2

Basic Concepts of Cost

CHAPTER OUTLINE

LEARNING OBJECTIVES

After reading this chapter, you will be able to understand:

Cost concepts

Classification of costs

Types of costing

Methods of costing

Elements of cost

2.1 INTRODUCTION

Cost accounting is concerned with cost and is therefore necessary to understand the meaning of the term ‘cost’ in a proper perspective. In general, cost means the amount of expenditure (actual or notional) incurred on, or attributable to, a given thing or activity. However, the term cost cannot be defined exactly. Its interpretation depends upon factors like nature of business or industry and the context in which it is used.

2.2 COST CONCEPTS AND TERMS

The term cost means the amount of expenses incurred on or attributable to a specified thing or activity. According to the Institute of Cost and Work Accounts (ICWA) India, cost is the ‘measurement in monetary terms of the amount of resources used for the purpose of production of goods or rendering services’.

With reference to production/manufacture of goods and services cost refers to the sum total of the value of resources used like raw material, labour and expenses incurred in producing or manufacturing a given quantity.

Note: The word cost cannot be understood independently and has to be understood in relation to a particular product, thing or service.

Initially, business houses considered factory cost, office cost and cost of sales for determining the cost of a product. Now, business has grown to an extent where selling and distribution expenses cannot be ignored while calculating the cost of a product. Thus, costs include ‘prime cost’, factory cost, cost of production, cost of goods sold and cost of sales.

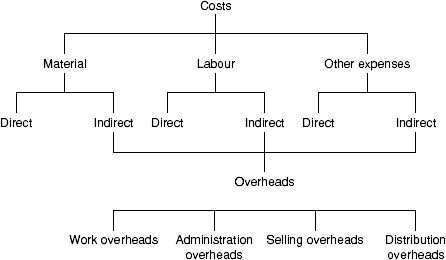

2.3 ELEMENTS OF COST

The total costs are classified into three elements: They are material, labour and other expenses. These elements are further analysed into different elements as shown in the following diagram:

2.3.1 Direct material

Direct materials are those that can be directly identified in a product. These materials become a major part of the product. These materials can be directly seen. Limestone in chalk pieces, wood in furniture and bricks in houses are examples. The following are considered as direct materials: (i) all raw materials, (ii) specially purchased material for a special job and (iii) primary packing materials.

In other words, direct materials are materials that can be easily identified and related with specific products, jobs and processes. Timber as a raw material for making furniture, cloth for making garments, sugarcane for making sugar, gold/silver for making jewellery, etc., are some examples of direct materials.

A material that the forms part and parcel of a finished product and that can be assigned to a particular unit is known as a direct material. Direct material is also known as ‘process material’, prime cost material, ‘production material’, ‘stores material’, ‘constructional material’, etc.

2.3.2 Direct labour

It is labour expended/spent in converting raw materials into finished goods. Wages given to workers who are engaged in converting raw material into finished goods comes under direct labour. Direct labour is also known as direct wages, ‘productive labour’, ‘process labour’ or prime cost labour. The following are considered as direct labour:

- Labour engaged in the actual production of a product

- Labour engaged in assisting the manufacture by way of supervision, maintenance, tool setting, etc.

- Inspectors and analysts specially needed for production

In other words, direct labour is labour that is directly involved in the production of a commodity. It can be easily identified and related with a specific product, job, process and activity. Direct labour cost is easily traceable to specific products. Direct labour varies in direct proportion with the volume of output. It is also known as process labour, productive labour, ‘operating labour’, direct wages, ‘manufacturing wages’, etc. Examples for direct wages are as follows: cost of wages paid to a sculptor for making a statue, cost of wages paid to a carpenter for making furniture, cost of a tailor producing readymade garments, and cost of a washer in dry cleaning.

The labour that actively and directly takes part in producing a particular commodity is called direct labour.

2.3.3 Direct expenses

Expenses that can be directly identified and allocated to cost centres or cost units are called direct expenses. They include expenses other than direct material and direct labour, which are incurred in manufacturing a product.

Direct expenses are also known as ‘chargeable expenses’, prime cost expenses, ‘productive expenses’ or ‘process expenses’. The following are considered direct expenses:

- Cost of special drawings, design or layout

- Hire charge, repairs and maintenance of special equipments hired

- Experiment expenses of a job

- Excise duty

- Royalty

- Architect fees

- Cost of rectifying defective work

These are the expenses that can be directly, conveniently and wholly allocated to specific cost centres or cost units. Examples of such expenses are as follows: hiring some special machinery required for a particular contract, cost of defective work incurred in connection with a particular job or contract, etc.

Hiring of special machinery; cost of special designs or patterns; the fee paid to architects, surveyors and other consultants; inward carriage and freight charges on special material; and the cost of patents and royalties are some examples of direct expenses.

- Cost centre means a location, person, item of equipment, or groups of these for which costs may be ascertained and used for the purpose of cost control.

- Cost object is anything for which a separate measurement of cost is desired. It may be a product, service, project or customer.

2.3.4 Indirect material

Materials that cannot be identified as part of a product are called indirect materials. The following are considered indirect materials: (i) cotton waste, (ii) brooms, (iii) lubricants, (iv) cleaning materials and (v) materials for repairs and maintenance.

An indirect material is a material that cannot be easily and conveniently identified and related with a particular product, job, process and activity. Consumables stores, oil and waste, and printing and stationery are some examples of indirect materials. Indirect materials are used in the factory, office, or the selling and distribution departments.

The material that is used for purposes ancillary to business and that cannot be conveniently assigned to specific physical units is termed indirect material.

2.3.5 Indirect labour

Wages that cannot be directly identified with a product are called indirect labour. The following are considered indirect labour: wages paid to those workers who assist in production, namely, who are indirectly involved in production, including (i) salary for supervisors, (ii) salary for storekeepers and (iii) salary for clerical staff.

Labour employed for the purpose of carrying out tasks that are indirectly related to goods produced or services provided is indirect labour. Such labour does not alter the construction, composition or condition of a product, although they form part of the product. It cannot be practically traced to specific units of output.

Wages of storekeepers, foremen and timekeepers; directors’ fees; salaries of salesmen and works manager; etc., are examples of indirect labour costs. Indirect labour is used in the factory, office or the selling and distribution divisions.

Indirect labour is labour that cannot be easily identified and related with a specific product, job, process or activity. It includes all labour not directly engaged in converting raw materials into finished products. It may or may not vary directly with the volume of output.

Labour employed for the purpose of carrying out tasks incidental to goods or services provided is indirect labour.

2.3.6 Indirect expenses

Expenses that are not directly identified with a product are called indirect expenses. The following are considered indirect expenses: (i) factory rent; (ii) factory insurance; (iii) factory depreciation; and (iv) plant repair, maintenance and insurance. All indirect materials, indirect labour and indirect expenses are called overheads. Overheads in general refer to all expenses incurred in connection with the general organization of the firm. Overheads are broadly classified into (i) factory overheads, (ii) administration overheads and (iii) selling and distribution overheads.

These are the expenses that cannot be directly, easily and wholly allocated to specific cost centres or cost units. All indirect costs other than indirect material and indirect labour are termed indirect expenses. Thus, indirect expenses = indirect cost − indirect material − indirect labour.

Indirect expenses are treated as a part of overheads. Rents, rates and taxes of building, repair, insurance and depreciation on fixed assets, etc., are some examples of indirect expenses.

Write the name of the element against each statement:

- A substance from which a product is made.

- A material that can be identified and related with a specific product.

- Labour that takes an active and direct part in the production of a commodity.

- Expenses that are directly and wholly allocated to specific cost centres.

2.4 OVERHEADS

The term overhead includes indirect material, indirect labour and indirect expenses. Thus, all indirect costs are overheads. A manufacturing organization can be divided broadly into the following three divisions:

Factory or works, where production is done

Office and administration, where routine as well as policy matters are decided

Selling and distribution, where products are sold and finally dispatched to customers

Overheads may be incurred in a factory, an office or the selling and distribution divisions. Thus, overheads may be of three types.

The term overhead has a wider meaning than the term indirect expenses. Overheads include the cost of indirect material, indirect labour and indirect expenses. This is the aggregate sum of indirect material, indirect labour and indirect expenses.

Overheads are classified into the following three categories:

- Factory/works/production overheads

- Office and administration overheads

- Selling and distribution overheads

2.4.1 Factory/works overheads

Expenses incurred in the production of goods in the factory are known as factory overheads. Such costs are concerned with the running of the factory or plant. Factory overheads include indirect material, indirect labour and indirect expenses incurred in the factory. Some examples are as follows:

- Indirect materials

- Grease, oil, lubricants, cotton waste, etc.

- Small tools, brushes for sweeping, sundry supplies, etc.

- Cost of threads, gum, nails, etc.

- Consumables stores

- Factory printing and stationery

- Indirect wages

- Salaries of factory manager, foremen, supervisors, clerks, etc.

- Salary of storekeeper

- Salaries and fees of factory directors and technical directors

- Contribution to Employees State Insurance, provident fund, leave pay, etc., of factory employees

- Indirect expenses

- Rent of factory buildings and land

- Insurance of factory building, plant and machinery

- Municipal taxes of factory building

- Depreciation of factory building, plant and machinery, and their repairs and maintenance charges

- Power and fuel used in factories

- Factory telephone expenses

In short, indirect material used in a factory such as lubricants, oil, consumable stores, etc.; indirect labour such as that by gatekeeper, timekeeper, works managers, etc.; and indirect expenses such as factory rent, factory insurance, factory lighting, etc., are called overheads.

2.4.2 Office and administrative overheads

These expenses are related to the management and administration of businesses. They are incurred in the direction and control of an undertaking. These represent the aggregate of the cost of indirect material, indirect labour and indirect expenses incurred by the office and the administration department of an organization. Some examples are as follows:

- Office printing and stationery

- Cost of brushes and dusters

- Postage and stamps

- Salary of office manager

- Clerks, salary of administrative directors

- Salaries of legal advisers, those of cost accountants and financial accountants

- Salary of the computer operator

- Rent

- Insurance, rates and taxes of office building.

- Lighting, heating and cleaning

- Depreciation and repairs of office building.

- Furniture, equipment, etc.

- Legal charges

- Trade subscriptions.

- Telephone charges, audit fee, etc.

2.4.3 Selling and distribution overheads

Selling and distribution overheads are incurred in the marketing of a commodity, securing orders for goods, dispatching goods sold or making efforts to find and retain customers. These expenses represent the aggregate of indirect material, indirect labour and indirect expenses incurred by the selling and distribution department of the organization.

These overheads have two aspects: (i) procuring orders and (ii) executing the orders. Based upon this concept, selling and distribution overheads are studied separately.

2.4.3.1 Selling overheads

Indirect costs incurred in relation to the procurement of sales orders are termed selling overheads. Some examples of selling overheads are as follows:

- Indirect material

- Catalogues, price list

- Printing and stationery

- Postage and stamps

- Cost of sample goods

- Indirect wages

- Salaries of sales managers, clerks and other employees

- Salaries and commissions of salesmen and technical representatives

- Fees of sales directors

- Indirect expenses

- Advertising

- Bad debts

- Rent and insurance of showroom

- Legal charges incurred for recovery of debts

- Travelling and entertainment expenses

- Expenses of sending samples

- Market research expenses

2.4.3.2 Distribution overheads

Indirect costs incurred in the execution of sales order is termed distribution overheads. Some examples of distribution overheads are as follows:

- Indirect material

- Cost of packing material.

- Oil, grease, spare parts, etc., for maintaining delivery vans.

- Indirect wages

- Salaries of godown employees.

- Wages of drivers of delivery vans.

- Wages of packers and dispatch staff.

- Indirect expenses

- Packing expenses

- Godown rent, insurance, depreciation, repair, etc.

- Outward freight carriage and other transport charges.

- Running expenses of delivery vans, expenses incurred for their repair and depreciation.

- Insurance in transit, etc.

Elements of cost

- Direct material

- Direct labour

- Direct expenses

- Overheads

- Factory overheads

- Selling and distribution overheads

- Office and administration overheads

- Indirect material

- Indirect labour

- Indirect expenses

- Indirect material

- Indirect labour

- Indirect expenses

2.5 CLASSIFICATION OF COSTS

Classification of costs means the grouping of costs according to their common characteristics. The important methods of classification of costs are as follows:

- By nature or element

- By functions

- As direct and indirect

- By variability, behaviour-wise classification

- By controllability

- By normality

- By nature or element: Under this classification, costs are divided into three categories, that is, material cost, labour cost and expenses. This type of classification is useful in determining the total cost.

- By functions: Under this classification, costs are divided according to the function for which they have been incurred. Some of the examples are

Production cost: The cost of sequence of operations, which begins swith supplying materials, labour and services and ends with the primary packing of a product.

Selling cost: The cost of seeking to create and stimulate demand (sometimes termed marketing) and of securing orders.

Distribution cost: It is the cost that is incurred in sending goods from the place of manufacture to their ultimate users. It also includes expenditure incurred in transporting articles to central or local storage. Distribution costs include the expenditure incurred in moving articles to and from prospective customers as in case of goods on sale or return basis. In the gas, electricity and water industry, distribution means pipes, mains and services, which may be regarded as the equivalent of packing and transportation.

Administrative cost: It is the cost incurred in running an office where the formulation of policy, direction of the firm and controlling of operations are carried out.

Research cost: The cost of researching for new or improved products, new applications of materials or improved methods.

Development cost: The cost of the process that begins with the implementation of the decision to produce a new or improved product or to employ a new or improved method and ends with commencement of formal production of that product or by that method.

Pre-production cost: The part of development cost incurred in making a trial production run preliminary to formal product.

Conversion cost: The sum of direct wages, direct expenses and the overhead cost of converting raw materials to the finished stage or converting a material from one stage of production to the next. (Note: In some circumstances, this phrase is used to include any excess material cost or loss of material incurred at a particular stage of production.)

- As direct and indirect: Under this classification, costs are divided as direct costs and indirect costs. Direct costs are costs that can be identified with either a cost centre or a cost unit. Costs that are not direct are termed indirect costs. In other words, costs that cannot be identified with either a cost centre or a cost unit are known as indirect costs.

- By variability: According to this classification, costs are classified into three groups, viz, fixed, variable and semi-variable (behaviour-wise classification) costs.

- Fixed costs: These are the costs that remain constant at all levels of production. They do not increase with changes in the volume of production. For example, rent, insurance of factory building, etc., remain the same for different levels of production. In other words, the cost that does not vary but remains constant within a given period of time and a given range of activity in spite of fluctuations in production is known as fixed cost. Some examples of fixed costs are as follows:

- Rent or rates

- Insurance charges

- Management salary

Per unit fixed cost varies with change in the volume of production. If production increases fixed cost per unit decreases and with decrease in production the fixed cost per unit increases. Rent and insurance of building, depreciation on plant and machinery, salary of employees, etc., are some examples of fixed costs.

- Variable costs: These costs tend to vary with the volume of output. Any increase in the volume of production results in an increase in variable cost and vice versa, for example, cost of material, cost of labour, etc. In other words, cost that varies directly in proportion with every increase or decrease in the volume of output or production is known as variable cost. Some examples of variable cost are as follows:

- Wages of labourers

- Cost of direct material

- Power

Variable costs are costs that vary directly in proportion to changes in the volume of output. The cost that increases or decreases in the same proportion as the units produced is termed

variable cost. Direct material, direct labour, direct expenses and variable overheads are some examples of variable costs.

- Semi-variable costs: These costs are partly fixed and partly variable in relation to output, for example, telephone bill, electricity bill, etc. In other words, the cost that does not vary proportionately but simultaneously does not remain stationary at all times is known as semi-variable cost. It can also be named semi-fixed cost. Some examples are as follows:

- Depreciation

- Repairs

- Fixed costs: These are the costs that remain constant at all levels of production. They do not increase with changes in the volume of production. For example, rent, insurance of factory building, etc., remain the same for different levels of production. In other words, the cost that does not vary but remains constant within a given period of time and a given range of activity in spite of fluctuations in production is known as fixed cost. Some examples of fixed costs are as follows:

- By controllability: Costs may be classified into controllable and uncontrollable costs:

- Controllable costs: These are the costs that can be influenced by the action of a specified member of an undertaking. Generally, a business is split into different units and the units are headed by specialists. These specialists have control over costs that are incurred in the units allotted to them.

- Uncontrollable costs: Costs that cannot be influenced by the action of a specified member of an undertaking are known as uncontrollable costs.

The distinction between controllable and uncontrollable costs is not very sharp and is sometimes left to individual judgment. In fact, no cost is uncontrollable; it is only in relation to a particular individual that we can specify a particular cost to be either controllable or uncontrollable.

- By normality: According to this basis, costs may be categorized as follows:

- Normal cost: It is the cost that is normally incurred at a given level of output under the conditions at which that level of output is normally attained.

- Abnormal cost: It is the cost that is not normally incurred at a given level of output in the conditions at which that level of output is normally attained. It is charged to the costing profit and loss account.

2.6 TYPES OF COSTING

For ascertaining cost, the following types of costing are usually used:

Uniform costing: When a number of firms in an industry agree among themselves to follow the same system of costing and adopt common terminology for various items and processes, they are said to follow a system of uniform costing.

Marginal costing: It is defined as the ascertainment of marginal cost by differentiating between fixed and variable costs. It is used to ascertain the effect of changes in volume or type of output on profit.

Standard costing: It is the name given to the technique whereby standard costs are predetermined and subsequently compared with recorded actual costs. It is thus a technique of cost ascertainment and cost control.

Historical costing: It is the ascertainment of costs after they have been incurred. This type of costing has limited utility.

Direct costing: It is the practice of charging all direct costs to operations, processes or products leaving all indirect costs to be written off against the profits that they raise.

Absorption costing: It is the practice of charging all costs, both variable and fixed costs, to operations, processes or products. This is different from marginal costing for which fixed costs are excluded.

2.7 METHODS OF COSTING

Different industries follow different methods of costing because of differences in the nature of their work. The various methods of costing are the following:

Job costing: The system of job costing is used when production is not highly repetitive and, in addition, consists of distinct jobs so that the material and labour costs can be identified by order number. This method of costing is very common in commercial foundries, drop forging shops and plants making specialized industrial equipment. In other words, job costing is used when the cost of each job is ascertained separately. It is suitable in all cases where work is undertaken on receiving a customer's order, like a printing press, motor workshop, etc.

Batch costing: It is an extension of job costing. It is practised where jobs are arranged in different batches. This method is particularly suitable for general engineering factories and pharmaceutical industries.

Contract costing: Contract costing is not different from job costing. A contract is a big job, whereas a job is a small contract. The term is usually applied where large-scale contracts are carried out. Shipbuilders, printers, building contractors, etc., use this system of costing. Job or contract costing is also termed terminal costing. It is suitable for firms engaged in the construction of bridges, roads, buildings, etc.

Single or output costing: In this method, cost per unit of output or production is ascertained and the amount of each element constituting such costs is determined. In cases where products can be expressed in identical quantitative units and where manufacture is continuous, this type of costing is applied. The method is suitable in industries like brick making, collieries, flour mills, paper mills, cement manufacturing, etc. Here, the cost of a product is ascertained, the product being the only one produced like bricks, coal, etc.

Process costing: The cost of completing each stage of work is ascertained, like the cost of making pulp and the cost of making paper from pulp. Process costing aims at calculating the cost at each stage through which a product passes in its production process. This system of costing is suitable for the extractive industries, for example, chemical manufacture, paints, foods, explosives and soap making.

Operation costing: Operation costing is a further refinement of process costing. The system is employed in industries where mass or repetitive production is carried out. This procedure of costing is broadly the same as process costing except that in this case cost unit is an operation instead of a process. It is used in the case of concerns rendering services like transport, supply of water, retail trade, etc.

Multiple costing: It is a combination of two or more methods of costing discussed in the preceding list items. The whole system of costing is known as multiple costing. Under this system, the costs of different sections of production are combined after finding out the cost of each and every part manufactured. The system of ascertaining cost in this way is applicable when a product comprises many assailable parts. As various components differ from each other in a variety of ways such as price, materials used and manufacturing processes, a separate method of costing is employed in respect of each component. The type of costing in which more than one method of costing is employed is called multiple costing.

Standard costing: Standard costing is a system under which the cost of a product is determined in advance on certain predetermined standards. It may be used as a basis for price fixing and for cost control through variance analysis.

Marginal costing: It is nothing but the study of variable costs. It is a technique in which allocation of expenses are restricted to those expenses that arise as a result of production. This technique is useful in manufacturing industries with varying levels of output.

Differential cost (incremental and decremental costs): The difference in total costs between two alternatives is termed differential cost. In case the choice of an alternative results in an increase in total cost, such increased costs are known as incremental costs.

Imputed costs/hypothetical costs: These are costs that do not involve cash in the real sense. It is only assumed to have been incurred. Although they are not included in cost accounting, they are very useful in the decision-making process. For example, interest on capital is ignored in cost accounts, although it is considered in financial accounts.

Inventoriable costs (or product costs): These are costs that are assigned to a product.

Opportunity cost: This cost refers to the value of sacrifice made or benefit of an opportunity foregone in accepting an alternative course of action.

Out-of-pocket cost: These are the costs that was incurred in the past depending on the decision made. It may not be incurred if a particular decision is not made. In other words, it is that portion of total cost that involves cash.

Shutdown costs: These are costs that continue to be incurred even when a plant is temporarily shut down, for example, costs like rent, rates, depreciation, etc. These costs cannot be eliminated with the closure of a plant. In other words, all fixed costs, which cannot be avoided during the temporary closure of a plant, are known as shutdown costs.

Sunk costs: Historical costs incurred in the past are known as sunk costs. They play no role in decision making in the current period. For example, in the case of making a decision relating to the replacement of a machine, the written down value of the existing machine is a sunk cost and therefore not considered.

Absolute cost: These costs refer to the cost of any product, process or unit in its totality.

Discretionary costs: These are ‘escapable’ or ‘avoidable’ costs. In other words, these are costs that are not essential for the accomplishment of a managerial objective.

Period costs: These are costs that are not assigned to products but are charged as expenses against the revenue of the period in which they are incurred.

Chargeable expenses: These are expenses that can be charged directly to jobs, products, processes, cost centres or cost units. These are also called direct expenses. Depending on the situation, the same item of an expense may be treated as a chargeable expense or an indirect cost.

2.7.1 Cost unit

Cost unit is a unit of quantity of product, service or time or combinations of these in relation to which cost may be expressed. ‘Cost unit is a device for the purpose of breaking up costs into smaller subdivisions.'

The cost units used in different industries cannot be uniform. Cost units should be those that suit the business and that are readily understood and accepted by all concerned. The Chartered Institute of Management Accountants, London, defines a unit of cost as a unit of quantity of product, service or time in relation to which costs may be ascertained or expressed. The unit selected should be unambiguous, simple and commonly used. Table 2.1 tabulates some examples of cost units

Table 2.1

| Name of industry | Cost units used |

|---|---|

| Brewery | Per dozen bottles |

| Bricks | Per 1,000 bricks |

| Case making | Per case |

| Confectionary | Per kilogram |

| Contractors | Per job |

| Electricity | Per kilowatt-hour |

| Fruit, pens, pencils | Per dozen |

| Furniture, shipbuilding, automobile, etc. | Number |

| Gas | Per cubic metre |

| Hospital | Patient-day |

| Ice cream | Per kilogram |

| Motor transport | Per passenger-kilometre |

| Paint | Per litre |

| Paper | Per ream |

| Petrol, other heavy oil | Per litre |

| Pharmaceuticals | Per litre or kilogram, or 1,000 numbers |

| Printing | Per job |

| Railway | Per passenger-kilometre |

| Readymade garments | Numbers |

| Road contracts | Per kilometre |

| Soft drinks | Per pack of 24 bottles |

| Steel and cement | Per tonne |

| Sugar, colliery | Per tonne |

| Textile | Per metre of cloth |

| Water | Per 1,000 litres |

2.7.2 Cost centre

According to the Chartered Institute of Management Accountants, London, cost centre means ‘a location, person or item of equipment (or group of these) for which costs may be ascertained and used for the purpose of cost control’. Thus, cost centre refers to one of the convenient units into which the whole factory or an organization has been appropriately divided for costing purposes. Each such unit consists of a department and a sub-department; an item, equipment or machinery; and a person or a group of persons. Sometimes, closely associated departments are combined together and considered as one unit for costing purposes.

'An organisational area of activity for which it is advisable to accumulate costs.'

'Cost centres are the departments or sub-departments of an organisation with reference to which cost is collected.'

Difference between cost centre and cost unit

According to R. K. Thakur, cost centres are the smallest segment of activity or area of responsibility for which costs are accumulated or ascertained.

Cost centres are the natural division of the organization into convenient units for the purpose of cost ascertainment and control. These are usually the departments of the organization, but sometimes a department may also contain several cost centres.

ICMA, London, defines a cost unit as ‘a unit of quantity of product, service, or time in relation to which cost may be ascertained or expressed’. Ordinarily, cost unit is an expression in the form of count, weight, dimension, etc. Cost unit is the unit of measurement of different types of products, for example, tonne in the case of coal, yards in the case of cloth, and litre in the case of petrol.

2.7.3 Profit centre

'That segment of activity of a business which is responsible for both revenue and expenditure.'

'Profit centre discloses the profit of a particular segment of activity.'

CHAPTER SUMMARY

From reading this chapter you have understood the various types and classification of costs. You have also understood the different elements of costs and subsequently the overheads involved.

EXERCISE FOR YOUR PRACTICE

Objective-Type Questions

I. State whether the following statements are true or false:

- All costs are controllable.

- Fixed cost per unit remains fixed.

- Variable cost per unit remains variable.

- Direct costs are those identified with a particular cost unit.

- Total variable cost does not increase in total proportion to output.

- Sunk costs are relevant for decision making.

- Costing and cost accounting are the same.

- Costs and expenses are the same.

- Abnormal cost is controllable.

- Variable cost increases as the fixed cost.

[Ans: 1—false, 2—false, 3—false, 4—true, 5—false, 6—false, 7—false, 8—false, 9—true, 10—false]

II. Choose the correct answer:

- A cost that is computed in advance before production starts is

- Marginal cost

- Standard cost

- Predetermined cost

- Opportunity cost

- A predetermined cost that is calculated from management standards of efficient operations is

- Standard cost

- Opportunity cost

- Out-of-pocket cost

- Shutdown cost

- _____ cost are not assigned to the product but are charged as expenses against revenue.

- Discretionary cost

- Period cost

- Absolute cost

- Sunk cost

- _____ cost concept is a short-run concept used in decision making related to fixation of selling price in recession.

- Inventoriable cost

- Sunk cost

- Out-of-pocket cost

- Imputed cost

- Historical cost incurred in the past are known as

- Shutdown costs

- Sunk cost

- Differential cost

- Predetermined cost

- The ascertainment of marginal cost by differentiating between fixed and variable cost is

- Standard costing

- Marginal costing

- Direct costing

- Absorption cost

- The ascertainment of cost after it has been incurred is

- Job costing

- Batch costing

- Absorption costing

- Historical costing

- The practice of charging all costs, both variable and fixed costs, to operation is

- Absorption costing

- Operation cost

- Multiple cost

- Process costing

- Royalty is considered as ______ expenses.

- Direct expense

- Indirect expense

- Indirect material

- Indirect labour

- Salary for clerical staff is a

- Indirect expense

- Indirect labour

- Indirect material

- Direct expense

[Ans: 1—(c), 2—(a), 3—(b), 4—(c), 5—(b), 6—(b), 7—(d), 8—(a), 9—(a), 10—(b)]

DISCUSSION QUESTIONS

Short Answer-Type Questions

- Define the term predetermined and standard cost.

- What do you mean by marginal cost?

- Define opportunity cost.

- What do you mean by imputed and inventoriable cost?

- Define absolute cost and discretionary cost.

- What do you mean by sunk cost?

- What is a cost unit?

- What do you mean by chargeable expenses?

Essay-Type Questions

- Explain the classification of cost in detail.

- What are the types of costing?

- Bring out the important methods of costing.

- Explain with the help of a chart the various elements of cost.