed, 2/3rd profit is taken to profit and loss account but it is restricted on cash received basis, i.e. 80%.

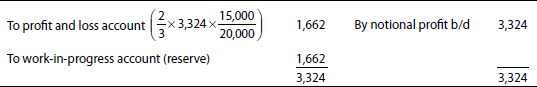

Illustration 9

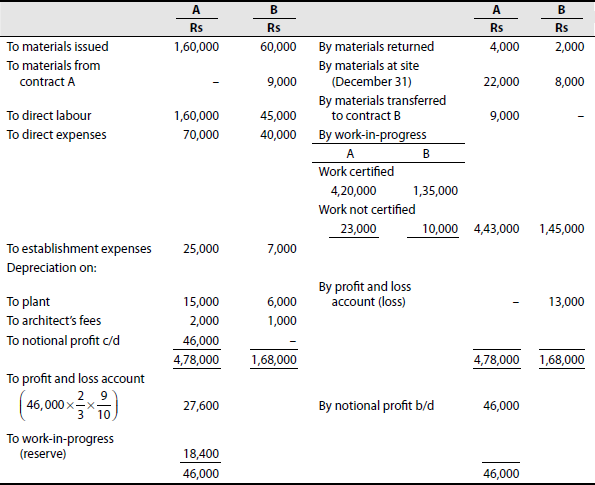

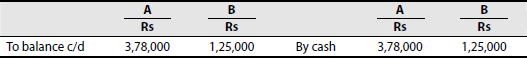

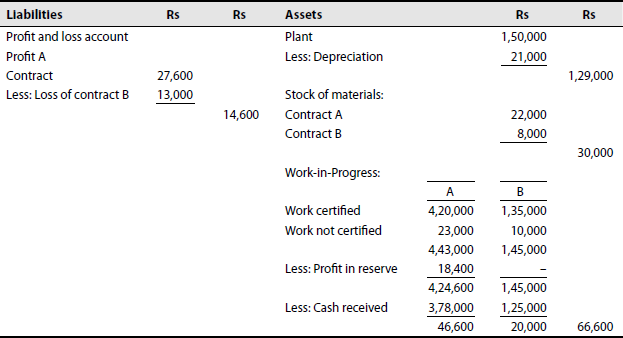

Construction Limited is engaged on two contracts A and B during the year. The following particulars are obtained at the year end (December 31):

| Contract A | Contract B | |

|---|---|---|

| April I | September I | |

| Date of commencement | Rs | Rs |

| Contract price | 6,00,000 | 5,00,000 |

| Materials issued | 1,60,000 | 60,000 |

| Materials returned | 4,000 | 2,000 |

| Materials at site (December 31) | 22,000 | 8,000 |

| Direct labour | 1,60,000 | 45,000 |

| Direct expenses | 70,000 | 40,000 |

| Establishment expenses | 25,000 | 7,000 |

| Plant installed at site | 80,000 | 70,000 |

| Value of plant (December 31) | 65,000 | 64,000 |

| Cost of contract not yet certified | 23,000 | 10,000 |

| Value of contract certified | 4,20,000 | 1,35,000 |

| Cash received from contractees | 3,78,000 | 1,25,000 |

| Architect's fees | 2,000 | 1,000 |

During the period materials amounting to Rs 9,000 have been transferred from contract A to contract B. You are required to show: (a) contract accounts, (b) contractees’ accounts, and (c) extract from balance sheet as on December 31, clearly showing the calculation of work-in-progress.

Solution:

Contract account

Contractee's account

Balance sheet as on 31st December

Problem 9. Two contracts that commenced on 1st January and 1st July 1994, respectively, were undertaken by a contractor and his accounts on 31st December 1994 showed the following position

| Contract I | Contract II | |

|---|---|---|

| Rs | Rs | |

| Contract price | 4,00,000 | 2,70,000 |

| Expenditure | ||

| Materials | 72,000 | 58,000 |

| Wages paid | 1,10,000 | 1,12,400 |

| General charges | 4,000 | 2,800 |

| Plant installed | 20,000 | 16,000 |

| Materials on hand | 4,000 | 4,000 |

| Wages accrued | 4,000 | 4,000 |

| Work certified | 2,00,000 | 1,60,000 |

| Work done but not certified (at cost) | 6,000 | 8,000 |

| Cash received in respect there of | 1,50,000 | 1,20,000 |

The plants were installed on the date of commencement of each contract; depreciation thereon is to be taken at 10% p.a.

Prepare the contract's account in the tabular form and ascertain the profit or loss to be taken to profit and loss account.

(B.Com., Kerala)

[Ans: A: Profit to be taken to profit and loss account: Rs 9,000; Profit in reserve: Rs 9,000; B: Loss: Rs 6,000]

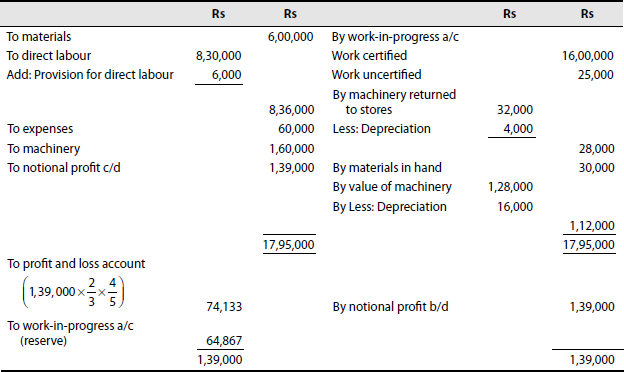

Illustration 10

The following trial balance was extracted on 31st December 1997 from the books of Swastik Company Limited contractors:

| Rs | Rs | |

|---|---|---|

| Share capital: shares of Rs 10 each | 3,71,800 | |

| Profit and loss account on 1st January 1997 | 25,000 | |

| Provision for depreciation of machinery | 63,000 | |

| Cash received on account: contract 7 | 12,80,000 | |

| Creditors | 81,200 | |

| Land and buildings (cost) | 74,000 | |

| Machinery (cost) | 52,000 | |

| Bank | 45,000 | |

| Contract 7: | ||

| Materials | 6,00,000 | |

| Direct labour | 8,30,000 | |

| Expenses | 60,000 | |

| Machinery at site (cost) | 1,60,000 | ______ |

| 18,21,000 | 18,21,000 |

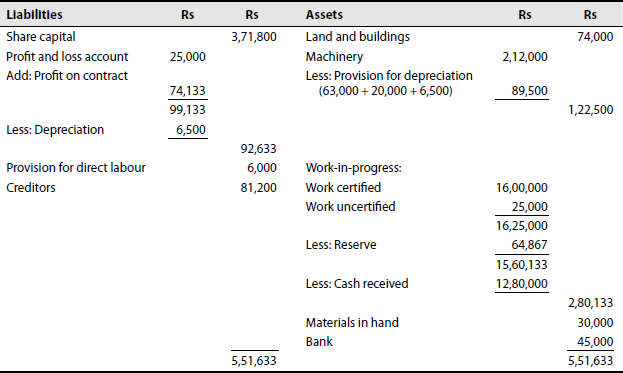

Contract 7 was begun on 1st January 1997. The contract price is Rs 24,00,000 and the customer has so far paid Rs 12,80,000 being 80% of the work certified.

The cost of the work done since certification is estimated at Rs 25,000. On 31st December 1997, after the above trial balance was extracted, machinery costing Rs 32,000 was returned to stores, and materials when at site were valued at Rs 30,000.

Provision is to be made for direct labour due Rs 6,000 and for depreciation of all machinery at 12½% on cost.

You are required to prepare: (a) the contract account, (b) a statement of profit, if any, to be properly credited to profit and loss account for 1997, and (c) the balance sheet of Swastik Company Limited as on 31st December.

Solution:

Contract account

Balance sheet (extracts as on 31-12-1997)

Problem 10. The following trial balance was extracted on 31st December 1997 from the books of Swastik Company Limited contractors:

| Rs | Rs | |

|---|---|---|

| Share capital: shares of Rs 10 each | 3,71,800 | |

| Profit and loss account on 1st January 1997 | 25,000 | |

| Provision for depreciation of machinery | 63,000 | |

| Cash received on account: contract 7 | 12,80,000 | |

| Creditors | 81,200 | |

| Land and buildings (cost) | 74,000 | |

| Machinery (cost) | 52,000 | |

| Bank | 45,000 | |

| Contract 7: | ||

| Materials | 6,00,000 | |

| Direct labour | 8,30,000 | |

| Expenses | 60,000 | |

| Machinery at site (cost) | 1,60,000 | _______ |

| 18,21,000 | 18,21,000 |

Contract 7 was begun on 1st January, 1997. The contract price is Rs 34,00,000 and the customer has so far paid Rs 13,80,000 being 80% of the work certified.

The cost of the work done since certification is estimated at Rs 25,000.

On 31st December 1997, after the above trial balance was extracted, machinery costing Rs 32,000 was returned to stores, and materials when at site were valued at Rs 30,000.

Provision is to be made for direct labour due Rs 6,000 and for depreciation of all machinery at 12½% on cost.

You are required to prepare: (a) the contract account, (b) a statement of profit, if any, to be properly credited to profit and loss account for 1997, and (c) the balance sheet of Swastik Company Limited as on 31st December.

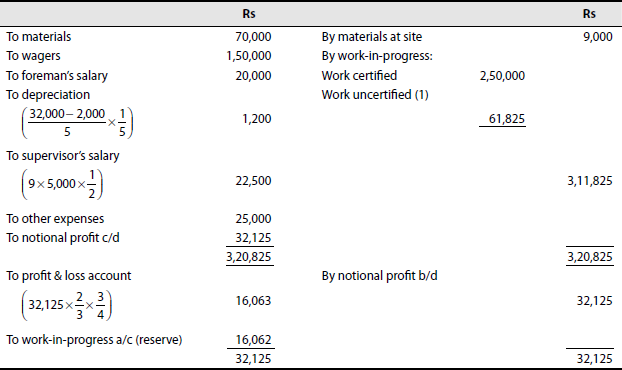

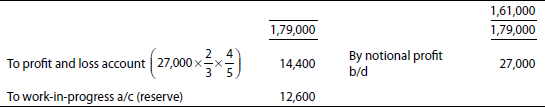

Illustration 11

(Ascertainment of work uncertified) M/s Kishore & Company commenced the work on a particular contract on 1st April 1997. They close their books of accounts for the year on 31st December each year. The following information is available from their costing records on 31st December 1997:

| Rs | |

|---|---|

| Material sent to site | 70,000 |

| Wages paid | 1,50,000 |

| Foreman's salary | 20,000 |

A machine costing Rs 32,000 remained in use on site for 1/5th of the year. Its working life was estimated at 5 years and scrap value at Rs 2,000. A supervisor is paid Rs 5,000 per month and had devoted one-half of his time on the contract.

All other expenses were Rs 25,000. The material on site was Rs 9,000. The contract price was Rs 5,00,000. On 31st December 1997, 2/3rd of the contract was completed; however, the architect gave certificate only for Rs 2,50,000 on which 75% was paid. Prepare the contract account.

Solution:

Contract account

Working Notes:

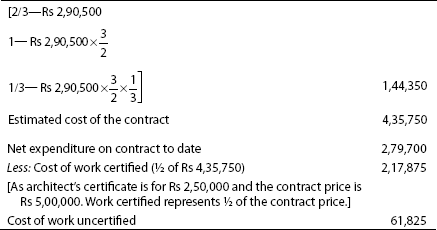

Calculation of work uncertified

| Rs | |

|---|---|

| Amount spent on contract | 2,88,700 |

| Less: Material at site | 9,000 |

| Net expenditure on contract | 2,79,700 |

Further expenditure to complete the contract, as the contract is 2/3rd completed.

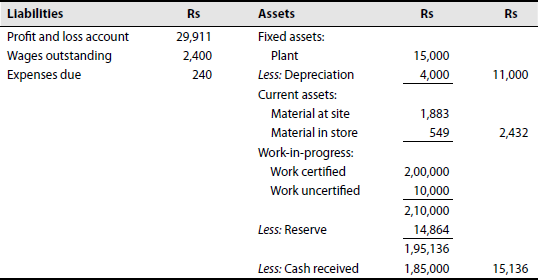

Problem 11. The following particulars relate to a contract undertaken by Ajit Engineers:

| Rs | |

|---|---|

| Materials sent to site | 85,349 |

| Labour engaged on site | 74,375 |

| Plant installed at site | 15,000 |

| Direct expenditure | 3,167 |

| Establishment charges | 4,126 |

| Materials returned to stores | 549 |

| Work certified | 1,95,000 |

| Cost of work not certified | 4,500 |

| Materials in hand at the end of year | 1,883 |

| Wages accrued at the end of year | 2,400 |

| Direct expenses accrued at the end of year | 240 |

| Value of plant at the end of year | 11,000 |

| The contract price agreed | 2,50,000 |

| Cash received from contract | 1,80,000 |

You are required to prepare the contract account showing profit, contractee's account and show suitable entries in the balance sheet of the contractor.

(B.Com., Delhi)

[Ans: Profit transferred to profit and loss account: Rs 17,400]

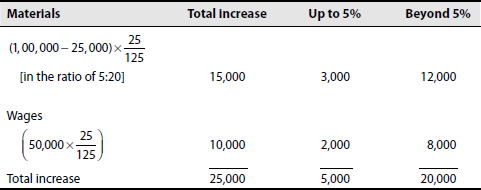

Illustration 12

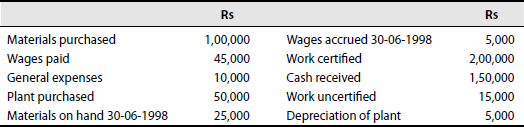

Deluxe Limited undertook a contract for Rs 5,00,000 on 1st July 1997. On 30th June 1998 when the accounts were closed, the following details about the contract were gathered:

The above contract contained an escalation clause, which read as follows:

"In the event of prices of materials and rates of wages increase by more than 5% the contract price would be increased accordingly by 25% of the raise in the cost of materials and wages beyond 5% in each case”.

It was found that since the date of signing the agreement the prices of materials and wages rates increased by 25%. The value of the work does not take into account the effect of the above clause.

Prepare the contract account working should form part of the answer.

(C.A. Inter and I.C.W.A. Inter)

Solution:

Contract account for the year ended 30-06-1998

Working Notes:

Problem 12. From the following data relating to a contract, extract from the books of a company as on 31-3-1994, prepare contract accounts also compute the profit and the value of preparing final accounts.

| Rs | |

|---|---|

| Materials issued for work | 90,000 |

| Wages paid to the worker at site | 50,000 |

| Plant issued to site | 75,000 |

| Salary of supervisory staff at site | 5,500 |

| Work certified for payment | 1,76,000 |

| Work not certified | 9,000 |

| Amount received on work certified | 1,58,400 |

You are further informed that:

- The work on the contract commenced on 1-10-1993.

- The wages of the workers for a week and the salary of the supervisory staff for a month were due at the end of the period Rs 3,100.

- The company writes off depreciation at 10% p.a. on its plants; and

- The value of materials at site on 31-3-1994 was Rs 4,200.

[Ans: Notional profit: Rs 36,850; Profit transferred to profit and loss account: Rs 22,110; Reserve: Rs 14,740]

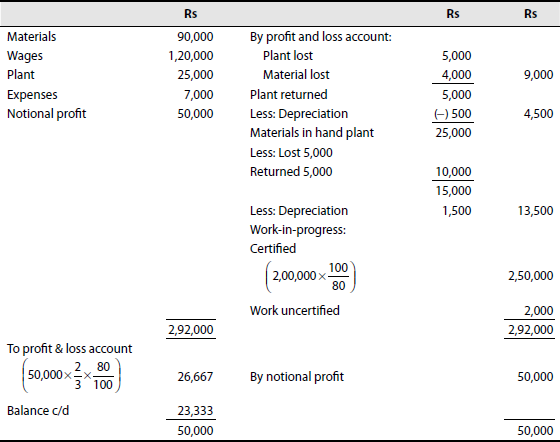

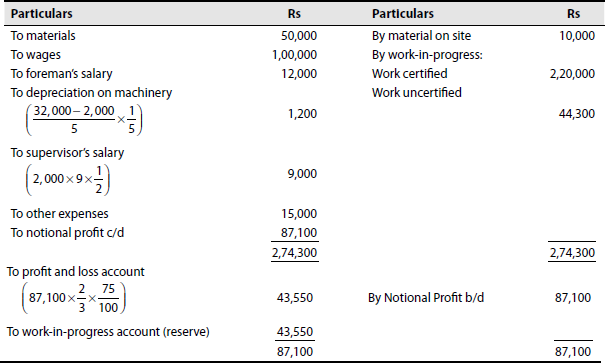

Illustration 13

M/s Kishore & Company commenced work on a particular contract on 1st April 1990. They close their books of accounts for the year on 31st December each year. The following information is available from their closing records on 31-12-1996:

| Rs | |

|---|---|

| Material sent to site | 50,000 |

| Foreman's salary | 12,000 |

| Wages paid | 1,00,000 |

A machine costing Rs 32,000 remained in use on site for 1/5th of the year. Its working life was estimated at 5 years and scrap value at Rs 2,000. A supervisor is paid Rs 2,000 per month and had devoted one half of his time on the contract.

All other expenses were Rs 15,000. The material on site was Rs 10,000. The contract price was Rs 4,50,000. On 31st December, 2/3rd of the contract was completed. However, the architect gave certificate only for Rs 2,20,000 on which 75% was paid.

Prepare the contract account in the company's books.

(Kerala, 1993)

Solution:

M/s Kishore & Company

Contract account for the year ended 31-12-1990

Working Notes:

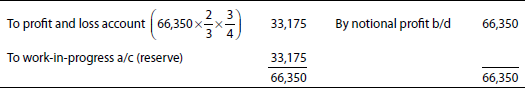

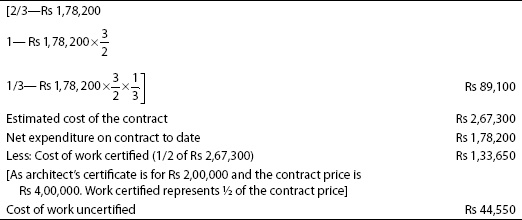

Computation of work uncertified

Total expenditure on the contract = Rs 1,87,200 – Rs 10,000 = Rs 1,77,200 which is 2/3rd completed

Therefore, total cost for full contract ![]()

Work certified Rs 2,25,000 is ½ of contract price of Rs 4,50,000

Net expenditure on contract till date = 1,77,200

Less: Cost of work certified ![]()

Cost of work uncertified = Rs 44,300

Problem 13. Kurian Construction Company undertook the construction of a bridge. The value of contract was Rs 75,00,000 subject to retention of 20% until one year after certified completion of the contract and the final approval of contractee's engineer. The following are the details shown in the books on 30th September 1994.

| Rs | |

|---|---|

| Labour on site | 24,30,000 |

| Materials direct bought at site | 19,20,000 |

| Materials from store | 4,97,200 |

| Hire and use of plant—plant upkeep | 72,600 |

| Direct expenses | 1,38,000 |

| Overheads charged to contract | 2,22,600 |

| Materials on hand (30-9-1994) | 37,800 |

| Wages accrued (30.9.1994) | 9,600 |

| Work not yet certified—cost | 99,000 |

| Work certified | 66,00,000 |

| Cash received on account | 52,80,000 |

| Materials lost in fire accident | 10,000 |

Prepare (a) contract account, (b) contractee's account. Show how the items relating to contract appear in the balance sheet.

(B. Com., Osmania)

[Ans: Profit taken: Rs 7,76,960]

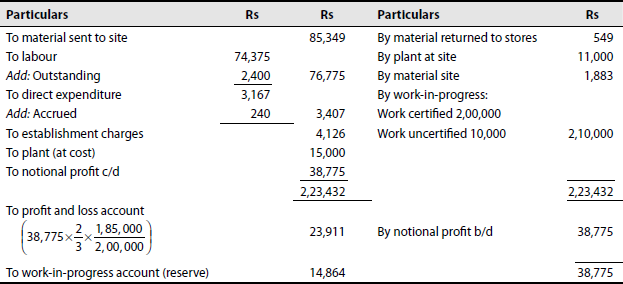

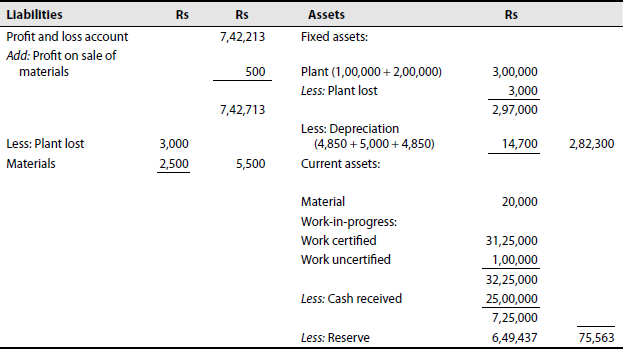

Illustration 14

M/s Arun and Varun undertook a contract for Rs 3,00,000 for constructing a college building. The following is the information concerning the contract during the year 1997:

| Rs | |

|---|---|

| Materials sent to site | 85,349 |

| Labour engaged on site | 74,375 |

| Plant installed at site at cost | 15,000 |

| Direct expenditure | 3,167 |

| Establishment charges | 4,126 |

| Materials returned to stores | 549 |

| Work certified | 2,00,000 |

| Value of plant as on 31st December 1997 | 11,000 |

| Cost of work not yet certified | 10,000 |

| Materials at site 31st December 1997 | 1,883 |

| Wages accrued 31st December 1997 | 2,400 |

| Direct expenditure accrued 31st December 1997 | 240 |

| Cash received from contractee | 1,85,000 |

Prepare contract account, contractee's account and show how the work-in-progress will appear in the balance sheet as on 31st December 1997.

(Madras, 2001)

Solution:

M/s Arun and Varun

Contract account for the year ended 31-12-1997

Contractee's account

Balance sheet (extracts as on 31-12-1997)

Note: When balance sheet ‘extracts’ are shown, there is no need to total both the sides, because they cannot tally. All the assets and liabilities are not available to complete the balance sheet.

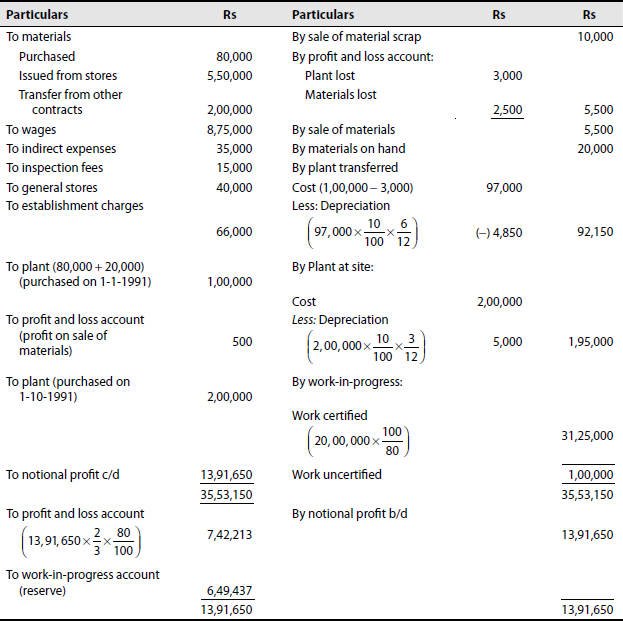

Illustration 15

The following particulars are extracted from the books of a building contractor on 31-12-1991.

| Materials | Rs |

|---|---|

| Purchased | 80,000 |

| Transfer from other contracts | 2,00,000 |

| Issued from central stores | 5,50,000 |

| Wages | 8,75,000 |

| Indirect expenses | 35,000 |

| Inspection fees | 15,000 |

| General stores | 40,000 |

| Establishment charges | 66,000 |

| Scrap (material sold) | 6,000 |

A cement mixing plant was purchased on 1st January 91 for Rs 80,000 and installation charges amounted to Rs 20,000. Of the plant and material charged to the contract, plant which cost Rs 3,000 and material which cost Rs 2,500 were lost. On June 30, plant was transferred to another contract. An additional plant was purchased on October 1, for Rs 2,00,000. Of the materials charged to contract, materials which cost Rs 5,000 were sold for Rs 5,500.

The contract price was Rs 60,00,000. Cash received on account till 31st December 1991 amounted to Rs 25,00,000 being 80% of work certified. The cost of work done but not certified was Rs 1,00,000. The value of material on hand was Rs 20,000. Charge depreciation on plant at 10% p.a. Prepare contract account. Show how work-in-progress account will appear in the balance sheet on 31st December 1991.

(Mangalore, 1992)

Solution:

Contract account for the year ended 31-12-1991

Balance sheet (extracts as on 31-12-1991)

Note: Depreciation on plant transferred to another contract should also be reduced from the plant in the balances sheet for full year. The other contract is to be debited for the depreciation of the later 6 months.

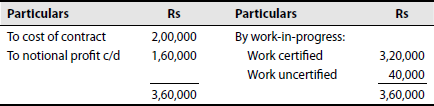

Illustration 16

The expenditure on a contract till 31st March 1998 was Rs 2,00,000 and the work certified was Rs 3,20,000. The contract price is Rs 4,50,000 and the contractee paid Rs 2,80,000 till 31-3-1998. The cost of work done but not certified on that date amounted to Rs 40,000.

It is estimated that the contract will take further 4 months to complete and will necessitate an additional expenditure of Rs 60,000.

You are consulted as to the amount to be credited to profit and loss account on 31-3-1998. State the different amounts of profit that may reasonably be credited to the profit and loss account.

Solution:

Contract account for the period ended 31-3-1998

Since estimated expenditure to complete the contract is given, it is appropriate to ascertain the estimated profit and on that basis, a reasonable amount out of notional profit can be transferred to profit and loss account.

Calculation of estimated profit

| Rs | |

|---|---|

| Total cost of contract till 31-3-98 | 2,00,000 |

| Add: Additional expenditure estimated | 60,000 |

| Estimated total cost of contract | 2,60,000 |

| Contract price | 4,50,000 |

| Estimated profit | 1,90,000 |

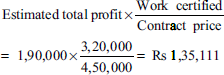

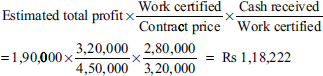

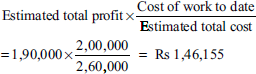

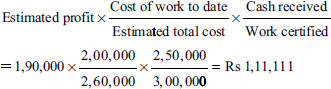

Different amounts of profit, which may reasonably be credited to profit and loss account, are as follows:

-

In this case, reserve = Rs 1,60,000 – Rs 1,35,111 = Rs 24,890

-

Profit in reserve = Rs 1,60,000 – Rs 1,18,222 = Rs 41,778

-

Profit in reserve = Rs 1,60,000 – Rs 1,46,155 = Rs 13,845

-

Profit in reserve = Rs 1,60,000 – Rs 1,46,155 = Rs 13,845

Illustration 17

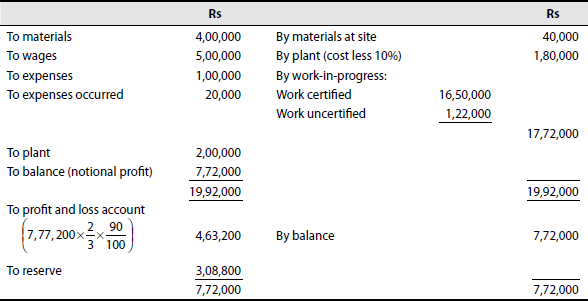

You are required to prepare a contract account for the year ending 31 December 1989 from the following particulars.

| Rs | |

|---|---|

| Materials | 4,00,000 |

| Wages | 5,00,000 |

| Expenses | 1,00,000 |

| Expenses occurred due | 20,000 |

| Plant | 2,00,000 |

| Work certified (90% received in cash) | 16,50,000 |

Materials at site (31-12-1989) Rs 40,000.

Depreciate plant by 10%. Fifteen per cent of the value of materials issued and 10% of the wages may be taken as incurred for the portion of the work completed, but not yet certified. Expenses are to be charged as a percentage to direct wages. Ignore depreciation on the uncertified portion of work. Ascertain the amount to be transferred to the profit and loss account.

(SK University, 1990)

Solution:

Contract account

Work uncertified is calculated as

| Rs | |

|---|---|

| Materials (15% of 4,00,000) | 60,000 |

| Wages (10% of 5,00,000) | 50,000 |

| Overheads (24% of 50,000) | 12,000 |

| 1,22,000 |

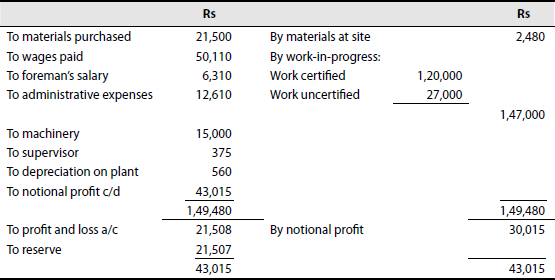

Illustration 18

A building contractor furnishes the following records about a contract commenced on 1 April 1985.

Expenses incurred on the contract up to 31st December 1985 were

| Rs | |

|---|---|

| Materials purchased | 21,500 |

| Wages paid | 50,110 |

| Foreman's salary | 6,310 |

| Administrative expenses | 12,610 |

| Machinery purchased | 15,000 |

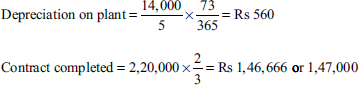

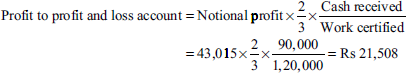

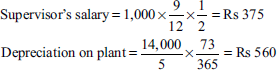

A supervisor with a monthly salary of Rs 1,000 has spent about half of his time on this contract. Materials at site on 31-12-1985 were worth Rs 2,480. The machinery purchased was used for 73 days. The estimated life of the machine is 5 years and its scrap value is estimated at Rs 1,000.

The contract price is fixed at Rs 2,20,000. On 31st December 1985, two-thirds of the contract was completed. Work certified was worth Rs 1,20,000 and Rs 90,000 have been paid on account. Prepare the contract account.

(Gulbarga University, 1988)

Solution:

Contract account

Working Notes:

![]()

Work certified (15,000 – 1,000) = Rs 14,000

Work certified = Rs 1,20,000

Work uncertified = Rs 1,47,000 – Rs 1,20,000 = Rs 27,000

Reserve = Rs 30,015 – Rs 15,008 = Rs 21,507

CHAPTER SUMMARY

Having gone through this chapter, one would be able understand the meaning, the types of contract accounting. It also gives the students a chance to know about the terms notional profit, cost plus contract, escalation clause and the manner in which notional profits are transferred to profit and loss account.

KEY FORMULAE

- If the work completed is less than ¼th of the contract value, the profit to be transferred to the profit and loss account is nil.

- If the work completed is between ¼ and ½, the profit to be transferred to the profit and loss account is notional profit × 1/3 × (cash received/work certified).

- If the work completed is >50%, notional profit × 2/3 × (cash received/work certified).

For the contracts, which are almost complete, any one of the following formula can be used for calculation of profit.

(Estimated profit = Contract price − (Total expenditure + Provision for contingency))

Work-in-progress = Work certified + Work uncertified − (Cash received + Profit reserve), i.e. unrealised profit.

EXERCISE FOR YOUR PRACTICE

Objective Type Questions

I. State whether the following statements are True or False:

- In cost-plus contracts, the contractor runs a risk of incurring a loss.

- The contract, which is complete up to one fourth, one fourth of the profit can be transferred.

- In contract costing profit of each contract is computed when the contract is completed.

- Contract costing is suitable where the products differ.

- Contract costing and job costing are the same.

- In contract costing payment of cash to the contractor is made on the basis of certified work.

- When the completion stage of a contract is less than ¼, the total expenditure on the contract is transferred to work-in-progress account

- In cost plus contracts, the contractor will get cost plus a stipulated profit.

- Final contract price to be paid is certain in cost plus contracts.

- Escalation clause in a contract provides that the contract price is fixed.

[Ans: 1—false, 2—false, 3—false, 4—false, 5—false, 6—true, 7—true, 8—true, 9—false, 10—false]

II. Choose the correct answer:

- In contract costing, contract account is prepared by

- contractee

- contractor

- both a & b

- none of these.

- Contract price is not fixed in case of

- de-escalation clause

- cost plus contracts

- escalation

- all the above.

- When a contract is 50% complete, the amount of profit to be taken to the credit is

- estimated profit

- 50% of the estimated profit

- 2/3 of estimated profit × cash ratio

- 1/3 of estimated profit × cash ratio.

- When contract is not complete at the end of the financial year, loss on incomplete contract is

- transferred to profit and loss

- debited to profit and loss

- transferred to work-in-progress

- transferred to work-in-progress and profit and loss.

- Profit on incomplete contract is termed as

- notional profit

- costing profit

- gross profit

- net profit.

- Work-in-progress in contract account consists of

- work certified and profit carried forward

- work certified

- work certified and work uncertified

- work certified, work uncertified and profit carried forward.

- Contract costing is a basic method of

- financial costing

- job costing

- specific order costing

- batch costing.

- In contract costing the cost unit is

- job

- batch

- unit produced

- contract.

- A contact that guarantees a certain percentage of profit is known as

- incomplete contract

- cost plus contracts

- work-in-progress

- finished goods.

- The escalation clause in contracts are often provided as safeguards against any likely changes in

- price of material

- price of labour

- both a & b

- none of these.

[Ans: 1 — (b), 2 — (d), 3 — (c), 4 — (a), 5 — (a), 6 — (d), 7 — (c), 8 — (d), 9 — (b), 10 — (c)]

DISCUSSION QUESTIONS

Short Answer-Type Questions

- What do you mean by notional profit?

- How are accounts prepared when contract lasts for more than a year?

- What is work-in-progress?

- What is work uncertified?

Essay-Type Questions

- What are the main features of cost-plus contract?

- What is escalation clause?

- What do you mean by profit on incomplete contracts?

- How do you fix up the amount of profit to be transferred to profit and loss account?

- Write a note on the following:

- work certified

- retention money

- percentage of work completed

PROBLEMS

Simple Finished Contracts

- Senthil Construction Company undertook a contract for constructing a building from 1st January 1998. The contract price was Rs 1,00,000. He incurred the following expenses.

Rs Materials issued 6,000 Materials in hand, at the end 1,000 Wages 5,000 Direct expenses 20,000 Plant purchased 10,000 The contract was completed on 30th June 1998 and the contract price was duly received. Provide depreciation at 20% p.a. on plant and charge indirect expenses at 20% on wages. Prepare contract account in the books of the company.

[Ans: Profit on the contrast: Rs 68,000]

- The following is the summary of transactions as on 31st December 1991, relating to a special contract completed during the year.

Rs Materials bought from the market 1,500 Materials issued from the stores 500 Wages 2,440 Direct expenses 294 Works on cost—25% of direct wages

Office on cost—10% of prime cost

Contract price—Rs 6,000

You are required to prepare a contract account keeping in view that material returned amounted to Rs 240.

(Calicut, 1995)

[Ans: Profit: Rs 447; Office on cost: Rs 449]

- The following information relates to contract no.123. You are required to prepare the contract account and contractee's account assuming that the amount due from the contract was fully received.

RS Direct material 20,250 Direct wages 15,500 Stores issued 10,500 Loose tools 2,400 Tractor expenses: Running material 2,300 Wages of drivers 3,000 5,300 Other direct charges 2,650 The contract price was Rs 90,000 and the contract took 13 weeks in its completion. The value of loose tools and stores returned at the end of the period were Rs 200 and Rs 3,000, respectively. A plant was also used and returned at a value of Rs 16,000 after charging depreciation at 20%. The value of tractor was Rs 20,000 and depreciation was to be charged to the contract at 15% p.a. The administration and office expenses are to be provided at 10% on works cost.

[Ans: Profit: Rs 26,035; Works cost: Rs 58,150; Depreciation on tractor: Rs 750 and on plant: Rs 4,000]

- A building contractor took a contract for the construction of a certain building on 1st January 1994. The contract price was agreed at Rs 4,00,000. The contractor had made the following expenditure during the year.

From the following further particulars, prepare a contract account for the year. Also show the amount of work-in-progress, which will be shown in the balance sheet of the contractor

Rs Value of plant on 31st December 1994 30,000 Stock of materials at the place of work on 31st December 1994 5,000 Materials returned to stores 1,000 Work certified by the architect 75,000 Cash received 70,000 Cost of work not yet certified 4,000 (B. Com., Kerala)

[Ans: No profit should be taken credit for, as the work certified is less than 1/4th of the contract price’ net expenditure: Rs 89,000]

- 'A’ undertook several large contracts and his ledger contained therefore a separate account for each contract. On 31-12-1991, the account of contract number 22 showed the following amounts as expended thereon.

RS Materials directly purchased 1,80,000 Materials issued from stores 50,000 Wages 2,44,000 Direct expenses 24,000 Plant purchased 1,60,000 Proportionate establishment charge 54,000 The contract was for Rs 15,00,000 and up to 31-12-1991 Rs 6,00,000 had been received in cash which represented 80% of work certified.

The materials at site unconsumed were valued at Rs 15,000. The contract plant was to be depreciated by Rs 16,000.

Prepare the contract account showing that profits thereon have been earned to date.

(Madras, 1992)

[Ans: Notional profit: Rs 1,97,000; Profit earned to date: Rs 1,05,067]

- A firm of builders, carrying on large contracts, kept in a contract ledger separate accounts for each contract. On 30th June 1994, the following was shown as being the expenditure in connection with a contract:

Rs Materials purchased 58,063 Material from stores 9,785 Plant which had been used on other contracts 12,523 Additional plant purchased 3,610 Wages 73,634 Direct expenses 2,036 Proportion of establishment charge 8,720 The contract which had commenced on 1st January 1994 was for Rs 3,00,000 and the amount certified by the architect, after a deduction of 20% retention money, was Rs 1,20,800, the work being certified up to 30th June 1994.

The materials on the site at the date were valued at Rs 9,858. A contract plant ledger was also kept in which depreciation was dealt with monthly, the amount debited in respect of the plant on the contract up to 30th June 1965 was Rs 1,130.

You are required to prepare an account showing the profit on the contract up to 30th June 1994.

(B. Com., Andhra)

[Ans: Profit: Rs 4,000]

- M/s Pari & Company obtained a contract for building a factory for Rs 10,00,000. Building operations started on 1st April 1984 and at the end of March 1985, they received from the contractee a sum of Rs 3,90,000 being 75% of the amount due on surveyor's certificate. The following additional information is given from the books of Pari & Company Limited.

Rs Stores issued to contract 2,00,000 Stores on hand on 31-3-1985 10,000 Wages paid 1,80,000 Plant purchased 2,00,000 Direct expenses 25,000 Overheads allocated to contract 12,000 Work finished but not yet certified 12,000 Plant to be depreciated at 10%. You are required to prepare an account showing profit and loss on contract as on 31-3-1985 and the amount of profit the company would be justified in taking to the credit of profit and loss account for the year.

(Madras, 1985)

[Ans: Notional profit: Rs 1,05,000; Profit to be taken to the credit of profit and loss account: Rs 52,500]

- Ashok Builders undertook several large contracts and their ledger therefore, contained a separate account for each contract. On June 30th 1994, the account of contract number 75 showed the following amounts as expended thereon:

Rs Materials directly purchased 90,000 Materials issued from stores 25,000 Plant purchased 80,000 Wages 1,22,000 Direct expenses 12,000 Proportionate establishment charges 27,000 3,56,000 The contract was for Rs 7,50,000 and up to 30th June 1994 Rs 2,90,000 had been received in cash which represented 80% of work certified by the architect. The materials on site unconsumed were valued at Rs 7,500. The depreciation on plant worked out to Rs 8,000.

Prepare the contract account showing what profit therein had been carried to date. Also state what amount should, in your opinion, be taken to profit and loss account of the period.

(Madras, 1995)

[Ans: Notional profit: Rs 86,000; Profit to be taken to profit and loss account: Rs 45,867]

- The contract ledger of a company showed the following expenditure on account of a contract on 31st December.

Rs Materials 60,000 Plant 10,000 Wages 82,200 Establishment charges 4,300 1,56,500 The contract was commenced on 1st January and the contract price was Rs 3,00,000; cash received on account to date was Rs 1,20,000 representing 80% of the work certified the remaining 20% being retained until completion. The value of materials on hand was Rs 2,000 and the cost of work finished but not certified as at 31st December was Rs 3,000.

Prepare an account in respect of the contract, showing the price to date, assuming depreciation on plant at 10 per cent annum and state the proportion of profit the company would be justified in taking to the credit of profit and loss account.

(B. Com., Agra)

[Ans: Rs 4,000]

- A firm of large contractors kept separate accounts for each contract. On 31.12.1992 the following were shown as being the expenditure in connection with contract number 101:

Rs Materials issued from stores 48,925 Materials purchased 2,90,315 Wages 3,68,170 Direct expenses 10,130 Establishment charges 43,600 Plant which had been used on other contracts 62,615 Additional plant purchased 18,050 The contract which had commenced on 1-7-1992 was for Rs 15,00,000 and the amount certified by the architect, after deduction of 20% retention money was Rs 6,04,000, the work being certified till 31-12-1992. The materials on site on that date were valued at Rs 49,290. The depreciation on plant in respect of this contract till 31-12-1992 was Rs 5,650.

Prepare a contract account, showing the profit on the contract up to 31-12-1992.

(Madras, 1995)

[Ans: Notional profit: Rs 37,500; Profit on the contract: Rs 20,000]

- A undertook several large contracts, and his ledger, therefore, contained a separate account for each contract on 30th June. The account of contract number 51 showed the following as expended thereon.

Rs Materials directly purchased 90,000 Materials issued from stores 25,000 Plant purchased 80,000 Wages 1,22,000 Direct expenses 12,000 Portion of establishment charges 27,000 3,56,000 The contract was for Rs 7,50,000; and up to 30th June Rs 2,90,000 had been received in cash which represented the full amount certified less 20% retention money. The materials on site unconsumed were valued at Rs 7,500. The contracting plant was to be depreciated by Rs 8,000.

Prepare the contract account showing the profit that had been earned to date. Also state what amount should, in your opinion, be taken to the profit and loss account of the period.

(B. Com., Allahabad)

[Ans: Rs 86,000, Rs 45,866]

- M/s Anil & Company, a firm of building contractors undertook a contract for construction of a commercial complex on 1st January 1997. The following was the expenditure on the contract for Rs 9,00,000.

Rs Materials issued to contract 76,500 Plant issued for contract 22,500 Wages 1,21,500 Other expenses 7,500 Cash received on contract to 31st December 1997 amounted to Rs 3,84,000 being 80% of work certified.

Of the plant and materials charged to the contract, plant which cost Rs 9,000 and materials costing Rs 7,500 were lost.

On 31st December 1997, plant costing Rs 6,000 was returned to stores. The cost of work done but uncertified was Rs 3,000 and materials costing Rs 6,900 were in hand. Charge 15% depreciation on plant. Reserve 1/3rd profits earned and prepare contract account from the above particulars.

[Ans: Notional profit: Rs 2,89,875; Closing plant at state: Rs 6,375; Profit kept in reserve at 1/3: Rs 96,625; Profit taken to profit & loss account: Rs 1,93,250]

Hint: Due to the specific instruction to reserve 1/3rd of the profits, increasing the reserve based on ‘cash received to work certified ratio’ may not be appropriate.

- Work certified is less than half of the value of contract. The Kedar accepted a contract for the construction of a building for Rs 10,00,000, the contractee agreeing to pay 90% of work certified as complete by the architect. During the first year, the amounts spent were.

At the end of the year, the machinery was considered to be worth Rs 20,000 and the materials at the site were of the value of Rs 5,000. Work certified during the year totalled Rs 4,00,000. In addition, the work-in-progress, but not certified at the end of the year cost Rs 15,000. Prepare the books of The Kedar. Also show various figures of profit that can be transferred reasonably to profit and loss account.

(B.Com., Delhi)

[Ans: Profit: Rs 15,000]

14. (Valuation of work uncertified)

Contractors Limited undertook a special contract for a total value of Rs 12,00,000. It was expected that the contract would be completed by 31st January 1992. You are required to prepare a contract account for the year ending 31-1-1992 from the following.

Rs Wages 3,00,000 Materials sent to site 1,50,000 Materials lying at site on 31-1-1992 20,000 Special plant 1,00,000 Overheads 60,000 Work certified 8,00,000 Depreciation at 10% to be provided on plant. Cash received is 80% of work certified. Five per cent of the value of materials used and 6% of wages may be taken to have been incurred for the portion of work completed but not yet certified. Overheads are charged as a percentage of direct wages.

[Ans: Notional profit: Rs 3,28,100; Profit transferred to profit and loss account: Rs 1,74,987; Cost of work uncertified: Rs 28,100]

- (Valuation of work uncertified)

Meenakshi Company Limited undertook a contract for construction of a bridge on 1-1-1997. The contract is expected to be completed by 30-6-1998. The contract price is Rs 8,00,000. You are required to prepare the contract account for the year ending 31-12-1997 from the following data:

Rs Materials issued 2,00,000 Wages 75,000 Materials returned to stores 10,000 Plant used for full year 2,00,000 General overheads 80,000 Depreciation of plant 10% supervisors’ salary 10,000 Work certified 5,00,000 Cash received is 80% of work certified. Ten per cent of materials issued and 15% of wages may be taken to have been incurred for the portion of work completed but not yet certified. General overheads are charged as percentage of direct wages.

[Ans: Notional profit: Rs 1,68,250; Profit transferred to profit & loss account: Rs 89,733; Cost of work uncertified: Rs 43,250]

- A building contractor having undertaken construction work at a contract price of Rs 5,00,000 began the execution of the work on 1st January 1981. The following are the particulars of the contract up to 31st December 1981.

Rs Machinery installed at site 30,000 Materials sent to site 1,70,698 Labour at site 1,48,750 Direct expenses 6,334 Overhead charges allocated 8,252 Materials returned from site 1,098 Work certified by architect 3,90,000 Cash received 3,60,000 Cost of work not certified 9,000 Materials on hand as on 31-12-1981 3,766 Wages accrued due on 31-12-1981 5,380 Value of machinery as on 31-12-1981 22,000 It was decided that profit made on the contract in the year should be arrived at by deducting the cost of work certified from the total value of the architect's certificates, that 1/3rd of the profit so arrived as should be regarded as provision against contingencies and that such provision should be increased by taking to the credit of profit and loss account only such portion of the 2/3rd profit as the cash received before the amount is taken to the credit of the profit and loss account. Prepare contract account.

(M.Com., 1989)

[Ans: Notional profit: Rs 56,450; Profit taken to the credit of profit and loss account: Rs 34,738; Total profit kept in reserve: Rs 21,712]

- On 1st January, ‘A’ undertook a contract for Rs 5,00,000. He incurred the following expenses during the year.

Rs Materials issued from stores 50,000 Materials purchased for the contract 45,000 Plant installed at cost 35,000 Wages paid 1,00,000 Wages accrued due on 31st December 40,000 Direct expenses paid 10,000 Direct expenses accrued due on 31st December 2,500 Establishment 6,500 Of the plant and materials charged to the contract, the plant which cost Rs 2,000 and the materials costing Rs 1,500 were lost. Some of the materials costing Rs 2,000 were sold for Rs 2,500. On 31st December the plant, which cost Rs 500, was returned to the stores and on the same date a part of the plant, which cost Rs 200, was damaged rendering itself useless.

The work certified was Rs 2,40,000 and 80% of the same was received in cash. Cost of work done but uncertified was Rs 1,000. Charge 10% p.a. depreciation on plant and prepare the contract account for the year ended 31st December, by transferring to the profit and loss account the portion of the profit, if any, which you think is reasonable. Show also the particulars relating to the contract in the balance sheet of the contractor on 31st December.

(B.Com., Bangalore)

[Ans: Loss on contract: Rs 12,800; Work-in-progress shown in balance sheet: Rs 49,000; Profit and loss account balance on the assets side of balance sheet (12,800 + 3,500 + 180 – 500) = Rs 15,980]

- (Two or more contracts)

Mr Ram undertook two contracts that commenced on 1st January 1998 and 1st July 1998, respectively. The accounts on 31st December 1998 showed the following position.

Contract I, Rs Contract II, Rs Contract price 4,00,000 2,70,000 Expenditure: Materials 72,000 58,000 Wages paid 1,10,000 1,12,400 General charges 4,000 2,800 Plant installed 20,000 16,000 Materials on hand 4,000 4,000 Wages accrued 4,000 4,000 Work certified 2,00,000 1,60,000 Cash received in respect thereof 1,50,000 1,20,000 Work done but not certified (at cost) 6,000 8,000 The plants were installed on the date of commencement of each contract; depreciation thereon is to be taken at 10% p.a.

Prepare the contract accounts in tabular form and ascertain the profit or loss to be taken to profit and loss account.

[Ans: Contract I—Notional profit: Rs 18,000; Profit credited to profit and loss: 9,000; Contract II—Loss, fully transferred to profit and loss: Rs 6,000]

- (Two or more contracts)

During 1997, Indian Contractors Limited undertook two contracts, the first on 1st July 1997 and the second on 30th September 1997. On 31st December when accounts were made up, their position was as follows:

Contract I, Rs Contract II, Rs Contract price 2,70,000 3,00,000 Expenditure: Materials 58,000 20,000 Wages 1,12,400 14,000 General expenses 2,800 1,000 Plant installed 16,000 12,000 Materials on hand 4,000 2,000 Wages accrued 3,600 1,600 General expenses accrued 400 200 Work certified 1,60,000 36,000 Cash received 1,20,000 27,000 Work uncertified 8,000 2,000 The plant was installed on the dates of the contracts and depreciation is to be provided at 10% p.a. Prepare contract accounts in columnar from and show the extracts in the balance sheet of the company relating to the two contracts.

(C.A. Adapted)

[Ans: Contract I—Loss fully transferred to profit and loss account: Rs 6,000; Contract II—Notional profit: Rs 2,900, fully kept in reserve; Work-in-progress in balance sheet—Contract I: Rs 48,000; Contract II: Rs 8,100; Total: Rs 56,100]

- (Two or more contracts)

Construction Limited is engaged on two contracts A and B during the year. The following particulars are obtained at the end of December 199

Contracts A April 1 Rs B September 1Rs Contract price 6,00,000 5,00,000 Materials issued 1,60,000 60,000 Materials returned 4,000 2,000 Materials at site (December 31) 22,000 8,000 Direct labour 1,50,000 42,000 Direct expenses 66,000 35,000 Establishment expenses 25,000 7,000 Plant installed at site at cost 80,000 70,000 Value of plant (December 31) 65,000 64,000 Cost of contract not yet certified 23,000 10,000 Cost of contract certified 4,20,000 1,35,000 Cash received from contractees 3,78,000 1,25,000 Architect's fees 2,000 1,000 During the period materials amounting to Rs 9,000 have been transferred from Contract A to Contract B.

You are required to show:

- Contract accounts

- Contractee's accounts

- Balance sheet extracts, showing work-in-progress clearly.

(Madras, 1998)

[Ans: Contract A—Notional profit: Rs 60,000; Profit credited to profit and loss account: Rs 36,000; Contract B—Loss, fully transferred to profit and loss account: Rs 5,000; Contractee's account balance—A: Rs 3,78,000; B: Rs 1,25,000; Work-in-progress shown in balance sheet: Total: Rs 61,000; A—Rs 41,000; B—Rs 20,000]

- (Two or more Contracts)

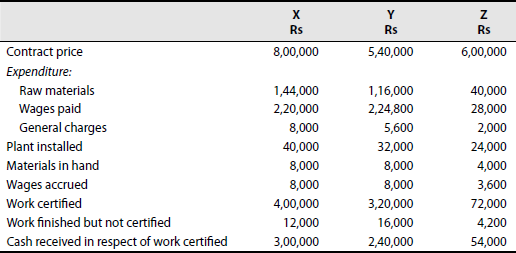

Three contracts X, Y and Z commenced on 1st January, 1st July and 1st October 1998, respectively, were undertaken by the Sampath Contractors Limited, and their accounts on 31st December showed the following position:

The plant was installed on the date of commencement of each contract; depreciation is to be taken at 10% p.a.

Prepare the contract accounts in tabular from and show how they would appear in the balance sheet as on 31st December 1998.

[Ans: X—Notional profit: Rs 36,000; Profit taken to profit and loss account: Rs 18,000; Y—Loss taken fully to profit & loss account: Rs 12,000; Z—Notional profit: Rs 6,000; Profit taken to profit and loss account: Nil; Work-in-progress in balance sheet—Total: Rs 2,06,200; X—Rs 94,000; Y—Rs 96,000; Z—Rs 16,200]

Continuing contracts (or) contracts spreading over two or more accounting years.

- The following information relates to a building contract for Rs 10,00,000.

1986 Rs 1987 Rs Materials issued 3,00,000 84,000 Direct wages 2,30,000 1,05,000 Direct expenses 22,000 10,000 Indirect expenses 6,000 1,400 Work certified 7,50,000 10,00,000 Work uncertified 8,000 – Materials at site 5,000 7,000 Plant issued 14,000 2,000 Cash received from contractee 6,00,000 10,00,000 The value of the plant at the end of 1986 and 1987 was Rs 7,000 and Rs 5,000, respectively.

Prepare (i) contract account and (ii) contractee's account for the two years 1986 and 1987 taking into consideration such profit for transfer to profit and loss account as you think proper.

(Madras, 1990)

[Ans: For 1986: Notional profit: Rs 1,98,000; Profit taken to profit and loss account: Rs 1,05,600; For 1987: Profit on contract, fully taken to profit and loss account: Rs 1,32,000]

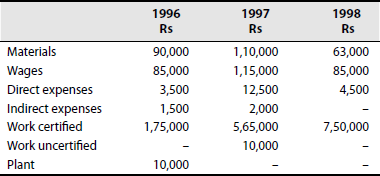

- The following information relates to a contract for Rs 7,50,000 (the contractee paying 90% of the value of work done and certified by the Architect and rest on completion of the contract) of Murugan Construction Company.

The value of plant at the end of 1996, 1997 and 1998 was Rs 8,000, Rs 5,000 and Rs 2,000 respectively.

Prepare contract account for the three years in the books of Murugan Construction Company.

[Ans: 1984—Loss transferred to profit & loss account: Rs 7,000; 1985—Notional profit: Rs 1,57,500; Profit credited to profit & loss account: Rs 94,500; Profit kept in reserve: Rs 63,000; 1986—Profit made, fully transferred to profit and loss account: Rs 82,500]

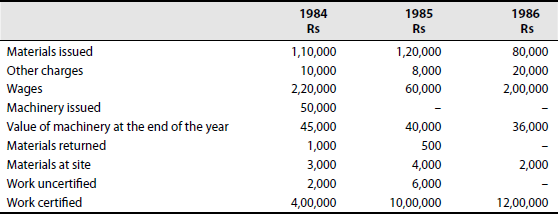

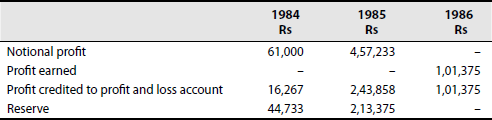

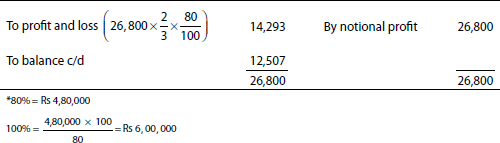

- From the following prepare contract account for three years 1984, 1985 and 1986.

The contract price was Rs 12,00,000. Cash received was 80% of work certified.

(Madras, 1987)

Ans:

Escalation clause

- Andal Construction Company undertook a contract on 1-1-1998 for construction of a stadium, with an escalation clause which provides that if material prices and wage rates increase by more than 12%, the contractor gets compensation for 35% of such rise in the cost of material and wages beyond 12%. It was agreed that since signing of the agreement material prices and wage rates have gone up by 42% on an average. The value of work certified does not take into account the effect of escalation clause.

The following are the details relating to the contract for the year ended 31st December 1998

Rs Contact price 3,00,000 Material issued 60,000 Wages 80,000 Overheads 5,000 Plant installed at the site 10,000 Material in hand as on 31-12-98 5,000 Work certified 2,00,000 Cash received 1,60,000 Depreciate plan at 10% p.a. Work done but not certified 5,000 Prepare contract account and show the profit to be taken to profit and loss account.

[Ans: Notional profit: Rs 73,982; Profit transferred to profit and loss account: Rs 39,457; Compensation for escalation in prices, to be credited to the contract account: On material: Rs 4,067; On wages: Rs 5,915; Total: Rs 9,982]

Hint: Escalation compensation is on material consumed.

- New Vistas Builders Limited undertook a contract on 1st January 1997 with an escalation clause. The clause provided that if material prices and wage rates increase by more than 10%, the contractor gets compensation for 60% of such rise in the cost of materials and 80% of such rise in wage rates beyond the 10% in each case. It is agreed that since the signing of the agreement till 31st December 1997, the material prices had gone up by 25% and wage rates by 30%. The value of work certified does not take into account the effect of the escalation clause.

The following are the details relating to the contract for the year ended 31-12-1997.

Rs Contact price 4,00,000 Material sent to site 78,800 Wages 1,26,500 Sundry expenses 8,000 Plant installed at site 20,000 Materials on hand 4,000 Work certified 2,40,000 Cash received in respect thereof 1,80,000 Work uncertified 6,000 Depreciation on plant at 10% p.a.

Prepare contract account and show the profit to be taken to profit and loss account.

(C.A. Adapted)

[Ans: Notional profit: Rs 55,654; Profit credited to profit & loss account: Rs 27,827; Escalation compensation to be credited to contract account: On material: Rs 5,385; On wages: Rs 15,569; Total: Rs 20,954]

Hint: For ascertaining escalation compensation, material consumed, i.e. 78,800 − 4,000 = Rs 74,400 should be taken.

EXAMINATION PROBLEMS

1. How much of profit, if any, would you allow to be considered in the following case?

| Rs | ||

|---|---|---|

| Contract cost | 2,80,000 | up-to-date |

| Contract value | 5,00,000 | |

| Cash received | 2,70,000 | |

| Uncertified work | 30,000 | |

| Deduction from bills | ||

| By way of security | 10% |

Ans: ![]()

2. The following was the expenditure on a contract for Rs 12,00,000 commenced in January.

| Rs | |

|---|---|

| Materials | 2,40,000 |

| Wages | 3,28,000 |

| Plant | 40,000 |

| Overheads | 17,200 |

Cash received on account of the contract up to 31st December was Rs 4,80,000 being 80% of the work certified. The value of materials in hand was Rs 20,000. The plant had undergone 20% depreciation.

Prepare contact account

(CAQ3. (a), Dec ‘08/Paper-8)

Ans:

3. On 1st January, A undertook a contract for Rs 5,00,000. He incurred the following expenses during the year:

| Rs | |

|---|---|

| Materials issued from stores | 50,000 |

| Material purchased for the contract | 45,000 |

| Plant installed at cost | 35,000 |

| Wages paid | 1,00,000 |

| Wages occurred due on 31st December | 40,000 |

| Direct expenses paid | 10,000 |

| Direct expenses accrued due on 31st December | 2,500 |

| Establishment | 6,500 |

Of the plant and materials charged to the contract, the plant which cost Rs 2,000 and the materials costing Rs 1,500 were lost. Some of the materials costing Rs 2,000 were sold for Rs 2,500. On 31st December, the plant, which cost Rs 500, was returned to the stores, and a part of the plant, which cost Rs 200, was damaged, rendering itself useless.

The work certified was Rs 2,40,000 and 80% of the same was received in cash. The cost of work done, but uncertified was Rs 1,000. Charge 10% p.a. depreciation on plant and prepare the Contract

Account for the year ended 31st December, by transferring to the profit and loss account the portion of the profit, if any, which you think is reasonable. Show also the particulars relating to the contract in the balance sheet of the contractor as on 31st December.

4. M/s Anand Associates commenced the work on a particular contract on 1st April 1994. They close their books of accounts for the year on 31st December each year. The following information is available from their costing records on 31st December 1994.

| Rs | |

|---|---|

| Materials sent to site | 43,000 |

| Foreman's salary | 12,620 |

| Wages paid | 1,00,220 |

A machine costing Rs 30,000 remained in use on site for 1/5th of the year. Its working life was estimated at 5 years and scrap value at Rs 2,000. A supervisor is paid Rs 2,000 per month and he had devoted one-half of his time on the contract.

All other expenses were Rs 14,000. The materials on site were Rs 2,500. The contract price was Rs 4,00,000. On 31st December 1994, 2/3rd of the contract was completed; however, the architect gave a certificate only for Rs 2,00,000 on which 80% was paid. Prepare the contract account.

Ans:

| To Profit and loss account | 35,682 | |

| Balance c/d | 31,223 | ______ |

| 66,905 | 66,905 |

Work uncertified:

Net expenditure = Gross expenditure − Value of materials on hand

Rs 1,77,460 = Rs 1,79,960 – Rs 2,500

Rs 1,77,460 represents the cost of two-thirds of the work.

Therefore, ![]()

Therefore, ![]()

Therefore, the difference of 2/3 and ½ of contract price = Rs 1,77,460 − Rs 1,33,095 = Rs 44,365 (work not certified)

5. A company of contractors began to trade on 1st January 1994. During 1994, the company was engaged on only one contract of which the contract price was Rs 5,00,000.

Of the plant and materials charged to contract, plant costing Rs 5,000 and material costing Rs 4,000 were lost in an accident.

On 31st December 1994, plant costing Rs 5,000 was returned to the stores. Cost of work uncertified, but finished Rs 2,000 and materials costing Rs 4,000 were in hand on site.

Charge 10% depreciation on plant and compile contract account and balance sheet form the following:

| Rs | Rs | |

|---|---|---|

| Share capital | 1,20,000 | |

| Creditors | 10,000 | |

| Cash received (80% of work certified) | 2,00,000 | |

| Land and buildings | 43,000 | |

| Bank balance | 25,000 | |

| Charged to contract: | ||

| Materials | 90,000 | |

| Plant | 25,000 | |

| Wages | 1,40,000 | |

| Expenses | 7,000 | ________ |

| 3,30,000 | 3,30,000 |

Ans:

Balance sheet as on 31st December 1994

| 1,32,200 | 1,32,200 |

6. The following was the expenditure on a contract for Rs 6,00,000 commenced in January, 1997:

Material Rs 1,20,000; Wages Rs 1,64,400; Plant Rs 20,000; Business Charges Rs 8,600.

Cash received on account to 31st December, 1997 amounted to Rs 2,40,000 being 80% of work certified; the value of materials in hand on 31-12-1997 was Rs 10,000. Prepare the contract account for 1997 showing the profit to be credited to the year's profit and loss account. Plant is to be depreciated at 10%.

Ans:

7. A company undertook a contract for construction of a large building complex. The construction work commenced on 1st April 1997 and the following data are available for the year ended 31st March 1998.

The contractors own a plant, which originally cost Rs 20,00,000, has been continuously in use in this contract throughout the year. The residual value of the plant after 5 years of life is expected to be Rs 5,00,000. Straight-line method of depreciation is in use.

As on 31st March 1998, the direct wages due and payable amounted to Rs 2,70,000 and the materials at site were estimated at Rs 2,00,000.

Required:

- Prepare the contract account for the year ended 31st March 1998.

- Show the calculation of profit to be taken to the profit and loss account of the year.

- Show the relevant balance sheet entries.

Ans:

8. A firm of building contractors began to trade on 1st April 1997. The following was the expenditure on the contract for Rs 3,00,000: Materials issued to contract Rs 51,000; Plant used for contract Rs 15,000; Wages incurred Rs 81,000; Other expenses incurred Rs 5,000.

Cash received on account to 31st March 1998, amounted to Rs 1,28,000 being 80% of the work certified. Of the plant and materials charged to the contract, plant which cost Rs 3,000 and materials which cost Rs 2,500 were lost. On 31st March 1998, plant which cost Rs 2,000 was returned to store, the cost of work done but uncertified was Rs 1,000 and materials costing Rs 2,300 were in hand on site.

Charge 15% depreciation on plant, and take to the profit and loss account 2/3rd of the profit received. Prepare the contract account, contractee's account and balance sheet from the above particulars.

Ans:

9. Construction Limited is engaged on two contracts A and B during the year. The following particulars are obtained at the year-end (December 31):

| Contract A | Contract B | |

|---|---|---|

| Date of commencement | April I Rs | September I Rs |

| Contract price | 6,00,000 | 5,00,000 |

| Materials issued | 1,60,000 | 60,000 |

| Materials returned | 4,000 | 2,000 |