16

Forward rate agreements (FRAs)

NOTATION

| i | annual interest rate |

| n | number of payments per year |

| days | number of days in the investment/coupon period |

| year | number of days in a year |

| N | number of years or coupon periods |

| P | price |

| APR | annual percentage rate, effective rate or equivalent annual rate |

| PV | present value |

| FV | future value |

| DF | discount factor |

TIME VALUE OF MONEY

Effective and nominal rates

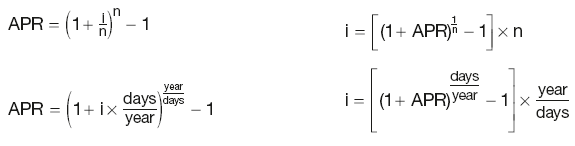

Relationship between the interest rate i with n payments per year and the APR:

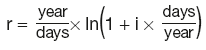

Continuously compounded rate

where i is the nominal interest rate.

For annual effective rate APR:

r = ln(1 + APR)

Reinvestment rates

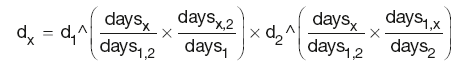

For unequal rates applying to different investment periods:

![]()

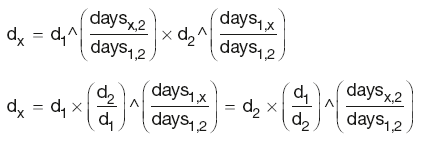

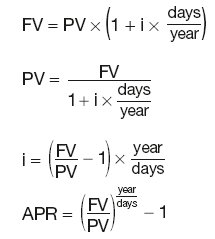

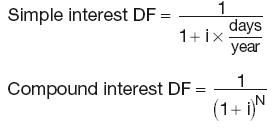

Short-term investments

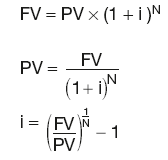

Long-term investments

Discount factors

NPV and IRR

Internal rate of return (IRR) is the rate that discounts all the cashflows, including any cashflow now, to zero.

IRR discounts all the future cashflows to a given NPV.

MONEY MARKETS CALCULATIONS

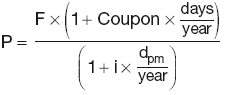

Certificate of deposit (CD)

Proceeds at maturity:

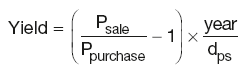

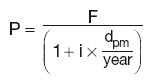

Secondary market yield:

Discount instruments

Proceeds at maturity:

Maturity proceeds P = F(face value)

Secondary market price:

CAPITAL MARKETS INSTRUMENTS

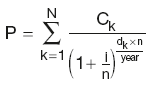

Simple bond dirty price formula

where:

Ck is the kth cashflow (including the final redemption amount)

i is the bond yield, based on the payment frequency

n is the number of coupons per year

dk is the number of days until the kth cashflow.

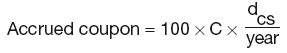

Accrued coupon

where dcs is the time period between the last coupon date and the sale of the bond.

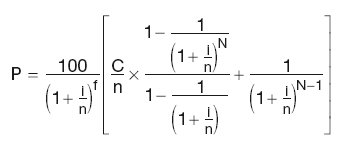

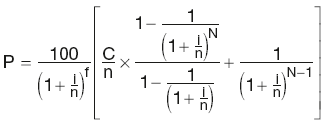

Clean bond price

where:

C is the annual coupon rate

N is the number of outstanding coupons

i is the annual bond yield, based on the payment frequency

n is the number of coupons per year

f is the ratio between the number of days until the next coupon and the full coupon period.

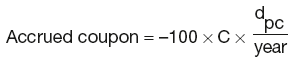

Ex-dividend

where:

dpc is the time period between the bond purchase and the next coupon.

Bond yield

Flat yield:

Flat yield = (Coupon rate/Clean price) × 100

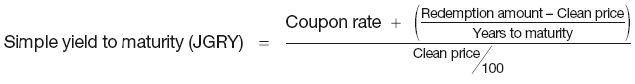

Simple yield to maturity:

Yield accounting for coupon payments and irregular first coupon period (derived from the pricing formula):

where:

C is the annual coupon rate

N is the number of outstanding coupons

i is the annual bond yield, based on the payment frequency

n is the number of coupons per year

f is the ratio between the number of days until the next coupon and the full coupon period.

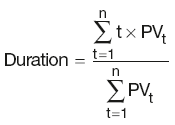

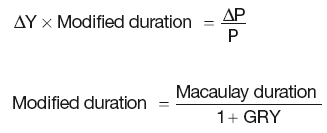

Portfolio duration

Macaulay duration:

Modified duration:

FINANCIAL FUTURES

Futures price

Price = 100 – Implied forward interest rate × 100

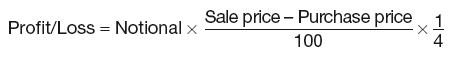

Futures settlement price

Expressed in terms of ‘ticks’:

Profit/Loss = Tick movement × Tick size × Number of contracts

Futures strip rate

FORWARD RATE AGREEMENTS (FRAs)

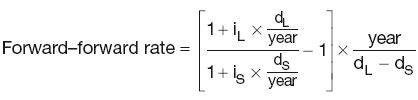

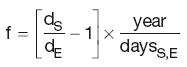

FRA rate

where:

iL is the interest rate for the longer period

iS is the interest rate for the shorter period

dL is the number of days in the longer period

dS is the number of days in the shorter period

year is the number of days in the year.

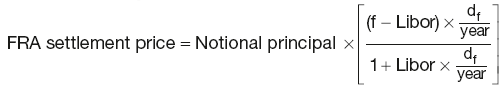

FRA settlement price

where:

f is the FRA interest rate

df is the number of days in the FRA period

year is the number of days in the year.

INTEREST RATE SWAPS

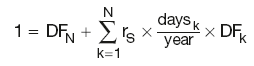

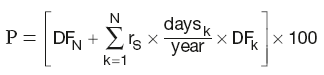

Short-term swap valuation at inception

where:

rS is the swap rate

daysk is the number of days covered by the kth FRA contract

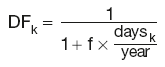

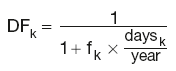

DFk is the discount factor derived from the kth FRA rate f using:

Later valuation of short-term swap fixed leg

where:

P is the value of the fixed leg at a later date

rS is the swap rate, fixed at inception

daysk is the number of days covered by the kth FRA contract

DFk is the discount factor derived from the kth FRA rate fk using:

FOREIGN EXCHANGE

Spot rates

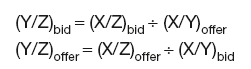

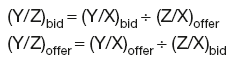

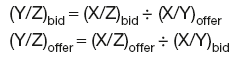

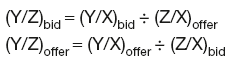

Given exchange rates X/Y and X/Z, the cross-rates are:

and

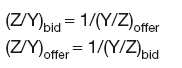

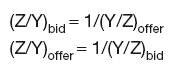

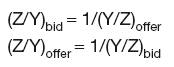

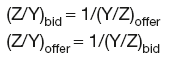

Given exchange rates Y/X and Z/X, the cross-rates are:

and

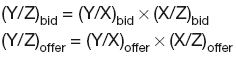

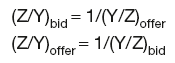

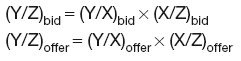

Given exchange rates Y/X and X/Z, the cross-rates are:

and

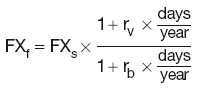

Forward outrights

where:

FXf is the forward exchange rate

FXs is the spot exchange rate

rv is the interest rate applicable to variable currency

rb is the interest rate applicable to base currency.

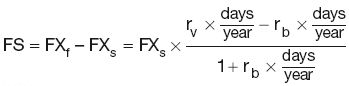

Forward swaps

Forward swap = Forward outright – Spot

where:

FS is the forward swap price

FXf is the forward exchange rate

FXs is the spot exchange rate

rv is the interest rate applicable to variable currency

rb is the interest rate applicable to base currency.

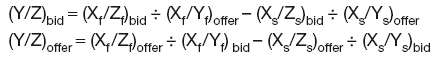

Cross-rate forwards

Given forward exchange rates X/Y and X/Z, the forward cross-rates are:

and

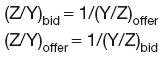

Given forward exchange rates Y/X and Z/X, the forward cross-rates are:

and

Given forward exchange rates Y/X and X/Z, the forward cross-rates are:

and

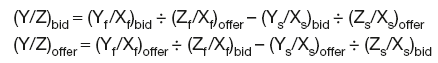

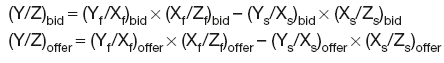

Cross-rate forward swaps

Given spot exchange rates Xs/Ys and Xs/Zs and forward exchange rates Xf/Yf and Xf/Zf, the forward cross-rate swap prices are:

Given exchange rates Y/X and Z/X, the forward cross-rates are:

Given exchange rates Y/X and X/Z, the forward cross-rates are:

OPTION CHARACTERISTICS

Put-call parity

C − P = S − K

where:

C is the call premium, P is the put premium

S is the futures price, K is the exercise price/option strike.

Physically settled options

C − P = S − Ke–rt

where:

r is the continuously compounded interest rate

t is time to expiry expressed as

.

Options on dividend-paying stocks

C − P = S − Ke–rt − D

where:

D is the present value of the expected dividend.

Options on stock index (dividend yield continuous)

C − P = Se–dt − Ke–rt

where:

d is the continuously compounded dividend yield.

Cross-currency options

C − P = Se–ft − Ke–rt

where:

f is the continuously compounded foreign currency interest rate

S is the spot exchange rate.

Options on futures with up-front premiums

C − P = S − K

Options on futures with margined premiums

C − P = Se–rt − Ke–rt

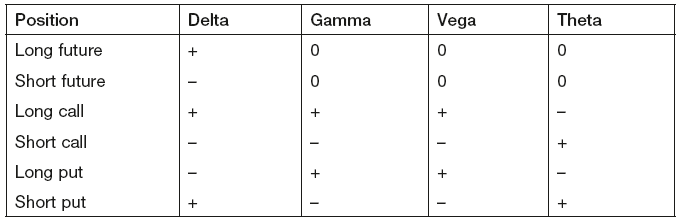

Option value sensitivities – ‘option Greeks’

| Options sensitivity to | Named as |

|---|---|

| Underlying | Delta |

| Changes in delta | Gamma |

| Volatility | Vega or kappa |

| Time decay | Theta |

| Interest rates | Rho |

OPTION PRICING

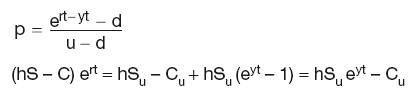

Risk-neutral pricing using binomial trees

Call option premium boundaries:

Probability-weighted stock price

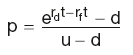

Pricing options using hedge ratio

where:

Dividend paying stock options

Cross-currency options

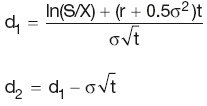

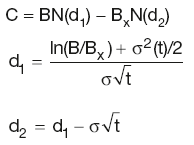

Option pricing using Black–Scholes

Black–Scholes model:

where:

and

S is the underlying stock/share price

X is the exercise price

r is the annual continuously compounded risk-free rate

t is the time (in years)

σ is the annual stock price volatility

N(d) is the cumulative probability that deviations less than d will occur in a normal distribution with a mean of 0 and a standard deviation of 1

N(d1) is the probability of the stock price rising to a certain level

N(d2) is the probability of the stock price rising above the strike (but it is irrelevant by how much).

Options on futures (premiums paid up front)

Options on futures (premiums margined)

Currency options

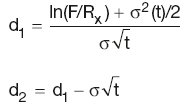

Black model

Black model for interest rate derivatives:

where:

where F is the current market forward swap rate, and Rx is the underlying swap rate (option strike). All other variables have the same meaning as before.

BOND DERIVATIVES

Bond futures

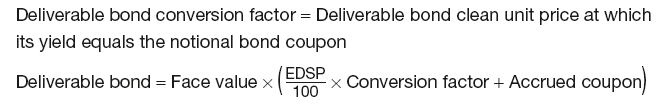

Deliverable bond valuation:

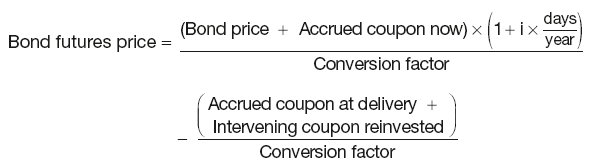

Bond futures price:

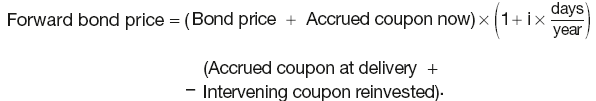

Forward bond price:

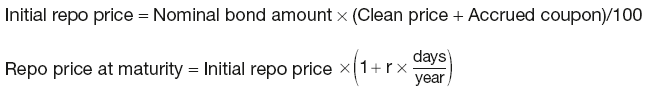

Bond repos

where r is the repo rate and days refers to number of days until maturity.

Bond options

Black model for bond options:

Put–call parity for bond options:

F is the futures price

K is the exercise price/option strike

r is the continuously compounded interest rate.

EQUITY DERIVATIVES

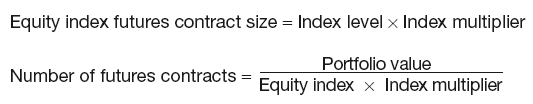

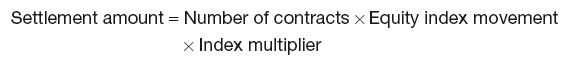

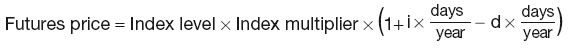

Equity index futures

The futures settlement price:

where:

i is the annual funding rate

d is the dividend yield on underlying equity.

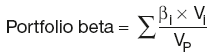

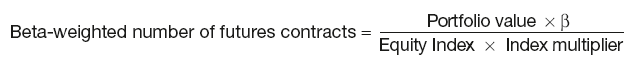

Stock beta

Portfolio beta:

where:

βi is the individual equity beta

Vi is the individual equity share value

VP is the total value of the portfolio.

Equity index options

Black–Scholes for equity index options:

where dividend yield d is assumed to be paid continuously.

Put-call parity for equity index options:

Single stock options

Black–Scholes for single stock options:

where dividend payments until expiry are captured by reducing the stock price by the present value of dividends.

Put–call parity for dividend-paying single stocks:

C − P = S − D − Ke−rt

where D is the present value of expected dividend.

Equity index swap valuation

PV(swap) = PV(equity index leg) − PV(floating leg) = 0

PROBABILITY AND STATISTICS

Main concepts of probability

Probability of an event E when there are several equally likely outcomes:

P(E) = Number of ways E can occur/Total number of possible outcomes

Sample-based probability:

P(E) = Number of observed occurrences of E/Total number of observed occurrences

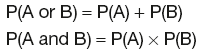

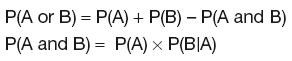

Joint probability

Independent events:

Dependent events:

Probability distribution

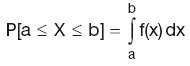

Probability that the continuous variable x has a value between a and b inclusive:

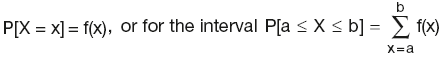

Probability that the discrete variable x has a value X or lies between a and b inclusive:

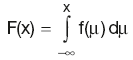

Probability that the continuous variable x has a value less than or equal to X:

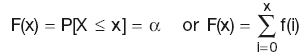

Probability that the discrete variable x has a value less than or equal to X:

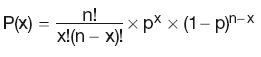

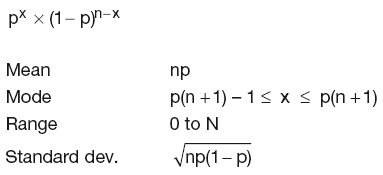

Binomial distribution

Binomial probability function:

where the number of possible combinations of x successes in n trials is given by:

and the probability of x successes and n – x failures in a trial is given by:

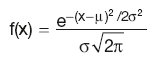

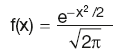

Normal distribution

Normal distribution function:

Standard normal distribution function:

| Mean | location parameter μ |

| Median | location parameter μ |

| Mode | location parameter μ |

| Standard dev. | scale parameter σ |

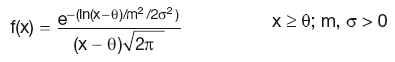

Log-normal distribution

Log-normal distribution function:

Standard log-normal distribution function:

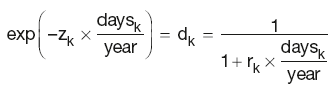

YIELD CURVES

Choice of instruments

- Cash deposits.

- Interest rate futures.

- Interest rate swaps.

Deposit discount factors

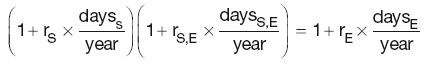

The forward–forward rate is given by:

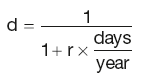

and the relationship between the rate and the DF is:

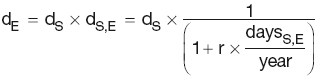

where:

year is the number of days in the year

daysS, daysE and daysS,E are the relevant time periods

dS and dE are the discount factors for the period start and end date

dS,E is the discount factor for the period daysS,E

rS and rE are the spot rates for the period start and end dates

rS,E is the interest rate for the period daysS,E.

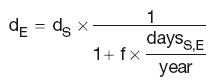

Futures discount factors

Given the futures rate:

the DF for the end of the forward period is given by:

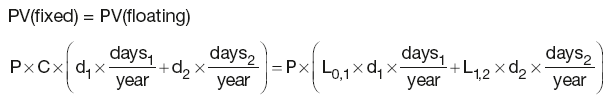

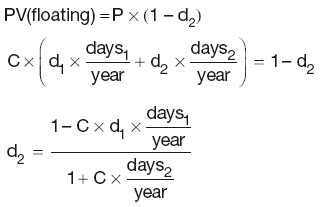

Swap discount factors

where:

P is the notional principal

dk is the discount factor for the end of period k, implying d0 = 1

daysk is the number of days in the coupon period k

Lk-1,k is the Libor for that period

C is the fixed coupon rate for the duration of the swap.

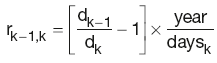

As the interest rate r implied by the DFs for adjacent periods can be calculated as:

It follows:

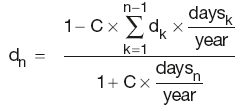

In general:

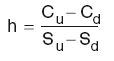

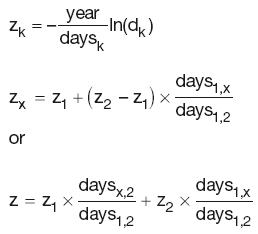

Interpolation methods

Zero rate linear interpolation:

which, when rearranged, gives:

DF for the unknown point can be calculated as:

where the symbol ^ denotes ‘power of ’.