14

Budgetary Control

CHAPTER OUTLINE

LEARNING OBJECTIVES

After reading this chapter, you should be able to understand:

- Meaning of budget and budgeting

- Process of establishing budgets

- Differences between fixed and flexible budgets

- Different types of budgets and their implications in planning

14.1 Introduction

A budget (from the old French word bougette, meaning purse) is generally a list of all planned expenses and revenues. It is a plan for saving and spending. In other terms, a budget is an organizational plan stated in monetary terms. A budget is a financial document used to project future income and expenses. It can be prepared by either an individual or a firm.

14.2 Meaning of Budget

The term budget is derived from the French word bougette, which means ‘little bag’ or a container of documents and accounts. A budget is an economic plan for a given period of time.

It is a quantified plan for future activities. It puts in black and white a quantitative plan to coordinate and control the use of resources for a specified period. It is defined as ‘the quantitative and financial interpretation of the future plans of operation’, and as the ‘overall financial plan for future activities’. It is viewed as a systematic plan for the utilization and coordination of materials, labour and other resources for the process by which plans for resource allocation are made.

Accounting terminology, published by the Canadian Institute of Chartered Accountants, explains budgeting in the following words:

An operating or financial plan comprising a detailed estimate of future transactions either in terms of quantities or money values, or both. In business, budgets are designed according to the types of transactions, e.g., cash or financial budgets, operating budgets, capital budgets. Budgets are also described as fixed or flexible, depending on whether the emphasis is placed on a rigid target such as specified sales volume, or on the relationship of the various items with the budgeted amounts being altered as volume changes.

A budget is a detailed statement of forecast.

Budgets are the individual objectives of a department.

A budget is a quantitative statement, prepared and approved prior to a particular period of time.

Budgeting is the act of building budgets.

Budgetary control is defined as ‘the establishment of budgets relating to the responsibilities of executives to the requirements of a policy’. It is a system of achieving a firm's objectives with minimum possible cost.

14.3 Purposes of Budgeting

The purposes of budgeting are as follows:

- Provide a forecast of revenues and expenditures

- Measure the financial operations of the business

Budgetary control is defined by the Institute of Cost and Management Accountants (CIMA) as follows: ‘The establishment of budgets relating the responsibilities of executives to the requirements of a policy, and the continuous comparison of actual with budgeted results, either to secure by individual action the objective of that policy, or to provide a basis for its revision.’

14.4 Salient Features of The Budgetary Control System

The salient features of a budgetary control system are the following:

- Determining the objectives to be achieved over the budget period, and the policy or policies that might be adopted for the achievement of these ends

- Determining the variety of activities that should be undertaken for the achievement of the stated objectives

- Drawing up a plan or a scheme of operation with respect to each class of activity, in physical as well as monetary terms for the full budget period and its parts

- Laying out a system of comparison of actual performance by each person, section or department with the relevant budget and determination of causes for discrepancies, if any

- Ensuring that corrective action is taken where the plan is not being achieved and, if that is not possible, for the revision of the plan.

14.4.1 Advantages of the budgetary control system

The advantages of a budgetary control system to an enterprise are as follows:

- It helps to conduct business activities of the enterprise in an efficient manner.

- It is a powerful instrument for the control of expenditure.

- It reveals the deviations from the budgeted figures to management after making a comparison with actual figures.

- Effective utilization of various resources like workers, material, machinery and money is made possible.

- It helps in the review of current trends and the framing of future policies.

- It creates suitable conditions for the implementation of standard costing system in a business organization.

- It develops a feeling of cost consciousness among workers.

14.4.2 Limitations of the budgetary control system

Limitations of the budgetary control system are as follows:

- Budgets may or may not be true, as they are based on estimates.

- Budgets are considered rigid documents.

- Budgets cannot be executed automatically.

- Staff cooperation is usually not available when exercising budgetary control.

- Budget's implementation is quite expensive.

14.4.3 Budget period

Budget period depends on the type of business and the control aspect. In the case of seasonal industries, the budget period should be a short one. In the case of industries with heavy capital, the budget period should be a long one.

14.5 Different Types of Budgets

14.5.1 Fixed budgets

A fixed budget is a budget designed to remain unchanged irrespective of the level of activity actually attained. This is prepared for a definite production and capacity level. Fixed budgets are not effective tools of cost control.

14.5.2 Flexible budget

A flexible budget is the opposite of a static budget; it shows expected costs at a single level of activity. Therefore, a flexible budget is one that is designed to change (flex) in accordance with the level of activity actually attained. In contrast to planning around one target volume, it employs a range of activities. It can be defined as a ‘concise statement of how costs are related to changes in the chosen activity volume’. Thus, a flexible budget has the following main distinguishing features:

- It is prepared for a range of activities instead of a single level.

- It provides a dynamic basis for comparison because it is automatically related to changes in volume.

The formulation of a flexible budget begins with analysing the overhead into fixed and variable costs and determining the extent to which variable costs vary within the normal range of activities. It is a budget designed to change in accordance with the level of activity actually attained. This budget is prepared in such a manner as to present budget cost for different levels of activity. While preparing a flexible budget, the expenses are classified into three categories:

- Fixed

- Variable

- Semi-variable

Semi-variable expenses are further segregated into fixed and variable expenses.

Flexible budget is also called ‘variable budget’ or ‘sliding scale budget’. Fixed costs are related mostly to the period of time and are not concerned with the level of production or volume of sales. Variable costs vary in direct proportion to the level of production or volume of sales. At zero-level activity, variable costs are not in existence. Semi-variable costs occupy an in between position between fixed and variable costs. A part of these costs is variable and the rest is fixed.

14.5.3 Need for flexible budgets

A need for preparing flexible budgets arises under the following circumstances:

- Seasonal fluctuations in sales and/or production, for example, in the soft drinks industry

- For a company that keeps on introducing new products or makes changes in the design of its products frequently

- Industries engaged in make-or-order businesses like shipbuilding

- An industry that is influenced by changes in fashion

- General changes in sales

Table 14.1 shows the distinction between fixed and flexible budgets.

Table 14.1 Distinction Between Fixed and Flexible Budgets

| Fixed budget | Flexible budget |

|---|---|

| 1. It does not change with the actual volume of activity achieved. Thus, it is known as rigid or inflexible budget. | It can be recasted on the basis of the activity level to be achieved. Thus, it is not rigid. |

| 2. It operates on one level of activity and under one set of conditions. It assumes that there will be no change in the prevailing conditions, which is unrealistic. | It consists of various budgets for different levels of activity. |

| 3. Here, as all costs like fixed, variable and semi-variable costs are related to only one level of activity, variance analysis does not give useful information. | Here, analysis of variance provides useful information as each cost is analysed according to its behaviour. |

| 4. If budgeted and actual activity levels differ significantly, then aspects like cost ascertainment and price fixation do not give a correct picture. | Flexible budgeting at different levels of activity facilitates the ascertainment of cost, fixation of selling price and tendering of quotations. |

| 5. Comparison of actual performance with budgeted targets is meaningless especially when there is a difference between the two activity levels. | It provides a meaningful basis for the comparison of actual performance with budgeted targets. |

14.5.4 Functional budgets

Budgets that relate to the individual functions of an organization are known as functional budgets. The various types of functional budgets to be prepared for a business vary according to the size and nature of the business. Some important functional budgets are discussed in Sections 14.5.4.1 through 14.5.4.6.

14.5.4.1 Sales budget

Sales budget is an estimate of future sales, often broken down into both units and dollars. It is used to create company sales goals.

The process of budgeting starts with sales forecasting. It is the forecasting of sales for a period in terms of both quantity and value. It is prepared by the sales manager. Such a forecast requires an assessment of the number of units of each product that can be sold, sales territories to be covered and prices at which sales can be effected. Besides these, the following factor should also be taken into account: Sales budget represents the total sales in physical quantities and values for a future budget period. Some important factors like products, areas, salespersons and types of customers should be kept in mind when preparing a sales budget. The following factors have to be considered when preparing the sales budget:

- Reports by salespersons who will have first-hand information about local conditions prevailing in their areas, competition and so on.

- Statistical forecasting techniques of past sales analyses can be used to project sales volume based on past sales data.

- General economic and political conditions.

- Relative product profitability.

- Market research studies that provide information like state of the market, changes in fashion, consumer preferences, activities of competitors, ability of the consumers to pay and so on.

- Pricing policies.

- Advertising and sales promotion.

- Quality of sales force.

- Competition.

- Seasonal and cyclical variations.

- Production capacity of the plant.

- Change in company policy like the introduction of a new product or design.

- Special conditions affecting the business; for example, an increase in the production of automobiles with an increase in the demand for tyres.

14.5.4.2 Production budget

Product-oriented companies create production budgets, which estimate the number of units that must be manufactured to meet sales goals. A production budget also estimates the various costs involved in manufacturing such units, including labour and material.

14.5.4.3 Material budget

The purchase budget sets out the quantity and volume of different types of materials to be purchased during the budget period, taking into consideration levels of production activity and inventory levels. While preparing a material budget, the following factors must be taken into account:

- The quantities of materials required for the production budget

- The probable dates by which the materials required must be available

- Storage facilities available

- Availability of credit facilities and other financial resources

- Price trends in the market

- The anticipated cost of purchases to be made

- Nature of the materials, that is, seasonal or otherwise

In order to ensure regular supply of raw materials for production, a budget is prepared. In this budget only direct materials are taken into account and indirect materials are considered under overheads. This budget helps in the proper planning of purchases.

14.5.4.4 Cash budget

Cash budget is a cash plan for a defined period of time. It provides a summary of monthly receipts and payments. Hence, it highlights monthly surpluses and deficits of actual cash. Main uses of a cash budget are as follows:

- Maintain control over a firm's cash requirements, for example, stock and debtors

- Enable a firm to take precautionary measures and arrange investment and loan facilities in advance whenever cash surpluses or deficits arise

- Show the feasibility of a management's plans in cash terms

- Illustrate the financial impact of changes in management policy, for example, change of credit terms offered to customers

Receipts of cash may come from one of the following:

- Cash sales

- Payments by debtors

- Sale of fixed assets

- Issue of new shares

- Receipt of interest and dividends from investments

Payments of cash can be for one or more of the following:

- Purchase of stocks

- Payments of wages or other expenses

- Purchase of capital items

- Payment of interest or dividends or taxation

Cash-flow budget is a prediction of future cash receipts and expenditures for a particular time period. It usually covers a period in the short-term future. A cash-flow budget helps a business in determining when income will be sufficient to cover expenses and when the company will need to seek outside financing.

Cash budget represents the cash requirements of the business during the budget period. It is prepared after all the functional budgets are prepared. A cash budget does the following: ensures sufficient cash for the business, proposes arrangements to be made in the case of cash shortage and reveals the surplus amount.

14.5.4.5 Labour budget

Personnel are a highly costly item in the operation of an enterprise. It is, therefore, essential that, like the other factors of production, managements determine in advance personnel requirements for various jobs in enterprises. This budget may be classified into labour requirement budget and labour recruitment budget. The labour requirements in various job categories such as unskilled, semi-skilled, skilled and supervisory categories are determined with the help of various departmental heads. Labour recruitment is done keeping in view the requirements of a job and its specifications, degree of skill and experience required, and rates of pay.

14.5.4.6 Master budget

A company might have a master budget or profit plan for the upcoming year. The master budget includes a projected income statement and balance sheet. Budgets such as sales budget, production budget, marketing budget, administrative budget and budgets for departments operate within the master budget. In addition, there is a cash budget and a capital expenditures budget.

Master budget is the summary of all budgets. Once all the necessary functional budgets are prepared, the budget officer prepares the master budget. This budget includes the budgeted position of profit and loss as well as balance sheet.

14.6 BUDGET RATIOS

Budget ratios provide information about performance level, that is, the extent of deviation of actual performance from budgeted performance and whether the actual performance is favourable or unfavourable. If the ratio is 100% or more the performance is considered favourable, and if the ratio is less than 100% the performance is considered unfavourable. The ratios discussed in Sections 14.6.1 through 14.6.5 are usually used by managements to measure development from budget.

14.6.1 Capacity usage ratio

The capacity usage ratio shows the relationship between the budgeted number of working hours and the maximum possible number of working hours in a budget period.

Example:

Budgeted number of working hours after deducting the hours expected to be lost because of surplus capacity = 4,000

Maximum possible number of working hours in a budget period before deduction of surplus capacity = 5,000

![]()

In ascertaining both the levels of hours, normal idle time should be deducted.

14.6.2 Standard capacity employed ratio

The standard capacity employed ratio indicates the extent to which facilities are actually utilized during the budget period.

Example:

Actual hours worked = 3,600

Budgeted hours = 4,000

![]()

14.6.3 Level of activity ratio

The level of activity ratio may be defined as the number of standard hours equivalent to work produced that is expressed as a percentage of the budget of standard hours.

Example:

Actual production converted into standard hours = 5,600

Budgeted production converted into standard hours = 6,000

![]()

The level of activity ratio is arrived at by comparing actual production with the anticipated production shown in the budget. The standard capacity employed ratio does not consider either actual or estimated production; it only measures actual hours worked.

14.6.4 Efficiency ratio

Efficiency ratio may be defined as standard hours equivalent of work produced expressed as a percentage of the actual hours spent working.

Example:

Standard hours equivalent of work produced = 5,600

Actual hours worked = 5,000

![]()

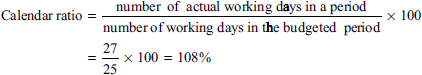

14.6.5 Calendar ratio

Calendar ratio may be defined as the relationship between the number of working days in a period and the number of working days in the relative budget period.

Example:

Actual working days = 26

Budgeted working days = 25

![]()

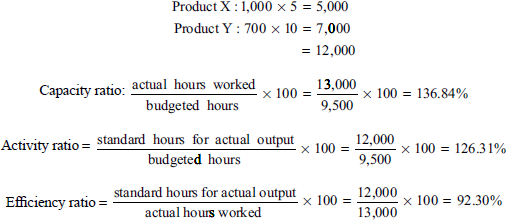

Illustration 1

A factory manufactures two types of products, X and Y. Manufacture of product X requires 5 hours and that of Y requires 10 hours. In a month of 25 effective days having 8 hours a day, 1,000 units of X and 700 units of Y were produced. The company employs 65 workers in the production department. Budgeted hours are 1,14,000 hours for the year. Calculate capacity ratio, activity ratio and efficiency ratio.

Solution:

![]()

Actual hours worked = 65 workers × 25 days × 8 hours = 13,000 hours

Standard hours for actual production:

Alternatively,

Activity Ratio |

= Capacity × Ratio × Efficiency Ratio |

| = 1.3684 × 0.923 | |

| = 1.2630, multiply by 100, we get | |

| = 126.3% |

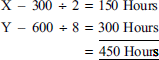

Illustration 1a

Two articles X and Y are manufactured in a department. Their specifications show that two Xs or eight Ys can be produced in 1 hour. The budgeted production for June 1998 is 300 Xs and 600 Ys. The actual production at the end of the month was 300 Xs and 530 Ys, and the actual hours spent on this production were 350. Find the capacity, activity and efficiency ratios for June 1998. Also find the calendar ratio if the actual working days during the month are 27 corresponding to 25 days in the budget.

Solution: Standard budgeted hours for June 1998

Standard hours for actual production:

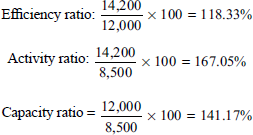

Illustration 2

A Ltd produces two commodities, Good and Better, in one of its departments. Each unit takes 7 hours and 12 hours as production times, respectively. 1,000 units of Good and 600 units of Better were produced during March. Actual manhours spent in this production were 12,000. Yearly budgeted hours are 1,02,000. Compute the various control ratios.

Solution: Yearly budgeted hours = 1,02,000

![]()

Standard hours for actual output = 1,000 × 7 + 600 × 12 = 14,200

Actual hours worked = 12,000 hours

Alternatively,

Activity ratio |

= Capacity ratio × Efficiency ratio |

| = 1.4117 × 1.1833 | |

| = 1.6704 | |

| = 1.375 is multiplied with 100, we get, | |

| = 167.04%. |

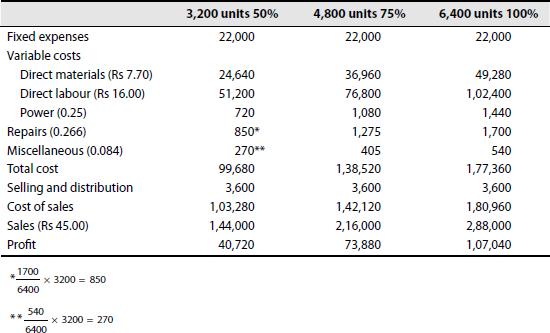

Illustration 3

The budgeted output of a factory specializing in the production of a single product at the optimum capacity of 6,400 units per annum amounts to Rs 1,76,048 as detailed here:

| Rs | Rs | |

|---|---|---|

| Fixed costs | — | 22,000 |

| Power | 1,440 | |

| Repairs and so on | 1,700 | |

| Miscellaneous and so on | 540 | |

| Direct materials | 49,280 | |

| Direct labour | 1,02,400 | 1,55,360 |

| 1,77,360 |

Taking into consideration possible impact on sales turnover by market trends, the company decides to have a flexible budget with a production of 3,200 and 4,800 units (the actual quantity proposed being left to a later date before commencement of budget period). Prepare a flexible budget for production levels at 50% and 75%. Assuming that the sales per unit is maintained at Rs 45 at present, indicate the effect on net profit. Administration, selling and distribution expenses continue at Rs 3,600.

Solution: Flexible budget

With the following data for a 60% activity, prepare a budget for production at 80% and 100% activity:

| Production at 60% activity—600 units | |

|---|---|

| Materials | Rs 100 per unit |

| Labour | Rs 40 per unit |

| Expenses | Rs 10 per unit |

| Factory expenses | Rs 40,000 (40% fixed) |

Administration expenses = Rs 30,000 (60% fixed)

[Ans: Rs 1,60,000 (60%); Rs 2,02,000 (80%); Rs 2,44,000 (100%)]

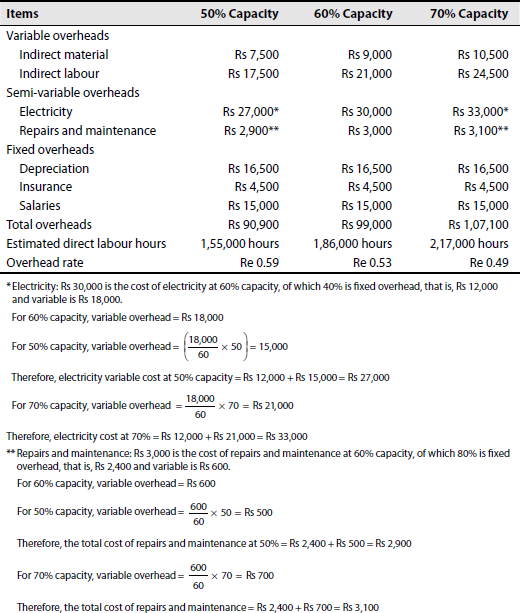

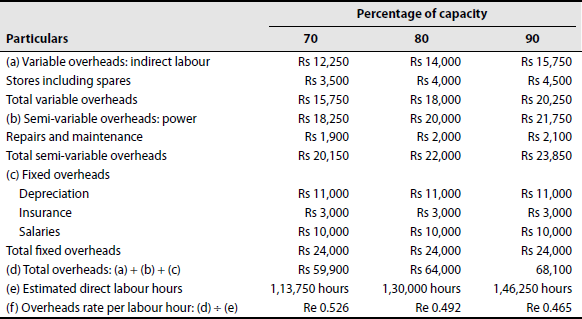

Illustration 4

Prepare a flexible budget for overheads on the basis of the following data. Ascertain the overhead rates at 50%, 60% and 70% capacity;

| At 60% capacity (Rs) | |

|---|---|

| Variable overheads | |

| Indirect material | 9,000 |

| Indirect labour | 21,000 |

| Semi-variable overheads | |

| Electricity (40% fixed, 60% variable) | 30,000 |

| Repairs (80% fixed, 20% variable) | 3,000 |

| Fixed overheads | |

| Depreciation | 16,500 |

| Insurance | 4,500 |

| Salaries | 15,000 |

| Total overheads | 99,000 |

| Estimated direct labour hours | 1,86,000 |

Solution: Flexible budget and overhead rates

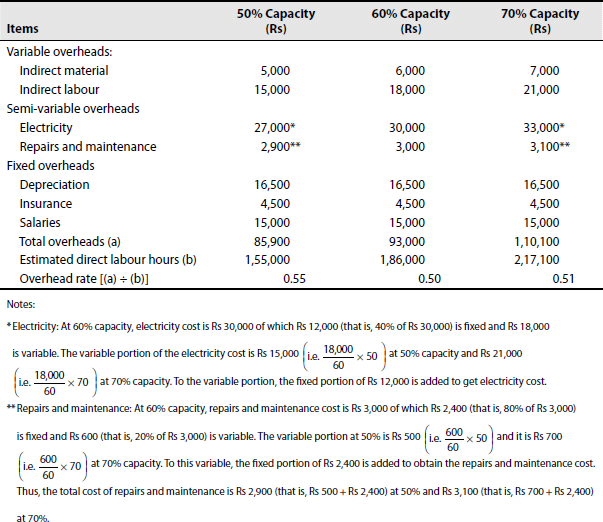

Prepare a flexible budget for overheads on the basis of the data given. Ascertain overhead rates at 50%, 60% and 70% capacity

| At 60% capacity (Rs) | |

|---|---|

| Fixed overheads | |

| Depreciation | 16,500 |

| Insurance | 4,500 |

| Salaries | 15,000 |

| Variable overheads | |

| Indirect material | 6,000 |

| Indirect labour | 18,000 |

| Semi-variable overheads | |

| Electricity (40% fixed, 60% variable) | 30,000 |

| Repairs and maintenance (80% fixed, 20% variable) | 3,000 |

| Total overheads | 93,000 |

Estimated direct labour hours = 1,86,000 hours

[Ans: Rs 85,900 (50%); Rs 1,00,100 (70%)]

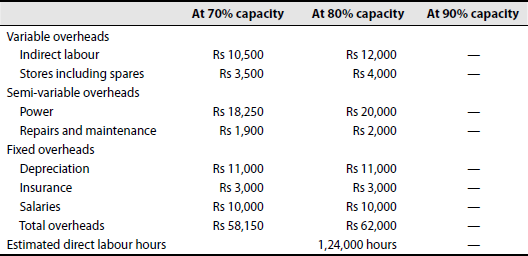

Illustration 5

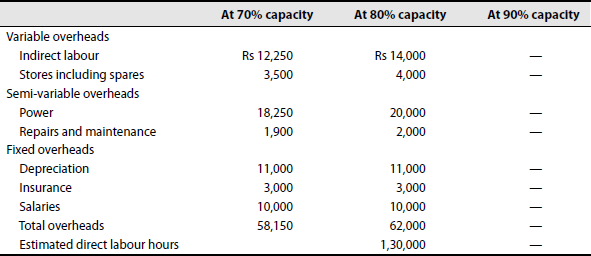

Draw up a flexible budget for overhead expenses on the basis of the following data and determine the overhead rates at 70%, 80% and 90% plant capacity:

Solution: Flexible budget

The expenses of producing 1,800 units in a factory having a capacity of producing 2,400 units are as follows:

| Rs | |

|---|---|

| Materials | 4 per unit |

| Labour | 3 per unit |

| Factory expenses | |

| Fixed | 720 |

| Variable | 900 |

| Variable selling expenses | 450 |

| Office and administration expenses | 1,800 (fixed) |

What is the cost of production per unit if actual output and normal capacity are taken into consideration?

[Ans: Rs 9.15 and Rs 8.80]

Illustration 6

Prepare a manufacturing overhead budget and ascertain the manufacturing overhead rates at 50% and 70% capacities. The following particulars are given for 60% capacity:

Solution: Manufacturing overhead budget and ascertainment of overhead rates

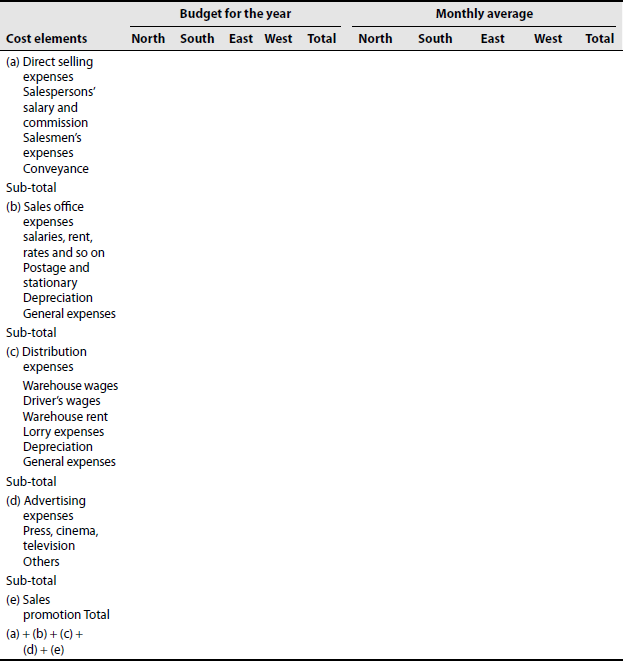

Selling and Distribution Cost Budget Biscuit division

The expenses budgeted for the production of 10,000 units in a factory is as follows:

| Rs (per unit) | |

|---|---|

| Materials | 70 |

| Labour | 25 |

| Variable overheads | 20 |

| Fixed overheads (1,00,000) | 10 |

| Variable overheads (direct) | 5 |

| Selling expenses (10% fixed) | 13 |

| Administration expenses (Rs 50,000) | 5 |

| Distribution expenses (20% fixed) | 7 |

| 155 |

Prepare a budget for the production of (a) 8,000 units and (b) 6,000 units. Assume that the administration expenses are rigid for all levels of production.

[Ans: (a) Rs 12,75,400; (b) Rs 10,00,800]

Illustration 7

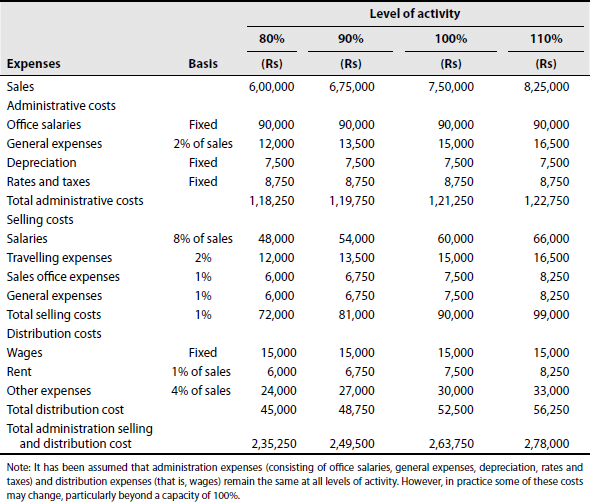

A department of company X attains sales of Rs 6,00,000 at 80% of its normal capacity and its expenses are as follows

| Administration costs | |

| Office salaries | Rs 90,000 |

| General expenses | 2% of sales |

| Depreciation | Rs 7,500 |

| Rates and Taxes | Rs 8,750 |

| Selling costs | |

| Salaries | 8% of sales |

| Travelling expenses | 2% of sales |

| Sales office | 1% of sales |

| General expenses | 1% of sales |

| Distribution costs | |

| Wages | Rs 15,000 |

| Rent | 1% of sales |

| Other expenses | 4% of sales |

Draw up flexible administration, and selling and distribution costs budget, operating at 90%, 100% and 110% of normal capacity.

Solution: Flexible budget of department

Draw up a flexible budget for overhead expenses on the basis of the following data and determine overhead rates at 70%, 80% and 90% capacity levels

| At 80% capacity | |

|---|---|

| Variable overheads | |

| Indirect labour | Rs 12,000 |

| Indirect material | Rs 4,000 |

| Semi-variable overheads | |

| Power (30% fixed and 70% variable) | Rs 20,000 |

| Repairs and maintenance (60% fixed and 40% variable) | Rs 2,000 |

| Fixed overheads | |

| Depreciation | Rs 11,000 |

| Insurance | Rs 3,000 |

| Others | Rs 10,000 |

| Total overheads | Rs 62,000 |

| Estimated direct labour hours | 1,24,000 hours |

[Ans: Overhead rate of recovery = Re 0.54 at 70%, Re 0.50 at 80% and Re 0.47 at 90%]

Illustration 8

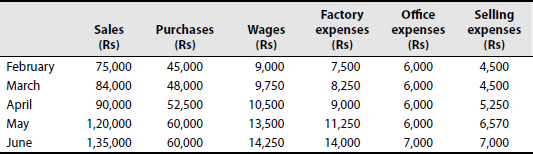

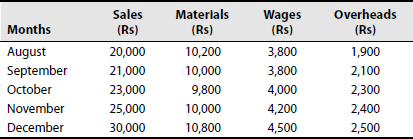

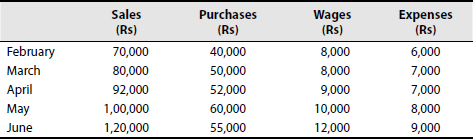

A company expects to have Rs 37,500 as cash in hand on 1 April and requires you to prepare an estimate of the cash position during the three months April, May and June. The following information is supplied:

Other information is as follows:

- The period of credit allowed by suppliers is 2 months.

- 20% of sales are for cash, and the period of credit allowed to customers for credit is 1 month.

- Delay in payment of all expenses = 1 month.

- Income tax of Rs 60,000 is due to be paid on 15 June.

- The company is to pay dividends to shareholders and bonuses to workers of Rs 20,000 and Rs 25,000, respectively, in the month of April.

- Plant has been ordered to be received and paid in May. It will cost Rs 1,50,000.

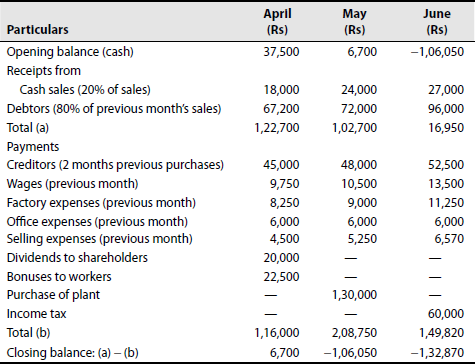

Solution: Cash budget

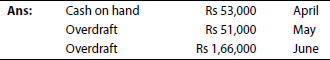

The company needs overdraft facilities in May and June to the extent of Rs –1,06,050 and Rs 1,32,870, respectively.

A company wishes to arrange overdraft facilities with its bankers during the period April to June when it will be manufacturing mostly for stock. Prepare a cash budget for this period from the following data, indicating the extent of bank facilities the company will require at the end of each month:

50% of credit sales are realized in the month following sales and the remaining 50% in the following month. Creditors are paid in the month following the month of purchase. Wages are paid on the first of every next month.

Cash at bank on 1 April = Rs 25,000

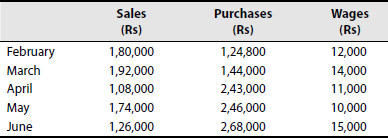

Illustration 9

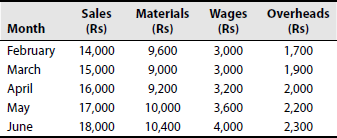

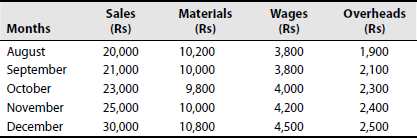

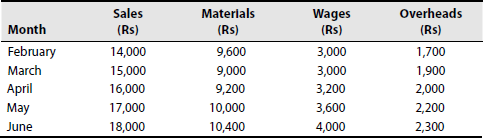

Prepare a cash budget for three months ending on 30 June from the following information:

-

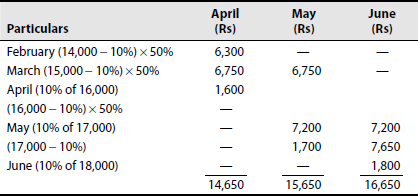

- Credit terms:

Sales/debtors: 10% sales are on cash, 50% of credit sales are collected in the next month and the balance in the following month.

- Creditors:

Materials, 2 months Wages, ¼ month Overheads, ½ month - Cash and bank balance on 1 April is expected to be Rs 6,000.

- Other relevant information:

- Plant and machinery will be installed in February at a cost of Rs 96,000. Monthly instalments of Rs 3,000 are payable from April onwards.

- Dividend at 5% on the preference share capital of Rs 2,20,000 will be paid on 1 June.

- Advance to be received for sales of vehicles is Rs 18,000 in June.

- Dividends from investments amounting to Rs 4,000 are expected to be received in June.

- Income tax (advance) to be paid in June is Rs 6,000.

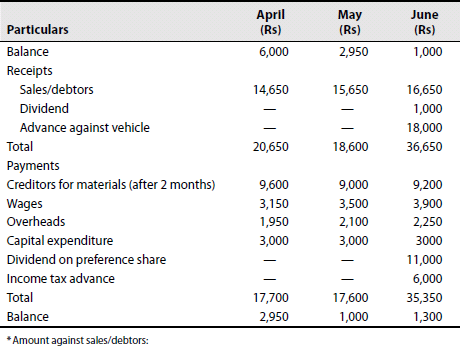

Solution: Cash budget

Wages = 75% of current month + 25% of previous month

Overheads = 50% of current month + 50% of previous month

ABC Company Ltd has given the following particulars. You are required to prepare a cash budget for the three months ending on 31 December 1997:

-

- Credit terms:

Sales/debtors: 10% sales are on cash basis, 50% of the credit sales are collected next month and the balance in the following month:

Creditors — Materials, 2 months — Wages, 1/5 month — Overheads, 1/2 month - Cash balance on 1 October 1997 is expected to be Rs 8,000.

- A machinery will be installed in August 1997 at a cost of Rs 1,00,000. Monthly instalments of Rs 5,000 are payable from October onwards.

- Dividend at 10% on the preference share capital of Rs 3,00,000 will be paid on 1 December 1997.

- Advance to be received for sale of vehicle is Rs 20,000 in December.

- Income tax (advance) to be paid in December is Rs 5,000.

[Ans: Closing balance in October = Rs 7,390; closing balance in November = Rs 8,180; bank overdraft for December = Rs 3,910]

Hint: Collection from debtors: October—Rs 18,450; November—Rs 19,800; and December—Rs 21,600.

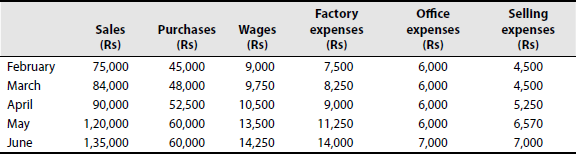

Illustration 10

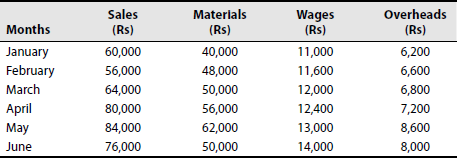

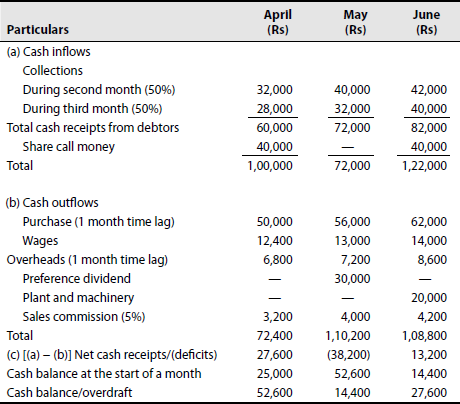

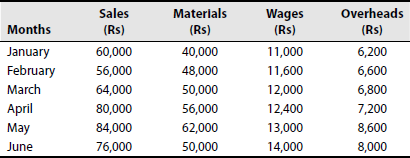

From the following budgeted figures, prepare a cash budget for three months till 30 June:

Expected cash balance on 1 April is Rs 25,000.

Other information:

- Materials and overheads are to be paid during the month following a month of supply.

- Wages are to be paid during the month in which they are incurred.

- Terms of sales: The terms of credit sales are payment by the end of the month following the month of sales; half of the sales are paid when due and the other half must be paid during the next month. Sales commission of 5% is to be paid within the month following actual sales.

- Preference dividend for Rs 30,000 must be paid on 1 May.

- Share call money for Rs 40,000 is due on 1 April and 1 June.

- Plant and machinery worth Rs 20,000 must be installed in January and the payment must be made in June.

Solution: Cash budget (April–June)

Illustration 11

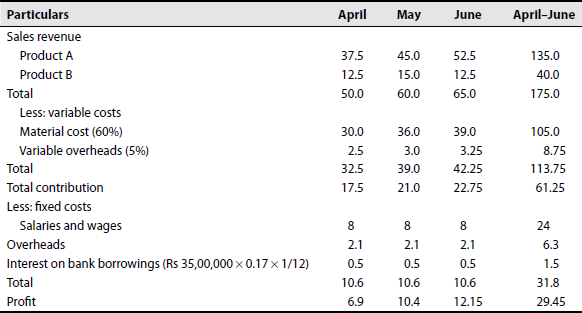

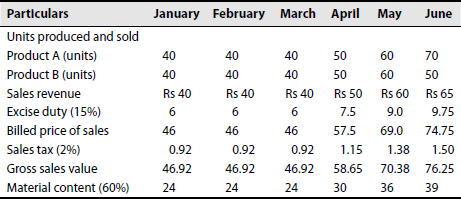

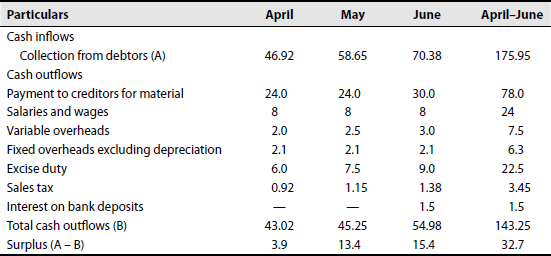

Prepare a profit and cash budget for the first quarter (April–June) for A.B. Industries Ltd from the following information for the coming year:

- The company produces two products and their unit sales prices and material contents are as follows

Sale price Material content Product A Rs 75,000 60% of sales price Product B Rs 25,000 60% of sales price - The production target is fixed as follows:

Product A Product B April 50 50 May 60 60 June 70 50 Production for January, February and March was at 80% of the level of production in April.

- The monthly expenses are as follows:

- Salaries and wages: payable in the following month

- Variable overheads: 5% of sales value payable in the following month

- Fixed overheads: Rs 2,10,000; payable as 50% in the current month and 50% in the following month

- Payment for material is made in the third month from the month of procurement.

- The company maintains a constant level of inventory. No stock of finished goods is kept and the entire production is invoiced the same month. The company gives 30 days’ credit to its customers.

- Company's products attract excise duty at 15%. Sales tax at 2% is payable to the authorities in the following month. These are to be borne by the buyer. The selling price of products is exclusive of these levies.

- The company enjoys a cash credit facility from its banker to the extent of Rs 35,00,000, which is fully drawn. The interest payable is at 17%, which is charged every quarter, that is, June, September, December and March. Presently, the company carries out its banking operations through a current account.

Solution:

Budgeted income statement of A.B. Industries Ltd for the first quarter (April–June; amount in lakhs of rupees):

Working notes and assumptions:

- Material cost ratio (material cost ÷ sales) is determined on the basis of the sales price of Rs 75,000 for product A and Rs 25,000 for product B.

- Sales tax is charged on sales price plus excise duty.

- Statement showing basic data (amount in lakhs of rupees)

- No repayment of bank loan is made.

- Cash budget of A.B. Industries Ltd for first quarter (April–June; amount in lakhs of rupees)

Comment: The firm's operations are expected to generate a cash surplus of Rs 34,50,000 during the quarter. This surplus should be used to pay off the bank loan.

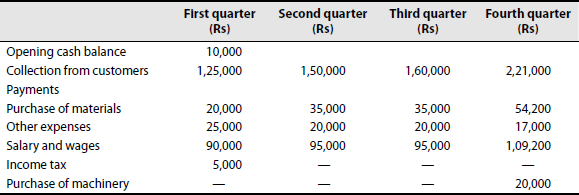

Illustration 12

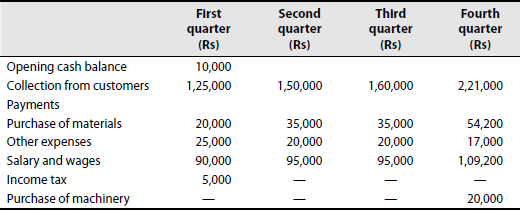

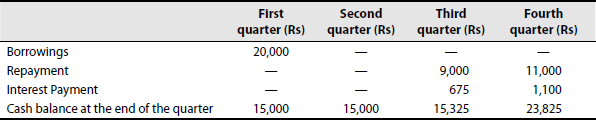

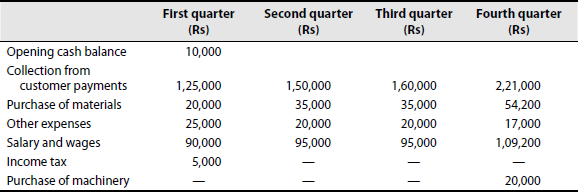

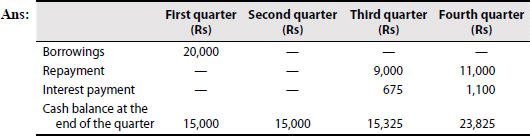

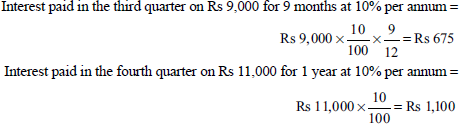

Based on the following information, prepare a cash budget for ABC Ltd:

The company desires to maintain a cash balance of Rs 15,000 at the end of each quarter. Cash can be borrowed or repaid in multiples of Rs 500 at an interest of 10% per annum. Management does not want to borrow more cash than what is necessary and wants to repay it as early as possible. In any event, loans cannot be extended beyond four quarters. Interest is computed and paid when the principal is repaid. Assume that borrowings take place at the beginning and repayments are made at the end of the quarters.

Solution:

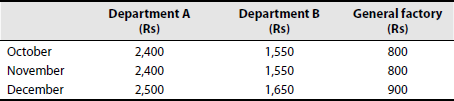

Illustration 13

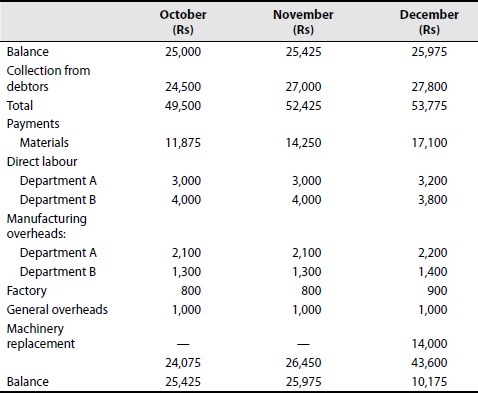

From the following data, prepare a cash budget for the quarter October–December. Draft a note from the management accountant and financial controller to accompany this statement

| Rs | ||

|---|---|---|

| Sales: from the months of August | August | 20,000 |

| September | 25,000 | |

| October | 30,000 | |

| November | 30,000 | |

| December | 32,000 |

- All the sales are on credit; half of the dues are collected in the month of sale, on which a cash discount of 20% is allowed, and the other half is realized in the next month.

- Materials are purchased for cash on which a rebate of 5% is offered by the supplier. If the company buys on credit, payment can be deferred by one month foregoing the rebate. The purchase budget for the next quarter is as follows: October—Rs 12,500; November—Rs 15,000; and December—Rs 18,000.

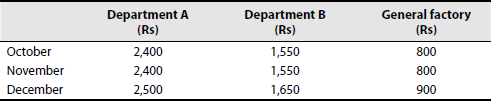

- The direct labour budget is as follows:

Department A (Rs) Department B (Rs) October 3,000 4,000 November 3,000 4,000 December 3,200 3,800 - The manufacturing overhead budget is as follows:

The aforementioned estimates include the quarter's provision for depreciation amounting to Rs 900 for department A and Rs 750 for department B.

- The general overheads for the quarter are Rs 3,500 (out of which Rs 200 is for depreciation reserve and Rs 300 for bad debts reserve).

- An old machine is to be replaced with an additional outlay of Rs 14,000 in the month of December.

- The cash balance on 1 October may be taken as Rs 25,000.

Solution: Cash budget for the period of receipts

Checked by:

Date:

Notes:

- It is better to pay for the materials every month as the discount percentage per annum is very advantageous, that is, 60%.

- It is advisable to reduce the cash float available so that some profitable investments can be made.

- The overheads (general) are to be paid from month to month, and all overheads are to be paid in the month of incurring.

Illustration 14

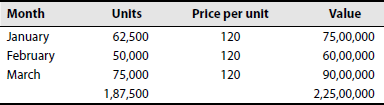

A manufacturing company submits the following figures for product X for the first quarter of 2001:

| Sales (in units) | January | 50,000 |

| February | 40,000 | |

| March | 60,000 | |

| Selling price per unit = Rs 100 | ||

| Targets for first quarter of 2002 | ||

| Sales quantity increase = 25% | ||

| Sales price increase = 20% |

Prepare a sales budget for the first quarter of 2002.

Solution: Sales budget for the first quarter of 2002

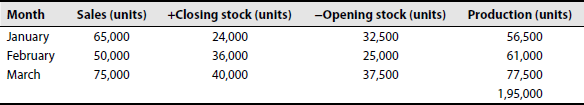

Illustration 15

A manufacturing company submits the following figures relating to product X for the first quarter of 1998

| Sales targets | January | 65,000 units |

| February | 50,000 units | |

| March | 75,000 units | |

| Stock position | 1 January 2001 (percentage of January 2001 sales) | –50% |

| Stock position | 31 March 2001 | –40,000 units |

| Stock position | End January, and February | –50% |

(Percentage of subsequent month's sales)

You are required to prepare the production budget for the first quarter of 2001.

Solution: Production budget for the first quarter of 1998

Illustration 16

Draw up a materials requirement budget (quantitative) from the following information:

Estimated sales of a product are 40,000 units. Each unit of the product requires 5 units of material A and 7 units of material B. Estimated opening balances at the commencement of the next year: finished product = 5,000 units; material A = 12,000 units; material B = 20,000 units; material on order—material A = 7,000 units and material B = −11,000 units. The desirable closing balances at the end of next year: finished product = 7,000 units; material A = 15,000 units; material B = 25,000 units; material on order: material A = 8,000 units and material B = 10,000 units.

Solution: Estimated production during the next year is not given in the question. It is calculated as follows: Estimated production = expected sales + desired closing stock of finished goods – estimated opening stock of finished goods – estimated opening stock of finished goods = 40,000 units + 7,000 units – 5,000 units = 42,000 units

Materials requirement budget (quantitative)

| Material A (units) | Material B (units) | |

|---|---|---|

| Material required to meet the production target | 2,10,000 | 2,94,000 |

| Material A at 5 units for 42,000 finished units | ||

| Material B at 2 units for 42,000 finished units | ||

| Desired closing balances of materials at the end of the budget period | 15,000 | 25,000 |

| Estimated units of materials to be on order at the end of the budget period | 10,000 | 12,000 |

| Total | 2,35,000 | 3,31,000 |

| Less: estimated opening balances of materials at the beginning of the period | (12,000) | (20,000) |

| 2,23,000 | 3,11,000 | |

| Less: estimated units of materials on order at the beginning of the budget period | 7,000 | 11,000 |

| Total | 2,16,000 | 3,00,000 |

Illustration 17

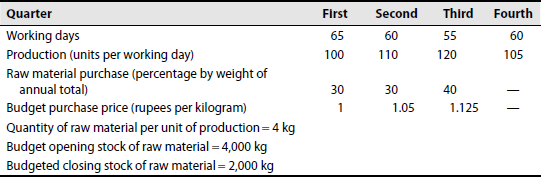

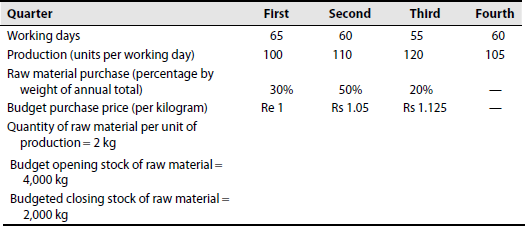

The following details apply to an annual budget for a manufacturing company:

Calculate the budgeted figures quarterly and the annual purchases of raw material by weight and value.

Solution: Raw materials purchase budget (by weight and value)

| Quarter I = 65 × 100 × 4 = 26,000 kg |

| II = 60 × 110 × 4 = 26,400 kg |

| III = 55 × 120 × 4 = 26,400 kg |

| IV = 60 × 105 × 4 = 25,200 kg |

| **Purchases |

| Quarter I = 30% of 1,02,000 = 30,600 kg |

| II = 30% of 1,02,000 = 30,600 kg |

| III = 40% of 1,02,000 = 40,800 kg |

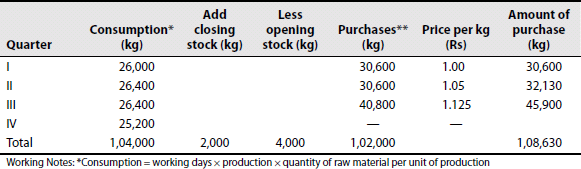

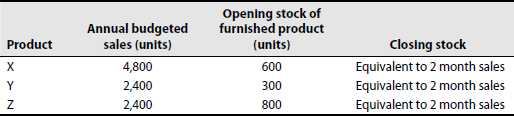

Illustration 18

Three articles X, Y and Z are produced in a factory. They pass through two cost centres A and B. From the data furnished here, compile a statement for budgeted machine utilization in both the centres:

- Sales budget for the year

- Machine hours per unit of products

Cost centres A B X 25 75 Y 100 100 Z 25 50 - Total number of machines

Cost centre A 284 B 256 Total 540 - Total working hours during the year: estimated 2,500 hours per machine

Solution:

Calculation of units of production of different products:

Production = sales + closing stock − opening stock

X = 7,200 + 1,200 − 600 = 7,800 units

Y = 3,600 + 600 − 300 = 3,900 units

Z = 3,600 + 600 − 300 = 3,900 units

Machine utilization budget

Illustration 19

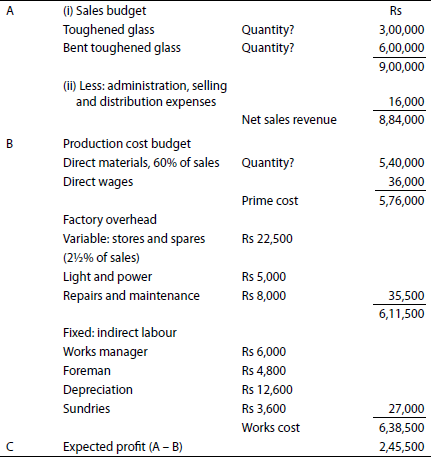

A glass manufacturing company requires you to calculate and present the budget for the next year from the following information

| Sales | |

|---|---|

| Toughened glass | Rs 3,00,000 |

| Bent toughened glass | Rs 6,00,000 |

| Direct material cost | 60% of sales |

| Direct wages | 20 workers at Rs 150 per month |

| Factory overheads | |

| Indirect labour works manager: Rs 500 per month | |

| Foreman | Rs 400 per month |

| Stores and spares | 2½% on sales |

| Depreciation on machinery | Rs 12,600 |

| Light and power | Rs 5,000 |

| Repairs and maintenance | Rs 8,000 |

| Other sundries | 10% on direct wages |

| Administration, selling and distribution expenses | Rs 16,000 per year |

Solution: Master budget

14.7 ZERO-BASE BUDGETING

The use of zero-base budgeting (ZBB) as a managerial tool has become increasingly popular since the early 1970s. It first came into existence when ex-President Jimmy Carter of the United States of America introduced it as a means of controlling state expenditure The underlying idea of ZBB is that there is no given base figure for a budget. A fresh budgeted figure is to be determined keeping in mind the circumstances and requirements.

The basic concept of ZBB is simple; budgeting starts from attach or zero. That is, every activity in an organization must be considered and its results evaluated. It is a method whereby all activities are re-evaluated each time a budget is formulated.

It implies that

- Every budget starts with a zero base.

- No previous figure is taken as a base figure for adjustments.

- Each activity is to be examined afresh.

- Every budget allocation is to be justified in the light of anticipated circumstances.

- Alternatives are to be given due consideration.

CHAPTER SUMMARY

From this chapter, one can understand the need to plan for the future and express the same in numbers so that projections are accurate. It also enables readers to understand the different types of budgets. It is not possible to have a fixed budget all the time, and at times business houses must rely on flexible budgets.

KEY FORMULAE

- Standard capacity usage ratio = budgeted number of working hours/maximum hours in a budget period × 100

- Actual usage of budget capacity or standard capacity ratio = actual number of working hours/budgeted number of working hours × 100

- Actual capacity usage ratio = actual working hours/maximum hours in a period × 100

- Level of activity ratio = actual production in standard hours/budgeted production in standard hours × 100

- Efficiency ratio = actual production in standard hours/actual hours worked × 100

- Calendar ratio = actual working days in a period/budgeted working days in a period × 100

- Flexible budget allowance = budgeted fixed overheads – budgeted fixed overhead (standard capacity usage ratio – level of activity ratio)

EXERCISE FOR YOUR PRACTICE

Objective-type questions

I. State whether the following statements are true or false

- A budget is nothing but an estimate.

- Budgets are drawn up by the chief accountant.

- Budgets are blueprints for action.

- A budget manual is a summary of all the functional budgets.

- Budgetary control system does not suit small businesses.

- Limiting factor is a major constraint on all the operational activities of an organization.

- The budget relating to the key factor should be prepared last.

- For control purposes, long-term budget should be prepared.

- Estimate of the sales given in the sales budget is mere guesswork.

- A fixed budget is useful only when the actual level of activity corresponds to the budgeted level of activity.

[Ans: 1—false, 2—false, 3—true, 4—false, 5—false, 6—true, 7—false, 8—false, 9—false, 10—true]

II. Choose the correct answer

- ZBB overcomes the weakness of

- Cost accounting

- Financial accounting

- Management accounting

- Conventional budgeting

Ans: (d)

- A written document that guides the executive in preparing budgets is termed as

- Budget manual

- Cost sheet

- Variance analysis

- Statement of profit

Ans: (a)

- Cash budget is prepared by

- Sales manager

- Finance manager

- Accountant

- Supervisor

Ans: (b)

- The chief executive prepares

- Production budget

- Sales budget

- Capital expenditure budget

- Material budget

Ans: (c)

- Purchase budget is dependent on

- Production budget

- Material requirement budget

- Both (a) and (b)

- Sales budget

Ans: (b)

- Shortcomings of the traditional budget is rectified by

- Sales budget

- Labour budget

- Performance budget

- Production budget

Ans: (c)

- An example of long-term budget is

- Capital expenditure budget

- Research and development budget

- Both (a) and (b)

- Cash budget

Ans: (b)

- Budgets prepared for a period of less than a year is known as

- Long-term budget

- Short-term budget

- Current budget

- Basic budget

Ans: (b)

- Budgets prepared mainly on past performance and actual cost is known as

- Conventional budget

- Long-term budget

- Short-term budget

- Sales budget

Ans: (a)

- Operational efficiency is promoted by

- Cash budget

- Sales budget

- Labour budget

- ZBB

Ans: (d)

DISCUSSION QUESTIONS

Short answer-type questions

- Define budget and describe two important budgets.

- Discuss the different types of budgets.

- Discuss the objectives and limitations of budgets.

- What are budget ratios?

- Explain briefly the procedure of preparing a sales budget.

- What is flexible budget? Explain its use.

- What are the advantages of flexible budget over fixed budget?

Essay-type questions

- Discuss the importance of ZBB in the light of present-day financial crisis.

- Explain the reasons for preparing a flexible budget.

- Is it possible to prepare a master budget keeping in mind fluctuations in the economy?

- Why is it necessary to prepare a cash budget for a firm? Discuss.

PROBLEMS

Control ratios

- In a manufacturing shop, product X requires 2.5 manhours and product Y requires 6 manhours for production. In a month of 25 working days with 8 hours a day, 2,000 units of X and 1,000 units of Y were produced. The company employs 50 workers in the shop and the budgeted manhours are 1,08,000 for the year. You are required to find the capacity ratio, activity ratio and efficiency ratio.

[Ans: capacity ratio = 111.11%; activity ratio = 122.22%; efficiency ratio = 110%)

- Two articles A and B are produced in a factory. Their specifications show that 4 As or 2 Bs can be produced in 1 hour. The budgeted production for January 1998 is 800 As and 200 Bs. The actual production at the end of the month was 900 As and 180 Bs. Actual labour hours spent were 350 hours Find the capacity, activity and efficiency ratios for January 1998.

[Ans: capacity ratio = 116.67%; activity ratio = 105%; and efficiency ratio = 90%]

Cash budgets

- Based on the following information, prepare a cash budget for ABC Ltd.

The company desires to maintain a cash balance of Rs 15,000 at the end of each quarter. Cash can be borrowed or repaid in multiples of Rs 500 at an interest of 10% per annum. Management does not want to borrow more cash than what is necessary and wants to repay borrowed cash as early as possible. In any event, loans cannot be extended beyond four quarters. Interest is computed and paid when the principal is repaid. Assume that borrowings take place at the beginning and repayments are made at the end of the quarters.

Hint: Interest is calculated only when the principal is repaid. Therefore, interest is calculated at the end of the third and fourth quarters when the principal is repaid.

- A company is expecting Rs 25,000 as cash in hand on 1 April 1994, and it requires you to prepare an estimate of its cash position during the three months from April to June 1994. The following information is supplied:

Other information: Period of credit allowed by suppliers is 2 months; 25% of sales is for cash and the period of credit allowed to customers for credit sale is 1 month; delay in payment of wages and expenses allowed is 1 month; and income tax of Rs 25,000 is to be paid in June 1994.

[Ans: balance of cash in hand: April—Rs 53,000; May—Rs 81,000; June—Rs 91,000]

- ABC Company Ltd gives the following particulars. You are required to prepare a cash budget for the three months ending on 31 December 1997.

-

- Credit terms are as follows:

Sales/debtors: 10% sales are on cash basis, 50% of the credit sales are collected next month and the balance is collected in the following month:

Creditors — Materials, 2 months — Wages, 1/5 month — Overheads, 1/2 month - Cash balance on 1 October 1997 is expected to be Rs 8,000.

- A machinery will be installed in August 1997 at a cost of Rs 1,00,000. The monthly instalment of Rs 5,000 is payable from October onwards.

- Dividend at 10% on the preference share capital of Rs 3,00,000 will be paid on 1 December 1997.

- Advance to be received for sale of vehicle is Rs 20,000 in December.

- Income tax (advance) to be paid in December is Rs 5,000.

[Ans: Closing balance for October = Rs 7,390; Closing balance for November = Rs 8,180; Bank overdraft for December = Rs 3,910]

Hint: Collection from debtors: October—Rs 18,450; November—Rs 19,800; December—Rs 21,600.

-

EXAMINATION PROBLEMS

1. A factory manufactures two types of products, X and Y. Product X takes 5 hours to make and Y requires 10 hours In a month of 25 effective days with 8 hours a day, 1,000 units of X and 600 units of Y were produced. The company employs 50 workers in the production department. The budgeted hours are 1,02,000 for the year. Calculate capacity ratio, activity ratio and efficiency ratio.

1a. Two articles X and Y are manufactured in a department. Their specifications show that 2 Xs or 8 Ys can be produced in 1 hour. The budgeted production for June 1998 is 200 Xs and 400 Ys. The actual production at the end of the month was 250 Xs and 480 Ys, and the actual hours spent on production were 160. Find the capacity, activity and efficiency ratios for June 1998. Also, find the calendar ratio if the actual working days during the month be 27 corresponding to 25 days in the budget.

2. Narayan Ltd produces two commodities, Good and Better, in one of its departments. Each unit takes 5 hours and 10 hours as production times for Good and Better, respectively. 1,000 units of Good and 600 units of Better were produced during March. Actual manhours spent in this production were 10,000. Yearly budgeted hours are 96,000. Compute the various control ratios.

3. The budgeted output of a factory specializing in the production of a single product at an optimum capacity of 6,400 units per annum amounts to Rs 1,76,048 as detailed here:

| Rs | Rs | |

|---|---|---|

| Fixed costs | — | 20,668 |

| Power | 1,440 | |

| Repairs and so on | 1,700 | |

| Miscellaneous and so on | 540 | |

| Direct materials | 49,280 | |

| Direct labour | 1,02,400 | 1,55,360 |

| Total | 1,76,048 |

Due to possible impact on sales turnover by market trends, the company decides to have a flexible budget with a production of 3,200 and 4,800 units (the actual quantity proposed to be produced being left to a later date before the commencement of budget period). Prepare a flexible budget for production levels at 50% and 75%. Assuming the sales per unit is maintained at Rs 40 at present, indicate the effect on net profit. Administration, selling and distribution expenses continue at Rs 3,600.

4. Prepare a flexible budget for overheads on the basis of the following data. Ascertain the overhead rates at 50%, 60% and 70% capacity.

| At 60% capacity (Rs) | |

|---|---|

| Variable overheads | |

| Indirect material | 6,000 |

| Indirect labour | 18,000 |

| Semi-variable overheads | |

| Electricity (40% fixed, 60% variable) | 30,000 |

| Repairs (80% fixed, 20% variable) | 3,000 |

| Fixed overheads | |

| Depreciation | 16,500 |

| Insurance | 4,500 |

| Salaries | 15,000 |

| Total overheads | 93,000 |

| Estimated direct labour hours | 1,86,000 |

5. Draw up a flexible budget for overhead expenses on the basis of the following data and determine the overheads rates at 70%, 80% and 90% plant capacity:

6. Prepare a manufacturing overhead budget and ascertain the manufacturing overhead rates at 50% and 70% capacities. The following particulars are given at 60% capacity:

| Variable overheads | |

| Indirect material | Rs 6,000 |

| Indirect labour | Rs 18,000 |

| Semi-variable overheads | |

| Electricity (40% fixed) | Rs 30,000 |

| Repairs and maintenance (20% variable) | Rs 3,000 |

| Fixed overheads | |

| Depreciation | Rs 16,500 |

| Insurance | Rs 4,500 |

| Salaries | Rs 15,000 |

| Total overheads | Rs 93,000 |

| Estimated direct labour hours | 1,86,000 hours |

7. A department of Company X attains sales of Rs 6,00,000 at 80% of its normal capacity; its expenses are as follows:

| Administration costs | |

| Office salaries | Rs 90,000 |

| General expenses | 2% of sales |

| Depreciation | Rs 7,500 |

| Rates and taxes | Rs 8,750 |

| Selling costs | |

| Salaries | 8% of sales |

| Travelling expenses | 2% of sales |

| Sales office | 1% of sales |

| General expenses | 1% of sales |

| Distribution costs | |

| Wages | Rs 15,000 |

| Rent | 1% of sales |

| Other expenses | 4% of sales |

Draw up flexible administration, selling and distribution costs budget, operating at 90%, 100% and 110% of normal capacity.

8. A company expects to have Rs 37,500 as cash in hand on 1 April and requires you to prepare an estimate of its cash position during the three months April, May and June. The following information is supplied:

Other information:

- Period of credit allowed by suppliers is 2 months.

- 20% of sales are for cash, and period of credit allowed to customers for credit is 1 month.

- Delay allowed in payment of all expenses is 1 month.

- Income tax of Rs 57,500 is due to be paid on 15 June.

- The company is to pay dividends to shareholders and bonuses to workers of Rs 15,000 and Rs 22,500, respectively, in April.

- A new plant has been ordered, which will be received and paid in May. It will cost Rs 1,20,000.

Prepare a cash budget for the three months ending on 30 June from the following information:

-

- Credit terms:

Sales/debtors: 10% sales are on cash, 50% of the credit sales are collected next month and the balance in the following month.

-

Creditors Materials, 2 months Wages, ¼ month Overheads, ½ month - Cash and bank balance on 1 April is expected to be Rs 6,000.

- Other relevant information:

- Plant and machinery will be installed in February at a cost of Rs 96,000. The monthly instalments of Rs 2,000 are payable from April onwards.

- Dividend at 5% on the preference share capital of Rs 2,00,000 will be paid on 1 June.

- Advance to be received for sales of vehicles is Rs 9,000 in June.

- Dividends from investments amounting to Rs 1,000 are expected to be received in June.

- Income tax (advance) to be paid in June is Rs 2,000.

10. From the following budgeted figures, prepare a cash budget for the three months till 30 June:

Expected cash balance on 1 April is Rs 20,000.

Other information:

- Materials and overheads are to be paid during the month following the month of supply.

- Wages are to be paid during the month in which they are incurred.

- Terms of sales: The terms of credit sales are payment by the end of the month following the month of sales; half of the sales are paid when due, and the other half is paid during the next month. 5% sales commission is to be paid within the month following actual sales.

- Preference dividend for Rs 30,000 is to be paid on 1 May.

- Share call money for Rs 25,000 is due on 1 April and 1 June.

- Plant and machinery worth Rs 10,000 must be installed in the month of January and the payment is to be made in the month of June.

11. Prepare a profit and cash budget for the first quarter, April–June, for A.B. Industries Ltd from the following information for the coming year:

- The company produces two products, and their unit sales prices and material contents are as follows:

Sales price Material content Product A Rs 75,000 60% of sales price Product B Rs 25,000 60% of sales price - The production target has been fixed as follows:

Product A (units) Product B (units) April 50 50 May 60 60 June 70 50 Production for January, February and March was at 80% of the level of April's production.

- The monthly expenses are as follows:

- Salaries and wages comprise Rs 7,50,000, which is payable in the following month.

- Variable overheads comprise 5% of sales value, which is payable in the following month.

- Fixed overheads comprise Rs 2,00,000, of which 50% is payable in the current month and 50% is payable in the following month.

- Payment for material is made in the third month from the month of procurement.

- The company maintains a constant level of inventory. No stock of finished goods is kept and the entire production is invoiced the same month. The company gives 30 days’ credit to its customers

- Company's products attract excise duty at 15%. Sales tax at 2% is payable to the authorities in the following month. These are to be borne by the buyer. The selling price of products is exclusive of these levies.

- The company enjoys a cash credit facility from its banker to the extent of Rs 35,00,000, which is fully drawn. The interest payable is at 17%, which is charged every quarter, that is, June, September, December and March. Presently, the company carries its banking operations through a current account.

12. Based on the following information, prepare a cash budget for ABC Ltd:

The company desires to maintain a cash balance of Rs 15,000 at the end of each quarter. Cash can be borrowed or repaid in multiples of Rs 500 at an interest of 10% per annum. Management does not want to borrow more cash than what is necessary and wants to repay the amount as early as possible. In any event, loans cannot be extended beyond four quarters. Interest is computed and paid when the principal is repaid. Assume that borrowings take place at the beginning and repayments are made at the end of the quarters.

13. From the following data, prepare a cash budget for the quarter October–December. Draft a note from the management accountant and financial controller to accompany this statement.

| Rs | ||

|---|---|---|

| (a) Sales: from the months of August | August | 20,000 |

| September | 25,000 | |

| October | 30,000 | |

| November | 30,000 | |

| December | 32,000 |

- All the sales are on credit; half the dues are collected in the month of sale, on which a cash discount of 20% is allowed, and the other half is realized in the next month.

- Materials are purchased for cash on which a rebate of 5% is offered by the supplier. If the company buys on credit, payment can be deferred by 1 month foregoing the rebate. The purchase budget for the next quarter is as follows: October—Rs 12,500; November—Rs 15,000; December—Rs 18,000.

- The direct labour budget is as follows:

Department A (Rs) Department B (Rs) October 3,000 4,000 November 3,000 4,000 December 3,000 3,800 - The manufacturing overhead budget is as follows:

The aforementioned estimates include the quarter's provision for depreciation amounting to Rs 900 for department A and Rs 750 for department B.

- The general overheads for the quarter is Rs 3,500 (out of which Rs 200 is for depreciation reserve and Rs 300 is for bad debts reserve).

- An old machine is to be replaced with an additional outlay of Rs 7,000 in the month of December.

- The cash balance on 1 October may be taken as Rs 15,000.

14. A manufacturing company submits the following figures for product X for the first quarter of 2001:

| Sales (in units) | January | 50,000 |

| February | 40,000 | |

| March | 60,000 |

Selling price per unit = Rs 100

Targets of first quarter 2002:

Sales quantity increase by 20%

Sales price increase by 10%

Prepare sales budget for the first quarter of 2002.

15. A manufacturing company submits the following figures for product X for the first quarter of 1998:

| Sales targets | January | 60,000 units |

| February | 48,000 units | |

| March | 72,000 units | |

| Stock position | 1 January 2001 (percentage of January 2001 sales) | –50% |

| Stock position | 31 March 2001 | –40,000 units |

| Stock position | End January, and February | –50% |

(Percentage of subsequent month's sales)

You are required to prepare production budget for the first quarter of 2001.

16. Draw up a material requirement budget (quantitative) from the following information:

Estimated sales of a product are 40,000 units. Each unit of the product requires 3 units of material A and 5 units of material B.

Estimated opening balances at the commencement of the next year: finished product = 5,000 units; material A = 12,000 units; material B = 20,000 units; material on order: material A = 7,000 units and material B = −11,000 units.

Desirable closing balances at the end of next year: finished product = 7,000 units; material A = 15,000 units; material B = 25,000 units; material on order: material A = 8,000 units and material B = 10,000 units.

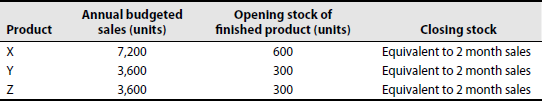

17. The following details apply to an annual budget for a manufacturing company:

Calculate the budgeted figures for quarterly and annual purchases of raw material by weight and value.

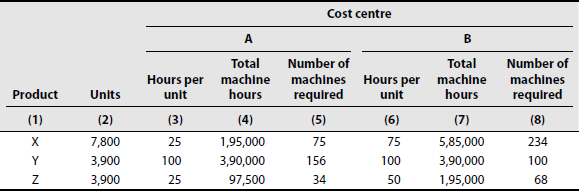

18. Three articles X, Y and Z are produced in a factory. They pass through two cost centres A and B. From the data furnished, compile a statement for budgeted machine utilization in both the centres:

- Sales budget for the year

- Machine hours per unit of products

Cost centres A B X 30 70 Y 200 100 Z 30 20 - Total number of machines

Cost centre A 284 B 256 Total 540 - Total working hours during the year is estimated as 2,500 hours per machine.

19. A glass manufacturing company requires you to calculate and present the budget for the next year from the following information:

| Sales | |

| Toughened glass | Rs 3,00,000 |

| Bent toughened glass | Rs 5,00,000 |

| Direct material cost | 60% of sales |

| Direct wages | 20 workers at Rs 150 per month |

| Factory overheads | |

| Indirect labour works manager: Rs 500 per month | |

| Foreman | Rs 400 per month |

| Stores and spares | 2½% on sales |

| Depreciation on machinery | Rs 12,600 |

| Light and power | Rs 5,000 |

| Repairs and maintenance | Rs 8,000 |

| Other sundries | 10% on direct wages |

| Administration, selling and distribution expenses | Rs 14,000 per year |