Chapter 18

Business as Usual: Managing Your Etsy Store

In This Chapter

![]() Settling up with Etsy

Settling up with Etsy

![]() Paying taxes and keeping good records

Paying taxes and keeping good records

![]() Trying Etsy tools for managing your shop

Trying Etsy tools for managing your shop

![]() Choosing a business structure

Choosing a business structure

![]() Running a charitable shop

Running a charitable shop

![]() Going on hiatus

Going on hiatus

![]() Closing your Etsy shop

Closing your Etsy shop

If you’re a fan of Chinese food, you’re probably familiar with the pu-pu platter — you know, the appetizer that features a little bit of everything. This chapter is the literary equivalent. It covers an assortment of topics that relate to managing and growing your Etsy business. They include paying Etsy bills, transferring money from your shop to your bank account, handling taxes and keeping records, running your shop with Etsy tools, and turning your thriving shop into a legitimate business.

I’m Just a Bill: Paying Your Etsy Bill

You’re not the only baby who needs a new pair of shoes; the folks at Etsy have their own financial obligations. As we mention in Chapter 1, Etsy stays afloat by charging sellers a listing fee (currently, 20¢) for each item listed on the site. In addition, Etsy collects a commission from the seller for each item sold — currently, 3.5 percent of the total price of the item (not counting shipping), as well as fees for shipping labels and search ads. These fees are assessed at the end of each month. Etsy lets you know when it’s time to pay up by sending you a billing statement via e-mail.

To pay your bill, log in to your Etsy account and follow these steps:

1. Click the link in the billing statement that Etsy sent via e-mail to open the Your Bill page on Etsy.

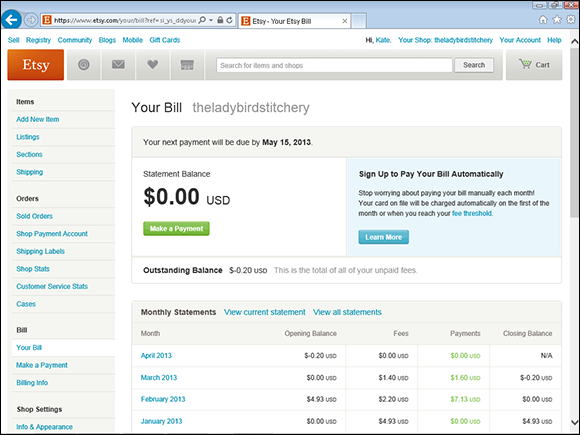

You can also access the Your Bill page, shown in Figure 18-1, by hovering your mouse pointer over the Your Shop link that appears along the top of every Etsy page and clicking the Your Bill option in the list that appears.

2. Click the Make a Payment Now button.

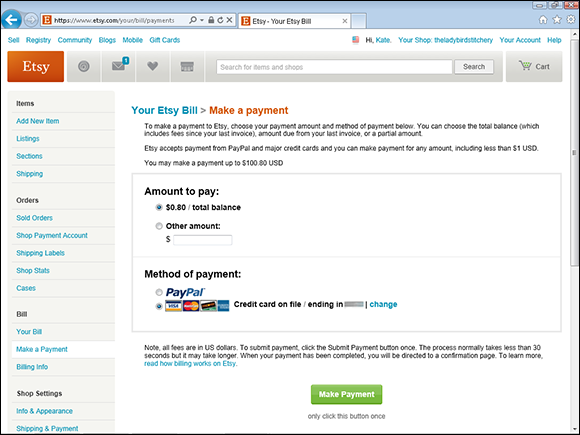

The Make a Payment page opens (see Figure 18-2).

3. Under Amount to Pay, indicate whether you want to pay your entire Etsy bill, the portion that’s due at this time, or some amount in between.

Figure 18-1: View your Etsy bill.

Figure 18-2: Pay your bill.

4. Under Method of Payment, choose PayPal or the credit card that you have on file with Etsy.

5. Click the Make Payment button.

If you opted to pay with a credit card, you’ll see a screen that thanks you for your payment, with a link that you can click to return to your Etsy bill.

If you opted to pay with PayPal, Etsy directs you to the PayPal site (www.paypal.com), where you're prompted to log in. After you do so, review the payment information. Assuming that it's correct, click the Continue button. PayPal processes your payment and directs you back to Etsy.

Worried you might forget to pay your bill? Fret not. If your shop is based in the United States, you can enroll with Etsy to pay your bill automatically. When you do, Etsy will charge the credit card you put on file for all outstanding fees on the first of every month or when it reaches a calculated fee threshold. To set up automatic bill pay, follow these steps:

1. Hover your mouse pointer over the Your Shop link that appears along the top of every Etsy page and click the Your Bill option in the list that appears.

The Your Bill page opens (refer to Figure 18-1).

2. In the Sign Up to Pay Your Bill Automatically section, click the Learn More button.

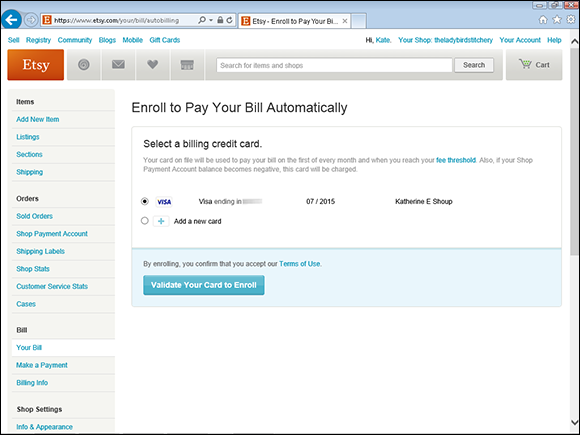

The Enroll to Pay Your Bill Automatically page opens (see Figure 18-3).

3. Select the credit card you want to use for billing (or add a new one if needed).

4. Click the Validate Your Card to Enroll button.

Etsy signs you up for its automatic bill-pay service.

If you change your mind and decide you’d rather pay your bills manually, just click the Looking to Turn Off Automatic Bill Payment link at the bottom of the Your Bill page. Etsy asks you to confirm your action; click the Turn Off Automatic Bill Pay button to confirm.

Figure 18-3: Enrolling in Etsy’s automatic bill-pay service.

Taxing Matters: Appeasing Uncle Sam

A world with no taxes would be lovely indeed — except for the fact that it would also be a world with no roads, public school teachers, or firefighters. Indeed, without taxes, there would be no Internet — and, by extension, no Etsy! After all, taxes bankrolled the U.S. government’s Advanced Research Projects Agency (ARPA), which, in 1969, created the network that would eventually become the Internet. (Thanks, Al Gore!) To make sure you’re square with Uncle Sam, read on.

To tax or not to tax: Collecting sales tax

Odds are, you need to collect sales tax at least some of the time, unless you live in Alaska, Delaware, Montana, New Hampshire, or Oregon, five states that don’t impose a statewide sales tax. You also may not need to collect sales tax if you use your Etsy shop to sell prescription drugs (not recommended); agricultural products, such as seeds; food; or products for resale. So, when do you need to collect sales tax?

In general terms, the sales tax process works like this:

1. You get a sales tax ID number from your state (check your state government’s website for details).

2. Each time you conduct a taxable transaction, you calculate the tax owed and collect it from the buyer.

3. You keep excellent records about the tax that you’ve collected through your Etsy business (as we advise later in this chapter).

4. Each month, quarter, or year (depending on your level of sales), you file a tax return and submit the sales tax that you’ve collected to your state.

5. You stay out of jail.

Drawn and quartered: Paying quarterly income tax

If you run your business as a sole proprietorship (covered later in this chapter) and you live in the United States, you have the distinct pleasure of paying income taxes not once, not twice, not three times, but four times per year — on April 15, June 15, September 15, and January 15 (unless any of those days falls on a weekend or holiday, in which case you must pay up on the next business day).

Paying these quarterly taxes is a breeze. You can download the necessary form (called a 1040-ES) from the IRS's website, here: www.irs.gov/pub/irs-pdf/f1040es.pdf. You need to download a similar form from your state government's site. Then fill out the forms, cut your checks, and send them to the appropriate office. (Check the form for details.)

Alternatively, you can pay your taxes online using the Electronic Federal Tax Payment System (EFTPS): www.eftps.gov/eftps. (Note: EFTPS is for federal taxes only; check with your state to see what resources are available for paying your state taxes online.)

Write this off: Determining tax deductions

If your Etsy shop is a proper business (rather than a hobby) and it’s set up as a sole proprietorship (one of the arrangements we discuss later in this chapter), you’re free to deduct shop-related expenses from your taxable income. Here are a few examples (again, for a complete list, hit up a qualified accountant):

![]() Cost of goods sold (COGS): This category is the cost of the materials that you purchased to craft your inventory. For example, if you make jewelry, your COGS may include the price that you paid for beads, thread, findings, and so on. The COGS may also include what you shelled out for your pretty packaging and your shipping costs.

Cost of goods sold (COGS): This category is the cost of the materials that you purchased to craft your inventory. For example, if you make jewelry, your COGS may include the price that you paid for beads, thread, findings, and so on. The COGS may also include what you shelled out for your pretty packaging and your shipping costs.

![]() Equipment: Did you buy a kiln to fire the ceramic bowls that you list in your Etsy shop? Or a laptop to help run your Etsy business? Or a printer to print invoices for your Etsy customers? If so, you can deduct the cost of these items from your taxable income.

Equipment: Did you buy a kiln to fire the ceramic bowls that you list in your Etsy shop? Or a laptop to help run your Etsy business? Or a printer to print invoices for your Etsy customers? If so, you can deduct the cost of these items from your taxable income.

![]() Selling expenses: These expenses include Etsy fees, PayPal fees, banking fees — even phone calls related to your business.

Selling expenses: These expenses include Etsy fees, PayPal fees, banking fees — even phone calls related to your business.

![]() Advertising fees: Say you printed some snazzy business cards for your Etsy shop. These costs and other marketing expenses are fair game. (Chapter 16 provides a general introduction to marketing tasks.)

Advertising fees: Say you printed some snazzy business cards for your Etsy shop. These costs and other marketing expenses are fair game. (Chapter 16 provides a general introduction to marketing tasks.)

![]() Office expenses: These purchases include pens and pencils, paper, letterhead, printer supplies, and the like.

Office expenses: These purchases include pens and pencils, paper, letterhead, printer supplies, and the like.

![]() Mileage: Do you regularly drive to your local craft store to stock up on supplies for your Etsy shop? Or to the post office, to ship items to Etsy buyers? If so, you can deduct your mileage for those outings; the current rate, as of this writing, is 56.5¢ per mile. Any tolls or parking fees that you incur en route are also deductible.

Mileage: Do you regularly drive to your local craft store to stock up on supplies for your Etsy shop? Or to the post office, to ship items to Etsy buyers? If so, you can deduct your mileage for those outings; the current rate, as of this writing, is 56.5¢ per mile. Any tolls or parking fees that you incur en route are also deductible.

![]() Home office: If you use a portion of your home to run your Etsy shop — maybe you devote a special room to crafting the pieces that you sell or handling administrative tasks — you can claim a home-office deduction. If you rent studio space, you can deduct that area instead.

Home office: If you use a portion of your home to run your Etsy shop — maybe you devote a special room to crafting the pieces that you sell or handling administrative tasks — you can claim a home-office deduction. If you rent studio space, you can deduct that area instead.

![]() Legal or professional services: If you follow our advice and hire an accountant, you can deduct her fee. Ditto for any fees associated with other professionals who serve your business — attorneys, graphic designers, and the like.

Legal or professional services: If you follow our advice and hire an accountant, you can deduct her fee. Ditto for any fees associated with other professionals who serve your business — attorneys, graphic designers, and the like.

Recording Artist: Keeping Accurate Records

Yes, we know. Record-keeping is for squares. But if you want to avoid getting sideways with the IRS — not to mention stay on top of your business — you’ll want to be scrupulous about your record-keeping, however tedious it may be. Keep careful track of all your sales and expenses. And keep all receipts — even the little ones. All those road tolls and parking fees add up! You’ll also want to hang on to invoices, bank statements, and any other financial-type documents that cross your desk.

1. Hover your mouse pointer over the Your Shop link that appears along the top of every Etsy page and choose Sold Orders from the list that appears.

The Open Orders page appears.

2. Click the Download a CSV File link at the bottom of the page to initiate the download.

The Download Shop Data screen appears.

3. To download a CSV containing all listings currently for sale, click the Download CSV button under Currently for Sale Listings and follow the onscreen prompts to save the file to your hard drive. (The steps differ by operating system.)

To download a CSV with order information, click the CSV Type drop-down list and choose Order Item, Order, or Direct Checkout Payments; select the desired month and year; click Download CSV; and follow the onscreen prompts.

You can also download your monthly Etsy bill in CSV format. Hover your mouse pointer over the Your Shop link that appears along the top of every Etsy page and choose Your Bill from the list that appears. On the Your Etsy Bill page, click the desired month; then click the Download This Entire Monthly Statement as a CSV File link at the bottom of the page that appears and follow the onscreen prompts.

Don’t Be a Tool: Using Etsy Tools to Manage Your Shop

Anthropologists used to say that tool use differentiated humans from other animals — until a few observant researchers spotted chimpanzees modifying sticks and using them to fish termites from holes in the ground. Tool use does, however, differentiate the serious Etsy sellers from other shop owners on the site — specifically, the use of Etsy tools to manage a shop. This section covers a few of Etsy’s more popular termite-fisher-outers.

We need those numbers, stat! Viewing Shop Stats

Ever wonder how many people have visited your Etsy shop? Or what keywords they used to find an item in your store? Or what page they were on before they landed on your doorstep? (This last one is helpful for determining whether that ad you placed on that blog is actually directing readers to your Etsy shop like it’s supposed to.) Thanks to Etsy Shop Stats, you can find out. You can also use Etsy’s Shop Stats tool to assess your sales activity at a glance. This tool offers you a great way to quickly digest whether sales in your shop are up, down, or steady. To access the tool, follow these steps:

1. Hover your mouse pointer over the Your Shop button that appears along the top of every Etsy page and click Shop Stats in the menu that appears.

The Shop Stats page opens.

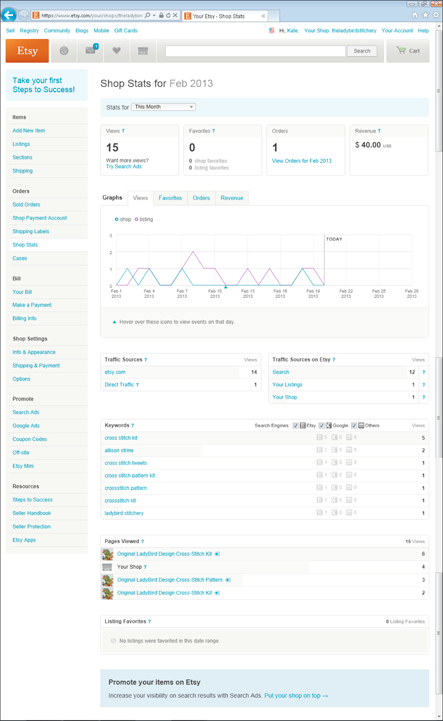

2. Click the Stats For drop-down list and choose the desired time period — for example, Last 7 Days, Last 12 Months, or what have you (see Figure 18-4).

Figure 18-4: Checking your shop sales stats is a cinch.

As you can see, this screen boasts a plethora of information, in text and graph form:

![]() The number of views: This helps you gauge how well the tags and keywords in your title are working for you.

The number of views: This helps you gauge how well the tags and keywords in your title are working for you.

![]() The number of people who have favorited your shop: This helps you determine how well your brand is working for you — that is, whether your entire shop is so compelling that someone would want to favorite it.

The number of people who have favorited your shop: This helps you determine how well your brand is working for you — that is, whether your entire shop is so compelling that someone would want to favorite it.

![]() The number of orders received: This can help you track order fluctuations — by day, by week, and by month — which is useful in planning. With this information, you know when your high and low cycles are, so you can plan for them (for example, ordering supplies before they get critically low).

The number of orders received: This can help you track order fluctuations — by day, by week, and by month — which is useful in planning. With this information, you know when your high and low cycles are, so you can plan for them (for example, ordering supplies before they get critically low).

![]() The amount of revenue generated: This can help you determine how well you’re meeting your income goals.

The amount of revenue generated: This can help you determine how well you’re meeting your income goals.

![]() Sources of shop traffic: This offers a gauge of how well your marketing efforts are working. With this info, you can figure out whether you need to focus more on getting found within Etsy — for example, by springing for Etsy Search ads — becoming more active on Pinterest, or what have you.

Sources of shop traffic: This offers a gauge of how well your marketing efforts are working. With this info, you can figure out whether you need to focus more on getting found within Etsy — for example, by springing for Etsy Search ads — becoming more active on Pinterest, or what have you.

![]() Sources of shop traffic from within Etsy: Use this info to determine how well you’re represented on Etsy. You may discover that you need to put a bit more emphasis on improving your results with Etsy Search or other Etsy tools.

Sources of shop traffic from within Etsy: Use this info to determine how well you’re represented on Etsy. You may discover that you need to put a bit more emphasis on improving your results with Etsy Search or other Etsy tools.

![]() Keywords used on Etsy, Google, and other search sites to find your shop: This is a great place to find new keywords to use in your product titles and descriptions, not to mention find new tags for your items.

Keywords used on Etsy, Google, and other search sites to find your shop: This is a great place to find new keywords to use in your product titles and descriptions, not to mention find new tags for your items.

![]() Specific shop pages viewed and listing favorites: Both of these are a gauge of which items in your shop are the most popular. You can use this to inform new designs.

Specific shop pages viewed and listing favorites: Both of these are a gauge of which items in your shop are the most popular. You can use this to inform new designs.

The Shop Stats page can also help you gauge the success of any Etsy Search Ads you may have running, including the amount spent on Search Ads, the number of impressions your ad has received, the number of times your listing page was viewed from your ad, the number of times your items have been favorited from an ad, the number of orders resulting from ads, and the revenue generated from ads.

Oh, one more thing: You may notice a Web Analytics tab in the Options page, which you access by clicking Options in the Shop Settings section of Your Shop. This is for shop owners with a Google Analytics account. We don't go into that here, because Etsy's Shop Stats are pretty effective on their own. But if you're interested in Google Analytics, read this Etsy Help article: www.etsy.com/help/article/230.

Statistically speaking: Viewing Customer Service Stats

In addition to viewing Shop Stats, you can view Customer Service Stats, Doing so will help you get a handle on areas where your customer-service skills excel — and which areas need a little work. To access your Customer Service stats, hover your mouse pointer over the Your Shop button that appears along the top of every Etsy page and click Customer Service Stats in the menu that appears.

These stats, which are based on the last 60 calendar days of your shop’s activity, cover the following:

![]() Response time to buyer conversations: Etsy suggests that you respond to any convos initiated by buyers from your listings, your shop, a purchases page, or a receipt page within one business day. This stat indicates whether, on average, you meet this benchmark.

Response time to buyer conversations: Etsy suggests that you respond to any convos initiated by buyers from your listings, your shop, a purchases page, or a receipt page within one business day. This stat indicates whether, on average, you meet this benchmark.

![]() Providing processing times: This stat reflects the percentage of active listings in your shop for which processing times have been set. Setting a processing time helps to manage your buyers’ expectations when it comes to how long it will take you to ship their items. You can set a processing time when you create or edit a listing, or by clicking the Provide Processing Times link on the Customer Service Stats page.

Providing processing times: This stat reflects the percentage of active listings in your shop for which processing times have been set. Setting a processing time helps to manage your buyers’ expectations when it comes to how long it will take you to ship their items. You can set a processing time when you create or edit a listing, or by clicking the Provide Processing Times link on the Customer Service Stats page.

![]() Meeting processing times: Of course, it’s not enough to set a processing time. You must also to meet it. This stat reflects whether, on average, you ship within one day of the processing times you set.

Meeting processing times: Of course, it’s not enough to set a processing time. You must also to meet it. This stat reflects whether, on average, you ship within one day of the processing times you set.

![]() Marking items as shipped: Marking items as shipped helps you to keep track of whether you’re meeting your processing times; it also lets buyers know their goodies are on the way. This stat indicates how frequently you mark items as shipped, measured as a percentage. (Note that if you use Etsy to print shipping labels, items are marked as shipped automatically.)

Marking items as shipped: Marking items as shipped helps you to keep track of whether you’re meeting your processing times; it also lets buyers know their goodies are on the way. This stat indicates how frequently you mark items as shipped, measured as a percentage. (Note that if you use Etsy to print shipping labels, items are marked as shipped automatically.)

![]() Providing tracking information: Etsy is a fan of providing tracking numbers for buyers to help keep them informed and to help you avoid being hit with a non-delivery case. Using this stat, you can gauge how frequently you offer this service, in percentage form.

Providing tracking information: Etsy is a fan of providing tracking numbers for buyers to help keep them informed and to help you avoid being hit with a non-delivery case. Using this stat, you can gauge how frequently you offer this service, in percentage form.

An app a day: Using Etsy apps to run your store

Need some extra help running your Etsy shop? Try installing some Etsy applications, or apps, for short. Apps are available to handle all manner of jobs: minimizing the hassle of international shipping (ATS International Shipping), managing your inventory (RunInventory), handling taxes (TaxTime), renewing listings (Clockbot), and more.

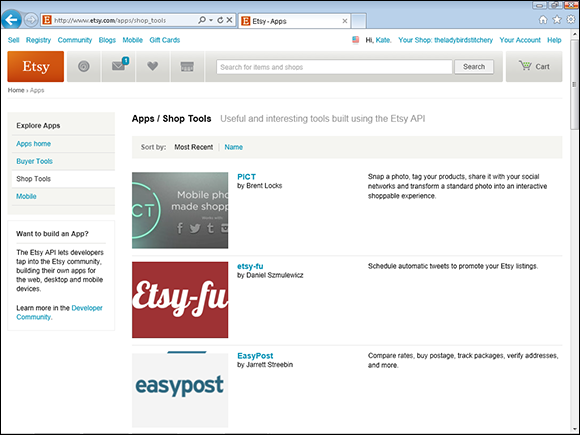

You can find out what apps are available by browsing the App Gallery. To access it, click the Your Shop link that appears along the top of any Etsy page. Then, on the left side of the page, under Resources, click the Etsy Apps link. Finally, to view shop-related apps, click the Shop Tools link on the left side of the page (see Figure 18-5).

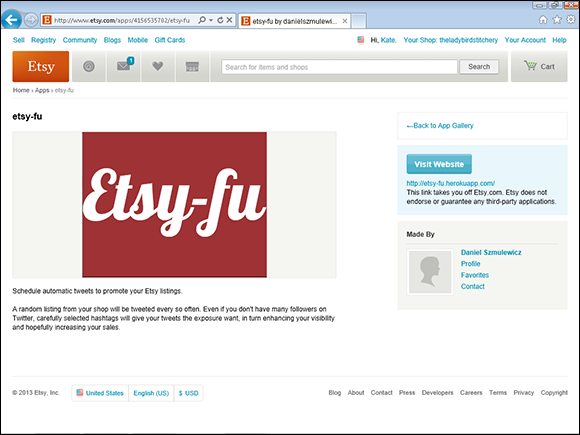

To find out more about an app, click the app’s link. To download it, click the Visit website button that appears on the app’s page (see Figure 18-6) and follow the onscreen instructions. (We’d walk you through the process, but the precise steps vary by app.)

Figure 18-5: The Etsy App Gallery.

Figure 18-6: Download an Etsy app.

Too Legit to Quit: Making Your Business Legit

If you’re starting your Etsy shop as a hobby, you probably haven’t given much thought to the structure of your Etsy business. It’s just you, making stuff and putting it up for sale on Etsy. But if your Etsy shop has grown into a full-time operation — or if you want it to — you’ll need to consider what business structure is best for you. The structure that you choose affects both your personal liability if your business is sued and the taxes you have to pay.

You have a few main options:

![]() Sole proprietorship

Sole proprietorship

![]() General partnership

General partnership

![]() Limited liability company (LLC)

Limited liability company (LLC)

![]() Corporation

Corporation

O sole mio: Understanding sole proprietorships

If you’re just starting out with your Etsy business, odds are, you’re running a sole proprietorship sort of by default. That is, you own your business outright and you’re solely responsible for all decisions and debts that pertain to it. This type of business is by far the easiest to start, but it’s also the riskiest type to run. Why? Because you’re held personally accountable if something goes wrong. For example, if someone using your product becomes sick or injured, that person could sue you, personally, placing your assets (and any assets that you hold jointly with a spouse) at risk. You’re also personally accountable for any debt that the business assumes.

Grab your partner, do-sell-do! Getting a handle on partnerships

A general partnership consists of two or more co-owners. Typically, the parties in a general partnership split the profits from the business equally, although that’s not always the case. For example, if you and your friend go into business together, but you invest more in startup costs, you may agree to a different split of the profits — say, 60/40. General partnerships are similar to sole proprietorships, in that you and your partner(s) are personally responsible for any debt that the business incurs.

In addition to general partnerships, limited partnerships exist. In that case, one partner contributes funds and shares in profits but assumes no role in the workings of the company.

LLC Cool J: Looking at limited liability companies

A popular choice for many business owners, a limited liability company (LLC) is a sort of hybrid between a partnership and a corporation (see the following section). It’s a popular choice for business owners because an LLC not only limits your liability for business debt, but also allows you to choose whether you want to be treated as a partnership or as a corporation, depending on which has the lower tax burden.

Go corporate: Considering corporations

A corporation is a legal entity all its own, separate from its founders (you), managers, and employees, and owned by its shareholders (again, you, along with anyone else you decide to bring into the fold). Operating as a corporation means, among other things, that your personal assets are protected in case the company is sued.

Two types of corporations exist: C-corporations and S-corporations. Although C-corporations provide the most financial protection to shareholders and offer other advantages, many small businesses go the S-corporation route because they’re cheaper to start and easier to maintain.

Sweet Charity: Handling Charitable Giving

Some kindly Etsy sellers use their shops as fundraising vehicles — for example, donating proceeds from certain listings to a particular charity or even devoting an entire shop to a cause. However, due to the fact that fundraising is subject to many laws, and also that the occasional bad apple may confuse “charity” with “larceny,” Etsy has established strict policies on charitable listings and shops. Members who fail to comply are subject to suspension of account privileges and/or termination (of their account, not their corporeal existence).

Here are the high points of Etsy’s policies on charitable giving:

![]() All charitable fundraising that occurs on Etsy must comply with applicable laws.

All charitable fundraising that occurs on Etsy must comply with applicable laws.

![]() Any seller who promotes the fact that that his Etsy shop engages in charitable fundraising on behalf of a recognized tax-deductible charitable organization must receive appropriate consent from the charitable organization.

Any seller who promotes the fact that that his Etsy shop engages in charitable fundraising on behalf of a recognized tax-deductible charitable organization must receive appropriate consent from the charitable organization.

![]() The seller must include clear information about the charitable organization in question, as well as donation details, in the listing and/or other public area of the shop.

The seller must include clear information about the charitable organization in question, as well as donation details, in the listing and/or other public area of the shop.

![]() No fair generating listings solely to solicit donations. All listings must be for a tangible item available for sale.

No fair generating listings solely to solicit donations. All listings must be for a tangible item available for sale.

![]() Sending unsolicited donation requests to other Etsy users via convos or in the forums is verboten.

Sending unsolicited donation requests to other Etsy users via convos or in the forums is verboten.

The Artist Is Out: Switching to Vacation Mode

Although many people don’t take nearly enough vacations, it’s a well-known fact that they’re as good for you as Brussels sprouts. Vacations do more than help you rest and relieve stress; they promote creativity — which is pretty important when the success of your Etsy shop depends a great deal on your ability to be creative!

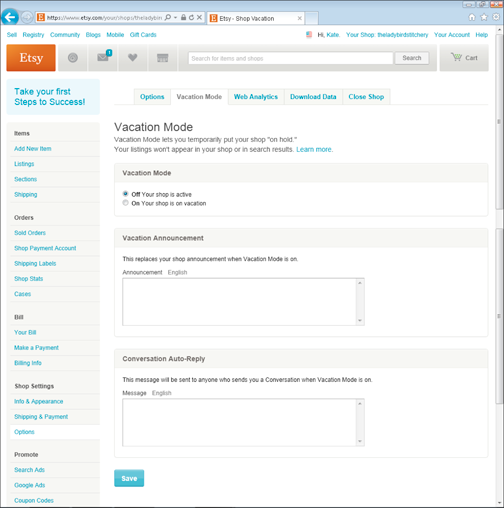

Of course, the key to getting the most out of any vacation is being able to put aside your work while you’re away. Fortunately, Etsy enables you to put your Etsy shop in vacation mode. When your shop is in vacation mode, your listings aren’t visible to anyone who visits your shop. In addition, you can add a special vacation mode notice, to appear along the top of your shop page. Anyone who attempts to convo you receives an auto reply containing the text that you specify.

You don’t have to actually be “on vacation” to put your shop in vacation mode. You can use this feature any time you need a break from your Etsy shop.

To put your shop in vacation mode, follow these steps:

1. Click the Your Shop button that appears along the top of every Etsy page.

2. Under Shop Settings on the left side of the page, click the Options link.

3. Click the Vacation Mode tab.

The Vacation Mode page opens (see Figure 18-7).

4. Click the On Your Shop Is On Vacation option button under Vacation Mode.

5. Type the desired text — how long you’ll be away, when you’ll be back, and so on — in the Vacation Announcement field.

This text replaces your shop announcement.

6. In the Conversation Auto-Reply field, type the message that you want prospective customers to receive if they convo you while you’re away.

7. Click the Save button.

Etsy puts your shop in vacation mode.

Figure 18-7: Put your shop in vacation mode any time you need a break.

Hanging It Up: Closing Your Etsy Shop

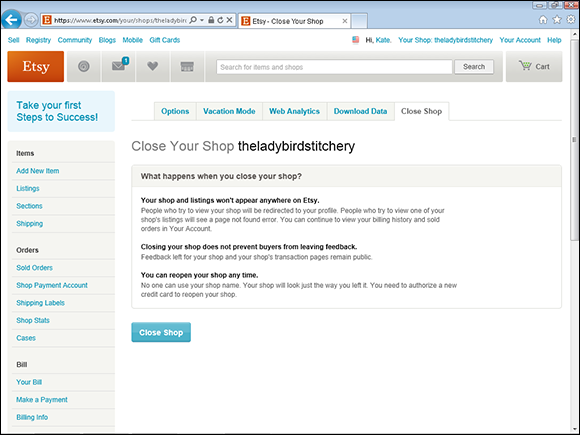

If — God forbid — you decide that running an Etsy shop just isn’t for you, you can close your Etsy shop (assuming you’ve closed all unresolved cases and paid any overdue fees). When you close your shop, your shop and listings will no longer appear on Etsy. If someone tries to view your shop, she will be redirected to your profile. Anyone who attempts to view a listing from your shop will see a “Page Not Found” error.

To close your shop, follow these steps:

1. Click the Your Shop button that appears along the top of every Etsy page.

2. Under Shop Settings on the left side of the page, click the Options link.

3. Click the Close Shop tab.

The Close Your Shop page opens (see Figure 18-8).

4. Click the Close Shop button.

Etsy prompts you to confirm the closure.

5. Click the Close Shop button again.

Etsy closes your shop. (Note that it may take 30 minutes or so for your request to be processed.) Your Etsy account will now be for buying only.

Figure 18-8: Things not working out? You can close your Etsy shop.

If — hallelujah! — you later change your mind and want to reopen your shop, you can easily do so. Simply hover your mouse button over the Your Account link found along the top of every Etsy page and choose Re-open Shop. Etsy will prompt you to re-enter your billing info and will re-validate your credit card before re-opening your shop. (Again, it may be a half-hour or so before your request is processed.)

Please forgive us: We’ve tried to cram several books’ worth of information into this one wee chapter. We strongly urge you to educate yourself further on all these business matters and more. A good place to start is

Please forgive us: We’ve tried to cram several books’ worth of information into this one wee chapter. We strongly urge you to educate yourself further on all these business matters and more. A good place to start is  Here’s the good news: You can set up your Etsy shop to calculate and collect sales tax automatically. That way, when a shopper from your neck of the woods ponies up for one of your items, she’s charged the appropriate tax automatically. It’s like magic! For help with setting up your shop to collect sales tax, refer to

Here’s the good news: You can set up your Etsy shop to calculate and collect sales tax automatically. That way, when a shopper from your neck of the woods ponies up for one of your items, she’s charged the appropriate tax automatically. It’s like magic! For help with setting up your shop to collect sales tax, refer to  The sales tax ID number that you obtain from your state entitles you to buy supplies and other items for your Etsy business wholesale — which is typically at least half off the retail price. Holy bonus, Batman!

The sales tax ID number that you obtain from your state entitles you to buy supplies and other items for your Etsy business wholesale — which is typically at least half off the retail price. Holy bonus, Batman! If your Etsy shop earns a profit — that is, its gross income is higher than the deductions that you claim for it — in any three of five consecutive years, it’s officially a “for-profit” business in the eyes of the IRS. That status means you’re free to deduct away! Otherwise, the IRS places severe limitations on what expenses you can deduct. Put another way: Don’t deduct the supplies that merely feed your craft addiction but don’t support a business. The IRS will notice if your deductions dwarf your income. Avoid waving the proverbial red flag by ensuring a reasonable balance!

If your Etsy shop earns a profit — that is, its gross income is higher than the deductions that you claim for it — in any three of five consecutive years, it’s officially a “for-profit” business in the eyes of the IRS. That status means you’re free to deduct away! Otherwise, the IRS places severe limitations on what expenses you can deduct. Put another way: Don’t deduct the supplies that merely feed your craft addiction but don’t support a business. The IRS will notice if your deductions dwarf your income. Avoid waving the proverbial red flag by ensuring a reasonable balance!